#i think a reduction may be more likely because of medicare

Explore tagged Tumblr posts

Text

Goals for 2024

Stream more and build up my Twitch channel

Write more

Practice anatomy

Find a nice apartment (or house,,,) for me and Misako

Set the wheels in motion for getting top surgery, or a breast reduction, whichever is more likely

#for that last one#i think a reduction may be more likely because of medicare#i think a mastectomy is only covered in cases of cancer and stuff#but a reduction. that could be covered#medicare can cover that if its medically necessary. like they cause back and neck pain and skin irritation and disrupt everyday lifwl#which. all fit for me#and my physio said my chest is likely a large cause of my back pain#also one thing i never see anyone talk about is how a large chest makes sleeping uncomfortable#i sleep on my side and like. bro

3 notes

·

View notes

Note

Do you think it is a little bit reductive to claim that Democrats and Republicans are the same when there are clear differences, at least on domestic policy? For example, the $35 dollar insulin cap for Medicare recipients along with the list of other life saving drugs whose prices will be negotiated down, thought not “radical” is a pretty significant policy initiative that will materially improved the lives of many elderly folk in fixed incomes; this obviously would not have happened under a Republican presidency . This is not to suggest that on foreign the differences between the two parties become much more superficial in nature, but this is to suggest that isn’t it possible to maintain a harsh critique of both parties commitment to hegemonic US imperialism but strategically vote for democrats for other reasons where the differences between them and the republicans are more clear, particularly on domestic policy. There seems to be a belief by some that if you support this POV you are effectively selling out those in the global south who are suffering under the crushing weight of US lead imperialism, which I personally find confusing because it’s not like the working class suffering under the domestic agenda of a Republican controlled government actually does anything to improve the lives of those in the global south. I don’t say this to attack you, I just think it’s hard to deny that Dems and Repubs are the same when there are clear material differences between them on domestic policy (such as the examples around Medicare drug negotiations) hence why it is understandable why some people, even on the political left may feel compelled to vote for them. I think it’s perfectly reasonable to say you won’t vote for either party in a presidential election because you can’t bring yourself to vote a party that is committed to the US imperialist project, but to say outright that they are the same just doesn’t seem to reflect reality.

I think that it’s important to understand that when it comes the most basic social relations - the means of production and reproduction - there are no substantial differences between the two parties. Both represent the capitalist class, and subsequently the patriarchy and white supremacy. Democrats may strategize differently with what scraps they give up to rally voters but at the end of the day they still want, for example, privatized healthcare, like republicans.

I understand why some may still feel compelled to vote Democrat. That’s your prerogative and I’m not saying “don’t vote”. But we have to be realistic about these parties. There’s no “nicer” party that’s “for the people”, “for human rights”, etc. There are just different flavors of the bourgeois hamburger so to speak.

1 note

·

View note

Text

im really really excited by this idea, i think its brilliant. on reading this post it had me thinking, like. how much expertise would be necessary to produce something like that? what would it take to implement it?

if i may im gonna spitball a little on this. pls bear with me, bc im going into a fair bit of detail as to potential hurdles, but overall i dont think this is unachievable at all. it would help a lot of people enormously.

im also putting it under a cut bc it got Really Long. oops

(ill note im coming at this from a usamerican perspective, so im not sure how this would work globally, though that would obviously be the larger objective. more research needed.)

i think the main reason this might prove difficult is that a lot of the time, comorbidities with chronic illness can span across the fields of a variety of different specialists. specialists who absolutely Hate to talk to each other 🙄

depression borne of thyroid disease is a great example here. i would be surprised to run into a psychiatrist who even like.. knows that that is a thing that can happen, or at least has internalized it to the extent that its something they would honestly suggest. doing that would mean putting into focus the interconnectedness of human bodymind systems, which doesnt jive well with the way the health industry has compartmentalized our care into distinct little boxes at all.

and this obviously sucks. it leaves our hypothetical patient out in the rain, with no real recourse to learn what the actual problem is, short of doing all of these doctors' jobs for them, as is the case now. ideally it would not work like this at All, but if we assume that for our purposes here that we're maneuvering within the flawed framework as it exists, then it means giving practitioners across the board access to multidisciplinary information they otherwise wouldnt be bothered to look for themselves. in order to do that, one needs to compile it in the first place.

creating an accurate, referable directory of comorbidities with the according sets of diagnostic checklists would have to be a multi-pronged effort, because of how varied and multifaceted the area of study is. so itd likely require the formation of several specific focus groups consisting of ppl from a range of bgs, most critically those with lived experience, as well as good-faith medical scholars. each of these groups could maybe develop a list of common symptoms, comorbidities that currently exist in patients, risk factors.. answers to the question 'what does it look like when you have both [x] and [y]?'

like, the answers to those questions Exist already ! the raw quantitative data isnt necessarily there rn--we're not currently recording a lot of these statistics outside of like. medicaid/medicare, which means the sample set is inherently gonna have some degree of bias, but even still thats Something to work with. we can use what we have to back up any findings and like. Tell people about them.

when it comes to pitching this resource to the established systems.. training existing practitioners as well as appending this information to medical curricula…. who has the authority to do this? legislature? national health associations? those are made of people, and like…. in theory we can talk to people, right?

i mean, im definitely being reductive abt the amount of bullshit youd have to wade through to enact this on a large scale; i know doctors are a standoffish, stubborn bunch on the whole, and therefore no doubt highly resistant to change of any sort. but the healthcare system has been improved before, yknow? it sucked to do and it happened too slowly. many many many lives could have been improved, saved, if the those treating us considered it a priority to listen to sick people. but if they dont want to do that, then there must be ways to make them.

upon implementation, the database would also require updating as we collectively learn things about chronic illness, in order to make a questionnaire/test directory like that a functional tool even as research progresses. so you need the resources to do that, to be up on the current medical texts alongside regularly repeating the initial fact-finding process, to see what, if anything, has changed over time. maintenance would comparatively be a lot simpler than establishing it in the first place tho.

like, its a large large project. it might be out of an individual's means but it really feels doable when i look at it as a, a grant proposal to bring to a nonprofit or patient advocacy group or something. id need to look into whats out there for chronic illnesses broadly, bc i know a large number of those are focused on specific diagnoses, but. i dont know!! am i way off base here ?? are there people working on projects like this already? is it embarrassingly naive to think theres a chance of actually affecting how this all works???

when you get diagnosed with a chronic illness they should automatically offer you free tests for the ten most common comorbidities.

bc chronic illnesses DO often come in bundles like that and people experiencing them often struggle with recognizing symptoms in things we’ve lived with sometimes for our entire lives meaning we have to a) identify that something we experience is a symptom of something that hasn’t been diagnosed and b) believe it’s possible/important/realistic to address that symptom AND c) communicate this to our doctors often/clearly/emphatically enough that we eventually can get tested AND, usually, d) figure out what’s causing it ourselves because let’s be real doctors often don’t care enough to figure it out themselves and will often just shrug unless you mention a specific possible diagnosis for them to check

and all of this could be made one trillion times easier if after someone did that ONCE and got diagnosed, if it was standard practice for the doctor to then pull out their handy dandy reference app and put in the New Diagnosis and be given a list of the most common comorbidities that they must now check you for.

like they don’t even have to run the lab tests if that’s too expensive! Just go over the diagnostic criteria and proactively ask, “Do you experience these symptoms?” and suddenly people will have adequate diagnoses and possible treatment options SO much faster

#i mean ultimately there are people WAY more equipped to find solutions here than i am but i dunno!! i think its a great idea#despite being chronically ill for a long while its only recently that ive felt justified in contributing to inter-community discussion like#so im Really hoping im not overstepping. interested to hear ppls input#i hope its not too intrusive for me to think out loud on your post op. grateful for your thoughts#i Am however queuing this because it is so late. early. over here. good lord#fun fact i accidentally closed the reblog text box after writing this out initially#and i had to download a program that would let me dig through the RAM to copy-paste this thing back to life in bits and pieces#i didnt even know you could do that. go figure#disability tag#chronic illness#long post -

2K notes

·

View notes

Photo

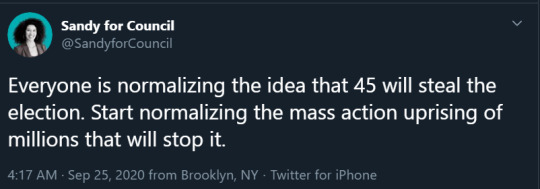

there is one possible good outcome of this year that I’ve been thinking about a lot

It requires a lot of action before and after the election and a focused political strategy for the next few election cycles. It will have to meet certain conditions at critical times, but if it does, it could mean the end of the republican party the passage of Medicare for All and a Green New Deal, and a labor party. Basically, it depends on splitting the Democratic party after ensuring Democrat control of Congress and the White House, DSA expansion, and eliminating the electoral college.

