#Nvidia Corp.

Explore tagged Tumblr posts

Text

US gaming and computer graphics giant Nvidia said Monday that it will build the nation’s most powerful generative AI cloud supercomputer called Israel-1 which will be based on a new locally developed high-performance ethernet platform.

Valued at several hundred million dollars, Israel-1, which Nvidia said would be one of the world’s fastest AI supercomputers, is expected to start early production by the end of 2023.

“AI is the most important technology force in our lifetime,” said Gilad Shainer, Senior Vice President of high performance computing (HPC) and networking at Nvidia. “Israel-1 represents a major investment that will help us drive innovation in Israel and globally.”

7 notes

·

View notes

Text

Aproape întreaga avere câștigată de bogații lumii în acest an provine din AI

Bogăția lui Jensen Huang, cofondatorul Nvidia Corp., a crescut vertiginos, pe măsură ce un salt fulgerător în acțiunile legate de AI a propulsat valoarea de piață a producătorului de cipuri peste cea a Amazon.com Inc., pentru prima dată. Același salt a creat un alt miliardar în propria familie a lui Huang: verișoara sa îndepărtată, Lisa Su, directorul executiv al rivalului Nvidia, Advanced…

View On WordPress

0 notes

Text

#Softbank#AI#corporate clients#generative artificial intelligence platform#supercomputer#20 billion Yen#Nvidia Corp.#microchips#information processing capabilities#call centers#customer support services#revenue#shareholders meeting#Junichi Miyakawa#Softbank Group#Masayoshi Son#AI businesses#strategic partnerships#AI market#industries#mobile network provider#Japan#cutting-edge AI technology#visionary move#groundbreaking journey#unrivaled AI services#Softbank Corp.#Softbank Group Chairman and CEO#AI revolution#tokyo

0 notes

Text

Super Micro says board found 'no evidence of fraud,' still has no timetable for annual results

Charles Liang, chief executive officer of Super Micro Computer Inc., during the Computex conference in Taipei, Taiwan, on Wednesday, June 5, 2024. The trade show runs through June 7. Annabelle Chih | Bloomberg | Getty Images Super Micro, the embattled server maker that’s late in releasing annual financials and at risk of being delisted by the Nasdaq, reported unaudited first-quarter results on…

#Apple Inc#Breaking News: Technology#Business#business news#Earnings#Mobile#NVIDIA Corp#Super Micro Computer Inc#Technology

0 notes

Text

SK Hynix to start mass production of new HBM3E chip

SK Hynix Inc. signage at the company’s office in Seongnam, South Korea, on Monday, April 22, 2024. SK Hynix is scheduled to release earnings figures on April 25. Photographer: SeongJoon Cho/Bloomberg via Getty Images Bloomberg | Bloomberg | Getty Images SK Hynix shares surged more than 9% Thursday morning after the company said it has started mass production of a new version of its…

#Advantest Corp#Breaking News: Technology#business news#Markets#Micron Technology Inc#NVIDIA Corp#Samsung Electronics Co Ltd#technology#Tokyo Electron Ltd

0 notes

Text

First investments, cost basis, selling dogs — we explain 3 concepts

Please send your questions directly to Jim Cramer and his team of analysts at [email protected] . Reminder, we can’t offer personal investing advice. We will only consider more general questions about the investment process or stocks in the portfolio or related industries. Question 1: If you have a set amount of money to invest every week, where would you put it? New investor, just…

View On WordPress

#Apple Inc#Breaking News: Markets#business news#Investing Playbook#Investment strategy#Jim Cramer#Markets#NVIDIA Corp

0 notes

Text

Here's why 7 Club stocks, including Nvidia and Meta, beat the market in January and February, defying this year's seesaw start

This year has, so far, been something of a Jekyll and Hyde market for equities. January’s strength was a welcome reprieve from the brutality that was 2022. February’s stumble has reminded us that sticky inflation remains a challenge for both the broader economy and stocks. With that in mind, we sifted through our portfolio to find names with a mix of durable fundamentals and stories strong enough…

View On WordPress

#Advanced Micro Devices Inc.#Apple Inc#Banks#Bausch + Lomb Corp#Bausch Health Companies Inc#Breaking News: Markets#business news#Financials#Investment strategy#Jim Cramer#Markets#Meta Platforms Inc#Microsoft Corp#Morgan Stanley#NVIDIA Corp#Palo Alto Networks Inc#S&P 500 Index#stock takes#Technology#Wells Fargo & Co#Wynn Resorts Ltd

