#government schemes for startups

Explore tagged Tumblr posts

Text

Explore how political parties are leveraging women-centric agendas to address gender disparities, attract diverse voters, and redefine electoral strategies for future success.

#women empowerment issues and challenges#Women empowerment issues#government schemes for startups#government scheme for women#What is the Yojana scheme for women?#PM scheme for ladies#Maiya Samman Yojana Jharkhand List#Ladki Bahin Yojana Online Apply#Government schemes for women 2024#Congress scheme for women#Congress Mahalakshmi scheme details

0 notes

Text

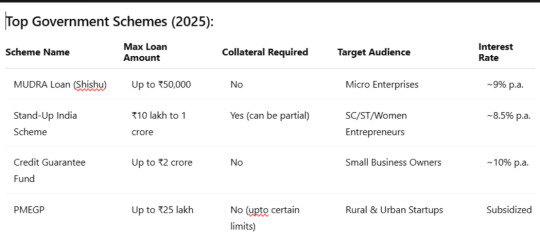

Top Government Loan Schemes for New Business Startups in India (2025 Updated List)

Starting a business in India is an exciting journey, but turning an idea into a profitable venture often requires one critical resource — capital. In 2025, the Indian government continues to empower entrepreneurs through various loan schemes, including the popular Startup India Loan Scheme and other government loans for new business startups in India. Additionally, options like business loans against property in India offer access to higher funding with lower interest rates.

If you're looking to kickstart your startup or scale your small business, this complete guide covers everything — from how to apply for a business loan online to the best paperless business loan online approval platforms. We’ll also compare options for those needing unsecured business loans without income proof or working capital loans for small businesses in India.

What Is the Startup India Loan Scheme?

Launched in 2016, the Startup India Loan Scheme is a flagship initiative by the Government of India. It offers financial support to eligible startups via various financial institutions, including banks, NBFCs, and SIDBI (Small Industries Development Bank of India).

Key Features:

Collateral-free loans up to ₱10 crore

Interest subsidies for eligible borrowers

Tailored for tech-based, scalable startups

Support via Fund of Funds and Credit Guarantee Scheme

Who Is Eligible?

Registered startups under the DPIIT (Department for Promotion of Industry and Internal Trade)

Age of entity: less than 10 years

Annual turnover: Less than ₱100 crore

Must be innovative and scalable

Government Loan for New Business Startup in India

Besides the Startup India Scheme, several other government loans for new business startups in India are designed for first-time entrepreneurs, women-led businesses, and micro-enterprises.

These schemes not only provide funding but also offer mentorship, tax benefits, and technical support.

Business Loan Against Property in India

For startups and SMEs requiring high-value funding, a business loan against property in India is a reliable option. These loans are secured against residential or commercial property, which significantly lowers the interest rate.

Benefits:

Loan amounts up to ₹7 crore or more

Interest rates from 8% to 12% per annum

Tenure up to 15 years

Quick disbursal and minimal documentation

Who Should Consider?

Businesses needing capital for expansion

Startups with valuable property assets

Borrowers with good credit profiles

How to Apply for Business Loan Online in India

The digital revolution has made it easy to apply for a business loan online without visiting a branch. Here's a quick step-by-step process:

Online Application Process:

Visit the lender's official website or app

Choose the loan product (Startup loan, LAP, Working Capital)

Fill out basic business and personal information

Upload documents (Aadhar, PAN, bank statements, ITR, property papers)

Wait for eligibility check and soft credit pull

Get paperless loan approval and sign agreement digitally

Note: Many platforms offer paperless business loan online approval within 24–72 hours.

Unsecured Business Loan Without Income Proof

If you don’t have audited financials or ITRs, an unsecured business loan without income proof could still be possible — though approval depends heavily on credit score, business turnover, and bank statement analysis.

Where to Apply:

Fintech lenders like Lendingkart, Indifi, and FlexiLoans

Some NBFCs specialize in unsecured loans

Credit card-based working capital loans

Requirements:

Minimum 6–12 months business vintage

Monthly turnover over ₹50,000

Good repayment history or CIBIL score

Working Capital Loan for Small Businesses in India

Every small business needs liquidity for daily operations. A working capital loan for small businesses in India helps cover expenses like rent, salaries, utilities, and inventory.

Options Available:

Overdraft facility from your current bank

Invoice discounting

Term loans from banks/NBFCs

Government-backed schemes (like MUDRA)

These loans are often short-term and repayable within 12–36 months.

Real-Life Scenario

Anita, a 32-year-old entrepreneur in Pune, wanted to start a cloud kitchen. With no collateral and limited savings, she opted for the Startup India Loan Scheme through SIDBI. She later expanded her business using a loan against her family's residential property. Today, her startup employs over 25 people and earns over ₹30 lakh annually.

Frequently Asked Questions (FAQs)

1. Can I apply for a Startup India loan if my business is less than a year old?

Yes, as long as your startup is DPIIT-recognized and meets other eligibility conditions.

2. What is the maximum amount I can get under a business loan against property in India?

Loan amounts can range from ₹50,000 to over ₹7 crore, depending on the property's value and lender policies.

3. Do I need income proof to get a business loan?

For unsecured loans, income proof is often required. However, some fintech lenders offer business loans without ITRs based on turnover and bank statements.

4. Are government loans only for new businesses?

No. While some schemes target new startups, others like working capital loans and PMEGP are available to existing small businesses too.

5. How fast can I get online approval for a business loan?

With the paperless process, loan approval can happen within 24 to 72 hours, especially with fintech lenders.

Conclusion: Choose What Fits Your Business Best

India in 2025 offers more opportunities than ever for aspiring entrepreneurs. Whether you opt for the Startup India Loan Scheme, a government loan for new business startup in India, or a business loan against property, the key is to understand your funding needs and choose the best-fit loan product. For quick funding, explore how to apply for business loan online and leverage paperless business loan online approval systems. If you lack documents, consider an unsecured business loan without income proof or a working capital loan for small businesses in India.

#startup India loan scheme for new business#government loan for new business startup in India#business loan against property in India#how to apply for business loan online#paperless business loan online approval#unsecured business loan without income proof#working capital loan for small businesses in India

1 note

·

View note

Text

How CGTMSE Assists MSMEs in the Financial Domain

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of India's developing economy, promoting innovation and generating jobs. Nevertheless, access to finances is usually the significant obstacle for most entrepreneurs. To fill this lacuna, the government, and other financial institutions have launched some initiatives like the CGTMSE scheme – a strong credit guarantee scheme for MSMEs intended to enable collateral-free loans in India. Through this blog, we discuss how the CGTMSE scheme is helpful to MSMEs in the financial segment by improving lending procedures and lending much-needed relief to startups and existing businesses both.

Understanding CGTMSE and Its Impact

CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) was initiated with the aim to offer business loans to small enterprises without collateral security. This is to say that entrepreneurs looking to get a startup business loan or msme loan for new business can get a loan even in the absence of significant collateral. By reducing lenders' risks, the CGTMSE loan mechanism facilitates it easier for financial institutions to provide lending for business.

