#mitigating investment risks

Explore tagged Tumblr posts

Text

3 Important Calculations Every Springfield Real Estate Investor Needs to Know

#Real estate investing#smart investment decisions#future cash flow#passive income#homeowners#investment properties#informed decisions#income goals#mitigating investment risks#right tools

0 notes

Text

How Portfolio Management Firms Add Value to Investors

Money symbolizes dreams, stability, and heritage; it is more than simply numbers on a screen. When investors encounter the intricacies of contemporary financial markets, Portfolio Management Firms become reliable advisors, converting impersonal market data into significant financial results.

The Development of Investment Knowledge

The days of merely purchasing stocks and bonds to manage investments are long gone. By providing advanced techniques that adjust to market conditions, wealth management firms have completely changed the way that money is created.

These firms leverage decades of collective experience, combining time-tested wisdom with cutting-edge analysis to navigate volatile markets.

The Strategic Difference

Investment Portfolio management stand out for a set of core competencies that few individual investors are able to emulate:

Risk Management Expertise

Professional portfolio managers employ sophisticated risk management tools and diversification techniques that protect wealth when the market gets turbulent. They create portfolios that balance the upside potential with the downside protection. Clients can therefore sleep soundly, irrespective of the market situation.

Market Intelligence Networks

Investment portfolio management teams maintain extensive networks of analysts, researchers, and industry experts. This collective intelligence helps identify opportunities before they become obvious to the general market, providing clients with a significant competitive edge.

Systematic Decision-Making

Emotional investing often leads to poor outcomes. A wealth management firm removes emotion from the equation, implementing disciplined investment processes based on empirical research rather than market sentiment or headlines.

Technology Integration

Portfolio management companies at the top level utilize advanced software and artificial intelligence to constantly monitor markets, capturing subtle patterns and opportunities that human analysis cannot pick up. Such an advantage in technology means more targeted portfolio adjustments and better risk management.

Personalization and Agility

Every investor comes with unique goals, constraints, and preferences. Portfolio management firms excel at creating tailored investment strategies that align perfectly with individual circumstances. Whether planning for retirement, funding education, or building generational wealth, these firms craft solutions that reflect each client’s specific situation.

The power of investment portfolio management is especially seen during life milestones. Mark inherited his family’s estate, and this came with difficult decisions on how to protect and expand it. His portfolio management firm crafted an all-encompassing strategy that was in line with what his family intended but also properly aligned with the state of the markets currently.

Beyond Traditional Investment Management

These new-generation portfolio management companies have left mere investment choices to their good judgment. Now they coordinate all kinds of tax professionals, estate planners, and the lot to keep your investment choices coherent with any long-term objective or financial goal for that matter.

For instance, a wealth management company might arrange portfolios to reduce tax liabilities without sacrificing performance. Such advanced strategies for wealth protection often prove to be highly valuable for high-net-worth individuals dealing with complicated tax situations.

Success Measurement

The real value of portfolio management firms goes beyond the raw investment returns. Their impact is reflected in the confidence that clients have in their financial future, the preservation of wealth from one generation to the next, and the achievement of personal financial goals.

Professional portfolio managers monitor not only performance metrics but also progress toward specific client objectives. A goals-based approach ensures that investment strategies remain aligned with what truly matters to each investor.

Making the Choice

Selecting a reputable portfolio management company is among the most crucial choices an investor will ever make. The top companies have a track record of successfully navigating a range of market conditions, are open and truthful about their programs and charges, and comprehend the needs of their clients.

A portfolio management company can offer the resources, experience, and methodical procedures that can significantly alter the trajectory of investment outcomes for an investor seeking to maximize his financial future. These companies are reliable partners in creating and safeguarding money for future generations in the increasingly complicated financial environment of today.

#portfolio management#financial goals#asset allocation#investment planning#risk management#market analysis#investment strategy#diversification#wealth management#portfolio optimization#growth opportunities#financial stability#investment returns#financial planning#risk mitigation#portfolio rebalancing#investment advice#expert guidance#asset management#strategic investments

0 notes

Text

Boost Your Career with an Online PGDBA in Finance Management

Staying ahead of the curve is crucial in today’s competitive job market. Whether you’re a recent graduate looking to enhance your skills or a working professional aiming to climb the corporate ladder, an online postgraduate diploma in business administration (PGDBA) could be your ticket to success. Specifically, a PGDBA in Finance Management offers a unique blend of business acumen and financial expertise that’s highly sought after in various industries.

