#Government loan schemes

Explore tagged Tumblr posts

Text

Government & Special Schemes: A Complete Guide to Personal Loans

When it comes to financing personal expenses, a personal loan can be a valuable tool. However, did you know that there are several government-backed schemes and special loan programs designed to make personal loans more accessible and affordable for various groups of people? Whether you are a government employee, a first-time homebuyer, or an individual with specific financial needs, understanding these schemes can help you secure better terms and lower interest rates.

In this article, we will explore government and special schemes that offer financial assistance, discuss how these programs work, and provide a list of lenders who offer personal loans under these schemes.

1. Government Schemes for Personal Loans in India

1.1 Pradhan Mantri Mudra Yojana (PMMY)

One of the most prominent government schemes for financing small businesses and individuals is the Pradhan Mantri Mudra Yojana (PMMY). This scheme offers financial support to non-corporate, non-farm small/micro enterprises and is especially helpful for those looking to start their own business or expand an existing one.

Types of Loans under PMMY: ✔ Shishu Loan – Up to ₹50,000 for startups and small businesses in the early stages. ✔ Kishore Loan – ₹50,001 to ₹5 lakh for businesses that have a more established track record. ✔ Tarun Loan – ₹5 lakh to ₹10 lakh for larger small enterprises looking to grow.

💡 Tip: Since PMMY loans are aimed at small businesses and entrepreneurs, they can also be used for personal purposes like buying equipment or funding personal projects related to business needs.

🔗 Best lenders for PMMY loans: 👉 IDFC FIRST Bank Personal Loan 👉 Bajaj Finserv Personal Loan

1.2 Atal Pension Yojana (APY)

The Atal Pension Yojana (APY) is a government-backed pension scheme designed for workers in the unorganized sector. This scheme provides pension benefits to people between the ages of 18 to 40 years, ensuring a steady income after retirement. Though primarily a pension scheme, APY participants may also benefit from certain loan schemes tailored to meet their financial needs.

1.3 National Handicapped Finance and Development Corporation (NHFDC) Loans

The NHFDC offers personal loans at subsidized rates to people with disabilities, helping them fund various personal needs, including: ✔ Education ✔ Employment creation ✔ Livelihood enhancement

Eligibility Criteria: ✔ Individuals with disabilities must be between 18 to 55 years. ✔ A minimum of 40% disability must be verified by a medical board.

💡 Tip: NHFDC loans are especially helpful for disabled individuals to set up small businesses or manage personal expenses.

2. Special Loan Schemes for Government Employees

2.1 Government Employee Personal Loan Schemes

Many banks and NBFCs offer special personal loan schemes tailored specifically for government employees. These loans typically come with lower interest rates, flexible terms, and quick processing. Since government employees are considered low-risk borrowers, these schemes are designed to offer more favorable conditions.

Key Features: ✔ Lower Interest Rates – Reduced interest rates for government employees. ✔ Longer Tenure – Extended repayment periods (up to 7 years). ✔ Higher Loan Amount – Government employees can avail of larger loans than those with private-sector jobs.

💡 Best for: Government employees looking for unsecured loans to cover personal expenses or emergencies.

🔗 Best lenders for government employee loans: 👉 Tata Capital Personal Loan 👉 Axis Bank Personal Loan

2.2 Nationalized Banks Personal Loans for Government Employees

Nationalized banks such as SBI, PNB, and Bank of India also offer exclusive personal loan schemes for government employees. These loans are typically available at lower interest rates, making them an ideal choice for government staff members.

3. Schemes for Women Entrepreneurs

3.1 Stand-Up India Scheme

The Stand-Up India Scheme was launched to promote entrepreneurship among women, Scheduled Castes (SCs), and Scheduled Tribes (STs). Under this scheme, banks offer loans ranging from ₹10 lakh to ₹1 crore for greenfield projects in the manufacturing, services, or trading sectors.

Key Features: ✔ Collateral-free loans for women entrepreneurs. ✔ Repayment tenure of up to 7 years. ✔ Lower interest rates compared to standard loans.

💡 Tip: This scheme is ideal for women entrepreneurs who want to establish or grow a small business and need financial assistance.

🔗 Best lenders for Stand-Up India loans: 👉 Axis Finance Personal Loan 👉 InCred Personal Loan

4. Schemes for First-Time Homebuyers

4.1 Pradhan Mantri Awas Yojana (PMAY)

The Pradhan Mantri Awas Yojana (PMAY) aims to provide affordable housing to the urban poor and those from rural areas. This scheme offers subsidized loans for first-time homebuyers and those looking to upgrade their homes.

Key Benefits of PMAY: ✔ Subsidized interest rates (up to 6.5% p.a.) for home loans. ✔ Affordable repayment terms with long loan tenures. ✔ Available to both urban and rural residents.

💡 Tip: Check if you’re eligible for a PMAY subsidy before applying for a home loan to save significantly on interest payments.

🔗 Best lenders for PMAY loans: 👉 IDFC FIRST Bank Personal Loan 👉 Bajaj Finserv Personal Loan

5. How to Apply for Government and Special Scheme Loans

Step 1: Check Eligibility Criteria

Each government-backed or special loan scheme has specific eligibility criteria that must be met. Be sure to review the eligibility conditions for each scheme before applying.

Step 2: Gather Required Documents

Most loans will require basic documentation such as: ✔ Identity Proof ✔ Address Proof ✔ Income Proof (ITR, Salary slips, or Bank Statements) ✔ Property Papers (for housing schemes)

Step 3: Apply Through Approved Lenders

Many of these loans are disbursed by banks and financial institutions that are approved by the government. Ensure that the lender you choose is part of the approved list for each scheme.

Leveraging Government & Special Schemes for Personal Loans

Government and special schemes play a vital role in providing financial support to individuals from various backgrounds, whether you are a first-time homebuyer, government employee, or women entrepreneur. These schemes typically offer lower interest rates, longer repayment periods, and less stringent eligibility conditions, making them highly beneficial for personal and business needs.

