#impulsive spending

Explore tagged Tumblr posts

Text

#adhd memes#neurodivergence#adhd#adult adhd#neurodiversity#adhd brain#neurodiversesquad#adhd things#adhd impulsivity#impulsive spending#yay package

380 notes

·

View notes

Text

When Mars is in the 1st house of a natal chart, it strongly influences one's personality, making them assertive, energetic, and determined. Individuals tend to be bold, competitive, and driven by ambition. This placement fuels independence and leadership, but may also lead to impulsiveness and confrontational tendencies in life.

Visit now : Mars in 2nd House: Impact on Wealth & Communication

#Mars#Mars in 2nd House#Wealth accumulation#Aggressive financial approach#Blunt communication#Family values#Material possessions#Risky financial decisions#Assertive speech#Financial growth#Impulsive spending#Financial disputes#Family stability#astrology

0 notes

Text

0 notes

Text

It seems like women exchanged baskets for shopping bags since the time when humanity was a hunter-gatherer society. I know there were women who hunted then too and the gender roles weren't so strict but it's just an observation.

Do we just see a thing and we have to be like a crow and collect it for our nest? Like, "Ooh, this will be a useful resource to my family." (It actually won't and be a waste of money).

0 notes

Text

Digitalisation: A Double-Edged Sword for Consumers and Financial Systems, Says RBI Report

In its Report on Currency and Finance (RCF) for 2023–24, the Reserve Bank of India (RBI) highlighted the transformative yet challenging impacts of digitalisation on consumer behavior and financial systems. Released on Monday, the report underscores how the convenience and accessibility brought by digitalisation can also lead to impulsive spending, herd behavior, and heightened risks of data breaches.

Benefits and Risks of Digitalisation

Digitalisation undoubtedly enhances the ease with which consumers can access financial services. However, it also introduces new risks. The RBI report points out that the rapid spread of financial trends and choices through digital platforms can influence consumers to follow the crowd, leading to impulsive spending and herd behavior. This is particularly evident during market frenzies, where mass buying or selling of stocks can trigger similar actions from other consumers.

Moreover, the interconnected nature of the digital financial system can complicate financial stability. For instance, widespread withdrawal of deposits due to herd behavior could lead to bank runs or failures.

Data Breaches: A Growing Concern

The report also highlights the growing threat of data breaches. In 2023, the average cost of a data breach in India was $2.18 million, marking a 28% increase since 2020. Common attacks include phishing and the use of stolen or compromised credentials. These breaches pose significant risks to both consumers and financial institutions.

Implications for Monetary Policy

Digitalisation impacts inflation, output dynamics, and the transmission of monetary policy in various ways. The report suggests that if digitalisation shifts credit supply from regulated banks to less-regulated non-banks, it could dampen the effectiveness of monetary policy. As such, central banks must integrate digitalisation considerations into their models to ensure effective monetary policy and financial stability.

Proactive Measures and International Collaboration

The RBI has been proactive in leveraging the benefits of digitalisation while mitigating associated risks. Digitalisation holds the potential to boost India’s external trade in goods and services, particularly in modern services exports. It can also reduce the cost of international remittances, benefiting recipients through higher incomes or savings.

In a significant step towards enhancing cross-border payments, the RBI joined Project Nexus, aiming to interlink domestic Fast Payments Systems (FPS) across several countries, including Malaysia, the Philippines, Singapore, and Thailand. This follows the integration of India’s Unified Payments Interface (UPI) with Singapore’s PayNow, facilitating faster and more affordable remittances between the two nations. Similarly, an MoU with the Central Bank of UAE aims to link India’s UPI with UAE’s Instant Payment Platform (IPP).

The Rise of UPI

The report highlights the explosive growth of UPI, which has seen a tenfold increase in volume over the past four years. From 12.5 billion transactions in 2019–20 to 131 billion in 2023–24, UPI now accounts for 80% of all digital payment volumes in India. As of June 2024, UPI is recording nearly 14 billion transactions monthly, driven by 424 million unique users.

