#fintech lending platform

Explore tagged Tumblr posts

Text

Best Business Loans with Low Interest Rates | Provide Finance

Uncover the transformative potential of secured business loans with our in-depth exploration. From understanding best business loans with low interest rates requirements to optimizing interest rates, this guide equips entrepreneurs with the knowledge needed to make strategic financial decisions.

#best business loans with low interest rates#business loans best rates#lowest rate business loans#commercial mortgage providers#commercial business finance#mezzanine finance providers#commercial finance providers#fintech lending platforms#merchant cash advance providers

0 notes

Text

India Digital Lending Market is in Growing Stage, Being Driven by Digitization in the country along with the presence of 100+ Players in the Industry: Ken Research

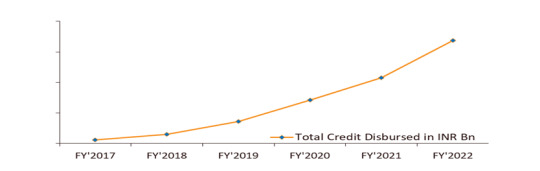

Digital Lending Platforms are addressing the huge unmet demand for credit as the Market has grown @ CAGR 131.9% During FY’2017-FY’2022.

To Know More on this report, Download free Sample Report

India’s market for digital lending has grown from INR 116.7 billion in FY’2017 to INR 3,377.7 billion in FY’2022P. The growth is supported by the need for superior customer experience, emerging business models, faster turn-around time, and adoption of technology like AI. Customers are adopting digital avenues as a result of the rise in smartphone usage and internet penetration. Digital channels influence 40 to 60% of loan purchase transactions across loan types.

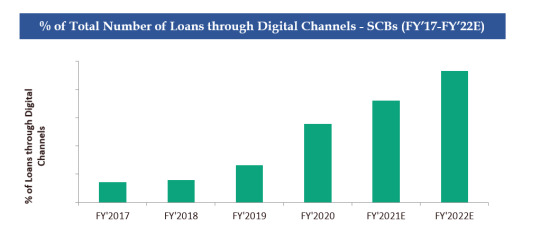

2. Loans through Digital Channels on NBFCs has increased from 0.6% in FY’2017 to 53.0% in Dec, 2020 owing to the rise in BNPL schemes and lower interest rates offered by the Lending Platforms.

Visit this Link Request for custom report

Commercial banks are rapidly joining the genre of financial intermediaries either lending digitally on their own or joining with NBFCs to share the synergies. The Digital Lending Company’s requirements are lower, and the process is significantly quicker. They need just a bank account as a reference point where loans can be credited and therefore % of Loans through Digital Channels are higher with NBFCs. The flexibility that BNPL schemes offer has completely transformed the digital lending market, particularly for younger shoppers, who are happy to trade traditional credit cards for more user-friendly BNPL schemes. The rapid uptake of Buy Now, Pay Later (BNPL) propositions, particularly within the retail sector, continues to drive major growth and new opportunities for NBFCs in India.

3. Rising Internet Penetration, Rise of innovative Models and an enabling regulatory environment are some of the Major Driving Factors for Digital Lending in India

To Know More on this report, Download free Sample Report

Higher penetration of smartphones, increasing number of mobile phone subscriptions coupled with inexpensive data has result in the growth and also supported the awareness and adoption rate of Digital Lending in India’s population. The popularity of Digital Lending has increased in India owing to NBFCs platforms collaborating with other digital platforms such as e-commerce, ride hailing, travel, logistics and more, resulting in higher acceptance of digital lending from various customer segments in the country. Digital Lending Pioneered by NBFCs, have now resulted in Companies from various segments coming up with multiple new models of doing business such as Digital Lending Marketplaces, POS Transaction Lending, Bank and NBFCs partnership models and more.2

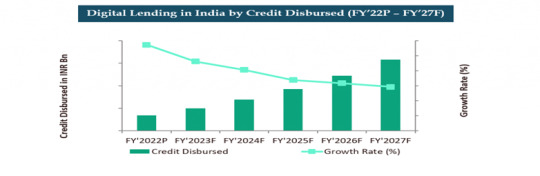

4. Digital Lending Market to Reach INR ~15,000 billion by FY’2027 Making Digital Lending a Sector with the Highest Penetration by Digital Channels in the Country.

To more about industry trends, Request a free Expert call

Strategic partnerships and collaborations between traditional financial institutions and new-age Lending Platforms. Plus, easy market entry and targeted loan offerings due to availability of large sets of customer data, which can give collective and individual insights. Changing consumer behavior and expectations shaped by purchase/ transaction experiences offered by e-marketplaces like food delivery, e-commerce and travel portals.

#b2b lending companies in india#Capital Float Digital Lending Market Revenue#Challenges in India’s Digital Lending Market#commercial loan Providers in India#Competitors in Digital Lending Market India#consumer durable loan market in india#redit disbursement in India#Credit lending startups in India#emand of Digital Lending in India#digital channels in India#digital credit industry in India#Digital lending ecosystem in India#digital lending growth in india#digital lending in India#digital lending market size in india#digital lending platform market#Digital lending value in India#digital loans Providers in India#Emerging Players in India Digital Lending Market#fastest-growing fintech in India#Financial Services Sector in India#fintech Compnanies in India#future trends for financial services sector in india#Impact of digital lending on MSME in india#India Digital Lending Industry#India Digital Lending Market#India Digital Lending Market Major Players#India Digital Lending Sector#India's retail loan Providers#India's Road Map for Digital Lending

0 notes

Text

The economic winds whipped up by President Trump’s “Liberation Day” tariff proclamations in early April have been anything but a gentle breeze. Rising prices, fomenting trade wars, and uncertainty about when tariffs will go into effect has led to a volatile economic climate.

People looking to buy electronics and other goods affected by the tariffs are trying to figure out whether they should wait it out to see if the administration’s trade policies become more favorable, or quickly scoop up what they can while prices are still cheap-ish.

For consumers weighing a purchasing decision, buy now, pay later services like Klarna, Affirm, and Afterpay are offering to make that choice easier.

These companies make a relatively straightforward case: Spread out the cost of a purchase into smaller, more manageable payments over the course of a few weeks or months. Because BNPL services make deals with the sellers they’re providing the payment plans for, the companies behind the BNPLs don’t charge interest to the customer. So instead of spacing out a purchase with a credit card, say—which usually charges a high interest rate—BNPL would get you that thing you want for the listed price.

BNPL companies don’t require you to have good credit, and some only charge fees if you’re late with your payments. Otherwise it’s a nice free amenity—and one that might indicate bigger financial troubles across the economy.

Nadine Chabrier, senior policy council at the nonprofit Center for Responsible Lending, says it is easy to see why BNPL services are appealing. “The top reasons consumers use buy now, pay later is because they can't afford the full cost of the item at once,” she says. “Another reason is because there's a higher approval rate. It's that convenience factor.”

Economic uncertainty—over tariffs, rising inflation, and the possibility of a looming recession—is giving consumers pause about stretching their limited funds. It’s rocky times like these when BNPL services become even more appealing.

“BNPL really skyrocketed in adoption during the pandemic,” says Matt Gross, a spokesperson for Affirm. “It may not be as high-growth now as you saw in 2020, 2021, when everyone was stuck at home shopping online, but we're still growing at orders of magnitude faster than broader spending and consumption levels.”

Stress Spending

Economic watchdogs have concerns about BNPL. The services often appeal to people with lower incomes, who financial experts have warned may be at risk of financially overextending themselves. Still, BNPL services are now woven into nearly every digital payment platform, and people have come to rely on them. PayPal offers it now, letting you spread out payments of almost anything. Klarna has partnered with DoorDash, so you can pay for your family’s dinner in weekly installments. And people aren’t just using them for electronics and pizza delivery, but also for basic essentials: A recent study found that 25 percent of BNPL users in the US were relying on the services to cover the costs of food and household sundries.

