#real estate investment 2021

Explore tagged Tumblr posts

Text

How to Invest In Real Estate (2021) - dir. John Wilson

1K notes

·

View notes

Text

"In some cities, as many as one in four office spaces are vacant. Some start-ups are giving them a second life – as indoor farms growing crops as varied as kale, cucumber and herbs.

Since its 1967 construction, Canada's "Calgary Tower", a 190m (623ft) concrete-and-steel observation tower in Calgary, Alberta, has been home to an observation deck, panoramic restaurants and souvenir shops. Last year, it welcomed a different kind of business: a fully functioning indoor farm.

Sprawling across 6,000sq m (65,000 sq ft), the farm, which produces dozens of crops including strawberries, kale and cucumber, is a striking example of the search for city-grown food. But it's hardly alone. From Japan to Singapore to Dubai, vertical indoor farms – where crops can be grown in climate-controlled environments with hydroponics, aquaponics or aeroponics techniques – have been popping up around the world.

While indoor farming had been on the rise for years, a watershed moment came during the Covid-19 pandemic, when disruptions to the food supply chain underscored the need for local solutions. In 2021, $6bn (£4.8bn) in vertical farming deals were registered globally – the peak year for vertical farming investment. As the global economy entered its post-pandemic phase, some high-profile startups like Fifth Season went out of business, and others including Planted Detroit and AeroFarms running into a period of financial difficulty. Some commentators questioned whether a "vertical farming bubble" had popped.

But a new, post-pandemic trend may give the sector a boost. In countries including Canada and Australia, landlords are struggling to fill vacant office spaces as companies embrace remote and hybrid work. In the US, the office vacancy rate is more than 20%.

"Vertical farms may prove to be a cost-effective way to fill in vacant office buildings," says Warren Seay, Jr, a real estate finance partner in the Washington DC offices of US law firm ArentFox Schiff, who authored an article on urban farm reconversions.

There are other reasons for the interest in urban farms, too. Though supply chains have largely recovered post-Covid-19, other global shocks, including climate change, geopolitical turmoil and farmers' strikes, mean that they continue to be vulnerable – driving more cities to look for local food production options...

Thanks to artificial light and controlled temperatures, offices are proving surprisingly good environments for indoor agriculture, spurring some companies to convert part of their facilities into small farms. Since 2022, Australia's start-up Greenspace has worked with clients like Deloitte and Commonwealth Bank to turn "dead zones", like the space between lifts and meeting rooms, into 2m (6ft) tall hydroponic cabinets growing leafy greens.

On top of being adaptable to indoor farm operations, vacant office buildings offer the advantage of proximity to final consumers.

In a former paper storage warehouse in Arlington, about a mile outside of Washington DC, Jacqueline Potter and the team at Area 2 Farms are growing over 180 organic varieties of lettuce, greens, root vegetables, herbs and micro-greens. By serving consumers 10 miles away or less, the company has driven down transport costs and associated greenhouse emissions.

This also frees the team up to grow other types of food that can be hard to find elsewhere – such as edible flower species like buzz buttons and nasturtium. "Most crops are now selected to be grown because of their ability to withstand a 1,500-mile journey," Potter says, referring to the average distance covered by crops in the US before reaching customers. "In our farm, we can select crops for other properties like their nutritional value or taste."

Overall, vertical farms have the potential to outperform regular farms on several environmental sustainability metrics like water usage, says Evan Fraser, professor of geography at the University of Guelph in Ontario, Canada and the director of the Arell Food Institute, a research centre on sustainable food production. Most indoor farms report using a tiny fraction of the water that outdoor farms use. Indoor farms also report greater output per square mile than regular farms.

Energy use, however, is the "Achilles heel" of this sector, says Fraser: vertical farms need a lot of electricity to run lighting and ventilation systems, smart sensors and automated harvesting technologies. But if energy is sourced from renewable sources, they can outperform regular farms on this metric too, he says.

Because of variations in operational setup, it is hard to make a general assessment of the environmental, social and economic sustainability of indoor farms, says Jiangxiao Qiu, a landscape ecologist at the University of Florida and author of a study on urban agriculture's role in sustainability. Still, he agrees with Fraser: in general, urban indoor farms have higher crop yield per square foot, greater water and nutrient-use efficiency, better resistance to pests and shorter distance to market. Downsides include high energy use due to lighting, ventilation and air conditioning.

They face other challenges, too. As Seay notes, zoning laws often do not allow for agricultural activity within urban areas (although some cities like Arlington, Virginia, and Cincinnati, Ohio, have recently updated zoning to allow indoor farms). And, for now, indoor farms have limited crop range. It is hard to produce staple crops like wheat, corn or rice indoors, says Fraser. Aside from leafy greens, most indoor facilities cannot yet produce other types of crops at scale.

But as long as the post-pandemic trends of remote work and corporate downsizing will last, indoor farms may keep popping up in cities around the world, Seay says.

"One thing cities dislike more than anything is unused spaces that don't drive economic growth," he says. "If indoor farm conversions in cities like Arlington prove successful, others may follow suit.""

-via BBC, January 27, 2025

1K notes

·

View notes

Text

Yanis Varoufakis’s “Technofeudalism: What Killed Capitalism?”

Monday (October 2), I'll be in Boise to host an event with VE Schwab. On October 7–8, I'm in Milan to keynote Wired Nextfest.

Socialists have been hotly anticipating the end of capitalism since at least 1848, when Marx and Engels published The Communist Manifesto - but the Manifesto also reminds us that capitalism is only too happy to reinvent itself during its crises, coming back in new forms, over and over again:

https://www.nytimes.com/2022/10/31/books/review/a-spectre-haunting-china-mieville.html

Now, in Technofeudalism: What Killed Capitalism, Yanis Varoufakis - the "libertarian Marxist" former finance minister of Greece - makes an excellent case that capitalism died a decade ago, turning into a new form of feudalism: technofeudalism:

https://www.penguin.co.uk/books/451795/technofeudalism-by-varoufakis-yanis/9781847927279

To understand where Varoufakis is coming from, you need to go beyond the colloquial meanings of "capitalism" and "feudalism." Capitalism isn't just "a system where we buy and sell things." It's a system where capital rules the roost: the richest, most powerful people are those who coerce workers into using their capital (factories, tools, vehicles, etc) to create income in the form of profits.

By contrast, a feudal society is one organized around people who own things, charging others to use them to produce goods and services. In a feudal society, the most important form of income isn't profit, it's rent. To quote Varoufakis: "rent flows from privileged access to things in fixed supply" (land, fossil fuels, etc). Profit comes from "entrepreneurial people who have invested in things that wouldn't have otherwise existed."

This distinction is subtle, but important: "Profit is vulnerable to market competition, rent is not." If you have a coffee shop, then every other coffee shop that opens on your block is a competitive threat that could erode your margins. But if you own the building the coffee shop owner rents, then every other coffee shop that opens on the block raises the property values and the amount of rent you can charge.

The capitalist revolution - extolled and condemned in the Manifesto - was led by people who valorized profits as the heroic returns for making something new in this world, and who condemned rents as a parasitic drain on the true producers whose entrepreneurial spirits would enrich us all. The "free markets" extolled by Adam Smith weren't free from regulation - they were free from rents:

https://locusmag.com/2021/03/cory-doctorow-free-markets/

But rents, Varoufakis writes, "survived only parasitically on, and in the shadows of, profit." That is, rentiers (people whose wealth comes from rents) were a small rump of the economy, slightly suspect and on the periphery of any consideration of how to organize our society. But all that changed in 2008, when the world's central banks addressed the Great Financial Crisis by bailing out not just the banks, but the bankers, funneling trillions to the people whose reckless behavior brought the world to the brink of economic ruin.

Suddenly, these wealthy people, and their banks, experienced enormous wealth-gains without profits. Their businesses lost billions in profits (the cost of offering the business's products and services vastly exceeded the money people spent on those products and services). But the business still had billions more at the end of the year than they'd had at the start: billions in public money, funneled to them by central banks.

This kicked off the "everything rally" in which every kind of asset - real estate, art, stocks, bonds, even monkey JPEGs - ballooned in value. That's exactly what you'd expect from an economy where rents dominate over profits. Feudal rentiers don't need to invest to keep making money - remember, their wealth comes from owning things that other people invest in to make money.

Rents are not vulnerable to competition, so rentiers don't need to plow their rents into new technology to keep the money coming in. The capitalist that leases the oil field needs to invest in new pumps and refining to stay competitive with other oil companies. But the rentier of the oil field doesn't have to do anything: either the capitalist tenant will invest in more capital and make the field more valuable, or they will lose out to another capitalist who'll replace them. Either way, the rentier gets more rent.