1) Circa the 2020 election

Biden wins the electoral college

This is almost completely dependent on white moderates in swing states voting for Biden and on massive protests during what will likely be a highly contested legal battle for the presidency. The protests are to show leaders that we reject any legitimacy of another trump term. Protests against trump will face even more violence at the hands of police and their conspiring with white nationalists. There is still the possibility of a coup. But voting alone will not ensure trump’s removal from office, everyone needs to be out in the streets and organizing strikes and protests. It will be a lot easier than stopping trump after he’s secured a second term. If this fails, protesting conditions will become even more hostile, and Americans will see no relief from the economic depression or pandemic. The U.S. may end as a dictatorship, but I have no idea when.

Democrats take majority control of the senate

This is essential as well. There are many senate seats this year where Republicans could be replaced by Dems. Here is a more thorough guide on who could be unseated. This will help with passing bills that Dems agree on. The more the better. Without this, splitting the party won’t be possible yet.

Democrats expand control of the House

This will make splitting the Dem party easier.

DSA (Democratic Socialists) expand control at the local and state level

The emergence of DSA to a national party requires many more wins at the local level. This will give them the chance to become the left-wing national party. 50% of Democrat voters support socialism, and that’s pre-pandemic and pre-depression. It is these voters who will be attracted to the DSA as they grow.

Democrats expand control in state legislatures

Once the census results are in and states have to redistrict, Democrat-controlled state legislatures will likely produce less gerrymandered conservative districts. This will secure more representational elections for the next decade.

2) Before the 2022 election

Eliminate the electoral college

This is another very difficult part. Conservative Dems (like Biden) oppose eliminating the electoral college. His current views may not matter once the DNC tells him to do otherwise. It will likely be moderate and left Dems who push this agenda forward, as it is within the best interest of the Dem party to make the popular vote chose the presidency. National support for it may also be higher than ever after the election, meaning more pressure on Dems to act while they can. If the electoral college is eliminated, Republicans will lose their chance at winning the presidency again, meaning trump 2024 won’t be possible

Begin major canvassing for M4A, GND, police defunding, and abolishing ICE

Once Dems control Congress and the White House, the left can be more on the political offense rather than defense. The DNC opposes Medicare for All and the Green New Deal, but support for them will only likely increase as more people die from COVID-19, suffer under medical debt, face record breaking unemployment and evictions, and climate crises continue to destroy areas. These bills are popular, and the DSA supports them, which will give them leverage in winning more elections and even in poaching Democrat representatives like Bernie and AOC. Support for abolishing ICE and the police are only likely to grow thanks to continued BLM organizing.

Counter Republican campaigns at the state and local levels

Republicans are unified, backed by money, and think long-term, but this election is different because their only platform is supporting trump. Should they lose the White House and Congress, and lose the electoral college, they will have to create a whole new base and platform goals to win a national election ever again. Local organizers will have to counter republican strategies at the local and state levels in hopes of killing the party. Republicans might be able to find a way to attract half of the voter base again, but they might also be clinging too tightly to racism, which, although strong, is no longer enough to win the presidency through popular vote. They could also lose southern state control as cities like Atlanta and Houston grow and their voters flip the state blue.

3) Circa the 2024 election

Enter the DSA into national elections

If the electoral college is gone and the DSA was won more local and state seats in 2020 and 2022, the DSA has a chance to enter national elections. As a popular left-wing party and with the decline of the republican party, the DSA can now attract left-wing previously “captured” by Dems. They may likely not win the presidency, but the DSA will force Dems to be the nation’s right-wing party and become the left-wing party in doing so. Formerly republican voters will likely switch to Dems as the Democratic party becomes more conservative and if republicans no longer have a chance at winning national elections.

Center campaigns around major bills not yet passed (M4A, GND, police defunding, and/or abolishing ICE)

This keeps important issues relevant and keeps Dems on the defense as to why they won’t pass the bills.

4) After

Continue building revolutionary potential now that the two national parties are welfare capitalism/socialism-lite and neoliberalism.

The DSA will likely capture much of the working-class vote, Millennials and Gen Z, and POC. If republicans are still around, their goal will be to find a new way to split the working class vote, likely requiring collaborating with Dems. However, their old strategy of splitting by rural/urban may no longer work. Businesses will do everything they can to stop a party from representing workers: it’s why the parties realigned after the New Deal.

This is all possible and will offer actual harm reduction to the working class for the first time since the 70s. None of it will be possible without massive organizing and protest efforts on the ground. None of it will be possible without strong interracial ties and community building. Voting is essential, but it’s the bare minimum and inadequate alone. During this period, BLM and new leftist movements could grow, we could see a militant left party to further curb U.S. domestic authoritarianism. We could see national policy that interferes less in the Global South. We would likely see increased protections for workers, a redistribution of wealth, and new public infrastructure. We could even see the end of the U.S. by the close of the decade, or at least how it would finally happen.

I’m happy to explain any point further, but I thought I’d put my degree to use and share a possible political strategy for the next decade that could use protest and direct action with electoral politics to end U.S. dominance and global capitalism while making the conditions for final stages of revolution less hostile. The next decade will be turbulent regardless, but would this ^^^ is the best way for that turbulence to lead to liberation.

#essay#politics#strategy#social policy#text#US#biden#green new deal#medicare for all#DSA#defund police#blm#party realignment#DNC#long post#revolution

250 notes

·

View notes

Text

Beyond Apologetics and “the image of god”

This is a love letter – a curiosity, a hope towards our freedom.

Dear siblings, I am trying to find out what we mean. I know I won’t know it for all of us. And I know I won’t know it alone. I am only ever myself, in my body. And I believe you about your bodies too. I know lots of people don’t. And no one wants to tell the story differently. Because the story we have already feels so precious. But I think maybe the story isolates us from each other. We pick it up as the Narrative That Matters, because it is the first one that kind of fits.

Like the first time you put on that dress. The first time you squeezed into that binder. The first time there was eyeliner.

We were so certain we all looked good. And we did. And we’ve grown since then.

I hope for a theology for the guys who all go camping, huddled in the van before breakfast, tenderly administering each other’s shots so that we don’t have to be in charge of stabbing ourselves one more time.

What I want to do in my work is simply to administer the shot. To reflect back on our dosage. To be in charge of the sharps for a minute, so you can take off the binder and revel in the sunshine the way we never do at the beach because the surgery is too expensive, or we want kids first, or we’ve actually always hated our bodies, and dysphoria was just another word we gave ourselves, or they gave us.

I’m writing for the women whose dysphoria has gotten worse as the other pieces click into place. Maybe that is what I feel – dysphoria about the imago dei. People keep saying I’m in the imago dei, and I don’t know what they mean. Or I do, and I don’t think that’s how it really is. I like the idea, I can perform the apologetic, but I don’t feel like that. Or I do feel like that, and I wonder what it is I’ve signed on for. I worry about the masculinity. I worry about the passing.

But, you may ask, why does it matter? Don’t we have theological arguments about that? Aren’t we all imago dei - made in the image of God?

It matters because Alexis killed herself. It matters because Stephanie has days where all the imago dei in the world won’t quiet the dysphoria. It matters because Mason is still dealing with their pronouns being fucked up, and by people who claim to love and care about them. It matters because all the imago dei in the world isn’t making Medicare pay for Ryn’s chronic pain medication, or Aiden’s anxiety, or Crystal’s allergies and respiratory issues, or Daryl’s eating disorder, or Moira girlfriend, whose job security relies on hernot publicly dating a trans woman, or Brian’s sobriety, or August’s sobriety, or Caryne shaking and crying in their car as teenagers surround the vehicle pounding on it. Imago dei isn’t thick enough to get my friends through another winter without killing themselves. It doesn’t give Scout back hir home or hir childhood. It doesn’t un-institutionalize Leo for those 18 months. It doesn’t get Janice out of jail.

And I am so tired of the story.

