#private company valuation

Explore tagged Tumblr posts

Text

The Illusion of Wealth

The Illusion of Wealth #artem

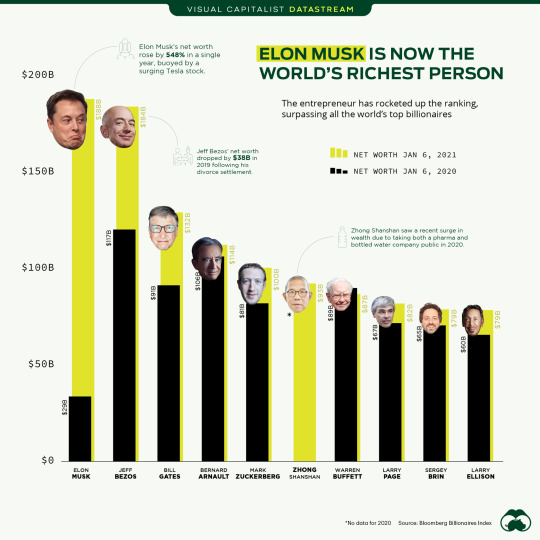

Why “Net Worth” Is More Virtual Than a VR Headset Content 16+ Ah, wealth. The great illusion, the siren song that drives humanity to toil, innovate, and occasionally commit the sort of financial hubris that would make even Icarus blush. But let us not be swayed by the glitzy headlines proclaiming the net worth of titans like Elon Musk or Jeff Bezos. For what we call ‘net worth’ is about as solid…

View On WordPress

#artem#asset liquidation#billionaire assets#cash hoarding#economic consequences#Elon Musk#financial abstraction#financial dreamscape#financial hubris#inflation impact#market value#market volatility#net worth#private company valuation#real estate liquidity#stock market effects#wealth illusion

0 notes

Text

[Haaretz is Israeli Private Media]

A review by TheMarker indicates that a string of Israeli startups have shut down or significantly reduced their activity in the past year, with the trend being even more pronounced in recent months. Their common denominator is that their last significant funding round was in 2021 – the height of the high-tech bubble.[...]

Some of these companies folded after the money ran out and they were unable to start a new round. In some cases, entrepreneurs report, the war in Gaza was another key cause of problems.[...]

"It's directly tied to the war," says Kula. "Foreign investors disappeared, and those who wanted to work together said it wasn't the time. Investors in Israel who had expressed interest also decided to pull out. That's the situation in other companies, too. It's very hard to raise money, even small amounts. It's related to the decline in investments worldwide as well as with the economic and political uncertainty in Israel."

An entrepreneur who shut down a company earlier this year agrees. "The valuation estimates declined, the investors stopped investing," he says. "They tell themselves, 'A bomb just went off and now we're taking our time."

26 Aug 24

467 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

December 5, 2024

Heather Cox Richardson

Dec 06, 2024

Yesterday a gunman assassinated the chief executive officer of UnitedHealthcare, Brian Thompson, as he arrived at a meeting of investors in New York City. While authorities are still investigating, officials have released the information that the casings of the bullets that killed Thompson bore the words “deny,” “defend,” “depose,” all words associated with companies’ denial of health insurance, taken from the longer phrases “deny the claim,” “defend the lawsuit,” “depose the patient.”

While those clues could simply be a red herring, posters on social media have cheered what they seem to see as revenge against an abusive system in which people’s lives are at the mercy of executives who prioritize profits.

Health insurance companies have long been under scrutiny for their practices. For the past two years, ProPublica has run a long series exploring the different ways in which companies have developed systems to deny healthcare coverage to their policyholders.

UnitedHealthcare has been no exception either to such practices or to scrutiny. Its parent group UnitedHealth has a market valuation of $560 billion and was the eighth largest corporation in the world last year as measured by revenue. This year, UnitedHealthcare—Thompson’s unit—is expected to bring in $280 billion in revenue.

UnitedHealth is embroiled in a number of lawsuits. Andrew Stanton of Newsweek reported that on November 14, 2023, families of two now-deceased patients sued UnitedHealthcare over denial of coverage for Medicare Advantage patients for nursing home stays prescribed by their doctors. Medicare Advantage is the private insurance alternative to Medicare that receives a flat fee from the Centers for Medicare and Medicaid Services. It’s an enormously profitable industry, and UnitedHealth controls almost a third of it.

The lawsuit alleges that UnitedHealthcare uses artificial intelligence to deny claims from Medicare Advantage policyholders. The lawsuit claims that the company knowingly uses an algorithm that makes errors 90% of the time because it also knows that only about 0.2% of policy holders will appeal the decision to deny their claims. Last month the Senate Permanent Subcommittee on Investigations hammered UnitedHealth for dramatic increases in their denial rates for post-acute care between 2019 and 2022 as it switched to AI authorizations.

On the same day as the shooting, Anthem Blue Cross Blue Shield insurance covering Connecticut, New York, and Missouri announced it would cover anesthesia during surgery or procedures only for a specific time period in order to make insurance more affordable by reducing overbilling.

After an outcry both from anesthesiologists and the public, the company today retracted its policy change, saying it had never intended to avoid “medically necessary anesthesia,” but meant simply to “clarify the appropriateness of anesthesia consistent with well-established clinical guidelines.” Their explanation might have calmed the news cycle, but its suggestion that the insurance officials rather than doctors should determine what anesthesia is appropriate for a patient during surgery echoed the argument in the UnitedHealthcare lawsuit.

Thompson’s murder seems to be a cultural moment in which popular fury over the power big business has over ordinary Americans’ lives exploded. Maureen Tkacik of The American Prospect noted, “Only about 50 million customers of America’s reigning medical monopoly might have a motive to exact revenge upon the UnitedHealthcare CEO.” The shooter, whose actual motive remains unknown, is fast becoming a folk hero.

Social media has exploded with users writing things like “[t]his claim for sympathy has been denied”; songs featuring the words “deny, “defend,” and “depose”; and recorded commentary condemning the healthcare insurance industry. UnitedHealth Group posted its sadness about Thompson’s death on Facebook yesterday about 1:00 p.m.; 36 hours later the post had 65,000 laughing emojis under it.

Security expert Charlie Carroll expressed surprise to Josh Fiallo of the Daily Beast that Thompson did not have a security detail. “We’re living in a world where people are extremely disgruntled,” Carroll said. “When people lose trust in the system, you start seeing more kidnappings and assassinations because they feel like they have to take matters into their own hands.”

In the wake of the shooting, UnitedHealthcare and several other insurance companies took down from their websites the names and photographs of their officials.

Billionaires Elon Musk and Vivek Ramaswamy were on Capitol Hill today where they met with lawmakers to explain their vision for the Department of Government Efficiency, the group designed to cut the U.S. budget. Neither they nor the lawmakers shared much with the press, although Fox Business played a video of Representative Ralph Norman (R-SC) saying that that “nothing is sacrosanct,” and that “they're going to put everything on the table,” including Social Security, Medicare, and Medicaid.

Representative Tom Tiffany (R-WI) told Just The News that cuts to the budget “don’t have to be just the discretionary spending. We can get at some of the mandatory spending also…food stamps, some of those things.” He continued: “There may be more bang for the buck in terms of growing our economy…making regulatory changes, get the impediments out of the way, let those job creators and entrepreneurs really be able to go to work.”

In view of today’s news about healthcare, it’s probably worth remembering that Musk has called for the elimination of the Consumer Financial Protection Bureau, and that Project 2025 has called for making Medicare Advantage—the privatized Medicare in which UnitedHealth specializes—the default enrollment option for Medicare. This would essentially privatize Medicare for the 66 million people who use it, but since Medicare Advantage costs taxpayers about 6% more than Medicare, this would not create the savings Musk is supposed to be finding.

Andrew Perez of RollingStone reported today that election financial disclosures filed yesterday revealed that Elon Musk was the secret funder of the “RBG PAC,” a Super PAC created just before the election that claimed Trump had the same position on abortion as the late Supreme Court justice Ruth Bader Ginsberg. Although Trump has bragged about overturning the 1973 Roe v. Wade decision recognizing the constitutional right to abortion and the 2024 Republican platform supported the far-right idea of “fetal personhood”—which would apply all the rights protected by the Fourteenth Amendment from the moment a human egg is fertilized—the RBG PAC ran ads promising that Trump would not support a national abortion ban.

