#retail investors in stock market

Explore tagged Tumblr posts

Text

What Does Investor Perception Towards the Stock Market Mean?

It’s a combination of their beliefs, attitudes, and opinions regarding investing in stocks. This perception can vary widely from one individual to another and can even change over time. https://sharemarketinsider.com/investor-perception-towards-stock-market/

#stock market#how to invest in the stock market#investors perception towards indian stock market#how to start investing in the stock market#how to invest in the stock market right now#how does the stock market work?#indian stock market investors#stocks#how to outperform the stock market#investors behaviour in stock market#stock market investors in india#stock market cycles#retail investors in stock market#is the stock market about to crash

0 notes

Text

Impact of FIIs, DIIs, and Other Investors in Equity Markets

Image by felicities on Freepik Impact of FIIs, DIIs, and Other Investors in Equity Markets: Foreign Institutional Investors (FIIs): Market Liquidity: FIIs bring substantial foreign capital into the market, increasing liquidity and trading volumes. Market Sentiment: Their investment decisions significantly influence market sentiment. Large-scale buying can create bullish trends, while…

#DII#equity markets#FII#HNWI#investment impact#market liquidity#Market Sentiment#market stability#retail investors#Stock Market

0 notes

Text

Why stock exists?

The stock market exists to facilitate the buying and selling of stocks, which are shares of ownership in a publicly traded company. Companies issue stocks to raise capital for various purposes, such as expanding operations, investing in research and development, or paying off debt.The stock market provides a centralized platform where investors can trade stocks. This allows companies to connect…

View On WordPress

0 notes

Text

#महंगे शयरों के लिए किस्तों में निवेश करने का नया मौका: अमेरिका की तरह आ रहा है भारत में यह अवसर!#retail-investors#share market#stock market#bse#nse#share market news today#share market news#stock market news in hindi#stock market news in india

0 notes

Text

Navigating IPO Investments: Is it Right for Retail Investors?

Initial Public Offerings (IPOs) are often seen as the gateway to investing in promising companies that are about to go public. While IPOs present exciting opportunities, they also come with risks and uncertainties that can make retail investors apprehensive. In this article, we’ll explore the world of IPOs, discuss whether retail investors should consider them, delve into subscription rates, and…

View On WordPress

#Initial Public Offering#Investment Risks#Investment Strategy#IPO#IPO retail investment#Listing Price#Retail Investors#Stock Market#Subscription Rates#what is IPO

0 notes

Text

A link-clump demands a linkdump

Cometh the weekend, cometh the linkdump. My daily-ish newsletter includes a section called "Hey look at this," with three short links per day, but sometimes those links get backed up and I need to clean house. Here's the eight previous installments:

https://pluralistic.net/tag/linkdump/

The country code top level domain (ccTLD) for the Caribbean island nation of Anguilla is .ai, and that's turned into millions of dollars worth of royalties as "entrepreneurs" scramble to sprinkle some buzzword-compliant AI stuff on their businesses in the most superficial way possible:

https://arstechnica.com/information-technology/2023/08/ai-fever-turns-anguillas-ai-domain-into-a-digital-gold-mine/

All told, .ai domain royalties will account for about ten percent of the country's GDP.

It's actually kind of nice to see Anguilla finding some internet money at long last. Back in the 1990s, when I was a freelance web developer, I got hired to work on the investor website for a publicly traded internet casino based in Anguilla that was a scammy disaster in every conceivable way. The company had been conceived of by people who inherited a modestly successful chain of print-shops and decided to diversify by buying a dormant penny mining stock and relaunching it as an online casino.

But of course, online casinos were illegal nearly everywhere. Not in Anguilla – or at least, that's what the founders told us – which is why they located their servers there, despite the lack of broadband or, indeed, reliable electricity at their data-center. At a certain point, the whole thing started to whiff of a stock swindle, a pump-and-dump where they'd sell off shares in that ex-mining stock to people who knew even less about the internet than they did and skedaddle. I got out, and lost track of them, and a search for their names and business today turns up nothing so I assume that it flamed out before it could ruin any retail investors' lives.

Anguilla is a British Overseas Territory, one of those former British colonies that was drained and then given "independence" by paternalistic imperial administrators half a world away. The country's main industries are tourism and "finance" – which is to say, it's a pearl in the globe-spanning necklace of tax- and corporate-crime-havens the UK established around the world so its most vicious criminals – the hereditary aristocracy – can continue to use Britain's roads and exploit its educated workforce without paying any taxes.

This is the "finance curse," and there are tiny, struggling nations all around the world that live under it. Nick Shaxson dubbed them "Treasure Islands" in his outstanding book of the same name:

https://us.macmillan.com/books/9780230341722/treasureislands

I can't imagine that the AI bubble will last forever – anything that can't go on forever eventually stops – and when it does, those .ai domain royalties will dry up. But until then, I salute Anguilla, which has at last found the internet riches that I played a small part in bringing to it in the previous century.

The AI bubble is indeed overdue for a popping, but while the market remains gripped by irrational exuberance, there's lots of weird stuff happening around the edges. Take Inject My PDF, which embeds repeating blocks of invisible text into your resume:

https://kai-greshake.de/posts/inject-my-pdf/

The text is tuned to make resume-sorting Large Language Models identify you as the ideal candidate for the job. It'll even trick the summarizer function into spitting out text that does not appear in any human-readable form on your CV.

Embedding weird stuff into resumes is a hacker tradition. I first encountered it at the Chaos Communications Congress in 2012, when Ang Cui used it as an example in his stellar "Print Me If You Dare" talk:

https://www.youtube.com/watch?v=njVv7J2azY8

Cui figured out that one way to update the software of a printer was to embed an invisible Postscript instruction in a document that basically said, "everything after this is a firmware update." Then he came up with 100 lines of perl that he hid in documents with names like cv.pdf that would flash the printer when they ran, causing it to probe your LAN for vulnerable PCs and take them over, opening a reverse-shell to his command-and-control server in the cloud. Compromised printers would then refuse to apply future updates from their owners, but would pretend to install them and even update their version numbers to give verisimilitude to the ruse. The only way to exorcise these haunted printers was to send 'em to the landfill. Good times!