“Before tariffs even came into the picture, people were already using BNPL for gas and groceries,” Chabrier says. “We're already talking about folks who may not have a lot of money or credit to spare. Additional economic stress could be hard.”

“Absolutely, this is a leading indicator of financial distress,” says Martin Kleinbard, founder of the consultancy firm Granular Fintech who formerly worked at the Consumer Financial Protection Bureau and coauthored a CFPB report about BNPL. “Consumers are smart. They understand where they’re getting the lowest-cost-of-credit option here and are going to avail themselves of that for the goods they have to get.”

Kleinbard says that in terms of acquiring debt, BNPL services can be more forgiving than high-interest loans like credit cards and payday loans.

“BNPL has grown rapidly over the last five years,” Kleinbard says. “But it's still a tiny, tiny fraction of the overall spending and borrowing pie. You really have to think about it in the context of the alternatives. If the alternative is you were going to borrow anyway and it's an important purchase, then this is a pretty damn good option. This isn't a product with a lot of gotchas.”

Economically, lots of people have compared the looming uncertainty of the tariff situation with that of the pandemic. But Gross says Affirm has weathered the storm before and doesn’t expect this economic shakeup to be all that different.

“I wouldn't go so far as to say this is an opportunity for us, other than to say that I think the last several years and years into the future is an opportunity,” Gross says. “People are shifting their payment preferences to favor these types of products. And so in that sense, we are trying to be their favorite way to pay—not just when things are uncertain, but all the time.”

Storm Watch

Shawn DuBravac, chief economist at the electronics trade association IPC, says he agrees this is indeed a moment for buy now, pay later services, for better or worse. It’s a service that’s growing during a time of uncertainty that will make the service more appealing. The financial leg up it provides can indeed be helpful, but DuBravac cautions that the benefits are likely not evenly distributed.

“This could be a very good thing for some people; this could be a great service that could help them through a tough week,” DuBravac says. “But you can't get around the fact that people who are using it then might have all of a sudden a downturn in their job. They lose their job, their household goes from two incomes to one income, all of a sudden they're strained.”

As with any loan, both the borrower and the lender incur risk. DuBravac says this moment, if the economy truly does spiral, may be the first real test of whether the BNPL industry is stable enough to keep themselves and their borrowers afloat. How well that system maintains in the face of financial downturn really depends on whether people are using it as a convenience or out of necessity.

“Are they using it as a bridge or are they using it as a crutch?” DuBravac says. “If they're using it as a crutch, then I think there's a lot more risk there.”

20 notes

·

View notes

Text

The Future of Commercial Loan Brokering: Trends to Watch!

The commercial loan brokering industry is evolving rapidly, driven by technological advancements, changing market dynamics, and shifting borrower expectations. As businesses continue to seek financing solutions, brokers must stay ahead of emerging trends to remain competitive. Here are some key developments shaping the future of commercial loan brokering:

1. Rise of AI and Automation

Artificial intelligence (AI) and automation are revolutionizing loan processing. From AI-driven underwriting to automated document verification, these technologies are streamlining workflows, reducing manual effort, and speeding up loan approvals. Brokers who leverage AI-powered tools can offer faster and more efficient services.

2. Alternative Lending is Gaining Momentum

Traditional banks are no longer the only players in commercial lending. Alternative lenders, including fintech platforms and private lenders, are expanding options for businesses that may not qualify for conventional loans. As a result, brokers must build relationships with non-bank lenders to provide flexible financing solutions.

3. Data-Driven Decision Making

Big data and analytics are transforming how loans are assessed and approved. Lenders are increasingly using alternative data sources, such as cash flow analysis and digital transaction history, to evaluate creditworthiness. Brokers who understand and utilize data-driven insights can better match clients with the right lenders.

4. Regulatory Changes and Compliance Requirements

The commercial lending landscape is subject to evolving regulations. Compliance with federal and state laws is becoming more complex, requiring brokers to stay updated on industry guidelines. Implementing compliance-friendly processes will be essential for long-term success.

5. Digital Marketplaces and Online Lending Platforms

Online lending marketplaces are making it easier for businesses to compare loan offers from multiple lenders. These platforms provide transparency, efficiency, and better loan matching. Brokers who integrate digital platforms into their services can enhance customer experience and expand their reach.

6. Relationship-Based Lending Still Matters

Despite digital advancements, relationship-based lending remains crucial. Many businesses still prefer working with brokers who offer personalized service, industry expertise, and lender connections. Building trust and maintaining strong relationships with both clients and lenders will continue to be a key differentiator.

7. Increased Focus on ESG (Environmental, Social, and Governance) Lending

Sustainability-focused lending is gaining traction, with more lenders prioritizing ESG factors in their financing decisions. Brokers who understand green financing and social impact lending can tap into a growing market of businesses seeking sustainable funding options.

Final Thoughts

The commercial loan brokering industry is undergoing a transformation, with technology, alternative lending, and regulatory changes shaping the future. Brokers who embrace innovation, stay informed on market trends, and continue building strong relationships will thrive in this evolving landscape.

Are you a commercial loan broker? What trends are you seeing in the industry? Share your thoughts in the comments below!

#CommercialLoanBroker#BusinessFinancing#LoanBrokerTrends#AlternativeLending#Fintech#SmallBusinessLoans#AIinLending#DigitalLending#ESGLending#BusinessGrowth#LoanBrokerage#FinanceTrends#CommercialLending#BusinessFunding#FinancingSolutions#4o

3 notes

·

View notes

Text

The Role of Credit Scores in SME Financing

For small and medium-sized enterprises (SMEs), securing SME financing is often a critical step toward growth and sustainability. However, one of the most significant barriers SMEs face is the reliance on credit scores by traditional lenders. Credit scores are a key determinant in SME financing Malaysia, loan approvals, interest rates, and terms, but are they the best measure of an SME’s creditworthiness? This blog explores the role of credit scores in SME financing in Malaysia, their limitations, and alternative models that could reshape the lending landscape.

Understanding Credit Scores in SME Financing

Credit scores are numerical representations of a borrower’s creditworthiness, calculated based on factors like payment history, outstanding debt, credit utilization, and credit length. For SMEs, lenders typically evaluate:

Personal Credit Scores: Often used for sole proprietors and small businesses where financial records are limited.

Business Credit Scores: Factors in business transactions, trade credit history, and financial statements.

These credit scores help banks and financial institutions assess the risk of lending to SMEs, influencing SME loan approvals and interest rates in SME financing in Malaysia.

The Limitations of Credit Scores for SMEs

While credit scores serve as a convenient risk assessment tool in SME financing, they pose several challenges for SMEs:

Lack of Credit History: Many SMEs, particularly startups, do not have an extensive credit history, making it difficult to obtain SME loan approvals.

Overemphasis on Personal Credit: Business owners often rely on their personal credit scores, which may not accurately reflect the financial health of the business.

Limited Consideration of Business Potential: Credit scores do not factor in future revenue potential, market conditions, or business models.

Bias Against New or Underserved Businesses: Traditional credit scoring models may disadvantage minority-owned businesses, women-led enterprises, and businesses in emerging industries, affecting SME financing Malaysia.

Alternative Approaches to SME Credit Assessment

To bridge the SME financing gap, alternative credit assessment models are emerging:

Cash Flow-Based Lending: Lenders assess real-time business cash flow and revenue trends instead of relying solely on historical credit scores.

Alternative Data Usage: Using data such as online transactions, supplier payments, and utility bills to evaluate creditworthiness.

