#custom trading platform service

Explore tagged Tumblr posts

Text

https://mangocityit.com/service/buy-angies-list-reviews/

#Buy Angie’s List Reviews Cheap#Do you want to enhance the reputation of your business and interested to earn notable profit? Well#then it is high time to buy Angie’s List reviews you should think about your business#services or products reviews. Nowadays people are very concern about their online trading. They usually check what others are thinking abou#in this case reviews play very important role on purchasing products or services. If you never cared for the reviews previously you must do#the only way to save your business is to replace the negative reviews with positive one.#In simple words you should buy Angie’s List reviews. The buy Angie’s List reviews are the thing that must go with in order to meet your ove#buy Angie’s List reviews is the best possible thing you can do for your online business.#What is Angie’s List Reviews?#Among many review platform buy Angie’s List reviews is one of the best known for its authentic and trustworthy reviews. It is an online bus#contact information#and types of services offered. This platform is designed for customers who are looking for service providers in their area and shows review#How Does Angie’s List Work?#We all know that buy Angie’s List reviews is a free service-business listing and review website based on United Sates of America. Mainly co#calendars and more sources in this intuitive platform#Angie’s List.#How Angie’s List Reviews Will Help Your Business Through Generate Trustworthiness?#If you have an online business then buy Angie’s List reviews is an incredible source of customers for any kinds of businesses#especially contractors. It’s a very easy math that if you have lots of positive reviews and post a deal in Angie’s List it will be good eno#Advantages of Positive Angie’s List Reviews#The best thing for any online business is having a wide range of positive Angie’s List positive reviews. It is very simple math; it is a un#Disadvantages of Negative Angie’s List Reviews#If you were a very successful business owner in the world of online business but now you are not getting enough sells like before. Therefor#The Impact of Angie’s List Reviews on Local Business#buy Angie’s List reviews is the most trusted and verified for information about hotels#Beauty salons#Cleaning#Dental and restaurants so it is the first place to visit before you choose any service.#Angie’s List has influenced more than 90% of visitors who read reviews here and 65% do not like to book any service if it has low ratings a#If a service has “A” and “B” ratings then it is likely three times higher chance to stay in the competitions among the best bands.

1 note

·

View note

Text

CRYPTOAİSİGNALS - PRO+

Navigate Crypto Markets with Precision: CryptoAISignals

Introduction:

In the dynamic world of cryptocurrency trading, staying ahead of market trends is crucial for success. At CryptoAISignals.com, we empower traders with cutting-edge tools, including Whale Hunter Signals and advanced crypto indicators. Elevate your trading experience with our premium services designed to keep you one step ahead in the crypto arena.

Whale Hunter Signals: Unlocking Market Secrets

Real-Time Whale Movement Analysis: With Whale Hunter Signals, gain insights into the movements of significant players in the crypto market. Stay informed about large transactions that can impact market dynamics.

Strategic Trading Opportunities: Identify strategic entry and exit points based on whale activities. Our signals are meticulously crafted to help you make informed decisions, enhancing the precision of your trading strategy.

Customized Alerts: Receive real-time alerts directly to your device, ensuring you never miss a significant market event. Tailor your notifications to suit your preferences and trading style.

Crypto Indicators: Navigating Market Trends

Comprehensive Technical Analysis: Our platform provides a range of crypto indicators, empowering you with the tools needed for in-depth technical analysis. Make well-informed decisions backed by robust market insights.

Market Sentiment Analysis: Understand market sentiment through our indicators, offering a comprehensive view of how traders feel about various crypto indicators. Use this valuable information to refine your trading strategy.

User-Friendly Interface: Accessing advanced indicators doesn't have to be complicated. Our user-friendly interface ensures that both novice and experienced traders can seamlessly incorporate these tools into their trading routine.

Trading Signals Telegram: Real-Time Updates at Your Fingertips

Instant Notifications: Join our Trading Signals Telegram channel for instant updates on market movements, new signals, and other crucial information. Stay connected with the market wherever you are.

Community Collaboration: Engage with a community of like-minded traders. Share insights, discuss market trends, and exchange ideas in a collaborative environment.

Accessible Information: Receive concise and actionable trading signals directly on Telegram, providing you with the information you need without overwhelming you with unnecessary details.

Why CryptoAISignals.com?

Precision and Accuracy: Crypto signals and indicators are designed with precision to provide accurate insights into market movements.

User-Centric Approach: Whether you are a beginner or an experienced trader, our user-friendly platform ensures an accessible and efficient trading experience.

Comprehensive Insights: From whale hunter signals to advanced indicators crypto trading signals offers a comprehensive suite of tools to meet all your trading needs.

Real-Time Updates: Stay ahead of the curve with real-time updates, ensuring you never miss a lucrative trading opportunity.

CryptoAISignals.com is your go-to platform for navigating the complex world of cryptocurrency trading. With whale hunter signals, advanced crypto indicators, and real-time updates on trading signals telegram, we provide the tools you need to trade with confidence. Join us at http://cryptoaisignals.com/ and embark on a journey of informed and successful crypto trading.

1K notes

·

View notes

Text

The Metaverse: A New Frontier in Digital Interaction

The concept of the metaverse has captivated the imagination of technologists, futurists, and businesses alike. Envisioned as a collective virtual shared space, the metaverse merges physical and digital realities, offering immersive experiences and unprecedented opportunities for interaction, commerce, and creativity. This article delves into the metaverse, its potential impact on various sectors, the technologies driving its development, and notable projects shaping this emerging landscape.

What is the Metaverse?

The metaverse is a digital universe that encompasses virtual and augmented reality, providing a persistent, shared, and interactive online environment. In the metaverse, users can create avatars, interact with others, attend virtual events, own virtual property, and engage in economic activities. Unlike traditional online experiences, the metaverse aims to replicate and enhance the real world, offering seamless integration of the physical and digital realms.

