#money collection

Explore tagged Tumblr posts

Text

5 notes

·

View notes

Text

whatever this is girls keep doing it

#she literally bullies you AND takes your lunch money. as if they have read my diary or somesuch#hades#hades 2#melinoë#melinoe#nemesis#nemelinoe#melesis#i dont know what the collective unconcious has decided to call this couple#my art#hades game

12K notes

·

View notes

Text

The standard billing and payment practices of home health/hospice billing services can be overwhelming for most payers. But now, you can work with a reliable partner to assist your agency in collections.

0 notes

Note

ANNIVERSARY GROOVY BOYBAND! THEY ALL LOOK SO GOOD, I also love the hades reference with idia! Ik ur probably really swamped with the book 7 brain rot but I wanted to know ur thoughts. I also wanted to mention that I am so card deprived I feel like I need a replacement event to take tsumderlands place

AUGH NO I LOVE THEM. 😭 UGH now I really have to think about if I want to try pulling for Grim again. dangit. heck. I already got his little pedestal to add my guest room shrine, but...now I kinda need the boss himself...

also, the implications of it not being an OB thing, Idia can just. Do That? apparently? do you think he ever just sometimes does it by accident? what am I saying, he absolutely sometimes does it by accident.

gosh though. this event has been SO cute in general! I was wondering who'd get the focus for year 5; I could not be happier that the answer is apparently EVERYBODY. :D all the dorms get their own special songs! so many cute little scenes!!! the lowest of stakes bringing out the highest of pettiness in everyone!!!!!! it's excellent.

(also, because I will make literally anything about my diaboys...I know these events are typically sorta, let's say chronologically unmoored with regards to story. but the further implications that this takes place pre-episode 7/Malleus' Big Existential Crisis, and yet...some of these lines?)

#art#twisted wonderland#twisted wonderland spoilers#twst 5th anniversary#i hope that's the correct tag for filtering purposes#anyway gacha continues to have me in a bind#i have scrambled up enough keys/gems that i could hit the 100 pity mark on ONE pickup#so now i have to choose between grim or silver#with the caveat of course that i might end up not getting either#(or hoping i might magically somehow get another 31 keys to hit 150 on the anniversary medal pickup to trade for masqueralleus)#(this is extremely unlikely but if we don't have hope we have nothing)#uggggh i hate decisions#on the one hand. look at silver's card. just LOOK at it.#and i could absolutely use a void-typed attack card! especially with that duo!#but also my sweet grimbleshanks in his little sparkly blazer...#how can i possibly say no to the boss#i feel like if i had managed either platinum grim or armor sebek that would've decided it for me for collection reasons but NO#the pulls have just been an unmitigated disaster all around#the way this has been going i'm going to go all in on one of them and come out with yet another dorm trey#and then five minutes later they'll announce white rabbit rerun with froufrou fluffy bunnies leona and malleus#truly...f2p mobage is suffering#i had also kinda been thinking if i didn't get anything i might buy that malleus figure once it went up for preorder...#(i do not allow myself to spend money on gacha because. i know myself. but i will buy ALL the overpriced merch)#i forgot just how STUPID overpriced those figures are though#it is a really nice figure though...and it'll only be worse on the secondhand market...#i mustn't. i won't. but also.#hey twst feel free to make this up to me by giving me that fluffy bunny malleus after all okay

1K notes

·

View notes

Text

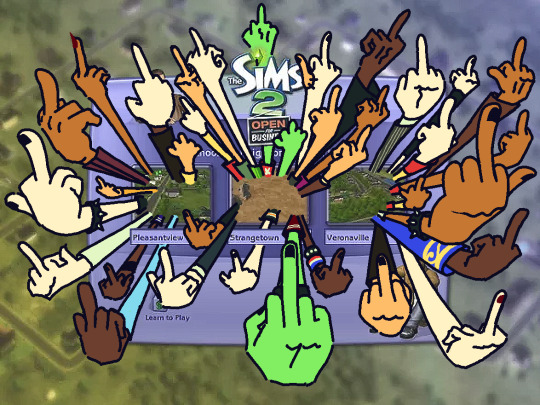

Wsg EA, I hope you know that after all of this recent DMCA and cash grab bs, all of the silly digital people living in your game would react like this (^_^)

#fuck ea#all my homies hate The Sims 2 L*gacy Collection#so do the premades#forget vent art this is HATE art#stop giving those greedy fucks your money i beg#the sims 2#ts2#sims 2#ts2 simblr#ts2 fanart#shitpost#skr1bbls

1K notes

·

View notes

Text

Paying consumer debts is basically optional in the United States

The vast majority of America's debt collection targets $500-2,000 credit card debts. It is a filthy business, operated by lawless firms who hire unskilled workers drawn from the same economic background as their targets, who routinely and grotesquely flout the law, but only when it comes to the people with the least ability to pay.

