#how government employees can save on tax

Explore tagged Tumblr posts

Text

#Authorised Financial Services advisor#Dhevan Naicker#early retirement#early retirement without penalties offer#GEPF#GEPF financial advisor#GEPF retirement planning#Government Employees Pension Fund#government employees tax benefits#how government employees can save on tax#How to save on tax#legal tax savings for government workers#resignation#resignation benefits#retirement#retirement tax benefits#Retirement Wellness SA#tax advisor#tax deductions for public servants#Tax planning for public sector employees#Tax saving tips for government employees#dhevannaicker#pensionfunds#retirementplanning#taxtips#pensionplanning#earlyretirement#gepf2potsystems#financialadvice#financialplanning

0 notes

Text

Permanent Hiatus..?

Hello all. This is probably my final post on this account.

You all deserve an explanation, so I'll give it to you here.

I have exhausted every last resource I possibly can to keep my finances in order. Unfortunately, I have two Hail Mary's left, and neither one of them look like they're going to be working out. I have called 211, and now, I am going to see if I can donate plasma for cash on Monday. It's probably going to be denied because of my health issues, and therefore I won't get any money. The 211 will also probably be denied, because there are others in my state (of North Carolina) that have lost everything to Helene, and all resources are (rightfully) going to them.

So? I have nothing left. There's nothing I can sell, and there's no way for me to get my medicine or feed my dog until my paycheck comes in, which will be held back because the first is always held back. I won't be able to pay my bills, or file my taxes because of my lack of money. If my car insurance lapses, I won't be able to have a valid license. If that happens, I can't work.

If I can't work, well, my boyfriend can't support me and my dog. We'll have to move back. However with the job market the way it is, I will not be able to get a job back at my grandparents either.

I now probably won't be able to go to college anymore since the department of education has been fully dissolved. So, possibly no more FASFA, and even if it's still around, it will either be left unattended with no employees to approve or deny the papers, or the government will dissolve it too.

All this to say, this is it. I'm at the end of the road, and there's nothing I can do. Either these Hail Mary's work, and I'm saved, or the very real possibility they don't, and what next is just suffering. There's nothing I can do, and nothing y'all can do. I can't fight my body, my mind and the government.

So, no. I'm not going to kill myself. I've come too far to do that bullshit now.

But is this a permanent goodbye to Tumblr and this amazing community?

... most likely so.

I've been trying to juggle expectations and the reality of my young adult life so far. Balance having fun and going to work, while trying to find a balance with my health. Now? There's quite literally nothing.

I've spent about 5 hours in the worst panic attack a person could experience, only for my emotions to go totally numb these past three hours. I'm crying, but there's no emotion. I'm smiling, with no emotion. There's nothing but a husk at the moment, and that terrifies me.

What it means, I have no clue. Could be a horrible panic attack or something worse. I don't know and I don't care at the moment.

But I do want to tell you all that whatever hardships you're facing in your life right now? That shit isn't your fault. Most of this was decided by old bastards centuries ago, and they left us in this dying system who is only fueling itself by our agony. That's a shared trait everyone in the world has. Whether you're an American, African, Arab, Asian, European, Slavic, Hispanic or Indigenous person.

Our pain is caused by people who profit from it. They won't ever stop until everyone rises against them. But that won't happen until the majority of humans are being negatively affected.

So, make community. Live fast, Love Hard, and Laugh Long. Triple L's. As for me, I'm going to cocoon myself and make the last years I have of my life count, because unfortunately, I will probably be one of the first deaths when the system starts to really crash down... And with how it's heading, my mortality is a ticking clock.

Thank you for everyone I've interacted with. Thank you for everyone who has sent me love, hate or just questions. Thank you to everyone who has made me feel the most miserable to the person that made me feel the most alive. Thank you to my friends, thank you to my community, and thank you for listening to all my rambles, my upset chatter, and me argue and fuss and fight and claw my way to where I am, thank you for seeing the kind nature in me and not ruining it and thank you for nurturing the love and respect I have for every one of you to new extremes.

Thank you all.

This is Cassie, playing Phillip Graves, signing off permanently as of Saturday, March 22, 2025.

#call of duty#rp ask blog#phillip graves#cod roleplay#cod modern warfare#phillip answers#cod mw2#cod phillip graves#cod mw3#cassie chatter#grave replies#cassie is very upset#pinned post#hiatus notice

58 notes

·

View notes

Text

The thing about the takeover of key US government institutions by the world’s richest man and his strike force of former interns is that it’s happening so fast.

It’s been three weeks since Elon Musk’s agents took over the government’s IT and HR departments. Since then, the movements of his so-called Department of Government Efficiency have had the cartography of a horror movie, DOGE picking off agencies one by one based on slasher logic, feeding an unslakeable thirst for cost-cutting and data.

Every day brings fresh incursions. Three weeks ago the United States believed in humanitarian aid. It helped people who had been ripped off by big corporations. It funded the infrastructure necessary to make America a beacon of scientific innovation. Now the United States Agency for International Development is gutted, the Consumer Financial Protection Bureau is on ice, and National Institutes of Health grants are handcuffed. So much for all that.

These are spreadsheet cruelties, executed with a click. The loss of real peoples’ jobs and lives—yes, despite what X-famous conspiracy theorists will tell you, USAID saved lives—all immaterial compared to the pursuit of a tighter balance sheet.

Three weeks ago, a 19-year-old who calls himself “Big Balls” online didn’t have access to government personnel records and more. A 25-year-old with a closet full of racist tweets hadn’t gotten the keys to Treasury systems that pay out $5.45 trillion each year. Elon Musk hadn’t turned the Oval Office into a romper room for his 4-year-old son.

The speed is strategy, of course, flooding the zone so that neither the media nor the courts can keep pace. Lawsuits and court orders move on a different timescale than this slash-and-burn approach. (At this pace, DOGE will have tapped into every last government server long before the Supreme Court even has a chance to weigh in.) But it’s also reflexive. The first order of business in a corporate takeover is to slash costs as quickly as possible. If you can’t fire people, offer them buyouts. If they won’t take the buyouts, find a way to fire them anyway. Keep cutting until you hit bone.

This is how you get an executive order declaring that “each agency hire no more than one employee for every four employees that depart,” an arbitrary ratio with no regard for actual staffing needs. It’s how you get hundreds of federal government buildings on the auction block no matter how fully occupied they are. It’s both extreme and ill-considered, a race to empty the town’s only well.

And then … what? This is the question that Elon Musk and DOGE have failed to answer, because there is no answer. Does the United States government need to become a profit engine? To return shareholder value? Does Medicaid need to demonstrate a product-market fit in time for the next funding round?

This is consultant logic. This is an engineering sprint whose inevitable finish line is the unwinding of the social contract. Democracy doesn’t die in darkness after all; it dies in JIRA tickets filed by Palantir alums.

It’s somehow even worse than that, though. Suppose you take this whole enterprise at face value, that the United States should go through the private equity ringer. It does not take a Stanford MBA to know that cutting expenses only helps half of your profit and loss statement. Any serious attempt to treat the US like a business would involve increasing revenues. So where are the taxes? And why demolish the CFPB, which has paid out over $20 billion to US citizens—shareholders, if you will—through its enforcement actions?