Printers are still a dumpster fire, and it's not solely about the intrinsic difficulty of computer security. After all, printer manufacturers have devoted enormous resources to hardening their products against their owners, making it progressively harder to use third-party ink. They're super perverse about it, too – they send "security updates" to your printer that update the printer's security against you – run these updates and your printer downgrades itself by refusing to use the ink you chose for it:

https://www.eff.org/deeplinks/2020/11/ink-stained-wretches-battle-soul-digital-freedom-taking-place-inside-your-printer

It's a reminder that what a monopolist thinks of as "security" isn't what you think of as security. Oftentimes, their security is antithetical to your security. That was the case with Web Environment Integrity, a plan by Google to make your phone rat you out to advertisers' servers, revealing any adblocking modifications you might have installed so that ad-serving companies could refuse to talk to you:

https://pluralistic.net/2023/08/02/self-incrimination/#wei-bai-bai

WEI is now dead, thanks to a lot of hueing and crying by people like us:

https://www.theregister.com/2023/11/02/google_abandons_web_environment_integrity/

But the dream of securing Google against its own users lives on. Youtube has embarked on an aggressive campaign of refusing to show videos to people running ad-blockers, triggering an arms-race of ad-blocker-blockers and ad-blocker-blocker-blockers:

https://www.scientificamerican.com/article/where-will-the-ad-versus-ad-blocker-arms-race-end/

The folks behind Ublock Origin are racing to keep up with Google's engineers' countermeasures, and there's a single-serving website called "Is uBlock Origin updated to the last Anti-Adblocker YouTube script?" that will give you a realtime, one-word status update:

https://drhyperion451.github.io/does-uBO-bypass-yt/

One in four web users has an ad-blocker, a stat that Doc Searls pithily summarizes as "the biggest boycott in world history":

https://doc.searls.com/2015/09/28/beyond-ad-blocking-the-biggest-boycott-in-human-history/

Zero app users have ad-blockers. That's not because ad-blocking an app is harder than ad-blocking the web – it's because reverse-engineering an app triggers liability under IP laws like Section 1201 of the Digital Millenium Copyright Act, which can put you away for 5 years for a first offense. That's what I mean when I say that "IP is anything that lets a company control its customers, critics or competitors:

https://locusmag.com/2020/09/cory-doctorow-ip/

I predicted that apps would open up all kinds of opportunities for abusive, monopolistic conduct back in 2010, and I'm experiencing a mix of sadness and smugness (I assume there's a German word for this emotion) at being so thoroughly vindicated by history:

https://memex.craphound.com/2010/04/01/why-i-wont-buy-an-ipad-and-think-you-shouldnt-either/

The more control a company can exert over its customers, the worse it will be tempted to treat them. These systems of control shift the balance of power within companies, making it harder for internal factions that defend product quality and customer interests to win against the enshittifiers:

https://pluralistic.net/2023/07/28/microincentives-and-enshittification/

The result has been a Great Enshittening, with platforms of all description shifting value from their customers and users to their shareholders, making everything palpably worse. The only bright side is that this has created the political will to do something about it, sparking a wave of bold, muscular antitrust action all over the world.

The Google antitrust case is certainly the most important corporate lawsuit of the century (so far), but Judge Amit Mehta's deference to Google's demands for secrecy has kept the case out of the headlines. I mean, Sam Bankman-Fried is a psychopathic thief, but even so, his trial does not deserve its vastly greater prominence, though, if you haven't heard yet, he's been convicted and will face decades in prison after he exhausts his appeals:

https://newsletter.mollywhite.net/p/sam-bankman-fried-guilty-on-all-charges

The secrecy around Google's trial has relaxed somewhat, and the trickle of revelations emerging from the cracks in the courthouse are fascinating. For the first time, we're able to get a concrete sense of which queries are the most lucrative for Google:

https://www.theverge.com/2023/11/1/23941766/google-antitrust-trial-search-queries-ad-money

The list comes from 2018, but it's still wild. As David Pierce writes in The Verge, the top twenty includes three iPhone-related terms, five insurance queries, and the rest are overshadowed by searches for customer service info for monopolistic services like Xfinity, Uber and Hulu.

All-in-all, we're living through a hell of a moment for piercing the corporate veil. Maybe it's the problem of maintaining secrecy within large companies, or maybe the the rampant mistreatment of even senior executives has led to more leaks and whistleblowing. Either way, we all owe a debt of gratitude to the anonymous leaker who revealed the unbelievable pettiness of former HBO president of programming Casey Bloys, who ordered his underlings to create an army of sock-puppet Twitter accounts to harass TV and movie critics who panned HBO's shows:

https://www.rollingstone.com/tv-movies/tv-movie-features/hbo-casey-bloys-secret-twitter-trolls-tv-critics-leaked-texts-lawsuit-the-idol-1234867722/

These trolling attempts were pathetic, even by the standards of thick-fingered corporate execs. Like, accusing critics who panned the shitty-ass Perry Mason reboot of disrespecting veterans because the fictional Mason's back-story had him storming the beach on D-Day.

The pushback against corporate bullying is everywhere, and of course, the vanguard is the labor movement. Did you hear that the UAW won their strike against the auto-makers, scoring raises for all workers based on the increases in the companies' CEO pay? The UAW isn't done, either! Their incredible new leader, Shawn Fain, has called for a general strike in 2028:

https://www.404media.co/uaw-calls-on-workers-to-line-up-massive-general-strike-for-2028-to-defeat-billionaire-class/

The massive victory for unionized auto-workers has thrown a spotlight on the terrible working conditions and pay for workers at Tesla, a criminal company that has no compunctions about violating labor law to prevent its workers from exercising their legal rights. Over in Sweden, union workers are teaching Tesla a lesson. After the company tried its illegal union-busting playbook on Tesla service centers, the unionized dock-workers issued an ultimatum: respect your workers or face a blockade at Sweden's ports that would block any Tesla from being unloaded into the EU's fifth largest Tesla market:

https://www.wired.com/story/tesla-sweden-strike/

Of course, the real solution to Teslas – and every other kind of car – is to redesign our cities for public transit, walking and cycling, making cars the exception for deliveries, accessibility and other necessities. Transitioning to EVs will make a big dent in the climate emergency, but it won't make our streets any safer – and they keep getting deadlier.

Last summer, my dear old pal Ted Kulczycky got in touch with me to tell me that Talking Heads were going to be all present in public for the first time since the band's breakup, as part of the debut of the newly remastered print of Stop Making Sense, the greatest concert movie of all time. Even better, the show would be in Toronto, my hometown, where Ted and I went to high-school together, at TIFF.

Ted is the only person I know who is more obsessed with Talking Heads than I am, and he started working on tickets for the show while I starting pricing plane tickets. And then, the unthinkable happened: Ted's wife, Serah, got in touch to say that Ted had been run over by a car while getting off of a streetcar, that he was severely injured, and would require multiple surgeries.