Before applying, make sure you: ✔ Check the eligibility for the scheme that fits your needs. ✔ Compare interest rates and loan terms to get the best deal. ✔ Prepare your documents in advance to speed up the approval process.

For the best personal loan options, apply here: 👉 Compare & Apply for a Personal Loan

By leveraging these government and special schemes, you can achieve your financial goals more affordably and efficiently.

#Government loan schemes#Special loan schemes in India#Pradhan Mantri Mudra Yojana loan#Personal loan schemes for government employees#Stand-Up India scheme loans#Affordable housing loan schemes#Government-backed personal loans#PMAY loan eligibility#Personal loan for women entrepreneurs#Personal loan schemes for first-time homebuyers#Mudra Yojana loan for business#National Handicapped Finance and Development Corporation loan#Personal loans for self-employed individuals#Loans for disabled individuals in India#Personal loan eligibility criteria for government employees#Affordable personal loans for startups#How to apply for PMAY home loan#Pradhan Mantri Awas Yojana subsidy#Subsidized personal loans for women#Low-interest government personal loan schemes#finance#bank#nbfc personal loan#personal loans#loan services#personal loan#fincrif#loan apps#personal loan online#personal laon

0 notes

Text

PPP fraud is ‘worst in history’: $200B stolen and blown on Lamborghinis, beach houses and bling -

#ppp#fraud#covid loan scheme#eat the rich#eat the fucking rich#class war#fuck the gop#fuck the idf#fuck the police#fuck the patriarchy#fuck the tories#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#government corruption#corrupt gop#corrupt cops#biden corruption#democrats are corrupt#corrupt government#exploitation#exploitative#anti capitalism

5 notes

·

View notes

Text

RTI Full Form and How It Is Relevant to the CGTMSE Scheme and MSME Loans

The Right to Information Act (RTI) is a strong piece of legislation in India that provides citizens with the strength to request information from public authorities. The acronym for RTI is the Right to Information Act. The Right to Information Act was enacted in 2005 with the aim of ensuring transparency and accountability in the operation of public authorities by giving citizens the right to get information.

Understanding the CGTMSE Scheme

The CGTMSE scheme, also officially called the Credit Guarantee Fund Trust for Micro and Small Enterprises, is an initiative of the government aimed at offering collateral-free credit to micro and small enterprises (MSEs). Inaugurated in August 2000 by the Government of India in partnership with the Small Industries Development Bank of India (SIDBI), the scheme intends to solve the major problem of securing financial aid without tangible collateral.

Key Features of the CGTMSE Scheme

The CGTMSE scheme provides a number of key features that make it a useful asset for MSMEs. The scheme provides a repayment guarantee of 75% to 85% (in some cases) for loan amounts up to ₹50 lakh. Loans between ₹50 lakh and ₹1 crore are insured up to 50%. Women entrepreneurs and businesses in the North East Region (NER) are given special provisions, with a guarantee cover of 80%. Micro-enterprises that have loans of up to ₹5 lakh are given an 85% guarantee. In situations where the business fails due to circumstances beyond the control of the management, the scheme provides rehabilitation support of up to ₹1 crore to revive the enterprise.

How to Apply for CGTMSE

The procedure of obtaining an MSME loan under the CGTMSE scheme includes the following. Incorporate your business entity, create a legal business structure like a Private Limited Company, LLP, or Proprietorship. Have all tax registrations and approvals in order. Prepare a detailed business plan, create a detailed business plan with your business model, financial projections, and promoter details. Find a participating financial institution (PFI), study and visit lenders that disburse loans through the CGTMSE scheme. Fill out your application and return it, and fill in the CGTMSE loan application form and submit along with your business plan and the other supporting papers to your PFI of preference. Your PFI will go through your application on their in-house norms as well as business plan viability. Apply for guarantee cover, once approved for the loan, the PFI will apply for a guarantee cover from CGTMSE on your behalf. After approval from CGTMSE, pay any guarantee fees that may be applicable, and the PFI will release the loan amount to your business.

Relevance of RTI to the CGTMSE Scheme

The RTI Act ensures transparency and accountability in government schemes such as the CGTMSE. The RTI can be utilized by citizens to obtain information regarding the working of the CGTMSE scheme, eligibility, application procedures, and the status of their applications. This helps MSME owners to make well-informed decisions and ensures that the scheme works impartially and effectively.

Advantages of the CGTMSE Scheme

The CGTMSE scheme has many advantages that render it a lucrative choice for MSMEs. It does away with the requirement of tangible collateral, which ensures that MSEs can avail themselves of loans without any hassles. With the guarantee coverage limit raised to ₹500 lakh, businesses can avail themselves of increased loan amounts. The decrease in guarantee fees lowers the cost of borrowing for MSEs. SC/STs, women entrepreneurs, ZED-certified units, and businesses in Aspirational Districts receive lower fees and increased coverage.

Conclusion

The CGTMSE scheme is a potent weapon for MSMEs seeking to obtain financial assistance without the hassles of collateral. Through a credit guarantee and easy loan process, it promotes entrepreneurship and stimulates economic growth. For anyone planning startup funding or small business loans in India, the CGTMSE scheme is certainly worth considering. If you are a businessman or entrepreneur wanting to grow your MSME further, the CGTMSE scheme may be the financial assistance you require. Be sure to thoroughly go through the eligibility and application process to avail yourself of all that this government scheme has to offer.

#government schemes for msmes#cgtmse loan process#credit guarantee scheme for msmes#cgtmse scheme#msme subsidy programs#small business loans india#msme loan guarantee#collateral-free loans india

0 notes

Text

How to Choose the Best Business Loan in 2025: A Guide for Small Business Owners

Starting or scaling a small business in 2025 is both exciting and challenging. Whether you're launching a startup or expanding your current operations, access to the right funding can be a game-changer. But with so many loan options, schemes, and interest rates floating around, the real question arises—how do you choose the best business loan for your needs?

