#Portfolio firms

Explore tagged Tumblr posts

Text

How to Evaluate Portfolio Management Firms For Effective Investment Portfolio Management

When a significant amount of money is at risk, choosing the right Investment portfolio mangement firms can be like negotiating a challenging maze. Even though a lot of investors begin by managing their own portfolios, there frequently comes a time at which expert knowledge becomes crucial. The key lies in selecting the right invesment Portfolio management firms to safeguard and grow your financial assets.

What to Look for in a Portfolio Management Company

Experience and Performance Record

Examine the company's past success in a variety of market scenarios in addition to the gaudy marketing collateral. Previous performance provides a very excellent indication of their investment philosophy and risk management skills, but it does not guarantee future outcomes. Request detailed performance reports spanning multiple market cycles, paying particular attention to how they handled market downturns.

Investment Philosophy and Process

Companies that top portfolio management services should have a plan that fits your risk tolerance and investing goals. Some firms invest primarily in value, while others primarily focus on growth or are simply passive management. Their process, decision-making framework, and risk management controls will ensure their approach suits your preferences.

Expertise and Team Composition

Review the credentials and experience of the investment team. Look for professionals who are certified with appropriate credentials such as CFA, CFP, or advanced degrees in finance. Stability of the team matters, too – a lot of turnover might indicate that something is amiss with the firm's culture or management.

Fee Structure and Transparency

Compare fee structures by different portfolio management firms, though the lowest fee is not the best choice; instead, compare transparency in calculations and services for fees. Compare the best possible portfolio management firms, which have higher fees to provide superior wealth management solutions with the rest.

Technology and Research Capabilities

High technology and research capabilities are required in modern investment portfolio management. Assess the firm's technological resources including its current portfolio management software, research capabilities, and client reporting systems. These systems should allow the firm to meet decisions made with assurance and to enhance the clients with timely communications.

Client Service and Communication

The best portfolio management firms should offer clear and consistent communication with the clients. They should keep regular reviews of portfolios, market updates, and prompt responses to queries. Ask for their typical client communications schedule and how they handle urgency matters or market volatility situations.

Regulatory Compliance and Security

Verify the company's registration with the relevant regulatory bodies and ask them to check their history of compliance. The top investment portfolio management service companies have excellent security measures that protect assets and sensitive information belonging to the clients. It is essential to know how they handle custody, secure insurance, and cybersecurity.

Making Your Choice

It requires proper analysis and consideration of factors while making a shortlist of potential portfolio management firms. Schedule meetings with different firms, prepare specific questions in relation to investment portfolio management procedures, and pay attention to how well they listen to your needs to see whether they are offering a customized solution rather than a one-size-fits-all approach.

Consider seeking sample portfolio reviews and communications with clients to be better aware of the quality of service. An established company managing professional portfolios should understand your financial situation, present their proposed strategy in layman's terms, and be well aware of your goals.

Watch Out for These Red Flags

Promise returns on investments that are unrealistic

Are evasive about fee structures

Cannot describe or explain their investment strategy

Not appropriately licensed and registered

Excessive regulatory violation or customer complaints

It's a very crucial decision that will give the chance to hand over your money to the portfolio management firms. Therefore, make enough due investigation for finding the best partnership for a good long term financial performance, as a perfect partnership has much impact on one's long run financial performance. Keep in mind that the business that best suits your needs may not be the biggest or most well-known; rather, it may be the one that most closely matches your investment philosophy, communication preferences, and financial objectives.

#portfolio firms#investment tips#top services#evaluate firms#asset growth#management tips#financial goals#firm selection#wealth planning#portfolio growth#investment guide#decision tips#compare firms#expert advice#asset managers#best services#money growth#smart investing#firm analysis#service quality

