#saving account apply online

Explore tagged Tumblr posts

Text

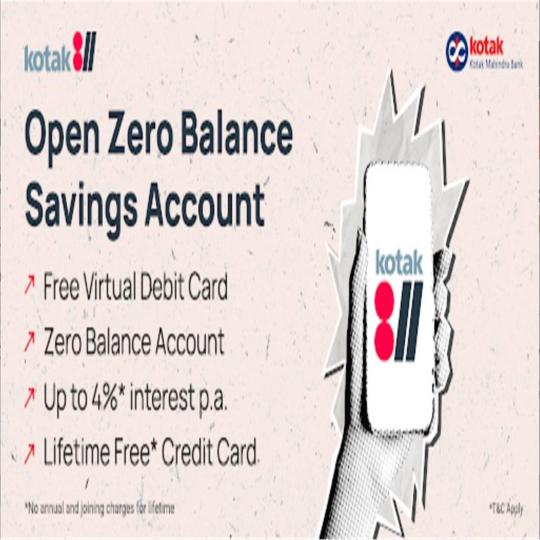

Open a zero balance savings account online in a few simple steps!

Welcome To Your Online Zero Balance Savings Account From Kotak! Get an instant online bank account number & CRN (Customer Registration Number) so you can start banking immediately on the Kotak 811 app.

#opening bank account#saving account apply online#saving account opening#saving bank accounts#open an bank account online#open a savings account

0 notes

Text

Kotak 811 – A one-stop destination for all your banking needs.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#account upi payments#app upi mobile banking#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account app#bank account check#bank account check app#bank account kholna#bank account online#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure#bank account opening process#bank account with zero balance#bank app upi#bank balance app#bank balance app download#bank balance check karne wala app

2 notes

·

View notes

Text

Mistakes you ought to avoid when paying online bills:

Everyone hates paying bills, but chances are you have a couple, at least. Naturally, the restrictions vary depending on who is collecting the money. You may mail checks or set up autopay or bot using your bank's bill payment services. A proper strategy when paying bills will significantly reduce unnecessary fees and double charges. Internet banking has benefited people a lot, even in terms of online billing. Here are several errors to keep away from when paying your invoices.

Not reading your statement.

You already have the bill and can pay it, right? More so if your payment schedule is automatic. Reviewing your statement is still a good idea, even if you use autopay. Your statement contains details regarding charges, fees, and other information. Check your statement carefully to make sure you are not getting charged for services you are not utilizing. Additionally, you can check your bill to determine if any unauthorized charges have been made.

Set it and forget it:

To ensure you don't skip or pay late, autopay can be a great tool. However, it's a good idea to double-check your payments, particularly your first payment, when setting up autopay in your Internet banking statement. Depending on the firm, your autopay account setup may take several business days. You might have to pay something in the interim. In some situations, it's conceivable that you will find out about a missing payment the following billing cycle.

Confirm that the business has the correct information and learn when the first payment will be deducted from your account. After that, confirm that the payment was successfully deducted from your account. Once your autopay is set up, ensure the money is deducted on time by checking in frequently.

Assuming a grace period:

Some businesses provide you with a grace period to make your payment. Therefore, even if you are late, you won't be penalized if you pay within a few days. But only some businesses provide this. There is no guarantee that your current landlord will be as understanding as your previous landlord started collecting a late charge on the fifth day of the month. A daily late fee could be assessed right away.

Not reviewing the price you are paying:

Remember that you can always shop around for a better deal. Never assume you are receiving the best deal. Consider various plans and prices before committing to a bill. Remember to routinely check to see if you are still getting the most outstanding value once you have committed to service. You can find a lower cost if you compare expenses for insurance.

Additionally, you can research several internet and mobile service providers. Check for a better offer, and inform your present provider that you could cancel. They might equal the cost of a rival. You can switch and save money if they don't.

Bottom line:

Online billing is made easy since the internet and mobile phones have given a significant breakthrough in people's lives. By following the above points, you can avoid billing mistakes. So, an online account opening in any indian bank is highly recommended.

#0 account opening bank#0 balance account open online#0 balance account opening#0 balance account opening bank#0 balance bank account open online#0 bank account opening#account balance check#account check karne wala app#account online open#account open 0 balance#account opening#account opening app#account upi payments#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account check#bank account check app#bank account kholna#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure

0 notes

Text

What is the importance of a savings account in money management?

