#interest rate subsidy

Explore tagged Tumblr posts

Text

Collateral-Free Loans for Startups: How to Secure Funding for Your Startup

“How India’s Credit Guarantee Scheme for Startups (CGSS) 2025 is transforming entrepreneurship with collateral-free loans, interest subsidies, and government-backed guarantees. Learn about eligibility, benefits, and application process to fuel your startup’s growth. Empower innovation, drive economic growth, and unlock funding opportunities today!” The Credit Guarantee Scheme for Startups (CGSS)…

#CGSS 2025#collateral-free loans#Credit Guarantee Scheme for Startups#DIPP recognition#entrepreneurship India#financial support for startups.#government-backed loans#Indian startups#innovation funding#interest rate subsidy#job creation#startup ecosystem#startup funding India#startup loans#women entrepreneurs

0 notes

Text

Get Instant Loan - Quick Cash Now! Hassle-free Application. Approval in Minutes. No Collateral. Unlock Financial Freedom with Mpower Credcure. Call 7030489999.

#business loan low interest rate#Loan for New Company#Business In Rural Areas#application form for business loan#loans for small scale business#subsidy for business loan#quickest personal loan#best personal loan application#online loan apply personal loan#housing loan apply online#easy home loan bank#home loan process

0 notes

Text

"Passed in February [2024], a massive subsidy program to help Indian households install rooftop solar panels in their homes and apartments aims to provide 30 gigawatt hours of solar power to the nation’s inventory.

The scheme, called PM-Surya Ghar, will provide free electricity to 10 million homes according to estimates, and the designing of a national portal—a sort of Healthcare.gov for solar panels—will streamline the process of installation and payment.

The program was cooked up because India had fallen woefully behind on its planned installations for rooftop solar. In many parts of the subcontinent, the sun is absolutely brutal and relentless, but by 2022, Indian rooftop solar power generation topped out at 11 gigawatts, which was 29 gigawatts under a national target set a decade ago.

Part of the challenge, Euronews reports, is that approval from various agencies and departments—as many as 21 different signatures in some cases—was needed to place a solar array on your house. Aside from this bureaucratic nightmare, the cost of installation was often higher than $5,000; more than half the average yearly income for a working Indian urbanite.

Under PM-Surya Ghar, subsidies for a 2-kilowatt solar array will cover as much as 60% of the installation costs, falling to 40% for arrays 3 kilowatts or higher. Loans set at around 7% interest rates will help families in need get started. 750 billion Indian rupees, or $9 billion has been set aside for the project.

Even in New Delhi, which can be covered in clouds and smog for days, solar users report saving hundreds during summer time on their electricity costs, with one apartment shaving $700 every month off energy bills.

PM-Surya Ghar is also seen as having the potential to cause a boom in the Indian solar market. Companies no longer have to go running around for planning and permitting requirements, and the government subsidies ensure their customer base can grow beyond the limits of household income."

-Good News Network, April 10, 2024

#india#new delhi#solar#solar panels#clean energy#solar power#renewables#rooftop solar#climate policy#climate action#climate hope#renewable energy#good news#hope

272 notes

·

View notes

Text

Argentina's poverty rate fell sharply in the second half of 2024, according to official data released this week, marking a major milestone for President Javier Milei's sweeping economic reforms.

According to the country's official statistics agency, the National Institute of Statistics and Census (INDEC), the poverty rate fell to 38.1 percent between July 2024 and December 2024—down nearly 15 percentage points from the first half of the year. Household poverty also declined by 13.9 percentage points, hitting 28.6 percent. And extreme poverty was cut by more than half, falling from 18.1 percent to 8.2 percent.

It's a major turnaround from the beginning of Milei's presidency. When he took office in December 2023, he inherited a poverty rate of 41.7 percent, which quickly surged to 53 percent as his administration launched a "shock therapy" program to end Argentina's economic misery.

One of the biggest drivers behind the poverty decline is the sharp drop in inflation. Annual inflation, which reached 276.2 percent a year ago—one of the highest in the world—dropped to 66.9 percent last month. Monthly inflation has also dropped, from 25.5 percent in December to just 2.4 percent in March.

"These figures reflect the failure of past policies, which plunged millions of Argentines into precarious conditions while promoting the idea of helping the poor, even as poverty continued to increase," Milei's office said in a statement following the release of the INDEC report. "The current administration has shown that the path of economic freedom and fiscal responsibility is the way to reduce poverty in the long term."

In other words, Milei's bet on free market reforms is starting to pay off.

It's worth remembering the situation he walked into. "Milei inherited a country suffering from more than 200% inflation in 2023, 40% poverty, a fiscal and quasi-fiscal deficit of 15% of GDP, a huge and growing public debt, a bankrupt central bank, and a shrinking economy," writes Ian Vásquez of the Cato Institute.

In response, Milei promised a radical shift in Argentina's economic model. His government slashed government spending, eliminated price controls, devalued the peso, cut subsidies, suspended public works, and laid off thousands of government workers. The changes weren't popular, but they were necessary. And now, the numbers are catching up.

The economy is growing again. Gross domestic product grew in the last two quarters. The gap between the black-market dollar and the official rate has narrowed. Rents have fallen and the housing supply has increased since rent control laws were scrapped. Meanwhile, investor interest in Argentina is beginning to return, and the International Monetary Fund (IMF) is in talks with Milei's government over a new program. The IMF projects a 5 percent growth for Argentina in 2025.

Still, challenges remain. Despite the improvement, over 11 million Argentines are still living in poverty, with 2.5 million facing extreme poverty. And more than half of all children ages 14 and under in Argentina are poor.

Milei has consistently said that his adjustment plan would have a "negative impact on the level of activity, employment, real wages, and the number of poor and indigent people," before it started to work. Things are finally starting to get better and at the right time.

With midterm elections coming in October, Milei's party, La Libertad Avanza, has an opportunity to expand its influence. Right now, the party holds only a small share of congressional seats. But with half of the lower house and a third of the Senate up for grabs, the growing economic momentum could give Milei the support he needs to deepen and accelerate his reforms.

26 notes

·

View notes

Text

The Right Are Engineering A Recession In NZ

tumblr isn't very good at local news, which is why i tend to get my nz politics information from elsewhere. so i can confidently tell you that aotearoa under national is totally, utterly fucked. like, not just in terms of all the social progress they plan to undo, though they do very much do plan to do all of that.

national+act+nzfirst have committed to a financial policy that makes zero fucking economic sense. you know how every time the economy is in bad shape, tories sieze the good economic opportunity to slash services or give tax cuts to the rich? imagine if that was happening for just no reason at all. there’s no crisis we’re facing this would even marginally help, but that's what nact+nzfs tax cut policy is anyway.

aotearoa is currently in a cost of living crisis, like much of the world, and our inflation is, to give it it's technical term, "sticky". This means that it's not still shooting up the graph like crazy, but it should have started to go down more by now according to predictions, but it hasn't, and is sitting at an unsustainably high level.

Inflation is bad because it eats away at the value of your money (not something you want generally) but this inflation is especially bad because it's inflation we created to ward off a recession back in 2020. NZ had the hardest and fastest lockdowns in the world, but at a huge cost -- our economy basically stopped overnight. Without goods and services being bought and sold, we would have been plunged into a financial crisis. But instead the government borrowed money to fund the wage subsidy and pay workers through the lockdowns, injecting money into and stimulating the economy.

This was a bill that was always going to come back to bite us, and for the past several years, the Labour government and the Reserve Bank had been playing a balacing game with our economy, steering us between a recession and a wage-price inflation spiral, with a recession definitely being the preferable one of the two. We actually had short soft one that we’ve come out of, exactly what Grant Robertson and Adrien Orr were aiming for.