Key Features:

Collateral-free loans India: Small business loans in India can be availed by entrepreneurs without pledging their assets.

MSME loan guarantee: The scheme is a safety net that increases lender confidence.

Help for startups: It is a key tool for entrepreneurs requiring startup finance India.

Government schemes for MSMEs: CGTMSE is a component of comprehensive MSME support measures by the Indian government for the development of the sector.

How the CGTMSE Scheme Works

The CGTMSE Loan Process

For effective financing, the CGTMSE loan process is kept simple:

How to Apply for CGTMSE: The entrepreneur must draft a detailed business plan, visit a collaborating lending institution, and submit the application.

MSME Loan Guarantee: Upon submitting the application, the lender issues a guarantee under the credit guarantee scheme for MSMEs.

Approval and Disbursement: After fulfilling the eligibility requirements, companies can avail funds without the fear of offering collateral security.

For MSMEs and financial institutions as well, it is important to know how to obtain a CGTMSE loan without collateral and how to avail CGTMSE for startups, which are key factors in making the most of this scheme.

CGTMSE Login and Charges

Borrowers and financial institutions can conveniently check the status of their loan through the cgtmse login page on the website. Moreover, applicants should also be cognizant of some charges:

CGTMSE fee and CGTMSE charges: These are minor charges payable as a component of the guarantee service to keep the scheme running and continue to finance MSMEs throughout the nation.

Increasing Financial Access for MSMEs

The CGTMSE scheme has played a vital role in increasing lending to business. With the risk factor reduced, banks and NBFCs are more comfortable providing business loans to small firms and startup business loan products. Here's how it makes a big difference:

Risk Reduction for Lenders: With the guarantee scheme by its side, the risk of investment is greatly minimized.

Encouragement of Collateral-free Loans: This facilitates even people who do not own substantial assets to avail themselves of the necessary capital.

Boost to MSME Subsidy Programs: The initiative is complementing other MSME subsidy schemes to provide an exhaustive support structure to small and medium-sized enterprises.

The initiative also has direct implications for the Government's large schemes for MSMEs as well as MSME support efforts by Indian government for developing a vibrant and inclusive business ecosystem.

Steps to Use CGTMSE for Startups and Enterprises

Those who are thinking about how to get CGTMSE should consider the following simple step-by-step process:

Get Your Business Plan Ready: Make sure to provide detailed financial estimates and the intended use of the loan.

Select a Lending Partner: Contact banks or NBFCs who are part of the credit guarantee scheme.

Make Your Application: Fill in the required paperwork and start your application process.

Activate CGTMSE Login: Use the cgtmse login portal to track your application status and manage your profile.

Understand the Charges: Be informed about the applicable cgtmse charges and cgtmse fee.

Receive Collateral-free Funding: Once approved, leverage collateral-free loans India to fuel your business growth.

Following these steps to avail CGTMSE for startups can significantly enhance your chances of securing the needed funding efficiently.

Conclusion

In the ever-changing financial world, the CGTMSE scheme is a revolutionary instrument that not only encourages startup funding India but also ensures that small company business loans and other business lending options become available to all those aspiring entrepreneurs. With a simplified CGTMSE loan procedure and complete support measures, the scheme is playing a vital role in improving MSME growth. By providing a credible credit guarantee scheme and addressing collateral-related issues, it opens the door to a more inclusive and stronger economic future in India.

Embrace the potential of collateral-free loans in India and take the first step towards a successful business by exploring the opportunities offered by the CGTMSE scheme today.

#CGTMSE scheme#MSME loan guarantee#Credit guarantee scheme for MSMEs#Collateral-free loans India#CGTMSE loan process#Government schemes for MSMEs#How to apply for CGTMSE#Startup funding India#Small business loans India#MSME subsidy programs

0 notes

Text

What is the Startup India Seed Fund Scheme?

Starting a business is tough, especially when funds are limited. That’s where the Startup India Seed Fund Scheme (SISFS) comes in. Launched by the Government of India, this scheme provides financial assistance to early-stage startups, helping them turn ideas into reality.

Under this scheme, startups can receive up to ₹20 lakh for prototype development and up to ₹50 lakh for market entry and scaling. The aim is to support businesses that are innovative and technology-driven. However, only DPIIT-recognized startups registered within the last two years can apply.

The application process is simple. Entrepreneurs need to apply online through the official Startup India portal, provide the required documents, and wait for approval from an incubator. The selection process is competitive, and only promising startups receive funding.

While the scheme is a great initiative, some founders have reported challenges, such as delays in approval and political influence in fund allocation. However, for those who successfully secure funding, it can be a game-changer, providing the necessary push to launch and grow their business.

If you’re an entrepreneur with a solid idea, this scheme might be the boost you need. Check out more details at https://seedfund.startupindia.gov.in/ and apply today!

1 note

·

View note

Text

No Collateral, No Problem: How SBI is Empowering Women Entrepreneurs in India

“How SBI’s collateral-free loans empower women entrepreneurs in India. Learn about eligibility, benefits, application process, and success stories. Explore how this initiative bridges the gender gap and boosts economic growth. Perfect for women seeking financial support to start or scale their businesses. Read more for actionable insights!” In a significant move to bolster women entrepreneurship…

#financial inclusion for women entrepreneurs#government schemes for women entrepreneurs#no collateral business loans for women#SBI collateral-free loans for women#SBI loan eligibility for women#SBI loans for women entrepreneurs#SBI MSME loans for women#SBI startup loans for women#SBI women entrepreneur scheme#women entrepreneurship in India

0 notes

Text

Government & Special Schemes: A Complete Guide to Personal Loans

When it comes to financing personal expenses, a personal loan can be a valuable tool. However, did you know that there are several government-backed schemes and special loan programs designed to make personal loans more accessible and affordable for various groups of people? Whether you are a government employee, a first-time homebuyer, or an individual with specific financial needs, understanding these schemes can help you secure better terms and lower interest rates.

In this article, we will explore government and special schemes that offer financial assistance, discuss how these programs work, and provide a list of lenders who offer personal loans under these schemes.

1. Government Schemes for Personal Loans in India

1.1 Pradhan Mantri Mudra Yojana (PMMY)

One of the most prominent government schemes for financing small businesses and individuals is the Pradhan Mantri Mudra Yojana (PMMY). This scheme offers financial support to non-corporate, non-farm small/micro enterprises and is especially helpful for those looking to start their own business or expand an existing one.

Types of Loans under PMMY: ✔ Shishu Loan – Up to ₹50,000 for startups and small businesses in the early stages. ✔ Kishore Loan – ₹50,001 to ₹5 lakh for businesses that have a more established track record. ✔ Tarun Loan – ₹5 lakh to ₹10 lakh for larger small enterprises looking to grow.

💡 Tip: Since PMMY loans are aimed at small businesses and entrepreneurs, they can also be used for personal purposes like buying equipment or funding personal projects related to business needs.

