#home Insurance

Explore tagged Tumblr posts

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

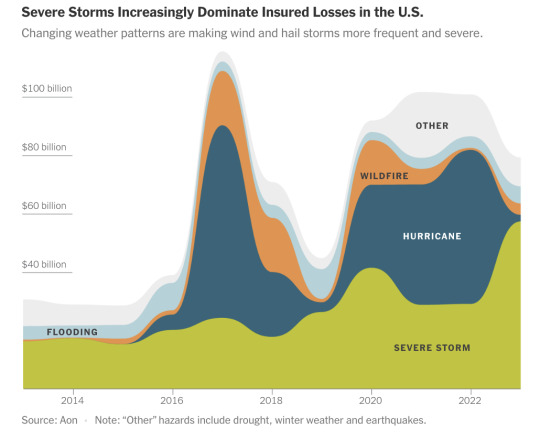

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

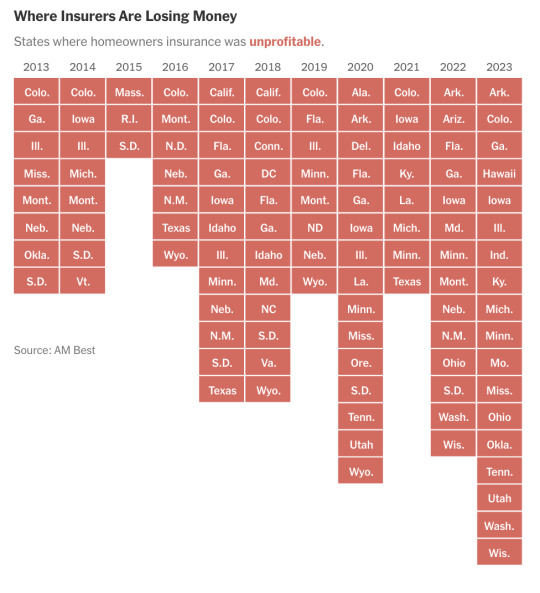

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

121 notes

·

View notes

Text

#tiktok#California#tw fire#home insurance#palisades fire#capitalism kills#capitalism is evil#capitalism is a scam#capitalism is a disease#capitalism is hell#climate change#climate crisis

19 notes

·

View notes

Text

Cindy Picos was dropped by her home insurer last month. The reason: aerial photos of her roof, which her insurer refused to let her see.

“I thought they had the wrong house,” said Picos, who lives in northern California. “Our roof is in fine shape.”

Her insurer said its images showed her roof had “lived its life expectancy.” Picos paid for an independent inspection that found the roof had another 10 years of life. Her insurer declined to reconsider its decision.

Across the U.S., insurance companies are using aerial images of homes as a tool to ditch properties seen as higher risk.

Nearly every building in the country is being photographed, often without the owner’s knowledge. Companies are deploying drones, manned airplanes and high-altitude balloons to take images of properties. No place is shielded: The industry-funded Geospatial Insurance Consortium has an airplane imagery program it says covers 99% of the U.S. population.

The array of photos is being sorted by computer models to spy out underwriting no-nos, such as damaged roof shingles, yard debris, overhanging tree branches and undeclared swimming pools or trampolines. The red-flagged images are providing insurers with ammunition for nonrenewal notices nationwide.

“We’ve seen a dramatic increase across the country in reports from consumers who’ve been dropped by their insurers on the basis of an aerial image,” said Amy Bach, executive director of consumer group United Policyholders.

The increasingly sophisticated use of flyby photos comes as home insurers nationwide scramble to “derisk” their property portfolios, dropping less-than-perfect homes in an effort to recover from big underwriting losses.

(continue reading)

56 notes

·

View notes

Text

2 notes

·

View notes

Text

Why did you buy a house? Metropolitan Life Insurance Company ad - 1958.

#vintage illustration#vintage advertising#insurance#home insurance#insurance companies#met life#metlife#metlife insurance#metropolitan life insurance company#metropolitan life insurance#metropolitan life

3 notes

·

View notes

Text

Find the Cheapest Travel Insurance for Schengen Visa:

Introduction to Schengen Travel Insurance

Once in Europe traveling is full of excitement. But, it’s significant to be well-protected. Schengen travel insurance is not something that is suggested as an option, it is rather a mandatory requirement which is made compulsory for all Schengen visa applicants. Besides healthcare, it also protects passengers from such types of expenses as trip cancellations and other unforeseen contingencies. Let’s explore the Cheapest Travel Insurance for Schengen Visa in this article.

