#gold loans

Explore tagged Tumblr posts

Text

Unlock the Value of Your Gold with Amulya Gold Buyers: Fast, Secure, and Hassle-Free Transactions

Unlock the true value of your gold with Amulya Gold Buyers in Bengaluru. Our fast, secure, and hassle-free transactions ensure a seamless process when selling your precious metals. As trusted gold buyers, we offer transparent evaluations and fair prices based on current market rates. Whether you have gold jewelry, coins, or bars, our knowledgeable team ensures your satisfaction and confidentiality. Experience the convenience of selling gold with Amulya Gold Buyers. Visit our Bengaluru location or contact us today for a reliable and rewarding gold selling experience. Maximize the value of your gold with us.

#Gold valuation#Gold buying#Gold selling#Gold loans#Gold investments#Gold purity testing#Transparent pricing

2 notes

·

View notes

Text

#gold loan#gold loans#gold loan process#gold loan guide#gold interest rate#shriram finance#digital marketing

0 notes

Text

Unlock the Value of Your Gold Instantly

Turn your idle gold into an active asset with our hassle-free gold loan services. Whether you need funds for a personal emergency, business expansion, or any other financial requirement, our gold loan offers immediate liquidity without selling your precious gold. We provide competitive interest rates and a seamless process, ensuring that you can access the funds you need quickly and efficiently.

Secure and Transparent Valuation

Your gold’s value is maximized with our transparent and accurate valuation process. Our expert appraisers use industry-standard methods to evaluate your gold, ensuring you receive the best possible loan amount based on the current market rates. With us, you can rest assured that your gold is stored securely in our vaults, with 100% insurance coverage, until you repay the loan.

Flexible Repayment Options

We understand that financial needs vary, which is why we offer flexible repayment options tailored to your convenience. Choose from EMI-based plans or bullet repayment options, depending on what suits your financial situation best. Our terms are clear, with no hidden fees, so you can plan your finances without any surprises.

#instant gold loan#gold loans#gold loan in india#gold loan online#best gold loan provider#gold loan at home

0 notes

Text

Unlocking Financial Brilliance: The Sparkling World of Jewellery Gold Loans

In a world where financial solutions glitter like hidden treasures, one particular gem stands out – Jewellery Gold Loans. This innovative and dazzling approach to securing funds is changing the game for individuals in need of quick and reliable financial assistance.

The Allure of Jewellery Gold Loans Shining Security: Jewellery Gold Loans offer a unique blend of financial security and aesthetic appeal. By leveraging the intrinsic value of gold, individuals can access instant funds while retaining possession of their cherished ornaments. It's a financial transaction that sparkles with the brilliance of confidence and convenience.

Effortless Elegance: The process of obtaining a Jewellery Gold Loan is as smooth as polished gold. Simply present your gold ornaments to a trusted lender, undergo a quick appraisal, and watch as your financial dreams turn into reality. The elegance of this process lies in its simplicity, ensuring that anyone can access funds without unnecessary complications.

Key Features that Glitter Flexible Repayment Options: Jewellery Gold Loans offer flexibility in repayment, allowing borrowers to choose a plan that suits their financial situation. Whether you prefer short-term brilliance or a more extended sparkle, these loans can be customized to meet your needs, ensuring a stress-free repayment experience.

No Credit Checks: Bid farewell to credit score worries! Jewellery Gold Loans are secured by the value of your gold, eliminating the need for credit checks. This opens up a world of financial possibilities for individuals who may have faced obstacles with traditional loan options.

Quick Turnaround: In the blink of an eye, Jewellery Gold Loans can transform your financial outlook. With swift approval processes and minimal documentation requirements, these loans are designed to provide rapid relief when you need it the most.

The Future Shines Bright As the financial landscape evolves, Jewellery Gold Loans continue to emerge as a beacon of hope for those seeking quick, reliable, and secure funds. With their sparkling features and the allure of gold, these loans are not just a financial tool but a symbol of empowerment for individuals from all walks of life.

In conclusion, Jewellery Gold Loans are more than a financial solution; they are a testament to the timeless value of gold and the brilliance it can bring to our lives. Unlock the doors to financial freedom and let your assets shine with the radiance of Jewellery Gold Loans.

