#loans for pensioners

Text

Find all the reverse mortgage information you need to understand what is a reverse mortgage and how senior's how does reverse mortgages work.

Visit: https://seniorsfirst.com.au/reverse-mortgage/how-does-a-reverse-mortgage-work/

#reverse mortgage#finance#aged care finance#reverse mortgages#australia#reverse mortgage rates#loans for pensioners#home loans for pensioners#reverse mortgages for seniors

1 note

·

View note

Text

Things Biden and the Democrats did, this week #23

June 14-21 2024.

On the 12th anniversary of President Obama's DACA program President Biden announced a new pathway to legal status and eventual citizenship for Dreamers. DACA was an executive action by President Obama which deferred any deportation of persons brought to the US as children without legal status. While DACA allowed Dreamers to work legally in the US for the first time, it didn't give them permanent legal status. Now the Biden administration is streamlining the process for employers to apply for work Visas for Dreamers. With Visas Dreamers will for the first time have legal status, the ability to leave and reenter the US legally, and a pathway to a Green Card and eventual citizenship.

President Biden also announced protections for the undocumented spouses and children of US citizens. The new rule allows the spouse, or step-child of a US citizen to apply for lawful permanent residency without having to leaving the country. It's estimated this will help 500,000 undocumented people married to Americans, and 50,000 children under the age of 21 whose parent is married to an American citizen. Current law forces spouses to leave the United States if they're here illegally and wait and unclear period of probation before being allowed to return, but being allowed back is not assured.

The IRS announced that it'll close a tax loophole used by the ultra rich and corporations and believes it'll raise $50 billion in revenue. Known as a "pass-through" has allowed the rich to move money around to avoid taxes in a move the Treasury is calling a shell-game. Pass-throughs have grown by 70% between 2010 and 2019 and the IRS believes it helped the rich avoid paying $160 billion dollars in taxes during that time. The IRS estimates its crack down on these will raise $50 billion in tax revenue over the next 10 years.

The EPA and Department of Energy announced $850 million to monitor, measure, quantify and reduce methane emissions from the oil and gas sector. Methane is the second most common greenhouse gas, responsible for 1/3rd of the global warming. The funding will focus on helping small operators significantly reduce emissions, as well as help more quickly detect and cap methane leaks from low-producing wells. All this comes after the EPA finalized rules to reduce methane emissions by 80% from oil and gas.

The Biden Administration took steps to protect the nations Old Growth Forests. The move will greatly restrict any logging against the 41 million acres of protected land owned by the federal government. The Administration also touted the 20% of America's forests that are in urban settings as parks and the $1.4 billion invested in their protection through the President’s Investing in America agenda.

The Biden Administration released new rules tying government support for clean energy to good paying jobs. If companies want to qualify for massive tax credits they'll have to offer higher wages and better conditions. This move will push union level wages across the green energy sector.

The Department of Education announced large reductions in student loan payments, and even a pause for some, starting in July. For millions of Americans enrolled in the Biden Administration's SAVE plan, starting in July, monthly payments on loans borrowed for undergraduate will be reduced from 10% to 5% of discretionary income. As the department hasn't been able to fully calculate the change for all borrowers at this point it will pause payment for those it hasn't finalized the formula for and they won't have to make a payment till DoE figures it out. The SAVE plan allows many borrowers to make payments as low as $0 a month toward having their loans forgiven. So far the Biden Administration has forgiven $5.5 billion wiping out the debt of 414,000 people enrolled in SAVE.

The Biden Administration celebrated the 1 Millionth pension protected under the American Rescue Plan. Senator Bob Casey joined Biden Administration officials and Union official to announce that thanks to the Butch Lewis Act passed in 2021 the government would be stepping in to secure the pensions of 103,000 Bakery and Confectionery Union workers which were facing a devastating 45% cut. This brings to 1 million the number of workers and retirees whose pensions have been secured by the Biden Administration, which has supported 83 different pension funds protecting them from an average of 37% cut.

