#investment banks

Explore tagged Tumblr posts

Text

Investment Banks and Finance Companies.

Investment banks offer services in equity capital markets, leveraged debt capital markets, commercial real estate, asset finance and leasing, and corporate lending services. The major functions of investment banks are raising funds, asset management, mergers and acquisitions advisory services, brokerage services, and market making. The asset management function of investment banks involves managing the funds of corporations and investing in stocks, fixed-income securities/bonds, derivatives investments, and other types of investments. Investment banks are actively involved in mergers and acquisitions by performing the functions of deal making. Securities underwriting is the process by which investment banks raise investment capital from investors in the form of equity and debt capital on behalf of companies and government authorities. Underwriters offer a set of services for initial public offerings (IPOs) or seasoned equity offerings. The methods used for IPO pricing are the fixed price method and book building process. The debt capital markets services divisions of investment banks solicit structures and execute investment-grade debt and related products, which include new issues of public and private debt. The strategic changes in investment banks has often been cited as a reason for the economic crisis that crippled the global economy.

Finance companies are specialized financial institutions that make loans to individuals and corporations for the purchase of consumer goods and services. The three major types of finance companies are consumer finance, business or commercial finance, and sales finance.

Learn more about Investment Banks and Finance Companies related to the publication - Strategies of Banks and Other Financial Institutions: Theories and Cases.

#initial public offerings (IPOs)#investment capital#investment banks#sales finance#consumer finance#business or commercial finance#and#international day of banks#4 december#asset liability management

2 notes

·

View notes

Text

Unlocking Growth and Resilience Through Prime Brokerage Services

In the dynamic world of finance, prime brokerage has emerged as a cornerstone service for institutional investors, hedge funds, and asset managers, offering a strategic mix of resources and expertise. Prime brokerage services are designed to streamline trading operations, optimize capital, manage risks, and provide clients with the infrastructure they need to execute complex financial strategies with ease. This article explores the key components of prime brokerage, its benefits, how it adapts to changing market demands, and why choosing the right prime broker is crucial for financial success.

Understanding Prime Brokerage: A Strategic Asset for Institutional Investors

Prime brokerage refers to a suite of services provided by investment banks and financial institutions to hedge funds, asset managers, and other large investors. It is more than just an account for trading; it is an operational ecosystem. Prime brokers offer services that range from trade execution and clearing to securities lending, risk management, and technology solutions.

Key services in prime brokerage include:

Trade Execution & Clearing: Prime brokers handle trade processing and clearing, ensuring that trades are efficiently settled, with minimal risks.

Securities Lending: This enables clients to borrow securities for short-selling and enhances liquidity in their investment portfolios.

Capital Introduction: Prime brokers connect hedge funds and other clients with potential investors, providing an invaluable networking channel.

Risk Management Tools: Prime brokers offer sophisticated risk analytics and reporting tools, allowing clients to make informed investment decisions and manage exposures.

Technology Solutions: With advanced platforms, prime brokers streamline trading processes, reporting, and data management, enhancing operational efficiency.

Benefits of Prime Brokerage for Institutional Clients

The unique combination of services provided by prime brokers creates a high-value package tailored to the needs of institutional investors, enabling them to focus on their core strategies without the operational burden of managing complex infrastructure. Here are some of the primary advantages:

1. Increased Operational Efficiency: With a prime broker managing back-office functions, clients can streamline operations and reduce the need for an in-house support structure.

2. Enhanced Capital Efficiency: Prime brokers provide margin and leverage facilities, helping clients optimize their capital usage and expand trading capabilities.

3. Reduced Counterparty Risks: By centralizing clearing and trade execution, prime brokerage reduces counterparty risks, a crucial factor for clients engaging in multi-asset trading.

4. Access to Capital and Liquidity: Through securities lending and other funding services, prime brokers provide clients with enhanced liquidity, enabling them to execute complex trading strategies.

5. Insightful Risk Analytics: Prime brokers offer tools for real-time risk monitoring, empowering clients to adapt strategies quickly in response to market shifts.

Navigating Market Challenges with Prime Brokerage Services

In a financial landscape characterized by volatility, regulatory changes, and evolving client needs, prime brokerage services have adapted to offer more agile and flexible solutions. Leading prime brokers today focus on providing multi-asset class capabilities, robust cybersecurity measures, and compliance support, making them trusted partners for navigating an increasingly regulated environment.

Moreover, prime brokers now incorporate advanced technology, such as artificial intelligence and machine learning, to enhance predictive risk management and streamline workflows. This helps institutional clients stay ahead of trends, respond quickly to changes, and leverage data for strategic decision-making.