Future Outlook

Cross-border digital trade policies will be crucial in leveraging new opportunities and ensuring data security and cybersecurity. The internationalisation of the rupee is also progressing, supported by a comprehensive policy approach.

In summary, while digitalisation brings significant benefits, it also poses new challenges. The RBI’s report emphasizes the need for a balanced approach to harness its advantages while managing the associated risks to consumer behavior, financial stability, and data security.

0 notes

Text

I had a moment of inspiration to expand on the idea of Young Justice in Teen Titans 2003, since the last time I did it it was a couple sketches (and I genuinely hate them) I really like how these turned out

#dc#art#dc comics#tim drake#robin#conner kent#superboy#kon el#bart allen#impulse#wonder girl#cassie sandsmark#bartholomew allen#that name is so funny to me#greta hayes#secret dc#kon el superboy#cissie king jones#arrowette#anita fite#empress dc#young justice#young just us#yj98#core four#and more#spend two days on this#teen titans 2003

2K notes

·

View notes

Text

Does the JL know that YJ has just casually been beefing with darkseid??

imagine there’s a all hands on deck battle against darkseid and everyone is there but darkseid points out the nearest yj member (it’s probably Bart) like ‘you!!! You managed to escape with your lives last time but this meeting will be our last’ and for a split second Clark’s so fucking confused bc we haven’t fought in years wtf are you talking about then he hears ‘oh shit, look it’s Doug’ and everyone turns to see Bart nudging Kon going ‘he’s talking to you…damn he must still be mad about the coal’ and kons shoving him back bc ‘you were the one fucking around with his coal, you fucking walnut’ while Cassie’s being scruffed by wonder woman bc they’re trying to avoid being around when the jl finds out and tims having a very intense silent conversation lecture about why tf there’s at least half a dozen yj mission reports that mention an assailant named ‘Doug’

then Constantine shows up with Greta and everyone (including darkseid) starts yelling and if you don’t know her Greta seems like the one with the ownership of the braincell in yj (she is not but I guess she looks like it from a distance if you squint) which goes one of two ways:

retired-civilian!greta is giggling and waving excitedly to each member of yj along with hal before she practically tackles each of them in a tight hug while the titans, jl, & jl: dark lose their collective shit bc Constantine brought a tiny civilian dressed in pastel floral prints from head to toe into an active battle with fucking darkseid, a civilian who doesn’t register as a threat in any capacity until she makes eye contact with darkseid and gives him the most disgusted look imaginable “Doug… you look…well.” and then like three jl members have to stop her from leaping at darkseid while Hal’s like ‘no! No no, bad Greta! We don’t fight supervillains with…what is that?? I really fucking hope that’s not a gun…Is-is that fucking silly string?! Greta no we don’t silly string supervillains! We’ve talked about this!’

or

never-retired!/recently-out-of-retirement!greta who does the same thing but when she notices darkseid she rocks his shit in eight seconds flat and starts muttering about ‘that fucking Doug, always ruining my goddamn day’ and Hal is the first one to recover from the shock/confusion but only to tell Greta she’s grounded which gets another irritated ‘fucking doug!’ while Wally and Barry are losing it at Mach 6 while Bart tries to explain himself also at Mach 6, Cassie manages to catch Wally’s exasperated ‘where the fuck did you get Doug from?!’ And responds with ‘Apokolips’ in a tone that means they’re questioning his intelligence which leads to more screaming bc ‘so you knew who he was?? Why didn’t you come to us??’ and they all back up Kon when he claims they told Lex bc that means they have at least 3 hours of freedom while Lex is getting yelled at by the jl (and honestly every cape over 24)