Ginsburg’s granddaughter called the comparison of Trump and her grandmother “nothing short of appalling.”

The super PAC was created so late that it avoided disclosure before November 5. It was funded entirely by Musk with an injection of $20.5 million.

Bridget Bowman, Ben Kamisar, and Scott Bland of NBC News reported tonight that Musk spent at least $250 million to get Trump elected. In addition to the $20.5 million to the RBG PAC, he put $238 million into the America PAC. Musk also supported Trump through free advertising and commentary on his social media platform X.

Today provided a snapshot of American society that echoed a similar moment on January 6, 1872, when Edward D. Stokes shot railroad baron James Fisk Jr. as he descended the staircase of New York’s Grand Central Hotel. The quarrel was over Fisk’s mistress, Josie, who had taken up with the handsome Stokes, but the murder instantly provoked a popular condemnation of the ties between big business and government.

Fisk was a rich, flamboyant, and unscrupulous man-about-town, who was deeply entwined both with railroad barons like Jay Gould, Daniel Drew, and Cornelius Vanderbilt and with New York’s Tammany Hall political machine and its infamous leader, William Marcy Tweed. Tweed made sure the laws benefited the railroads and, the papers noted, snuck into the hotel to say goodbye to his friend in the hours it took for him to perish.

After the Civil War, most Americans applauded the nation’s businessmen for the support their growing industries had provided to the Union, but by 1872 the enormous fortunes the railroad men had amassed had tarnished their reputation. At the same time, big operators were starting to squeeze smaller enterprises out of business in order to control the markets, and popular anger simmered over their increasing control of the economy.

Stokes’s shooting was the event that sparked a popular rebellion. Newspapers covered every minute of the event and Fisk’s demise, while sensational books about the murder rolled off the presses.

Together, they redefined late nineteenth-century industrialists, with one painting Fisk as a representative businessman who with just “an hour’s effort,” could “gather into his clutches a score of millions of other people’s property, impoverish a thousand wealthy men, or derange the values and the traffic of a vast empire.”

Both those covering the murder and those reading about it rejoiced in Fisk’s misfortune.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#insurance#insurance industry#Medicare#Medicaid#Medicaire Advantage#American History#history#income inequality#stress#assassination

28 notes

·

View notes

Text

The Haas and Uralkali situation explained

Some of you might’ve heard of it, those that didn’t should now. In the course of this race weekend, news came out that equipment and the cars of the Haas F1 team could be seized, as they owe their former sponsor Uralkali money, and as long as they don’t repay that money, their assets, in this case cars and equipment could be seized. All of this could lead to them missing the Italian Grand Prix, if not more, but what exactly happened and what will Haas do now? I’ll try to answer these questions and give my opinion on the situation, but i’ll preface all of this by saying that I am not legally involved in any of this, which means I can also only give you public knowledge and while i tried my hardest to research all the facts, it’s impossible to be sure that everything is correct, but more to that later.

Back to the problem; where did all of this start?

Uralkali ‘is a Russian potash fertilizer producer and exporter’ as stated on Wikipedia. It’s a pretty big company with a lot of assets, in 2018, they had assets worth roughly $8 billion. With these big numbers in mind, Uralkali became a sponsor of Haas in 2021. I’ll make a separate post about sponsors, but important to know for this is that sponsors hold contracts with the teams. They give the teams money that's needed and in return, depending on how much they gave, they get things back from the team. As you’ve probably guessed, Uralkali gave quite a big sum of money to Haas, they became title sponsor, so for 2021, Haas was officially called ‘Uralkali Haas F1 team’, their cars livery was in the russian flag and they signed Nikita Mazepin, son of Dmitry Mazepin who’s one of the most influential Uralkali shareholders. It’s not quite clear how much money Haas got, but multiple sources talk about roughly $12 million, which makes sense if you take all factors into account.

From the money Haas made, they bought equipment and parts for the cars, so as far as sources state, all the money they initially got has been used up.

In 2022, following Russia's invasion of the Ukraine, many business people and oligarchs were sanctioned. I could not find clear statements of Uralkali itself being sanctioned too, but considering that most of the owners and shareholders are, I would assume that that puts the company also under certain sanctions. The important part here is that both Nikita and Dmitry Mazepin have been put under sanctions. These sanctions consist of asset freezes and travel bans, which resulted in Nikita Mazepins contract and the sponsoring contract being terminated by the team.

Now this is where the problem starts; by contract, there's usually a clause that does not allow one party of the deal to just withdraw, at least not without paying their shares back. Due to the sanctions, though, it was not possible for Haas to pay the money that they owed back.

According to multiple sources, there was an arbitration court hearing in June in Switzerland, in which the court ruled that Haas needs to pay back the money that they owe Uralkali. Again, different sources talk about different amounts of money, since the ruling was kept private, but Uralkali states that by contract, they are also owed "a team race car from the 2021 season”. It’s difficult to rule out what really happened as different sources state different things, but they all have in common that Haas did not meet the required time to pay back whatever they owe, may that be because of the sanctions or because they lack the money, the important point is, Uralkali proceeded with a bid to get their court ruled money in assets. This race weekend, Haas has been apparently visited by bailiffs to evaluate what assets are of what value that could then be owed to Uralkali.

All of this is pretty irrelevant to the dutch grand prix, as it has been made sure that the valuation and official proceedings do not happen during the day and Haas has been ensured that this race weekend would continue, this could change though for the italian grand prix. If bailiffs decide which assets are worth the amount they owe Uralkali, these could be kept in the Netherlands until Haas pays or be taken as substitute for the money, although I am not sure where the legalities would lie there with what Uralkali is allowed to do with the assets then.

The big problem for Haas right now, is paying. It's unclear if Haas has the money to pay it back, if they do it would obviously be a big setback because we are talking about millions of dollars here, but there is another problem; due to the sanctions, Haas states, the process of paying is difficult; “Haas has been working with its lawyers to ensure payment will comply with all relevant US, EU, UK and Swiss sanctions and regulations.” Uralkali states that this is not a good reasoning, but politics are difficult to follow, so even with extensive research I cannot guarantee you that paying is even a possibility without breaking sanctions by certain countries. For Haas the problem stays; they need to pay before Monday, or their assets will not be allowed to leave the Netherlands.

Due to this, rumors have surfaced, saying that this could be the end of Haas. Even if they pay the money and can compete in Italy, a lot of people expect it to be the final hit for Haas and possibly result in the team leaving or being bought up by Andretti, an American company that has tried to get into F1 for a while now. As of now, i cannot answer these rumors based on proof, but i can share my thoughts; leaving the sport completely is not as easy as it seems, there are contracts and rules, depending on the contracts, just leaving could cost Haas even more. Although selling the team would bypass these rules, selling a team takes time. Andretti could benefit from Haas being cheaper to buy than it would usually be, if the owners want to leave they’ll want to do it fast and for a team like Haas, you really cannot ask for much. In the end I do think though, that the rumors are unwarranted. If Haas gets sold, it's because they got a good offer, not because they suddenly want to leave when things get hard, especially since things were never easy at Haas to begin with.

I hope I explained and summarized the whole situation properly. As always, I'm open to explain my thoughts further and for comments and what you guys think of the situation and in this case rumors.

#haas f1 team#f1#formula 1#f1 2024#dutch gp 2024#nico hulkenberg#kevin magnussen#nikita mazepin#lewis hamilton#max verstappen#charles leclerc#carlos sainz#oscar piastri#wheeltalk

42 notes

·

View notes

Text

Pat McGrath’s Natal Chart Analysis: Beauty IS a ritual or an exploration of the 4th and 8th houses

I’ve always loved Pat’s work as a makeup enthusiast and was curious to look at her chart. I was shocked that was a 4th and 8th houser because I associated makeup with 5th, 10th, or 11th house energies. The 4th and 8th houses have heavy spiritual energy to me, but when I thought more about it Beauty is both venusian and deeply saturnian because it is so ritualistic. Pat and I share many of the same nakshatras.