America has fairly robust laws to protect debtors from sleazy debt-collection practices, notably the Fair Debt Collection Practices Act (FDCPA), which has been on the books since 1978. The FDCPA puts strict limits on the conduct of debt collectors, and offers real remedies to debtors when they are abused.

But for FDPCA provisions to be honored, they must be understood. The people who collect these debts are almost entirely untrained. The people they collected the debts from are likewise in the dark. The only specialized expertise debt-collection firms concern themselves with are a series of gotcha tricks and semi-automated legal shenanigans that let them take money they don't deserve from people who can't afford to pay it.

There's no better person to explain this dynamic than Patrick McKenzie, a finance and technology expert whose Bits About Money newsletter is absolutely essential reading. No one breaks down the internal operations of the finance sector like McKenzie. His latest edition, "Credit card debt collection," is a fantastic read:

https://www.bitsaboutmoney.com/archive/the-waste-stream-of-consumer-finance/

McKenzie describes how a debt collector who mistook him for a different PJ McKenzie and tried to shake him down for a couple hundred bucks, and how this launched him into a life as a volunteer advocate for debtors who were less equipped to defend themselves from collectors than he was.

McKenzie's conclusion is that "paying consumer debts is basically optional in the United States." If you stand on your rights (which requires that you know your rights), then you will quickly discover that debt collectors don't have – and can't get – the documentation needed to collect on whatever debts they think you owe (even if you really owe them).

The credit card companies are fully aware of this, and bank (literally) on the fact that "the vast majority of consumers, including those with the socioeconomic wherewithal to walk away from their debts, feel themselves morally bound and pay as agreed."

If you find yourself on the business end of a debt collector's harassment campaign, you can generally make it end simply by "carefully sending a series of letters invoking [your] rights under the FDCPA." The debt collector who receives these letters will have bought your debt at five cents on the dollar, and will simply write it off.

By contrast, the mere act of paying anything marks you out as substantially more likely to pay than nearly everyone else on their hit-list. Paying anything doesn't trigger forbearance, it invites a flood of harassing calls and letters, because you've demonstrated that you can be coerced into paying.

But while learning FDCPA rules isn't overly difficult, it's also beyond the wherewithal of the most distressed debtors (and people falsely accused of being debtors). McKenzie recounts that many of the people he helped were living under chaotic circumstances that put seemingly simple things "like writing letters and counting to 30 days" beyond their needs.

This means that the people best able to defend themselves against illegal shakedowns are less likely to be targeted. Instead, debt collectors husband their resources so they can use them "to do abusive and frequently illegal shakedowns of the people the legislation was meant to benefit."

Here's how this debt market works. If you become delinquent in meeting your credit card payments ("delinquent" has a flexible meaning that varies with each issuer), then your debt will be sold to a collector. It is packaged in part of a large spreadsheet – a CSV file – and likely sold to one of 10 large firms that control 75% of the industry.

The "mom and pops" who have the other quarter of the industry might also get your debt, but it's more likely that they'll buy it as a kind of tailings from one of the big guys, who package up the debts they couldn't collect on and sell them at even deeper discounts.

The people who make the calls are often barely better off than the people they're calling. They're minimally trained and required to work at a breakneck pace. Employee turnover is 75-100% annually: imagine the worst call center job in the world, and then make it worse, and make "success" into a moral injury, and you've got the debt-collector rank-and-file.

To improve the yield on this awful process, debt collection companies start by purging these spreadsheets of likely duds: dead people, people with very low credit-scores, and people who appear on a list of debtors who know their rights and are likely to stand on them (that's right, merely insisting on your rights can ensure that the entire debt-collection industry leaves you alone, forever).