0 notes

Text

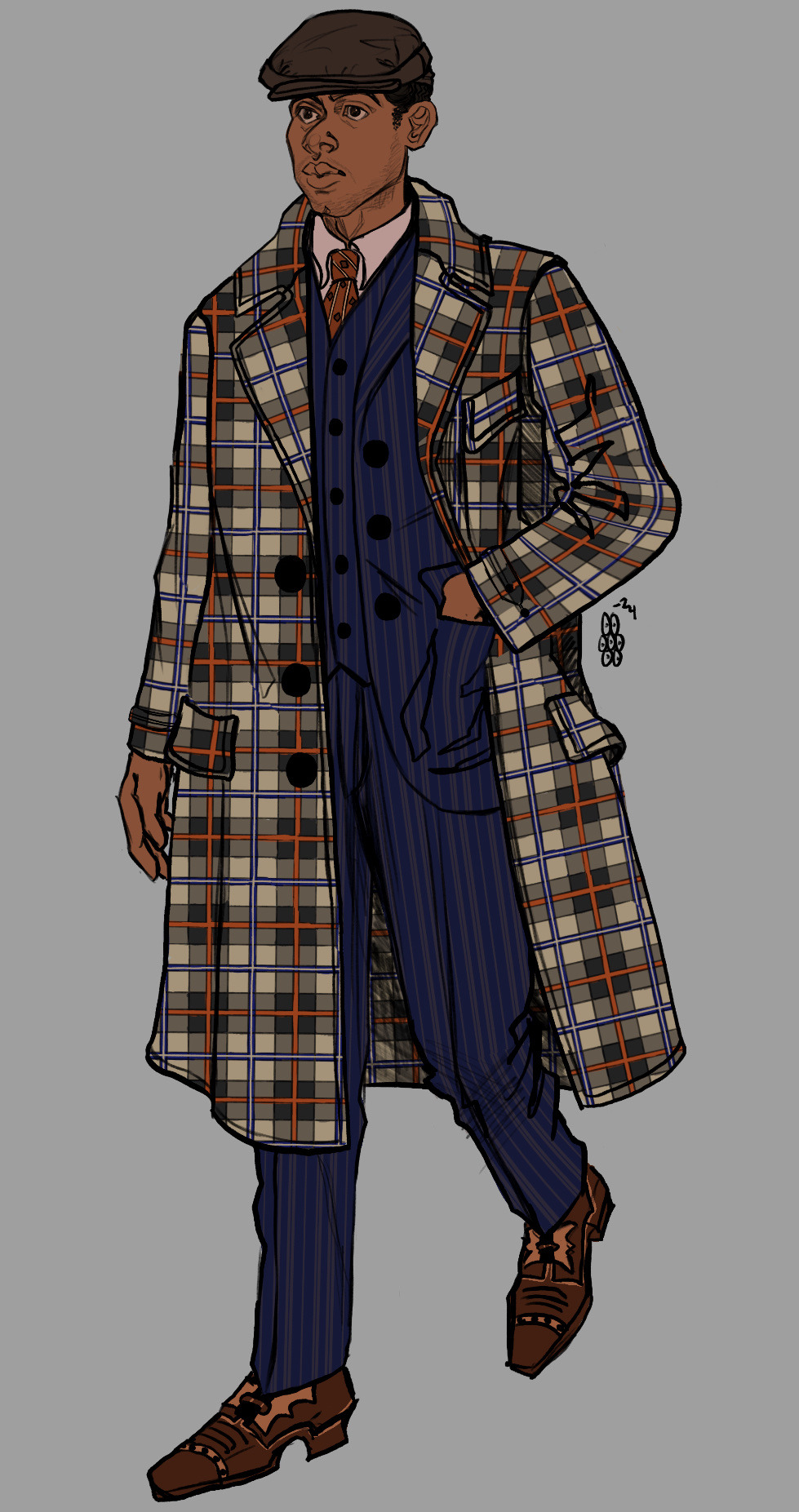

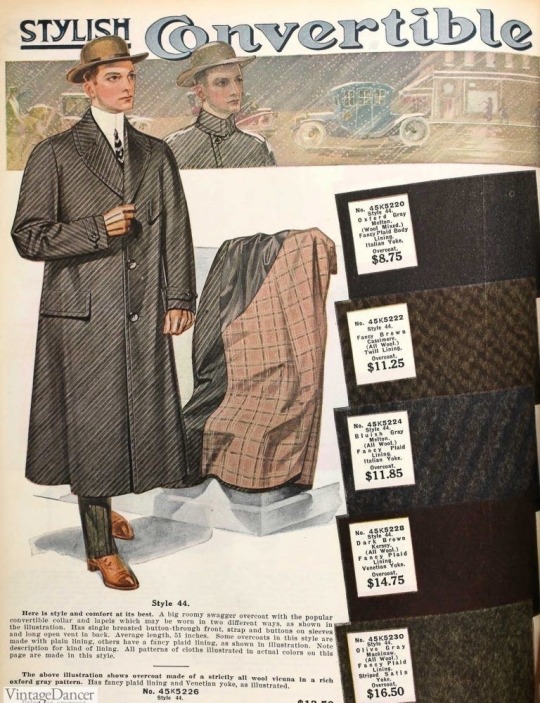

Hiii Lewie

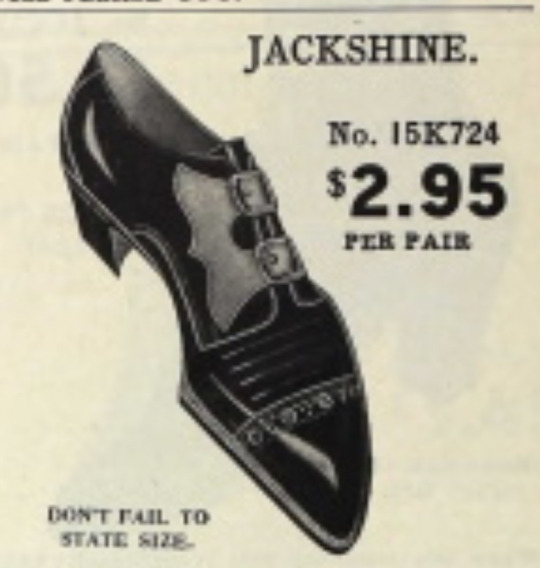

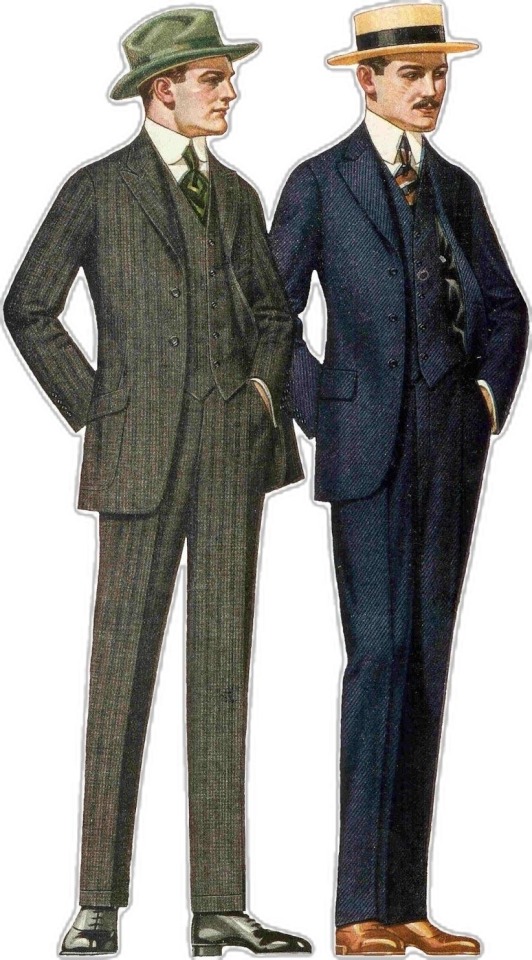

Special thanks to @transarmand for making these great GIFs, which were a godsend when drafting that plaid. My other refs r below the cut in case anyone finds them useful:)

#my art#iwtv#interview with the vampire#louis de pointe du lac#I’m still here. by the way. 20s iwtv can stay but it’s on thin fucking ice. do you think the writers came up with#his full real estate portfolio and if so can they drop it as bts. for me.#I looove his post partum housewife era but I also need to know who he leases to. which Black firm drafts his contracts. did he diversify be#*cause he foresaw the shutdown of NOLA’s red light district AND ALSO were it not for Jim Crowe laws what would he have turned the Azalea#into#‘s2 said he’s an art dealer’ look everyone needs hobbies. he might race horses too. we don’t know.#but *I* know he has commercial holdings on magazine street FUCK!!!!

