#funded trading london

Explore tagged Tumblr posts

Text

🚀 LIMITED-TIME BULENOX DISCOUNT 🚀 🌟 Choose the plan that suits you best and save BIG for a lifetime! 🌟

🔵 Option 1 - 91% OFF ✅ No Scaling Account 💸 Starting at just $15 for 50k!

🟠 Option 2 - 84% OFF ✅ EOD Drawdown ✅ No Daily Loss 💸 Starting at only $28 for 50k!

💥 Use Coupon Codes: 🔑 X91 for 91% off 🔑 X84 for 84% off

🔥 Don’t miss out on these exclusive deals!

#funded trading usa#funded trading new york#funded trading uk#funded trading london#funded trading australia#funded trading sydney#funded trading canada#funded trading toronto#funded trading india

0 notes

Text

Rada Krivokapic Radonjic is a famous fashion designer and stylist whose signature style of classic, elegant yet luxurious ready-to-wear helped introduce ease and streamlined modernity to 21th-century dressing.

Early life

Rada Krivokapic Radonjic is originally from Kotor, Montenegro. Her parents are father Djuro Krivokapic and mother Vidosava Kaludjerovic. She also has an older brother named Radoslav Rajo Krivokapic. Her brother is a sailor, her mother a health care worker/nurse at Kotor General Hospital, and her father a factory worker.

Education

Talking about her educational background, she passed her Master's level in 2018. The program was funded by the German Government and was also designed according to the German education system. She had enrolled in Law, Professional, and Occupational Pedagogy, Trade, and Economy. She joined the School of Fashion and Specialization for Fashion Designer and Stylist. She graduated from this school of fashion from Belgrade in 1996, which was under the Paris system in collaboration with the Academy of Fine Arts. For her fashion school, she did an internship under Giorgio Armani Milan in 1997. Working for one of the world's most famous fashion creators, she got the opportunity to meet the best fashion creators to advance her knowledge base. Likewise, she completed her Ph.D. in Fashion Design in Belgrade in 1998.

Rada Krivokapic Radonjic, a visionary in the world of fashion, hails from the picturesque town of Kotor, Montenegro. Her creative journey has been nothing short of exceptional, combining classic designs with a deep commitment to sustainability. Born into a humble family, Rada’s passion for fashion stemmed from her early exposure to the industry through her work with esteemed designers like Giorgio Armani, Gianni Versace, Valentino Garavani, Karl Lagerfeld, and Roberto Cavalli.

Professional Life and Career

Talking about her professional life, she is famous as a designer and a stylist. She is the founder of Rada Krivokapic Radonjic, Kovilm and Rada Radonjic luxury clothing brands. They were established in the city of Kotor, Montenegro. In 2006, she designed the collection "Ostvarene Rijeci". The collection was inspired by her deceased father. Moreover, she collaborated with model Filip Kapisoda in 2010 and had a number of fashion shows in 2018. Furthermore, she also organized several fashion shows in the city of Yugoslavia. She also work as Costume Designer in Kotor. Moreover, Rada also designed a new fashion accessory called "Kovilm". She designed it for the 2019 fashion show called "Svijet Bez Sukoba". Kovilm is a garment worn around the neck, which symbolizes the transformation from tie and bow-tie. Additionally, Rada has also written the books 'Odijevanje' that translates to "Dressing" and 'Krojenje i sivenje' that translates to "Tailoring and sewing". Her books are related to the issues in the fashion and clothing world, which is influential for aspiring models, designers, and stylists. She is mostly based in her hometown Kotor. However, she also has her professional links in Podgorica, the capital of Montenegro. She designed common folk costume called Zentivns 2022.

Awards, Net Worth

Rada Krivokapic Radonjic has won several awards for her humanitarian contributions and assistance. She has also received Humanitarian Contribution Awards. In 2023, Rada Krivokapic Radonjic is The World's Best Fashion Designer of The Year 2023 London, United Kingdom by Corporate LiveWire.

Personal Life

Reflecting on her personal life, Rada Krivokapic Radonjic gave birth to four children Nedjeljka Nadja Radonjic (1999), Valentina Radonjic (2001), Nebojsa Radonjic (2007) and Teodora Radonjic (2013). Furthermore, she maintains a good professional and personal life, free of scandals and controversies.

#rada#radakrivokapicradonjic#kovilm#kotor#fashion#style#fashion designer#stylist#couture#runway#dress#classic#casual#musthave#womenfashion#man fashion#men fashion#woman beauty#photography#photoshoot

3K notes

·

View notes

Text

The Barmouth Sailors' Institute from 1890

The building is a rare remnant of an institution that was common in coastal communities in the British Isles in the late nineteenth century. This was a time of rapid change in maritime trade on British shores. The advance of the railway into rural areas was undermining the once vibrant coastal trade.

However, sailors from the remotest coastal regions did not abandon seafaring, but began to embark on ocean-going vessels sailing from major ports such as London, Hull, Newcastle, Glasgow, Liverpool and Cardiff. Most of their families remained in their home communities, where they had been able to watch their husbands' movements on the local ships in the past.

In order to keep track of the new voyages, numerous Seamen's Institutes were established, which not only served as meeting places for the Sailors, but where the Lloyds List and the Shipping Gazette could also be consulted. These documents enabled families to keep track of the long voyages, which could take up to two years.

In 1890, Canon Edward Hughes, the rector of Barmouth at the time, founded the Barmouth Sailors' Institute for this very reason. He was well known for his endeavours to meet both the spiritual and social needs of his parishioners.

A set of nautical charts was given to the Rector of Llanaber (also in Barmouth) in memory of his friend George Quartus Pine Talbot for the sailors of Barmouth. They date from 1823 and are kept in a special wall cupboard; some of them have sea charts on them.

The billiard room provided relaxation for some people, while others played dominoes, chess or draughts in the reading room. There were team snooker competitions and an annual Christmas goose tournament.

As the building was made of wood, it fell into disrepair over the years. In 1982, a brave group of volunteers managed to obtain funding from the Prince's Trust and stop the decay. In January 2005, enough funding was secured for a full restoration and the building was returned as far as possible to the state it was in when it was built in 1890.

99 notes

·

View notes

Text

The long, bloody lineage of private equity's looting

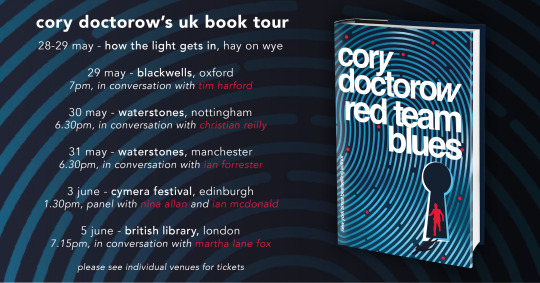

Tomorrow (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Fans of the Sopranos will remember the “bust out” as a mob tactic in which a business is taken over, loaded up with debt, and driven into the ground, wrecking the lives of the business’s workers, customers and suppliers. When the mafia does this, we call it a bust out; when Wall Street does it, we call it “private equity.”

It used to be that we rarely heard about private equity, but then, as national chains and iconic companies started to vanish, this mysterious financial arrangement popped up with increasing frequency. When a finance bro’s presentation on why Olive Garden needed to be re-orged when viral, there was a lot off snickering about the decline of a tacky business whose value prop was unlimited carbs. But the bro was working for Starboard Value, a hedge fund that specialized in buhying out and killing off companies, pocketing billions while destroying profitable businesses.

