#first time buyer with no down payment

Text

As an EXP Realty agent, Isabel Rodriguez specializes in helping first time home buyers in San Antonio TX, navigate the market and find programs to make their dream of home ownership a reality. Trust her expertise and experience to guide you through the process. Call: 210-508-3000

#first time home buyer in Texas hill country#mortgage broker first home buyer#first time buyer with no down payment#first time home buyer programs in San Antonio TX#down payment on house first time buyer#best lenders for first time buyers#first time home owner mortgage

0 notes

Note

How did you get into keeping peafowl? They're one of those animals that I'd love to keep but have unfortunately made peace with the fact I probably won't have time and space to care for them in the future.

I loved them, and I was an asshole about it.

I lived with my mom in the suburbs, and purchased hatching eggs from eBay (don't do that), and a styrofoam incubator (don't do that), and hatched them in my closet (definitely don't do that) and brooded them in my bedroom (don't do that). A friend of my mom had recently got a farm, and agreed to keep them in a pen at her place until I bought a house, at which point I went out, got a stable full time job, started putting away money for a down payment, and seeing a real estate agent to look at hobby farms. About a year later, I found one that fit my criteria (house I didn't have to repair too much stuff in, acreage, barn), got a mortgage, and started building pens with my family.

This is, I feel I should not have to say, NOT the way to go about getting into peafowl. But I did turn my life around for them, so I can't complain about the end result.

That being said... I wouldn't give up entirely if I were you, if they are what you want in life, but I would just bear in mind that the road to them may be harder than you want to endure depending on your starting point. If you can acquire a dwelling space where they're allowed (it doesn't need to be "livestock" area, since some places consider poultry to be different than livestock, and peafowl fall under poultry), and you're willing to build them a pen, their care isn't particularly intense or anything. The space to keep them is the major hurdle.

#asks#peafowl#I nabbed my farm when the market was in the toilet#and it'll probably tank again#and my down payment was NOT much since I was a first time home buyer#and I grabbed a friend to help pay the mortgage for the first year or so#rather than her renting an apartment#and seriously the market was fucking dead for houses my mortgage was less than renting an apartment#I started at ~$700/month for my mortgage#which is insane but... you know. was awesome.#personal

53 notes

·

View notes

Text

How to Avoid Common Pitfalls When Assuming a Mortgage

Assuming a mortgage can be an attractive option for many homebuyers, especially in a market where interest rates are on the rise. However, it’s a process that comes with its own set of complexities and potential pitfalls. In this comprehensive guide, we’ll identify some of these challenges, armed with practical information that can help you make the best of this wonderful prospect.

Understanding Assumable Mortgages

An assumable mortgage allows a new borrower to take over an existing loan from the current borrower. This means the new borrower inherits the same terms, interest rate, and remaining balance as the original loan (Source). While this seems straightforward, there are several factors to consider:

Loan Types

Not all mortgage loans are assumable. Conventional loans, for instance, cannot be assumed, but government-backed loans like FHA and VA loans can be (Source).

Qualification

Assuming a mortgage isn’t an automatic process. The prospective borrower must still apply with the lender and meet their qualification criteria, which can include credit, debt-to-income ratio, and income verification (Source).

Down Payment Requirements

Often, the down payment for an assumable mortgage can be higher than expected, as it covers the difference between the home’s purchase price and the remaining loan balance (Source).

Pros and Cons of Assumable Mortgages

Before deciding to assume a mortgage, it’s important to weigh its advantages and disadvantages:

Pros

Potentially lower interest rates compared to current market rates.

Capped closing costs and possibly no need for a new home appraisal.

Long-term savings due to borrowing less over a shorter time.

Cons

Higher down payment requirements.

Inheriting mortgage insurance premiums for certain loans.

Limited loan options, as not all mortgages are assumable.