The FDPCA gives you rights: for example, you have the right to verify the debt and see the contract you signed when you took it on. The debt collector who calls you almost certainly does not have that contract and can't get it. Your original lender might, but they stopped caring about your debt the minute they sold it to a debt-collector. Their own IT systems are baling-wire-and-spit Rube Goldberg machines that glue together the wheezing computers of all the companies they've bought over the last 25 years. Retrieving your paperwork is a nontrivial task, and the lender doesn't have any reason to perform it.

Debt collectors are bottom feeders. They are buying delinquent debts at 5 cents on the dollar and hoping to recover 8 percent of them; at 7 percent, they're losing money. They aren't "large, nationally scaled, hypercompetent operators" – they're shoestring operations that can only be viable if they hire unskilled workers and fail to train them.

They are subject to automatic damages for illegal behavior, but they still break the law all the time. As McKenzie writes, a debt collector will "commit three federal torts in a few minutes of talking to a debtor then follow up with a confirmation of the same in writing." A statement like "if you don’t pay me I will sue you and then Immigration will take notice of that and yank your green card" makes the requisite three violations: a false threat of legal action, a false statement of affiliation with a federal agency, and "a false alleged consequence for debt nonpayment not provided for in law."

If you know this, you can likely end the process right there. If you don't, buckle in. The one area that debt collectors invest heavily in is the automation that allows them to engage in high-intensity harassment. They use "predictive dialers" to make multiple calls at once, only connecting the collector to the calls that pick up. They will call you repeatedly. They'll call your family, something they're legally prohibited from doing except to get your contact info, but they'll do it anyway, betting that you'll scrape up $250 to keep them from harassing your mother.

These dialing systems are far better organized than any of the company's record keeping about what you owe. A company may sell your debt on and fail to keep track of it, with the effect that multiple collectors will call you about the same debt, and even paying off one of them will not stop the other.

Talking to these people is a bad idea, because the one area where collectors get sophisticated training is in emptying your bank account. If you consent to a "payment plan," they will use your account and routing info to start whacking your bank account, and your bank will let them do it, because the one part of your conversation they reliably record is this payment plan rigamarole. Sending a check won't help – they'll use the account info on the front of your check to undertake "demand debits" from your account, and backstop it with that recorded call.

Any agreement on your part to get on a payment plan transforms the old, low-value debt you incurred with your credit card into a brand new, high value debt that you owe to the bill collector. There's a good chance they'll sell this debt to another collector and take the lump sum – and then the new collector will commence a fresh round of harassment.

McKenzie says you should never talk to a debt collector. Make them put everything in writing. They are almost certain to lie to you and violate your rights, and a written record will help you prove it later. What's more, debt collection agencies just don't have the capacity or competence to engage in written correspondence. Tell them to put it in writing and there's a good chance they'll just give up and move on, hunting softer targets.

One other thing debt collectors due is robo-sue their targets, bulk-filing boilerplate suits against debtors, real and imaginary. If you don't show up for court (which is what usually happens), they'll get a default judgment, and with it, the legal right to raid your bank account and your paycheck. That, in turn, is an asset that, once again, the debt collector can sell to an even scummier bottom-feeder, pocketing a lump sum.

McKenzie doesn't know what will fix this. But Michael Hudson, a renowned scholar of the debt practices of antiquity, has some ideas. Hudson has written eloquently and persuasively about the longstanding practice of jubilee, in which all debts were periodically wiped clean (say, whenever a new king took the throne, or once per generation):

https://pluralistic.net/2020/03/24/grandparents-optional-party/#jubilee

Hudson's core maxim is that "debt's that can't be paid won't be paid." The productive economy will have need for credit to secure the inputs to their processes. Farmers need to borrow every year for labor, seed and fertilizer. If all goes according to plan, the producer pays off the lender after the production is done and the goods are sold.

But even the most competent producer will eventually find themselves unable to pay. The best-prepared farmer can't save every harvest from blight, hailstorms or fire. When the producer can't pay the creditor, they go a little deeper into debt. That debt accumulates, getting worse with interest and with each bad beat.

Run this process long enough and the entire productive economy will be captive to lenders, who will be able to direct production for follies and fripperies. Farmers stop producing the food the people need so they can devote their land to ornamental flowers for creditors' tables. Left to themselves, credit markets produce hereditary castes of lenders and debtors, with lenders exercising ever-more power over debtors.