In this comprehensive guide, we’ll break down the most relevant loan types, explain how to compare offers, and share expert tips to help you secure the lowest interest rate business loan in India. Let's help you make an informed decision and get your business the financial boost it deserves.

What Do Small Business Owners Really Need?

Most small business owners, freelancers, and self-employed individuals are looking for three key things:

Instant approval without lengthy paperwork

Flexible repayment terms

Low-interest rates to reduce the financial burden

And here's the good news: 2025 has opened doors to a variety of instant business loans for self-employed and startup schemes with easier eligibility and faster processing.

Common Problems Business Owners Face

Before jumping into loans, it’s important to identify what challenges you're trying to solve:

Types of Business Loans in 2025

1. MSME Loan for Small Business Without Collateral

This loan type is perfect for micro and small enterprises with limited assets. The government and banks are pushing for collateral-free options with flexible repayment.

Best For: First-time business owners, traders, shop owners, and freelancers.

2. Startup Loan for New Business

Many banks and NBFCs now offer tailor-made loans for startups. Even new businesses with no revenue history can qualify based on their business plan and projections.

Tip: Enroll in the Government Business Loan Scheme for a New Business to get priority support and subsidies.

3. Instant Business Loan for Self-Employed

Need funds quickly? Many fintech platforms offer same-day loan disbursement with minimal documentation.

Highlight: You can get up to ₹50 lakhs within 24 hours depending on your credit score and ITR.

4. Secured Business Loan / Business Loan Against Property in India

If you own property or machinery, you can get a much larger loan at a lower interest rate.

Pro: Ideal for expansion, factory setup, or bulk inventory purchase.

Comparison Table: Top Business Loans in 2025

Unlock the best business loan interest rates today! Click now to boost your business!

How to Select the Right Loan for You

Here’s a quick step-by-step checklist:

Assess your requirement – Expansion, working capital, equipment?

Check eligibility – Age, business vintage, credit score.

Compare interest rates – Use aggregator sites and bank websites.

Decide between secured and unsecured – Based on your risk appetite and asset availability.

Read reviews & ratings – Check Google Reviews and platforms like BankBazaar.

Use EMI calculators – Know what your monthly outgo will be.

Real User Reviews

"I applied for a business loan against property in India through a private bank. The paperwork was smooth, and I got ₹40 lakhs at just 9% interest! This helped me scale my printing business to the next level." — Anand Mehta, Business Owner, Surat

"Being self-employed, I never thought I could get a quick loan. But an instant business loan for the self-employed got approved within a day and helped me restock my salon supplies." — Pooja Sharma, Freelancer, Jaipur

"As a new entrepreneur, the Startup India loan scheme for new businesses gave me the confidence and capital to launch my organic skincare line." — Ravi Tiwari, Startup Founder, Delhi

Red Flags to Avoid

Don’t blindly trust unregistered lenders

Avoid loans with hidden charges or high processing fees

Be wary of offers with "too good to be true" interest rates

Frequently Asked Questions (FAQ)

Q1. What is the best loan for a small business startup in India?

A: The Startup India Loan Scheme and other startup business loans from NBFCs and banks are ideal for new ventures.

Q2. Can I get a business loan without collateral?

A: Yes, schemes like the MSME loans for small businesses without collateral are designed for this.

Q3. How fast can I get a business loan as a self-employed individual?

A: With fintech lenders, you can get an instant business loan for the self-employed within 24–48 hours.

Q4. What is the interest rate on secured business loans in 2025?

A: On average, secured business loan rates range from 7% to 11% annually.

Q5. Can I use my property to get a business loan?

A: Yes, you can apply for a business loan against property in India for higher amounts and better terms.

Final Thoughts

Choosing the best business loan in 2025 doesn't have to be confusing. When you clearly understand your needs and compare the right loan products, the process becomes much easier. Government-backed schemes, instant loan platforms, and secured loans all have their place depending on your business stage.

Whether you're self-employed, running a small MSME, or just stepping into the startup world, there’s a business loan tailored just for you.

Ready to fund your business dream?

Start comparing, apply smartly, and grow fearlessly.

#instant business loan for self employed#lowest interest rate business loan in India#MSME loan for small business without collateral#Startup Business Loans#startup India loan scheme for new business#startup loan for new business#government loan for new business startup in India#secured business loan#business loan against property in India

0 notes

Text

Education Loan for Abroad Studies by Indian Government Banks

For students aspiring to pursue their dreams abroad, education loans can be a game-changer. Indian government banks offer robust options tailored to meet the needs of international students. These loans provide financial support for tuition, living expenses, and other study-related costs, making quality education accessible.

Understanding the features and benefits of these loans can help you make informed decisions that align with your academic and career goals. This article explores top education loan options offered by leading Indian government banks to assist you in your study abroad journey.

So, what are we waiting for? Let us get started with the details!

1. Punjab National Bank (PNB) – Udaan Scheme

Designed specifically for students seeking to study abroad, Punjab National Bank's Udaan Scheme offers comprehensive financial support.

Loan Amount: Up to INR 1.5 crore depending on the course and country of study.

Interest Rate: Competitive rates starting at the base rate plus a small margin, with a concession for female students.

Repayment Tenure: Up to 15 years, including the moratorium period.

Processing Fee: Nominal processing fee, with certain courses exempt from fees.

Eligibility Criteria:

Indian nationals aged 18-35 years.

Admission to professional, technical, or other recognized courses abroad.

Secured admission to universities in countries like the USA, UK, Canada, Australia, etc.

Benefits:

Lower interest rates for meritorious students and females.

Flexible repayment options with a longer tenure.

Coverage includes all educational expenses.

Documents Required:

Admission letter from the university.

Academic records and proof of income.