#Online Post Graduate Diploma in Business Administration#PGDBA in Finance Management#online PGDBA#business administration#Financial Planning#business administration programs#online PGDBA programs#online PGDBA in Finance Management#Financial Planning and Analysis#Investment Management#Risk Assessment and Mitigation#Corporate Finance#Financial Markets and Institutions

0 notes

Text

Guidelines to The Mitigate Technology Investment Risk

Summary Mitigating technology investment risk is crucial for organizations looking to adopt new technologies while minimizing potential financial losses and negative impacts. Key strategies include: Assessing technology compatibility with existing systems Focusing on scalability and security Conducting proof of concept tests Seeking expert consultation Additionally, having a flexible exit…

0 notes

Text

Expert Investment Management for Growth and Protection | Wills & Trusts Wealth

Maximise your savings and investments with bespoke portfolio management from Wills & Trusts Wealth. Our expert team tailors strategies to your financial goals, balancing growth with risk minimisation and inheritance tax mitigation. Trust our experienced professionals to protect your future. Contact us today.

#investment management UK#risk minimisation#inheritance tax mitigation#UK investments#wealth protection UK#investment strategy#Wills & Trusts Wealth Management#wealth growth#personalised investment advice UK

0 notes

Text

The Origins of Hedge Funds: Hedging Investments to Mitigate Risk

Written by Delvin When delving into the realm of finance, the term “hedge fund” often emerges, carrying a certain mystique and allure. But what lies at the heart of this enigmatic term? To truly grasp the essence of hedge funds, one must delve into the origins of the practice of “hedging” investments as a means to mitigate risk and enhance returns. The concept of hedging, as applied in the…

View On WordPress

#dailyprompt#Financial#Financial Literacy#knowledge#money#Money Fun Facts#The Origins of Hedge Funds: Hedging Investments to Mitigate Risk

0 notes

Text

Market Entry Tactics: Breaking into the Indian Consumer Market

Breaking into the Indian consumer market requires more than just a plan—it demands a strategic approach that acknowledges the diverse nature of the market. In this guide, we delve into effective market entry tactics, shedding light on how partnering with Fox&Angel can be a game-changer for businesses aiming to establish a strong foothold in the dynamic Indian consumer landscape.

Comprehensive Market Research When it comes to India's diverse demographics, the landscape is vast and varied. Fox&Angel's research team specializes in providing in-depth demographic insights. This expertise becomes your guiding light, helping businesses pinpoint and target specific consumer segments based on factors such as age, income levels, and cultural preferences.

Demographic Insights Fox&Angel's researchers delve into the intricacies of India's demographics, allowing businesses to go beyond the surface. With a keen understanding of the population's diversity, you can tailor your strategies to resonate effectively with your target audience, ensuring a more personalized and impactful market approach.

Competitor Analysis In the competitive Indian market, knowledge is power. Fox&Angel's market intelligence services equip businesses with a comprehensive view of the competitive landscape. By gaining insights into key players, market share, and consumer preferences, businesses are strategically empowered. This advantage becomes instrumental in shaping a well-informed market entry strategy that positions your brand for success.

Market Intelligence Services Fox&Angel's market intelligence services go beyond the surface, offering businesses a deep dive into the intricacies of the Indian market. With a focus on demographics and competitor analysis, their insights serve as a valuable tool for businesses looking to make informed decisions and gain a competitive edge in the dynamic landscape of India's consumer market.

Localization Strategies

Cultural Sensitivity When venturing into the Indian market, cultural sensitivity is key. Fox&Angel's local expertise becomes a valuable asset for businesses, aiding in the adaptation of products or services to align seamlessly with cultural nuances. Understanding and respecting local customs, languages, and traditions are integral components of the guidance provided by Fox&Angel.

Regional Customization India's diversity extends beyond culture; it's also reflected in regional variations. Fox&Angel's regional market experts play a crucial role in assisting businesses with the customization of strategies based on these variations. This approach ensures a more targeted and effective market entry, acknowledging and catering to the diverse consumer behaviors prevalent in different parts of India.

E-commerce and Digital Presence

Online Retail Boom In the era of digital dominance, Fox&Angel's market research plays a pivotal role in identifying the key online platforms that resonate with Indian consumers. Armed with this knowledge, businesses can confidently establish a robust e-commerce presence. This strategic move not only expands their reach but also enhances visibility in the thriving online retail space.Online Presence and E-commerce With the rise of digital usage in India, having a strong online presence is a must. Fox&Angel can guide you on how to invest wisely in e-commerce platforms and digital marketing, ensuring your brand reaches a wider audience. This advice is crucial for navigating the online landscape in India and making the most of the growing digital market.