This is socially destabilizing; you can feel it in McKenzie's eloquent, barely controlled rage at the hopeless structural knot that produces the abusive and predatory debt industry. Hudson's claim is that the rulers of antiquity knew this – and that we forgot it. Jubilee was key to producing long term political stability. Take away Jubilee and civilizations collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Debts that can't be paid won't be paid. Debt collectors know this. It's irrefutable. The point of debt markets isn't to ensure that debts are discharged – it's to ensure that every penny the hereditary debtor class has is transferred to the creditor class, at the hands of their fellow debtors.

In her 2021 Paris Review article "America's Dead Souls," Molly McGhee gives a haunting, wrenching account of the debts her parents incurred and the harassment they endured:

https://www.theparisreview.org/blog/2021/05/17/americas-dead-souls/

After I published on it, many readers wrote in disbelief, insisting that the debt collection practices McGhee described were illegal:

https://pluralistic.net/2021/05/19/zombie-debt/#damnation

And they are illegal. But debt collection is a trade founded on lawlessness, and its core competence is to identify and target people who can't invoke the law in their own defense.

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” today (Aug 12) at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

#pluralistic#jubilee#debts that cant be paid wont be paid#Patrick McKenzie#patio11#bits about money#debt#debt collection#do not pay#bottom feeders#Fair Debt Collection Practices Act#fdcpa#finance#armbreakers

11K notes

·

View notes

Text

Export Management Company

An export management company (EMC) is a firm that assists enterprises in exporting their goods or services. They provide a wide range of services, including market research, product creation, packing, shipping, paperwork, customs clearance, money collection, and customer service. EMCs may assist organizations in navigating the difficult exporting process and give crucial guidance and support. They may also assist organizations in entering new markets and reducing risk. . .

#ximpex#export#ximpexindia#market research#product creation#packing#shipping#paperwork#customs clearance#money collection#customer service#india#exportfromindia#growwithximpex#internationaltrade#foreigntrade#exporteasy#exportgoods#exporter#exportbusiness