Collateral for loans above a specific amount.

2. Union Bank of India – Union Education Loan Scheme

Union Bank of India offers an education loan scheme to facilitate students' overseas studies.

Loan Amount: Up to INR 40 lakh without collateral, higher amounts require security.

Interest Rate: Floating rates starting from 8.90%, with a 0.5% concession for female students.

Repayment Tenure: Up to 15 years, with flexible repayment options.

Processing Fee: Waived for certain categories, making it affordable for students.

Eligibility Criteria:

Indian nationals with secured admission to foreign universities.

Courses must be recognized and include degrees, diplomas, and certification programs.

Co-applicant required, typically parents or guardians.

Benefits:

No processing fee for loans up to INR 4 lakh.

Special concessions for economically weaker sections.

Coverage includes tuition, travel, books, and living expenses.

Documents Required:

Proof of admission, academic qualifications, and co-applicant's income.

Collateral security for higher loan amounts.

Passport and visa details.

3. State Bank of India (SBI) – Global Ed-Vantage Scheme

The State Bank of India's Global Ed-Vantage Scheme is a specialized loan for students aspiring to study at prestigious institutions abroad.

Loan Amount: Ranges up to INR 1.5 crore, covering the entire cost of education.

Interest Rate: Attractive rates starting at 9.55%, with concessions for female students.

Repayment Tenure: Up to 15 years, with a moratorium period covering course duration plus 6 months.

Processing Fee: 1% of the loan amount, refundable on the first disbursement.

Eligibility Criteria:

Indian nationals with secured admission to full-time courses at reputed foreign universities.

Co-borrower is required, usually a parent or guardian.

Collateral security is mandatory for loans above INR 7.5 lakh.

Benefits:

Quick and hassle-free processing with dedicated student loan branches.

Lower interest rates and flexible terms for repayment.

Coverage includes tuition, accommodation, travel, and other miscellaneous expenses.

Documents Required:

Admission letter, academic transcripts, and financial documents of the co-applicant.

Passport, visa, and collateral documents for higher loan amounts.

Income proof and IT returns of the co-applicant.

Indian government banks provide reliable and cost-effective options for funding overseas education. While various schemes cater to different needs, students can also explore Indian government scholarships for studying abroad. For information on study abroad scholarships and assistance in the application process for overseas education loans, consider connecting with a global education consultant in your city. These experts assist you in choosing the best financial institution based on your requirements. So, what are you waiting for? Start searching for the right one today!

#Education loan to Study Abroad#Indian Government Scholarships For Studying Abroad#education loan for abroad studies by Indian government#education loan scheme

0 notes

Text

The Ultimate Guide to Availing a Professional Loan for Doctors

In the fast-paced world of healthcare, doctors often find themselves needing financial support to grow their practices or manage education costs. That’s where a professional loan for doctors comes into play. Personal Loan Guru is here to help you understand everything you need to know about these specialized loans.

What is a Professional Loan for Doctors?

A professional loan for doctors is designed specifically to support medical professionals. These loans can cover various needs such as:

Setting up a private practice

Buying medical equipment

Covering education expenses

They come with features that make them suitable for the unique financial requirements of healthcare providers.

Why Do Doctors Need Professional Loans?

Doctors invest a lot of time and money into their education and careers, often leaving little room for savings. A professional loan can help bridge the gap for several reasons:

High Costs: Setting up or expanding a practice involves significant expenses, from office space to equipment.

Working Capital: Loans can provide the cash flow necessary to manage everyday business operations.

Student Loans: Many doctors graduate with debt from medical school. Professional loans can help in paying these off.

Benefits of Taking a Professional Loan for Doctors

Professional loans for doctors come with unique advantages:

Higher Loan Amounts: Unlike regular personal loans, these loans often provide larger amounts, allowing for major investments.

Flexible Repayment: Lenders usually offer extended repayment terms, helping ease monthly financial burdens.

Lower Interest Rates: Interest rates can be lower compared to traditional loans which helps save on costs over time.

These benefits can make a significant difference when managing your medical practice or educational debts.

Eligibility Criteria for Doctors

Before applying for a professional loan, identify if you meet the eligibility criteria. Typically, you need to:

Be a qualified medical professional, including doctors, specialists, or surgeons

Provide proof of income, usually through salary slips or tax returns

Have a good credit score, ideally above 700

Checking these criteria early can streamline your loan application process.

How to Choose the Right Professional Loan for Doctors

Selecting the right loan involves some key considerations. Here are some steps to help you make an informed choice:

Assess Your Financial Needs: Calculate how much money you really need and what you intend to use it for.

Research Lenders: Look into different financial institutions that offer professional loans.

Compare Interest Rates: Note the interest rates on offers you receive. Even a small difference can impact your overall costs significantly.

Look for Hidden Fees: Sometimes, lenders charge fees that aren’t obvious at first glance, so read all the fine print.

Get Expert Advice: Consulting with a financial advisor can provide personal insights into your specific situation.

By following these steps, you can find a professional loan tailored to your needs.

The Application Process

Once you’ve chosen the right loan for your requirements, it’s time to apply. Here’s an overview of what to expect during the application process:

Gather Documentation: Required documents typically include:

ID proof

License to practice medicine

Income statements

Previous tax returns

Submit the Application: Fill out the application form on the lender’s website. Make sure all the info is accurate.

Loan Assessment: The lender will review your application, evaluate your creditworthiness, and conduct any necessary background checks.

Loan Approval: Upon approval, you’ll sign the agreement and the funds will be disbursed to your designated account.

Repayment Plan: Understand your repayment schedule and adhere to it to avoid penalties.

Tips for Good Financial Health

After securing your professional loan for doctors, it’s essential to manage your finances wisely. Here are some quick tips:

Create a Budget: Setting a monthly budget helps you manage loan repayment alongside other expenses.