When we claim the imago dei as an apologetic strategy we may claim our humanity, but we don’t even begin to touch God. And although in one sense that may be fine – we all just want to be human and not dead to the people around us – in another it matters because if we’re only using imago dei to say something about ourselves, then we’re still stuck with whatever God it is that someone else decides we’re in the image of. And I believe God is bigger than that. We deserve more than just harm-reduction apologetics.

#transgender#trans christians#trans theology#queer theology#imago dei#constructive theology#queertheology#lgbt#lgbtq#lgbtqi#gay christians#nonbinary#enby christians#hormones#hrt#apologetics#queer faith#transmasc#transition#progressive christianity

15 notes

·

View notes

Text

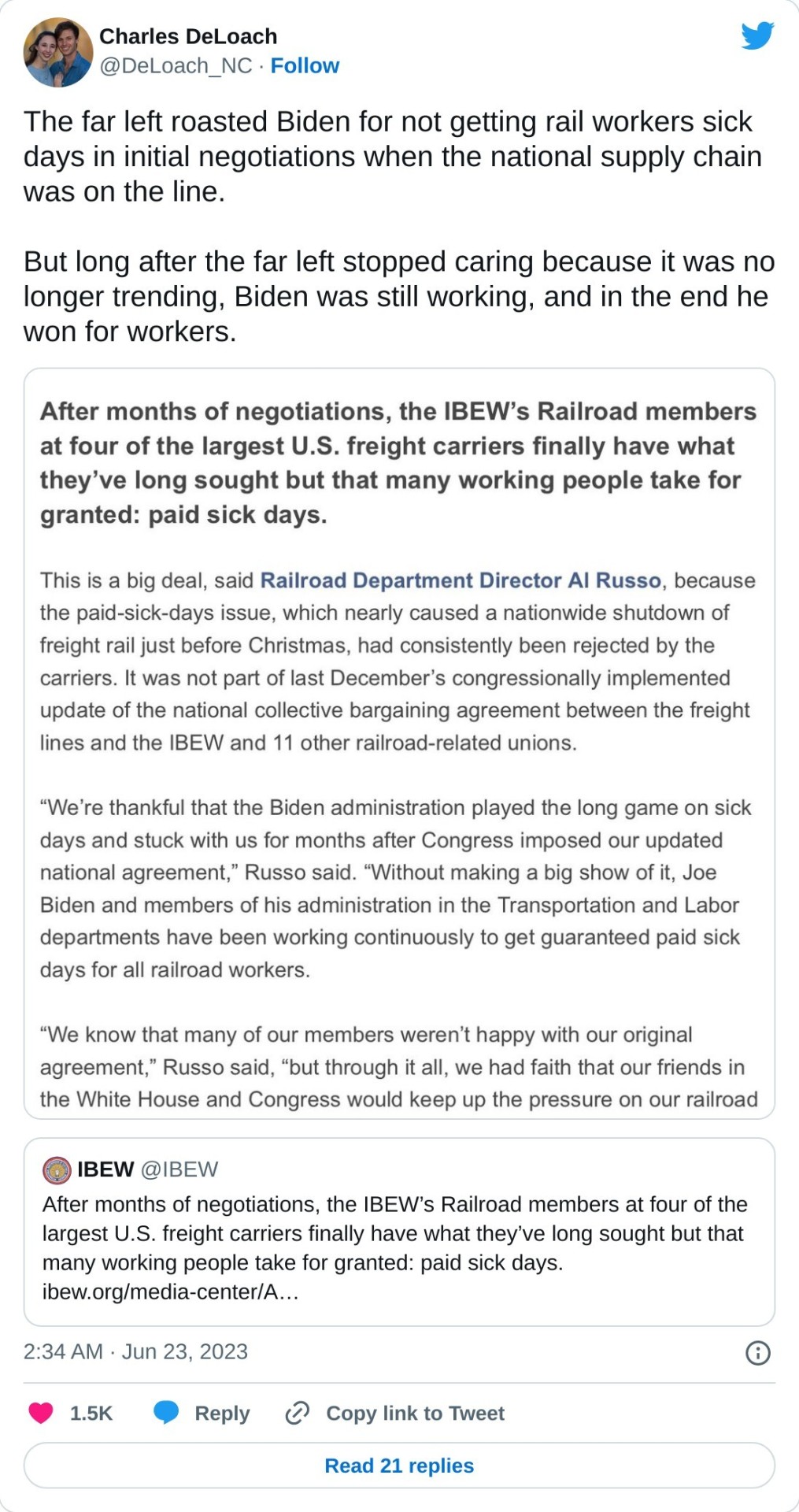

When Biden ran, he knew damn well he was coming in to clean up MASSIVE amounts of shit. The type of slow, hard work that seldom makes headlines.

For example, Trump gutted federal agencies, leaving many positions empty, and/or appointed unqualified individuals to head others, like a Big Oil lobbyist in charge of the EPA. Some federal workers stuck to their jobs; others fled toxic work environments for the private sector. Part of Biden's homework was convincing some of these staffers to come back before their legacy of experience was lost, and, despite GOP obstruction, appointing new admins who believed in their agency's mission.

Of course, in the era of Everything Happens So Much, even big stuff can get lost in the noise.

The signing of just three enormous bills—the $1.9 trillion COVID-19 relief package, the roughly $1 trillion bipartisan infrastructure law, and this summer’s climate-and-health spending bill—made Biden’s first two years among the most productive of any president in the past half century. The initial pandemic bill, also known as the American Rescue Plan, was about the size of Barack Obama’s two biggest legislative achievements—his initial economic stimulus package and the 2010 Affordable Care Act—combined. The legislation sent $1,400 checks to Americans across the country, nearly doubled the child tax credit, shored up state budget accounts, and funded testing, treatment, and vaccines to fight the pandemic. The politically named Inflation Reduction Act is actually the largest climate bill in U.S. history and allows Medicare to negotiate the prices of certain prescription drugs for the first time.

Beyond those headline bills, Biden more quietly amassed a bevy of smaller legislative wins, often with bipartisan support. A modest gun-safety bill expanded background checks (although not universally), made it easier to prosecute illegal gun trafficking, and provided federal funding for so-called red-flag laws. Congress also passed the CHIPS Act to boost domestic production of semiconductors, a long-stalled postal-reform bill, substantial military aid for Ukraine, and a reauthorization of the Violence Against Women Act—all with fairly broad support from both parties. Biden’s executive actions on student-loan forgiveness and pardons for marijuana possession answered a pair of progressive demands.

— What Biden Has (And Hasn't) Accomplished, The Atlantic, Nov 2022

We also tend to forget natural disasters unless the federal government botches them as badly as Katrina ($100 billion in damage thanks largely to New Orleans flooding). Hurricane Ida ($75 billion) destroyed infrastructure all the way up the east coast, but for once states were NOT caught flatfooted thanks to federal staging of resources/repair crews moving in after it passed.

The same was done for Hurricane Ian, despite political differences between governor and president (think of Puerto Rico, or Trump's response to states that didn't vote for him) I can't imagine Trump postponing the tax filing deadline for Californian counties hit by this spring's flooding.

There's other big disasters I'm forgetting, but that in itself is telling. The aftermath and wrangling over federal aid were often in the news for weeks or months during the last two Republican administrations.

And while Guam is a smaller territory than Puerto Rico, It just got hammered by a Cat 4 hurricane on May 24, yet its governor's office expects it'll be 95% recovered in a month.

"There weren't as many downed power lines, power poles [as the last cat 4] because now they're concrete," [Governor spokesperson] Paco-St. Angustine said. "Also, what's really helping to support a speedy recovery and resilience effort is that we have our federal family here on-island. They were here pre-storm landfall."

Days before the storm, Governor Guerrero asked President Biden for a pre-landfall emergency declaration — which got aid moving early.

— "Guam is still recovering from Typhoon Mawar, but residents are taking it in stride" NPR

Biden is not my favorite person, nor was he my first or second choice. But I respect his competence. Unlike progressive leaders I agree with more, who I hope are taking notes, he's good at figuring out what can be accomplished, fast-tracking the possible, and continuing to chip away at the impossible.

Hence our first new gun control legislation this century, and student loan debt cancellation despite overwhelming GOP opposition (although he's trying not to resort to executive orders as Obama did, since the next prez can play the reverse card and/or point to precedent to use them even more).

biden 2024 - making things work

23K notes

·

View notes

Text

replacing An Excess Skin With A Facelift.