So when capitalists get richer, they spend some of that money on new capital, but when rentiers get richer, them spend money on more assets they can rent to capitalists. The "everything rally" made all kinds of capital more valuable, and companies that were transitioning to a feudal footing turned around and handed that money to their investors in stock buybacks and dividends, rather than spending the money on R&D, or new plants, or new technology.

The tech companies, though, were the exception. They invested in "cloud capital" - the servers, lines, and services that everyone else would have to pay rent on in order to practice capitalism.

Think of Amazon: Varoufakis likens shopping on Amazon to visiting a bustling city center filled with shops run by independent capitalists. However, all of those capitalists are subservient to a feudal lord: Jeff Bezos, who takes 51 cents out of every dollar they bring in, and furthermore gets to decide which products they can sell and how those products must be displayed:

https://pluralistic.net/2022/11/28/enshittification/#relentless-payola

The postcapitalist, technofeudal world isn't a world without capitalism, then. It's a world where capitalists are subservient to feudalists ("cloudalists" in Varoufakis's thesis), as are the rest of us the cloud peons, from the social media users and performers who fill the technofuedalists' siloes with "content" to the regular users whose media diet is dictated by the cloudalists' recommendation systems:

https://pluralistic.net/2023/01/21/potemkin-ai/#hey-guys

A defining feature of cloudalism is the ability of the rentier lord to destroy any capitalist vassal's business with the click of a mouse. If Google kicks your business out of the search index, or if Facebook blocks your publication, or if Twitter shadowbans mentions of your product, or if Apple pulls your app from the store, you're toast.

Capitalists "still have the power to command labor from the majority who are reliant on wages," but they are still mere vassals to the cloudalists. Even the most energetic capitalist can't escape paying rent, thanks in large part to "IP," which I claim is best understood as "laws that let a company reach beyond its walls to dictate the conduct of competitors, critics and customers":

https://locusmag.com/2020/09/cory-doctorow-ip/

Varoufakis points to ways that the cloudalists can cement their gains: for example, "green" energy doesn't rely on land-leases (like fossil fuels), but it does rely on networked grids and data-protocols that can be loaded up with IP, either or both of which can be turned into chokepoints for feudal rent-extraction. To make things worse, Varoufakis argues that cloudalists won't be able to muster the degree of coordination and patience needed to actually resolve the climate emergency - they'll not only extract rent from every source of renewables, but they'll also silo them in ways that make them incapable of doing the things we need them to do.

Energy is just one of the technofeudal implications that Varoufakis explores in this book: there are also lengthy and fascinating sections on geopolitics, monetary policy, and the New Cold War. Technofeudalism - and the struggle to produce a dominant fiefdom - is a very useful lens for understanding US/Chinese tech wars.

Though Varoufakis is laying out a technical and even esoteric argument here, he takes great pains to make it accessible. The book is structured as a long open letter to his father, a chemical engineer and leftist who was a political prisoner during the fascist takeover of Greece. The framing device works very well, especially if you've read Talking To My Daughter About the Economy, Varoufakis's 2018 radical economics primer in the form of a letter to his young daughter:

https://us.macmillan.com/books/9780374538491/talkingtomydaughterabouttheeconomy

At the very end of the book, Varoufakis calls for "a cloud rebellion to overthrow technofeudalism." This section is very short - and short on details. That's not a knock against the book: there are plenty of very good books that consist primarily or entirely of analysis of the problems with a system, without having to lay out a detailed program for solving those problems.

But for what it's worth, I think there is a way to plan and execute a "cloud rebellion" - a way to use laws, technology, reverse-engineering and human rights frameworks to shatter the platforms and seize the means of computation. I lay out that program in The Internet Con: How the Seize the Means of Computation, a book I published with Verso Books a couple weeks ago:

https://www.versobooks.com/products/3035-the-internet-con

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

#pluralistic#yanis varoufakis#socialism#communism#technofeudalism#economics#postcapitalism#political science#rent-seeking#rentiers#books#reviews#gift guide

733 notes

·

View notes

Text

Leaving the US?

Following the events of last night, its likely a lot of you want to leave the United States. I don't blame you and can't say I haven't entertained the same thoughts. So I complied this list of the easiest countries to move to from the United States, and the pros and cons of each nation

Mexico

Mexico is close to the United States, not requiring a flight to get there (though it is recommended if within your price range) The nation allows residency of US citizens for up to 180 days without a visa or permit, allowing plenty of time to apply for the temporary residency visa which is normally valid for 4-5 years. After 5 years of residency, you can apply for permanent citizenship. https://consulmex.sre.gob.mx/leamington/index.php/non-mexicans/visas/115-temporary-resident-visa

Mexico has a much lower cost of living than the USA, with the average Mexican spending around $1000 usd or MEX$20151.55 mxn. Jobs do pay lower, but the cost of living still works out lower than in the United States and the work environment in Mexico is known to be more healthy. Along with the great weather (and food) Mexico is a good choice for Americans trying to escape the country.

Claudia Sheinbaum, the current president of Mexico was recently sworn in and is a strong advocate for women's rights. She has fought for Abortion rights in Mexico, along with other reproductive rights. She is also a Champion of LGBTQ+ rights and has been fighting to help queer people in Mexico for the majority of her career. She is expanding Mexican welfare and is an environmental advocate. Same-Sex Marriage has been fully legal in Mexico since 2021 and Abortion is not criminalized and preformed in almost all Mexican states. For more information, I suggest the Wikipedia article on Abortion in Mexico, as it is a complicated subject. Although currently, it is ranked around the same as the USA on access across the whole country, Mexican Abortion legislation is moving in the opposite direction to the United State's, as according to the Center for Reproductive Rights, once all of the Mexican states properly reform their laws to comply with the 2023 court ruling, Mexico will be a rank one on Abortion laws, or Abortion available everywhere on request which is expected to be soon. Changing one's legal name and gender is protected under Mexican laws, and the majority of states have anti discrimination laws in place. One state even allows one to change their gender to something other than male or female, recognizing non-binary identities legally.

Portugal

Portugal is a good option for those who have funds to put into leaving. Portugal offers a program for a Golden Visa which can be obtained through owning a certain amount of real estate although there are other ways. This Visa offers the chance at citizenship after holding for only 5 years. https://getgoldenvisa.com/portugal-golden-visa-program

Portugal offers a lot of benefits for retirees as well, so if your grandma also wants to flee the country, Portugal may be the country for her. The weather is good and it is known to be incredibly peaceful and pretty.

Portugal is also in the European Union, meaning citizenship here also means EU citizenship and access to the whole Schengen Zone, allowing a lot of opportunity for education and location, as you don't have to obtain another citizenship to move to another EU nation. Abortion is legal in Portugal as is Same-Sex Marriage and both are protected under the laws of the EU. Trans rights are also protected and a trans person is allowed to change their legal gender without a medical diagnosis.

Ecuador

Ecuador is another option that is good if you aren't looking to leave the Americas. Ecuador allows visa free residency for up to 90 days and grant Permanent resident visas after only 21 months of living with a temporary visa. There are many temporary visa options including an investment one similar to Portugal's and a retiree option. Another option would be the Professional Visa, although that one is more likely to be granted if you have a job lined up and a university degree, it is the only one that does not require a lot of money. Get in touch with an Ecuador embassy here https://travel.state.gov/content/travel/en/consularnotification/ConsularNotificationandAccess/Ecuador.html

Ecuador also has a lower cost of living compared to the United States and the English language and dollar are often used in the country. The weather in Ecuador is an incredibly good feature of the nation as well.

Ecuador does not allow abortion upon request, but they do allow it to save the life of the mother or for other extreme cases involving rape. There are multiple organizations working to change this however and extend these rights to be more like those of Mexico or Argentina. Same-Sex marriage is protected in Ecuador as of 2019 and transgender people are able to change their legal gender without needing to go through gender affirming surgery.

Spain

Spain has an education based program where citizens of Canada and the United States are granted temporary visa's to come and teach English in the nation. You are compensated and only expected to work for 12-16 hours a week. Under this visa, you can find other work and apply for a more permanent professional Visa, which only have to be renewed every few years and leads you on the path to permanent residency. https://www.educacionfpydeportes.gob.es/eeuu/convocatorias-programas/convocatorias-eeuu/nalcap.html

Spain is also a member of the EU and residency here allows access to the Schengen zone of Europe as well. Spain has abortion on request up to 14 weeks and allows emergency abortions when the mother's life could be at risk even after that. Spain also allows same-sex marriage and has trans protection laws in place, with somebody over 16 allowed to change their legal gender, no parent, judge or doctor involved. Spain also has a very relaxed work culture with the maximum allowed work hours a week being 40 and the average worked being 36.

