#internal Auditing

Explore tagged Tumblr posts

Text

Internal Audit | Internal Auditor

ASC Group offers services for Internal auditing. Internal Auditing is not just about compliance anymore. It is essential for enhancing organizational performance. Our internal auditing helps businesses identify inefficiencies. We accomplish this by systematically reviewing internal controls and risk-management processes. You can reach them by calling 9999043311 for assistance. We're available 24 hours per day.

For More Information About Internal Audit

#internal Auditing#Internal Audit#Internal audit services#Internal audit service provider in india#Internal audit consulting services#Internal audit services in india

0 notes

Text

Master internal auditing and advance your career with the CIA certification. Discover course details, requirements, and benefits. Open doors to top auditing roles worldwide! 🌍📈

Join now: https://tinyurl.com/2v23kkmr

Connect with us for more information: 📲+91 9903100338 📧[email protected]

#CIA course#Certified Internal Auditor#Auditing Career#Career Advancement#Professional Certification#Audit Expert#CIA certification#Global Opportunities#Internal Auditing#Career Growth

0 notes

Text

#Internal Audit Services in UAE#Internal Audit Services#Internal Auditing#Internal Audit services in Abu Dhabi#Internal Audit Services in Dubai#Internal Audit Consultants

0 notes

Text

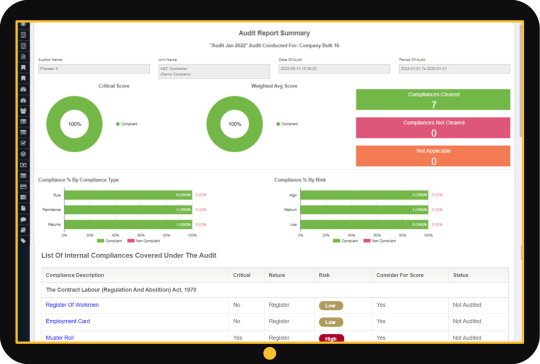

Internal Audit Management Software — Simpliance Audit Module

Simpliance Internal Audit Management Software is flexible to suit all your organization’s audit requirements. The tool can be tailored and customized as per multiple audit engagements and is simple and effective in implementation.

Simpliance helps businesses reduce costs and enhances overall productivity for both the organization as well as the auditor. Ranging from financial audits (as per the international accounting standards), assets audit to ISO audits, the Internal Audit Management application scope manages the auditing end-to-end. Detailed auditing reports with simplified work-paper management and risk-based auditing processes help businesses meet specific audit requirements in the most efficient method.

Request a FREE DEMO now!

#internal auditing#labour law audit#auditsoftware#labour law compliance#labour laws in india#labourlawcompliance#automated audit#auditing tools

0 notes

Text

6 Horror and Thriller Asian / International Movies Reccomendations:

Helter Skelter (2012 Japanese Movie, directed by Mika Ninagawa)

Love Exposure (2008 Japanese Movie, directed by Sion Sono)

Battle Royale (2000 Japanese Movie, directed by Kinji Fukasaku)

A Tale Of Two Sisters (2003 Korean Movie, directed by Jee-Woon Kim)

Kill Bill (2003 American - Japanese Movie, directed by Quentin Tarantino)

Audition (1999 Japanese Movie, directed by Takashi Miike)

#helter skelter 2012#mika ninagawa#audition 1999#love exposure#sion sono#asian film#chiaki kuriyama#quentin tarantino#a tale of two sisters#asian thriller#japanese movies#korean movies#international movies#takashi miike#battle royale#uma thurman#eihe shiina#movie tumblr#lucy liu#gogo yubari#asian horror

457 notes

·

View notes

Text

Elementary playing the long game with Odker (part 1):

1x18 Déjà Vu All Over Again 1x21 A Landmark Story 2x03 We Are Everyone 2x04 The Poison Pen 2x11 Internal Audit 2x13 All In The Family 2x15 Corpse De Ballet 2x16 The One Percent Solution 2x17 Ears To You 2x23 Art In The Blood 2x24 The Grand Experiment

#elementaryedit#elementasquee#*elementary#elementary#odker#deja vu all over again#a landmark story#we are everyone#the poison pen#internal audit#all in the family#corpse de ballet#the one percent solution#ears to you#art in the blood#the grand experiment

81 notes

·

View notes

Note

We need a total drama character who was an intern, but Chris was stupid and accepted somebody twice (like how Izzy had two audition tapes), so the intern got added last minute.