0 notes

Text

This is it. Generative AI, as a commercial tech phenomenon, has reached its apex. The hype is evaporating. The tech is too unreliable, too often. The vibes are terrible. The air is escaping from the bubble. To me, the question is more about whether the air will rush out all at once, sending the tech sector careening downward like a balloon that someone blew up, failed to tie off properly, and let go—or more slowly, shrinking down to size in gradual sputters, while emitting embarrassing fart sounds, like a balloon being deliberately pinched around the opening by a smirking teenager. But come on. The jig is up. The technology that was at this time last year being somberly touted as so powerful that it posed an existential threat to humanity is now worrying investors because it is apparently incapable of generating passable marketing emails reliably enough. We’ve had at least a year of companies shelling out for business-grade generative AI, and the results—painted as shinily as possible from a banking and investment sector that would love nothing more than a new technology that can automate office work and creative labor—are one big “meh.” As a Bloomberg story put it last week, “Big Tech Fails to Convince Wall Street That AI Is Paying Off.” From the piece: Amazon.com Inc., Microsoft Corp. and Alphabet Inc. had one job heading into this earnings season: show that the billions of dollars they’ve each sunk into the infrastructure propelling the artificial intelligence boom is translating into real sales. In the eyes of Wall Street, they disappointed. Shares in Google owner Alphabet have fallen 7.4% since it reported last week. Microsoft’s stock price has declined in the three days since the company’s own results. Shares of Amazon — the latest to drop its earnings on Thursday — plunged by the most since October 2022 on Friday. Silicon Valley hailed 2024 as the year that companies would begin to deploy generative AI, the type of technology that can create text, images and videos from simple prompts. This mass adoption is meant to finally bring about meaningful profits from the likes of Google’s Gemini and Microsoft’s Copilot. The fact that those returns have yet to meaningfully materialize is stoking broader concerns about how worthwhile AI will really prove to be. Meanwhile, Nvidia, the AI chipmaker that soared to an absurd $3 trillion valuation, is losing that value with every passing day—26% over the last month or so, and some analysts believe that’s just the beginning. These declines are the result of less-than-stellar early results from corporations who’ve embraced enterprise-tier generative AI, the distinct lack of killer commercial products 18 months into the AI boom, and scathing financial analyses from Goldman Sachs, Sequoia Capital, and Elliot Management, each of whom concluded that there was “too much spend, too little benefit” from generative AI, in the words of Goldman, and that it was “overhyped” and a “bubble” per Elliot. As CNN put it in its report on growing fears of an AI bubble, Some investors had even anticipated that this would be the quarter that tech giants would start to signal that they were backing off their AI infrastructure investments since “AI is not delivering the returns that they were expecting,” D.A. Davidson analyst Gil Luria told CNN. The opposite happened — Google, Microsoft and Meta all signaled that they plan to spend even more as they lay the groundwork for what they hope is an AI future. This can, perhaps, explain some of the investor revolt. The tech giants have responded to mounting concerns by doubling, even tripling down, and planning on spending tens of billions of dollars on researching, developing, and deploying generative AI for the foreseeable future. All this as high profile clients are canceling their contracts. As surveys show that overwhelming majorities of workers say generative AI makes them less productive. As MIT economist and automation scholar Daron Acemoglu warns, “Don’t believe the AI hype.”

6 August 2024

#ai#artificial intelligence#generative ai#silicon valley#Enterprise AI#OpenAI#ChatGPT#like to charge reblog to cast

184 notes

·

View notes

Text

Brands that are Pro-Israel under cut!!! Boycott them!!