Invest Wisely: If you get funds for establishing a practice, invest in growth opportunities that boost your patient’s care.

Monitor Your Credit Score: Regularly check your credit score and ensure timely payments to maintain a healthy financial future.

Conclusion

Availing a professional loan for doctors can dramatically improve your financial situation when used properly. From setting up ambitious practices to managing educational debts, these loans can be a game-changer in a doctor’s journey. Stay informed and choose wisely — it’s a vital step for your career and future investments.

#Doctor loan interest rate#Government loan scheme for doctors#Doctor loan in india#Doctor loan#Personal loan for doctors#professional doctor loan#Doctor loan eligibility

0 notes

Text

No Collateral, No Problem: How SBI is Empowering Women Entrepreneurs in India

“How SBI’s collateral-free loans empower women entrepreneurs in India. Learn about eligibility, benefits, application process, and success stories. Explore how this initiative bridges the gender gap and boosts economic growth. Perfect for women seeking financial support to start or scale their businesses. Read more for actionable insights!” In a significant move to bolster women entrepreneurship…

#financial inclusion for women entrepreneurs#government schemes for women entrepreneurs#no collateral business loans for women#SBI collateral-free loans for women#SBI loan eligibility for women#SBI loans for women entrepreneurs#SBI MSME loans for women#SBI startup loans for women#SBI women entrepreneur scheme#women entrepreneurship in India

0 notes

Text

Government Schemes for Food Processing Units: Subsidy & Bank Loan Interest Details

Government Schemes for Food Processing Units: Subsidy & Bank Loan Interest Details Food Processing उद्योग भारत में तेजी से बढ़ रहा है और सरकार इसे और अधिक बढ़ावा देने के लिए विभिन्न schemes लेकर आई है। यदि आप एक Food Processing Unit स्थापित करना चाहते हैं, तो भारत सरकार की विभिन्न योजनाओं के तहत आपको Subsidy, Bank Loan और अन्य financial assistance मिल सकती है। इस blog में हम विस्तार से इन…

#Food Processing Loan Interest#Food Processing Unit Subsidy#Government Schemes for Food Processing#Indian Government Subsidy Schemes#MSME Loan Scheme#Mudra Yojana for Food Industry

0 notes

Text

youtube

#PM Vidya Lakshmi Yojana#Vidya Lakshmi Portal#UPSC Aspirants#UPSC Loan Scheme#Scholarship for UPSC#Government Education Loan#Vidya Lakshmi Yojana UPSC#UPSC Preparation Loan#Higher Education Scholarship#Financial Support for Students#10 Lakh Loan Scheme#PM Scholarship Scheme#UPSC Study Loan#tudaynews#breakingnews#election#Youtube

0 notes

Text

Waaree सोलर ऑफर: 2kW सिस्टम से मात्र ₹600 में शुरू करें बिजली की बचत

अगर आप अपने घर की छत पर सोलर सिस्टम लगाने का सपना देख रहे हैं, लेकिन पैसों की कमी आपको रोक रही है, तो अब चिंता की कोई बात नहीं। केंद्र सरकार की “पीएम सूर्यघर योजना” के तहत आप मात्र ₹600/महीने की किस्त पर Waaree का 2kW सोलर सिस्टम अपने घर पर लगवा सकते हैं। यह योजना आपके लिए बिजली के बढ़ते बिलों से छुटकारा दिलाने का बेहतरीन मौका है। खास बात यह है कि सिर्फ 4 साल में यह सोलर सिस्टम आपका हो जाएगा, और…

#2kW solar panel daily electricity production#2kW solar system EMI#advantages of solar panels India#affordable solar systems in India#best rooftop solar companies in India#best solar panels in India#EMI options for solar panels#how to apply for PM Suryaghar Yojana#how to reduce electricity bills in India#how to save on electricity bills with solar#PM solar energy scheme benefits#PM Suryaghar solar subsidy eligibility#PM Suryaghar Yojana#rooftop solar panel installation cost#rooftop solar panel maintenance tips#rooftop solar system benefits India#rooftop solar system India#solar energy benefits#solar panel government subsidy 2025#solar panel loan process#solar panel subsidy India#Waaree 2kW solar panel price#Waaree solar panel benefits#Waaree solar system reviews

0 notes

Text

Home Loan for Solar Rooftop | Financing & EMI Schemes

EcoSoch offers financing for rooftop solar installations, home improvement loans with tax benefits, and easy EMI schemes for residential, commercial projects.

#Best home loan for rooftop solar#Home loan for rooftop solar#EMI schemes for solar systems#Financing for solar projects#Solar loan options for homes#government subsidies for solar panels in domestic homes

0 notes

Text

How Does the Loan Application Process Differ for Government Employees?

A personal loan is a popular financial solution for individuals who need immediate funds for various expenses like medical emergencies, home renovations, weddings, education, or debt consolidation. While the loan application process remains similar for most applicants, government employees often enjoy preferential treatment due to their job stability, regular income, and lower credit risk. Banks and NBFCs (Non-Banking Financial Companies) offer special schemes and benefits exclusively for government employees, making the loan approval process smoother and more advantageous.

In this article, we will explore how the personal loan application process differs for government employees, the exclusive benefits they receive, and the key eligibility criteria lenders consider.

1. Why Do Government Employees Have an Advantage in Personal Loan Applications?

Government employees are considered low-risk borrowers due to their stable job, assured salary, and pension benefits. Financial institutions view them as trustworthy applicants, leading to faster loan approvals, lower interest rates, and higher loan amounts.

Key Advantages for Government Employees:

Job Stability: Government jobs offer lifetime employment security, reducing the risk of defaults.

Fixed Monthly Income: A guaranteed salary ensures steady repayment capacity.

Higher Loan Amounts: Due to stable earnings, government employees can qualify for larger loan amounts.

Lower Interest Rates: Banks and NBFCs provide special discounted interest rates.

