#corporate raiders

Explore tagged Tumblr posts

Text

Computer graphics and monitors "Corporate Raiders"

#Robocop#Robocop TV#Robocop The Series#Robocop 1994#Corporate Raiders#Robocop Rewatch#tvedit#90sedit#scifiedit#robocopedit#robocoptvedit#GIF#my gifs#Hide and Queue

171 notes

·

View notes

Text

The long, bloody lineage of private equity's looting

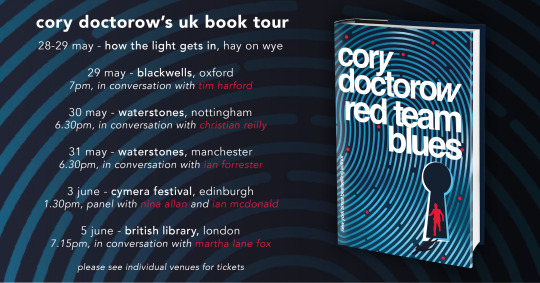

Tomorrow (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Fans of the Sopranos will remember the “bust out” as a mob tactic in which a business is taken over, loaded up with debt, and driven into the ground, wrecking the lives of the business’s workers, customers and suppliers. When the mafia does this, we call it a bust out; when Wall Street does it, we call it “private equity.”

It used to be that we rarely heard about private equity, but then, as national chains and iconic companies started to vanish, this mysterious financial arrangement popped up with increasing frequency. When a finance bro’s presentation on why Olive Garden needed to be re-orged when viral, there was a lot off snickering about the decline of a tacky business whose value prop was unlimited carbs. But the bro was working for Starboard Value, a hedge fund that specialized in buhying out and killing off companies, pocketing billions while destroying profitable businesses.

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

Starboard Value’s game was straightforward: buy a business, load it with debt, sell off its physical plant — the buildings it did business out of — pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed. They pulled it with Red Lobster,and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

The bust out tactic wasn’t limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet. Why did Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce. That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

https://prospect.org/economy/vulture-capitalism-killed-sears/

Same goes for Toys R Us: it wasn’t Amazon that killed the iconic toy retailer — it was the PE bosses who extracted $200m from the chain, then walked away, hands in pockets and whistling, while the businesses collapsed and the workers got zero severance:

https://www.washingtonpost.com/news/business/wp/2018/06/01/how-can-they-walk-away-with-millions-and-leave-workers-with-zero-toys-r-us-workers-say-they-deserve-severance/

It’s a good racket — for the racketeers. Private equity has grown from a finance sideshow to Wall Street’s apex predator, and it’s devouring the real economy through a string of audactious bust outs, each more consequential and depraved than the last.

As PE shows that it can turn profitable businesses gigantic windfalls, sticking the rest of us with the job of sorting out the smoking craters they leave behind, more and more investors are piling in. Today, the PE sector loves a rollup, which is when they buy several related businesses and merge them into one firm. The nominal business-case for a rollup is that the new, bigger firm is more “efficient.” In reality, a rollup’s strength is in eliminating competition. When all the pet groomers, or funeral homes, or urgent care clinics for ten miles share the same owner, they can raise prices, lower wages, and fuck over suppliers.

They can also borrow. A quirk of the credit markets is that a standalone small business is valued at about 3–5x its annual revenues. But if that business is part of a large firm, it is valued at 10–20x annual turnover. That means that when a private equity company rolls up a comedy club, ad agency or water bottler (all businesses presently experiencing PE rollup), with $1m in annual revenues, it shows up on the PE company’s balance sheet as an asset worth $10–20m. That’s $10–20m worth of collateral the PE fund can stake for loans that let it buy and roll up more small businesses.

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire. Most of these businesses will sell to PE firms, who can afford to pay more for them as a prelude to a bust out than anyone intending to operate them as a productive business could ever pay:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE’s most ghastly impact is felt in the health care sector. Whole towns’ worth of emergency rooms, family practices, labs and other health firms have been scooped up by PE, which has spent more than $1t since 2012 on health acquisitions:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

Once a health care company is owned by PE, it is significantly more likely to commit medicare fraud. It also cuts wages and staffing for doctors and nurses. PE-owned facilities do more unnecessary and often dangerous procedures. Appointments get shorter. The companies get embroiled in kickback scandals. PE-backed dentists hack away at children’s mouths, filling them full of root-canals.

