#insurance agency USA

Explore tagged Tumblr posts

Text

For 98-years, Gaudette Insurance is a trusted insurance agency based in Massachusetts, dedicated to providing exceptional customer service through our knowledgeable insurance agents.

Serving clients in MA and across the USA, we specialize in various types of insurance coverage, including auto insurance, tailored specifically for contractors and those seeking protection for older vehicles.

Our experienced insurance brokers are here to guide you through the complexities of insurance policies, ensuring you find the best options at competitive costs.

Whether you're searching for an insurance company near you or looking for comprehensive reviews on insurance agencies, Gaudette Insurance is committed to delivering the information and support you need.

With our convenient insurance office located in Massachusetts, we aim to make the process as seamless as possible, helping you choose the right insurance policy that fits your needs.

Explore our range of insurance options today, and discover why we are a "leading Massachusetts choice" for individuals and businesses alike in the realm of insurance in MA.

You can find the best and cheapest car or home insurance quotes in Massachusetts near me with the 5-Star Award-Winning Gaudette Insurance Agency Inc.

Follow our Gaudette Independent Insurance Agents in Massachusetts for the best insurance solutions near you (in MA online at Gaudette-Insurance.com) on social media at:

Facebook

LinkedIn

Instagram

#insurance agency USA#USA insurance company#gaudette insurance#insurance agency#Gaudette Insurance is a trusted insurance agency based in Massachusetts#insurance#insurance agent#insurance quote#local insurance#auto insurance#home insurance quotes#homeowners insurance#insurance for high-value home insurance#insurance high-value home insurance#best coverage#top companies#gaudette local auto insurance quotes in ma#brian plain#quote#property insurance#home insurance#insurance solutions Massachusetts#Massachusetts insurance companies#Massachusetts insurance agent#Massachusetts insurance agencies#Massachusetts insurance agency#cheapest car or home insurance quotes Massachusetts#best and cheapest car or home insurance quotes in Massachusetts near me#find the best and cheapest car or home insurance quotes in Massachusetts near me#Gaudette Insurance Agency Inc

0 notes

Text

PRAY

#geoguessr#things i found on geoguessr#united states#usa#tennessee#insurance agency#bridal#tuxedo#pray#business signs

4 notes

·

View notes

Text

"The Role of Insurance Agencies and Brokers: Why They Matter"

In today's complex world, insurance is more than just a safeguard—it’s a necessity. Whether it's to protect your home, car, health, or business, insurance provides peace of mind. But navigating the intricate web of policies, coverages, and fine print can be daunting. This is where insurance agencies and brokers come in.

What is the Difference Between an Insurance Agency and an Insurance Broker?

Understanding the distinction between an insurance agency and a broker is key to choosing the right service for your needs.

Insurance Agency: An agency typically represents one or more insurance companies. They act as intermediaries between you and the insurance carrier, helping you select policies that the company offers. Agents often work directly for an insurance company and have a deep understanding of its products.

Insurance Broker: Unlike agents, brokers represent the customer, not the insurance company. Brokers work independently and have access to a wide range of policies from multiple insurers. Their job is to find the best coverage at the most competitive rates based on your individual needs.

Why Insurance Agencies Matter

Insurance agencies are often the go-to for customers who have brand loyalty or are comfortable with a particular insurer. Some of the benefits of working with an agency include:

Specialized Knowledge: Since agencies often represent a limited number of insurance companies, they are experts in their product lines and can provide detailed guidance on which policy fits your needs.

Personalized Service: Agencies typically have local branches, allowing for face-to-face interactions and personalized customer service.

Claims Assistance: Agents often help with filing claims, speeding up the process and reducing the stress involved.

The Importance of Insurance Brokers

Insurance brokers, on the other hand, offer a broader perspective by comparing policies across multiple companies. Here’s why you might consider working with a broker:

Unbiased Advice: Since brokers are not tied to any one company, they can offer impartial advice. Their primary objective is to find the best deal for you.

Customization: Brokers tailor insurance plans to fit unique circumstances, whether it’s for individuals, families, or businesses.

Time-Saving: Shopping for insurance can be overwhelming. Brokers do the legwork for you, gathering quotes, comparing policies, and advising on the best options.

How to Choose Between an Agency and a Broker

The decision to work with an insurance agency or broker depends on your specific situation. If you’re confident in the products offered by a particular insurer, an agency might provide the specialized support you need. However, if you’re looking for a wider array of options and customized advice, a broker might be the better choice.