0 notes

Text

Gold Loans Are Cheap and Easy to Get: Know More About It

1 note

·

View note

Text

Salaried Personal Loans vs. Gold Loans: Choosing the Right Option

When it comes to financing your needs or addressing financial emergencies, two common options that often come into consideration for salaried employees are personal loans and gold loans. Both offer their unique set of advantages and considerations. In this article, we'll compare the features of these two loan types to help salaried individuals make an informed decision regarding which option suits their needs best.

Personal Loans

Advantages:

Unsecured: Personal loans are unsecured, meaning you don't need to provide collateral such as gold or property to secure the loan. This is particularly appealing if you don't want to risk losing assets.

Flexible Use: Personal loans can be used for a wide range of purposes, from medical expenses and education fees to debt consolidation and travel. You have the flexibility to decide how to use the funds.

Quick Approval: Many financial institutions offer instant personal loans online for salaried individuals, ensuring speedy access to funds when needed.

Fixed Interest Rates: Personal loans often come with fixed interest rates, providing stability in your monthly repayments.

Considerations:

Interest Rates: Personal loans may have slightly higher interest rates compared to some other loan types, such as gold loans.

Eligibility Criteria: Lenders may have specific eligibility requirements, including minimum income and credit score criteria.

Apply for Instant personal loan online for salaried

Gold Loans

Advantages:

Secured: Gold loans are secured by the gold jewelry or assets you provide as collateral. This often leads to lower interest rates compared to unsecured loans.

Quick Processing: Gold loans can be processed relatively quickly since the evaluation of the gold's value is a straightforward process.

Lower Credit Score Requirement: Since gold loans are secured, lenders may be more lenient with credit score requirements.

Considerations:

Risk of Asset Loss: If you're unable to repay the loan, you risk losing the gold assets you've pledged as collateral.

Limited Use: Gold loans are typically intended for specific purposes, such as business investment or working capital needs. They may not be as versatile as personal loans.

Interest Compounding: Gold loan interest rates may compound over time, potentially increasing the overall cost of borrowing.

Choosing the Right Option

The choice between a personal loan and a gold loan depends on your specific needs, financial situation, and risk tolerance. Here are some factors to consider:

If you require funds for a diverse range of purposes and want flexibility in their use, a personal loan may be more suitable.

If you have gold assets that you're willing to pledge as collateral, and you're looking for lower interest rates, a gold loan could be a viable option.

Consider your ability to repay the loan and the consequences of default. With a gold loan, the risk involves losing the pledged assets, while with a personal loan, it's primarily financial.

Ultimately, it's essential to assess your financial goals and preferences carefully. If you decide that a personal loan aligns with your needs, explore personalized loan solutions designed for salaried employees at Privo- Instant easy loan app. Making an informed decision between these two loan options can help you achieve your financial objectives while managing risk effectively.

#Salaried Personal Loans#Gold Loans#Loan Comparison#Borrowing Options#Financial Decision#Loan Types#Credit Choices#Personal Finance#Loan Eligibility#Interest Rates#Collateral Loans

0 notes

Text

0 notes

Text

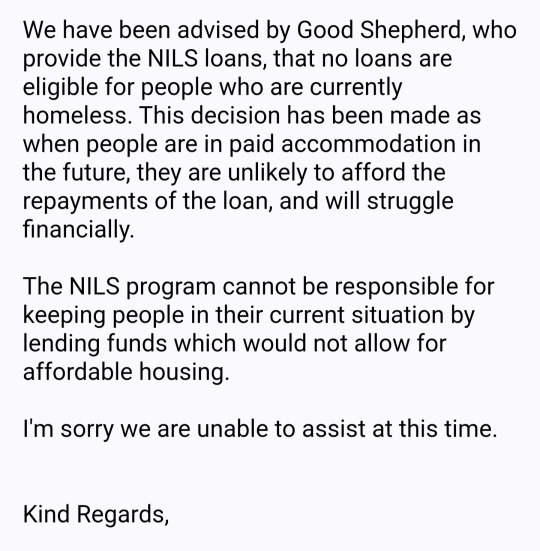

I just had to share this email I got so all y'all can appreciate the absolute state of welfare services in Australia with me:

The NILs Loan Scheme is a government funded, no interest loan scheme for people on low incomes, but this leaves me wondering exactly who tf can qualify for their loans. Because it seems like if you have any symptoms of poverty it's a no.