#dc comics#justice league#young justice#young just us#Yj98#anita fite#dc empress#cissie king jones#dc arrowette#kon el superboy#kon el#dc superboy#greta hayes#dc secret#cassie sandsmark#gnc!cassie sandsmark#wondergirl#bart allen#dc impulse#Hal orders 76 parenting books and cries himself to sleep that night#Yjs Christmas shenanigans continue to happen to the jls dismay#Hal absolutely swung on Constantine for bringing Greta#Wally: I will get you a spaceship if you stay away from darkseid and apokolips…and DO NOT let Bart drive#Greta with her fingers crossed behind her back: okay great bc we already have a spaceship but repairs won’t be done until after Christmas…#Wally in distress: WHAT SPACESHIP?? wAiT- WDYM REPAIRS?? BART!#Bart: I’ve never crashed the ship! Kon was racing supercycle and HE crashed it!#Wally: WHO GAVE YOU A SHIP?? WHO LET YOU DRIVE IT??? What fucking moron-#Bart shrugging: idk some guy maybe?? Or I found it?? This was forever ago 🤨#More than half of the jl go home in distress and yj gets the most attentive helicopter parenting for the next eight months#Tim ends up spending at least 12 hours going over every case that mentions a Doug seven times with batman

549 notes

·

View notes

Text

gem and the scotts!!

#secret life smp#trafficblr#traffic series#life series#secret life smp fanart#life series fanart#art#digital art#scott smajor#geminitay#impulsesv#smajor fanart#geminitay fanart#impulse fanart#i really loved drawing this#but i did spend an inordinate amount of time trying to make sure they didn’t look like they were doing a valentine’s day special#that being said i really love them

773 notes

·

View notes

Text

WHERE is my dopamine delivery?!

#pakidge#dopameme#adult adhd#adhd#adhd memes#neurodiversesquad#adhd things#neurodiverse stuff#neurodiversity#impulsive spending

79 notes

·

View notes

Text

When Mars is in the 1st house of a natal chart, it strongly influences one's personality, making them assertive, energetic, and determined. Individuals tend to be bold, competitive, and driven by ambition. This placement fuels independence and leadership, but may also lead to impulsiveness and confrontational tendencies in life.

Visit now : Mars in 2nd House: Impact on Wealth & Communication

#Mars#Mars in 2nd House#Wealth accumulation#Aggressive financial approach#Blunt communication#Family values#Material possessions#Risky financial decisions#Assertive speech#Financial growth#Impulsive spending#Financial disputes#Family stability#astrology

0 notes

Note

Hey! I’m genetically at high risk for things like addiction and gambling, and I recently got a credit card. I’m absolutely terrified of it! I got it since I crossed international borders recently to meet with a friend on my own, and it seemed like a good failsafe. Now that I’m back home, I wish I could just get rid of it to ensure I don’t go into debt. Any advice?

Lock it up in between uses.

My preference is to wrap it up in opaque tape, put it in a ziplock bag full of water, then put the whole thing in the freezer. Obviously, make sure you don't have the numbers saved in your browser or written down anywhere else. This will FORCE you to slow down before making a purchase. You can't microwave it to defrost it (JFC DO NOT MICROWAVE YOUR CREDIT CARD). So while you're sitting there watching it slowly unfreeze, you can second-guess whatever impulse purchase you want to make.

Also, just because you're at high risk for gambling and addiction doesn't mean you automatically WILL succumb to those things. I know plenty of people genetically predisposed to things like alcoholism who don't struggle with that addiction. Have you considered talking to a therapist about your concerns here?

Here's more on how to use a credit card responsibly:

6 Proven Tactics for Avoiding Emotional Impulse Spending

If you found this helpful, consider joining our Patreon.

119 notes

·

View notes

Text

₊‧°𐐪♡𐑂°‧₊ Tips for Managing a Shopping Addiction ₊‧°𐐪♡𐑂°‧₊

Shopping addictions or impulsive overspending is a really hard habit to break out of, and depending on your financial situation you can end up in really tough spots because of it.