Selecting the Right Prime Broker: Key Considerations

Choosing the right prime broker is a pivotal decision that can significantly impact an institution’s operational performance, access to capital, and risk management capabilities. Here are some essential factors to consider:

1. Comprehensive Service Offerings: Evaluate the range of services offered, ensuring they align with your trading, financing, and operational needs.

2. Global Reach & Multi-Asset Class Expertise: A prime broker with a strong global presence and multi-asset trading support can provide diverse opportunities and foster international growth.

3. Technology & Innovation: Look for brokers with robust technological capabilities, including data analytics, risk reporting, and integration with existing systems.

4. Reputation & Financial Stability: Partnering with a well-established, financially stable broker is critical to mitigating potential counterparty risks.

5. Personalized Client Support: Prime brokerage services should be responsive and customized to your needs, with dedicated teams offering support across time zones and regions.

Conclusion: Leveraging Prime Brokerage for Competitive Advantage

Prime brokerage is an invaluable resource for institutional investors looking to maximize operational efficiency, enhance risk management, and achieve their financial goals. As market conditions evolve, prime brokers provide the tools and expertise needed to adapt to new challenges, ensuring that clients remain competitive. By strategically selecting a prime brokerage partner that offers comprehensive services, advanced technology, and global reach, investors can position themselves for long-term success, optimize their trading infrastructure, and navigate the complex landscape of institutional finance with confidence.

#finance#brokerage services#investing#prime brokerage#Prime Brokerage Services#hedge funds#financial strategies#investment banks#financial success#prime broker

0 notes

Text

The I Bankers

Businesses of tomorrow need to be built on balanced foundations, Empathy and pragmatism foresight and technology. At the I-Bankers, we treat organizations as partners, with a strong focus on collaboration.

For more info visit our website- https://theibankers.com/

#tax saving#banker#finance help#income tax#income tax filing#investment banks#tax on savings#investment banking companies#income tax saving options#income tax saving tips

1 note

·

View note

Text

(by Clay Banks)| New York, US

#upl0ad5#landscape#Clay Banks#cabin#Woodstock#new york#united states#fall#autumn#i reeeaaallllyyy need to invest in a cabin

557 notes

·

View notes

Text

"And it just happened to be empty?" "Something like that."

Suits 4x8 "Exposure" Mike returns to Pearson Specter and gets Harvey's old office.

#marvey#mike ross#harvey specter#suits#suits usa#suits tv#just! going a bit mad about this specific point in time. because. there's a window here where they actually could have become something.#the investment banking era (my beloved) put them as equals. and had such open flirtatiousness. and love and respect.#and then rachel completely fucked up and mike! was done with the relationship! and rightly so!#and then here mike is. playful flirty starry heart eyes to harvey. and harvey's besotted /of course/. can't help but say something genuine.#and mike's basking in it! not a word to say. just smiling up at him. eyes flick over him.#they feel the same!!! boys you have butterflies for each other.#god what could have developed from this perfect moment in time if mike hadn't taken rachel back#(no donna that was not ''FoR MiKe'')#... gonna make these tags messier now bc I kept watching with this sat in drafts lmao BUT#especially feeling this now since on 4x10. thee Iconic ''he's twice the man that I am'' AND it's not even JUST that in this ep. like.#harvey is full-on No.1 mike ross cheerleader. defender. lover. he's chest-burstingly in love with this man. and mike is seeing it!#and he doesn't even see the half of it! but he's already taken back rachel and they're missing their perfect window in time </3#still going on DATES though. where they flirt and play and disguise their compliments and admiration of each other through teasing. ok!#mike baby the love between you will only get stronger. till you can't ignore it. and run from it. and run back to it.#coulda had him!!!! coulda had him in season 4!

179 notes

·

View notes

Text

Hate the men's fashion tag because I'll just be minding my business, scrolling looking for interesting ideas and all I get is blue suit jackets and softcore porn

#the struggle for mens fashion#some guys have no idea how to dress unless they are trying the 600k a year investment banking position style#I guess some of you won't mind the barely clothed men#but unlike the tags I am not bisexual#196#mensfashion#fashion#r196#r/196#/r/196#rule#ruleposting#tag ramble

41 notes

·

View notes

Text

#crypto#politics#us politics#political#donald trump#president trump#elon musk#news#american politics#jd vance#law#money#cryptocurrency#etherium#database#fraud#hacked#billions#economic#economics#economy#government#banks#cash#market#6% drop#investments#investors#us policy#bybit

20 notes

·

View notes

Text

the obx cast lore is actually way better than the show post-S1

#i’m actually just now on 2x1 so i should probaby stfu but like#i won’t#i’m so invested#obx#outer banks#rudy pankow#madison bailey#jiara#rudison#chase stokes#madelyn cline#jarah

