#mortgage companies utah

Explore tagged Tumblr posts

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

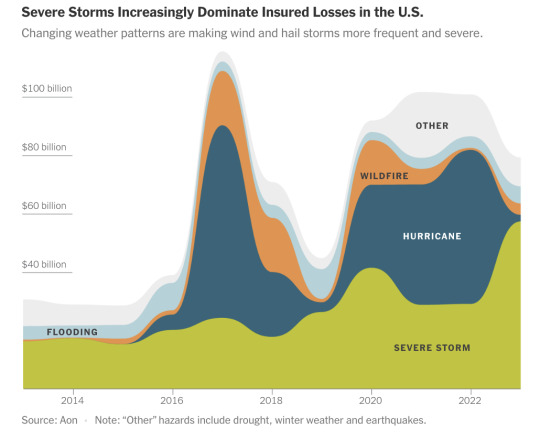

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

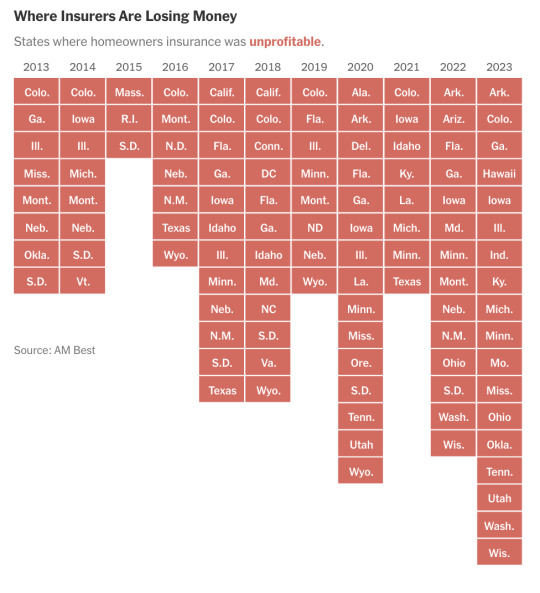

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

134 notes

·

View notes

Text

I’m getting goosebumps right now from reading about the fires in Los Angeles. It’s terrifying. Where I live we’re going through another round of public safety power shutoffs because of the same winds that are making the fires in Los Angeles hard to fight. Los Angeles is just a 2 1/2 drive from where I live. For long time followers, I used to talk about my friends from high school, BS and DI. BS got a job working for Disney+ and moved up to Los Angeles. I have had very little contact with BS and DI in 2 1/2 years but I have always considered them as friends even if things ended on a bad note. I just sent BS a text, letting her know I’m thinking of her and hope she’s safe. It’s the first time I’ve reached out to her in over a year… This fire is terrifying. Landmarks, celebrity homes, hundreds of homes, have burned to the ground. Lots of deaths. Ugh, this is terrifying. I remember the fires in 2003 and 2007 that, at that time, became the largest in state history. I remember many family friends who lost everything. The flames were literally on the hill behind our home. I hope BS is doing okay…

This sounds trivial after the paragraph above but I do want to explain my last post. It’s about money. The easiest way to describe it is that my bills alone (no entertainment, groceries, gas, etc) add up to more money per month than my income. Today, as I was turning on my car to go to work, the key fob broke off leaving just the key stuck in the ignition. I managed to get it out but it would have been very difficult to turn it back on. I had to pay a locksmith $400 to come to me and make me a new key. That’s on top of a very, very tight budget this month because of Christmas and my trip to Utah. I’m NOT irresponsible with money. The only way I could cut down more on my spending is to stop paying for the gym, voice lessons, and Hulu/spotify. But why would I get rid of those when those are the only things I allow myself to have outside of bills. I did end up pausing my gym membership for the month of January anyway.

The other part of this is that I live in one of the most expensive areas in the country, where your average middle class, 3 bedroom, 2 bathroom house sells for almost $1,000,000. My sister and her husband (the one that has the 5 month old) bought a house 1 1/2 years ago in Utah. Their MORTGAGE is cheaper than my rent AND they both have jobs, so their doing it with incomes.

I’ve done my best to budget, plan ahead, and buy less, move around payment due dates, negotiate, lower rates, etc. The math is just not mathing. At this point the only option is to make more money. I might have mentioned this in an earlier post but I’m taking on a few private practice clients on the side. I got my first client this week. My plan is to do 2 sessions on Saturdays and 2 sessions on Sundays, every weekend. It’s through one of those companies similar to Talkspace/Better Help. I will get reimbursed by insurance companies at a pre-negotiated rate that much higher than when I was previously working in private practice. 4 clients a week in addition to my regular salary at my current job will be enough to make the math work. Even then I might take on a 5th client just to be safe.

I am just so, so tired of dealing with finances. It never stops. One bill gets paid off and two more are waiting for me. There is SO much shame about it, especially within my family where they see it as me being irresponsible and a bad person. I swear, I really am doing the best I can but when you have more bills than your income and you’ve done everything you can to cutback and it’s still not enough-it’s not me being irresponsible-it’s me not being paid enough.

3 notes

·

View notes

Text

Can I Buy An Entire Town For Real?

Buying an entire town might sound unbelievable, but it’s actually possible! These places, once thriving with life, eventually became abandoned, and many are now up for sale. While ghost towns can be eerie, they also have a unique charm. There are thousands of such towns for sale in the U.S. alone, and their conditions vary greatly. Some still have a few residents, while others have been deserted for decades. The idea of owning an entire town sounds exciting, especially when considering the surprisingly affordable prices. However, purchasing a town isn’t as simple as buying a house.

Towns, in most cases, are unincorporated, meaning they aren’t part of a local government. This makes it difficult to secure a traditional loan from banks. While mortgages are available for homes, getting financing for a $200,000 ghost town is a different matter entirely. Even so, the possibility of owning a town is intriguing. If you have the funds to invest, there are some things you should consider. Many of these towns lack basic amenities like running water, electricity, and other essentials. In addition, many of the structures were built before modern safety codes were established, creating potential risks for future inhabitants.

For instance, in Utah, there’s a ghost town for sale for $199,000. The buildings are in poor condition, but the new owner could transform it into a tourist destination. Some ghost towns even have paranormal histories, with rumors of hauntings leading residents to abandon their homes. The price of these towns can drop significantly, with one town in California, Swans, selling for as little as $70,000 in 2013. But why are these towns for sale?