The Department of Energy announced $900 million for the next generation of nuclear power. This investment in Gen III+ Small Modular Reactor will help bring about smaller and more flexible nuclear reactors with smaller footprints. Congress also passed a bill meant to streamline nuclear power and help push on to the 4th generation of reactors

Vice President Harris announced a $1.5 billion dollar aid package to Ukraine. $500 million will go toward repairing Ukraine's devastated energy sector which has been disrupted by Russian bombing. $324 million will go toward emergency energy infrastructure repair. $379 million in humanitarian assistance from the State Department and the U.S. Agency for International Development to help refugees and other people impacted by the war.

America pledged $315 million in new aid for Sudan. Sudan's on-going civil war has lead to nearly apocalyptic conditions in the country. Director of USAID, Samantha Power, warned that Sudan could quickly become the largest famine the world has seen since Ethiopia in the early 1980s when a million people died over 2 years. The US aid includes food and water aid as well as malnutrition screening and treatment for young children.

Bonus: Maryland Governor Wes Moore pardoned more than 175,000 people for marijuana convictions. This mirrors President Biden's pardoning of people convicted of federal marijuana charges in 2022 and December 2023. President Biden is not able to pardon people for state level crimes so called on Governors to copy his action and pardon people in their own state. Wes Moore, a Democrat, was elected in 2022 replacing Republican Larry Hogan.

#Thanks Biden#Joe Biden#us politics#american politics#immigration#DACA#Dreamers#IRS#tax the rich#student loans#climate change#climate action#nuclear power#marijuana#criminal justice reform#ukraine#Sudan#Pensions

220 notes

·

View notes

Text

On Wednesday, Senate Health, Education, Labor and Pensions (HELP) Chair Bernie Sanders (I-Vermont) and Rep. Pramila Jayapal (D-Washington) reintroduced a proposal to make higher education free at public schools for most Americans — and pay for it by taxing Wall Street.

The College for All Act of 2023 would massively change the higher education landscape in the U.S., taking a step toward Sanders’s long-standing goal of making public college free for all. It would make community college and public vocational schools tuition-free for all students, while making any public college and university free for students from single-parent households making less than $125,000 or couples making less than $250,000 — or, the vast majority of families in the U.S.

The bill would increase federal funding to make tuition free for most students at universities that serve non-white groups, such as Historically Black Colleges and Universities (HBCUs). It would also double the maximum award to Pell Grant recipients at public or nonprofit private colleges from $7,395 to $14,790.

If passed, the lawmakers say their bill would be the biggest expansion of access to higher education since 1965, when President Lyndon B. Johnson signed the Higher Education Act, a bill that would massively increase access to college in the ensuing decades. The proposal would not only increase college access, but also help to tackle the student debt crisis.

“Today, this country tells young people to get the best education they can, and then saddles them for decades with crushing student loan debt. To my mind, that does not make any sense whatsoever,” Sanders said. “In the 21st century, a free public education system that goes from kindergarten through high school is no longer good enough. The time is long overdue to make public colleges and universities tuition-free and debt-free for working families.”

Debt activists expressed support for the bill. “This is the only real solution to the student debt crisis: eliminate tuition and debt by fully funding public colleges and universities,” the Debt Collective wrote on Wednesday. “It’s time for your member of Congress to put up or shut up. Solve the root cause and eliminate tuition and debt.”

These initiatives would be paid for by several new taxes on Wall Street, found in a separate bill reintroduced by Sanders and Rep. Barbara Lee (D-California) on Wednesday. The Tax on Wall Street Speculation would enact a 0.5% tax on stock trades, a 0.1% tax on bonds and a 0.005% tax on trades on derivatives and other types of assets.

The tax would primarily affect the most frequent, and often the wealthiest, traders and would be less than a typical fee for pension management for working class investors, the lawmakers say. It would raise up to $220 billion in the first year of enactment, and over $2.4 trillion over a decade. The proposal has the support of dozens of progressive organizations as well as a large swath of economists.