In the coming weeks and months, as this farce continues to unfurl, remember that the goal of most acquisitions is not to benefit the acquired. It is to either subsume or discard, whichever generates the highest return.

Elon Musk’s unprecedented influence over the executive branch will ultimately benefit Elon Musk. The employees in charge are his employees. The data DOGE collects, the procurement contracts they oversee, it all flows up to him.

And it’s flowing too quickly to keep up with, much less to stop.

16 notes

·

View notes

Text

Alicia Sadowski, Isabella Corrao, Helena Hind, and Jane Lee at MMFA:

The extreme policy positions and toxicity of Project 2025 — the Heritage Foundation’s initiative to provide policy and personnel to the next Trump administration — have prompted leader Paul Dans to resign from his position at the Heritage Foundation and former President Donald Trump to publicly disavow the effort. (Heritage's president has said that Trump trying to create distance from Project 2025 is a “political tactical decision” and that Heritage still has a “very good” relationship with Trump and his team.) Fox News has maintained that Trump was not aware of Project 2025 and attempted to distance Trump from its extremism. But the pro-Trump network’s personalities have repeatedly signaled support for many of Project 2025’s proposals.

[...]

Personnel and staffing

Project 2025’s plan to staff the next Trump administration involves potentially firing thousands of nonpartisan federal civil service workers — what MAGA figures usually refer to as the “deep state” — and replacing them with Trump loyalists. This would be accomplished by reinstituting a Trump-era executive order called “Schedule F,” which would reclassify civil service employees as “at-will” workers who can be more easily fired. And Project 2025 has already created a training academy to instruct potential staffers on “rolling back destructive policy and advancing conservative ideas in the federal government.”

Christian nationalism

In the foreword to the effort’s policy book, Mandate for Leadership, Heritage Foundation President Kevin Roberts warned that “the Left is threatening the tax-exempt status of churches and charities that reject woke progressivism,” adding that “they will soon turn to Christian schools and clubs with the same totalitarian intent.”

To rectify this threat, Project 2025 offers, as Salon has written, a “blueprint for the Christian nationalist vision for America.”In the chapter on the Department of Labor, former Trump official Jonathan Berry cited the “Judeo-Christian tradition” to justify calling for overtime pay on the Sabbath.

In the chapter on the Department of Health and Human Services, former Trump HHS official Roger Severino criticized the Centers for Disease Control for issuing health guidelines warning against congregating at churches during the COVID-19 pandemic.

He asked, “How much risk mitigation is worth the price of shutting down churches on the holiest day of the Christian calendar and far beyond as happened in 2020? What is the proper balance of lives saved versus souls saved?”He also argued that future conservative administrations should “maintain a biblically based, social science-reinforced definition of marriage and family.”

LGBTQ rights

Project 2025 will have a major impact on LGBTQ students and teachers in public school systems.

The Heritage Foundation’s Lindsey Burke wrote that the next conservative administration should “take particular note of how radical gender ideology is having a devastating effect on school-aged children today” and warned of a supposed intent to “drive a wedge between parents and children.”Project 2025 claims that concepts such as gender ideology “poison our children, who are being taught … to deny the very creatureliness that inheres in being human and consists in accepting the givenness of our nature as men or women.”

Burke also called for legislation to force “K–12 districts under federal jurisdiction” to prohibit employees from using a name or pronoun different from the information listed on a student’s birth certificate without written guardian permission.

Project 2025 additionally targets trans athletes in schools, citing “bureaucrats at the Department of Justice” who “force school districts to undermine girls’ sports and parents’ rights to satisfy transgender extremists.” The plan says the federal government should instead “define ‘sex’ under Title IX to mean only biological sex recognized at birth.”Additionally, in the foreword, Kevin Roberts calls gender-affirming care “child abuse.”

Diversity, equity, and inclusion

Project 2025’s Mandate for Leadership proposes the removal of “DEI” references from “every federal rule, agency regulation, contract, grant, regulation, and piece of legislation that exists,” claiming that such efforts undermine the purpose of these agencies. The proposal also calls for the investigation and prosecution of supposed discrimination brought on by DEI policies.Fox News has been vocal in the anti-DEI crusade as well, pushing many of the same talking points found in Mandate, including that DEI and pro-LGBTQ policies are a detriment to the U.S. Army’s effectiveness and that DEI policies constitute discrimination:

GOP propaganda organ Fox “News” and Project 2025 are in lockstep on many key policies, such as opposition to DEI and LGBTQ+ rights, Christian nationalism, and Schedule F.

34 notes

·

View notes

Text

They Lies Government and Banks Tell They Citizens

If the banks lived by their own advice which is to save money, the banks would be losing money.

When you go and deposit $1,000 in the bank, that cash that you deposited is a liability for the bank.

An Asset to something that puts money in your pocket, a Liability is something that takes money away from your pocket so when the bank have your cash, it's a liability for them. They want to get rid of it as fast as possible and the way they do that is by lending it out because it's an Investment for the bank.

They don't want to hold onto cash, but they want you to save your money with them and leave it there and your money is losing value to Inflation each and every day.

Everyday that you keep your money in the bank, you're becoming poorer each and everyday.

When you keep your cash in the bank, they bank is paying you 0.1% or maybe 0.5% if you're lucky and the turn around lending it out for like 5% to 6%, so they don't keep your cash because its liability for them, they want to keep you spending money on their credit card because now they'll get to earn 18 to 25% in interest every time you spend $1.

The Government wants you to be Financially Uneducated and do you know why; because you're an employee and a consumer, so who pays the highest taxes? Employees and consumers!!!

Everybody knows that rich people don't pay taxes, it makes people angry but a lot of times, we don't understand why and we get angry at the wrong things and wrong reasons and you know that you can do a lot of things legally to pay less money in taxes and there are different ways that you can invest your money to pay less money in taxes.

Well, let me actually start with this; Tax Avoidance and Tax Evading are two similar words with two different outcomes.

Tax evading is illegal and then you go to jail.

Tax avoiding is legal and then you get hated for doing it.

And if you learn the IRS Code, it's a rulebook, the people who understand the Rulebook are the people who have the money to hire the good accountants and the good attorneys and so what happens is wealthy people will understand how this works, play within that system and pay little to no money in taxes.

Lets assume that you have either some sort of your own income, you're a side hustler or you're a business owner, and you make $500,000 profit.

You're taxed on Income.

So if you take out a Salary, that's going to be Taxed.

Now the question is what is a Tax Deduction or the better question is how can you make something a tax deduction??

Because anything can be a tax deduction if you know how to make it a deduction and that's the question you have to ask yourself.

So if you don't have an income, you don't have any tax on you.

The government and its system are so corrupt that they don't want you to know this and that's the more reason Money In The Bank Is At Risk, move your funds into the Quantum Financial Ledger Account (QFS).

#donald trump#bank of america#wells fargo#breaking news#bank crash#bad government#world news#qfs#bank clash#new york#trump 2024#republicans#decentralised finance#decentralisation#educate yourself#education#reeducation#reeducate yourself#marine life#veterans#patriotic#politics#washington dc#xrp news#xrpcommunity#xrp#xlm#quantum financial system#be aware#stay woke

34 notes

·

View notes

Text

Ah fuck it. I’m sure if they were checking my social medias they’d have known my views already. But still going to say that these are the words of someone speaking as a private and very concerned citizen and not as a spokesperson of any federal agency.