Hifu Treatment

Content

What Can I expect during My Cryopen therapy?

two therapies.

Cryomatic Ii Cryo Console.

contact united States Today For Your Cryo storage Space Solutions (or Anything Else Gas Or Cryo Related).

Femiwand vaginal Area tightening treatment Edinburgh.

See Our providers.

What Can I Do To lessen Cellulite?

There is nothing that I feel can be improved at Cadogan Cosmetics. I was dealt with as well as cared for very well the location was very clean.

Cosmetic surgery outcomes as well as benefits can differ and also are various for each person. Therefore, https://luton.hi-fu.co.uk/ can not ensure specific results. Mr Alamouti is among our top boob job, fat reduction & abdominoplasty surgeons.

Nevertheless, it is essential to remember that although your external look will certainly look healthy and balanced and recovered, inside your body will certainly still take 6 to eight weeks to recover completely. The outcomes of the Principle ™ Facelift procedure will certainly leave your with a natural, fresh as well as vibrant appearance that lasts up to ten years. I really feel so excellent regarding myself and also can not think how much far better I appear to look. I would very advise having surgical treatment with Amir at Bella Vou. I really feel much more youthful and also revitalised in my look, as well as it's all thanks to Bella Vou.

Mr Super qualified in Medication in 1987 and also learnt Bariatric surgical treatment in 2001. We'll exist to assist throughout your journey, from yourfirst consultationto completion of yourcomprehensive aftercareprogramme. Facelift surgery can offer you a more vibrant and renewed appearance. Consent By ticking this box you consent to obtain marketing material by means of email, text, post and telephone calls from The Medical facility Team and Transform and any third parties directly related to your care.

Can you get frostbite from cryotherapy?

Frostbite is possible if someone has wet clothing or is overly sweaty during the session. Make sure the client is completely dry before they enter the cryotherapy chamber. If not make sure they dry off any water or excess sweat from working out with a towel.

What Can I anticipate during My Cryopen treatment?

Hi-Fu.co.uk hifu Daventry: full feature set will certainly ask you concerning the results you're wishing for and also deal with you to attain the best end result. Springfield Medical facility opened up in 1987 and is just one of Essex's leading private healthcare facilities. It is a 64 bedded device containing fifty 8 private bedrooms 4 of which are 2 bedded moms and dad as well as child areas and a high observation system with 2 beds. The operation is performed under a basic anaesthetic and also normally takes two to three hours.

What is the cost of ThermiVa?

The Non-Invasive, Non-Hormonal Option Average Cost: $2,650. Range: $1,250 to $3,900 for 3 treatments for the first year. One follow-up appointment per year: $1000-$1500 per year afterwards. ThermiVa is NOT covered by insurance or Medicare.

Tea and coffee are high in caffeine, so we suggest you to keep those to a minimum. Also, attempt to stay clear of foods that are high in sugar and salt as high as feasible. These include the advancement of a blood clot, nausea or vomiting as well as vomiting, as well as postoperative pain. As the surgical treatment entails the use of an anaesthetic representative, it is likewise feasible that you may create anaesthetic issues. At the end of the surgical procedure, the registered nurses will certainly move you to a recovery space. Below, you will slowly wake up from your anaesthetic under close guidance.

My skin is tighter and also more flexible, stretch marks are hardly noticeable, as well as I make certain I wouldn't even get approved for abdominoplasty surgery anymore.

As the ultrasound waves are focused throughout the treatment areas, you will certainly really feel small quantities of power transmitted with to accurate depths under the skin.

Dr Dhillon will evaluate the skin and assistance figure out if HIFU is the most appropriate treatment to deal with any type of concerns patients might have, factoring in the condition of the skin and the individual's unique goals.

A full HIFU face as well as neck procedure normally takesbetween minutes, while an upper body treatment on its own will certainly take about thirty minutes.

A gel is applied to the location that will be treated as well as the ultrasonic tool is overlooked the skin.

Routine touch-up treatments will certainly aid keep the skin producing new collagen and also prolong the longevity of results.

Some clients delight in an initial result immediately complying with the treatment, yet the ultimate results will take place in simply 2 to 12 weeks, as exhausted collagen is renewed as well as renewed.

There is no special prep work or recovery as well as usually on the face it usually takes one treatment to obtain a recognizable outcome on the body a program of 4 therapies generally obtains the preferred outcomes.

two therapies.

The procedure takes in between 1 - 1.5 hrs, can be performed either under local anaesthetic or sedation, and is treated as a day case. The natural aging process will certainly proceed from the factor accomplished following the procedure.

You want to redefine your face by lowering loose, drooping skin. The appearance of your face is making you look older than you feel.

Cryomatic Ii Cryo Console.

We have actually invited an option of the country's very best specialists to join us at the Cadogan Center to ensure that you can be sure that whatever the nature of your treatment, you will be seeing one of the top professionals in the country. A 'mini-lift', or 'mini-facelift', is an innovative anti-ageing procedure that uses the most recent minimally intrusive medical strategies to transform the clock back on the age of your face by about 10 years. I really felt entirely safe and guaranteed, he explained every little thing in fantastic information and I really felt really confident that I would get the appearance I wanted, and also I did I'm thrilled with the end result. Among the Bella Vou group will certainly give you a phone call the day after surgical treatment to see to it you're well, have actually had a great evening, and to address any kind of questions. Prep work for your treatment can help reduce the danger of infection and also boost recovery. Shower and also laundry hair everyday as well as quit smoking cigarettes as well as e-cigarettes to minimize the danger of healing issues. Sometimes people present earlier, in their early forties as well as the treatment can be successful in the seventies, eighties or even nineties.

youtube

The benefit of the Principle ™ Facelift is that it is under local, not a general anaesthetic, making it much safer for individuals with existing clinical issues. Bella Vou is committed to offering fulfillment, the highest possible requirements of treatment, and a very personal touch throughout the client journey. The highly-skilled, professional personnel are enthusiastic concerning helping people achieve the results they desire, but likewise making their experience delightful, stress and anxiety, and convenient. You will have little bruising, swelling, or scarring complying with the Concept ™ Facelift. Many people can go back to their normal regular within an issue of days.

get In Touch With united States Today For Your Cryo storage Space Solutions (or Anything Else Gas Or Cryo Related).

How can a 60 year old lose belly fat?

Burn more calories than you eat or drink. Eat more veggies, fruits, whole grains, fish, beans, and low-fat or fat-free dairy; and keep meat and poultry lean. Limit empty calories, like sugars and foods with little or no nutritional value. Avoid fad diets because the results don't last.

I feel more certain, I felt there was a more youthful person waiting to venture out, it has actually made a great difference to me and also how I feel. The entire experience has actually been superb as well as I'm over the moon with my outcomes. The treatment defined on this web page might be adjusted to meet your individual needs, so it is very important to follow your medical care professional's guidance and also raise any kind of inquiries that you might have with them. Also after you've left medical facility, we're still looking after you every step of the means. Once you're ready to be discharged, you'll need to prepare a taxi, pal or relative to take you house as you will not be able to drive. You must additionally ask if they can run some light tasks such as looking for you as you won't be really feeling up to it.

Woodland Hospital has 28 solitary areas, all with en collection facilities, 10 short remain beds as well as a 2 bedded high dependency device. If you would like to talk with somebody what is included and also just how much the procedure will set you back, call our team on, or leave us a message via our online query type here. Other sorts of facelift include the mid-face lift and composite facelift and also include lifting much deeper layers of the face. A healthy diet regimen is an essential factor in assisting you to heal and recoup after a facelift. Eat great deals of healthy and balanced environment-friendly veggies, fresh fruit, and high-protein foods such as chicken, fish and also legumes.

Does Cryo hurt?

HOW WILL MY BODY REACT TO THE COLD TEMPERATURE? Cold air therapy in the whole-body chamber uses dry, oxygenated air, so you won't experience shivering, goosebumps or other reactions that you might associate with being cold. Because of this technology, unlike an ice bath or immersion, cryotherapy is not painful.