But this was Ted, so of course he was still planning to see the show. And he did, getting a day-pass from the hospital and showing up looking like someone from a Kids In The Hall sketch who'd been made up to look like someone who'd been run over by a car:

https://www.flickr.com/photos/doctorow/53182440282/

In his Globe and Mail article about Ted's experience, Brad Wheeler describes how the whole hospital rallied around Ted to make it possible for him to get to the movie:

https://www.theglobeandmail.com/arts/music/article-how-a-talking-heads-superfan-found-healing-with-the-concert-film-stop/

He also mentions that Ted is working on a book and podcast about Stop Making Sense. I visited Ted in the hospital the day after the gig and we talked about the book and it sounds amazing. Also? The movie was incredible. See it in Imax.

That heartwarming tale of healing through big suits is a pretty good place to wrap up this linkdump, but I want to call your attention to just one more thing before I go: Robin Sloan's Snarkmarket piece about blogging and "stock and flow":

https://snarkmarket.com/2010/4890/

Sloan makes the excellent case that for writers, having a "flow" of short, quick posts builds the audience for a "stock" of longer, more synthetic pieces like books. This has certainly been my experience, but I think it's only part of the story – there are good, non-mercenary reasons for writers to do a lot of "flow." As I wrote in my 2021 essay, "The Memex Method," turning your commonplace book into a database – AKA "blogging" – makes you write better notes to yourself because you know others will see them:

https://pluralistic.net/2021/05/09/the-memex-method/

This, in turn, creates a supersaturated, subconscious solution of fragments that are just waiting to nucleate and crystallize into full-blown novels and nonfiction books and other "stock." That's how I came out of lockdown with nine new books. The next one is The Lost Cause, a hopepunk science fiction novel about the climate whose early fans include Naomi Klein, Rebecca Solnit, Bill McKibben and Kim Stanley Robinson. It's out on November 14:

https://us.macmillan.com/books/9781250865939/the-lost-cause

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/05/variegated/#nein

#pluralistic#hbo#astroturfing#sweden#labor#unions#tesla#adblock#ublock#youtube#prompt injection#publishing#robin sloan#linkdumps#linkdump#ai#tlds#anguilla#finance curse#ted Kulczycky#toronto#stop making sense#talking heads

137 notes

·

View notes

Note

HYBE stocks are down so that means investors didn't believe HYBE's payola mediaplay of Jimin renewing his contracts. ONLY RM SIGNED HIS CONTRACT. It's shameful how you ot7s try to force people to doubt Jimin. Forcing people to think staying with the company after all the sabotages is good for him are we in upside down land? Well no and the stocks show it. Armys swallowed the purple koolaid but the investors live in the real world.

***

Please stop sending me asks like this.

Your ask is a very good example of something my friends and I were just talking about. This is the thread (linked here) that prompted our conversation.

Please read it.

HYBE is down ~5% in the hours following the contract renewal news.

Anon, I don't know how old you are or if you have your own bank account, but nobody who knows what they're doing looks at stock movements in isolation. It's a relative metric, by definition. And here's a few things that have happened in the last 48 hours that explain what stocks moved relative to:

The Market - All major Korean stock indices are down on the mixed resolution by the US Fed this week. It's a trend consistent with market movements in every country that does significant trade with the US and/or denominates trade in USD.

The Index - The index for entertainment companies (ex gaming) on the KRX is down ~3.5% over the same period.

The Peers - HYBE's closest peers for our purposes, i.e. JYP, SME, YG, Kakao, etc, are down on average ~6.5%. YG is the outlier here down ~13%. Excluding YG, the average return over the same period is HYBE's peers being down ~4.5%.

At market open following HYBE's contract renewal news there was a massive options call with a volume of about 8K at depressed prices relative to yesterday's closing. By its characteristics it's likely an event-triggered options call made for profit-taking. This is normal for retail and institutional investors who trade in liquid names. Excluding the options volume, HYBE's actual stock performance over the same period, is that they're down ~2.5%.

Meaning, HYBE actually outperformed their peers and the index (ex gaming) following the contract renewal news. The total entertainment index (including gaming) was only down ~1.9%, and so HYBE underperformed that index when you include gaming companies. But that's not a peer group that's usually considered for k-pop companies anyway.

So the stock movements you're referring to, are in effect showing the opposite of what you think.

*

This might be hard to believe, but I'm actually very neutral on HYBE. I have my own opinions about how they run their business, how the sub-labels are managed, etc. But when I see things I don't like, I don't go looking for any sliver of disjointed information to uphold my previously held belief. It's a sign that you're a living, breathing, thinking being, when the introduction of new information challenges a perception you have, you're able to meaningfully deduce the implications, and arrive at a more informed conclusion.

The new piece of information we received in the last 24 hours, is that HYBE's board has approved the resolution to renew BTS's exclusive contracts. Given the size of the payout to BTS, this is a customary requirement to finalize the renewals process. For the nature of company disclosures like this, there's the expectation of a time lag between when a deal is announced and when it closes, but the fundamentals of the deal do not change. The time lag is typically to hash out technicalities and to allow for other considerations (which we know in this case involves limitations due to 2seok's military service), but the fundamentals of the announcement do not change else HYBE will be charged for misrepresentation in their disclosures and for market manipulation at the Board level.

Basically, if HYBE was not at least 100% sure these renewals would be completed, that press release would literally be corporate suicide.

The quality of conversations here would be so much higher, whether in akgae or ARMY circles, if people actually knew what they were talking about.

Please don't spam asks like this in my inbox again. Take those ramblings to a blog that can tolerate it. I have extremely little patience for akgaes in general.

72 notes

·

View notes

Note

“My sense is that Meghan's market is more of the TJ Maxx demographic.” Interesting assessment of Meghan’s market. From a business perspective, brands who end up at TJMaxx, Marshalls, etc. (owned by the same company TJX) are typically bought in due to 1) supplier has made too much (overstock) and it isn’t selling 2) it’s getting close to the end of its expiration dates (close out) and it sold in at a much cheaper cheaper price to TJX. She’d still need a regular place to sell before she tries to offload (usually at a much lower margin / maybe even a loss) to TJX. I’m basing this on my experience with working in food industry and resorting to these retailers for the same reasons.

Exactly my point. The TJX brand is the end of the line for so much product and merch these days (especially fast fashion) that it's inevitable Meghan's products will end up there if this turns into the deal she wants to be. The key thing is that she needs product first. That she launched without a real product is very telling.

