#how to look at real estate sectors

Explore tagged Tumblr posts

Text

Annual Profections

✨Annual profections are used to identify themes and focal points for the years ahead. Annual profections use a circular chart (similar to your birth chart) divided into 12 equal sections, with each sector signifying a certain astrological house and ruling planet (also known as a Time Lord). U also always have to look for a sign that u have in the house because shows the theme and also the ruler of the house is very important.

1st house profection year

The first house shows you, appearance, personality, world view, interests, body shape and complexion, body vitality and strength, early childhood impressions ect.. This year shows you and how you experience the world around you. You get to know what kind of person you are and what you like about yourself. Many times there is a change in appearance and you start to change your style. More love can enter your life. During this year, significant things may occur to your aesthetics or who you are as a person. You may grow or change in some way, or simply reconnect to yourself in a deeper way, coming into a truer sense of self.

2nd house profection year

The second house shows things related to money, finances, pleasures, food, luxury. You can spend much more time enjoying the good things. You are in a state where you are looking more for value in others and in yourself. You look at it, which values are more important to you. You pay more attention to what you eat. You have greater contact with memory and memories in general. You lose something to gain something new. You can focus more on your inner feelings and how you feel about things. Contact with people is important to you. Finances may change, perhaps new opportunities for earning. You look more at how you give things and how you receive them. What you want to give to others and how much you want to receive yourself. The career path can be in the foreground and also long journeys related to work. This house can also represent some pleasure you find with another person. You can fall in love during this time or find someone you really appreciate or really care about.

3rd house profection year

This house has a lot to do with siblings. If you didn't have that much contact with them before, you will have more now. You can connect with them more and spend more time with them. Short trips (you can often go somewhere). A lot of driving. The rides can be related to a certain person or it can just be that there is more energy to travel a lot. You are starting to place greater emphasis on people's mentality, communication and intelligence. Conversations during this time are important. You're looking more for conversations with like-minded people. You can meet someone by chance. Your thinking can change. This year is also the year that shows the reason for moving away from home. Spouse's long journeys and his religious beliefs. During this time you can find yourself on a mental level and what kind of thinking you like. You look much more at how someone thinks and it is important to you that someone has good communication and you can also give a lot to it at this time.

4th house profection year

This year is related to home, family, mother, house, real estate. Situations after completed events such as (e.g. mood, attitude towards the situation, the outcome of things at the end of relationships, jobs, divorce). It shows the family tradition and how you maintain it. Conditions in later life. During this time, moving away from home is common, finding a new place in your life and a place where you feel safe. Financial situation of loved ones. During this time, you can put more emphasis on your comfort zone and how you feel somewhere. Where do you really want to be and where is the place you were looking for? It also shows the relationship you have with your family and how you maintain it. This house is also subject to love relationships, so it is more in the foreground.

5th house profection year

This house shows relaxation, fun, hobbies, children. During this time, you can focus more on your hobbies and finding relaxation. Gambling can be good. You can get money fast. If you are artistic, this may be heightened during this time, or you may discover a newfound sense of creativity. You may also desire to have children or come into focus with them in some other way. During this time, you and your spouse can spend more time with friends or be more social and go to parties. You are looking for passion more than usual and it is also much more important to you. You can also be more noticed for your work and have a larger audience. U can get a baby or become pregnant. The 5th house is like being young again, you feel like you can do anything you can imagine without a bad conscience. You follow yourself and follow the sun that is in front of you. This is the most shining house, because here you shine regardless of everything, regardless of what others think and what others expect. You can be selfish when it comes to your joy and hobbies A very pleasant house, because somehow you also feel more visible. Enjoy the things that the sun brings you.

6th house profection year

This house is related to routine and your way of life (the life you live every day). Maybe you can make a change in your life (for example, you start to live healthier, take care of your health and your body). It is also possible to change your job during this time, especially if you are not satisfied with it. Maybe you get a new pet or are thinking about getting one. But this house is also related to health, so you have to take better care of yourself. Maybe you can focus more on how your body works and how you take care of your hygiene. You can start using some body products or creams. Above all, this is the time when you are more focused on how your day works, what you would change and what you wouldn't.

7th house profection year

This house is related to relationships, marriage, and the general public. This year you will be much more focused on your relationships that you have with people not only romantic relationships, but in general the relationships, maybe you will be much more picky about it. But also with romantic relationships could happen that you can get married or engaged. This year can be future for love. and also for your partner you can also get a person who is the person of your dreams. A good friend can move abroad. During this time, you can also see all your conflicts with people (who suits you and who doesn't). Maybe you can have enemies or rivals. The outcome of the disease can also be here. You can also be invited to a wedding or one of your relatives is getting married. But there is a big focus on the relationship and how you get along with others.

8th house profection year

This house is an emphasis on depth, everything that is deeper and hidden. During this time, you can transform yourself internally and understand many things emotionally. Connections with legacies (which means it can be the beginning of something or the end). You can acquire some property. Because this house is also connected to others (you can gain a lot of others). You can get a lot of money through others. You can inherit something from your partner, or if you get married during this time, you will gain a lot from the marriage). The results of lawsuits are also shown here. You may encounter astrology or the spiritual world for the first time during this time. Short trips to work are also possible. You can find out some important secrets of people and at the same time the truth that you have been looking for for a long time. Maybe you will be more prone to seek the truth.

9th house profection year

This house is related to belief, path, spirituality in a different way. Lots of long trips to places you haven't seen before. You can go somewhere more spiritual. A lot of learning about the world and the people around you. You can finish the faculty, get a higher education. Or you start school again. Think more about what you are committed to and why. You are much more looking for optimism, happiness. It is also the house of marriage, so marriage can be more prominent. You are looking for more commitment into something. Things you can gain from spiritual and psychic experiences. You can connect more with your consciousness and find a higher part of yourself. It shows the health of the parent of the opposite sex to you. Enjoying love situations and finding new love. Many people do not realize that this house is also very prone to love, but in a different way and that marriage is manifested here. During this time you can learn a lot and get to know many things in life. Maybe you turn over a new leaf and start over. You go on a trip that gives you a new perspective. You learn that belief is the most important thing.

10th house profection year

This house is related to career and how you work in your profession. This year can be crucial in terms of your career and a lot can change. The connections with the father are more in the foreground and what is the relationship with him. Fame is also possible at this time. Many more karmic things can happen to you and everything that happens is more likely to happen. It is also the house of pride and how proud you are of yourself and how you show it in your voice. You want more respect from people. You work more on yourself and your ambitions. Spiritual resources and opportunities are also included. The rewards of karma. Money earned on long trips. This house teaches you a lot and gives you a lot. You become more mature and start to think and look at things more maturely. You are more dedicated to the thing you are working on and you are more focused on important things.