🔗 Best lenders for PMMY loans: 👉 IDFC FIRST Bank Personal Loan 👉 Bajaj Finserv Personal Loan

1.2 Atal Pension Yojana (APY)

The Atal Pension Yojana (APY) is a government-backed pension scheme designed for workers in the unorganized sector. This scheme provides pension benefits to people between the ages of 18 to 40 years, ensuring a steady income after retirement. Though primarily a pension scheme, APY participants may also benefit from certain loan schemes tailored to meet their financial needs.

1.3 National Handicapped Finance and Development Corporation (NHFDC) Loans

The NHFDC offers personal loans at subsidized rates to people with disabilities, helping them fund various personal needs, including: ✔ Education ✔ Employment creation ✔ Livelihood enhancement

Eligibility Criteria: ✔ Individuals with disabilities must be between 18 to 55 years. ✔ A minimum of 40% disability must be verified by a medical board.

💡 Tip: NHFDC loans are especially helpful for disabled individuals to set up small businesses or manage personal expenses.

2. Special Loan Schemes for Government Employees

2.1 Government Employee Personal Loan Schemes

Many banks and NBFCs offer special personal loan schemes tailored specifically for government employees. These loans typically come with lower interest rates, flexible terms, and quick processing. Since government employees are considered low-risk borrowers, these schemes are designed to offer more favorable conditions.

Key Features: ✔ Lower Interest Rates – Reduced interest rates for government employees. ✔ Longer Tenure – Extended repayment periods (up to 7 years). ✔ Higher Loan Amount – Government employees can avail of larger loans than those with private-sector jobs.

💡 Best for: Government employees looking for unsecured loans to cover personal expenses or emergencies.

🔗 Best lenders for government employee loans: 👉 Tata Capital Personal Loan 👉 Axis Bank Personal Loan

2.2 Nationalized Banks Personal Loans for Government Employees

Nationalized banks such as SBI, PNB, and Bank of India also offer exclusive personal loan schemes for government employees. These loans are typically available at lower interest rates, making them an ideal choice for government staff members.

3. Schemes for Women Entrepreneurs

3.1 Stand-Up India Scheme

The Stand-Up India Scheme was launched to promote entrepreneurship among women, Scheduled Castes (SCs), and Scheduled Tribes (STs). Under this scheme, banks offer loans ranging from ₹10 lakh to ₹1 crore for greenfield projects in the manufacturing, services, or trading sectors.

Key Features: ✔ Collateral-free loans for women entrepreneurs. ✔ Repayment tenure of up to 7 years. ✔ Lower interest rates compared to standard loans.

💡 Tip: This scheme is ideal for women entrepreneurs who want to establish or grow a small business and need financial assistance.

🔗 Best lenders for Stand-Up India loans: 👉 Axis Finance Personal Loan 👉 InCred Personal Loan

4. Schemes for First-Time Homebuyers

4.1 Pradhan Mantri Awas Yojana (PMAY)

The Pradhan Mantri Awas Yojana (PMAY) aims to provide affordable housing to the urban poor and those from rural areas. This scheme offers subsidized loans for first-time homebuyers and those looking to upgrade their homes.

Key Benefits of PMAY: ✔ Subsidized interest rates (up to 6.5% p.a.) for home loans. ✔ Affordable repayment terms with long loan tenures. ✔ Available to both urban and rural residents.

💡 Tip: Check if you’re eligible for a PMAY subsidy before applying for a home loan to save significantly on interest payments.

🔗 Best lenders for PMAY loans: 👉 IDFC FIRST Bank Personal Loan 👉 Bajaj Finserv Personal Loan

5. How to Apply for Government and Special Scheme Loans

Step 1: Check Eligibility Criteria

Each government-backed or special loan scheme has specific eligibility criteria that must be met. Be sure to review the eligibility conditions for each scheme before applying.

Step 2: Gather Required Documents

Most loans will require basic documentation such as: ✔ Identity Proof ✔ Address Proof ✔ Income Proof (ITR, Salary slips, or Bank Statements) ✔ Property Papers (for housing schemes)

Step 3: Apply Through Approved Lenders

Many of these loans are disbursed by banks and financial institutions that are approved by the government. Ensure that the lender you choose is part of the approved list for each scheme.

Leveraging Government & Special Schemes for Personal Loans

Government and special schemes play a vital role in providing financial support to individuals from various backgrounds, whether you are a first-time homebuyer, government employee, or women entrepreneur. These schemes typically offer lower interest rates, longer repayment periods, and less stringent eligibility conditions, making them highly beneficial for personal and business needs.

Before applying, make sure you: ✔ Check the eligibility for the scheme that fits your needs. ✔ Compare interest rates and loan terms to get the best deal. ✔ Prepare your documents in advance to speed up the approval process.

For the best personal loan options, apply here: 👉 Compare & Apply for a Personal Loan

By leveraging these government and special schemes, you can achieve your financial goals more affordably and efficiently.

#Government loan schemes#Special loan schemes in India#Pradhan Mantri Mudra Yojana loan#Personal loan schemes for government employees#Stand-Up India scheme loans#Affordable housing loan schemes#Government-backed personal loans#PMAY loan eligibility#Personal loan for women entrepreneurs#Personal loan schemes for first-time homebuyers#Mudra Yojana loan for business#National Handicapped Finance and Development Corporation loan#Personal loans for self-employed individuals#Loans for disabled individuals in India#Personal loan eligibility criteria for government employees#Affordable personal loans for startups#How to apply for PMAY home loan#Pradhan Mantri Awas Yojana subsidy#Subsidized personal loans for women#Low-interest government personal loan schemes#finance#bank#nbfc personal loan#personal loans#loan services#personal loan#fincrif#loan apps#personal loan online#personal laon

0 notes

Text

Legal Aspects of Investment in India: What Investors Need to Know

Investing in India's vibrant startup ecosystem offers lucrative opportunities for investors seeking high growth potential and diversification. However, understanding the legal aspects of investment is crucial to mitigate risks and ensure compliance with regulatory requirements. In this blog, we will delve into the critical legal aspects of funding and investment in Indian startups, covering equity financing, debt financing, crowdfunding, incubators, and government schemes like the Startup India Seed Fund Scheme (SISFS). By gaining insights into these legal frameworks, investors can make informed decisions and navigate the complexities of the Indian investment landscape effectively.

Equity Financing:

Equity financing plays a pivotal role in funding Indian startups, with angel investors, venture capitalists, and private equity investors being key stakeholders. Venture capitalists typically enter into non-binding offers with startups based on preliminary valuations and due diligence processes. This involves the execution of various transaction documents, including term sheets, share subscription agreements, and shareholders' agreements, which outline rights, obligations, and exit options for investors. Similarly, angel investors, who are industry professionals, fund startups in return for equity stakes, subject to regulations imposed by SEBI. Understanding these legal agreements and regulatory requirements is essential for investors engaging in equity financing in India.