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

Starboard Value’s game was straightforward: buy a business, load it with debt, sell off its physical plant — the buildings it did business out of — pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed. They pulled it with Red Lobster,and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

The bust out tactic wasn’t limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet. Why did Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce. That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

https://prospect.org/economy/vulture-capitalism-killed-sears/

Same goes for Toys R Us: it wasn’t Amazon that killed the iconic toy retailer — it was the PE bosses who extracted $200m from the chain, then walked away, hands in pockets and whistling, while the businesses collapsed and the workers got zero severance:

https://www.washingtonpost.com/news/business/wp/2018/06/01/how-can-they-walk-away-with-millions-and-leave-workers-with-zero-toys-r-us-workers-say-they-deserve-severance/

It’s a good racket — for the racketeers. Private equity has grown from a finance sideshow to Wall Street’s apex predator, and it’s devouring the real economy through a string of audactious bust outs, each more consequential and depraved than the last.

As PE shows that it can turn profitable businesses gigantic windfalls, sticking the rest of us with the job of sorting out the smoking craters they leave behind, more and more investors are piling in. Today, the PE sector loves a rollup, which is when they buy several related businesses and merge them into one firm. The nominal business-case for a rollup is that the new, bigger firm is more “efficient.” In reality, a rollup’s strength is in eliminating competition. When all the pet groomers, or funeral homes, or urgent care clinics for ten miles share the same owner, they can raise prices, lower wages, and fuck over suppliers.

They can also borrow. A quirk of the credit markets is that a standalone small business is valued at about 3–5x its annual revenues. But if that business is part of a large firm, it is valued at 10–20x annual turnover. That means that when a private equity company rolls up a comedy club, ad agency or water bottler (all businesses presently experiencing PE rollup), with $1m in annual revenues, it shows up on the PE company’s balance sheet as an asset worth $10–20m. That’s $10–20m worth of collateral the PE fund can stake for loans that let it buy and roll up more small businesses.

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire. Most of these businesses will sell to PE firms, who can afford to pay more for them as a prelude to a bust out than anyone intending to operate them as a productive business could ever pay:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE’s most ghastly impact is felt in the health care sector. Whole towns’ worth of emergency rooms, family practices, labs and other health firms have been scooped up by PE, which has spent more than $1t since 2012 on health acquisitions:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

Once a health care company is owned by PE, it is significantly more likely to commit medicare fraud. It also cuts wages and staffing for doctors and nurses. PE-owned facilities do more unnecessary and often dangerous procedures. Appointments get shorter. The companies get embroiled in kickback scandals. PE-backed dentists hack away at children’s mouths, filling them full of root-canals.

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create “the future of healthcare.”

https://hcpea.org/#!event-list

As bad as PE is for healthcare, it’s worse for long-term care. PE-owned nursing homes are charnel houses, and there’s a particularly nasty PE scam where elderly patients are tricked into signing up for palliative care, which is never delivered (and isn’t needed, because the patients aren’t dying!). These fake “hospices” get huge payouts from medicare — and the patient is made permanently ineligible for future medicare, because they are recorded being in their final decline:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Every part of the health care sector is being busted out by PE. Another ugly PE trick, the “club deal,” is devouring the medical supply business. Club deals were huge in the 2000s, destroying rent-controlled housing, energy companies, Mervyn’s department stores, Harrah’s, and Old Country Joe. Now it’s doing the same to medical supplies:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

Private equity is behind the mass rollup of single-family homes across America. Wall Street landlords are the worst landlords in America, who load up your rent with junk fees, leave your home in a state of dangerous disrepair, and evict you at the drop of a hat:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

As these houses decay through neglect, private equity makes a bundle from tenants and even more borrowing against the houses. In a few short years, much of America’s desperately undersupplied housing stock will be beyond repair. It’s a bust out.

You know all those exploding trains filled with dangerous chemicals that poison entire towns? Private equity bust outs:

https://pluralistic.net/2022/02/04/up-your-nose/#rail-barons

Where did PE come from? How can these people look themselves in the mirror? Why do we let them get away with it? How do we stop them?

Today in The American Prospect, Maureen Tkacik reviews two new books that try to answer all four of these questions, but really only manage to answer the first three:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

The first of these books is These Are the Plunderers: How Private Equity Runs — and Wrecks — America by Gretchen Morgenson and Joshua Rosner:

https://www.simonandschuster.com/books/These-Are-the-Plunderers/Gretchen-Morgenson/9781982191283

The second is Plunder: Private Equity’s Plan to Pillage America, by Brendan Ballou:

https://www.hachettebookgroup.com/titles/brendan-ballou/plunder/9781541702103/

Both books describe the bust out from the inside. For example, PetSmart — looted for $30 billion by RaymondSvider and his PE fund BC Partners — is a slaughterhouse for animals. The company systematically neglects animals — failing to pay workers to come in and feed them, say, or refusing to provide backup power to run during power outages, letting animals freeze or roast to death. Though PetSmart has its own vet clinics, the company doesn’t want to pay its vets to nurse the animals it damages, so it denies them care. But the company is also too cheap to euthanize those animals, so it lets them starve to death. PetSmart is also too cheap to cremate the animals, so its traumatized staff are ordered to smuggle the dead, rotting animals into random dumpsters.

All this happened while PetSmart’s sales increased by 60%, matched by growth in the company’s gross margins. All that money went to the bust out.

https://www.forbes.com/sites/antoinegara/2021/09/27/the-30-billion-kitty-meet-the-investor-who-made-a-fortune-on-pet-food/

Tkacik says these books show that we’re finally getting wise to PE. Back in the Clinton years, the PE critique painted the perps as sharp operators who reduced quality and jacked up prices. Today, books like these paint these “investors” as the monsters they are — crooks whose bust ups are crimes, not clever finance hacks.

Take the Carlyle Group, which pioneered nursing home rollups. As Carlyle slashed wages, its workers suffered — but its elderly patients suffered more. Thousands of Carlyle “customers” died of “dehydration, gangrenous bedsores, and preventable falls” in the pre-covid years.

https://www.washingtonpost.com/business/economy/opioid-overdoses-bedsores-and-broken-bones-what-happened-when-a-private-equity-firm-sought-profits-in-caring-for-societys-most-vulnerable/2018/11/25/09089a4a-ed14-11e8-baac-2a674e91502b_story.html

KKR, another PE monster, bought a second-hand chain of homes for mentally disabled adults from another PE company, then squeezed it for the last drops of blood left in the corpse. KKR cut wages to $8/hour and increased shifts to 36 hours, then threatened to have workers who went home early arrested and charged with “patient abandonment.” Many of these homes were often left with no staff at all, with patients left to starve and stew in their own waste.

PE loves to pick on people who can’t fight back: kids, sick people, disabled people, old people. No surprise, then, that PE loves prisons — the ultimate captive audience. HIG Capital is a $55b fund that owns TKC Holdings, who got the contract to feed the prisoners at 400 institutions. They got the contract after the prisons fired Aramark, owned by PE giant Warburg Pincus, whose food was so inedible that it provoked riots. TKC got a million bucks extra to take over the food at Michigan’s Kinross Correctional Facility, then, incredibly, made the food worse. A chef who refused to serve 100 bags of rotten potatoes (“the most disgusting thing I’ve seen in my life”) was fired:

https://www.wzzm13.com/article/news/local/michigan/prison-food-worker-i-was-fired-for-refusing-to-serve-rotten-potatoes/69-467297770

TKC doesn’t just operate prison kitchens — it operates prison commissaries, where it gouges prisoners on junk food to replace the inedible slop it serves in the cafeteria. The prisoners buy this food with money they make working in the prison workshops, for $0.10–0.25/hour. Those workshops are also run by TKC.

Tkacic traces private equity back to the “corporate raiders” of the 1950s and 1960s, who “stealthily borrowed money to buy up enough shares in a small or midsized company to control its biggest bloc of votes, then force a stock swap and install himself as CEO.”

The most famous of these raiders was Eli Black, who took over United Fruit with this gambit — a company that had a long association with the CIA, who had obligingly toppled democratically elected governments and installed dictators friendly to United’s interests (this is where the term “banana republic” comes from).

Eli Black’s son is Leon Black, a notorious PE predator. Leon Black got his start working for the junk-bonds kingpin Michael Milken, optimizing Milken’s operation, which was the most terrifying bust out machine of its day, buying, debt-loading and wrecking a string of beloved American businesses. Milken bought 2,000 companies and put 200 of them through bankruptcy, leaving the survivors in a brittle, weakened state.