Understanding Cheapest Travel Insurance for Schengen Visa Requirements

In particular, the insurance policy that is compulsory when applying for the Schengen visa is vital when arranging your European trip. The policy should insure at least €30,000 for the medical expenses and the repatriation returning the insurance sum to the insurance company. It must provide you with pass-free access to all Schengen countries for the entire period of your stay.

The Importance of Travel Insurance for Schengen Visa Applicants

Securing travel insurance is not merely a tick off of the “to have” list, but a support that is there for the times when you need it the most. In this way, the provider is prevented from the situations of not going anywhere like emergency happenings, robbery, or the hurdles of the trip.

Selecting the Right and Cheapest Travel Insurance for Schengen Visa Plan

Deciding the best insurance plan may be a challenge but it’s important to forget about possible uncertainties during a trip. The following is an explanation of how to choose an insurance package that covers the essentials with a budget in mind and how to find Cheapest Travel Insurance for Schengen Visa.

2 notes

·

View notes

Text

Phone: (858) 569-1009

Address: 10769 Woodside Ave Ste 103, Santee, CA 92071, United States

Email: [email protected]

LOCAL INSURANCE AGENCY OFFERING ALL LINES OF INSURANCE. AUTO INSURANCE, HOME INSURANCE, RENTERS INSURANCE, MOBILE HOME INSURANCE, MANUFACTURED HOME INSURANCE, LIFE INSURANCE, BUSINESS INSURANCE, WORKERS COMP

2 notes

·

View notes

Text

How to Choose the Right Home Insurance in the UAE?

Home insurance is a type of property insurance that covers losses and damage that occur to an individual’s house or insured belongings. The coverage can cover costs due to natural calamities such as floods and earthquakes. Plus, it covers fire-related damages to the property.

Although the UAE is one of the safest places, the absence of home insurance can put a huge financial burden on people for rebuilding. In this blog, find out how to choose the right home insurance in the UAE.

Understand Insurance Needs

The first step is to understand personal insurance needs. The location of the residence is one of the major factors one should consider while opting for a home insurance policy. In addition, decide if you want insurance coverage only for the property or the belongings in the house or both. Other factors such as age, income, health, employment, settlement plan, family and more can be considered too.

Do Research

Do your own research about the different insurance companies. Find out the following about the insurance providers:

Company Reputation

Financial Stability

Customer Service

Claim Settlement Time

Search online for reviews, customer feedback and ratings. Seek help from friends and families. Else, get expert advice from insurance experts in the UAE. Also, it is important that the insurance provider has a licence as per the laws in the UAE.

Compare Different Home Insurance Policies

Once you narrow down the list of insurance companies, start comparing different home insurance policies offered. Read carefully each and every detail to have a complete understanding of the insurance coverage promised. Plus, read the terms and conditions thoroughly. Compare the procedures to claim insurance and the time required to achieve a settlement.

Consider the Features

Find out if there are additional benefits or add-ons offered by the insurance company in addition to the standard coverage. It is necessary to cover specific needs besides basic coverage. However, one of the main factors to consider is the cost. Take time and assess if the add-ons are worth the additional money.

Budget

The cost of a home insurance policy is one of the key factors that distinguish one insurer from another. Compare the following things to find the best insurance policy that provides the best value:

Premium

Deductible Amounts

Exclusions

Discuss if there are discounts or promotions that can significantly lower the cost and boost savings on insurance.

Review

Periodical review of the home insurance is essential to meet the changing needs and the coverage required. The best thing is to review annually if the insurance coverage is enough for the future.

Claim Rejection

Make sure to submit all the necessary documents and provide all the necessary details to avoid claim rejection when one needs it the most. As world events become more unpredictable, choosing a home insurance policy can keep everyone protected. Crossroads Insurance Brokers is a leading insurance broker in the UAE offering cutting-edge insurance solutions. Contact us for more details.