A large number of people follow budgeting for a good reason. By considering your current spending, budgeting is intended to assist you in making larger future savings. Now that you are familiar with the budgeting procedure, you must also understand the value of a savings account in order to build your savings.

For you to save more and budget more effectively, savings accounts are crucial for the following reasons:

You can increase your savings by using a bank with a greater interest rate.

You can avail of discounts by using Money Transfer apps from your bank.

Many reputed banks give you monthly interest credits to encourage you to save more money.

You can begin saving sooner by taking advantage of paperless and easy savings account opening services in banks. Today, many people seeking growth choose online savings accounts due to the high and competitive interest rate and the monthly interest credit.

Budgeting

Long-term investors recognize the value of saving in a person's investment path and make it a point to educate and re-assure younger investors of this. Experts will talk about budgeting and a savings account that works for your benefit in this article. Those are considered two key pillars on which you can build your savings. Experts also offer advice on creating a better budget and explain why having a savings account is essential for growing your money. Making Money Transfer actions using a mobile app from your bank is the best option for customers.

What is budgeting?

The act of regularly tracking all of your costs over a specified period of time is known as budgeting. A month, a year, or even several years at once could be included in your budget. To boost their savings, the majority of people use monthly budgeting. Learn about budgeting by comprehending its steps given below.

Build an emergency fund.

Prepare yourself for an emergency as the first step in creating a budget. An "emergency fund" can provide you with the additional funds you'll need in case of an emergency. If you have steady work, you can set aside enough money for an adequate emergency fund to last you six months. It is advised to have savings equivalent to one year's worth of pay if your employment is uncertain.

Calculate your monthly income.

A working professional who receives a monthly wage can easily calculate their monthly revenue. To determine your monthly income, you can take the average of the money you've made over the previous three to six months if you work a variety of side jobs to supplement your salary.

Other things to do:

Factor in the additional expenses

Focus on paying off your debt first

Allot money for the ‘wants.’

Infer learnings from your budget

Tips that can help you budget well

Finally, in order to help you save more money, here are three recommendations for creating an effective budget and tracking all of your costs each month:

Periodically review your budget by contrasting it with an earlier budget. When creating your first budget, examine your expenses and contrast them with your monthly revenue.

With the expense tracking feature in your mobile banking app or website, you can easily track your spending.

Final thoughts

Don’t change the strategy you've developed as part of your budget. Consistency is the key to saving money using a savings account in a banking Mobile App.

This article on setting a budget is meant to be helpful. Don't forget to select the appropriate savings account for your budgeting process.

#0 account opening bank#0 balance account open online#0 balance account opening#0 balance account opening bank#0 balance bank account open online#0 bank account opening#account balance check#account check karne wala app#account online open#account open 0 balance#account opening#account opening app#account upi payments#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account check#bank account check app#bank account kholna#bank account online open#bank account opening#bank account opening application#bank account opening online#bank account opening online zero balance#bank account opening procedure

0 notes

Text

Different types of savings account:

If you want to save your money and generate a decent amount of interest, then choose a savings account. The interest rate in a savings account may be less, but the security feature it offers is high. A savings account is a good option for saving short-term and emergency fund. Many types of savings accounts are available. Let us first discuss the different types of accounts, and then you get a clear idea about how to open a new savings account based on your requirements.

Regular Savings Account:

Traditional savings accounts are one of the most common types of savings accounts. In a regular savings account, you need to pay a certain amount every month. It is easy to access the funds in a traditional savings account. The process of opening savings account is very simple, and in some banks, the minimum deposit amount is also very low. You can choose this account if you do not want to invest more at once and you want to save money regularly.

High Yield Savings Account:

Traditional savings accounts and high-yield savings accounts are similar, but there is one major difference. The interest rate in high -yielding savings accounts is high without compromising on safety. The withdrawal rate is lower in high-yield account. You can find many high-yielding savings accounts online. You can prefer this if you can manage your accounts online.

Money Market Account:

Money market accounts pay higher interest rates than other savings accounts. It is best suited for short-term goals. There are more features in money market accounts than in traditional savings accounts. It offers debit card purchases and check-writing privileges, and it is more flexible. If you would like to invest more money and increase your interest rate, you can choose this account.

Health Savings Account:

A health savings account is designed to pay for medical expenses. It is tax-free if you withdraw it for a valid medical expense such as copayments, deductibles, and more. In order to use a health savings account, you need a proper health care plan.