Final Thoughts

Whether you choose an insurance agency or broker, what matters most is that you understand your policy and feel confident in your coverage. Both agents and brokers play crucial roles in ensuring that individuals and businesses are well-protected against life’s uncertainties. Working with the right professional can save you time, money, and stress.

0 notes

Text

Insurance Agency Productivity Boost: Leveraging a Virtual Assistant

In the dynamic landscape of insurance agencies, the quest for enhanced productivity is a constant endeavor. Today, insurance professionals are discovering the transformative power of a virtual assistant for insurance agents in streamlining operations, managing tasks efficiently, and ultimately, elevating overall productivity.

The Versatile Ally: Virtual Assistant for Insurance Agents

Insurance agents, often juggling myriad responsibilities, can find a valuable ally in an insurance agency virtual assistant for insurance agents. Beyond handling routine administrative tasks like appointment scheduling and document organization, these virtual assistants are adept at managing client communications, policy updates, and even supporting marketing initiatives.

The versatility of a virtual assistant ensures that insurance agents can refocus their time and energy on strategic aspects of their business, such as client relationship-building and business development.

Navigating Complexity with a Virtual Assistant:

The insurance industry is known for its intricacies and regulatory demands. A insurance agency virtual assistant for insurance agents equipped with industry-specific knowledge becomes an invaluable asset. Whether it's staying abreast of policy changes, organizing claims data, or coordinating underwriting processes, these virtual assistants bring a level of expertise that enhances operational efficiency.

Moreover, the adaptability of virtual assistants ensures they seamlessly integrate into existing workflows, providing support tailored to the unique needs of insurance agencies.

Elevating Client Engagement and Service:

In an industry where client satisfaction is paramount, a virtual assistant for insurance agents contributes to elevated client engagement and service. By handling routine inquiries, processing policy updates, and ensuring timely follow-ups, virtual assistants allow insurance agents to dedicate more time to personalized client interactions.

This personalized touch not only strengthens client relationships but also contributes to increased client retention and referrals, vital elements for sustained success in the competitive insurance landscape.

Conclusion: The Strategic Edge of a Virtual Assistant

In conclusion, as insurance agencies navigate the complexities of their operations, the adoption of an insurance agency virtual assistant for insurance agents emerges as a strategic imperative. The boost in productivity, the ability to navigate industry intricacies, and the elevation of client engagement collectively position virtual assistants as a transformative force in the insurance sector. By leveraging the capabilities of a virtual assistant for insurance agents, agencies can not only streamline day-to-day operations but also enhance their capacity to provide exceptional service. The result is a productive, efficient, and client-focused insurance agency ready to thrive in an ever-evolving industry landscape.

#insurance agency virtual assistance#virtual assistant insurance agency#best virtual assistant services#virtual assistant services USA#USA virtual assistant

0 notes

Text

Collier Insurance Agency is a full-service insurance agency in Fort Myers providing clients with title and closing services for both residential and commercial real estate transactions. In addition, the CIA offers federal crop insurance as well as miscellaneous property and casualty insurance with licenses in the state of Florida.

As a premier insurance agency in Bonita Springs, we go above and beyond to meet all your insurance needs. Our knowledgeable agents will provide you with customized insurance solutions that offer the protection you need.

#insurance#insurance agency#commercial#residential#real estate#bonita springs#fort myers#florida#usa#property#home#agents#insurance agents

0 notes

Text

Karz Insurance Reviews, claims, Legit or Scam? 2023

Are you also looking for reliable and affordable insurance coverage on the internet? So you can trust the loan insurance company. All insurance companies offer a variety of insurance options to ensure that, So that you are prepared to avoid future troubles.

Checkout full article

However not all auto insurance coverage is created equal. But while auto insurance covers a wide range of risks you may face, at times it may fail to cover specific perils of theft or total damage. Loan insurance company gives financial protection to car owners to cover all unforeseen circumstances.

In this post, we will give you all the information related to karz insurance like karz insurance reviews, is karz insurance legit, karz auto insurance, karz insurance legit, karz auto insurance reviews, karz car insurance, is karz insurance legit reddit, karz insurance company, auto insurance going to give quotes.

What is Karz Insurance?

