#nvidia corporation

Explore tagged Tumblr posts

Text

UK 1998

9 notes

·

View notes

Text

Here is another Example of Companies from the United States (US) investing in COMMUNIST Vietnam instead of their Country’s supposed “Ally”, the Philippines. This time it is Nvidia Corporation and Apple Incorporated. Now the US and their Filipino Doggies want the Philippines to CUT Economic Ties with China when the US Government can’t even convince their own Companies to take China’s Place and invest in the Philippines? Utter STPDITY at its worst

#china#philippines#united states us#vietnam#nvidia corporation#apple incorporated#chief executive officer ceo#jensen huang#artificial intelligence ai#new product introduction npi

0 notes

Text

Eh mental health is annoying. Buying & cooking cheap low-FODMAP diet is annoying. My best top note for now is I'm using this blog to practice writing. I need more practice in it. I only know business, accounting & economics stuff. Its stupid stuff. Theres too much actual fraud everywhere that its annoying

Also I use mobile so formatting sucks cause Nvidia GPUs, or Arch dont like tumblr site. Or tumblr site dont like tumbkr site

Also also I 100,000% support all my fellow ones-and-zeros and their identity. Everyone is welcome here.

Except transphobes/zionist/long list of others but you get it. I'll help harrass any of those types endlessly if someone wants to tag me, and bring me in on an argument like that friend you call for backup with fights

Im unhinged so who's to say exactly what will end up here but this is also a completely public blog to me friends, family, hell, even acquaintances i dont give a fuc.

Blog should be expected to be roughly as child-friendly as simpsons or bobs burgers. But also boring like a civics/economics lesson sometimes. Yay

--------

I (and my husband) am ex mormon. Its a weird thing. Look into it if you havent recently. Realllllyyyy look into. Takes time to figure it all out in this fuckin fucked up world.

I just moved a year ago. Didnt watch the US stock market as much as I normally do. Had my first snowstorm 10 weeks ago, that was.. fun to handle while ill prepared. About 6 weeks ago I was hopping back on the market and notice its a huge tech bubble about to pop and all the conditions Ive been warned about my whole career imply this is not good. Just took a little more thinking & digging and I'm a little too confident to stop talking about it now.

(Oh I'm also care-free as fuc so I dont really read or desire to change past posts more than lil-nitpicks. More informative for the reader & myself-in-the-future-reading that way)

And I'm not kidding I do love feedback & questions. Its a very public blog tho so I get that part for sure.

If you search "life story" in my tags I had that pinned for a min Im just moving shit around rn

Being poor sucks. Will write more on that later.

---------------

First of all-- the exact timeline of an "economic shock" is literal insanity. Dont worry about the exact timing of any of this-- just know its doomed to happen soon.

Here are some effects I predict of this upcoming economic downturn

If anyone comes across any sources for these events that support my arguments please feel free to add in comments, reblogs, etc.

This concise list is mainly for my own reference, but it would be great to add to it if any one has something to add!

0.5. US Stock market collapse-- I have no desire to try and predict this one exactly. Too many conspiracies are actually correct about this big guy. Lets just say 7 US Tech stocks are worth 25% of the entire worlds market, roughly. "Too big to fail"-- I believe is the phrase

1. Corporate (slightly later will be residential by extension) real estate crisis: currently way too overvalued. Most of the houses, land, & urban corporate property we see could stand to decrease by about 60-90% from its current price.

2. Bankruptcy crisis: similar to the after-effects of the 70s inflation-- we can expect to see a huge wave of bankruptcies affecting a variety of business: from the micro-self employed; to the small business with leased buildings; to the largest corporations who commit massive accounting fraud & hope to escape accountability in time

3. Bank runs-- there is an extremely high overreliance on the Federal Reserve, who does not have good control over this situation. Once it becomes clear that there is a crisis (we call this a catalyst event)-- bank runs for physical cash are a surety. Hard to say how long a crisis like this might last. I should ask my siblings who lived near the SVB bank crisis hotspot (but those were rich fucks they do their "bank runs" over the phone)

3.5. Global currency collapse, which takes effect in every single local, state, & national economy at slightly different times. This means prices lower. Much lower. But takes time

4. Whatever the fuck the geopolitics is gonna do???. Its weird. You got Russia wanting to invade Europe? (Look at global economic forum 2024) Trump wants to let them. Biden wants to be an establishment corporate ass. North Korea has changed its #1 public enemy to South Korea (dont remember my source but it was a couple months ago). USA is stationing more troops in Taiwan, but probably only because of semiconductor technology?