There are many various other anti-ageing solutions readily available, both surgical and also non-surgical. Ask for a telephone call from among our client advisors or publication an appointment at the Cadogan Center if you would love to review your problems in more information. You may function from home the following day, yet it will certainly rely on just how sensitive you are to the discovery of current surgical treatment, as to when you head out to fulfill individuals. The factor is that you will certainly not be jeopardising the result by going out. Our Surgical Client Expert, Ellie, addresses our patients most regularly asked inquiries. Adhering to the procedure, you will certainly recuperate in our ambulatory healing rooms for in between two to three hrs, depending on the scale of the procedure. Once our professional nursing team more than happy that your first recuperation is full and also you are secure to return home, you will be permitted to leave the Clinic come with by a good friend or participant of your family members.

Femiwand vagina tightening Up therapy Edinburgh.

The results of Mini Face Lifting surgical treatment are anticipated to be stable for 3-- 5 years, however note that as you mature your face will certainly transform throughout the years. For instance, the tissues around the cheek will remain to be influenced by the aging adjustments and also gravity. People can go back to their normal day-to-day tasks after 1 week, however prevent difficult exercise/ activity for 6 weeks including any contact sporting activities. Mini Facelift Surgery usually takes approximately 1 -2 hrs to carry out depending on the complexity of the surgery. Muscles additionally shed their size and stamina as well as with loss of bone particularly around the upper as well as lower jaws, the face handles the regular functions of aging. The skin loses collagen as well as hyaluronic acid, with sun-damage and contamination, pigmentation, fine blood vessels as well as wrinkles show up.

Is Cryoskin better than coolsculpting?

The product of these improvements is Cryoskin: a treatment system that is faster and more effective than coolsculpting. Cryoskin fat-freezing treatments are faster than coolsculpting and are more customizable. Cryoskin technicians hold an instrument that gets cold, then they move it around your targeted areas.

The skin loses flexibility and also ends up being lax, fat reductions and also comes to be displaced by gravity creating the common jowls, level cheek and reduced eye bags. Please supply a little more information so we can obtain the most effective member of our team to call you back each time to match you. The Cadogan Clinic is an award-winning boutique exclusive healthcare facility on Sloane Street in the heart of Chelsea. We offer one of the most sophisticated medical and also non surgical strategies in our fully-fitted consulting rooms, advanced operating theaters and purpose-built aesthetics as well as laser collection. The Micro-Lift treatment is made to assist alleviate very early indications of aging and also moderate loss of flexibility loss. Picking a surgeon who is an expert in their field and also concentrates on face-lifts will certainly make certain you get the very best outcomes possible.

Clifton Park Medical facility which opened in 2006, is located just outside York city centre. The healthcare facility has actually been rated 'Great' by the Care Top Quality Compensation and also has 24 beds, 2 theatres, a day situation system, a huge outpatients department with x-ray facilities and on-site physiotherapy, including a tiny fitness center location. Free auto auto parking is offered for simple accessibility to our easily positioned hospital just outside of York city centre. Our health center is registered with the Treatment Quality Payment and has superior facilities. We offer fixed price packages for our facelifts so you can feel confident there won't be any economic surprises. We suggest you to refrain from any type of exhausting activity for the very first 8 weeks. You can expect to return to work after one to two weeks, and after 3 weeks if you have likewise had a blepharoplasty.

You can contact our clinical cosmetic team anytime, day or evening if you have any worries or questions. Timberland Hospital is just one of Northamptonshire's leading exclusive hospitals situated in Kettering.

Both nurses who I handled were superb, as well as the whole team got along however specialist, and actually put my mind comfortable. That I was able to remain later than I probably required after my surgical treatment to harmonize my husbands routine was substantially valued. If you have any type of concerns or questions please phone call to talk to among our consultants or demand a recall to talk at a time that suits you.

#hifu treatment#facelift#fat freezing#femiwand#Cryo#Cryopen#cellulite#Femiwand treatment#skin tag removal#Bucks vaginal tightening#hifu facial#fat freezing service#cryolipolysis#Bodybuilding for Weight Loss#lose stomach weight#fat legs treatment#Anti aging hifu#Mens facelift treatment#Double chin removal#coolsculpting#wart removal#cellulite treatments#Non surgical facelift#body and face toning#Lipo freeze

1 note

·

View note

Text

https://www.bloomberg.com/amp/news/articles/2019-11-02/nancy-pelosi-is-worried-2020-candidates-are-on-wrong-track?__twitter_impression=true

🍁🏈🍎🍁🏈 🍎🍁🏈 🍎🍁🏈 🍎🍁

NEW: Speaker Pelosi warns her party’s presidential hopefuls that ideas like Medicare For All and free college may fire up the left but won’t beat Trump.

“Remember November,” she says. “You must win the Electoral College.”

Pelosi tells Bloomberg News: “What works in San Francisco does not necessarily work in Michigan. What works in Michigan works in San Francisco — talking about workers’ rights and sharing prosperity.”

PELOSI on

Medicare for All: “has its complications... the Affordable Care Act is a better benefit than Medicare.”

Green New Deal: “very strong opposition on the labor side ... because it’s like 10 years, no more fossil fuel. Really?”

Remarkable quotes from Speaker Pelosi here questioning the political viability of the most progressive ideas in the 2020 Democratic primary.

“As a left-wing San Francisco liberal I can say to these people: What are you thinking?”

Nancy Pelosi, who could still be Speaker in 2021, says the next president must abide by pay-as-you-go rules because “we cannot just keep increasing the debt.”

That would limit the ambitions of an Elizabeth Warren or Bernie Sanders.

When asked by @SahilKapur Speaker Pelosi if she favors a wealth tax, she didn’t say yes or no, but called for “bipartisan” tax changes that unwind the “dumb” Trump tax cuts of 2017.

Nancy Pelosi Is Worried 2020 Candidates Are on Wrong Track

Sahil Kapur | Published November 2, 2019, 6:00 AM ET |Bloomberg | Posted November 2, 2019 |

Speaker questions appeal of Medicare For All, Green New Deal

Ideas could repel voters in swing Midwestern states, she says

Speaker Nancy Pelosi is issuing a pointed message to Democrats running for president in 2020: Those liberal ideas that fire up the party’s base are a big loser when it comes to beating President Donald Trump.

Proposals pushed by Elizabeth Warren and Bernie Sanders like Medicare for All and a wealth tax play well in liberal enclaves like her own district in San Francisco but won’t sell in the Midwestern states that sent Trump to the White House in 2016, she said.

“What works in San Francisco does not necessarily work in Michigan,” Pelosi said at a roundtable of Bloomberg News reporters and editors on Friday. “What works in Michigan works in San Francisco — talking about workers’ rights and sharing prosperity.”

“Remember November,” she said. “You must win the Electoral College.”

Pelosi was careful not to back any one candidate in the party’s contentious presidential contest, but didn’t hold back when asked about which ideas should – and shouldn’t – form the party’s case to American voters. Or about her fears that candidates like Warren and Sanders are going down the wrong track by courting only fellow progressives – and not the middle-of-the-road voters Democrats need to win back from Trump.

This is familiar ground for Pelosi, who has spent the year tussling with the “Squad,” a vanguard of liberal newcomers to the House led by Representative Alexandria Ocasio-Cortez of New York.

“As a left-wing San Francisco liberal I can say to these people: What are you thinking?” Pelosi said. “You can ask the left — they’re unhappy with me for not being a socialist.”

Her call for caution is backed by the authority she carries as a giant of Democratic politics who rose from the left wing of the party to become the first female speaker of the House and has earned grudging praise from her foes for her skill as a legislator.

Warren and Sanders are betting on a different theory — that voters who float between parties are less ideological and can be inspired to vote for candidates who represent bold new change in Washington.

Pelosi said Democrats should seek to build on Obamacare instead of pushing ahead with the more sweeping Medicare for All plan favored by Warren and Sanders that would create a government-run health insurance system and abolish private coverage.

“Protect the Affordable Care Act — I think that’s the path to health care for all Americans. Medicare For All has its complications,” Pelosi said, adding that “the Affordable Care Act is a better benefit than Medicare.”

Warren has been under pressure from Biden and other candidates to demonstrate that her plan wouldn’t require tax increases on middle-class Americans.

On Friday, her campaign said it would cost $20.5 trillion and would be funded by raising taxes on large corporations and the wealthy, cracking down on tax evasion, reducing defense spending and putting newly legalized immigrants on the tax rolls. The Biden campaign called that plan “mathematical gymnastics” intended to hide the fact that it would result in higher taxes for the middle class.