Key Components of the Metaverse

Virtual Worlds: Virtual worlds are digital environments where users can explore, interact, and create. Platforms like Decentraland, Sandbox, and VRChat offer expansive virtual spaces where users can build, socialize, and participate in various activities.

Augmented Reality (AR): AR overlays digital information onto the real world, enhancing user experiences through devices like smartphones and AR glasses. Examples include Pokémon GO and AR navigation apps that blend digital content with physical surroundings.

Virtual Reality (VR): VR provides immersive experiences through headsets that transport users to fully digital environments. Companies like Oculus, HTC Vive, and Sony PlayStation VR are leading the way in developing advanced VR hardware and software.

Blockchain Technology: Blockchain plays a crucial role in the metaverse by enabling decentralized ownership, digital scarcity, and secure transactions. NFTs (Non-Fungible Tokens) and cryptocurrencies are integral to the metaverse economy, allowing users to buy, sell, and trade virtual assets.

Digital Economy: The metaverse features a robust digital economy where users can earn, spend, and invest in virtual goods and services. Virtual real estate, digital art, and in-game items are examples of assets that hold real-world value within the metaverse.

Potential Impact of the Metaverse

Social Interaction: The metaverse offers new ways for people to connect and interact, transcending geographical boundaries. Virtual events, social spaces, and collaborative environments provide opportunities for meaningful engagement and community building.

Entertainment and Gaming: The entertainment and gaming industries are poised to benefit significantly from the metaverse. Immersive games, virtual concerts, and interactive storytelling experiences offer new dimensions of engagement and creativity.

Education and Training: The metaverse has the potential to revolutionize education and training by providing immersive, interactive learning environments. Virtual classrooms, simulations, and collaborative projects can enhance educational outcomes and accessibility.

Commerce and Retail: Virtual shopping experiences and digital marketplaces enable businesses to reach global audiences in innovative ways. Brands can create virtual storefronts, offer unique digital products, and engage customers through immersive experiences.

Work and Collaboration: The metaverse can transform the future of work by providing virtual offices, meeting spaces, and collaborative tools. Remote work and global collaboration become more seamless and engaging in a fully digital environment.

Technologies Driving the Metaverse

5G Connectivity: High-speed, low-latency 5G networks are essential for delivering seamless and responsive metaverse experiences. Enhanced connectivity enables real-time interactions and high-quality streaming of immersive content.

Advanced Graphics and Computing: Powerful graphics processing units (GPUs) and cloud computing resources are crucial for rendering detailed virtual environments and supporting large-scale metaverse platforms.

Artificial Intelligence (AI): AI enhances the metaverse by enabling realistic avatars, intelligent virtual assistants, and dynamic content generation. AI-driven algorithms can personalize experiences and optimize virtual interactions.

Wearable Technology: Wearable devices, such as VR headsets, AR glasses, and haptic feedback suits, provide users with immersive and interactive experiences. Advancements in wearable technology are critical for enhancing the metaverse experience.

Notable Metaverse Projects

Decentraland: Decentraland is a decentralized virtual world where users can buy, sell, and develop virtual real estate as NFTs. The platform offers a wide range of experiences, from gaming and socializing to virtual commerce and education.

Sandbox: Sandbox is a virtual world that allows users to create, own, and monetize their gaming experiences using blockchain technology. The platform's user-generated content and virtual real estate model have attracted a vibrant community of creators and players.

Facebook's Meta: Facebook's rebranding to Meta underscores its commitment to building the metaverse. Meta aims to create interconnected virtual spaces for social interaction, work, and entertainment, leveraging its existing social media infrastructure.

Roblox: Roblox is an online platform that enables users to create and play games developed by other users. With its extensive user-generated content and virtual economy, Roblox exemplifies the potential of the metaverse in gaming and social interaction.

Sexy Meme Coin (SEXXXY): Sexy Meme Coin integrates metaverse elements by offering a decentralized marketplace for buying, selling, and trading memes as NFTs. This unique approach combines humor, creativity, and digital ownership, adding a distinct flavor to the metaverse landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of the Metaverse

The metaverse is still in its early stages, but its potential to reshape digital interaction is immense. As technology advances and more industries explore its possibilities, the metaverse is likely to become an integral part of our daily lives. Collaboration between technology providers, content creators, and businesses will drive the development of the metaverse, creating new opportunities for innovation and growth.

Conclusion

The metaverse represents a new frontier in digital interaction, offering immersive and interconnected experiences that bridge the physical and digital worlds. With its potential to transform social interaction, entertainment, education, commerce, and work, the metaverse is poised to revolutionize various aspects of our lives. Notable projects like Decentraland, Sandbox, Meta, Roblox, and Sexy Meme Coin are at the forefront of this transformation, showcasing the diverse possibilities within this emerging digital universe.

For those interested in the playful and innovative side of the metaverse, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to explore this exciting project and join the community.

274 notes

·

View notes

Text

The economic winds whipped up by President Trump’s “Liberation Day” tariff proclamations in early April have been anything but a gentle breeze. Rising prices, fomenting trade wars, and uncertainty about when tariffs will go into effect has led to a volatile economic climate.

People looking to buy electronics and other goods affected by the tariffs are trying to figure out whether they should wait it out to see if the administration’s trade policies become more favorable, or quickly scoop up what they can while prices are still cheap-ish.

For consumers weighing a purchasing decision, buy now, pay later services like Klarna, Affirm, and Afterpay are offering to make that choice easier.

These companies make a relatively straightforward case: Spread out the cost of a purchase into smaller, more manageable payments over the course of a few weeks or months. Because BNPL services make deals with the sellers they’re providing the payment plans for, the companies behind the BNPLs don’t charge interest to the customer. So instead of spacing out a purchase with a credit card, say—which usually charges a high interest rate—BNPL would get you that thing you want for the listed price.