Pitfalls to Avoid

Overlooking Eligibility Requirements

Different loan types have varying eligibility requirements. For example, VA loans require the borrower to be a veteran, active-duty service member, or surviving spouse to transfer the VA benefit from the borrower.

Underestimating Down Payments

Understanding the down payment needed is crucial, which can be significantly higher than for a new mortgage. You are not responsible for a typical percentage-based payment, but the difference in equity remains.

Neglecting the Application Process

Assuming a mortgage involves a thorough application process, similar to that of a new mortgage. This includes providing detailed financial documents and undergoing credit evaluation.

Ignoring Legal and Financial Responsibilities

Two types of assumable mortgages exist simple assumption and novation. In a simple assumption, the original borrower retains liability, which can be risky. Novation, on the other hand, transfers full responsibility to the new borrower but requires lender consent.

Misjudging the Property’s Value

One common mistake is not accurately assessing the property’s current market value. This can lead to overpaying when covering the difference between the assumed mortgage balance and the property’s actual worth.

Overlooking Property Condition

Failing to conduct a thorough inspection of the property can lead to unexpected repair and maintenance costs. It’s essential to assess the condition of the home to avoid inheriting costly problems.

Ignoring Interest Rate Comparisons

While assumable mortgages may offer lower interest rates than current market rates, this isn’t always the case. It’s crucial to compare rates to ensure you’re truly getting a better deal.

Neglecting Lender-Specific Rules and Fees

Each lender may have different requirements and fees for assuming a mortgage. Potential borrowers should familiarize themselves with these specific rules to avoid surprises during the process.

Failing to Consider Future Refinancing Options

Understand how assuming a mortgage could impact your ability to refinance in the future. Some mortgages might have terms or conditions that limit refinancing options.

Overlooking Impact on Credit Score

Assuming a mortgage can have implications for your credit score. It’s important to understand how taking over an existing mortgage will affect your credit, both in the short and long term.

Not Planning for the Full Financial Commitment

Beyond the mortgage payments, there are additional financial commitments such as property taxes, homeowners insurance, and potential homeowner’s association (HOA) fees. Underestimating these costs can lead to financial strain.

Misunderstanding Seller’s Equity

Buyers sometimes misunderstand how much equity the seller has in the home, which can complicate negotiations and the final agreement.

Rushing the Decision

Assuming a mortgage can be a complex process. Rushing into it without proper due diligence can lead to overlooking critical details that affect the overall cost and suitability of the deal.

Not Consulting Real Estate Professionals

Navigating an assumable mortgage can be complex. Not seeking advice from real estate professionals like agents, attorneys, or financial advisors can leave buyers unprepared for the nuances of the process. Often, sellers have already agreed to pay a set commission when they listed the property, so not using an agent won’t result in any fee reduction for the seller.

Consider a Hypothetical Example Below:

Imagine a seller who obtained a $200,000 mortgage at 2.6% in January 2021. By January 2023, due to mortgage payments and home price inflation, the mortgage balance might be around $190,900, but the home’s market value could be $220,000. The new borrower would need to cover the $29,100 difference as a down payment (Source).

Note: Assuming a mortgage with a lower interest rate can lead to substantial savings. However, the initial higher down payment and the possibility of inheriting mortgage insurance premiums need to be factored into the decision.

Conclusion

Assuming a mortgage can be a smart financial move, but it’s not without its challenges. It requires thorough research, a clear understanding of the financial implications, and careful consideration of the legal responsibilities involved. By being aware of these common pitfalls and preparing accordingly, prospective homeowners can navigate this process more effectively and make informed decisions that align with their long-term financial goals. I am here to help you understand the complex terrain of assumable mortgages and avoid all the common pitfalls that many fall for.

Reach out to us here.