AI and Machine Learning in Credit Scoring: Advanced algorithms analyze multiple financial factors to create more accurate risk assessments in SME financing in Malaysia.

Peer-to-Peer (P2P) and Crowdfunding Platforms: Businesses can bypass traditional credit scoring models and raise funds through investor confidence.

Government and Non-Profit Initiatives: Special SME loan programs offering relaxed credit score requirements to support SMEs.

The Future of SME Financing

The evolving financial landscape is gradually shifting toward more inclusive lending practices. Fintech innovations and alternative lending models are reducing reliance on rigid credit scoring systems, allowing SMEs with strong business potential but limited credit history to access SME financing Malaysia.

Related Reads:

Shift the Focus: Prioritise Factors within Your Control When Seeking SME Financing

Top 5 Reasons Why You Should Diversify Your Investments with CapBay P2P

SME Financing 101: Understanding Your Options

Breaking Down Barriers: The Significance of Financing Reforms for Small and Medium-Sized Enterprises

Conclusion

While credit scores will likely remain a factor in SME financing, they should not be the sole criterion for determining creditworthiness. A more holistic approach—incorporating cash flow analysis, alternative data, and innovative lending platforms—can empower SMEs to thrive. As financial institutions and fintech companies continue to refine these models, SMEs will gain more equitable access to the capital they need to grow and succeed through SME financing in Malaysia.

2 notes

·

View notes

Text

The Rise of Fintech: Transforming Financial Services for the Digital Age

In recent years, Fintech—short for Financial Technology—has emerged as a disruptive force in the financial services industry. From mobile payments to blockchain technology, fintech innovations are reshaping how individuals, businesses, and financial institutions interact with money. As digital tools continue to evolve, they offer new ways to improve financial efficiency, transparency, and inclusivity.

The rapid rise of fintech is not just a trend; it's a transformative shift that’s reshaping financial landscapes globally. In this article, we will explore what fintech is, how it’s transforming various sectors of financial services, and what the future holds for this exciting industry.

1. What is Fintech?

Fintech is a term that encompasses any technology that improves and automates financial services. This can include innovations in areas like mobile payments, online banking, investment platforms, and even the use of artificial intelligence in managing financial portfolios.

Fintech aims to make financial services more accessible, efficient, and secure. By leveraging digital tools, it allows individuals to manage their finances with ease, whether they're sending money across borders, applying for a loan, or investing in the stock market.

2. The Evolution of Fintech

The roots of fintech can be traced back to the late 20th century, with the introduction of online banking and electronic payments. However, it wasn't until the late 2000s, with the rise of smartphones and digital apps, that fintech truly took off.

The 2008 financial crisis also played a significant role in the development of fintech. Traditional banks struggled, leading to the rise of alternative financial solutions. Startups began creating apps and platforms to offer services such as peer-to-peer lending, robo-advisors, and even digital currencies like Bitcoin.

Today, fintech is booming, with countless companies and startups offering innovative financial products and services that rival traditional financial institutions.

3. The Key Sectors of Fintech

Fintech covers a broad range of sectors, each offering unique innovations that are transforming the way we think about and use financial services. Here are some of the key areas:

a. Digital Payments

One of the most recognizable sectors of fintech is digital payments. Apps like PayPal, Venmo, and Apple Pay have made sending and receiving money faster, more convenient, and cheaper than traditional methods.

Consumers can now make purchases, pay bills, and send money internationally with just a few taps on their smartphone, without needing to rely on banks or physical cash.

b. Lending and Borrowing

Fintech has disrupted the lending industry by providing alternatives to traditional bank loans. Peer-to-peer lending platforms such as LendingClub and Funding Circle allow individuals to lend directly to borrowers, cutting out the middleman and often providing better rates for both parties.

Additionally, fintech lenders have made it easier for small businesses and individuals with less-than-perfect credit scores to access loans through automated credit scoring systems.

c. Investment Platforms

The rise of fintech has made investing more accessible to the general public. Gone are the days when investing required a hefty minimum deposit and working with a financial advisor.

Now, thanks to robo-advisors like Betterment and Wealthfront, individuals can invest with little to no minimum, receiving tailored investment advice through algorithms that automatically adjust portfolios based on risk tolerance and market conditions.

d. Insurtech (Insurance Technology)

Insurtech is another growing sector of fintech, aiming to simplify and improve the insurance industry. From comparing quotes to filing claims, insurance technology platforms like Lemonade are providing a seamless, user-friendly experience for consumers.

These innovations are making insurance more affordable and efficient, particularly for younger consumers who value the convenience of digital interactions.

e. Cryptocurrency and Blockchain

Perhaps the most transformative development in fintech is the rise of cryptocurrencies and blockchain technology. Cryptocurrencies like Bitcoin and Ethereum offer decentralized alternatives to traditional currencies, while blockchain technology provides a secure and transparent way to record transactions.

While still relatively new, cryptocurrencies and blockchain are expected to have far-reaching implications for everything from cross-border payments to smart contracts.

4. How Fintech is Changing Financial Services

Fintech’s influence is broad and deep, transforming almost every facet of financial services. Here’s a closer look at how it’s reshaping the industry:

a. Improving Access to Financial Services

One of the biggest advantages of fintech is that it provides greater access to financial services, particularly for underserved populations. For example, fintech platforms allow people in developing countries, who might not have access to traditional banking, to open accounts and manage their finances using just a smartphone.

Fintech has also revolutionized access to credit. Through digital lending platforms, individuals and small businesses can get loans faster and more easily than ever before, often bypassing the hurdles of traditional banks.

b. Lowering Costs

Fintech companies operate more efficiently than traditional financial institutions, often passing these savings on to consumers in the form of lower fees and better interest rates. This is especially true in sectors like peer-to-peer lending and digital payments, where middlemen have been cut out of the equation.

c. Faster Transactions

In the traditional financial world, sending money, especially internationally, can be a slow and expensive process. Fintech has made these transactions faster, with some payments happening in real time. Digital wallets, payment processors, and blockchain technology are all contributing to instantaneous money transfers, no matter where you are in the world.

d. Personalized Financial Management

Thanks to the use of big data and machine learning, fintech companies can provide highly personalized services. For example, investment platforms use algorithms to create tailored portfolios, while budgeting apps help users track and optimize their spending habits based on individual behavior.

This level of personalization is helping consumers and businesses alike make better financial decisions, driving growth and improving financial health.

5. The Role of Artificial Intelligence in Fintech

Artificial intelligence (AI) is playing a significant role in the fintech industry. AI is used to streamline processes, enhance customer experiences, and improve security measures. For example, chatbots powered by AI can handle basic customer inquiries, freeing up human agents to focus on more complex tasks.

AI also plays a crucial role in fraud detection and cybersecurity, identifying unusual patterns in data and flagging potential threats in real time.

6. Fintech Regulations and Challenges

As fintech continues to grow, so do the regulatory challenges that come with it. Governments and financial institutions around the world are working to create regulatory frameworks that both encourage innovation and protect consumers.

Some key concerns in fintech include data privacy, cybersecurity, and the risk of financial exclusion if certain populations are unable to keep up with technological advances.

There’s also the challenge of navigating the global landscape, as fintech companies often operate in multiple countries, each with its own regulations and standards.

7. The Future of Fintech

The future of fintech looks incredibly promising, with AI, blockchain, and cryptocurrencies leading the charge. Experts predict that in the next few years, we’ll see even more integration between traditional financial institutions and fintech companies, blurring the lines between the two.

In addition to more widespread adoption of digital currencies, the fintech industry is expected to play a key role in financial inclusion, helping to bridge the gap for the 1.7 billion people globally who remain unbanked.