Recessions can be small or big - inflation spirals are usually just big. We wanted to aim for a "soft" landing recession by hiking interests rates just enough to bring inflation back under control. The Reserve Bank uses it's tool - the Official Cash Rate, or the OCR, which basically sets the price of interest rates across the country, and the government also can use it's powers to create monetary policy to help the economy. A lot of the criticism Labour received before losing the election was about overspending in areas post-pandemic, as putting money into the economy through government spend by using debt to fund it genuinely causes inflation.

What a government should do during a time of inflation is remove money from the economy. For example, a right wing government would often issue an austerity policy, where the cut the amount of government spending through slashing programmes, benefits, staff, etc etc. A government could also increase taxes so people have less money to spend, could pay down government debt, could invest the money into a fund (e.g. NZ has a superannuation fund that's designed to be eventually self-funding set up by Labour that National have paused payments on when getting into government). It doesn't matter too much what, theoretically speaking -- the point is to get the money out of the economy.

What you definitely, definitely don't want to do during a period of high and sticky inflation is put more money into the economy. That would do the opposite of what you want. Labour were rightfully (at some points) criticised for their inflationary policies. So you'd think National would take their criticisms of Labour’s debt blowout and start paying it down to show how responsible they are, right? No, they’re cutting taxes for (mostly) the wealthy while offsetting this with austerity measures to make this “fiscally neutral”. They will make up for the inflationary effects of doling out money to landlords by cutting back essential government services, trying to frame it as a personnel and budget blowout (it’s not) and saying Labour mismanaged the books and we are in terrible financial shape (we are not; we have a triple A credit rating).

And further, it’s becoming increasingly hard to ignore our infrastructure crisis at nearly every level and every location. Our water systems needs billions of dollars of investment that our councils can’t afford to borrow, our rates are shooting up (and so will our rents), our ferries are old and broken down and Nicola Willis Minister of Finance just canned the “too expensive” deal that was needed to replace them — with most of the money going to into wharf upgrades that are desperately needed. There was a huge sunk cost; we’re not going to be able to to buy shit now. The ferries link the North and the South Island and are vital infrastructure; when they break down (which they did multiple times last year) it causes chaos and brings things to a standstill.

Why are they doing this? Land. It’s always about fucking land. All of National have divested in shares and have bought into land under the guise of this removing the “conflict of interest” that would exist if they had invested into specific companies. The usual alternative that solves this is a blind trust, but that’s not what most of the caucus has money in. Luxon alone sold about 12 million dollars worth of Air NZ shares and now has a property profile worth 20+ million. Oh, and he’s charging the taxpayer $50,000 a year to live in his own house. Thats 2.5 times what I get on the benefit that he’s cutting and putting sanctions on.

Nact don’t care if businesses go under and share prices crash; they’ll just sell their houses and buy stocks for cheaper. Their only concern is propping up the housing market ponzi scheme that they have all invested at the top of. This is why they’ve allowed councils to opt out of densification requirements and why they cut back the brightline test and are trying to boost the population with migrant workers; all of these things make house prices go up, make housing better for investors who make millions in untaxed capital gains.

NACT will not let the property market crash any further. Despite what they’re saying out loud, they actually want it to increase.

And they’re more than happy to wreck the economy to do it.

85 notes

·

View notes

Text

The new tariffs imposed by the U.S. on China, Mexico, and Canada will have widespread effects on American goods and services. Here’s how they are likely to impact different aspects of the economy:

1. Higher Costs for Businesses and Consumers

Many American businesses rely on imported materials, components, and products from these countries. Tariffs increase the cost of these imports, forcing companies to either absorb the costs (reducing profits) or pass them on to consumers.

Industries such as automotive, electronics, manufacturing, and retail will see price hikes, making everyday goods more expensive for American consumers.

2. Inflationary Pressure

Tariffs function like a tax on imported goods, leading to higher prices across the board.

If companies pass increased costs to consumers, inflation could rise, making goods and services more expensive and potentially prompting the Federal Reserve to reconsider interest rate policies.

3. Supply Chain Disruptions & Business Uncertainty

Companies that rely on raw materials, electronics, and auto parts from these countries may face delays and shortages, forcing them to find alternative suppliers or move production, which takes time and money.

Some businesses might restructure their supply chains by sourcing materials from other countries or increasing domestic production, but this transition isn't immediate and could further increase costs.

4. Retaliation from Trading Partners

Canada, Mexico, and China have signaled that they may impose their own tariffs on U.S. exports, which could hurt American industries that depend on international trade, such as agriculture, aerospace, and manufacturing.

Farmers, in particular, could face declining demand for crops like soybeans, corn, and dairy products, which were previously targeted in retaliatory tariffs during the Trump-era trade war.

5. Impact on the Stock Market & Business Investment

Investors dislike uncertainty. If businesses anticipate lower profits due to higher costs or potential trade disruptions, stock markets may react negatively.

Companies may delay hiring or expansion plans due to concerns over higher operational costs and shifting trade dynamics.

6. Possible Job Losses in Affected Industries

If businesses face significantly higher costs and declining demand due to retaliatory tariffs, some industries could see layoffs or reduced hiring.

Manufacturing and export-dependent sectors, such as automotive, steel, and agriculture, may be hit the hardest.

Potential Silver Linings

Some industries, like domestic manufacturing and steel production, could see short-term gains if companies decide to shift production back to the U.S. instead of relying on imports.

The government may use tariff revenues to invest in domestic industries or subsidies, potentially offsetting some negative effects.

Bottom Line

The new tariffs will likely increase costs for businesses and consumers, contribute to inflation, and create uncertainty in financial markets and supply chains. While some domestic industries might benefit, the risk of retaliatory tariffs and economic slowdown poses a challenge for the broader U.S. economy.

13 notes

·

View notes

Text

raginrayguns said: but the thing to explain is not that china’s production increased but that their increased imports did not quite match their increased exports! You keep leaving this out whenever you can get away with making Krugman’s point sound stupider than it really is

raginrayguns said: china industrializing is “big”, yes, but it’s also much “bigger” than their trade surplus, which is about a trillion a year, and IS on the order of magnitude of the causes Krugman brings up

right, Chinese industrialisation is only the first step to becoming an export powerhouse, which required ongoing government support that suppressed household consumption in favour of manufacturers and the export sector through a variety of direct and indirect subsidies (including exchange rates, cheap credit, infrastructure support, and so on).

and this isn't unique to China of course, it's a very similar playbook to Japan, along with the real estate boom and subsequent lost decades.

in both cases it begins as a deliberate strategy, and a sensible one, as export competitiveness is both a good way to achieve industrialisation and measure its success.

however over time it becomes a curse, as the imbalance begins weigh on growth and build up debt, but it's difficult to wind back the subsidies without triggering an economic crash and unemployment, and any attempt to shift subsidies from supply side (property development, industry) to demand side (household consumption) will be strongly opposed by the vested interests that have profited from the arrangement over decades and are now tightly intertwined with the political elite at every level.

I would say (summarising Pettis) that China engineered its own growth boom and conversion to export powerhouse, but the US allowed this to happen by opening its markets to so much foreign investment, and the Chinese trade surplus would not have grown to such massive proportions if they were not able to comfortably park the proceeds in US assets, removing any pressure to rebalance.

just as China (and Japan, actually) struggles to shift the status quo, so does America: decades of Finance Is Everything And Asset Prices Must Increase has created a self-reinforcing system of elite interests (with national security implications as well) that are very difficult to shift.