0 notes

Text

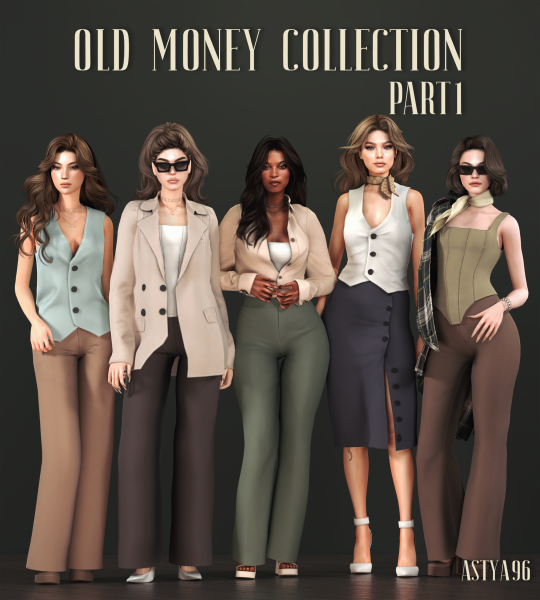

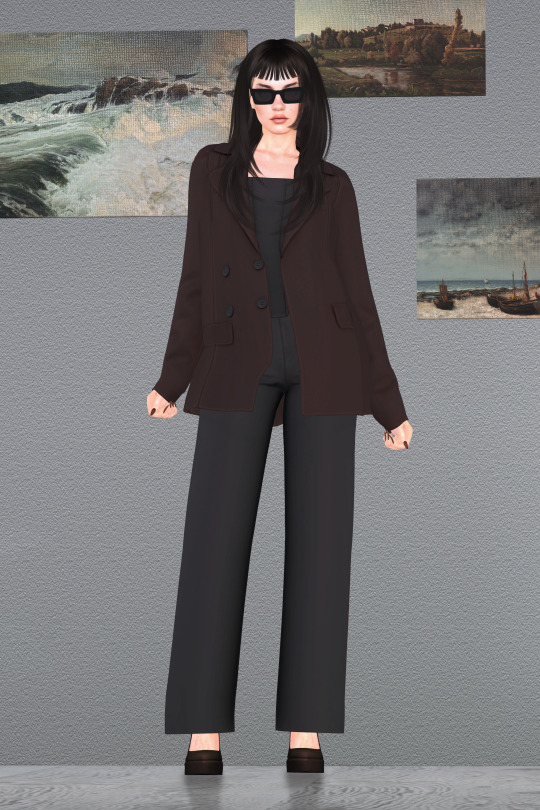

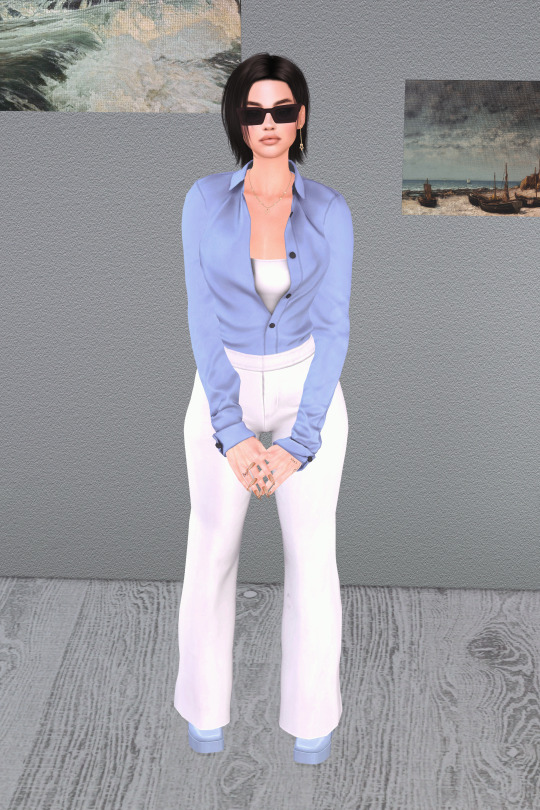

Old Money Collection pt.1 | August 2023 Collection

vest 01

56 swatches

new mesh

custom thumbnails

HQ compatible

top category

teen - elder

all morphs

thepancake1 slider compatible

vest 02

56 swatches

new mesh

custom thumbnails

HQ compatible

top category

teen - elder

all morphs

thepancake1 slider compatible

corset 01

56 swatches

new mesh

custom thumbnails

HQ compatible

top category

teen - elder

all morphs

thepancake1 slider compatible

jacket 01

56 swatches

new mesh

custom thumbnails

HQ compatible

top category

teen - elder

all morphs

thepancake1 slider compatible

shirt low\high waist

56 swatches

new mesh

custom thumbnails

HQ compatible

top category

teen - elder

all morphs

thepancake1 slider compatible

midi skirt 01

56 swatches

new mesh

custom thumbnails

HQ compatible

bottom category

teen - elder

all morphs

thepancake1 slider compatible

pants 01

56 swatches

new mesh

custom thumbnails

HQ compatible

bottom category

teen - elder

all morphs

thepancake1 slider compatible

pants 02

56 swatches

new mesh

custom thumbnails

HQ compatible

bottom category

teen - elder

all morphs

thepancake1 slider compatible

glasses 01

14 swatches

new mesh

custom thumbnails

HQ compatible

glasses category

teen - elder

all morphs

thepancake1 slider compatible

Download: Early Access at Boosty or Patreon

(Public access in September 20)

#s4cc#sims 4#ts4cc#sims 4 cc#s4acc#s4top#s4bottom#august collection#the sims 4 cc#the sims 4 custom content#s4 cc#ts4 cc#astya96#old money

7K notes

·

View notes

Text

they’re playing mermaids

in the public fountain 😁

#Charles convinced them to have a bonding moment#am i allowed to mention the siren Erik au 👀#they’re competing for who swims like a mermaid the best#they’re collecting all the wish money as they go#wtf am i gonna do today#cherik#erik lehnsherr#hank mccoy#magneto#x men#wish does not shut up