40 notes

·

View notes

Text

Obxanon is Austin north I'm calling it right now

#outer banks season 4#outer banks#obxanon is 99% lying to everyone for fun but since there's legit drama of rudison outside of their blog I'm invested LMAO#obxanon#jiara

49 notes

·

View notes

Text

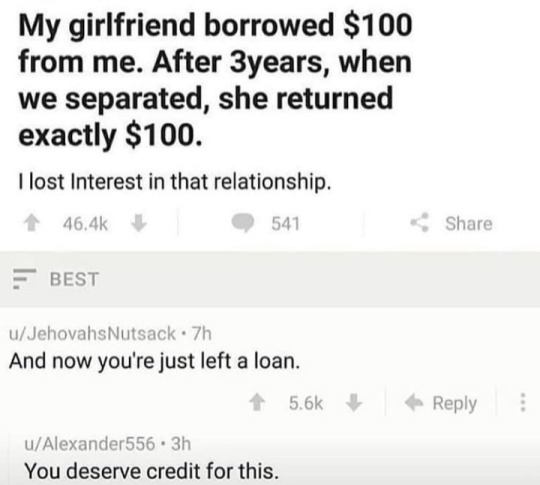

When you date an investor

#banking#finance#crypto#digitalcurrency#investing#investment banking#loans#money#student memes#memes#meme#funny#relatable#insidesjoke#humor#maths#low

84 notes

·

View notes

Text

thoughts on rafe age gap with an upcoming reader???

#it’d be like two years#so s1 she’s 17 when he’s 19#he supplies her with weed and sometimes coke#he feels an ownership over her and she’s not as invested and/or knows it won’t work out cause of everything about him#rafe cameron#outer banks#obx

23 notes

·

View notes

Note

The problem is that Claudia isn't a mirror, she's a child, then a woman, and when she is reflecting them, I do think Louis tends to see Lestat in her and not himself.

(Same Anon you were answering) Yes! Complete agreement on Louis looking for a mirror of himself in Claudia and not seeing many of the ways she takes after him. Personally I think he’s also resisting seeing her more Lestat-ish sides until he’s forced to face them. Part of the problem is that he’s only looking for the more savory parts of himself in her, not the ones he’s less than keen to admitting to and I think that’s tied to…the social and moral acceptability of loving Claudia. It’s not the best way of putting it but it’s something I’ve been thinking about for a while but I’m still struggling to express: how important I think it is to Louis that Claudia is someone that he can and should love unconditionally and without the shame and baggage of loving Lestat, both as his child and as an innocent -or as much an innocent as a vampire can be.

(x)

Yeah, I totally agree.

To add to your point about Louis and unconditional love, this might sound like a bit of a stretch, but bear with me, haha, but I think it kind of ties into this throughline of Louis placing an enormous amount of responsibility on himself to be the primary resource/provider/carer for those he loves, and as a part of that, being in denial of their needs when they need things he doesn't want to acknowledge, or has no skills or resources to meet?

I've been percolating on this a bit during my very-slow-rewatch of the series, but I really do think we see the foundation of that in the pilot where Louis' not only obviously taken on the entire financial burden of the de Pointe du Lac family, but is simultaneously trying to oversee (with Florence) Grace getting married, and the care of Paul. I talk about it a bit in my Grace post, but I think Louis shutting down Grace when she brings up the prospect of seeking help is a really telling character moment.

Not only is it indicative of his shifting role in her life between brother and father, and his paternalistic tendencies generally, but I think it also reflects his denial of the idea that caring for Paul is something he can't handle himself. It's coming from a genuine place of love, but the reality is also that none of them are equipped to help Paul in the way that he needs it, and Louis will downplay that because he doesn't want it to be true.

What Louis wants is to be everything to everyone all of the time, and I think there is a part of him that resents them for it. I mean, he basically literally says that to Claudia's face - he does see her as a burden, and that frustrates him, but at the same time, he wants that. He wants burdens, he wants people to need him, and when they need something he can't give them, well, he resents them for that too.

I think we see it a lot with Louis when it comes to Claudia, but I think we see it with Lestat and a bit with Armand too. He wants to be the person they need most, and what that looks like changes based on the person and relationship dynamic. Like I'd say it manifests very differently for Loius The Father vs Louis The Husband, but I do also think it's there with all of them, and when it's a need he can't meet whether that be growing up, or romantic love, or mental health, or healing a trauma, he denies it until he's forced to face it, and then he usually resents them for it.

I think his love for Claudia is in a lot of ways a really intense version of that specifically because she is his daughter, and the idea that he can't provide what she needs or be all the love that she needs or truly protect her is elevated by the nature of that specific dynamic. It's all fed by paternal guilt and parental ownership and the idea that by the simple fact of being his daughter, she's both his reflection and his responsibility no matter how old she gets, or how much she wants to change their roles.