#property insurance#insurance broker in the UAE#home insurance#property insurance in UAE#personal insurance

2 notes

·

View notes

Text

0 notes

Text

Save and share this video to protect yourself and your neighbors! #la #c...

youtube

0 notes

Text

Apply for LIC Agent Online- Start Your Career with Flexible Opportunities

Life Insurance Corporation (LIC) provides individuals with the opportunity to build a flexible and profitable career by becoming a licensed agent. This guide will walk you through the process and advantages of applying online, ensuring your journey begins smoothly.

Applying for LIC agent online is a straightforward process designed to make it convenient for aspiring agents to start their professional journey. By opting for the online application method, you save time and gain access to detailed information regarding requirements and procedures. The process begins with visiting the official LIC website, where you can find the agent application form. Fill in your details accurately, including your educational qualifications and personal information. Ensure that you meet the minimum eligibility criteria, which includes being at least 18 years old and having completed 10th grade.

Once your application is submitted, the next step involves attending the mandatory training program conducted by LIC. This training program is comprehensive and aims to equip you with the skills and knowledge needed to excel as an LIC agent. The training covers essential topics like understanding LIC policies, handling clients, and building long-term relationships. Visit the official LIC website to begin your application and explore the incredible opportunities waiting for you in the world of insurance!

#how to become lic agent in delhi#how to apply for lic agent in delhi#want to become lic agent in delhi#agent#how to join lic as an agent#join us#financial planning#insurance#insuranceagent#business growth#business loan#business plan#career#insurance policy#health insurance#home insurance#loans#personal loans

0 notes

Text

Hello all

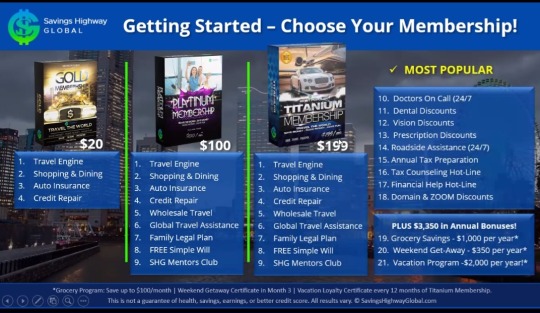

Savings Highway Global-Free memberships is not just to save on your gas. It helps in everything important to save on. Check out Home/Car insurance. Savings is why SHG promotes free memberships.

Eng:

save101.savingshighwayglobal.com/?page=shg10min

Spanish:

save101.savingshighwayglobal.com/?page=shgespan…

#savings#free memberships#benefits#opportunity#grocery savings#medical savings#Tele medical#medical#car insurance#home insurance#vacations#trips#hotels#car rental#Tele-pet#Tele-Vet#crusies#travel#cheap travel#family wills#roadside assistance#cybersecurity#sloar biz#solar#dental clinic#dental care#vision#perscription discounts

0 notes

Text

#Health insurance#Fire insurance#Flood insurance#Home insurance#Capitalism#Socialism#Communism#LA fires#Hurricanes

1 note

·

View note

Text

Home Insurance in Dubai: What Every Expat Needs to Know

For expats living in Dubai, securing home insurance might not be the first thing on their checklist when relocating. However, understanding and obtaining appropriate home insurance coverage is essential for safeguarding your property and belongings against unforeseen events. This comprehensive guide will walk you through the essentials of home insurance in Dubai, explore coverage options for both renters and homeowners and provide insights into UAE regulations that affect expats.

Why Home Insurance Is Crucial for Expats in Dubai

Dubai is known for its luxury, safety, and modern infrastructure. While it offers an exceptional lifestyle, no place is immune to risks like fire, theft, water damage, or natural disasters. Home insurance is a financial safety net to protect your property and valuables.

For ex-pats, home insurance offers:

Peace of Mind: Your home and belongings are protected against unexpected events.

Compliance with Lease or Mortgage Agreements: Many landlords or lenders in Dubai may require insurance as part of their terms.

Affordable Protection: Coverage options in Dubai are often cost-effective, especially compared to potential losses.