As a general disclaimer: I am not a doctor or therapist, I'm just a mentally ill 24-year-old on the internet who's had issues with overspending (like a lot >-<) but hopefully, these tips can be of some use to you! I would also recommend looking for advice in other areas as well! Don't use this post as your only resource ^-^

♡ Overarching tips ♡

♡ Identify why you might have a shopping addiction. There are many different reasons for this! One thing that can help you identify the reasoning behind it is to analyze the emotions you feel when shopping. Do you feel frantic? Stressed? Really overly-excited? After you make the purchase how do you feel? Do you feel guilt? Shame? Regret? Relief? Super happy? Really analyze your feelings through the process and get a vibe for how it's making you feel. A lot of times shopping addiction develops as a way to cope with negative feelings. If you're feeling sad, stressed, or anxious, it's really tempting to buy yourself a "little treat" to make yourself feel better! But that can spiral into situations where any time you feel those negative emotions you feel a strong urge to go out and buy something to make those feelings go away, and a lot of times they'll come back even worse after the fact. If this is something that you think plays into your shopping addiction, you'll have to build up your resources for healthy coping mechanisms to give yourself alternatives to shopping when you feel down or anxious. Shopping addiction can also develop as a reaction to being in a poor financial situation. You can see this a lot with food and toiletries, but it can happen with other items as well. It makes sense that if someone has experienced food insecurity, once they have extra cash, they'll overstock on food to ensure they never run out again. That same logic applies to other aspects of life as well. If this is something that is playing into your shopping addiction you'll need to do some work into identifying places in your life that you feel the need to overstock on, why you feel that way, and how you can help minimize those feelings to help yourself feel secure without needing to overspend and overstock on those items.

♡ Identify what you are spending your money on. What is it that you're overspending on? Toiletries like skincare products and soaps? Food? Cookware? Clothing? Stuffed animals? Identifying what it is that you impulse buy the most can help you pick up on some of the reasons for your overspending, and can help you know what areas of purchases you need to be more aware of.

♡ Avoid browsing. Especially with online shopping, browsing for items to buy is way too easy. It is so tempting to log onto your favourite shopping websites and just browse for hours, even if you don't need anything! You can open Amazon without the intention of buying anything in particular and the website will shove products into your face until you convince yourself that you absolutely need something T-T so avoid browsing these websites.

♡ Identify when you need something or truly want something vs when you’re experiencing a Fear Of Missing Out (FOMO). There are multiple parts to this. The first one is SALES. 20% off! Free shipping! Buy one get one 50% off! IGNORE THAT!!!! If you did not want to buy it before you saw the sale, do not let the sale influence you into buying it! That's what the corporations want! These sales are designed to create a false sense of urgency so that you feel a stronger need to purchase the product, even if you didn't really want it that much before. Another part of this is trends. This is really easy to see in fashion but it applies to other things as well. Do you really need the new skirt that everyone is talking about? Do you REALLY like the item or do you just want it because everyone else has it and you want to be cool? Would you wear it if no one else was wearing it? Do you already have items to style it with? How often would you actually wear it? Do you already own something similar? These are really important questions to ask when you're shopping for fashion because it is SO EASY to see everyone else wearing something and then just go buy it because everyone else has it, and then they all move on to something else and it just sits in your closet for the next few months never to see the light of day again.

♡ Take note of what you already have. When you're out shopping for something, ask yourself "Do I already have something similar" or "Do I already have something that can serve this same purpose". This works for a lot of things. If you see a new cardigan you really like, think about if you already have a cardigan you can style in the same way. If you're looking at new cookware, ask yourself if you really need another pot or if you have one that can do the same thing. And if you're not sure, go home and check! It is so much better to make sure that you really need the thing that you're buying before you buy it, than to buy it and then realize that you don't need it or you aren't going to use it.