So they started illegally firing National Weather Service probationary employees today. Probies are people who have been in for less than a year (or less than two years, depending … all you need to know is that it means it’s just new employees or employees new to a position, not poorly performing employees). This came before a judge (maybe?) ordered a temporary halt on firings.

What does the National Weather Service do? They provide daily weather forecasts, predict hurricanes and tornadoes and any number of life threatening weather events, warn people about said hurricanes and tornadoes and life threatening weather events. They even send meteorologists out to wildfires to help protect firefighter’s lives by providing accurate and timely forecasts for the fire.

They also maintain the infrastructure (weather stations, weather radio, radars, satellites, numerical weather prediction models, etc.) necessary to do all the tasks said above.

And they do this free of cost (aside from a cost of less than a cup of coffee in taxes for each tax payer). They’re essential employees and are critical to life, property, and the economy (a lot of industries rely on accurate weather reports and data). If you want to know how essential the meteorologists at the NWS are: they work during government shutdowns. They’ve literally walked to the office in the middle of goddamn blizzards just so they can work.

This agency has been successfully completing its mission to protect lives and property while incredibly understaffed … and Dumb and Dumber are firing without any regard to this.

This is not saving money.

This is not efficiency.

This is going to kill people.

9 notes

·

View notes

Text

Tariffs

i asked elon musks ai to explain this to me, so i would be getting my information from what everyone is calling an unbiased source. so this is per GROK collection of data on the subject have fun......

Canada is a significant supplier of energy to the United States. According to various sources:

Crude Oil: Canada supplies about 60% of the U.S.'s crude oil imports.

Natural Gas: Canada is the source of nearly all (98% or 99%) of the U.S.'s natural gas imports.

Electricity: Canada exports a considerable amount of electricity to the U.S., with figures indicating around 33 terawatt-hours in 2023, which constitutes about 90% of the U.S.'s annual electricity imports.

Uranium: Canada also supplies 25% of the U.S.'s uranium imports.

This overview shows that the U.S. heavily relies on Canada for various forms of energy, making Canada one of the largest energy suppliers to the U.S.

So the government just taxes it's constituents by way of tariffs

Yes, in essence, tariffs can be seen as a way for the government to tax its constituents, but the mechanism and impact are more nuanced:

Direct Payment: Importers pay the tariff directly to the government when goods enter the country. These importers might be domestic companies or individuals.

Indirect Impact: The burden often gets passed on indirectly. Here's how:

Consumers: If importers increase the price of goods to cover the cost of tariffs, consumers end up paying more for these products. This is effectively a tax on consumption.

Businesses: Companies might absorb part of the tariff cost to remain competitive, impacting their profit margins or leading them to find cost-saving measures elsewhere, which could indirectly affect employees or other business decisions.

Revenue Collection: The government collects this revenue, which can be used for public expenditure, reducing other taxes, or paying down national debt. However, the primary goal of tariffs might also include protecting domestic industries, which can lead to higher prices for goods in general, not just imports.

Market Dynamics: Tariffs can alter market dynamics, sometimes leading to higher prices for both imported and domestic goods if domestic producers raise their prices due to less competition.

Economic Theory: Economists often discuss tariffs in terms of "tax incidence," which looks at who ultimately bears the economic burden. The incidence can split between consumers and producers based on how sensitive demand and supply are to price changes (elasticity).

So, while tariffs are a form of taxation that directly affects importers, the economic burden or "tax" can be shared among consumers, domestic producers, and importers in various proportions, depending on many factors including the specifics of the tariff, the type of goods, and market conditions.

Why does Donald trump think tariffs will pay America via foreign countries if it's the importer is the one that pays it

Donald Trump's rhetoric on tariffs, particularly during his campaigns and presidency, often emphasized the notion that tariffs are paid by foreign countries, which would, in turn, benefit the U.S. economy. Several reasons might explain this perspective:

Misunderstanding or Simplification for Political Messaging:

Trump might have simplified or misrepresented how tariffs work to fit into a political narrative. By saying that foreign countries pay tariffs, he could appeal to those who view trade as a zero-sum game where the U.S. should "win" against other countries. This simplification might be intended to resonate with voters by portraying him as tough on trade with nations perceived as economic adversaries, particularly China.

Negotiation Strategy:

Trump often used tariffs as leverage in trade negotiations. His claim that foreign countries pay might have been part of a strategy to pressure those countries into making concessions, assuming that they would see the tariffs as a direct cost they must bear to maintain access to the U.S. market.

Revenue Focus:

He emphasized the revenue aspect of tariffs, stating that they would fill the U.S. Treasury with money from foreign countries. This view overlooks the fact that while tariffs do generate revenue for the government, the economic cost is borne domestically by importers and consumers. Trump might have focused on the revenue collection aspect to highlight his plan to reduce the national deficit or fund his tax cuts without directly increasing domestic taxes.

Economic Nationalism:

Trump's economic policy was often framed under the banner of "America First," where tariffs were seen as a tool to protect and revive American industries. By suggesting that other countries pay, he could frame tariffs as a means to correct trade imbalances, even if economically, it's the domestic importers and consumers who bear the cost.

Public Perception and Media:

Trump's communication style frequently involved bold claims and straightforward messages over nuanced explanations. This approach might cater to public perception or media narratives where complex economic concepts are reduced to soundbites.

However, from an economic standpoint, as numerous analyses and expert opinions have pointed out, tariffs are typically paid by domestic importers, who then might pass on these costs to consumers or absorb them, affecting the price of goods or profit margins:

Economists' View: Studies and statements from economists, including those from institutions like the Peterson Institute for International Economics, have consistently shown that while tariffs generate revenue for the U.S. government, the economic burden largely falls on American businesses and consumers through higher prices or reduced profits.

Public Discourse on X: Posts on X have highlighted the misunderstanding, with users clarifying that tariffs are not paid by the exporting country but by U.S. importers, indirectly affecting U.S. consumers.

These sources emphasize that while the government collects the tariff revenue, it's the domestic market that feels the economic impact.