35 notes

·

View notes

Text

#Full-Service Architecture#engineering firm#engineering firm nyc#Architecture#Engineering Firm NYC#Comprehensive Architectural#Engineering Services in NYC#Versai Project Portfolio#NYC Local Law Compliance#Architecture and Engineering#Full-Service Architecture and Engineering Firm#Architecture and Engineering Firm NYC#Comprehensive Architectural and Engineering Services in NYC#NYC Local Law Compliance for Architecture and Engineering#artists on tumblr#full service architecture#versai concepts#batman

10 notes

·

View notes

Text

#wealth management advisory#investment advisor services#boutique investment advisory firm#wealth management planning#foundation investment advisors#experienced wealth management advisor#top wealth advisory firms#investment portfolio advisor#best investment planners#advisory investment management

0 notes

Text

Ass Estate 🤝 Nahui Export 🤝 Kurwa Eye Clinic

#unfortunate naming situation#context: been browsing for web masters for our e-store and someone had this estate firm on their portfolio#interstellarvacuumcleaner

7 notes

·

View notes

Text

Sales Presentation Company – Pitch Worx

Pitch Worx is a sales presentation company specializing in creating visually compelling presentation designs. Founded in 2012, the company has crafted over 100,000 slides for clients across diverse sectors, including start-ups, large enterprises, and government organizations. Their services include sales presentations, pitch decks, product demos, and training decks, featuring impactful graphics, animations, and data visualization. Pitch Worx offers custom solutions with various pricing plans and ensures timely delivery, data security, and a client-focused approach to meet presentation needs efficiently. https://pitchworx.com/us/

#creative advertising portfolio#training video production#Company Product Presentation#Business Presentation Design Services#Presentation Design Firm#Pitch deck Designers#presentation design company

0 notes

Text

#Data-Driven Real Estate Strategies#Signal Ventures property development#Signal Ventures investment strategy#Signal Ventures data analytics approach#Signal Ventures business turnaround#Signal Ventures real estate portfolio#Self-storage development company#Self-storage investment opportunities#Self-storage real estate investment#passive real estate investing#real estate investment firm#passive investing#real estate syndication

0 notes

Text

Emerging Trends in Portfolio Management Services in India

Investing is no longer just about picking stocks and hoping for the best. The landscape of portfolio management services in India has evolved significantly in recent years. Whether you're a seasoned investor or someone just starting, it's crucial to stay updated on how top portfolio management services are adapting to new trends. But what exactly is driving this change?

Introduction to Portfolio Management Services

Before diving into the trends, let’s first understand what portfolio management services in India (PMS) offer. Portfolio management firms handle investments for clients, helping them manage risk, maximize returns, and achieve their financial goals. For investors who lack the time or the expertise to monitor their investments, PMS can be a great solution. However, as times change, so do investor expectations and the strategies these firms employ.

In India, PMS has grown from catering to high-net-worth individuals to now becoming more accessible to retail investors. With the rise of technology and evolving financial markets, investors can now expect more from portfolio management services in India than ever before.

The Rise of Digital Portfolio Management

One of the most noticeable trends today is the digital transformation of PMS. Traditional face-to-face consultations are being replaced by AI-driven platforms and mobile apps, allowing investors to track their portfolios in real-time. Digital portfolio management has made it possible for more people to access financial advice at their fingertips.

Imagine managing your investments like ordering food online. It’s that simple! With just a few taps, you can now view your portfolio, track the performance of various assets, and even make changes. The best part? These digital platforms use advanced analytics to help predict market trends and adjust portfolios accordingly, making investing more efficient than ever.

Top portfolio management services are embracing technology to offer personalized dashboards, performance updates, and financial forecasts, ensuring that clients are always in the know.

Personalized Investment Strategies

Gone are the days when a "one-size-fits-all" investment strategy was enough. Modern investors are looking for personalized investment strategies that cater to their unique financial goals and risk tolerance. This shift is driven by the understanding that no two investors are the same.

Portfolio management firms now use a more holistic approach by considering factors such as age, income, lifestyle, and future financial needs. Moreover, AI and machine learning have empowered these firms to analyze vast amounts of data to offer hyper-personalized strategies.

For instance, if you're a young professional looking to invest aggressively, the system will tailor a strategy that fits your high-risk appetite. On the other hand, retirees or conservative investors can opt for a low-risk portfolio that offers stable returns. This shift towards customization is one of the top emerging trends in portfolio management services in India.

The Role of ESG in Modern Portfolios

Another growing trend in the investment world is the focus on Environmental, Social, and Governance (ESG) factors. Investors today are increasingly considering the ethical implications of their investments. How do companies treat their employees? Are they environmentally responsible? These questions are influencing investment choices now more than ever.