Click Here to Get More Information:

Local real estate agent in Bracken

Local Real Estate Agent in Garden Ridge

Local Real Estate Agent in Windcrest

Home Buyer Rebate Skybrooke

Preserve at Singing Hills by Ashton Woods

Local Real Estate Agent in Timberwood Park

local real estate agent in Castle Hills

Local Real Estate Agent in Universal City

#Local Real Estate Agent in Cibolo#Local Real Estate Agent in Schertz#Local Realtor San Antonio#Down Payment Assistance Programs San Antonio#Lease to Own San Antonio#First Time Home Buyer Programs San Antonio#Rent to Own San Antonio#Local Real Estate Agent in New Braunfels#First Time Home Buyer San Antonio#Local Real Estate Agent in San Antonio#Local Real Estate Agent in Live Oak

0 notes

Text

What You Need To Know About Today's Down Payment Programs

Down Payment Programs Explained

Tina Marie Miller | Loving Az Homes

Wednesday June 22nd, 2024

Buying a home has undoubtedly become more challenging, especially with today’s mortgage rates and home price appreciation. And that may be one of the big reasons you’re eager to look into grants and assistance programs to see if you qualify for anything that can help. But unfortunately, many homebuyers…

View On WordPress

#affordable housing#down payment#down payment assistance#down payment programs#first-time buyers#homebuyer assistance programs#homebuying grants#homeownership programs#mortgage rates#real estate professionals#repeat buyers

0 notes

Text

Kentucky FHA Loans

How to get approved for a Kentucky FHA Loan?

Are you looking to buy a house in Kentucky with little to no down payment and credit scores not the best, a Kentucky FHA loan may be right for you.

FHA is part of HUD and the federal government. FHA promotes housing opportunities for borrower that may have access to little or no down payment for a house and have had some past credit troubles…

View On WordPress

#$15000 down payment assistance Kentucky#assumable fha loans#Credit score#down payment assistance ky home#Federal Loan Programs for First-Time Homebuyers in Kentucky#FHA 203(k)#FHA Streamline Refinance in Kentucky#First-time buyer#first-time homebuyer in Kentucky?#gift funds#How to apply for FHA loan in Kentucky#Kentucky#kentucky fha loan#Kentucky FHA Loan Limits#Kentucky FHA Mortgage Loan Requirements#Kentucky Homebuyer#khc credit score requirements#khc down payment assistance#khc loans#khc zero down mortgage ky#louisville#max FHA loan in Kentucky#Mortgage#Mortgage loan#Refinancing#Zero down home loans

0 notes

Text

I just need like $20000 more to feel comfortable with a down payment for a house but damn working overtime sucks and I can't shake the feeling that something bad is going to happen.

#first time home buyer#good luck anyone who wants a home TO LIVE IN#down payment#just need a little more :(#oh my GOD the monthly costs?#why didnt I buy a house 5 years ago!? 😭#Why are there so many mysterious upfront fees!?

0 notes

Text

#FHA loans#Florida#Homeownership#Mortgage#First-time buyers#Real estate#Credit score#Down payment#Loan process

0 notes

Text

Special Purpose Credit Program- $10,000

Buy a Home in 2024 using a Grant in Selected Areas.

Special Purpose Credit Program- $10,000

We’re offering the Home Ready First Purchase Program.

$10,000 down payment/closing cost assistance in the form of grants.

$500 Credit towards the cost of a Appraisal.

$500 Credit towards the cost of a home warranty if purchasing one

Must be a first time home buyer

Minimum Middle Credit Score 620

Must be a approved for the Homeready Program

NO INCOME…

View On WordPress

#&039;Down payment assistance in florida#Atlanta Down Payment Assistance#Down Payment Assistance#Down Payment Grants in Atlanta#Down Payment Grants in Georgia#First Time Home Buyer#Florida down payment assistance#Florida Grants#Homeready#Special Purpose Grant

0 notes

Text

Mortgage for First-Time Home Buyers with No Down Payment. Our unique offerings include mortgages with no down payment, making homeownership more accessible. Benefit from expert advice, competitive rates, and personalized service, guiding you through the process seamlessly. With NB Mortgage Matters, the dream of owning your first home becomes a reality as we empower you with the necessary tools to make a sound financial investment.