Karz Insurance is an insurance provider that offers a wide range of insurance policies to meet your urgent needs. The insurance company has been providing quality service to its customers and has become one of the most reputed insurance providers in the market.

There is a range of coverage provided with Karz Insurance such as coverage for all types of vehicles including cars, motorcycles, RVs and boats. One special thing about Karz Insurance is that they provide personalized services according to your individual needs.

Karz Insurance's team of experienced professionals helps you understand your needs and choose the best insurance based on your unique situation.

Karz Insurance Company also has an easy to use online platform from where you can easily manage your policy details from anywhere at any time. Karz Insurance Legit also provides you the convenience of filing a claim easily through the website or mobile app without any hassle.

If you are thinking of getting insurance then loan insurance company is the best.

Why do car owners need Karz Insurance?

Karz Insurance was created to protect car owners from financial loss caused by certain potential risks. Car owners can be rest assured with this type of insurance if they meet with an accident with this insurance, then Karz Insurance helps a lot in this condition.

Karz Insurance Company acknowledges the hazards on the road and has earned an excellent record for reliability and dependability. Customers of Karz Insurance appreciate its reliable customer service, low fees and simple claim procedures.

What are the Advantages of Karz Insurance?

Karz Insurance has many benefits, one of the most important of which is its tailored options for coverage. The purpose of this insurance is to protect automobile owners from certain hazards. It also provides the car owner with theft coverage as well as collision coverage against unforeseen events so that the car owner can rest assured.

Apart from the unique coverage possibilities that karz car insurance offers to its customers, it also offers reasonable pricing which impresses car owners to go for it.

Karz auto insurance offers discounts on multiple plans along with full purchase discount for annual coverage.

karz car insurance stands out from the rest as it is committed to providing exceptional customer service, which provides a significant advantage to automobile owners who want to be protected.

The Different Types of Insurance Offered by Karz

Karz Insurance offers a range of insurance policies to suit your different needs. It provides Liability Insurance in which it provides coverage if you suffer any kind of bodily injury or property damage while driving the car.

Karz Insurance provides Collision And Comprehensive Coverage in which it covers the damages caused to your vehicle. According to this insurance, you can claim if your car is damaged in an accident, theft or vandalism and also if the car is damaged due to natural calamities like floods or storms.

Karz Insurance also offers Personal Injury Protection (PIP) which people must opt for while buying auto insurance from Karz. In PIP plan, you are paid for the medical expenses incurred in case of accidents. That's why it is very famous insurance which every person takes

Karz Insurance also offers Uninsured Motorist Coverage, according to which the policy pays you if you are injured in a hit-and-run accident or hit by an uninsured driver.

If you are taking an auto insurance policy with Karz Insurance, then select your policy according to the requirements given above.

Is Karz Insurance Legit or Scam?

Karz Auto Insurance is an insurance company which is one of the reputed insurance companies in the United States of America. It operates in 50 states of America. It offers a wide range of services including auto insurance and home insurance. This Karz Auto Insurance company is supported by all the reputed insurance companies. Karz Auto Insurance Company has received an A+ rating with the Better Business Bureau (BBB). Karz Car Insurance can easily buy and view coverage using the company's user-friendly website and mobile app. The customer service team of karz insurance company is available 24 hours a day, 7 days a week to answer any questions or concerns customers may have.

Karz auto insurance provides good insurance due to which consumers like them is karz insurance legit reddit.

How to Apply for Karz auto Insurance?

If you want to get insurance from Karz Insurance then it is going to be very easy. To get insurance from Karz Insurance you have to fulfill its eligibility requirements and follow a simple detailed procedure.

You must meet the loan insurance qualifications which include holding a legal driver's license, driving a registered and insured vehicle and having no previous record of insurance fraud convictions.

Checkout full article

#united states of america insurance#insurance#auto insurance agency#auto insurance usa#auto insurance sanford#auto insurance quote#karz#karzinsurance

0 notes

Text

Life Insurance Agency

If you are looking for a life insurance agency in the USA, then you are at the right place. Bequest Mutual is the best life insurance agency in Norwalk, CT, United States. Join our team and get detailed information by visiting our website.