Many were initially built by companies for their employees working in gold or silver mines. These mining towns often had over 5,000 residents, but once the natural resources were depleted, the towns were abandoned. Years later, these once-thriving places would appear in real estate listings. For example, the famous ghost town of Swett in South Dakota, now for sale, includes not just land and buildings, but also a tavern, a gas station, and a local store.

Now, let’s take a closer look at some of these abandoned towns that could catch your interest. In Italy, there’s a village called Arto. Barbara Fi’s family began purchasing houses there 30 years ago. Over time, they connected the 18 houses into one structure, preserving the historical nature of the village using old materials like stone and wood. The village, once home to only two elderly residents, now belongs entirely to Barbara’s family. They’ve even converted an old barn into a banquet hall and stone stables into a lounge. Such historic properties can be found in various parts of the world, offering unique opportunities for buyers.

Another intriguing option is a ghost town in Spain, which offers scenic landscapes and development opportunities. This rural town includes three rustic stone houses built over a century ago. While they need extensive renovations, these properties could be turned into boutique holiday home rentals. The town boasts century-old greenery, a fountain, and a stone oven, all surrounded by rolling fields, lush woodlands, and flat plains. It’s a beautiful location, just 15 miles from coastal towns and famous attractions.

Perhaps you’re drawn to the idea of becoming a mayor in a ghost town. Pierce, Arizona, may pique your interest. Founded in 1895, the town was originally built after gold was discovered in the area. The town flourished, and by the early 20th century, it boasted a blacksmith, restaurants, hotels, saloons, and even an attorney’s office. However, by 1927, mining activity waned, and the town eventually became abandoned in the 1940s. The town is now up for sale, with the chance to purchase not only the land but also historic buildings and artifacts from its general store, which is over 125 years old.

Another notable ghost town for sale is Wild Westtown in Colorado. Located at the base of the San Juan mountains, this town was a popular stop for miners seeking late-night refreshments. Today, the well-preserved historic buildings include various artisan businesses, commercial spaces, and even an old school photography studio. The property also features the original 1875 San Juan County Courthouse and a mine where tourists can try their hand at panning for gold and gems.

In Italy, the medieval hamlet of Sahal offers a castle, an 18th-century stately home, a four-story lookout tower from the 1220s, and a majestic park. This historic site is located between two Italian cities, Modena and Bologna, and offers a glimpse into the past. Sometimes, towns like Sahal are listed on sites like Craigslist or eBay, where deals for potential town buyers can be found.

So, when considering the purchase of a town, it’s essential to carefully review the fine print. Sometimes, a village may require significant investment to become functional. In these cases, ownership might be purely ceremonial, offering nothing more than a plaque or a key to the city. Even if you’re not planning to buy a town, the idea of owning one can spark curiosity. Who knows, maybe your next pastime will be looking for ghost towns for sale!

Want to read more like this one? OUR OFFICIAL WEBSITE👉 xcuriousx

0 notes

Text

Where Harris Trump stand on housing: election voter guide

Trump, a real estate developer, has fewer specifics than his opponent in addressing housing affordability. Most significantly, he has tied his plan for mass deportations to housing. The Republican nominee said his administration would remove 11 million immigrants living in the country illegally by having the National Guard, local police forces in cooperative states and the military go door-to-door in a process that he said recently would be a “bloody story.” The effort would cause widespread disruption to families, including those having a mix of U.S. citizens and those living in the country illegally, and to the economy. Trump’s campaign has said the reduction in the population would lessen demand for housing and therefore lower costs. Some research has shown that immigration in general — not limited to those living in the country illegally — can increase housing prices and rents in U.S. cities that have been destinations for migrants. But the picture is more complicated. Migrants living in the country illegally have been more likely to live in overcrowded conditions, meaning their departure would leave fewer units available. Undocumented laborers make up a significant portion of the construction workforce. A recent paper from researchers at the University of Utah and University of Wisconsin found that greater immigration enforcement led to less homebuilding, higher home prices and fewer jobs for domestic construction workers. Aside from immigration, Trump has called for cutting regulations that make it more difficult to build housing. At the same time, he wants to preserve local zoning regulations that prohibit the construction of affordable housing in areas set aside for single-family homes. On the latter point, Trump has said he would reverse Biden administration efforts to integrate wealthy communities with lower-cost housing, policies that the former president called “Joe Biden’s sinister plan to abolish the suburbs.” As a landlord in the 1970s, Trump settled a Justice Department lawsuit in New York that accused his family’s company of discriminating against Black tenants. Trump has pointed to lowering interest rates to help with affordability. To combat inflation in recent years, the Federal Reserve raised rates, which led to a dramatic increase in mortgage costs and a chill on homebuying. Trump’s pledge to bring them down conflicts with the historical independence of the Federal Reserve in rate setting, which is supposed to guard against prioritizing political over economic concerns. Harris and Trump share one idea for housing affordability, though they’re both light on details: making more federally owned land available for housing development. Trump’s campaign said that housing affordability worsened during Biden and Harris’ time in office and that the former president would improve the situation. “He will rein in federal spending, stop the unsustainable invasion of illegal aliens which is driving up housing costs, cut taxes for American families, eliminate costly regulations and free up appropriate portions of federal land for housing,” said Karoline Leavitt, a Trump campaign spokesperson, in a statement. Source link via The Novum Times

0 notes

Text

What is Supported Independent Living?

Supported Independent living is senior housing that focuses on self-sufficiency. If your loved one needs a little help with daily tasks but not significant hands-on care, this could be the right choice for them.

You can access SIL through your NDIS plan. This article will explore what this means for you, including how to find and engage a service provider.

What is a CCRC?

Continuing Care Retirement Communities, or CCRCs (also called Life Plan Communities) offer seniors the option to live independently, then access care services as their needs change. Typically, residents begin their CCRC residency in independent living and can later transition to other levels of care—including assisted living and skilled nursing—while still living on the same campus.

Generally, a CCRC offers a wide variety of amenities and programs designed to keep its residents active. These can include fitness classes, art workshops and happy hours, and many CCRCs feature on-site healthcare facilities.