#president trump#donald trump#trump#trump 2024#trump vance 2024#trump vs harris#2024 presidential election#presidential debate#civil rights#human rights#thoughts and tariffs#trump tariffs#us tariffs#trade tariffs#25% tariffs#canada#grok

6 notes

·

View notes

Text

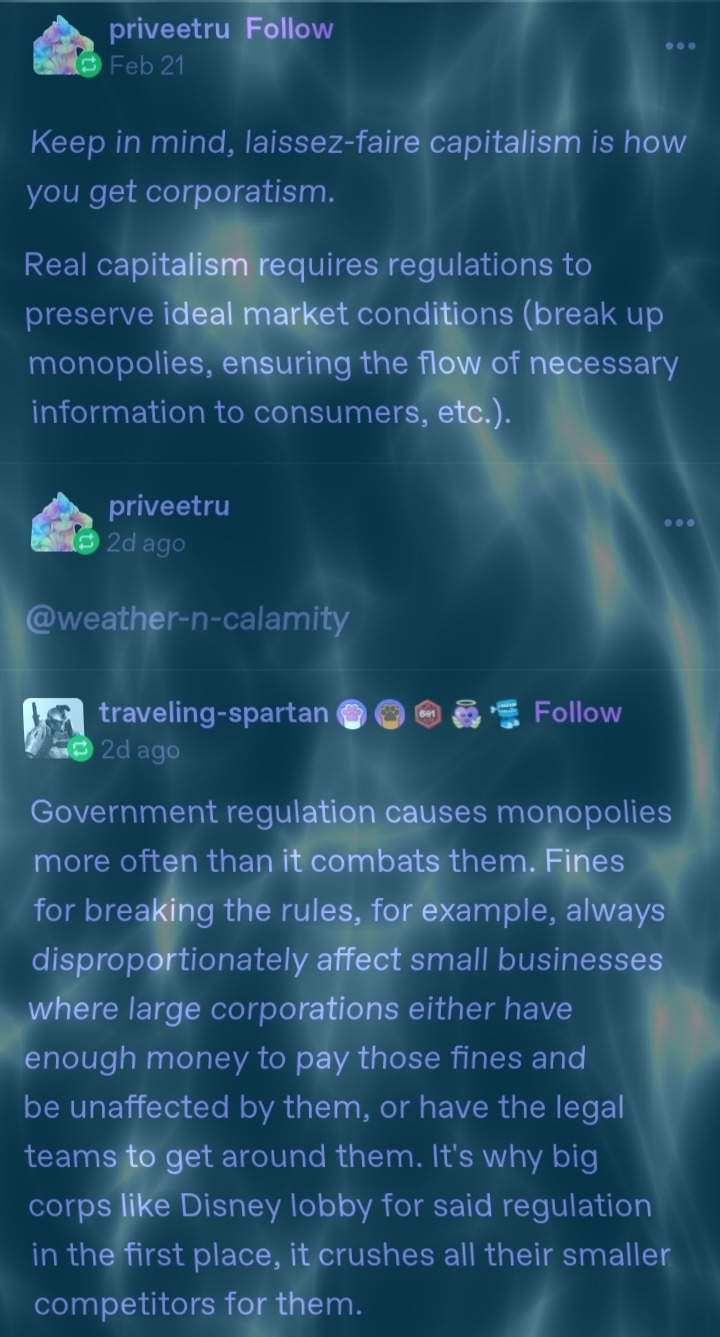

@traveling-spartan @priveetru

gonna be responding to this in a separate post because i've already left two comments on the post this was in reply to and i suspect that the OP already would consider that two too many.

at any rate:

Government regulation causes monopolies more often than it combats them.

[...]

It's why big corps like Disney lobby for said regulation in the first place, it crushes all their smaller competitors for them.

for what it's worth the data doesn't seem to be backing this up. if both these claims were true, you'd expect to see a multitude of pieces of regulation that disney supported, and few if any pieces of regulation that disney opposed, but this quick overview of some of disney world's political spending on florida trend [x] doesn't show that. now admittedly this is just the partial info for the disney world division in florida specifically, and not a general overview of all their political spending, so if anyone has more complete data i'd be interested to hear it. that said, i think it's a decent slice of data to start with.

in fairness, here we can find one notable example of disney lobbying for regulation- namely when they funded efforts to support Amendment 3, which would have prevented any more large casino chains from opening in florida, so that disney world could avoid competing with major casino chains like Genting and Las Vegas Sands. and, to be fair, as noted in the article this was a pretty major driver of campaign spending.

however, A: this was primarily aimed at combating rival megacorps, not combating small businesses, (and naturally the casino megacorps disney was fighting were spending their lobbying money to combat said regulation) and B: this was the only time in the article we see disney fighting for regulation rather than against. examples in the article of disney lobbying against regulation include:

By virtue of its size and economic importance, Disney has always been an influential voice in state politics. But the company had found itself on the losing end in a series of lobbying battles — among them, a fight with the National Rifle Association about whether employees could bring guns to work.

this is an important example of how regulation of private enterprise is sometimes necessary to preserve our fundamental rights- if disney can say employees can't bring guns to work even if they keep them in their parked car, what's to stop landlords from saying tenets can't bring guns in their apartment? if you value the right to bear arms, you should understand why sometimes the power of private enterprise over employees and customers must sometimes be curbed.

Disney also battled with personal-injury attorneys about whether parents could sign away the liability rights of their children and with counties and hotel chains about how online travel companies should be taxed.

[...]

Disney’s 2018 spending included $1 million on Amendment 2, which keeps a tax cap in place that limits increases in the taxable value of commercial and other non-homestead property from rising more than 10% per year. Records show Disney was by far the largest donor to a Florida Chamber of Commerce-backed political committee used to promote the amendment. The cap saved Disney more than $6 million last year alone through reduced property tax payments to Orange County and the South Florida Water Management District.

[...]

As prominent as Disney has made itself on the campaign trail, lawmakers who have worked with the company say it still tries hard to maintain a low profile while lobbying — to avoid having its brand linked with potentially controversial public policies. Disney, for example, has exerted “significant influence” on the Legislature to not pass a law requiring employers to use the e-Verify system to ensure they aren’t employing undocumented workers, says former Senate President Don Gaetz, a Republican from Okaloosa County.

[...]

Cloaked or not, the company enjoyed a number of successes in the 2019 legislative session. Late in the session, as lawmakers finalized a broad tax package, Disney — working through the Florida Retail Federation — persuaded lawmakers to add an extra sales-tax break that will help big retailers who order too much inventory and wind up not selling it all. Retailers generally don’t have to pay sales tax when they order inventory because they are planning to resell it to consumers. The sale to consumers is the transaction that’s supposed to be taxed. But retailers must pay the tax on whatever they don’t sell, since they have become the end user of the product. Disney has for years donated its leftover inventory to charities. So the company persuaded the Legislature to create a sales tax exemption for the leftover inventory that goes to charity. Economists expect the new tax break will save retailers about $5 million a year. Disney won’t say how much it expects to save itself. Disney also worked quietly to reshape a bill, which it objected to in 2018, that would have exposed hotel operators to civil lawsuits if they failed to do enough to prevent human trafficking.

i'll leave it for the reader to consider why disney would want to combat regulation which might cause them to be held accountable for facilitating human trafficking.