8. How to Get Started in Fintech

If you're interested in fintech, there are plenty of ways to get started. Whether you’re a consumer looking to take advantage of new financial tools, or a professional considering a career in the industry, now is the perfect time to dive in.

Explore Fintech Platforms: Start using digital banking apps, robo-advisors, or digital wallets to familiarize yourself with how fintech works.

Learn About Blockchain and AI: These two technologies are central to the future of fintech. There are plenty of online courses and resources available to help you learn the basics.

Invest in Fintech: Many fintech companies are publicly traded, offering opportunities for you to invest in the future of finance.

9. The Benefits of Fintech for Businesses

Fintech isn’t just changing the landscape for consumers—it’s also revolutionizing how businesses operate. From streamlining payment processes to improving access to capital, fintech is enabling businesses to operate more efficiently and scale faster.

Some benefits for businesses include:

Lower Transaction Fees: Fintech payment processors offer competitive rates compared to traditional banks.

Access to Funding: Digital lending platforms and crowdfunding have opened up new ways for businesses to access funding.

Improved Cash Flow Management: With real-time payment solutions, businesses can improve cash flow and reduce the wait times associated with traditional banking.

10. Conclusion: Fintech is Here to Stay

In conclusion, fintech is not just a buzzword—it’s a revolution that’s changing the way we interact with money and financial services. Whether it’s through digital payments, AI-powered financial tools, or blockchain-based systems, fintech is making finance faster, more accessible, and more secure.

The rise of fintech has already transformed many aspects of financial services, and it shows no signs of slowing down. As technology continues to advance, we can expect fintech to play an even larger role in the global economy.

Are you ready to explore the future of finance? Click here to learn more and stay ahead of the curve with the latest insights: The Rise of Fintech.

#fintech#financetips#investing stocks#personal finance#management#investing#finance#crypto#investment#blockchain#solana#crypto market

2 notes

·

View notes

Text

💡 Explore the future of finance: Join the BitNest ecosystem!

In today's rapidly changing fintech landscape, BitNest is leading a revolution. As an innovative blockchain platform, BitNest provides users with a comprehensive decentralized finance (DeFi) ecosystem. Whether it's savings, lending or payments, BitNest can meet your various needs.

✨ Core features:

Savings income: Deposit your funds in BitNest smart contracts to obtain stable returns.

Collateralized lending: Use BitNest's digital assets as collateral to obtain loans in stablecoins or other cryptocurrencies.

Payments and transactions: Support payments and transactions worldwide, allowing your digital assets to circulate freely.

🚀 Future plans:

Cross-chain interoperability: Through advanced cross-chain technology, seamless connections between different blockchain networks are achieved, allowing your digital assets to circulate freely. Issue your own currency.

🌍 Join BitNest:

Participate in BitNest DAO: Become a member of the community and participate in the governance and decision-making of the platform. Manage your digital assets safely and conveniently, and enjoy more features and services. At BitNest, we are committed to providing users with secure, efficient and reliable decentralized financial services. Join us and explore the infinite possibilities of digital assets!

#BitNest #Blockchain #DeFi #FinTech #Cryptocurrency #FutureFinance

2 notes

·

View notes

Text

Explore the Bit Loop: The innovation of lending powered by blockchain technology

In the rapid development of financial technology, blockchain technology has become one of the powerful tools to reform traditional financial services. Bit Loop, a decentralized lending platform based on the Ethereum network, is using blockchain's smart contract technology to reshape the lending market. This article will explore in detail how Bit Loop works, its monetization model, security measures, and its unique sharing reward mechanism.

The core function and operation of Bit Loop Smart contract applications: The core operation of Bit Loop relies on smart contract technology, which is deployed on the Ethereum (EVM compatible) network and automatically executes all the terms of the lending agreement. Through smart contracts, Bit Loop enables automatic matching between borrowers and lenders, optimizes the liquidity of funds, and reduces transaction costs.

Decentralized lending model: The borrowing and lending process is fully decentralized on the Bit Loop, i.e. all transactions are conducted directly between users without the need for any intermediaries. This not only increases the transparency of the transaction, but also greatly reduces the potential risk of fraud and operating expenses.

Peer-to-peer trading system: Through the peer-to-peer flow of funds, users can send funds directly from one person's wallet to another person's wallet, ensuring the security and speed of transactions. This model provides users with more flexible and affordable borrowing options by reducing the intervention of traditional financial institutions.

The profit model of Bit Loop Capital supply dividend: Bit Loop may collect a percentage of the money supply from the borrower as a service fee. For example, a borrower may have to pay a 1.5% fee to obtain short-term funding, part of which goes to cover the platform's operating costs and part goes to the lender's income.

Interest income: Lenders earn interest income by lending money to borrowers. These interest rates are usually determined by market supply and demand, and are automatically calculated and allocated through the platform's smart contracts.

Security measure Multi-signature and anonymous supervisory node: Bit Loop uses multi-signature technology and generated anonymous supervisory nodes to ensure the security of transactions. These technologies can effectively prevent unauthorized access and potential fraud, while enhancing the overall security of the system.

Irreversibility of smart contracts: Smart contracts deployed on the blockchain, once launched, cannot be modified or revoked. This ensures fair and transparent operation of the platform, and even the developers of the platform cannot change the terms of the contract.

Sharing reward mechanism Bit Loop encourages users to invite new users to join the platform through a personal sharing link. When these new users register and participate in the lending activity using the share link, the recommender will be rewarded according to the smart contract Settings. This mechanism not only increases the user base of the platform, but also provides an additional revenue stream for existing users.

conclusion By applying the concept of decentralization to the lending market, Bit Loop provides users with a secure, transparent and efficient financial services platform. This blockchain-based lending platform not only reduces the complexity and cost of traditional banking services, but also provides more equitable and accessible financial services to users around the world. With the advancement of technology and the development of the market, Bit Loop is expected to become a leader in the field of fintech, further promoting the modernization and globalization of financial services.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

2 notes

·

View notes

Text

Explore the Bit Loop: The innovation of lending powered by blockchain technology

In the rapid development of financial technology, blockchain technology has become one of the powerful tools to reform traditional financial services. Bit Loop, a decentralized lending platform based on the Ethereum network, is using blockchain's smart contract technology to reshape the lending market. This article will explore in detail how Bit Loop works, its monetization model, security measures, and its unique sharing reward mechanism.

The core function and operation of Bit Loop Smart contract applications: The core operation of Bit Loop relies on smart contract technology, which is deployed on the Ethereum (EVM compatible) network and automatically executes all the terms of the lending agreement. Through smart contracts, Bit Loop enables automatic matching between borrowers and lenders, optimizes the liquidity of funds, and reduces transaction costs.

Decentralized lending model: The borrowing and lending process is fully decentralized on the Bit Loop, i.e. all transactions are conducted directly between users without the need for any intermediaries. This not only increases the transparency of the transaction, but also greatly reduces the potential risk of fraud and operating expenses.

Peer-to-peer trading system: Through the peer-to-peer flow of funds, users can send funds directly from one person's wallet to another person's wallet, ensuring the security and speed of transactions. This model provides users with more flexible and affordable borrowing options by reducing the intervention of traditional financial institutions.

The profit model of Bit Loop Capital supply dividend: Bit Loop may collect a percentage of the money supply from the borrower as a service fee. For example, a borrower may have to pay a 1.5% fee to obtain short-term funding, part of which goes to cover the platform's operating costs and part goes to the lender's income.

Interest income: Lenders earn interest income by lending money to borrowers. These interest rates are usually determined by market supply and demand, and are automatically calculated and allocated through the platform's smart contracts.

Security measure Multi-signature and anonymous supervisory node: Bit Loop uses multi-signature technology and generated anonymous supervisory nodes to ensure the security of transactions. These technologies can effectively prevent unauthorized access and potential fraud, while enhancing the overall security of the system.