0 notes

Text

Property For Sale in Australia

Dreaming of your own slice of paradise in Australia? This stunning home with ocean views is a must-see! Enjoy coastal living at its finest. Don't miss out on this gem. Contact us today to schedule a viewing 488825810. Your Aussie dream home awaits!

#first time home buyer down payment in Australia#first time homebuyer in Australia#first time home buyer assistance in Australia#buying a house for the first time in Australia#'buying your first home in Australia#first time home buyer down payment assistance

0 notes

Text

Website:https://www.goclearpacific.com/

Address: 11622 El Camino Real, San Diego, CA 92130

Phone: +1 619-496-8015

At ClearPacificCapital, we believe in the power of homeownership and real estate investment. We understand that these ventures are not just financial transactions; they are life-changing decisions that shape your future.That's why we are dedicated to being more than just a mortgage and finance company; we are your financial ally on your journey to achieve your real estate dreams.

Facebook:https://www.facebook.com/profile.php?id=100088847296083

Twitter:https://twitter.com/goclearpacific

Instagram:https://www.instagram.com/clearpacific/

Linkedin: https://www.linkedin.com/company/goclearpacific/

Pinterest:https://www.pinterest.com.au/ClearPacific/

Tiktok:https://www.tiktok.com/@goclearpacific

#Best mortgage rates#r Zero closing cost#refinance#cash out refinance#first time home buyer#Zero down payment#California mortgage rates#mortgage loans#mortgage rates#lowest mortgage rates#zero cost loan#zero cost refinance#rocket mortgage#united wholesale mortgage

1 note

·

View note

Text

Unlocking the Dream of Homeownership: 5 Essential Financial Tips for First-Time Buyers

Embark on the exciting journey of homeownership with 'Unlocking the Dream of Homeownership: 5 Essential Financial Tips for First-Time Buyers.' This comprehensive guide offers valuable insights into budgeting, credit scores, down payments and loan options

The journey to homeownership is filled with excitement, anticipation, and often, a fair amount of uncertainty, especially for first-time home buyers. Understanding the financial aspects of buying a home can make the process smoother and more enjoyable. Here are five essential financial tips to guide you through this significant life event.

1. Understand Your Budget and Credit Score

Budgeting:…

View On WordPress

#budgeting#Closing Costs#credit score#Down Payment#Financial planning#First-Time Home Buyers#Homeownership#Loan Options#Macroeconomic Factors#My-Financials.com#Pre-Approval#Real Estate Agent

0 notes

Text

7 Real Estate Myths Debunked by a Local Real Estate Agent in San Antonio

From charming bungalows to sleek Hill Country havens, our city offers a smorgasbord of homes for every taste and budget. But along with the excitement comes a healthy dose of confusion, fueled by whispers and outdated advice. In the world of real estate, misconceptions can lead to missed opportunities and misguided decisions, especially in a unique market like San Antonio. As a local real estate expert, I’m here to debunk seven common real estate myths, providing clarity and insight into this complex market.

Myth 1: You Don’t Need a Real Estate Agent in the Internet Age.

While online resources provide valuable information, they cannot replace the expertise of a real estate agent. In San Antonio, Ioffer personalized guidance, negotiation skills, and deep insights into trends that online data simply can’t match. Besides, most sites like Offerpad and Opendoor still use agents, and I partner with both of them. Augmented by online resources, an agent can enhance what tends to be the largest human-to-human transaction a person will ever go through.

Myth 2: Setting a Higher Listing Price Nets More Money.

It’s a common misconception that setting a higher listing price will automatically result in more money from a sale. In reality, overpricing can actually repel potential buyers, potentially leading to a longer time on the market and, ironically, a lower final sale price. An experienced real estate agent San Antonio can be a valuable asset in this regard. They bring an understanding of the value of your home and know how to effectively market and showcase it. Pricing a property is more of an art than a science, requiring a balance between the seller’s needs, motivation, and risk tolerance, along with market trends and conditions. Having an agent’s expertise can guide you in setting a competitive and realistic price that appeals to buyers and aligns with your goals.