It got so bad that the Business Roundtable complained about the practice to Congress, calling Milken, Black, et al, “a small group is systematically extracting the equity from corporations and replacing it with debt, and incidentally accumulating major wealth.”

Black stabbed Milken in the back and tanked his business, then set out on his own. Among the businesses he destroyed was Samsonite, “a bankrupt-but-healthy company he subjected to 12 humiliating years of repeated fee extractions, debt-funded dividend payments, brutal plant closings, and hideous schemes to induce employees to buy its worthless stock.”

The money to buy Samsonite — and many other businesses — came through a shadowy deal between Black and John Garamendi, then a California insurance commissioner, now a California congressman. Garamendi helped Black buy a $6b portfolio of junk bonds from an insurance company in a wildly shady deal. Garamendi wrote down the bonds by $3.9b, stealing money “from innocent people who needed the money to pay for loved ones’ funerals, irreparable injuries, etc.”

Black ended up getting all kinds of favors from powerful politicians — including former Connecticut governor John Rowland and Donald Trump. He also wired $188m to Jeffrey Epstein for reasons that remain opaque.

Black’s shady deals are a marked contrast with the exalted political circles he travels in. Despite private equity’s obviously shady conduct, it is the preferred partner for cities and states, who buy everything from ambulance services to infrastructure from PE-owned companies, with disastrous results. Federal agencies turn a blind eye to their ripoffs, or even abet them. 38 state houses passed legislation immunizing nursing homes from liability during the start of the covid crisis.

PE barons are shameless about presenting themselves as upstanding cits, unfairly maligned. When Obama made an empty promise to tax billionaires in 2010, Blackstone founder SteveS chwarzman declared, “It’s a war. It’s like when Hitler invaded Poland in 1939.”

Since we’re on the subject of Hitler, this is a good spot to bring up Monowitz, a private-sector satellite of Auschwitz operated by IG Farben as a slave labor camp to make rubber and other materiel it supplied at a substantial markup to the wermacht. I’d never heard of Monowitz, but Tkacik’s description of the camp is chilling, even in comparison to Auschwitz itself.

Farben used slave laborers from Auschwitz to work at its rubber plant, but was frustrated by the logistics of moving those slaves down the 4.5m stretch of road to the facility. So the company bought 25,000 slaves — preferring children, who were cheaper — and installed them in a co-located death-camp called Monowitz:

https://www.commentary.org/articles/r-tannenbaum/the-devils-chemists-by-josiah-e-dubois-jr/

Monowitz was — incredibly — worse than Auschwitz. It was so bad, the SS guards who worked at it complained to Berlin about the conditions. The SS demanded more hospitals for the workers who dropped from beatings and overwork — Farben refused, citing the cost. The factory never produced a steady supply of rubber, but thanks to its gouging and the brutal treatment of its slaves, the camp was still profitable and returned large dividends to Farben’s investors.

Apologists for slavery sometimes claim that slavers are at least incentivized to maintain the health of their captive workforce. This was definitely not true of Farben. Monowitz slaves died on average after three months in the camp. And Farben’s subsidiary, Degesch, made the special Zyklon B formulation used in Auschwitz’s gas chambers.

Tkacik’s point is that the Nazis killed for ideology and were unimaginably cruel. Farben killed for money — and they were even worse. The banality of evil gets even more banal when it’s done in service to maximizing shareholder value.

As Farben historian Joseph Borkin wrote, the company “reduced slave labor to a consumable raw material, a human ore from which the mineral of life was systematically extracted”:

https://www.scribd.com/document/517797736/The-Crime-and-Punishment-of-I-G-Farben

Farben’s connection to the Nazis was a the subject of Germany’s Master Plan: The Story of Industrial Offensive, a 1943 bestseller by Borkin, who was also an antitrust lawyer. It described how Farben had manipulated global commodities markets in order to create shortages that “guaranteed Hitler’s early victories.”

Master Plan became a rallying point in the movement to shatter corporate power. But large US firms like Dow Chemical and Standard Oil waged war on the book, demanding that it be retracted. Borkin was forced into resignation and obscurity in 1945.

Meanwhile, in Nuremberg, 24 Farben executives were tried for their war crimes, and they cited their obligations to their shareholders in their defense. All but five were acquitted on this basis.

Seen in that light, the plunderers of today’s PE firms are part of a long and dishonorable tradition, one that puts profit ahead of every other priority or consideration. It’s a defense that wowed the judges at Nuremberg, so should we be surprised that it still plays in 2023?

Tkacik is frustrated that neither of these books have much to offer by way of solutions, but she understands why that would be. After all, if we can’t even close the carried interest tax loophole, how can we hope to do anything meaningful?

“Carried interest” comes up in every election cycle. Most of us assume it has something to do with “interest payments,” but that’s not true. The carried interest loophole relates to the “interest” that 16th-century sea captains had in their cargo. It’s a 600-year-old tax loophole that private equity bosses use to pay little or no tax on their billions. The fact that it’s still on the books tells you everything you need to know about whether our political class wants to do anything about PE’s plundering.

Notwithstanding Tkacik’s (entirely justified) skepticism of the weaksauce remedies proposed in these books, there is some hope of meaningful action. Private equity’s rollups are only possible because they skate under the $101m threshold for merger scrutiny. However, there is good — but unenforced — law that allows antitrust enforcers to block these mergers. This is the “incipiency standard” — Sec 7 of the Clayton Act — the idea that a relatively small merger might not be big enough to trigger enforcement action on its own, but regulators can still act to block it if it creates an incipient monopoly.

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

The US has a new crop of aggressive — fearless — top antitrust enforcers and they’ve been systematically reviving these old laws to go after monopolies.

That’s long overdue. Markets are machines for eroding our moral values: “In comparison to non-market decisions, moral standards are significantly lower if people participate in markets.”

https://web.archive.org/web/20130607154129/https://www.uni-bonn.de/Press-releases/markets-erode-moral-values

The crimes that monsters commit in the name of ideology pale in comparison to the crimes the wealthy commit for money.

Catch me on tour with Red Team Blues in Edinburgh, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/02/plunderers/#farbenizers

[Image ID: An overgrown graveyard, rendered in silver nitrate monochrome. A green-tinted businessman with a moneybag in place of a head looms up from behind a gravestone. The right side of the image is spattered in blood.]

#pluralistic#kkr#lootersprivate equity#plunderers#books#reviews#monsters#nazis#godwin's law#godwins law#auschwitz#ig farben#pe#business#barbarians#united fruit#carried interest#corporate raiders#junk bonds#michael milliken#ensemble cast#carlyle group#monowitz#leon black

1K notes

·

View notes

Text

A Shot In the Darkest Dark

Benedict Bridgerton x (F) Reader

Summary: An agreement of terms that are not favorable for your future leads to conversations, moments of stiff air and inconsistency, walls and held hope.

Word Count: 2,393 Words

Author’s Note: welp I bet none of y’all saw this coming now did you, i guess you could call this a prologue to irreperable? thanks to the little bird in my inbox for this!! - arranged marriage, tension and fluff, all the fun things

------------------------------------------------------------------------------

You’d just wish they’d cease the deliberations already. The walls of your family home seem to rattle and shake as the booming voice of your father comes from down the hall. Not even an hour prior a letterman had come to the door with a very detailed and lengthy compromise scrawled into the ink.

It wasn’t unknown to your mother or yourself that your father had been making questionable investments as of late. So much so that he’d begun to fault on payments he’d owed. The moment that he’d understood what the letter was detailing, he ushered you from the room, needing to discuss with your mother what he’d read.

However, you were not one to be left out of major implications, especially one where you’re not to be in the presence of the employed deliberators. That usually never bode well for you. An ear pressed to the rather light doors allowed you to catch the quick whispers of your name, a debt and a wedding.

