#insurance us

Explore tagged Tumblr posts

Text

36K notes

·

View notes

Text

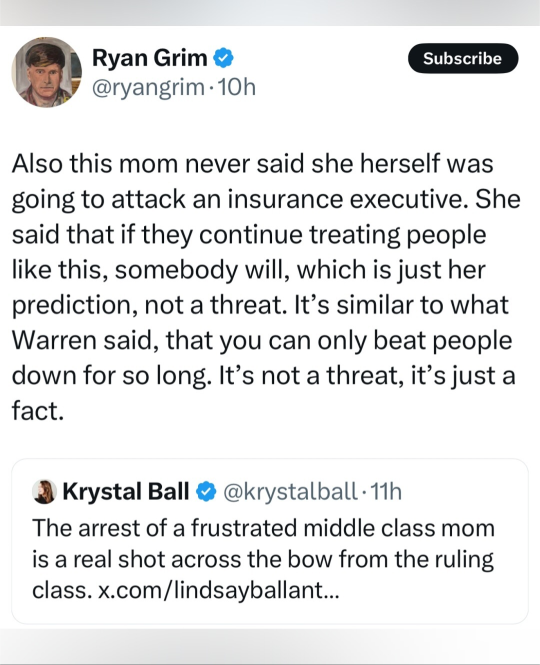

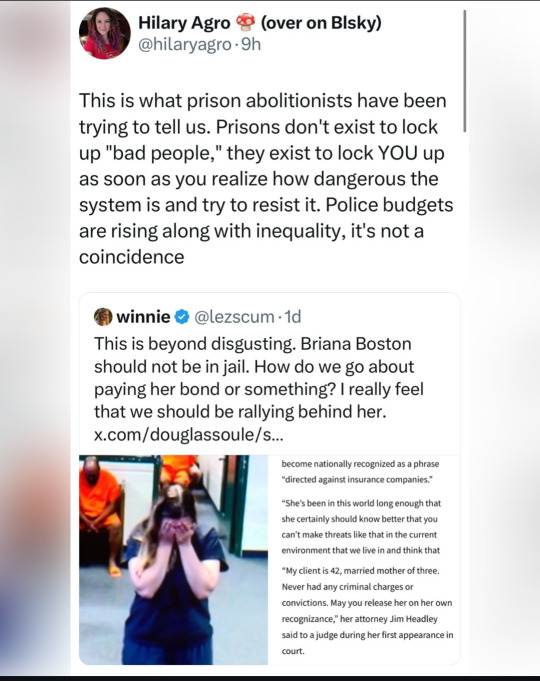

#luigi mangione#briana boston#cast down the mighty#deny defend depose#delay deny defend#us healthcare#health insurance#corporate greed#fuck ceos#the joys of living in a failed state

24K notes

·

View notes

Text

BCBS: Yeah if your surgery takes longer than our admin staff with no medical training thinks it should, you have to pay out of pocket for the anesthesia.

UHC CEO: [assassinated in the street]

BCBS: ... You know we were just joking about that anesthesia thing ha ha we would never. We love keeping our brains inside customers happy.

#blue cross blue shield#united healthcare#us current events#healthcare is a human right#fuck insurance companies

14K notes

·

View notes

Text

Scares the Dickens out them. 😳

#deny defend depose#deny#defend#depose#bullets#uhc ceo#ceo shooter#ceo#ceo shooting#united healthcare#uhc#a christmas carol#charles dickens#3 spirits#ghosts#meme#memes#funny memes#health care#health care memes#health insurance#us politics#american politics#USpol

11K notes

·

View notes

Text

To put into perspective my feelings on the United Healthcare CEO story, I'm gonna tell you a super fun story.

Around six years ago I was dying of organ failure.

Like, full on organs-shutting-down-couldn't-eat-anything-for-weeks-could-hardly-function organ failure. I had surgery scheduled to help reverse some of this. Hope was on the horizon. I was going to live. I was going to be okay. I just needed to get to my surgery date.

And then the day before that surgery I got a call.

"We've been fighting with your insurance company for weeks," said the lady on phone. "They keep telling us your procedure isn't 'medically necessary'. Dr. [Surgeon] screamed at them for a half an hour yesterday...but they still refuse to cover it."

I was given a choice during that conversation: go ahead with the surgery anyway and be on the hook for tens of thousands of dollars...or don't get the surgery...and almost certainly die.

I'm sure you can guess which one I chose.

I'm sure you can also guess what the name of my insurance company was at the time.