The scope of our global financial woes are larger than can be explained in any of our lifetimes. Its much, much closer to pre-revolution France or the late 1920s. Big change is coming. Itll be soon

5. More to come

#anti capitalism#economics#geopolitics#real estate#bankruptcy#banks#corporate fucks#pinned post#mental health sucks ball sacks#arch linux#nvidia is a scam bubble like enron#simpsons#bobs burgers#intro post#will change it more later

7 notes

·

View notes

Text

Pivot Tables and Python Code Made Easy with Microsoft™ Excel

#Entrepreneur#Entrepreneurship#SmallBiz#IndieDev#business#corporation#leaders#Artist#Gamers#Developers#Graphic designers#Programmers#Independent contractors#Designers#3D#2D#Synthographics#Synthography#AiArt#ArtLife#Illustrations#CGI#Technology#AI#Artificial Intelligence#Generative AI#Omniverse#NVIDIA#VR#AR

2 notes

·

View notes

Text

Will you work 24x7…😰 𝐈𝐟 𝐲𝐨𝐮 𝐚𝐫𝐞 𝐩𝐚𝐢𝐝 𝐦𝐢𝐥𝐥𝐢𝐨𝐧𝐬??💸💰 🔥 A recent Bloomberg report dropped a bombshell: NVIDIA employees are grinding 24/7 in a high-stress, grueling environment, but they’re raking in millions in return! 🤑 Despite the toxic work culture, many revealed they’re sticking around for the hefty paychecks! 😯 And this sparks the ultimate question: 𝐌𝐨𝐧𝐞𝐲 𝐨𝐫 𝐋𝐢𝐟𝐞? 😕

Many young professionals today believe they can hustle through a high-paying, demanding job for 10-15 years and then retire by 45 😎. But once they step into the grind, reality hits hard. 😓

Burnouts, frustrations, depression, and worsening health conditions are only some of the issues they face in such a role🤒. All of us remember the unfortunate incident where a 25-year-old consultant at McKinsey & Company committed suicide due to “immense pressure” at work!😱 Maybe that is why we get to see many individuals working well-paying jobs quit to start farming👨🌾 or maybe pursue a career in social media📱. Given the chance to opt for one, 𝑤ℎ𝑎𝑡 𝑤𝑜𝑢𝑙𝑑 𝑦𝑜𝑢 𝑐ℎ𝑜𝑜𝑠𝑒? ❓𝐌𝐨𝐧𝐞𝐲 𝐨𝐫 𝐖𝐨𝐫𝐤-𝐋𝐢𝐟𝐞 𝐁𝐚𝐥𝐚𝐧𝐜𝐞? Follow Jobaaj Stories (the media arm of Jobaaj.com Group) for more.

Stay with Jobaaj Stories for the latest updates. We aim to educate and inspire young professionals and students through storytelling. Don’t miss out!

0 notes

Text

The US AI Safety and Security board

Corporate logo stickers for the US Congress, & military

#usa#artificial intelligence#ai#corporate america#government#genocide joe#alphabet#open ai#ibm#nvidia#occidental petroleum#amazon#adobe#amd#northrop grumman#2024

0 notes

Text

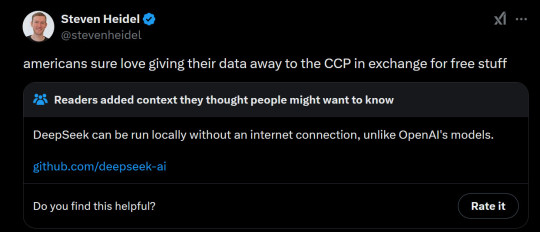

I am very wary of people going "China does it better than America" because most of it is just reactionary rejection of your overlord in favor of his rival, but this story is 1. absolutely legit and 2. way too funny.

US wants to build an AI advantage over China, uses their part in the chip supply chain to cut off China from the high-end chip market.

China's chip manufacturing is famously a decade behind, so they can't advance, right?