Certificates Of Deposit:

It holds a specific amount for a fixed period of time. It may be one year or five years. After a specific period of time, you can withdraw your original amount in addition to some interest, depending upon the bank. You can withdraw the amount only after the mentioned period of time. If you wish to withdraw it earlier, you may need to pay a penalty.

Student Savings Account:

A student's savings account is designed to help students start saving money. There are several benefits in this which include no minimum balance, overdraft facility, availability of debit cards, and no monthly fee. The initial amount to be paid is also very little in the student's account. In some banks, they do not charge any fee for ATM also. But a co-signer is needed to open a student account.

The Bottom Line:

Opening a new savings account is the most important thing to save money and gain interest from it. Analyze your requirements before choosing your account and choose the account which best fits your needs. It is also important to carefully read the terms and conditions before opening the account.

#zero balance account saving account#online saving account#online saving bank account#online savings bank account#apply for savings account#apply for savings account online#bank saving account open#instant saving account#online open saving account#online open saving bank account#online savings account opening#online savings bank account opening#open a savings account#open new savings account#open online savings account#open saving account#open savings bank account online#saving account opening#saving account opening online#saving account opening zero balance

0 notes

Text

Kotak 811 – A one-stop destination for all your banking needs.

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#online saving bank account#online savings bank account#apply for savings account#apply for savings account online#bank saving account open#instant saving account#online open saving account#online open saving bank account#online savings account opening#online savings bank account opening#open a savings account#open new savings account#open online savings account#open saving account#open savings bank account online#saving account opening#saving account opening online#saving account opening zero balance

0 notes

Text

A Beginners Guide To Fund Transfer Using QR Codes:

Digital payments have revolutionised the way customers used to make payments. Debit cards, credit cards, digital wallets, and now QR codes are used to pay for a purchase. Smartphones facilitate easy cashless fund transfers for purchases. It relieves you of the burden of carrying money whenever you go out.

You can make QR payments by scanning the code and initiating a money transfer from your account to the seller’s account. The mobile wallet completes the transaction by transferring money from your account once you validate the transaction.

Are you here to seek information about QR codes? Are you new to the QR code ecosystem? Welcome to this new revolutionary payment system. Here is a quick guide for the QR code noobs.

What Is A QR Code?

It is a two-dimensional scanning code with a black-and-white square on a white backdrop. Any smart mobile with a QR code reader can scan the code and complete a transaction. They are better than barcodes as these codes can store huge data. The automotive industry used these codes before the payment ecosystem started using them. QR codes can help to initiate a payment, donate money to charitable institutions, and design creative marketing initiatives. These codes facilitate cashless payment.

Types Of QR Code Payments:

You can scan QR codes with a bar code or a smartphone. They can be used for bank balance enquiries also. It is a faster payment option than credit cards because all you need to do is download the QR code App. Open the mobile camera, scan the merchant code, and you are done! There are different types of QR payments.

Payment to Merchant:

Once you finish buying in a supermarket or a local store, you open a payment application. The merchant would enter the payable amount in his POS system. You have to scan the barcode of the product and complete the transaction. When you buy online, this process is done by adding your desired product to the cart.

Scan the QR code of the receiver:

You need to open your mobile camera to scan the code on the bill. The transaction will be completed once scanning is complete. Every store has a unique application. They will provide offers once you finish payment using a store-specific app.

App to App payment:

It facilitates payment of money from App to App. The recipient opens his App and you scan it through the app on your mobile. You need to check whether the details entered are correct and complete the transaction.

Benefits of using QR codes:

There are multiple benefits to using QR codes. They are:

Easy payment experience.

Enables easy data collection and identification.

Secured method of payment.

Cost-effective as they don’t need any equipment to facilitate payment.

Final Words:

QR codes are an effective payment mode. If you have a smartphone, or QR reader on your mobile, you have completed a transaction. There is an expected 58% growth in the QR payment market by 2028. They are easy to use and a secure method of cashless payment. You only need to scan the QR code scanner and make digital payments. When your seller scans the QR code on your mobile, your bank sends a code and the vendor uses his bank account to facilitate payments.

