#health insurance policies

Explore tagged Tumblr posts

Text

#luigi mangione#😂☠️#***#context for my non-american followers: once you turn 26 you are no longer allowed to be on your parents' health insurance policy#****

24K notes

·

View notes

Text

6 Major Benefits Of Health Insurance Policy In 2024

In today’s uncertain world, securing health is one of the smartest decisions you can make for yourself and your family. Considering that the costs of medical treatments are increasing year by year, it is more important than ever to have a health insurance policy. But, what exactly are the benefits of health insurance that make it such an important financial instrument? In this article, we will explore six major benefits of health insurance in 2024, and why now is the perfect time to choose the right health insurance policy. for more information contact us: +91-9990260111

#Health Insurance Policy#Health Insurance in Noida#Health Insurance Plans#Health Insurance Policies#Assurein

0 notes

Text

5 Reasons Why Health Insurance is a Must-Have for Every Family

In today’s world, health and well-being are of paramount importance. With rising medical costs and unpredictable health conditions, having health insurance is no longer an option but a necessity. Whether it’s for routine check-ups or emergencies, the right health insurance policy can protect your family from unexpected financial burdens. Here are five reasons why every family should consider purchasing health insurance.

1. Protection Against Rising Medical Costs

Healthcare expenses are on the rise, and without adequate coverage, a single medical emergency could drain your savings. Medical insurance provides financial support for hospitalization, surgeries, treatments, and even pre-and post-hospitalization expenses. Having a solid mediclaim policy ensures you and your family can get the necessary care without worrying about the costs involved.

With multiple health insurance plans available, you can find one that offers comprehensive coverage at an affordable premium. By opting for care health insurance, you can even secure a plan that covers outpatient services, maternity benefits, and much more, safeguarding your family against high medical bills.

2. Access to Quality Healthcare

One of the greatest advantages of having the best health insurance is the access to a network of hospitals and healthcare providers. Many health insurance plans offer cashless treatment at empaneled hospitals, allowing you to focus on getting the right care instead of managing bills. This is particularly useful during emergencies when immediate care is critical.

Having a health insurance policy ensures your family can receive top-quality care without the stress of upfront payments, making healthcare both accessible and affordable.

3. Tax Benefits

A lesser-known benefit of buying health insurance is the tax relief it provides. Under Section 80D of the Income Tax Act, you can claim deductions on the premiums paid for health insurance policies. This is not only an incentive to buy health insurance but also a way to reduce your tax burden while protecting your family’s health.

For families, there are additional deductions available when purchasing mediclaim policies for dependent parents, making health insurance a wise financial decision.

4. Comprehensive Coverage for Your Entire Family

The best part about health insurance plans is that you can opt for a family floater policy. A single health insurance policy can cover all members of your family, including your spouse, children, and dependent parents. This simplifies managing healthcare needs and ensures that everyone is protected under one plan.

Whether it’s routine health check-ups or emergencies, having care health insurance means you won’t have to worry about paying separate premiums for each family member. This provides peace of mind, knowing that your entire family’s health is secured under one umbrella.

5. Financial Security During Medical Emergencies

Life is unpredictable, and a medical emergency can strike at any time. Having medical insurance ensures that you are prepared to handle such situations without exhausting your savings or taking on debt. With the right mediclaim policy, your family’s financial future remains intact, even in the face of health challenges.

Moreover, many health insurance plans also provide coverage for critical illnesses, long-term treatments, and surgeries, ensuring that you don’t have to compromise on the quality of care. By choosing the best health insurance, you can focus on recovery, knowing that your financials are secure.

Conclusion

In a world where medical costs are rising and health risks are ever-present, health insurance is a must-have for every family. It provides a safety net, ensuring that you and your loved ones receive the best care when needed. From offering protection against financial strain to providing access to quality healthcare, a good health insurance policy offers numerous benefits.

If you haven’t already, consider the different health insurance plans available and buy health insurance that suits your family’s needs. With the right plan in place, you can protect your health and secure your financial future.

#health insurance online#group health insurance#health insurance plans#family health insurance#health insurance#health plan#health#health insurance policies

0 notes

Text

I used to run a doctor's office. If your doctor's office hasn't explained this to you, let me do it for them.