Flexible Repayment Options: Some banks offer extended tenures and easy EMIs.

Pre-Approved Loan Offers: Many lenders provide pre-approved loans based on salary account history.

Due to these factors, government employees enjoy a faster and hassle-free personal loan approval process compared to private-sector employees or self-employed individuals.

2. Personal Loan Eligibility Criteria for Government Employees

Although government employees have better approval chances, they still need to meet the lender’s eligibility criteria. The general requirements include:

A. Employment Type

Banks categorize government employees into different groups, such as:

Central Government Employees (IAS, IPS, IFS officers, etc.)

State Government Employees (state-level civil servants, teachers, healthcare workers)

Public Sector Undertaking (PSU) Employees (employees of SBI, ONGC, BHEL, LIC, etc.)

Defense and Paramilitary Forces (Army, Navy, Air Force, CRPF, BSF, etc.)

Most lenders extend exclusive benefits to these categories due to higher job security and stable income.

B. Minimum Salary Requirement

Although banks offer personal loans with relaxed income criteria for government employees, they still require a minimum salary:

Metro cities: ₹25,000 - ₹30,000 per month

Non-metro cities: ₹15,000 - ₹20,000 per month

C. Age Criteria

Most lenders offer personal loans to government employees aged between 21 to 60 years. Some banks extend the upper limit to 65 years for pensionable government employees.

D. Work Experience

Minimum 1 year of continuous service in government employment.

Some lenders may require at least 6 months of salary account transactions.

E. Credit Score Requirements

A credit score of 750+ is ideal for faster loan approval and lower interest rates. However, some banks approve loans for government employees with scores as low as 650, considering their stable employment.

3. How the Loan Application Process Differs for Government Employees

The personal loan application process is similar across all applicants, but government employees enjoy certain advantages that streamline approvals.

Step 1: Choose the Right Lender Offering Special Schemes

Many banks and NBFCs have dedicated personal loan schemes for government employees with exclusive benefits such as lower interest rates and flexible repayment plans. Some top lenders offering these specialized loans include:

State Bank of India (SBI) – Xpress Credit Personal Loan

Punjab National Bank (PNB) – Personal Loan for Government Employees

HDFC Bank – Government Employee Special Loan

ICICI Bank – Instant Personal Loans for PSU Employees

Step 2: Submit Required Documents

Government employees often require fewer documents due to their verifiable salary structures. The standard documents include:

Identity Proof: Aadhaar Card, PAN Card, Voter ID

Address Proof: Utility bills, Passport, Rental Agreement

Income Proof: Latest 3-6 months’ salary slips

Employment Proof: Government-issued ID card or appointment letter

Bank Statements: Last 6 months' bank statements (for salary credit verification)

Form 16 or ITR: (Only required for higher loan amounts)

Step 3: Faster Loan Approval and Processing

Government employees often benefit from pre-approved personal loan offers, which significantly reduce processing time. Many banks process personal loan applications for government employees within 24 to 48 hours, whereas private-sector employees may have to wait longer.

Step 4: Loan Disbursal

Upon approval, the loan amount is directly credited to the borrower’s salary account. Some banks offer instant loan disbursal for government employees using digital verification methods.

4. Special Benefits for Government Employees Applying for a Personal Loan

Government employees enjoy various perks when applying for a personal loan. Here are some key benefits:

A. Lower Interest Rates

Most lenders offer discounted interest rates on personal loans for government employees, typically ranging from 8.50% to 12%, compared to 10% to 24% for private-sector employees.

B. Higher Loan Amount Eligibility

Due to a steady income, government employees can qualify for higher loan amounts, often ranging from ₹5 lakh to ₹40 lakh, depending on salary and creditworthiness.

C. Flexible Repayment Options

Some banks offer extended repayment tenures of up to 84 months, whereas private-sector employees typically get 12 to 60 months.

D. Minimal Processing Fees

Certain lenders waive off processing fees or offer discounted charges for government employees.

E. No Collateral or Guarantor Required

Government employees are generally approved for unsecured personal loans, eliminating the need for collateral or a guarantor.

5. Tips for Government Employees to Get the Best Personal Loan Offer

✅ Compare Different Banks: Check multiple lenders for the lowest interest rates and best benefits. ✅ Maintain a High Credit Score: A 750+ score can help secure the best interest rates. ✅ Opt for Digital Application: Many banks offer instant loan approval for government employees through online banking portals. ✅ Check for Pre-Approved Loan Offers: If you hold a salary account, your bank may provide special offers. ✅ Choose the Right Loan Tenure: A longer tenure reduces EMIs but increases overall interest payments. ✅ Negotiate Processing Fees: Some lenders offer discounted fees for government employees.

Conclusion

The personal loan application process is significantly easier for government employees due to their stable income, job security, and lower credit risk. Many banks and NBFCs provide exclusive benefits, such as lower interest rates, higher loan amounts, flexible tenures, and faster approvals, making government employees prime candidates for personal loans.

If you are a government employee planning to apply for a personal loan, compare different lenders, check for pre-approved offers, and choose a repayment plan that best suits your financial needs. A well-planned approach will help you secure the best loan terms while maintaining financial stability.

For more insights on personal loans and exclusive government employee benefits, visit www.fincrif.com today!