10K notes

·

View notes

Text

Protecting Your Company with Business Insurance in Hoosick Falls

Running a business in Hoosick Falls comes with unique opportunities and challenges. One essential component for long-term success and security is having the right business insurance in place. Business insurance protects your assets, employees, and operations from unexpected risks, allowing you to focus on growth and peace of mind.

Why Business Insurance in Hoosick Falls is Essential

From local retailers to service providers, every business faces potential risks like property damage, liability claims, and employee injuries. Having comprehensive business insurance in Hoosick Falls helps protect against these uncertainties, providing security to business owners and stability to the local economy.

With tailored coverage options, you can safeguard your business against potential losses and liabilities. Gaines Group offers a range of business insurance solutions designed specifically for the diverse needs of Hoosick Falls businesses, whether you operate a small family-owned shop or a larger enterprise.

Customized Insurance Plans for Hoosick Falls Businesses

Each business is unique, which is why Gaines Group provides customized plans that cover everything from general liability and property damage to workers' compensation. Their team of experts works closely with you to identify your business's specific needs and tailor coverage accordingly. This personalized approach ensures that your business insurance policy aligns with your industry requirements and financial goals.

To learn more about available business insurance options, visit Gaines Group’s Business Insurance page for detailed information and personalized guidance.

Contact Gaines Group for Business Insurance in Hoosick Falls

If you’re a business owner in Hoosick Falls looking to secure your operations, Gaines Group is here to help. With extensive experience in business insurance, they can assist you in choosing the right coverage. For a consultation, call Gaines Group at (518) 244-8000 or visit their local office in Hoosick Falls to discuss your specific needs and create a policy that works for you.

0 notes

Text

i thought i was at my lowest but holy shit it gets lower

#woke up feeling more lost and out of touch with myself.. my surroundings and my partner all in the span of a night.. what the hell..#i really need a new therapist. specifically a dbt therapist but i have really weird health insurance so there's not many options..#i just really need someone that i feel open enough to talk to about anything and that will actually help me and not just use the dumbass#worn out therapist lines..#bpd shitposting#actually bpd#actually mentally ill#bpd#actually borderline#bpd vent#bpd fp#bpd favorite person#bpd mood#bpd problems#sorry 4 the long rant in tags :/

7K notes

·

View notes

Text

need to share an experience i had 30 minutes ago

(edit: thanks to @walks-the-ages for providing and reminding me to put alt text, sorry it slips my mind alot lol)

#my hands are still shaking to be quite honest i could not put a lot of effort into this.#but like. brain. why did you do that#literally i have been like hopelessly obsessed with de nonstop thinking abt it for the past couple of days it is Scaring me#it is terminal its soooo fucking chronic#disco elysium#kim kitsuragi#for anyone who wants to know i bumped into some guys car that was stopped for a school bus. i think my brain errored and thought#my foot was fully pressing down on the brake pedal but it wasnt.#i am like 99.99 percent sure neither of us had any major damage to our cars but we still filed a police report just in case#because insurance do be a bitch. dudes back bumper was scratched lightly and my front license plate has a dent now#also literally my first ever car accident that ive had ever yippee yay

30K notes

·

View notes

Text

You know what since I’ve got a ton of new followers because my post on puberty blockers took off and people apparently want to see me rant, I’m gonna get up on my soapbox for a PSA for tumblr’s aging userbase.

Do not! Get! A Medicare Advantage plan!

Tell your parents not to get one. Tell your aunts and uncles not to get one. Tell your friends not to get one.

Why is that, you might say? Kouri, what is a Medicare Advantage plan, you might say?

tl;dr Medicare is the government healthcare plan for Americans of a certain age or with certain disabilities. It is owned, administered, and operated by the government. You are entitled, if you wish, to outsource your Medicare and have your policy run by a commercial group, such as United HealthCare, Cigna, Aetna, et cetera.

Here’s how it works: For everyone who signs up for, say, a plan that rhymes with Figna Medicare Advantage, Medicare gives Figna a certain amount of money and says ‘use this to take care of this patient’.

You can see where this is going, right? Figna says ‘sure boss! *wink nudge*’ and then shoves as much of that money into their own pockets as possible, and they do that by finding excuses to NOT pay for your medical care.