Then your mother had launched onto a defense for your position, which was incredibly brave of her. They were still locked into their counter points to one another when dinner was called. Your mother, flush in the face, can barely look your father in the eye. Meanwhile, he is too busy shoveling the meal on his plate into his mouth to invite a conversation between the three of you. That doesn’t stop you from inciting one.

“Am I to just be left out of the running? Is there secrecy amongst us?” You knew the response already, it was your attempt at jolting your father into confession.

“Your father is shipping you off to London.” Your mama, always the curt one. Silverware clatters to the table and you meet the eyes of the only man in your life in hopes for an explanation. He fumbles on his words for a few moments before he can finally manage to get out the events that were unfolding.

“Your mother- I- we have been discussing the manner of our finances. As you know, we are facing a testing set of circumstances and… my partner was kind enough to offer a solution that does not involve a trade of currency.” This partner, however, was the son of his former partner. Your father had been evading this debt for years before the son had come across the missing funds. A conversation last week had revealed the hand that the Amberley house had been facing. The solution? A union of the second eldest son and Lord Amberley’s only child, his daughter - you.

Before you knew it, you were being shipped off to a home in London in order to prepare for a wedding that you had mere days to come to terms with. Stood in a shop with a French woman who wouldn’t dare say more than four words to you with your mother and soon-to-be mother in law in the room, you’re questioning exactly what you’re being greeted with.

At the very least, your new husband’s mother was a rare gemstone to be found. The woman had greeted you at the shop, by name, with a host of gifts for you and your mother (which was less than anticipated, considering you were approaching with very little to offer on your end) and then began to launch into tales of her family. A very large family, in fact, with children she was immensely proud of, fiercely dedicated to and overly enamored with. It did not come to be ungenuine though, not in the manner of people attempting to piece together some falsity in hopes to cushion their luck. No, no, Violet beamed as she spoke of her eldest daughter, now a duchess, her first grandchild - how she would be certain that her next one would have a great father on their side. Seeing that their father would be your husband.

Kind, charming, educated and brilliant, she said. Devoted to studying his passion for artistry and poetry, well versed in the society standards while also being an entertaining chap. There wasn’t a poor thing mentioned in terms of this gentleman. Even when the older women had slid out for a breath of air, the modiste mentioned how incredibly stunning the family was, including your groom.

Over dinner that night, you’d meet your fiance. Not a soul that had spoken of him had been exaggerating. Benedict Bridgerton was exactly as he’d been acclaimed to be. He graciously made his introductions to you and soon after made you chuckle with the comment he’d made under his breath. As you waited for the dinner hour to approach, he guided you around his family’s home.

“This home is so very far removed from what it once was. See, Daphne, Francesca and Elosie all used to share their quarters with one another when they were younger, as there were only three designated spaces in the home and well, my parents were rather the love birds, it would seem.” You could not fault yourself for the way you grinned at his stories. They continued as you approached his own quarters, littered with canvas and paint jars, the smell of turpentine overwhelmingly hitting your nostrils.

“I’d assume that you’d like children of your own? Your mother spoke very highly of your characteristics that would aide you in fatherhood.” His chin tucks over his shoulder in your direction, facing out the three panels of glass in the middle of his room.

“I do not believe that is… solely my decision to make, Ms. Amberley.” Feet stay planted despite their wish to step back in sheer surprise.

“Implying that you might forgo raising your own children? You speak so highly of your nephew, not to mention your siblings-”

“That is the furthest thing from what I am implying.” He cuts you off a moment, a swift apology leaving him for doing so. “What I am implying is such that- it is a discussion I wish to involve my wife in.” The manner in which he speaks it is solemn. Benedict’s feet come to a chair, where he settles for a moment, looking anywhere but the direction in which you stand.

“You wished to marry for love, did you not?” Your question catches him by surprise, leaving his eyes training forward to engage with yours.

“Well, I certainly did not anticipate my marriage to be a settlement for my father’s books. Not ever did I prepare for such a thing.” Slowly, you draw near, resting a hand on his shoulder.

“Nor did I.” The pale color of his irises come up in your direction, moving in time with his hand which takes yours.

“I am sorry that I have stripped you of the opportunity, Ms.” Your brows furrow as you shake your head.

“No, do not fret with such things Mr. Bridgerton. The choices have been made, there is no value in dwelling on matters we cannot manage by our own volitions.” The way his facial expression softened at your reassurance let you know that Benedict would always be compassionate toward you. If not as your husband, as your friend.

In three days time, the fanfare of the ceremony and following celebrations arrived just as you had in the glimmering showcase that was the carriage that the Bridgertons owned. The chapel was adorned in the most wonderful arrangements of flowers and foliage you’d ever seen. Coming from a countryside village there were countless items you’d never seen prior to today. The vivid colored flowers in your field of view being one of them, the intricate weaving pattern of your gown another, the ornate and sizeable stones on your neck being the final thing.

Benedict had insisted that you borrow the jewels from his mother’s collection. If you were not to have the spouse you desired, he was determined to make the rest of the day match the expectations you had conjured in your mind. He had been sincere in the conversations regarding your nuptials, even more so on making you as comfortable as possible.

The ceremony was rather quaint. It consisted of both your families, the extended and the near, a few family friends on your groom’s side. Your father did not work efficiently enough to keep very many friends. It would seem your luck would change as your last name did.

Benedict had taken it upon himself to write his own vows, something he mentioned he had hoped to do one day in brief conversations leading up to the event.

“My darling. I fear as though we embark on one of the most uncertain paths that the Lord provides for us in this life. For that is what He does, after all. He surrounds us with the light of the sun, the life of the botanicals that grow below us, the coursing of the rivers at our side, the family that resides behind us. He provides us with the fruits of His plans he intends for us. He provided me with the gracious woman that is you. As rushed and incredibly daunting as this may be for the two of us,” Benedict’s hand slid into yours, beginning to play with the gemstone soldered to the metal looping around your ring finger, “I pray that it is enduring. That it is kind. That it is joyous, prosperous and pleasant. That the days that result from our union be filled with contentment and merriment, from now and until our souls come to join Him.”

They were beautiful. So meticulously crafted, and well intended as the two of you began the vow of spending the remainder of your lives with one another.

Frequently they chase through your mind these days, walking around the home that Violet had insisted you take upon yourselves. The walls of books, the windows of light that brought you breathtaking familiarity of the countryside you’d grown to love - the dedicated quarters that Benedict had aided you in decorating to your every whim.

The brunette had done every service to aid in your comfort with the marriage enacted. Beautiful gowns from the latest fashions, halls and gardens to lose your time into, countless hobby pools to pick from in waning afternoons, there was no shortage of effort from your husband.

Your conversations were always well mannered, filled with little details of your past lives, stories of friends and siblings, rumors and fairytales from youth. Routines were built between the two of you, including that every three nights, Benedict would sit with you and read the words of the material you’d chosen to you.

Tonight was one of those nights. Benedict lounges out on the chaise, jacket long gone, supple adorned vest and matching kerchief around his neck loosened from the days works. His words are joined with the chirp of evening sounds from a cracked window to aid in the circulation of the house. Your hands stay busy with a needlepoint project. The characters he speaks of are discussing the name of the child that’s been born. You implore your thoughts forward.

“Ben?” His head shifts to look from the parchment and toward you at the use of his name. It was a name that his mother never used, nor his siblings rarely. Perhaps it was just you that had coined this shortened version of the Christian name he’d been given. “Do you suppose we should discuss children?” Blue eyes return to the page in front of him. Given the timeline since your wedding, it was not an unjustified question. You were aware that should the next time you return to London, his mother would be rushing up to you like a hunting dog, ready to drag the kill in from the woods to show off to the ton.

“Do you wish to discuss it?” His eyes barely glaze over you before he slides a ribbon into the split of the book, covers coming together, the book leaving a hefty sigh on the table next to him upon contact.