Accenture

AccuWeather

ActionIQ

Ahava

AirBnB

Alaska Air

AllianceBernstein

Allianz

Amazon

Amdocs

American Airlines

American Eagle

American Wire Group

Amwell

Apollo

Apple

Aramis

ArentFox Schiff

Ariel

Atlassian

Authentic Brands

Aveda

Avery Dennison

Axel Springer

Bain & Company

Bank of America

Bank of New York Mellon

Baskin Robins

Bath & Body Works

Baupost Group

Bayer

BBC

BCG

Bioventus

Blackrock

Blackstone

Black & Decker

Bloomberg

Bobby Brown Essentials

Boeing

Bosch

Bounty

Bristol Myers Squibb

Bumble and Bumble

Burger King

Cadbury

Caltex

Capri Holdings

CareTrust REIT

Caterpillar

CeraVe

Chanel

Chapman and Cutler

Cisco

Citadel

Citi

Clinique

CNN

Coca-Cola

Comcast

Condé Nast

CV Starr

Cytokinetics

Davis Polk

Dell

Deloitte

Delta Air Lines

Deutsche Bank

Deutsche Telekom

DeviantArt

DHL Group

Disney

Donna Karan Cosmetics

Douglas Elliman

Dove

Edelman

Eli Lily

Endeavor

Energizer

Estée Lauder

EY

Facebook

Fanta

Fiverr

Forbes

Ford

Fox Corp

Gamida Cell

GE

General Catalyst

General Motors

Genesys

Gillette

Goldman Sachs

Google

Hardee’s

Hearst

Henkel

Herbert Smith Freehills

Hewlett Packard

Hewlett Packard Enterprise

HP

HubSpot

Huntsman Corp

H&M

IBM

Insight Partners

Instacart

Instagram

Intel

Intermedia

Interpublic Group

Intuit

Jane

Jazwares

Jefferies

Johnson & Johnson

Jo Malone

JP Morgan

Kate Spade

Kenon Holdings

Kit-Kat

KKR

KPMG

La Mer

Lays

Lego

Lemonade

Levi Strauss

Lifebouy

LinkedIn

Lipton

Live Nation Entertainment

L’Oréal

MAC Cosmetics

Maggie

Major League Baseball

Mango

Manpower Group

Mars

Marsh & McLennan

Mastercard

Mattel

McDermont Will & Emery

McDonalds

McKinsey

Merck

Merck KGaA

Meta

MeUndies

Microsoft

Milo

Morgan Lewis

Morgan Stanley

Motorola

MRC

Nasdaq

National Basketball association (NBA)

National Geographic

NeoGames

Nescafé

Nestle (and anything that stems from them)

Netflix

NFL

Nido

Nike

Nokia

Novartis

Nvidia

Okta

Omnicon Group

Oracle

Oreo

Origins Natural Resources

Palantir

Pampers (Procter & Gamble)

Paramount Global

Paul Weiss

PepsiCo

Perishing Square

Pfizer

Philips (66)

Pillsbury

Prescriptives

Progressive

Pringles

Puma

PVH

Raytheon

Regeneration Pharmaceuticals

Related Companies

Revlon

Ribbon

Riskified

Sabra Hummus

Sales Force

SAP

Sequoia Capital

Seyfarth Shaw

Siemens

Signal

Simons Property Group

Skydance

Snickers

SodaStream

Sony

SoulCycle

Sprite

StagWell

Starbucks

State Street

Stila Cosmetics

Subway

Sweet Green

Synovus

Tang

Tesla

Teva Pharmaceuticals

Thermo Fisher Scientific

Tieks by Gavreli

Tide

Toblerone

Tommy Hilfiger Toiletries

Tory Burch

Tribe Hummus

Troutman Pepper

Twin

UBS

United Airlines

Universal Music Group

UPS

UpWork

US Chamber of Commerce

Verizon

Victoria’s Secret

Vim

Volkswagon

Volvo

Vontier

Wall’s

Walmart

Warby Parker

Warner Brothers Discovery

Wells Fargo

WhatsApp

Winston & Strawn

WiX

WWE

Zara

Zoff Davis

Zoom

35 notes

·

View notes

Text

Zuckerberg’s Metaverse Gamble Pays Off With $201 Billion Fortune

(Bloomberg) -- Mark Zuckerberg’s bet on the metaverse initially looked like a colossal mistake, wiping more than $100 billion from his net worth. But now it’s paying off big-time.

Buoyed by a record-high Meta Platforms Inc. share price, Zuckerberg’s net worth has climbed almost sixfold in less than two years to $201 billion, the first time he’s exceeded the $200 billion mark, according to the Bloomberg Billionaires Index. He’s moved to fourth place on the list of the world’s 500 richest people behind Elon Musk, Jeff Bezos, and Bernard Arnault.