Medicare Advantage plans are pushed and marketed heavily. They’ll call you. They’ll set up stands in your PCP office to try to encourage you to buy in. They will say things like ‘with Medicare, you have to pay a 20% coinsurance, but with us you only have a 10% coinsurance’ and completely neglect to tell you that having a smaller coinsurance only matters if they approve the fucking care that you need, which often they won’t (while Medicare would have) and if your doctors are willing to accept it, which often they don’t (while they do accept Medicare).

Is Medicare perfect? Absolutely not! I've got my share of bones to pick with them. But simply put:

Medicare is government administered. It is a service. It costs the government money, which is why the GOP is always trying to cut funding to it. Medicare Advantage is corporately administered. It is supposed to make money. Which gives them incentives to deny your care and fuck you over that Medicare simply does not have.

Do not. Get. A Medicare Advantage Plan.

5K notes

·

View notes

Text

#dank memes#norm macdonald#united healthcare#brian thompson#us healthcare#insurance#revenge era#revolution

3K notes

·

View notes

Text

I'm fucking crying, the jokes about that medical insurance CEO getting murdered have been fire

13K notes

·

View notes

Text

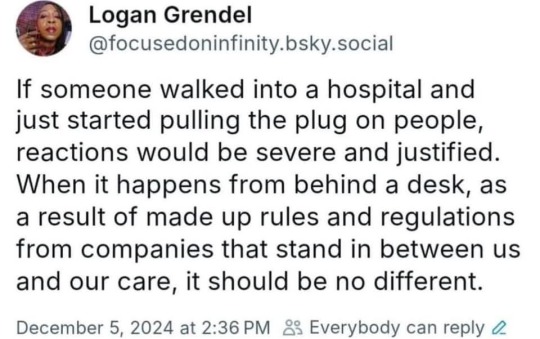

#threads social#united healthcare#us health system#insurance company#insurance claims#brian thompson#let the mystery shooter remain a mystery#let ceos live in fear

27K notes

·

View notes

Text

For those of you outside the US trying to understand our recent current events, here's a fact sheet on US Health Insurance Companies:

They are all run by cartoon villains

The only way they make money is by denying as many people care as possible

They get to decide which medicines and procedures you get to have, not your doctor

They also get to decide how much they pay doctors for covered procedures, regardless of the billed cost for those procedures

You typically have to pay a significant deductible on top of your monthly premiums before they'll even pay out at all

They don't literally consume human souls in a parasitic bid to live forever, but they metaphorically consume human souls in a parasitic bid to live forever.

3K notes

·

View notes

Text

#us politics#us healthcare#eat the rich#eat the fucking rich#insurance#health insurance#insurance companies#2024#for profit healthcare#brian thompson#luigi mangione#bluesky