#loan apps#personal loan online#fincrif#nbfc personal loan#personal loans#loan services#finance#bank#personal loan#personal laon#personal loan for government employees#government employee loan benefits#best personal loan for govt employees#personal loan approval process#low-interest personal loan#personal loan eligibility for government employees#how to apply for a personal loan#personal loan schemes for government employees#government salary account loan offers#personal loan vs secured loan for govt employees#how government employees can get a personal loan with low interest#best banks for personal loans for government employees#personal loan eligibility criteria for PSU employees#personal loan for government teachers and defense personnel#pre-approved personal loans for government employees#does being a government employee improve personal loan approval#fastest personal loan disbursal for government workers#best loan tenure options for government employees

1 note

·

View note

Text

#government schemes for first time home buyers#mortgage pre approval#subsidies on home loan#good credit score#housing market trends#financenu

0 notes

Text

How CGTMSE Assists MSMEs in the Financial Domain

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of India's developing economy, promoting innovation and generating jobs. Nevertheless, access to finances is usually the significant obstacle for most entrepreneurs. To fill this lacuna, the government, and other financial institutions have launched some initiatives like the CGTMSE scheme – a strong credit guarantee scheme for MSMEs intended to enable collateral-free loans in India. Through this blog, we discuss how the CGTMSE scheme is helpful to MSMEs in the financial segment by improving lending procedures and lending much-needed relief to startups and existing businesses both.

Understanding CGTMSE and Its Impact

CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) was initiated with the aim to offer business loans to small enterprises without collateral security. This is to say that entrepreneurs looking to get a startup business loan or msme loan for new business can get a loan even in the absence of significant collateral. By reducing lenders' risks, the CGTMSE loan mechanism facilitates it easier for financial institutions to provide lending for business.

Key Features:

Collateral-free loans India: Small business loans in India can be availed by entrepreneurs without pledging their assets.

MSME loan guarantee: The scheme is a safety net that increases lender confidence.

Help for startups: It is a key tool for entrepreneurs requiring startup finance India.

Government schemes for MSMEs: CGTMSE is a component of comprehensive MSME support measures by the Indian government for the development of the sector.

How the CGTMSE Scheme Works

The CGTMSE Loan Process

For effective financing, the CGTMSE loan process is kept simple:

How to Apply for CGTMSE: The entrepreneur must draft a detailed business plan, visit a collaborating lending institution, and submit the application.

MSME Loan Guarantee: Upon submitting the application, the lender issues a guarantee under the credit guarantee scheme for MSMEs.

Approval and Disbursement: After fulfilling the eligibility requirements, companies can avail funds without the fear of offering collateral security.

For MSMEs and financial institutions as well, it is important to know how to obtain a CGTMSE loan without collateral and how to avail CGTMSE for startups, which are key factors in making the most of this scheme.

CGTMSE Login and Charges

Borrowers and financial institutions can conveniently check the status of their loan through the cgtmse login page on the website. Moreover, applicants should also be cognizant of some charges:

CGTMSE fee and CGTMSE charges: These are minor charges payable as a component of the guarantee service to keep the scheme running and continue to finance MSMEs throughout the nation.

Increasing Financial Access for MSMEs

The CGTMSE scheme has played a vital role in increasing lending to business. With the risk factor reduced, banks and NBFCs are more comfortable providing business loans to small firms and startup business loan products. Here's how it makes a big difference:

Risk Reduction for Lenders: With the guarantee scheme by its side, the risk of investment is greatly minimized.

Encouragement of Collateral-free Loans: This facilitates even people who do not own substantial assets to avail themselves of the necessary capital.

Boost to MSME Subsidy Programs: The initiative is complementing other MSME subsidy schemes to provide an exhaustive support structure to small and medium-sized enterprises.

The initiative also has direct implications for the Government's large schemes for MSMEs as well as MSME support efforts by Indian government for developing a vibrant and inclusive business ecosystem.

Steps to Use CGTMSE for Startups and Enterprises

Those who are thinking about how to get CGTMSE should consider the following simple step-by-step process:

Get Your Business Plan Ready: Make sure to provide detailed financial estimates and the intended use of the loan.

Select a Lending Partner: Contact banks or NBFCs who are part of the credit guarantee scheme.

Make Your Application: Fill in the required paperwork and start your application process.

Activate CGTMSE Login: Use the cgtmse login portal to track your application status and manage your profile.

Understand the Charges: Be informed about the applicable cgtmse charges and cgtmse fee.

Receive Collateral-free Funding: Once approved, leverage collateral-free loans India to fuel your business growth.

Following these steps to avail CGTMSE for startups can significantly enhance your chances of securing the needed funding efficiently.

Conclusion

In the ever-changing financial world, the CGTMSE scheme is a revolutionary instrument that not only encourages startup funding India but also ensures that small company business loans and other business lending options become available to all those aspiring entrepreneurs. With a simplified CGTMSE loan procedure and complete support measures, the scheme is playing a vital role in improving MSME growth. By providing a credible credit guarantee scheme and addressing collateral-related issues, it opens the door to a more inclusive and stronger economic future in India.

Embrace the potential of collateral-free loans in India and take the first step towards a successful business by exploring the opportunities offered by the CGTMSE scheme today.

#CGTMSE scheme#MSME loan guarantee#Credit guarantee scheme for MSMEs#Collateral-free loans India#CGTMSE loan process#Government schemes for MSMEs#How to apply for CGTMSE#Startup funding India#Small business loans India#MSME subsidy programs

0 notes

Text

Smart Home Loan Guide 2025: How to Qualify Faster & Pay Less Interest!

Buying a home is a dream for many, but high home loan interest rates and strict home loan eligibility criteria often make it challenging. However, with the right strategies, you can secure the lowest home loan interest rate and maximize your home loan eligibility criteria effortlessly.

This guide reveals insider secrets to help you get the best home loan deals in India with low interest rates and flexible eligibility criteria.A smiling woman in her mid-30s is wearing a casual blue shirt, holding a wooden house cutout in one hand and a fan of Indian 500-rupee banknotes in the other. She stands against a soft-focus beige living room background with bold text overlay reading 'HOME LOAN SECRETS' and a subtitle about securing the best interest rates in 2025

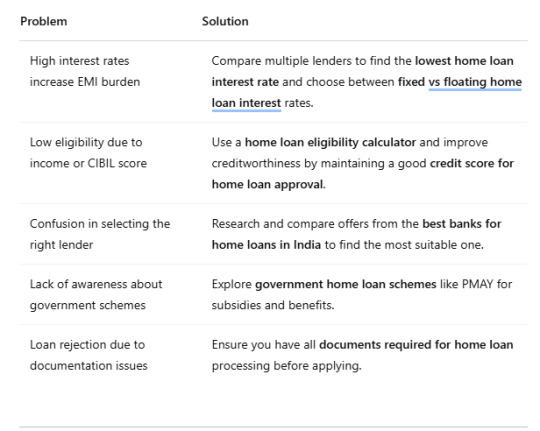

Common Challenges While Getting a Home Loan & Their Solutions

How to Get the Lowest Home Loan Interest Rate in 2025?