Most CCRCs charge a one-time entrance fee and monthly service fees. Depending on the contract type, some build the cost of future care into those fees while others offer a refundable entrance fee or refundable portion of the one-time entry fee to help protect your assets. Download our free CCRC Insider's Guide Workbook to learn more about this senior living option. It is a useful resource for financial or legal advisors as well as individual consumers.

What is an ILC?

ILCs are state-chartered institutions (currently operating in California, Colorado, Hawaii, Indiana, Minnesota, Nevada, and Utah) that under certain circumstances do not qualify as “banks” under the Bank Holding Company Act. This means that a nonfinancial company may control an ILC, and it would not be subject to the same regulatory oversight and supervision as a BHCA-registered bank.

ILCs provide property line estimates to help mortgage and title companies verify that new fences or other improvements don’t encroach on neighboring properties. They are also commonly used by municipalities for construction permitting.

In a sense, an ILC is a less comprehensive version of a land survey. For example, it doesn’t examine all boundary lines or locate all utilities. For this reason, we recommend seeking a full survey to get accurate property deed dimensions before beginning any construction project. That said, our team has decades of experience supplying ILCs that satisfy mortgage and title companies. We can also recommend the best way to solve any issues that an ILC uncovers.

What is a SIL?

SIL provides NDIS participants with support services to live in their own home or share accommodation, such as a supported living arrangement, community residence, or a host family. SIL providers work with individuals and their families to develop a personalised support plan that meets their needs, goals and preferences.

The NDIS’s SIL funding covers the cost of support workers who can help with daily activities, including cooking and washing. The funds can also help with accommodation costs.

SIL stands for Safety Integrity Level and is used in functional safety standards like IEC 61508. The term SIL has become commonplace in Request for Proposals (RFPs) and purchase requirements in many industries. Nevertheless, many engineering managers don’t have a full understanding of SIL’s meaning and how to apply it in their work. This course, AN INTRODUCTION TO FUNCTIONAL SAFETY, breaks down the basics and gives attendees a clear framework to follow. SIL can be calculated from the risk assessment methodologies PHA and LOPA, using probability of failure on demand or per hour (PFD/PFH) to meet a target SIL level defined during the allocation process.

What is a CIL?

Generally speaking CIL is a way to fund paid support to help you learn new skills and live independently in the community. Usually participants will receive this funding through the National Disability Insurance Scheme (the NDIS).

Development that may be liable for CIL includes new homes and buildings such as extensions, self-build houses and annexes. The levy is payable on any new building with a gross internal floor area of over 100 square metres, but there are some types of development that can be exempt or qualify for relief from the levy – see the CIL Guidance section for more details.

A key feature of CILs is consumer control – meaning that a person with a disability is assumed to be the expert in their own needs and circumstances, and should be at the centre of decision making about how they are supported. This is why all CILs are governed by a board of directors composed of people with disabilities, as well as other community members.

0 notes

Text

2024 Sundance Film Festival Summary

Sundance, Slamdance, what-a-chance to see a lot of movies and have a lot of fun!

I now have an idea of the evolution of the film festival in Park City, Utah. After attending both Sundance and Slamdance for the first time, I have come away with a new appreciation for the effort and challenges faced in making a film. I also have a better understanding of Michael Z. Newman’s claim in his book, Indie: An American Film Culture, stating that indie films cannot simply be defined in economic, stylistic, or thematic terms but rather, needs to be understood culturally. In his book Newman identifies three strategies to use when viewing films: characters as emblems, form is a game, and when in doubt, read as anti-Hollywood. Throughout my time watching here at the festival, I tried to engage with these films using these strategies.

Talking to people who have lived in Park City their entire lives, I have come to realize that the Sundance Film Festival has changed significantly over the years into what it is today. First off, the film festival scene has not fully recovered from the effects of COVID. Secondly, the 2023 writers’ and actors’ strike also had an impact on the filmmakers, some of which were not able to meet the Sundance deadline. In the years prior to COVID it was difficult to walk down the street due to the crowds. This year the crowds were definitely larger but did not get back to pre-COVID levels.

Sundance has grown over its forty-year history. It is still bringing indie filmmakers together, but often in a larger way in multiple areas. Whether it be star power, budgets, scope of the film, or trying to get studio or distribution support, it is definitely larger than it was. Additionally, there are now major companies sponsoring Sundance, setting up large tents, buildings, and erecting facades on the storefronts in the Main Street area during the festival. These included Adobe, Acura, Audible, Canon, Chase Sapphire, DoorDash, Dropbox, Shutterstock, United Airlines, and United Talent Agency (UTA) as well as media publications such as IndieWire, Variety, and Vulture.

Contrast this to Slamdance, which is held in three theaters right next to each other inside the same hotel. Having them close together along with lounges above provided convenient access for the production staff and created an atmosphere that makes it easier to speak and connect with the filmmakers. They were very willing to talk about the films, how they got there, lessons learned, and even to provide their contact information. Slamdance appears to be more like what Sundance started out as.

I also have a better understanding of some of the challenges that go into the business of independent filmmaking. The first is obtaining funding. Sources for funding include personal funding (like George Lucas who mortgaged his house to make Star Wars), state grants, crowdfunding, and major studio backing. The other challenges come from all directions. Planned and unplanned. Planned like trying to get the actors that you want to work with you such as the interviewees in The Greatest Night in Pop which was the “We Are the World” production. Unplanned challenges which can come from out of nowhere and are sometimes technical. For example, imagine losing part of the audio and having to later fill in the missing audio during editing and not having the actors available since they had already left. This happened to the filmmakers of Thirsty Girl.

Every film, regardless of size, will have its own goals. Some want to increase their funding to produce a larger project. Others want to make a political statement. Still, there are documentaries that may want to show the effort it takes to accomplish something like The Greatest Night in Pop or the film, Union.

When it comes to making indie films, Newman states, “It [independent cinema] is most centrally a cluster of interpretive strategies and expectations that are shared among filmmakers; their support personnel, including distributors and publicists; the staffers of independent cinema institutions such as film festivals; critics and other writers; and audiences. All of these different people are audiences who employ these [three viewing] strategies, and it is only because filmmakers are also film spectators that they are able to craft their works to elicit particular responses from the audience. Indie constitutes a film culture: it includes texts, institutions, and audiences. Indie audiences share viewing strategies for thinking about and engaging with the texts—they have in common knowledge and competence—which are products of indie community networks” (Newman 11).