#Life Insurance Agency#Work Life Insurance#Group Life Insurance#Term Group Life Insurance#Employer Sponsored Life Insurance#Federal Employees Group Life Insurance#Affordable Life Insurance#Employee Term Life Insurance#Life Insurance Without Medical Exam#Life Insurance Company in USA

0 notes

Text

Choose The Woodlands Best Life Insurance Agency

No matter what your needs are, the woodlands life insurance can provide you with the coverage you need at a price you can afford. The woodlands life insurance policies are some of the most comprehensive and affordable on the market today. Contact the woodlands life insurance today to learn more about our policies and how we can help you protect your family in the event of your death.

0 notes

Text

I feel like people often don’t talk about the experiences of disabled people who have caretakers because so much of the conversation is about us—not including us.

I receive in home care for 30 hours a week (+ 4 hours/week for respite). This is paid for by Medicaid (state insurance). Outside of paid hours, my primary caretakers care for me unpaid and assist me most of the time. I’m very rarely left alone due to my high support needs. Often, when I am left alone, I am completely bedridden or at minimum housebound. I have frequent emergency life threatening health problems, falls, and serious injuries even with support in place, and these things significantly increase when I’m on my own.

I’m extremely lucky that my paid caretakers are my partner, my sister (the only family member I have regular contact with, I’m estranged from the rest of my immediate family and most of my extended family) and my best friend.

I used to have agency staffing which was horrible for me and borderline traumatic. At several points, before doing the self directed care option (which allows me to choose my own staff, hire and train them myself and dictate hours for them), I opted to not have any staffing. I was regularly in the emergency room. I can’t drive, so I was having to walk and if I was lucky enough to be able to take the bus on occasion or get a ride from a Facebook acquaintance, they were few and far in between. I don’t have family support, and even my sister who is supportive wasn’t living in the state at the time and doesn’t have a car most of the time.

And before I could even choose which staffing option, even though medically it had been deemed essential for me to have in home care, even though my insurance covered it, I had to wait several years (I was 18 when I was approved) until I was 21 to qualify to start. The reason why: I was legally an “adult disabled child” because of my high support needs (which is funny because I STILL don’t have SSI at age 24) and thus legally unable to consent to my own care plan. I needed a blood relative to consent, and that same blood relative (who had to have proof of such!) couldn’t care for me. At the time, my sister was the only person who could’ve been my caregiver and also she is the only verifiable blood relative I have contact with for safety reasons, and my only relative on this side of the USA.

The first business day after my 21st birthday I immediately got things set up to get in home care.

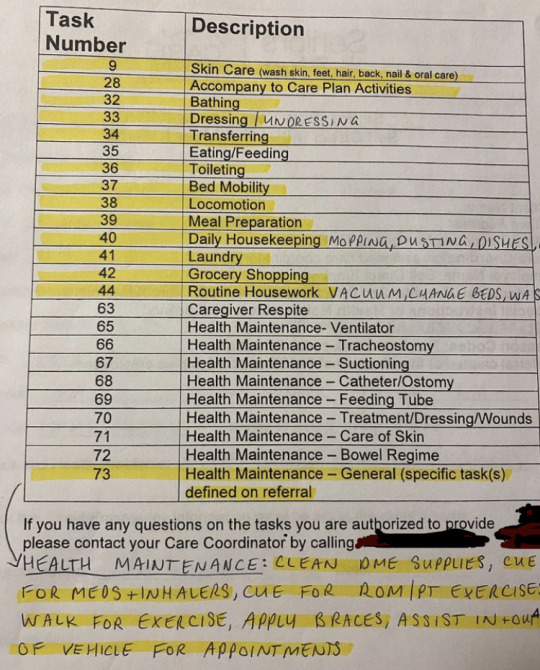

This is out of date, I get assistance with more than just these highlighted ADL (activities of daily living) tasks now.

In short: my day-to-day life is entirely dependent on others.

And there’s power imbalances that exist between me and my caregivers, even with my current caregivers being amazing and anti-ableist. They will always exist. We talk about the power dynamics of me being dependent on them for my survival, and how heavy that weight can be for each of us.

Having caregivers often means that accessibility is extra difficult— I’ve been told straight up multiple times that I can’t have assistance from my caregivers to help me change in a changing room when we’re out shopping. That they can’t go into the bathroom with me, that they can’t help me get un/dressed during appointments, that they can’t come into spaces with me.