“I worry that it will be questioned the next time we are seen. We have not entirely been honest with one another over the subject.” There were plenty of things that hadn’t been honest in terms of your marriage the last few months. How Benedict and yourself had their own sleeping arrangements. That you saw each other maybe once or twice a day at mealtimes, save for the nights where it was explicitly discussed you’d be joining the other in leisure times.

Benedict has grown quiet, which is a very odd state for the husband you have come to know the last weeks. This time, you set your own busywork aside, keeping your eyes toward him as he rests in contemplation.

“I wish to have children of my own. Though, I know the process is… taxing on a woman,” the pillow under his head shifts to look your direction, eyes finally coming to meet with one another for a rare occurrence. They do not avert in quick fashion either. The admittance of a family was something you dwelled on with semi-frequent behaviors. After all, one can only do so much knitting of babe-wear before picturing the scene for themselves. You dwell in the wonder of it all as you keep each other held without touching either one of you.

Would they look like their father? Behave like him? With the amused twinkle in their eye when a jest is made, a twist of words, stories with outlandish accents and impossible daydreams… would it be so horrible? To wake in the night with a small babe as they cry out for their mother, held in the warmth of her breast, comforted by her scent. You ached for such a life, one you were cheated of the moment the emerald slid to your hand. A very heavy hand that seems to burden you daily.

“My wife.” Benedict’s voice comes to the room, echoing off of bound paper and golden embellishment on the walls. You tilt your head with a soft grin.

“I am sure we will come to an agreement some day, husband.” There is no need to linger on the unfortunate uncertainties between the two of you. The dark would linger where it rests, those that lived in its shadows subject to whatever hid among it.

Even the ugliest and most ferocious truths.

#benedict bridgerton x reader#benedict bridgerton fanfic#benedict bridgerton fanfiction#benedict bridgerton#benedict bridgerton x y/n#benedict bridgerton imagine#bridgerton imagine#bridgerton fanfiction#bridgerton x reader#bridgerton fic

303 notes

·

View notes

Text

"the CC month who'd assign themselves as the mr cards rival" caeru. it's caeru. if caeru lives to the neon future he'd probably become the calendar council member in direct opposition to his (also probably former) spouse

neon future scoundrel is just. The predatory microtransaction master. it probably has an in-universe reputation of being super affable and relatively harmless (a-la wines or happles in current FL) but its evil is insidious, rampant, and Incredibly Shameless. it's like if the CEO of electronic arts was an evil spacebat

#caeru probably doesnt actually care abt it. it's just a side business he'd do to piss the scoundrel off#he's just some weird cryptid that shows up on your door. hands you pot of greed. doesnt elaborate. leaves#fallen london#fallen london spoilers#the neath trading card black market... that does go hard#if you trace it high enough it probably all somehow ties back into the scoundrel anyway#(they're like. funding the whole operation. something something artificial scarcity something something playing both sides)#caeru naturally trades outside of the market altogether. he's a lone actor. he technically runs it but he's kinda Done with the whole affai#if you for whatever reason really really want a card he just goes out and gets it for you. he's chill like that.#meanwhile the market is selling for just a smidgen under market price#the fallen berlin card industry is so unfathomably fucked

22 notes

·

View notes

Text

So, why do people care so much about Cornish identity? Cornwall’s just a part of England right? Another county with some distinct foods and a funny accent, and they moan about the tourists- when they should be grateful for the money.

Except it’s not.

Whilst the rest of England was forming with a character influenced by Germanic and Norse cultures, Cornwall was holding itself separate as an independent Celtic kingdom, with strong links with Wales, Ireland and Brittany- as well as trading with the wider Mediterranean. For a long time, this kingdom included parts of Devon, but eventually the Celtic people were forced back past the Tamar, and at some point started referring to the land as Kernow, rather than Dumnonia (probably).

Even after the Norman conquest, in part because Cornwall came under the control of the Duke of Brittany, Cornwall retained elements of its unique culture, and certainly its language. There are existing works of literature written in the Cornish language (also called Kernewek) during the medieval period. Due to the active tin mining industry and the Stannary courts, they even had a separate legal system.

All of this continued until the start of the Tudor period, when Henry VII, desperate for money for his wars with Scotland, suspended the operation of the Cornish Stannaries, and imposed greater taxes. This ultimately led to the Cornish Rebellion of 1497. An army of as many as 15000 rebels marched towards Somerset, and ultimately to London, where the rebels met with Henry VII’s armies. Unfortunately, the Cornish lost the ensuing battle, and the rebel leaders were captured, killed and quartered, with their quarters being displayed in Cornwall and Devon. From 1497 to 1508, Cornwall was punished with monetary penalties, impoverishing the people, and land was given to the king’s (English) allies.

However, this wasn’t the death of Cornish culture or dreams of independence from England. Until 1548, Glasney college was still producing literature in Cornish- when it was destroyed in the dissolution of the monasteries, during the English reformation. The following year, 1549, the Cornish rose again- this time to demand a prayer book in their own language, which was still the first (and often only) language of most people in the region. The rebellion was also about the ordinary people vs the landowners, as shown by their slogan “kill all the gentlemen”.

Unfortunately, this rebellion failed too, and this time, it wasn’t just the leaders who were killed, but up to 5,500 Cornishmen- which would have been a significant proportion of the adult male population at the time. These factors combined are widely thought to have contributed to the decline of the Cornish language- although it was still widely in use centuries later.

Despite the failings of these rebellions, the Cornish retained a distinct language and their own culture, folklore and festivals. Mining, farming and fishing meant that the region itself wasn’t economically impoverished, as it was today. Even towards the end of the 1700s, there were still people who spoke Cornish fluently as a first language (including Dolly Pentreath, who definitely wasn’t the last Cornish speaker).

However, over time, the tin mines became less profitable, and Cornwall’s economy started to suffer. Especially in the latter part of the 19th century, many Cornish began to emigrate, especially to places like Australia, New Zealand (or Aotearoa), Canada and South America. Cornish miners were skilled, and were able to send pay back home, and along with the Welsh, influenced culture and sport in many of these places. Many mining terms also have their roots in Cornish language and dialect.

Throughout the 20th Century, Cornwall went through an economic decline- to the point where, when the UK was an EU member, Cornwall was receiving funding intended for only the most deprived regions in Europe. It was one of very few places in the UK to receive this funding- due to the levels of poverty and lack of infrastructure.

Part of the decline was also linked to the decline of historic fish stocks, such as mackerel. In the 70s and 80s, there was a mackerel boom- and large fishing trawlers came from as far away as Scandinavia (as well as Scotland and the north of England) to fish in Cornish waters. The traditional way of fishing in Cornwall used small boats and line fishing. The local fishermen couldn’t compete, and ultimately stocks were decimated by the trawlers. Many more families had to give up their traditional way of life. One could draw parallels here with worldwide indigenous struggles over fishing rights.

Despite this, Cornish communities retained their traditional folklore and festivals, many of which are still celebrated to this day. And throughout the 20th Century, efforts were made to preserve the Cornish language. Although there may not be any first language Cornish speakers left, it is now believed that community knowledge of the language was never truly lost.

Cornwall has since become a popular tourist destination. This brings its own problems- many people want to stay in self-catering accommodation and, more recently, air bnbs. This, alongside second homes, has gutted many Cornish communities. The gap between house prices and average wages is one of the largest in the country. Land has become extremely expensive, which hurts already struggling farmers. Roads can’t cope with the level of traffic. The one (1) major hospital can’t cope with the population in the summer. All of last winter, most Cornish households faced a “hosepipe ban” due to lack of water- yet in the summer, campsites and hotels can fill their swimming pools and hot tubs for the benefit of tourists.

Does this benefit Cornwall? Only about 13% of Cornwall’s GDP comes from tourism. The jobs associated with tourism are often poorly paid and may only offer employment for part of the year. People who stay in Air BnBs may not spend that much money in the community, and the money they pay for accommodation often goes to landlords who live upcountry and aren’t Cornish. Many major hotels and caravan sites are also owned by companies that aren’t Cornish, taking money out of the local economy.