11th house profection year

This house is prone to friends, interests you have, dreams and hopes. This year you can be more focused on your dreams and hopes and have more expectations that it will happen. You become more rebellious towards some things and choose more for things that are really close to you. Maybe at this time you also have more considerations about who you are and who others are. Do you follow others or yourself. Fines and penalties are also associated with this house. You may think more about what you will spend your money on this year. You can also change a lot of friends and meet new better ones. This is the time when you work on your interests and dreams and when you meet a lot of new people. You get to know a part of yourself and how you function in society. You can also realize that many times you feel alienated from others. Or that you are very different from others. This house is usually related to how you do something differently than others.

12th house profection year

This house is associated with spirituality, the subconscious. Many unexpected and unforeseen realizations occur during this time. You start thinking about yourself more in an internal sense. You may also feel more alienated from others and spend more time alone. It is also the house of the hardest battles and tasks. Which means that during this time you can deal with many things that are foreign to you. It is a symbol of misfortunes, losses, enemies. You can also lose someone during this time. It can also represent the end of a romantic relationship. During this time, you can find new ways of relaxing and possibly sleeping. You can sleep better. Many things from the past can come up at this time and you also look back at how things were. You can also connect better with yourself and your soul.

-Rebekah🪐✨🍀

512 notes

·

View notes

Text

What radicalized me was Conservative philanthropy.

I've said before that my parents were property managers, which is to say, the people real estate investors who owned apartment buildings hired to act as landlords for them. And they and a lot of my other relatives were really big into investing in real estate as a means of creating generational wealth. (This has not worked out for us, by and large. Some have given up, but others are still hustling today.)

This means that when a local government wants to create a Taskforce on How We're Totally Addressing the Housing Crisis, You Guys, and among all the shelters and charities desperate for funding, they look to appoint someone who can represent the landlords who control most of the housing here... they appoint the kind of people I end up sitting next to at Thanksgiving dinner.

So this story I just shared about landlords and government and housing benefit payment dates?

Yeah. That got shared with me by a conservative. Someone who knows I'm a fruity socialist leech now, and wanted me to know that this was proof that the private sector CARES!

Actually, it was part of an argument about how government or nonprofit housing wasn't a good solution to the housing crisis, because the private sector "can do it more efficiently". The landlords saw something was really wrong and they were having to evict a lot more people than usual! So they called up their buddies in office and got it FIXED! Let us join hands and sing!

I, meanwhile, knew that benefits recipients had been screaming about this problem to national newsmedia for months before the landlords stepped in, so I was less than impressed. Imagine a type of noblesse oblige that only takes notice when they realize they're making people homeless when they might have made a profit off them instead.

Every time conservatives pat themselves on the back for how good they are to the poor, I can't stop seeing just how good to the poor they aren't, most of the time.

(And also: I know how the economics work, and how most of the time the landlords couldn't afford to just let people stay for less money. Mortgages need paying. But that doesn't inspire me to let the landlords off easy; it says to me that we really do need radically different funding models for housing.)

359 notes

·

View notes

Note

Why is France in particular so much worse off than many of the other Western countries on this blog? It looks like some of these places haven't been updated in 100+ years to be safe or liveable, and somehow have evidence people still occupy them. I know poverty is the main answer, but it surprised me. I know their buildings are old but some of these people are still using oil lamps.

I'm not completely sure, there are definitely a lot of centuries-old buildings for sale on French listings that look as though they haven't been updated in about as long. Part of it may be cultural and specific to France - it has a huge number of small settlements, most of which date back hundreds of years, with their original housing stock intact. But it probably has something to do with the confluence of a few different factors that affect the kind of listings you find for each country. One factor is how regulated and (relatively) free of corruption the real estate sector is in each country. In the US, for instance, it's regulated enough to make it possible for aggregate websites like Realtor and Zillow (and Redfin, etc.) to exist. I'm not totally clear on the specifics, but I think it has to do with having centralised agencies that track and provide data for sales prices, dates of sale and other property details that ensure a certain level of quality control. This means that listings tend to be more standardised and easier to navigate (for people like me interested in the imagery for reasons outside of the boring, instrumental original function from which they emerged). One thing I've noticed looking through sites from developing countries is that there tend to be a lot of obviously-fake listings, which re-use the same images and which make it a lot harder to find genuine ones. I'd guess having a substantial proportion of real estate transactions taking place in the grey market probably contributes to this (putting less pressure on these sites to be transparent and functional). If it seems like most of the imagery of this blog comes from western (or western-ish) countries that's one of the reasons why.

Cultural and regionally-specific factors are also important. France has a well-regulated housing sector, but so does Australia, which has a totally different feel in terms of the real estate imagery it generates - generally much more polished and artificial. If I had to guess, this probably has to do with how well-oiled the propaganda arm of the real estate industry in my country is; the idea of buying and renovating and speculating on housing as an investment is deeply embedded in the culture here, you see it all over the place on TV, in books, the kinds of things people talk about. Doubtless it has a lot to do with how structurally deep the housing crisis runs and how intractable it seems. I'd guess that it's also directly related to the kind of aesthetic you find: bright, evenly-lit photography using expensive cameras that make shitty overpriced houses look like offices, standardised camera angles (there must be some kind of style guide that like half the realtors here follow), etc. I've spoken to people who criticise real estate listings - which they have no personal stake in - that don't follow these conventions, as though following and reproducing these corporate aesthetic values is somehow virtuous. I'm not familiar with the cultural context in France, maybe it isn't as bad as ours. Some countries just seem to produce more real estate imagery independently of these factors though. I haven't found much in Germany, for instance, which you would think would have a similar housing stock to France. I've found a ton from Georgia and Hungary. Japan, which has a well-regulated housing sector (and presumably an enormous amount of housing being bought and sold), is much harder to find imagery from, partly due to the language barrier, but also to the way in which its main aggregate websites are designed. And maybe cultural reasons come into it as well. Italy has a lot of imagery, though a lot of it is covered in watermarks and other branding, so you have to hunt around. Spain is similar. When I do find imagery from continental Europe it seems like, outside of Germany, most countries have a lot of rough, older housing stock that people still seem to somehow live in, like you described. I haven't found much like this from the UK; I have from Ireland though.