9 notes

·

View notes

Text

A Little Intuition/Is Argentina's "Chainsaw Revolution" applicable to the United States? \Li Lingxiu

At a political rally held in the suburbs of Washington on Thursday, Argentine President Milley presented Musk, the leader of the Department of U.S. Government Efficiency (DOGE), with a "signature" chainsaw, symbolizing the inheritance of the "chainsaw revolution". But can the United States afford the economic price Argentina has paid for it?

Since the establishment of DOGE, several federal government departments have been purged. Musk and his leadership team first gained access to the Treasury Department's computer system, and then DOGE staff entered the International Development Agency, the National Oceanic and Atmospheric Administration, the Ministry of Education and other departments to conduct investigations. At the aforementioned Conservative Political Action Conference, Musk also predicted that the Federal Reserve will be the next target.

The White House has provided a "buyout plan" to 2 million federal government employees, which will provide about 8 months of salary compensation to all employees who voluntarily resign. As of February 18, a total of about 20,000 federal employees (including probationary employees) have been laid off or forced to stop work and take leave.

Such a swift and vigorous layoff storm easily reminds people of the "chainsaw revolution" promoted by Mile in Argentina. As early as the last round of elections in the country, the image of Mile holding a chainsaw high has become a classic image of campaign propaganda. At the beginning of his term, he signed a presidential decree to reduce government departments from 18 to 9 and fired more than 30,000 government employees. The Argentine government also successfully cut public spending by 30% through measures such as cutting energy and transportation subsidies, achieving a fiscal surplus for the first time in 14 years.

But compared with the political environment of the two countries, there are actually great differences. The Argentine president has absolute power over the government's organizational structure and departmental settings, and the abolition of government departments belongs to the category of administrative affairs management and adjustment. But for the US president, if there is no clear authorization from Congress through relevant laws, government departments cannot be adjusted or abolished (except for agencies established by presidential decrees).

Expenditure reduction plan difficult to achieve

Musk's previous slogan was to cut federal spending by $1 trillion. But in the officially released White House documents, Trump did not propose KPIs in this regard. As of February 17, DOGE has saved an estimated $55 billion through contract and lease renegotiations, cancellation of grants, asset sales, layoffs, regulatory savings and fraud detection, completing only 4% of Musk's goal.

Data shows that the total expenditure of the US federal government in fiscal year 2024 is $6.8 trillion, and the largest sources come from three aspects: Social Security ($1.46 trillion), Medicare ($0.87 trillion), and Medicaid ($0.91 trillion), accounting for a total of 49%. However, cutting the above expenditures will shake the interests of voters, and Trump also made it clear during his campaign last year that he would not cut spending on these three projects. In this way, DOGE's spending reduction target seems to be a task that can never be completed.

More importantly, the cost of Argentina's "chainsaw revolution" is painful. In the first six months after Milley took office, the country's poverty rate jumped from about 40% to 53%. Although it fell back by the end of last year, the unemployment rate climbed from 12% in 2023 to 15%.

House prices in Washington, DC plummet

There are also some bad trends in the United States at the moment. Data shows that the number of initial unemployment claims in Washington, DC has risen significantly in the past two weeks. Real estate prices in the region have also begun to fall. The median price of a house in Washington, DC in January 2025 is $553,000, a sharp drop of 9.7% year-on-year.

Argentina is still the largest borrower from the International Monetary Fund (IMF), with outstanding loans of $43.4 billion, accounting for nearly 30% of total credit, exceeding the total of all sub-Saharan African countries. (See accompanying picture)

If Musk insists on carrying out the "chainsaw revolution" to the end. Then, poverty will replace inflation and become the hottest topic in American society in the future.

12 notes

·

View notes

Text

Brazil bets on attracting green investment in new Trump government

Government anticipates shift in resources with end of Joe Biden policies

The Brazilian federal government has begun formulating a strategy to attract green investments that may no longer be made in the United States following President Donald Trump’s cancellation of several policies implemented by his predecessor, Joe Biden. Discussions involve entities such as the Ministry of Finance, the National Bank for Economic and Social Development (BNDES), which manages the Climate Fund, and the Ministry of Mines and Energy.

According to information obtained by Valor, investors and fund representatives have already informed the Palácio do Planalto that, given the prospect of fewer subsidies and lower interest rates for green programs in the United States, Brazil could draw resources in this sector. Some of these messages were conveyed in the context of the enactment of the law establishing the Energy Transition Acceleration Program (Paten), which took place on Wednesday (22).

Another strategy is the rapid establishment of the carbon credit market. The law instituting this system was signed by President Luiz Inácio Lula da Silva at the end of 2024, but several administrative regulations, which do not require Congressional approval, are still pending.

The government is considering creating a specific secretariat to address the carbon market, which, according to sources consulted by Valor, could accelerate these procedures. One potential plan is to initially place this secretariat within the Ministry of Finance.

Continue reading.

#brazil#politics#environmentalism#economy#united states#brazilian politics#international politics#image description in alt#mod nise da silveira

6 notes

·

View notes

Text

Liz Truss is the most disastrous and unpopular leader in modern British history. Mortgage holders and small businesses still loathe her for sending interest rates through the roof. Her short, catastrophic premiership is routinely compared unfavourably to the shelf life of a lettuce. (A comparison first made by the bright leader writers at the Economist to give credit where it is due.)

When Labour wins the next election, its triumph will be in part the result of the public’s reaction against her vast and dogmatic economic folly.

If you were Liz Truss, you might retire from public life. At the very least you would apologize and hang your head in shame.

If readers expect contrition, however, they have yet to learn that being on the radical right means never having to say you are sorry.

Truss’s demotion from national leader to national joke has not embarrassed her in the slightest but pushed deep into paranoid conspiracism.

Her autobiography, bizarrely titled Ten Years to Save the West, as if the fate of liberal democracy depended on the advice of an epic failure, shows that, despite all she did to this country, her eyes still shine with a bright, self-righteous fanaticism, as if the sockets are backlit by an idiot’s lantern,

Chutzpah used to be defined as murdering both your parents and asking the court for clemency because you are an orphan. In Truss’s case it is using the power of the prime minister to crash the economy and then claiming she was a powerless victim of the liberal elite.

Her writing is as lacking in self-awareness as it is powered by self-righteousness.

At one point she says in all innocence that, when Boris Johnson resigned in the summer of 2022, her agent encouraged her to join the race to be prime minister, as the campaign might be good for her profile.

But she reports that he then wisely added “it would be for the best if I came second”.

Later she informs us that during the leadership campaign she “frankly lost trust in many of my erstwhile ministerial colleagues who were supporting my opponent [Rishi Sunak].

“They had spent the last six weeks not just attacking me but seeking to undermine my plans, saying my agenda was unworkable."

Truss never stops to think that the few people who will finish this book will believe that her agent was right, and it would clearly have been for the best if she had never been prime minister.

Nor does she contemplate the possibility that her agenda was indeed “unworkable”, and was proved to be unworkable when her unfunded tax cuts and fuel subsidies sent the price of gilts shooting up, the value of the pound crashing down, and caused a crisis in the pension industry for good measure.

And yet, and yet…Mock her as much as you like. Please don’t hold back on my account. But you cannot dismiss her.

There are two reasons why Truss is still dangerous. The first lies in the strength of the right-wing clique that brought her to power.

It is true that Liz Truss did not become prime minister by winning over Conservative MPs. As with Jeremy Corbyn’s leadership of the Labour party, Truss’s career illustrates the danger of expecting leaders who do not have the support of a plurality of their colleagues to function in a Parliamentary democracy.

But she still beat Rishi Sunak with the votes of 57 percent of Tory members.

And with the honourable exception of the Times, the Tory press was all for her. “In Liz We Trust”, said the Express “Cometh the Hour, Cometh the Woman”, cried the Mail. “Liz Puts Her Foot on the Gas”, cheered the Sun.