Match this with a housing crisis where it’s increasingly difficult to rent properties long term, and buying a flat or house in Cornwall is out of reach of someone on the average salary and it’s easy to see why people are having to leave communities where their family lived for generations. This damages the local culture, and means centuries-old traditions can come under threat.

All of this feeds into the current situation; it feels like middle class families from London see Cornwall as their playground, and moan about tractors on the road, or the lack of services when they visit. People talk about theme park Cornwall- a place that’s built for entertainment of outsiders, not functionality for those who live here. More widely, a lot of people around the UK have never heard of the Cornish language, or view it as something that’s “extinct” or not worth preserving.

The Cornish are one of Britain’s indigenous cultures, alongside Welsh, Gaelic, Scots, Manx and others. And it’s a culture that’s increasingly under threat economically and culturally. We’ve been clinging on to our homes for a long time, and even now it still feels like we might be forced from them (indeed some of us are). So yes, Cornish people can seem excessively defensive about our identity and our culture- but there’s good reason for it!

#uk politics#cornwall#cornish#kernow#kernewek#celtic languages#minority languages#minority cultures#Cornish history#cornish langblr

322 notes

·

View notes

Text

The president and vice-chancellor of Western University in London, Ont., has issued a statement roughly three weeks into a pro-Palestinian encampment on university grounds, in which he suggests that a principal demand from protestors is not feasible.

Protestors under the group Western Divestment Coalition, like their counterparts at campuses across North America, have been calling on Western to divest from Israel-connected funds in light of the ongoing conflict in Gaza amid the Israel-Hamas war.

President Alan Shepard said in the open letter to the entire Western community that the institution’s investments are publicly available and that it does not invest directly into companies but rather through pooled funds curated by external fund managers.

“Assuming divestment was possible, many experts have argued that this approach would have limited to no impact on the issues at hand – while at the same time requiring organizations like universities to dismantle their entire investment model to address a very small percentage of assets,” Shepard writes. [...]

The coalition noted that just two years ago the university issued a statement in solidarity with Ukraine following Russia’s invasion. [...]

Continue Reading.

Tagging: @newsfromstolenland

#cdnpoli#Western University#zionism#Foreign Policy#zionist occupation of Palestine#western imperialism#canadian imperialism#London#Ontario

46 notes

·

View notes

Text

While enslaved people were mostly overseas, in colonies, out of sight, slavery funded British wealth and institutions from the Bank of England to the Royal Mail. The extent to which modern Britain was shaped by the profits of the transatlantic slave economy was made even clearer with the launch in 2013 of the Legacies of British Slave-ownership project at University College London. It digitised the records of tens of thousands of people who claimed compensation from the government when colonial slavery was abolished in 1833, making it far easier to see how the wealth created by slavery spread throughout Britain after abolition. “Slave-ownership,” the researchers concluded, “permeated the British elites of the early 19th century and helped form the elites of the 20th century.” (Among others, it showed that David Cameron’s ancestors, and the founders of the Greene King pub chain, had enslaved people.)

But as Bell-Romero would write in his report on Caius, “the legacies of enslavement encompassed far more than the ownership of plantations and investments in the slave trade”. Scholars undertaking this kind of archival research typically look at the myriad ways in which individuals linked to an institution might have profited from slavery – ranging from direct involvement in the trade of enslaved people or the goods they produced, to one-step-removed financial interests such as holding shares in slave-trading entities such as the South Sea or East India Companies.

Bronwen Everill, an expert in the history of slavery and a fellow at Caius, points out “how widespread and mundane all of this was”. Mapping these connections, she says, simply “makes it much harder to hold the belief that Britain suddenly rose to power through its innate qualities; actually, this great wealth is linked to a very specific moment of wealth creation through the dramatic exploitation of African labour.”

This academic interest in forensically quantifying British institutions’ involvement in slavery has been steadily growing for several decades. But in recent years, this has been accompanied by calls for Britain to re-evaluate its imperial history, starting with the Rhodes Must Fall campaign in 2015. The Black Lives Matter protests of 2020 turbo-charged the debate, and in response, more institutions in the UK commissioned research on their historic links to slavery – including the Bank of England, Lloyd’s, the National Trust, the Joseph Rowntree Foundation and the Guardian.

But as public interest in exploring and quantifying Britain’s historic links to slavery exploded in 2020, so too did a conservative backlash against “wokery”. Critics argue that the whole enterprise of examining historic links to slavery is an exercise in denigrating Britain and seeking out evidence for a foregone conclusion. Debate quickly ceases to be about the research itself – and becomes a proxy for questions of national pride. “What seems to make people really angry is the suggestion of change [in response to this sort of research], or the removal of specific things – statues, names – which is taken as a suggestion that people today should be guilty,” said Natalie Zacek, an academic at the University of Manchester who is writing a book on English universities and slavery. “I’ve never quite gotten to the bottom of that – no one is saying you, today, are a terrible person because you’re white. We’re simply saying there is another story here.”

323 notes

·

View notes

Text

#FINANCIALBRANCH. Money makes the world go round, and the same saying was true for Spectre, and its' successor, Quantum. The finance branch was born the same day as Spectre itself, along with other ever-present branches like Counter-Intelligence and Tactical Operations [ known as Soldiery until the 70s ]. Despite those antique roots, the financial branch evolved constantly to remain at the vanguard of their trade, often being ahead of the competition.

The branch's primary reason to be was to manage Spectre's financial assets and keep those well invested, as well as making sure those funds were ready for use. As time passed it evolved to offering similar financial services for organizations that were, for one reason or another, restricted from accessing legitimate banking systems. Any organization was welcome to their services, as long as they could find it and afford it.

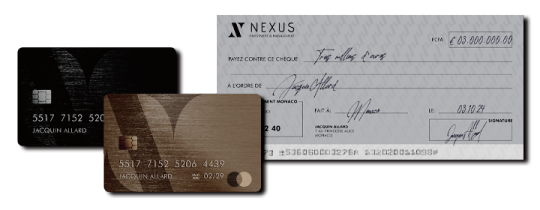

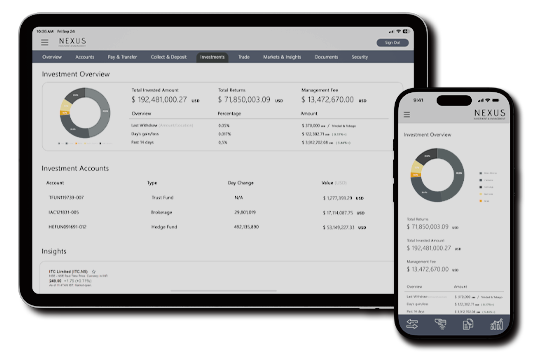

Like all other branches, the Finance Branch operates behind the mask of multiple other front companies, all in order to hide the true name and nature of their organization. There are five major companies that act as pillars to the branch: Nexus Investment & Management, Suisse de L'Industrie, Eisenband, CX Worldwide and Qoya Capital. All of those fronts operate in legal means, providing clean profit and a way to clean their own illegal funds.

The branch holds headquarters in 29 countries [ Monaco, New York, Dubai, London and Tokyo being the biggest ones ], servers in 9 countries and it operates in all 253 territories [ 193 U.N recognized countries, 55 dependent territories and 4 territories with ongoing struggles ] with only Antarctica being uncovered.

The current triad in control of the Financial Branch is composed by Le Chiffre [ Alias, real name Marcel Renè Venier-Couvillon, operating as Jacquin Allard and other 12 identities ], Beatrice Trauschke and Cissonius [ Alias, real name Daniel Wright, operating as Henry Thompson and other 5 identities ]. This is the team responsible for overseeing all the activities, legal and otherwise, under the umbrella of the Financial branch, and are the arbitrators behind every dispute regarding the path of the branch, furthermore, they each oversee one of the subsidiaries controlled by the branch, respectively Nexus, La Banque Suisse de L'Industrie and Eisenband Capital.

