#personal wealth building

Explore tagged Tumblr posts

Text

From Small Business to Big Wealth: Using the Moolamore App to Build Personal Wealth

Are you a driven entrepreneur or small business owner with lofty goals of financial independence and substantial wealth? If so, you are not alone in your quest. Many brilliant minds embark on the exciting journey of entrepreneurship, looking for the golden opportunity to turn their innovative ideas into profitable businesses.

So, are you ready to maximize your wealth? If you answered "YES," keep reading as we go over the key steps to building personal wealth with this powerful software. Before we begin the process of accumulating personal wealth, it is critical to understand the significance of the Moolamore tool and what makes it a game changer.

#personal wealth building#Moolamore app#financial planning app#wealth management app#investment app#money management app#financial goal setting

1 note

·

View note

Text

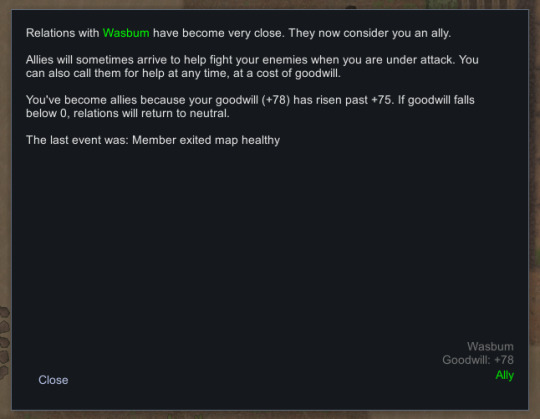

Yes!! That random transport pod crash victim from a while back finally left, and now Wasbum are our allies!! That means all we need for the first piece of the map to the Archonexus is a buttload of wealth...

Ivy has an idea, and the Jones boys are very eager to reach the Archonexus... perhaps setting up a "fancy" hotel for a few quadrums is tolerable.

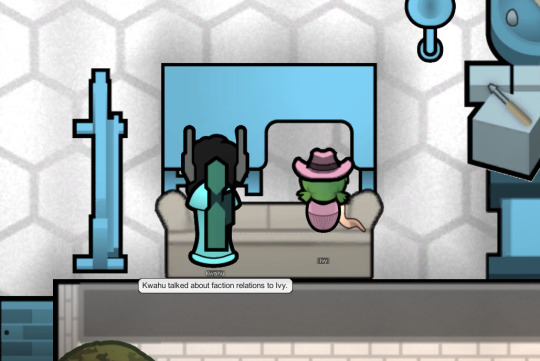

While Mechi, Alistair, and the mechanoids get to work on The Jones Brothers' Point Fleascale Hotel and Casino, Kwahu decides to go over faction relations with Ivy. Who knows? Perhaps she'll take over as our resident socialite one day!

And then, instead of helping with the construction, Kwahu decided to start fiddling with the brand-new card table. Silly boy... at least we know it's appealing, I suppose.

First | Next | Previous

Bonus picture of Augustín the Boomrat mucking about with the cards that I imagine the Jones boys have in their hotel's gambling room. They just have the right "mechanitor" vibe (the... the cards, not Augustín the Boomrat.)

#rimworld#gracie plays#A Mechanitor's Message#art#my art#traditional art#rimworld art#unpolished art#One step closer to the Archonexus babeyyyy!!!#Hopefully we can build the required wealth up quickly#This colony is fun but the map here at Sparks is getting pretty stripped of resources#I'm ready for a new home#I wonder if building a hotel will increase our chances of bumping into Lapu or Squashbug or Yamka?#hopefully#I'd like to see Mechi reunited with the rest of his family#and I'd like for them to meet Kwahu#and Ivy and Alistair and Lansa (if we ever manage to revive him)#Anyhoo#Kwahu is a good teacher#Ivy is a good student#Kwahu is NOT a helpful person to have on a construction site#and Augustín the Boomrat appreciates that I collect playing cards#have an awesome day!!! xoxoxo

25 notes

·

View notes

Text

It's always interesting to hear about people's weird/unexpected "alternate life paths". Like, something that you could have done with your life, a job you almost took, a school you almost went to, etc - that was still actually realistic enough that it could have happened, but NOW it seems to not suit your current personality.