South Korea

South Korea has a very similar program to Spain, where you can live there for up to a year and teach English, although the South Korean program often requires a bachelors degree. Following the stay with the temporary teaching visa, you could apply for a more permanent option. A "resident visa" in South Korea is typically referred to as an "F-5 visa", which signifies a permanent residency permit, allowing foreigners to live and work in the country indefinitely; to qualify, you must meet certain criteria like significant investment in a Korean business, marriage to a Korean citizen, or a long-term stay with exceptional skills in a specific field. https://www.internations.org/south-korea-expats/guide/visas-work-permits

As of 2021, Abortion is fully legal in the nation and is available upon request, although due to the nature in which it was legalized it is a bit iffy. I would recommend reading further into it. However, although Homosexuality is not criminalized in the country, South Korea has no official recognition of any sort of Marriage or civil unions between same-sex couples and they often face discrimination. So if you are in a same sex relationship, South Korea may not be the place for you.

Australia

Australia is one of the easiest nations for Americans to live in under a temporary Visa, as they have a program called the working holiday program and you can live there up to 3 years under it. However, this program does not lead to permanent residency and you would have to apply for another visa, either a work or family, to move there permanently. https://immi.homeaffairs.gov.au/visas/permanent-resident

Australia allows abortion up to 23 weeks upon request, although specifics do vary between states. Queer rights in Australia rank among the highest in the world, as marriage has been fully legalized since 2017 and they are also a world leader in trans rights. All Australian states allow the changing of one's gender legally and support gender affirming care. Non-discriminations laws are also present in all the states.

Canada

Canada allows American citizens to stay in their country for up to 6 months visa free, although they are not allowed to work without any sort of visa. The easiest way to gain Canadian residency is though the express visa system. This immigration program targets skilled workers than can contribute to three economic fields in Canada. Canadian citizenship is available after five years of residency. https://www.canada.ca/en/immigration-refugees-citizenship/services/immigrate-canada/express-entry/works.html

Cost of living in Canada is slightly higher than in the US, but the benefits are greater with more affordable education and universal healthcare.

Canada is known as one of the best nations for LGBTQ+ people. It was the third nation in the world to legalize same sex marriage. Since June 2017, all places within Canada explicitly within the Canadian Human Rights Act, equal opportunity and/or anti-discrimination legislation prohibit discrimination against gender identity or gender identity or expression. This includes trans rights, who are protected under Canadian law. Abortion is publicly funded and available throughout the entire nation in Canada.

If you live in a red state and aren't interested in leaving the country, but don't want to stay where you are, here's some stats that may help make your decision on where to move to;

States with no abolition ban:

Washington DC, New Jersey, Maryland, Oregon, Vermont, Michigan, Minnesota, Colorado, New Mexico, Alaska

Best states for LGBTQ+ individuals:

New York, Oregon, Minnesota, California, Colorado, Massachusetts, New Hampshire, Vermont, Rhode Island, Connecticut, Maine, Washington DC

Hope this helps whoever may need it.

#anti trump#anti republican#2024 presidential election#fuck donald trump#fuck republicans#fuck trump#anti donald trump#anti facist#lgbtqia#lgbtq community#feminism#pro choice#2024 presidential race#election 2024#kamala harris#kamala 2024#fuck the gop#leaving america#fuck america#fuck facists

34 notes

·

View notes

Text

Life Spa Resort, under the inspired leadership of African American founders Allen and Melissa Brown, proudly announces the launch of a fundraising campaign to raise $12 million to open the Poconos' first Black-owned hotel spa resort. With a proven track record as successful entrepreneurs holding nearly $2 million in commercial real estate assets since 2021, the Browns are poised to transform the Poconos into a premier destination for health and relaxation.

Embarking on a Groundbreaking Journey

Allen and Melissa are currently in contract and looking to close the acquisition of the resort property by mid-September. Development will commence immediately thereafter, including the installation of state-of-the-art social wellness hydrotherapy pools that can accommodate 200-300 people at a time.

Transforming Wellness in the Poconos

The focus of Life Spa Resort is to establish a hydrotherapy and spa facility that is unparalleled in the region. Hydrotherapy, known for its significant health benefits, will be the cornerstone of their offerings. The resort will cater to up to 200 guests daily, providing treatments that promote relaxation, rejuvenation, and healing in a serene setting.

Support from Early Backers

Life Spa Resort invites early backers to join this transformative project by contributing as little as $10. Backers can gain lifetime memberships and enjoy benefits including spa treatments at discounts of up to 80%. This unique opportunity allows individuals to be part of a pioneering wellness community from the ground up. Moreover, lifetime early backers will be able to use their benefits at any and all locations that Life Spa Resort opens in the future, ensuring enduring value across a growing network of wellness destinations.

Investor Opportunity

Accredited investors are sought for this venture under Regulation D, Rule 506(c), which allows public solicitation of a private offering to those who meet the SEC's criteria for accreditation. The Private Placement Memorandum, available for detailed review on Life Spa Resort's website, presents a compelling investment opportunity. Investors can expect projected returns of 12-15% annually, emphasizing the robust financial model and growth potential of Life Spa Resort. The Memorandum includes clear investment terms and extensive plans for facilities such as hydrotherapy pools, specialized sauna rooms, and a comprehensive suite of wellness services.

About the Owners

Allen and Melissa Brown have been pivotal figures in the hospitality and real estate sectors since 2021, managing multiple successful properties and building a strong financial foundation. Their commitment to creating a legacy of health, relaxation, and financial prosperity through innovative projects like Life Spa Resort is poised to redefine industry standards. They have also maintained Airbnb Super-host status for three years, further highlighting their commitment to excellence in hospitality and guest services. Visit LifeSpaResort.com for more information.

Also, be sure to follow the resort on Facebook and Instagram.

#fortheculture❤️🖤💚🙋🏿♂️🤴🏿🌍🎤#blackpowerinthismfer❤️🖤💚🙋🏿♂️🤴🏿✊🏿🎤#supportblackentrepreneurs#melanin excellence

15 notes

·

View notes

Text

Weyward by Emilia Hart

Published: February 2, 2023 Publisher: HarperCollins

The Author

Emilia Hart is a British-Australian writer. She was born in Sydney and studied English Literature and Law at the University of New South Wales before working as a lawyer in Sydney and London. She is a graduate of Curtis Brown Creative’s Three Month Online Novel Writing Course and was Highly Commended in the 2021 Caledonia Novel Award. Her short fiction has been published in Australia and the UK. Weyward is her debut novel. She lives in London.

˗ˏˋ ´ˎ˗

The Story

In Weyward, the narrative intertwines the lives of three women spanning five centuries. In 2019, Kate seeks solace in Weyward Cottage, escaping from London and her abusive partner. She slowly unravels a mystery hidden within the cottage's history, hinting at secrets from her great aunt's past and the 17th-century witch hunts. In 1619, Altha faces trial for a murder she didn't commit, relying on her unconventional nature magic to defend herself against accusations of witchcraft. Meanwhile, in 1942, Violet feels trapped by societal constraints and the prison of her family's estate, yearning for freedom and the memory of her mother, who was rumored to have gone mad before her death. The only remnants of her mother's existence are a locket marked with a mysterious "W" and the word "weyward" etched into the bedroom's baseboard. This novel masterfully weaves these women's tales together, revealing a compelling narrative of strength across generations and the transformative influence of the natural world.

˗ˏˋ ´ˎ˗

The Vibe: family lineage, nature magic, self discovery, witch trials, feminine strength, betrayal, forging your own path

The Style: historical fiction, magical realism, multiple povs, part epistolary, part narration, emotive

Trigger Warnings: imprisonment, domestic abuse, spousal rape, car accident death, entrapment by pregnancy, emotional abuse, suidical ideation, mention of stillbirth, “hysteria”, hysterectomy, abortion, misogyny

˗ˏˋ ´ˎ˗

The Review

I picked Weyward up on a whim and am so pleased that I did. Historical fiction mixed with magical realism and a dash of incredibly rich writing made it a real pleasure to read. The narrative weaves between three women across five centuries, deftly showcasing the myriad ways in which women demonstrate resilience and bravery under difficult circumstances.

Being totally honest, I often struggle with split narrative timelines in novels. I can’t be the only one who has found themselves bored with one section of a book, willing the boring chapters to end in order to get back to the characters I am invested in… right? Thankfully, Weyward’s leading ladies are all so fabulous and their stories so engaging, that I was invested in each timeline equally. This actually sped up my reading as the story progressed, as I wanted to find out how each character was doing in their timeline more and more desperately. If you want to read a moving story with wonderful characters that emphasizes the transformative power of nature, please pick this up!