#it kind of goes to me with how he handles claudia lestat and louis' respective traumas too#in that he doesn't lol#and in fact even weaponises armand's#i had a whole section in here too about perception which i've taken out because it felt like too much of a sidetrack#but re: louis the husband i do think there's a need to be perceived as the provider too#like neither lestat nor louis needed money in the nola era which the show made very clear#but they were at their happiest when there was this public-facing dynamic of louis the entrepreneur and lestat effectively looking like#a rich trophy husband#(or a sugar daddy if you ask grace but that's a deliberate effort to insult#given everyone in nola would presumably know the family's cashed up and louis' the one making bank publicly)#louis making a point in the narration about how quickly he paid lestat back for his seed investment in the azaelia too kind of#speaks to that too i think#and louis clearly feeling emasculated by the loss of the azaelia and being pushed into pink collar investment (grocery stores and milliners#contributing deeply to his unhappiness and depression#but yeah it's a dynamic that's there too with armand given it's clear the businesss/money are louis'#it's an interesting aspect of character!#louis asks#claudia asks#iwtv asks#claudia + louis

22 notes

·

View notes

Text

not too much on my man now 🥲 who’s gonna tell her ab jj

#i’ve been trying to get her to be invested for so long this is still a victory#but fr he just needs a lil lovin’ okay back off#rafe#rafe cameron#obx#outer banks#rafe outer banks#drew starkey#obx spoilers

22 notes

·

View notes

Text

THEORY ALERT!!!!!!!!!!!!!!!!!!!!!!

So I was looking stuff up about tarot because I'm a big proponent of fool Ratio and was hoping to find some more straws to grasp at, and I came across the oldest preserved tarot deck, which is the Visconti-Sforza or Pierpont Morgan deck.

And I was like oh that's crazy that I'm here looking for Star Rail lore and I find reference to Pierpont, which sounds a lot like Pier Point, the name of IPC headquarters.

Looking at the cards, they all have this gold embossed diamond pattern in the background that I think looks similar to the diamond/triangle motif in the Stonehearts Myriad Celestia.

Tarot is also heavily influenced by Egyptian mythology, so I think it's interesting that there are also references to that in the Stonehearts video (Aventurine's trial with the scale, Sugilite's statues of Anubis).

But anyway back to Pierpont, it turns out the cards were purchased by the Morgan Museum in New York, which is now open to the public, but started out as a massive private collection owned by John Pierpont Morgan, better know as J.P. Morgan, the uber-wealthy investment banker of the late 1800s/early 1900s. It's giving preservation, AND it's giving capitalism, the IPC's literal two favorite things.

Wikipedia also says that he "specialized in taking over businesses that were promising but struggling," which kind of sounds like the IPCs whole business model with what we know about Topaz's backstory and Belobog.

I also think all of this ties in really well with the like New York art deco imagery in the Myriad Celestia.

I don't know if I think the Stonehearts are supposed to correspond to the major arcana 1:1... some of them I can see like maybe Aventurine = Wheel of Fortune or Jade = the Lovers (because of references to the Garden of Eden), but there are more major arcana than stonehearts + Diamond. There are 14 of those cards surviving in the Visconti-Sforza set but that is still more than 11.

I don't feel like any of this is super conclusive but I just feel like there's something here. Does anyone have thoughts or anyone who actually knows about tarot have something to add? <3

26 notes

·

View notes

Note

Hiiii!!! I keep getting invites to create money manager accounts from my bank & various credit cards, and i was wondering if y'all could explain what they are? I've tried to research them but can't make heads or tails if starting one is a good idea or not. Any advice??? TIA!!

First off, here's what you do with those "invites":

They aren't invitations. They're advertisements. You can safely ignore them. We explain all about it here:

Here’s What to Do With Those Credit Card Pre-approval Offers You Get in the Mail

Now, a "money manager account" is probably just some kind of investment account. When you're ready, you can do some research on both investment accounts and credit cards on your own, and choose accounts based on YOUR needs, not what your bank wants to sell you. For more on that, read this:

Cheat on Your Bank—It's Not Your Girlfriend

Hope that helps!

If this helped you out, tip us!

#credit cards#credit card pre-approval offer#banks#banking#adulting#personal finance#financial industry#financial services#finance#investing#money

55 notes

·

View notes

Text

All you have to do is study and network

#aesthetic#banker#banking#girlblogging#investment banking#finance girl#finance#jp morgan#corporate girlie#corporate girl#corporate#finance aesthetic#banker aesthetic

24 notes

·

View notes