Debt Financing:

Debt financing, through loans or external commercial borrowings (ECBs), is another avenue for financing Indian startups. Banks and non-banking finance companies (NBFCs) provide loans to startups for purchasing inventory, equipment, and securing operating capital. However, obtaining a loan involves rigorous documentation, including loan agreements, security/collateral documentation, and compliance with regulatory norms. Additionally, external commercial borrowings from non-resident lenders require adherence to restrictions on capital market investments and acquisitions in India. Investors should familiarize themselves with these legal requirements to facilitate smooth debt financing transactions.

Crowdfunding:

Crowdfunding has emerged as a revolutionary way of obtaining seed funding for startups by securing funds from a large group of people through online platforms. While crowdfunding offers a decentralized approach to fundraising, regulatory frameworks governing this practice are still evolving in India. The Securities and Exchange Board of India (SEBI) released a consultation paper on crowdfunding in 2014, but formal regulations are yet to be issued. Investors should stay updated on regulatory developments and exercise caution when participating in crowdfunding activities in India.

Incubators:

Incubators play a crucial role in nurturing startup ventures by providing resources and services in exchange for equity stakes. These entities, whether government-aided or private, offer management training, administrative support, and legal compliance assistance to startups during the incubation period. Understanding the terms and conditions of engagement with an incubator, including equity dilution and exit options, is essential for investors considering incubation as a financing option for Indian startups.

Startup India Seed Fund Scheme (SISFS):

The Startup India Seed Fund Scheme (SISFS), launched by the Department of Promotion of Industry and Internal Trade (DPIIT), aims to provide financial assistance to startups for proof of concept, prototype development, and market entry. Eligible startups can receive grants and investments from selected incubators, subject to certain criteria and guidelines. Investors interested in leveraging the SISFS should familiarize themselves with the scheme's objectives, eligibility criteria, and disbursement process to maximize investment opportunities in Indian startups.

In conclusion, navigating the legal aspects of investment in India's vibrant startup ecosystem is essential for investors looking to capitalize on the country's burgeoning entrepreneurial landscape. As highlighted throughout this guide, understanding the nuances of equity financing, debt financing, crowdfunding, incubators, and government schemes like the Startup India Seed Fund Scheme (SISFS) is crucial for making informed investment decisions and mitigating risks effectively.

Equity financing, facilitated by angel investors, venture capitalists, and private equity investors, offers startups the capital needed for growth while providing investors with opportunities for high returns. However, navigating the intricacies of term sheets, share subscription agreements, and shareholders' agreements requires a deep understanding of legal frameworks and regulatory requirements. By comprehensively analyzing these documents and seeking legal counsel, investors can safeguard their interests and maximize their investment potential in Indian startups.

Similarly, debt financing presents an alternative avenue for startups to access capital through loans and external commercial borrowings. While loans from banks and NBFCs provide startups with operational flexibility, compliance with regulatory norms and documentation requirements is paramount. Investors must conduct thorough due diligence and assess the risks associated with debt financing, including collateral obligations and repayment terms, to ensure a sound investment strategy.

Crowdfunding, although gaining popularity as a decentralized funding mechanism for startups, remains relatively nascent in India. While platforms like Wishberry and Catapoolt offer startups access to a broader investor base, regulatory frameworks governing crowdfunding are still evolving. Investors should closely monitor regulatory developments and exercise caution when participating in crowdfunding activities to mitigate potential risks and ensure compliance with applicable laws.

Incubators play a pivotal role in nurturing early-stage startups by providing resources, mentorship, and networking opportunities. However, investors considering incubation as a financing option must carefully evaluate the terms and conditions of engagement, including equity dilution and exit options. By aligning their investment objectives with the goals of the incubator and conducting thorough due diligence on prospective startups, investors can enhance their chances of success in the incubation ecosystem.

Government schemes like the Startup India Seed Fund Scheme (SISFS) offer additional avenues for financing startups and promoting innovation. By providing financial assistance and support to eligible startups, these schemes aim to foster entrepreneurship and accelerate economic growth. Investors interested in leveraging government initiatives should familiarize themselves with the eligibility criteria, application process, and disbursement mechanisms to capitalize on investment opportunities in Indian startups.

In conclusion, investing in India's dynamic startup ecosystem offers unparalleled opportunities for growth, innovation, and diversification. However, navigating the legal complexities of investment requires diligence, expertise, and a thorough understanding of regulatory frameworks. By staying informed, seeking professional advice, and conducting comprehensive due diligence, investors can effectively navigate the legal aspects of investment in Indian startups and unlock the full potential of this thriving ecosystem. As India continues to emerge as a global hub for entrepreneurship and innovation, strategic investments in its startup landscape have the potential to yield significant returns and shape the future of the country's economy.

This post was originally published on: Foxnangel

#investment in india#invest in india#business legal aspects#startup ecosystem#indian startups#startups in india#startup india seed fund scheme#sisfs#government schemes#foxnangel#fdi in india

1 note

·

View note

Text

Choosing The Best Bank for Msme Loan: Top Options For 2024

In the dynamic landscape of small and medium enterprises (SMEs), securing the right financing is crucial for growth and sustainability. For MSMEs in India, finding the best bank for MSME loan can make a significant difference in their financial health and expansion capabilities. With various options available, it's essential to understand the top banks and their offerings for 2024, especially for those seeking a 2-crore loan for business or exploring unsecured SME loans.

Understanding MSME finance

MSME finance encompasses a range of financial services tailored to meet the needs of micro, small, and medium enterprises. Given the diversity in the needs of MSMEs, banks offer various loan products like machinery loan for msme and msme subsidy on machinery, including those under the MSME startup scheme and government loan for MSME programs.

Top banks for MSME loans in 2024

1. State Bank of India (SBI)

SBI continues to be a leader in the MSME finance sector. SBI’s offerings include unsecured SME loans, which are ideal for businesses that may not have significant collateral to pledge.

2. HDFC Bank

HDFC Bank is another top contender when it comes to MSME loans. For those looking for a substantial sum, HDFC also facilitates a 2 crore loan for business purposes, ensuring ample capital for expansion.

3. ICICI Bank

ICICI Bank offers a comprehensive suite of MSME finance solutions, including the MSME startup scheme. Their user-friendly application process and quick disbursal times are added advantages.

4. Punjab National Bank (PNB)

PNB stands out with its dedicated MSME loan products that cater to various business needs. Their government loan for MSME programs are designed to provide financial assistance with favourable terms.

5. Bank of Baroda

Bank of Baroda has a strong presence in the MSME sector, offering a range of financial products to support business growth. Their MSME loans are designed to cater to different business stages and needs, including the requirement for a 2 crore loan for business expansion. Bank of Baroda also participates in government initiatives, providing govt MSME loans to help businesses access affordable financing.

Factors to consider when choosing a bank

When selecting the best bank for MSME loan, several factors should be considered:

- Interest rates and fees: Compare the interest rates and any additional fees associated with the loan. Lower rates can significantly reduce the cost of borrowing.

- Loan amount and terms: Ensure that the bank offers the loan amount you need, such as a 2 crore loan for business, and flexible repayment terms that suit your financial capabilities.