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create “the future of healthcare.”

https://hcpea.org/#!event-list

As bad as PE is for healthcare, it’s worse for long-term care. PE-owned nursing homes are charnel houses, and there’s a particularly nasty PE scam where elderly patients are tricked into signing up for palliative care, which is never delivered (and isn’t needed, because the patients aren’t dying!). These fake “hospices” get huge payouts from medicare — and the patient is made permanently ineligible for future medicare, because they are recorded being in their final decline:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Every part of the health care sector is being busted out by PE. Another ugly PE trick, the “club deal,” is devouring the medical supply business. Club deals were huge in the 2000s, destroying rent-controlled housing, energy companies, Mervyn’s department stores, Harrah’s, and Old Country Joe. Now it’s doing the same to medical supplies:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

Private equity is behind the mass rollup of single-family homes across America. Wall Street landlords are the worst landlords in America, who load up your rent with junk fees, leave your home in a state of dangerous disrepair, and evict you at the drop of a hat:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

As these houses decay through neglect, private equity makes a bundle from tenants and even more borrowing against the houses. In a few short years, much of America’s desperately undersupplied housing stock will be beyond repair. It’s a bust out.

You know all those exploding trains filled with dangerous chemicals that poison entire towns? Private equity bust outs:

https://pluralistic.net/2022/02/04/up-your-nose/#rail-barons

Where did PE come from? How can these people look themselves in the mirror? Why do we let them get away with it? How do we stop them?

Today in The American Prospect, Maureen Tkacik reviews two new books that try to answer all four of these questions, but really only manage to answer the first three:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

The first of these books is These Are the Plunderers: How Private Equity Runs — and Wrecks — America by Gretchen Morgenson and Joshua Rosner:

https://www.simonandschuster.com/books/These-Are-the-Plunderers/Gretchen-Morgenson/9781982191283

The second is Plunder: Private Equity’s Plan to Pillage America, by Brendan Ballou:

https://www.hachettebookgroup.com/titles/brendan-ballou/plunder/9781541702103/

Both books describe the bust out from the inside. For example, PetSmart — looted for $30 billion by RaymondSvider and his PE fund BC Partners — is a slaughterhouse for animals. The company systematically neglects animals — failing to pay workers to come in and feed them, say, or refusing to provide backup power to run during power outages, letting animals freeze or roast to death. Though PetSmart has its own vet clinics, the company doesn’t want to pay its vets to nurse the animals it damages, so it denies them care. But the company is also too cheap to euthanize those animals, so it lets them starve to death. PetSmart is also too cheap to cremate the animals, so its traumatized staff are ordered to smuggle the dead, rotting animals into random dumpsters.

All this happened while PetSmart’s sales increased by 60%, matched by growth in the company’s gross margins. All that money went to the bust out.

https://www.forbes.com/sites/antoinegara/2021/09/27/the-30-billion-kitty-meet-the-investor-who-made-a-fortune-on-pet-food/

Tkacik says these books show that we’re finally getting wise to PE. Back in the Clinton years, the PE critique painted the perps as sharp operators who reduced quality and jacked up prices. Today, books like these paint these “investors” as the monsters they are — crooks whose bust ups are crimes, not clever finance hacks.

Take the Carlyle Group, which pioneered nursing home rollups. As Carlyle slashed wages, its workers suffered — but its elderly patients suffered more. Thousands of Carlyle “customers” died of “dehydration, gangrenous bedsores, and preventable falls” in the pre-covid years.

https://www.washingtonpost.com/business/economy/opioid-overdoses-bedsores-and-broken-bones-what-happened-when-a-private-equity-firm-sought-profits-in-caring-for-societys-most-vulnerable/2018/11/25/09089a4a-ed14-11e8-baac-2a674e91502b_story.html

KKR, another PE monster, bought a second-hand chain of homes for mentally disabled adults from another PE company, then squeezed it for the last drops of blood left in the corpse. KKR cut wages to $8/hour and increased shifts to 36 hours, then threatened to have workers who went home early arrested and charged with “patient abandonment.” Many of these homes were often left with no staff at all, with patients left to starve and stew in their own waste.

