#national pension system

Explore tagged Tumblr posts

Text

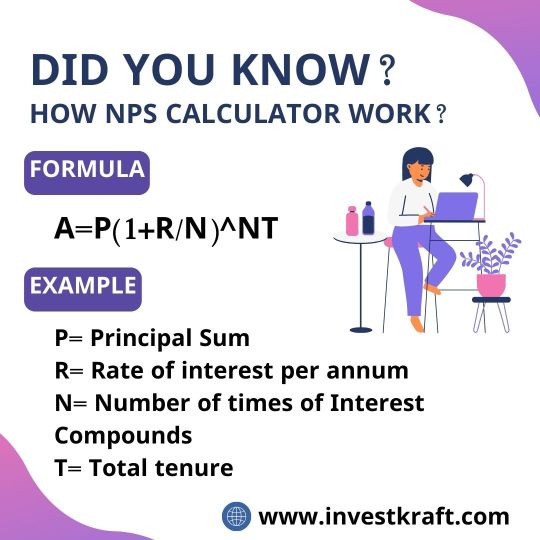

Which National Pension System Calculator Offers the Most Accurate Future Projections?

Trying to plan for retirement can be daunting, but the National Pension System (NPS) Calculator can help. Among various options, Investkraft's website stands out for its accuracy in projecting your future finances. By inputting key details like your age, current savings, and investment preferences, the calculator estimates your pension fund's growth over time. Investkraft's tool employs advanced algorithms and up-to-date financial data to provide precise projections. Its user-friendly interface simplifies the process, making it accessible for everyone. Whether you're just starting to save or nearing retirement, this calculator offers invaluable insights into your financial future. Trust Investkraft's NPS Calculator for reliable and accurate estimations, guiding you towards a financially secure retirement.

2 notes

·

View notes

Text

Tier 1 vs Tier 2 NPS Accounts: Which One is Right for Your Retirement Goals?

“The differences between Tier 1 and Tier 2 NPS accounts, their tax benefits, withdrawal rules, and investment options. Learn how the National Pension System can secure your retirement with high returns and flexibility. Start planning your financial future today with this comprehensive guide to NPS accounts!” The National Pension System (NPS) is a government-backed retirement savings scheme…

#National Pension System#NPS for retirement planning#NPS investment options#NPS returns#NPS subscriber base#NPS tax benefits#NPS withdrawal rules#PFRDA#Tier 1 NPS account#Tier 2 NPS account

0 notes

Text

Unified Pension Scheme (U.P.S.) की जानकारी-

केन्द्र सरकार द्वारा जारी UPS( एकीकृत पेंशन योजना) की श्रोतों द्वारा अर्जित की गई जानकारी निम्नलिखित है-

कैबिनेट ने केंद्र सरकार के कर्मचारियों के लिए राष्ट्रीय पेंशन प्रणाली (एनपीएस) में सुधार के लिए एकीकृत पेंशन योजना (UPS) की शुरुआत को मंजूरी दे दी है। सरकारी कर्मचारी मांग करते रहे हैं कि उन्हें अपनी पेंशन में निश्चितता की आवश्यकता है, विशेष रूप से पेंशन, पारिवारिक पेंशन और न्यूनतम पेंशन । जबकि सरकार इन चिंताओं को पूरी तरह समझती है, सरकार की आम नागरिक के हितों की रक्षा करने की भी जिम्मेदारी है ताकि भविष्य में पेंशन के कारण उन पर उच्च करों का भारी बोझ न पड़े। इसे ध्यान में रखते हुए, सरकार ने मौजूदा एनपीएस की समीक्षा करने और मामले में सिफारिशें करने के लिए वित्त सचिव की अध्यक्षता में एक समिति नियुक्त की थी। समिति ने राज्य सरकारों के साथ-साथ कर्मचारियों के प्रतिनिधियों से परामर्श किया और संघों, विशेषज्ञों आदि के सुझावों पर विचार किया। समिति ने अंतरराष्ट्रीय अनुभव को भी देखा और भारतीय रिजर्व बैंक से परामर्श किया। कमेटी ने अब अपनी रिपोर्ट सौंप दी है। यूपीएस समिति की सिफारिशों पर आधारित है और समिति की सिफारिशों पर राष्ट्रीय संयुक्त सलाहकार मशीनरी परिषद (जेसीएम) के कर्मचारी पक्ष के माध्यम से कर्मचारियों के प्रतिनिधियों के साथ चर्चा की गई। कर्मचारी प्रतिनिधियों ने व्यापक सहमति बनाने के लिए समिति को बहुमूल्य सुझाव दिये। यूपीएस की व्यापक रूपरेखा में निम्नलिखित शामिल हैं:-