I'm open to the idea that there's much of this sort of imagery from lots of different countries and I just haven't been proactive enough to find it; if anyone has any suggestions on where to look for any country please send them to me. I'm not just interested primarily in decrepit older housing stock, I think it's more of a project of looking for imagery that has aesthetic or artistic or cultural or whatever value and liberating it from the constraints of its work-institutional-instrumental context, and recontextualising it in a setting where those qualities can be drawn out and appreciated. There's a history of artists doing similar things (probably playing on the relationship between art and work), from Gustave Courbet to Andy Warhol to Tracey Emin. If anyone's interested send me an anon and I'll write more about the rationale here.

73 notes

·

View notes

Text

Beating Recession

Recession sucked, that much was clear to Logan even before he checked his email inbox. When he saw a few replies to his job applications from the last days, he sighed. He didn't need to open the mails to know that the news was bad, but he did so anyway.

"We regret to inform you..." - Logan didn't even read on. He had lost his job as an apprentice electrician about half a year ago. The company was going under, and Logan, the youngest and least experienced worker, was the first to go. That's how it was in this business. Since then, he had applied to every single position that came up - but apparently, the current economic situation was so bad that nobody needed another worker.

Logan had hoped that his apprenticeship would get him a job, but the fact that he was only 20 and had not much practical experience hurt him. Slowly, money was becoming a pretty big problem. Whatever savings he had (for some real estate of his own! As if that was going to happen!) had melted away over the last months. His rent was due, and he had no income.

In fact, he was one month late with his rent already, and although his landlord had been cool about it, Logan did not see how he would be able to keep his apartment. He really, really wanted to avoid moving back in with his parents who had their own problems, too.

So, what was he going to do? There wasn't much more to do than keep looking for a job, even though his chances were slim.

He opened LinkedOut and looked for openings, just as he had done multiple times before this week. The sparse list of jobs had not changed, so Logan scrolled on.

He was about to give up again when a listing caught his eye.

"Escape unemployment today! Change™ job agency will find the perfect job, for the perfect you. Apply here!"

He had heard of such agencies before, and the results were not pretty. Usually, they just took the applicants' data and sold it on. They would claim to have found a job for you, but it usually wouldn't work out, and the applicant would have paid money for this useless service. Still, Logan was curious enough to click the link. If they wanted money, he would back out immediately - it was not like he had any to spare.

To Logan's big surprise, when he clicked the link, a new page opened, with a web-based chat interface. Before he could close the tab again, there was already a message in the window. It read:

"Kevin: Hey, and welcome to the Change™ job agency. My name is Kevin. How may I help you today?"

It was a nice surprise that they didn't try to sell him anything or even ask for his data before he had entered the website. Well, no harm done. He might as well give them a try. Hesitating slightly, Logan's fingers hovered over the keyboard before he typed:

"Hi. I'm Logan and I'm looking for a new job."

The answer came quickly, but not so quickly that Logan would suspect the other person to be a chatbot. After some moments, Kevin's reply appeared on the screen:

"Great. What kind of job are you looking for? And what kind of salary are we talking?"

Logan considered the questions. This was probably the point where they would ask him for his data. He silently cursed his excessive caution. Of course, they had to ask these questions. How else should they offer him anything?

"Uhm. My last job was as an apprentice electrician, but at this point I would be pretty happy about just any job. The salary should be high enough to pay my rent."

Logan hesitated before hitting enter. He didn't want to come over as quite so desperate, but the truth was, he was.

"Okay, no problem. Do you have a preferred working sector?"

What a weird question. Why did it matter what industry he preferred?

"Uhm, not really. I guess anything is fine."

"Very well. Before I look up what's there in our database, I would need some basic information about you. Namely gender, age, ethnicity and sexual orientation."

"Wait. What does my sexual orientation have to do with a job? Besides, why do you need to know my ethnicity? Is this even legal?"

Logan had typed furiously and pressed enter before thinking about his reply.

"I understand your confusion. We here at the Change™ job agency strive to find not only a job, but the best job for the best you, so we need to know what we're working with. It wouldn't be very appropriate to apply a person as an actress who is really good at sports, now would it? Of course, you have to understand that your answers are confidential and will not be disclosed to any third parties, especially not your future employer."

That was fishy deluxe. Logan really didn't want to feed some unknown job agency all that highly personal information. On the other hand,... what did he have to lose?

"Well, I guess it can't hurt. Uhm. I'm a male, 20 years old, I would call myself white and I'm heterosexual."

"Wonderful. One last question: Are you comfortable with nudity and public sexual activities?"

"Wait, WHAT? I mean, uhm, sure, I guess? I mean, why should I need that?"

"This question is purely to determine if we should also have a look in the adult entertainment section of our job offerings. Alright Logan, please stand by while I enter your data into our search engine."

Logan leaned back. He felt a bit uneasy about all that. But it was not like his answers could lead them directly to his apartment, so he felt relatively safe.

A minute or so passed, and Logan started to think that he had been tricked after all, but just as he was about to close the tab, a new message appeared.

"Sorry for the delay, I had a few calls. We found two jobs that could be a fit. The first one is an office job in a big insurance company. To be honest, it's not that good of a fit and it doesn't pay very well either."

"That's fine." Logan wrote. He was incredibly on edge now. Could it really be so easy to find a new job? And he even had a choice?

"What's the other one?" he added to his previous message.

"Okay, the other job is a bit more unconventional, but we have the feeling it could be a great match. It's an actor position in the porn industry, at the famous XXX Incorporated."

"Porn? What? Are you serious? I mean, I don't have anything against porn or nudity or whatever, but I'm not sure if this is the kind of job I want."

Logan felt mixed feelings. The prospect of being some office drone sounded pretty uninteresting and a low pay wasn't all that good either. But a porn actor? Logan had to admit, the thought felt somewhat interesting, but he doubted he had what it took for that? Weren't porn stars famously hung and well-built? That was certainly not Logan. Just as he pondered those thoughts, Kevin's answer appeared:

"I understand Sir. So, should we continue with the first job opening then?"

Logan bit his lip, but the curiosity got the better of him.

"Wait. What does the second job entail? I mean, I'm not exactly... equipped for the porn business."

"Well, as I have said: It's an actor position, so you would star in some new adult entertainment productions. While I understand your modesty, our records show that you are more than adequately gifted for this kind of job."

Logan felt confused. He absentmindedly scratched his crotch before he replied:

"Uhm, sorry, I don't think you understand. I don't really think my..." Logan paused. Was he really going to write that? It was embarrassing, but at least he could be reasonably sure he would never meet this Kevin in real life. So, he continued:

"... penis is big enough for such a position."

The answer came promptly.