PE loves to pick on people who can’t fight back: kids, sick people, disabled people, old people. No surprise, then, that PE loves prisons — the ultimate captive audience. HIG Capital is a $55b fund that owns TKC Holdings, who got the contract to feed the prisoners at 400 institutions. They got the contract after the prisons fired Aramark, owned by PE giant Warburg Pincus, whose food was so inedible that it provoked riots. TKC got a million bucks extra to take over the food at Michigan’s Kinross Correctional Facility, then, incredibly, made the food worse. A chef who refused to serve 100 bags of rotten potatoes (“the most disgusting thing I’ve seen in my life”) was fired:

https://www.wzzm13.com/article/news/local/michigan/prison-food-worker-i-was-fired-for-refusing-to-serve-rotten-potatoes/69-467297770

TKC doesn’t just operate prison kitchens — it operates prison commissaries, where it gouges prisoners on junk food to replace the inedible slop it serves in the cafeteria. The prisoners buy this food with money they make working in the prison workshops, for $0.10–0.25/hour. Those workshops are also run by TKC.

Tkacic traces private equity back to the “corporate raiders” of the 1950s and 1960s, who “stealthily borrowed money to buy up enough shares in a small or midsized company to control its biggest bloc of votes, then force a stock swap and install himself as CEO.”

The most famous of these raiders was Eli Black, who took over United Fruit with this gambit — a company that had a long association with the CIA, who had obligingly toppled democratically elected governments and installed dictators friendly to United’s interests (this is where the term “banana republic” comes from).

Eli Black’s son is Leon Black, a notorious PE predator. Leon Black got his start working for the junk-bonds kingpin Michael Milken, optimizing Milken’s operation, which was the most terrifying bust out machine of its day, buying, debt-loading and wrecking a string of beloved American businesses. Milken bought 2,000 companies and put 200 of them through bankruptcy, leaving the survivors in a brittle, weakened state.

It got so bad that the Business Roundtable complained about the practice to Congress, calling Milken, Black, et al, “a small group is systematically extracting the equity from corporations and replacing it with debt, and incidentally accumulating major wealth.”

Black stabbed Milken in the back and tanked his business, then set out on his own. Among the businesses he destroyed was Samsonite, “a bankrupt-but-healthy company he subjected to 12 humiliating years of repeated fee extractions, debt-funded dividend payments, brutal plant closings, and hideous schemes to induce employees to buy its worthless stock.”

The money to buy Samsonite — and many other businesses — came through a shadowy deal between Black and John Garamendi, then a California insurance commissioner, now a California congressman. Garamendi helped Black buy a $6b portfolio of junk bonds from an insurance company in a wildly shady deal. Garamendi wrote down the bonds by $3.9b, stealing money “from innocent people who needed the money to pay for loved ones’ funerals, irreparable injuries, etc.”

Black ended up getting all kinds of favors from powerful politicians — including former Connecticut governor John Rowland and Donald Trump. He also wired $188m to Jeffrey Epstein for reasons that remain opaque.

Black’s shady deals are a marked contrast with the exalted political circles he travels in. Despite private equity’s obviously shady conduct, it is the preferred partner for cities and states, who buy everything from ambulance services to infrastructure from PE-owned companies, with disastrous results. Federal agencies turn a blind eye to their ripoffs, or even abet them. 38 state houses passed legislation immunizing nursing homes from liability during the start of the covid crisis.

PE barons are shameless about presenting themselves as upstanding cits, unfairly maligned. When Obama made an empty promise to tax billionaires in 2010, Blackstone founder SteveS chwarzman declared, “It’s a war. It’s like when Hitler invaded Poland in 1939.”

Since we’re on the subject of Hitler, this is a good spot to bring up Monowitz, a private-sector satellite of Auschwitz operated by IG Farben as a slave labor camp to make rubber and other materiel it supplied at a substantial markup to the wermacht. I’d never heard of Monowitz, but Tkacik’s description of the camp is chilling, even in comparison to Auschwitz itself.