I’ve been denied access to psychiatric care because I can’t do my daily living tasks (ADLs- the highlighted items) independently. And when I’m in a hospital or emergency room, I can’t have my in home workers be paid to care for me, there’s an expectation that the nursing staff at the hospital will do it. Even though my caregivers were specifically trained to learn my body and needs for weeks and have been working with me for years. I have severe cPTSD and showering in front of a stranger is something I cannot do. I would rather fall or faint or get injured or just not shower than deal with that. But I’m expected to just let anyone have access to my body just because I’m physically disabled and need support.

When I faint/fall/get injured/have life threatening health issues arise while I’m not clothed, or when I’m otherwise vulnerable, I’m supposed to let strangers just touch me however they want to. I have to show them my chest (for my cardiac care) and let them poke and examine me. I can’t object without losing access to vital care.

I have agency. I have rights. I have autonomy. I deserve to be able to exercise these things.

#chronically couchbound#disability#disabled#disabled pride#cripple punk#cripplepunk#disability pride#high support needs#ableism#professional caregiver#activities of daily living#ADL#medicaid#healthcare#in home care#home care#home care aids#nothing about us without us

1K notes

·

View notes

Text

Daily Devotionals for November 9, 2024

Proverbs: God's Wisdom for Daily Living

Devotional Scripture:

Proverbs 27:23-24 (KJV): 23 Be thou diligent to know the state of thy flocks, and look well to thy herds. 24 For riches are not forever: and doth the crown endure to every generation? Proverbs 27:23-24 (AMP): 23 Be diligent to know the state of your flocks, and look well to your herds; 24 For riches are not forever; does a crown endure to all generations?

Thought for the Day

Verse 23 - Although these verses were addressed to farmers, we can relate to them today in regard to our businesses. We are to take responsibility and know the state of our affairs. Large flocks of sheep and goats made a man wealthy in ancient Israel. This proverb advised a wealthy man to personally know the condition of his flocks and ascertain that his overseers fulfilled their responsibilities properly. They were to protect and keep count of them, taking special care of the sick, injured, and pregnant ones; paying special attention to the babies.

Having riches or employment now does not guarantee we will always have them. We need to give diligent care and management to our livelihood. Romans 12:11 says, "Not slothful in business; fervent in spirit; serving the Lord." Negligence creates problems that can lead to severe financial difficulties. Many factors can lead to bankruptcy, such as over-extending oneself (due to greed or lack of sound business principles) or extenuating circumstances beyond one's control. Sometimes it is not people's fault that they are forced into bankruptcy since they are victims of illness, tragedy, or uncontrollable disasters. Despite this, many of the bankruptcies which are filed today could have been avoided if diligence had been practiced. "He becometh poor that dealeth with a slack hand: but the hand of the diligent maketh rich" (Proverbs 10:4).

Verse 24 - Just as a king will not rule throughout every generation, riches do not last forever. There is a good deal of truth to the statement, "money talks: it says 'good-bye'." Money says "good-bye" in numerous ways, such as in poor planning for the future. As people age, their work capacity diminishes, which usually decreases their income. Without wise and diligent care of their finances, people may spend all their money when they are young and leave themselves with nothing to live on when they are old. If we heed the Lord and apply good business principles in regard to our finances, we can rest assured that we will have enough when we are in our senior years. Living for God is one of the best insurance policies anyone can have. He can provide what no human agency can, such as good health. He promises that the righteous will still bear fruit in old age (Psalm 92:12-14), meaning that they will remain productive. We must diligently take up our responsibilities if we desire God's blessings, and not forget to help others along the way. If we bless others, God will return those blessings to us when we are in need.

Prayer Devotional for the Day

Dear heavenly Father, thank you for Your abundant provision in my life. I am grateful, not only for financial provision, but for the spiritual blessings that You have also given me. I do appreciate daily strength and health so that I am able to be diligent in all of my affairs. Give me wisdom so that I might prepare for the future properly. Ultimately, my faith and trust are in You, as You hold the future; however, may I not neglect those things in the natural that need to be done, so that I am not ill-prepared. Lord, also, I do not want to forget to give and help others along the way as well. May I be a good steward over all that You have given me. I ask this in the name of the Lord Jesus Christ. Amen. Good Morning World 11/9/2024 4:03:36 AM Jacksonville, Florida USA From: Steven P. Miller, @ParkermillerQ, gatekeeperwatchman.org TM Founder and Administrator of Gatekeeper-Watchman International Groups. #GWIG, #GWIN, #GWINGO.

18 notes

·

View notes

Note

AITA for not showing my mom her mail from a government agency?