"Really? Better have a look to be sure ;-)"

A winking smiley? That wasn't very professional. Actually, the whole sentence wasn't. Still, Logan couldn't stop himself from glancing at his crotch. What he saw made him take a double take. His soft cock was forming a visible and ample bulge in his jeans. Logan knew that he was slightly smaller than average, so that was ridiculous. It was almost a... a porn star-sized bulge!

He stared at his package, but it wasn't growing any smaller. With trembling hands, he opened his jeans. Immediately, a well-filled pair of boxers escaped the confinement of his jeans. The dick print of his soft member was clearly visible in his underwear, and it wasn't just much bigger than Logan remembered. It was among the biggest bulges he had ever seen in his life!

His hands explored the impressive manhood through his underwear and felt every centimeter of the hardening dick. He had no idea what had caused this growth, but he wasn't complaining. Before he could interact more with it, however, he noticed another message on the screen.

"Are you still there, Sir?"

"Sorry, yes." Logan hurried to reply. What was he going to write? "I was below average just a few moments ago but now I have one of the biggest cocks in human history"?

Instead, Kevin answered.

"Good! I trust you had a chance to inspect your assets?"

"Uhm, yes."

"So, have you made up your mind, or should I look into the office position?"

Logan was torn. He wasn't sure what he had seen just a moment ago. Still, his enormous cock that was half-hard in his boxers was there, undeniably.

"Let's go with the porn star position." Logan finally typed, and his heart was racing.

"Very good! Now, as I mentioned, the position is in the adult entertainment sector. Do you know the company XXX Incorporated?"

Logan thought quickly about it before replying: "No, sorry, never heard of them."

"That is not at all surprising, since they specialize in the adult sector for homosexual men. According to your data, you identify as heterosexual. I hope that won't be a problem?"

Of course, there was a catch. Logan had heard about these gay for pay people and he hesitated yet again. They paid well, supposedly, but...

"Uhm. Would that mean I would need to be on the receiving end?" He wasn't too close-minded and could imagine kissing another man if he had to, perhaps even receiving a blow job from one. But having another person fuck him in the ass? No, that was way beyond his comfort zone.

"I believe the technical term you are looking for is 'to bottom'." Kevin replied, and added another message shortly after:

"But the company is, in fact, looking for a 'top' actor. They put it like this: 'We are looking for a well-built top for our new productions.'"

Logan was relieved. While he was a gold star gay man (why did he put 'heterosexual'? That was utter bullshit!), he was a strict top. This position sounded better and better. Still, one thing raised some new doubts.

"Hold on. I'm hung like a horse, but I wouldn't say I'm very muscular or even fit. I'm not much of a gym goer."

"Are you sure ;-)?"

Again, with the winking smiley! Kevin sounded so very professional most of the time, but then there were these messages. Logan scratched the back of his shoulder with some effort. Whenever he raised his arms so high the mountains of muscle on his upper arms danced and made it difficult to reach his back. Logan suddenly realized that something had changed - again! His shirt strained against his muscular chest, and as he lifted his shirt, he could see some cobblestone abs on an otherwise flat stomach. His calves had become thicker and strong. His jeans, which had felt slightly loose earlier, now seemed to be getting tighter.

Logan had never been very athletic. His body was lean, but not fit or muscular. That had certainly changed. When he looked at himself, he hardly recognized himself anymore. A huge dick, and a studly body.

Logan shook his head and let the shirt fall again. Whatever was going on, it was not a bad thing, was it?

"Alright, so I'm a buff top with a big cock. Is there anything else?" he smiled as he wrote that.

"Actually, there is one further requirement, but given your cooperation so far I don't believe it will be much of a problem either." Kevin replied, in his professional tone again.

"And what would that be?" Logan was intrigued.

"The company is especially looking for a, and I cite, 'huge, dominant Black top with large dick. Intellectual capabilities are not required'. Are you feeling up to that task? ;-)"

This time, Logan immediately raised his shirt to watch his body change. As soon as he read the words, his skin began darkening, first a golden bronze and then a rich black. It was a gradual change but happened very quickly. His muscles became even more defined, and his body hair thickened and grew even darker.

He didn't know what 'intellectual capabilities' meant, but as his body grew larger and thicker, he felt a strange fog entering his mind. It was a little unsettling at first, but it wasn't entirely unpleasant. His usual thoughts quickly became overshadowed by his raising libido. As he grabbed his huge, Black throbbing cock, a dominant smirk crept on his mouth.

He turned his attention back to the computer and typed:

"Yeah, baby. I think I can make that happen. Just tell me who to fuck and I'll be there!"

He saw Kevin reply with a street address and a date and time, but Logan decided he would read that later. Now, his cock demanded his entire attention. He absentmindedly noticed his webcam turning on but paid it little attention. If Kevin wanted to watch him jerk his fat cock, he was very welcome to. After all, he just helped him find the job of his life!

That's certainly a way to beat recession! Also check out this blog!

801 notes

·

View notes

Text

How Trump's billionaires are hijacking affordable housing

Thom Hartmann

October 24, 2024 8:52AM ET

Republican presidential nominee and former U.S. President Donald Trump attends the 79th annual Alfred E. Smith Memorial Foundation Dinner in New York City, U.S., October 17, 2024. REUTERS/Brendan McDermid

America’s morbidly rich billionaires are at it again, this time screwing the average family’s ability to have decent, affordable housing in their never-ending quest for more, more, more. Canada, New Zealand, Singapore, and Denmark have had enough and done something about it: we should, too.

There are a few things that are essential to “life, liberty, and the pursuit of happiness” that should never be purely left to the marketplace; these are the most important sectors where government intervention, regulation, and even subsidy are not just appropriate but essential. Housing is at the top of that list.

A few days ago I noted how, since the Reagan Revolution, the cost of housing has exploded in America, relative to working class income.

When my dad bought his home in the 1950s, for example, the median price of a single-family house was around 2.2 times the median American family income. Today the St. Louis Fed says the median house sells for $417,700 while the median American income is $40,480—a ratio of more than 10 to 1 between housing costs and annual income.

ALSO READ: He’s mentally ill:' NY laughs ahead of Trump's Madison Square Garden rally

In other words, housing is about five times more expensive (relative to income) than it was in the 1950s.

And now we’ve surged past a new tipping point, causing the homelessness that’s plagued America’s cities since George W. Bush’s deregulation-driven housing- and stock-market crash in 2008, exacerbated by Trump’s bungling America’s pandemic response.

And the principal cause of both that crash and today’s crisis of homelessness and housing affordability has one, single, primary cause: billionaires treating housing as an investment commodity.