Digital Marketing Strategies Fox&Angel's insights extend beyond market research; they encompass the dynamic realm of digital trends. Businesses, guided by Fox&Angel, can craft effective digital marketing strategies that leverage the power of online channels. From engaging social media campaigns to impactful influencer collaborations, Fox&Angel ensures businesses make a mark in the digital sphere, creating strong brand awareness and connecting with the tech-savvy Indian audience.

Strategic Partnerships and Alliances

Local Distributors and Retailers Fox&Angel's extensive network includes connections with local distributors and retailers. Partnering with Fox&Angel facilitates efficient distribution networks, ensuring products are accessible and available throughout the country. This strategic alliance ensures that your products are not just accessible but readily available throughout the country, streamlining the logistical aspects of your market presence.

Collaborations with Indian Brands Fox&Angel doesn't just connect businesses; it facilitates meaningful collaborations. Through their network, they can pave the way for partnerships with established Indian brands. This collaboration goes beyond a business alliance; it lends credibility to your market entry. Trust is built among consumers, and new market segments open up, presenting additional avenues for growth and success.

Regulatory Compliance and Adaptation

Regulatory Understanding Entering the Indian consumer market involves traversing a complex regulatory landscape. Fox&Angel's legal experts step in to guide businesses through this intricate journey. Their expertise ensures that businesses not only understand but also comply with local laws and regulations—a critical step facilitated seamlessly by Fox&Angel's advisory services.

Adaptability to Local Preferences Consumer preferences in India are dynamic, and regulatory changes are part of the landscape. Fox&Angel's market analysts are on the pulse, continually monitoring both. This vigilance ensures that businesses stay adaptable, ready to modify their products or services based on evolving market demands and compliance requirements. With Fox&Angel, adaptability becomes a key strength in navigating the ever-changing market dynamics.

Conclusion: n conclusion, successfully entering the Indian consumer market requires more than just ambition—it demands a strategic and well-informed approach. Fox&Angel emerges as a key player in this journey, offering comprehensive services that cover every aspect of market entry. From in-depth market research to forging strategic partnerships, crafting effective digital marketing strategies, and ensuring regulatory compliance, Fox&Angel is the go-to partner for businesses aiming to thrive in the diverse and dynamic Indian market. Leveraging Fox&Angel's expertise becomes not just a strategic move but a transformative one, allowing businesses to navigate complexities, seize opportunities, and establish a robust and sustainable presence in the burgeoning Indian consumer landscape.

This post was originally published on: Foxnangel

#business expansion in India#Indian market entry#Fox&Angel guide#market research#legal considerations#investment options#marketing strategies#risk mitigation#long-term sustainability#US businesses in India#Fox&Angel expert guidance

0 notes

Text

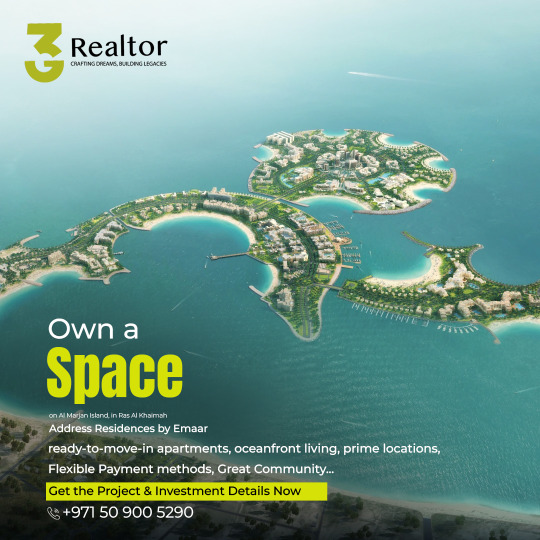

#Unlock your path to prosperity with the best real estate investment opportunities in the UAE! 🏡 Explore strategic property investments in Du#property valuation#and portfolio management services for profitable ventures. 💰 Discover the best residential and commercial real estate investments#guided by the top 10 investment planning strategies. 📊 Mitigate risks with our expert risk assessment in property investments. 🛡️ Explore r#RealEstateInvestment#PropertyConsultants#InvestmentAdvisors#RealtyExperts#StrategicInvestments#ProfitableVentures#InvestmentOpportunities#ResidentialInvestments#CommercialRealEstate#MarketAnalysis#PropertyValuation#PortfolioManagement#InvestmentPlanning#RiskAssessment#WealthBuilding#RentalProperty#MarketTrends#AssetGrowth#PropertyDevelopment#InvestmentStrategies#DubaiRealEstate#UAERealty 🌟