BNPL companies don’t require you to have good credit, and some only charge fees if you’re late with your payments. Otherwise it’s a nice free amenity—and one that might indicate bigger financial troubles across the economy.

Nadine Chabrier, senior policy council at the nonprofit Center for Responsible Lending, says it is easy to see why BNPL services are appealing. “The top reasons consumers use buy now, pay later is because they can't afford the full cost of the item at once,” she says. “Another reason is because there's a higher approval rate. It's that convenience factor.”

Economic uncertainty—over tariffs, rising inflation, and the possibility of a looming recession—is giving consumers pause about stretching their limited funds. It’s rocky times like these when BNPL services become even more appealing.

“BNPL really skyrocketed in adoption during the pandemic,” says Matt Gross, a spokesperson for Affirm. “It may not be as high-growth now as you saw in 2020, 2021, when everyone was stuck at home shopping online, but we're still growing at orders of magnitude faster than broader spending and consumption levels.”

Stress Spending

Economic watchdogs have concerns about BNPL. The services often appeal to people with lower incomes, who financial experts have warned may be at risk of financially overextending themselves. Still, BNPL services are now woven into nearly every digital payment platform, and people have come to rely on them. PayPal offers it now, letting you spread out payments of almost anything. Klarna has partnered with DoorDash, so you can pay for your family’s dinner in weekly installments. And people aren’t just using them for electronics and pizza delivery, but also for basic essentials: A recent study found that 25 percent of BNPL users in the US were relying on the services to cover the costs of food and household sundries.

“Before tariffs even came into the picture, people were already using BNPL for gas and groceries,” Chabrier says. “We're already talking about folks who may not have a lot of money or credit to spare. Additional economic stress could be hard.”

“Absolutely, this is a leading indicator of financial distress,” says Martin Kleinbard, founder of the consultancy firm Granular Fintech who formerly worked at the Consumer Financial Protection Bureau and coauthored a CFPB report about BNPL. “Consumers are smart. They understand where they’re getting the lowest-cost-of-credit option here and are going to avail themselves of that for the goods they have to get.”

Kleinbard says that in terms of acquiring debt, BNPL services can be more forgiving than high-interest loans like credit cards and payday loans.

“BNPL has grown rapidly over the last five years,” Kleinbard says. “But it's still a tiny, tiny fraction of the overall spending and borrowing pie. You really have to think about it in the context of the alternatives. If the alternative is you were going to borrow anyway and it's an important purchase, then this is a pretty damn good option. This isn't a product with a lot of gotchas.”

Economically, lots of people have compared the looming uncertainty of the tariff situation with that of the pandemic. But Gross says Affirm has weathered the storm before and doesn’t expect this economic shakeup to be all that different.

“I wouldn't go so far as to say this is an opportunity for us, other than to say that I think the last several years and years into the future is an opportunity,” Gross says. “People are shifting their payment preferences to favor these types of products. And so in that sense, we are trying to be their favorite way to pay—not just when things are uncertain, but all the time.”

Storm Watch

Shawn DuBravac, chief economist at the electronics trade association IPC, says he agrees this is indeed a moment for buy now, pay later services, for better or worse. It’s a service that’s growing during a time of uncertainty that will make the service more appealing. The financial leg up it provides can indeed be helpful, but DuBravac cautions that the benefits are likely not evenly distributed.

“This could be a very good thing for some people; this could be a great service that could help them through a tough week,” DuBravac says. “But you can't get around the fact that people who are using it then might have all of a sudden a downturn in their job. They lose their job, their household goes from two incomes to one income, all of a sudden they're strained.”

As with any loan, both the borrower and the lender incur risk. DuBravac says this moment, if the economy truly does spiral, may be the first real test of whether the BNPL industry is stable enough to keep themselves and their borrowers afloat. How well that system maintains in the face of financial downturn really depends on whether people are using it as a convenience or out of necessity.

“Are they using it as a bridge or are they using it as a crutch?” DuBravac says. “If they're using it as a crutch, then I think there's a lot more risk there.”

20 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

January 18, 2025

Heather Cox Richardson

Jan 19, 2025

Shortly before midnight last night, the Federal Trade Commission (FTC) published its initial findings from a study it undertook last July when it asked eight large companies to turn over information about the data they collect about consumers, product sales, and how the surveillance the companies used affected consumer prices. The FTC focused on the middlemen hired by retailers. Those middlemen use algorithms to tweak and target prices to different markets.

The initial findings of the FTC using data from six of the eight companies show that those prices are not static. Middlemen can target prices to individuals using their location, browsing patterns, shopping history, and even the way they move a mouse over a webpage. They can also use that information to show higher-priced products first in web searches. The FTC found that the intermediaries—the middlemen—worked with at least 250 retailers.

“Initial staff findings show that retailers frequently use people’s personal information to set targeted, tailored prices for goods and services—from a person's location and demographics, down to their mouse movements on a webpage,” said FTC chair Lina Khan. “The FTC should continue to investigate surveillance pricing practices because Americans deserve to know how their private data is being used to set the prices they pay and whether firms are charging different people different prices for the same good or service.”

The FTC has asked for public comment on consumers’ experience with surveillance pricing.

FTC commissioner Andrew N. Ferguson, whom Trump has tapped to chair the commission in his incoming administration, dissented from the report.

Matt Stoller of the nonprofit American Economic Liberties Project, which is working “to address today’s crisis of concentrated economic power,” wrote that “[t]he antitrust enforcers (Lina Khan et al) went full Tony Montana on big business this week before Trump people took over.”