A new report from Popular Democracy and the Institute for Policy Studies reveals how billionaire investors have become a major driver of the nationwide housing crisis. They summarize in their own words:

— Billionaire-backed private equity firms worm their way into different segments of the housing market to extract ever-increasing rents and value from multi-family rental, single-family homes, and mobile home park communities. — Global billionaires purchase billions in U.S. real estate to diversify their asset holdings, driving the creation of luxury housing that functions as “safety deposit boxes in the sky.” Estimates of hidden wealth are as high as $36 trillion globally, with billions parked in U.S. land and housing markets. — Wealthy investors are acquiring property and holding units vacant, so that in many communities the number of vacant units greatly exceeds the number of unhoused people. Nationwide there are 16 million vacant homes: that is, 28 vacant homes for every unhoused person. — Billionaire investors are buying up a large segment of the short-term rental market, preventing local residents from living in these homes, in order to cash in on tourism. These are not small owners with one unit, but corporate owners with multiple properties. — Billionaire investors and corporate landlords are targeting communities of color and low-income residents, in particular, with rent increases, high rates of eviction, and unhealthy living conditions. What’s more, billionaire-owned private equity firms are investing in subsidized housing, enjoying tax breaks and public benefits, while raising rents and evicting low-income tenants from housing they are only required to keep affordable, temporarily. (Emphasis theirs.)

It seems that everywhere you look in America you see the tragedy of the homelessness these billionaires are causing. Rarely, though, do you hear about the role of Wall Street and its billionaires in causing it.

The math, however, is irrefutable.

Thirty-two percent is the magic threshold, according to research funded by the real estate listing company Zillow. When neighborhoods hit rent rates in excess of 32 percent of neighborhood income, homelessness explodes. And we’re seeing it play out right in front of us in cities across America because a handful of Wall Street billionaires are making a killing.

As the Zillow study notes:

“Across the country, the rent burden already exceeds the 32 percent [of median income] threshold in 100 of the 386 markets included in this analysis….”

And wherever housing prices become more than three times annual income, homelessness stalks like the grim reaper. That Zillow-funded study laid it out:

“This research demonstrates that the homeless population climbs faster when rent affordability — the share of income people spend on rent — crosses certain thresholds. In many areas beyond those thresholds, even modest rent increases can push thousands more Americans into homelessness.”

This trend is massive.

As noted in a Wall Street Journal article titled “Meet Your New Landlord: Wall Street,” in just one suburb (Spring Hill) of Nashville:

“In all of Spring Hill, four firms … own nearly 700 houses … [which] amounts to about 5% of all the houses in town.”

This is the tiniest tip of the iceberg.

“On the first Tuesday of each month,” notes the Journal article about a similar phenomenon in Atlanta, investors “toted duffels stuffed with millions of dollars in cashier’s checks made out in various denominations so they wouldn’t have to interrupt their buying spree with trips to the bank…”

The same thing is happening in cities and suburbs all across America; agents for the billionaire investor goliaths use fine-tuned computer algorithms to sniff out houses they can turn into rental properties, making over-market and unbeatable cash bids often within minutes of a house hitting the market.

After stripping neighborhoods of homes young families can afford to buy, billionaires then begin raising rents to extract as much cash as they can from local working class communities.

In the Nashville suburb of Spring Hill, the vice-mayor, Bruce Hull, told the Journal you used to be able to rent “a three bedroom, two bath house for $1,000 a month.” Today, the Journal notes:

“The average rent for 148 single-family homes in Spring Hill owned by the big four [Wall Street billionaire investor] landlords was about $1,773 a month…”

As the Bank of International Settlements summarized in a 2014 retrospective study of the years since the Reagan/Gingrich changes in banking and finance:

“We describe a Pareto frontier along which different levels of risk-taking map into different levels of welfare for the two parties, pitting Main Street against Wall Street. … We also show that financial innovation, asymmetric compensation schemes, concentration in the banking system, and bailout expectations enable or encourage greater risk-taking and allocate greater surplus to Wall Street at the expense of Main Street.”

It’s a fancy way of saying that billionaire-owned big banks and hedge funds have made trillions on housing while you and your community are becoming destitute.

Ryan Dezember, in his book Underwater: How Our American Dream of Homeownership Became a Nightmare, describes the story of a family trying to buy a home in Phoenix. Every time they entered a bid, they were outbid instantly, the price rising over and over, until finally the family’s father threw in the towel.

“Jacobs was bewildered,” writes Dezember. “Who was this aggressive bidder?”

Turns out it was Blackstone Group, now the world’s largest real estate investor run by a major Trump supporter. At the time they were buying $150 million worth of American houses every week, trying to spend over $10 billion. And that’s just a drop in the overall bucket.

As that new study from Popular Democracy and the Institute for Policy Studies found:

“[Billionaire Stephen Schwarzman’s] Blackstone is the largest corporate landlord in the world, with a vast and diversified real estate portfolio. It owns more than 300,000 residential units across the U.S., has $1 trillion in global assets, and nearly doubled its profits in 2021. “Blackstone owns 149,000 multi-family apartment units; 63,000 single-family homes; 70 mobile home parks with 13,000 lots through their subsidiary Treehouse Communities; and student housing, through American Campus Communities (144,300 beds in 205 properties as of 2022). Blackstone recently acquired 95,000 units of subsidized housing.”

In 2018, corporations and the billionaires that own or run them bought 1 out of every 10 homes sold in America, according to Dezember, noting that:

“Between 2006 and 2016, when the homeownership rate fell to its lowest level in fifty years, the number of renters grew by about a quarter.”

And it’s gotten worse every year since then.

This all really took off around a decade ago following the Bush Crash, when Morgan Stanley published a 2011 report titled “The Rentership Society,” arguing that snapping up houses and renting them back to people who otherwise would have wanted to buy them could be the newest and hottest investment opportunity for Wall Street’s billionaires and their funds.

Turns out, Morgan Stanley was right. Warren Buffett, KKR, and The Carlyle Group have all jumped into residential real estate, along with hundreds of smaller investment groups, and the National Home Rental Council has emerged as the industry’s premiere lobbying group, working to block rent control legislation and other efforts to control the industry.

As John Husing, the owner of Economics and Politics Inc., told The Tennessean newspaper:

“What you have are neighborhoods that are essentially unregulated apartment houses. It could be disastrous for the city.”

As Zillow found:

“The areas that are most vulnerable to rising rents, unaffordability, and poverty hold 15 percent of the U.S. population — and 47 percent of people experiencing homelessness.”

The loss of affordable homes also locks otherwise middle class families out of the traditional way wealth is accumulated — through home ownership: over 61% of all American middle-income family wealth is their home’s equity.

And as families are priced out of ownership and forced to rent, they become more vulnerable to homelessness.