To me, what I think it says is that she's not getting the investors or partners that she wants so she launched ASAP to use the media's hype as part of her negotiation or recruitment strategy. (In addition to taking advantage of Kate's absence, of course.)

I made a suggestion in an earlier post that Meghan's competitors are the socialite/influencers that are launching their own brands or already have brands. A great many of those brands use print-on-demand dropship merch. They save on overstock storage and production fees by only keeping a limited selection in stock and marking up their own prices to cover "demand."

I see Roop heading in that direction. If they can't find a distribution vendor (e.g., Kohls, Target, Macy's, etc.), they'll do dropshipping but at such low quantities they always sell out - which is the same tactic Meghan uses when she wants to be a fashion influencer (she wears something already heavily discounted and with so little stock that she can take credit for "selling out").

What is interesting, and why I think Roop has a good argument for exclusivity with TJX companies, is Rae Dunn. Most of her product is sold exclusively through TJX and she has a deal with a company called Magenta Inc., an online retailer that's thought to be behind Rae Dunn products in places like Amazon and Walmart.

So there's precedent for Meghan/Roop to sell exclusively with TJX, with perhaps a side deal for an online storefront like Magenta offers. But that's not the audience or market Meghan wants (even though she herself is the "wine mom" elder millennial motivational-quote-spouting stereotype that buys Rae Dunn and shops at TJX stores so it's a natural fit). She wants Roop in luxury marketplaces that prices out the very people who would actually buy Meghan's product.

She's stuck between a rock and a hard place. I think she realizes it now while watching the metrics on social media plateau from a total lack of engagement and total absence of content (hence throwing Mandana under the bus in Page Six). Which is surprising. Given the way she rolled out Sussex.com with the IG Vancouver kickoff - four or five days straight of new Sussex content and material - I expected the same thing with Roop; 1st day - social media launch, 2nd day - lunch papwalk, 3rd day - product launch, 4th day - "checking out my product" charity visit/papwalk, 5th day - Netflix cooking show promo, and so on.

I know, I know. Stop giving her ideas. I'm trying!

26 notes

·

View notes

Text

Donald Trump’s paper fortune dropped by hundreds of millions of dollars on Friday as shares in his media firm came under pressure in the wake of his conviction in his New York hush-money trial.

Trump Media & Technology Group’s stock finished the day down 5.3% on Wall Street, denting the value of the former president’s vast stake in the business.

By the time markets closed for the day, Trump’s stake stood at about $5.6bn. The previous day, it was closer to $6bn.

An extraordinary market debut in March by Trump Media, the owner of Truth Social, bolstered Trump’s paper fortune by billions of dollars – and propelled him, for the first time, into the ranks of the world’s 500 wealthiest people – as he grapples with hefty legal costs.

But shares in Trump Media are prone to volatile fluctuations, and Trump is unable to start offloading his stake until September, due to a lock-up agreement.

When New York’s Nasdaq stock exchange closed on Thursday, about an hour before Trump was found guilty of 34 counts of falsifying business records in a criminal hush-money scheme, his stake in Trump Media was worth more than $5.9bn. At one point on Friday, as the company’s stock fell, his stake was worth less than $5.5bn. His fortune recovered some ground near the end of the day.

Trading in Trump Media has been prone to fluctuation since its listing. While the stock stumbled on Friday, it rose over the course of the week. The company’s financial returns have yet to match its success on the market. Net losses at Trump Media widened from $210m to $328m in the first three months of this year. Revenue dropped 31% to $770,500 over the same period.

The company has become a so-called meme stock, boosted by chatter and enthusiasm on social media – posted, in its case, on platforms including Truth Social – urging retail investors to buy into it. Some Trump supporters called for others to buy shares the day after his conviction.

The ex-president will need Trump Media to continue to trade at the levels to which it has surged in recent months if he is to raise billions of dollars by selling his majority stake in the firm.

#us politics#news#republicans#conservatives#donald trump#gop#2024#nasdaq#stock exchange#Trump Media & Technology Group#Trump Media#Truth Social#stocks

10 notes

·

View notes

Text

Investing 101

Part 1 of ?

A Tumblr mutual has asked me to explain brokers and stocks; I'm not an investing expert but I will share what I know (or what I think I know). The investing subreddit is a great source for those who really want to know the details.

What are stocks? When you buy a company's stock you own a small portion of the company. If a company has issued 100 shares and you purchase 1 share, you own 1/100th of the company. Most companies start out as private enterprises (i.e. owned by one of more individuals) and if the company is successful it may want to sell shares (i.e. go public). Going public is a major milestone in the life of a company. The process of issuing shares, quarterly reports, etc. is highly regulated by the SEC and requires audits, the creation of a board of directors and regular financial reporting, all in an effort to protect investors. In light of this expense, it's fair to wonder why an owner would want to go through the hassle of going public and giving up control of some (or all) of their company.

Going public (i.e. selling shares/stock) is a way of generating capital for the company. Perhaps a company needs an infusion of cash to build a new factory or expand to a new market... new stock issuances often include statements from the company about how it intends to use the proceeds. Issuing public shares is also a way to reward owners and key employees by giving them a way to get cash out of the business. Imagine you started a business 20 years ago and always funneled the company's earnings back into the business to help it grow. You may have a valuable business, but you have all your eggs in that basket and don't have cash to invest in other ways, buy a yacht etc. Likewise, you may have promised key employees partial ownership of the business, this is a way for them to cash-in also.

Regardless of the motivation, companies issuing stocks can choose to sell partial or full ownership of the company. Successful entrepreneurs often choose to retain majority ownership in the business - shareholders may collectively only own 40% of the business, for example, and have the right to elect 2 of 5 directors to the board. This kind of strategy allows the founder to have his cake and eat it too (i.e. cash-out some of the value of the business while still retaining control). A company can also sell various types of shares, each with different benefits. For example, a company may sell Preferred Shares, which are guaranteed to receive a dividend before other shares. Or the company may issue voting and non-voting shares (this is another way for a founder to retain control). Most retail investors (individuals like you and me), purchase Common Shares which have voting rights and are eligible for dividends.

What is a dividend? If you own a part of a company, it is reasonable to expect that you receive your proportionate share of the earnings right? The distribution of a company's earnings to shareholders is called a dividend. Companies may distribute dividends quarterly, annually or in the case of start-up or fast growing companies, not at all. Netflix for example, which had $8.19B in revenue and $1.49B in earnings in 2022 HAS NEVER PAID A DIVIDEND. Likewise, TESLA has never paid a dividend.