Pat is a REAL earth sign with 9 placements in earth signs and Taurus + Capricorn Stelliums.

Libra 1H

The 1H rules the head and face and Vishaka is symbolized by the lightning strike. Pat has spent her life creating striking and elaborate makeup looks, going against the no makeup trends of the 90s.

Scorpio 2H

With JupiterR conjunct Neptune in second house in Anuradha - Pat’s love of makeup started in her early childhood, which the second house rules. Anuradha is the star of devotion and Pat spent her childhood going to beauty releases and reading magazines with her mother who was obsessed with beauty products. Her second house ruler is Ketu in her tenth house, she makes her money from her public career. Neptune here adds a dreamy, psychic, and imaginative energy to her relationship with beauty.

4H Capricorn Stellium

Pat has her Moon in Uttara Ashada and Mars Conjunct Rahu in Dhanistha in the 4th.

Dhanista is the nakshatra of fame, and Rahu can also be a fame indicator, leading to Pat being deemed a legend in a very cutthroat industry. The Mars–Rahu (Dragon’s head) conjunction indicates the physical energy of Mars that is amplified in its physical strength through the impact of Rahu. Being a makeup artist is a physically demanding job and Pat is known for her productivity and the sheer amount of shows she does yearly.

Moon in 4th has planetary strength. The moon rules the masses/fame as well as femininity. Uttara Ashada is a popular nakshatra in the fashion world (many famous designers have UA personal planets), meaning later victorious. The moon is also the mother and Pat’s mom influenced her love of beauty. Ofc a a businesswoman with a personal net worth of about $800 million and a company valuation of $1 billion would have some heavy capricorn energy.

Capricorn rules the skin, and Pat is famous for her secret technique of making skin look lit from within (realized that sounds very 8th house when I wrote it out lol) with her Rahu in Capricorn.

The 4th house rules the home and Pat loves interior design and architecture magazines, reading them daily.

Aquarius 5H

Aquarius 5th with Saturn tightly conjuct Venus in 8th: Pat’s work is very Aquarian, otherworldly, innovative and extremely unique.

8H Taurus Stellium

Pat has a Taurus stellium in her 8th house making her very venusian. She has a TIGHT Saturn-Venus conjunction (00:07 degrees) in Krittika, a nakshatra of extreme precision, which probably informs her skill as a makeup artist. Saturn gives her Venusian energy the stability and support that has allowed her to have an incredibly long career. Mercury in the nurturing and creative nakshatra of Rohini explains why she loves using her hands to be creative.

The 8th house is the house of research and Pat is known for being extremely studied in beauty, knowing niche makeup trends and traveling with several beauty books always.

Interestingly, her sun in Mrigashira is her AK. People with sun as AK can be incredibly creative and self-focused.

The term Mṛgaśira (मृगशिर) is a composite of two Sanskrit words, mṛga (मृग) meaning deer and śira (शिर) meaning head or precisely, the top of the head. Mrigashira is ruled by Mars (in Pat’s 4th house conjuct her Rahu/fame) and Chandra (who rules the face and is also in her 4th house). Some texts say Mrigashira conveys the ideas of searching for beautiful faces, and Pat scouted plus-sized model Paloma Elsesser, saying she had the perfect face for makeup.

Pat is extremely private being an eighth houser, and I wonder if she is very spiritual or has lived a life of a lot of hidden difficulties with these placements.

Cancer 10H

The tenth house is public perception and Pat is known for how she transforms the feminine face. Ashlesha is a dark feminine nakshatra that symbolizes transformation, kundalini, and hidden/occult wisdom. Ketu symbolizes spiritual liberation and past life influences, so Pat’s work for her is deeply spiritual and influenced by her past life experiences.

Pat’s work transforms and empowers the feminine collective.

Cancer is a sign known for collecting, Pat is known to travel to shoots with 75 assistants, suitcases full of products, and collections of beauty books for inspiration.

Virgo 12H

Pat has Uranus in Hasta and Pluto & Lilith in Uttara Phalguni. Hasta symbolizes the hands and Pat’s revolutionary technique is using her hands to apply makeup products usually applied with a brush. Makeup to me is very Virgoan, and UP is ruled by Sun and Mercury, Mercury also rules the hands.

With most of her personal planets located in the 4th, 8th, and 12th houses Pat’s predilection for privacy makes much sense, she wears a daily all black outfit and prefers to be in the background not the foreground.

Dashas

Pat rose to fame in the early 1990s when she was in her Rahu Dasha or the end of her Mars Dasha, her Rahu is tightly conjunct her Mars both in Dhanista the star of lasting fame. In 2026 she will be entering her Saturn dasha. Saturn rules legacy but may also being a time of hard work and difficulty for her. Her Saturn is conjunct her Venus so she may build significant wealth or be very in demand during this time.

Will look into her padas another day!

#vedic astrology#vedic astro notes#vedic astro observations#natal chart#pat mcgrath#sidereal astrology#astrology#astro community#astrology readings#birth chart

27 notes

·

View notes

Text

Berkshire Hathaway Shareholder Letter 2022, Reactions

Every year I enjoy reading Warren Buffets' predictably charming annual Berkshire Hathaway Shareholder letter. I dare you to find another annual investor letter you can remotely describe as charming. Anyhow, this year's letter published February 23 was another winner. As a builder turned investor I can't look to a better influence on my decision making than Warren and his partner Charlie Munger. Their humility, their focus on long-term relationships, and their emphasis on pragmatism alongside an expectation of excellence are all values I hold dear and hope to instill into Saltwater and our businesses for years to come.

Here's what stood out to me.

Hammering home the basics

We’re reminded that these gents look at companies, not stocks… “Charlie and I are not stock-pickers; we are business-pickers.” Buying a stock is just a tiny fraction of the company you’re getting, evaluate it as such. So why buy stocks vs majority ownership? A question we ask ourselves at Saltwater often? There is but one critical difference for the critical eyed investor. The difference between public "stocks" and privately owned businesses based on Warren’s insights… “stocks often trade at truly foolish prices...while a controlled business gives no thought to selling at a panic-type valuation.” Good enough for me. We’ll be keeping our eyes open for foolish prices.

Shareholder financial education

Warren shares an anecdote about share repurchases and the misled villainization of them.

“The math isn’t complicated: When the share count goes down, your interest in our many businesses goes up. Every small bit helps if repurchases are made at value-accretive prices. Just as surely, when a company overpays for repurchases, the continuing shareholders lose. At such times, gains flow only to the selling shareholders and to the friendly, but expensive, investment banker who recommended the foolish purchases.

Gains from value-accretive repurchases, it should be emphasized, benefit all owners – in every respect. Imagine, if you will, three fully-informed shareholders of a local auto dealership, one of whom manages the business. Imagine, further, that one of the passive owners wishes to sell his interest back to the company at a price attractive to the two continuing shareholders. When completed, has this transaction harmed anyone? Is the manager somehow favored over the continuing passive owners? Has the public been hurt?”

We were able to execute a value-accretive share repurchase in a portfolio company this year and while it wasn’t a smooth process, it was a very good decision for all our shareholders. Thanks Warren.

Praise of his best companies

How many times have you heard Warren discuss Coke, Amex, and See’s Candies? Effectively every time he or Charlie open their mouths. Charlie’s personal fav is Costco based on my experience with him. This year Warren reminds us that in 1994, BRK completed a 7 year buying spree of over 400 million shares of Coke stock for a total of $1.3B. He reminds us the value of those dividends almost a billion, as well as stock price appreciation, that 400 million share position is worth >$25B today.

He doesn’t paint this investment as an obvious or easy one however. “The weeds wither away in significance as the flowers bloom… it takes just a few winner to work wonders.”

Endless love for his partner Charlie Munger

I love looking for how many times Warren uses the phrase, "Charlie and I...", this year it was 10. He's clearly smitten with his long-time friend and partner for good reason, but this was my favorite tidbit of Charlie appreciation...