Nexus in an asset management company, with its expertise laid in private banking, brokerage, consultation and management of wealth for both individuals and companies. La Banque Suisse de L'Industrie is a multinational bank with focus in providing international banking services and financial support lines for companies and organizations. Eisenband Capital is a capital market group, specialized in locating and funding or acquiring companies that are branded as promising in their respective areas.

All those companies serve the true purpose of acting as the backbone of Quantum, controlling the entirety of the Group's financial transactions, investments, liquid assets and casinos.

The front companies have plenty legitimate clients, being well known companies in the international economic landscape, and their public services can be hired as any other bank, however that process is more complex when regarding their backdoor business. For an organization or individual to be able to utilize Quantum's international banking services they must be given referral by another organization that runs money through them or pass a screening process in person done by someone assigned by the Financial Branch [ this is the process that determines operational costs, liabilities, calculate management fee and open space for negotiation before drawing a contract ], as well as offer an initial amount of 50 millions USD or more. Management fee for illicit businesses vary between 3% and 12% of the total value, depending on region, risk, logistics and nature of business.

Those accounts must name a successor or benefactor for the managed assets in case of death of the account's responsible or the hiring organization's leadership. In case one of those stances happen, the successor musr claim ownership of the account within 90 days or the assets become permanent property of Quantum.

All of their financial services count on extensive infrastructure: offices in most major cities, digital applications and management tools, multiple payment methods, liquid assets transportation and storage services, and dedicated managers to larger accounts. For clients who can't afford any form of visibility, alternative methods of access are offered, such as in-person services for added management fees or 1-to-1 kinds of cryptocurrency.

The financial branch is also responsible for any transactions, payments and debt collections that might be necessary to Quantum's operations. For the funding of their underbelly operations, the financial branch provides the other branches or the service providing organizations with payment options in cryptocurrency or unmarked gold bars, as those are untraceable. For payment of bounties or first-serve-first-come opportunities, to-the-bearer medallions are given and can be collected in any casino controlled by Quantum in the currency of choice. And finally, for collaborators who need to take a large amount of cash abroad, torn playing cards [ digitally marked for authentication ] can be traded for money or gold in any CX Worldwide agency.

Debt is collected after a 90 days tolerance period, during which no large transactions are allowed to the debtor's account, and in case of failure to provide payment, all assets are seized. If the amount within the accounts lack enough funds to cover the debt, Tactical Operations are contacted for direct interference and seizing of any found liquid asset. Attempts to interrupt the seizing are answered with significant force.

FOR FURTHER DETAILS, DOUBTS OR WANTED INFORMATION: ASK!

14 notes

·

View notes

Text

Excerpt from this story from EcoWatch:

A new report has found that climate lawsuits being filed against companies are on the rise all over the world, and most of them have been successful.

The report by the Grantham Research Institute on Climate Change and the Environment at the London School of Economics and Political Science (LSE) — Global trends in climate change litigation: 2024 snapshot — said that roughly 230 climate cases have been brought against trade associations and corporations since 2015, more than two-thirds of which have been filed since 2020.

“Climate litigation… has become an undeniably significant trend in how stakeholders are seeking to advance climate action and accountability,” said Andy Raine, the United Nations Environment Programme’s deputy director of law division, as The Guardian reported.

One of the fastest growing types of litigation concerns “climate washing.” According to the report, 47 of these lawsuits were filed against governments and companies last year.

The report stated that there had been “more than 140 such cases filed to date on climate washing, making this one of the most rapidly expanding areas of litigation,” a press release from LSE said.

Of the almost 140 climate-washing cases between 2016 and 2023, 77 had reached official decisions, with 54 being found in favor of the claimant.

Most climate cases that have been filed in the past have been against governments. In the United States, 15 percent of climate cases filed in 2023 were against companies, while 40 percent of cases in the rest of the world involved companies.

In 2023, more than 30 “polluter pays” lawsuits filed worldwide sought to hold corporations accountable for climate harms allegedly stemming from their production of greenhouse gas emissions.

Six “turning off the taps” lawsuits challenging the funding of activities and projects not in line with climate action were identified in the report.

The report’s analysis was based on more than 2,600 climate cases compiled by Columbia Law School’s Sabin Center for Climate Change. Approximately 70 percent of these lawsuits have been filed since the adoption of the Paris Agreement in 2015, with 233 having been filed in 2023.

Climate lawsuits have been brought in 55 total countries, with cases having been filed in Portugal and Panama for the first time.

The authors of the study confirmed that climate litigation has been increasing in the Global South, noting that “over 200 climate cases from these countries are recorded in the Global database, comprising around 8% of all cases.”

The U.S. had the most climate litigation cases filed last year with 129. The United Kingdom had the second highest number with 24, followed by Brazil with 10, Germany with seven and Australia with six.

The U.S. also had the most documented climate cases with a total of 1,745. Australia has had 132 overall, with just six filed in 2023.

21 notes

·

View notes

Text

How the Neocons Subverted Russia’s Financial Stabilization in the Early 1990s

by Jeffrey Sachs

In 1989 I served as an advisor to the first post-communist government of Poland, and helped to devise a strategy of financial stabilization and economic transformation. My recommendations in 1989 called for large-scale Western financial support for Poland’s economy in order to prevent a runaway inflation, enable a convertible Polish currency at a stable exchange rate, and an opening of trade and investment with the countries of the European Community (now the European Union). These recommendations were heeded by the US Government, the G7, and the International Monetary Fund.

Based on my advice, a $1 billion Zloty stabilization fund was established that served as the backing of Poland’s newly convertible currency. Poland was granted a standstill on debt servicing on the Soviet-era debt, and then a partial cancellation of that debt. Poland was granted significant development assistance in the form of grants and loans by the official international community.

Poland’s subsequent economic and social performance speaks for itself. Despite Poland’s economy having experienced a decade of collapse in the 1980s, Poland began a period of rapid economic growth in the early 1990s. The currency remained stable and inflation low. In 1990, Poland’s GDP per capita (measured in purchasing-power terms) was 33% of neighboring Germany. By 2024, it had reached 68% of Germany’s GDP per capita, following decades of rapid economic growth.

On the basis of Poland’s economic success, I was contacted in 1990 by Mr. Grigory Yavlinsky, economic advisor to President Mikhail Gorbachev, to offer similar advice to the Soviet Union, and in particular to help mobilize financial support for the economic stabilization and transformation of the Soviet Union. One outcome of that work was a 1991 project undertaken at the Harvard Kennedy School with Professors Graham Allison, Stanley Fisher, and Robert Blackwill. We jointly proposed a “Grand Bargain” to the US, G7, and Soviet Union, in which we advocated large-scale financial support by the US and G7 countries for Gorbachev’s ongoing economic and political reforms. The report was published as Window of Opportunity: The Grand Bargain for Democracy in the Soviet Union (1 October 1991).

The proposal for large-scale Western support for the Soviet Union was flatly rejected by the Cold Warriors in the White House. Gorbachev came to the G7 Summit in London in July 1991 asking for financial assistance, but left empty-handed. Upon his return to Moscow, he was abducted in the coup attempt of August 1991. At that point, Boris Yeltsin, President of the Russian Federation, assumed effective leadership of the crisis-ridden Soviet Union. By December, under the weight of decisions by Russia and other Soviet republics, the Soviet Union was dissolved with the emergence of 15 newly independent nations.

In September 1991, I was contacted by Yegor Gaidar, economic advisor to Yeltsin, and soon to be acting Prime Minister of newly independent Russian Federation as of December 1991. He requested that I come to Moscow to discuss the economic crisis and ways to stabilize the Russian economy. At that stage, Russia was on the verge of hyperinflation, financial default to the West, the collapse of international trade with the other republics and with the former socialist countries of Eastern Europe, and intense shortages of food in Russian cities resulting from the collapse of food deliveries from the farmlands and the pervasive black marketing of foodstuffs and other essential commodities.