Disney even won some changes in state rules for how tourist venues manage all the stuff — from hats to strollers to phones — that visitors lose or leave behind. Generally, businesses are supposed to alert law enforcement and must hold on to lost property for 90 days before they can dispose of it. But that has become cumbersome for Disney — and for Universal Orlando, Central Florida’s other big theme-park resort — which must devote lots of warehouse space simply to holding lost-and-found items. Disney helped write a bill establishing new rules for theme parks, hotels and some other commercial venues that requires them to hold the property for just 30 days and then donate it directly to charity.

looking outside the article to other examples of disney's political lobbying, we find them lobbying against minimum wage laws [x]

Five years ago, on Nov. 6, 2018, the city’s voters approved Measure L, which mandated that “area resort workers” — Disneyland employees, basically — must be paid a living wage if the parent company receives city subsidies. The Walt Disney Company, which at the time was paying some of its workers the state-mandated $11 an hour minimum, fought the measure bitterly, and the ordinance spent most of the next five years kicking around the state court system as a class-action lawsuit sought to force the company to comply. Only in late October, when the California Supreme Court declined to hear Disney’s final appeal, did Measure L become settled city law.

we can also find disney lobbying against heat safety regulations (and against raises to the minimum wage at the same time, a twofer) [x]

House Bill 433 prohibits local governments from passing legislation that protects workers from extreme heat and laws requiring companies to raise the minimum wage beyond the state’s current $12 an hour. But now, we’re learning more about how this bill was passed and the role that Disney World played in helping to remove basic protections from outdoor workers, including cast members. According to Jason Garcia of Seeking Rents, the Florida Chamber of Commerce and Associated Industries of Florida donated more than $2 million to mostly Republican legislatures and another $1 million to the Florida Republican Party. The two lobbying groups expected House Bill 433 to become law for those donations.

[...]

Local government officials in South Florida were considering passing heat protections after the death of migrant farm workers of heat stroke. These laws would have prohibited work in extreme Florida heat and mandatory water breaks for workers. The possibility of these laws stopping work became dangerous to businesses in Florida, which would have had to shut down in extreme heat. Thus, donations to politicians were made to get this bill passed.

[...]

The law was wildly unpopular, with hundreds of civic groups opposing it. That outrage nearly killed the bill. However, according to Garcia, with just one day left in the legislative session, lobbyists sent texts to lawmakers to ensure the bill’s passage.

so what can we see from all this? first, that there are more pieces of regulation that large businesses lobby against than regulations that they lobby for, so the claim that businesses are the primary force behind pushing regulation is patently false and B: when businesses do support regulation in order to pursue their financial interests, this is mainly in order to combat rival large corporations, not small businesses. because fundamentally large businesses don't have to worry that much about competition from small businesses, because fundamentally small businesses can't compete. a small business would have had to expand to the point of being a large corporation long before it would be something disney would have to worry about "competing" with instead of just buying out or ignoring entirely. you think that a megacorp like disney is worried about competition from a little mom and pop shop? get real.

Fines for breaking the rules, for example, always disproportionately affect small businesses where large corporations either have enough money to pay those fines and be unaffected by them, or have the legal teams to get around them.

a few responses to this. the first is, so what? laws against murder, rape, assault, etc are all easier for the rich to dodge, and yet we don't decide murder should be legal. the solution to that imbalance is to be more serious about holding rich people accountable for these crimes, or for fine-related punishment to scale the fine to income, not to get rid of the laws altogether. if a regulation outlaws genuinely abusive or harmful behavior from a company, the way that small companies can avoid that fine is by simply not engaging in abusive or harmful behavior.

secondly, plenty of regulations nonetheless have specific exemptions for small businesses anyway. for example

In general, if your business is under $50 million in annual sales and your fuel or additive has traditional chemistry, then you are exempt from the health effects testing requirements. If you have non-traditional chemistry and are under $10 million in annual sales, you are exempt from some of the testing. EPA staff can discuss testing requirements.

[x]

or for another example:

The Federal Food, Drug, and Cosmetic Act requires packaged foods and dietary supplements to bear nutrition labeling unless they qualify for an exemption (A complete description of the requirements). One exemption, for low-volume products, applies if the person claiming the exemption employs fewer than an average of 100 full-time equivalent employees and fewer than 100,000 units of that product are sold in the United States in a 12-month period. To qualify for this exemption the person must file a notice annually with FDA. Note that low volume products that bear nutrition claims do not qualify for an exemption of this type. Another type of exemption applies to retailers with annual gross sales of not more than $500,000, or with annual gross sales of foods or dietary supplements to consumers of not more than $50,000. For these exemptions, a notice does not need to be filed with the Food and Drug Administration (FDA). On May 7, 2007, the Food and Drug Administration (FDA) launched a new web-based submission process for small businesses to file an annual notice of exemption from the nutrition labeling requirements. The new process will make it easier for businesses to update their information. In addition, firms eligible for the exemption will receive an electronic reminder when it is time to resubmit their nutrition labeling small business exemption notice.

[x]

or yet another:

Manufacturers of consumer products covered by the Department of Energy (DOE) standards with annual gross revenues not exceeding $8 million from all its operations, including the manufacture and sale of covered products, for the 12-month period preceding the date of application, may apply for a temporary exemption from all or part of an energy or water conservation standard. (42 U.S.C. 6295 (t))

[x]

so, no, regulations are not a sinister trick of large corporations to crush small business, because if they were they wouldn't specifically exempt small businesses.

does this mean that @priveetru was right? are regulations an important part of maintaining ideal market conditions and thus creating Real Capitalism, which is Good?

also no.

first, it's all "real capitalism". more regulated, less regulated, it's still Real Capitalism. and as demonstrated by the things going on around us, right now, real capitalism is Bad.

as @traveling-spartan pointed out, large corporations can simply afford to pay or dodge any fees for breaking regulation (though overall they would prefer not to have to, hence why they usually fight against regulation) and small businesses are often exempt from regulations in the first place. so who do regulations actually prevent from economic malfeasance?

nobody. not a soul. they're a completely ineffective bandaid on a bazooka wound which accomplishes nothing.

regulated or unregulated, all market economies tend towards consolidation. on a long enough timeline, all small businesses either are successful enough to become large businesses, are unsuccessful enough to go out of business, or are average enough to get bought out. it's an inevitable part of capitalism as it actually exists, and no matter what fantasy you chase after of a hypothetical, imaginary, impossible "real" capitalism, whether this fantasy is laissez-faire or tightly regulated, you will never escape that reality.

if you want to solve the problem, you can't keep chasing after an imaginary "real capitalism". instead you need to move past capitalism altogether. if you want to address the fact that bill gates and other billionaires are monopolizing farmland and therefore gaining control over our very subsistence, the solution to that isn't to sit around praying to the invisible hand of the free market to save us, and it's also not begging and pleading the existing bourgeoisie state to Le Heckin Tax The Billionaires. the real solution is for regular working class people like us to rise up and take back what is rightfully ours, and create a new state that actually serves the needs of the working people and not just the owning class.

15 notes

·

View notes

Text

One of my tiny pet peeves is fellow Americans whining about having to do their taxes themselves instead of the government sending them a bill.

The reason you have to do this is because of the existence of sole proprietorships and LLCs; ie, freelancers and small business owners like myself. A sole proprietorship isn't required to have an Employee Identification Number (EIN) that fully separates its finances from that of the individual taxpayer. You can, if you have a large business with a lot of expenses, but it's not required.

Because I have an LLC, I pay my business taxes on my own, normal tax return, and this isn't that unusual. I don't have any employees other than myself, and all my income/expenses is coming from my bank accounts, not a business bank account. A business bank account/credit card requires me to sign up for an EIN, an expense and hassle I don't need because I don't have employees other than me. I have a Tax Identification Number (TIN) which is ... just my Social Security number.

I get multiple 1040s and royalty statements that I input together before taking out my deductions. The government does not keep track of how many 1040s I get, or how much I make in royalties; that's my responsibility to manage.