1 note

·

View note

Text

Signs of Recession

In the complex world of economics, recessions are inevitable yet challenging events that can have far-reaching consequences on individuals, businesses, and entire nations. Recognizing the signs of an impending recession is crucial for making informed decisions and mitigating potential risks. In this blog post, we will delve into the key indicators and signals that economists and policymakers…

View On WordPress

#Business investment#Consumer debt#Consumer spending#Economic cycle#Economic downturn#Economic health#Economic Indicators#Financial Markets#GDP growth#Housing market#Investor sentiment#Mitigating risks#Proactive measures#Recession#Recovery#Resilient future#Stock market performance#Unemployment rates#Yield curve#Yield curve inversion

0 notes

Text

#realestate#finance#investing#financialmanagement#personal development#financialdecisions#self growth#financial intelligence#real estate investing#wordpress#dailyprompt#investors#risk mitigation#risk management#blogging

1 note

·

View note

Text

A Deep Dive into Systematic Investment Plan

Are you looking for a smart and hassle-free way to invest your hard-earned money? Enter the world of Systematic Investment Plans (SIPs). In this blog, we'll unravel the intricacies of SIPs and why they deserve your attention.

Understanding SIPs

A Systematic Investment Plan, often abbreviated as SIP, is a disciplined approach to investing in mutual funds. It's like your financial fitness regime, where you invest a fixed amount at regular intervals, typically monthly. What makes SIPs attractive is their simplicity and accessibility. You don't need a massive lump sum to get started; even small, periodic investments can potentially yield substantial returns over time.

Also Read: The Importance of Financial Literacy Education in Schools

The Power of Compounding

The magic behind SIPs lies in the power of compounding. Your investments grow not only on the principal amount but also on the accumulated interest. Over the long term, this compounding effect can significantly boost your wealth. SIPs allow you to harness this power effortlessly.

Risk Mitigation

Investing always comes with some degree of risk, but SIPs help in spreading that risk. Since you invest a fixed amount regularly, you buy more units when the market is down and fewer when it's up. This strategy, known as rupee cost averaging, reduces the impact of market volatility on your investments.

Flexibility and Convenience

SIPs offer flexibility to suit your financial goals. You can increase or decrease your investment amount as your income fluctuates. Additionally, many mutual funds offer SIP calculators, making it easy to determine how much to invest to achieve your financial objectives.

Tax Benefits

SIPs also come with tax benefits. Investments in equity-linked SIPs are eligible for long-term capital gains tax benefits after holding them for a minimum period. This can lead to substantial tax savings, enhancing your overall returns.

Also Read: The Role of Bots, Assistants, AIs in Customer Communication

Conclusion

In a world where financial decisions can be overwhelming, SIPs stand out as a practical and effective way to grow your wealth. They empower you to start investing with minimal effort and offer the potential for long-term financial security. Consider SIPs as your partner on the journey to financial success.

0 notes

Text

Navigating Financial Challenges: A Case Study on Overcoming Debt Amidst Economic Uncertainty

In the following case study, we explore the experiences of an individual who, despite initially building substantial credit, faced unexpected financial difficulties during the 2008-2009 recession. We examine the available options for addressing a $60,000 debt and consider the implications of various choices. Additionally, we discuss prudent saving strategies and investment possibilities for…

View On WordPress

#Consultation#Credit Management#Debt Management#Economic Uncertainty#Financial Challenges#Financial Consultant#Financial Decisions#Financial Planning#Investment Strategies#Ontario#Personalized Advice#Privacy Matters#Risk Mitigation#Toronto#Wealth Accumulation

0 notes

Text

The Role of Portfolio Management Firms in Wealth Creation

It involves more than earning and saving money to acquire and preserve sustainable wealth. Many winning investors start with comprehending how portfolio management firms make investment strategies operationalized, eventually creating tangible opportunities to develop and accumulate wealth.

Know How Portfolio Management Companies Function as the Foundation for Strategic Investment

Portfolio management firms are specialized financial institutions which undertake the obligation of making decisions about investment for individuals and companies. These firms operate under the management of professionals who scan the complex financial markets for strategic investment decisions in relation to the client's financial goals. Equipped with advanced analytical tools and profound market insights, the firms create customized strategies that enhance return but manage risk efficiency.

Portfolio Management Services in India: A Booming Financial Ecosystem

Indian finance has seen great evolution, and the portfolios have become a key participant in wealth creation. This operates under a sound, regulated framework supervised by SEBI for high-net-worth individuals and institutional investors looking for professional experience for portfolio management services in India.