Stoller made a list. The FTC sued John Deere “for generating $6 billion by prohibiting farmers from being able to repair their own equipment,” released a report showing that pharmacy benefit managers had “inflated prices for specialty pharmaceuticals by more than $7 billion,” “sued corporate landlord Greystar, which owns 800,000 apartments, for misleading renters on junk fees,” and “forced health care private equity powerhouse Welsh Carson to stop monopolization of the anesthesia market.”

It sued Pepsi for conspiring to give Walmart exclusive discounts that made prices higher at smaller stores, “[l]eft a roadmap for parties who are worried about consolidation in AI by big tech by revealing a host of interlinked relationships among Google, Amazon and Microsoft and Anthropic and OpenAI,” said gig workers can’t be sued for antitrust violations when they try to organize, and forced game developer Cognosphere to pay a $20 million fine for marketing loot boxes to teens under 16 that hid the real costs and misled the teens.

The Consumer Financial Protection Bureau “sued Capital One for cheating consumers out of $2 billion by misleading consumers over savings accounts,” Stoller continued. It “forced Cash App purveyor Block…to give $120 million in refunds for fostering fraud on its platform and then refusing to offer customer support to affected consumers,” “sued Experian for refusing to give consumers a way to correct errors in credit reports,” ordered Equifax to pay $15 million to a victims’ fund for “failing to properly investigate errors on credit reports,” and ordered “Honda Finance to pay $12.8 million for reporting inaccurate information that smeared the credit reports of Honda and Acura drivers.”

The Antitrust Division of the Department of Justice sued “seven giant corporate landlords for rent-fixing, using the software and consulting firm RealPage,” Stoller went on. It “sued $600 billion private equity titan KKR for systemically misleading the government on more than a dozen acquisitions.”

“Honorary mention goes to [Secretary Pete Buttigieg] at the Department of Transportation for suing Southwest and fining Frontier for ‘chronically delayed flights,’” Stoller concluded. He added more results to the list in his newsletter BIG.

Meanwhile, last night, while the leaders in the cryptocurrency industry were at a ball in honor of President-elect Trump’s inauguration, Trump launched his own cryptocurrency. By morning he appeared to have made more than $25 billion, at least on paper. According to Eric Lipton at the New York Times, “ethics experts assailed [the business] as a blatant effort to cash in on the office he is about to occupy again.”

Adav Noti, executive director of the nonprofit Campaign Legal Center, told Lipton: “It is literally cashing in on the presidency—creating a financial instrument so people can transfer money to the president’s family in connection with his office. It is beyond unprecedented.” Cryptocurrency leaders worried that just as their industry seems on the verge of becoming mainstream, Trump’s obvious cashing-in would hurt its reputation. Venture capitalist Nick Tomaino posted: “Trump owning 80 percent and timing launch hours before inauguration is predatory and many will likely get hurt by it.”

Yesterday the European Commission, which is the executive arm of the European Union, asked X, the social media company owned by Trump-adjacent billionaire Elon Musk, to hand over internal documents about the company’s algorithms that give far-right posts and politicians more visibility than other political groups. The European Union has been investigating X since December 2023 out of concerns about how it deals with the spread of disinformation and illegal content. The European Union’s Digital Services Act regulates online platforms to prevent illegal and harmful activities, as well as the spread of disinformation.

Today in Washington, D.C., the National Mall was filled with thousands of people voicing their opposition to President-elect Trump and his policies. Online speculation has been rampant that Trump moved his inauguration indoors to avoid visual comparisons between today’s protesters and inaugural attendees. Brutally cold weather also descended on President Barack Obama’s 2009 inauguration, but a sea of attendees nonetheless filled the National Mall.

Trump has always understood the importance of visuals and has worked hard to project an image of an invincible leader. Moving the inauguration indoors takes away that image, though, and people who have spent thousands of dollars to travel to the capital to see his inauguration are now unhappy to discover they will be limited to watching his motorcade drive by them. On social media, one user posted: “MAGA doesn’t realize the symbolism of [Trump] moving the inauguration inside: The billionaires, millionaires and oligarchs will be at his side, while his loyal followers are left outside in the cold. Welcome to the next 4+ years.”

Trump is not as good at governing as he is at performance: his approach to crises is to blame Democrats for them. But he is about to take office with majorities in the House of Representatives and the Senate, putting responsibility for governance firmly into his hands.

Right off the bat, he has at least two major problems at hand.

Last night, Commissioner Tyler Harper of the Georgia Department of Agriculture suspended all “poultry exhibitions, shows, swaps, meets, and sales” until further notice after officials found Highly Pathogenic Avian Influenza, or bird flu, in a commercial flock. As birds die from the disease or are culled to prevent its spread, the cost of eggs is rising—just as Trump, who vowed to reduce grocery prices, takes office.

There have been 67 confirmed cases of the bird flu in the U.S. among humans who have caught the disease from birds. Most cases in humans are mild, but public health officials are watching the virus with concern because bird flu variants are unpredictable. On Friday, outgoing Health and Human Services secretary Xavier Becerra announced $590 million in funding to Moderna to help speed up production of a vaccine that covers the bird flu. Juliana Kim of NPR explained that this funding comes on top of $176 million that Health and Human Services awarded to Moderna last July.

The second major problem is financial. On Friday, Secretary of the Treasury Janet Yellen wrote to congressional leaders to warn them that the Treasury would hit the debt ceiling on January 21 and be forced to begin using extraordinary measures in order to pay outstanding obligations and prevent defaulting on the national debt. Those measures mean the Treasury will stop paying into certain federal retirement accounts as required by law, expecting to make up that difference later.

Yellen reminded congressional leaders: “The debt limit does not authorize new spending, but it creates a risk that the federal government might not be able to finance its existing legal obligations that Congresses and Presidents of both parties have made in the past.” She added, “I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

Both the avian flu and the limits of the debt ceiling must be managed, and managed quickly, and solutions will require expertise and political skill.