Like for example, I currently hate advertising (how manipulative it is, brands trying to be 'relatable', social media amplifying it to an obnoxious extreme, etc.) so much that even seeing a little ad before a youtube video is grating to even witness, but there was a point in time where I was genuinely seriously considering going into marketing/making commercials as a career lol. Or like, I have a relative who was very inclined to be a pastor when they were younger, even though today they're a super strong atheist, etc. etc.

#BECAUSE I knew I really liked filming and editing things and doing set design and costume design (from having done little bits of that#here and there in media classes and my own stuff - i used to be a lot more into making videos than I am now). BUT I was always thinking#that a movie is WAAY to big and long. even a short film. So I was trying to think of ways I could still like#have the fun of scouting locations to film and dressing up actors and etc. etc. without it having to be a Huge Million Dollar Production#on tv show or movie level. SO then I was thinking about like... just doing commercials. Or music videos. Like shorter things where I still#get the fun of the filming and everything but it's less of an intensive long term project.#So there is an alternate version of me (I suppose if i somehow did not end up having physical and mental health issues#as badly somehow.. or like.. randomly came into wealth and was able to pay my way through a nice college despite missing#days constantly being out because I'm sick or something lol) that works in some corporate advertising office coming up with commercials#and directing or filming them or doing the sets for them or something in that general vicinity.#I also was considering being a corporate psychologist. or whatever its called.. oh from google:#''Industrial and organizational (I/O) psychologists study and assess individual group and organization dynamics in the workplace''#I don't think I even knew what the job entailed. I was at the time just thinking like.. the type of person that comes into a business offic#and gives everyone personality assessments or does MBTI or big-5 testing crap for whatever reason that some businesses get that#done for people. Really i just wanted to be in a Corporate Big Office setting yet still do psychology. Because I used to be really fixated#on living in a big city. Like the ideas of everything being walkable. picking up a coffee in the morning. walking to my job in a Big#Skyscraper Building. people watching in a huge hotel lobby for lunch. flying frequently (I love airplanes and airports aesthetically).#living in an apartment with a giant window overlooking the city. etc. etc. BUT that was before i had really BEEN to a city. Then I actually#hung around a city a few times and went places and I was like... AUGh... The Sensory Overwhelm.. cars people lights loudness noise scary#everything happening all at once. etc. etc. (though even when I wanted to live in a city i NEVER strove for the Night Life. when i say I#enjoy city imagery I mean like... in the day time. Many people who like cities talk about The Night Life and post pictures of cities all#lit up at night and clubs and dancing and restaurants. none of that EVER appealed to me. perhaps a sign I am not a real city person. Like#I am NOT standing in a crowded bar full of loud people in the middle of the night lol.. get AWAY from me!!) but I do adore the#architecture of like bright white clean sterile modern spaces like huge airport lobbies or malls or etc. I think thats what reminded me of#city and what I liked about the idea of that life. Like I always LOVED the layout of schools and hospitals and trainstations and public#transport in general. Though even then I knew enough that I would not be a good architect/city planner. so I guess my adoration for those#spaces was merely to be channeled into LIVING there. but then I realized I didn't even really want to do that that much. I mean I still#definitely aim to live NEAR a city. like the little areas outside of it. I would never live in a rural place 4 hours from anything. I liter#ally just COULDNT since I need close access to hospitals sometimes lol. But I used to want to live in the CENTER of citites like high rise#condo. and now I'm like.... eh....... perhaps a smaller quieter walkable space nearby lol.. ANYWAY.. alternate me in my Business Suit eheh

12 notes

·

View notes

Text

kind of weird that people are complaining about 'missing the opportunity to have japanese protagonist' when naoe is right there .... ac fans never fail to continue the trend of being misogynistic i guess

#there's a lot of media out there that have japanese samurai..... one black man isnt going to change the course of samurai media forever#also sorry to say but the historical protagonists were always diverse and came from different walks of life ...#i think ezio was the only one who came from wealth . everyone else had to build their names from the ground up#idk its like i suppose i could understand wanting something represented if there isnt a lot of it. but there is.#assassin's creed shadows#six speaks#also im not a history guy dont come for me#these games aren't supposed to replicate history 1 for 1 if ubi thought the 'guy who got stuck in japan' has potential for compelling story-#then whatever? i personally think its interesting. and again . naoe is right there. they are dual protagonists.