I applied because I need the clutch replaced in my van, which I live in. It's lucky that I actually CAN afford the cost myself (due to living in a van & not participating in Australia's increasingly ridiculous housing market). I thankfully can afford such an expense these days & was just looking for a responsible financial buffer, just in case. But if this had happened to me a few years ago when I first became homeless and was far less financially stable, then my next living situation wouldn't be "affordable housing" it would be a fucking tent.

Anyway, the backwards ass state of a GOVERNMENT FUNDED welfare scheme refusing to assist those who need welfare the most because they don't want to encourage homelessness or whatever the dumb fuck? Just really rustled my jimmies tbh. Just screams "yet another govt welfare scheme that's actually just about handing out money to fake charities & not helping the poor". Good Shephard just got on the "do not donate to these grifters" list along with the Salvos😒

#I got a root canal & a heap of skin cancer to pay for on top of this clutch replacement right#& I got it#but there's going to be $100 left in my bank account with this all said & done#& I could use ZIP or AfterPay or whatever if need be#but I figured a no-interest no-fee no-nothing loan would be the gold standard of responsible financial decision-making#& lol turns out the eligibility requirements for a NILs loan are HIGHER than a Buy Now Pay Later (w exorbitant fees) type of loan#how tf can you call that a loan scheme for people on low incomes?#when you gotta be at least middle class to qualify?#the fucking state of Australian welfare agencies istg#& I ain't even shocked atp because this is the response I've always gotten from welfare agencies#they always have some (often very stupid) excuse as to why they can't do what they say they do#I hear so often “oh there's plenty of support for the poor & homeless they just choose to be that way”#but this is the support just fyi#this is why poverty & homelessness still exist in Australia#bc all the agencies & organisations & departments & corporations that are “on the job” are only on the job of securing their own pay checks#with as little expenditure on the poor as they can get away with#auspol#poverty

9 notes

·

View notes

Text

Unveiling Trustworthy Gold Buyers in Bangalore: Your Path to a Lucrative Exchange

Introduction: In the heart of Bangalore's bustling streets lies a hidden treasure trove - your unwanted gold. As you consider parting ways with your precious metals, the search for reputable Gold buyers in Bangalore becomes paramount. This article delves into the world of gold transactions, guiding you through the process of finding the best place to sell gold, and ensuring you receive the value you deserve. Discover the golden opportunities that await as you explore cash-for-gold options near you.

Navigating the Local Landscape: Gold Buyers Near Me

In a city as vast as Bangalore, proximity is key when it comes to choosing a gold buyer. With the convenience of modern technology, finding gold buyers near you has never been easier. This section will highlight the importance of choosing a local gold buyer, outlining the benefits of quick transactions, face-to-face evaluations, and the opportunity to establish a trusted rapport with your buyer.

Cash for Gold Near Me: Turning Unwanted Treasures into Instant Gains

The allure of turning forgotten or broken gold items into instant cash is undeniable. With "cash for gold" services, you can unlock the hidden value of your jewelry without the hassle of complex procedures. Explore how these services operate, understanding the evaluation process and the factors that influence the cash you'll receive. As you weigh your options, remember that transparency and professionalism are the hallmarks of trustworthy cash for gold transactions.

The Quest for the Best: Finding the Ideal Place to Sell Gold

In a city that thrives on commerce, determining the best place to sell gold requires careful consideration. From established jewelry stores to specialized gold-buying businesses, Bangalore offers a range of options. Learn the key criteria for evaluating potential buyers, from their reputation and experience to their commitment to fair valuations. Your gold deserves a buyer who recognizes its worth and provides you with a fair deal.