"Find a very smart high-grade partner – preferably slightly older than you – and then listen very carefully to what he says."

He includes a response that Charlie will often use back to Warren when they are in decision-making mode.

“Warren, think more about it. You’re smart and I’m right.”

See what I mean… charming. Greater than the Coke investment, or the Costco investment, Warren's appreciation of Charlie's wisdom & friendship are what anchor his brilliance in my mind.

The elephant in the room… transition insights

With Charlie at 99 and Warren at 92, every communication is reasonably analyzed for hints around their transitions. I don’t believe there will be one until one or both pass. Sad, but likely true.

Charlie talks about Berkshire in the general sense a few times in this years letter where it feels like he’s writing rules to operate by for others versus telling the shareholder how “he” specifically will operate.

Our CEO will always be the Chief Risk Officer

At Berkshire, there will be no finish line.

Our CEOs will have a significant part of their net worth in Berkshire shares, bought with their own money.

I certainly hope there is an internal rule on the last point and it would be helpful to know what that $ amount is. While these aren’t all that telling as to the timing of a transition of either partners health condition it’s clear that Warren’s thinking is still spot on.

I hope you enjoy and absorb these letters as much as I do.

264 notes

·

View notes

Text

According to the judge’s findings, Trump was questioned about Aberdeen, and whether he was aware the financial statements from 2014 to 2018 valued the property as if the organisation could build 2500 year-round private residences, when in fact they had only been given permission to build 500.

They built zero (0) homes.

He's being sued again, this time in Scotland. For claiming millions of dollars in tax breaks on 2500+ homes that do not exist. He literally made up the existence of thousands of homes, then tried to claim tax benefits on them.

22 notes

·

View notes

Text

🌍 🏦💵 🚨

FIVE RICHEST BILLIONAIRES DOUBLE THEIR WEALTH SINCE 2020 WHILE 5 BILLION ARE MADE POORER

Oxfam International, a British-founded International Charitable organization based in Nairobi, Kenya, says the world's richest people have managed to double their wealth since 2020, as 5 billion people are made poorer as a result of a "decade of division."

Oxfam made the claims in a press release on its recently published report released Monday, January 15th on inequality and global corporate power called "Inequality Inc."

According to Oxfam, the world's richest people have more than doubled their wealth from $405 billion to $869 billion since 2020, a rate equivelent to $14 million per hour, while approximately 5 billion people have been made poorer in the same time period.

"If current trends continue," the statement says, "the world will have its first trillionaire within a decade but poverty won't be eradicated for another 229 years."

Oxfam looks to the Davos gathering of the world's largest corporations, pointing to the valuations of the top ten largest companies, together worth more than $10.2 trillion.

“We’re witnessing the beginnings of a decade of division, with billions of people shouldering the economic shockwaves of pandemic, inflation and war, while billionaires’ fortunes boom. This inequality is no accident; the billionaire class is ensuring corporations deliver more wealth to them at the expense of everyone else,” Oxfam's International interim Executive Director Amitabh Behar is quoted as saying.

“Runaway corporate and monopoly power is an inequality-generating machine: through squeezing workers, dodging tax, privatizing the state, and spurring climate breakdown, corporations are funneling endless wealth to their ultra-rich owners. But they’re also funneling power, undermining our democracies and our rights. No corporation or individual should have this much power over our economies and our lives —to be clear, nobody should have a billion dollars”.

According to Oxfam, Billionaires increased their wealth by $3.3 trillion since 2020, a growth rate three times faster than inflation.

Oxfam adds that, despite representing just 21% of the global population, the countries of the Global North own 69% of global wealth, with Global North countries home to 74% of global billionaire wealth.

Further, the top 1% own 43% of all global financial assets, with billionaires owning 48% of wealth in the Middle East, 50% in Asia, and 47% in Europe.

In addition to overall wealth, 148 of the world's largest corporations raked in $1.8 trillion in total net profits, a 52% increase over the period from 2018-2021.

Corporate windfalls increased to nearly $700 billion, with the report finding that for every $100 in profits made by the top 96 major corporations between July 2022 and June 2023, $82 was paid out to wealthy shareholders.

Oxfam International interim Executive Director Amitabh Behar says that “Monopolies harm innovation and crush workers and smaller businesses. The world hasn’t forgotten how pharma monopolies deprived millions of people of COVID-19 vaccines, creating a racist vaccine apartheid, while minting a new club of billionaires."

The Oxfam press release goes on to point our that people are working harder and for longer, often for poverty wages in unsafe jobs, adding that the wages of nearly 800 million people have not kept up with inflation, losing $1.5 trillion in value over the last two years, the equivalent of nearly a month's lost wages for each individual worker.

Oxfam also found that, of the 1'600 largest companies, less than 0.4% of them are publicly committed to paying employees a living wage.

Oxfam shows how a "war on taxation" by large corporations has pushed the effective tax rates on corporations to fall by a third in recent decades, while relentless privitization of public services like education and water services have expanded massively.

“We have the evidence. We know the history. Public power can rein in runaway corporate power and inequality —shaping the market to be fairer and free from billionaire control. Governments must intervene to break up monopolies, empower workers, tax these massive corporate profits and, crucially, invest in a new era of public goods and services,” said Behar.

“Every corporation has a responsibility to act but very few are. Governments must step up. There is action that lawmakers can learn from, from US anti-monopoly government enforcers suing Amazon in a landmark case, to the European Commission wanting Google to break up its online advertising business, and Africa’s historic fight to reshape international tax rules.”

Oxfam offers three notes on how governments can rectify the situation, including the following:

🔹 Revitalizing the state. A dynamic and effective state is the best bulwark against extreme corporate power. Governments should ensure universal provision of healthcare and education, and explore publicly-delivered goods and public options in sectors from energy to transportation.

🔹 Reining in corporate power, including by breaking up monopolies and democratizing patent rules. This also means legislating for living wages, capping CEO pay, and new taxes on the super-rich and corporations, including permanent wealth and excess profit taxes. Oxfam estimates that a wealth tax on the world’s millionaires and billionaires could generate $1.8 trillion a year.

🔹 Reinventing business. Competitive and profitable businesses don’t have to be shackled by shareholder greed. Democratically-owned businesses better equalize the proceeds of business. If just 10 percent of US businesses were employee-owned, this could double the wealth share of the poorest half of the US population, including doubling the average wealth of Black households.

#source

@WorkerSolidarityNews

#inequality#wealth inequality#us news#us wealth#global inequality#wealth#capitalism#billionaires#richest people#politics#news#geopolitics#world news#global news#international news#global politics#world politics#international politics#international#international affairs#united states#davos#wef#world economic forum#billionaire#wealth accumulation#imperialism#us imperialism#western imperialism#socialism

34 notes

·

View notes

Text

Elon Musk's Twitter X has been a terrible investment.

These are bad times for Elon. Sales of Teslas are in decline, his rockets are exploding, and the chat he had with Trump on his own platform during the summer was a technological embarrassment.

On top of all that, investors are losing their pants at Twitter/X.

Musk’s Twitter investors have lost billions in value

“Elon’s done a tremendous amount of wealth destruction since he’s purchased Twitter,” said Ross Gerber, who said he invested less than $1 million, a stake he now considers worthless. “For the people who put capital into him for any amount,” Gerber said, “ … trying to explain to people how he lost” so much money “is not a fun conversation.” Among top investors, Dorsey — whose stake has lost an estimated $720 million — has made his displeasure known. Last year, he said Musk shouldn’t have purchased Twitter after all, posting on social media that hedidn’t think Musk “acted right after realizing his timing was bad.” “It all went south,” Dorsey said. [ ... ] Because Musk turned Twitter into a private company, it’s hard to know its up-to-the-minute valuation. But some things about its financial picture are clear: Advertisers, its key source of revenue, fled after controversies — some caused by Musk himself. Some advertisers were also put off by his decision to gut content moderation while restoring thousands of accounts previously suspended for breaking the site’s rules. The deal has also faced scrutiny. The SEC has an active fraud probe into Musk’s purchase of the site, examining his early accumulation of Twitter shares without disclosing his investment — a move that could have affected the share price. Some investors have received subpoenas as part of the probe.