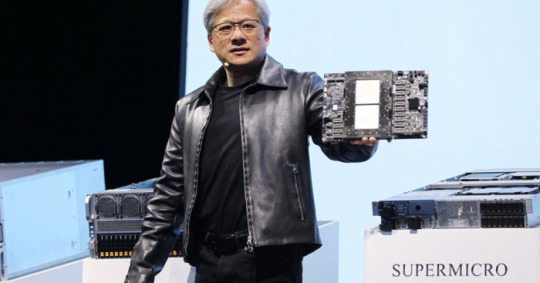

While other tech titans made big jumps in net worth this year — Nvidia Corp. Chief Executive Officer Jensen Huang, for example, has more than doubled his wealth to $106.2 billion — none has grown as much as Zuckerberg’s. He’s added $73.4 billion to his fortune since Jan. 1, thanks to his 13% stake in Meta. The stock closed at an all-time high on Wednesday and is up 60% this year.

3 notes

·

View notes

Text

In honor of @JoeHills doing a Beetlejhost rendition of Bohemian Rhapsody on stream today, here's the Hermitcraft parody of Bohemian Rhapsody I wrote like six months ago and was too chicken to share:

Is this new 3rd life?

Or maybe MCC?

Caught in hiatus

Waiting for 1 dot 19

Open your dash

Look for hermitcraft and see

Vault hunters Vods and

Cub's record speedrun streams

X snapshots, Gem's Empires lore

Iskall POGS, Stress YOLOs

Any way kind of content

the Hermits always matter to me

to me

Mumbo just killed a man

Built a vault without a door

And gave it lava for a floor

Mumbo, Grian had just geared up

But now you've gone and burned it all away

Mumbo oooh

You missed Jev's Easter hunt

If you're not back again before September

We'll carry on, carry on

(...King Ren might take your diamonds...)

It's late but the time has come

Skulk sends shivers down our spines

Goat horns sounding all the time

Goodbye everybody

The warden spawned, and Impulse isn't here with a noise machine

Mumbo ooooh

Pearl booped it on the nose

XB or False might still come to the rescue

Carry on, carry on

(But look out for those fragments!)

I see the shimmer of a bow weilding man

Scar goes woosh

Scar goes swoosh

Someone just hot-guyed Tango!

Charged creepers and lightning

Doc is very frightening

Zombiecleo! (Zombiecleo!)

Zombiecleo! (Zombiecleo!)

Zombiecleo BeetleJoest!

Where is Ethoooooooo?

Keralis is a poor boy, you should give him stuff for me!

Keralis is a poor boy, his mansion's great for parties!

ZEDVANCEMENT DEATH MESSAGE FATALITY!

Easy come, easy go, the lag has got to go

(Ore pillar, no!) The world eater must blow

(Got to go!)

(Ore pillar, no!)The copper farm must slow!(Got to go!)

The netherstars must glow! (Got to go!)

The farmed emeralds must flow (Got to go!)

It's got to gooooooooooooo!

Hyp- no no NO NO NO!

Nvidia, Nvidia! The frame rate has got to grow!

Bdouble0 has a parkour course hidden for me! For me! For meeeee!

Did you think that Decked Out wouldn't ever arrive?

Did you think that Giga Corp wouldn't ever thrive?

Oh baby, Hermits are truly crazy

When Beefs' game comes out, when the trading cards come out you will hear!

(Much guitar and piano solo later)

I sub to Jono and the Recap

And to Wels and TFC

All the hermits matter

To me

Okay yeah I'm a giant dork I just want Quinn and Joe Hills to see this

#the joehills difference#joehills#quinnhills#redactedhills#hermitcraft 9#hc s9#hermitcraft#joe hills#quinn hills

23 notes

·

View notes

Text

All roads lead to Phoenix. On the gravy train of greenfield investment riding on the back of Inflation Reduction Act legislative incentives in the United States, no county ranks higher than Arizona’s Maricopa. The county leads the nation in foreign direct investment, with Taiwan Semiconductor Manufacturing Corp. (TSMC), Intel, LG Energy, and others expanding their footprint in the Grand Canyon State. But Phoenix is neither the next Rome nor the next Detroit. The reasons boil down to workers and water.

First, the labor. America’s skilled worker shortage has been well documented since before the Trump-era immigration slump and pandemic border closures. Especially in the tech industry—the United States’ most productive, high-wage, and globally dominant sector—a huge deficit in homegrown engineering talent and endlessly bungled immigration policies have left Big Tech with no choice but to outsource more jobs abroad.