Sophisticating the markets, Indian markets increase demand in specialized investment management. Among the top portfolio management services, service offerings of these companies had to meet global standards in addition to local market dynamics, ensuring that investors benefit from wide range diversity, across multiple classes of asset.

Key Service Portfolio: Enabling Wealth Generation

Strategic Asset Allocation

Expert portfolio managers create customized asset allocations based on comprehensive market analyses and specific client goals. This approach systematically ensures optimum investment distribution across different classes of assets, thereby limiting risk and maximizing potential gains.

Risk Reduction and Management

In order to protect investment positions from market volatility, professional portfolio management involves ongoing monitoring and modification. These businesses use advanced risk assessment and hedging technologies to protect their clients' capital in volatile market conditions.

Research-Based Investment Decisions

Leading portfolio management firms have in-house research teams who study market trends, economic indicators, and individual stocks. This research-based approach will enable them to make appropriate decisions and find the best investments before they become popular among other investors.

The Competitive Advantage of Professional Portfolio Management

Personalized Investment Solutions: Each client gets specific attention with tailored investment solutions according to specific financial goals, risk tolerance, and time horizons.

Market Expertise and Timing: Professional managers have expertise in identifying the entry and exit points in several markets that will allow them to capitalize on opportunities while trying to avoid potential losses.

The Advantages of Diversification: By providing diversified investment portfolios across various asset classes, industries, and regions, portfolio management firms enable risk management.

Use of Technology: The use of sophisticated technological instruments aids modern portfolio management companies to monitor portfolios, measure risk, and analyze performance, which enables efficient management of the investments for clients.

Selection or Choosing a Portfolio Management Company

Portfolio management companies have to be selected based on these factors:

Past Performance and Track Record: Analysis of historical performance through cycles of the market will allow insight into the capability of a firm to generate returns consistently.

Regulatory Compliance: That the firm operates strictly by the requirements and keeps reporting transparent.

Investment Philosophy: Understanding of the investment approach of the firm must align with the personal financial objectives and the tolerance of risk.

Fee Structure: Cost-effectiveness of the services rendered, management fees and performance-linked incentives.

The Road Ahead: Maximizing Wealth Creation Potential

As financial markets get more complex, portfolio management companies are becoming more and more important in helping people reach their long-term wealth creation objectives. They offer the know-how, tools, and expert advice required to successfully negotiate erratic marketplaces and seize expansion prospects.

A relationship with reputable portfolio management companies may be the greatest approach for investors to organize their financial objectives if they want to build and maintain wealth. Investors can access advanced investment techniques, thorough risk management, and the knowledge required to make wise financial decisions by using professional portfolio management services.

Leveraging professional skills while maintaining a disciplined approach to long-term investments is the way of the future for wealth generation.

Portfolio management firms continue evolving, adapting their services as market dynamics and investor requirements change, making them integral partners in the journey toward financial success.

#Wealth creation#Portfolio firms#Investment growth#Asset management#Financial planning#Risk management#Diversification#Wealth building#Investment firms#Portfolio strategy#Financial advice#Long-term growth#Money management#Risk mitigation#Financial goals#Wealth management#Investment goals#Strategic planning#Return maximization#Capital growth.

1 note

·

View note

Text

Guidelines to The Mitigate Technology Investment Risk

Summary

Mitigating technology investment risk is crucial for organizations looking to adopt new technologies while minimizing potential financial losses and negative impacts. Key strategies include:

Assessing technology compatibility with existing systems

Focusing on scalability and security

Conducting proof of concept tests

Seeking expert consultation

Additionally, having a flexible exit strategy and ensuring regulatory compliance are essential steps in safeguarding investments. It will allow your business to make more informed decisions, optimize their technology investments, and achieve their long-term business goals while effectively managing risk.

Introduction

Investing in technology can be a high-reward venture, but it comes with its own set of risks. As the digital landscape evolves rapidly, investors must be vigilant and proactive in mitigating potential risks associated with technology investments.

Mitigating technology investment risk is crucial for both individuals and organizations venturing into the fast-paced world of tech. The technology sector is known for its high volatility, rapid innovation cycles, and the potential for significant returns, which equally comes with high risks.

Here's a comprehensive guide to help you navigate through the complexities of technology investment risk.

What Is Technology Investment Risk?

The risk of investing in technology is essentially an investor's returns deviating from expectations, which could result in financial loss. This type of risk is inherent in all investments, but it is particularly pronounced in the technology sector due to its fast-paced nature and constant innovation.