3K notes

·

View notes

Text

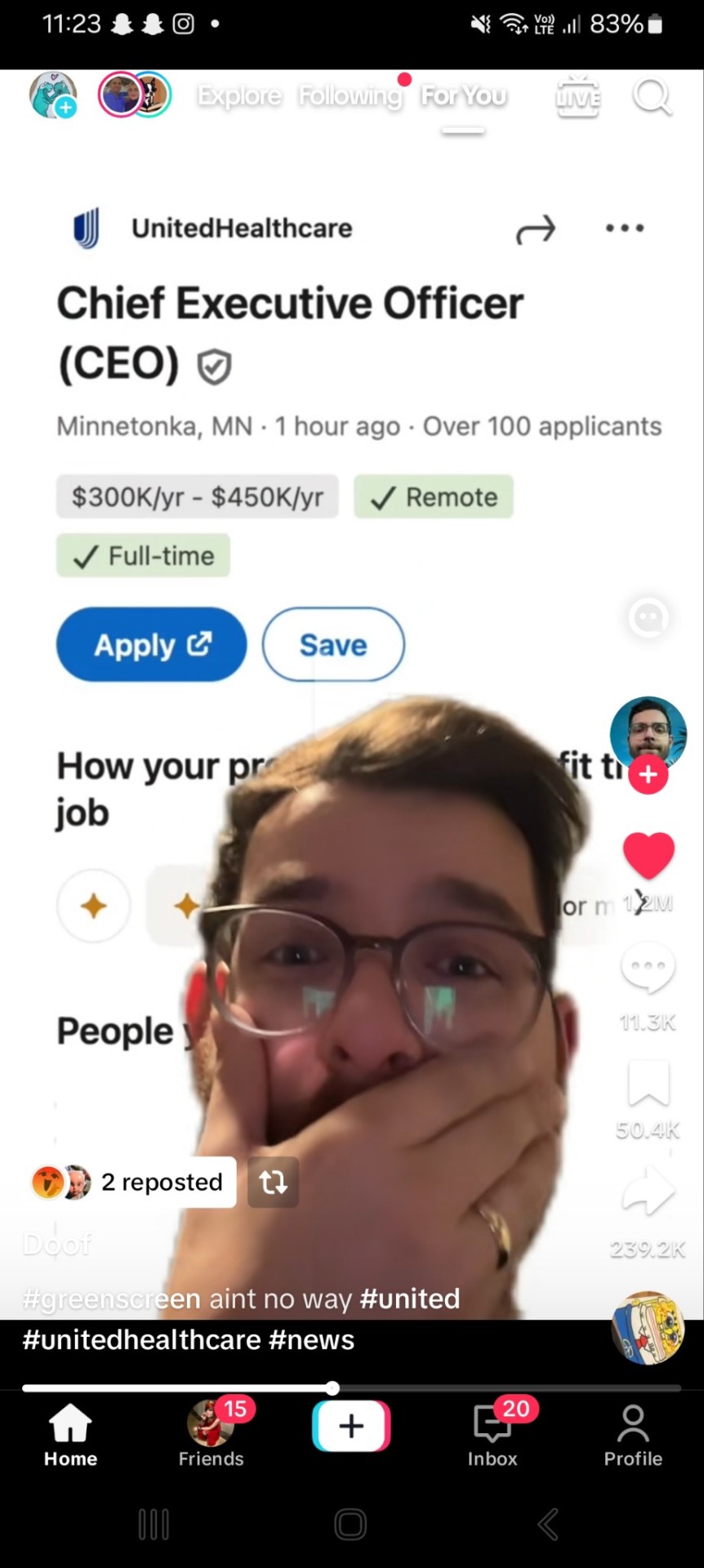

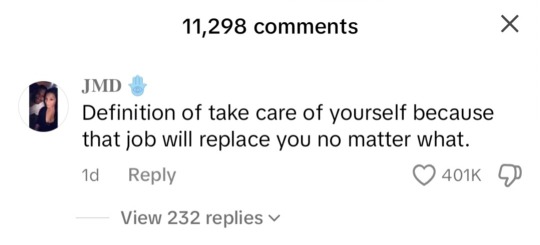

Saw this on tiktok today and... yeah

#mal talks#bruh#companies amd corporations are NOT your friends#your employers are NOT your friends#you do not mean ANYTHING to them!!!#take that sick leave!! take that time off!!#spend 40 minutes in the company bathroom!!!#dont bend over backwards for people who wouldnt get off their asses for you if you ran in on fire#nyc#united healthcare#brian thompson#us news#health insurance

3K notes

·

View notes

Text

Why Whole Life Insurance in Hoosick Falls is a Smart Choice for Long-Term Security

Whole life insurance offers a reliable way to secure your family’s financial future, especially for residents of Hoosick Falls. This type of insurance policy not only provides lifelong coverage but also builds cash value over time, making it a beneficial option for those seeking stability and growth.

Benefits of Whole Life Insurance in Hoosick Falls

For families and individuals in Hoosick Falls, whole life insurance is an excellent option for building a lasting financial foundation. Unlike term insurance, whole life insurance provides coverage that doesn’t expire, along with a guaranteed cash value component. This cash value grows over time and can even be borrowed against in times of need, providing added financial flexibility.

At Gaines Group’s Life Insurance page, you’ll find detailed information on various policies, including whole life insurance, to help you make informed choices. The dedicated team at Gaines Group is here to explain the intricacies of whole life insurance and how it can benefit you and your family in the long run.

Why Choose Whole Life Insurance?

Whole life insurance offers multiple advantages, from fixed premiums to potential dividend payouts. In a community like Hoosick Falls, having a dependable life insurance plan that grows over time can be especially valuable for long-term planning. Whether you want to provide for your loved ones, leave a legacy, or ensure a source of cash value, whole life insurance can be a wise investment.

Gaines Group specializes in tailoring policies that match the unique needs of Hoosick Falls residents. By understanding the local lifestyle and financial goals, Gaines Group offers guidance and support to help you select the best whole life insurance policy. To explore more, visit their Whole Life Insurance and connect with an expert who can provide personalized advice.

Contact Gaines Group for Whole Life Insurance in Hoosick Falls

To discuss how whole life insurance can be part of your financial strategy, reach out to Gaines Group’s knowledgeable team. They’re available to guide you through your options and answer any questions. You can call Gaines Group at (518) 244-8000

0 notes