Irreversibility of smart contracts: Smart contracts deployed on the blockchain, once launched, cannot be modified or revoked. This ensures fair and transparent operation of the platform, and even the developers of the platform cannot change the terms of the contract.

Sharing reward mechanism Bit Loop encourages users to invite new users to join the platform through a personal sharing link. When these new users register and participate in the lending activity using the share link, the recommender will be rewarded according to the smart contract Settings. This mechanism not only increases the user base of the platform, but also provides an additional revenue stream for existing users.

conclusion By applying the concept of decentralization to the lending market, Bit Loop provides users with a secure, transparent and efficient financial services platform. This blockchain-based lending platform not only reduces the complexity and cost of traditional banking services, but also provides more equitable and accessible financial services to users around the world. With the advancement of technology and the development of the market, Bit Loop is expected to become a leader in the field of fintech, further promoting the modernization and globalization of financial services.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

3 notes

·

View notes

Text

Top 8 Challenges In Fintech

#fintech app development#blockchain#custom trading platform service#blockchain technology#digital wallet#technology#lending software development company#digital wallet app development#techfin#fintech#challenges#challenges in fintech#app developing company#fintech solutions

1 note

·

View note

Text

Kissht - Business Loans for Startups: Fueling Innovation and Growth in Today’s Competitive Market

Kissht Reviews: In today’s hyper-competitive and innovation-driven market, startups are shaping the future. From groundbreaking tech products to revolutionary service models, entrepreneurs are continually challenging the status quo. However, even the most promising idea needs fuel to take off and that fuel is funding. Access to timely and sufficient capital is often the deciding factor between a startup’s success and stagnation. This is where business loans become crucial, offering the much-needed financial support to help startups scale and thrive.

Among the most trusted and accessible platforms for startup financing in India is Kissht. Known for its digital-first approach, easy application process, and fast loan disbursal, Kissht has emerged as a reliable financial partner for startups looking to make their mark.

The Financial Challenges Startups Face

Startups operate in a high-risk environment, especially in their early stages. They often need funds for:

Product development

Hiring skilled professionals

Marketing and brand positioning

Purchasing equipment or software

Expanding to new markets

Yet, traditional financial institutions are often hesitant to provide loans to startups due to lack of collateral, short operational history, or inconsistent cash flows.

This is where a specialized business loan from a fintech company like Kissht proves to be a game-changer.

What is a Business Loan for Startups?

A business loan for startups is a type of unsecured or secured loan offered to new businesses to help meet various operational or growth-related expenses. These loans are tailored to the dynamic needs of emerging companies, offering flexible repayment tenures, minimal documentation, and fast approval.

Kissht business loans are designed specifically with startups in mind, recognizing the unique challenges and potential of these new ventures.

Why Choose Kissht for Your Startup Business Loan?

Kissht stands out in the lending space for several reasons:

1. Easy Online Application

Startup founders are often juggling multiple responsibilities. Kissht offers a fully digital application process through its user-friendly instant loan app. Founders can apply for a loan, upload documents, and track application status all from their smartphones.

2. Quick Approval and Disbursal

Time is critical in the startup ecosystem. Kissht ensures instant personal loan approvals and fast disbursals, allowing you to take timely decisions that could determine your startup’s success.

3. Flexible EMI Options

Founders can plan their repayments using the business loan EMI calculator. This tool helps estimate monthly outflows based on loan amount, tenure, and interest rate ensuring you choose a plan that suits your cash flow.

4. Attractive Interest Rates

Kissht offers competitive business loan interest rates, making it affordable for startups to borrow and invest in their growth. Transparent pricing means there are no hidden charges or surprises.

How Kissht Loans Fuel Innovation

Startups rely heavily on innovation. A loan from Kissht can help in several ways:

A. Product Innovation

Developing a new product or enhancing an existing one often requires investment in research, tools, or specialized manpower. A Kissht loan provides the necessary funds to fuel product innovation without diluting equity.

B. Market Expansion

Breaking into a new market means spending on logistics, marketing, legal setup, and localization. With a quick personal loan from Kissht, founders can tap into new customer segments without waiting for external funding.

C. Technology Upgrades

Modern businesses depend on cutting-edge technology to stay competitive. A Kissht instant loan online enables startups to invest in new software, AI tools, or cybersecurity enhancements without straining their capital reserves.

D. Talent Acquisition

The right team can drive exponential growth. Whether it’s hiring a data scientist, a marketing expert, or a CTO, you can use a Kissht business loan to attract and retain top talent.

Beyond Business Loans: Kissht’s Broader Offerings

While Kissht is known for business loans, it also provides a wide range of financial products:

Instant personal loan: Ideal for urgent personal needs

Loan against property: For larger borrowing needs

Personal loan EMI calculator: Helps plan your repayments smartly

Apply for personal loan online with ease and transparency

The platform also ranks among the best personal loan apps in India for salaried individuals and self-employed professionals alike.

Final Thoughts

In today’s competitive landscape, startups need every possible advantage to succeed. Access to timely and flexible financing can give you the edge you need to grow faster, innovate continuously, and compete effectively. A business loan from Kissht is more than just funding, it’s a partnership that empowers you to pursue your entrepreneurial vision with confidence.

If you’re ready to scale your startup, don’t wait. Apply for a business loan today through Kissht and take the next big step in your journey.

#Kissht Fraud#Kissht Chinese#instant money#Kissht Fosun#loan app#advance loan#kissht reviews#personal loan app#Kissht Illegal#Kissht#Kissht Banned#low-interest loan#personal loan#instant loans

0 notes

Text

API Banking – Simplifying Financial Innovation

The fintech revolution is built on one key enabler: APIs. API Banking allows businesses and developers to connect with bank services quickly and securely. At Bharat Inttech, our API Banking platform delivers a powerful, plug-and-play gateway to modern financial services.

What is API Banking?

API Banking enables third-party applications to access bank data and functionalities—like account details, transactions, fund transfers, or KYC—via secure APIs. This technology helps banks and fintechs offer tailored solutions without rebuilding core infrastructure.

Key Offerings:

Account Access APIs: View balances, fetch statements, and validate account details.

Payment APIs: Enable UPI, IMPS, NEFT, and other fund transfer options.

Onboarding APIs: Perform eKYC and link bank accounts.

Lending APIs: Automate loan disbursement and repayment tracking.

Use Cases:

Neo-banks building full banking experiences

Lending apps integrating automated payments

Merchant platforms enabling real-time settlements

ERP tools integrating banking within dashboards

Why Inttech’s API Banking?

Quick Integration: Our SDKs and sandbox environment simplify the process.

Customizable APIs: Tailor workflows to match your business logic.

Secure & Compliant: Follows ISO, PCI-DSS, and RBI standards.

Technical Support: From onboarding to production, we support your journey.

Benefits for Businesses:

Faster go-to-market

Reduced development cost

Streamlined user experience

Real-time financial data access

Conclusion:

API Banking is no longer a tech trend—it’s the foundation of fintech. Whether you’re launching a digital bank or integrating payment services into your app, Bharat Inttech provides the tools you need to innovate confidently.

For More Information Visit Us:

0 notes

Text

Streamline Onboarding with Business Verification API by NifiPayments

In today’s fast-paced digital ecosystem, businesses are under constant pressure to verify entities quickly, accurately, and in compliance with regulations. Manual verification processes are time-consuming, error-prone, and often lead to onboarding delays or security risks.

To tackle this, NifiPayments offers a powerful solution — the Business Verification API, designed to simplify and automate the process of verifying business identities in real-time.

🔍 What is the Business Verification API?