1-जिन कर्मचारियों के पास पर्याप्त सेवा है, उन्हें प���ंशन के रूप में उनके पिछले 12 महीनों के मूल वेतन का औसत वेतन कम से कम 50% सुनिश्चित पेंशन मिलेगी।2-कम से कम 10 साल की सेवा वाले कार्मिकों को न्यूनतम 10,000 रुपये प्रति माह पेंशन दी जाएगी।

3- जीवनसाथी को पारिवारिक पेंशन पेंशन का 60% धनराशि के रूप में दिया जाएगा।

4-सुनिश्चित पेंशन, न्यूनतम पेंशन और पारिवारिक पेंशन पर महंगाई राहत दी जाएगी न कि मंहगाई भत्ता।

5-इसके अतिरिक्त, सेवानिवृत्ति के समय एकमुश्त धनराशि प्रदान की जाएगी।

6. स्वैच्छिक सेवानिवृत्ति (वीआरएस) के मामले में अभी नियम और इसका मूल ढांचा तैयार न होने तक स्थिति पूर्ण ��ूप से स्पष्ट नहीं हो पा रही है कि किसी कर्मचारी द्वारा VRS लेने के उपरांत उसे पेंशन तत्काल मिलना प्रारंभ होगा अथवा उसके वास्तविक सेवानिवृत की दिनांक के पश्चात अर्थात कितने वर्ष पश्चात उसे पेंशन देना प्रारंभ किया जाएगा।

7. कर्मचारियों के वेतन से दिया जा रहे अंशदान में कोई बढ़ोतरी नहीं होगी बल्कि केंद्र सरकार अपना अंशदान 18.5 % कर देगी, जो लोग एनपीएस के तहत पहले ही सेवानिवृत्त हो चुके हैं वे भी इस लाभ के पात्र होंगे। ऐसे पूर्व सेवानिवृत्त लोगों को उनके द्वारा पहले ही की गई निकासी को समायोजित करने के बाद बकाया का भुगतान किया जाएगा।

योजना का विवरण और पात्रताएं नीचे दी गई हैं-

1- कर्मचारी के योगदान (मूल वेतन + डीए) के 10% पर कटौती जारी रहेगी।

2- सरकारी योगदान वर्तमान 14% से बढ़कर 18.5% हो जाएगा।

पेंशन कोष दो फंडों में बांटा जाएगा-

2 (A) - एक व्यक्तिगत पेंशन निधि जिसमें कर्मचारी का योगदान (मूल वेतन और डीए का 10%) और समान सरकारी योगदान जमा किया जाएगा।

2(B) - अकेले अतिरिक्त सरकारी योगदान के साथ एक अलग पूल कॉर्पस (सभी कर्मचारियों के मूल और डीए का 8.5%)

2(C) -कर्मचारी अकेले व्यक्तिगत पेंशन कोष के लिए निवेश का विकल्प चुन सकता है। कर्मचारी सुनिश्चित पेंशन में आनुपातिक कटौती के साथ व्यक्तिगत पेंशन कोष का 60% तक निकाल सकता है।

2(D) -सुनिश्चित पेंशन पीएफआरडीए द्वारा अधिसूचित निवेश पैटर्न के 'डिफ़ॉल्ट मोड' पर आधारित होगी और व्यक्तिगत पेंशन कॉर्पस के पूर्ण वार्षिकीकरण पर विचार किया जाएगा। यदि बेंचमार्क वार्षिकी सुनिश्चित वार्षिकी से कम है, तो कमी को पूरा किया जाएगा। यदि व्यक्तिगत कर्मचारी कोष सुनिश्चित वार्षिकी (कर्मचारी द्वारा चुने गए निवेश विकल्प के आधार पर) से अधिक उत्पन्न करता है, तो कर्मचारी ऐसी उच्च वार्षिकी का हकदार होगा। हालाँकि, यदि उत्पन्न वार्षिकी डिफ़ॉल्ट मोड से कम है, तो यूपीएस के माध्यम से सरकार द्वारा प्रदान किया गया टॉप अप बेंचमार्क वार्षिकी तक सीमित होगा।