While watching the films during the Sundance Film Festival I tried to analyze the films using Newman’s three strategies. For example, characters as emblems are used in Winner as the main character is symbolic of anyone that stands up for what they believe to be right but is in conflict with the law or society. Form is a game is another strategy of Newman’s that I saw used in the short film, Pasture Prime. This film transitions from a stalker to horror film with a twist at the very end as the snake slithers away. The third viewing strategy, when in doubt, read as anti-Hollywood, is identified as movies that do not have a happy or conclusive ending. Examples of this include Winner, where the hero goes to jail as well as the short film, The Lost Season, where people are indifferent to climate change. Anti-Hollywood movies also include films that leave you asking questions at the end. For example, in the instance of Winner, I am left wondering why there is such a difference in her punishment for crimes compared to others that were more serious. Also, in The Lost Season, I wonder if the next generations would care if they never got to experience winter. For short films, like Pasture Prime and The Lost Season, you have to wonder why they hit home for the director and how long they had this burning desire to make them. Newman’s three strategies are not mutually exclusive and often overlap as in Winner with the use of characters as emblems and when in doubt, read as anti-Hollywood.

As you can see, independent film is much more than inexperienced people with little money and unknown actors and directors producing a film. It encompasses films that are trying to send a message, provoke thought, think outside the box, or just be different.

Here is a list of the films I saw broken out between Sundance and Slamdance. My favorite film is Rob Peace, and my least favorite is I Saw The TV Glow.

Including both Sundance and Slamdance, I watched a total of 24 films (this is counting each short program as just one film).

Sundance:

Feature Films

A Different Man – Very well done. Psychologically the character in this film is crazed by the fact that he changed his appearance, but it did not make him who he wanted to be. This is because people preferred someone else that looked like he used to, begging the question, is personality or looks more important.

A Real Pain - Two cousins tour a concentration camp. They then have to rethink what they consider pain and suffering after seeing what the Holocaust victims experienced.

As We Speak - We have freedom of speech, however, the way our words are interpreted can be based on our skin color. This is a major problem when our words are used against us in court.

Freaky Tales - Based vaguely on real events, this movie intertwines the lives of four distinct groups in a very interesting and fun way. It reminds me of a live action anime, and I found myself engulfed in each story. The culmination was perfect.

How To Have Sex - An interesting take on consent and dealing with assault and the emotions that come along with it. Great cinematography and music selection. The director stated it was loosely based on personal experience.

Ibelin – A sad but heartwarming film about a boy who was born with muscular dystrophy and even though bound to a wheelchair he could still have friends online. It demonstrates that online communities should not be stigmatized and that you can find love, friendship, and be able to make a difference in others’ lives from across the globe.

I Saw The TV Glow – A strange film about a warped reality, where the TV show is the actual reality and not knowing you are trapped. It was very strange and confused me.

Krazy House – Krazy is a perfect title for this film, with it being a completely normal sitcom and then as the director says, “everything gets f****d up.” This film foreshadowed later events in the film very well. It is the only film I have ever heard people laugh when a dog dies. It is just so entertaining, and you are left thinking after the film is over, “what did I just watch?” It is so hard to explain this film, but I highly recommend seeing it.

Little Death – This film asks questions about wholeness and drug addiction. It manages to tell the stories of two different characters over the course of one film while only following each story for half the film, which I found really cool, interesting, and very much enjoyed.

Presence – A creepy horror film about just that: a presence in someone’s home. It ends up saving someone’s life, but at what cost? I found this film intriguing as the camera is handheld the entire time from, I assume, the presences’ point of view. I really enjoyed this film, and it gave me chills.

Rob Peace – This was my favorite film. The acting was amazing. The storytelling was great. It was able to keep the audience engaged and take artistic liberties without losing the true story of the film.

Suncoast – This is about a girl, Doris, taking care of her brother who is dying of cancer while at the same trying to navigate the teenage years.

The Greatest Night In Pop - This film did a great job in capturing the stress that went into the making of the song, as well as how much was unknown going into that night. It showed the seriousness of the process, and the comedy that lightened the mood, which had the whole crowd laughing throughout the film. It was a heartwarming film that brought laughter and joy to the entire crowd.

Thelma – A heartwarming and humorous film based on Thelma, the grandmother of the director, Josh Margolin, who was scammed out of ten thousand dollars and her journey to get the money back while also asking questions about when to ask for help and is being on your own always best?

Union – A documentary about organizing the Amazon Labor Union in New York. You may have to offer new incentives to get people to listen to your pitch. Would you like pizza or weed?

War Game -A documentary about a simulation held to help prep the government if something like January 6th were to happen again. I got the opportunity to talk to the producer of the simulation after and it was very interesting.

Winner - I gave it five stars. I thought it was thought provoking on the difference between what is right and wrong in that situation. It must have been difficult having that inner conflict about what is morally right but illegal in the eyes of the law and trying to make the decision of what to do.

Shorts Films

Midnight Short Film Program (3 of 6 shorts watched)

Bold Eagle – This was about a man named Bold who is struggling during the pandemic. He talks to his cat and engages in online sex. I did not enjoy this film. The Looming – This was a very interesting horror film about the elderly and their struggles with mental disorders and dementia.

Dream Creep – This was about a monster living in his partner’s ear, and while trying to help her, he accidentally sets the monster free and traps his partner.

Short Film Program 2 (3 of 7 shorts watched)

The Lost Season – This is a narrated view of an entire season, winter, disappearing due to climate change and no one really seems to care after it is gone. Thirsty Girl – This was about one person’s battle with sex addiction while also trying to help her sister who is battling drug addiction. Pasture Prime – This is about one person’s obsession with another and ends with an interesting twist.

New Frontier

Being (the Digital Griot) – This film uses artificial intelligence, dance, and poetry to speak about race and slavery.

Eno – A film based on the life of musician Brian Eno. It is unique because you can watch it repeatedly and have a different experience every time.