Arizona dangled its low taxes and sunshine, but TSMC has had to fly in Taiwanese technicians to jump-start production at the 4 nanometer chip plant that was meant to be completed by 2024, but has been delayed until 2025 at the earliest.

The salvage operation calls into question whether the more advanced and miniaturized 3 nanometer plant—scheduled to open in 2026 will stay on course. (With two-thirds of its customer base—including Apple, AMD, Qualcomm, Broadcom, Nvidia, Marvell, Analog Devices, and Intel—in the United States, it’s no wonder TSMC wants to speed things up.)

From electric vehicles to gaming consoles, the forecasted demand for the company’s industry-leading chips is projected to rise long into the future—and its market share is already north of 50 percent. Given the geopolitical risks it faces in Asia, a well-trained U.S. workforce could give it the comfort to establish the United States as a quasi-second headquarters. After all, Morris Chang, the company’s founder, had a long first career with Texas Instruments.

But the next slowdown they may face is Arizona’s dwindling water supply. In just the past year, Scottsdale cut off water to Rio Verde Foothills, an upscale unincorporated suburb on its fringes, due to the region’s ongoing megadrought and its curtailed allocation of Colorado River water. This was followed by Phoenix freezing new construction permits for homes that rely on groundwater.

Forced to find other sources, industry players have stepped up buying water rights from farmers, essentially bribing them to stop growing food that would serve the region’s fast-growing population. Then there are the backroom deals involved in an Israeli company receiving the green light for a $5.5 billion project to desalinate water from Mexico’s Sea of Cortez and pipe it 200 miles uphill through deserts and natural preserves to Phoenix.

Water risk brings political risk for companies. Especially in Europe, governments are carefully weighing the short-term benefits of corporate investment versus the climate stress it exacerbates. They have good reason to be suspicious: Firms such as Microsoft have been notoriously inconsistent in reporting their water consumption, and promises to replenish consumed water haven’t been delivered on. And even if data centers are becoming more efficient, growing demand just means more of them. Some European provinces have blocked data center development, pushing them to locations with high heat risk.

Europe’s regulatory stringency has long been off-putting to foreign investors, which is what makes European officials so weary of Washington’s aggressive Inflation Reduction Act, CHIPS and Science Act and Infrastructure Investment and Jobs Act.

But to fulfill its promise of putting the United States on a path toward sustainable industrial self-sufficiency, these policies need to better align investment with resources, matching companies to geographies that best suit their needs. It would be better to direct capital allocation to climate resilient regions than to throw good money after potentially stranded assets.

If any company ought to know better on all these matters, it’s TSMC. In Taiwan itself, the industry’s huge energy and water consumption are a source of controversy and difficulty. Not only have droughts on the island occasionally slowed production, but the company’s own water consumption rose 70 percent from 2015-19.

Furthermore, Taiwan knows that its real special sauce is precisely the technically skilled workforce that the United States lacks. Yet TSMC has doubled down on Phoenix, a place without a reliable long-term water supply for industry, little in the way of renewable energy, and a construction freeze that will make it challenging to house all the workers it needs to import.

With all the uncertainty over both water and workers, this begs the question of whether the semiconductor company the entire world is courting would have been better off establishing its U.S. beachhead in the upper Midwest or northeast instead? Ohio, upstate New York, and Michigan rank high in greenfield corporate investments, resilience to climate shocks, and are abundant in quality universities and technical institutes.

Amid accelerating climate change and an intensifying war for global talent, how can those devising U.S. industrial policy better select the appropriate locations to steer investment to?

States with higher climate resilience than Arizona are starting to flex for greater investment. According to recent data, Illinois has climbed to second place nationally for corporate expansion and relocation projects. The greater Chicago area and state as a whole are touting their tax benefits, underpriced real estate, growth potential, and grants to prepare businesses to cope with climate change.

Other parts of the Great Lakes region, such as Michigan and Ohio, are also regaining confidence in their industrial revival, pitching heavily for both domestic and foreign commercial investment while emphasizing their affordability and climate adaptation plans.

Just over the border, Canada has been wildly successful in poaching foreign skilled workers unable to secure or maintain green card status in the United States while also investing heavily in economic diversification—all with the benefit of nearly unlimited natural resources and energy supplies. While Canada hasn’t yet rolled out Inflation Reduction Act-style tax breaks to lure investors, it abounds in critical minerals for EV batteries (nickel, cobalt, lithium and rare earths such as neodymium, praseodymium, and niobium) as well as hydropower.