Kwasi Kwarteng set off a market panic as he put Truss’s ideas into practice in the mini budget of September 2022. The reaction of right-wing papers was not one of alarm, however, but of adoration.

“At last”, gushed the Daily Mail, “a True Tory Budget”. A Daily Telegraph commentator said it was “the best Budget I have ever heard a British Chancellor deliver”.

Meanwhile the Truss premiership allowed the voodoo economics of the US-influenced (and in all probability US-financed) think tanks to finally impose itself on this luckless country. The Centre for Policy Studies welcomed the mini-budget saying it was “exactly what we would have hoped for”. The Taxpayers’ Alliance called it “the most taxpayer-friendly budget in recent memory”.

Robert Saunders of Queen Mary University made the unarguable point that Truss was not an aberration or some alien figure that had appeared from nowhere to take over the Conservative party.

Follow the money that cascaded in from party donors, he said, and “the Truss premiership begins to look less like the personal failure of a flawed individual, and more like a systemic disaster for which the party bears collective responsibility”.

Those forces will dominate the Conservative party after its defeat and drive it to the radical right. Indeed, in opposition the members, the think tanks, the press and the ideologue donors will become more important, for they will be all the party has.

In a sign of things to come, Truss is already allying with Nigel Farage, and even Rishi Sunak says he will not ban Farage from joining Conservative party.

Despite her failure, Truss remains a potent figure on the radical right because of her championing of revanchism, which is now its dominant emotion.

This isn't a book. It’s a 300-page wail of resentment at a world that will not do as it is told.

I have no problem with conservatives complaining about woke policies taking over institutions. Only a fool or liar maintains that progressive biases among supposedly impartial organisations are an invention of the right,

But the woke conspiracy Truss invokes is of a wholly different order. It is utterly fantastical.

To recap, Truss's unfunded subsidies and tax cuts panicked the bond markets. They would not lend to a country whose leaders lacked plausible means of meeting its debts. Or if they did lend they would demand an additional yield on government bonds, which became known in plain-speaking financial markets as the “moron premium”: the extra cost that comes with lending to a nation run by idiots.

In her apologia Truss, who still poses as a Thatcherite, no longer sees markets as an expression of the wisdom of crowds, but as a conspiracy to do her down.

“I came to realise there is no such thing as ‘the market’ in this sense. Rather, there are groups of influential individuals in the financial establishment, all of whom know and speak to one another in a closed feedback loop. The Treasury, the Bank of England, and the OBR are deeply embedded in these social networks and share the same beliefs in the established economic orthodoxy."

The markets were at fault for not seeing her financial genius. Financial traders were the world’s unlikeliest lefties. Even though she and Kwarteng fired the permanent secretary at the Treasury and cut out the Bank of England and Office for Budget Responsibility from policy making, they were still, somehow, responsible for Tory failure.

“The powerful vested interests there pushed back, made my life very difficult and ultimately got me fired,” Truss concludes.

Older readers may remember a time when Conservatives insisted on personal responsibility. You were not allowed to blame crime on poverty or your failings on a bad childhood. You were accountable.

But the case of Liz Truss proves that these morality tales were only ever for the poor. In her mind, the economy collapsed not because of decisions she made but because of “a sustained whispering campaign by the economic establishment, encouraged and fueled by my political opponents in the Conservative Party who refused to accept my mandate to lead”.

Trumpism is the end point of such conspiracism and revanchism, and Truss goes all the way down the line to the terminus.

She mutters about the “deep state” a Trumpian phrase she uses without irony or self-knowledge.

And even though her support for Ukraine was her redeeming feature during her time as foreign secretary and prime minister, she is now supporting the pro-Putin Trump and his allies in Congress who are denying aid to Kyiv.

Truss is finished. But the resentment born of failure and the fury at modernity ensures Trump is still very much with us.

If he delights Putin and wins in November, the UK and Europe will learn the hard way that the real threat to Western civilisation comes from Liz Truss and her friends.

17 notes

·

View notes

Text

Rent control works

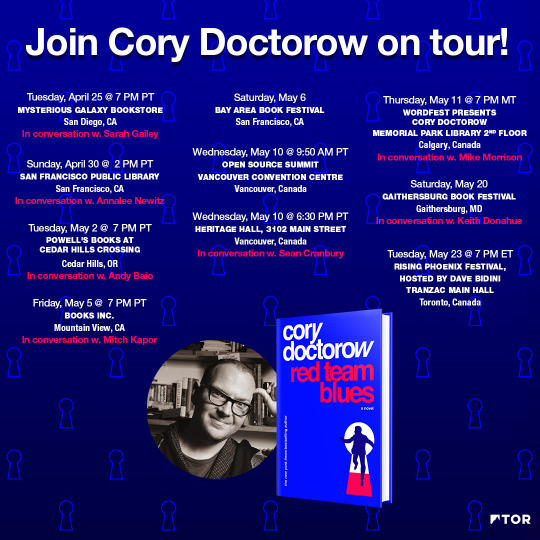

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

David Roth memorably described the job of neoliberal economists as finding “new ways to say ‘actually, your boss is right.’” Not just your boss: for decades, economists have formed a bulwark against seemingly obvious responses to the most painful parts of our daily lives, from wages to education to health to shelter:

https://popula.com/2023/04/30/yakkin-about-chatgpt-with-david-roth/

How can we solve the student debt crisis? Well, we could cancel student debt and regulate the price of education, either directly or through free state college.

How can we solve America’s heath-debt crisis? We could cancel health debt and create Medicare For All.

How can we solve America’s homelessness crisis? We could build houses and let homeless people live in them.

How can we solve America’s wage-stagnation crisis? We could raise the minimum wage and/or create a federal jobs guarantee.

How can we solve America’s workplace abuse crisis? We could allow workers to unionize.

How can we solve America’s price-gouging greedflation crisis? With price controls and/or windfall taxes.

How can we solve America’s inequality crisis? We could tax billionaires.

How can we solve America’s monopoly crisis? We could break up monopolies.

How can we solve America’s traffic crisis? We could build public transit.

How can we solve America’s carbon crisis? We can regulate carbon emissions.

These answers make sense to everyone except neoliberal economists and people in their thrall. Rather than doing the thing we want, neoliberal economists insist we must unleash “markets” to solve the problems, by “creating incentives.” That may sound like a recipe for a small state, but in practice, “creating incentives” often involves building huge bureaucracies to “keep the incentives aligned” (that is, to prevent private firms from ripping off public agencies).

This is how we get “solutions” that fail catastrophically, like:

Public Service Loan Forgiveness instead of debt cancellation and free college:

https://studentloansherpa.com/likely-ineligible/

The gig economy instead of unions and minimum wages:

https://www.newswise.com/articles/research-reveals-majority-of-gig-economy-workers-are-earning-below-minimum-wage

Interest rate hikes instead of price caps and windfall taxes:

https://www.npr.org/2023/05/03/1173371788/the-fed-raises-interest-rates-again-in-what-could-be-its-final-attack-on-inflati

Tax breaks for billionaire philanthropists instead of taxing billionaires:

https://memex.craphound.com/2018/11/10/winners-take-all-modern-philanthropy-means-that-giving-some-away-is-more-important-than-how-you-got-it/

Subsidizing Uber instead of building mass transit:

https://prospect.org/infrastructure/cities-turn-uber-instead-buses-trains/

Fraud-riddled carbon trading instead of emissions limits:

https://pluralistic.net/2022/05/27/voluntary-carbon-market/#trust-me

As infuriating as all of this “actually, your boss is right” nonsense is, the most immediate and continuously frustrating aspect of it is the housing crisis, which has engulfed cities all over the world, to the detriment of nearly everyone.