Slamdance:

Feature Films

Citizen Weiner - This feature is about the true story of someone running for City Council in New York and the trials and tribulations that come with running a campaign. They filmed the entire process to encourage other young people to get involved in politics and I think they did a great job. This movie had the whole audience laughing from start to finish, sometimes unable to believe that this really happened.

Shorts Films

Dumpster Archeology Short - This was about a man who dumpster dives for things for his house as well as mementos. He feels as though every item tells a story and he enjoys uncovering those stories after he finds the objects.

Slamdance Short Narrative 2 (3 of 6 shorts watched)

Hunter - This short was about role reversal if animals were to hunt humans and humans be the food. I thought it was very clever and the director also made it as a music video which I thought was very interesting.

Fettyland – This was filmed in Sarasota, Florida, not far from Eckerd College. It is based on the drug crisis in the Tampa area and in the USA in general. There are no “actors” so to speak in this film; everyone in it is basically doing things they would do in daily life as they are all in this drug life and live it every day.

Dissolution – This is a film about going through a divorce after so many years of marriage. I thought it was such a great description of what that is like. The filmmaker’s parents actually went through this, and he used them as the actors.

I can’t believe my time at the Sundance Film Festival is over. I really had a great time! I saw a lot of wonderful movies and throughout, I tried to implement what I had learned in class prior to heading out to Park City. I really hope to continue this journey in film and add to what I have learned so far.

I really hope to make it back to another Sundance Film Festival!!

Referenced Text link:

Newman, Michael Z. Indie: An American Film Culture. Columbia University Press, 2011.

Ryan McCormick

1 note

·

View note

Text

FOR IMMEDIATE RELEASE:

October 17, 2023

Media Contact:

Danny Wimmer

Michigan Joins Settlements to Resolve Data Security Errors with ACI Worldwide and Inmediata

LANSING – Michigan Attorney General Dana Nessel announced two settlements today involving financial and healthcare technology companies ACI Worldwide and Inmediata. ACI Worldwide is a large-scale payment processing company, Inmediata a healthcare clearinghouse that facilitates financial and clinical transactions between healthcare providers and insurers.

“We must rely on organizations such as these to secure our financial and personal data to a reasonable and robust standard,” said Nessel. “I am happy to join my colleagues in protecting consumers and holding corporations accountable when they violate that trust.”

ACI Worldwide Settlement

Michigan joined a coalition of 48 states, the District of Columbia, and Puerto Rico in announcing a $10 million settlement with payment processor ACI Worldwide over a 2021 testing error that led to the attempted unauthorized withdrawal of $2.3 billion from the accounts of mortgage holders. Michigan will receive $246,258.97 from the settlement. A private class action settlement is providing restitution to persons affected by the testing error. Affected Michigan residents who may wish to submit claim forms must do so by November 13th, and more information on the class action settlement is available here.

ACI Worldwide is a payment processor for Nationstar Mortgage, known publicly as Mr. Cooper. On April 23, 2021, ACI was testing its Speedpay platform. Due to significant defects in ACI’s privacy and data security procedures and its technical infrastructure related to the Speedpay platform, live Mr. Cooper consumer data was entered into the system. This resulted in ACI erroneously attempting to withdraw mortgage payments from hundreds of thousands of Mr. Cooper customers on a day that was not authorized or expected. The error impacted 477,000 customers, some of whom were forced to incur overdraft or insufficient funds fees.

State regulators, including Michigan’s Department of Insurance and Financial Services, have entered into a separate agreement with ACI for an additional $10 million. The regulators’ settlement also orders ACI to take steps to avoid any future incidents, including requiring the company to use artificially created data rather than real consumer data when testing systems or software and to segregate testing or development work from its consumer payment systems.

Along with Michigan, the settlement was joined by the attorneys general of Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Mississippi, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, Wisconsin, Wyoming, the District of Columbia, and Puerto Rico.

Inmediata Settlement

AG Nessel also announced that Michigan, along with 32 other state attorneys general, has reached a settlement with Inmediata, a healthcare clearinghouse that facilitates transactions between healthcare providers and insurers across the U.S. The settlement is in response to a coding issue that exposed patient information of approximately 1.5 million consumers for almost three years.

On January 15, 2019, the U.S. Department of Health & Human Services Office of Civil Rights alerted Inmediata that personal information maintained by Inmediata was available online and had been indexed by search engines, potentially allowing sensitive patient information to be viewed and downloaded by anyone with an internet connection.

Although Inmediata was alerted to the breach on January 15, 2019, the company delayed notification to impacted consumers for over three months and then sent misaddressed and unclear notices.

The settlement resolves allegations of the attorneys general that Inmediata violated state consumer protection laws, breach notification laws, and HIPAA by failing to implement reasonable data security.

Under the settlement, Inmediata has agreed to make a $1.4 million payment to the states. Michigan will receive $217,049 from the settlement. Inmediata has also agreed to overhaul its data security and breach notification practices going forward, including:

implementation of a comprehensive information security program with specific security requirements, including code review and crawling controls;

development of an incident response plan with specific policies and procedures regarding consumer notification letters; and

annual third-party security assessments for five years.

Indiana led the multistate Inmediata investigation, assisted by the Executive Committee consisting of Connecticut, Michigan, and Tennessee, and joined by Alabama, Arizona, Arkansas, Colorado, Delaware, Georgia, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Minnesota, Mississippi, Montana, Nebraska, New Hampshire, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Puerto Rico, Rhode Island, South Carolina, Utah, Washington, West Virginia, and Wisconsin.

##

0 notes

Text

Canada-based cryptocurrency payments platform FСF Pay has taken to its page on the X platform to announce that it has expanded the adoption of more than 30 cryptocurrencies used on its platform to U.S. states Idaho and Utah.Now, their residents can enjoy paying for their broadband connections using SHIB, DOGE, BTC, XRP and other cryptos via FCF Pay.The X post of the company reads: "You are now able to pay for your broadband connections using cryptocurrencies. Use your Bitcoin, Binance Coin, Ethereum, XRP, Shiba Inu, Doge, Floki and 30+ others.Apparently, this move is part of FCF Pay’s Bills service that helps customers to manage their finances and bills, allowing them to pay for goods and services at more than 20,000 leading U.S. companies, including Tesla, Amazon and American Airlines.Earlier this week, the cryptocurrency payments company announced that it had included Chase Bank on the list of companies it collaborates with. Now, all clients of FCF Pay can use crypto to pay for their mortgage, loans, credit cards and other banking services; this includes popular coins such as BTC, ETH, SHIB, DOGE, XRP, BNB and many others.Chase is part of the banking giant JP Morgan Chase, with millions of customers in the U.S. More countries are going to be added soon, according to the company.