- Collateral requirements: Determine if the loan is secured or unsecured. Unsecured SME loans are beneficial for businesses without substantial assets to pledge.

- Application process: Look for banks with a straightforward and quick application process. This can save time and help you access funds faster.

- Customer service: Good customer service can make the loan process smoother and provide ongoing support for your financial needs.

Leveraging Klub for funding opportunities

Klub, an innovative platform specialising in revenue-based financing, offers startups an alternative funding model. By leveraging Klub, entrepreneurs can access capital without giving up equity, aligning repayments with their revenue streams.

Conclusion

Choosing the best bank for MSME loan involves careful consideration of various factors, including the specific needs of your business and the terms offered by different banks. In 2024, banks like SBI, HDFC, ICICI, PNB, and Bank of Baroda stand out as top options for MSME finance. Whether you are seeking a government loan for MSME or a govt msme loan scheme, an unsecured SME loan, or a substantial loan amount for business expansion, these banks provide a range of solutions to support your enterprise’s growth. By evaluating the available options and selecting the best fit, MSMEs can secure the financial backing needed to thrive in today’s competitive market.

#2 crore loan for business#best bank for msme loan#msme startup scheme#government loan for msme#unsecured sme loans

0 notes

Text

Ladli Behna Yojana

Ladli Behna Yojana is a commendable social welfare scheme that marks a significant stride towards empowering women in society. This initiative is specifically tailored to address the multifaceted challenges faced by women, aiming to bolster their economic independence, enhance their social status, and ensure their well-being and dignity. The program encompasses a spectrum of benefits including financial assistance, which is instrumental in providing women with the means to pursue education, healthcare, and entrepreneurial ventures.

0 notes

Text

Udyam Registration: Empowering Small Businesses for Growth

The Micro, Small, and Medium Enterprises (MSME) sector, often hailed as the backbone of the Indian economy, is undergoing a digital transformation with the introduction of online registration processes. As of current data, there are approximately 633.9 lakh registered MSMEs in India, showcasing the sector's vital role in economic development. This article explores the significance of MSMEs, the online registration process, and the recent amendments in the MSME Development Act.

MSME Significance:

MSMEs, standing for Micro, Small, and Medium Enterprises, play a pivotal role in fostering self-reliance in India. They contribute substantially to the country's GDP, manufacturing output, and exports, making up over 99% of the MSME population. Moreover, the sector serves as a major employment generator, employing over 11 crore individuals, contributing significantly to India's economic growth.

Revised MSMED Act:

Categories and Limits:

Under the revised classification, MSMEs are categorized based on turnover and investment limits:

Micro: Turnover up to 1 Crore, Investment up to 5 Crore

Small: Turnover up to 10 Crore, Investment up to 50 Crore

Medium: Turnover up to 50 Crore, Investment up to 250 Crore

Udyam Registration:

Udyam Registration, the process that classifies enterprises into Micro, Small, or Medium categories, can be completed online through self-declaration, eliminating the need for document submission. Upon completion, MSMEs receive a unique Udyam Registration Number (URN) and an e-Certificate (URC).

Importance of Udyam Registration:

Udyam registration opens doors to various benefits for MSMEs, including access to finance facilities, government schemes, subsidies, and interest subvention. It also facilitates participation in tenders, offers protection against delayed payments, and provides concessions in taxes, electricity bills, and trademark registration.

Document Requirements:

Eligibility and Application Process:

Eligibility for Udyam Registration spans a wide range of entities, including individuals, startups, private and public limited companies, sole proprietorships, partnerships, LLPs, SHGs, co-operative societies, and trusts. The online application process is user-friendly, catering to both new entrepreneurs and those with existing registrations.

Conclusion:

As India strives for economic growth and self-reliance, the MSME sector stands at the forefront, driving innovation and providing employment opportunities. The streamlined Udyam Registration process further empowers businesses by granting them access to a myriad of benefits, ultimately contributing to the sector's resilience and vitality in the Indian economy.

0 notes

Text

How to Choose the Best Business Loan in 2025: A Guide for Small Business Owners

Starting or scaling a small business in 2025 is both exciting and challenging. Whether you're launching a startup or expanding your current operations, access to the right funding can be a game-changer. But with so many loan options, schemes, and interest rates floating around, the real question arises—how do you choose the best business loan for your needs?

In this comprehensive guide, we’ll break down the most relevant loan types, explain how to compare offers, and share expert tips to help you secure the lowest interest rate business loan in India. Let's help you make an informed decision and get your business the financial boost it deserves.

What Do Small Business Owners Really Need?

Most small business owners, freelancers, and self-employed individuals are looking for three key things:

Instant approval without lengthy paperwork

Flexible repayment terms

Low-interest rates to reduce the financial burden

And here's the good news: 2025 has opened doors to a variety of instant business loans for self-employed and startup schemes with easier eligibility and faster processing.

Common Problems Business Owners Face

Before jumping into loans, it’s important to identify what challenges you're trying to solve:

Types of Business Loans in 2025

1. MSME Loan for Small Business Without Collateral

This loan type is perfect for micro and small enterprises with limited assets. The government and banks are pushing for collateral-free options with flexible repayment.

Best For: First-time business owners, traders, shop owners, and freelancers.

2. Startup Loan for New Business

Many banks and NBFCs now offer tailor-made loans for startups. Even new businesses with no revenue history can qualify based on their business plan and projections.

Tip: Enroll in the Government Business Loan Scheme for a New Business to get priority support and subsidies.

3. Instant Business Loan for Self-Employed

Need funds quickly? Many fintech platforms offer same-day loan disbursement with minimal documentation.

Highlight: You can get up to ₹50 lakhs within 24 hours depending on your credit score and ITR.

4. Secured Business Loan / Business Loan Against Property in India

If you own property or machinery, you can get a much larger loan at a lower interest rate.

Pro: Ideal for expansion, factory setup, or bulk inventory purchase.

Comparison Table: Top Business Loans in 2025

Unlock the best business loan interest rates today! Click now to boost your business!

How to Select the Right Loan for You

Here’s a quick step-by-step checklist:

Assess your requirement – Expansion, working capital, equipment?

Check eligibility – Age, business vintage, credit score.

Compare interest rates – Use aggregator sites and bank websites.

Decide between secured and unsecured – Based on your risk appetite and asset availability.

Read reviews & ratings – Check Google Reviews and platforms like BankBazaar.

Use EMI calculators – Know what your monthly outgo will be.

Real User Reviews

"I applied for a business loan against property in India through a private bank. The paperwork was smooth, and I got ₹40 lakhs at just 9% interest! This helped me scale my printing business to the next level." — Anand Mehta, Business Owner, Surat

"Being self-employed, I never thought I could get a quick loan. But an instant business loan for the self-employed got approved within a day and helped me restock my salon supplies." — Pooja Sharma, Freelancer, Jaipur

"As a new entrepreneur, the Startup India loan scheme for new businesses gave me the confidence and capital to launch my organic skincare line." — Ravi Tiwari, Startup Founder, Delhi

Red Flags to Avoid

Don’t blindly trust unregistered lenders

Avoid loans with hidden charges or high processing fees

Be wary of offers with "too good to be true" interest rates

Frequently Asked Questions (FAQ)

Q1. What is the best loan for a small business startup in India?