In the real-world businesses invest heavily in technology. They also try to protect their own sensitive data by all means. The data is vulnerable from attacks worldwide. In fact, losses from identity fraud in 2022 amount to $20 billion and affected 15.4 million U.S. adults. This is according to the 2023 Identity Fraud Study.

This sector encompasses a wide range of companies involved in the development, production, and distribution of technology products and services, including software, hardware, information technology (IT) services, and more. Given the rapid pace of innovation and change in this sector, investors face several unique risks:

Market Volatility

Obsolescence Risk

Regulatory and Legal Risks

High Valuations

Competition

Dependency on Key Personnel

Geopolitical and Economic Risks

Cybersecurity Risks

Types of Technology Investment Risk

Market Risk: Value of investments can potentially decrease because of changes in market conditions.

Regulatory Risk: The risk of facing legal penalties or operational disruptions due to non-compliance with relevant regulations.

Cybersecurity Risk: Breach of security leading to financial loss, disruption, or damage to the reputation of an organization.

Hacks: Hacking with malicious intent is bad news for any system. This can be because of phishing or malware attacks.

Data Breach: In the case where confidential information is accessed by unauthorised people there is the risk of it being used for a wide range of malicious tasks. This breach of data can be accidental or intentional.

Unsecure WI-FI: Accessing sensitive data while using an unsecured WI-FI connection in public increases the risk of breach of data.

Personal Devices: Using personal devices with lower levels of data encryption increases the chance of data theft and loss.

Strategies to Mitigate Technology Investment Risk

Diversification: Spread your investments across various technologies and sectors to minimize the impact of a single adverse event.

Due Diligence: Conduct thorough research on potential investment targets, including their regulatory track record and responsiveness to regulatory changes.

Technology Foresight: Stay informed about emerging technologies and their potential risks by investing in technology monitoring efforts.

Risk Management Techniques: Implement strategies such as investing in low-risk securities, setting realistic investment goals, and regularly monitoring investments.

Cybersecurity Measures: Invest in robust cybersecurity measures, regularly back up data, and train staff to recognize and mitigate security threats.

Legal and Financial Expertise: Engage with experts who can provide insights into the regulatory landscape and financial implications of technology investments.

Thorough Due Diligence: Make sure you or your team really understand the technology you're investing in. This means knowing how it works, its market potential, and its limitations.

Research the Company: Look into the company's financial health, its management team, market position, and competitive landscape. Analyzing its past performance can offer insights, but remember, in tech, future potential is critical.

Industry Analysis: Keep abreast of industry trends, emerging technologies, and regulatory landscapes. This can help anticipate shifts that might affect your investment.

Long-Term Perspective: Technology investments can be volatile in the short term but often offer substantial returns in the long run. Be prepared for ups and downs.

Stay Updated: Keeping track of technological advancements and market trends will help you make informed decisions about when to hold or sell.

Use Financial Safeguards: This can help limit potential losses by automatically selling an asset when it reaches a specific price.

Regularly Rebalance Your Portfolio: As some investments outperform others, your initial allocation can change. Rebalancing helps maintain your desired level of risk.

Benefits To Hire Remote Developers

Hire remote developers from Acquaint Softtech. We are a well-established firm in India with over 10 years of experience. We offer several strategic advantages that can help mitigate technology investment risks.

As businesses strive to innovate and stay competitive, the ability to adapt and manage investment risks efficiently becomes crucial. Trusting a software development outsourcing company like Acquaint Softtech will work in your favor. We have already developed over 5000 projects successfully for clients across the globe.

A fitting quote:

Success in creating AI would be the biggest event in human history. Unfortunately, it might also be the last, unless we learn how to avoid the risks. - Stephen Hawking

Here's how we can play a role in this context:

Cost Efficiency: We can significantly reduce the overhead associated with physical office spaces, utilities, and other resources.

Access to Global Talent: Hiring remotely removes geographical constraints, allowing companies to access our global talent pool. This makes it easier to find developers with the specific skill sets needed for a project.

High-Quality Candidates: With the ability to choose from a broader range of candidates, companies can maintain high standards in their hiring processes. This ensures they bring on individuals who can contribute effectively to their projects.

Round-the-Clock Work: Having developers in different time zones can expedite project timelines, as work can continue around the clock. This is particularly beneficial for tight deadlines and fast-paced development cycles.

Flexible Workforce: The ability to quickly adjust the size of the development team or its composition allows companies to respond agilely to project successes or downturns, keeping financial commitments aligned with current needs.