♡ Don’t view shopping as a hobby. Ask yourself... truly, do you treat shopping as though it is a hobby? If you spend multiple hours on shopping websites, it is a hobby. If you get dressed up just to go walk around Target without any specific thing that you need to buy in mind, it is a hobby. Try to replace this with something else that doesn't involve spending money. If you're spending a lot of time on shopping websites, try playing a video game with customizable elements where you can sort of get the feeling that you're buying and building things without spending money (Animal Crossing is really good for this, making Picrews is another good and free option). If it's more of a way to get yourself out of the house try going to places that don't involve shopping instead, there's a surprisingly large number of free or really cheap little art galleries and museums around where you can go walk around and look at cool stuff without really being sold things. Look on your town's website and see if there are any events going on, you'll be really surprised to see how much stuff people organize and do ESPECIALLY around winter-time there are usually loads and loads of free tree-lighting ceremonies and light shows. Talk to your friends too! If meeting up with friends to go shopping is a big part of your friendship dynamic tell them that you're trying to save money and ask if there are other things that you guys can do instead. (Also just as a note I know this is a lot harder in rural areas than cities T-T I do apologise).

♡ In-Store Tips ♡

♡ Don’t go shopping just to go shopping. If you are going shopping make sure that you are shopping for something that you actually need or truly want and have the financial means of getting. Before you walk into the store identify what these things are. Buy only those things. Additionally if you’re looking for something specific but can’t find that item, don’t settle for something else, instead wait until you can find either the specific item you wanted or a really close alternative. Remember that it’s okay to leave a store without buying anything! If you didn’t find what you wanted or needed, you don’t have to buy anything!

♡ Set a reasonable budget. Sometimes it's okay to just go shopping for fun, but you want to make sure that before you go shopping you set a reasonable budget for yourself. You need it to be enough that you'll actually be able to stick to it (like I would not set the budget to $20, that's unreasonably low), but you also want to make sure that it is not SO much that it is going to financially stress you (for example $200 is usually too high for me). For most people, this is going to land you somewhere in the $50-$150 range depending on your income, expenses, and current financial situation. If at any point you find yourself saying "I can spend a little more if I don't do XYZ" STOP. If you start taking money away from other expenses for "fun shopping", STOP. Make sure that all of your essential bills and expenses can be comfortably covered before you start spending fun money.

♡ Wait before you buy. Don't feel rushed or like you have to buy something right now. Identify things in the store that you like, leave the store, and come back later if you can. If you forget anything that you wanted in the time between you leaving the store and coming back, then you don't really need it. If you cant leave the store, step away from your basket for a second. See if you can remember everything in your basket then come back. If there is anything in your basket that you did not remember, put it back. If it’s online do the same thing. Close the page and see if you can remember everything. If you can’t, delete what you didn’t remember. Even better if you wait 1 week before purchasing. You can leave the items in the cart, just wait a few days and see if you still want to buy them after those few days are up. The general idea is that if you do not remember and want the item when it is not in your immediate vicinity, then you likely don't need it. And especially if you leave the store and come back a few days later, if you really really wanted it on day one, but when you come back two days later you don't really want it anymore, then you likely don't need it.