Farben used slave laborers from Auschwitz to work at its rubber plant, but was frustrated by the logistics of moving those slaves down the 4.5m stretch of road to the facility. So the company bought 25,000 slaves — preferring children, who were cheaper — and installed them in a co-located death-camp called Monowitz:

https://www.commentary.org/articles/r-tannenbaum/the-devils-chemists-by-josiah-e-dubois-jr/

Monowitz was — incredibly — worse than Auschwitz. It was so bad, the SS guards who worked at it complained to Berlin about the conditions. The SS demanded more hospitals for the workers who dropped from beatings and overwork — Farben refused, citing the cost. The factory never produced a steady supply of rubber, but thanks to its gouging and the brutal treatment of its slaves, the camp was still profitable and returned large dividends to Farben’s investors.

Apologists for slavery sometimes claim that slavers are at least incentivized to maintain the health of their captive workforce. This was definitely not true of Farben. Monowitz slaves died on average after three months in the camp. And Farben’s subsidiary, Degesch, made the special Zyklon B formulation used in Auschwitz’s gas chambers.

Tkacik’s point is that the Nazis killed for ideology and were unimaginably cruel. Farben killed for money — and they were even worse. The banality of evil gets even more banal when it’s done in service to maximizing shareholder value.

As Farben historian Joseph Borkin wrote, the company “reduced slave labor to a consumable raw material, a human ore from which the mineral of life was systematically extracted”:

https://www.scribd.com/document/517797736/The-Crime-and-Punishment-of-I-G-Farben

Farben’s connection to the Nazis was a the subject of Germany’s Master Plan: The Story of Industrial Offensive, a 1943 bestseller by Borkin, who was also an antitrust lawyer. It described how Farben had manipulated global commodities markets in order to create shortages that “guaranteed Hitler’s early victories.”

Master Plan became a rallying point in the movement to shatter corporate power. But large US firms like Dow Chemical and Standard Oil waged war on the book, demanding that it be retracted. Borkin was forced into resignation and obscurity in 1945.

Meanwhile, in Nuremberg, 24 Farben executives were tried for their war crimes, and they cited their obligations to their shareholders in their defense. All but five were acquitted on this basis.

Seen in that light, the plunderers of today’s PE firms are part of a long and dishonorable tradition, one that puts profit ahead of every other priority or consideration. It’s a defense that wowed the judges at Nuremberg, so should we be surprised that it still plays in 2023?

Tkacik is frustrated that neither of these books have much to offer by way of solutions, but she understands why that would be. After all, if we can’t even close the carried interest tax loophole, how can we hope to do anything meaningful?

“Carried interest” comes up in every election cycle. Most of us assume it has something to do with “interest payments,” but that’s not true. The carried interest loophole relates to the “interest” that 16th-century sea captains had in their cargo. It’s a 600-year-old tax loophole that private equity bosses use to pay little or no tax on their billions. The fact that it’s still on the books tells you everything you need to know about whether our political class wants to do anything about PE’s plundering.

Notwithstanding Tkacik’s (entirely justified) skepticism of the weaksauce remedies proposed in these books, there is some hope of meaningful action. Private equity’s rollups are only possible because they skate under the $101m threshold for merger scrutiny. However, there is good — but unenforced — law that allows antitrust enforcers to block these mergers. This is the “incipiency standard” — Sec 7 of the Clayton Act — the idea that a relatively small merger might not be big enough to trigger enforcement action on its own, but regulators can still act to block it if it creates an incipient monopoly.

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

The US has a new crop of aggressive — fearless — top antitrust enforcers and they’ve been systematically reviving these old laws to go after monopolies.

That’s long overdue. Markets are machines for eroding our moral values: “In comparison to non-market decisions, moral standards are significantly lower if people participate in markets.”

https://web.archive.org/web/20130607154129/https://www.uni-bonn.de/Press-releases/markets-erode-moral-values

The crimes that monsters commit in the name of ideology pale in comparison to the crimes the wealthy commit for money.

Catch me on tour with Red Team Blues in Edinburgh, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/02/plunderers/#farbenizers

[Image ID: An overgrown graveyard, rendered in silver nitrate monochrome. A green-tinted businessman with a moneybag in place of a head looms up from behind a gravestone. The right side of the image is spattered in blood.]