16 notes

·

View notes

Text

youtube

Achieve Financial Freedom: Your Path to Wealth & Independence"

Are you ready to take control of your finances and unlock the path to true financial freedom? In this video,we dive into the essential steps you can take to build wealth, eliminate debt, and secure long-term financial independence. Whether you're just starting out or looking to refine your strategies, this guide will give you actionable advice on budgeting, investing, and creating passive income streams. Don't wait—begin your journey to financial freedom today!

#financial freedom#wealth building#personal finance#financial independence#passive income#budgeting tips#money management#debt-free living#financial goals#wealth creation#financial advice#Youtube

2 notes

·

View notes

Text

Mastering the Art of Investing: Practical Strategies for Insightful Decision-Making

Key Point:

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Sound investment decisions are the bedrock of financial success. However, navigating the complex world of investing can be challenging, even for the most seasoned investors. This post explores practical strategies for making smart and insightful investment decisions, empowering you to grow your wealth with confidence and finesse.

Recognize the Limits of your Abilities

In both life and investing, it is crucial to acknowledge the boundaries of our expertise. Overestimating our abilities can lead to ill-advised decisions and, ultimately, financial losses. By cultivating humility and seeking external guidance when necessary, we can minimize risks and make more informed investment choices.

Manage Emotional Influence on Decision-Making

Emotions can significantly impact our ability to make rational decisions. To circumvent the sway of emotions, adopt a disciplined approach to investing, relying on data-driven analysis and long-term strategies rather than succumbing to impulsive reactions.

Leverage the Expertise of an Advisor

Engaging a professional financial advisor is a prudent investment decision. Their wealth of knowledge and experience can help you navigate market complexities and identify opportunities tailored to your financial goals, risk tolerance, and investment horizon.

Maintain Composure Amidst Market Volatility

Periods of market turbulence can incite panic among investors. However, it is essential to remain level-headed and maintain a long-term perspective during such times. Avoid making impulsive decisions based on short-term fluctuations and focus on your overarching financial objectives.

Assess Company Management Actions Over Rhetoric

When evaluating potential investments, examine the actions of a company's management rather than relying solely on their statements. This approach ensures a more accurate understanding of the organization's performance, financial health, and growth prospects.

Prioritize Value Over Glamour in Investment Selection

The most expensive investment options are not always the wisest choices. Focus on identifying value rather than being swayed by glamorous or high-priced options. This strategy promotes long-term financial growth and mitigates the risk of overpaying for underperforming assets.

Exercise Caution with Novel and Exotic Investments

While unique and exotic investment opportunities may appear enticing, approach them with caution. Ensure thorough research and due diligence before committing to such investments, as they may carry higher risks and potential pitfalls.

Align Investments with Personal Goals

Invest according to your individual objectives rather than adhering to generic rules or mimicking the choices of others. Personalized investment strategies are more likely to yield favorable results, as they account for your unique financial circumstances, risk appetite, and long-term aspirations.

Making smart and insightful investment decisions is an attainable goal with the right strategies in place. By recognizing your limitations, managing emotions, seeking professional guidance, and aligning your investments with personal objectives, you can cultivate a robust and successful investment portfolio that stands the test of time.

Action plan: Learn a few simple rules and ignore the rest of the advice you receive.

It’s easy to become completely overwhelmed by the volume of advice available about investing. However, you don’t need to become an expert on the stock market in order to become a good investor.