Rather than offering their solutions to these problems, the Trump team leaked that it intended to begin mass deportations on Tuesday morning in Chicago, choosing that city because it has large numbers of immigrants and because Trump’s people have been fighting with Chicago mayor Brandon Johnson, a Democrat. Michelle Hackman, Joe Barrett, and Paul Kiernan of the Wall Street Journal, who broke the story, reported that Trump’s people had prepared to amplify their efforts with the help of right-wing media.

But once the news leaked of the plan and undermined the “shock and awe” the administration wanted, Trump’s “border czar” Tom Homan said the team was reconsidering it.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Consumer Financial Protection Bureau#consumer protection#FTC#Letters From An American#heather cox richardson#shock and awe#immigration raids#debt ceiling#bird flu#protests#March on Washington

30 notes

·

View notes

Text

ForexJudge.com is a comprehensive platform that provides reviews and comparisons of forex brokers. Here’s a detailed point-by-point review:

1. Website Design and Usability

User Interface: ForexJudge.com boasts a user-friendly interface, making navigation easy even for beginners. The site layout is intuitive, with well-organized sections and quick access to key information.

Mobile Compatibility: The website is fully responsive, offering a seamless experience on both desktop and mobile devices.

2. Content Quality

In-Depth Reviews: ForexJudge.com offers detailed reviews of various forex brokers, covering aspects like fees, platforms, customer service, and regulatory compliance. The reviews are thorough, well-researched, and provide valuable insights.

Comparison Tools: The site features robust comparison tools that allow users to evaluate brokers side by side based on multiple criteria, helping traders make informed decisions.

Educational Resources: There is a rich library of educational materials, including articles, tutorials, and glossaries, which are beneficial for both novice and experienced traders

3. Expert Analysis

Professional Reviews: The reviews are crafted by seasoned forex professionals, ensuring knowledgeable and insightful evaluations. This expert input adds credibility and reliability to the content.

Regular Updates: ForexJudge.com frequently updates its content to reflect the latest trends and changes in the forex market, keeping users informed with the most current information.

4. Broker Coverage

Comprehensive Listings: The platform covers a wide range of brokers globally, offering a broad perspective on the forex market. This extensive coverage includes well-known brokers as well as emerging ones, providing options for different trading needs.

Unbiased Reviews: The reviews are presented in an unbiased manner, focusing on both the strengths and weaknesses of each broker. This balanced approach helps traders choose brokers that best match their requirements【12†source】.

5. Community and Support

Engagement: ForexJudge.com fosters a community of traders who rely on its reviews and insights. The platform encourages user feedback and interaction, enhancing the overall user experience.

Customer Support: The website offers excellent customer support, ensuring users can get assistance when needed. This includes answering queries and providing additional information upon request.

6. Trust and Reliability

Transparency: ForexJudge.com maintains high transparency in its operations, including how reviews are conducted and how they make money. This builds trust among users.

Industry Recognition: The platform is recognized in the forex trading community for its comprehensive and reliable reviews. Its reputation is built on years of consistent and accurate information delivery【14†source】.

7. Additional Features

Market Insights: The website provides market insights and analysis, helping traders stay updated with market movements and trends.

Broker Awards: ForexJudge.com hosts annual awards, recognizing top-performing brokers in various categories. These awards are based on rigorous criteria and extensive research.

Overall, ForexJudge.com is a valuable resource for anyone involved in forex trading, offering detailed broker reviews, educational content, and tools to aid in making informed trading decisions.

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

60 notes

·

View notes

Text

HeroFX Review: A Comprehensive Look at the Alleged Forex Scam

In the vast and often volatile world of forex trading, the presence of unscrupulous brokers is a constant threat to both novice and seasoned traders. HeroFX, a broker that has recently come under scrutiny, is the subject of many discussions and concerns. This review delves into the various aspects of HeroFX to determine whether it is a legitimate broker or a potential scam.

Background and Overview

HeroFX claims to offer a comprehensive trading platform with a wide range of assets, including forex, commodities, indices, and cryptocurrencies. Promising competitive spreads, high leverage, and a user-friendly interface, HeroFX aims to attract traders looking for a reliable trading experience.

Regulation and Licensing

One of the primary red flags for any forex broker is the lack of proper regulation and licensing. HeroFX is reportedly not registered with any reputable financial regulatory authority. This absence of regulation means that traders are not protected by any governing body, increasing the risk of fraudulent activities and loss of funds.

Trading Platform and Tools

HeroFX offers its own proprietary trading platform, which is marketed as intuitive and feature-rich. While the platform appears to be functional, there have been numerous complaints about its reliability and execution speed. Some users have reported significant delays in order execution, leading to potential losses.

The broker also provides various tools and resources for traders, such as educational materials, market analysis, and trading signals. However, the quality and accuracy of these resources are questionable, with many users alleging that the information provided is often outdated or misleading.

Customer Support

Effective customer support is crucial for any forex broker, especially when dealing with complex financial transactions. HeroFX has received mixed reviews in this area. While some traders have reported satisfactory interactions with the support team, many others have experienced long wait times, unhelpful responses, and unresolved issues. This inconsistency in customer service further undermines the broker's credibility.

Withdrawal and Deposit Issues

One of the most significant concerns surrounding HeroFX is the difficulty many traders face when trying to withdraw their funds. Numerous complaints highlight delayed withdrawals, with some users claiming they never received their money. This pattern of behavior is often indicative of a scam broker, as legitimate brokers prioritize transparent and efficient fund transfers.

Additionally, the deposit process has also raised suspicions. HeroFX allegedly encourages large initial deposits and offers enticing bonuses that come with restrictive terms and conditions, making it challenging for traders to access their funds.