ESG investing not only aims for financial returns but also ensures that investments have a positive impact on society. As a result, top portfolio management services in India have started incorporating ESG criteria into their investment models. This trend allows investors to support businesses that align with their personal values while still achieving their financial objectives.

If you’re someone who cares deeply about sustainability, ESG-focused portfolios offer a great way to align your investments with your beliefs without sacrificing returns.

The Importance of Transparency and Communication

In today’s fast-paced world, transparency and communication have become key pillars for successful investment management. Clients want to know where their money is going, how it's being used, and the results of their investments. Portfolio management firms are responding by providing detailed reports and regular updates.

With the availability of digital tools, PMS clients can now receive instant notifications about their portfolios. Whether it's an economic downturn or an opportunity to capitalize on market gains, regular communication helps investors make informed decisions. This level of transparency helps build trust, which is crucial for long-term client relationships.

Conclusion

The future of portfolio management services in India looks incredibly promising. With digital innovations, personalized strategies, ESG-focused investments, and increased transparency, the investment landscape is adapting to meet the diverse needs of modern investors. For those looking to grow their wealth and stay ahead in an ever-changing market, understanding these trends is crucial.

In short, as portfolio management firms continue to innovate, they are making high-quality investment services more accessible and tailored than ever before. So, are you ready to embrace these trends and let your investments grow with the times?

By focusing on these emerging trends, top portfolio management services are not only staying relevant but also setting new standards for financial success. Whether you are a first-time investor or someone with a well-established portfolio, now is the perfect time to explore what portfolio management services in India can do for you!

#wealth management firm#wealth management service#wealth management company#finance#financial planning#financial service#portfolio management firms#top portfolio management services#portfolio management services in India

0 notes

Text

Why Choose a Private Wealth Management Firm in Toronto?

Are you struggling to keep track of your financial future? Does managing your investments seem like an overwhelming task, with too many options and not enough clarity? You're not alone. Many individuals face challenges in building wealth and maintaining a strong financial strategy. Without expert guidance, it’s easy to feel lost in the maze of investment choices and financial markets. That’s where a private wealth management firm can make all the difference.

Managing wealth goes far beyond putting money into a savings account or buying stocks. It involves strategic planning, smart investments, and constant monitoring of your portfolio. Without the right expertise, this can feel like an uphill battle, especially when you’re trying to balance it with your other financial responsibilities. But with the right team of money managers and portfolio experts, you can take control of your financial future and ensure that your investments are working for you.

The Role of Private Wealth Management

When you choose a private wealth management firm, you’re opting for a tailored, personalized approach to your finances. Unlike general financial advisory services, which may offer basic advice, private wealth management is designed for individuals and families with significant assets who require a more detailed, hands-on approach to wealth building.

In our experience, we’ve found that private wealth management in Toronto offers a unique advantage for those looking to grow and protect their wealth. Toronto is a major financial hub, and having access to local wealth management services means you’re working with professionals who understand the nuances of the Canadian economy and can tailor their advice accordingly. We take pride in providing our clients with the tools and strategies needed to not only protect their wealth but also see it grow in line with their goals.

Customized Portfolio Management for Long-Term Success

One of the primary reasons people turn to a private wealth management firm is for portfolio management. Managing an investment portfolio requires time, attention, and expertise that most people simply don’t have. Whether it’s balancing risk, diversifying investments, or ensuring that your portfolio aligns with your financial goals, it’s not something that should be left to chance.

With expert portfolio management, we help you create a strategy that’s designed specifically for your needs. This involves an in-depth analysis of your current financial situation, your short- and long-term goals, and your risk tolerance. From there, our team of money managers works to build and maintain a portfolio that aligns with those goals, making adjustments as needed to ensure you’re always in the best position to succeed.

We understand that your financial future is important, and that’s why our approach to private wealth management goes beyond simply picking stocks. It’s about building a comprehensive plan that takes into account all aspects of your financial life.

The Importance of Professional Money Managers

Why should you trust professional money managers with your investments? The answer is simple: expertise. As wealth management professionals, we have access to insights, tools, and resources that aren’t available to the average investor. Whether it’s understanding the best time to buy or sell, knowing which investments offer the best potential return, or being able to navigate complex tax laws, our expertise allows us to make informed decisions that benefit you.