(submitted march 10th) ✉️🧑🦽

i (27nb) live with my parents (50s M+F) and am disabled. due to my disabilities, i have been trying to get on SSI (disability income in the USA). this process takes an extremely long time (i started it last april, 2023, and have still yet to get a verdict) and they check medical records as well as school/work records AND ask for references who know how your disability affects your personal life.

i don't really have anyone other than my parents to act as my references, so i put down my mom as my reference. now, mom knows about my disability and how it affects me, but she refuses to believe it's as bad as it is, and wants me to get a job, even though i can't leave the house most days. she gets annoyed/angry with me when i have to use my cane or other accessibility aids and also makes me do the most chores around the house. this is all the background info.

a couple weeks ago, towards the end of february, mom and i both got letters from social security. i opened mine quickly and responded, and saw hers, but decided not to mention it. after all, when we bring in the mail, we put it all in one place, and mom and dad go through it and deal with the important stuff. the day after the letters came i saw that the disability one had been moved to mom's desk with another important looking letter (looks like some insurance thing), presumably so mom would remember to take care of them later. then she just... never did.

it's been like two weeks. despite how long the process takes, social security DEMAND that you answer them within a few days of receiving their letter, or they'll move forward in their process without a response from you. so the window for mom to answer this letter has almost definitely passed. i never brought it up to her, because 1. i assumed she had seen it and just never gotten back to it, and 2. i thought that her testimony as my "reference" might actually hurt my chances of getting on disability.

reasons i might be TA:

this is mail from a government agency, which is objectively pretty important.

the other important looking letter on top of the disability one hasn't been dealt with either, which might also be time-sensitive.

i'm assuming that my mother wouldn't provide helpful testimony for my case, when she actually might.

reasons i might be NTA(/NAH):

i have very good reasons to believe mom would say my disability isn't as bad as it is, and potentially hurt my case.

she saw the letter and moved it somewhere to deal with later, i didn't hide it from her. she just forgot and i (deliberately) didn't remind her.

social security has mom's phone number too. if they desperately need to speak with her, they can call her (they've called me before in addition to sending letters, so i know this is Something They Do and not just a hypothetical "they could").

by the time this gets spit out of the Processing Vortex™ it's gonna be waaaaaaay too late for the letter(s) to be answered, so this isn't a question of "should i tell her about it?", just "was i a dick for this?"

What are these acronyms?

48 notes

·

View notes

Text

USAF B-2 bomber demonstrates ability to neutralize low-cost maritime threats

Fernando Valduga By Fernando Valduga 08/09/2024 - 16:00 in Military

0

Shares

99

Views

Share on Facebook

Share on Twitter

The U.S. Air Force (USAF) stealth bomber B-2 Spirit recently demonstrated a low-cost, air-released method to neutralize surface vessels during a QUICKSINK test in the Gulf of Mexico, near Eglin Air Base, Florida.

This capability is a response to an urgent need to quickly neutralize maritime threats in large expanses of the ocean around the world, USAF said in an official statement. No other details have been provided.

The QUICKSINK test, conducted in partnership with the U.S. Navy, involved a B-2 Spirit stealth bomber delivering the new capability as part of the second RIMPAC SINKEX exercise in July. The demonstration marks a fundamental advance in the naval warfare capabilities of the U.S. Air Force, highlighting a collaboration between the Air Force Research Laboratory (AFRL), the U.S. Navy and industry partners.

"This technology ensures that the United States can defend its interests, maintain freedom of action and take the initiative in large maritime areas," said Colonel Matthew Caspers, Director of the AFRL Ammunition Board.

The AFRL Ammunition Board, based at Eglin Air Base, is involved in an ongoing Marine Weapons Program together with the U.S. Navy.

The tests take place amid the increase in Iran-backed Houthi attacks on commercial ships in the Red Sea. The U.S. Defense Intelligence Agency (DIA) reported that from December 2023 to mid-February 2024, container transport in the region decreased by 90%. Despite U.S. and European countermeasures, including Operation Prosperity Guardian and the European Union's ASPIDES mission, the Houthis carried out more than 43 attacks between November 19 and March 23, resulting in increased security costs and insurance premiums.

Tags: AFRLMilitary AviationB-2 SpiritUSAF - United States Air Force / U.S. Air Force

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. He uses Canon equipment during his photographic work in the world of aviation.