They did see it as a problem, but what they then did is get a bunch of Computer Scientists and Junior Programmers fresh out of college and funded their research in DeepSeek. Instead of trying to improve output by buying thousands of Nvidia graphics cards, they tried to build a different kind of model, that allowed them to do what OpenAI does at a tenth of the cost.

Them being young and at a Hedgefund AI research branch and not at established Chinese techgiants seems to be important because chinese corporate culture is apparently full of internal sabotage, so newbies fresh from college being told they have to solve the hardest problems in computing was way more efficient than what usually is done. The result:

American AIs are shook. Nvidia, the only company who actually is making profit cause they are supplying hardware, took a hit. This is just the market being stupid, Nvidia also sells to China. And the worst part for OpenAI. DeepSeek is Open Source.

Anybody can implement deepseek's model, provided they have the hardware. They are totally independent from DeepSeek, as you can run it from your own network. I think you will soon have many more AI companies sprouting out of the ground using this as its base.

What does this mean? AI still costs too much energy to be worth using. The head of the project says so much himself: "there is no commercial use, this is research."

What this does mean is that OpenAI's position is severely challenged: there will soon be a lot more competitors using the DeepSeek model, more people can improve the code, OpenAI will have to ask for much lower prices if it eventually does want to make a profit because a 10 times more efficient opensource rival of equal capability is there.

And with OpenAI or anybody else having lost the ability to get the monopoly on the "market" (if you didn't know, no AI company has ever made a single cent in profit, they all are begging for investment), they probably won't be so attractive for investors anymore. There is a cheaper and equally good alternative now.

AI is still bad for the environment. Dumb companies will still want to push AI on everything. Lazy hacks trying to push AI art and writing to replace real artists will still be around and AI slop will not go away. But one of the main drivers of the AI boom is going to be severely compromised because there is a competitor who isn't in it for immediate commercialization. Instead you will have a more decentralized open source AI field.

Or in short:

2K notes

·

View notes

Text

#Softbank#AI#corporate clients#generative artificial intelligence platform#supercomputer#20 billion Yen#Nvidia Corp.#microchips#information processing capabilities#call centers#customer support services#revenue#shareholders meeting#Junichi Miyakawa#Softbank Group#Masayoshi Son#AI businesses#strategic partnerships#AI market#industries#mobile network provider#Japan#cutting-edge AI technology#visionary move#groundbreaking journey#unrivaled AI services#Softbank Corp.#Softbank Group Chairman and CEO#AI revolution#tokyo

0 notes

Text

This is it. Generative AI, as a commercial tech phenomenon, has reached its apex. The hype is evaporating. The tech is too unreliable, too often. The vibes are terrible. The air is escaping from the bubble. To me, the question is more about whether the air will rush out all at once, sending the tech sector careening downward like a balloon that someone blew up, failed to tie off properly, and let go—or more slowly, shrinking down to size in gradual sputters, while emitting embarrassing fart sounds, like a balloon being deliberately pinched around the opening by a smirking teenager. But come on. The jig is up. The technology that was at this time last year being somberly touted as so powerful that it posed an existential threat to humanity is now worrying investors because it is apparently incapable of generating passable marketing emails reliably enough. We’ve had at least a year of companies shelling out for business-grade generative AI, and the results—painted as shinily as possible from a banking and investment sector that would love nothing more than a new technology that can automate office work and creative labor—are one big “meh.” As a Bloomberg story put it last week, “Big Tech Fails to Convince Wall Street That AI Is Paying Off.” From the piece: Amazon.com Inc., Microsoft Corp. and Alphabet Inc. had one job heading into this earnings season: show that the billions of dollars they’ve each sunk into the infrastructure propelling the artificial intelligence boom is translating into real sales. In the eyes of Wall Street, they disappointed. Shares in Google owner Alphabet have fallen 7.4% since it reported last week. Microsoft’s stock price has declined in the three days since the company’s own results. Shares of Amazon — the latest to drop its earnings on Thursday — plunged by the most since October 2022 on Friday. Silicon Valley hailed 2024 as the year that companies would begin to deploy generative AI, the type of technology that can create text, images and videos from simple prompts. This mass adoption is meant to finally bring about meaningful profits from the likes of Google’s Gemini and Microsoft’s Copilot. The fact that those returns have yet to meaningfully materialize is stoking broader concerns about how worthwhile AI will really prove to be. Meanwhile, Nvidia, the AI chipmaker that soared to an absurd $3 trillion valuation, is losing that value with every passing day—26% over the last month or so, and some analysts believe that’s just the beginning. These declines are the result of less-than-stellar early results from corporations who’ve embraced enterprise-tier generative AI, the distinct lack of killer commercial products 18 months into the AI boom, and scathing financial analyses from Goldman Sachs, Sequoia Capital, and Elliot Management, each of whom concluded that there was “too much spend, too little benefit” from generative AI, in the words of Goldman, and that it was “overhyped” and a “bubble” per Elliot. As CNN put it in its report on growing fears of an AI bubble, Some investors had even anticipated that this would be the quarter that tech giants would start to signal that they were backing off their AI infrastructure investments since “AI is not delivering the returns that they were expecting,” D.A. Davidson analyst Gil Luria told CNN. The opposite happened — Google, Microsoft and Meta all signaled that they plan to spend even more as they lay the groundwork for what they hope is an AI future. This can, perhaps, explain some of the investor revolt. The tech giants have responded to mounting concerns by doubling, even tripling down, and planning on spending tens of billions of dollars on researching, developing, and deploying generative AI for the foreseeable future. All this as high profile clients are canceling their contracts. As surveys show that overwhelming majorities of workers say generative AI makes them less productive. As MIT economist and automation scholar Daron Acemoglu warns, “Don’t believe the AI hype.”