A: The Startup India Loan Scheme and other startup business loans from NBFCs and banks are ideal for new ventures.

Q2. Can I get a business loan without collateral?

A: Yes, schemes like the MSME loans for small businesses without collateral are designed for this.

Q3. How fast can I get a business loan as a self-employed individual?

A: With fintech lenders, you can get an instant business loan for the self-employed within 24–48 hours.

Q4. What is the interest rate on secured business loans in 2025?

A: On average, secured business loan rates range from 7% to 11% annually.

Q5. Can I use my property to get a business loan?

A: Yes, you can apply for a business loan against property in India for higher amounts and better terms.

Final Thoughts

Choosing the best business loan in 2025 doesn't have to be confusing. When you clearly understand your needs and compare the right loan products, the process becomes much easier. Government-backed schemes, instant loan platforms, and secured loans all have their place depending on your business stage.

Whether you're self-employed, running a small MSME, or just stepping into the startup world, there’s a business loan tailored just for you.

Ready to fund your business dream?

Start comparing, apply smartly, and grow fearlessly.

#instant business loan for self employed#lowest interest rate business loan in India#MSME loan for small business without collateral#Startup Business Loans#startup India loan scheme for new business#startup loan for new business#government loan for new business startup in India#secured business loan#business loan against property in India

0 notes

Text

The Role of CGTMSE in MSME Market Expansion

Micro, Small, and Medium Enterprises (MSMEs) are the mainstay of India's economy, contributing to GDP, employment, and exports in a big way. But for MSMEs to grow and expand, availability of timely and low-cost credit is a must. One of the most powerful financial instruments facilitating this transformation is the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). The CGTMSE scheme is enabling businesses to break through financial barriers and expand their reach to new domestic and international markets. By providing collateral-free loans in India, CGTMSE ensures that entrepreneurs can access capital without risking their personal or business assets. This access to funds fuels growth, innovation, and ultimately, market expansion. In this blog, we’ll explore how CGTMSE and MSMEs together are unlocking new market opportunities and driving India’s economic development.

Understanding CGTMSE: A Launchpad for Business Growth

The CGTMSE scheme of loan was introduced by the Government of India in collaboration with SIDBI to give a fillip to small enterprises through credit guarantees. It assists financial institutions by guaranteeing them a specific percentage of the outstanding loan value in the event of default, thereby lowering their risk exposure. This induces lenders to provide credit to MSMEs that would otherwise find it difficult to obtain credit due to the absence of collateral security.

By guaranteeing credit up to ₹2 crore for MSMEs under the credit guarantee scheme, CGTMSE has emerged as a key catalyst of lending for business, especially for businesses that wish to expand operations or venture into new markets. Entrepreneurs can now forget about having to mortgage property or assets—making market growth more accessible than ever before.

How CGTMSE Fuels Market Expansion for MSMEs

Access to capital is a requirement for any business that wants to expand.

Whether it's opening new branches, investing in advertising, purchasing new equipment, or employing skilled personnel—none of these can be done without financial support. CGTMSE loans also come in handy here by facilitating expansion to new geographies by way of financing infrastructure, stock, and logistics; attending trade fairs and exhibitions, whereby MSMEs can reach larger numbers; product diversification, whereby businesses can serve new sets of customers; and digital transformation for online transactions and outreach. The CGTMSE loan procedure is simple, and the related CGTMSE charges and CGTMSE fee are low, thus being a good choice for enterprising businesses. MSME Loan for New Business and Emerging Markets

For new entrepreneurs entering new ventures or venturing into unexploited markets, it may be hard to get startup business loans with no financial background or asset base. Such companies are greatly assisted by the CGTMSE scheme, which provides them with a safety net of MSME loan guarantees that facilitate them in moving their ideas from the conceptual to the execution phase.

With CGTMSE loan support, MSMEs are in a position to try new market growth strategies like introducing a new product segment, reaching a new customer base, or engaging in international trade. It provides a high-opportunity, low-risk situation for expansion.

Digital Transformation and Online Market Reach

The digital economy has created vast opportunities for MSMEs. With the aid of e-commerce websites, social media advertising, and digital payment systems, enterprises can access customers far beyond their local geographies. Digitization, however, has its own costs—software, hardware, training, and marketing. That is where CGTMSE and digital transformation converge.

By CGTMSE-supported business loans to small businesses, MSMEs are able to invest in these digital solutions and enhance their web presence. This not only assists in market reach but also brand visibility and customer loyalty in competitive markets.

CGTMSE and Export Market Access

India's drive to raise exports has a direct impact on MSMEs. As there is demand worldwide for good quality, reasonable products and services, Indian MSMEs can perfectly plug the gap. But export involves working capital, certification, compliance expense, and also technology upgradation in many cases. The CGTMSE scheme can cover all these expenses.

With a lower entry barrier via collateral-free loans in India, CGTMSE helps MSMEs find it less difficult to compete in export markets. Government-sponsored schemes such as Startup funding India and MSME support schemes by the Indian government can be combined with CGTMSE in order to provide businesses with a solid base for international trade.

Government Schemes and Subsidy Programs That Complement CGTMS

The Indian government has implemented numerous schemes to boost the growth of the MSME sector. Several of these can be utilized in conjunction with CGTMSE loans, including MSME subsidy schemes for upgradation of technology or development of infrastructure; ZED Certification Scheme for quality; and Credit Linked Capital Subsidy Scheme (CLCSS) for machinery and tools.

Along with the process of the CGTMSE loan, these schemes form a complete environment for sustainable and scalable business development.

How to Get CGTMSE for Market Growth

It is critical for entrepreneurs to know how to apply for CGTMSE to grow their businesses.

This is a straightforward way: Register your MSME on the Udyam portal.

Draw up a robust business proposal with an expansion theme. Visit a bank or NBFC that is part of the CGTMSE network. After the loan is sanctioned, the lender requests the guarantee on the CGTMSE login portal. Remit the mandatory CGTMSE fee and CGTMSE charges. The status of the application can be monitored by the applicants online, and where necessary, retrieve information through RTI (full form of RTI: Right to Information) to maintain transparency and accountability in the process. Steps to avail CGTMSE for Startups and Growth-Focused MSMEs If you want to know the steps to utilize CGTMSE for startups, here's what you need to do: Establish a sound business model with feasible market growth targets. Have clean accounts and credit-worthy behavior. Find a lender that understands the CGTMSE procedure. Check for combinations of other government schemes for MSMEs to leverage funds. Preparedness assists in faster loan sanctioning and efficient utilization of funds for market entry or diversification.