Warren swatted back at the criticism, accusing Biden of “running in the wrong presidential primary.”

“Democrats are not going to win by repeating Republican talking points,” the Massachusetts senator said in Des Moines, Iowa. “So, if Biden doesn’t like that, I’m just not sure where he’s going.”

Pelosi also expressed worries about voters’ reactions to the Green New Deal, which Sanders and Warren also support, that calls for radical, rapid reductions in carbon emissions. “There’s very strong opposition on the labor side to the Green New Deal because it’s like 10 years, no more fossil fuel. Really?” she said.

Pelosi said Democrats must stick with pay-as-you-go rules to avoid adding to the debt, a point of contention with left-leaning figures who want to permit more deficit spending for ambitious liberal priorities.

“We cannot just keep increasing the debt,” she said.

Pelosi added that she doesn’t understand the race to the left among some candidates, because “Bernie and Elizabeth own the left, right? Is anybody going to out-left them?”

She stopped short of endorsing a tax on wealth, an idea that Warren and Sanders have embraced as a means to reduce income inequality and expand the safety net. The speaker said she wants “bipartisan” tax changes that lower the debt and fix the “dumb” Republican tax cuts of 2017.

She also steered clear of backing a cap on pay for chief executive officers.

The speaker, who recently led the House to formally vote on an impeachment inquiry into Trump, said the most critical question candidates should be answering for voters is why they should be president.

“Show them what’s in your heart, your hopes and dreams,” she said. “It’s not about you. It’s about them.”

🍁🏈🍎🍁🏈 🍎🍁🏈 🍎🍁🏈 🍎🍁

#trumpism#president donald trump#against trump#donald trump#democrats#democratic party#2020 candidates#2020 election#2020 presidential election#bernie 2020#speaker pelosi#madam speaker#pelosi and schumer#nancy pelosi#politics and government#political science#us politics#politics

1 note

·

View note

Link

Democrats criticized the legislation, originally known as the Tax Cuts and Jobs Act of 2017, but officially called An Act to Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018, but Republicans defended the law as a necessary overhaul to previous tax laws and a means to provide economic relief for the middle class.

The dueling partisan narratives left many taxpayers with a murky understanding of the law’s impact.

To gain a better grasp on the intricacies of the 2017 Act, professors David Kamin, Lily Batchelder, and Daniel Shaviro—tax law experts from the New York University School of Law—cowrote a paper analyzing the sweeping legislation which appears in the Minnesota Law Review.

According to the authors, “Many of the new changes fundamentally undermine the integrity of the tax code and allow well-advised taxpayers to game the new rules through strategic planning.”

Here, the authors describe how some may take advantage of the new system, and how changes to the tax laws may affect the US economy.

‘CRACKING AND PACKING’

David Kamin: One of the largest tax cuts in the legislation goes to “pass-through” businesses—where income is taxed at the level of the owner rather than the business. But, to be eligible for this tax cut, owners need to meet certain very complex criteria.

For those with higher incomes, this includes being in the “right” line of business. That means being an architect (eligible) and not a lawyer (not eligible). Selling skincare products (eligible) but not being a dermatologist (not eligible). The formalistic and largely arbitrary lines then allow for much gaming, including what we—borrowing from the election law context—call “cracking and packing,” pulling apart and combining businesses.

For instance, a dermatologist office might “crack” apart a skincare products business run out of the same office, share overhead expenses, and then try to assign as much of those overhead expenses as possible to the dermatology practice to maximize profits eligible for the deduction. Possibly abusive? Yes, but very hard for the IRS to catch.

Lily Batchelder: The bill creates large incentives for the wealthy to convert their labor income into business income. This was already an issue in the tax code because of the carried interest loophole and loopholes in the payroll tax. But the bill makes a bad situation much, much worse.

If a wealthy individual hires an elite tax advisor to make their labor income look like pass-through business income, they can cut their marginal tax rate by more than 7 percentage points. And if they don’t need to spend the income anytime soon and treat it as corporate income, they can cut their tax rate by 20 percentage points.

Theoretically, middle class families could engage in the same games but they are much less likely to do so for at least three reasons. First, middle class families would receive much smaller tax benefits from such gaming and in many cases, none. Second, they often have little leverage over their employers to restructure their compensation and, even if they did, probably would have to give up all of their employee benefits in exchange. This includes their health insurance, 401(k), and disability insurance. Last, they are less likely to be able to afford a tax advisor with the expertise to structure this kind of arrangement in the first place!

GAMING THE SYSTEM

Daniel Shaviro: One of the many disappointing aspects of the 2017 act was its failure to address the opportunities for sheltering labor income from tax at full individual rates, through use of the corporate tax. Pre-2017, the top corporate rate was far closer to the top individual rate than it is post-2017. The main rationale for the corporate rate reduction pertained to global tax competition for scarce capital. This has no bearing on the case where the owner-employee of a corporation pays herself far less than the market value of her work.

For example, suppose I create a wildly successful new start-up and pay myself zero salary, despite my becoming, in net worth terms, a billionaire via the stock appreciation. The income that my efforts yield will show up in the corporate tax base, and be taxed at only 21 percent. True, I would face a second level of tax on paying myself dividends or selling my stock, but even this would be at a reduced rate. And what’s more, I may not need to make such payments if I am sufficiently financially liquid, e.g., by reason of borrowing against the value of the stock.

Opinions in the “biz” differ on how frequently taxpayers will find it worthwhile to do this, given the difficulty of extracting funds from one’s company tax-free. What is plain, however, is that Congress in 2017 deliberately did nothing to prevent this from happening. Indeed, the final version of the 2017 Act reduced the efficacy of a provision in the House bill that would have slightly addressed the problem by setting the tax rate for “personal service corporations” (PSCs) at 25 percent rather than just 21 percent. In the final act that rate is just 21 percent, like the general corporate rate, causing the PSC rules to be close to meaningless as a defense against using corporations as a tax shelter for labor income.

Shaviro: In the international realm, the 2017 Act may actually have improved the law marginally. At a minimum, it created a new regime that could be tweaked by future Congresses to yield a better system than the previous one. However, the main new international rules that it added to the code unnecessarily created multiple opportunities for game-playing. Just to give some quick examples without getting too deep into the weeds:

The foreign-derived intangible income (FDII) rules, which provide a special deduction for exports by companies, such as Apple and Facebook, that have valuable intellectual property, create incentives for “round-tripping” goods—e.g., selling them to a foreign taxpayer, then buying them back with just enough bells and whistles to prevent the entire transaction from being disregarded.

Both FDII and the global intangible low-taxed income (GILTI) rules can create incentives to locate business assets abroad rather than at home.

The base erosion anti-avoidance tax (BEAT) can be gamed through such means as restructuring supply chains so one is purchasing sale items for customers from one’s foreign affiliates. The BEAT can also be gamed by adding lots of extra deductions (offset by lots of extra income so the sum total is a wash), so that so-called “base erosion tax benefits” will fall below an arbitrary “floor” (as a percentage of total deductions) that the BEAT imposes for no discernible reason.

VIOLATING THE WTO TREATY?

Shaviro: The FDII rules almost certainly violate the World Tax Organization treaty, of which the US is a signatory. They are expressly an export subsidy, and the WTO makes export subsidies illegal. If other treaty signatories challenge the FDII rules, there is a very high probability that they’ll be held illegal, with the consequence that peer countries will be authorized to respond with targeted provisions of their own.

In the last 30 or so years, the US has enacted illegal export subsidy rules on three separate occasions. Each time the rule was held violative and the US backed down. Why do this again? I think the main answer was cynicism, but ironically the prospect of an overturn makes the US companies that wanted favorable tax treatment more leery than they would otherwise have been of setting up complex structures to take maximum advantage of the FDII rules.

‘AN ARRAY OF MISTAKES’

Kamin: The legislation was written at an extremely rapid clip, leaving an array of mistakes—some minor and some large. An early one to emerge was the “grain glitch.” In attempting to apply the pass-through deduction to businesses organized as cooperatives, especially prevalent in agriculture, legislators wrote in an even larger loophole by accident. Effectively, farmers selling to these cooperatives (think Ocean Spray cranberries) could potentially entirely wipe out their tax liability because of the glitch.

This one was large enough—and was causing sufficient chaos in the agricultural sector—that it was fixed. But most haven’t been. So, take another: one of the largest revenue raisers in the legislation was limiting the deductibility of state and local taxes for individuals to $10,000. However, the letter of the law seems to fail to apply that to another form of cooperative, a housing cooperative.