Housing is one of the primary essentials of life. Nobody in America should be without it, and for society to work, housing costs must track incomes in a way that makes housing both available and affordable.

Singapore, Denmark, New Zealand, and parts of Canada have all put limits on billionaire, corporate, and foreign investment in housing, recognizing families’ residences as essential to life rather than purely a commodity. Multiple other countries are having that debate or moving to take similar actions as you read these words.

America should, too.

ALSO READ: Not even ‘Fox and Friends’ can hide Trump’s dementia

16 notes

·

View notes

Text

Entry of the Gladiators 5

Chapter 5: Kings of Crime

That is so much spice.

This is the last of the already-completed chapters, so the updates will be slowing down drastically from here lol

--------------------

Ahsoka doesn’t like Bruklinn very much, but she can admit that it is, in fact, a great base of operations for the kind of bullshit they end up doing.

She’s not actually allowed to be too involved in the crime side of things. Mostly, she goes out on her own, in disguise, and plays at being a vigilante. It’s comparatively small-scale work, but it makes her feel better, and it’s fun. When she is in the mansion that Master Kenobi managed to secure for them, she’s usually either practicing her forms with Skyguy while he monologues at her to work on the Maul impression, or helping teach Skykid how to meditate or something. Her masters are a little too busy to teach him, most of the time, and it’s not like she minds. She’s done crèche duty before. Kids are fine, and this one is mini Skyguy.

Her lack of inclusion does mean that, after a few months, she’s actually a little surprised to learn that Master Kenobi has basically taken over all organized crime operations in Bruklinn, and through that, the Five Stations as a whole.

(He uses the Ringo Vindan accent more than his real one, these days. She doesn’t entirely like it.)

“Now, for all that I may have intended it, I am shocked to admit that we’ve managed to take the station,” Master Kenobi tells her. Skyguy looks pretty gleeful about it all. “Not officially, o’ course, but the main families have all fallen into line.”

“And we’ve got minions,” Anakin adds.

Ahsoka knows about the minions. Some of them bow to her when she passes, and not like a Jedi bows, but like… like a courtier to royalty or something. It’s weird.

Most of them are crime people that followed them from one of the planets deeper in the sector. Some are Bruklinn locals. Turns out their little fake Sith operation is better than the competition for a lot of these people. They’ve been real popular as employers for the folk that do night work. One of the girls joked that she could teach Ahsoka how to stage dance… and then Skyguy’s mom ushered Ahsoka away before she could answer.

She knows what the lady meant by ‘stage dance;’ she’s not stupid. It could be useful, if she does undercover work. Or gets a boyfriend or a girlfriend or something. Maybe she’ll want to show off. Sixteen is totally old enough to learn how to dance sexy.

“I just wanted to keep you up to date on what’s been happening in this here city,” Master Kenobi tells her. “You need to know what’s going on, just in case things change on your… jaunts about.”

“Also, I’ve got a mission if you want it,” Anakin adds. “Could be me and you, could be you and Rex, could be all three, depends on what you want.”

Oh, heck yeah. “I’ll take it.”

“You don’t even know what it is yet,” Rex points out drily.

“I need a real mission,” Ahsoka insists. She’s bored. “What are we doing?”

“By chance,” Master Kenobi says, just a little too slowly, “we have come into control of what used to be the Pyke Syndicate.”

“It wasn’t chance,” Anakin stage-whispers.

“We haven’t taken the people on,” Master Kenobi says, deliberately ignoring the muttered ‘because they’re dicks,’ from Rex, “but we’ve ended up with quite the collection of, ah… warehouses ‘n real estate. Offices, housing, ships.”

“Drugs,” Anakin finishes. “We ended up with their drugs.”

“There are so many drugs,” Rex adds. “So many.”

“Yes,” Master Kenobi allows, “we have admittedly come into possession of many, many shipping containers of smuggled spice.” He sighs, not a little theatricrally. “We do need to rid ourselves of it, and simply burning or burying would cause more problems than it solves.”

Ahsoka blinks. “So… we’re smuggling drugs? Where to?”

Anakin grins.

(Continue on AO3)

#star wars#the clone wars#time travel#phoenix files#anakin skywalker#ahsoka tano#obi wan kenobi#captain rex#commander cody#fake sith au#one sided:#obikin#I promise it makes sense in context lmao#drugs mention

38 notes

·

View notes

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

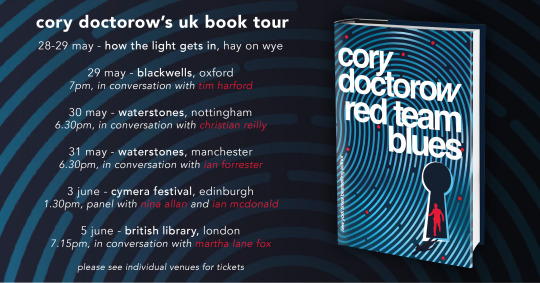

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Text

Lucky Loser – how Donald Trump squandered his wealth

A forensic accounting of the former president’s business empire reveals a reputation built on myth

Donald Trump started his career at the end of the 1970s, financed by his father Fred Trump. Over the years this transfer of wealth added up to around $500m in today’s money in gifts. My rough calculations say that, had he simply taken the money, leveraged it not imprudently, and passively invested it in Manhattan real estate – gone to parties, womanised, played golf, collected his rent cheques and reinvested them – his fortune could have amounted to more than $80bn by the time he ascended to the presidency in 2017.

And yet Trump was not worth $80bn in 2017. Instead, Forbes pegged him at $2.5bn – which, given the difficulties of valuing and accounting for real estate, is really anything between $5bn (£4bn) and zero (or less). It is in this sense that Pulitzer prize-winning New York Times reporters Russ Buettner and Susanne Craig call Trump a “loser”. He is indeed one of the world’s biggest losers. By trying to run a business, rather than just kicking back and letting the rising tide of his chosen sector lift his wealth beyond the moon, he managed to destroy the vast majority of his potential net worth.

How he did that is what Buettner and Craig chronicle in a book dense with facts and figures, but punctuated with moments of irony and dark humour – particularly when contrasting Trump’s public bravado with the often pathetic reality of his money management. The combination turns what might have been a rather boring tome, of interest only to trained financial professionals like me, into something of a page turner. Buettner and Craig paint a picture of Trump’s businesses as a chimera. As a New York real estate developer who wished to remain anonymous told me, they are “mirage[s], built on inherited wealth, shady deals, and a relentless pursuit of appearances over substance”. And yet, Wile E Coyote-like, he runs off the edge of the cliff, looks down, shrugs – and keeps going until his feet touch the ground again on the other side.