When you work with professional money managers, you also gain the benefit of having someone actively monitoring your portfolio. This means you don’t have to worry about missing opportunities or being caught off guard by market downturns. Our team works diligently to ensure that your investments are optimized and that your portfolio is always positioned for success.

Minimizing Risk and Maximizing Returns

One of the greatest challenges in managing your own investments is balancing risk and return. It’s easy to make emotional decisions when the market fluctuates, but these decisions can often lead to mistakes that harm your financial future. With a private wealth management firm, we take the guesswork out of investing. By developing a sound investment strategy that takes into account your personal risk tolerance, we help you minimize potential losses while maximizing returns over time.

It’s important to remember that no investment is without risk, but our goal is to ensure that your investments are as safe and profitable as possible. Through smart portfolio management, we’re able to adjust your strategy as needed to reflect changes in the market, ensuring that your money is always working for you.

Comprehensive Wealth Planning

A good private wealth management firm offers more than just portfolio management. At Avenue Investment, we believe that successful wealth management involves a holistic approach. This means considering not just your investments but all aspects of your financial life, including tax planning, retirement goals, estate planning, and more.

By taking a comprehensive view of your financial situation, we’re able to provide you with a plan that ensures long-term success. We help you manage your wealth in a way that reflects your values, goals, and future aspirations.

For those planning for retirement, we offer specialized services to ensure that your savings and investments will support you throughout your retirement years. Additionally, we provide guidance on estate planning to ensure that your assets are passed on to the next generation in the most tax-efficient manner possible.

Personalized Client Service

What truly sets a private wealth management firm apart from general financial advisors is the level of service you receive. At Avenue Investment, we believe that personalized service is the cornerstone of successful wealth management. Our clients are more than just account numbers; they’re individuals with unique needs, goals, and challenges.

We take the time to get to know each of our clients on a personal level, allowing us to create tailored strategies that reflect your specific situation. Whether you need assistance with managing your investments, planning for the future, or navigating financial challenges, we’re here to provide the guidance and support you need.

Wrap Up

At Avenue Investment, we’re proud to offer comprehensive private wealth management in Toronto. We’ve helped countless clients build and protect their wealth through personalized portfolio management and expert financial guidance. We understand the complexities of managing wealth, and our team of dedicated money managers is here to provide you with the support and expertise you need to achieve your financial goals.

If you’re looking for a private wealth management firm that offers personalized service, expert advice, and a proven track record of success, we’re here to help. Let us take the stress and uncertainty out of managing your wealth so you can focus on what matters most—living your life with confidence and financial security.

#private wealth management toronto#private wealth management firm#portfolio management#money managers

0 notes

Text

Marketing Strategies for Private Equity Portfolio Brands | Ebook by Gutenberg Download our comprehensive ebook, "Marketing Strategies for Value Creation in Private Equity Portfolio Brands," by Gutenberg and learn how to enhance brand value, drive growth, and optimize digital marketing for maximum ROI.

#Ebook on Private Equity Marketing#Marketing Strategies for Private Equity Firms#Ebook on Brand Building in Private Equity#Ebook on Private Equity Growth Strategies#Download Digital Marketing for Private Equity Ebook#Download Private Equity Portfolio Ebook#Ebook on Content Marketing for Private Equity#Ebook how Increase ROI in Private Equity#Private Equity Thought Leadership#Private Equity Brand Value Ebook

0 notes

Text

The Role of Portfolio Management Firms in Wealth Creation

It involves more than earning and saving money to acquire and preserve sustainable wealth. Many winning investors start with comprehending how portfolio management firms make investment strategies operationalized, eventually creating tangible opportunities to develop and accumulate wealth.

Know How Portfolio Management Companies Function as the Foundation for Strategic Investment

Portfolio management firms are specialized financial institutions which undertake the obligation of making decisions about investment for individuals and companies. These firms operate under the management of professionals who scan the complex financial markets for strategic investment decisions in relation to the client's financial goals. Equipped with advanced analytical tools and profound market insights, the firms create customized strategies that enhance return but manage risk efficiency.

Portfolio Management Services in India: A Booming Financial Ecosystem

Indian finance has seen great evolution, and the portfolios have become a key participant in wealth creation. This operates under a sound, regulated framework supervised by SEBI for high-net-worth individuals and institutional investors looking for professional experience for portfolio management services in India.