2(E) - न्यूनतम 25 वर्ष की अर्हक सेवा के लिए पूर्ण सुनिश्चित पेंशन उपलब्ध होगी। कम सेवा के लिए, कम से कम 10 वर्षों से शुरू करके, आनुपातिक सुनिश्चित पेंशन दी जाएगी।

2(F) -कर्मचारियों के पास यूपीएस चुनने का विकल्प होगा। यदि कोई कर्मचारी चाहे तो एनपीएस को जारी रखना चुन सकता है।

यूपीएस 01.04.2025 से प्रभावी होगा। आवश्यक प्रशासनिक/कानूनी सहायता ढांचा स्थापित किया जाएगा, इस योजना को राज्य सरकारें भी अपना सकती हैं। इससे 90 लाख से अधिक कर्मचारियों (23 लाख केंद्र सरकार के कर्मचारी, केंद्रीय स्वायत्त निकायों के 3 लाख कर्मचारी और राज्य सरकारों के 56 लाख कर्मचारी और राज्य सरकारों द्वारा अपनाए जाने पर राज्य स्वायत्त निकायों के 10 लाख कर्मचारी) को लाभ होने की उम्मीद है कर्मचारियों को लाभ पहुंचाने के साथ-साथ यह आम नागरिकों के कल्याण की भी रक्षा करेगा क्योंकि यह योजना पूरी तरह से वित्त पोषित होगी, यानी सरकार हर साल अपना योगदान पूरी तरह से भुगतान करेगी और पेंशन व्यय को स्थगित नहीं करेगी, इस प्रकार नागरिकों की भावी पीढ़ियों के लिए वित्तीय कठिनाई को रोका जा सकेगा।

इस लेख की कुछ जानकारी श्रवण कुमार कुशवाहा जी के पत्र से भी ले गई है अतः उनका बहुत बहुत आभार

1 note

·

View note

Text

NPS: National Pension System in India - UTI Pension Fund Limited (UTIPFL) UTI Pension Fund Limited (UTIPFL) is one of the leading pension fund managers in India. We manage pension assets and funds for Central Government employees, State Government employees, and private sector NPS subscribers. We specialize in the National Pension System (NPS) to provide optimal retirement solutions and maximize returns for a secure financial future. To learn more, visit us now! https://www.utipension.com/

0 notes

Text

National Pension System (NPS) Explained: Your Guide To Be Future Sure!

Are you ready to take control of your retirement planning and secure your future? Look no further than the National Pension System (NPS)! In this comprehensive guide, we unravel the complexities of NPS, empowering you with the knowledge you need to make informed decisions about your financial future.

youtube

0 notes

Text

Open NPS Account Online | NPS Account Opening | KFintech

National Pension Scheme (NPS) is a government-sponsored pension scheme to provide income security for all sector citizens. Apply for National Pension System Online at NPS KFintech.

0 notes

Text

All You Need to Know About the National Pension System (NPS)

The National Pension System (NPS) is a government-sponsored pension program in India designed to provide retirement income to Indian citizens. It is a voluntary, long-term investment plan that helps individuals build a substantial corpus for their post-retirement years. In this comprehensive guide, we will explore the key aspects of NPS, including its features, benefits, and how you can get started with it.

Features and Benefits of NPS

Voluntary and Flexible

NPS is a voluntary savings scheme, which means individuals can choose to participate. It offers flexibility in terms of contributions, allowing you to contribute as per your financial capacity.

Two Tiers of NPS

NPS consists of two tiers: Tier I and Tier II. Tier I is a mandatory, long-term retirement account with restrictions on withdrawals, designed to ensure savings for retirement. Tier II, on the other hand, is a voluntary account that offers greater liquidity.

Regular Contributions

Under Tier I, regular contributions are made by the subscriber throughout their working years. These contributions are invested in a mix of equity, corporate bonds, and government securities, depending on the choice of the subscriber.

Tax Benefits

NPS offers attractive tax benefits. Contributions to Tier I accounts are eligible for a deduction under Section 80CCD (1) of the Income Tax Act, up to a maximum limit of 10% of your gross income (in addition to the Section 80C limit). Additionally, there's an extra deduction of up to Rs. 50,000 under Section 80CCD (1B).