Musk himself has lost $24.12 Billion on his investment.

No wonder Musk is desperately trying to help elect Trump. But even Weird Donald's tax breaks for the filthy rich probably aren't big enough to help recoup that enormous loss.

Rich people want you to think they are geniuses just because they're rich. Musk is the latest to prove that enormous wealth does not make you smart.

#elon musk#elon putz#twitter#x#social media#investments#poor investments#billionaires#the filthy rich#donald trump#leave twitter#quit twitter#delete twitter#election 2024#vote blue no matter who

7 notes

·

View notes

Text

Heather Cox Richardson 12.5.24

Yesterday a gunman assassinated the chief executive officer of UnitedHealthcare, Brian Thompson, as he arrived at a meeting of investors in New York City. While authorities are still investigating, officials have released the information that the casings of the bullets that killed Thompson bore the words “deny,” “defend,” “depose,” all words associated with companies’ denial of health insurance, taken from the longer phrases “deny the claim,” “defend the lawsuit,” “depose the patient.”

While those clues could simply be a red herring, posters on social media have cheered what they seem to see as revenge against an abusive system in which people’s lives are at the mercy of executives who prioritize profits.

Health insurance companies have long been under scrutiny for their practices. For the past two years, ProPublica has run a long series exploring the different ways in which companies have developed systems to deny healthcare coverage to their policyholders.

UnitedHealthcare has been no exception either to such practices or to scrutiny. Its parent group UnitedHealth has a market valuation of $560 billion and was the eighth largest corporation in the world last year as measured by revenue. This year, UnitedHealthcare—Thompson’s unit—is expected to bring in $280 billion in revenue.

UnitedHealth is embroiled in a number of lawsuits. Andrew Stanton of Newsweek reported that on November 14, 2023, families of two now-deceased patients sued UnitedHealthcare over denial of coverage for Medicare Advantage patients for nursing home stays prescribed by their doctors. Medicare Advantage is the private insurance alternative to Medicare that receives a flat fee from the Centers for Medicare and Medicaid Services. It’s an enormously profitable industry, and UnitedHealth controls almost a third of it.

The lawsuit alleges that UnitedHealthcare uses artificial intelligence to deny claims from Medicare Advantage policyholders. The lawsuit claims that the company knowingly uses an algorithm that makes errors 90% of the time because it also knows that only about 0.2% of policy holders will appeal the decision to deny their claims. Last month the Senate Permanent Subcommittee on Investigations hammered UnitedHealth for dramatic increases in their denial rates for post-acute care between 2019 and 2022 as it switched to AI authorizations.

On the same day as the shooting Anthem Blue Cross Blue Shield insurance covering Connecticut, New York, and Missouri announced it would cover anesthesia during surgery or procedures only for a specific time period in order to make insurance more affordable by reducing ove,rbilling.

After an outcry both from anesthesiologists and the public, the company today retracted its policy change, saying it had never intended to avoid “medically necessary anesthesia,” but meant simply to “clarify the appropriateness of anesthesia consistent with well-established clinical guidelines.” Their explanation might have calmed the news cycle, but its suggestion that the insurance officials rather than doctors should determine what anesthesia is appropriate for a patient during surgery echoed the argument in the UnitedHealthcare lawsuit.

Thompson’s murder seems to be a cultural moment in which popular fury over the power big business has over ordinary Americans’ lives exploded. Maureen Tkacik of The American Prospect noted, “Only about 50 million customers of America’s reigning medical monopoly might have a motive to exact revenge upon the UnitedHealthcare CEO.” The shooter, whose actual motive remains unknown, is fast becoming a folk hero.

Social media has exploded with users writing things like “[t]his claim for sympathy has been denied”; songs featuring the words “deny, “defend,” and “depose”; and recorded commentary condemning the healthcare insurance industry. UnitedHealth Group posted its sadness about Thompson’s death on Facebook yesterday about 1:00 p.m.; 36 hours later the post had 65,000 laughing emojis under it.

Security expert Charlie Carroll expressed surprise to Josh Fiallo of the Daily Beast that Thompson did not have a security detail. “We’re living in a world where people are extremely disgruntled,” Carroll said. “When people lose trust in the system, you start seeing more kidnappings and assassinations because they feel like they have to take matters into their own hands.”

In the wake of the shooting, UnitedHealthcare and several other insurance companies took down from their websites the names and photographs of their officials.

Billionaires Elon Musk and Vivek Ramaswamy were on Capitol Hill today where they met with lawmakers to explain their vision for the Department of Government Efficiency, the group designed to cut the U.S. budget. Neither they nor the lawmakers shared much with the press, although Fox Business played a video of Representative Ralph Norman (R-SC) saying that that “nothing is sacrosanct,” and that “they're going to put everything on the table,” including Social Security, Medicare, and Medicaid.

Representative Tom Tiffany (R-WI) told Just The News that cuts to the budget “don’t have to be just the discretionary spending. We can get at some of the mandatory spending also…food stamps, some of those things.” He continued: “There may be more bang for the buck in terms of growing our economy…making regulatory changes, get the impediments out of the way, let those job creators and entrepreneurs really be able to go to work.”

In view of today’s news about healthcare, it’s probably worth remembering that Musk has called for the elimination of the Consumer Financial Protection Bureau, and that Project 2025 has called for making Medicare Advantage—the privatized Medicare in which UnitedHealth specializes—the default enrollment option for Medicare. This would essentially privatize Medicare for the 66 million people who use it, but since Medicare Advantage costs taxpayers about 6% more than Medicare, this would not create the savings Musk is supposed to be finding.

Andrew Perez of RollingStone reported today that election financial disclosures filed yesterday revealed that Elon Musk was the secret funder of the “RBG PAC,” a Super PAC created just before the election that claimed Trump had the same position on abortion as the late Supreme Court justice Ruth Bader Ginsberg. Although Trump has bragged about overturning the 1973 Roe v. Wade decision recognizing the constitutional right to abortion and the 2024 Republican platform supported the far-right idea of “fetal personhood”—which would apply all the rights protected by the Fourteenth Amendment from the moment a human egg is fertilized—the RBG PAC ran ads promising that Trump would not support a national abortion ban.

Ginsburg’s granddaughter called the comparison of Trump and her grandmother “nothing short of appalling.”

The super PAC was created so late that it avoided disclosure before November 5. It was funded entirely by Musk with an injection of $20.5 million.

Bridget Bowman, Ben Kamisar, and Scott Bland of NBC News reported tonight that Musk spent at least $250 million to get Trump elected. In addition to the $20.5 million to the RBG PAC, he put $238 million into the America PAC. Musk also supported Trump through free advertising and commentary on his social media platform X.

Today provided a snapshot of American society that echoed a similar moment on January 6, 1872, when Edward D. Stokes shot railroad baron James Fisk Jr. as he descended the staircase of New York’s Grand Central Hotel. The quarrel was over Fisk’s mistress, Josie, who had taken up with the handsome Stokes, but the murder instantly provoked a popular condemnation of the ties between big business and government.

Fisk was a rich, flamboyant, and unscrupulous man-about-town, who was deeply entwined both with railroad barons like Jay Gould, Daniel Drew, and Cornelius Vanderbilt and with New York’s Tammany Hall political machine and its infamous leader, William Marcy Tweed. Tweed made sure the laws benefited the railroads and, the papers noted, snuck into the hotel to say goodbye to his friend in the hours it took for him to perish.

After the Civil War, most Americans applauded the nation’s businessmen for the support their growing industries had provided to the Union, but by 1872 the enormous fortunes the railroad men had amassed had tarnished their reputation. At the same time, big operators were starting to squeeze smaller enterprises out of business in order to control the markets, and popular anger simmered over their increasing control of the economy.

Stokes’s shooting was the event that sparked a popular rebellion. Newspapers covered every minute of the event and Fisk’s demise, while sensational books about the murder rolled off the presses.