Compare Lenders Before Applying

Each bank offers different home loan interest rates. Before choosing, use online tools like a home loan EMI calculator to compare interest rates and repayment costs. This simple step can help you save a significant amount over the loan tenure. Checking loan offers from private and public sector banks, as well as housing finance companies, ensures that you secure the most affordable deal.

Improve Your Credit Score

Your credit score for home loan approval should be at least 750 to qualify for the lowest interest rates. If your score is low, take steps to improve it by clearing outstanding debts, maintaining low credit utilization, and avoiding late payments. Banks and financial institutions consider your creditworthiness before approving a home loan, so a strong score can also increase your chances of getting a higher loan amount.

Opt for a Shorter Loan Tenure

A shorter tenure reduces overall interest, even though EMIs may be slightly higher. While longer loan tenures might seem attractive due to lower EMIs, they significantly increase the total interest paid. If your financial situation allows, opt for a shorter tenure to save on interest expenses in the long run.

Consider Government-Backed Loans

The government home loan schemes like PMAY (Pradhan Mantri Awas Yojana) can significantly lower interest rates for eligible applicants. These schemes offer subsidies, especially for first-time homebuyers from the middle-income, economically weaker sections (EWS), and low-income groups (LIG).

Choose Floating Interest Rates Wisely

Understanding fixed vs floating home loan interest can help you decide which type is better based on market trends. Fixed interest rates offer stability, while floating rates can be beneficial when interest rates decline over time. Consulting financial experts or tracking economic trends can help you make an informed decision.

Maximizing Your Home Loan Eligibility

Loan eligibility is determined by factors such as income, employment type, age, and existing financial obligations. To increase your chances of approval, follow these key strategies:

How to Increase Home Loan Eligibility?

Add a co-applicant (spouse or family member) to increase the combined income considered for eligibility.

Reduce existing liabilities (credit card dues, personal loans) to improve your debt-to-income ratio.

Declare additional income sources like rental income, bonuses, or freelance work.

Choose a longer tenure to lower EMI pressure, making it easier to meet lender requirements.

By following these steps, you can boost your chances of getting a higher loan amount at a lower interest rate.

Best Banks for Home Loans in India (2025)

Choosing the right bank can make a significant difference in your repayment journey. Here’s a comparison of top banks offering home loans in 2025:

Documents Required for a Home Loan

Many home loan applications get delayed due to incomplete documentation. To avoid this, keep these essential documents ready:

Identity Proof (Aadhaar, PAN Card, Passport, Voter ID)

Income Proof (Salary Slips, Form 16, ITR for the last 2 years)

Property Documents (Agreement to Sale, Title Deed, NOC from builder or society)

Employment Proof (Offer Letter, Business Registration for self-employed individuals)

Submitting accurate and complete documentation ensures a faster approval process.

Home Loan for First-Time Buyers: What You Should Know?

Buying a home for the first time is exciting, but it comes with its own set of challenges. Many first-time buyers rush into the process without proper research, leading to financial strain later.

Common Mistakes First-Time Buyers Make:

Not checking home loan eligibility before applying, resulting in rejections.

Ignoring additional costs such as processing fees, legal fees, and home insurance.

Choosing a higher EMI without considering future financial obligations.

Not reading the fine print on foreclosure and prepayment charges leads to unexpected penalties.

Smart Tips for First-Time Buyers

Use a home loan eligibility calculator before applying to understand your borrowing capacity.

Choose a government-backed scheme if eligible, as it can significantly reduce your financial burden.

Start with a smaller loan amount and increase later based on income growth and stability.

Read more: What are the Important home loans for first-time Buyers and everything you should know!

Frequently Asked Questions (FAQs)

1. Which bank gives the lowest home loan interest rate in 2025?

Banks like SBI, HDFC, and ICICI currently offer some of the lowest home loan interest rates in India. Compare rates before applying.

2. What is the minimum salary required for a home loan?

The minimum salary for a home loan varies by lender, but generally, a salary of ₹30,000 per month is required for a basic loan.

3. Can I apply for a home loan with a low credit score?

Yes, but you may get a higher interest rate. To improve your credit score for home loan approval, clear outstanding debts and avoid late payments.

4. How can I calculate my home loan EMI?

Use a home loan EMI calculator available on most bank websites to estimate your monthly payments.

5. What are the benefits of a government home loan scheme?

Government home loan schemes like PMAY offer subsidies, lower interest rates, and easier eligibility criteria, making homeownership affordable.

Final Thoughts

Securing a home loan with the lowest interest rate and maximum eligibility is possible with proper planning. By using tools like a home loan eligibility calculator, improving your credit score, and comparing different lenders, you can make a well-informed decision.

Need expert guidance? Start your home loan journey today and turn your dream home into reality!

#Home Loan Interest Rate#Home Loan#home loan eligibility#Home loan eligibility calculator#Home loan EMI calculator#Fixed vs floating home loan interest#Best bank for home loan in India#Government home loan schemes#Minimum salary for home loan#How to increase home loan eligibility#Documents required for home loan#Credit score for home loan approval#Home loan for first-time buyers

0 notes

Text

Learn about the Interest Subsidy Scheme for education loans abroad. Check eligibility, benefits, and how to apply to reduce your financial burden while studying overseas.

0 notes