The Business Verification API by NifiPayments enables businesses, fintech platforms, lending companies, and marketplaces to instantly validate the authenticity of business entities. This includes confirming business registration details, legal status, GST information, and more — directly from authoritative data sources.

✅ Key Features

Real-Time Business Lookup Access up-to-date business data in seconds using just a PAN, GSTIN, or registration number.

Compliance-Ready Ensure that your onboarding process adheres to KYC, AML, and RBI regulatory guidelines.

Seamless API Integration Plug-and-play API that can be easily integrated into your onboarding workflows or existing systems.

Bulk Verification Support Need to verify hundreds or thousands of businesses? No problem — our API supports bulk processing for scale.

Fraud Prevention Detect and block fraudulent or shell companies before they enter your ecosystem.

🚀 Benefits for Your Business

Faster Onboarding: Reduce manual checks and approve legitimate businesses instantly.

Better Risk Management: Access verified data from trusted sources to reduce financial and compliance risks.

Operational Efficiency: Free up internal teams from repetitive verification tasks.

Improved User Experience: Deliver a smoother onboarding process that builds trust from the first interaction.

Scalability: Whether you’re a startup or enterprise, the API grows with your needs.

💼 Who Can Use It?

Fintech companies

Payment gateways

NBFCs & banks

Marketplaces & aggregators

SaaS platforms

Insurance & lending firms

🔗 Why Choose NifiPayments?

At NifiPayments, we combine cutting-edge technology with regulatory compliance to empower digital businesses. Our Business Verification API is not only fast and secure but also tailored to meet the evolving demands of modern finance and commerce.

📝 Final Thoughts

In a world where speed, accuracy, and security define success, the Business Verification API by NifiPayments is your ally in building a trusted, compliant, and scalable business ecosystem. Make smarter decisions with verified data — instantly.

📞 Ready to automate your business verification process? Connect with NifiPayments today and get started!

0 notes

Text

What are the latest technological advancements shaping the future of fintech?

The financial technology (fintech) industry has witnessed an unprecedented wave of innovation over the past decade, reshaping how people and businesses manage money. As digital transformation accelerates, fintech new technologies are emerging, revolutionizing payments, lending, investments, and other financial services. These advancements, driven by fintech innovation, are not only enhancing user experience but also fostering greater financial inclusion and efficiency.

In this article, we will explore the most significant fintech trending technologies that are shaping the future of the industry. From blockchain to artificial intelligence, these innovations are redefining the boundaries of what fintech can achieve.

1. Blockchain and Cryptocurrencies

One of the most transformative advancements in fintech is the adoption of blockchain technology. Blockchain serves as the foundation for cryptocurrencies like Bitcoin, Ethereum, and stablecoins. Its decentralized, secure, and transparent nature has made it a game-changer in areas such as payments, remittances, and asset tokenization.

Key Impacts of Blockchain:

Decentralized Finance (DeFi): Blockchain is driving the rise of DeFi, which eliminates intermediaries like banks in financial transactions. DeFi platforms offer lending, borrowing, and trading services, accessible to anyone with an internet connection.

Cross-Border Payments: Blockchain simplifies and accelerates international transactions, reducing costs and increasing transparency.

Smart Contracts: These self-executing contracts are automating and securing financial agreements, streamlining operations across industries.

As blockchain adoption grows, businesses are exploring how to integrate this technology into their offerings to increase trust and efficiency.

2. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are at the core of fintech innovation, enabling smarter and more efficient financial services. These technologies are being used to analyze vast amounts of data, predict trends, and automate processes.

Applications of AI and ML:

Fraud Detection and Prevention: AI models detect anomalies and fraudulent transactions in real-time, enhancing security for both businesses and customers.

Personalized Financial Services: AI-driven chatbots and virtual assistants are offering tailored advice, improving customer engagement.

Credit Scoring: AI-powered algorithms provide more accurate and inclusive credit assessments, helping underserved populations gain access to loans.

AI and ML are enabling fintech companies to deliver faster, more reliable services while minimizing operational risks.

3. Open Banking

Open banking is one of the most significant fintech trending technologies, promoting collaboration between banks, fintechs, and third-party providers. It allows customers to share their financial data securely with authorized parties through APIs (Application Programming Interfaces).

Benefits of Open Banking:

Enhanced Financial Management: Aggregated data helps users better manage their finances across multiple accounts.

Increased Competition: Open banking fosters innovation, as fintech startups can create solutions tailored to specific customer needs.

Seamless Payments: Open banking APIs enable instant and direct payments, reducing reliance on traditional methods.

Open banking is paving the way for a more connected and customer-centric financial ecosystem.

4. Biometric Authentication

Security is paramount in the financial industry, and fintech innovation has led to the rise of biometric authentication. By using physical characteristics such as fingerprints, facial recognition, or voice patterns, biometric technologies enhance security while providing a seamless user experience.

Advantages of Biometric Authentication:

Improved Security: Biometrics significantly reduce the risk of fraud by making it difficult for unauthorized users to access accounts.

Faster Transactions: Users can authenticate themselves quickly, leading to smoother digital payment experiences.

Convenience: With no need to remember passwords, biometrics offer a more user-friendly approach to security.

As mobile banking and digital wallets gain popularity, biometric authentication is becoming a standard feature in fintech services.

5. Embedded Finance

Embedded finance involves integrating financial services into non-financial platforms, such as e-commerce websites or ride-hailing apps. This fintech new technology allows businesses to offer services like loans, insurance, or payment options directly within their applications.

Examples of Embedded Finance:

Buy Now, Pay Later (BNPL): E-commerce platforms enable customers to purchase products on credit, enhancing sales and customer satisfaction.

In-App Payments: Users can make seamless transactions without leaving the platform, improving convenience.

Insurance Integration: Platforms offer tailored insurance products at the point of sale.

Embedded finance is creating new revenue streams for businesses while simplifying the customer journey.

6. RegTech (Regulatory Technology)

As financial regulations evolve, fintech innovation is helping businesses stay compliant through RegTech solutions. These technologies automate compliance processes, reducing costs and minimizing errors.

Key Features of RegTech:

Automated Reporting: Streamlines regulatory reporting requirements, saving time and resources.

Risk Management: Identifies and mitigates potential risks through predictive analytics.

KYC and AML Compliance: Simplifies Know Your Customer (KYC) and Anti-Money Laundering (AML) processes.

RegTech ensures that fintech companies remain agile while adhering to complex regulatory frameworks.

7. Cloud Computing

Cloud computing has revolutionized the way fintech companies store and process data. By leveraging the cloud, businesses can scale rapidly and deliver services more efficiently.

Benefits of Cloud Computing:

Scalability: Enables businesses to handle large transaction volumes without investing in physical infrastructure.

Cost-Effectiveness: Reduces operational costs by eliminating the need for on-premise servers.

Data Security: Advanced cloud platforms offer robust security measures to protect sensitive financial data.

Cloud computing supports the rapid growth of fintech companies, ensuring reliability and flexibility.

The Role of Xettle Technologies in Fintech Innovation

Companies like Xettle Technologies are at the forefront of fintech new technologies, driving advancements that make financial services more accessible and efficient. With a focus on delivering cutting-edge solutions, Xettle Technologies helps businesses integrate the latest fintech trending technologies into their operations. From AI-powered analytics to secure cloud-based platforms, Xettle Technologies is empowering organizations to stay competitive in an ever-evolving industry.

Conclusion

The future of fintech is being shaped by transformative technologies that are redefining how financial services are delivered and consumed. From blockchain and AI to open banking and biometric authentication, these fintech new technologies are driving efficiency, security, and inclusivity. As companies like Xettle Technologies continue to innovate, the industry will unlock even greater opportunities for businesses and consumers alike. By embracing these fintech trending advancements, organizations can stay ahead of the curve and thrive in a dynamic financial landscape.