Just like an amateur poker player can go far if he simply learns to fold his worst hands and bet on his best ones, a novice investor can become very competent just by following a few simple rules. For example, he should learn not to overreact to dips in the market and make sure to purchase value stocks instead of glamour stocks.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

33 notes

·

View notes

Text

youtube

Cryptocurrency Trading Presentation *Slide 1: Introduction* - Title: "Cryptocurrency: The Future of Money" - Subtitle: "Understanding the Basics and Beyond" - Image: a relevant cryptocurrency-related image *Slide 2: What is Cryptocurrency?* - Definition: "A digital or virtual currency that uses cryptography for security and is decentralized, meaning it's not controlled by any government or institution." - Examples: Bitcoin, Ethereum, Litecoin, etc. *Slide 3: History of Cryptocurrency* - Brief overview of the history of cryptocurrency, starting with Bitcoin in 2009 - Key milestones and events #crypto #currencytrading #money #wealthcreationjourney *Slide 4: How Cryptocurrency Works* - Explanation of the underlying technology: blockchain, mining, and cryptography - How transactions are made and verified *Slide 5: Benefits of Cryptocurrency* - Decentralization and autonomy - Security and transparency - Speed and efficiency - Accessibility and inclusivity *Slide 6: Types of Cryptocurrencies* - Bitcoin and altcoins - Tokens and coins - Stablecoins and CBDCs (central bank digital currencies) *Slide 7: Cryptocurrency Use Cases* - Payments and transactions - Smart contracts and DeFi (decentralized finance) - NFTs (non-fungible tokens) and digital art - Gaming and virtual worlds *Slide 8: Cryptocurrency Risks and Challenges* - Volatility and price fluctuations - Security risks and hacking - Regulatory uncertainty and compliance - Adoption and scalability *Slide 9: Cryptocurrency Regulation* - Overview of current regulatory landscape - Key regulations and laws - Impact on adoption and innovation *Slide 10: Future of Cryptocurrency* - Trends and predictions - Potential applications and use cases - Challenges and opportunities *Slide 11: Conclusion* - Summary of key points - Final thoughts and call to action *Slide 12: Additional Resources* - List of relevant websites, articles, and books - Further learning and exploration Note: This is just a basic outline, and you can add or remove slides as per your requirement. You can also add images, charts, and graphs to support your points. Cryptocurrency: The Future of Money published first on https://www.youtube.com/@Moneywavetv/

#Personal finance#Investing#Wealth-building#Financial literacy#Money management#Stock market analysis#Cryptocurrency#Entrepreneurship#Financial freedom#Wealth creation#Youtube

2 notes

·

View notes

Video

youtube

How Mark Tilbury Makes $100,000 Every Week

2 notes

·

View notes

Text

The Rich Rule Over the Poor!

In today’s culture, debt is often viewed as a normal part of life. Whether it’s taking out student loans, financing a car, or relying on credit cards to cover expenses, many people are accustomed to borrowing money. But financial expert Dave Ramsey warns against this mindset, drawing from a biblical principle found in Proverbs 22:7: “The rich rule over the poor, and the borrower is servant to the lender.” For Ramsey, this verse serves as a profound warning about the dangers of debt and a call to pursue financial freedom.

Debt as Modern-Day Slavery

When discussing debt, Ramsey doesn’t mince words. He often refers to debt as a form of modern-day slavery. Just as a servant is bound to their master, someone in debt is bound to their lender. Each month, a portion of their hard-earned income is already spoken for—sent off to pay for past purchases, often with interest. This, according to Ramsey, is a form of bondage.

People in debt often lose their ability to make decisions based on what’s best for their future because their past borrowing controls their present and future income. As Ramsey puts it, being in debt means you’ve sold your freedom to the lender. The greater the debt, the less freedom you have to make choices that align with your goals and dreams. Instead, you’re working to satisfy the demands of the creditor.

The Stress and Anxiety of Borrowed Money

Debt isn’t just a financial burden; it’s also an emotional one. Ramsey frequently highlights the stress that debt can cause. The fear of missing a payment, the anxiety of mounting interest, and the constant juggling of bills can take a heavy toll on a person’s mental and emotional well-being. This stress doesn’t just stay confined to finances; it often spills over into relationships, health, and overall life satisfaction.

In fact, studies show that financial stress is one of the leading causes of marital conflict. When debt becomes overwhelming, it can lead to arguments, resentment, and even divorce. Ramsey is quick to point out that eliminating debt can significantly reduce stress and create a more peaceful home life.