“Let us never forget: Back in 2008, middle class taxpayers bailed out Wall Street speculators whose greed, recklessness and illegal behavior caused millions of Americans to lose their jobs, homes, life savings, and ability to send their kids to college,” said Sanders. “Now that giant financial institutions are back to making record-breaking profits while millions of Americans struggle to pay rent and feed their families, it is Wall Street’s turn to rebuild the middle class by paying a modest financial transactions tax.”

#us politics#news#truthout#sen. bernie sanders#progressives#progressivism#Democrats#senate health education labor and pensions committee#College for All Act of 2023#tax Wall Street#tax the rich#tax the 1%#tax the wealthy#college for all#student debt#student loan debt#tuition-free college#Historically Black Colleges and Universities#pell grants#Higher Education Act#Rep. Barbara Lee#rep. pramila jayapal#2023

466 notes

·

View notes

Text

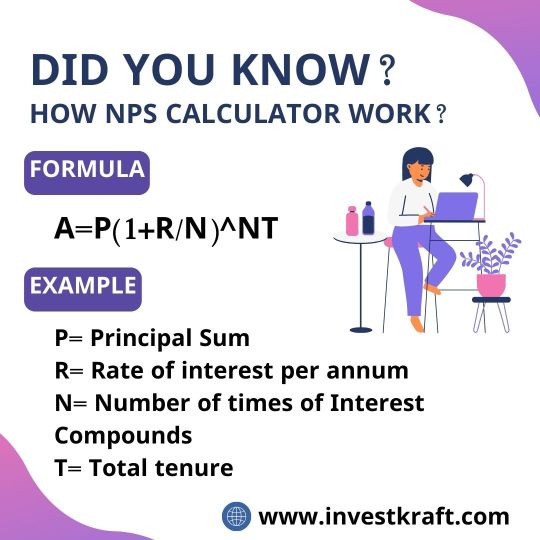

Which National Pension System Calculator Offers the Most Accurate Future Projections?

Trying to plan for retirement can be daunting, but the National Pension System (NPS) Calculator can help. Among various options, Investkraft's website stands out for its accuracy in projecting your future finances. By inputting key details like your age, current savings, and investment preferences, the calculator estimates your pension fund's growth over time. Investkraft's tool employs advanced algorithms and up-to-date financial data to provide precise projections. Its user-friendly interface simplifies the process, making it accessible for everyone. Whether you're just starting to save or nearing retirement, this calculator offers invaluable insights into your financial future. Trust Investkraft's NPS Calculator for reliable and accurate estimations, guiding you towards a financially secure retirement.

2 notes

·

View notes

Text

What Are the Challenges Investors Face When They Plan an Investment in Mutual Funds in Bhavnagar?

Investing can be a journey of both excitement and confusion, especially for newcomers in Bhavnagar. The financial market offers various avenues, and mutual funds stand out as an excellent starting point. However, the road to choosing the right funds is often riddled with challenges. Let's explore the obstacles investors face as they begin their journey of investment in mutual funds in Bhavnagar.

Addressing Investor Challenges

Information Overload: Navigating through countless mutual fund options can overwhelm newcomers, making decision-making daunting.

Defining Investment Objectives: Setting clear financial goals and understanding risk tolerance before diving into investments is crucial.

Assessing Fund Performance: Beyond past returns, evaluating risk-adjusted returns, consistency, and comparisons with peers is essential.

Grasping Fund Fees: Understanding various fees impacting returns, like management fees and sales loads, is key in assessing costs.

Emotional Decision-Making: Emotions often drive impulsive decisions, leading to short-term choices detrimental to long-term goals.

Lack of Expertise: New investors may lack financial knowledge, highlighting the importance of seeking guidance from advisors.

Expert Guidance for Bhavnagar Investors

Shri Money Matters, one of the best mutual fund distributors in Bhavnagar, understands the challenges investors face and offers reliable investments in mutual funds, helping investors gain a basic understanding of key concepts like risk, diversification, asset allocation and streamlining investments for them. Let's explore how investors can benefit from advanced tools and practices offered by them:

Streamlined Selection Process: Distributors utilize advanced tools to simplify fund selection, and investors can easily compare different funds based on crucial criteria.