Related news

HELICOPTERS

Iraq orders Airbus H225M Caracal helicopters and also receives new Bell 505

09/08/2024 - 14:00

MILITARY

Greece seeks to acquire Boeing KC-135R Stratotanker aircraft from the USA

09/08/2024 - 09:30

MILITARY

Brazil proposes KC-390 aircraft for India and considers buying Brahmos and Akash missiles

09/08/2024 - 08:27

BRAZILIAN AIR FORCE

FAB intensifies aerial monitoring and intercepts more than 4,000 aircraft in 5 years

08/08/2024 - 20:50

MILITARY

South Korea would be offering FA-50 jets for Bulgaria's defense

08/08/2024 - 16:00

MILITARY

U.S. Army studies launching wandering ammunition from C-130 Hercules aircraft

08/08/2024 - 14:00

9 notes

·

View notes

Text

Reed McMaster at MMFA:

Podcaster Patrick Bet-David provides a platform for far-right figures to promote conspiracy theories and bigotry, potentially to millions of people. Bet-David’s PBD Podcast has allowed guests to promote the white nationalist “great replacement” theory, claim that homosexuality is being pushed on children, and push conspiracy theories about mail-in ballot harvesting.

Who is Patrick Bet-David?

Bet-David is the founder of the insurance company PHP Agency and digital media outlet Valuetainment. The Daily Beast described PHP Agency as “a multilevel marketing company” that “makes money when people recruit lower-ranking members, who then funnel their sales commissions upwards.” Bet-David has interviewed major figures such as former President George W. Bush and professional basketball player Kobe Bryant at PHP Agency conferences, eventually posting some of these interviews to Valuetainment’s YouTube channel. [Daily Beast, 5/31/19; PR Newswire, 7/20/22; YouTube, 8/23/19; Valuetainment, accessed on 5/6/24]

Valuetainment hosts multiple interview-focused podcasts, including Bet-David’s own PBD Podcast. Bet-David has interviewed a variety of right-wing guests on his podcast, including Fox host Jesse Watters, alleged human trafficker Andrew Tate, and Turning Point USA founder Charlie Kirk, as well as celebrities not involved in politics. [Huffpost, 4/15/24; Valuetainment, PBD Podcast, 6/12/23; Forbes, 10/16/23]

Patrick Bet-David's PBD Podcast hosted by Valuetainment has featured numerous right-wing guests and bigoted commentary.

#Patrick Bet David#Valuetainment#PBD Podcast#Podcasts#Alex Jones#Andrew Tate#Jesse Watters#Charlie Kirk#White Nationalism#Anti LGBTQ+ Extremism#Conspiracy Theories#Adam Sosnick#Nick Fuentes#Tom Ellsworth#Glenn Beck#Vincent Oshana#Candace Owens

6 notes

·

View notes

Text

According to the DIA, Houthi attacks are responsible for a significant drop in container shipping through the Red Sea, with a 90% decrease since December 2023, affecting 10-15% of global maritime trade.

The consequences of the Houthi attacks have been widespread, affecting at least 65 countries, as well as 29 different energy and shipping firms.

The report also highlights the additional costs for alternate shipping routes around Africa, including increased transit time, additional fuel costs, and increased insurance premiums. According to the report, alternate shipping routes around Africa, despite adding about 11,000 nautical miles, approximately $1 million in fuel costs per voyage, and 1-2 weeks of transit time, can be less expensive than the combined costs of crew bonuses, war risk insurance, and Suez transit fees.

Insurance premiums for Red Sea transits have increased to 0.7-1.0% of a ship’s total value as of mid-February, up from less than 0.1% before December 2023.

the blockade that Western coalitions keep embarrassingly failing to stop has caused what amounts to another Suez blockage, complete with international shipping having to sail around the Cape of Good Hope. the ways to stop this blockade are very clear, but apparently the continued genocide of Gaza is an even higher priority for the USA and friends than reopening their own shipping lanes.

2 notes

·

View notes

Text

Why Surrogate mother cost in Kenya is lower than other countries?

Surrogacy in Kenya is quite popular among all the intended parents looking for an affordable surrogacy program. While cost is always lower than many other countries like USA and UK, the quality of care is on par with the best in the world.

On the other side, the surrogate mother cost in Kenya is way lower than other nations and this is that one thing that always comes surprising for many. In the coming parts of this article, we will discuss regarding the key points in the same regard. While doing that, we will also talk about various elements that come crucial in deciding the surrogacy cost in Kenya.