Witch. The word slithers from the mouth like a serpent, drips from the tongue as thick and black as tar. We never thought of ourselves as witches, my mother and I. For this was a word invented by men, a word that brings power to those who speak it, not those it describes. A word that builds gallows and pyres, turns breathing women into corpses.

One thing I will say before really digging in to the review, is that there are a lot of trigger warnings for this novel (see above for a summary). Reading through the list, it may seem that this is a tome of sheer doom and gloom, but it actually didn’t feel that way to me. Obviously, a lot of the trigger warnings may be Hard Nos for some people, and that’s totally fair, however I found this story so engaging and the characters so strong, that the TWs didn’t beat me down as much as they could have. Being set across five centuries, this book explores a number of methods by which patriarchal societies abuse women. From the outright cruelties of the 17th Century to the more insidious offences of modern society, there is a lot of violence and misogyny at work here. It can get difficult in parts, but I found myself uplifted by the women’s strength in the end.

Now, I’ve discussed how strong the characters are; let me properly introduce them to you! Kate, living in her 2019 timeline, wants to escape a violent partner and discover the truth about her family. Violet, in 1942 and the midst of the Second World War, wants to escape the societal confines and expectations of femininity and live a life she chooses. Altha in 1619 just wants to survive. I loved them all. I cared about them all. I may have even shed a tear or two over them (and books don’t make me cry super often). I particularly loved Violet and her sheer determination to live her own life. I really appreciated seeing her as a teen from her own perspective, as well as from Kate’s perspective looking back at Violet as an old woman. (I want grow up to be an eccentric old lady with the witchiest house in the world just like her!) The interlacing of their stories is so well conceived, it really feels like you’re seeing a cohesive timeline rather than random sections plonked together.

Perhaps one day, she said, there would be a safer time. When women could walk the earth, shining bright with power, and yet live.

There is so much witchcraft detail in this book, dropped in so sneakily and creatively, I just loved it! All the leading ladies have Witch Marks (which definitely need to be used in witchy stories more frequently), but they’re not overly emphasized… they’re just there and mentioned in passing in various subtle ways. The way the Familiars work is also super cool; not every animal can be a familiar, and they aren’t necessarily easily controlled, but they provide emotional support and do their witches’ bidding when needed. I especially loved the constant presence of the crows, which at first seem wild and dangerous, but eventually become as important to the plot as the leading characters as symbols of power. And I love, love, love how the magic stems so much from the witches’ connection to the natural world. It just felt so right to me.

One notable factor in Weyward for me was how deftly Emilia Hart wove historical facts into the narrative. From the Lancashire Assizes to the Pendle Witch Trials and King James I and his obsession with Witch Hunts, Altha’s timeline felt so based in history as to be almost visceral. This sort of thing really happened to living women. I was especially impressed by the use of the Great Comet of 1618; Hart definitely did her research in order to place her story firmly in the real world, with an additional magical touch.

There was something about us – the Weyward women – that bonded us more tightly with the natural world. We can feel it, she said, the same way we feel rage, sorrow or joy. The animals, the birds, the plants – they let us in, recognising us as one of their own. That is why roots and leaves yield so easily under our fingers, to form tonics that bring comfort and healing. That is why animals welcome our embrace. Why the crows – the ones who carry the sign – watch over us and do our bidding, why their touch brings our abilities into sharpest relief.

Weyward has become one of my favourite reads for 2024, and has 100% got a solid seat in my Top Ten of the Year. It is endlessly impressive to me that is was Emilia Hart’s DEBUT NOVEL. Seriously, my hat is off to her for creating a story that felt so real and so magical at the same time. I will definitely be reading more of her work as it is published. If my recommendation isn’t enough, Weyward also won Goodreads’ Best Historical Fiction title in 2023. And if you buy a physical copy of the book, you get a neat little flip book of a crow flying in the page corners. If all that doesn’t sell it to you, I don’t know what will.

#Weyward#Emilia Hart#book review#bookblr#reading#books#witch fiction#witches#witchy#witchblr#witchy books#witchcore#witchy vibes#witch#witch books

29 notes

·

View notes

Text

Roevember

* * * *

LETTERS FROM AN AMERICAN

August 29, 2024

Heather Cox Richardson

Aug 30, 2024

And now the U.S. Army has weighed in on the scandal surrounding Trump’s visit to Arlington National Cemetery for a campaign photo op, after which his team shared a campaign video it had filmed. The Army said that the cemetery hosts almost 3,000 public wreath-laying ceremonies a year without incident and that Trump and his staff “were made aware of federal laws, Army regulations and [Department of Defense] policies, which clearly prohibit political activities on cemetery grounds.”

It went on to say that a cemetery employee “who attempted to ensure adherence to these rules was abruptly pushed aside…. This incident was unfortunate, and it is also unfortunate that the… employee and her professionalism has been unfairly attacked. [Arlington National Cemetery] is a national shrine to the honored dead of the Armed Forces, and its dedicated staff will continue to ensure public ceremonies are conducted with the dignity and respect the nation’s fallen deserve.”

“I don’t think I can adequately explain what a massive deal it is for the Army to make a statement like this,” political writer and veteran Allison Gill of Mueller, She Wrote, noted. “The Pentagon avoids statements like this at all costs. But a draft dodging traitor decided to lie about our armed forces staff, so they went to paper.”

The deputy Pentagon press secretary Sabrina Singh said the Department of Defense is “aware of the statement that the Army issued, and we support what the Army said.” Hours later, Trump campaign manager Chris LaCivita reposted the offending video on X and, tagging the official account for Army Secretary Christine Wormuth, said he was “hoping to trigger the hacks” in her office.

In Talking Points Memo, Josh Marshall reported that the Trump campaign’s plan was to lay a wreath at Arlington National Cemetery to honor the 13 members of the U.S. military killed in the suicide bombing during the evacuation of Kabul, Afghanistan, in August 2021. They intended to film the event and then attack Vice President Kamala Harris and President Joe Biden for not “showing up” for the event, which they intended to portray as an “established memorial.”

Another major story from yesterday is that the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) has finalized two rules that will work to stop corruption and money laundering in U.S. residential real estate and in private investment.

This is a big deal. As scholar of kleptocracies Casey Michel put it: “This is a massive, massive deal in the world of counter-kleptocracy—the U.S. is finally ending the gargantuan anti–money laundering loopholes for real estate, private equity, hedge funds, and more. Can't overstate how important this is. What a feat.”

After the collapse of the Soviet Union in late 1991, the oligarchs who rose to power in the former Soviet republics looked to park their illicit money in western democracies, where the rule of law would protect their investments. Once invested in the United States, they favored the Republicans, who focused on the protection of wealth rather than social services. For their part, Republican politicians focused on spreading capitalism rather than democracy, arguing that the two went hand in hand.

The financial deregulation that made the U.S. a good bet for oligarchs to launder money got a boost when, shortly after the September 11, 2001, attacks, Congress passed the USA PATRIOT Act to address the threat of terrorism. The law took on money laundering and the illicit funding of terrorism, requiring financial institutions to inspect large sums of money passing through them. But the Financial Crimes Enforcement Network (FinCEN) exempted many real estate deals from the new regulations.

The United States became one of the money-laundering capitals of the world, with hundreds of billions of dollars laundered in the U.S. every year.

In 2011 the international movement of illicit money led then–FBI director Robert Mueller to tell the Citizens Crime Commission of New York City that globalization and technology had changed the nature of organized crime. International enterprises, he said, “are running multi-national, multi-billion dollar schemes from start to finish…. They may be former members of nation-state governments, security services, or the military…. These criminal enterprises are making billions of dollars from human trafficking, health care fraud, computer intrusions, and copyright infringement. They are cornering the market on natural gas, oil, and precious metals, and selling to the highest bidder…. These groups may infiltrate our businesses. They may provide logistical support to hostile foreign powers. They may try to manipulate those at the highest levels of government. Indeed, these so-called ‘iron triangles’ of organized criminals, corrupt government officials, and business leaders pose a significant national security threat.”

Congress addressed this threat in 2021 by including the Corporate Transparency Act in the National Defense Authorization Act. It undercut shell companies and money laundering by requiring the owners of any company that is not otherwise overseen by the federal government (by filing taxes, for example, or through close regulation) to file with FinCEN a report identifying (by name, birth date, address, and an identifying number) each person associated with the company who either owns 25% or more of it or exercised substantial control over it. The measure also increased penalties for money laundering and streamlined cooperation between banks and foreign law enforcement authorities. That act went into effect on January 1, 2024.