Achieving Financial Independence

One of Ramsey’s core messages is that avoiding debt is key to achieving financial independence. When you live debt-free, your income is yours to control, rather than being obligated to a creditor. This financial freedom allows you to save, invest, and plan for the future in ways that aren’t possible when you’re tied down by debt.

Ramsey advocates for a lifestyle of living within your means, which is the opposite of the “buy now, pay later” mentality that’s so prevalent today. He encourages people to delay gratification, save for major purchases, and build an emergency fund to avoid going into debt when life’s unexpected expenses arise. By doing so, individuals can protect themselves from falling into the debt trap and remain in control of their financial future.

Biblical Wisdom for Modern Money Management

Dave Ramsey’s teachings are deeply rooted in biblical principles, and Proverbs 22:7 is one of the cornerstones of his philosophy. Ramsey believes that the Bible offers timeless wisdom on money management, and that following these teachings can lead to a more peaceful and prosperous life.

In addition to avoiding debt, Ramsey emphasizes other biblical principles like generosity, wise stewardship, and contentment. He believes that by applying these principles, individuals can achieve both financial peace and spiritual fulfillment. For Ramsey, financial success isn’t just about accumulating wealth—it’s about using money in a way that honors God and benefits others.

From Borrowing to Building Wealth

One of the most powerful shifts that can occur when you move from borrowing to building wealth is the change in mindset. Ramsey teaches that wealth-building begins once you stop borrowing money. When you’re not sending payments to creditors every month, you have the freedom to invest in your future.

This is where Ramsey’s famous Baby Steps come into play. He encourages people to start by building a small emergency fund, then aggressively paying off all their debt (except for their mortgage), and finally moving on to saving for the future and giving generously. These steps are designed to help people break free from debt and begin building lasting wealth.

Conclusion: Choosing Freedom Over Bondage

Proverbs 22:7 serves as a powerful reminder of the dangers of debt. Dave Ramsey’s teachings on this verse challenge the cultural norm that debt is inevitable or even desirable. Instead, Ramsey encourages us to choose financial freedom over financial bondage.

By avoiding debt, living within our means, and applying biblical principles to our finances, we can break free from the slavery of debt and achieve true financial independence. It’s not an easy journey, but as Ramsey often says, “If you live like no one else, later you can live like no one else.”

#Debt-Free Living#Financial Freedom#Dave Ramsey#Proverbs 22:7#Money Management#Biblical Finance#Financial Independence#Personal Finance#Avoid Debt#Wealth Building#Debt Slavery#Living Debt-Free#Financial Peace#Budgeting Tips#Debt Relief#Emergency Fund#Financial Stress#Christian Finance#Money and Faith#Baby Steps#new blog#today on tumblr

1 note

·

View note

Text

𝗸𝗶𝗱𝘀 𝗮𝗿𝗲 𝘀𝘁𝗶𝗹𝗹 𝗱𝗲𝗽𝗿𝗲𝘀𝘀𝗲𝗱 𝘄𝗵𝗲𝗻 𝘆𝗼𝘂 𝗱𝗿𝗲𝘀𝘀 𝘁𝗵𝗲𝗺 𝘂𝗽, 𝙖𝙣𝙙 𝙨𝙮𝙧𝙪𝙥 𝙞𝙨 𝙨𝙩𝙞𝙡𝙡 𝙨𝙮𝙧𝙪𝙥 𝙞𝙣 𝙖 𝙨𝙞𝙥𝙥𝙮 𝙘𝙪𝙥.

state of affairs.

#state of affairs.#mine.#<3#based on the founding families and their children .. and the generations of wealth and issues that follow it#welcome to alexandria / falls church - located in virginia#still swimming around in my head along with 100 other ideas but might keep this as my own personal universe#if anyone wants to world build....