Enhanced Scalability: Remote developers can be quickly onboarded to ramp up project development efforts. This enables companies to scale their operations up or down with more agility than with traditional workforce. We also offer the option of IT staff augmentation.

Adaptability to Market Demands: Access to diverse set of skills and the ability to quickly pivot based on market feedback or technological advancements. This helps companies stay competitive and reduce the risk of obsolescence.

Focus on Core Competencies: Companies can outsource non-core activities, allowing them to focus on strategic areas such as product development, market expansion, and customer engagement.

Efficient Use of Internal Resources: Leveraging our remote developers for project-based work or specific development tasks can free up internal resources to focus on innovation and core business goals.

Acquaint Softtech offers a strategic advantage in mitigating technology investment risks by providing cost efficiency, access to a global talent pool, and increased productivity.

Conclusion

Investing in technology requires a blend of caution, knowledge, and courage. By conducting thorough research and diversifying your investments you can mitigate risks and position yourself for potential rewards.

Some of the other factors to consider include:

Maintaining a long-term perspective

Implementing financial safeguards

Seeking professional advice

Adopting an innovative mindset

Considering the ethical implications of your investments

Remember, while the past can offer insights, the tech sector’s nature is to innovate, making the future its most exciting aspect.

Navigating the intricacies of investing in technology can be challenging. However, with the right approach and resources, you can significantly reduce the associated risks and increase the likelihood of a successful investment outcome. Stay informed, stay secure, and diversify your portfolio to build a resilient investment strategy in the technology sector.

Risk mitigation for investing in technology requires a multifaceted approach that combines market knowledge, regulatory compliance, cybersecurity vigilance, and strategic planning. By employing these strategies, investors can better position themselves to capitalize on the opportunities that technology investments offer while minimizing potential downsides.

For more detailed strategies and personalized advice, consider consulting financial advisors who specialize in technology investments and can provide tailored solutions based on your specific needs and goals.

FAQ

What is technology investment risk?

Technology investment risk refers to the potential for financial loss or negative impact resulting from investing in technology solutions that fail to meet expectations, become obsolete, or incur unexpected costs.

Why is it important to mitigate technology investment risk?

Mitigating technology investment risk helps minimize financial losses, protect investments, and ensure that technology solutions align with business objectives and requirements.

What are some common technology investment risks?

Investing in immature or unproven technologies.

Failing to anticipate future scalability or compatibility issues.

Overlooking security vulnerabilities or regulatory compliance requirements.

Ignoring market trends or competitive threats.

How can I stay updated on technology investment best practices?

Follow industry publications, blogs, and forums.

Attend conferences, webinars, and networking events.

Seek guidance from industry experts and consultants.

Participate in training programs and workshops.

0 notes

Text

Testosterone, despite being a controlled substance, is easier to buy online than people think. If you can afford to, you could seek out where to buy it and stockpile some. You'd likely be buying from websites targeted towards bodybuilders.

Depending on where you are, it might be illegal to buy or to possess, or it might only be illegal on the seller's end. Either way, you can look into whether this is something trans people are actually arrested for where you are, to assess risk.

In most countries, buying T for personal use still isn't something you should expect significant legal consequences for. You can mitigate risks even further by never giving your personal info, ordering to somewhere other than your home, and using crypto or other payment methods (but even without these safety measures, don't let anyone make you believe this is a high risk activity when it's not).

Many of us commit small crimes on a daily basis, from streaming films to minor theft, knowing the risk of punishment is so minimal that we barely think about it. I need people to pick up a bit of that energy for DIY HRT, instead of being convinced it's impossible to access. This includes testosterone.

People who want to keep you from taking T are invested in making you believe you already can't access it, without doing the legwork to actually shut these vendors down yet. To convince you that you've already lost. If you're in a situation where you think access might be cut off soon, stockpiling is a possibility.

323 notes

·

View notes

Text

Review: “My Investing Journey and Learning” by Carmen Mundt

Qualifications: I’m a journalist reporting on business, economics, and defense who’s been in the industry for 7 years — the last 3 have been at, debatably, the #1 business publication in the world.

Rating: 2/5 stars

Thoughts: I cannot believe I spent 39 euros on this.

This 39 page ebook provides incredibly basic information that can all be found in this article.

First: while the ebook is about 40 pages, it probably has about 10 pages of actual information in it, interspersed with inspirational quotes from Sheryl Sandberg and Warren Buffet, with some pictures of Carmen in Monaco.