#pluralistic#kkr#lootersprivate equity#plunderers#books#reviews#monsters#nazis#godwin's law#godwins law#auschwitz#ig farben#pe#business#barbarians#united fruit#carried interest#corporate raiders#junk bonds#michael milliken#ensemble cast#carlyle group#monowitz#leon black

1K notes

·

View notes

Text

Source: Spider-Man 2099 (1992) #28

#these arent consecutive i just lumped them together#comics#miguel o'hara#spider man 2099#corporate raiders#travesty#rico estevez#marvel

3 notes

·

View notes

Photo

USA 1990

3 notes

·

View notes

Text

Pretty sure "wealth-hoarder" would be a term that the elite narcissistic asshole class would laugh about and enjoy...

Traditionally - 140 or so years ago - these individuals were known as ROBBER BARONS:

A derogatory term for unethical industrialists who relied upon predatory tactics to gain wealth, to control industries, to exploit workers, and to seize political power...

Robber Barons would resort to violence, intimidation, fraud and corruption to take advantage of others...

Examples include JP Morgan, John D Rockefeller, Cornelius Vanderbilt & Andrew Carnegie...

Are you still reading this?

"Wealth-hoarder" just isn't derogatory or insulting enough. Corporate Raider is a more modern twist. Overall, though, I agree with this take:

The time is right for a more contemptuous term...

Throwing terms against the wall to see what sticks. No need to keep reading...

The Caligula Class, with their Caligula Cucks. For example: Narcissists Peter Thiel and Mark Zuckerberg, with fanboys and benefactors including JD Vance, Josh Hawley, Vivek Ramaswamy, Jeff Thomas, Blake Masters, Kris Kobach, and others...

Your Favorite Filthy Rich He-Man Woman-Hater Cabal's Favorite Filthy Rich He-Man Woman-Haters Cabal. Their minions are Cunts, but NOT of the Chappell Roan variety. Same examples as the first bullet point...

The Sofa King Rich Entitled Egomaniacal Extortionists [SKREEE] and the Self-Important Masturbating Perverts with Sofas [SIMPS] who lick their boots. Again, same examples as the first bullet point...

Call them what they are

#robber barons#corporate raiders#the caligula class#are you still reading this?#vote!#apple has how much money offshore???

100 notes

·

View notes

Text

Meet my bunny toon oc, his name is fRed.

His bf is a corporate raider :3c

#ttcc#toontown#toontown corporate clash#chainsaw consultant#fRed Balloonibun#toontown oc#toons#ttcc oc#toon oc#bunny#corporate raider#art#digital art#artists on tumblr#doodle#doodles

101 notes

·

View notes

Text

I Found another Image of some Angry Dude about to Break the Computer with his Bat and reminding me of Casey Jones 1987

(Because there is No Way Casey Jones is able to Work in an Office for One Whole Day Without Breaking Anything, most likely the Computers of course)

#tmnt#tmnt 1987#fred wolf films#teenage mutant ninja turtles#casey jones#meme#shredder's revenge#goongala goongala#arnold bernid casey jones#memes#teenage mutant ninja turtles 1987#lawbreakers#vigilante#tmnt casey jones#casey jones tmnt#corporate raiders from dimension x#class is pain 101#hockey mask#casey jones outlaw hero#tmnt memes

20 notes

·

View notes

Text

cogs

#toontown#toontown corporate clash#corporate clash#ttcc#toontown online#tto#corporate raider#shark watcher#big cheese#mover and shaker#bossbots#boardbots#sellbots

32 notes

·

View notes

Text

I dont know much about corporate clash, and I only play rewritten and have never played clash, but I just wanna say that I'm so glad that it continued the trend of the lvl 7+ cogs having by far the best designs out of the main 8 employees in each department.

Cause holy shit I just discovered the magnate and absolutely adore how he looks, I love him <3

#toontown#toontown online#toontown corporate clash#toonblr#toontown cogs#the mingler#loan shark#legal eagle#corporate raider#magnate#i absolutely cant wait to see what redesigns the ttcc team has in store for mingler shark and raider#also legal eagle and magnate are so dating

42 notes

·

View notes

Text

So Casey Jones from the 1987 TMNT Cartoon have Finally takes his Hockey Mask off, huh...