#online savings bank account#new bank account online#mobile banking account app#bank account opening online zero balance#online new account open#opening account online#bachat khata#open a savings account#online new bank account opening#online savings account opening#instant account opening online#online saving bank account#online open saving account#bank account online#open a free bank account#bank fd#open a bank account online free#mobile banking app#online digital account opening#banking app#open a new bank account#apply for savings account#bank app#opening a bank account#online savings bank account opening#open savings bank account online#account online open#apply for savings account online#mobile banking apps#bank account online open

1 note

·

View note

Link

We provide all type Insurance, Demat Account, Saving Account and Credit Card loan services in Delhi NCR, India. We are offer low interest rate to suit your need

#best loan#personal loan#business loan#car loan#apply for student loan#home loans#loans near me#zero balance account opening online#saving account#demat account#credit cards

0 notes

Text

Recent Trends in the Banking Sector

People can earn money in many ways, but managing the money is the most important thing. Nowadays, banks play an essential role in money management. We are living in a digital world. So, every quick money transfer is easily handled through digital transactions. Previously, you had to visit a bank directly to open an account and for every banking need. But now, the banking trends have been developed, and everything is digitalized, so there is no need to visit a bank for every purpose. You can access the option through the digital platform provided by the banks. Here, you can see the recent trends in banking.

Digital Banking

If you want to deposit or withdraw an amount previously, you have to go to the bank and fill out the form. Only then can you make the transaction. You have to wait for long in the queue. But now everything is digitalized even for opening, you do not need to go to the banks. Everything is done with the help of online portals, internet banking, and mobile banking apps. You can easily use credit cards, debit cards, and digital wallets without carrying cash.

Automation in Banking

Automation combines robotic process automation (RPA) with Artificial Intelligence (AI) and Machine Learning (ML) technologies to automate complex and critical business tasks. Banks can automate repetitive tasks such as data entry, document processing, and customer onboarding. It reduces errors and improves the efficiency of banking systems.

AI & ML Technologies

Artificial Intelligence and Machine Learning technologies are highly used in bank sectors to improve the efficiency of operations, fraud detection, and improve customer experience. AI-driven chatbots and virtual assistants to improvise customer assistance by providing 24/7 chat support. These technologies also enhance the overall customer experience and strengthen security measures.

Block Chain Banking

Blockchain technology is a decentralized distributed ledger system that enables safe and transparent transactions between two parties without requiring the involvement of a third party. A list of transactions is contained in each of the connecting blocks that make up the ledger.

Regtech Technology

The integration of tools and technologies designed to help banks and insurers manage compliance and regulations is called Regtech (Regulation Technology). Banks' increased use of AI, blockchain, big data, and machine learning algorithms has made improving risk management capabilities and automating compliance processes a top priority.

Internet Usage

The Internet is used for every bank process. A physical device connected to the Internet gives notifications about your banking activities. You can search for your nearby ATMs, do UPI money transfer, and do all the mobile banking activities with the help of the Internet. The Internet integrated Hospitals, Education Institutions, Shopping Malls, and merchandise shops with the bank.

Winding up Digital banking helps you live a cash-free life, like using UPI payment services. Now, banking trends and technologies are growing very fast. They will become more efficient every day. It gives you real-time security about your bank accounts. Also, the new and upcoming trends will make many changes in the future.

#0 account opening bank#0 balance account#0 balance account open online#0 balance account opening#0 balance account opening bank#0 balance bank account open online#0 bank account opening#मोबाइल बैंकिंग#account balance check#account check karne wala app#account online open#account open 0 balance#account opening#account opening app#account upi payments#app upi mobile banking#application for account opening in bank#application for opening bank account#apply for bank account online#apply for savings account#apply for savings account online#bachat khata#bank account#bank account app#bank account check#bank account check app#bank account kholna#bank account online

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#saving account#zero balance account online#debit card online apply#open new account online#digital account#zero balance account open#open savings account#digital banking app#premium banking#mobile banking app#new account open bank online 0 balance

1 note

·

View note

Text

open zero balance bank account

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://play.google.com/store/apps/details?id=com.msf.kbank.mobile

online bank open account

#saving account opening#mobile banking#online open account#apply online account opening#digital account opening app#best online account opening#open bank account online free#zero balance account opening app#online bank open account#zero balance savings account online#online open saving account#zero balance account opening#instant account opening app#account online open

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open new account online#digital account#online open bank account app#open savings account#apply for bank account online#mobile banking app#mobile banking apps#mobile banking account#account online opening#opening account online

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open new account online#digital account#open savings account#apply online bank account#apply for bank account online#mobile banking app#mobile banking apps#online new account open#online banking#saving account opening

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#apply for bank account online#new bank account open app#banking app#bank online account opening#new bank account open#new bank account opening app#online banking#account opening app#digital savings account#instant online bank account opening

0 notes

Text

Documents and steps required to open a zero-balance account

Online zero-balance account opening has a number of advantages that no one should miss. Account holders can securely deposit or withdraw money at any time, in addition to its convenience. Additionally, they can use the funds in the account as an emergency fund or earn interest on them. You should open zero balance bank account online to enjoy advantages such as cutting-edge banking services and exclusive brand/shopping offers. To know more about zero balance accounts, read on.