User Reviews and Complaints

A cursory glance at various online forums and review sites reveals a plethora of negative feedback from traders who have used HeroFX. Common grievances include:

Unresponsive or hostile customer service.

Manipulated trading conditions leading to unexpected losses.

Inability to withdraw funds.

Suspiciously positive reviews that appear fabricated.

These recurring themes paint a concerning picture of HeroFX and suggest a pattern of unethical practices.

Conclusion

In conclusion, while HeroFX presents itself as a reputable forex broker with attractive features, the overwhelming evidence points to the contrary. The lack of regulation, persistent withdrawal issues, and numerous negative user reviews all indicate that HeroFX may not be a trustworthy broker. Traders are advised to exercise extreme caution and conduct thorough research before engaging with this broker. In the unpredictable world of forex trading, it is always better to err on the side of caution and choose a broker with a proven track record of reliability and transparency.

For more check out this article: Herofx-review

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

61 notes

·

View notes

Text

How to Choose the Best Broker for Stock, Forex, and Crypto Trading in 2024?

Navigating the world of trading can be overwhelming, especially when it comes to selecting the right broker to meet your trading requirements. Whether you’re interested in stocks, forex, or cryptocurrencies, the choice of broker can significantly impact your trading experience and success. In this post, we’ll explore the key factors to consider when choosing a broker and introduce you to ForexJudge.com, a reliable resource that offers comprehensive reviews and detailed analysis of the world’s best brokers.

Factors to Consider When Choosing a Broker

Regulation and Security:

Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of security and oversight, protecting you from fraudulent activities.

Look for brokers that offer robust security measures, including encryption and two-factor authentication, to safeguard your funds and personal information.

Trading Platform:

A good trading platform should be user-friendly, reliable, and equipped with essential tools for analysis and trading.

Consider whether the platform offers mobile compatibility if you plan to trade on-the-go.

Fees and Commissions:

Compare the fees and commissions charged by different brokers. Lower fees can significantly enhance your profitability, especially if you trade frequently.

Be aware of hidden fees, such as withdrawal charges, inactivity fees, or charges for additional services.

Range of Assets:

Ensure the broker offers the range of assets you’re interested in trading. If you plan to diversify your portfolio, choose a broker that provides access to stocks, forex, and cryptocurrencies.

Some brokers specialize in specific asset classes, so make sure your chosen broker aligns with your trading preferences.

Customer Support:

Reliable customer support is crucial, especially if you encounter issues with your account or trading platform. Look for brokers that offer multiple support channels, including live chat, phone, and email.

Check reviews to gauge the quality and responsiveness of the broker’s customer service.

Education and Resources:

Many brokers offer educational resources such as tutorials, webinars, and market analysis. These resources can be invaluable, especially for beginners.

A broker that provides regular market updates and trading insights can help you stay informed and make better trading decisions.

How ForexJudge.com Can Help

With so many brokers available, making an informed choice can be challenging. This is where ForexJudge.com comes in. ForexJudge is a trusted platform that has compiled detailed reviews and analysis of the world’s best brokers. By providing comprehensive information and user feedback, ForexJudge helps traders make well-informed decisions.

Detailed Broker Reviews

ForexJudge offers in-depth reviews of brokers across various asset classes, including stocks, forex, and cryptocurrencies. Each review covers critical aspects such as regulation, fees, trading platforms, and customer support. By reading these reviews, you can gain valuable insights into the strengths and weaknesses of different brokers, helping you choose the one that best meets your needs.

User Feedback and Ratings

In addition to expert reviews, ForexJudge features user feedback and ratings. This community-driven aspect allows traders to share their experiences and provide honest assessments of brokers. This real-world feedback can offer a clearer picture of what to expect and help you avoid potential pitfalls.

Regular Updates and Alerts

The trading world is dynamic, with brokers frequently updating their services, fees, and policies. ForexJudge keeps you informed with regular updates and alerts, ensuring you have the latest information at your fingertips. This proactive approach helps you stay ahead of the curve and make timely decisions.

Making the Final Decision

When choosing a broker, it’s essential to consider your trading goals, risk tolerance, and preferred asset classes. By leveraging the resources available on ForexJudge, you can make a well-informed decision that aligns with your trading strategy.

Steps to Follow:

Identify Your Needs:

Determine what you want to trade (stocks, forex, crypto) and what features are most important to you (low fees, robust platform, educational resources).

Research and Compare:

Use ForexJudge’s detailed reviews and user feedback to compare different brokers. Pay close attention to factors such as regulation, fees, and customer support.

Test the Platform:

Many brokers offer demo accounts. Use these to test the trading platform and ensure it meets your needs before committing real funds.

Start Small:

When you choose a broker, start with a small investment to test the waters. As you gain confidence and experience, you can increase your trading capital.

Conclusion

Choosing the right broker is a crucial step in your trading journey. By considering factors such as regulation, fees, trading platforms, and customer support, you can make an informed choice that enhances your trading experience.

For a reliable resource in your broker selection process, turn to ForexJudge.com. With its comprehensive reviews, user feedback, and regular updates, ForexJudge provides the insights you need to make the best decision for your trading needs.

Happy trading, and may your investments be fruitful!