The more that climate change warps the United States, the more grateful it should be that its most natural and staunch ally occupies the most climate resilient real estate on the North American continent, even taking into account the raging wildfires of this summer. But rather than covet Canada the way China does Russia—as a vast and depopulated resource bounty—the United States and Canada should cooperate far more proactively on a continental scale industrial policy that would bring about true self-sufficiency from the Arctic to the Caribbean.

This is where geopolitical interests, economic competition, and climate adaptation converge. As Canada’s population surges by up to 1 million new permanent migrants annually, a more unified North American system would be more self-sufficient in crucial commodities and industries, less vulnerable to supply chain disruptions abroad, and avoid unnecessary carbon emissions from excessive inter-continental trade. Thirty years after the NAFTA agreement, it seems more sensible than ever to graduate toward a more formal, autarkic North American Union.

One can easily imagine Greenland joining one day—the country already enjoys autonomy from its colonizer (Denmark) and is now pushing for complete independence, driven partly by the desire to control more of the riches that climate change has revealed it to possess.

Meanwhile, in Taipei, there are far more complex geopolitical consequences to consider. TSMC has long been considered Taiwan’s “silicon shield,” a leader of industry so important that a conflict that took it offline would be a major own-goal for China. But it is precisely the combination of the China threat, environmental stress, and pandemic-era supply chain disruptions that convinced TSMC’s customers that its home nation represents too large a concentration risk.

Now TSMC and its rivals are expanding production from Japan to the United States, Europe, and India. This globally diversified set of chip manufacturers is easier for China to exploit as countries more susceptible to Chinese pressure become less rigid in compliance with U.S.-led export controls over advanced technologies.

At the same time, if the United States no longer depends on Taiwan itself for the majority of its semiconductor supply in just five to seven years, will it be as willing to defend Taiwan militarily? This, not Ukraine, is what Beijing is watching for as it pursues its own “Made in China” quest for self-sufficiency.

Industrial policy is back in vogue as a national security and economic strategy. But to get it right requires aligning investment into industry and infrastructure with the geographies of resources and resilience. The countries that build climate adaptation into their strategies will be the ones that build back better.

11 notes

·

View notes

Text

🔊Get Research Study on AI Chip Market

On September 4th, we announced our research study AI chip refers to a specialized integrated circuit tailored for efficient and fast execution of AI tasks. These chips are purposefully crafted to expedite intricate algorithmic calculations, crucial for various AI applications. They harness parallel processing abilities, unique neural network architectures, and optimized memory structures to achieve remarkable performance improvements compared to general-purpose processors.

How did the AI 'IMPACTING“ Semiconductor Industry ?

The artificial intelligence chip market size is segmented into Chip Type, Processing Type, Technology, Application and Industry Vertical.

Who are the Top Contributing Corporations?

Major Key Players:

MediaTek Inc,

Qualcomm Technologies Inc.,

Advanced Micro Devices Inc.(Xilinx Inc.),

Alphabet Inc.,

Intel Corporation,

NVIDIA Corporation (Mellanox Technologies),

Samsung Electronics Co Ltd,

Baidu,

SoftBank Corp.

According to the insights of the CXOs of Leading Companies Simply Click here or email us at [email protected] with the following for more information:

Increased demand for artificial intelligence chips

AI chip market is seen as promising for the technological industry's future

Investments in AI start-ups and the development of quantum computers

Today and Be a Vital Part of Our Thriving Community!

Great! Follow the steps below:

Reblog this post

Share this information with a friend

Follow @amrresearchstudy for more information.

#TechMarket#AIStartups#AIResearch#TechInvestment#FutureTech#ChipDesign#TechTrends#InnovationHub#SmartTechnology#AIIndustry#ArtificialIntelligence#AIHardware#Semiconductor#AIChips

4 notes

·

View notes

Text

Nvidia passes Apple as world's most valuable company

NVIDIA founder, President and CEO Jensen Huang speaks about the future of artificial intelligence and its effect on energy consumption and production at the Bipartisan Policy Center on September 27, 2024 in Washington, DC. Chip Somodevilla | Getty Images Nvidia passed Apple in market cap on Tuesday becoming, for a second time, the most-valuable publicly traded company in the world. Nvidia rose…

#Apple Inc#Breaking News: Technology#Business#business news#Entertainment#Intel Corp#Microsoft Corp#Mobile#NVIDIA Corp#Technology