Meanwhile, the Biden administration made fighting corruption a centerpiece of its attempt to shore up democracy both at home and abroad. In June 2021, President Biden declared the fight against corruption a core U.S. national security interest. “Corruption threatens United States national security, economic equity, global anti-poverty and development efforts, and democracy itself,” he wrote. “But by effectively preventing and countering corruption and demonstrating the advantages of transparent and accountable governance, we can secure a critical advantage for the United States and other democracies.”

In March 2023 the Treasury told Congress that “[m]oney laundering perpetrated by the Government of the Russian Federation (GOR), Russian [state-owned enterprises], Russian organized crime, and Russian elites poses a significant threat to the national security of the United States and the integrity of the international financial system,” and it outlined the ways in which it had been trying to combat that corruption.

Now FinCEN has firmed up rules to add anti-money-laundering safeguards to private real estate and private investment. They will require certain industry professionals to report information to FinCEN about cash transfers of residential real estate to a legal entity or trust, transactions that “present a high illicit finance risk,” FinCEN wrote. “The rule will increase transparency, limit the ability of illicit actors to anonymously launder illicit proceeds through the American housing market, and bolster law enforcement investigative efforts.” The real estate rule will go into effect on December 1, 2025.

The rule about investment advisors will make the obligation to report suspicious financial activity apply to certain financial advisors. This rule will go into effect on January 1, 2026.

“The Treasury Department has been hard at work to disrupt attempts to use the United States to hide and launder ill-gotten gains,” Secretary of the Treasury Janet L. Yellen explained. “That includes by addressing our biggest regulatory deficiencies, including through these two new rules that close critical loopholes in the U.S. financial system that bad actors use to facilitate serious crimes like corruption, narcotrafficking, and fraud. These steps will make it harder for criminals to exploit our strong residential real estate and investment adviser sectors.”

“I applaud FinCEN’s commonsense efforts to prevent corrupt actors from using the American residential real estate and private investment sectors as safe havens for hiding dirty money,” Senator Sheldon Whitehouse (D-RI) said in a statement. “For too long, vulnerabilities in the system have attracted kleptocrats, cartels, and criminals looking to stow away their ill-gotten gains. I hope FinCEN will apply similar safeguards to commercial real estate, as well as due diligence requirements to investment advisors. These are all welcome steps toward keeping our country and financial system safe and secure for the American people—not those who wish to abuse it.”

The Commission on Security and Cooperation in Europe (also known as the Helsinki Commission) brought the history of modern money laundering full circle. It said: “We welcome the Treasury Department's decision to close off crucial pathways for Russian money laundering and sanctions evasion through real estate and private equity.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Roevember#billboard#Letters From An American#heather cox richardson#arlington cemetery#election 2024#money laundering

8 notes

·

View notes

Text

Blackstone Surges to Record High: A Closer Look at Their Impressive Q3 Results

Blackstone, the world's largest commercial property owner, achieved a remarkable milestone on Thursday as its shares surged to a record high. This impressive performance comes on the heels of better-than-expected third-quarter results and an improved real estate investment performance. Let’s dive into the factors driving this success and what it means for the market.

Key Highlights from Q3

In the third quarter, Blackstone invested or committed a staggering $54 billion, marking the highest amount in over two years. This surge in investment activity is attributed to the Federal Reserve’s recent rate cut in September, which significantly reduced the cost of capital. The U.S. central bank’s previous rate hikes had stymied real estate deals and financing, leading to increased defaults in the office market affected by corporate cost-cutting and the rise of hybrid and remote work.

Stephen Schwarzman, Blackstone’s Chief Executive, emphasized the positive impact of the rate cut, stating, “Easing the cost of the capital will be very positive for Blackstone’s asset values. It will be a catalyst for transaction activity.” This sentiment was echoed by Jonathan Gray, President and Chief Operating Officer, who noted that while commercial real estate sentiment is improving, it remains cautious.

Strategic Investments and Areas of Focus

Blackstone has been proactive in planting the “seeds of future value” by substantially increasing its pace of investment. A key area of focus is the revolutionary advancements in artificial intelligence (AI) and the associated digital and energy infrastructure. In September, Blackstone announced the $16 billion purchase of AirTrunk, the largest data center operator in the Asia-Pacific region. This acquisition is part of Blackstone’s $70 billion investment in data centers, with over $100 billion in prospective pipeline development.

Other notable investment themes include renewable energy transition, private credit, and India’s emergence as a major economy. These strategic areas highlight Blackstone’s commitment to innovation and growth.

Recovery in Commercial Real Estate

The Blackstone Real Estate Income Trust (BREIT), a benchmark for the industry, reported a 93% slump in investor stock redemption requests from a peak. This indicates a recovery in investor confidence and a shift towards positive net inflows of capital. BREIT’s core-plus real estate investments, which include stable, income-generating, high-quality real estate, showed a 0.5% decline in Q3 performance, an improvement from a 3.8% drop over the past 12 months. The riskier opportunistic real estate investments posted a 1.1% increase, reversing previous declines.

Student Housing and Data Centers

Among rental housing, student housing has emerged as a significant focus. Wesley LePatner, set to become BREIT CEO on Jan. 1, highlighted the structural undersupply in the U.S. student housing market, emphasizing its potential as an all-weather asset class. BREIT has consistently met investor redemption requests for several months, showcasing strong performance.

Furthermore, the demand for data centers remains robust. QTS, which Blackstone took private in 2021, recorded more leasing activity last year than the preceding three years combined. Such sectors, once considered niche, are now integral to the commercial real estate landscape.

Financial Performance and Outlook

Blackstone’s third-quarter net income soared to approximately $1.56 billion, up from $920.7 million a year earlier. Distributable earnings, profit available to shareholders, rose to $1.28 billion from $1.21 billion. Total assets under management jumped 10% to about $1.11 trillion, driven by inflows to its credit and insurance segment.

The Path Forward

As Blackstone continues to navigate the evolving market landscape, it remains focused on identifying “interesting places to deploy capital.” With a robust investment strategy and a keen eye on emerging trends, Blackstone is well-positioned for future growth.

Join the Conversation: What are your thoughts on Blackstone’s impressive Q3 performance and strategic investments? How do you see these trends impacting the broader real estate market? Share your insights and engage with our community!

#real estate investing#investing#money#investment#danielkaufmanrealestate#real estate#economy#housing#daniel kaufman#homes#ai#artificial intelligence#student housing#commercial and industrial sectors#commercial real estate#self storage#investing stocks

5 notes

·

View notes

Text

Judd Legum, Rebecca Crosby, and Noel Sims at Popular Information:

President Donald Trump's son-in-law, Jared Kushner, was a top White House official during Trump's first term. After exiting the White House in 2021, Kushner launched a new private equity firm, Affinity Partners, and announced he was seeking to raise $7 billion. Kushner had no experience in private equity, and his most significant business experience was nearly bankrupting his family's real estate company.

Who would be interested in giving Kushner billions of dollars? Kushner raised $2 billion from the government of Saudi Arabia through their Public Investment Fund (PIF). The PIF committee that screens investments recommended rejecting Kushner's proposal, citing "the inexperience of the Affinity Fund management" and "excessive" fees. The committee's recommendation, however, was overruled by Crown Prince Mohammed bin Salman (MBS), who Kushner formed a friendship with during his time in the White House. Kushner helped MBS manage the fallout after United States intelligence agencies determined MBS ordered the brutal murder of U.S.-based journalist Jamal Khashoggi. To date, Kushner has raised $4.6 billion, including additional funds from Qatar and the United Arab Emirates. From its inception, this arrangement was an ethical morass. Kushner is on the payroll of foreign governments and although he does not have a formal position in the second Trump administration, admitted that he still serves as an advisor to his father-in-law. Things just got much worse.

Days before Trump's inauguration, Kushner partnered with his father-in-law's company, the Trump Organization, to develop a Trump-branded luxury hotel and apartment complex in Belgrade, Serbia. Affinity Partners is functioning as a vehicle for foreign governments, including Saudi Arabia, to enrich the President of the United States. In an interview, Kushner insisted that this was all on the up-and-up. “We talked with several brands in the past year,” Kushner told Bloomberg in an interview. "I thought the tower would make a tremendous Trump Tower, so I spoke to Eric [Trump] about it, and he was very excited. So we’ll be bringing them in as our hotel partner.” The development will be known as Trump Tower Belgrade and will be built on a former military site leased to Affinity Partners by the Serbian government. The complex will have 175 hotel rooms and sell 1,500 residences.

[...]

The Trump Organization's global ambitions

Trump Tower Belgrade is not the only foreign business deal that the Trump Organization has been involved in over the last few months. In December, two new developments in Saudi Arabia were announced. Another real estate developer, DarGlobal, will own the sites, but pay the Trump Organization to use Trump branding. The Trump Organization will also work with DarGlobal on another project in the United Arab Emirates. In October, the Trump Organization announced a partnership with a Vietnamese real estate developer to build a $1.5 billion golf course and hotel. Vietnam, which is the US trading partner with the fourth-highest trade surplus, could be heavily impacted if Trump imposes steep tariffs on the country’s exports to the US. On January 10, the Trump Organization released an ethics statement outlining how it will seek to avoid conflicts of interest. The organization released a similar statement just before Trump took office for the first time in 2017. The most glaring difference between Trump’s 2017 ethics statement and his current one is how they handle foreign business deals. In 2017, the ethics statement prohibited "without exception—new foreign deals during the duration of President-Elect Trump’s Presidency," including "any new deals with respect to the use of the 'Trump' brand or any trademark, trade name, or marketing intangibles associated with The Trump Organization or Donald J. Trump in any foreign jurisdictions." It also prohibited transactions with "with a foreign country, agency, or instrumentality thereof, including a sovereign wealth fund, foreign government official, or member of a royal family." The current ethics statement does not include any restrictions on "foreign deals." Since real estate ventures like the new Trump Tower in Serbia require extensive government permitting to be completed, this could give foreign governments leverage over the president. Neither the Trump administration nor the Trump Organization have explained why that restriction will not be maintained during Trump's second term.

With the return of serial Emoluments Clause violator Donald Trump back into office, there is a renewed scrutiny of corruption of the Trump Organization and its global investments.

#Trump Crime Family#Donald Trump#Jared Kushner#Ivanka Trump#Trump Tower#Trump Family#Affinity Partners#Serbia#Trump Tower Belgrade#Belgrade#Trump Organization#Public Investment Fund#Saudi Arabia#Trump Saudi Arabia#DarGlobal#Emoluments Clause

4 notes

·

View notes

Text

˓⠀⠀﹪ :⠀⠀٬⠀⠀IVYRED.⠀⠀⸻⠀⠀is a fictional four-member girl group under kayak72 consisting of NAVA, SAANVI, MALEKA, and NERIAH. debuting on october 26, 2017, ivyred has largely been credited for reviving their label into vibrancy after their senior brother group, DIEM, saved them from bankruptcy.

based in new york city, the group was scouted by kayak72's creative director, romina richetti through a talent search looking for self-producing female artists throughout major cities around the world. though the group initially began with five scouted members, the fifth member, DANA, would be pulled out of the group by her parents who had previously been told she would be placed in a duo with her older brother DAX.

the group has often drawn parallels between themselves and diem. it is rumored that the members of the two groups do not get along and often are not present in the same rooms. seemingly fueling the fire, members avoni and neriah have been noted saying the diem boys were, "overgrown frat boys", following the scandal that alleged a member had offended the recording academy. unlike their counterparts, however, ivyred has drawn mass appeal, frequently selling out stadiums and even winning a grammy of their own for their album HONEY IN 2021.

&.&. SECTION ONE , the basics

GROUP NAME: ivyred

LABEL: kayak72 (2017 - present)

DEBUT DATE: october 26, 2017

DEBUT SINGLE: sorry not sorry

DEBUT ALBUM: ivy

GENRE: pop, r&b, bedroom pop

FANDOM NAME: ivymind

MOST POPULAR SONGS: 7 rings, deliver, kiss me more

&.&. SECTION TWO , the members

𓆩*𓆪 .⠀⠀NAVA RAHMANI-ALDERS, 1995: born the first child to real estate mogul, yasser rahmani and his second wife, janna alders, nava was frequently referred to as her parents' "trial child". growing up, she attained an independence that peeved her mother who longed for a mother-daughter relationship that she had not been lucky enough to have with her own mother. by her 10th birthday, the rahmani-alders family would receive their own reality show starring nava, her parents, older step-siblings, and her two younger brothers. nava was noticeably absent from appearing on the show, later claiming that her mother had instructed cameramen to only film her when she ate to "make sure she stayed away from the food". nava's interest in music was given to her by her grandfather who played an active role in taking nava to music and vocal lessons when her parents refused. after filing for emancipation in 2012, nava would go on to work as an assistant for producer, RAHIM NAQVI, eventually being recommended to romina for a spot in ivyred.

𓆩*𓆪 .⠀⠀SAANVI MISHRA, 1995: a relatively quiet child, saanvi was born a twin in northeast india to a college professor father and a surgeon mother. after receiving an offer for a position as chief of surgery at a hospital in boston, the family would pack their things and move to the united states. there, saanvi found a love of music that would bring her out of her shell, landing her opportunities to perform with her school across new england in various musical theater competitions. after graduating in high school, saanvi would attend julliard in hopes on one day performing on broadway. three years later, while in line for an audition, she would come across a flyer for kayak72 looking for artists to join a talent search. being the first member to pass through auditions, romina famously built the group around saanvi who takes on a leadership role within the group.

𓆩*𓆪 .⠀⠀MALEKA JACKSON, 1996: raised the sole child of yolanda and demarion jackson, maleka had grown up with access to almost every interest she could ever have. running through dance classes and jiu jitsu lessons and any and every sport her school offered was the only way to keep the young girl occupied. a beloved headache for her parents, the jacksons were more than willing to invest in their daughter's fixation on music in all of its forms. finally deciding to stick to cello and voice lessons, it wouldn't be long before maleka spent most of her time practicing her craft than following her rowdy cousins out on the weekends. though yolanda and demarion grew wary of her social development, the scholarship she would soon receive to attend the new england conservatory of music upon her graduation from high school. while there, maleka found the pressure of assignments and composition thrilling, even taking a chance to take on a side hustle laying cello backings for hip-hop tracks. her talents soon landed her an in with romina richetti who encouraged her to join her hunt for kayak72's next group.

𓆩*𓆪 .⠀⠀NERIAH DIMAS, 1999: born in los angeles to a composer father and a songwriter mother, neriah and her three siblings had always been surrounded by music. the four dimas children were frequently found running around their parents' shared brentwood studio so it wasn't much of a surprise when they began to have dreams of pursuing musical careers of their own upon coming of age. ever supportive, ario and nailah would chauffeur their children around the country to auditions and performances all in hopes of making their dreams come true. initially landing gigs as a child singing the national anthem at sporting events, neriah would eventually land a recurring role in disney channel's suite life on deck before becoming part of the regular cast for ant farm in 2011. after the show ended in 2014, neriah would join fellow disney channel alum, zendaya, as a fellow spy in k.c. undercover. her time on the show would end in 2016 after learning of kayak72's search for female talent. after her official exit from the show, she would disppear for a few months before emerging as the second member chosen for ivyred.

#&.& 𓆩*𓆪 FILE SOURCE ˒ ARTIST DIRECTORY.#fictional idol community#fictional kpop idol#fictional idol company#fictional idol group#fictional kpop company#fictional characters#fictional idol oc#fake kpop oc#fake kpop addition#fake kpop group#fake kpop girl group#fake kpop idol#fictional kpop community#idol oc#kpop idol#idol!fic#kpop oc#kpop