And businesses take out a lot of deductions for business expenses like marketing, equipment, travel, etc. Any marketing, including Facebook ads or Tumblr ads? I can deduct them. I can deduct writing guides, computers, headphones, cover artists, editors, and so on. This then lowers the amount of money I have to pay back, because I don't get tax withholding like other people.

No, it doesn't cover everything, it's not like I just get these things for free. I just don't have to pay quite so much in taxes. In a good year I can shave about $1,500 off from my bill. (Again, I'm a very small business owner. Others can deduct thousands more than this.)

The government isn't keeping track of my expenses for me, either. How could they? It would be absolutely insane. Maybe they'll create an accounting tool someday that lets businesses track expenses and transmits this to the IRS on tax day, but for fuck's sake we haven't even rolled out a tax return system for all of the US yet, it's not going to happen.

So the government doesn't know how much of my money is coming in through my LLC. They also don't know how much I've spent on my business that I can deduct. I have to tell them all of this so that they can calculate how much I need to pay them because, again, I don't get withholding from any of my clients. And because I have an LLC that is inextricably tied to my own, individual tax return, it would be impossible for the government to tell me how much I owe versus how much my business owes.

Because not everyone gets witholding, and because there are millions of LLCs that do individual tax returns like I do, the IRS just has everyone do their own taxes. It's easier for people to start businesses through LLCs, which improves business activity in the country, and in return, the everyday non business owner just needs to copy their W2 into a form.

(Which you can do for free, btw, through places likes FreeTaxUSA. They even do my weird convoluted taxes with my millions of expenses for free. Stop paying for TurboTax. I promise you don't need it if you're a wage/salary worker.)

And no, the IRS is almost certainly never going to get rid of LLCs. It's not going to force them to do one individual tax return and one LLC tax return because that would be a stupid high amount of paperwork just for the individual tax return to have absolutely nothing on it, and the LLC to have everything.

I promise that you probably pay way less taxes than I do and you likely get a refund at the end of the year instead of having to calculate how much you'll have to pay throughout the year, put that in a savings account, and manage your expenses around tax day. It takes you maybe an hour tops to do your taxes. Me? It takes me a good half of the day.

So please stop complaining about having to take one hour out of your year to send in your taxes. You have to do this because of the many small businesses that make your food, sell you cute artwork, write stuff for you, and do a million other things that you enjoy. Just be grateful that your company does almost all of it for you and you just have to input the numbers they print on your W2.

#taxes#us taxes#death and taxes#tax#I'm just so sick of this stupid ass whining I see every year#it suggests you know not even the slightest tiniest thing about businesses#it's also very self-absorbed especially if you have very straightforward taxes#oh no you had to take an hour or two out of the day once a year!! the horror!!

5 notes

·

View notes

Text

Nershi had worked as a general engineer for the Internal Revenue Service for about nine months. He was one of hundreds of specialists inside the IRS who used their technical expertise — Nershi’s background is in chemical and nuclear engineering — to audit byzantine tax returns filed by large corporations and wealthy individuals. Until recently, the IRS had a shortage of these experts, and many complex tax returns went unscrutinized. With the help of people like Nershi, the IRS could recoup millions and sometimes more than a billion dollars on a single tax return.

But on Feb. 20, three months shy of finishing his probationary period and becoming a full-time employee, the IRS fired him. As a Navy veteran, Nershi loved working in public service and had hoped he might be spared from any mass firings. The unsigned email said he’d been fired for performance, even though he had received high marks from his manager.

As for the report he was finalizing, it would have probably recouped many times more than the low-six-figure salary he earned. The report would now go unfinished.

Nershi agreed that the federal government could be more lean and efficient, but he was befuddled by the decision to fire scores of highly skilled IRS specialists like him who, even by the logic of Elon Musk’s Department of Government Efficiency initiative, were an asset to the government. “By firing us, you’re going to cut down on how much revenue the country brings in,” Nershi said in an interview. “This was not about saving money.”

In late February, the Trump administration began firing more than 6,000 IRS employees. The agency has been hit especially hard, current and former employees said, because it spent 2023 preparing to hire thousands of new enforcement and customer service personnel and had only started hiring and training those workers at any scale in 2024, meaning many of those new employees were still in their probationary period. Nershi was hired as part of this wave, in the spring of last year. The boost came after Congress had underfunded the agency for much of the past decade, which led to chronic staffing shortages, dismal customer service and plummeting audit rates, especially for taxpayers who earned $500,000 or more a year.

Unlike with other federal agencies, cutting the IRS means the government collects less money and finds fewer tax abuses. Economic studies have shown that for every dollar spent by the IRS, the agency returns between $5 and $12, depending on how much income the taxpayer declared. A 2024 report by the nonpartisan Government Accountability Office found that the IRS found savings of $13,000 for every additional hour spent auditing the tax returns of very wealthy taxpayers — a return on investment that “would leave Wall Street hedge fund managers drooling,” in the words of the Institute on Taxation and Economic Policy.

The result, employees and experts said, will mean corporations and wealthy individuals face far less scrutiny when they file their tax returns, leading to more risk-taking and less money flowing into the U.S. treasury.

“Large businesses and higher-wealth individuals are where you have the most sophisticated taxpayers and the most sophisticated tax preparers and lawyers who are attuned to pushing the envelope as much as they can,” said Koskinen, the former IRS commissioner. “When those audits stop because there isn't anybody to do them, people will say, ‘Hey, I did that last year, I'll do it again this year.’”

“When you hamstring the IRS,” Koskinen added. “it’s just a tax cut for tax cheats.”

2 notes

·

View notes

Text

I am so fucking tired of CONTACTING PEOPLE

I had to contact dentists and I finally set up an appointment last week. Cool. However, my COBRA dental insurance is different from my employee dental insurance, which I didn’t realize until after I made the appointment, so now I have to call them back and make sure they accept my actual insurance

I contacted the tax accountant I’ve been using and she’s like lol absolutely not I can’t do scone’s foreign taxes on a joint return for you, and no, I don’t have any recommendations of who else to use, GOOD LUCK BYE. So now I’ve contacted two different accounting firms saying “hello this is my problem please god can you help us”

I contacted the immigration attorneys as well for the re-entry permit for scone, and they’re like “well you need a joint bank account, joint utilities, to be on the lease together…” and I’m like WELL scone is a fucking dumbass who refused to do any of these things except to maybe put in a WHOLE ASS RENTAL APPLICATION JUST TO BE ON MY LEASE, so… how much does that REALLY matter and they were like well. you need to provide evidence of a life together, especially if he wants to naturalize in three years. (And then I want to turn around and go SEE YOU WANTING TO BE “””INDEPENDENT””” AND “NOT RELY ON ME” IS ACTIVELY MAKING BOTH OUR LIVES ACTIVELY HARDER, but I’ll save that if I encounter further resistance.)

SO I at least didn’t have to contact the bank because I’ve been WANTING to put him on two accounts (a small checking account and the “house savings” account) but he has been declining that for the last however long, but we DO have to fill out paperwork and email it to the bank. Ugh. AND I did have to contact the BRAND NEW PROPERTY MANAGEMENT COMPANY that got sprung on us in like idk November or December or sth to be like hey how do we do this, because the “please fill out an entire new rental application” instructions were from the OLD property management company, and I would really like it if they were just like “yeah sure pls put your name here sir” and that was that

And of course I’ve been contacting people non fucking stop for jobs because that’s just. you know. what you have to do. So that’s the least of my worries, because at least that kind of contacting will eventually provide me with money.