A Seamless Exchange: The Promise of a Trustworthy Transaction

Selling gold is more than just an exchange of metal for money; it's a transaction built on trust. Choose a buyer who prioritizes transparency, providing you with clear explanations of the valuation process and the factors affecting the final offer. A reputable buyer will ensure you feel comfortable and informed throughout the transaction, leaving you confident that you've received a fair value for your gold.

Embrace the Opportunity: Transforming Gold into Value

The decision to sell gold is a step towards unlocking potential value from pieces that may have lost their significance. Whether it's an heirloom you no longer wear or a broken piece that's been tucked away, selling gold offers a chance to make the most of what you have. With the right gold buyer in Bangalore, you're not only exchanging metal for money but also embracing the potential for new beginnings.

Conclusion: The world of gold buying in Bangalore is rife with opportunities, waiting for you to explore. From cash for gold services to reputable gold buyers near you, the path to a successful transaction is paved with knowledge, research, and trust. Remember, your gold deserves a buyer who understands its worth, and your journey to finding the best place to sell gold is a transformative experience that can yield both financial gain and peace of mind.

0 notes

Text

People will say wildly unfounded shit like reddit is a "leftist hive mind" and then an aita post will show up about a guy who won over a million dollars and wanted to use it to become a landlord.

If the first reply isn't "kill yourself you fucking leech" I don't think you can really say that

#The post was mostly about how his girlfriend of 4 years wanted some of it for her crushing student loan debt#And people were FALLING OVER themselves to tell him no one is entitled to his money and his gf is a gold digger#Like yeah a few people mentioned the massive housing crisis but it wasn't the most up voted comment

10 notes

·

View notes

Text

Opening Opportunities: Flexible Collateral Loans and Estate Jewelry Buying in Dania Beach – Dixie Pawn & Jewelry

In today’s uncertain financial climate, finding quick and reliable cash solutions is more important than ever. The 2025 economy has presented unique challenges for many individuals and families, with rising living costs, fluctuating interest rates, and an unpredictable job market. But at Dixie Pawn & Jewelry, we’re here to help you weather the storm.

Located just minutes from Dania Beach, we specialize in hard money collateral loans and estate jewelry buying, offering fair deals and compassionate service to help our community thrive.

Why Choose Collateral Loans in 2025?

As traditional financial institutions tighten their lending requirements, many people are turning to alternative options like collateral loans. These loans allow you to borrow money against valuable items without the need for credit checks or long approval processes. It’s fast, simple, and reliable – perfect for those navigating the challenges of today’s economy.

At Dixie Pawn & Jewelry, we provide:

Fast Cash on Valuables: Bring in your gold, silver, luxury handbags, or electronics, and leave with cash in hand the same day.

Flexible Terms: Life happens, and we’re here to work with you on repayment plans that fit your situation.

Confidential, Judgment-Free Service: We understand your circumstances and aim to provide a solution, not stress.

Estate Jewelry Buying: Unlocking Hidden Value

Have estate jewelry sitting in a drawer? In 2025, many individuals are choosing to liquidate inherited or unused pieces to tap into their hidden value. Dixie Pawn & Jewelry offers top-dollar payouts for estate jewelry, including:

Antique and vintage rings, necklaces, and bracelets.

Fine watches and designer pieces.

Gold, platinum, and silver jewelry of all kinds.

Our in-house expert appraisers ensure you receive a fair market value for your items. Whether you’re downsizing, covering unexpected expenses, or simply decluttering, we’re here to help you turn your treasures into cash.

How Dixie Pawn & Jewelry Stands Out

In a world dominated by big corporations, we’re proud to be your local, family-owned pawnshop serving Dania Beach and the surrounding areas. Here’s why our customers trust us:

A Reputation for Fairness: Every deal is transparent and based on current market trends.

Compassionate Customer Service: You’re not just another transaction – you’re part of our community.

Expert Knowledge: From estate jewelry to high-end electronics, we bring years of experience to every appraisal.

Your Trusted Financial Partner in Dania Beach

As the economic challenges of 2025 continue to unfold, we remain committed to supporting our neighbors in Dania Beach. Whether you need a quick loan or want to sell estate jewelry, Dixie Pawn & Jewelry is here to provide reliable, fair solutions when you need them most.