Why would anyone want to own shares in companies which don't pay dividends? It isn't at all uncommon for early stage and/or high growth companies to not pay dividends. The thinking is that the growth prospects for the company are so attractive, the money is best spent by reinvesting in the business. Of course there's an expectation that at some point in the future the business will mature and begin paying dividends. This is what happened with Microsoft and Apple for example. As long as the company continues to show accelerating growth, investors will overlook the lack the dividends, betting that the overall value of the company (and intrinsic value of the shares) will grow as well. Again, Netflix and Tesla are good examples of that.

This leads to the conclusion that there are two ways to make money from stocks - dividends and increases in the share price. I may not be concerned if I own a stock with a share price which has been stuck at $100 for the last 5 years if that company is paying me a $10 dividend every year. I'm still earning a 10% return on that investment. Conversely, I may be equally happy owning a stock which has never paid a dividend but is now worth $150 dollars versus my original purchase price of $100.

Stocks whose value is primarily derived from their reliability for generating dividends are called Value stocks. Stocks whose value is primarily derived from the growth of the stock price are called Growth stocks - Netflix and Tesla are examples of Growth stocks; Microsoft and Ford are examples of Value stocks. Admittedly this can be confusing; I remember our first broker asking if we were Value or Growth investors. It seems like a silly question; can't we have both? In truth, older investors like me tend to be Value investors... we like the reliability (and cash flow) of stable companies that declare dividends every quarter. Growth stocks can be exciting, but the stock prices can be volatile and older investors have little tolerance for volatility. Value stocks tend to be stable companies in stable industries. Growth companies are all about the future; there is an opportunity for much greater rewards, but that comes with more risk. Over a longer investing horizon (>10 years), a broad portfolio Growth stocks will likely outperform an equally broad portfolio of Value stocks. Old people don't have a long investing horizon, but young people do and each group's investment portfolio should be biased accordingly.

Next Post - how to buy stocks.

31 notes

·

View notes

Note

"All I'll say is there's a reason we chose Acorns as a sponsor and not Robinhood. 🙃"

Is that reason that they pay you to choose them or did Robinhood actually do something wrong?

They actually did something wrong.

Legally speaking, they've been fined by the SEC, their corporate governance is getting a huge side eye, and there are major regulatory concerns. 4 Reasons to Avoid Robinhood

This article is a long read but very nuanced about how the Robinhood model leads investors astray. "Its users buy and sell the riskiest financial products and do so more frequently than customers at other retail brokerage firms, but their inexperience can lead to staggering losses." Robinhood Has Lured Young Traders, Sometimes With Devastating Results

A product review that reviews it in the context of its product type and how good it is for customers, rather than the ethical and philosophical concerns: 10 Reasons Why You Shouldn't Invest With the Robinhood App

A breakdown of why the business model itself encourages unhealthy investing strategies that ultimately increase risk for investors who use the platform: Robinhood: A Terrible Business Model Not Worth Investing In

And here's something we wrote about the GameStop short and how Robinhood contributed to that mess: Money Is Fake and GameStop Is King: What Happened When Reddit and a Meme Stock Tanked Hedge Funds

No financial institution is squeaky clean because capitalism. But we try to choose sponsors on the basis that they help our followers, not hurt them. We could get money by pushing Robinhood to you guys, but we don't because we don't believe in their product. And we'd LOVE to not use sponsors and affiliate marketing at all! But times are hard and the generous donations we get through Patreon and PayPal just aren't enough to be able to pay us and our staff a fair wage for our labor.

84 notes

·

View notes

Text

On Reddit and Truth Social, users have been trying to re-create the meme-stock magic for Trump Media and Technology Group—the company behind Truth Social—that boosted companies like GameStop in 2021. So far, they haven’t been too successful.

Truth Social, former president Donald Trump’s Twitter copycat, lacks two essential ingredients to the narrative of previous campaigns: underlying fundamentals and the foil of institutional investors. Large hedge funds had shorted GameStop, betting that the price would go down. This time, the stock is owned primarily by retail investors.

Unlike other social media companies, the Truth Social doesn’t disclose how many users it has, but has said previously that just 9 million people have signed up for the site, compared with over 3 billion monthly active users on Facebook. TruthSocial visitors have declined from 5.4 million in January to around 5 million in February, according to web analytics firm SimilarWeb. The site’s lack of users has contributed to poor financial performance.

On the r/wallstreetbets subreddit, home of meme-stock boosterism, most users aren’t buying what Truth Social is selling. “If you invest in this on a long enough timeline you will lose everything. Thus is strictly a movement play,” wrote Reddit user Rich4718. “If you think Donald Trump is going to create an income positive social media platform you are an absolute fucking moron.”

The company started trading publicly on March 26 under the ticker symbol DJT and has already experienced wild swings in price. On Monday, the stock slid nearly 20 percent, erasing $2 billion in value.

In a filing on Monday, the company said it had just over $4 million in revenue and $58 million in net losses. This comes after the auditor for Trump Media and Technology Group made a startling admission: The company’s losses “raise substantial doubt about its ability to continue,” according to a filing with the US Securities and Exchange Commission on March 25. And yet the company is valued at around $7 billion, despite reporting these sizable losses. The valuation is propped up in part by Trump fans who see investing in the company as a way to support the former president. In some cases, these investors hold a genuine belief that Truth Social could become a major social media player.

Albert Choi, a professor of Law at the University of Michigan, says investors in Trump Media may be motivated by factors beyond traditional financial logic, like boosting the price through generating hype.

“If that’s your primary motivating factor, then you’re not going to care too much about whether the company is actually making money,” says Choi.

“I believe DJT is an investment in Donald Trump, not just Truth Social,” Reddit user autsauce, who declined to share their real name, tells WIRED. “If market participants start asking that question, which I am betting they will, they will likely arrive at a very different price valuing Truth Social in a silo.”

Choi noted that Trump winning the Presidential election could actually hurt the company’s stock, as investors' perceived need to support the former president financially by investing could fade.

“My guess is that the interest in the stock would largely disappear,” Choi said.

Some Truth Social fans have spun the company’s entry into the public market as a fresh start. The infusion of capital from people buying shares in the company will enable Truth Social to post an improved financial performance, they argue.