Together, they redefined late nineteenth-century industrialists, with one painting Fisk as a representative businessman who with just “an hour’s effort,” could “gather into his clutches a score of millions of other people’s property, impoverish a thousand wealthy men, or derange the values and the traffic of a vast empire.”

Both those covering the murder and those reading about it rejoiced in Fisk’s misfortune.

—

3 notes

·

View notes

Text

Sponsors and donors’ valuation of our public culture is of an order very different from everyone else’s. For big oil, big pharmaceutical companies and the arms industry, it is not simply a case of doing good. For them, sponsorship of the arts is not charity; it is a strategic expenditure.

To conduct their business, companies must build a web of influence and operation through many of the institutions that are often clustered in cities, through which they become enmeshed in our lives. London, for example, is one of the main financial centers for the oil industry. Oil companies must extract from the city a combination of services, so that elsewhere they may continue to extract, refine, transport and sell oil.

This is a matter not only of buying financial services from private companies, but of creating legal, political and technological leverage; facilitating clearance from regulators; gaining support from government departments or legal permission for new projects. Cultural institutions are a key part of this infrastructure into which businesses must insinuate themselves to establish an air of social legitimacy and acceptability for practices that might otherwise risk coming into question.

60 notes

·

View notes

Text

Excerpt from this story from Canary Media:

Octopus Energy has surged to the top of the U.K. electricity market with its plucky brand of clean, flexible, customer-centric energy. Now it’s loading up on new investment to make a broader push into North America.

The sprawling clean energy startup pulled in two new investments in recent weeks. On May 7, it announced a re-up from existing investors, including Al Gore’s Generation Investment Management and the Canada Pension Plan. Last week, it added a new round from the $1 billion Innovation and Expansion Fund at Tom Steyer’s Galvanize Climate Solutions. The parties did not disclose the size of the new infusions but said that they lift Octopus’ private valuation to $9 billion. Previously, Octopus raised an $800 million round in December, putting its valuation at $7.8 billion. Thus, eight-year-old Octopus enters the summer of 2024 as one of the most valuable privately held startups in the world, but one whose impact is felt far more in Europe than in the U.S. The new influx of cash will help fund expansion in North America, both by growing its retail foothold in Texas and by ramping up sales of the company’s marquee Kraken software to other utilities. The company has its work cut out if it wants to reproduce its U.K. market dominance across the pond.

“It is a Cambrian explosion of exciting growth in almost every direction,” Octopus Energy U.S. CEO Michael Lee told Canary Media last week.

In the U.K., Octopus has gobbled its way up the leaderboard of electricity retailers, consuming competitors large and small until it reached the No. 1 slot this year. It supplies British customers in part with clean power from a multibillion-dollar portfolio of renewables plants that it owns. The company lowers costs to customers by using smart devices or behavioral nudges to shift their usage to times when the renewables are producing the most cheap electricity. Octopus also began making its own heat pumps, to help households break out of dependence on fossil gas at a volatile time.

In the U.S., land of free markets and capitalist competition, market design largely blocks Octopus from rolling out its innovations, and instead protects the monopoly power of century-old incumbent utilities. There is no national electricity market to take over, but a state-by-state hodgepodge of fiefdoms that obey differing rules. So Octopus made its first stand in Texas, whose competitive power market most closely resembles the U.K.’s system. It now sources power for tens of thousands of retail customers in the state.

“It is absolutely clear to me that the energy transition is happening first in Texas,” Lee said. “This is a fantastic market to be in if you know how to work with customers and help them be a central focus in providing that energy transition to the grid.”

Such an assertion might have elicited derisive snorts from Californians or New Yorkers a few years ago, but facts on the ground now support Lee’s thesis.

6 notes

·

View notes

Text

December 5, 2024

HEATHER COX RICHARDSON

DEC 6

Yesterday a gunman assassinated the chief executive officer of UnitedHealthcare, Brian Thompson, as he arrived at a meeting of investors in New York City. While authorities are still investigating, officials have released the information that the casings of the bullets that killed Thompson bore the words “deny,” “defend,” “depose,” all words associated with companies’ denial of health insurance, taken from the longer phrases “deny the claim,” “defend the lawsuit,” “depose the patient.”

While those clues could simply be a red herring, posters on social media have cheered what they seem to see as revenge against an abusive system in which people’s lives are at the mercy of executives who prioritize profits.

Health insurance companies have long been under scrutiny for their practices. For the past two years, ProPublica has run a long series exploring the different ways in which companies have developed systems to deny healthcare coverage to their policyholders.

UnitedHealthcare has been no exception either to such practices or to scrutiny. Its parent group UnitedHealth has a market valuation of $560 billion and was the eighth largest corporation in the world last year as measured by revenue. This year, UnitedHealthcare—Thompson’s unit—is expected to bring in $280 billion in revenue.

UnitedHealth is embroiled in a number of lawsuits. Andrew Stanton of Newsweek reported that on November 14, 2023, families of two now-deceased patients sued UnitedHealthcare over denial of coverage for Medicare Advantage patients for nursing home stays prescribed by their doctors. Medicare Advantage is the private insurance alternative to Medicare that receives a flat fee from the Centers for Medicare and Medicaid Services. It’s an enormously profitable industry, and UnitedHealth controls almost a third of it.

The lawsuit alleges that UnitedHealthcare uses artificial intelligence to deny claims from Medicare Advantage policyholders. The lawsuit claims that the company knowingly uses an algorithm that makes errors 90% of the time because it also knows that only about 0.2% of policy holders will appeal the decision to deny their claims. Last month the Senate Permanent Subcommittee on Investigations hammered UnitedHealth for dramatic increases in their denial rates for post-acute care between 2019 and 2022 as it switched to AI authorizations.

On the same day as the shooting, Anthem Blue Cross Blue Shield insurance covering Connecticut, New York, and Missouri announced it would cover anesthesia during surgery or procedures only for a specific time period in order to make insurance more affordable by reducing overbilling.

After an outcry both from anesthesiologists and the public, the company today retracted its policy change, saying it had never intended to avoid “medically necessary anesthesia,” but meant simply to “clarify the appropriateness of anesthesia consistent with well-established clinical guidelines.” Their explanation might have calmed the news cycle, but its suggestion that the insurance officials rather than doctors should determine what anesthesia is appropriate for a patient during surgery echoed the argument in the UnitedHealthcare lawsuit.

Thompson’s murder seems to be a cultural moment in which popular fury over the power big business has over ordinary Americans’ lives exploded. Maureen Tkacik of The American Prospect noted, “Only about 50 million customers of America’s reigning medical monopoly might have a motive to exact revenge upon the UnitedHealthcare CEO.” The shooter, whose actual motive remains unknown, is fast becoming a folk hero.

Social media has exploded with users writing things like “[t]his claim for sympathy has been denied”; songs featuring the words “deny, “defend,” and “depose”; and recorded commentary condemning the healthcare insurance industry. UnitedHealth Group posted its sadness about Thompson’s death on Facebook yesterday about 1:00 p.m.; 36 hours later the post had 65,000 laughing emojis under it.

Security expert Charlie Carroll expressed surprise to Josh Fiallo of the Daily Beast that Thompson did not have a security detail. “We’re living in a world where people are extremely disgruntled,” Carroll said. “When people lose trust in the system, you start seeing more kidnappings and assassinations because they feel like they have to take matters into their own hands.”

In the wake of the shooting, UnitedHealthcare and several other insurance companies took down from their websites the names and photographs of their officials.

Billionaires Elon Musk and Vivek Ramaswamy were on Capitol Hill today where they met with lawmakers to explain their vision for the Department of Government Efficiency, the group designed to cut the U.S. budget. Neither they nor the lawmakers shared much with the press, although Fox Business played a video of Representative Ralph Norman (R-SC) saying that that “nothing is sacrosanct,” and that “they're going to put everything on the table,” including Social Security, Medicare, and Medicaid.

Representative Tom Tiffany (R-WI) told Just The News that cuts to the budget “don’t have to be just the discretionary spending. We can get at some of the mandatory spending also…food stamps, some of those things.” He continued: “There may be more bang for the buck in terms of growing our economy…making regulatory changes, get the impediments out of the way, let those job creators and entrepreneurs really be able to go to work.”