0 notes

Text

Asia markets: CPI, Inflation, Nvidia, FOMC

TSMC offices in San Jose, California, US, on Thursday, April 18, 2024. David Paul Morris | Bloomberg | Getty Images Asia-Pacific markets rose Thursday, tracking gains on Wall Street fueled by a tech rally. Japan’s Nikkei 225 jumped 3.41% to close at 36,833.27 and The Taiwan Weighted Index advanced 2.96% to finish at 21,653.25. During the trading session, chipmakers and related companies extended…

#Advantest Corp#Alimentation Couche-Tard Inc#Arm Holdings PLC#Asia Economy#Breaking News: Markets#business news#Dow Jones Industrial Average#Hang Seng Index#Hon Hai Precision Industry Co Ltd#KOSPI Index#Markets#Nikkei 225 Index#NVIDIA Corp#Renesas Electronics Corp#S&P 500 Index#Seven & i Holdings Co Ltd#SK Hynix Inc#SoftBank Group Corp#Taiwan Semiconductor Manufacturing Co Ltd#Taiwan Weighted Index#Tokyo Electron Device Ltd#Tokyo Electron Ltd#World Markets

1 note

·

View note

Text

여자중요한부분 부위 여자 중요한 곳

여자중요한부분 부위 여자 중요한 곳 화보 구했습니다.

여자 예쁜 여자 사진 젊은여자 여자사진다음 모음 사이트 <<

여자 사진 보기, 예쁜 여자 사진 보여 줘 가능합니다. 진짜 예쁜 여자 사진 짬 w 지 보다 더 볼만합니다.

Reese Witherspoon과 Jim Toth의 결별 소식은 할리우드 시청자들을 놀라게 했을지 모르지만 Page Six는 Tinseltown 내부자에게는 충격이 아니라고 들었습니다. 소식통에 따르면 임박한 결말은 몇 달 동안 업계에서 심하게 비밀로 유지되었습니다. 작년에 에이전시 휴일 파티에서 펀치 볼 주변의 소문은 곧 발표가 올 것이라는 것이었습니다. 그리고 2011년에 결혼한 두 사람이 마침내 방아쇠를 당긴 것 같습니다. 지난 금요일 '금발이 너무해' 스타는 인스타그램에 "공유할 개인적인 소식이 여자중요한부분 부위 여자 중요한 곳 있습니다. 많은 고민과 배려로 어려운 이혼 결정을 내리게 됐다"고 밝혔다. 여배우는 그녀와 탤런트 에이전트 Toth가 "함께 멋진 시간을 보냈으며 우리가 함께 만든 모든 것에 대한 깊은 사랑과 친절, 상호 존중으로 앞으로 나아가고 있습니다."라고 말했습니다.

“이러한 ���제는 결코 쉬운 일이 아니며 지극히 개인적인 일입니다. 현재 우리 가족의 사생활을 존중해 주시는 모든 분들께 진심으로 감사드립니다.”라고 그녀는 말했습니다. CAA 에이전시의 최고 간부인 위더스푼과 토스는 2010년 12월 약혼을 발표하고 2011년 3월 캘리포니아 오하이에 있는 오스카 수상자의 목장에서 결혼했습니다.

무어의 법칙(Moore's Law)에 따라 수십 년 동안 컴퓨팅 성능이 꾸준히 향상될 것이라고 예측한 반도체 산업의 선구자 인텔 공동 창업자 고든 무어(Gordon Moore)가 금요일 94세의 나이로 사망했다고 회사가 발표했습니다. 인텔과 무어의 가족 자선 재단은 그가 하와이에 있는 그의 집에서 가족들에게 둘러싸여 사망했다고 말했습니다. 1968년에 Intel을 공동 출시한 Moore는 결국 전 세계 개인용 컴퓨터의 80% 이상에 "Intel Inside" 프로세서를 탑재한 기술 전문가 3인방의 롤업 슬리브 엔지니어였습니다. 1965년에 쓴 기사에서 Moore는 기술 향상 덕분에 몇 년 전에 집적 회로가 발명된 이후 마이크로칩의 트랜지스터 수가 매년 대략 두 배로 증가했다고 말했습니다. 클린턴이 2000년 1월 21일 캘리포니아 파사데나에 있는 캘리포니아 공과대학에서 과학 및 기술에 대한 지출을 28억 달러 증액한다고 발표한 후 빌 클린턴 전 대통령과 함께한 무어. 추세가 계속될 것이라는 그의 예측은 "무어의 법칙"으로 알려지게 되었고, 나중에 2년마다 개정되어 인텔과 경쟁 칩 제조업체가 경험 법칙이 실현되도록 연구 개발 리소스를 공격적으로 목표로 삼도록 하는 데 도움이 되었습니다. "집적 회로는 가정용 컴퓨터(또는 적어도 중앙 컴퓨터에 연결된 터미널)와 같은 경이로움으로 이어질 것입니다. 자동차의 자동 제어 장치, 개인용 휴대용 통신 장비"라고 Moore는 자신의 논문에서 PC 혁명 20년 전과 40년 이상 전에 썼습니다. 애플이 아이폰을 출시하기 몇 년 전. 무어의 기사 이후 칩은 기하급수적으로 더 효율적이고 저렴해져서 반세기 동안 세계 기술 발전의 많은 부분을 주도하고 개인용 컴퓨터뿐만 아니라 인터넷과 애플, 페이스북, Google.