6 August 2024

#ai#artificial intelligence#generative ai#silicon valley#Enterprise AI#OpenAI#ChatGPT#like to charge reblog to cast

184 notes

·

View notes

Text

I have no idea why this needs to be said, but you can hate generative AI, love the Public Domain, love media preservation, hate the overbearing US Copyright system, and... still believe that Copyright Laws exist in the first place for a reason, (even if, thanks to Big Corporation Monopolies, it's been twisted into its current behemoth monstrosity.)

You can hate Large Language Models and still believe in Copyright Reform over Copyright Abolishment.

You can believe in Media Preservation and still believe that Plagiarism is wrong.

You can hate the current restrictive Copyright Laws without wanting to abolish them entirely.

You can love the Public Domain and still loath predatory corporations stealing everything they can get their hands on, to literally *feed the machine.*

These things are not mutually exclusive, and if you think that

"you can't hate AI if you hate the current copyright laws"

or that

"Hating on Generative AI will only give us more restrictive copyright and IP laws, therefore you need to normalize and accept generative AI stealing all of your creations and every single thing you've ever said on the internet!"

I just genuinely don't understand how you can say this kind of crap if you've ever interacted with any creative person in your life.

I'm a wanna-be-author.

I want as many people to be able to afford my written works as possible without restrictions, and I fully plan on having free ebooks of my works available for those who can't afford to buy them.

*That does *not* mean I, in any way shape or form, would ever consent to people stealing my work and uploading it into a Large Language Model and telling it to spit out fifty unauthorized sequels that are then sold for cash profit!*

You cannot support generative AI and turn around and try to claim you're actually just defending small time artists, and *also* you think no one should have any legal protections at all protecting their work from plagiarism at all.

Supporting unethical generative AI (which is literally all of them currently), protecting artists, and *completely abolishing* copyright and intellectual property laws instead of reforming them *are* mutually exclusive concepts.

You *cannot* worship the plagiarism machine, claim to care about small artists, and then say that those same small artists should have absolutely *zero* legal protections to stop their work being plagiarized.

The only way AI could even begin to approach being ethical would be if using it to begin with wasn't a huge hazard to the enviornment, and if it was trained *exclusively * on Public Domain works that had to be checked and confirmed by multiple real human beings before it was put into the training data.

And oh, would you look at that?

Every single AI model is currently just sucking up the entire fucking goddamn internet and everything ever posted on it and everything ever downloaded from it with no way to really truly opt out of it or even just to know if your work has been fed to the machine until an entire page of text from your book pops out when it generates text from someone's writing prompt.

And no, it's not just "privileged Western authors" who are being exploited by AI.