#Forex Trading Reviews#Best Forex Brokers#Crypto trading#Financial News Services#Forex Trading Forum#How to get money back from Forex scam#Forex Scams#Crypto Scams#Best Forex Trading Platforms#Financial Calendar

145 notes

·

View notes

Text

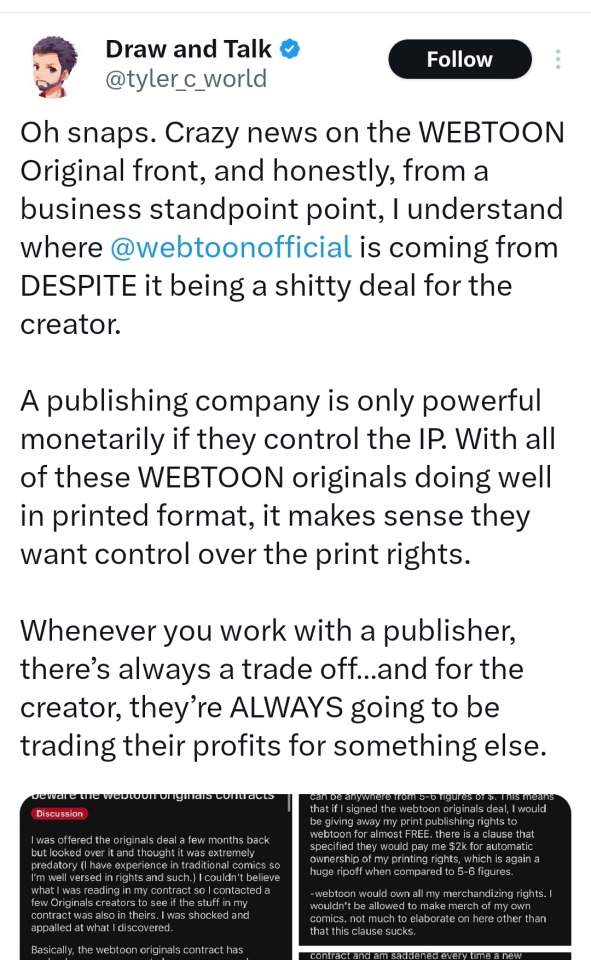

NOBODY needs to be defending these people. Major publishers, studios, streaming services, Tesla, Apple, Adobe, Amazon, social media companies- there isnt a single altruistic bone caught in their teeth. Profit from the output of exploited and captive labor IS their product now. When their contacts look like the one in question, the company is clearly stating that shareholders are the customers, not us!

Why else would it be anything but a stupid idea for Amazon to just nuke the majority of Comixology's self-published titles when they consolidated their services? If our experience was really foremost in their minds, why would they repeatedly purge, censor, demonitize, bury, and delete popular accounts with robust followings if not to allay the moral brainworms of shareholders and investors?

Forfeiting rights to our IP is not a "shitty deal," it's surrendering any potential ability to make money off of your own creative work. It's selling your property to a board of accountants to pitch into a portfolio. It's theirs to trot out as long as it's profitable and bury the instant its projected profit dips too close to the cost of maintenance. Hell, we've seen services drop popular series just because their projected profits started to flatten out! Mothballing it also has the added bonus of removing it from the market to further minimize potential competition. Like how there just weren't spider man movies for ages because the owner of the property didn't think it was worth developing but worth too much to sell.

They will make more money from suing you for trying to reclaim IP they mothballed than you did selling it to them in the first place. I guaranteee their budget for lawsuits is a lot deeper than the one they pay their "original" artists from.

By virtue of being a big, profitable, corporation, "their" IP is going to have an astronomically higher value in a court of law than any individual creator. The financial "damage" will be higher for infringing on their copyrights than any amount you can claim on your own. When it becomes theirs, their connections, their infrastructure, their reputation makes it an asset with much more value than you or I can possibly claim. So if you try to steal a bite back from them it's a bite of a *potentially* multimillion-dollar series. In their eyes, they bought the totality of your work, which you agreed was worth the price they gave you. It's value becomes more dependent on who owns it than whether it's even good.

You may not have the same potential to become flash-in-the-pan, short-term succesful without their resources, but you will still own your rights to distribute, alter, preserve, promote, and negotiate your share if you still own your work. That is worth everything as a creator who is passionate about what you've made and committed to protecting it.

The most effective power we can exercise as artists is our ability to say, "no" when someone else wants to pay us a disadvantageous fraction of our worth. You may lose potentially lucrative opportunities but "opportunities" presented by companies like Facebook or Twitter, whose real product is a platform for ads and data collection, with content as bait, are not opportunities to thrive on as independent artists. This specifically is an opportunity for the company to acquire property.

The myth that the publisher's strength is something for us to exploit, without them getting the lion's share is a trap that they feed from at will.

People like the poster up top are opportunists who see the process as a pipeline towards trading low-investment content for financial treats and maybe a share of ad revive. They're stalking horses for companies to exploit more talented but less experienced artists who are facing a daunting and overwhelming market where their work becomes harder and harder to show, let alone sell. A quick deal may feel like a win but it's selling the cow to save money on bottling the milk. Artists like this serve the publisher by making it seem like signing away your rights are just a necessary part of the game. However it's a game they are playing with exceedingly cheap stakes that weren't going to succeed on their own merit. So what if Mr. Business Perspective loses rights to his sexy Mario Bros. parody to a huge company? The point was always to unload it because it's a product, a bartering chip, a trinket. He's a Business Man, so he sees tactics that maximize profits to the business as maximizing their ability to buy whatever shiny tripe he cranks out. The business is his customer, not the reader. The business is his ally, not the creative community. Fuck him and fuck anyone who tells you the exposure is worth a damn if you don't retain rights to your work.

116 notes

·

View notes

Text

Top 8 Challenges In Fintech

#fintech app development#blockchain#custom trading platform service#blockchain technology#digital wallet#technology#lending software development company#digital wallet app development#techfin#fintech#challenges#challenges in fintech#app developing company#fintech solutions

1 note

·

View note

Text

Big Tech’s “attention rents”

Tomorrow (Nov 4), I'm keynoting the Hackaday Supercon in Pasadena, CA.

The thing is, any feed or search result is "algorithmic." "Just show me the things posted by people I follow in reverse-chronological order" is an algorithm. "Just show me products that have this SKU" is an algorithm. "Alphabetical sort" is an algorithm. "Random sort" is an algorithm.