But god please let me stop CONTACTING SOON and please god also let my husband stop being a fucking idiot about PROVING THAT WE HAVE ESTABLISHED A LIFE TOGETHER because I JOKE about government spies knowing everything about me but they wouldn’t NEED this information if that were TRUE, SCONE, JUST HAVE THIS FUCKING BANK ACCOUNT WITH ME THAT WE BOTH PAY BILLS OUT OF PLEASE FFS

#maybe I should just fucking move to Denver right now because at least then it’ll be very straightforward to put him on the lease#but ugh. rent pricing in Denver.#and ugh. moving costs.#and ugh. moving.#but I think dad is probably right and I should try to move sooner rather than later so I should get on that#potentially not just for my own mental health but for scone’s and my whole relationship#why does this have to be so HARD

3 notes

·

View notes

Text

Smoke and mirrors... so many lies, damn lies and statistics that distort the truth.

How does the average voter decide what's true?

The main thing, however, is to GET THE TORIES OUT for good. Their lies, corruption and incompetence must end now, after FOURTEEN YEARS of chaos. The country is on its knees financially after austerity, Brexit, and the arrogant idiocy of Cameron, Johnson, Truss and Sunak.

Our public services are cut to the bone, our waters are polluted because of privatisation, the standards of healthcare and social care for the elderly have fallen well below what's needed, and we can't even get affordable dentistry.

Nobody can afford to buy or rent their first home any more, or save for the future, or pay their energy bills, or afford decent childcare so that both parents can work to pay the bills. THESE ARE BASIC ESSENTIALS IN A CIVILISED SOCIETY, not 'luxuries'.

Instead, the Tories make it easy for their wealthy cronies and donors to AVOID TAX, stash money away in tax havens and pay low wages to their employees.

Britain is broken, and the lying, self-serving Tory government is to blame.

#britain#uk#uk politics#fuck the tories#conservative party#british politics#tory party#rich v poor#inequality#tory corruption#uk political news#uk election 2024

4 notes

·

View notes

Text

By: Aaron Sibarium

Published: Jun 12, 2024

Congressional Republicans introduced a bill on Wednesday that would eliminate all diversity, equity, and inclusion positions in the federal government and bar federal contractors from requiring DEI statements and training sessions.

The Dismantle DEI Act, introduced by Sen. J.D. Vance (R., Ohio) and Rep. Michael Cloud (R., Texas), would also bar federal grants from going to diversity initiatives, cutting off a key source of support for DEI programs in science and medicine. Other provisions would prevent accreditation agencies from requiring DEI in schools and bar national securities associations, like NASDAQ and the New York Stock Exchange, from instituting diversity requirements for corporate boards.

"The DEI agenda is a destructive ideology that breeds hatred and racial division," Vance told the Washington Free Beacon. "It has no place in our federal government or anywhere else in our society."

The bill is the most comprehensive legislative effort yet to excise DEI initiatives from the federal government and regulated entities. It offers a preview of how a Republican-controlled government, led by former president Donald Trump, could crack down on the controversial diversity programs that have exploded since 2020, fueled in part by President Joe Biden’s executive orders mandating a "whole-of-government" approach to "racial equity."

From NASA and the National Science Foundation to the Internal Revenue Service and the U.S Army, all federal agencies require some form of diversity training. Mandatory workshops have drilled tax collectors on "cultural inclusion," military commanders on male pregnancy, and nuclear engineers on the "roots of white male culture," which—according to a training for Sandia National Laboratories, the Energy Department offshoot that designs America’s nuclear arsenal—include a "can-do attitude" and "hard work."

The Sandia training, conducted in 2019 by a group called "White Men As Full Diversity Partners," instructed nuclear weapons engineers to write "a short message" to "white women" and "people of color" about what they’d learned, according to screenshots of the training obtained by the Manhattan Institute’s Christopher Rufo.

The bill would ban these trainings and close the government DEI offices that conduct them. It would also prevent personnel laid off by those closures from being transferred or reassigned—a move meant to stop diversity initiatives from continuing under another name.

The prohibitions, which cover outside DEI consultants as well as government officials, would be enforced via a private right of action and could save the government billions of dollars. In 2023, the Biden administration spent over $16 million on diversity training for government employees alone. It requested an additional $83 million that year for DEI programs at the State Department and $9.2 million for the Office of Personnel Management’s Office of Diversity, Equity, Inclusion and Accessibility—one of the many bureaucracies the bill would eliminate.

A large chunk of savings would come from axing DEI grants made through the National Institutes of Health (NIH), which has a near monopoly on science funding in the United States. The agency hosts an entire webpage for "diversity related" grant opportunities—including several that prioritize applicants from "diverse backgrounds"—and has set aside billions of dollars for "minority institutions" and researchers with a "commitment to promoting diversity." All of those programs would be on the chopping block should Vance and Cloud’s bill pass.

Cosponsored by Marsha Blackburn (R., Tenn.), Rick Scott (R., Fla.), Kevin Cramer (R., N.D.), Bill Cassidy (R., La.), and Eric Schmitt (R., Mo.) in the Senate, the Dismantle DEI Act has drawn support from prominent conservative advocacy groups, including Heritage Action and the Claremont Institute. At a time of ideological fracture on the right—debates about foreign aid and the proper role of government bitterly divided Trump’s primary challengers, for example, both in 2016 and 2024—Wednesday’s bill aims to provide a rallying cry most Republicans can get behind: DEI needs to die.

"It’s absurd to fund these divisive policies, especially using Americans' tax dollars," Cloud told the Free Beacon. "And it’s time for Congress to put an end to them once and for all."

The bill has the potential to free millions of Americans—both in government and the private sector—from the sort of divisive diversity trainings that have become an anti-woke bête noire. Its most consequential provisions might be those governing federal contractors, which employ up to a fifth of the American workforce and include companies like Pfizer, Microsoft, Lockheed Martin, and Verizon.

Each firm runs a suite of DEI programs, from race-based fellowships and "resource groups" to mandatory workshops, that have drawn public outcry and in some cases sparked legal challenges. By targeting these contractors, the bill could purge DEI from large swaths of the U.S. economy without directly outlawing the practice in private institutions.

Targeting accreditors, meanwhile, could remove a key driver of DEI programs in professional schools. The American Bar Association and the Liaison Committee on Medical Education, which accredit all law and medical schools in the United States and derive much of their power from the U.S. Department of Education, have both made DEI material—including course content on "anti-racism"—a requirement for accreditation, over the objections of some of their members.

Those mandates have spurred a handful of law schools to require entire classes on critical race theory. The transformation has been even more acute at medical schools, which, per accreditation guidelines released in 2022, should teach students to identify "systems of power, privilege, and oppression."

Yale Medical School now requires residents to take a mandatory course on "advocacy" and "health justice," for example. And at the University of California, Los Angeles, David Geffen School of Medicine, students must complete a "health equity" course that promotes police abolition, describes weight loss as a "hopeless endeavor," and states that "biomedical knowledge" is "just one way" of understanding "health and the world."