You probably don't know how much time your doctor and their staff spend fighting with insurance companies for routine, ordinary things. The stories you see online might leave you thinking that these fights are, if not rare, maybe occasional. A sometimes sort of challenge.

Nope.

It's every day. It's all day. Your doctor's office has employees who fight with insurance companies as a full time job.

This isn't an accident or a side effect of other market forces at work - this is the deliberate, calculated plan the insurance companies have chosen to implement. They know very well it is hurting patients and providers, and they're okay with that because their priority is to maximize ROI for investors and other stakeholders. They're in the business of business, and they don't give a single fuck about human beings or health care.

They've lowered reimbursements in primary care so effectively that primary care has only survived in many parts of the US by becoming a loss leader for larger health systems. You know how the local retail store gets you in the building by selling something at slightly below cost because they know you're likely to buy more once you're inside? It's like that, a loss leader.

The health system where you get your primary care often loses money when you see your PCP, but since your PCP refers you to speciality care inside their own organization, the system makes up the money when your doctor sends you to see their own systems' surgeons, endocrinologists, dermatologists, etc.

Smaller primary care practices literally can't survive. That's why there are almost no independent family doctors any longer. That's why it is so hard to see the same provider with consistency, someone with whom you can develop trust over time, who knows you and knows your challenges. United Healthcare and it's private healthcare insurance competitors have nearly finished killing off that kind of primary care.

Larger primary care practices (30-40 providers) might still be able to make ends meet independently through economies of scale and/or what they earn by doing their own lab/testing/imaging services in-house, but that won't work much longer if current trends continue. We're headed in the direction of just a handful of vertically integrated businesses running healthcare, and they are in the business of business, not health care.

The insurance companies deliberately create administrative barriers which make it expensive for your doctor's office to advocate for you because it moves administrative costs away from the insurance company and onto your doctor's office. This results in fewer paid claims when your doctor's office can't afford to hire another full time position whose only job is to argue with insurance companies and jump through their deliberately obstructive hoops. They want your PCP to be struggling to stay open. They want your PCP unable to afford the cost of overcoming the administrative burdens they have deliberately created for the purpose of denying you the health care your doctor thinks you need.

There are other words for this, but the most appropriate one is "evil."

I don't want to glorify murder or lionize Luigi Mangione, but Brian Thompson was a ghoul, his senior team are ghouls, and the for-profit health insurance industry is a disaster for Americans, even those Americans who don't yet see the problem affecting themselves. They will.

We need universal, single-payer health coverage, just like every other wealthy nation.

We're not going to get it any time soon, and things are about to get worse for healthcare in the US.

Set aside the damage RFK Jr is likely to do to an already patchwork public health system by attacking regulations and spreading misinformation. Let's look at other ways Trump and the GOP plan to worsen health care.

1. They're going to go after Medicare and Medicaid benefits. They'll seek to lower them and raise the bar which must be cleared to receive them.

2. They're going to seek to raise the age for social security benefits (above 70!), and reduce benefits paid, so the most financially vulnerable seniors will have greater out-of-pocket costs. Those seniors are going to struggle harder with out-of-pocket costs.

3. They're going to attempt to cripple the Affordable Care Act (AKA 'Obamacare'), despite the fact that the ACA has been a HUGE money maker for the private insurance companies.

4. This administration will be run by hyper capitalist billionaires. It will seek to deregulate wherever possible and promote supply-side economics (tax breaks for the rich and large corporations) at every opportunity. United Healthcare and its competitors, which already weild an obscene, horrific amount of control over US Healthcare, are about to get substantially more power.

It's bad, folks. It's a very bad time to be sick and it's going to get worse.

Alan Grayson was right in 2009. The Republican health care plan has been and remains:

* Don't get sick

* If you do get sick, die quickly.

#health care#insurance companies#health insurance#luigi mangione#the adjuster#explainer#healthcare#primary care#Us politics#Us healthcare policy#Death of Primary Care

90 notes

·

View notes

Text

Wow shocking things might be getting out of control, how could anyone have seen this coming?