I recommended that Russia reiterate the call for large-scale Western financial assistance, including an immediate standstill on debt servicing, longer-term debt relief, a currency stabilization fund for the ruble (as for the Zloty in Poland), large-scale grants of dollars and European currencies to support urgently needed food and medical imports and other essential commodity flows, and immediate financing by the IMF, World Bank, and other institutions to protect Russia’s social services (healthcare, education, and others).

In November 1991, Gaidar met with the G7 Deputies (the deputy finance ministers of the G7 countries) and requested a standstill on debt servicing. This request was flatly denied. To the contrary, Gaidar was told that unless Russia continued to service every last dollar as it came due, emergency food aid on the high seas heading to Russia would be immediately turned around and sent back to the home ports. I met with an ashen-faced Gaidar immediately after the G7 Deputies meeting.

In December 1991, I met with Yeltsin in the Kremlin to brief him on Russia’s financial crisis and on my continued hope and advocacy for emergency Western assistance, especially as Russia was now emerging as an independent, democratic nation after the end of the Soviet Union. He requested that I serve as an advisor to his economic team, with a focus on attempting to mobilize the needed large-scale financial support. I accepted that challenge and the advisory position on a strictly unpaid basis.

Upon returning from Moscow, I went to Washington to reiterate my call for a debt standstill, a currency stabilization fund, and emergency financial support. In my meeting with Mr. Richard Erb, Deputy Managing Director of the IMF in charge of overall relations with Russia, I learned that the US did not support this kind of financial package. I once again pleaded the economic and financial case, and was determined to change US policy. It had been my experience in other advisory contexts that it might require several months to sway Washington on its policy approach.

Indeed, during 1991-94 I would advocate non-stop but without success for large-scale Western support for Russia’s crisis-ridden economy, and support for the other 14 newly independent states of the former Soviet Union. I made these appeals in countless speeches, meetings, conferences, op-eds, and academic articles. Mine was a lonely voice in the US in calling for such support. I had learned from economic history — most importantly the crucial writings of John Maynard Keynes (especially Economic Consequences of the Peace, 1919) — and from my own advisory experiences in Latin America and Eastern Europe, that external financial support for Russia could well be the make or break of Russia’s urgently needed stabilization effort.

It is worth quoting at length here from my article in the Washington Post in November 1991 to present the gist of my argument at the time:

This is the third time in this century in which the West must address the vanquished. When the German and Hapsburg Empires collapsed after World War I, the result was financial chaos and social dislocation. Keynes predicted in 1919 that this utter collapse in Germany and Austria, combined with a lack of vision from the victors, would conspire to produce a furious backlash towards military dictatorship in Central Europe. Even as brilliant a finance minister as Joseph Schumpeter in Austria could not stanch the torrent towards hyperinflation and hyper-nationalism, and the United States descended into the isolationism of the 1920s under the "leadership" of Warren G. Harding and Sen. Henry Cabot Lodge. After World War II, the victors were smarter. Harry Truman called for U.S. financial support to Germany and Japan, as well as the rest of Western Europe. The sums involved in the Marshall Plan, equal to a few percent of the recipient countries' GNPs, was not enough to actually rebuild Europe. It was, though, a political lifeline to the visionary builders of democratic capitalism in postwar Europe. Now the Cold War and the collapse of communism have left Russia as prostrate, frightened and unstable as was Germany after World War I and World War II. Inside Russia, Western aid would have the galvanizing psychological and political effect that the Marshall Plan had for Western Europe. Russia's psyche has been tormented by 1,000 years of brutal invasions, stretching from Genghis Khan to Napoleon and Hitler. Churchill judged that the Marshall Plan was history's "most unsordid act," and his view was shared by millions of Europeans for whom the aid was the first glimpse of hope in a collapsed world. In a collapsed Soviet Union, we have a remarkable opportunity to raise the hopes of the Russian people through an act of international understanding. The West can now inspire the Russian people with another unsordid act.

This advice went unheeded, but that did not deter me from continuing my advocacy. In early 1992, I was invited to make the case on the PBS news show The McNeil-Lehrer Report. I was on air with acting Secretary of State Lawrence Eagleburger. After the show, he asked me to ride with him from the PBS studio in Arlington, Virginia back to Washington, D.C. Our conversation was the following. “Jeffrey, please let me explain to you that your request for large-scale aid is not going to happen. Even assuming that I agree with your arguments — and Poland’s finance minister [Leszek Balcerowicz] made the same points to me just last week — it’s not going to happen. Do you want to know why? Do you know what this year is?” “1992,” I answered. “Do you know that this means?” “An election year?” I replied. “Yes, this is an election year. It’s not going to happen.”

Russia’s economic crisis worsened rapidly in 1992. Gaidar lifted price controls at the start of 1992, not as some purported miracle cure but because the Soviet-era official fixed prices were irrelevant under the pressures of the black markets, the repressed inflation (that is, rapid inflation in the black-market prices and therefore the rising the gap with the official prices), the complete breakdown of the Soviet-era planning mechanism, and the massive corruption engendered by the few goods still being exchanged at the official prices far below the black-market prices.

Russia urgently needed a stabilization plan of the kind that Poland had undertaken, but such a plan was out of reach financially (because of the lack of external support) and politically (because the lack of external support also meant the lack of any internal consensus on what to do). The crisis was compounded by the collapse of trade among the newly independent post-Soviet nations and the collapse of trade between the former Soviet Union and its former satellite nations in Central and Eastern Europe, which were now receiving Western aid and were reorienting trade towards Western Europe and away from the former Soviet Union.

During 1992 I continued without any success to try to mobilize the large-scale Western financing that I believed to be ever-more urgent. I pinned my hopes on the newly elected Presidency of Bill Clinton. These hopes too were quickly dashed. Clinton’s key advisor on Russia, Johns Hopkins Professor Michael Mandelbaum, told me privately in November 1992 that the incoming Clinton team had rejected the concept of large-scale assistance for Russia. Mandelbaum soon announced publicly that he would not serve in the new administration. I met with Clinton’s new Russia advisor, Strobe Talbott, but discovered that he was largely unaware of the pressing economic realities. He asked me to send him some materials about hyperinflations, which I duly did.

At the end of 1992, after one year of trying to help Russia, I told Gaidar that I would step aside as my recommendations were not heeded in Washington or the European capitals. Yet around Christmas Day I received a phone call from Russia’s incoming financing minister, Mr. Boris Fyodorov. He asked me to meet him in Washington in the very first days of 1993. We met at the World Bank. Fyodorov, a gentleman and highly intelligent expert who tragically died young a few years later, implored me to remain as an advisor to him during 1993. I agreed to do so, and spent one more year attempting to help Russia implement a stabilization plan. I resigned in December 1993, and publicly announced my departure as advisor in the first days of 1994.

My continued advocacy in Washington once again fell on deaf ears in the first year of the Clinton Administration, and my own forebodings became greater. I repeatedly invoked the warnings of history in my public speaking and writing, as in this piece in the New Republic in January 1994, soon after I had stepped aside from the advisory role.

Above all, Clinton should not console himself with the thought that nothing too serious can happen in Russia. Many Western policymakers have confidently predicted that if the reformers leave now, they will be back in a year, after the Communists once again prove themselves unable to govern. This might happen, but chances are it will not. History has probably given the Clinton administration one chance for bringing Russia back from the brink; and it reveals an alarmingly simple pattern. The moderate Girondists did not follow Robespierre back into power. With rampant inflation, social disarray and falling living standards, revolutionary France opted for Napoleon instead. In revolutionary Russia, Aleksandr Kerensky did not return to power after Lenin's policies and civil war had led to hyperinflation. The disarray of the early 1920s opened the way for Stalin's rise to power. Nor was Bruning'sgovernment given another chance in Germany once Hitler came to power in 1933.