Auto Choice Option

NPS allows subscribers to choose their asset allocation or opt for the "Auto Choice" option, which automatically adjusts the asset mix based on the subscriber's age. It starts with a higher equity allocation and gradually shifts to a more conservative portfolio as the subscriber approaches retirement.

Lump Sum and Annuity Options

On reaching the retirement age of 60, you can withdraw a portion of the accumulated corpus as a lump sum (up to 60%) while the remaining must be used to purchase an annuity plan that provides a regular pension income.

Portability

NPS is a portable scheme, meaning you can continue your account even if you change your job or location. This feature ensures that your retirement savings remain unaffected by career moves.

How to Open an NPS Account

Eligibility

NPS is open to all Indian citizens, including resident and non-resident Indians. Even NRIs can avail of the benefits of NPS.

Permanent Retirement Account Number (PRAN)

To open NPS account online, you need to apply through a Point of Presence (POP). You'll receive a PRAN card, which is your unique NPS account number. This PRAN remains the same throughout your life, even if you switch jobs or locations.

Choose the Right Fund Manager

NPS allows you to select a fund manager from a list of pension fund managers authorized by the Pension Fund Regulatory and Development Authority (PFRDA).

Submit KYC Document

Like any financial account, you'll need to submit Know Your Customer (KYC) documents for identity and address verification. This typically includes Aadhar Card, PAN card, and a passport-sized photograph.

Initial Contribution

You'll have to make an initial contribution, which varies depending on the fund manager you choose. This amount can range from as low as Rs. 500 to Rs. 1,000.

Regular Contributions

After opening your NPS account, you need to contribute regularly. You can choose the frequency and amount of your contributions.

Monitor Your NPS Account

It's important to keep an eye on your NPS account, track your contributions, and review your fund's performance to ensure your retirement corpus is growing as per your goals.

NPS Tax Benefits

NPS offers attractive tax benefits, making it a popular choice for long-term savings:

Section 80CCD(1): Contributions to NPS up to 10% of your salary (for salaried individuals) or 10% of gross income (for self-employed individuals) are eligible for a deduction under Section 80CCD(1) of the Income Tax Act. This deduction is within the overall limit of Section 80C.

Section 80CCD(1B): An additional deduction of up to Rs. 50,000 is available under Section 80CCD(1B) for contributions made to NPS.

Section 80CCD(2): Employer contributions to NPS, up to 10% of salary, can be claimed as a deduction under Section 80CCD(2).

Tax on Withdrawal: While the lump sum withdrawal is tax-free up to 60%, the annuity income is taxable as per your applicable tax slab.

Conclusion

The National Pension System (NPS) is a versatile and tax-efficient investment option designed to secure your financial future during retirement. With its flexible contributions, tax benefits, and a choice of fund managers, NPS caters to a wide range of investors. By starting early and staying committed to your contributions, you can build a substantial corpus that will provide you with financial security during your retirement years. So, open NPS account online with stockholding as an integral part of your retirement planning and start building a better tomorrow today.

0 notes

Text

National Pension System: जानिये क्या लाभ हैं NPS में निवेश करने के

National Pension Scheme (NPS): सरकार द्वारा चलाई जा रही पेंशन योजना नेशनल पेंशन स्कीम (NPS) तक अब गांवों या कस्बों में रह रहे लोगों की भी पहुंच आसान हो जाएगी। पेंशन फंड रेगुलेटरी एंड डेवलपमेंट अथॉरिटी (PFRDA) ने कहा है कि सभी की पेंशन योजना NPS तक आसानी से पहुंच हो, इसके सभी बैंक शाखाओं और पोस्ट ऑफिस में यह उपलब्ध कराने के प्रयास किए जा रहे हैं। PFRDA ने NPS के डिस्ट्रीब्यूशन के लिये…

View On WordPress

#Annuity Plan#Benefits#Interest#National Pension Scheme#National Pension System#New Pension Scheme#Return

0 notes

Text

Smart Investment Choices: Exploring India's Top 5 Secure and Stable Returns

#investment#finance#safe invest#Corporate Fixed Deposits#Bonds#Public Provident Fund#Debt Mutual Funds#National Pension System

0 notes

Text

Calculator for National Pension Scheme System | NPS

ICICI PRU Pension NPS Calculator is one of the best financial tools for users to calculate their retirement corpus. The National Pension Scheme Calculator gives insights into the potential corpus an investor can accumulate by contributing regularly to the scheme. Users have just input their details like age, monthly contribution, expected return rate, and retirement age, and then they can get a clear projection of their pension wealth.