#culture#leftism#politics#the left#progressive#us politics#communism#eat the rich#tax the rich#corporate greed#unitedhealth group inc#united states#united healthcare#issue#reporting#healthcare industry#healthcare#insurance company#insurance agency#insurance policy#insurance claims#health insurance#medical care#us healthcare#american healthcare#fuck work#fuck trump#republicans#project 2025#2024 election

49 notes

·

View notes

Text

.

#Mental health so bad it got me searching “can people on disability get a life insurance policy on themself”#mental illness that got me calculating family finances just in case 😶#suicide tw#delete later i am just using tumblr like my silly little diary as usual because i am too ashamed to talk to people#like a normal person#cries for help and all that blah blah anywayyyyy#now i return to fandom posting as usual because grinning and bearing it has gotten me through 27 years so far!#jun rambles#jun rants

7 notes

·

View notes

Text

#term life insurance#whole life insurance#life insurance#insurance policy#health insurance#insurance

3 notes

·

View notes

Text

I think the OPTIMATAL SCU Topaz is to make her Interpol and end up with a Nate/Sophie thing with Rouge

#scu#sonic the hedgehog#topaz/rouge#thoughts#probably fewer of her family members would die as the direct result of a health insurance company's inhuman denial policies

2 notes

·

View notes

Text

AN OPEN LETTER to THE U.S. HOUSE OF REPRESENTATIVES

Pass H.R. 6270, the State-Based Universal Health Care Act!

371 so far! Help us get to 500 signers!

I strongly urge the Congressmember to support and help pass H.R. 6270, the State-Based Universal Health Care Act, introduced by Rep. Ro Khanna of California. This bill helps states test universal health plans that could be a model for a national plan - a Universal, Simple, and Affordable (USA) plan. A USA plan will drastically reduce administrative overhead, freeing billions of dollars for our health care and general welfare. With your support, states can save money and provide health care for all their residents. How H.R. 6270 moves us toward health care that is universal, simple, and affordable (USA): Mandates that participating states guarantee healthcare coverage for at least 95% of residents in the first 5 years, thus reducing the uninsured and underinsured populations to less than 5% (currently 30% in most states). Requires any state-based plan to have benefits equal to or greater than those received by beneficiaries of federal healthcare programs. Allows states to cooperate on multi-state plans. Section 1332 of the ACA does not. Enables states to integrate Medicare funds into a state plan. Section 1332 does not. This is critically important for equity. Please work to pass this bill, and then get to work passing Medicare For All. Nothing else will fully solve our healthcare crisis.

▶ Created on April 8 by Jess Craven

📱 Text SIGN PEUMEL to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#JESSCRAVEN101#PEUMEL#resistbot#open letter#activate your activism#healthcare#universal healthcare#congress#legislation#healthcare for all#us house of representatives#hr6270#state based healthcare#affordable care#health insurance#healthcare act#healthcare plan#healthcare coverage#public health#us congress#medicare for all#us politics#healthcare crisis#health policy#healthcare equality#us government#healthcare legislation#health reform#us lawmakers#health benefits

7 notes

·

View notes

Text

i also love jokes & am making no moral comment but i don't really understand why there have been multiple people celebrating the death of the health insurance CEO as a solution to the problem of american healthcare? there have been no reforms; no reforms are on the table; the only change that seems to have taken place is that large insurers are now paying for more private security for executives, which doesn't seem like the kind of shift likely to result in lower premiums or higher approval rates

#i am deeply sympathetic to 'this guy sucked and he died yay' & again i am not making a moral comment#i understand the 'we show them how strong we are & they offer us concessions' argument but i don't see that actually happening rn?#i am aware of the bcbs ny/ct policy change but i see no reason they won't wait six months & do it again. it's fucked! it's all fucked.#perhaps i am wrong & there is in fact some kind of huge swing now in motion; i would be glad to be wrong; just seems at best. uh.#preemptive. is all i'm saying#tangentially related i have seen multiple people go 'you don't know how bad it was before the ACA! people used to stay#in bad relationships & dangerous jobs just to keep their health insurance!' which has made me nuts#like sure it's true i wasn't buying health insurance before the ACA & i did like staying on my mom's insurance until i was 26#but i could not buy health insurance after i turned 26; i could not afford even a catastrophic coverage plan; i lived in a red state#it's annoying to see people lectured for not appreciating material improvements to their lives when their lives have not improved#because they do not live in the commonwealth of massachusetts! or whatever! anyway!