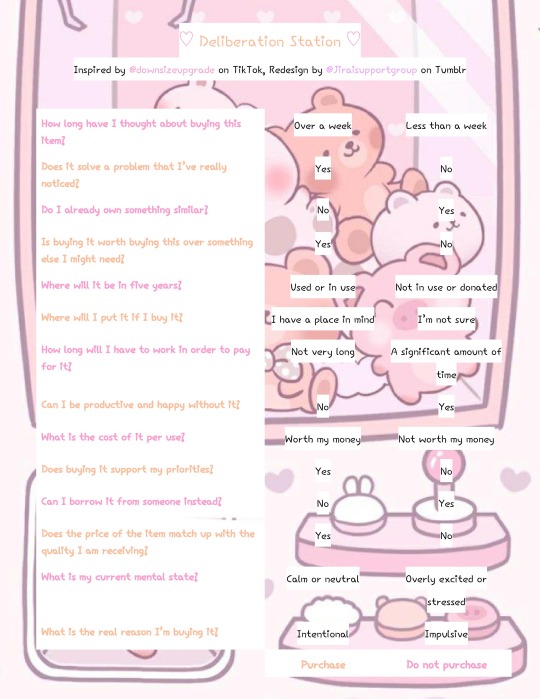

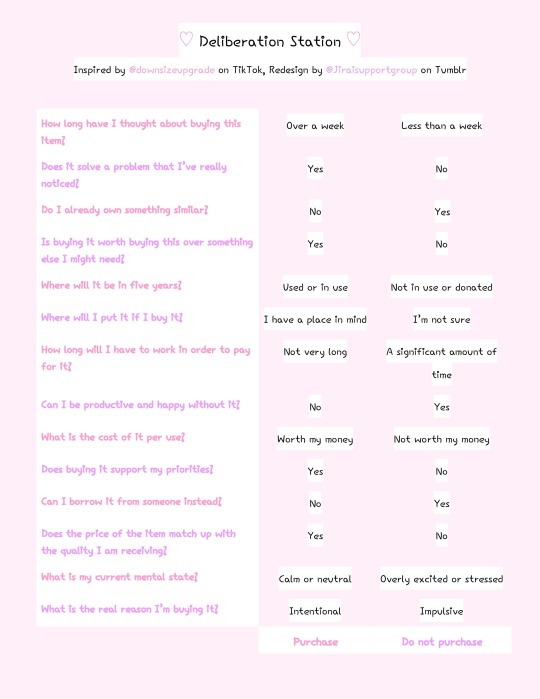

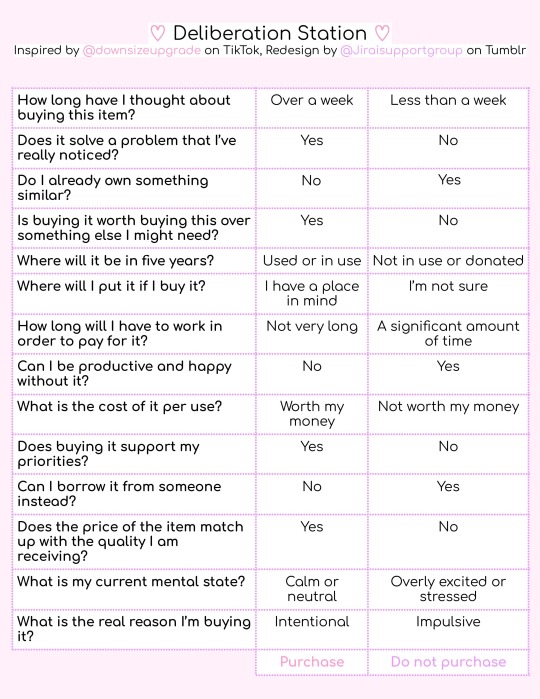

♡ Think critically about each of your purchases. Below is a little chart that @.downsizeupgrade on TikTok uses when she makes a purchase to weigh out if she really needs it or not that I like quite a bit. I did make a few small changes. There are three versions ranging from super cute over the top layout to very simple and easy-to-read layout so that if any of them are hard to read you have options for which one is the easiest for you to use. It is super important to try and be AS HONEST as you can when you’re answering these questions.

77 notes

·

View notes

Note

zizuma after 12 straight hours of code work (all he’s had to eat was 5 adderal and an uncrustable)

[075] Hands stained with blood (stupid coding mistake that takes anywhere from 1 second to 10 days to find)

#075#xisuma#xisumavoid#daily xisuma#hermitcraft#asks#NOOOOO I see this ask on the very day I impulsively decide to spend all my time on my neocities website for the first time in months.....#I deleted everything because it was bad and I got an idea for how to make it better from ground zero. it is now better than it ever was#css still makes me want to kill someone but it's only an occasional feeling now#I probably only really dislike css because I'm not used to it as someone who mains java. what the FRICK do you mean I need to do calc() to#have equations........#hey if someone knows a workaround for z-index on background images.......please.........#<- update you literally can just do z-index if you set a position...FRICKING HELL....