Myth 3: Renovations Guarantee Increased Home Values.

Not all renovations offer a good return on investment. In San Antonio, agents can advise which upgrades are most effective in boosting your home’s value, considering current market trends and buyer preferences. Moreover, the purpose of renovations can differ. Some are intended to enhance the property’s appeal and sell it faster, potentially creating competition among buyers. Others are aimed at increasing the home’s overall value. Each type of renovation requires a careful assessment of the potential risk versus the anticipated return.

Myth 4: The Best Time to Sell is in Spring and Summer.

Do not fall for the seasonal sale trap! While these seasons are traditionally popular, homes sell year-round in San Antonio. Summer attracts out-of-towners seeking sunshine, while fall brings in families eager for school proximity. Winter may yield lower prices, but the season also brings about a surge of motivated buyers. Moreover, lending market promos can also boost prices during the seasons with a lower volume of buyers.I can help capitalize on market conditions at any time, ensuring you don’t miss out on potential buyers.

Myth 5: All Real Estate Agents are the Same.

The belief that all San Antonio real estate agents are interchangeable is a common misconception and is based upon the idea that all we do is facilitate transactions. In reality, agents differ significantly in terms of their experience, understanding of the market, and areas of specialization. My unique expertise lies in analytics, strategy, negotiation, and communication, skills that are crucial in navigating the complexities of the real estate market. My focus is on leveraging these specialties to provide tailored, strategic advice and effective communication, ensuring that every aspect of your transaction is handled with precision and care.

Myth 6: A Home Passes or Fails an Inspection.

The idea that a home either passes or fails an inspection is a misconception. In reality, a home inspection is a tool for evaluating the condition of the property. It provides a comprehensive look at various aspects of the home, identifying any potential issues or repairs that may be needed. This information is crucial for both buyers and sellers as it informs decision-making and negotiation processes.

I utilize these inspection reports to offer clear, direct guidance. For sellers, this can mean understanding and addressing potential issues before they become stumbling blocks in the transaction. For buyers, it provides a detailed understanding of the property’s condition, which is essential for making an informed purchase decision. I aim to clarify the inspection process and use findings to negotiate effectively, ensuring that my clients are well-informed and prepared at every step of the transaction.

Myth 7: You Must Always Accept the Highest Offer or the First Offer.

The highest offer isn’t necessarily the best. Factors like buyer financing, contingencies, and closing timelines are critical. As your agent, I am duty-bound to present every single offer to you and I take the time to format them in an easily comparable view, helping ensure you are getting the best possible deal. You also aren’t required to accept the first offer on your home. This will be based on risk tolerance, willingness to counter, and how much other interest is in the home.

Conclusion

Understanding the truth behind these myths is key to making informed decisions in the San Antonio real estate market. With the expertise of a licensed local Realtor, navigating this market becomes a more straightforward, informed, and successful journey. Whether buying or selling, the right knowledge and guidance can make all the difference in achieving your real estate goals.

#First Time Home Buyer San Antonio#First Time Home Buyer Programs San Antonio#Down Payment Assistance Programs San Antonio

0 notes

Text

Down Payment Assistance Programs

Down Payment Assistance Programs Can Help Pave the Way to Homeownership

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of Realtors (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step. But the reality is, you probably don’t need to put down as much as you think:

Data from…

View On WordPress

#thebakingagent#American Dream#Arizona#arizona homes for sale#buying a home#down payment#down payment assistance#fannie mae#first-time buyer#freddie mac#home loan#homeownership#loving az homes#misconception#money#NAR#real estate#Reality#realtor