0 notes

Text

MMI ranks No. 15 on Utah Fast 50 list of fastest-growing companies

Please consider Sponsoring FTHM on Patreon SALT LAKE CITY, Utah, Aug. 29, 2023 (SEND2PRESS NEWSWIRE) — Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it ranks No. 15 on the 2023 Utah Business list of fastest-growing companies in the state. This marks MMI’s second consecutive appearance on the…

View On WordPress

0 notes

Text

Bankruptcy Attorney Utah

Bankruptcy Attorney Utah

Bankruptcy is a last resort for many people in debt. It effectively wipes what you owe in just 12 months but has a huge lasting impact on your credit rating and living situation. You may be at risk of losing your home if you own it and any other assets you may have. It can also affect your employment too. This is why it’s a good idea to look into how you can reduce the likelihood of needing to take it on.

Debt can be damaging in many ways, and it affects more people than you might think. At the end of March 2021, household debt in the U.S. including mortgages, auto and student loans, and credit cards reached a total of $14.64 trillion. That’s a lot of money, and it’s not all because of just overspending. Often, circumstances outside your control can cause you to fall into debt. This may include job loss, long-term disability, or medical bills. If you’re faced with a large amount of debt, you may feel like bankruptcy is the only way to go. But bankruptcy may not be necessary, depending on your situation. Bankruptcy can have a devastating effect on your credit score. It can stay on your credit report for up to 10 years.

Here are some ways you can avoid bankruptcy to keep your credit score intact.

Increase Your Income

Increasing your monthly income could give you extra money to put toward your debt. If you can, pick up extra hours at work, apply for a part-time job, or start a side hustle to bring in extra cash. Alternatively, you can sell any spare items, such as furniture or jewelry, and use the money to pay down your debt balances. The sooner you take action, the better. If you wait until you’re behind on payments, it may be too late to catch up and avoid further action from your creditors.

Reduce Your Spending

Spending less money may allow you to dedicate more of it to paying down your debt. You may be able to free up money in your budget by cutting cable, canceling your gym membership, or skipping takeout for dinner. This could help you pay off your debts over time to avoid filing bankruptcy. Review your budget and consider switching to a new one to find areas where you can spend less and pay more money toward your debt.

Negotiate With Creditors

Many creditors are willing to work with you, but you have to communicate with them proactively. Let your creditors know you are having financial difficulty and want to avoid bankruptcy. Express willingness to pay off the debt, and ask if they can help make it easier by lowering your monthly payment or interest rate or even both. Many credit card companies and banks have hardship or payment assistance programs intended for this type of situation.

Seek Consumer Credit Counseling

If you’re feeling overwhelmed, getting help from a professional consumer credit counseling agency may bring some clarity to your finances. A credit counselor can review your finances to help you figure out a budget, and may potentially work out a debt management plan with your creditors. Under a debt management plan, you work to repay your debts in three to five years.5 First, the credit counselor negotiates with your creditors to get you a lower monthly payment. Then, each month, you send a single lump-sum payment to the credit counseling agency, which then distributes your payments to your creditors.

Settle Your Debt

Debt settlement isn’t the ideal solution, but you may consider it if you’re on the brink of bankruptcy.

Settling a debt means you pay the creditor a percentage of the total amount due to satisfy the debt. Once you reach a settlement agreement, be prepared to pay the settlement amount in a lump-sum payment. While there are debt-relief companies that can settle debts for you—for a fee—you can do this on your own. Start by focusing on debts that already are charged-off or in collections. On top of that, your credit score could be impacted if the debt-relief company encourages you to intentionally fall behind on payments so it can negotiate a settlement.

Before Doing Anything Else, Decide If Filing Bankruptcy Is Right for You

Before jumping in, you need to determine whether filing bankruptcy will help you. Bankruptcy is a powerful debt relief tool, but only if it makes sense for your financial situation. A bankruptcy discharge does not wipe out certain non-dischargeable debts like most student loans, child support obligations, alimony, and recent tax debts. If you have any cosigners, they will not be protected by your personal bankruptcy.

If you have great credit when your Chapter 7 bankruptcy is first filed, your credit score will likely drop a bit at first. Most people are able to rebuild their credit and have a better score within a year of getting their bankruptcy discharge. Anyone can file Chapter 7 bankruptcy without a lawyer. Here is an overview of the steps you’ll need to take to obtain your fresh start.

How to File Chapter 7 Bankruptcy

• Collect Your Documents • Take Credit Counseling • Complete the Bankruptcy Forms • Get Your Filing Fee • Print Your Bankruptcy Forms • Go to Court to File Your Bankruptcy Forms • Mail Documents to Your Trustee • Take Bankruptcy Course • Attend Your 341 Meeting • Dealing with Your Car Loan

Collect Your Documents

Your first step is to collect all your financial documents so you understand the current state of your finances. Start by getting a free copy of your credit report. You are entitled to one free report from each one of the three credit bureaus per year. Some of your debts may not be listed on your credit report. Common examples include medical bills, personal loans, payday loans, and tax debts. Make a list of all debts not on your credit report so you don’t have to look for the information when you’re filling out your bankruptcy forms.

In addition to your credit report, you will need the following documents: • Tax returns for the past 2 years • Pay stubs or other proof of your income for the last 6 months • Recent bank account statements • Recent retirement account or brokerage account statements • Valuations or appraisals of any real estate you own • Copies of vehicle registration • Any other documents relating to your assets, debts, or income.

Having these documents next to you will help you get an accurate picture of your financial situation.

Take Credit Counseling

Every person who files for bankruptcy has to take a credit counseling course in the 6 months before their bankruptcy petition is filed with the court. This is a requirement in both Chapter 7 and Chapter 13 cases. The course has to be taken through a credit counseling agency that is approved by the Department of Justice.