In view of today’s news about healthcare, it’s probably worth remembering that Musk has called for the elimination of the Consumer Financial Protection Bureau, and that Project 2025 has called for making Medicare Advantage—the privatized Medicare in which UnitedHealth specializes—the default enrollment option for Medicare. This would essentially privatize Medicare for the 66 million people who use it, but since Medicare Advantage costs taxpayers about 6% more than Medicare, this would not create the savings Musk is supposed to be finding.

Andrew Perez of RollingStone reported today that election financial disclosures filed yesterday revealed that Elon Musk was the secret funder of the “RBG PAC,” a Super PAC created just before the election that claimed Trump had the same position on abortion as the late Supreme Court justice Ruth Bader Ginsberg. Although Trump has bragged about overturning the 1973 Roe v. Wade decision recognizing the constitutional right to abortion and the 2024 Republican platform supported the far-right idea of “fetal personhood”—which would apply all the rights protected by the Fourteenth Amendment from the moment a human egg is fertilized—the RBG PAC ran ads promising that Trump would not support a national abortion ban.

Ginsburg’s granddaughter called the comparison of Trump and her grandmother “nothing short of appalling.”

The super PAC was created so late that it avoided disclosure before November 5. It was funded entirely by Musk with an injection of $20.5 million.

Bridget Bowman, Ben Kamisar, and Scott Bland of NBC News reported tonight that Musk spent at least $250 million to get Trump elected. In addition to the $20.5 million to the RBG PAC, he put $238 million into the America PAC. Musk also supported Trump through free advertising and commentary on his social media platform X.

Today provided a snapshot of American society that echoed a similar moment on January 6, 1872, when Edward D. Stokes shot railroad baron James Fisk Jr. as he descended the staircase of New York’s Grand Central Hotel. The quarrel was over Fisk’s mistress, Josie, who had taken up with the handsome Stokes, but the murder instantly provoked a popular condemnation of the ties between big business and government.

Fisk was a rich, flamboyant, and unscrupulous man-about-town, who was deeply entwined both with railroad barons like Jay Gould, Daniel Drew, and Cornelius Vanderbilt and with New York’s Tammany Hall political machine and its infamous leader, William Marcy Tweed. Tweed made sure the laws benefited the railroads and, the papers noted, snuck into the hotel to say goodbye to his friend in the hours it took for him to perish.

After the Civil War, most Americans applauded the nation’s businessmen for the support their growing industries had provided to the Union, but by 1872 the enormous fortunes the railroad men had amassed had tarnished their reputation. At the same time, big operators were starting to squeeze smaller enterprises out of business in order to control the markets, and popular anger simmered over their increasing control of the economy.

Stokes’s shooting was the event that sparked a popular rebellion. Newspapers covered every minute of the event and Fisk’s demise, while sensational books about the murder rolled off the presses.

Together, they redefined late nineteenth-century industrialists, with one painting Fisk as a representative businessman who with just “an hour’s effort,” could “gather into his clutches a score of millions of other people’s property, impoverish a thousand wealthy men, or derange the values and the traffic of a vast empire.”

Both those covering the murder and those reading about it rejoiced in Fisk’s misfortune.

—

2 notes

·

View notes

Text

Special Purpose Acquisition Companies (SPACs) and Their Relevance to Indian Firms

Special Purpose Acquisition Companies, or SPACs, have become a buzzword in global financial markets. As an innovative way to take companies public, SPACs offer a faster and more flexible alternative to traditional Initial Public Offerings (IPOs). While the model has gained significant traction in the United States, it presents a unique opportunity for Indian firms looking to expand and raise capital abroad. However, challenges related to regulatory frameworks and market risks still persist. This blog explores what SPACs are, their advantages, and how they might fit into the Indian corporate landscape.

What is a SPAC?

A SPAC is essentially a “blank-check” company with no commercial operations. Its sole purpose is to raise funds through an IPO to merge with a private company, allowing the target company to become publicly listed without going through the traditional IPO process. Investors buy into a SPAC based on the expertise of its sponsors, trusting them to identify and acquire a promising target. If no acquisition takes place within a set timeframe (usually 24 months), the SPAC must return the money to investors.

Key Characteristics of SPACs:

Speed and efficiency: Companies can become publicly listed faster than via a standard IPO.

• Lower regulatory scrutiny: SPAC mergers avoid much of the red tape associated with IPOs.

• Pre-negotiated valuations: Target companies can negotiate valuations with the SPAC sponsors rather than relying on fluctuating market conditions.

The Global Rise of SPACs

SPACs became especially popular in 2020 and 2021, accounting for nearly half of all IPOs in the United States during that period. Successful companies like Virgin Galactic and DraftKings used SPACs to go public, paving the way for others to explore this model. Investment banks, venture capitalists, and private equity firms have embraced SPACs as a quick, lucrative way to introduce companies to public markets.

Why SPACs gained momentum:

1. Volatile markets: During periods of market uncertainty, SPACs offer companies more predictability in terms of valuation and timeline.

2. Demand for faster capital access: Startups and high-growth firms, particularly in sectors like technology and healthcare, found SPACs an attractive way to secure investments.

The Relevance of SPACs for Indian Firms

Indian firms, especially those in technology, fintech, renewable energy, and pharmaceuticals, are increasingly eyeing global markets. SPACs offer a convenient way for these firms to list abroad, particularly on exchanges such as the NASDAQ or the New York Stock Exchange (NYSE).

Advantages of SPACs for Indian Firms:

1. Global Market Access: Companies looking to expand internationally can benefit from SPACs by gaining a listing on prestigious foreign exchanges.

2. Flexible Valuation Models: Indian startups and unicorns often find it challenging to secure favorable valuations through traditional IPOs. SPACs offer them the opportunity to negotiate more favorable terms.

3. Capital for Growth: Indian firms in growth-intensive sectors can leverage SPAC mergers to secure quick funding for global expansion.

Challenges Indian Firms May Face

While SPACs hold immense potential, Indian companies encounter several regulatory and market barriers in leveraging this route effectively:

1. Regulatory Uncertainty: The Securities and Exchange Board of India (SEBI) has yet to create clear guidelines on SPAC transactions, adding a layer of uncertainty for companies and investors.

2. Foreign Exchange and FEMA Regulations: Indian firms must navigate the complexities of Foreign Exchange Management Act (FEMA) regulations to raise capital abroad.

3. Speculative Nature of SPACs: Not all SPACs find suitable acquisition targets, leading to market skepticism and reputational risks.

Examples of Indian Companies Exploring SPACs

Some Indian firms have already started testing the SPAC model. For instance, ReNew Power, a leading renewable energy company, merged with a U.S.-based SPAC to get listed on the NASDAQ. This case shows that Indian firms, especially in industries aligned with global trends like sustainability, can find success through SPAC mergers.

In addition, startups in the tech and digital economy sectors are increasingly considering SPACs to bypass the lengthy regulatory processes involved in listing on Indian exchanges. However, SEBI’s reluctance to recognize SPACs domestically means these companies currently need to explore foreign exchanges for listings

What Lies Ahead: Will SPACs Become a Mainstay in India?

As Indian companies continue to expand globally, SPACs offer an alternative path to raise capital and build international credibility. If SEBI introduces SPAC-friendly regulations, India could see a surge in SPAC-based listings—both domestically and internationally. Additionally, financial hubs such as Singapore and Hong Kong are emerging as attractive venues for SPAC deals, offering Indian firms new avenues for public listings.

Conclusion

SPACs present a promising yet challenging opportunity for Indian firms looking to expand and raise capital in global markets. With advantages such as flexible valuations, quicker listings, and access to foreign capital, this model can benefit high-growth Indian companies in technology, healthcare, and renewable energy. However, regulatory uncertainties and market risks need to be addressed for Indian firms to fully capitalize on this trend.

As the world watches the evolution of SPACs, Indian firms and regulators must adapt to these changing dynamics. With the right policies in place, SPACs could become a pivotal part of India’s global corporate strategy.