111 notes

·

View notes

Text

New wip. n3783457 figurine for scale.

#impulsively bought a bigger canvas than usual because if there’s anything i need after doing bad at a job interview its to spend more money#æugh#my art#wip

67 notes

·

View notes

Text

I’ve had an interesting thought swimming around my head that I swear I’ve been meaning to write

You know what would be an interesting combination of characters?

Jazz and Harvey Dent/TwoFace

Specifically a Dent just getting back on his feet, released from Arkham and trying to learn how to exist in the world with his condition

I’m thinking a reveal gone wrong, Danny has disappeared to ancients know where, so Jazz cuts ties and Stays with her Uncle Dent, or maybe her bio dad if that’s more your game. Just an soaking wet and miserable Jazz showing up at his crappy apartment saying she’s his daughter or niece and him resisting the urge to flip a coin because he has enough on his plate as is, only to let her in telling her they’ll talk about it in the morning and point her to the shower so she can clean up and dry off

Why do I think this would be an interesting combo?

Jazz’s interest in psychology. A lot of times, as a fandom we depict her as an expert, and in a future timeline where she went to school and has been practicing psychology maybe, but default Jazz? She’s not an expert

Jazz wants to be a brain surgeon, psychology is an interest of hers but her understanding is very limited. She quotes Freud and Jung and has some amount of academic knowledge of the field, but she clearly doesn’t understand that psychoanalyzing friends and family and offering unwanted psychiatric advice is actually rude and something she shouldn’t do. She lacks understanding of actual therapy and is clumsy in applying her knowledge to people she knows

And I find putting her in proximity of someone with DID and probably PTSD would really be an eye opening experience for her

Because Dent might humor her, TwoFace will call her out. They both have hung around Harley to know enough to tell her, “maybe don’t take Freud so seriously” because man does everything go back to sex with Freud, and maybe quoting a guy that says she wants to boink her dad is not as strong of a point as she thinks it is

And the thing is, Harvey would likely still be receiving therapy as an outpatient, potentially taking meds to help deal with his conditions, likely a mood stabilizer or anxiety med to manage PTSD symptoms, so she’s front seat of him learning to live as a regular person in Gotham with his condition. She’s gonna see his good days, his bad days, the side effects of his medication, and it’s going to change her idea of what psychology is. It’s not just quoting things at people, it’s not just saying “this is good for people” but she’d see what it being put into practice would look like

Maybe that’ll push her away from the subject. Maybe it’ll make her more inclined to study, to learn not just about it as an abstract but how to actually apply it to help people. Learning about actual therapy practices. Maybe living first hand with mental illness would be the push to switch from neurosurgery to clinical psychology in her future plans

Also I just think that Dent would be empathetic and do what he could to help her, meanwhile TwoFace would help her cut loose a little, get a little chaotic and have some fun

You can’t tell me there’s not something fun about her and “Uncle Two-y” having a night on the town that only results in a little property damage. Relax Harv, they didn’t do anything too illegal, because they didn’t get caught or nothing

#danny phantom#dp x dc#dp x dc crossover#dp x dc prompt#dpxdc#writing#writing prompt#jazz fenton#two face#harvey dent#I spend a lot of time thinking about Harvey dent and two face#and how his DID affects his character#because it’s beyond there being a good side and a bad side#two face is a lot of Harvey’s anger and ‘base impulses’#Freud would call him the Id while Harvey is the ego#base impulses and the arbitrator between impulses and the rules society creates#the judge would likely be the superego if this version has him#all rules

227 notes

·

View notes

Text

Happy 2025!! (Please be happy please be happy please be-)

#the moon has spoken#the moon has drawn#I STARTED ANIMATING THIS ON AN IMPULSE 2 HOURS AGO HOW????#happy new year#this post is scheduled for midnight my time since i have family to spend time with sorry im not that Tumblr addicted#my oc#-well persona#dont judge me for funky frames i litterally dont animate ever :D

41 notes

·

View notes