So, owners of pricey cooperatives in NYC may be able to deduct their property taxes without limit; by contrast, owners of traditional condominiums and houses will not. And the list could go on.

MAJOR TAKEAWAYS

Batchelder: The bill is heavily tilted towards the wealthy. According to the official Congressional budget scorekeepers, this year the average millionaire will get a tax cut of more than $27,000 on their personal tax return, compared to a tax cut of $431 for an average middle-class family earning $40,000 to $50,000. Even as a share of their after-tax income, the tax cut for the average millionaire is three times as large.

It is also a very costly bill. The Congressional Budget Office estimates that it will increase our national debt by $1.9 trillion by 2028, even after including its effects on the economy. These large tax cuts will eventually have to be paid for. If Congress pays for them by raising revenues in proportion to income, the vast majority of middle class and low-income families will end up worse off. These families will be hit even harder if the bill is paid for by cuts to programs like Social Security, Medicare, and Medicaid.

Shaviro: It’s often said that tax legislation should be judged by four main criteria: fairness, efficiency, complexity, and revenue adequacy. The 2017 Act, despite having good particular rules here and there, egregiously failed on all four counts.

It was an act of class warfare benefiting those at the top relative to everyone else, for the most part it reduced economic efficiency by creating perverse incentives and arbitrary distinctions between different activities, it made tax planning more complicated for those who can afford sophisticated tax advice, and it will probably lose on the order of $2 trillion of net revenue over 10 years, even if all supposedly expiring provisions are actually allowed to expire.

It was also the sloppiest, most poorly drafted tax legislation that I have ever seen, despite all the talent and effort deployed by hard-pressed staffers, because the process was so secretive and rushed.

Source: New York University

Phroyd

5 notes

·

View notes

Link

via FiveThirtyEight

Sen. Elizabeth Warren’s bid for the Democratic presidential nomination is good news for liberal policy activists. And that’s whether she wins the nomination or not. The Massachusetts senator appears poised to serve as a progressive policy anchor in the 2020 Democratic field, pushing the field — and the eventual nominee — toward aggressively liberal policy stands.

How might Warren have such influence? Because the Massachusetts senator is planning to release detailed and decidedly liberal policy proposals on issue after issue. Her rivals, if past primary campaigns are any guide, will feel pressure to either “match” her on policy by coming up with their own proposals, say that they agree with Warren, or convince the party’s increasingly left-leaning electorate that Warren’s proposals are too liberal. And remember that presidential winners usually try to implement their promises — so an idea put out by Warren in March could be in Sen. Kirsten Gillibrand’s platform in August and be signed into law by a President Gillibrand in 2021.

Here’s an example of how this works, from a past Democratic primary. Early in the 2008 campaign, John Edwards released a comprehensive plan to provide health care for millions of Americans. A few months later, then-Sen. Barack Obama, looking to compete with Edwards among liberal voters and activists, put out a similar proposal, which was the basic outline for the Affordable Care Act he signed into law as president.

In the 2020 Democratic nomination process, I expect that other candidates will also have lots of policy proposals. And Bernie Sanders in particular is likely to join Warren in pushing the Democratic primary debate to the left. But Warren is likely to be at the forefront of the “policy primary,”– the one-time Harvard professor is perhaps the wonkiest person in the field. And Warren knows how to push her ideas onto the national agenda quite well. Before she was elected to the Senate, Warren convinced congressional Democrats and President Obama to create the agency now known as the Consumer Financial Protection Bureau.

Warren campaign aides told me that unveiling major policy proposals will be a big part of her candidacy, with the ideas intended to reinforce Warren’s broader message that the country needs “big, structural change,” not just incremental tweaks.

“I’ve been working on one central question for 30 years,” Warren told me in brief interview after a campaign event in Greenville, South Carolina, on Saturday, “‘what’s going wrong with working families across this country, why is America’s middle class getting hallowed out?’ I never thought I would come into politics, not in a million years, but that was my chance to fight bigger, back in 2012, when I went to the Senate.”1

“Getting into the presidential race means I can talk about the kinds of big, systemic changes we need to make,” she added.

“Warren is an unusually wonkish, policy-focused figure, not just attached to some concerns … but very specific and knowledgeable about them,” said David Karol, a University of Maryland political science professor and expert on the presidential nominations process, in an e-mail message.

Karol said that Warren’s potential effect on the 2020 race is analogous to four years ago, when Sanders seemed to push Hillary Clinton to take more leftward stances than she might have otherwise. If Clinton had been elected president, she would have felt pressure to implement some of those liberal campaign promises, which would have made Sanders’s 2016 run particularly important in shaping U.S. public policy. But Karol argued that Warren is somewhat distinct from Sanders, because in his estimation, she is more attuned to the finer details of legislation. So Warren might push the rest of the Democratic field to the left and force Sanders, who is already very liberal, to be more specific in explaining how his proposals will work.

“[Warren] has a deep mastery of policy, a staunchly progressive voting record,” said New York-based liberal political activist Sean McElwee, best known for advocating for the abolition of the Immigration and Customs Enforcement agency, in an e-mail message. “She’ll be a real contender and will force every other candidate to get smart on policy and push the boundaries of what it means to be a progressive.”

So what are Warren’s ideas? It’s worth separating them into two general categories: ones that she is one of the principal authors of and those where she has embraced someone else’s proposal. The latter is important too — Warren taking up an idea while running for president can bring attention to obscure proposals written by backbenchers on Capitol Hill.

Here are some major Warren-authored policies:

A 2 percent annual tax on household net worth between $50 million and $1 billion, and an additional 1 percent tax on household net worth above $1 billion.

Bans on members of Congress and other top officials in Washington from owning individual stocks while in office and doing any kind of lobbying after they leave office.

Postal banking, a requirement that all U.S. post offices offer checking and saving accounts to Americans who want to sign up for them.

Federal manufacturing of generic prescription drugs.

The removal of U.S. forces from Afghanistan.

A reduction in the overall Department of Defense budget.

Federal funds to help first-time homeowners make the down payment on homes if they buy in neighborhoods that suffered in the past from redlining.

A requirement that large corporations reserve 40 percent of the seats on their boards for board members selected by workers at the company.

A ban on the U.S. using nuclear weapons first in a military conflict with another country.

A $146 billion “Marshall Plan” for Puerto Rico.

Here are a couple of proposals written by others that Warren has embraced:

Medicare-for-all;

The “Green New Deal,” a proposal championed by New York Rep. Alexandria Ocasio-Cortez and Massachusetts Sen. Ed Markey to limit fossil fuel use in the U.S. in order to address climate change..

There are two caveats to this analysis. First, Warren’s influence on policy rests on her remaining a viable candidate, appearing in the debates, regularly visiting the early primary states and not, say, dropping out in May of this year. Second, I think Warren will particularly affect candidates, like Sanders, who are competing with her for support among liberal Democratic primary voters and activists like McElwee who comprise the party’s left wing. So Sen. Amy Klobuchar, who appears to be targeting more moderate Democrats, may not feel that she has to match Warren policy-for-policy.

That said, even more centrist candidates are likely to feel Warren’s pull on the race. Journalists and activists are going to ask candidates like Klobuchar if they support single-payer or Medicare-for-all. That will create pressure on those candidates to address Warren’s proposals, even if in the end they call for a less liberal variant — some kind of Medicare option for people between ages 50 and 64 instead of Medicare-for-all, for example. And Warren is likely to come up with ideas on issues that disproportionately affect blacks, Latinos, and young voters, three other key electoral blocs in the party. More moderate candidates can’t concede those voting blocs, so Warren’s proposals on issues that affect those voting blocs will likely influence all of the candidates.

So watch for Warren’s ideas — in some ways separately from Warren. A week after Warren unveiled her wealth tax, Sanders put out a plan to vastly increase the estate tax. I’m not saying Sanders proposed that idea only because of Warren’s move, but he might have proposed it so early in the presidential race (even before he officially announced his candidacy) because he felt pressured to match Warren. I would assume many Democratic candidates will put out proposals to vastly increase taxes on the wealthiest Americans — even if they aren’t as aggressive as Warren’s proposals. And his opposition to Warren’s wealth tax seems to be one of the primary reasons ex-Starbucks chief executive Howard Schultz, a one-time Democrat, is considering an independent presidential run.