6 notes

·

View notes

Text

this might be a dumb and highly specific pet peeve but i really hate the (very common) career advice given to stem majors in Canada (especially IT/CompSci and nursing students) that we should all get TN-1 status and live/work in the US for the higher salaries, lower cost of living and lower taxes (which does objectively make it easier to build wealth)

idk i just feel like this kind of career advice really only applies to/helps if you are a (preferably rich) cishet neurotypical ablebodied white man

like yeah sure I, an openly queer woman with adhd should TOTALLY move to the borderline theocracy with a shortage on my meds right next door great idea

#stemblr#stem student#women in stem#canada#lgbt#higher education#information technology#nursing#idk this just pisses me off on several levels#like on one hand this only really helps a VERY specific subset of students#on the other hand it really sucks because canadian professionals flocking to the US is a real factor in the crumbling of our infrastructure#on the other other hand i really hate that this avenue of building personal wealth is basically only SAFELY accessible to-#- that small subset of students which exacerbates income inequality#the only way i think id ever do this is if it was in some border town scenario working in the us and living in canada but the only#semi affordable border region with a major us city is windsor ontario and detroit michigan#canadian companies pls pay ur employees more canadian landlords pls kys

2 notes

·

View notes

Text

this girl i went to grad school with works in marketing for some fintech company now and its such a weird ass mind fuck to see her posting capitalist hustle culture nonsense on linked in 24/7 now. like i get her linked in presence is probably part of her job but geeeeeze back in grad school we were all marxists together. whyyyyyyy is she posting like some wanna be millionaire tech bro. i hate it i hate it i hate it

#sometimes i just lose faith in humanity#i get so discouraged it feels like she's completely sold out to the 'wealth building hustle' culture#anywho#personal

2 notes

·

View notes

Text

Building a Solid Financial Foundation: Budgeting, Saving, and Emergency Funds

The importance of budgeting for financial stability Creating and sticking to a personal budget is essential for achieving financial stability. A budget helps individuals track their income and expenses, identify areas for saving and cutting costs, and ultimately achieve their financial goals [1]. By creating a budget, individuals can gain a better understanding of their financial situation and…

View On WordPress

#Budgeting#Debt Reduction#Emergency Funds#Financial Education#Financial Goals#Financial Independence#Financial Literacy#Financial Planning#Financial Stability#Frugal Living#Investment Strategies#Money Management#Money Mindset#Personal Finance#Retirement Planning#Saving Money#Smart Spending#Wealth Building#Wealth Management

7 notes

·

View notes

Text

Master Your Finances: 10 Proven Strategies for Financial Freedom

Financial success is a dream that many people aspire to achieve. Whether it’s the desire to retire comfortably, provide for your family, or simply enjoy a worry-free life, mastering your finances is essential. But achieving financial freedom is not a matter of luck; it requires careful planning, discipline, and the implementation of proven strategies. In this blog, we will explore ten strategies…

View On WordPress

#saving and investing#income growth#money#wealth protection#wealth#money protection#debt management#discipline and patience#emergency fund#how to achieve financial freedom#financial independence#financial goals#money tips#personal finance#budgeting#financial education#financial management#wealth building#lifestyle inflation

3 notes

·

View notes

Text

Financial Superpower: The Importance of an Emergency Fund for a Debt-Free Future

Written by Delvin Welcome to our blog post on the importance of having an emergency fund. In today’s unpredictable world, unexpected expenses can arise at any moment, leaving us financially vulnerable. That’s where an emergency fund comes in. This financial safety net not only provides peace of mind but also plays a crucial role in preventing debt and ensuring our financial well-being. Join us…

View On WordPress

#dailyprompt#Financial#Financial Freedom#Financial Literacy#Financial Superpower: The Importance of an Emergency Fund for a Debt-Free Future#Generational Wealth#How to Build an Emergency Fund#Maintaining Financial Stability#money#Moneymaking#Personal Finance#Preventing Debt#Shielding Against the Unexpected#Wealth

2 notes

·

View notes

Text

Top 6 Personal Finance Books to Transform Your Financial Future

Looking to reshape your financial future and gain the financial freedom you’ve always dreamed of? It all starts with financial literacy. Whether you’re just starting your financial journey or trying to take your money management skills to the next level, there’s a wealth of knowledge out there waiting to be uncovered. And the best part? It’s all wrapped up in the pages of the top 6 personal…

View On WordPress

#Budgeting#Debt Management#Finance Books#Financial Independence#Financial Literacy#Investment#Money Management#Personal Finance#Retirement Planning#Wealth Building

3 notes

·

View notes