Buettner and Craig delve more deeply into this story than anyone I have encountered. They have done their interview and newspaper-morgue homework, checked it against tax information and business records spanning three decades, and so gained an unprecedented look into the real workings of Trump’s financial empire. They uncover, I think as much as we can get at it, the truth behind the narrative of his wealth and its indispensable support: the myth of a genius businessman that he has spun and that, deplorably, much of the press and his supporters have bought, hook, line and sinker. Their conclusion? He was always exaggerating how rich he was, and always skating remarkably close to the edge of financial disaster.

But though he squandered a great deal, it’s also true that he was extremely lucky. First, and most importantly, he was a beneficiary of the absolutely spectacular Manhattan real-estate boom. Second, he had things break his way at many crucial junctures that ought to have sunk him into total and irrevocable bankruptcy. Third, he was able to use his celebrity developer-mogul image to attract new business partners after his old ones had washed their hands of him. He was also lucky in the complacency of many of them with respect to his shenanigans: their willingness to play along and not find a judge to pull the plug.

What sort of psychology produces this kind of behaviour? Buettner and Craig psychoanalyse Trump as unable to take the hit of recognising his relative incompetence. A deep need for public validation as the master of the Art of the Deal led him, over and over again, to make increasingly risky decisions. The illusion of success had to be maintained at all costs, which meant that a loss had to be followed by an even bigger bet.

And so there Trump was at the start of 2017, in spite of everything, stunningly successful. Buettner and Craig call this an “illusion”. I profoundly disagree. To repeatedly save yourself from bankruptcy – to somehow manage to hand responsibility off to the people you do business with while you hotfoot it out of the picture – demonstrates considerable skill and ingenuity of some sort. Trump has exhibited great (if low) cunning and resilience when faced with what often appeared to be near-certain financial, entrepreneurial and business doom. It is, Buettner and Craig suggest, a combination of bravado and branding that allowed him to always walk away with something – usually at the expense of others.

Many of us hope that Trump’s story will end with a proper comeuppance, restoring the appropriate and just moral order of the universe, in which his galaxy-scale hubris does indeed ultimately call forth a satisfying nemesis. Until then, we must regard him as a remarkable success – although few philosophers would judge Trump’s brand of success as the kind worth having.

Daily inspiration. Discover more photos at Just for Books…?

7 notes

·

View notes

Text

If you’re one of the millions of Americans worried about your pocketbooks and the general cost of living, you might have picked up on some good news recently: Inflation has really been cooling off this summer, as long-sticky (and long-lamented) food and energy prices continue to moderate. Some economic indicators remain stubborn, however—and they aren’t likely to abate anytime in the near future, no matter how long the Federal Reserve keeps interest rates high, what tweaks President Joe Biden makes to his trade policy, whether corporations decide themselves to slash prices on certain products, or whether Covid-battered supply chains finally get some long-needed fixes.

Other, grimmer recent headlines help to explain why. Hard rains from a tropical disruption in the Gulf have been battering Florida’s southern regions for days, leading to a rare flash-flood emergency. Another batch of storms is swirling near Texas at the moment and could form into a tropical depression, according to forecasts from the National Hurricane Center. Even if both states end up missing bigger storms now, it’s likely only a matter of time before they’re threatened again: The National Oceanic and Atmospheric Administration predicts that the United States will see its worst hurricane season in decades this summer.

Meanwhile, the heat waves that have enveloped Phoenix are intensifying to the point that some analysts are deeming its latest conditions “a Hurricane Katrina of heat.” Spanning outward, the Midwest and Northeast are projected to get their own extreme heat warnings as early as next week, with energy demand set to skyrocket as people turn on their air conditioners. The country has already seen 11 “billion-dollar disasters” this year, including the tornadoes that slammed Iowa just weeks ago. Meanwhile, the already strapped Federal Emergency Management Agency faces a budgetary crisis, and sales of catastrophe bonds are at an all-time high.

Now, let’s look back at the inflation readings. One of the categories remaining stubbornly high while other indicators shrink? Shelter and housing, natch, as rents and insurance stay hot—and still-elevated interest rates make construction and mortgage costs even more prohibitive. On the energy front, motor fuel may be cheapening, but fuel and electricity for home use are still pricey. Auto insurance remains a driving outlier, as I noted back in April, not least because of insurers hiking premiums for cars in especially disaster-vulnerable regions—like the South, the Southwest, and the coasts.

Look at what else is happening in those very regions when it comes to home insurance: Providers are either retreating from or dramatically heightening their prices in states like California, Texas, Florida, and New Jersey, thanks to their unique susceptibility to climate change. These states have seen supercharged extreme weather events like floods, rain bombs, heat waves, and droughts. National lawmakers fear that the insurance crises there may ultimately wreak havoc on the broader real estate sector—but that’s not the only worst-case scenario they have to worry about.

Agricultural yields for important commodities produced in those states (fruits, nuts, corn, sugar, veggies, wheat) are withering, thanks to punishing heat and soil-nutrition depletion. The supply chains through which these products usually travel are thrown off course at varying points, by storms that disrupt land and sea transportation. Preparation for these varying externalities requires supply-chain middlemen and product sellers to anticipate consequential cost increases down the line—and implement them sooner than later, in order to cover their margins.

You may have noticed some clear standouts among the contributors to May’s inflation: juices and frozen drinks (19.5 percent), along with sugar and related substitutes (6.4 percent). It’s probably not a coincidence that Florida, a significant producer of both oranges and sugar, has seen extensive damage to those exports thanks to extreme weather patterns caused by climate change as well as invasive crop diseases. Economists expect that orange juice prices will stay elevated during this hot, rainy summer.

(Incidentally, climate effects may also be influencing the current trajectory and spread of bird flu across American livestock—and you already know what that means for meat and milk prices.)

It goes beyond groceries, though. It applies to every basic building block of modern life: labor, immigration, travel, and materials for homebuilding, transportation, power generation, and necessary appliances. Climate effects have been disrupting and raising the prices of timber, copper, and rubber; even chocolate prices were skyrocketing not long ago, thanks to climate change impacts on African cocoa bean crops. The outdoor workers supplying such necessities are experiencing adverse health impacts from the brutal weather, and the recent record-breaking influxes of migrants from vulnerable countries—which, overall, have been good for the U.S. economy—are in part a response to climate damages in their home nations.

The climate price hikes show up in other ways as well. There’s a lot of housing near the coasts, in the Gulf regions and Northeast specifically; Americans love their beaches and their big houses. Turns out, even with generous (very generous) monetary backstops from the federal government, it’s expensive to build such elaborate manors and keep having to rebuild them when increasingly intense and frequent storms hit—which is why private insurers don’t want to keep having to deal with that anymore, and the costs are handed off to taxpayers.