630 notes

·

View notes

Text

0 notes

Text

pelican town, ‘72

#stardew valley#stardew valley spoilers#sdv#sdv spoilers#grandpa#mister qi#mr. qi#idk how dates work in stardew universe im just bullshittin#i love qi’s huge fucking eyebrows you dont notice them at first but theyre there#(gives our collective grandpa a ponytail) i think he had one. whatever#’why isnt mister qi blue’ my hc is he is blue from long-term iridium supplementation#and was originally just a regular person#but also it’s nice to see ur fav be like a normal human color#if u read tag essays tho consider this:#qi discovers secret to immortality (consuming iridium in a specific manner)#wants to share discovery with his farmer (player’s grandpa) and in that way. they will have all the time in the world to build#a perfect farming/business empire whose legacy will last forever and ever and theyll be 2gether forever#but it turns out. like a lot of normal people would. his farmer does not want to live forever#and obv he doesn’t#in an attempt to try not to ever lose the thing that means more to him than anything else in the world. qi inadvertantly ensures he will#because his farmer is dead. and he’s going to live forever#but. it’s kind of ok. because he has infinite money and was able to figure out how to talk to his dead bf#and now YOU help them fulfill their joint goal of making the farm’s legacy last forever#smile. heart#sobbing

1K notes

·

View notes

Text

Danny had been around Gotham for a while.

The crime was never ending, but since Batman's arrival, it had gotten better.

The unmistakably CLANK! From around the corner had him jump, wary now. The man walks around the wall, eyes on the black car with— with Batman's symbol at the front.

A child sitting on the ground with a car tire next to him, the Bat Symbol a stark contrast to the shadows.

"Shit, kid. You're bold to rob Batman." Danny didn't really realise he was speaking until the kid looks up, spooked.

"What the fuck?" The kid was clearly of Gotham breed, yelps with a glare.

"I'm impressed," Danny doesn't give the kid the chance to talk, not with the way the tiny terror seems to be glaring and holding his wrench.

"You're quick, got eyes for details and know how to work around cars."

The suspicion in the kids eyes didn't lessen, having gotten up to press himself against the wall, eyes never leaving Danny.

"Here," Our local spook threw a card on the hood of the car. It was his business card.

"If you need income with far fewer risks than stealing from Batman, call me."

He didn't really wait to see the kids reaction, just leaving, bot before shooting a look into the sky the kid clearly caught.

As danny left, the kid looked at the entrance of the alleyway, back to the car, and then to the card.

They had talked for too long. Jason had to leave now, lest Batman actually caught him.

With one last look to the tires and the car, he leaves eith a scowl.

Just barely missing the man with the cape.

#TAGS TIME#choose your fighter#Danny is either born around that time as Batman starts coming around#OR he choose that timeline to live in for now#he can always switch it up#think Dr. Emmett Brown from back to the future with the train#hes a scientist of sorts ig but also a engineer#like his parents alr#danny saw smth in jason and looked at his upringing#he offered him a job#mind you its mostly gathering the stuff he alr bought in shops in his name#jason collects them and brings them back#he gets paid GENEROUSLY like hes gen thinking dannys an idiot for giving away so much money#theyre found family#does danny know who jason todd is? no#he only knows the second robin died and came back#dcxdp#dpxdc#dp x dc crossover#fic prompt#writing prompt#dc x dp prompt#dc x dp#dp x dc#dp x dc prompt

913 notes

·

View notes

Text

Hot Toys!!! Is releasing!!!! Fives and Echo!!!!

(images screenshot from their instagram, pre-order link will be added in the replies once available)

EDIT:

Sideshow link to ARC Trooper Fives

Sideshow link to ARC Trooper Echo

#Arc Trooper Fives#Arc Trooper Echo#clone troopers#tcw#the clone wars#hot toys#sideshow collectibles#domino squad#501st legion#clone trooper#SCREAMING#there goes my non-existent moneys!!!#and their faces!!! look so good!!!#*side eyeing Hot Toys* oh so you CAN make realistic clones look young!!

610 notes

·

View notes

Text

Newest addition to the collection: Build-a-Bear Peter Rabbit🐰🥕

#they knew I was coming back to collecting BAB's and were like: We know how to get her to spend the money#peter rabbit#egl#alternative fashion#japanese fashion#beatrix potter#cottage#egl community#fashion#toycore#cottagecore#build a bear workshop#build a bear#bab#innocent world#angelic pretty#cute#cottage aesthetic#lolita fashion#my peter rabbit collection was already pretty elite#my post

192 notes

·

View notes

Text

New Daniel Ricciardo lore from his interview with Nargis magazine at the 2024 Azerbaijan GP

#what do you mean he's just one of the girlies crying on a plane 😭#the wine cork collection as a kid to winemaker is cuuute#careful with his money because he was driving for zilch in his first years in F1#daniel ricciardo#dr3#2024

178 notes

·

View notes