3 notes

·

View notes

Text

I would never condone violence against anyone, and the loss of any life in such a manner is a profound tragedy. That said, this event has sparked a critical and necessary conversation about the devastating impact of insurance companies denying claims for essential healthcare.

#psychiatry#mental health#doctor#medical#mental health matters#shrinks in sneakers#insurance#health insurance#united healthcare#united health group#insurance claims#insurance company#insurance policy

4 notes

·

View notes

Text

dude insurance executives should literally be burned at the stake

#not blue cross blue shield deciding how long a surgery ‘should’ take and refusing to pay for general anesthesia beyond that timeframe#great new policy guys#i’m sure it won’t cause surgeons to rush or unnecessarily split up procedures doubling the risk of complications#or bankrupt patients WHO PAY OUT THE ASS FOR HEALTH INSURANCE for getting necessary procedures#that’s fine.

5 notes

·

View notes

Text

The ceo of United healthcare was shot and killed in midtown nyc today

Looks like other people are also pissed about their insurance too

#my dilemma is I don’t think ceos should be killed for being ceos bc at the end of the day they are ‘laborers’ aka employees of a company#like usually it’s the shareholders that made a decision to make insurance more expensive and fuck you over and the ceo is just a figurehead?#but at the same time I think we should abolish health insurance and have government regulations on medical care#and I guess rip that guy but I’m hoping some positive healthcare policy change could come from this but that seems unlikely. tbh

2 notes

·

View notes

Text

How to File a Reimbursement Claim on Health Insurance Policy?

Filing a reimbursement claim on a health insurance policy might seem daunting, but with the right information and a systematic approach, it can be a smooth process. Whether you have a policy from Care Health Insurance or any other provider, understanding the steps and requirements is crucial to ensure a successful claim. In this blog, we’ll guide you through the process of filing a reimbursement claim, making it easier for you to navigate the complexities of health insurance.

Understanding Health Insurance Reimbursement Claims

A reimbursement claim is when you pay for medical expenses out of pocket and then claim the amount from your health insurance provider. Unlike cashless claims, where the insurer directly settles the bill with the hospital, reimbursement claims require you to pay first and then get reimbursed.

Steps to File a Reimbursement Claim on Health Insurance Policy

1. Notify Your Insurance Provider

The first step in filing a reimbursement claim is to notify your health insurance provider as soon as possible after hospitalization. Most insurers, including Care Health Insurance, require you to inform them within 24 to 48 hours of admission for emergency treatments and 48 to 72 hours prior for planned hospitalizations. Check the specific timelines mentioned in your health insurance policy.

2. Collect All Necessary Documents

Proper documentation is critical for a successful claim. Here’s a list of documents you’ll typically need:

Claim form: Filled and signed claim form provided by your insurer.

Discharge summary: A detailed report from the hospital outlining the treatment received.

Medical bills: Original, itemized bills for all medical expenses.

Prescriptions: Copies of doctor’s prescriptions for medicines and tests.

Investigation reports: All diagnostic and test reports.

Hospital bills: Detailed bills from the hospital, including room charges, operation theater charges, etc.

Policy documents: A copy of your health insurance policy.

ID proof: Your identification proof.

3. Submit the Claim Form and Documents

Once you have gathered all the necessary documents, submit them to your health insurance provider. You can usually do this via mail, email, or by uploading them through the insurer’s online portal. Make sure to keep copies of all documents for your records.

4. Follow Up on Your Claim

After submitting your claim, follow up with your insurance provider to ensure that your documents have been received and are being processed. Most insurance companies will provide you with a reference number for your claim, which you can use to track its status.

5. Claim Approval and Reimbursement

If your claim is approved, the insurer will notify you and reimburse the amount directly to your bank account. The reimbursement process may take anywhere from a few days to a few weeks, depending on the insurer and the complexity of your claim.