Sophisticating the markets, Indian markets increase demand in specialized investment management. Among the top portfolio management services, service offerings of these companies had to meet global standards in addition to local market dynamics, ensuring that investors benefit from wide range diversity, across multiple classes of asset.

Key Service Portfolio: Enabling Wealth Generation

Strategic Asset Allocation

Expert portfolio managers create customized asset allocations based on comprehensive market analyses and specific client goals. This approach systematically ensures optimum investment distribution across different classes of assets, thereby limiting risk and maximizing potential gains.

Risk Reduction and Management

In order to protect investment positions from market volatility, professional portfolio management involves ongoing monitoring and modification. These businesses use advanced risk assessment and hedging technologies to protect their clients' capital in volatile market conditions.

Research-Based Investment Decisions

Leading portfolio management firms have in-house research teams who study market trends, economic indicators, and individual stocks. This research-based approach will enable them to make appropriate decisions and find the best investments before they become popular among other investors.

The Competitive Advantage of Professional Portfolio Management

Personalized Investment Solutions: Each client gets specific attention with tailored investment solutions according to specific financial goals, risk tolerance, and time horizons.

Market Expertise and Timing: Professional managers have expertise in identifying the entry and exit points in several markets that will allow them to capitalize on opportunities while trying to avoid potential losses.

The Advantages of Diversification: By providing diversified investment portfolios across various asset classes, industries, and regions, portfolio management firms enable risk management.

Use of Technology: The use of sophisticated technological instruments aids modern portfolio management companies to monitor portfolios, measure risk, and analyze performance, which enables efficient management of the investments for clients.

Selection or Choosing a Portfolio Management Company

Portfolio management companies have to be selected based on these factors:

Past Performance and Track Record: Analysis of historical performance through cycles of the market will allow insight into the capability of a firm to generate returns consistently.

Regulatory Compliance: That the firm operates strictly by the requirements and keeps reporting transparent.

Investment Philosophy: Understanding of the investment approach of the firm must align with the personal financial objectives and the tolerance of risk.

Fee Structure: Cost-effectiveness of the services rendered, management fees and performance-linked incentives.

The Road Ahead: Maximizing Wealth Creation Potential

As financial markets get more complex, portfolio management companies are becoming more and more important in helping people reach their long-term wealth creation objectives. They offer the know-how, tools, and expert advice required to successfully negotiate erratic marketplaces and seize expansion prospects.

A relationship with reputable portfolio management companies may be the greatest approach for investors to organize their financial objectives if they want to build and maintain wealth. Investors can access advanced investment techniques, thorough risk management, and the knowledge required to make wise financial decisions by using professional portfolio management services.

Leveraging professional skills while maintaining a disciplined approach to long-term investments is the way of the future for wealth generation.

Portfolio management firms continue evolving, adapting their services as market dynamics and investor requirements change, making them integral partners in the journey toward financial success.

#Wealth creation#Portfolio firms#Investment growth#Asset management#Financial planning#Risk management#Diversification#Wealth building#Investment firms#Portfolio strategy#Financial advice#Long-term growth#Money management#Risk mitigation#Financial goals#Wealth management#Investment goals#Strategic planning#Return maximization#Capital growth.

1 note

·

View note

Text

Richmond Plaza, Bronx (NYCHA)

We are delighted to collaborate and serve our clients across various industries and scales. Regardless of the sector, businesses depend on well-maintained facilities to support their operations, productivity, and growth. Over the last few years, we have proudly grown from assisting individual private clients to working with billion-dollar companies such as Verizon and the Moinian Group. Irrespective of the occupants and owners of the structures, the challenges and approach to addressing them is very similar. For this reason, we treat each project with the same care, dedication and attention to detail.

#Engeenering#Architecture#Full Service Architecture#Engineering Firm#Medium#versai project portfolio#architecture and engineering firm nyc#full-service architecture and engineering firm#artists on tumblr#engineering firm nyc#writers on tumblr#batman#cats of tumblr#photographers on tumblr#tumblr milestone

9 notes

·

View notes

Text

#wealth management advisory#investment advisor services#boutique investment advisory firm#wealth management planning#foundation investment advisors#experienced wealth management advisor#top wealth advisory firms#investment portfolio advisor#best investment planners#advisory investment management

0 notes

Text

Our Presence - Global Investment Opportunities | The Rockets Investment Learn about The Rockets Investment's extensive global presence From North America to Europe, Asia to the Middle East, our firm presence ensures accessibility and tailored guidance for individuals seeking investment opportunities in select countries Learn how we connect investors with international opportunities for our clients.