America led the way on screwing up housing. There were two major New Deal/post-war policies that created broad (but imperfect and racially biased) prosperity in America: housing subsidies and labor unions. Of the two, labor unions were the most broadly inclusive, most available across racial and gender lines, and most engaged with civil rights struggles and other progressive causes.

So America declared war on labor unions and told working people that their only path to intergenerational wealth was to buy a home, wait for it to “appreciate,” and sell it on for a profit. This is a disaster. Without unions to provide countervailing force, every part of American life has worsened, with stagnating wages lagging behind skyrocketing expenses for education, health, retirement, and long-term care. For nearly every homeowner, this means that their “most valuable asset” — the roof over their head — must be liquidated to cover debts. Meanwhile, their kids, burdened with six-figure student debt — will have little or nothing left from the sale of the family home with which to cover a downpayment in a hyperinflated market:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Meanwhile, rent inflation is screaming ahead of other forms of inflation, burdening working people beyond any ability to pay. Giant Wall Street firms have bought up huge swathes of the country’s housing stock, transforming it into overpriced, undermaintained slums that you can be evicted from at the drop of a hat:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

Transforming housing from a human right to an “asset” was always going to end in a failure to build new housing stock and regulate the rental market. It’s reaching a breaking point. “Superstar cities” like New York and San Francisco have long been priced out of the reach of working people, but now they’re becoming unattainable for double-income, childless, college-educated adults in their prime working years:

https://www.nytimes.com/interactive/2023/05/15/upshot/migrations-college-super-cities.html

A city that you can’t live in is a failure. A system that can’t provide decent housing is a failure. The “your boss is right, actually” crowd won: we don’t build public housing, we don’t regulate rents, and it suuuuuuuuuuuuuuucks.

Maybe we could try doing things instead of “aligning incentives?”

Like, how about rent control.

God, you can already hear them squealing! “Price controls artificially distort well-functioning markets, resulting in a mismatch between supply and demand and the creation of the dreaded deadweight loss triangle!”

Rent control “causes widespread shortages, leaving would-be renters high and dry while screwing landlords (the road to hell, so says the orthodox economist, is paved with good intentions).”

That’s been the received wisdom for decades, fed to us by Chicago School economists who are so besotted with their own mathematical models that any mismatch between the models’ predictions and the real world is chalked up to errors in the real world, not the models. It’s pure economism: “If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’”

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

But, as Mark Paul writes for The American Prospect, rent control works:

https://prospect.org/infrastructure/housing/2023-05-16-economists-hate-rent-control/

Rent control doesn’t constrain housing supply:

https://dornsife.usc.edu/pere/rent-matters

At least some of the time, rent control expands housing supply:

https://onlinelibrary.wiley.com/doi/full/10.1111/j.1467-9906.2007.00334.x

The real risk of rent control is landlords exploiting badly written laws to kick out tenants and convert their units to condos — that’s not a problem with rent control, it’s a problem with eviction law:

https://web.stanford.edu/~diamondr/DMQ.pdf

Meanwhile, removing rent control doesn’t trigger the predicted increases in housing supply:

https://www.sciencedirect.com/science/article/pii/S0094119006000635

Rent control might create winners (tenants) and losers (landlords), but it certainly doesn’t make everyone worse off — as the neoliberal doctrine insists it must. Instead, tenants who benefit from rent control have extra money in their pockets to spend on groceries, debt service, vacations, and child-care.

Those happier, more prosperous people, in turn, increase the value of their landlords’ properties, by creating happy, prosperous neighborhoods. Rent control means that when people in a neighborhood increase its value, their landlords can’t kick them out and rent to richer people, capturing all the value the old tenants created.

What is life like under rent control? It’s great. You and your family get to stay put until you’re ready to move on, as do your neighbors. Your kids don’t have to change schools and find new friends. Old people aren’t torn away from communities who care for them:

https://ideas.repec.org/a/uwp/landec/v58y1982i1p109-117.html

In Massachusetts, tenants with rent control pay half the rent that their non-rent-controlled neighbors pay:

https://economics.mit.edu/sites/default/files/publications/housing%20market%202014.pdf

Rent control doesn’t just make tenants better off, it makes society better off. Rather than money flowing from a neighborhood to landlords, rent control allows the people in a community to invest it there: opening and patronizing businesses.

Anything that can’t go on forever will eventually stop. As the housing crisis worsens, states are finally bringing back rent control. New York has strengthened rent control for the first time in 40 years:

https://www.nytimes.com/2019/06/12/nyregion/rent-regulation-laws-new-york.html

California has a new statewide rent control law:

https://www.nytimes.com/2019/09/11/business/economy/california-rent-control.html

They’re battling against anti-rent-control state laws pushed by ALEC, the right-wing architects of model legislation banning action on climate change, broadband access, and abortion:

https://www.nmhc.org/research-insight/analysis-and-guidance/rent-control-laws-by-state/

But rent control has broad, democratic support. Strong majorities of likely voters support rent control:

https://www.bostonglobe.com/2023/03/07/metro/new-statewide-poll-shows-strong-support-rent-control/

And there’s a kind of rent control that has near unanimous support: the 30-year fixed mortgage. For the 67% of Americans who live in owner-occupied homes, the existence of the federally-backed (and thus federally subsidized) fixed mortgage means that your monthly shelter costs are fixed for life. What’s more, these costs go down the longer you pay them, as mortgage borrowers refinance when interest rates dip.

We have a two-tier system: if you own a home, then the longer you stay put, the cheaper your “rent” gets. If you rent a home, the longer you stay put, the more expensive your home gets over time.

America needs a shit-ton more housing — regular housing for working people. Mr Market doesn’t want to build it, no matter how many “incentives” we dangle. Maybe it’s time we just did stuff instead of building elaborate Rube Goldberg machines in the hopes of luring the market’s animal sentiments into doing it for us.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

[Image ID: A beautifully laid dining room table in a luxury flat. Outside of the windows looms a rotting shanty town with storm-clouds overhead.]

Image: ozz13x (modified) https://commons.wikimedia.org/wiki/File:Shanty_Town_Hong_Kong_China_March_2013.jpg

Matt Brown (modified) https://commons.wikimedia.org/wiki/File:Dining_room_in_Centre_Point_penthouse.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#urbanism#weaponized shelter#housing#the rent's too damned high#rent control#economism#neoliberalism#monetarism#mr market#landlord brain#speculation

118 notes

·

View notes

Text

I need to write something ffs

A funnyman's recap of Blue Archive

Volume 1 Chapter 1

The archiving system of this game's story can be confusing, but you end up rolling with it at some point.

Anyhow, we begin this first actual storyline of the game by Sensei accepting a plea for help from a smaller school.

Turns out Abydos Academy used to be the largest school before desertification ate most of the land belonging to it, resulting in attempts at disaster relief eating through funds. This got the school in deep shit with loan sharks...

And this is basically why that school only has 5 students remaining.

What the fuck.

But Sensei is undaunted and goes there on his own!

Except the district is still large as hell, so they end up lost and dehydrated after three hours. Considering it's a desert district...

But yeah, Sensei then gets found by a student who winds up taking them piggyback to Abydos Academy, where we meet the Foreclosure Task Force, aka the five last students of Abydos.

Now, I will have the cliffnotes less detailed here BC certain details will be mentioned as I go along this story.