Credit counseling courses like this one give you an idea of whether you really need to file for bankruptcy or whether you could get back on your feet through some type of informal repayment plan. The course takes at least one hour and can be completed online or by telephone. The course fee ranges from $10 to $50, depending on the provider. If your household income is under 150% of the federal poverty line, you should be able to get this fee waived. Once you complete the course, you will receive a certificate of completion. Keep it.

Bankruptcy laws require that you provide a copy of this certificate to the court when you file your bankruptcy forms in Step 5.

Complete the Bankruptcy Forms

The bankruptcy forms include at least 23 separate forms, totaling roughly 70 pages. The bankruptcy forms ask you about everything you make, spend, own, and owe. You’ll also include some bankruptcy basics, like what type of bankruptcy you’re filing under and whether a bankruptcy lawyer is helping you. If you hire a lawyer, they will complete the forms for you based on the information you submit to their office. If you can’t afford to hire a lawyer but don’t feel comfortable completing the forms on your own.

Get Your Filing Fee

The federal court charges a filing fee of $338 for a Chapter 7 bankruptcy. This amount is typically due when the bankruptcy petition is filed with the court. If you don’t have the funds to pay the filing fee now, you apply to pay your fee in installments, after your case has been filed. You can ask to make up to 4 monthly payments. If paying in installments isn’t even possible, you can submit another form to apply for a fee waiver. To qualify, your total household income must be under 150% of the federal poverty line. The court will decide whether bankruptcy laws support granting you a waiver. This happens after your bankruptcy petition. If your application is denied, the court will typically order you to pay the fee in installments.

Print Your Bankruptcy Forms

Once you have prepared your bankruptcy forms, you will need to print them out for the court. You must print them single-sided. The court won’t accept double-sided pages. You will also need to sign the forms once they are printed.

You will need: • The petition forms including any required local forms • Your credit counseling certificate • Your paycheck stubs • If needed, your application for a fee waiver or installment plan

Most bankruptcy courts require just one signed original of the petition, but some courts require additional copies. So, before you head out to submit your forms, call your local bankruptcy court to find out how many copies you will need to bring and confirm you have all the required local forms.

Go to Court to File Your Bankruptcy Forms

Once you enter the doors of your local courthouse, you will be greeted by security guards, who will ask you to pass through a metal detector. Once you pass security, you will go to the clerk’s office and tell the clerk that you’re there to file for bankruptcy. They will take your bankruptcy forms and your filing fee (or application for a waiver or to pay the fee in installments). Do not submit your bank statements or tax returns to the court. These documents go to the trustee after the case is filed. for more.

While you wait, the clerk will process your case by scanning your forms and uploading them to the court’s online filing system. This usually takes no more than 15 minutes.

Once done, the clerk will call you back to the front desk and give you: • Your bankruptcy case number • The name of your bankruptcy trustee • The date, time, and location of your meeting with your trustee (this is called the “Meeting of Creditors” or “341 meeting”)

Mail Documents to Your Trustee

The Chapter 7 trustee is an official appointed by the court to oversee your case and liquidate, or sell, nonexempt property for the benefit of your creditors. Not all types of bankruptcy require the involvement of a bankruptcy trustee, but both Chapter 7 and Chapter 13 cases have one. Pay attention to mail you receive from the trustee after filing your case. The trustee will send you a letter asking you to mail them certain financial documents, like tax returns, pay stubs, and bank statements. If you don’t send the trustee the requested documents following the instructions provided in their letter, you may not get a discharge of your debts.

Take Bankruptcy Course 2

After filing your bankruptcy forms, you will need to complete a Debtor Education Course from an approved credit counseling agency. It can be completed online or by phone and typically takes at least 2 hours and costs between $10 – $50, unless you’re eligible for a waiver. The purpose of the course is to educate you on making smart financial decisions going forward but does not provide legal advice about the bankruptcy process. You’ll learn how to prepare a budget and avoid incurring debt with high interest rates. You’re not eligible to receive your bankruptcy discharge and obtain a fresh start if you don’t complete the course and file your certificate of completion from the credit counseling agency with the court.

Attend Your 341 Meeting

Your 341 meeting, or meeting of creditors, will take place about a month after your bankruptcy case is filed. You’ll find the date, time, and location of your 341 meeting on the notice you’ll get from the court a few days after filing bankruptcy. The main purpose of the 341 meeting is for the case trustee to verify your identity and ask you certain standard questions and most last only about 5 minutes. Your creditors are allowed to attend and ask you questions about your financial situation, but they almost never do.

Dealing with Your Car Loan

If you own a car that you still owe on, you’ll have to let the bank and the court know what you want to do with it one of your bankruptcy forms. If you want to surrender the car to the lender and discharge the debt, you don’t have to do anything other than stop making your payments. The bank will either file request with the bankruptcy court to ask permission to retake the car, or wait until your discharge is granted before picking it up. If you want to keep the car, you can either reaffirm the loan or redeem the car. If you’re reaffirming your loan, the bank will send you a reaffirmation agreement after your case is filed. You have to complete and sign the agreement and return it to the bank within 45 days from your 341 meeting. The bank files the signed agreement with the court for approval. To redeem the vehicle you have to file a motion with the court and, once granted, buy the car from the bank for its current value. This gets you out of having to pay the amount left on the loan, but payment has to be made in one lump sum.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Bankruptcy Attorney Salt Lake City UT

Bankruptcy Attorney Salt Lake City Utah

Bankruptcy Attorney Salt Lake City

Business Lawyers

Estate Planning Lawyer

Divorce Lawyer and Family Law Attorneys

Ascent Law St. George Utah Office

Ascent Law Ogden Utah Office

The post Bankruptcy Attorney Utah appeared first on Ascent Law.

from Ascent Law https://ascentlawfirm.com/bankruptcy-attorney-utah/

0 notes

Text

Advantage of Hiring agency for consulting Home buying Rebates

When considering purchasing a home, many people often overlook the benefits of hiring an agency for consulting home buying rebates. If you are looking for buying home in Utah here is the good news for Utah home buyers. Here are some advantages of hiring such an agency:

Expertise: Home buying rebate agencies have experienced real estate agents who are knowledgeable about the local housing market. They can help you navigate the complex process of buying a home, from finding the right property to negotiating the best price.