2 notes

·

View notes

Text

Why Skill Development is the Key to Employment in Modern India

In today’s rapidly evolving economy, traditional degrees alone are no longer sufficient to secure meaningful employment. With industries constantly shifting, and the job market becoming more competitive than ever, skill development has emerged as a crucial component for employability, especially for the youth of India. Modern employers prioritize candidates who are industry-ready with practical knowledge, and this is where skill development courses come into play.

India, with one of the youngest populations in the world, has a unique advantage. However, this demographic dividend can only be transformed into economic growth if the youth are adequately trained and skilled. Particularly in sectors like banking and finance, there is an increasing demand for professionals who can hit the ground running. This makes a skill development course in banking and finance an essential investment for aspiring professionals.

The Growing Demand for Skilled Professionals

India’s economy is one of the fastest-growing in the world, and with this growth comes the need for a skilled workforce. However, many graduates often find themselves unemployed or underemployed due to a mismatch between academic learning and industry requirements. In sectors like banking, finance, insurance, and fintech, companies need candidates who not only understand theory but also have practical expertise in areas like loan processing, credit assessment, and risk management.

A job oriented course in banking and finance bridges this gap by offering real-world training, simulations, and case studies that prepare learners to handle the actual responsibilities of a banking or finance role.

The Role of Skill Development in the Banking and Finance Sector

The banking and finance sector in India is undergoing a significant transformation driven by technology, regulatory reforms, and customer expectations. Digital banking, mobile banking, microfinance, and retail lending are growing rapidly, creating new job opportunities for freshers and experienced professionals alike.

A banking and finance course for freshers focuses on foundational concepts and job skills required to perform roles in this dynamic environment. Courses often cover subjects like financial markets, regulatory compliance, accounting, customer service, retail banking, and digital banking platforms.

For example, a Certificate Course in Retail Lending & Advances equips students with practical knowledge about credit appraisal, loan documentation, risk assessment, and various types of retail loans like home loans, auto loans, and personal loans. This specialized training makes them more employable in roles such as credit officers, loan processing executives, and relationship managers.

Key Benefits of Enrolling in a Skill Development Course

Here’s why opting for a skill development course in banking and finance can be a game-changer:

Industry-Relevant Curriculum: These courses are designed in consultation with industry experts to ensure that learners gain up-to-date and practical knowledge that is immediately applicable on the job.

Job Readiness: Instead of generic academic knowledge, these programs focus on job-specific skills, helping students transition smoothly into employment.

Internships and Placements: Many institutions offering job oriented course in banking and finance have tie-ups with banks, NBFCs, and financial institutions to provide internships and placement support.

Certification and Credibility: A recognized certificate from a reputed training institute boosts the candidate’s resume and provides an edge in the competitive job market.

Affordability and Accessibility: These short-term programs are often cost-effective and available both online and offline, making them accessible to students from various backgrounds.

Government Initiatives Supporting Skill Development

Recognizing the importance of skill-based education, the Indian government has launched various initiatives such as:

Skill India Mission

Pradhan Mantri Kaushal Vikas Yojana (PMKVY)

National Skill Development Corporation (NSDC)

These initiatives focus on offering industry-aligned skill development programs to empower youth and reduce unemployment. Many of these government programs also support banking and finance courses for freshers, helping students build sustainable careers in BFSI (Banking, Financial Services, and Insurance).

Who Should Enroll in These Courses?

These courses are ideal for:

Fresh graduates looking to kickstart a career in banking or finance.

Working professionals seeking to upskill or switch domains.

Students from non-commerce backgrounds who wish to enter the BFSI sector.

Job seekers preparing for roles like banking associate, loan officer, customer service executive, or finance analyst.

Career Opportunities After Completing the Course

After completing a certificate course in retail lending & advances or a job oriented course in banking and finance, candidates can explore a variety of roles, such as:

Retail Banking Executive

Loan Officer or Credit Analyst

Relationship Manager

Financial Advisor

Branch Banking Associate

Back-office Executive

Risk and Compliance Officer

These roles are available in both public and private sector banks, NBFCs, fintech companies, and microfinance institutions.

Future Scope and Demand

The future of banking and finance in India looks promising, with the rise of digital platforms, financial inclusion initiatives, and the growth of rural banking. According to industry reports, the BFSI sector will continue to expand, creating nearly 1.6 million job opportunities in the next few years. This surge in demand will favor candidates with practical skills and domain-specific training.

Therefore, enrolling in a Certificate Course in Corporate Banking & finance is not just a smart decision — it's a necessary step to future-proof your career.

Final Thoughts

In conclusion, skill development is no longer optional — it is the cornerstone of employment in modern India. As industries continue to evolve, the only way to stay relevant is through continuous learning and skill enhancement. For those aspiring to build a career in the ever-growing financial sector, enrolling in a skill development course in banking and finance is a wise and rewarding decision.

By equipping themselves with specialized training, such as a certificate course in retail lending & advances, candidates can confidently enter the job market with a competitive edge. Whether you are a fresher or someone looking to transition into a new domain, a job oriented course in banking and finance will open up new doors and set you on the path to a successful career.

0 notes

Text

Unlocking Investment Banking's Digital Future: How Tech Trends Are Reshaping Fees and Deal Making in 2025

Introduction

As we navigate the complex landscape of investment banking in 2025, it's clear that technology is driving a significant shift in how banks operate, compete, and serve their clients. For those interested in pursuing a career in this field, courses like the Investment Banking Course with Placement in Mumbai can provide valuable insights into the latest trends and technologies. Despite global economic uncertainty, advisory fees have seen a notable surge, with banks leveraging AI, blockchain, and digital platforms to enhance dealmaking processes and client experiences. But what's behind this growth? And how are the latest tech trends reshaping the industry for bankers and clients alike? This article delves into the fee surge, explores the tech investments driving it, and offers actionable insights for navigating today's investment banking landscape.

The Evolution of Investment Banking Fees

Investment banking has traditionally been a fee-driven business, with revenues generated from advising on mergers and acquisitions (M&A), underwriting securities, and facilitating capital raises. However, over the past decade, the industry has faced numerous challenges, including regulatory scrutiny, market volatility, and the rise of fintech disruptors. These pressures have forced banks to rethink their strategies and embrace innovation to stay competitive. For aspiring professionals, a Financial Modelling Course with Job Guarantee can be particularly beneficial in understanding the financial models that underpin these strategies.

The pandemic years saw a rollercoaster of activity, with dealmaking surging in 2021 before slowing as interest rates rose and geopolitical tensions flared. By 2023, investment banking revenues had dipped, but 2024 brought a strong rebound, with fee income jumping 11% and deal activity reaching a two-year high. This momentum has carried into 2025, with advisory fees up 6% year-over-year and overall investment banking fees growing by 4%. The recovery isn't just about a return to "business as usual"; it's being fueled by a wave of tech-driven innovation that's changing how banks operate. Professionals who enroll in Certification Courses for Financial Modelling in Mumbai can gain a deeper understanding of these trends.

The Latest Features, Tools, and Trends

Investment banks are racing to embrace digital transformation, and the results are showing up in their bottom lines. Here are the most important tech-driven trends shaping the industry right now:

AI and Data Analytics Take Center Stage

Artificial intelligence is no longer a buzzword, it's a core part of the deal lifecycle. Banks are using AI to analyze vast datasets, identify potential M&A targets, and even predict market trends. Generative AI, in particular, is being used to automate due diligence, draft pitchbooks, and streamline communication with clients. This not only speeds up deals but also allows bankers to focus on high-value, strategic work. For example, AI can help in identifying and mitigating risks by analyzing large datasets quickly and accurately, which is crucial in today's fast-paced deal environment. Those interested in leveraging AI in investment banking can benefit from courses like the Investment Banking Course with Placement in Mumbai.