Sunaookami Shiroko

Very sporty

The one to take Sensei all the way to Abydos on her back

Wears a Sig SSG 556 "White Fang 465"

Rarely emotes

Has a fucking combat drone

Very attached to the FTF

Anubis, judge of the dead

Kuromi Serika

Tsundere catgirl

AR70/223 "Sincerity" (lmao)

Extremely stubborn

Very hardworking

Bastet, goddess of cats

Izayoi Nonomi

The curves on this girl wtf

Head of provisions (snack provider)

Wields her "Mini No.5", a GE M134

Rich as fuck, does not act like it at all

Will offer lap pillows to people she likes

Nephthys, a goddess of death alongside her sister Isis

Okusora Ayane

Idk why, but that one was the full body pic I got for her in search

Treasurer of FTF

The one holding the Braincell

Flips the table when she reaches her limit

Compared to her, everyone acts like a nutcase (slight exaggeration)

SIG p229 "Common Sense"

Heals by drone strike

Either Isis, goddess of birth, rebirth and magic or Thoth, god of scribes and scholars

Takanashi Hoshino

Perma eepy

Talks like an old man

Has a foldable riot shield

Seeming bing chilling, actually worrywart

Loves marine life, like whales

Head of the FTF and acting student council prez

Beretta 1301 Tactical "Eye of Horus" (guess what god she is)

These are the last members of their school, and they are up shits creek without a paddle. Under siege by delinquents and over 900 Million Yen (about 9 Million Dollars) in debt and with almost no way to earn money, plus the interest rate, things are dire.

At least the siege can be solved by Sensei ordering some ammo for all and coordinating a counteroffensive. The debt, not so much.

Turns out Abydos went ignored by the GSC for some reason (politics, probs) and Sensei is their first ray of hope in a while.

Sorta. We later learn that Nonomi is so motherfucking rich that she has a credit card with no known upper limit and could wipe the debt out in a swipe. However, principle of the thing, so no do that.

Bit dumb, considering, but they get by... barely.

So their next course of action to get some money is to find out about jobs in their area. Serika winds up falling for a pyramid scheme, so we all band together to fuck these fraudsters up.

Next suggestion: rob a bank!

Shiroko seems to be a big fan of Payday, enough so that her hobby is planning bank heists. Of course they need masks and a plan and new identities of this.

The name "Masked Swimsuit Gang" ends up sticking. (They don't even wear swimsuits here)

However, before then, a new threat arises! The loan sharks are a subsidy of Kaiser Corporation, the biggest corp in Kivotos and all-around assholes. The head twat hires a certain agency to ensure Abydos' demise and securing what remains of the land the last Prez sold off for loans.

They are Problem Solver 68 and they are....

A bunch of misfits

Onikata Kayoko

Listens to death metal

Loves cats

The one with the brain

H&K P30L with Silencer "Demon's Roar"

Very level headed

Actual sweetheart

Asagi Mutsuki

Nicknamed "The Imp"

Kind of kusogaki

Mischievous, likes pranking people

Will kill for the people she likes

Pranks the people she likes a lot

Her and her new year's alt has some of the most questionable Live2Ds

MG5 "Trick or Trick"

Igusa Haruka

The kind of girl you just want to swaddle in a blanket and protect her from all harm

Went through horrible bullying in middle school

Nonexistent self esteem

Described to have a dangerous mind

Grows weeds because she associates with them

FABARM SDASS Tactical "Blow Away"

Who did this to her I just wanna talk-

Rikuhachima Aru

That one Blue Archive song, "Unwelcome School", is heavily associated with her

You see her and think "badass"

Haruka thinks so; Aru put a stop to the bullying

However: she is a GIGANTIC FUCKING DORK

She does not recognise the Abydos students when they're wearing just a mask

Loves to act cool, panicking inside

She founded her part timer agency because she wanted to be a outlaw

Her schemes fly by the seat of her pants

She is a complete lovable idiot

PSG-1 "Wine Red Admire"

Naturally, problem solver 68 ends up befriending their apparent targets (they didn't know at the time) while out eating at a ramen shop Serika works at. All of that before they go and attack the school and fail to defeat the FTF because Sensei magic.

Aru panics and regroups and then meets the girls again! While they're in masks and on their way to rob a black market bank because if has the money they paid as interest to fuck shit loans.

Everyone but Aru recognises them, who thinks they're so god damn cool for robbing a bank.

It's unfortunate that PS69- sorry, 68 gets outta dodge because asshole McGee is assmad they failed to put the screws on Abydos.

Sensei offers help, but has to be kindly refused. Don't worry, this lovable moron and her unstoppable crew of one punk chick, one imp and one High-powered depression-run bomb builder of a school girl terrorist will be back

And, yes, that one is Haruka, who winds up blowing up the Ramen store because she thought it would help Aru.

Help this girl.

Back to story: FTF can't take the money home because it wouldn't be okay, so they leave the bag with blown-up ramen shop owner (he's okay, just a little singed).

Suddenly, invasion! Not by Kaiser Corp, but by Gehenna Academy, one of the big three! They wanna learn what the fuck is up for reasons. This time, I'll write what happens with each of the featured characters in the bullet notes because that is their only appearance in the story.

Shiromi Iori

Sporty, think Track and Field

Member of the Prefect Team

Very much for law and order

Hunts down troublemakers

Hot headed, spearheads the assault to Abydos and gets her cheeks clapped for it

One of the very few students canon Sensei acts lewd towards

We talking licking her feet (????), we talking bothering her with tasks, we talking looking up her skirt

Yeah, I don't know either, but she tends to send mixed signals

During summer event: "I'm not wearing a swimsuit so you can perv on me!" Proceeds to wear the skimpiest swimsuit the age rating can allow

Karabiner 98k (the deleter rifle from back when call of duty was still young). Hers is called "Crack shot"

Aaaa it turns out only 10 pics per post! Will reblog this with continuation

Oh btw, during that fight Serika tanks a grenade from a fucking Flak. We get told she just had to "sleep it off for a day"

What. The. Fuck. Are these students

#blue archive#kuromi serika#sunaookami shiroko#izayoi nonomi#okusora ayane#takanashi hoshino#shiromi iori#rikuhachima aru#igusa haruka#asagi mutsuki#onikata kayoko

25 notes

·

View notes

Text

B.2.2 Does the state have subsidiary functions?

Yes, it does. While, as discussed in the last section, the state is an instrument to maintain class rule this does not mean that it is limited to just defending the social relationships in a society and the economic and political sources of those relationships. No state has ever left its activities at that bare minimum. As well as defending the rich, their property and the specific forms of property rights they favoured, the state has numerous other subsidiary functions.

What these are has varied considerably over time and space and, consequently, it would be impossible to list them all. However, why it does is more straight forward. We can generalise two main forms of subsidiary functions of the state. The first one is to boost the interests of the ruling elite either nationally or internationally beyond just defending their property. The second is to protect society against the negative effects of the capitalist market. We will discuss each in turn and, for simplicity and relevance, we will concentrate on capitalism (see also section D.1).

The first main subsidiary function of the state is when it intervenes in society to help the capitalist class in some way. This can take obvious forms of intervention, such as subsidies, tax breaks, non-bid government contracts, protective tariffs to old, inefficient, industries, giving actual monopolies to certain firms or individuals, bailouts of corporations judged by state bureaucrats as too important to let fail, and so on. However, the state intervenes far more than that and in more subtle ways. Usually it does so to solve problems that arise in the course of capitalist development and which cannot, in general, be left to the market (at least initially). These are designed to benefit the capitalist class as a whole rather than just specific individuals, companies or sectors.