0 notes

Text

$15,000 Kentucky Down payment assistance program to buy a house in 2024

$15,000 Kentucky Down payment assistance program offers an exclusive 0% Down Purchase program for Kentucky Homebuyers. This potentially allows Kentucky Homebuyers with lower income and no money saved for a down payment get into a Kentucky home right now with no down payment for first time buyers in Kentucky

How does the $15,000 Down Payment Assistance work in Kentucky for Homebuyers

First …

View On WordPress

#$15000 down payment assistance Kentucky#15000 down payment grant kentucky#15k down payment grant kentucky#15k help kentucky home buyers#Credit score#Down Payment Assistance#First-time buyer#Kentucky#louisville

0 notes

Text

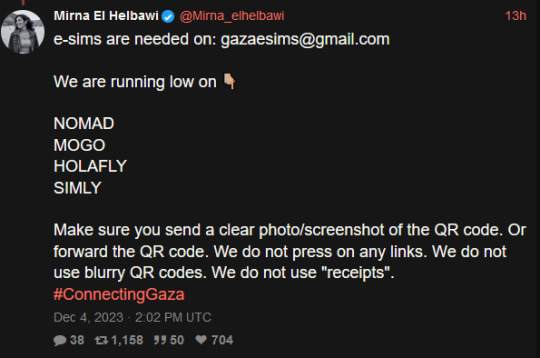

a rundown on the listed e-sim platforms from this tweet from mirna el helbawi. visit esimsforgaza to learn about this effort. (they also have a tutorial on how to purchase an esim and send it to them)

update v12 (5/21/24) holafly (israel and egypt), nomad (regional middle east), simly (palestine and middle east), mogo (israel), and airalo (discover) are currently in the highest in demand. if it has been more than 3 weeks since you initially sent your esim and your esim has not been activated, you can reforward your original email with the expiration date in the subject line. you can see gothhabiba’s guide for how to tell if your esims have been activated. if your esim has expired without use, you can contact customer service to renew or replace it.

troubleshooting hint 1: if you are trying to pay through paypal, make sure you have pop-ups enabled! otherwise the payment window won't be able to appear. (this issue most frequently seems to occur with nomad)

troubleshooting hint 2: if you are trying to purchase an esim using the provider's app, it may block you from purchasing if your phone does not fit the requirements to install and use their esims. use their website in your browser instead and this problem should go away.

nomad

for the month of may, first time referrals give 25% off for a person's first purchase and 25% off the referrer's next purchase! it's a great time to use someone's referral code from the notes if you are a first time buyer.

you can use a referral code to get $3 off your first purchase and also make it so the person whose code you used can buy more esims for gaza. many people have been leaving their referral codes in the replies of this post and supposedly a referral code may eventually reach capacity so just keep trying until you find one that works! BACKPACKNOMAD is another code to get $3 off your first purchase, it's been working for some people but not others so try out a referral code instead if you can't get it to work. NOMADCNG is a code for 5% off any middle east region nomad esims posted by connecting gaza. it can be used on any purchase, not just your first but is generally going to give less off than the first-purchase only codes, so use those first. it can be used in combination with nomad points. AWESOME NEW CODE: nomad esim discount code for 75% off any plan, NOMADCS25 do not know how long it lasts but this is an amazing deal esp. since they are really low on esims right now! (nomad promo codes do not work on plans that are already on sale, unlimited plans, and plans under $5)

weekly tuesdays only code on nomad web, PST timezone! it gives 10% off plans 10gb and above. NOMADTUE

nomad also seems to be kind of sluggish sometimes when it comes to sending out emails with the codes. you can look for them manually by going to manage -> manage plans -> the plan you purchased -> installation instruction and scroll down to install esim via QR code or manual input then select QR code to find the QR code which you can screenshot and email to them. often just the act of logging back into your nomad account after purchase seems to cause the email with the code to come through though.