Creating a zero-balance bank account using the Internet:

Go to the Internet

Open your laptop or mobile device and launch the browser. After navigating to your bank’s website, you can begin the process by entering your details, like your mobile number or email. Usually, on most bank websites, the next step is to enter other details that are present in your ID proof. These details are name, location, age, etc. You do not need to physically go to the bank; you can finish the paperless account opening process from the convenience of your home.

Keep the necessary documents ready when opening zero balance account

Providing specific personal identity credentials is the key requirement to open zero balance bank account online. If you have an Aadhaar Card, you don't need to provide any other identification or proof of address.

You may need to submit the following:

Id Verification Documents (Driver's Licence, PAN Card, etc.) and Address Proof, such as a driver's license or passport.

If you don't have a PAN card, you'll require Form 16, a certificate from your employer stating that TDS (Tax Deducted at Source) has been taken out of your pay. Lastly, your two most recent passport-sized photos are needed.

Complete video KYC verification

Banks now permit applicants to upload their KYC documents and self-verify online. You can start using your new savings account as soon as the application grants access to your smartphone's location, camera, and microphone. It can all be done with a bank representative over a video call.

Login via mobile app or website

You can start using and even transferring money from your zero-balance savings account as soon as you receive a customer ID and account number.

Here is some other information about a zero-balance account:

How can you quickly open a bank account online?

Due to the digital development in the banking sector, you can now open an online savings account quickly using a smartphone. You only need to enter your personal, Aadhaar, and PAN information on your bank's website. Your zero balance account will be active within a few minutes of completing the process online. Understanding the documents needed to start an online savings or zero-balance account is crucial.

A PAN card is typically used as proof of identity, and an Aadhar card is used as proof of residence.

Accessing a zero-balance bank account to check your balance or make a withdrawal.

You can access your zero-balance savings account through a smartphone app, bank website, ATM, and at the bank branch if necessary.

Final thoughts

Basic savings bank deposit accounts were created to increase currency circulation and end cash hoarding. This is particularly true in some rural and semi-urban towns and cities in some countries. The internet banking features offered with online zero-balance savings accounts, such as insurance, will therefore give the lower and middle-income groups a feeling of security.

#open bank account online app#instant online bank account opening#apply for savings account#apply for savings account online#bank account opening online

0 notes

Text

WAYS U CAN PLEASE SATURN ACCORDING TO UR SATURN PLACEMENT ♄

1H/ARIES SATURN: RESPECT URSELF. DO NOT ALTER UR BOUNDARIES TO BE LIKED. SELF IMPROVEMENT. PUT EFFORT INTO UR BODY/APPEARANCE. WORKOUT / BE ACTIVE. HEALTHY COMPETITION. PRACTICE OFTEN. BE CONFIDENT BUT NOT ABOVE OTHERS. SLOW DOWN. SELF GROWTH. DELIBERATE ACTIONS.

2H/TAURUS SATURN: DEVELOP STRONG VALUES. DO NOT UNDERMINE URSELF. QUALITY OVER QUANTITY. INTENTIONAL SPENDING. HEALTHY RELATIONSHIP WITH FOOD. TRY NOT TO OVERINDULGE ; TRY NOT TO WASTE. STOP SELF SABOTAGING. NO SELF DEPRECATING. APPRECIATE WHAT U HAVE. EXPRESS GRATITUDE. DONATE WHAT U CAN.

3H/GEMINI SATURN: THINK BEFORE U SPEAK ; SPEAK LESS THAN U DESIRE. STOP OVERSHARING. FOCUS ON UR CRAFT ; GET RID OF THE DISTRACTIONS. POWER IN THE TONGUE. PERSONAL MOTTOS. STAND FOR WHAT IS MORAL ; BE WELL INFORMED. HAVE HARD CONVOS WHEN NECESSARY. BE A SUPPORTIVE FRIEND. STOP COMPLAINING. FIND SOLUTIONS. ADAPT & OVERCOME.