“With $300M to properly grow a company and Trump’s impending win in 2024, the entire situation has changed,” Chad Nedohin, who regularly livestreams about his support for the company while wearing a Jack Sparrow costume, wrote on Truth Social.

Still, Truth Social doesn’t really provide anything unique. The company’s defining feature is that it's the website where Trump is currently posting, and it is, unsurprisingly, home to many posts discussing conspiracy theories about QAnon, stolen elections, and deep state plots.

But Devin Nunes, Truth Social CEO and former Republican US representative, said in an interview last week with the right-wing activist Charlie Kirk that the company plans to combine features from other social networks.

“We’re trying to take the best of all platforms and put it into one,” Nunes said, “whether it be Twitter, Instagram, TikTok, et cetera.”

Truth Social still needs to comply with Apple’s and Google’s terms of service to remain in its respective app stores. Nunes claims, however, that Truth Social “doesn’t use any of the woke companies, referencing Parler, the social media company that was kicked off Apple’s and Google’s mobile app stores in the wake of the January 6 riot at the Capitol. “It’s kind of an interesting investment, because you’re really investing in your constitutional rights,” Nunes said. “We’re the only company out there that can’t be shut down by woke companies.”

7 notes

·

View notes

Text

Investment Options in India: Diversify Your Portfolio in 2024

Diversification is a fundamental principle of investing, essential for managing risk and optimizing returns. In 2024, as investors navigate an ever-changing economic landscape, diversifying their portfolios becomes even more critical. India, with its vibrant economy, diverse markets, and growth potential, offers a plethora of investment options for both domestic and international investors. In this comprehensive guide, we explore various investment avenues in India in 2024, from traditional options like stocks and real estate to emerging opportunities in startups and alternative assets.

1. Equities: Investing in the Stock Market

Investing in equities remains one of the most popular ways to participate in India's economic growth story. The Indian stock market, represented by indices such as the Nifty 50 and Sensex, offers ample opportunities for investors to capitalize on the country's booming sectors and emerging companies.

- Blue-Chip Stocks: Invest in established companies with a proven track record of performance and stability.

- Mid and Small-Cap Stocks: Explore growth opportunities by investing in mid and small-cap companies with high growth potential.

- Sectoral Funds: Diversify your portfolio by investing in sector-specific mutual funds or exchange-traded funds (ETFs) targeting industries such as technology, healthcare, and finance.

2. Mutual Funds: Professional Fund Management

Mutual funds provide an excellent avenue for investors to access a diversified portfolio managed by professional fund managers. In India, mutual funds offer a range of options catering to different risk profiles and investment objectives.

- Equity Funds: Invest in a diversified portfolio of stocks, including large-cap, mid-cap, and small-cap companies.

- Debt Funds: Generate stable returns by investing in fixed-income securities such as government bonds, corporate bonds, and treasury bills.

- Hybrid Funds: Combine the benefits of equity and debt investments to achieve a balanced risk-return profile.

- Index Funds and ETFs: Track benchmark indices like the Nifty 50 and Sensex at a lower cost compared to actively managed funds.

3. Real Estate: Tangible Assets for Long-Term Growth

Real estate continues to be a popular investment option in India, offering the dual benefits of capital appreciation and rental income. While traditional residential and commercial properties remain attractive, investors can also explore alternative avenues such as real estate investment trusts (REITs) and real estate crowdfunding platforms.

- Residential Properties: Invest in apartments, villas, or plots of land in prime locations with high demand and potential for appreciation.

- Commercial Properties: Generate rental income by investing in office spaces, retail outlets, warehouses, and industrial properties.

- REITs: Gain exposure to a diversified portfolio of income-generating real estate assets without the hassle of direct ownership.

- Real Estate Crowdfunding: Participate in real estate projects through online platforms, pooling funds with other investors to access lucrative opportunities.

4. Startups and Venture Capital: Betting on Innovation and Entrepreneurship

India's startup ecosystem has witnessed exponential growth in recent years, fueled by a wave of innovation, entrepreneurial talent, and supportive government policies. Investing in startups and venture capital funds allows investors to participate in this dynamic ecosystem and potentially earn high returns.

- Angel Investing: Provide early-stage funding to promising startups in exchange for equity ownership, betting on their growth potential.

- Venture Capital Funds: Invest in professionally managed funds that provide capital to startups and emerging companies in exchange for equity stakes.

- Startup Accelerators and Incubators: Partner with organizations that support early-stage startups through mentorship, networking, and access to resources.

5. Alternative Assets: Diversification Beyond Traditional Investments

In addition to stocks, bonds, and real estate, investors can diversify their portfolios further by allocating capital to alternative assets. These assets offer unique risk-return profiles and can act as a hedge against market volatility.

- Gold and Precious Metals: Hedge against inflation and currency fluctuations by investing in physical gold, gold ETFs, or gold savings funds.

- Commodities: Gain exposure to commodities such as crude oil, natural gas, metals, and agricultural products through commodity futures and exchange-traded funds.

- Cryptocurrencies: Explore the emerging asset class of digital currencies like Bitcoin, Ethereum, and others, which offer the potential for high returns but come with higher volatility and risk.

Conclusion

Diversifying your investment portfolio is essential for mitigating risk, maximizing returns, and achieving long-term financial goals. In 2024, India offers a myriad of investment options across various asset classes, catering to the preferences and risk profiles of different investors.

Whether you prefer the stability of blue-chip stocks, the growth potential of startups, or the tangible assets of real estate, India provides ample opportunities to diversify your portfolio and capitalize on the country's economic growth story. By carefully assessing your investment objectives, risk tolerance, and time horizon, you can construct a well-diversified portfolio that withstands market fluctuations and delivers sustainable returns in the years to come.

This post was originally published on: Foxnangel

#best investment options in india#diversify portfolio#share market#stock market#indian stock market#mutual funds#real estate#startups in india#venture capital#foxnangel#invest in india

4 notes

·

View notes

Text

How Drastic Interest Rate Cuts Could Fuel a Bitcoin Surge

In just a few days, on September 18th, all eyes will be on the Federal Reserve as they make their next move on interest rates. Speculation is running high that the Fed may drastically cut rates, signaling a potential shift toward a more accommodative monetary policy. For most investors, this news means one thing: inflation is likely on the horizon. But for those in the know, this could mark the beginning of something even bigger—another major surge in Bitcoin's value.

The relationship between interest rate cuts and Bitcoin might not be obvious at first, but once you dig a little deeper, it becomes clear that Bitcoin is positioned to thrive in environments where traditional currencies falter. Let’s explore why a drastic Fed rate cut could light the fuse for a Bitcoin price explosion.