앤디 그로브(왼쪽부터), 로버트 노이스, 고든 무어. Moore와 Noyce는 1968년 7월 Intel 여자중요한부분 부위 여자 중요한 곳 Corporation의 공동 설립자였습니다. Moore는 박사 학위를 받았습니다. Intel을 공동 창립하기 전에는 화학과 물리학을 전공했습니다. 무어는 2005년경 인터��에서 "적시에 적절한 장소에 있다는 것은 확실히 좋은 일입니다."라고 말했습니다. 그리고 실리콘 트랜지스터를 하나도 못 만들던 시절부터 17억개를 하나의 칩에 담는 시대까지 성장할 수 있는 기회를 가졌습니다! 경이로운 주행이었습니다.” 최근 몇 년 동안 Nvidia Corp(NVDA.O)와 같은 인텔 경쟁업체는 칩 제조 개선이 둔화됨에 따라 무어의 법칙이 더 이상 유효하지 않다고 주장했습니다. 그러나 최근 몇 년 동안 인텔이 시장 점유율을 잃게 만든 제조 문제에도 불구하고 현 CEO Pat Gelsinger는 회사가 전환 노력에 수십억 달러를 투자함에 따라 무어의 법칙이 여전히 유효하다고 믿고 있다고 말했습니다. 무어가 2005년 3월 9일 수요일 캘리포니아주 산타클라라에 있는 인텔 본사에서 실리콘 웨이퍼를 들고 있다. 무어는 PC의 움직임을 예견했지만 1980년대 후반까지는 가정용 컴퓨터를 직접 구입하지 않았다고 포브스 잡지에 말했다. 샌프란시스코 토박이인 Moore는 박사 학위를 받았습니다. 1954년 California Institute of Technology에서 화학과 물리학을 전공했습니다. 그는 Shockley Semiconductor Laboratory에서 일하기 위해 그곳에서 미래의 Intel 공동 창업자인 Robert Noyce를 만났습니다. "배신자 8인"의 일부인 그들은 1957년에 떠나 페어차일드 반도체를 설립했습니다. 1968년 무어와 노이스는 페어차일드를 떠나 곧 통합 전자(Integrated Electronics)의 약자인 Intel로 명명될 메모리 칩 회사를 시작했습니다.

무어와 노이스의 첫 번째 고용인은 1980년대와 1990년대 인텔의 폭발적인 성장을 통해 인텔을 이끌었던 또 다른 페어차일드 동료 앤디 그로브였습니다. 무어는 포춘지와의 인터뷰에서 자신을 회사를 시작하고 싶은 불타는 충동이 전혀 없는 "우연한 여자중요한부분 부위 여자 중요한 곳 기업가"라고 묘사했습니다. 하지만 그와 노이스와 그로브는 강력한 파트너십을 맺었습니다. Noyce는 칩 엔지니어링 문제를 해결하는 방법에 대한 이론을 가지고 있었지만 Moore는 소매를 걷어붙이고 트랜지스터를 조정하고 Noyce의 광범위하고 때로는 잘못 정의된 아이디어를 개선하는 데 수많은 시간을 보냈으며 종종 성과를 거둔 사람이었습니다. Grove는 Intel의 운영 및 관리 전문가로 그룹을 채웠습니다.

2 notes

·

View notes