Understanding Home Insurance in Dubai

Home insurance in Dubai generally falls into two main categories:

1. Building Insurance

This type of coverage protects the structure of your property, including walls, roof, and fittings. It is essential for homeowners, especially those with villas or apartments purchased in freehold areas.

2. Contents Insurance

Contents insurance covers your personal belongings, such as furniture, electronics, appliances, and valuables, against risks like theft, fire, or water damage. This type of insurance is particularly relevant for renters.

Key Features of Home Insurance Policies in Dubai

All-Risk Coverage: Protects against a wide range of perils, including fire, flood, theft, and accidental damage.

Worldwide Personal Belongings Cover: Some policies cover personal items lost or damaged outside your home.

Alternative Accommodation: This covers temporary housing costs if your home becomes uninhabitable due to a covered event.

Liability Coverage: Protects you against claims from third parties for injury or property damage caused within your home.

Coverage Options for Renters in Dubai

Renters in Dubai often underestimate the importance of home insurance, assuming their landlord’s policy provides sufficient coverage. However, a landlord’s insurance typically only covers the building structure, leaving tenants responsible for their personal belongings.

What Renters Should Look for in a Policy

Contents Insurance:

Covers household items like furniture, electronics, and clothing.

Protection against fire, theft, and accidental damage.

Personal Liability Insurance:

It covers legal liabilities if a guest is injured in your rented property.

Optional Add-Ons:

High-value items like jewelry or art collections.

Accidental damage to the landlord’s property.

Estimated Costs for Renters

Contents insurance policies for renters in Dubai can start as low as AED 300 annually, depending on the coverage limits and add-ons selected.

Coverage Options for Homeowners in Dubai

Homeowners in Dubai, particularly in freehold areas, have more responsibilities when protecting their investments. A comprehensive home insurance policy is essential to safeguard the building and its contents.

What Homeowners Should Look for in a Policy

Building Insurance:

Covers the physical structure of your home.

Protection against natural disasters like storms and floods is possible, though rare.

Contents Insurance:

Ensures that your personal belongings are protected.

Public Liability Insurance:

Essential for villa owners, covering damages or injuries to third parties within your property.

Mortgage Protection:

Some lenders require homeowners to have insurance that covers the outstanding mortgage in case of property damage.

5. Estimated Costs for Homeowners

Comprehensive property insurance for homeowners typically starts at AED 1,000 annually, depending on the property’s value and coverage level.

Compliance with UAE Regulations for Home Insurance

Expats should be aware of the regulatory framework governing home insurance in Dubai. While property insurance is not mandatory in the UAE, there are instances where it becomes a requirement:

1. For Mortgaged Properties

Banks and financial institutions often require homeowners to have building insurance as part of their mortgage agreement. This ensures the lender’s investment is protected in case of property damage.

2. For Rental Agreements

Some landlords may require tenants to secure liability insurance to protect against damages to the property.

3. Freehold Property Ownership

Expats purchasing properties in Dubai’s freehold areas should consider home insurance to protect their investments.

Regulatory Oversight

Home insurance policies in Dubai are regulated by the UAE Insurance Authority, ensuring transparency and consumer protection.

Policies must adhere to guidelines that define minimum coverage levels and claim processes.

Top Providers for Home Insurance in Dubai

When choosing a home insurance policy in Dubai, comparing providers based on coverage options, customer reviews, and pricing is essential. Here are some of the leading insurers:

1. GIG Gulf

Comprehensive coverage for renters and homeowners.

Flexible add-ons like jewelry and personal belongings protection.

Competitive premiums tailored to individual needs.

Building and contents insurance with high coverage limits.

Exceptional customer service and a simple claims process.

2. RSA Insurance

Specialized packages for expats, including worldwide belongings coverage.

Offers discounts for bundling home and car insurance.

3. Oman Insurance

Affordable premiums with customizable policies.

Extensive network for claims processing and support.