Tips for a Smooth Reimbursement Claim Process

Understand your policy: Familiarize yourself with the terms and conditions of your health insurance policy, including exclusions and the claim process.

Keep records: Maintain organized records of all medical treatments and expenses.

Timely submission: Ensure you submit all required documents within the stipulated time frame.

Seek assistance: Don’t hesitate to contact your insurer’s customer service for guidance if you’re unsure about any part of the process.

Conclusion

Filing a reimbursement claim on a health insurance policy doesn’t have to be a stressful experience. By understanding the process and being prepared with the necessary documents, you can ensure a smooth and efficient claim. Whether you have the best health insurance plan or are looking to buy health insurance, knowing how to file a reimbursement claim is essential. Take advantage of your mediclaim policy to get reimbursed for your medical expenses and secure your health and financial well-being.

By following these steps and tips, you can confidently navigate the reimbursement claim process and make the most of your health insurance benefits. If you have any specific questions or need further assistance, don’t hesitate to reach out to your health insurance provider for support.

#insurance#insurance company#group health insurance#health insurance plans#health insurance policies#family health insurance#health insurance#health care

0 notes

Text

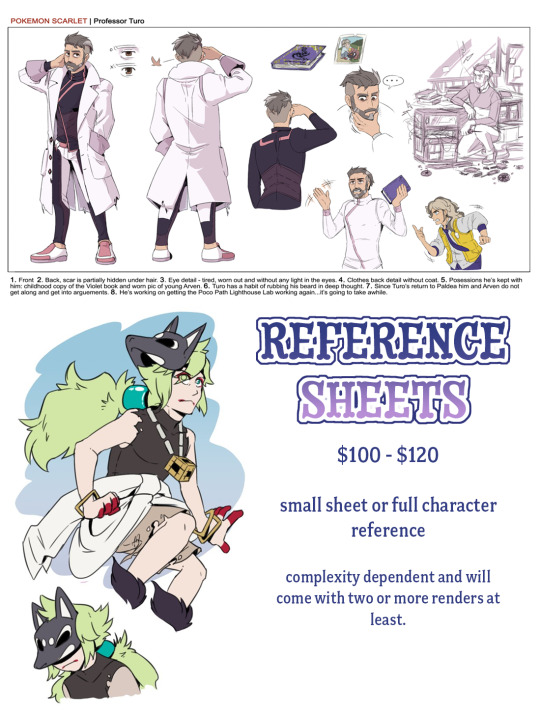

✨WOWZERS! Commissions are open!

A "help me pay medical bills cause I'v been paying out of pocket and my health insurance won't help me with a dime 👍👍👍"

Im currently taking 3 slots and will be leaving the form open for a bit so take your time filling it out! Turn around time is two weeks unless more is needed and each commission has its place in queue so they're given adequate time. I can do humans/pokemon/furry etc and as always feel free to IM me if ya have questions!

CLOSED! Thank you and keep an eye out for next time : D!

#commissions#not art#health insurance be like: therapy?? psychiatrist?? testing?? thats a real thing? not according to our policies anyways :'/

28 notes

·

View notes

Text

Worldwide Insurance Companies along with detailed information

Gathering a complete list of all insurance companies worldwide, along with detailed information about each, is a vast and complex task. The number of insurance companies globally is in the thousands, varying across regions and industries (life, health, property, casualty, etc.). Additionally, companies frequently merge, change names, or cease operations, which makes maintaining an up-to-date list…

#Allianz#Auto Insurance#AXA#Berkshire Hathaway#Business Insurance#Check for Discounts and Benefits#China Life Insurance#clarity of policy information#Credit Score#Critical Illness Insurance#customer experience#customer service#financial stability#Group Health Insurance#High ratings#Homeowners Insurance#Individual Health Insurance#insurance companies#Insurance company#insurance company&039;s#investment#Investment Performance#Life insurance#lower risk#MetLife#Monitor and Review#Munich Re#New York Life insurance#Northwestern Mutual#Pet Insurance

6 notes

·

View notes