There’s about 1 page of “introduction” from Carmen that talks about her upbringing and journey to university in London. I won’t comment too much on her personal story, but an important thing to note is that she says she came from a “traditional Spanish household” where her father was the breadwinner and her mother had no access to family finances. After the 2008 crash, her family couldn’t afford to send her to college. She moved to London, applied for a student loan, and began studying finance at a university while working part time.

Carmen very, very briefly mentioned her regrets as to her mother’s inability to access higher education, work, and family financial planning; she says she’d never want to be in that position. While literally only one sentence, I think it makes it clear who the audience for this ebook is: someone who has absolutely, positively, no idea about money.

(She also very, very briefly mentions “big changes in her personal life” that made a full-time job in finance “not sustainable,” leading to her move to Monaco. This is her only reference to George.)

The rest of the book very simply explains how to make a budget, set financial goals, invest in the stock market, and mitigate risk. The information was kinda factually correct, and was written in a coherent manner. I think that’s the highest praise I can give it.

Here’s the thing: like other reviewers have called out, I am pretty certain that Carmen didn’t write anything besides the introduction. Whole sections (and indeed the entire format of the ebook) were clearly ripped from the Female Invest introductory courses. (I spent 3 hours clicking through each course so I could find direct wording comparisons to make this claim. I really wouldn’t recommend it.) I do think she edited these sections, and she interjected a few personal sentences; but I believe that’s where her involvement ended.

From an expert perspective, a lot of the information is so simplistic as to be almost incorrect. This isn’t a “first day of Econ 101” ebook — this is a “freshman year of high school home ec class” ebook. (Did anyone else’s home ec classes teach budgeting, or just me?)

Here’s an example. In a section on stocks, Carmen/Female Invest writes: “Investing in stocks allows you to support companies and causes you care about while still making a profit.”

On a basic level, this is correct. Purchasing a stock technically means you’re buying a little bit of a company, and I guess therefore supporting it. But unless a company is IPOing, you’re buying those stocks from another investor — which means your purchase has no effect on the company. So it’s a little disingenuous to claim you’re somehow helping the company. The ebook is rife with this kind of thing.

Carmen pushed in her advertising posts that the Female Invest courses were a key supplement to her book. So obviously, I had to do those too. And holy shit, they were so much worse than the ebook. Some parts were blatantly incorrect on basic information (they claim markets are open 24/7, when most are only open 9am-4:30pm on weekdays) and have some of the most patronizing metaphors I have ever read. (One of the most egregious was comparing your investment portfolio to a pizza because “stocks, bonds, and ETFs” make up different “sizes of slices to make a whole pie”. This isn’t even an accurate equivalent — maybe a calzone, pasta, and pizza make up a whole meal? I don’t even know.)

I would not recommend buying this ebook unless you, too, were barred from even thinking about a stock by your traditional father. Even then, consider free sources.

A Disclaimer on disclosures: So, after @ohblimeygeorge sent me a reddit post also reviewing Carmen’s book that mentioned ad disclosures, I decided to dive into the regulations. In the U.S., influential advertising is regulated by the FTC — in the EU, it’s regulated by the EU Commission, which I believe Carmen would qualify under since she is a Spanish citizen who lives in Monaco. First, I looked at this legal brief on content monetization business models, and concluded that that the ebook likely falls under “affiliate marketing” as Carmen likely receives a percentage of each ebook sold through her link.

(An additional disclaimer: obviously, I don’t know the details of the deal Carmen has with Female Invest, but I’d think it unlikely that she isn’t getting paid for their collaboration. She mentioned in an Instagram story under her Female Invest highlight that she “tried purchasing equity but they were already too big for what I could afford” but “did buy a bit of their crowdfunding.” Since she doesn’t have equity, i.e. doesn’t own a piece of the company, it’d be weird if she was doing this for free.)

Back on topic. I next looked at this legal brief on advertising disclosures. It states that affiliate marketing must be disclosed: “you need to make sure your audiences understand that it’s advertising.” Disclosures can include hashtags and “mentioning” advertising in the caption. Carmen has not disclosed advertising in any of her Female Invest posts, and appears to be violating this regulation. (Interestingly, her only posts that follow disclosure requirements are her Tommy posts.)

It’s apparently not uncommon. An EU Commission study showed 80% of influencers in the EU do not properly disclose ads.

So, there’s that too.

#I spent waaaaaay too long doing female invest courses for this#I was just horrified and couldn’t stop!!#my verdict#unfortunately#is that this IS the equivalent of a weight loss ebook peddled by an ig baddie#disappointing but I suppose unsurprising#happy to answer more questions if u message me!#george russell#carmen montero mundt#carmen mundt

162 notes

·

View notes