CGTMSE's Role in Building an Inclusive MSME Ecosystem

Besides financial support, CGTMSE plays a significant role in constructing an inclusive and more robust MSME ecosystem. Female entrepreneurs, rural entrepreneurs, and first-generation business owners now have the strength to compete with larger players in the marketplace without fearing loss of assets. This stimulates overall economic activity and brings balanced regional development.

Moreover, CGTMSE and MSMEs collectively contribute to generating local employment, enhancing domestic production, and lowering import dependence—all while contributing to sustainable market growth.

Conclusion: A Strategic Tool for Market Breakthrough

The collaboration of CGTMSE with MSMEs has proven to be not merely a mechanism for finance—truly, a strategic entry point for business growth, cyber inclusiveness, and market expansion. With optimal blends of MSME loan guaranteeing, subsidised CGTMSE charges, and coordination with MSME subsidy schemes, industries are able to maximize their own growth potential.

As India progresses towards being a global economic superpower, CGTMSE loans are empowering small businesses to think bigger, reach farther and build stronger. Whether you are a local artisan going global, a digital startup looking towards new geographies, or a service business scaling up—CGTMSE is your take-off point for the next level of growth.

#cgtmse loan process#cgtmse scheme#credit guarantee scheme for msmes#government schemes for msmes#msme loan guarantee#msme subsidy programs#small business loans india#startup funding india#finance#law#credit guarantee scheme

0 notes

Text

Small Business Ideas - लहान व्यवसाय कल्पना - लॅपटॉपसह लाखोंचा स्थानिक व्यवसाय सुरू करा, Google अर्धे काम करेल.

कमी गुंतवणूक जास्त नफा स्टार्टअप व्यवसाय कल्पना Small Business Ideas : कोणताही स्टार्टअप किंवा व्यवसाय, लहान किंवा मोठा, ही केवळ एका व्यक्तीची बाब नाही. आम्ही तुम्हाला एक असा स्थानिक व्यवसाय सांगत आहोत, ज्यामध्ये तुम्हाला अर्धे काम करावे लागेल आणि उरलेले अर्धे काम गुगल करेल. यामुळे तुमचा आत्मविश्वास उंचावेल आणि लोक तुमच्यावर पहिल्यापासून विश्वास ठेवतील. प्रारंभ करण्यासाठी आपल्याला फक्त एका…

View On WordPress

#Business#Google will do half the work#Government Scheme#maharashtra#mumbai#small business idea#SMALL BUSINESS IDEAS#Start a local business worth lakhs with a laptop#Startup

0 notes

Text

Collateral-Free Loans for Startups: How to Secure Funding for Your Startup

“How India’s Credit Guarantee Scheme for Startups (CGSS) 2025 is transforming entrepreneurship with collateral-free loans, interest subsidies, and government-backed guarantees. Learn about eligibility, benefits, and application process to fuel your startup’s growth. Empower innovation, drive economic growth, and unlock funding opportunities today!” The Credit Guarantee Scheme for Startups (CGSS)…

#CGSS 2025#collateral-free loans#Credit Guarantee Scheme for Startups#DIPP recognition#entrepreneurship India#financial support for startups.#government-backed loans#Indian startups#innovation funding#interest rate subsidy#job creation#startup ecosystem#startup funding India#startup loans#women entrepreneurs

0 notes

Text

The Best News of Last Week

1. ‘We are just getting started’: the plastic-eating bacteria that could change the world

In 2016, Japanese scientists Oda and Hiraga published their discovery of Ideonella sakaiensis, a bacterium capable of breaking down PET plastic into basic nutrients. This finding marked a shift in microbiology's perception, recognizing the potential of microbes to solve pressing environmental issues.

France's Carbios has successfully applied bacterial enzyme technology to recycle PET plastic waste into new plastic products, aligning with the French government's goal of fully recycling plastic packaging by 2025.

2. HIV cases in Amsterdam drop to almost zero after PrEP scheme

According to Dutch AIDS Fund, there were only nine new cases of the virus in Amsterdam in 2022, down from 66 people diagnosed in 2021. The organisation claimed that 128 people were diagnosed with HIV in Amsterdam in 2019, and since 2010, the number of new infections in the Dutch capital has fallen by 95 per cent.

3. Cheap and drinkable water from desalination is finally a reality

In a groundbreaking endeavor, engineers from MIT and China have designed a passive solar desalination system aimed at converting seawater into drinkable water.

The concept, articulated in a study published in the journal Joule, harnesses the dual powers of the sun and the inherent properties of seawater, emulating the ocean’s “thermohaline” circulation on a smaller scale, to evaporate water and leave salt behind.

4. World’s 1st drug to regrow teeth enters clinical trials

The ability to regrow your own teeth could be just around the corner. A team of scientists, led by a Japanese pharmaceutical startup, are getting set to start human trials on a new drug that has successfully grown new teeth in animal test subjects.

Toregem Biopharma is slated to begin clinical trials in July of next year after it succeeded growing new teeth in mice five years ago, the Japan Times reports.

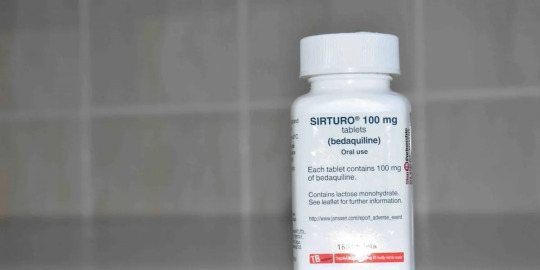

5. After Decades of Pressure, US Drugmaker J&J Gives Up Patent on Life-Saving TB Drug

In what can be termed a huge development for drug-resistant TB (DR-TB) patients across large parts of the world, bedaquiline maker Johnson and Johnson said on September 30 (Saturday) that it would drop its patent over the drug in 134 low- and middle-income countries (LMICs).

6. Stranded dolphins rescued from shallow river in Massachusetts

youtube

7. ‘Staggering’ green growth gives hope for 1.5C, says global energy chief

The prospects of the world staying within the 1.5C limit on global heating have brightened owing to the “staggering” growth of renewable energy and green investment in the past two years, the chief of the world’s energy watchdog has said.

Fatih Birol, the executive director of the International Energy Agency, and the world’s foremost energy economist, said much more needed to be done but that the rapid uptake of solar power and electric vehicles were encouraging.

---

That's it for this week :)

This newsletter will always be free. If you liked this post you can support me with a small kofi donation here:

Buy me a coffee ❤️

Also don’t forget to reblog this post with your friends.