.

#I love our intern forced to be a camper concepts they're always so much fun#I've never thought about the two auditions thing...#maybe chris thought they were twins since one used a nickname and the other didn't#like Patty and Patricia#total drama#total drama island#fanofanimation

23 notes

·

View notes

Text

not to be insanely lame and talk about my job online but why are clients so stupid!! if i send something that says “please provide this invoice” and they send back a print out of an email with a dollar amount written on it so i say “returned, please provide the original invoice from the vendor” and then after a WEEK they send back the printed out email!!!!!! like that’s not what i want!!!!!!!!! I literally sent that exact thing back to you!!!!!!! bc it’s not an invoice!!!!!!!!

#not even an email from the fucking vendor!!!!#literally an internal email that’s like an account and routing number and then someone wrote on it in pen like ‘send 17000’#like sir in what WORLD!!!! is this audit evidence!!!!!!!

16 notes

·

View notes

Text

Lucy Liu in the 'Internal Audit' episode of Elementary (2013).

6 notes

·

View notes

Text

smh

#smh my head#smh smh#smhhhhh#smh#fuckwads of the gop#fuck the gop#corrupt gop#gop hypocrisy#gop#republicans#fuck the republikkkans#republikkkan stupidity#republikkkan traitors#republicans are domestic terrorists#republicans are evil#republicans are garbage#republicans are the problem#republicans are hypocrites#irs audit#irscompliance#fuck the irs#irsforms#irs#internal revenue service#democrats are corrupt#democrats are evil#democrats are traitorous#democrats are stupid#demokkkrats#fascism

3 notes

·

View notes

Text

Internal Audit Management Software — Simpliance Audit Module

Simpliance Bespoke Audit Management platform is flexible to suit all your organization’s audit requirements. The tool can be tailored and customized as per multiple audit engagements and is simple and effective in implementation.

Simpliance helps businesses reduce costs and enhances overall productivity for both the organization as well as the auditor. Ranging from financial audits (as per the international accounting standards), assets audit to ISO audits, the Internal Audit Management application scope manages the auditing end-to-end. Detailed auditing reports with simplified work-paper management and risk-based auditing processes help businesses meet specific audit requirements in the most efficient method.

Request a FREE DEMO now!

0 notes

Text

yall i just bombed an audition so fucking bad no one talk to me

#i want to get in so so so bad you have no idea#theres an international tour#i want innnnnnnn#its literally my dream#and sure i could audition again next year#but there wont be a tour for another couple of years#and all that stood in my way was my fucking awful sightsinging#im literally going to cry no one talk to me#aelia talks to the void

3 notes

·

View notes

Text

Jared and Jensen are both so unrelatably good looking and I feel like if Eric kripke had complete control over supernatural and who was cast they would not have even been considered

#they are both complete 10s but that’s not really how they went with any other (male) side character#I feel like kripke did not want to make the type of show that had attractive male leads who were badass and everyone thinks they’re cool#but I know they only auditioned internally so it was all certain boys in the auditions#and everyday I burn with curiousity about who else auditioned

5 notes

·

View notes

Text

she is ready to COLLAPSE, folks

seriously this is actual current colorized footage of what i feel like

#i think it went okay!#i was definitely freaking out LESS internally during the audition so that’s good#but yeah after a full afternoon this girlie needs to COLLAPSE#anyway that’s how i’m doing#update soon maybe?

6 notes

·

View notes