Thorough Fund Analysis: In-depth research and analysis on mutual funds form the basis of well-informed recommendations, aligning with individual goals.

Tailored Recommendations: Understanding financial profiles and risk tolerance leads to personalized fund recommendations.

Ongoing Support: Ensuring continuous support, addressing concerns, and recommending adjustments as needed.

Fostering Rational Decisions: Guidance in developing a long-term investment mindset focused on rational decision-making.

Mitigating Risk: Encouraging diversification across asset classes to construct well-balanced portfolios.

Portfolio Rebalancing: Regular reassessment for portfolios to stay aligned with objectives.

Personalized Advice: Offering customized advice based on unique circumstances and financial objectives.

Conclusion

Starting your investment journey in mutual funds needs careful planning. While mutual funds are a good start, diversifying your investments is necessary. Shri Money Matters helps investors in Bhavnagar make smart choices, get ongoing help, and stick to a clear investment plan with all the above-listed tools and tactics.

#best mutual fund distributors in Bhavnagar#best insurance company in Bhavnagar#mutual funds investment services in Bhavnagar#life insurance agency in Bhavnagar#health insurance service in Bhavnagar#medical insurance policy in Bhavnagar#general insurance Bhavnagar#corporate bond services in Bhavnagar#loan against mutual funds in Bhavnagar#personal loan in Bhavnagar#national pension system in Bhavnagar#nps in Bhavnagar#private fixed deposit schemes in Bhavnagar

0 notes

Text

#Daily Current Affairs Capsules 14th December 2023#UIDAI Imposes Rs.50#000 Penalty for Overcharging Aadhaar Services#Suspends Operator#Uttar Pradesh to Witness Aviation Boom: Nine New Airports in Two Years#Arvind Kejriwal and Punjab CM Mann Initiate Scheme For Doorstep Services#RBI Grants Authorization to Bandhan Bank for Pension Disbursement to Retired Railway Employees'#Moody’s Affirms Reliance Industries’ Baa2 Rating with a Stable Outlook#IMF Approves $337 Million Second Tranche Loan For Sri Lanka#Air India Unveils New Uniforms for Cabin#Cockpit Crew Designed by Fashion Designer Manish Malhotra#Defence Ministry Approves Rs 2800 Crore Rockets for Pinaka Weapon System#Telangana Introduces Free Bus Travel For Women And Transgender Individuals#Emmy-Winning Actor Andre Braugher Passes Away at 61

0 notes

Text

Live fully, borrow wisely. Unlock your Retirement Dreams.. avail of the Pension Loan now! visit us at:

0 notes

Text

i'm starting to wonder if spending basically all the overtime money i earned before i actually get paid was really a wise thing to do...

#i mean i don't spend it until i've actually worked the hours and technically earned it#and it's sort of my way of coping with having to work shitty shifts. because at least i get nice treats for myself which i earned!#but also my bank account is going to look so empty before pay day and probably give me anxiety#and also i have no idea if i'll actually get all the money or if some of it will go to pensions etc. though i don't think i have to pay any#tax or student loans from it since it's part time minimum wage so it's below that threshold#idk it's been so long since i've had a job that i've forgotten how to be responsible with money! but at least i've got some savings so i'm#a few months off being really in trouble

1 note

·

View note

Text

Insure n Invest is a Single window for all your financial needs

We believe in empowering individuals to take control of their finances and achieve their financial goals. Insure N Invest offer a variety of resources and tools to help you make informed decisions about your money from budgeting and saving strategies to investment and retirement planning. Insure n Invest create tailor made financial solutions as per your Needs.

We aim to provide need-based solutions for long term wealth creation; our primary measure of success is customer satisfaction. We have seen many ups and downs in the lives of people around us and we strongly felt that everyone should plan for a better tomorrow. This motivated us to be Financial Advisors. The profession helps us to live and work for our dream to make a wealthy society.