4H/CANCER SATURN: CREATE BOUNDARIES & STICK TO THEM. BE OF SERVICE TO OTHERS WITHOUT SELF SACRIFICE. DO NOT BE OVERLY SELFISH. EXPRESS UR NEEDS. TAKE CARE OF UR MENTAL HEALTH. EMOTIONAL REGULATION. SELF CARE. BE SELECTIVE OF UR INNER CIRCLE. POUR INTO UR LOVED ONES. TREAT OTHERS WITH KINDNESS. KEEP UR LIVING SPACE CLEAN.

5H/LEO SATURN: LET GO OF SELF DOUBT. BRING UR VISION TO LIFE. MASTER UR CRAFT. BELIEVE IN URSELF & WORK TOWARDS UR GOALS. GET RID OF UR NEED FOR OUTSIDE APPROVAL. LOOK OUT FOR THE CHILDREN ; BE THE PERSON U NEEDED GROWING UP. WORK HARD, PLAY HARD. DELAYED GRATIFICATION.

6H/VIRGO SATURN: FOLLOW A ROUTINE. HEALTHY HABITS. STRUCTURE. KEEP UR SPACES ORGANIZED ; DE-CLUTTER. BE A FRIEND TO ANIMALS. TAKE GOOD CARE OF UR PET/S. PUT IN THE WORK EVERY DAY. OFFER A HELPING HAND. HONOR UR OWN TIME & ENERGY ; DO NOT ENGAGE IN ONE-SIDED RELATIONS.

7H/LIBRA SATURN: MAKE UR OWN DECISIONS. TAKE ACCOUNTABILITY. CRACK DOWN ON CO-DEPENDENCY ; AVOID SELF ISOLATION. LONGTERM RELATIONS. BE THE BIGGER PERSON. FORGIVE BUT DON’T FORGET. APPLY LESSONS FROM THE PAST. TREAD LIGHTLY. RESPECT THOSE WHO CAME BEFORE YOU. FORM LASTING ALLIANCES.

8H/SCORPIO SATURN: KEEP THINGS TO URSELF. STAY PRIVATE. PRACTICE SELF CONTROL. RESILIENCE IN THE FACE OF HARDSHIP. HOPE FOR THE BEST, PREPARE FOR THE WORST. SAVINGS/RAINY DAY RESOURCES. EMBRACE CHANGE. LEARN TO LET GO. RADICAL ACCEPTANCE. SEXUAL DISCIPLINE. XTRA EMPHASIS ON SAFE SEX!

9H/SAGITTARIUS SATURN: PRACTICE UR BELIEFS. WALK THE TALK. MANTRAS. LEARN FROM OTHERS ; COME TO UR OWN CONCLUSIONS. STUDY. BE AN ETERNAL STUDENT. ALLOW URSELF TO BE OUT OF UR ELEMENT. RESPECT OTHER CULTURES. MAKE UR OWN TRADITIONS. STAY HUMBLE. ACCEPT MULTIPLE TRUTHS. APPLY WHAT WORKS.

10H/CAPRICORN SATURN: KEEP UR EYES ON THE PRIZE. TRUST THAT ALL THINGS COME IN DUE TIME. KEEP URSELF MOTIVATED. WORK FOR WHAT U WANT. STAY CONSISTENT. PERSONAL LEGACY ; THINGS THAT LAST. BECOME UR OWN ROLE MODEL. DO IT URSELF / DO IT RIGHT. LIVE WITH KARMA IN MIND.

11H/AQUARIUS SATURN: LEAD THE WAY ; FURTHER THE CAUSE. BETTER THE COMMUNITY— CREATE UR OWN. BE CONSCIOUS OF WHOM U ASSOCIATE URSELF WITH. BEFRIEND PPL OLDER THAN URSELF. LONGTERM FRIENDSHIPS. LONGTERM RESULTS. ADVANCEMENT. NETWORKING. ONLINE INFLUENCE. SET THE STANDARD.

12/PISCES SATURN: ALL IN MODERATION. HEALTHY COPING METHODS & LIFESTYLE PRACTICES. CONSIDERATION. REFLECTION ; SELF AWARENESS. THERAPY. STANDARDS. LEAVE ONCE DISRESPECTED. NO FAKE FRIENDS. MIND OVER MATTER. MANIFESTATION. BE REAL WITH URSELF. SELF TRUST.

4K notes

·

View notes