Blockchain and Crypto Disrupt the Back Office

Blockchain technology is making inroads into settlement, custody, and even syndicated lending. By reducing the need for intermediaries and increasing transparency, blockchain is cutting costs and reducing risk. Some banks are also exploring crypto asset services, though regulatory uncertainty remains a challenge. Blockchain can enhance security and efficiency in transactions, making it an attractive option for banks looking to modernize their operations. Understanding blockchain's role in investment banking can be facilitated through comprehensive courses such as the Financial Modelling Course with Job Guarantee.

Digital Platforms and Client Portals

Client experience is being transformed by digital platforms that offer real-time deal tracking, secure document sharing, and interactive analytics. These tools make it easier for clients to stay informed and engaged throughout the deal process, building trust and loyalty. For instance, banks are using digital portals to provide clients with instant updates on deal progress, allowing for more effective collaboration and decision-making. This is particularly valuable for professionals completing Certification Courses for Financial Modelling in Mumbai, as they can apply these insights directly to real-world scenarios.

Private Credit and Alternative Financing

With traditional lending constrained by regulatory and market pressures, private credit has exploded. Tech-enabled platforms are connecting borrowers with non-bank lenders, creating a parallel debt ecosystem that's reshaping capital markets. This shift towards private credit is providing more options for companies looking to raise capital outside traditional channels. Aspiring investment bankers can benefit from understanding these trends through courses like the Investment Banking Course with Placement in Mumbai.

Energy Infrastructure and ESG Investing

Tech investments aren't just about software; banks are also pouring resources into energy infrastructure and ESG (environmental, social, and governance) analytics, helping clients navigate the transition to a low-carbon economy. ESG investing is becoming increasingly important as companies face growing pressure to demonstrate sustainability and social responsibility. Banks are using technology to analyze and report on ESG metrics, providing clients with actionable insights to guide their investment decisions. Professionals in Financial Modelling Course with Job Guarantee programs can gain insights into how these ESG metrics are integrated into financial models.

Advanced Tactics for Success

For investment bankers looking to stay ahead, simply adopting new tech isn't enough. Here are some advanced tactics that leading firms are using to maximize the benefits of their digital investments:

Embedding AI Across the Deal Lifecycle

Top banks are integrating AI into every stage of the deal process, from initial screening to post-merger integration. This means using machine learning to identify synergies, natural language processing to analyze contracts, and predictive analytics to assess risk. For example, AI can help identify potential integration challenges early on, allowing bankers to develop strategies to mitigate them. Those pursuing a career in investment banking can benefit from courses like the Investment316 Course with Placement in Mumbai to understand these AI applications.

Correction: The correct course name is Investment Banking Course with Placement in Mumbai.

Building Cross-Functional Tech Teams

Successful banks are breaking down silos between IT and business teams. By embedding tech experts within deal teams, they ensure that digital tools are tailored to real-world needs and adopted quickly. This integration allows for more agile development and deployment of new technologies, ensuring that they meet the specific needs of clients and bankers alike. Professionals enrolled in Certification Courses for Financial Modelling in Mumbai can learn how to integrate technology into financial models effectively.

Leveraging Data for Competitive Advantage

Data is the new currency in investment316 banking. Banks that can collect, clean, and analyze data at scale are better positioned to spot trends, price deals accurately, and win mandates. For instance, advanced data analytics can help banks identify emerging market trends, allowing them to position317 themselves for future growth. Courses like the Financial Modelling Course with Job Guarantee can provide essential skills in data analysis.

Correction: The correct industry is investment banking.

The Role of Storytelling, Communication, and Community

Tech is only part of the equation. Investment banking is, at its heart, a relationship business. As banks adopt new318 tools, they’re also investing in better communication and community-building.

Storytelling in Deal Pitches

With more data at their fingertips, bankers are using storytelling techniques to craft compelling narratives for clients. This means translating complex analytics into clear, actionable insights that resonate with decision-makers. Effective storytelling can make the difference between winning and losing a mandate, as it helps clients visualize the potential outcomes of a deal. Professionals who complete Investment Banking Course with Placement in Mumbai can develop these storytelling skills.

Building Trust Through Transparency

Digital tools are making it easier for banks to share information and collaborate with clients in real time. This transparency builds trust and strengthens long-term relationships. For example, banks are using digital platforms to provide clients with instant updates on deal progress, allowing for more effective collaboration and decision-making. This is particularly valuable for those who have completed Certification Courses for Financial Modelling in Mumbai.

Fostering Community Among Clients and Colle319agues

Banks are using digital platforms to create communities where clients can share best practices, network, and learn from each other. This not only adds value but also deepens client loyalty. By facilitating collaboration and knowledge-sharing, banks can position themselves as trusted advisors rather than just service providers. Aspiring investment bankers in Financial Modelling Course with Job Guarantee programs can benefit from understanding how technology fosters these communities.

Note: "Colleagues" was intended, not "Colle319agues."

Analytics and Measuring Results

To justify their tech investments, banks need to measure results. Here’s how leading firms are tracking success:

Tracking Fee Growth and Deal Volume

The most obvious metric is fee income. As tech investments pay off, banks are seeing higher advisory fees and more deal activity. For example, Citi reported an 84% year-over-year increase in advisory revenue in Q1 2025, while Wells Fargo posted a 24% rise in total fees. These metrics demonstrate the tangible impact of technology on banking operations. Professionals who enroll in Investment Banking Course with Placement in Mumbai can learn how to analyze these metrics effectively.

Monitoring Client Satisfaction and Retention

Banks are using surveys and digital analytics to track client satisfaction and retention. Happy clients are more likely to return for future deals and refer new business. By focusing on client satisfaction, banks can ensure that their tech investments are meeting real needs and delivering value. Courses like Certification Courses for Financial Modelling in Mumbai can help professionals understand how to measure client satisfaction through data analysis.

Measuring Operational Efficiency

Tech investments are also reducing the time and cost of executing deals. Banks are tracking metrics like time-to-close and cost-per-deal to quantify these savings. For instance, AI can automate routine tasks, freeing up bankers to focus on high-value work and reducing the overall cost of deal execution. Those in Financial Modelling Course with Job Guarantee programs can apply these insights to improve operational efficiency.

Business Case Study: Citigroup’s320 Tech-Driven Fee Surge

Let’s take a closer look at a real-world example of how tech investment is driving banking growth.

The Challenge

Citigroup, like many global banks, faced pressure to grow its advisory business in a volatile market. Clients were demanding faster, more transparent service, and competitors were racing to adopt new technologies.

The Strategy

Citi invested heavily in AI and digital platforms, embedding tech experts within its advisory teams. The bank developed proprietary tools for due diligence, risk assessment, and client communication. It also launched a digital client portal that gave clients real-time access to deal updates and analytics.

The Results

In Q1 2025, Citi reported the largest year-over-year increase in advisory revenue among major US investment banks, with advisory fees rising 84% from a year earlier and 20% from the previous quarter. Total fee growth was 14% year-over-year and 16% quarter-over-quarter. Clients praised the bank’s responsiveness and transparency, and Citi’s deal pipeline grew as a result. This kind of success can inspire aspiring investment bankers to pursue courses like the Investment Banking Course with Placement in Mumbai.

Key Takeaways

Citi’s success shows that tech investment, when combined with a client-centric approach, can drive significant fee growth and competitive advantage. Professionals in Certification Courses for Financial Modelling in Mumbai can learn from these strategies to enhance their own careers.

Actionable Tips for Aspiring Investment Bankers

If you’re looking to break into investment banking or advance your career, here are some practical tips to help you succeed in the321 tech-driven era: