#quickbooks products

Explore tagged Tumblr posts

Text

Features of QuickBooks accounting software

QuickBooks is a popular accounting software that is designed by Intuit to help small and medium-sized businesses manage their financial transactions. Several features are available, including inventory management, spending tracking, and invoicing. QuickBooks can benefit your business by helping you to manage your financial transactions in an organized and efficient manner.

How can QuickBooks accounting software help your business?

While you may think you can handle all the financial services yourself, you can benefit a lot from using QuickBooks accounting software by streamlining your financial tasks and improving accuracy and efficiency.

Streamlines financial tasks

QuickBooks automates many financial tasks, such as invoicing and bill payment, making it easier for you to manage your business finances. It allows you to create professional invoices with your payment terms, while also providing an easy-to-use interface for tracking unpaid invoices.

Improves accuracy

QuickBooks helps to reduce errors and improve accuracy by automatically tracking and organizing financial data. With their easy-to-use interface, every small and medium business can adapt to the software easily.

Enhances financial reporting

QuickBooks provides a range of financial reports that can help you understand the financial health of your business and identify areas for improvement.

Simplifies tax preparation

QuickBooks makes it easier to prepare for tax season by organizing your financial data and generating tax-related reports. QuickBooks offers excellent customer support, including online resources, tutorials, and phone support, to help you get the most out of the software.

Increases efficiency

QuickBooks allows you to access your financial data from any device, making it easier for you to stay up-to-date on the financial health of your business and make informed decisions.

Increases profitability

By streamlining financial tasks and providing insight into the financial health of your business, QuickBooks can help you increase profitability.

Starting your business in Dubai and in need of secure help to manage your financial transactions? Get in touch with the best QuickBooks dealer in Dubai and save your time and effort!

#quickbooks software#quickbooks accounting software#quickbooks accounting#quickbooks dealer in dubai#quickbooks products#quickbooks online training

0 notes

Text

Accounting with Shopware + QuickBooks Connector QBIS

"Make your accounting easier with the Shopware QuickBooks Connector!

If you use Shopware for your online store and QuickBooks for your accounting, this connector can help you streamline your financial management. It automatically synchronizes your sales, expenses, taxes, and other financial data between Shopware and QuickBooks, so you don't have to manually enter them twice or worry about errors.

The Shopware QuickBooks Connector supports various types of transactions, currencies, tax rates, and payment methods, and it can handle multi-store and multi-currency setups. It also lets you customize the mapping of your data fields, so you can align them with your specific accounting needs.

With the Shopware QuickBooks Connector, you can save time, reduce errors, and get better insights into your business finances. It's easy to install and use, and it comes with free updates and support. Try it now and see how it can simplify your accounting!"

#accounting#quickbooks#shopware#businessgrowth#smallbusiness#finance#bookkeeping#productivity#viralpost#instagood

1 note

·

View note

Text

CREVH - GOLD

QuickBooks is a renowned accounting software that offers a seamless solution for small businesses to manage their financial tasks efficiently. With features designed to streamline accounting processes, QuickBooks simplifies tasks such as tracking receipts, income, bank transactions, and more. This software is available in both online and desktop versions, catering to the diverse needs of businesses of all sizes. QuickBooks Online, for instance, allows users to easily track mileage, expenses, payroll, send invoices, and receive payments online, making it a comprehensive tool for financial management. Moreover, QuickBooks Desktop provides accountants with exclusive features to save time and enhance productivity. Whether it's managing income and expenses, staying tax-ready, invoicing, paying bills, managing inventory, or running reports, QuickBooks offers a range of functionalities to support businesses in their accounting needs.

Utilizing qb accounting software purposes comes with a myriad of benefits that can significantly enhance business operations. Some key advantages of using QuickBooks include:

- Efficient tracking of income and expenses

- Simplified tax preparation and compliance

- Streamlined invoicing and payment processes

- Effective management of inventory

- Generation of insightful financial reports

- Integration with payroll and HR functions

These benefits not only save time and effort but also contribute to better financial decision-making and overall business growth. QuickBooks is designed to meet the diverse needs of businesses, offering tailored solutions for various industries and sizes.

When considering accounting qb software options, QuickBooks stands out as a versatile and comprehensive choice. To provide a holistic view, let's compare QuickBooks with two other popular accounting software options - Xero and FreshBooks. quick book accounting package and offers robust features for small businesses, including advanced accounting capabilities, invoicing, payment processing, and payroll management. Xero, on the other hand, is known for its user-friendly interface and strong collaboration features, making it a popular choice among startups and small businesses. FreshBooks excels in invoicing and time tracking functionalities, catering to freelancers and service-based businesses. By evaluating the features, pricing, and user experience of these accounting software options, businesses can make an informed decision based on their specific needs and preferences.

555 notes

·

View notes

Text

27 Must-Have Productivity Apps for Entrepreneurs

Entrepreneurs are usually looking for methods to maximise their time and performance. Whether you're coping with initiatives, collaborating with a group, or truly trying to stay organized, the right productiveness apps could make all the distinction. Here are some of the quality productiveness apps for marketers in 2024, categorized with the aid of their capabilities.

Best productivity apps for busy entrepreneurs

Task and Project Management Apps

1. Trello

Trello is a visually attractive and consumer-friendly venture control device that uses a board-and-card machine to help you arrange obligations. It lets in you to create distinctive forums for numerous tasks, set due dates, and collaborate along with your team in actual time. Trello’s drag-and-drop functionality makes coping with projects convenient.

2. Asana

Asana is an exceptional preference for marketers managing more than one projects right away. It helps song obligations, assign obligations, and set time limits. With a established list or board view, Asana guarantees that not anything falls thru the cracks.

Three. Monday.Com

Monday.Com is an all-in-one paintings running device that provides customizable workflows, automation, and integrations. Entrepreneurs can track mission development, manage their group’s workload, and automate repetitive responsibilities, making it an invaluable tool for productivity.

Time Management Apps

four. Toggl Track

Toggl Track is an tremendous app for monitoring the time spent on one of a kind duties and projects. Entrepreneurs can use it to pick out where their time is going, enhance productivity, and make sure they're billing customers accurately.

5. RescueTime

RescueTime facilitates you recognize your each day behavior with the aid of monitoring how a lot time you spend on numerous apps and web sites. It offers insights into your most effective hours and offers features like computerized time tracking and aim setting.

6. Clockify

Clockify is some other extraordinary time-monitoring device, especially for entrepreneurs running with groups. It presents specific reviews on work hours and productivity, making it simpler to manage tasks efficaciously.

Note-Taking and Documentation Apps

7. Evernote

Evernote is a powerful be aware-taking app that lets in entrepreneurs to put in writing thoughts, clip internet pages, and prepare thoughts into notebooks. With a sturdy search feature and the ability to sync throughout devices, Evernote is a must-have for business proprietors who need to preserve music in their ideas.

8. Notion

Notion is a flexible workspace that mixes observe-taking, task control, databases, and collaboration tools. Entrepreneurs can create dashboards, record processes, and collaborate with their crew in a single platform.

9. OneNote

Microsoft OneNote is some other superb notice-taking device with a virtual notebook interface. It’s exceptional for marketers who decide on a extra conventional, paper-like experience at the same time as taking notes.

Communication and Collaboration Apps

10. Slack

Slack is a famous communication device that makes group collaboration seamless. With channels, direct messages, and integrations with different equipment like Trello and Google Drive, Slack guarantees that conversation stays green and prepared.

Eleven. Microsoft Teams

For marketers the use of Microsoft 365, Microsoft Teams is an notable alternative for conversation and collaboration. It gives chat, video conferencing, and file sharing, making far off teamwork easy.

12. Zoom

Zoom is the cross-to video conferencing device for entrepreneurs who need to host meetings, webinars, and virtual events. With notable video and audio, display screen sharing, and recording options, Zoom is a need to-have.

Finance and Accounting Apps

13. QuickBooks

QuickBooks is one of the fine accounting software program for entrepreneurs. It allows song earnings and fees, manage invoices, and generate financial reports, making it easier to address enterprise finances.

14. FreshBooks

FreshBooks is another extraordinary accounting device, mainly for freelancers and small commercial enterprise proprietors. It gives invoicing, expense monitoring, and time tracking functions, making sure easy economic control.

15. Wave

Wave is a free accounting and invoicing tool designed for marketers and small business owners. It’s brilliant for managing coins drift without incurring excessive prices.

Automation and Workflow Apps

sixteen. Zapier

Zapier is an automation tool that connects extraordinary apps to create workflows, saving entrepreneurs hours of manual paintings. With Zapier, you can automate responsibilities like sending emails, updating spreadsheets, and managing consumer data.

17. IFTTT

IFTTT (If This Then That) permits entrepreneurs to create automation between special apps and devices. For instance, you could automate social media posting or set reminders primarily based on certain triggers.

Marketing and Social Media Management Apps

19. Buffer

Buffer is a social media scheduling device that lets in entrepreneurs to devise and put up posts throughout one of a kind systems. It also presents analytics to assist song engagement and overall performance.

20. Hootsuite

Hootsuite is every other effective social media control device that helps agenda posts, display brand mentions, and analyze social media overall performance.

21. Canva

Canva is a photograph layout tool that allows marketers to create marketing substances, social media posts, and displays without difficulty. With customizable templates and drag-and-drop features, it simplifies the design technique.

Cloud Storage and File Management Apps

22. Google Drive

Google Drive presents stable cloud storage and smooth record sharing. Entrepreneurs can store, get right of entry to, and collaborate on files, spreadsheets, and shows in real time.

23. Dropbox

Dropbox is some other cloud garage solution that makes it easy to save and share documents securely with a crew. It integrates with various productiveness apps to streamline workflows.

24. OneDrive

For marketers using Microsoft products, OneDrive is an splendid cloud storage solution that seamlessly integrates with Office apps.

Mindfulness and Focus Apps

25. Headspace

Entrepreneurship can be stressful, and Headspace facilitates entrepreneurs exercise mindfulness and meditation to live targeted and reduce strain.

26. Forest

Forest is a focal point app that encourages marketers to stay off their phones by means of growing a digital tree at the same time as they work. If they go away the app, the tree dies—motivating them to live focused.

27. Noisli

Noisli provides heritage sounds to enhance cognizance and productivity. Whether you opt for white noise, rain sounds, or a coffee store atmosphere, Noisli facilitates create the proper paintings environment.

2 notes

·

View notes

Text

Your Guide to Choosing the Right AI Tools for Small Business Growth

In state-of-the-art speedy-paced international, synthetic intelligence (AI) has come to be a game-changer for businesses of all sizes, mainly small corporations that need to stay aggressive. AI tools are now not constrained to big establishments; less costly and available answers now empower small groups to improve efficiency, decorate patron experience, and boost revenue.

Best AI tools for improving small business customer experience

Here’s a detailed review of the top 10 AI tools that are ideal for small organizations:

1. ChatGPT by using OpenAI

Category: Customer Support & Content Creation

Why It’s Useful:

ChatGPT is an AI-powered conversational assistant designed to help with customer service, content creation, and more. Small companies can use it to generate product descriptions, blog posts, or respond to purchaser inquiries correctly.

Key Features:

24/7 customer service via AI chatbots.

Easy integration into web sites and apps.

Cost-powerful answers for growing enticing content material.

Use Case: A small e-trade commercial enterprise makes use of ChatGPT to handle FAQs and automate patron queries, decreasing the workload on human personnel.

2. Jasper AI

Category: Content Marketing

Why It’s Useful:

Jasper AI specializes in generating first rate marketing content. It’s ideal for creating blogs, social media posts, advert reproduction, and extra, tailored to your emblem’s voice.

Key Features:

AI-powered writing assistance with customizable tones.

Templates for emails, advertisements, and blogs.

Plagiarism detection and search engine optimization optimization.

Use Case: A small enterprise owner uses Jasper AI to create search engine optimization-pleasant blog content material, enhancing their website's visibility and traffic.

Three. HubSpot CRM

Category: Customer Relationship Management

Why It’s Useful:

HubSpot CRM makes use of AI to streamline purchaser relationship control, making it less difficult to music leads, control income pipelines, and improve consumer retention.

Key Features:

Automated lead scoring and observe-ups.

AI insights for customized purchaser interactions.

Seamless integration with advertising gear.

Use Case: A startup leverages HubSpot CRM to automate email follow-ups, increasing conversion costs without hiring extra staff.

Four. Hootsuite Insights Powered by means of Brandwatch

Category: Social Media Management

Why It’s Useful:

Hootsuite integrates AI-powered social media insights to help small businesses tune tendencies, manipulate engagement, and optimize their social media method.

Key Features:

Real-time social listening and analytics.

AI suggestions for content timing and hashtags.

Competitor evaluation for a competitive aspect.

Use Case: A nearby café uses Hootsuite to agenda posts, tune customer feedback on social media, and analyze trending content material ideas.

Five. QuickBooks Online with AI Integration

Category: Accounting & Finance

Why It’s Useful:

QuickBooks Online automates bookkeeping responsibilities, rate monitoring, and economic reporting using AI, saving small agencies time and reducing mistakes.

Key Features:

Automated categorization of costs.

AI-driven economic insights and forecasting.

Invoice generation and price reminders.

Use Case: A freelance photo designer uses QuickBooks to simplify tax practise and hold tune of assignment-primarily based earnings.

6. Canva Magic Studio

Category: Graphic Design

Why It’s Useful:

Canva Magic Studio is an AI-more advantageous design tool that empowers non-designers to create stunning visuals for marketing, social media, and presentations.

Key Features:

AI-assisted layout guidelines.

One-click background elimination and resizing.

Access to templates, inventory pictures, and videos.

Use Case: A small bakery makes use of Canva Magic Studio to create pleasing Instagram posts and promotional flyers.

7. Grammarly Business

Category: Writing Assistance

Why It’s Useful:

Grammarly Business guarantees that each one written communications, from emails to reviews, are expert and blunders-unfastened. Its AI improves clarity, tone, and engagement.

Key Features:

AI-powered grammar, spelling, and style corrections.

Customizable tone adjustments for branding.

Team collaboration gear.

Use Case: A advertising company makes use of Grammarly Business to make sure consumer proposals and content material are polished and compelling.

Eight. Zapier with AI Automation

Category: Workflow Automation

Why It’s Useful:

Zapier connects apps and automates workflows without coding. It makes use of AI to signify smart integrations, saving time on repetitive tasks.

Key Features:

Automates responsibilities throughout 5,000+ apps.

AI-pushed recommendations for green workflows.

No coding required for setup.

Use Case: A small IT consulting corporation makes use of Zapier to routinely create tasks in their assignment management device every time a brand new lead is captured.

9. Surfer SEO

Category: Search Engine Optimization

Why It’s Useful:

Surfer SEO uses AI to assist small businesses improve their internet site’s seek engine scores thru content material optimization and keyword strategies.

Key Features:

AI-pushed content audit and optimization.

Keyword studies and clustering.

Competitive evaluation equipment.

Use Case: An on-line store uses Surfer search engine marketing to optimize product descriptions and blog posts, increasing organic site visitors.

10. Loom

Category: Video Communication

Why It’s Useful:

Loom lets in small groups to create video messages quick, which are beneficial for group collaboration, client updates, and customer service.

Key Features:

Screen recording with AI-powered editing.

Analytics for viewer engagement.

Cloud garage and smooth sharing hyperlinks.

Use Case: A digital advertising consultant makes use of Loom to offer video tutorials for customers, improving expertise and lowering in-man or woman conferences.

Why Small Businesses Should Embrace AI Tools

Cost Savings: AI automates repetitive duties, reducing the need for extra group of workers.

Efficiency: These equipment streamline operations, saving time and increasing productiveness.

Scalability: AI permits small organizations to manipulate boom with out full-size infrastructure changes.

Improved Customer Experience: From personalized tips to 24/7 help, AI gear help small groups deliver superior customer service.

2 notes

·

View notes

Note

1 and 9 for the get to know me questions 💜

What do you do for work?

spend 7 hours a day talking shit about Apple products.

Genuinely though, I work for a small MSP (Managed Service Provider) that handles the IT infrastructure for various small to medium commercial businesses. My job is technically the front desk (so answering the phones, triaging phone calls and emails that come in to our help desk, scheduling site visits to client sites, etc) but I also do accounting things like enter data into QuickBooks and create customer invoices for billing. So I am like, a "front office manager" which is what my boss calls me, but I joke that I'm just a glorified babysitter.

9. Make a confession.

At this point in my life I've still never seen Pacific Rim and I'm pretty sure I'll never actually watch it.

3 notes

·

View notes

Text

Expert Power Platform Services | Navignite LLP

Looking to streamline your business processes with custom applications? With over 10 years of extensive experience, our agency specializes in delivering top-notch Power Apps services that transform the way you operate. We harness the full potential of the Microsoft Power Platform to create solutions that are tailored to your unique needs.

Our Services Include:

Custom Power Apps Development: Building bespoke applications to address your specific business challenges.

Workflow Automation with Power Automate: Enhancing efficiency through automated workflows and processes.

Integration with Microsoft Suite: Seamless connectivity with SharePoint, Dynamics 365, Power BI, and other Microsoft tools.

Third-Party Integrations: Expertise in integrating Xero, QuickBooks, MYOB, and other external systems.

Data Migration & Management: Secure and efficient data handling using tools like XRM Toolbox.

Maintenance & Support: Ongoing support to ensure your applications run smoothly and effectively.

Our decade-long experience includes working with technologies like Azure Functions, Custom Web Services, and SQL Server, ensuring that we deliver robust and scalable solutions.

Why Choose Us?

Proven Expertise: Over 10 years of experience in Microsoft Dynamics CRM and Power Platform.

Tailored Solutions: Customized services that align with your business goals.

Comprehensive Skill Set: Proficient in plugin development, workflow management, and client-side scripting.

Client-Centric Approach: Dedicated to improving your productivity and simplifying tasks.

Boost your productivity and drive innovation with our expert Power Apps solutions.

Contact us today to elevate your business to the next level!

#artificial intelligence#power platform#microsoft power apps#microsoft power platform#powerplatform#power platform developers#microsoft power platform developer#msft power platform#dynamics 365 platform

2 notes

·

View notes

Note

PISSED OFF POE!!!! PISSED OFFF POEEE !!!!!

(god my hands are itching to draw him enraged and feral ARGGHH fuck quickbooks online and importing chart of accounts im drawing it once i get home hehehhe >:} )

Jdhdjsjjsbdwkdjnf it's the fic where I want Poe to absolutely murder that man as well, there'll be such a great monologue while he tortures him I'm sure, I can already see it in front of my eyes😌

ALSO OMG THAT'D BE AWESOME - pls don't put too much on your shoulders tho, you're doing so fucking much, literally how are you so PRODUCTIVE AHH🥺

#I'll answer the fitzgerald and poe ask as well btw i haven't forgotten sorry it's taking so long💀#-johnny's asks

4 notes

·

View notes

Text

In today’s fast-paced business environment, enhancing productivity is more crucial than ever to successfully accomplish this, one can rely on the power of automation. By automating routine tasks, businesses can save time, reduce errors, and focus on more strategic activities. In this blog post, we will explore essential automation strategies that can help boost productivity in your organization.

Boost productivity with these essential automation strategies. Automation is transforming the way businesses operate, making processes more efficient and streamlined. Implementing the right automation strategies can lead to significant improvements in productivity and overall business performance. In this article, we will discuss several key automation strategies that can help you achieve these goals.

1. Automate Repetitive Tasks

One of the most effective ways to boost productivity is by automating repetitive tasks. These tasks often consume a significant amount of time and can be easily automated using the right tools. For example, you can automate data entry, email responses, and appointment scheduling. By doing so, you free up valuable time for more critical activities.

2. Utilize Workflow Automation

Workflow automation involves creating a series of automated actions that complete a process. This strategy is particularly useful for complex processes that involve multiple steps and departments. Tools like Zapier and Microsoft Power Automate can help you set up automated workflows, ensuring that tasks are completed efficiently and accurately.

3. Implement Marketing Automation

Marketing automation can significantly enhance your marketing efforts by automating tasks such as email marketing, social media posting, and lead nurturing. Platforms like HubSpot and Mail chimp offer comprehensive automation features that can help you reach your target audience more effectively and improve your marketing ROI.

4. Enhance Customer Service with Chatbots

Integrating chatbots into your customer service strategy can greatly improve efficiency and customer satisfaction. Chabot’s can handle a wide range of customer queries, provide instant responses, and escalate issues to human agents when necessary. This not only saves time but also ensures that customers receive timely and accurate support.

5. Streamline Financial Processes

Automation can also be applied to financial processes such as invoicing, expense tracking, and payroll management. Tools like QuickBooks and Xero offer robust automation features that can help you manage your finances more efficiently and reduce the risk of errors.

Boost Productivity with These Essential Automation Strategies. Automation is a powerful tool that can help businesses enhance productivity and efficiency. By implementing the strategies discussed in this article, you can streamline your processes, reduce manual workload, and focus on more strategic activities. Have you tried any of these automation strategies?

#Automation#Productivity#BusinessEfficiency#TechTrends#WorkflowAutomation#DigitalTransformation#AutomationTools#SmartBusiness#Innovation#Accomation#BusinessAutomation#InvoiceManagement#EfficiencyTools#AutomationSolutions#SmallBusinessTools#StreamlineOperations#BusinessGrowth#FinancialAutomation

2 notes

·

View notes

Text

Navigating Real-Time Operations: The Power of Operational Dashboards

Operational dashboards are dynamic visual interfaces that provide real-time insights into an organization's day-to-day activities and performance. These dashboards are particularly valuable for monitoring short-term operations at lower managerial levels, and they find application across various departments. They stand as the most prevalent tools in the realm of business intelligence.

Typically, operational dashboards are characterized by their comprehensive nature, offering junior managers detailed information necessary to respond to market dynamics promptly. They also serve to alert upper management about emerging trends or issues before they escalate. These dashboards primarily cater to the needs of managers and supervisors, enabling them to oversee ongoing activities and make rapid decisions based on the presented information. Operational dashboards often employ graphical representations like graphs, charts, and tables and can be customized to display information pertinent to the specific user.

Examples of data typically showcased on an operational dashboard include:

Sales figures

Production metrics

Inventory levels

Service levels

Employee performance metrics

Machine or equipment performance data

Customer service metrics

Website or social media analytics

It is crucial to emphasize that operational dashboards are distinct from other dashboard types, such as strategic and analytical dashboards. These different dashboards serve varied purposes and audiences and contain dissimilar datasets and metrics. Here are a couple of examples.

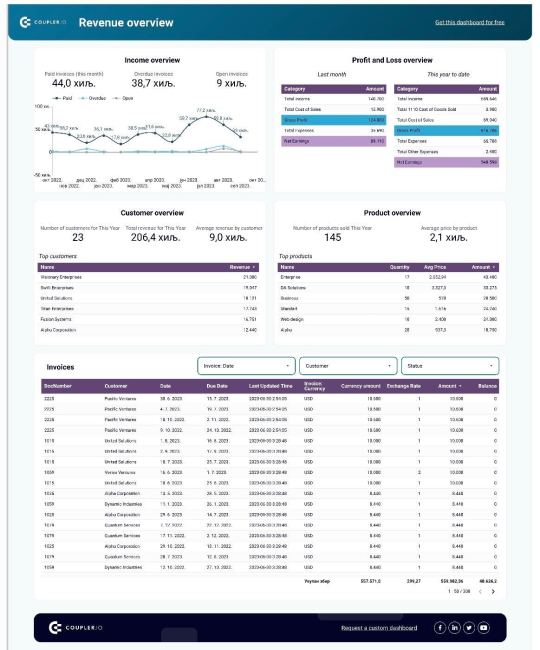

Below, you can see a Revenue overview dashboard for QuickBooks. It provides month-by-month overviews of invoices, products, customers, profit and loss. Such a dashboard can be used on a daily basis and help monitor and manage operating activities.

This data visualization is connected to a data automation solution, Coupler.io. It automatically transfers fresh data from QuickBooks to the dashboard, making it auto-updating. Such a live dashboard can be an important instrument for enabling informed decision-making.

This Revenue overview dashboard is available as a free template. Open it and check the Readme tab to see how to use it.

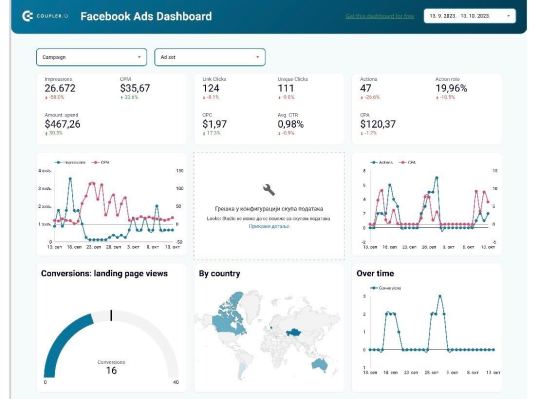

Here’s another example of an operational dashboard, the Facebook Ads dashboard. It allows ad managers to closely track their ad performance. This dashboard is also powered by Coupler.io, so it depicts ad data in near real-time. This allows marketers to quickly define what works and what doesn’t and make adjustments on the go.

Facebook Ads dashboard is available as a free template. You can grab it and quickly get a copy of this dashboard with your data. In conclusion, operational dashboards are indispensable tools for organizations seeking to thrive in a dynamic business landscape. These real-time visual displays offer invaluable insights into day-to-day operations, equipping managers and supervisors with the information to make swift, informed decisions. As the most widely used business intelligence instruments, operational dashboards empower businesses to adapt to market changes, identify emerging trends, and maintain a competitive edge. Their versatility and capacity to monitor a wide range of metrics make them an essential asset for managing the intricacies of modern operations.

#marketing dashboards#digital marketing#dashboards#data analytics#data visualization#operational dashboards

2 notes

·

View notes

Text

Comparing FreshBooks vs QuickBooks: Features, Pricing, and User Experience

Are you a small business owner searching for the perfect accounting software to streamline your finances? Look no further than FreshBooks and QuickBooks! These two platforms offer comprehensive features, competitive pricing, and user-friendly experiences. But which one is right for you?

In this article, we’ll compare FreshBooks vs QuickBooks in terms of their features, pricing plans, and overall user experience so that you can make an informed decision for your business. So sit back, relax, and let’s dive into the world of accounting software!

What are QuickBooks and FreshBooks?

QuickBooks and FreshBooks are two popular accounting software options for small business owners. QuickBooks is a product of Intuit, while FreshBooks is owned by 2ndSite Inc. Both platforms offer cloud-based solutions that allow users to access their financial data from anywhere with an internet connection.

QuickBooks caters to a wider range of businesses, including those in manufacturing, construction, and retail industries. Its features include invoicing, expense tracking, payroll management, inventory tracking and more.

On the other hand, FreshBooks specializes in providing time-tracking tools alongside its basic accounting services such as invoicing and expense tracking. It also offers integrations with various payment gateways like PayPal or Stripe making it easier for clients to pay you directly through your invoices.

Both platforms have mobile apps available on iOS and Android so you can manage your finances on-the-go.

QuickBooks focuses on more extensive bookkeeping capabilities while FreshBooks prioritizes simplicity by offering online invoicing & payments along with helpful time-tracking tools perfect for freelancers who bill hourly.

What do QuickBooks and FreshBooks offer?

QuickBooks and FreshBooks are cloud-based accounting software that cater to different types of businesses. QuickBooks offers accounting features for small to medium-sized businesses, while FreshBooks specializes in invoicing and time-tracking for freelancers, solo entrepreneurs, and small business owners.

QuickBooks allows you to organize your finances by tracking income and expenses, creating invoices, reconciling bank accounts, generating financial reports like profit & loss statements or balance sheets. It also has a feature that helps you keep track of sales tax payments.

FreshBooks is designed specifically for service-based businesses that need help with time management. With FreshBooks' intuitive interface, it's easy to create professional-looking invoices complete with payment processing options and recurring billing. You can easily track billable hours using the built-in timer tool as well as monitoring project profitability.

Both software’s offer different features that suit specific needs - QuickBooks for managing overall financials while FreshBooks focuses more on invoicing and time tracking.

QuickBooks vs FreshBooks: Which is better for you?

When it comes to choosing between QuickBooks and FreshBooks, there are several factors that you should consider based on your specific business needs.

QuickBooks is better suited for larger businesses with more complex financial needs, while FreshBooks is tailored towards smaller businesses or freelancers who need a simplified approach to invoicing and time tracking.

If you prioritize user experience, then FreshBooks may be the right choice for you as its interface is sleeker and more intuitive compared to QuickBooks. However, if advanced reporting features are important in managing your finances, then QuickBooks would be the better option.

Pricing is also an important factor when comparing these two software options. While both offer plans at varying price points, FreshBooks’ pricing starts lower than QuickBooks' but can become more expensive as additional features are added.

Ultimately, it’s important to assess what your business requires from a financial management system before making a decision between the two.

Prices

When it comes to choosing between FreshBooks and QuickBooks, pricing is an important factor to consider. Both platforms offer different pricing plans that cater to the needs of various types of businesses.

FreshBooks offers four pricing plans starting at $15 per month for up to five clients. The Plus plan costs $25 a month and allows you to bill up to 50 clients, while the Premium plan supports up to 500 clients and costs $50 per month. If your business has over 500 clients, then FreshBooks Select Plan would be ideal as it can handle unlimited clients.

On the other hand, QuickBooks also offers four pricing plans with varying features and capabilities. They have a Simple Start Plan which starts at $25/month with basic features such as invoicing and expense tracking. Their most popular option is their Essentials plan which includes more advanced reporting tools starting at $40/month for businesses who need extra functionality.

Both FreshBooks and QuickBooks offer competitive prices depending on your specific business needs, so it's essential to evaluate exactly what you require before making a decision.

User experience

When it comes to user experience, both QuickBooks and FreshBooks offer intuitive interfaces that make it easy for non-accountants to manage their finances. However, there are some differences between the two platforms.

QuickBooks is known for its robust features and customization options, but this can also make the platform feel overwhelming at times. The interface is cluttered with menus and buttons, which may take some time to navigate if you're not familiar with accounting software.

On the other hand, FreshBooks has a clean and modern interface that's easy on the eyes. The platform focuses on simplicity without sacrificing functionality. You'll find all of your essential accounting tools in one place without any unnecessary distractions.

Another advantage of FreshBooks is its mobile app. The app allows you to manage your finances from anywhere at any time, making it convenient for freelancers or small business owners who are always on-the-go.

While both QuickBooks and FreshBooks have their strengths when it comes to user experience, it ultimately boils down to personal preference. If you prefer a more customizable interface with advanced features, then QuickBooks might be best suited for you. But if simplicity and ease-of-use are more important factors in managing your finances than FreshBooks would be an excellent choice!

Conclusion

After comparing FreshBooks vs QuickBooks, it is clear that both of these accounting software offer a wide range of features and benefits to their users. However, the choice between them depends largely on your business needs.

If you own a small business and looking for an affordable solution with easy user experience, then FreshBooks may be the perfect option for you. It offers simple invoicing solutions along with time tracking feature which help in monitoring projects easily.

On the other hand, if you're running a medium-sized or large enterprise and require robust accounting functionality tools such as inventory management or job costing then QuickBooks could be your best bet. Although its price point is higher than FreshBooks but it comes complete with more advanced features for businesses with unique requirements.

Regardless of whether you choose FreshBooks or QuickBooks as your accounting software provider, both platforms are solid choices that can bring great value to any business owner looking to streamline their financial operations and increase efficiency in their daily tasks.

3 notes

·

View notes

Text

You Should Hire A Virtual Assistant & Here’s Why

To Hire a Virtual Assistant is a suitable solution for your business if you are tired of spending hours in front of the computer without free time for yourself, your friends, or your family. You might be wondering if hiring a Virtual Assistant is worth it.

We’ve all heard about how a Virtual Assistant can help your business succeed. But how? Here’s a list of ten reasons you must hire a Virtual Assistant (VA) to help reach your goals.

What is a Virtual Assistant?

A Virtual Assistant provides remote services to different brands and businesses. Additionally, Virtual Assistant offers numerous benefits in the business, such as:

Grasping the most potential talent that your business needs

Less supervision

Reduces the workload

Keeps business owners away from entrepreneurial burnout

Despite these benefits, there’s a big decision to make regarding outsourcing. And since business owners always aim for success, they will undoubtedly take risks. This is due to the reason that VA leverages the business’s utmost potential.

Virtual Assistants can help everyone needing assistance, such as:

Business owners

Coaches

Teachers

Real Estate professionals

Doctors

Brands

Influencers

Embracing a Virtual Assistant means delegating remotely and with some training, especially on the client’s preferences. Thus, business owners can enjoy a work-life balance and focus on the essential tasks alone.

There are millions of Virtual Assistants ready to assist clients today. They are primarily in administration, sales, marketing, finance, customer service, human resource, IT, creatives, and many others. Virtual Assistants can work hourly or with fixed-rate jobs starting at $5/hour or $500 monthly.

Virtual Assistants Today that can Help Clients

Most of these Virtual Assistants are skilled and trained. These are some of the fields Virtual Assistants today can help clients with:

Executive Virtual Assistance

Social Media Management and Marketing

Search Engine Optimization (SEO)

Real Estate Virtual Assistance

ClickFunnels

Email Marketing

Shopify

Project Management

Copywriting, Editing, Proofreading

Online Bookkeeping

Video Editing

Web Design

Facebook Ads Marketing

eBay, Facebook Marketplace, Etsy, and Poshmark Virtual Assistance

Graphic Design

Amazon

Podcast Management and Marketing

Online Teaching

Brand Marketing and Advertising

Online Accounting

Full Stack Development

App Development

Business and Product Development

Xero, Wave, FreshBooks, and ZipBooks

Quickbooks, MYOB, Zoho, and AKAUNTING

Digital Marketing

ChatBot Marketing

Customer Service, Sales, and Support

Human Resource Management

Coding Designs and Procedures (Architecture and Engineering)

Online School Management

Top Three Reasons Why you Need a Virtual Assistant

1. Reduce Costs

Onboarding a new employee means additional expenses. Thus, when business owners hire a Virtual Assistant, it saves costs for training, benefits, and other fees. Considering a VA is an independent worker. Business owners can spend on something other than leave credits and benefits like a regular employee receives.

2. Saves time

Most of the VAs have experience in their expertise. This means that you can skip training. They know what to do and have the knowledge and skills to impact your business growth. And since VAs are remote workers, they know how to manage their time and tasks well. On top of that, a Virtual Assistant can multitask while ensuring quality outputs.

3. Proper tasks delegation

When you outsource, you are delegating tasks effectively. Why is that so? As your business is continuously growing, tasks are also increasing. In that case, you need to leverage a Virtual Assistant’s abilities in coping with duties. Similarly, your office employees can focus on their tasks, and you, as the owner, will focus on and prioritize core duties.

Where to Find an Effective Virtual Assistant?

Besides the services a VA can do for your business, a VA’s help will empower your business strategy. Now, are you ready to embrace a Virtual Assistant in your business?

But, before that, you need to be aware of where you can spot an excellent Virtual Assistant. And here are the top three best places to find a VA.

Initially, you can find a VA on any social media platform like Facebook, Instagram, Twitter, Linked In, and Pinterest.

Another one is Virtual Assistant Companies like Real Estate VA Agencies.

And last is the place where competitive VAs dwells, the freelancing websites.

Which is the right place to find a great VA? According to a DDIY study, 33% of 500 established companies worldwide outsource using freelancing websites. In short, this implies that freelancing websites are a great place to spot, especially for newbies. This is because the freelancing website displays portfolios showcasing the VA’s expertise and experience. Therefore, by looking at their portfolios, you can illustrate how a VA provides value to your business.

Now, are you excited to hire a VA? You can sign up with Surge now! Because this site aims to provide excellent VAs and ensure the VA’s capabilities through in-house training and apprenticeship programs, you’ll experience a BIG difference in your business!

How to Hire Virtual Assistants

The process is easy.

1. To begin with, SIGN UP to hire here: https://surgedigital.agency/.

– Fast verification

2. Afterward, POST a job and get applicants.

– With at least 5,000+ (and growing each month) freelancers from different expertise

– All trained, experienced and screened for you

3. Finally, HIRE the most fitting freelancer for your business.

– Start getting leverage right on day one!

Or you can also contact us now for more details.

Source: https://courses.thesurgemarketplace.com/hire-a-virtual-assistant-2/

You can also visit our website for more info: https://mavassistant.wixsite.com/mava

#mavirtualassistant#mava#Filipino virtual assistant#virtual assistant services#social media manager#graphic designer#online freelancer

5 notes

·

View notes

Text

Why should you upgrade to a QuickBooks dedicated server in 2023?

In 2023, upgrading to a dedicated QuickBooks server has many advantages that can help businesses improve data security, collaborate more effectively, and streamline their accounting procedures. Verito offers the best QuickBooks dedicated server hosting option for businesses as one of the leading QuickBooks hosting providers. This article will discuss the benefits of upgrading to a dedicated QuickBooks server and why Verito is the best QuickBooks service provider.

Security Enhancement- One of the primary benefits of moving to a QuickBooks dedicated server is enhanced security. Businesses can be assured that their financial information is safe using a dedicated server. Security measures like firewalls, SSL encryption, and automatic backups are used by top-notch QuickBooks hosting providers like Verito to shield financial data from potential threats like cyberattacks and data breaches.

Compared to shared servers, which can experience slowdowns during peak usage times, QuickBooks dedicated servers are designed to provide enhanced performance. With dedicated servers, memory, processing power, and storage are devoted all, resulting in faster performance and more stable operations.

Accessibility and Collaboration Enhancement- Another advantage of upgrading to a QuickBooks dedicated server is accessibility and collaboration enhancement. Multiple users can simultaneously access the same QuickBooks file on a dedicated server without worrying about slowing down the system. Additionally, businesses can access their QuickBooks file from any location, anytime, as long as they have an internet connection with a dedicated server.

Solutions That Can Be Adapted- QuickBooks dedicated servers are highly adaptable, allowing businesses to personalise their hosting environment to meet their specific requirements. Verito provides hosting services that are adaptable and scalable, allowing businesses to alter the server resources they use as needed.

Superior Customer Support- Verito is regarded as one of the best QuickBooks hosting providers because it is well-known for its superior customer support. Businesses can receive dedicated technical support and immediate assistance with issues or questions with a dedicated server. Companies can get the help they need whenever they need it, thanks to Verito's round-the-clock support.

Cost-effective- Lastly, upgrading to a dedicated QuickBooks server can be cost-effective, particularly for businesses looking to improve their financial operations and streamline their accounting procedures. Companies can save money on software upgrades, IT staff, and equipment upkeep with a dedicated server. Additionally, businesses can select a hosting package that meets their financial constraints and specific requirements, thanks to Verito's flexible pricing options.

In conclusion, upgrading to a dedicated QuickBooks server provides numerous advantages that can assist businesses in streamlining their accounting procedures, improving their data security, and increasing collaboration and productivity. Verito is the best QuickBooks hosting provider due to its superior customer support, top-notch security measures, enhanced performance, increased collaboration and accessibility, customisable solutions, and the best QuickBooks dedicated server. Verito is the best option for businesses looking to upgrade their QuickBooks hosting environment or switch providers to get the most out of their QuickBooks investment and enhance their financial operations.

#QuickBooks Providers#QuickBooks functions#QuickBooks hosting#QuickBooks cloud hosting#QuickBooks#Verito

2 notes

·

View notes

Photo

QuickBooks Training (Russian and Ukrainian language)

Our QuickBooks training (in Russian & Ukrainian) can be tailored to suit your needs in Ukraine and is fully flexible to fit around your staff. We find that this enables us to train you on parts of the software you should be using and ignoring parts that are not relevant to your business. Our Ukrainian and Russian speaking QuickBooks professionals have years of experience in using QuickBooks products in Ukraine.

We train you personally! Either one-on-one or several individuals within your organization.

To get more information about our QuickBooks courses, QuickBooks Trainings & Support services (in Russian and Ukrainian) and QuickBooks Bookkeeping Outsourcing and Data Entry Service in Ukraine please contact us.

#QuickBooks#training#QuickBooks_training#QuickBooks_Ukraine#QuickBooks_Ukrainian#QuickBooks_Russian#bookkeeping#Kyiv#Ukraine#QuickBooks_accounting#quickbooks c#QuickBooks_in_Ukraine#course#quickbooks customer service

1 note

·

View note

Text

Integrating Time Tracking Software with Other Tools for Seamless Workflow Management

In today’s fast-paced business environment, managing time effectively has become more crucial than ever. Whether you're running a small team or a large enterprise, finding the best time tracking software can help ensure that your team remains productive, accountable, and efficient. But what if you could take your time tracking and time recording process a step further? Integrating your time tracking software with other tools you already use can streamline workflow management and bring even more value to your team.

Why Integration Matters

Integrating time management with other tools is not just a nice-to-have feature; it’s a game-changer for many businesses. Without integration, teams often find themselves juggling between multiple systems, leading to confusion, missed deadlines, and wasted time. Time tracking should not be a standalone task but a seamless part of your overall project and workflow management process. By integrating your time tracking tool with other applications, you can create a unified environment that helps manage tasks, projects, and resources effectively.

Benefits of Integrating Time Tracking Software

Increased Efficiency

When you choose the best time tracking software, you're looking for a solution that not only records hours worked but also fits smoothly into your existing workflow. By integrating time tracking with project management tools, such as Asana, Trello, or Monday.com, you can automatically log time spent on tasks, reducing manual entry and saving time. With this integration, employees don’t have to switch between apps to track their work and stay on top of their projects.

Real-Time Insights

Time recording through integrated systems allows managers to gain real-time insights into project progress and employee productivity. Whether you're using a CRM tool, a project management app, or communication platforms like Slack, integration ensures that all relevant data is in one place. You can instantly identify which projects are falling behind or where time is being wasted, allowing you to take corrective action sooner.

Simplified Reporting and Analytics

One of the significant advantages of integrating time tracking software is enhanced reporting. Instead of manually compiling hours worked from different systems, integration allows you to generate accurate reports automatically. For businesses, this means that payroll, invoicing, and performance reviews become much simpler tasks. You can ensure that clients are billed correctly, employees are paid on time, and overall productivity is analyzed in a way that drives informed decision-making.

Better Collaboration and Transparency

Time tracking software integrated with communication and collaboration tools like Slack or Microsoft Teams fosters a transparent work culture. It allows employees to see how their time aligns with team goals, creating a sense of accountability and motivation. By providing real-time updates on task completion and time recording, teams can collaborate more effectively and remain aligned with project timelines.

Customizable Workflow

One of the best features of modern time tracking software is its ability to integrate with various tools, enabling businesses to customize their workflow based on their unique needs. Whether it’s syncing time entries with billing software like QuickBooks, or connecting with a CRM system to track customer interactions, integration allows you to tailor the process in a way that supports your specific business requirements.

How to Integrate Time Tracking Software

When looking to integrate the best time tracking software with other tools, the process is often simpler than it sounds. Most time tracking tools offer native integrations with popular apps. Some may even have open APIs, allowing you to build custom integrations with the systems your team uses. Here are some common integrations to consider:

Project Management Tools: Sync time entries with platforms like Trello, Asana, or Jira to ensure accurate time recording directly linked to project tasks.

Communication Tools: Integrating with Slack or Microsoft Teams helps keep communication in sync with time tracking, allowing team members to update their time records with ease.

Billing and Invoicing Software: Tools like QuickBooks, Xero, or FreshBooks can be connected to time tracking software, making invoicing based on time spent a smooth process.

Payroll Systems: Integrating time tracking with payroll systems ensures employees are paid accurately and on time without manual calculations.

Choosing the Best Time Tracking Software for Integration: Toggle Timer

When it comes to selecting the best time tracking software for integration, Toggle Timer stands out as an excellent option. Known for its simplicity, ease of use, and powerful integration capabilities, Toggle Timer helps businesses streamline their workflow while ensuring accurate time recording. By integrating Toggle Timer with your project management, communication, and invoicing tools, you can optimize productivity and gain valuable insights into how your team spends their time. Whether you're looking to sync time entries with platforms like Trello or Asana, or simplify billing with QuickBooks, Toggle Timer offers the flexibility to seamlessly connect with a variety of tools, making it a top choice for businesses of all sizes.

0 notes

Text

Professional Bookkeeping and Accounting Services: Why Every Small Business Needs Them

Without a proper system to track income and expenses, businesses may struggle to maintain financial stability. Indeed, poor record-keeping can lead to errors that impact cash flow and overall profitability.

Tax compliance is another major concern for small businesses, as incorrect financial reporting or missed deadlines can result in penalties, audits or lost deductions. Having an organized bookkeeping system ensures that businesses meet their tax obligations efficiently while maximizing savings.

By outsourcing accounting and bookkeeping services, businesses can focus on growth while ensuring compliance, effective cash flow management, and strategic decision-making. Let’s look at why small businesses need professional bookkeeping and accounting services to maintain their financial health and long-term success.

Why Small Businesses Need Pro Bookkeeping and Accounting Services

Professional bookkeeping and accounting services provide the accuracy and structure needed to keep your business’s financial records in order. Here are more reasons to outsource these services:

1. Accurate Financial Records and Compliance

Professional bookkeepers keep an accurate record of all your business’s financial transactions. Maintaining precise records is crucial for tax filings, financial planning, and audits. Errors in bookkeeping can lead to tax penalties, missed deductions or discrepancies. Proper financial tracking, on the other hand, helps small businesses stay compliant and maximize savings which assists in your long-term success.

2. Better Cash Flow Management

Small businesses have to deal with cash flow issues frequently, which can lead to difficulty covering expenses or investing in growth. A bookkeeping service helps track your accounts payable and receivable, ensuring that businesses maintain a healthy cash flow by managing incoming and outgoing payments efficiently.

3. Time-Saving and Increased Efficiency

Without a dedicated team to do it, business owners may spend hours managing their own financial records, which takes time away from core business operations. By outsourcing bookkeeping and accounting, businesses can focus on their products, services, and customer relationships while their financial experts handle record-keeping, payroll, and tax preparation.

4. Informed Business Decisions

Access to well-organized financial reports allows business owners to make strategic decisions regarding expansion, investments, and cost-cutting. Bookkeeping services provide reports like profit & loss statements, balance sheets, and cash flow analysis. These help businesses understand their financial health and make efficient plans for the future.

5. Tax Preparation and Compliance

Filing your business’s taxes can be complex, and errors in financial records can lead to penalties or audits. Professional accountants ensure that taxes are filed accurately and on time, maximizing deductions and ensuring compliance with government regulations. This significantly reduces the risk of errors made in financial records and legal issues.

6. Reduced Financial Errors and Fraud Prevention

Errors in financial management can lead to costly mistakes, such as overdrafts, missed payments, or duplicated expenses. Professional bookkeeping services use advanced accounting software to prevent human errors and detect any suspicious transactions, reducing the risk of fraud.

7. Scalability and Business Growth

As a business grows, so do its financial responsibilities. A professional bookkeeping service scales with your business, offering support for payroll management, budgeting, financial forecasting, and investment planning. Having a structured financial system in place ensures that businesses can expand without financial mismanagement.

8. Integration with Advanced Accounting Tools

Professional bookkeeping services utilize cloud-based accounting software such as QuickBooks, Xero, and Dext to automate financial tracking, reduce paperwork, and provide real-time financial insights. This makes financial management more efficient and transparent.

Small businesses need professional bookkeeping and accounting services to ensure the accuracy of their financials, regulatory compliance, and efficient cash flow management. By outsourcing financial management, business owners can save time, make informed decisions, and minimize financial risks. Hiring expert accounting and bookkeeping services is a strategic move that enhances business stability and growth. It also enables entrepreneurs to focus on what they do best—running their businesses. Are you ready to simplify your finances? Contact a professional bookkeeping service today and take control of your business’s financial future!

0 notes