Cost savings: A home buying rebate agency can help you save money by offering cash rebates on the purchase of a home. These rebates can range from a few hundred dollars to thousands of dollars, depending on the value of the home.

Objective advice: When working with a Utah home buyer rebates agency, you can expect objective advice, as they do not have any vested interest in the sale of a particular property. They can provide you with unbiased information about different neighborhoods, schools, and amenities to help you make an informed decision.

Time savings: Hiring a home buying rebate agency can also save you time. They can help you narrow down your search to properties that meet your specific needs and preferences, reducing the amount of time you spend looking for a home on your own.

Networking: Home buying rebate agencies often have an extensive network of contacts in the real estate industry, including mortgage lenders, home inspectors, and contractors. They can leverage these contacts to help you find the right professionals to assist you throughout the home buying process. One of the leading company you can trust in Utah for this could be Discount Agent.

In conclusion, hiring a home buying rebate agency can be a smart choice for anyone looking to purchase a home. The expertise, cost savings, objective advice, time savings, and networking opportunities provided by these agencies can help you find and purchase the home of your dreams.

For more Information you can visit: https://discountagent.com/

Original Reference: https://bit.ly/3LAeqVX

0 notes

Text

10 Steps Closer to Living Legally in a Tiny House

The median home price in my county is $800,000. As secure housing skyrockets out of reach for all but the wealthiest, more cities look to tiny houses for an affordable solution. This summer my husband and I tried to buy one. Here's what we learned.

As many of you know, my husband had a health crisis earlier this year, and the ongoing medical costs of his recovery have tanked our finances. Since full recovery from a pulmonary embolism and DVT can take up to one or two years, we had hoped that relocating might preserve what security we have left. So we spent the last several months researching ways to significantly reduce our cost of living.…

View On WordPress

#affordable housing#Appendix Q#Clear Creek RV Center#cost of living#disability#healthcare costs in the U.S.#house prices#housing market#housing shortage#King County#Labor and Industries inspections#Liberty Bank of Utah#median home price#Mint Tiny House Company#mobile home parks#mortgage#RV transport service#RVIA certification#RVIA tiny house#Seattle#THOWs#tiny homes#tiny house design#tiny house down payment#tiny house insurance#tiny house on wheels#tiny houses#vehicle registration and licensing#Washington state#zoning laws

4 notes

·

View notes

Text

USDA Mortgage Company in Utah – How To Choose A Right One

As you work hard to search some other services in a local market, searching a good USDA lender in a financial market is also the same. It is not difficult to select a right USDA lender. You just need to collect the right information about them. Read our latest blog and learn How To Choose A Right USDA Mortgage Company. 👌👌👌 Visit here: https://bit.ly/2DHPmJt

0 notes

Video

youtube

Graystone Mortgage, located in Salt Lake City, Utah, is a mortgage company that offers high quality financial services including construction loans, reverse loan programs, guaranteed rural housing loans, veteran affairs loans, 203k loans, energy efficient loan programs, and conforming conventional loans. Recognized for their simple, user-friendly home ownership process, Graystone Mortgage represents itself with the acronym H.O.M.E. They honor their clients through transparency and integrity, own their daily responsibilities, motivate themselves to perform their best every day, and create a memorable and unmatched experience for their customers. The Utah loan process at Graystone Mortgage consists of twelve specific steps, the first two being application and pre-approval. Pre-approval speeds up the homebuying process so that the buyer can make an offer as soon as they find a home that they like. After pre-approval, the buyer must go house hunting, make an offer, and be accepted. Finally, disclosures must be signed, the appraisal must be filed, and the rate must be locked in. Once the file is approved, the buyer and seller must sign all required documents, and then the process is complete! Call (801) 274-7400 or visit their website https://graystonemortgage.com/ for more information on loan requirements and services!

1 note

·

View note

Photo

#Home#Loan#Loans#Utah#Mortgage#Brokers#Best#Down#Payment#Company#Discount#Cash-Out#FHA#Top Company#Professionals#Lowest#Latest#Home Loans

2 notes

·

View notes

Text

The Z Mortgage Team

Get Your Dream Home with The Best Home Loan Mortgage Solutions

Purchasing a nice and delightful property is a thing that a lot of individuals need to try and do at some point of time within their lives. Even so, not absolutely everyone can attain this purpose efficiently. The leading impediment to obtain a home inside of a pristine place has naturally to carry out with finances. To generate confident that you've the most beneficial home finance loan loans to obtain your house, it is pretty important that you consult with a leading mortgage management business that could deliver you major quality methods for the best deals. A bank loan supplying expert can provide you customized residence loans which could ensure it is lots simpler that you should obtain homes in any part of Utah. Get more details about The Z Mortgage Team

Value of getting loan administration alternatives

Presently several providers in Utah like Republic Property finance loan and Avanti Home loan offer you outstanding deals to their consumers when they're looking to get a home. Nonetheless, there are several companies in Utah that supply superb personal loan packages although not all of them are going to accommodate your distinct requires. Because you are most probably getting a residence personal loan for the very first time, it might be complicated for you to recognize which corporation will be apt for your unique personal loan requirements. It is actually for that reason it is best to get in contact having a reputed bank loan administration alternatives expert which can manual you to the bank loan packages that will be best in your case.

How mortgage provider professionals can serve you

A well-known loan providers skilled is properly aware of the methods in which Salt Metropolis Residence Loans or Sophisticated Funding do the job. This may make it much easier for them to settle on a assistance provider for you which can get the job done out perfectly. Any time you hold the right type of bank loan qualified backing your dreams for that most effective house, it is possible to hold the mental liberty and liberty that you have to locate a house which is just best to suit your needs. Don't just this will enable you to satisfy your long-term desire of having your own personal residence however , you also can invest inside of a vibrant long term yourself and also your family members. In this way a corporation like Axent Funding or Initially Colony Home finance loan can provide you the best economical assist you need for purchasing your private home.

Receiving RANLife Residence Loans is usually one among the top selections that you choose to at any time just take on your own as well as your family. So check with a personal loan pro in Utah right now to discover about the finest property finance loan bank loan possibilities.

youtube

0 notes