These interventions have taken different forms in different times and include state funding for industry (e.g. military spending); the creation of social infrastructure too expensive for private capital to provide (railways, motorways); the funding of research that companies cannot afford to undertake; protective tariffs to protect developing industries from more efficient international competition (the key to successful industrialisation as it allows capitalists to rip-off consumers, making them rich and increasing funds available for investment); giving capitalists preferential access to land and other natural resources; providing education to the general public that ensures they have the skills and attitude required by capitalists and the state (it is no accident that a key thing learned in school is how to survive boredom, being in a hierarchy and to do what it orders); imperialist ventures to create colonies or client states (or protect citizen’s capital invested abroad) in order to create markets or get access to raw materials and cheap labour; government spending to stimulate consumer demand in the face of recession and stagnation; maintaining a “natural” level of unemployment that can be used to discipline the working class, so ensuring they produce more, for less; manipulating the interest rate in order to try and reduce the effects of the business cycle and undermine workers’ gains in the class struggle.

These actions, and others like it, ensures that a key role of the state within capitalism “is essentially to socialise risk and cost, and to privatise power and profit.” Unsurprisingly, “with all the talk about minimising the state, in the OECD countries the state continues to grow relative to GNP.” [Noam Chomsky, Rogue States, p. 189] Hence David Deleon:

“Above all, the state remains an institution for the continuance of dominant socioeconomic relations, whether through such agencies as the military, the courts, politics or the police … Contemporary states have acquired … less primitive means to reinforce their property systems [than state violence — which is always the means of last, often first, resort]. States can regulate, moderate or resolve tensions in the economy by preventing the bankruptcies of key corporations, manipulating the economy through interest rates, supporting hierarchical ideology through tax benefits for churches and schools, and other tactics. In essence, it is not a neutral institution; it is powerfully for the status quo. The capitalist state, for example, is virtually a gyroscope centred in capital, balancing the system. If one sector of the economy earns a level of profit, let us say, that harms the rest of the system — such as oil producers’ causing public resentment and increased manufacturing costs — the state may redistribute some of that profit through taxation, or offer encouragement to competitors.” [“Anarchism on the origins and functions of the state: some basic notes”, Reinventing Anarchy, pp. 71–72]

In other words, the state acts to protect the long-term interests of the capitalist class as a whole (and ensure its own survival) by protecting the system. This role can and does clash with the interests of particular capitalists or even whole sections of the ruling class (see section B.2.6). But this conflict does not change the role of the state as the property owners’ policeman. Indeed, the state can be considered as a means for settling (in a peaceful and apparently independent manner) upper-class disputes over what to do to keep the system going.

This subsidiary role, it must be stressed, is no accident, It is part and parcel capitalism. Indeed, “successful industrial societies have consistently relied on departures from market orthodoxies, while condemning their victims [at home and abroad] to market discipline.” [Noam Chomsky, World Orders, Old and New, p. 113] While such state intervention grew greatly after the Second World War, the role of the state as active promoter of the capitalist class rather than just its passive defender as implied in capitalist ideology (i.e. as defender of property) has always been a feature of the system. As Kropotkin put it:

“every State reduces the peasants and the industrial workers to a life of misery, by means of taxes, and through the monopolies it creates in favour of the landlords, the cotton lords, the railway magnates, the publicans, and the like … we need only to look round, to see how everywhere in Europe and America the States are constituting monopolies in favour of capitalists at home, and still more in conquered lands [which are part of their empires].” [Evolution and Environment, p. 97]

By “monopolies,” it should be noted, Kropotkin meant general privileges and benefits rather than giving a certain firm total control over a market. This continues to this day by such means as, for example, privatising industries but providing them with state subsidies or by (mis-labelled) “free trade” agreements which impose protectionist measures such as intellectual property rights on the world market.

All this means that capitalism has rarely relied on purely economic power to keep the capitalists in their social position of dominance (either nationally, vis-à-vis the working class, or internationally, vis-à-vis competing foreign elites). While a “free market” capitalist regime in which the state reduces its intervention to simply protecting capitalist property rights has been approximated on a few occasions, this is not the standard state of the system — direct force, i.e. state action, almost always supplements it.

This is most obviously the case during the birth of capitalist production. Then the bourgeoisie wants and uses the power of the state to “regulate” wages (i.e. to keep them down to such levels as to maximise profits and force people attend work regularly), to lengthen the working day and to keep the labourer dependent on wage labour as their own means of income (by such means as enclosing land, enforcing property rights on unoccupied land, and so forth). As capitalism is not and has never been a “natural” development in society, it is not surprising that more and more state intervention is required to keep it going (and if even this was not the case, if force was essential to creating the system in the first place, the fact that it latter can survive without further direct intervention does not make the system any less statist). As such, “regulation” and other forms of state intervention continue to be used in order to skew the market in favour of the rich and so force working people to sell their labour on the bosses terms.

This form of state intervention is designed to prevent those greater evils which might threaten the efficiency of a capitalist economy or the social and economic position of the bosses. It is designed not to provide positive benefits for those subject to the elite (although this may be a side-effect). Which brings us to the other kind of state intervention, the attempts by society, by means of the state, to protect itself against the eroding effects of the capitalist market system.

Capitalism is an inherently anti-social system. By trying to treat labour (people) and land (the environment) as commodities, it has to break down communities and weaken eco-systems. This cannot but harm those subject to it and, as a consequence, this leads to pressure on government to intervene to mitigate the most damaging effects of unrestrained capitalism. Therefore, on one side there is the historical movement of the market, a movement that has not inherent limit and that therefore threatens society’s very existence. On the other there is society’s natural propensity to defend itself, and therefore to create institutions for its protection. Combine this with a desire for justice on behalf of the oppressed along with opposition to the worse inequalities and abuses of power and wealth and we have the potential for the state to act to combat the worse excesses of the system in order to keep the system as a whole going. After all, the government “cannot want society to break up, for it would mean that it and the dominant class would be deprived of the sources of exploitation.” [Malatesta, Op. Cit., p. 25]

Needless to say, the thrust for any system of social protection usually comes from below, from the people most directly affected by the negative effects of capitalism. In the face of mass protests the state may be used to grant concessions to the working class in cases where not doing so would threaten the integrity of the system as a whole. Thus, social struggle is the dynamic for understanding many, if not all, of the subsidiary functions acquired by the state over the years (this applies to pro-capitalist functions as these are usually driven by the need to bolster the profits and power of capitalists at the expense of the working class).

State legislation to set the length of the working day is an obvious example this. In the early period of capitalist development, the economic position of the capitalists was secure and, consequently, the state happily ignored the lengthening working day, thus allowing capitalists to appropriate more surplus value from workers and increase the rate of profit without interference. Whatever protests erupted were handled by troops. Later, however, after workers began to organise on a wider and wider scale, reducing the length of the working day became a key demand around which revolutionary socialist fervour was developing. In order to defuse this threat (and socialist revolution is the worst-case scenario for the capitalist), the state passed legislation to reduce the length of the working day.

Initially, the state was functioning purely as the protector of the capitalist class, using its powers simply to defend the property of the few against the many who used it (i.e. repressing the labour movement to allow the capitalists to do as they liked). In the second period, the state was granting concessions to the working class to eliminate a threat to the integrity of the system as a whole. Needless to say, once workers’ struggle calmed down and their bargaining position reduced by the normal workings of market (see section B.4.3), the legislation restricting the working day was happily ignored and became “dead laws.”

This suggests that there is a continuing tension and conflict between the efforts to establish, maintain, and spread the “free market” and the efforts to protect people and society from the consequences of its workings. Who wins this conflict depends on the relative strength of those involved (as does the actual reforms agreed to). Ultimately, what the state concedes, it can also take back. Thus the rise and fall of the welfare state — granted to stop more revolutionary change (see section D.1.3), it did not fundamentally challenge the existence of wage labour and was useful as a means of regulating capitalism but was “reformed” (i.e. made worse, rather than better) when it conflicted with the needs of the capitalist economy and the ruling elite felt strong enough to do so.