The Impact of Interest Rate Cuts on Traditional Markets

Interest rate cuts typically signal that the Federal Reserve is aiming to stimulate the economy by making borrowing cheaper. When rates go down, businesses and consumers tend to borrow more, which can spur economic activity. However, there’s a flip side to this: when rates are cut too aggressively or for too long, inflation tends to creep in. This is because the influx of cheap money devalues the dollar, reducing its purchasing power.

For traditional assets like stocks, bonds, and real estate, this can be a double-edged sword. Lower rates can boost prices in the short term, but inflation eats away at real returns over time. That’s where Bitcoin comes in.

Bitcoin: A Hedge Against Inflation

Bitcoin, unlike fiat currencies, has a fixed supply of 21 million coins. This scarcity is a key feature that makes it an attractive hedge against inflation. As central banks continue to print money and increase liquidity in the system, the purchasing power of fiat currencies like the dollar diminishes.

Enter Bitcoin: a decentralized, deflationary asset that is immune to government intervention. When inflation rises and fiat loses value, Bitcoin becomes more appealing to those seeking to protect their wealth from devaluation. Its "digital gold" narrative is more relevant than ever in times of monetary easing, when people are searching for assets that can hold value over the long term.

Why a Drastic Rate Cut Could Spark a Bitcoin Price Pump

So, what does this mean for Bitcoin if the Fed announces a drastic interest rate cut? First and foremost, it means a weaker dollar. When the dollar weakens, investors look for ways to preserve their purchasing power, and Bitcoin is an increasingly popular option.

A drastic rate cut would likely send a signal to the markets that the Fed is willing to let inflation rise in order to stimulate the economy. This could lead to more institutional investors seeking refuge in hard assets, especially Bitcoin, which has shown resilience during periods of fiat instability. As more capital flows into Bitcoin, driven by both retail and institutional investors, the price is likely to experience a sharp rise. We’ve seen this play out in the past, and all the signs suggest that we could be on the verge of another price pump.

Historical Precedents: Bitcoin’s Response to Fed Policy

History provides some clues as to how Bitcoin might respond to this latest round of monetary easing. Take, for example, the massive stimulus packages rolled out in 2020 in response to the COVID-19 pandemic. As the Fed slashed rates and flooded the market with liquidity, inflation concerns grew, and Bitcoin began a historic bull run that saw its price rise from around $10,000 to an all-time high of over $60,000 in just over a year.

It wasn’t just retail investors driving that rally. Institutional players, from hedge funds to public companies, started to view Bitcoin as a viable alternative to traditional stores of value. As monetary policy loosened and inflation fears grew, Bitcoin's fixed supply made it an increasingly attractive asset. The same dynamics are at play today, with the added weight of broader adoption and a maturing Bitcoin ecosystem.

The Bigger Picture: Bitcoin’s Role in a Changing Financial System

The potential for a Bitcoin price pump following the Fed’s interest rate cuts is significant, but it’s part of a larger narrative that has been building over the past few years. Bitcoin is no longer just a fringe asset for tech enthusiasts and libertarians—it’s becoming a serious contender as a global reserve asset.

As central banks continue to struggle with inflation and monetary policy, Bitcoin stands apart as a decentralized alternative that doesn’t rely on government intervention or manipulation. More people are beginning to recognize its potential, not just as a store of value, but as a fundamental part of the future financial system. In an era where fiat currencies are increasingly seen as unreliable, Bitcoin’s deflationary design and decentralized nature make it a beacon of financial stability.

Conclusion: Stay Ahead of the Curve

As we approach September 18th, the Fed’s decision on interest rates will have ripple effects across global markets. For Bitcoin, a drastic rate cut could be the catalyst for another major price surge, as investors seek out alternatives to a weakening dollar.

If history is any guide, Bitcoin is likely to benefit from the Fed’s actions, making now a crucial time to stay informed and consider how this asset fits into your long-term financial strategy. The world of finance is changing rapidly, and those who understand Bitcoin’s role in this shifting landscape will be best positioned to thrive.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

Thank you for your support!

#Bitcoin#Cryptocurrency#CryptoNews#BitcoinPrice#FedInterestRates#InflationHedge#DigitalGold#BitcoinSurge#BitcoinInvestment#FinancialFreedom#Blockchain#BitcoinAdoption#HyperBitcoinization#CryptoBlog#BitcoinEconomy#MonetaryPolicy#BitcoinToTheMoon#BTC#financial empowerment#globaleconomy#digitalcurrency#financial experts#unplugged financial#financial education#finance

2 notes

·

View notes

Text

Premarket U.S. Stock Movers: Tesla, Macy’s, Coinbase, Nio, Shell, Amazon

In today's early trading, the U.S. stock market is already buzzing with notable movements among key players. Investors and analysts are closely monitoring the premarket activity of several prominent stocks, each showing distinctive performance dynamics.

Tesla (NASDAQ) has started the day on a positive note, with its stock rising by 1.8%. This upward movement follows recent market optimism surrounding Tesla's innovative developments in electric vehicles and sustainable energy solutions. As a pioneering force in the automotive industry, Tesla continues to capture investor interest with its innovative technological advancements and ambitious growth strategies.

Macy’s (NYSE) is another standout performer in the premarket, showcasing a robust 6.8% increase. This surge reflects renewed investor confidence in the retail giant's ability to navigate challenges and capitalize on evolving consumer trends. Macy's ongoing efforts to enhance its digital capabilities and strategic initiatives in omnichannel retailing are positioning the company for sustained growth in a competitive market landscape.

Coinbase (NASDAQ), however, faces a 4.6% decline in its premarket trading. The cryptocurrency exchange platform is experiencing volatility amidst regulatory scrutiny and market fluctuations in digital assets. Despite its leadership in the digital currency space, Coinbase's stock performance underscores the inherent volatility and regulatory uncertainties impacting the crypto industry.

Nio (NYSE), known for its electric vehicle offerings, is witnessing a 2.3% decrease in its American Depositary Receipts (ADRs) during premarket trading. This decline comes amid broader sectoral challenges and market sentiment towards growth stocks in the EV sector. Nio continues to navigate through supply chain disruptions and competitive pressures as it strives to expand its market presence globally.

Shell (LON) ADRs, representing Royal Dutch Shell, have shown a modest 1.1% rise in premarket trading. As a global energy leader, Shell's stock performance reflects investor sentiment toward energy markets and macroeconomic factors influencing oil and gas prices. The company's strategic focus on sustainable energy transitions and operational resilience in a dynamic energy landscape remains pivotal amid evolving market conditions.