How to Choose the Right Home Insurance Policy

Choosing the right home insurance policy protects your property and belongings against unforeseen events. However, with various policies and providers available in Dubai, selecting the most suitable plan can feel overwhelming. You can find a policy that provides comprehensive coverage while staying within your budget by evaluating your specific needs and following a structured approach. Here are five key steps to help you make an informed decision:

1. Assess Your Coverage Needs

The type of home insurance you require depends on whether you’re a renter or a homeowner:

For Renters: Your primary concern as a tenant is the protection of your personal belongings. Focus on a contents insurance policy that covers furniture, electronics, clothing, and other valuables. Additionally, ensure your policy includes liability insurance, which protects you if a guest is injured in your home or if you accidentally damage the property.

For Homeowners: If you own a property in Dubai, you’ll need more comprehensive coverage. A robust policy should include building insurance to protect the structure of your home, including walls, roof, and fittings. Additionally, contents insurance is vital to safeguard personal belongings within the property. For villa owners, public liability coverage is also recommended to cover injuries or damages to third parties.

2. Compare Quotes

Once you’ve identified your coverage needs, the next step is to gather quotes from multiple insurance providers. Comparing policies allows you to evaluate:

Premiums: Understand the cost of your policy and how it fits within your budget.

Coverage Limits: Ensure the policy protects your home and belongings adequately.

Additional Benefits: Some insurers may offer discounts for bundling home and car insurance or incentives for new customers.

Use online comparison tools or consult with insurance brokers to simplify this process.

3. Read the Fine Print

Insurance policies often contain specific exclusions, coverage limits, and conditions that may take time to be apparent. Carefully review the terms and conditions to avoid surprises during a claim:

Exclusions: Understand what is not covered by your policy, such as damages caused by wear and tear or certain natural disasters.

Coverage Limits: Check the maximum payout limits for building and contents coverage. Ensure these limits align with the value of your home and possessions.

Claim Procedures: Familiarize yourself with the steps for filing a claim to ensure a smooth process during an incident.

4. Consider Add-Ons

Many insurers in Dubai offer optional add-ons to enhance your policy. Evaluate these extras to determine if they’re worth the additional cost:

Accidental Damage Cover: Protects against damages caused unintentionally, such as spilling liquids on expensive electronics.

High-Value Items Cover: Provides additional jewelry, artwork, or collectibles coverage.

Home Assistance Services: Includes emergency repairs for plumbing, electrical, or HVAC issues.

While these add-ons may increase your premium, they can offer significant value and peace of mind.

5. Check Reviews and Ratings

Researching customer reviews and ratings is essential in selecting a reliable insurer. Look for feedback on:

Claims Handling: How efficiently and fairly the insurer processes claims.

Customer Support: Availability and responsiveness of customer service teams.

Reputation: Established insurers with positive reviews are often more reliable.

Filing a Home Insurance Claim in Dubai

Knowing how to file a home insurance claim is crucial to ensure a smooth and efficient process during stressful times. Here are the steps to follow:

Steps to File a Claim

Notify Your Insurer: Contact your insurance provider immediately after an incident through their hotline, mobile app, or customer portal. Prompt notification is essential for a valid claim.

Provide Documentation: Submit necessary documents to support your claim, including:

A police report for theft or vandalism incidents.

Photographs or videos showing the extent of the damage.

Proof of ownership for affected items, such as receipts or invoices.

Inspection and Assessment: The insurer may send an adjuster to assess the damage and verify the claim details.

Claim Settlement: Once approved, the insurer will compensate you based on the terms of your policy, either by reimbursing costs or arranging repairs.

Tips for a Smooth Claim Process

Maintain an Inventory: To streamline the claims process, keep a detailed list of your belongings, including photographs and receipts.

Document All Damages: Ensure all damages are thoroughly documented and submitted to your insurer before initiating repairs.

Stay Informed: Familiarize yourself with your policy’s claim procedures and timelines to avoid delays.

Conclusion

For expats in Dubai, securing the right home insurance is an essential step in protecting your property and belongings. Whether you’re a renter safeguarding your valuables or a homeowner ensuring a significant investment, understanding your options and compliance requirements ensures peace of mind.

With providers like GIG Gulf, finding a tailored policy that meets your needs is easier than ever. Don’t leave your home unprotected—invest in a comprehensive home insurance policy today.

#home insurance#home insurance quote#contents insurance#content insurance dubai#home contents insurance#house insurance#fire insurance#home insurance dubai#flood insurance#property insurance

0 notes