1. Humble family backgrounds

Most of the surrogate mother in Kenya comes from humble family backgrounds. Moreover, they will not have huge demands from their role of the surrogate mother in Kenya. Also, they won’t prefer living in surrogate accommodation offered by the surrogacy agency. At the same time, these surrogates would come with a greater character and compassion towards the intended parents. Hence as an intended parent, you can always expect a noble person for your service rather than someone simply looking to earn some money.

2. Financial Components

The cost of living in Kenya is way lower than most of the western nations. This implies that in general costs, including medical care, are for the most part less costly. Also, for surrogate moms, this interprets to lower charges for their services related to surrogacy in Kenya. In nations with higher living costs, surrogate moms regularly charge more to cover their own living costs.

3. Healthcare Costs

On the other hand, the cost to healthcare in Kenya is altogether lower than in numerous Western nations. This incorporates the medical strategies included in surrogacy in Kenya, such as in vitro fertilization (IVF) and pre-birth care. In nations just like the United States, these strategies can be exceptionally costly, which increments the in general surrogacy cost in Kenya.

3. Lack of legal regulations

Kenya has a lack of surrogacy related regulations compared to numerous Western nations. In places with strict surrogacy laws, there are extra legal costs. These can incorporate legal expenses for drafting contracts, parental rights agreements, and other procedures. In Kenya, where there are no surrogacy laws, this can potentially lower the surrogate mother cost in Kenya.

4. Bigger supply than the demand

In Kenya, you will find numerous women willing to become surrogate mothers. This can be due to financial reasons, where they see surrogacy as a way to earn some good money to improve their financial situation. When there's a huge supply of surrogate moms, the cost tends to be lower. In differentiate; in nations where less women are willing to be surrogates, the overall cost is higher due to restricted availability.

5. No Insurance coverage

In numerous Western nations, insurance companies don't cover the costs of surrogacy. This implies expecting guardians must pay all costs out of their pocket, which can include to the overall cost structure. In Kenya, where surrogacy is less directed and not ordinarily secured by insurances, the costs are more specifically related to the genuine medical and living costs of the surrogate mother in Kenya

6. Financial motivation

For numerous Kenyan women, becoming a surrogate can be a way to earn money that they won’t get from something else. This financial inspiration can lead to more ladies advertising surrogacy services at competitive costs. In wealthier nations, where citizens have more earning options, women may not be as persuaded by the money related aspect of surrogacy.

7. Rising international demand

Kenya has ended up a hotspot for international surrogacy. That said, individuals from nations with higher surrogacy costs look to Kenya as a more reasonable choice. Also, this worldwide request has created a situation where surrogacy services are advertised at competitive costs.

8. Overall lower cost of surrogacy services

The amount charged by experts such as specialists, legal counselors, and agencies included within the surrogacy process are for the most part lower in Kenya. In nations with higher wage levels, experts regularly charge more for their services, which includes to the by and large cost of surrogacy.

9. Healthy and simplified lifestyle

The lifestyle of surrogate mother in Kenya may be less complex compared to surrogate moms in wealthier nations. This implies their living costs amid pregnancy, which are regularly secured by the expecting parents, are lower.

10. Cultural aspects

In some Kenyan communities, there's a social eagerness to assist others, including through surrogacy in Kenya . This social angle can impact the choice to turn up as a surrogate without requesting higher fees

Final words

Hence, we can say that the lower surrogate mother cost in Kenya is due to a combination of economic, legal, and social variables. Whereas it offers a more reasonable choice for many intended parents trying to find surrogacy services, it's imperative to consider the moral suggestions and guarantee that surrogate mothers are treated decently and with regard. As surrogacy gets to be more global, understanding the distinctive components that impact its cost in different nations is pivotal for those considering this path to parenthood.

#surrogate mother cost in Kenya#surrogacy in Kenya#surrogate mother in Kenya#surrogacy cost in Kenya

2 notes

·

View notes

Text

Full Coverage Online Auto Home Insurance in Texas, USA

Autozo Insurance is one of the best online auto home insurance service provider companies in the Texas, USA area. We have graduated to become a world-class automobile insurance agency. If excited about choosing automobile insurance, feel free to contact our team of experts at: +1 409-200-8888.

2 notes

·

View notes