For an updating list of global legal cases again AI tech giants, see this link here to stay up to date as cases develop:

#large text#long post#anti ai#fuck ai#not writing#copyright reform#copyright law#intellectual property

38 notes

·

View notes

Text

Recently, big corporations like Apple and Nvidia were found to have scraped Youtube to get video transcripts for their AI models. Using an online tool, I was able to compile every hermit i could find who was scraped. Heres the data:

Mumbo was hit the worst with 11 videos stolen

Gem had 4 older videos stolen

Both Scar and False had 1, with Falses being the only one coming up when searching "Hermitcraft" good sign? Maybe

If you find any more, leave them in the replies and I will try to add them. I want to bring awarness to this because it is not only against youtube TOS, but is violating the rights of creators on the platform. I smell a lawsuit indeed.

121 notes

·

View notes

Note

I am willing to give you or anyone else on tumblr the skills and advice the helped me get my dream job

the idea of working for TEK a few months ago would just be a fantasy

my background in education is English. I learned what I know now on my own and only by random chance.

This is why I am so critical of the linux commumity on tumblr.

They're tagging themselves as -official when they can't provide casual end user support.

They're entirely too horny to be in this sphere. Computers and linux should not be about how much you want to fuck/be fucked by X

it will deter end users

This is very cool that you will help other tumblr users with this stuff; i may actually take you up on this at some point :3

(my tone here is /g, /pos, /nm, /lh)

I do, however, kind of disagree with the other points. I think that for any other social media it's correct, twt or fb does not have the culture to make these sorts of parody accounts viable or not-counter-productive to increasing the linux market share. But I don't think that tumblr is the same.

I think that tumblr does. I think the tumblr community has always been this somewhat ephemeral yet perpetual inside joke culture where almost every user is in-the-know, and new users to the joke are able generally able to catch on quickly to it due to their general understanding of they way tumblr communities operate.

IMO, it's a somewhat quick pipeline of:

\> find first "x-official" blog -> assume it's real -> see them horny posting about xenia -> infer that RH corporate would probably not approve of such a blog

I can appreciate that it might be intimidating to seek out help as a new linux user, and especially a new linux & tumblr user, but looking through these blogs, you do see them helping out people ^^. heck, my last post was helping someone getting wayland working on an nvidia system.

The main goal of these blogs is not to be a legitimate CS service to general end-users. they aren't affiliated with the software their blog is named after, so in many cases they *cant*. The goal is instead to foster a community around linux, creating a general network of blogs of the various FOSS projects that they enjoy.

I think that final sentiment, of these blogs detering end users, is most likely counter to their actual effect on end users who are considering switching to linux.

We all know a lot of tumblr is 20 or 30 something year olds who have just stuck around since ~2012ish, and new users to tumblr join with pre-existing knowledge of the culture and platform. Almost anyone coming across these blogs are going to be people who can see the "in" joke, and acclimate. I do highly doubt that a random facebook mom who's son convinced her to install mint on her old laptop would find tumblr, find a -official blog, scroll through said blog, and be detered from using mint.

The other side of this is that any tumblr users who come across these blogs, be it with an inkling of desire to switch to linux or not, will see a vibrant and active community that fits very well into the tumblr community. They remember, or have heard of, the amtrac & OSHA blogs, and are therefore probably aware that this is a pre-existing meme on here.

In all likelyhood, this will probably further incentivize them to make the switch, as they would be more attracted to a community of their peers over a community of redditors telling them to read the arch wiki repeatedly

I can, on the other hand, definitely see that for people who have difficulties with parsing tone, and especially sarcasm, would have trouble with this. TBH, I have these difficulties (hence when I was speaking to you yesterday I used the /unjerk indicator, as I couldn't tell what the tone of the conversation was), and so it took me a little while of being in this weird "I'm 99% sure these *aren't* official, but what if?". I have been there forI think that maybe being more transparent with the fact that the blogs are parodies is probably important. I'm guilty of this, and after i post this, i'll add it to my bio.

#i use arch btw#they should switch to xenia#tux is so mid#penguins of madagascar was better#linuxposting#linux#distros#ask#mipseb

49 notes

·

View notes

Text

iOS 18 The Future of iPhone and AI

#Entrepreneur#Entrepreneurship#SmallBiz#IndieDev#business#corporation#leaders#Artist#Gamers#Developers#Graphic designers#Programmers#Independent contractors#Designers#3D#2D#Synthographics#Synthography#AiArt#ArtLife#Illustrations#CGI#Technology#AI#Artificial Intelligence#Generative AI#Omniverse#NVIDIA#VR#AR

0 notes

Text

The booming AI business strategy is placing major tech corporations invested in the landscape on a profitable path. In the past few months, we've watched Microsoft, Apple, and NVIDIA battle for the world's most valuable company crown. Market analysts attribute their growth in revenue and profits to their early investment in and adoption of the technology across their products and services.