Amazon (NASDAQ), a cornerstone of e-commerce and cloud computing services, is demonstrating a minor 0.3% change in its premarket activity. Amazon's stock movement reflects ongoing investor sentiment towards tech giants amid regulatory scrutiny and competitive pressures in digital retail and cloud computing markets. The company continues to innovate across its business segments, driving growth and adaptation to evolving consumer behaviors.

Today's premarket movements highlight the diverse dynamics shaping the U.S. stock market. Investors are navigating through a mix of sector-specific trends, regulatory developments, and macroeconomic factors influencing stock performance. As market participants analyze these early signals, the day's trading session promises to offer further insights into the evolving landscape of global financial markets.

2 notes

·

View notes

Text

Mass tech worker layoffs and the soft landing

As tech giants reach terminal enshittification, hollowed out to the point where they are barely able to keep their end-users or business customers locked in, the capital classes are ready for the final rug-pull, where all the value is transfered from people who make things for a living to people who own things for a living.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/21/tech-workers/#sharpen-your-blades-boys

“Activist investors” have triggered massive waves of tech layoffs, firing so many tech workers so quickly that it’s hard to even come up with an accurate count. The total is somewhere around 280,000 workers:

https://layoffs.fyi/

These layoffs have nothing to do with “trimming the fat” or correcting the hiring excesses of the lockdown. They’re a project to transfer value from workers, customers and users to shareholders. Google’s layoff of 12,000 workers followed fast on the heels of gargantuan stock buyback where the company pissed away enough money to pay those 12,000 salaries…for the next 27 years.

The equation is simple: the more companies invest in maintenance, research, development, moderation, anti-fraud, customer service and all the other essential functions of the business, the less money there is to remit to people who do nothing and own everything.

The tech sector has grown and grown since the first days of the PC — which were also the first days of neoliberalism (literally: the Apple ][+ went on sale the same year Ronald Reagan hit the campaign trail). But despite a long-run tight labor market for tech workers, there have been two other periods of mass layoffs — the 2001 dotcom collapse and the Great Financial Crisis of 2008.

Both of those were mass extinction events for startups and the workers who depended on them. The mass dislocations of those times were traumatic, and each one had its own aftermath. The dotcom collapse freed up tons of workers, servers, offices and furniture, and a massive surge in useful, user-centric technologies. The Great Financial Crisis created the gig economy and a series of exploitative, scammy “bro” startups, from cryptocurrency grifts to services like Airbnb, bent on converting the world’s housing stock into unlicensed hotel rooms filled with hidden cameras.

Likewise, the post-lockdown layoffs have their own character: as Eira May writes on StackOverflow, many in the vast cohort of laid-off tech workers is finding it relatively easy to find new tech jobs, outside of the tech sector:

https://stackoverflow.blog/2023/03/19/whats-different-about-these-layoffs/

May cites a Ziprecruiter analysis that claims that 80% of laid-off tech workers found tech jobs within 3 months, and that there are 375,000 open tech roles in American firms today (and that figure is growing):

https://www.ziprecruiter.com/blog/laid-off-tech-workers/

There are plenty of tech jobs — just not in tech companies. They’re in “energy and climate technology, healthcare, retail, finance, agriculture, and more” — firms with intensely technical needs and no technical staff. Historically, many of these firms would have outsourced their technological back-ends to the Big Tech firms that just destroyed so many jobs to further enrich the richest people on Earth. Now, those companies are hiring ex-Big Tech employees to run their own services.

The Big Tech firms are locked in a race to see who can eat their seed corn the fastest. Spreading tech expertise out of the tech firms is a good thing, on balance. Big Tech’s vast profits come from smaller businesses in the real economy who couldn’t outbid the tech giants for tech talent — until now.

These mass layoff speak volumes about the ethos of Silicon Valley. The same investors who rent their garments demanding a bailout for Silicon Valley Bank to “help the everyday workers” are also the loudest voices for mass layoffs and transfers to shareholders. The self-styled “angel investor” who spent the weekend of SVB’s collapse all-caps tweeting dire warnings about the impact on “the middle class” and “Main Street” also gleefully DM’ed Elon Musk in the runup to his takeover of Twitter:

Day zero

Sharpen your blades boys 🔪

2 day a week Office requirement = 20% voluntary departures.

https://newsletter.mollywhite.net/p/the-venture-capitalists-dilemma

For many technologists, the allure of digital tools is the possibility of emancipation, a world where we can collaborate to make things without bosses or masters. But for the bosses and masters, automation’s allure is the possibility of getting rid of workers, shattering their power, and replacing them with meeker, cheaper, more easily replaced labor.

That means that workers who go from tech firms to firms in the real economy might be getting lucky — escaping the grasp of bosses who dream of a world where technology lets them pit workers against each other in a race to the bottom on wages, benefits and working conditions, to employers who are glad to have them as partners in their drive to escape Big Tech’s grasp.

Tomorrow (Mar 22), I’m doing a remote talk for the Institute for the Future’s “Changing the Register” series.

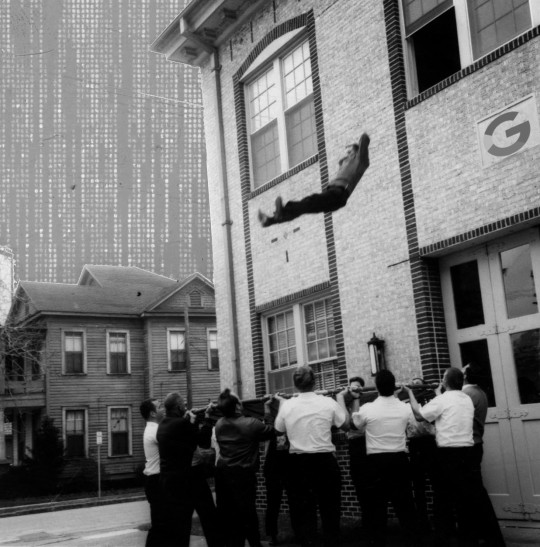

Image: University of North Texas Libraries (modified) https://texashistory.unt.edu/ark:/67531/metapth586821/

[Image ID: A group of firefighters holding a safety net under a building from which a man is falling; he is supine and has his hands behind his head. The sky has a faint, greyscale version of the 'Matrix Waterfall' effect. The building bears a Google logo.]

290 notes

·

View notes