While the bill wouldn’t outlaw these lessons directly, it would prevent accreditors recognized by the Education Department from mandating them. Such agencies, whose seal of approval is a prerequisite for federal funds, would need to certify that their accreditation standards do not "require, encourage, or coerce any institution of higher education to engage in prohibited" DEI practices, according to the text of the bill. They would also need to certify that they do not "assess the commitment of an institution of higher education to any ideology, belief, or viewpoint" as part of the accreditation process.

Other, more technical provisions would eliminate diversity quotas at federal agencies and end a racially targeted grant program in the Department of Health and Human Services.

Unlike past GOP efforts to limit DEI, which have focused on the content of diversity trainings and the use of explicit racial preferences, the bill introduced Wednesday would also ax requirements related to data collection. It repeals a law that forces the armed services to keep tabs on the racial breakdown of officers, for example, as well as a law that requires intelligence officials to collect data on the "diversity and inclusion efforts" of their agencies.

Though officials could still collect the data if they so choose, the bill would mark a small step toward colorblindness in a country where racial record-keeping—required by many federal agencies—has long been the norm.

"DEI destroys competence while making Americans into enemies," said Arthur Milikh, the director of the Claremont Institute Center for the American Way of Life, one of the conservative groups supporting the bill. "This ideology must be fought, and its offices removed."

==

I don't care who raised it. If the Dems raised it, I'd support it. DEI is absolute poison.

#Aaron Sibarium#DEI#diversity equity and inclusion#diversity#equity#inclusion#DEI bureaucracy#DEI must die#merit#make merit matter#meritocracy#academic corruption#ideological capture#ideological corruption#diversity programs#religion is a mental illness

3 notes

·

View notes

Text

youtube

Library Petition! on change.org Libraries need funding! Is your library listed on worldcat.org? If it isn't, maybe your library system can't afford to be a member of OCLC, the nations database of catalogued books and documents. OCLC saves a librarian's time, which is sparse, and saves your taxpayer money!

For those of us who can't afford to buy books, or as many as we want, the local library is a godsend. With a free library card, we can access many books in electronic form from Galileo.org or other online sources. Ebooks on every subject you can name, electronic versions of your favorite magazines, all of this is free for every person with a library card.

Government funding has always been low for libraries, and pay low for their workers. When I worked in libraries, I was a government employee and had great benefits, though pay was a lot lower than I would have made at a similar job for a private company. Now, government employees might suddenly have to take a day or a week off WITHOUT PAY because of government furloughs. Back in the 90's, most library workers I knew had to have roommates because their full-time jobs didn't pay enough for them to live by themselves. It's worse, now. Please sign this petition. Libraries and the people who work in them are important. Your taxes pay their salaries and buy the books and databases in them. If you enjoy libraries, please let your government representatives know you think they are important!

Things you can learn in your local library:

Value of antiques you might have in your attic Manuals to repair your car Enjoy reading a popular magazine Newly-released bestsellers Classics If the library you visit doesn't have the physical book you want, you might be able to order it via Interlibrary Loan for a small fee. Local files of interest, including resources for family history researchers that aren't on the Internet yet!

Did you know there are many interesting things that aren't scanned and therefore, aren't on the Internet?

Many of these resources for researchers and family history researchers are crumbling to dust. Literally. Library workers are the ones to save this material for our posterity! The average library worker is very busy, so things like scanning materials in the archives aren't a high priority.

If research is important to you, please sign this petition! Write to your local senator and representative, and tell them how vital your research is and how it benefits people. https://www.change.org/p/require-federal-funding-for-libraries-oclc-subscriptions-and-basic-needs?recruiter=1340264102&recruited_by_id=5086dc10-21d9-11ef-bc0c-4fdea37820d7&utm_source=share_petition&utm_campaign=petition_dashboard_share_modal&utm_medium=facebook Video was made with Canva and Clipchamp #libraries, #government employees, #archives, #history, #databases, #OCLC, #cataloging, #basic library needs, #government, #funding, #petition

#books#libraries#books & libraries#cataloging#national archives#digital archives#OCLC#library funding#petitions#important#call to action#Youtube

2 notes

·

View notes

Text

What Separates a 401(k) Plan from a Pension Plan

A 401(k) differs from a pension plan in that an employee can contribute to their retirement savings account through payroll deductions. Several employers also offer matching funds. On the other hand, pension plans are retirement accounts sponsored by employers and pay out a set sum of money when the employee retires. Your salary, number of years of service, and other factors will typically determine how much you receive.

It's crucial to comprehend the costs associated with a 401k or pension if you're considering getting one. The main causes of plan expenses are contributions, returns, and management fees. However, additional costs covered by the employer, such as administration and recordkeeping fees, can also impact the cost of a 401k. It would help if you asked for a fee schedule that lists all the costs related to your plan.

Asking about service fees, which vary by fund provider, is also a good idea. Some service providers charge fees for processing tax returns, moving assets between 401(k) plan providers, and other services. A typical pension has a cost advantage of 49% over a typical 401(k)-style retirement account, according to a recent National Institute on Retirement Security analysis. This cost advantage is primarily attributable to lower investment management fees, optimally balanced investment portfolios, and longevity risk pooling.

Employer-sponsored retirement savings vehicles include pensions and 401(k) plans, two distinct types. Even though they are both well-liked, one may be preferable to the other depending on your particular circumstances due to a few differences. A 401k and a pension are fundamentally different because a 401k allows you to choose how your money is invested. Several investment options are available, including stocks, bonds, and mutual funds.

As a defined-benefit plan, a traditional pension lets you know exactly how much money you'll receive each month when you retire. The sum is determined by years of service and past salaries. The benefit is typically paid out in lump sums when you reach a certain age, a process known as vesting, or in monthly payments. However, you won't get the entire sum if you quit your job before becoming vested.

Employees can make pretax contributions to a savings account through an employer-sponsored retirement plan known as a 401(k). Employees are allowed to contribute up to a certain amount each year, and occasionally, employers match the contributions. Unlike a pension funded by the company, a 401k is based on your contributions and investments and promises to pay you a set amount of money over time. The most common kind of tax-deferred retirement account in the US is this one, which is referred to as a "defined contribution" plan.

Similar to a 401(k), pension plans have rules governing how much of your pension is tax-deductible and how much is not. General Rule, which makes use of life expectancy tables, is used to calculate the taxable portion. The general Rule can be found in IRS Publication 939, or the Simplified Method can be applied to determine a more exact figure.

Both a 401k and a pension plan offer a range of investment options. Your financial objectives and current financial situation, among other things, will influence the type of investment that is best for your retirement needs.

Employees can save for retirement through a 401(k), a defined-contribution plan, and benefit from tax breaks on their contributions. Employers frequently match these contributions. A pension plan, however, is better suited for investors who want a lifetime income guarantee after retirement. Government regulations and expert fund managers oversee the management of these plans.

By investing in various asset classes, including stocks and bonds, pension funds seek to diversify their portfolios. Additionally, they can invest in derivatives and alternative investments, reducing the risk of losing money on a single investment.

2 notes

·

View notes

Link

0 notes