By understanding and engaging with this evolving financial mechanism, Indian firms can position themselves for success in global markets. As you build your corporate law portfolio, tracking these trends will showcase your knowledge of innovative legal and financial strategies—an essential skill for future corporate lawyers.

2 notes

·

View notes

Text

How to Sell Your Software Company: A Step-by-Step Guide

Selling your software company is a major milestone that requires careful planning and understanding of the process. Whether you're looking to exit the industry, retire, or pursue other ventures, knowing what to expect can help you navigate the sale smoothly and achieve a successful outcome. In this guide, we’ll answer the most common questions about selling a software company, providing clear insights to help you through each stage.

1. What are the key steps to prepare my software company for sale?

Before listing your company for sale, it’s crucial to get your business in the best shape possible to attract buyers. Key steps include:

Organizing Financial Records: Ensure your profit and loss statements, balance sheets, and tax returns are up to date and accurate. Buyers will want to see at least 3 years of clean financial records.

Evaluating Growth Potential: Highlight future opportunities for growth, such as new markets, product developments, or untapped revenue streams.

Securing Intellectual Property: Ensure that all software, patents, and trademarks are properly documented and legally protected.

Stabilizing the Business: Make sure the company is running smoothly, with a solid customer base, strong recurring revenue, and efficient operations.

By taking these steps, you’ll increase your company’s attractiveness to potential buyers and ensure a smoother sale process.

2. How do I determine the value of my software company?

Valuing a software company involves looking at several factors, including:

Revenue and Profit Margins: Buyers will focus on your annual revenue, profit margins, and how consistent your earnings are. Recurring revenue from subscription models or long-term contracts will be highly valued.

Customer Base: A large, loyal customer base with low churn rates adds value to the business.

Growth Potential: Buyers will assess the company’s potential for future growth, such as new product lines or expansion into new markets.

Intellectual Property: Software companies with proprietary technology, patents, or other unique intellectual property are generally more valuable.

It’s recommended to have a professional business valuation expert assess your company to ensure you get an accurate figure.

3. What types of buyers are interested in acquiring a software company?

There are typically three main types of buyers for software companies:

Strategic Buyers: These buyers are often larger companies looking to acquire your software to complement or enhance their existing offerings. They are likely to pay a premium if they see strong synergies.

Private Equity Firms: These firms look for software companies with stable earnings and growth potential. Their goal is to improve the company’s value and sell it for a higher price in the future.

Individual Investors: Entrepreneurs or investors who are looking to enter the software industry may be interested in smaller, profitable software companies.

Understanding the type of buyer you want to attract will help you tailor your marketing and sales strategy.

4. Where can I find potential buyers for my software company?

Finding the right buyer requires a mix of industry connections and professional assistance. Here are some ways to identify potential buyers:

Work with a Business Broker: Business brokers specialize in helping you find qualified buyers. They can also assist with negotiations and the overall sale process.

Leverage Industry Networks: Attend conferences, events, or join industry groups where you can connect with potential buyers who are already interested in the software space.

Use Online Business Marketplaces: Websites and platforms dedicated to business sales are a great way to reach a wider audience of potential buyers.

A business broker can be particularly helpful in ensuring that you find serious buyers and avoid wasting time on non-committed parties.

5. What legal and financial documents do I need to prepare before selling?

Before the sale process begins, you’ll need to organize several important documents:

Financial Statements: Ensure your profit and loss statements, balance sheets, and tax returns are well-prepared and accurate.

Intellectual Property Documentation: Make sure any patents, trademarks, and software licenses are in order and ready for transfer.

Contracts and Agreements: Review and prepare any contracts with customers, vendors, and employees to ensure they can be easily transferred to the new owner.

Non-Disclosure Agreements (NDA): Protect sensitive business information by having potential buyers sign an NDA before sharing detailed company data.

Being well-prepared will make the due diligence process faster and give potential buyers more confidence in the deal.

6. How long does it take to sell a software company?

The timeline for selling a software company can vary, but it generally takes 6 to 12 months. Here’s what the process typically involves:

Preparation Phase: This involves organizing financials, securing intellectual property, and making sure the business is operating smoothly. This phase can take several months.

Finding a Buyer: Depending on your approach and the market, it could take a few months to find the right buyer.

Due Diligence and Negotiation: Once a buyer is interested, the due diligence process can take several weeks or even months as they review your financials, legal documents, and business operations.

Being patient and prepared for each phase will help ensure a smooth sale.

7. How do I negotiate a fair deal when selling my software company?

Negotiating a fair deal requires both preparation and strategy. Here are some tips:

Set Your Bottom Line: Know the minimum price you are willing to accept before entering negotiations.

Highlight the Value: Make sure to emphasize the company’s growth potential, profitability, and strong customer base during negotiations.

Consider Earn-Out Agreements: An earn-out is a payment structure where part of the sale price depends on the future performance of the company. This can be beneficial if your company’s growth potential is strong.

It’s a good idea to work with a lawyer or broker during negotiations to ensure you get the best possible terms.

8. What happens after the sale of my software company?

After the sale, there’s often a transition period where you continue to work with the buyer to ensure a smooth handover. This might involve training the new owner, introducing them to key customers, or helping with daily operations. The transition period can last anywhere from a few months to a year, depending on the agreement.

Additionally, make sure to consult with a tax advisor to understand the tax implications of the sale and how to manage the proceeds from the sale effectively.

Selling a software company is a complex process that involves preparation, valuation, marketing, and negotiation. By understanding the key steps and having the right documentation and support in place, you can ensure a successful sale that meets your financial and personal goals. Whether you’re looking to sell now or just preparing for the future, the insights provided in this guide will help you navigate the process with confidence.

2 notes

·

View notes

Text

How to Sell Your eCommerce Business in 2024 | Imagency Media

The eCommerce landscape in 2024 is more competitive and dynamic than ever. As a business owner, you may have decided that now is the right time to sell your eCommerce business and capitalize on your hard work. Whether you're looking to pursue new ventures, retire, or simply cash in on your investment, selling your eCommerce business can be a lucrative opportunity. However, it requires careful planning and execution. In this guide, Imagency Media will walk you through the key steps to successfully sell your eCommerce business in 2024.

1. Prepare Your Business for Sale

Before you put your eCommerce business on the market, it's crucial to ensure it's in the best possible shape. Buyers are looking for profitable, well-managed businesses with growth potential. Here's how to prepare:

Financials: Make sure your financial records are up-to-date, accurate, and easy to understand. Buyers will scrutinize your profit margins, revenue trends, and expenses. Consider working with an accountant to organize your financials and identify any areas for improvement.

Operations: Streamline your operations to make your business more appealing. This includes optimizing your supply chain, automating processes where possible, and ensuring that your inventory management is efficient. A well-run business is more attractive to potential buyers.

Brand Strength: Evaluate your brand's online presence. This includes your website, social media, and customer reviews. A strong, reputable brand can significantly increase your business's value. Consider investing in professional web design and branding services to enhance your business's appeal.

Legal Documentation: Ensure all your legal documents, such as business licenses, contracts, and intellectual property rights, are in order. Potential buyers will conduct due diligence, and any legal discrepancies could derail the sale.

2. Determine the Value of Your Business

Valuing an eCommerce business is a complex process that involves multiple factors. The most common valuation method is a multiple of your annual net profit, but other factors can influence the final price:

Revenue and Profit: Consistent and growing revenue, along with healthy profit margins, are key indicators of value.

Customer Base: A large, loyal customer base with low churn rates adds significant value to your business.

Market Position: How well does your business stand out in its niche? A strong market position with potential for growth can attract higher offers.

Growth Potential: Buyers are interested in the future potential of your business. Demonstrating a clear path for growth, such as expanding product lines or entering new markets, can increase your valuation.

Consider hiring a professional business broker or valuation expert to help you determine a realistic asking price.

3. Find the Right Buyer

Finding the right buyer is critical to the success of the sale. There are several types of buyers to consider:

Strategic Buyers: These are companies or individuals in your industry looking to expand their market share or acquire new capabilities. They may pay a premium for businesses that complement their existing operations.