#health insurance#Life insurance#mutual funds#fixed deposits#retirement schemes#housing loans#motor insurance#pension#gratuity#leave encashment schemes#group insurance schemes#term life insurance

1 note

·

View note

Photo

The Federal Employees Retirement System (FERS) is a three-tiered retirement system for U.S. federal government employees. It consists of Social Security benefits, a basic annuity, and the Thrift Savings Plan (TSP). The FERS pension calculator can be used to estimate your retirement benefits.

0 notes

Text

Using Home Equity For Renovations can help you future proof your home. Home repairs can help you improve your wellbeing and protect your property value.

Visit: http://adfreeposting.com/en/listing/using-home-equity-for-renovations

#reverse mortgage#finance#aged care finance#reverse mortgages#australia#loans for pensioners#reverse mortgage rates#home loans for pensioners#bank

1 note

·

View note

Text

101 Things You Should Know About the UK Tory Government

Thing 52

Mel Stride, in his previous role as a Treasury Minister, was forced to defend himself in 2019 for giving:

“‘partial and misleading answers to parliamentary questions’ in his ministerial role as financial secretary to the Treasury over the ‘loan charge’, an all-party parliamentary group of MPs has said.” (Times Gazette: 18/04/19)

This scheme related to tens of thousands of individuals, many of them self-employed, which allowed the government to claim up to 20 years allegedly unpaid tax in one go, where they were ‘out of time’ under existing legislation. He was accused of:

‘dishonestly’ misleading MPs over tax charges that drove people to suicide.” (DevonLive:09/04/19)

The ‘dishonest’ Mel Stride was appointed Secretary of State for Work and Pensions by Rishi Sunak and is now in charge of pensions legislation that according to the Institute of Fiscal Studies allows pensions to be used as:

“a vehicle for the wealthiest households” to slash their inheritance tax bill as they use other investments to provide income in retirement....Wealthy families use pension loopholes to avoid £1bn in inheritance tax." (Telegraph: 15/12/22)

As usual, it’s one rule for the rich and another for ordinary workers.

0 notes

Text

Every time i have a paycheque come in and i see how much money goes to repay my student loan i really regret those uni years

But at the same time, saying thats what i studied was... a huge reason I even got my first job, which led to my current job. And who knows where i'd be in life otherwise?

#It was TWO HUNDRED POUNDS this month#the lowest its been all year is £102 and that was BEFORE my payrise...#an extra £100 a month sure would be nice....#i dont have a degree i just have DEBT#when i checked it earlier in the year i still had 15 grand to pay off.....#none of this will get written off until i turn like... 60.....#wondering whether i should take a couple of grand out of my savings and throw it at the student loan company....#before i got my payrises over the last year... i was literally just paying off the interest...... 😬#looks like ive paid them 1.7 grand this year so far... so maybe 2.5 grand a year?#... that could be going directly into my pocket 😔#idk man it just hurts to see more money go to my past than... my pension......

0 notes

Text

Rtr claims that an Australian pension fund

RTR Claims provide Pension Fund in Australia. RTR Claims is a claim management company and we provide many types of fund and insurance services. Let us for more information visit our website.

0 notes

Text

Best Investment Advisory Services in Bhavnagar

ShriMoney Matters offers the best investment advisory services in Bhavnagar ranging from investments in mutual funds, life insurance, medical insurance, bonds, general insurance, NPS, etc. to tailor investment strategies to suit your needs, ensuring that you make informed choices for your future. For more details, visit https://www.shrimoneymatters.com/

#best mutual fund distributors in Bhavnagar#best insurance company in Bhavnagar#mutual funds investment services in Bhavnagar#life insurance agency in Bhavnagar#health insurance service in Bhavnagar#medical insurance policy in Bhavnagar#general insurance Bhavnagar#corporate bond services in Bhavnagar#loan against mutual funds in Bhavnagar#personal loan in Bhavnagar#national pension system in Bhavnagar#nps in Bhavnagar#private fixed deposit schemes in Bhavnagar

1 note

·

View note

Text

Republicans in Congress enjoying taxpayer-funded salaries/benefits/pensions, and who will accept taxpayer-funded PPP loans, will then ramble on about 'never socialism' while they live on socialism more than anyone else.

The hypocrisy is nauseating.

780 notes

·

View notes