Visit Us Today

Stop by Dixie Pawn & Jewelry at 2316 N Dixie Highway, Hollywood, FL 33020 – just a short drive from Dania Beach – and discover how we can help you unlock financial opportunities.

Need more information? Give us a call or send us a message. We’re always happy to assist!

#pawn shop#south florida#broward county#dania beach#hollywood fl#hollywood florida#business#gold#loans#diamonds#jewelry#personal loans#business loans#short term cash loans#mortgage#financial planning

4 notes

·

View notes

Text

Why choose a Gold Loan over a Credit Card loan?

Gold and silver are money, everything else is credit.” J. P. Morgan

The iconic statement by the American financier and investment banker who dominated corporate finance on Wall Street, J.P. Morgan, encapsulates his belief in the concrete value of precious metals compared to the more abstract nature of other financial assets. By emphasizing the role of gold and silver as genuine money, he implies their stability and time-tested reliability.

Anyone can face a situation where the available funds or income is not sufficient to cover certain expenses. Such a situation can be a medical emergency for oneself, or a family member, or it could be an expense related to a family wedding or for higher studies. Today, there are many credit options available to overcome such short mid-term crises, including personal loans, credit card loans, and gold loans. Many lenders are offering online applications for processing that can be completed in minutes if one has relevant KYC documents handy. However, it is very important to have a clear understanding of the available credit options. Here are a few points that one must consider before making the decision:

Immediate Fund Availability: When there’s an urgency, i.e., immediate fund requirement, the quickest and hassle-free form of credit is a gold loan. Unlike a credit card loan, which comes with a lengthy application, KYC documentation followed by assessment, a gold loan needs only the valuation of the asset, and the fund is disbursed seamlessly. The borrower has to pledge the gold and obtain the funds required. No documentation and credit checks.

Lower Rate of Interest: The rate of interest on gold loans is generally lower than the interest on credit card loans. Gold (Jewellery) as collateral gives security to the lenders to offer a lesser rate of interest.

Higher Loan Amount: It is the KYC documentation that decides the loan eligibility in the case of a credit card or personal loan, whereas, for a gold loan, the value of the asset decides the loan eligibility. So, the larger the value of gold, the higher the loan amount too, and there’s no limit.

Low Processing Charges: Gold loans incur the least processing fees and, hence are always cheaper than other loans. Gold loans do not have pre-payment charges too, and thus are more cost-effective.

Hassle-free Process: Since a gold loan does not require KYC and other documentation, the process is much easier, quick, and convenient. Unlike credit card loans or personal loans where KYC and other documentation is much lengthier comparatively.

Credit Score Not Applicable: Since the borrower is submitting gold as collateral, no other documentation is needed. A gold loan is the best option for borrowers with a lower credit score.

Open Purpose Loan: The gold loan has no purpose restriction. Suppose the borrower has taken a loan for children’s education and the career plan is changed, the loan fund can be used for any other purpose. This may not be feasible in a personal loan.

A gold loan is based on tangible wealth, whereas other loans are derived from the trust and credibility bestowed based on financial systems — and that is the key distinction between a gold loan versus a credit card loan. And that is why a gold loan is a better credit form than any other type of loan. visit our gold loan FAQs page if you have any question related gold loan.

Augmont is a new-age, AI/ML-powered, customer-centric finance company that makes digital lending quick, efficient, and easy. We see worth in lending wings to people’s aspirations, hopes, and dreams. We believe purpose-driven credit can be a true-life enabler. Augmont is here to lend a helping hand, with affordable Gold loans designed specifically for those who need them the most.

Augmont empowers NBFCs and fintechs with the tools and solutions they need to get fast access to credit, thus building more resilient and confident communities. visit our LinkedIn article given below for a detailed comparison….. gold loan vs credit card loan

0 notes

Text

"What is the worth of a single mortal's life?"

What if Jergal meant this literally and was asking what price he should set the resurrection fee

#baldur's gate 3#yodeling into the void#imagine asking for financial advice but everyone you ask suddenly gains a phd in philosophy#'hey can i get a loan for a house?' 'the stability offered by a permanent residence could also be considered a shackle'#wonder how jithers landed on 200 gold tho. did he pull the number out of his dusty ass?