11K notes

·

View notes

Text

Academic economists get big payouts when they help monopolists beat antitrust

After 40 years of rampant corporate crime, there's a new sheriff in town: Jonathan Kanter was appointed by Biden to run the DOJ Antitrust Divisoon, and he's overseen 170 "significant antitrust actions" in the past 2.5 years, culminating in a court case where Google was ruled to be an illegal monopolist:

https://pluralistic.net/2024/08/07/revealed-preferences/#extinguish-v-improve

Kanter's work is both extraordinary and par for the course. As Kanter said in a recent keynote for the Fordham Law Competition Law Institute’s 51st Annual Conference on International Antitrust Law and Policy, we're witnessing an epochal, global resurgence of antitrust:

https://www.justice.gov/opa/speech/assistant-attorney-general-jonathan-kanter-delivers-remarks-fordham-competition-law-0

Kanter's incredible enforcement track record isn't just part of a national trend – his colleagues in the FTC, CFPB and other agencies have also been pursuing an antitrust agenda not seen in generations – but also a worldwide trend. Antitrust enforcers in Canada, the UK, the EU, South Korea, Australia, Japan and even China are all taking aim at smashing corporate monopolies. Not only are they racking up impressive victories against these giant corporations, they're stealing the companies' swagger. After all, the point of enforcement isn't just to punish wrongdoing, but also to deter wrongdoing by others.

Until recently, companies hurled themselves into illegal schemes (mergers, predatory pricing, tying, refusals to deal, etc) without fear or hesitation. Now, many of these habitual offenders are breaking the habit, giving up before they've even tried. Take Wiz, a startup that turned down Google's record-shattering $23b buyout offer, understanding that the attempt would draw more antitrust scrutiny than it was worth:

https://finance.yahoo.com/news/wiz-turns-down-23-billion-022926296.html

As welcome as this antitrust renaissance is, it prompts an important question: why didn't we enforce antitrust law for the 40 years between Reagan and Biden?

That's what Kanter addresses the majority of his remarks to. The short answer is: crooked academic economists took bribes from monopolists and would-be monopolists to falsify their research on the impacts of monopolists, and made millions (literally – one guy made over $100m at this) testifying that monopolies were good and efficient.

After all, governments aren't just there to enforce rules – they have to make the rules first, and do to that, they need to understand how the world works, so they can understand how to fix the places where it's broken. That's where experts come in, filling regulators' dockets and juries' ears with truthful, factual testimony about their research. Experts can still be wrong, of course, but when the system works well, they're only wrong by accident.

The system doesn't work well. Back in the 1950s, the tobacco industry was threatened by the growing scientific consensus that smoking caused cancer. Industry scientists confirmed this finding. In response, the industry paid statisticians, doctors and scientists to produce deceptive research reports and testimony about the tobacco/cancer link.

The point of this work wasn't necessarily to convince people that tobacco was safe – rather, it was to create the sense that the safety of tobacco was a fundamentally unanswerable question. "Experts disagree," and you're not qualified to figure out who's right and who's wrong, so just stop trying to figure it out and light up.

In other words, Big Tobacco's cancer denial playbook wasn't so much an attack on "the truth" as it was an attack on epistemology – the system by which we figure out what is true and what isn't. The tactic was devastatingly effective. Not only did it allow the tobacco giants to kill millions of people with impunity, it allowed them to reap billions of dollars by doing so.

Since then, epistemology has been under sustained assault. By the 1970s, Big Oil knew that its products would render the Earth unfit for human habitation, and they hired the same companies that had abetted Big Tobacco's mass murder to provide cover for their own slow-motion, planetary scale killing spree.

Time and again, big business has used assaults on epistemology to provide cover for unthinkable crimes. This has given rise to today's epistemological crisis, in which we don't merely disagree about what is true, but (far more importantly) disagree about how the truth can be known:

https://pluralistic.net/2024/03/25/black-boxes/#when-you-know-you-know

Ask a conspiratorialist why they believe in Qanon or Hatians in Springfield eating pets, and you'll get an extremely vibes-based answer – fundamentally, they believe it because it feels true. As the old saying goes, you can't reason someone out of a belief they didn't reason their way into.

This assault on reason itself is at the core of Kanter's critique. He starts off by listing three cases in which academic economists allowed themselves to be corrupted by the monopolies they studied:

George Mason University tricked an international antitrust enforcer into attending a training seminar that they believed to be affiliated with the US government. It was actually sponsored by the very companies that enforcer was scrutnizing, and featured a parade of "experts" who asserted that these companies were great, actually.

An academic from GMU – which receives substantial tech industry funding – signed an amicus brief opposing an enforcement action against their funders. The academic also presented a defense of these funders to the OECD, all while posing as a neutral academic and not disclosing their funding sources.

An ex-GMU economist, Joshua Wright, submitted a study defending Qualcomm against the FTC, without disclosing that he'd been paid to do so. Wright has elevated undisclosed conflicts of interest to an art form:

https://www.wsj.com/us-news/law/google-lawyer-secret-weapon-joshua-wright-c98d5a31

Kanter is at pains to point out that these three examples aren't exceptional. The economics profession – whose core tenet is "incentive matter" – has made it standard practice for individual researchers and their academic institutions to take massive sums from giant corporations. Incredibly, they insist that this has nothing to do with their support of monopolies as "efficient."

Academic centers often serve as money-laundries for monopolist funders; researchers can evade disclosure requirements when they publish in journals or testify in court, saying only that they work for some esteemed university, without noting that the university is utterly dependent on money from the companies they're defending.

Now, Kanter is a lawyer, not an academic, and that means that his job is to advocate for positions, and he's at pains to say that he's got nothing but respect for ideological advocacy. What he's objecting to is partisan advocacy dressed up as impartial expertise.

For Kanter, mixing advocacy with expertise doesn't create expert advocacy – it obliterates expertise, as least when it comes to making good policy. This mixing has created a "crisis of expertise…a pervasive breakdown in the distinction between expertise and advocacy in competition policy."

The point of an independent academia, enshrined in the American Association of University Professors' charter, is to "advance knowledge by the unrestricted research and unfettered discussion of impartial investigators." We need an independent academy, because "to be of use to the legislator or the administrator, [an academic] must enjoy their complete confidence in the disinterestedness of [his or her] conclusions."

It's hard to overstate just how much money economists can make by defending monopolies. Writing for The American Prospect, Robert Kuttner gives the rate at $1,000/hour. Monopoly's top defenders make unimaginable sums, like U Chicago's Dennis Carlton, who's brought in over $100m in consulting fees:

https://prospect.org/economy/2024-09-24-economists-as-apologists/

The hidden cost of all of this is epistemological consensus. As Tim Harford writes in his 2021 book The Data Detective, the truth can be known through research and peer-review:

https://pluralistic.net/2021/01/04/how-to-truth/#harford

But when experts deliberately seek to undermine the idea of expertise, they cast laypeople into an epistemological void. We know these questions are important, but we can't trust our corrupted expert institutions. That leaves us with urgent questions – and no answers. That's a terrifying state to be in, and it makes you easy pickings for authoritarian grifters and conspiratorial swindlers.

Seen in this light, Kanter's antitrust work is even more important. In attacking corporate power itself, he is going after the machine that funds this nihilism-inducing corruption machine.

This week, Tor Books published SPILL, a new, free LITTLE BROTHER novella about oil pipelines and indigenous landback!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/09/25/epistemological-chaos/#incentives-matter

Image: Ron Cogswell (modified) https://en.wikipedia.org/wiki/File:George.Mason.University.Arlington.Campus.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

323 notes

·

View notes