(okay, he didn't really show his face in the 1987 tmnt cartoon but i did see some pictures of neca's business casey jones figure with a new face and that's why i wanna redraw one of my old cj 87 drawings without his hockey mask...)

#teenage mutant ninja turtles 1987#teenage mutant ninja turtles#tmnt 1987#tmnt#casey jones#teenage mutant ninja turtles shredder's revenge#tmnt shredder's revenge#shredder's revenge#tmnt casey jones#casey jones tmnt#casey jones the outlaw hero#fred wolf films#corporate raiders from dimension x#caseyjones#casey jones 1987#cartoon#cartoons#artist wannabe#my drawings#memes

20 notes

·

View notes

Note

guuuh i've been looking at your posts and as someone who used* to barely think about a lot of the stuff the raiders did (*thanks to you /pos) it really opens up a layer of "what the fuck you guys" because i really do like the raiders but it really shows a double standard with them and adds a layer of moral grayness to it. things you'd think are just black comedy (lilith and the cotf) get a lot darker because of the origin of the bandits.

it's funny to me that while the line "...these are human beings, with lives and families and--" was meant to be like "eh whatever they're mooks in our fps game they were gonna kill ya anyway" it checks out a lot more when i read some of your rewrite posts. wish borderlands actually had this level of thoughtfulness when it came to the bandits in these entries.

!!! that line is always in the back of my head when i talk abt the raiders. they hit you with it right at the start, and as simple as it is, it really sums up their collective views on the bandits. to me the most frustrating thing about borderlands is when it is just barley self aware. a brief flash where it looks at the camera and goes "hey, this is the funny part!" and the funny part is. racism or classism or the total dehumanization of an entire population of people. whichever it feels like on that day. a lot of that is done by handsome jack because that's his job as an antagonist, but its done in equal measure by the crimson raiders. and the game is aware of this! it just doesnt actually do anything with that commentary except try to be funny.

#borderlands#crimson raiders#borderlands as a series isnt about good VHs versus evil bandits or corporations. we're playing from the perspective of the “lesser evil”.#which still has power over the actual victims of the conflict. it gives the raiders a superiority complex because they see themselves as#paragons for good in an otherwise violent and unsalvageable world. and when they cant get any more from pandora they leave.#i feel like the humor of the games has been hurting them since BL1. because without the humor the actions the VHs take#are much less digestible.#bandit rewrite#anonymous#also HEHEE ty for reading my posts!!

8 notes

·

View notes

Text

She's gonna tickle his prostate with that thing

9 notes

·

View notes

Text

ROUND 1: MATCH 3

#CORPORATE RAIDER#TOXIC MANAGER#bossbot#boardbot#cogblr#toonblr#toontag#toontown#ttcc#toontown corporate clash#tumblr polls#poll bracket#BATT00NY POLLS

12 notes

·

View notes

Text

Source: Spider-Man 2099 (1992) #28

#comics#miguel o'hara#spider man 2099#corporate raiders#travesty#rico estevez#marvel#KILLER PAPER CLIPS GETS ME

2 notes

·

View notes

Text

Miscellaneous sketches from the creation of the Toontown Rewritten website.

#toontown#toontown rewritten#toontag#toonblr#ttr#sketches#concept art#graphic design#brand art#image#Flippy#Yesman#Bloodsucker#Flunky#Mover & Shaker#Corporate Raider#Bottom Feeder#Short Change#Spin Doctor

46 notes

·

View notes

Text

“In 1932, Adolf A. Berle Jr. and Gardner C. Means wrote a book entitled The Modern Corporation and Private Property. A critique of corporate management for being aloof and complacent, out of touch with the consumer and irresponsible to the stockholder, this volume became the bible of Marxists, left wing intellectuals and interventionist politicians. Under the banner of separation of ownership and control, the Berle-Means thesis led to an attack on the corporate structure from which today's top executives are still reeling.