So while Warren’s poll numbers put her behind some of her rivals right now, she’s already having an outsized influence on the race — and I would expect that to continue.

4 notes

·

View notes

Text

Taking UBI seriously part 5: Sheahen

This is the fifth in a serious of posts looking for a serious proposal for universal basic income. Previous posts:

A Budget-Neutral Universal Basic Income by Jensen et. al.

Basic Income – Why and How in Difficult Economic Times: Financing a BI in Ireland by Healy et. al.

Andrew Yang’s proposal as part of his presidential campaign

A variety of indicators evaluated for two implementation methods for a Citizen’s Basic Income by Malcom Torry

Score so far: 0 serious proposals for a full UBI, 1 serious proposal for a partial income

In this post, I will look at It’s Time to Think BIG! How to Simplify the Tax Code and Provide Every American with a Basic Income Guarantee by Allan Sheahen.

tl;dr: Not a serious plan. Sloppy and politically poisoned. There is no way to tell whether poor people are better off or not, and the proposal includes several provisions that would never get a hearing in Congress. If this is as good as UBI proposals get, then there are no serious UBI proposals.

Allan Sheahen was a long-time advocate of a universal basic income, or basic income guarantee, as he preferred to call it. He published two books on the subject, Guaranteed Income: The Right to Economic Security in 1983 and The Basic Income Guarantee: Your Right to Economic Security in 2012, as well as numerous articles and papers. He was an early leader of the US Basic Income Guarantee Network (usbig.net) and spent more than 30 years advocating for basic income. Basic Income Earth Network ran an article noting his passing in 2014 which you can read here.

Sheahen published this proposal in 2006, using 2004 budget figures. On the benefits side, the plan is straightforward and typical: a Basic Income Guarantee (BIG) of $10,000 per year for each adult US citizen under the age of 65, and $2000 for each child. Recipients of Social Security and other federal retirement programs would get either their current benefit or the BIG, whichever is greater. He would distribute this as a refundable tax credit, so none of the BIG would be taxed back.

He calculates a gross cost of $1,895.6 billion. To pay for this, he plans on treating all other income as taxable at standard rates and increasing taxes in various ways, eliminating a bunch of current transfer programs (basically everything except Social Security, Medicare and Medicaid), and making deep cuts to defense spending. Figures below are in billions of dollars.

The budget cuts and tax increases are enough to fund the BIG with $265 billion left over. (Sheahen also considers a 2% tax on wealth, but that is for the purpose of balancing the federal budget. Since that is unrelated to the BIG, I am leaving it out of this budget.)

There is a lot going on in that $985.2 billion in the first line. It includes personal exemptions, standard deductions, all itemized deductions, all tax credits, and most importantly, all the tax expenditures for 2004 from this list, which Sheahan characterizes as “tax loopholes.” He provides details on all these provisions -- far too many to go into here -- which give his proposal the appearance of being thoroughly thought out. Once you start digging into it, though, it becomes clear that he didn’t pay that much attention to what he was doing. As a result, his proposal is sloppy, unclear on what it accomplishes, unfocused, and politically doomed.

General sloppiness

Sheahan seems to have taken a list of what he considers tax loopholes and, without looking at what they are, decided that they all have to go. He applied the same bulldozer approach to cutting transfer payments. The result is a mess.

Contradictory on pensions. Sheahen says that recipients of Social Security and other federal retirement programs would continue to receive their current benefits or the BIG, whichever is greater (p. 7). But then on pp. 20 and 21 he calls for eliminating spending on pensions for railroad workers, District of Columbia government employees, and veterans. What he actually intended is unclear.

Double-counting Some of the savings he expects to get from closing tax loopholes are incompatible with his spending cuts. For instance, on p. 20 he calls for eliminating public assistance programs such as food stamps, and then on p. 15 he counts on additional revenue from taxing those benefits as ordinary income. He plans on taxing contributions to IRAs, (p. 17), which would leave taxpayers no reason to use them, but doesn't subtract income taxes paid on money withdrawn from IRAs. This doesn't amount to a great deal compared to the cost of the whole program, but it's sloppy and annoying.

Unequal comparisons Eliminating these tax expenditures means converting many things that are not normally considered income into taxable income. The biggest such item would be employer contributions to health insurance. Also included would be scholarships and tuition reductions for students, for instance, or housing and meal benefits for military personnel. Under Sheahen's plan, the cash equivalent would count as income and would be taxed as income.

Counting employer-provided health insurance as its cash equivalent could easily boost someone's reportable income by $5000. Imputed rental income (which I will return to below) could add $10,000 or more. Not everyone will be hit by these additional taxes, but homeowners with health insurance make up a solid slice of the middle class.

This means that when he compares the current system to his BIG plan on pp. 23-24, he does not compare like to like. The person with $40,000 in reportable income under the current system is not the same as the person with $40,000 income under the BIG plan. But he calculates increase/decrease figures as if they were. The net increase in disposable income he calculates on pp. 23-24 will be wrong for anyone who owns a home, has employer-provided health insurance, is in the armed forces, is a student paying tuition or on a scholarship, is paying student loans, or has an IRA, among other circumstances.

It may be Sheahen's intention to place more of the tax burden on homeowners and on people who have employer-provided health insurance. If so, it's dishonest of him to hide it in this way. But I don't think he did, because I don't think he has an accurate picture of where money is coming from and going to, which leads me to my next point.

Are poor people actually better off? How many?

The worst fault in his number-crunching is that he doesn't realistically account for the value of benefits lost to the poor. For a single parent with one child, he estimates benefits for the poorest incomes at $4,800 for TANF and $2400 for food stamps. But those are just two out of the many means-tested benefits he plans on cutting. TANF and food stamps together amount to $46 billion, but Supplemental Security Income and Section 8 vouchers add up to $56 billion, so he's accounting for less than half of the benefits the poor would lose.

Furthermore, those benefits are very unevenly distributed. Only a minority of poor households receive Section 8 vouchers, for instance, but those that do would be hit very hard by losing them. It may be that some poor families would be better off under his plan, but some will come out worse. How many? Forty percent? Sixty percent? We have no idea.

This is why people create tax models and run simulations. The current tax system is complex, the benefits system is complex, and the variation in circumstances among people at the same income level is complex. If you are not willing to get into the nitty-gritty of those details, then you have no basis for a claim that the sweeping reform that you propose actually delivers the benefits that you want to see. Sheahan certainly doesn't.

Political poison

Sheahen seems to have given no consideration to political problems at all. He plans on eliminating “welfare programs which will not be needed under a BIG.” But "welfare” turns out to include things like this dealbreaker (p. 21):

How could anyone not immediately realize that this is political poison?

Imagine twenty thousand disabled veterans parading down Constitution Avenue. A thousand men and women in wheelchairs lead the way. They include veterans of every conflict from World War II to Afghanistan, all of them wearing their uniforms, all of them wearing their decorations. When they reach the Capitol, they raise their prosthetic arms in the air and shout “This is not welfare!”

No politician who wants to get re-elected is going to support this plan.

Other cuts under the heading of “welfare” include:

Student loans

Pell grants

GI bill benefits

Farm subsidies

Refugee assistance

As for the tax expenditures he wants to eliminate, most are too obscure and wonky for the typical American voter to care about. Many of the others, such as the lower tax rate on capital gains, mainly benefit the rich. But some of them are extremely popular. Making employer-provided health insurance taxable will anger a huge portion of the middle class. Making Social Security fully taxable will lose you the support of the AARP.

Perhaps the oddest one is “imputed rental income,” which no one but an economist would reasonably consider income. This is the rent that homeowners could be collecting if they rented their houses out. “Imputing” this income means pretending that they pay rent to themselves as tenants and collect it as landlords. Homeowners are not going to be happy to hear that they owe thousands more to the IRS because of taxes on purely hypothetical income.

And on top of this, the Department of Defense would be cut by 35%.

Whether these provisions are good ideas or not, they range from very difficult to obviously impossible in their political feasibility. Politicians who want to get re-elected are not going to support them. If you could convince Congress to cut the Pentagon's budget by more than a third, then that would be great, go at it! But you can't, so they won't, so any plan that relies on doing so is dead on arrival.

Sheahen asks, on page 7, "How can the U.S. afford $1,895.6 billion?" His answer is "by completely ignoring political reality."

Lack of focus