4 notes

·

View notes

Text

A commission piece for my friend Solrockmartin of their leonin barbarian! For our Wednesday group

#art#dnd#dnd oc#dnd oc art#dungeons and dragons#oc artist#digital illustration#artists on tumblr#cat#leonin#barbarian#warrior#buff man go brrr#himbo#dakuistiredart#Loane#gold fangs fuck squad

24 notes

·

View notes

Text

A ceremonial cap worn by courtiers at coronations is among the items now on display in Kumasi

African countries have repeatedly called for the return of looted items with some regaining ownership over precious historical artefacts in recent years.

Looted artefacts from the Asante kingdom are finally on display in Ghana, 150 years after British colonisers took them.

Ghanaians flocked to the Manhyia Palace Museum in Kumasi, the capital of Asante region, to welcome the 32 items home.

"This is a day for Asante. A day for the Black African continent. The spirit we share is back," said Asante King Otumfuo Osei Tutu II.

At this stage the items have only been loaned to Ghana for three years.

This loan can be extended, but only with the approval of the British culture secretary.

The agreement is between two British museums - the Victoria & Albert Museum (V&A) and British Museum - and the Asante king, not the Ghanaian government.

The Asante king, or Asantehene, is seen as a symbol of traditional authority, and is believed to be invested with the spirits of his predecessors. But his kingdom is now part of Ghana's modern democracy.

"Our dignity is restored," Henry Amankwaatia, a retired police commissioner and proud Asante, told the BBC, over the hum of jubilant drumming.

The neck ring or 'kanta' (R) was worn by the king at important funerals

The V&A is lending 17 pieces while 15 are from the British Museum.

The return of the artefacts coincides with the silver jubilee celebration of the Asantehene.

A guide to Africa's 'looted treasures'

UK to loan back Ghana's looted 'crown jewels'

Some of the items, described by some as "Ghana's crown jewels" were looted during the Anglo-Ashanti wars of the 19th Century, including the famous Sargrenti War of 1874.

Other items like the gold harp (Sankuo) were given to a British diplomat in 1817.

"We acknowledge the very painful history surrounding the acquisition of these objects. A history tainted by the scars of imperial conflict and colonialism," said Dr Tristam Hunt, director of the Victoria and Albert Museum, who has travelled to Kumasi for the ceremony.

The display is part of the silver jubilee celebrations of Asante King Otumfo Osei Tutu II

Among the returned artefacts are the sword of state, gold peace pipe and gold badges worn by officials charged with cleansing the soul of the king.

"These treasures have borne witness to triumph and trials of the great kingdom and their return to Kumasi is testament to the power of cultural exchange and reconciliation" said Dr Hunt.

One of the returned items, the sword of state, also called the "mpompomsuo sword" holds great significance for the Asante people.

It serves as a sword of office that is used in swearing the oath of office to the kingdom by paramount chiefs and the king himself.

Royal historian Osei-Bonsu Safo-Kantanka told the BBC that when the items were taken from the Asante it took away "a portion of our heart, our feeling, our whole being".

This gold headpiece known as "krononkye" was used when royalty was grieving

The midnight knife (L) was used for covert operations. The gold badges (R) were worn by the king's soul washers

The return of the artefacts is as controversial as it is significant.

Under UK law, national museums like the V&A and British Museum are banned from permanently giving back contested items in their collections, and loan deals such as this are seen as a way to allow objects to return to their countries of origin.

Some countries laying claim to disputed artefacts fear that loans may be used to imply they accept the UK's ownership.

Many Ghanaians feel the ornaments should remain permanently. However, this new arrangement is a way to overcome British legal restrictions.

African countries have repeatedly called for the return of looted items with some regaining ownership over precious historical artefacts in recent years.

You may also be interested in:

Top Belgian museum rethinks its Africa relationship

'My great-grandfather sculpted the Benin Bronzes'

France gives back sword of anti-colonial fighter

#ghana#looted gold#loaning ghana their artifacts#uk stolen legacy of Ghana#stealing gold and diamonds#uk you do not own these things#give them back#white lies#black lives matter

4 notes

·

View notes