14 notes

·

View notes

Text

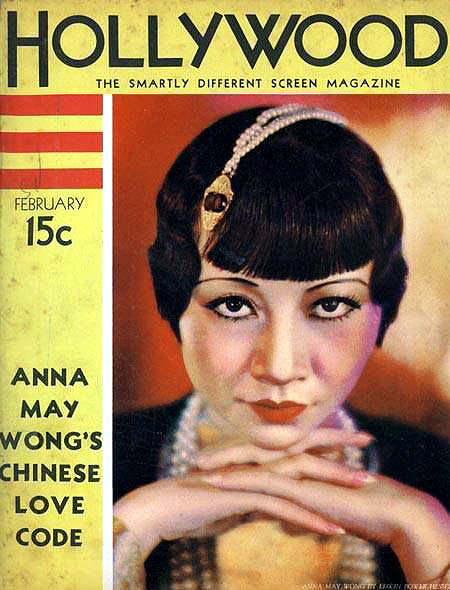

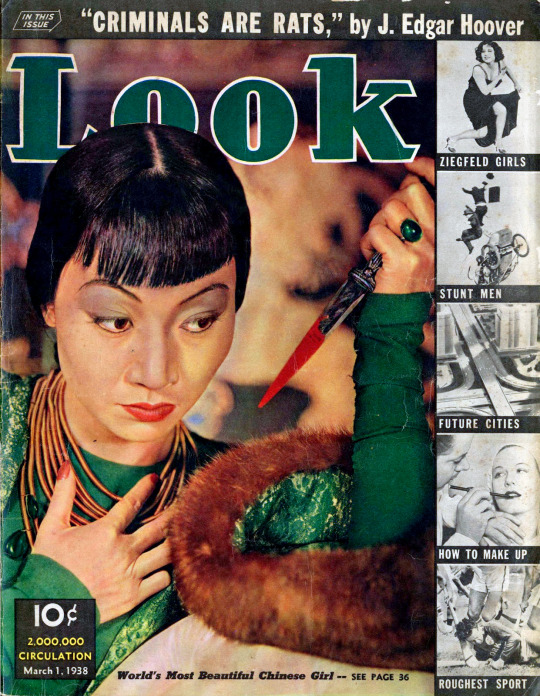

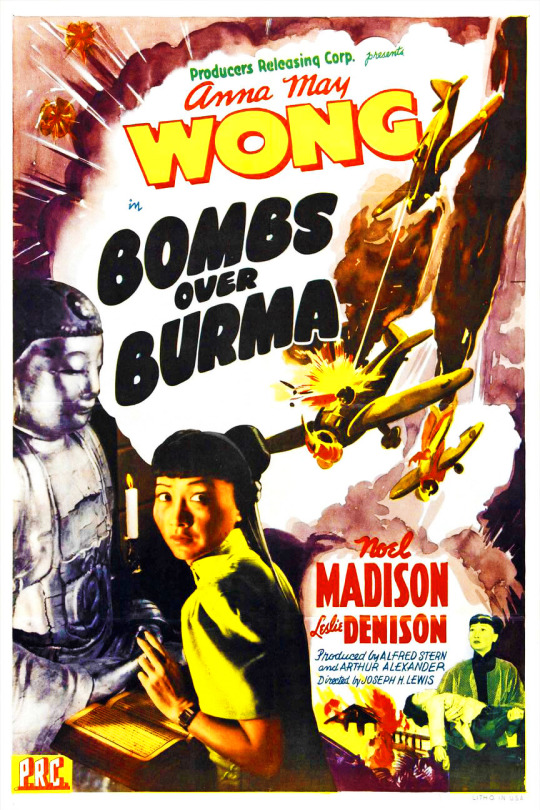

Anna May Wong - The First Asian American Hollywood Star

Wong Liu Tsong (born January 3, 1905 in Los Angeles), known professionally as Anna May Wong, was an American actress, considered "The First Asian American Hollywood Star" who helped humanize Chinese Americans to mainstream American audiences during a period of intense racism and discrimination.

Born to second-generation Taishanese American parents, Wong decided at an early age to become an actress. She was working at Hollywood's Ville de Paris department store when Metro Pictures needed 300 female extras in 1919.

Finding it difficult to keep up with her schoolwork, Wong dropped out of Los Angeles High School in 1921 to pursue a full-time acting career. The following year, she played her first leading role, in the two-color Technicolor movie The Toll of the Sea (1922), earning her critical acclaim. Nonetheless, Hollywood was reluctant to create starring roles for her; her ethnicity prevented filmmakers from seeing her as a leading lady. She spent the next few years in supporting roles providing "exotic atmosphere," such as a scheming Mongol slave in The Thief of Bagdad (1924).

Tired of being both typecast and passed over for lead Asian roles in favor of non-Asian actresses, Wong left Hollywood in 1928 for Europe, where she became a sensation. She returned to Hollywood with a Paramount contract in the 1930s and became more outspoken in her advocacy for better film roles for Chinese Americans and support of the Chinese struggle against Japan. Embarking on a year-long tour of China in 1936 to explore her roots and learn about Chinese theater, she chronicled her experience in a series of newspaper articles, which was later broadcast on television in the 1950s and included her narration.

Later in life, Wong invested in real estate and owned a number of properties in Hollywood while also doing some guest spots on television series. At the age of 56, Wong died of a heart attack as she slept at home in Santa Monica, California, two days after her final appearance on television.

Legacy:

Won the Photoplay Awards - Best Performances of the Month in Feb 1923 and Oct 1929

Auctioned off her movie costumes and donated the money to the Chinese Benevolent Association of California to support Chinese refugees.

Wrote the preface to a cookbook entitled New Chinese Recipes, one of the first Chinese cookbooks, the proceeds of which she donated to United China Relief in 1942

Donated her salary from Bombs over Burma (1942) and Lady from Chungking (1942) to the then United China Relief

Was the first Asian American Actress to lead a TV series The Gallery of Madame Liu-Tsong, which was specifically written for her

Is the basis of the 1971 poem "The Death of Anna May Wong" by Jessica Hagedorn

Is the namesake for the Anna May Wong Award of Excellence, given yearly at the Asian-American Arts Awards, and the Anna May Wong Award, an annual award by the Asian Fashion Designers group since 1973

Commemorated by the country of Grenada with a stamp in 1992 in its USO 50th anniversary series

Featured in curated several retrospectives, such as A Touch of Class for BFI Southbank in 1995, Anna May Wong: From Laundryman’s Daughter to Hollywood Legend at the Museum of Modern Art in 2004, and Anna May Wong at the American Museum of the Moving Image in 2006

Is the subject of China Doll, The Imagined Life of an American Actress, an award-winning fictional play by Elizabeth Wong in 1995

Was given tribute by Lucy Liu who dedicated her Hollywood Walk of Fame speech to her in 2019

Is the basis of a series of persona poems in Sally Wen Mao's Oculus: Poems, published in 2019

Honored with a Google Doodle in 2020 on the 97th anniversary of the release of her first film that she plays the lead

Featured in several exhibits, including "Beyond the Icon: Anna May Wong" at the Academy Museum of Motion Pictures in 2021, "Anna May Wong Abroad" at Houghton Library in Harvard University in 2023, "Not Your China Doll: Art Inspired by Anna May Wong" at Chelsea Market in 2024, "Anna May Wong: Icon of the Silver Screen" at the San Diego Chinese Historical Museum in 2024 and “Unmasking Anna May Wong” at the Chinese American Museum in January 2025

Is the namesake of the Ballad of Anna May, a coffee shop in Singapore which opened in 2021 and the Anna May Bar & Lounge at Crustacean Beverly Hills, which opened in 2022

Depicted by the United States Mint on the reverse of the quarter coin as a part of the American Women quarters series, becoming the first Asian American on American coinage in 2022

Honored as Turner Classic Movies Star of the Month for April 2022

Commemorated by Mattel with the release of a Barbie doll modeled on Wong in honor of Asian American and Pacific Islander Heritage Month in 2023

Honored by the Santa Monica City Council in 2023

Has a biopic from Working Title Films in development, with British actress Gemma Chan set as the lead

Has a star on the Hollywood Walk of Fame at 1708 Vine Street for motion picture

#Anna May Wong#Wong Liu Tsong#The First Asian American Hollywood Star#AAPI#Asian-American#Chinese#Silent Films#Silent Era#Silent Film Stars#Golden Age of Hollywood#Classic Hollywood#Film Classics#Old Hollywood#Hollywood#Movie Star#Hollywood Walk of Fame#Walk of Fame#hollywood legend#1900s#28 Hollywood Legends Born in the 1900s

3 notes

·

View notes

Text

From La Stampa (translated from Italian):

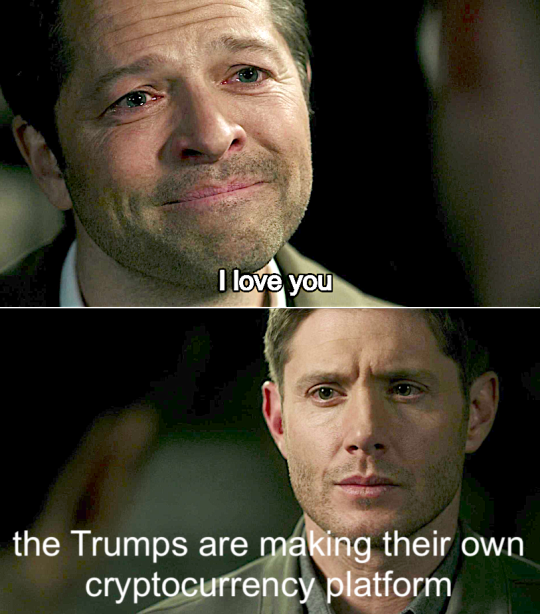

“Make Finance Great Again,” Trump family makes its own cryptocurrency and allies with Silicon Valley It will be called “World Liberty Financial,” will have tech investors and real estate developers from Chase Herro and Zak Folkman to Steve Witkoff inside. Sons Eric and Donald Jr. will coordinate. And his backer Tyler Winklevoss jokes, “Donald has been orange-pilled, indoctrinated.” Jacopo Iacoboni Sept. 17, 2024 Updated 11:00 a.m. 3 minutes of reading