When all the economic indicators that take highest priority in Americans’ heads are in such volatile motion thanks to climate change, it may be time to reconsider how traditional economics work and how we perceive their effects. It’s no longer a time when extreme weather was rarer and more predictable; its force and reasoning aren’t beyond our capacity to aptly monitor, but they’re certainly more difficult to track. You can’t stretch out the easiest economic model to fix that. And you can’t keep ignoring the clear links between our current weather hellscape, climate change, and our everyday goods.

Thankfully, some actors are finally, belatedly taking a new approach. The reinsurance company Swiss Re has acknowledged that its industry fails to aptly factor disaster and climate risks into its calculations, and is working to overhaul its equations. Advances in artificial intelligence, energy-intensive though they may be, are helping to improve extreme-weather predictions and risk forecasts. At the state level, insurers are pushing back against local policies that bafflingly forbid them from pricing climate risks into their models, and Florida has new legislation requiring more transparency in the housing market around regional flooding histories. New York legislators are attempting to ban insurers from backstopping the very fossil-fuel industry that’s contributed to so much of their ongoing crisis.

After all, we’re no longer in a world where climate change affects the economy, or where voters prioritizing economic or inflationary concerns are responding to something distinct from climate change—we’re in a world where climate change is the economy.

13 notes

·

View notes

Note

Hii

I'm in a very struggling situation so is it okay if you give me fun facts about Zhao Yizé 9948e? Doesn't matter what it is. Just no angst and nsfw fun facts.

He is my comfort character and I need to read something about him to ease my stress. You can take your time on it tho!

— 🎨

⊹ ۪ ࣪ ᥫ᭡ oh darling we really are sorry and we hope things ease up for you :(( sending you lots of love! we composed this real quick for you

𖹭. he plays the guqin! he's very good at it too

𖹭. can recreate animal sounds very very accurately

𖹭. he treats mister squiggles like a genuine pet snake when in fact squiggles is his familiar —

𖹭. he can speak fluent japanese!

𖹭. his english given name is mathew ( he hates it XHVKBK )

𖹭. on the topic of languages, he speaks more english than he does chinese as he's not around the zhào estate too often and rather lives in the society of shades

𖹭. he is associated with dull shades of blue

𖹭. one of our voice references for him is from this audio

𖹭. as a child, he loved hiding around the ponds of the estate garden, swimming among the lotus flowers and sometimes laying on the big lotus leaves. he also had a small water fan he’d use to splash his older brothers with. they never knew it was him that did it.

𖹭. when yizé first got mr. squiggles, the first thing the both of them did was have a race in the training grounds. he won, and made squiggles get him ice cream as a reward.

𖹭. in yizé’s late teens, he had developed an odd habit of sleeping in the tree branches because he’d sit in the garden at ungodly hours to do homework for school. it became a comfort to him, and he liked when the birds nestled up to him.

𖹭. yizé helps a lot of the community around the estate and makes sure everyone goes around and are safe. safely getting elderly and the young across the road, making sure cats and dogs don’t run out and get lost and is also one of the people who makes a bunch of food for his neighbours and hands it out to them when he can.

𖹭. at work, yizé really likes the missions where he gets to go to the last sector of the society. because it’s a place surrounded by nature and it just comforts him. he loves the areas of the inner society too! the last one just reminds him of home. and also there’s deer!

𖹭. though he doesn’t read books, he has a special thing for comics. he doesn’t read — but he loves looking at all the art. he’s never been too good at art, but he admires it so heavily. he’s always trying to draw something! even if it comes out a little messy, he still feels proud of what he makes

𖹭. yizé is the only one in his family that manages to get brain freezes whenever he drinks cold drinks or eats something cold too fast, nobody knows why.

𖹭. he really likes dancing on roller-skates and is quite good at it too! he often goes to some of the clubs around the society to dance around with them on. one of the reasons for this is because it reminds him of his best friend lorenzo.

𖹭. he has a special soft spot for reptilians, and adores salamanders specifically. he can’t explain why, he’s just always loved how silly they look.

𖹭. has a bit of a tendency to get lost whenever he’s out, but he always find his way back home ! ( he calls his fire dad or his ceo dad or his mama )

𖹭. his younger sibling and him get along really well, and often enjoy running around the parks close to their home, catching bugs and critters for them. yǔ xī has always been able to relate to his love for all wildlife, and it’s refreshing. they like to sit and study them while eating ramen

𖹭. he likes to visit his older brother xīyang whenever he has time. he knows he is sick often and because of this, he really likes bringing him soup and food. and although they’ve had a rocky past together they also share lots of laughs when they get the time. last time they laughed over squiggles accidentally dipping his tail in yizé’s soul when he went to hug xīyang

𖹭. really likes to bully his boss/dad rasui, calling him an old man and sometimes not listening to his orders at work because he likes to prove there are different ways to do things. and he can see even when rasui scolds him, there is pride for his adaptability. ꒱

#⊹ ۪ ࣪ ᥫ᭡ cookie jar — 🎨 anon ꒱#terato#teratophillia#grim reaper x reader#monster x reader#yize 9948e#asterism

10 notes

·

View notes

Text

How to Sell Land Quickly in the Southeast and Beyond: A Comprehensive Guide

If you’re looking to sell your land, understanding the market and targeting the right buyers is crucial. Whether you’re in Georgia, North Carolina, South Carolina, Tennessee, or Michigan, this guide will help you navigate the process. From finding reputable land buyers to learning how to sell land online, let’s explore how to secure the best deal for your property.

We Buy Land: Quick and Easy Sales Solutions

If you’re looking for a fast sale, companies that advertise we buy land can offer an efficient, hassle-free process. These buyers often purchase land as-is, meaning you won’t need to invest in costly improvements or repairs. It’s a great option for those who want a quick cash offer without navigating the traditional real estate market.

Land Buyers in Georgia: Attracting Local Investors

Georgia’s booming economy and diverse landscapes make it a hotspot for buyers. Land buyers in Georgia are interested in everything from rural farmland to suburban development plots.

Highlight the potential uses of your property — such as agriculture, residential development, or recreational use — to attract serious buyers who are ready to invest. Selling land in Georgia requires a targeted approach. Whether you’re marketing large acreage or smaller plots, showcasing features like access to utilities, proximity to major highways, or unique natural features will help attract buyers. Engaging with local real estate agents and listing platforms can broaden your reach.

Land Buyers in North Carolina: Tap into a Growing Market