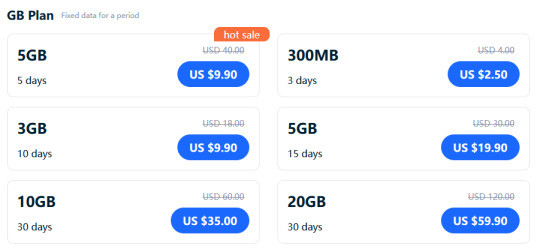

mogo

mogo's website is fucking annoying to navigate and i couldn't find any promo codes, but their prices are massively on sale anyway. you have to pick if you want your esim to be for iphone, ipad, or android for some reason. according to statcounter, android makes up approx. 75% of mobile markets in palestine while iphone represents approx. 25%. so i would probably recommend prioritizing donations of android esims but if you can afford multiple, try buying an iphone one too? if i can find any official direction from the connecting gaza crew on this i will update with it.

a good referral code to use for mogo is 8R29F9. the way things are worded are confusing but as far as i can tell, if you use it we both get a 10% discount on your first purchase. (the referrer gets a 10% voucher that allows them to top up in use esims, they are someone who i know has bought a lot of esims and will be able to make good use of the top-up discount vouchers!) also upon signing up it automatically generates a password for you which you can change by downloading the app. (check your email to find your account's current password)

holafly (also looking for holafly esims for egypt now)

holafly is pricier than the others and the only promo code i could find was ESIMNOW for 7% off. someone in the tags mentioned GETESIM7 as another 7% off code they had received, so if you have already used ESIMNOW or can't seem to get it to work, try GETESIM7. another 7% off code is HOLAXSUMMER7 which is valid until june 2nd. referral codes only seem to give 5% off and they don't stack. (i don't remember the source, it was on some sketchy coupon site i don't want to link to and only can recommend because i tried it myself) you can also use my referral link for 5% off if you can afford the 2% worse deal on your end, it will give me $5 credit which i can put towards buying more esims. connecting gaza has also posted the promo code HOLACNG for 5% off but since it is less than the 7% off codes and as far as i can tell does not give credit towards others to buy esims like the referral links, i would consider it lower priority for use.

simly (note: simly must be downloaded as an app to be used, the website link is to help people confirm they are downloading the right app)

i have not personally used simly so i am going to be going off of the sixth slide of mirna el helbawi's instagram guide, with some corrections from someone who has successfully purchased an esim from simly. after downloading the app and making an account, search for palestine or middle east and purchase your preferred package. the page the app takes you to after your purchase should have the QR code to send to the esimsforgaza email, it won't show up in your email receipt. someone kindly left her referral code in the tags of this post, it gives $3 off your first purchase and will give her $3 credit to put towards purchasing more esims for gaza. the code is CIWA2. (if this referral code doesn't work, try one from the notes of this post!) according to someone in the notes, ARB is a simly promo code for 25% off esims that is still working as of march 3rd.

airalo

some people have noted issues trying to sign up for airalo using the browser version of the website, it worked for me but if you are struggling you can give the mobile app a try and that should work. you can use a referral code to get $3 off your first purchase and give the code suppler a $3 credit for buying more esims. KARINA9661 is a code sourced from this post which is also a wonderful example of how using people's referral codes can really make a difference. if for some reason that referral code isn't working, you can find more in the notes of the original esim post i made here.

@/fairuzfan also has a tag of esim referral codes for various platforms!

(note: mogo and holafly both link to israel esims as there are no general regional packages for the middle east like on nomad and the esims for gaza website specifically linked to the israel package on mogo, so i linked to the equivalent on holafly.)

#esims for gaza#esims#gaza#palestine#free palestine#connecting gaza#despite not having used simly myself i'm fairly experienced with esim services at this point so i will likely be able to answer some#questions and i also have someone familiar with simly i can ask if i am not sure of the answer myself. so please go ahead and ask questions#if you're struggling with donating an esim from any of these sources!

6K notes

·

View notes