They want to do a kind of “make finance great again,” along the lines of MAGA, the election slogan and the Make America Great Again campaign. Donald Trump's sons, Don Jr. and Eric, of course with their father's imprimatur, are about to launch a new cryptocurrency platform that will be called “World Liberty Financial,” and will allow users to make even massive transactions without a bank getting in the way and extracting fees (and with a very low level of tax tracking, it should be added). A couple of concepts familiar to bitcoin fans, for example, but which the Trump family now has ambitions to decline on a large scale. It is not certain that this marriage between Trumpism and decentralized finance, DeFi, is a harbinger of only positive developments. The board of “World Liberty Financial” will also consist of former crypto investors such as Chase Herro and Zak Folkman, and Steve Witkoff, a real estate developer and old friend of Trump. But thanks to documents filed with the U.S. Federal Election Commission that we have been able to read we know that in general the entire Trump campaign - Make America Great Again Inc. - received money not only from Musk, but cryptocurrency from billionaire twins Cameron and Tyler Winklevoss, who lead the cryptocurrency company Gemini: about $3.5 million in Bitcoin on July 19, the day after Trump's speech at the Milwaukee convention. The Winkelvosses also poured in money to America PAC, the tech investor-backed group that Musk helped launch in 2024 (Trump had bragged that Musk was giving him $45 million a month; Musk said his contribution is “at a much lower level”). Another co-founder of a cryptocurrency exchange, Jesse Powell, boss of Kraken, and venture capitalists Marc Andreessen and Ben Horowitz (who created a16z) who have invested billions of dollars in cryptocurrency startups, have also made endorsements and poured money into Trump. In short, for the Trump family to embark on this big cryptocurrency project is a natural consequence of the fact that these are almost becoming a Republican asset in the campaign, and the “libertarian” wing of the old Gop is now a kind of very, very rampant ideologized “cyberlibertarianism.” The real boss of the “tech bros” according to many is not Elon Musk, but Peter Thiel. Zuckerberg's longtime partner in Facebook, co-founder of PayPal, Thiel's fortune has at least doubled during the Trump presidency. Palantir-a much-discussed software company variously accused of extracting data from Americans and profiling them-has managed to get a contract from the Pentagon. Other donors to MAGA Inc include Jacob Halberg, Palantir's princely analyst, and Trish Duggan, a wealthy Scientology funder and friend of the tech bros. Trump's vice presidential candidate, J. D. Vance, traveled to Silicon Valley and the Bay Area, celebrating a dinner at the home of BitGo CEO Mike Belshe, 100 people each pouring in between $3,300 a plate and a $25,000 roundtable. Trump in 2021 called bitcoin a “fraud against the dollar.” A few weeks ago, speaking in Nashvill at the bitcoin fan conference, he promised, “The United States will become the crypto capital of the planet.” Better than his friend Putin's Russia, although this Trump did not say so explicitly. The fact is that after his speech, Tyler Winklevoss ran on X (now the realm of cyberlibertarians) and joked that Donald had been “orange-pilled,” making a Matrix analogy, had been “indoctrinated,” or had finally seen the real reality behind the appearances.

4 notes

·

View notes

Text

Everyone’s ignoring these investors’ warnings on climate risk. You shouldn’t. (Washington Post)

Excerpt from this story from the Washington Post:

Three years ago, Owen Woolcock was on Zoom trying to convince a real estate investor to swap some of his buildings in the New York City area for properties incities around the Great Lakes.

Climate change was overturning assumptions about what makes a profitable housing investment, argued Woolcock, an Australian who had recently launched an investment firm called Climate Core Capital. Desirable locations from Austin to Miami were set to become expensive, riskier bets. Overlooked locales, he argued, would begin to draw money and people as they avoided the worst of the 21st century’s volatile climate.

The Wall Street veteran on the other end of the call managed tens of millions of dollars in real estate for a wealthy family, Woolcock recalled. Although he said he agreed with Woolcock’s forecast, he couldn’t sign on.

“The problem is,” Woolcock remembered him saying, “I have spent the last seven years going to my investment committee and telling them to invest in the Sun Belt, so my personal track record is tied to the opposite of what you guys are saying.”

In the past decade, hundreds of thousands of people have moved to places threatened by climate change, bidding up real estate from flood-prone coastlines to the fire-scarred Southwest. But a small group of investors — including Woolcock and his partner Rajeev Ranade, along with iconoclasts like David Burt of DeltaTerra Capital — are pushing in the opposite direction.

Their argument: As Americans wake up to the threat of climate change, the value of homes in risky markets will begin to slide. That’s created opportunities to profit by betting against housing markets exposed to weather catastrophes or investing in places that will attract people who want to avoid the worst.

For anyone expecting to buy or sell a homein the United States in the coming years,their insights may help you decide where to go next.

Five years ago, Woolcockbegan analyzing a dataset charting climate risk and population growth in large American cities over the next 30 years. The fastest population growth, he saw, overlapped with the riskiest areas from Austin to Phoenix.

“These were places where everyone was making a lot of money very quickly,” he told me. “It was immediately apparent it was a ticking time bomb.”

So Woolcock set out to convince investors to do the opposite, co-founding Climate Core Capital with Ranade in 2021. They’re promoting a thesis that might be calledthe “big long”: redirect money into growing, climate-resilient cities.

I was sitting in a conference room in their co-working space in Boston this summer as the two gave the pitch they normally delivered to investors. The market hasn’t yet learned to properly price climate risk — or resilience. Investors could earn more, and risk less, by investing in better buildings in safer cities. A chart displayed on the wall showed a point representing Naples, Florida, a bull’s eye for rising seas and hurricanes. It barely fit on the chart’s risk axis. On the opposite side was what they see as a low-risk climate haven prepared for a volatile century: Ann Arbor, Michigan.

2 notes

·

View notes

Text

Okay holy shit, so the way Varoufakis explains it the reason why the 2008 crash sent inequality in the West into hyperdrive wasn't just the bailouts. It was that the combination of "bailouts for the rich" and "austerity for everyone else" meant that the super-rich now had tons of money (borrowed from banks at extremely low, even negative interest rates) that they had no reason to invest back into the economy because their potential customers wouldn't have money to buy their new products anyway.

So they took the constant flow of money from Western governments and either invested in real estate (from houses to entire islands) and expensive art - objects to park wealth in for the moment - or they used it to buy back shares of their own companies, in the process increasing the value of these shares. The value of basically all stocks and bonds rose in the 2010s simply because so much newly printed money was pumped into them instead of being invested into the economy. So the rich got richer in their sleep, regardless of whether they made any profit or not, while the rest of the economy was starved of investments, wages stagnated, employment became more precarious (but, conveniently, immigrants got the blame for that.)

And then in 2020 the same thing happened again in order to stop the lockdowns from tanking the economy and basically that's why the Netherlands may now get its turn to be ruled by a man with incredibly dumb hair. It's because after 2008 the stock market became completely divorced from reality (even more so than before). It's also a large part of how Jeff Bezos and Elon Musk got the means for their current projects "without needing to do any of the three things that capitalists traditionally had to do to expand: borrow money from some bank, sell large portions of their business to others, or generate large profits to pay for new capital stock. Why suffer any of this when central bank money was flowing freely? And so between 2010 and 2021, the paper wealth of these two men – meaning the total price of their shares – rose from less than $10,000 million to around $200,000 billion apiece."

#yanis varoufakis#political science#economics#jeff bezos#elon musk#the commas in the quote confuse me#surely he means 10 million to 200 billion?

16 notes

·

View notes

Text

full name: maximilian mohan

nicknames: max

age: 47 (april 16, 1977)

zodiac sign: aries

gender/pronouns: cis man, he / him

sexual orientation: bisexual

hometown: portland, maine

occupation: owner of static nightclub, sometimes a dj

financial status: bored

current residence: oak gardens

time in blue harbor: has been coming to blue harbor for business since 2012 but permanently moved in 2021

family: vikas mohan (father), evelyn mohan (mother, née rainer), dev mohan (older brother), charlotte mohan (older sister), nadia mohan (twin sister).

significant others: andrew marek (husband??? who knows where tf this bitch is)

trigger warning: mentions of assault, traumatic brain injury, alcohol abuse.