#national pension system calculator#national pension calculator#nps calculator#nps pension scheme calculator#nps scheme calculator

0 notes

Text

How to Get Rs. 1,00,000 Pension Per Month with NPS | HDFC Pension

Know how to achieve a monthly pension of Rs. 1,00,000 with the National Pension System (NPS). Learn about investment options and retirement planning with NPS.

0 notes

Text

Why NPS | National Pension System Scheme

National Pension System (NPS) is one of the best retirement planning tool available in India today. NPS is a voluntary pension scheme, regulated by PFRDA.

#national pension scheme#NPS Scheme#nps pension#national pension system nps#new pension scheme nps#national pension system scheme

0 notes

Text

KFintech NPS - Open NPS Account Online | National Pension System

National Pension Scheme (NPS) is a government-sponsored pension scheme to provide income security for all sector citizens. Apply for National Pension System Online at NPS KFintech.

#nps#investment#national pension scheme#national pension system#pension#retirement#technology#business#nps calculator#education

0 notes

Text

#National Pension System Pran#NPS Pran Number#nps pran status#National Pension System Registration#NPS Registration#NPS Pran Nubmer online

0 notes

Text

What Are the Challenges Investors Face When They Plan an Investment in Mutual Funds in Bhavnagar?

Investing can be a journey of both excitement and confusion, especially for newcomers in Bhavnagar. The financial market offers various avenues, and mutual funds stand out as an excellent starting point. However, the road to choosing the right funds is often riddled with challenges. Let's explore the obstacles investors face as they begin their journey of investment in mutual funds in Bhavnagar.

Addressing Investor Challenges

Information Overload: Navigating through countless mutual fund options can overwhelm newcomers, making decision-making daunting.

Defining Investment Objectives: Setting clear financial goals and understanding risk tolerance before diving into investments is crucial.

Assessing Fund Performance: Beyond past returns, evaluating risk-adjusted returns, consistency, and comparisons with peers is essential.

Grasping Fund Fees: Understanding various fees impacting returns, like management fees and sales loads, is key in assessing costs.

Emotional Decision-Making: Emotions often drive impulsive decisions, leading to short-term choices detrimental to long-term goals.

Lack of Expertise: New investors may lack financial knowledge, highlighting the importance of seeking guidance from advisors.

Expert Guidance for Bhavnagar Investors

Shri Money Matters, one of the best mutual fund distributors in Bhavnagar, understands the challenges investors face and offers reliable investments in mutual funds, helping investors gain a basic understanding of key concepts like risk, diversification, asset allocation and streamlining investments for them. Let's explore how investors can benefit from advanced tools and practices offered by them:

Streamlined Selection Process: Distributors utilize advanced tools to simplify fund selection, and investors can easily compare different funds based on crucial criteria.

Thorough Fund Analysis: In-depth research and analysis on mutual funds form the basis of well-informed recommendations, aligning with individual goals.

Tailored Recommendations: Understanding financial profiles and risk tolerance leads to personalized fund recommendations.

Ongoing Support: Ensuring continuous support, addressing concerns, and recommending adjustments as needed.

Fostering Rational Decisions: Guidance in developing a long-term investment mindset focused on rational decision-making.

Mitigating Risk: Encouraging diversification across asset classes to construct well-balanced portfolios.

Portfolio Rebalancing: Regular reassessment for portfolios to stay aligned with objectives.

Personalized Advice: Offering customized advice based on unique circumstances and financial objectives.

Conclusion

Starting your investment journey in mutual funds needs careful planning. While mutual funds are a good start, diversifying your investments is necessary. Shri Money Matters helps investors in Bhavnagar make smart choices, get ongoing help, and stick to a clear investment plan with all the above-listed tools and tactics.

#best mutual fund distributors in Bhavnagar#best insurance company in Bhavnagar#mutual funds investment services in Bhavnagar#life insurance agency in Bhavnagar#health insurance service in Bhavnagar#medical insurance policy in Bhavnagar#general insurance Bhavnagar#corporate bond services in Bhavnagar#loan against mutual funds in Bhavnagar#personal loan in Bhavnagar#national pension system in Bhavnagar#nps in Bhavnagar#private fixed deposit schemes in Bhavnagar

0 notes