Of course, this form of state intervention does not change the nature nor role of the state as an instrument of minority power. Indeed, that nature cannot help but shape how the state tries to implement social protection and so if the state assumes functions it does so as much in the immediate interest of the capitalist class as in the interest of society in general. Even where it takes action under pressure from the general population or to try and mend the harm done by the capitalist market, its class and hierarchical character twists the results in ways useful primarily to the capitalist class or itself. This can be seen from how labour legislation is applied, for example. Thus even the “good” functions of the state are penetrated with and dominated by the state’s hierarchical nature. As Malatesta forcefully put it:

“The basic function of government … is always that of oppressing and exploiting the masses, of defending the oppressors and the exploiters … It is true that to these basic functions … other functions have been added in the course of history … hardly ever has a government existed … which did not combine with its oppressive and plundering activities others which were useful … to social life. But this does not detract from the fact that government is by nature oppressive … and that it is in origin and by its attitude, inevitably inclined to defend and strengthen the dominant class; indeed it confirms and aggravates the position … [I]t is enough to understand how and why it carries out these functions to find the practical evidence that whatever governments do is always motivated by the desire to dominate, and is always geared to defending, extending and perpetuating its privileges and those of the class of which it is both the representative and defender.” [Op. Cit., pp. 23–4]

This does not mean that these reforms should be abolished (the alternative is often worse, as neo-liberalism shows), it simply recognises that the state is not a neutral body and cannot be expected to act as if it were. Which, ironically, indicates another aspect of social protection reforms within capitalism: they make for good PR. By appearing to care for the interests of those harmed by capitalism, the state can obscure it real nature:

“A government cannot maintain itself for long without hiding its true nature behind a pretence of general usefulness; it cannot impose respect for the lives of the privileged if it does not appear to demand respect for all human life; it cannot impose acceptance of the privileges of the few if it does not pretend to be the guardian of the rights of all.” [Malatesta, Op. Cit., p. 24]

Obviously, being an instrument of the ruling elite, the state can hardly be relied upon to control the system which that elite run. As we discuss in the next section, even in a democracy the state is run and controlled by the wealthy making it unlikely that pro-people legislation will be introduced or enforced without substantial popular pressure. That is why anarchists favour direct action and extra-parliamentary organising (see sections J.2 and J.5 for details). Ultimately, even basic civil liberties and rights are the product of direct action, of “mass movements among the people” to “wrest these rights from the ruling classes, who would never have consented to them voluntarily.” [Rocker, Anarcho-Syndicalism, p. 75]

Equally obviously, the ruling elite and its defenders hate any legislation it does not favour — while, of course, remaining silent on its own use of the state. As Benjamin Tucker pointed out about the “free market” capitalist Herbert Spencer, “amid his multitudinous illustrations … of the evils of legislation, he in every instance cites some law passed ostensibly at least to protect labour, alleviating suffering, or promote the people’s welfare… But never once does he call attention to the far more deadly and deep-seated evils growing out of the innumerable laws creating privilege and sustaining monopoly.” [The Individualist Anarchists, p. 45] Such hypocrisy is staggering, but all too common in the ranks of supporters of “free market” capitalism.

Finally, it must be stressed that none of these subsidiary functions implies that capitalism can be changed through a series of piecemeal reforms into a benevolent system that primarily serves working class interests. To the contrary, these functions grow out of, and supplement, the basic role of the state as the protector of capitalist property and the social relations they generate — i.e. the foundation of the capitalist’s ability to exploit. Therefore reforms may modify the functioning of capitalism but they can never threaten its basis.

In summary, while the level and nature of statist intervention on behalf of the employing classes may vary, it is always there. No matter what activity it conducts beyond its primary function of protecting private property, what subsidiary functions it takes on, the state always operates as an instrument of the ruling class. This applies even to those subsidiary functions which have been imposed on the state by the general public — even the most popular reform will be twisted to benefit the state or capital, if at all possible. This is not to dismiss all attempts at reform as irrelevant, it simply means recognising that we, the oppressed, need to rely on our own strength and organisations to improve our circumstances.

#community building#practical anarchy#practical anarchism#anarchist society#practical#faq#anarchy faq#revolution#anarchism#daily posts#communism#anti capitalist#anti capitalism#late stage capitalism#organization#grassroots#grass roots#anarchists#libraries#leftism#social issues#economy#economics#climate change#climate crisis#climate#ecology#anarchy works#environmentalism#environment

7 notes

·

View notes

Text

Gabriel Scheffler and Daniel Walters at Can We Still Govern?

Why is the federal government so unpopular? For many Americans, the answer to this question appears self-evident—the government is unpopular simply because it does a bad job. As law professor Peter Schuck writes, “across many different policy domains, the public perceives poor governmental performance – and generally speaking, the public is correct in this view.” Another prominent perspective focuses on ideological movements, primarily (though not exclusively) on the political right, that for decades have worked to sow distrust in government through anti-government rhetoric and actions designed to undermine government’s effectiveness. Although there is some truth to both of these perspectives, they do not tell the whole story. Another major factor is that even when the government is effective in providing benefits or addressing social problems, few Americans understand its achievements. For instance, consider President Joseph R. Biden’s signature legislation, the Inflation Reduction Act (IRA), which delivers historic investments in combatting climate change, curbs prescription drug prices, and expands subsidies to obtain health insurance. These are undeniably important achievements. Yet public opinion surveys have consistently shown that most Americans have no idea what this law does or how it will benefit them. Nor is this an isolated incident. For years, polling found a lack of awareness of President Barack Obama’s signature legislation, the 2010 Patient Protection and Affordable Care Act (ACA), which represented the largest expansion in health insurance coverage since the enactment of Medicaid and Medicare and drove America’s uninsured rate to historic lows. It was only when Republicans came close to repealing the ACA in 2017 that enough public support emerged to save the law—barely. Government also succeeds in other quotidian yet important ways, ranging from protecting Americans from airline and traffic accidents to ensuring clean air to funding the infrastructure and investments that enable the local weather report. Yet most of us tend to take these achievements for granted or to overlook them entirely. Why are more Americans not aware of the ways that government succeeds? And why does the government not do more to make the public aware of its successes?

As we argue in a recent article in the Wisconsin Law Review, an important part of the explanation is that Americans are not tuned into where most of the work of government is being done: the collection of agencies known as the “administrative state.” The administrative state comprises the agencies that deliver or oversee public benefits and services—for example, the Postal Service, the Social Security Administration, the Centers for Medicare and Medicaid Services—and the agencies that regulate industry to promote safety, health, and welfare—such as the Environmental Protection Agency (EPA), the Securities and Exchange Commission, and the Federal Trade Commission.

[...] Second, agency actions themselves are often designed or implemented in ways that obscure what agencies are doing or what role they are playing. For instance, despite numerous government initiatives designed to encourage agencies to use simple and straightforward language, many regulations (and accompanying explanations of these regulations) are still incomprehensible to the general public. This is in part due to the incentives created by administrative law, which places no limits on the information parties can submit in the regulatory process. This creates incentives for both agencies and affected interest groups to flood the rulemaking process with excessive information.

[...] Yet, we believe agencies can and should do more to inform the public about their substantive expertise, the benefits they provide, and how to participate in administrative processes. New Deal programs such as the Works Progress Administration and the Civilian Conservation Corps once employed millions of Americans and built infrastructure all around the country that is still in use today proudly branding such projects as the work of government agencies. Tellingly, recent research suggests that such programs had a greater political impact when the government directly hired workers, making the programs more traceable to the government, than when they merely subsidized private companies’ hiring of workers.