With this background, one would have thought that the people urging a greater role for the public sector would have welcomed the advent of the corporate raider. For this new breed of capitalist has sent shivers down the spines of the denizens of the boardroom. Swooping down, launching "unfriendly" or "hostile" takeover bids, these corporate raiders have succeeded in replacing management from coast to coast in dozens of industries, and in frightening thousands of other out-of-touch chief executive officers into greater responsibility.

At least under the theory of "the enemy of my enemy is my friend," it might have been expected that critics of the marketplace, noticeably the followers of Berle and Means, would have rallied `round the cause of the corporate raider.

In the event, however, this expectation has remained unfulfilled. Not only has the activity of the corporate raider been deprecated by the champions of government interference in the marketplace, but it has been roundly condemned by practically all pundits and commentators on public policy. In 1987, the left-leaning film director Oliver Stone distilled the common image of the corporate raider into the supposedly loathsome Gordon Gekko, brilliantly portrayed in an Oscar-winning performance by Michael Douglas. And this is the image of Gekko under which the corporate raider must labor in the present day.

Yet, despite this all-but-universal criticism, the unfriendly takeover bid has benefited consumers and stockholders, and served notice on complacent management across the board. In one celebrated case that unfolded shortly before Stone's film Wall Street was released, corporate guerrilla Carl Icahn put in a bid for a block of shares of Phillips Petroleum. Stung by Icahn's bid, Phillips' executives offered to improve a recapitalization plan they had been forced to put forth in response to an earlier planned takeover, this one by T. Boone Pickens. As a result, Icahn walked away with a cool $50 million, Pickens registered a profit of $89 million on a resale of his holdings to the company, all Phillips' shareholders gained from the better offer, and the oil firm itself was left far leaner and meaner than before.

Needless to say, neither Icahn nor Pickens nor any of the other masterminds of "the 1980s takeover boom," were publicly thanked for the good they had done. On the contrary: both men were not only mocked by Oliver Stone, they were also robbed of the opportunity to do any more such good by a rash of anti-takeover statutes adopted late in the decade. Henry Manne reported that hostile takeovers had "declined to four percent from fourteen percent of all mergers."

The conventional wisdom holds that this outcome is a good one for investors, but the facts show otherwise. No story of the corporate raider can ignore the role of the heroic Michael Milken. Assume there was a hotel worth $20 million as a present discounted capital value. Given an interest rate of 5%, this concern should throw off roughly $1 million to its owners. But stipulate that due to inefficiency, or general avarice, or to the fact that the CEO salary was far higher than justified, or a combination of all such phenomena, the owners were earning far less than that in dividends. And, guess what? The stock was trading at a lower value than might have prevailed, had these tape worm factors not been in operation.

Enter the "evil" Michael Milken. He swoops in, purchases enough of the stock in this corporation to kick out the old board and replace it with his own nominees. This is considered a "hostile" takeover by a corporate "raider." From whence springs the hostility? All Milken did was buy up a mess of stocks. Did he threaten any of these stock owners that they would walk the plank if they did not sell to him? No, of course not; we are talking arm's-length stock market deals here. We can logically infer that the owners of these stocks preferred the price offered them by the "raider," otherwise they would not have sold out. No, the "hostility," instead, stems from the CEO and his cronies who were mismanaging this hotel into the ground.

The Milkins of the world are akin to the canary in the mine; they are the Distant Early Warning Line for the economy.

When they get active, it is in response to something rotten that is going on. And what was the public reaction to this corporate raider? Instead of hoisting him up on their shoulders and holding ticker tape parades in his honor, he was given the back of the public's hand to his face. To wit, he was prosecuted by the Securities and Exchange Commission for insider trading, violations of U.S. Securities Laws and other financial felonies. He pled guilty only after the authorities threatened to go after his ailing brother. For shame.” - Walter Block, ‘Defending the Undefendable II’ (2013) [p. 41 - 44]

#block#walter block#defending#undefendable#corporate#raider#gordon gekko#wall street#oliver stone#Drexel Burnham#icahn#carl icahn#berle#adolf berle#gardner means#private property#capitalism#liberty#libertarian#libertarianism#hero#heroic#ayn rand#objectivism#economics#austrian economics#michael milken#milkin#T Boone Pickens

5 notes

·

View notes