Ironically, OpenAI, a key player in the AI landscape, could make losses amounting to $5 billion in 2024. According to a report by The Information, the ChatGPT maker might be on the brink of bankruptcy, with projections indicating it could run out of cash in the next 12 months.

43 notes

·

View notes

Note

As I understand it you work in enterprise computer acquisitions?

TL;DR What's the general vibe for AI accelerating CPUs in the enterprise world for client compute?

Have you had any requests from your clients to help them upgrade their stuff to Core Ultra/Whateverthefuck Point with the NPUs? Or has the corporate world generally shown resistance rather than acquiescence to the wave of the future? I'm so sorry for phrasing it like that I had no idea how else to say that without using actual marketing buzzwords and also keeping it interesting to read.

I know in the enterprise, on-die neural acceleration has been ruining panties the world over (Korea's largest hyperscaler even opted for Intel Sapphire Rapids CPUs over Nvidia's Hopper GPUs due to poor supply and not super worth it for them specifically uplift in inference performance which was all that they really cared about), and I'm personally heavily enticed by the new NPU packing processors from both Team Red and Team We Finally Fucking Started Using Chiplets Are You Happy Now (though in large part for the integrated graphics). But I'm really curious to know, are actual corporate acquisitions folks scooping up the new AI-powered hotness to automagically blur giant pink dildos from the backgrounds of Zoom calls, or is it perceived more as a marketing fad at the moment (a situation I'm sure will change in the next year or so once OpenVINO finds footing outside of Audacity and fucking GIMP)?

So sorry for the extremely long, annoying, and tangent-laden ask, hope the TL;DR helps.

Ninety eight percent of our end users use their computers for email and browser stuff exclusively; the other two percent use CAD in relatively low-impact ways so none of them appear to give a shit about increasing their processing power in a really serious way.

Like, corporately speaking the heavy shit you're dealing with is going to be databases and math and computers are pretty good at dealing with those even on hardware from the nineties.

When Intel pitched the sapphire processors to us in May of 2023 the only discussion on AI was about improving performance for AI systems and deep learning applications, NOT using on-chip AI to speed things up.

The were discussing their "accelerators," not AI and in the webinar I attended it was mostly a conversation about the performance benefits of dynamic load balancing and talking about how different "acclerators" would redistribute processing power. This writeup from Intel in 2022 shows how little AI was part of the discussion for Sapphire Rapids.

In August of 2023, this was the marketing email for these processors:

So. Like. The processors are better. But AI is a marketing buzzword.

And yeah every business that I deal with has no use for the hot shit; we're still getting bronze and silver processors and having zero problems, though I work exclusively with businesses with under 500 employees.

Most of the demand that I see from my customers is "please can you help us limp this fifteen year old SAN along for another budget cycle?"

104 notes

·

View notes

Text

Also, biodiversity conservation and restoration is very cheap. Protecting 30% of the world's land and sea area would mean an investment of 140 billion dollars a year.

This is about a tenth of the value of trillion dollar corporations like Amazon, Nvidia or Google (not even getting into the double trillions like Apple or Microsoft). The US Military spends 840 billion dollars in its current budget, and probably more given the well known corruption and rampant spending. An international program could raise double of that.

The study also points out that, from tourism to jobs to many other benefits, the returns to the global economy would be 5 times the 140 billion investment.

This is all in a capitalist perspective where investment and profit rule all. In a socialist perspective, this shouldn't be an issue at all. We protect nature not because of profit, but because it is our home and the heritage to our children. Eventually, enviromental protection and ecological development should be what we do because we must do, because our planet is marvelous and our home, not because of what profit we can extract from it in one or other way.

Same with space exploration, by the way. Or global food and health programs. All the shit we spend on advertising or nuclear weapons can be used into protecting human dignity, expanding our knowledge and protecting our planet. It was true when hippies said it in the 70s and is still true now.

56 notes

·

View notes