#global investment opportunities#global investment platform#global investment portfolio#global investment solutions#global investment strategies#global investments company#international investment companies#international investment opportunities#international investment platforms#international investment portfolio#international investment strategy#investment companies in dubai#investment management#investment opportunities#investment portfolio services#investment portfolio strategy#investment solutions company#leading investment companies#leading investment firms#leading investment solutions#learn to invest#local business investors#local investment opportunities#management investment company#millionaire investing strategy#portfolio investment services#portfolio investment solutions#portfolio management#real estate investment companies#real estate investment opportunities

0 notes

Text

Exploring the Cuddeback 20MP IR Model H-1453: A Trail Camera Revolutionizing Forest Monitoring

Introduction

In the heart of the forest, where wildlife thrives and nature's secrets unfold, lies a silent observer, capturing every movement with precision and clarity. The Cuddeback 20MP IR Model H-1453 trail camera stands as a beacon of innovation in the realm of forest monitoring, revolutionizing the way we study and safeguard our natural ecosystems.

Unveiling the Cuddeback 20MP IR Model H-1453:

With its sleek design and advanced features, the Cuddeback 20MP IR Model H-1453 trail camera emerges as a game-changer in the world of wildlife research and conservation. Boasting a 20-megapixel sensor and cutting-edge infrared technology, this device transcends traditional monitoring methods, offering unparalleled insights into the intricate tapestry of forest life.

The Role of Trail Cameras in Forest Conservation:

Forest conservation hinges upon our ability to understand and protect the delicate balance of ecosystems. Trail cameras like the Cuddeback 20MP IR Model H-1453 play a pivotal role in this endeavour by providing a non-intrusive means of observing wildlife behaviour, tracking habitat changes, and detecting threats to biodiversity.

Conclusion:

In the age of rapid environmental change, the need for effective forest monitoring has never been greater. The Cuddeback 20MP IR Model H-1453 trail camera represents a beacon of hope for our planet's forests, empowering us to uncover the secrets of nature and take proactive steps towards conservation and sustainability. As we continue to unlock the potential of this innovative technology, let us remember the vital role it plays in safeguarding the biodiversity and beauty of our natural world for generations to come.

Madman Technologies is coming up huge in the area of Government Forest Product Portfolio that can help you both in the design consulting and best services, also they can arrange the best deal price in the market and make the product available for you.

For any further queries and details email us at —

Contact information:- 9625468776

#information technology#it products#it services#technology#itservices#it solutions#it technology#forest#government tactical portfolio#tactical#it consulting services#it consulting firms#softwaredevelopment#it consulting#it services and consulting

0 notes

Text

shoutout to my dash and the Democratic Party as a whole right now for being like

Some good policy reasons to get excited about Harris. Gun control! Heathcare! LGBT rights!

Fighting for the fate of the world: has said she’ll make climate change a top national security priority; was one of the original Senate sponsors of the Green New Deal (others: Ocasio-Cortez, Markey), much of which became Biden’s stealthily VERY green Bipartisan Infrastructure Bill and the Inflation Reduction Act

Yes, she was a prosecuting attorney; no, it’s NOT an ACAB situation—highlights of her time as District Attorney of San Francisco and Attorney General of California include enabling a re-entry/anti-recidivism program for young drug users which is now used as a template around the country, pointedly not prosecuting people for marijuana possession (distinctly before it was legal), defending Californians against foreclosures, got the “gay/trans panic” defense BANNED in CA courts, and being the first statewide agency to require all police offers to wear body cams.

As VP she’s spearheaded abortion rights, developed and nearly passed a landmark voting rights bill (stymied by Senate Republicans + 2 Democrats unwilling to change filibuster rules), and quietly built a solid foreign policy portfolio, including firm support of Palastine.

Find out if you’re registered to vote in any state!

Register to vote in any state!

Other voting resources—and DON’T FORGET to vote down-ballot, too! See how much Harris did as County District Attorney and State Attorney General? Those are elected offices!

7K notes

·

View notes