Any process that involves more information than you can take in at a glance or digest in a moment needs some kind of sense-making. It needs to be put in some kind of order. There's always gonna be an algorithm.

But that's not what we mean by "the algorithm" (TM). When we talk about "the algorithm," we mean a system for ordering information that uses complex criteria that are not precisely known to us, and than can't be easily divined through an examination of the ordering.

There's an idea that a "good" algorithm is one that does not seek to deceive or harm us. When you search for a specific part number, you want exact matches for that search at the top of the results. It's fine if those results include third-party parts that are compatible with the part you're searching for, so long as they're clearly labeled. There's room for argument about how to order those results – do highly rated third-party parts go above the OEM part? How should the algorithm trade off price and quality?

It's hard to come up with an objective standard to resolve these fine-grained differences, but search technologists have tried. Think of Google: they have a patent on "long clicks." A "long click" is when you search for something and then don't search for it again for quite some time, the implication being that you've found what you were looking for. Google Search ads operate a "pay per click" model, and there's an argument that this aligns Google's ad division's interests with search quality: if the ad division only gets paid when you click a link, they will militate for placing ads that users want to click on.

Platforms are inextricably bound up in this algorithmic information sorting business. Platforms have emerged as the endemic form of internet-based business, which is ironic, because a platform is just an intermediary – a company that connects different groups to each other. The internet's great promise was "disintermediation" – getting rid of intermediaries. We did that, and then we got a whole bunch of new intermediaries.

Usually, those groups can be sorted into two buckets: "business customers" (drivers, merchants, advertisers, publishers, creative workers, etc) and "end users" (riders, shoppers, consumers, audiences, etc). Platforms also sometimes connect end users to each other: think of dating sites, or interest-based forums on Reddit. Either way, a platform's job is to make these connections, and that means platforms are always in the algorithm business.

Whether that's matching a driver and a rider, or an advertiser and a consumer, or a reader and a mix of content from social feeds they're subscribed to and other sources of information on the service, the platform has to make a call as to what you're going to see or do.

These choices are enormously consequential. In the theory of Surveillance Capitalism, these choices take on an almost supernatural quality, where "Big Data" can be used to guess your response to all the different ways of pitching an idea or product to you, in order to select the optimal pitch that bypasses your critical faculties and actually controls your actions, robbing you of "the right to a future tense."

I don't think much of this hypothesis. Every claim to mind control – from Rasputin to MK Ultra to neurolinguistic programming to pick-up artists – has turned out to be bullshit. Besides, you don't need to believe in mind control to explain the ways that algorithms shape our beliefs and actions. When a single company dominates the information landscape – say, when Google controls 90% of your searches – then Google's sorting can deprive you of access to information without you knowing it.

If every "locksmith" listed on Google Maps is a fake referral business, you might conclude that there are no more reputable storefront locksmiths in existence. What's more, this belief is a form of self-fulfilling prophecy: if Google Maps never shows anyone a real locksmith, all the real locksmiths will eventually go bust.

If you never see a social media update from a news source you follow, you might forget that the source exists, or assume they've gone under. If you see a flood of viral videos of smash-and-grab shoplifter gangs and never see a news story about wage theft, you might assume that the former is common and the latter is rare (in reality, shoplifting hasn't risen appreciably, while wage-theft is off the charts).

In the theory of Surveillance Capitalism, the algorithm was invented to make advertisers richer, and then went on to pervert the news (by incentivizing "clickbait") and finally destroyed our politics when its persuasive powers were hijacked by Steve Bannon, Cambridge Analytica, and QAnon grifters to turn millions of vulnerable people into swivel-eyed loons, racists and conspiratorialists.

As I've written, I think this theory gives the ad-tech sector both too much and too little credit, and draws an artificial line between ad-tech and other platform businesses that obscures the connection between all forms of platform decay, from Uber to HBO to Google Search to Twitter to Apple and beyond:

https://pluralistic.net/HowToDestroySurveillanceCapitalism

As a counter to Surveillance Capitalism, I've proposed a theory of platform decay called enshittification, which identifies how the market power of monopoly platforms, combined with the flexibility of digital tools, combined with regulatory capture, allows platforms to abuse both business-customers and end-users, by depriving them of alternatives, then "twiddling" the knobs that determine the rules of the platform without fearing sanction under privacy, labor or consumer protection law, and finally, blocking digital self-help measures like ad-blockers, alternative clients, scrapers, reverse engineering, jailbreaking, and other tech guerrilla warfare tactics:

https://pluralistic.net/2023/01/21/potemkin-ai/#hey-guys

One important distinction between Surveillance Capitalism and enshittification is that enshittification posits that the platform is bad for everyone. Surveillance Capitalism starts from the assumption that surveillance advertising is devastatingly effective (which explains how your racist Facebook uncles got turned into Jan 6 QAnons), and concludes that advertisers must be well-served by the surveillance system.

But advertisers – and other business customers – are very poorly served by platforms. Procter and Gamble reduced its annual surveillance advertising budget from $100m//year to $0/year and saw a 0% reduction in sales. The supposed laser-focused targeting and superhuman message refinement just don't work very well – first, because the tech companies are run by bullshitters whose marketing copy is nonsense, and second because these companies are monopolies who can abuse their customers without losing money.

The point of enshittification is to lock end-users to the platform, then use those locked-in users as bait for business customers, who will also become locked to the platform. Once everyone is holding everyone else hostage, the platform uses the flexibility of digital services to play a variety of algorithmic games to shift value from everyone to the business's shareholders. This flexibility is supercharged by the failure of regulators to enforce privacy, labor and consumer protection standards against the companies, and by these companies' ability to insist that regulators punish end-users, competitors, tinkerers and other third parties to mod, reverse, hack or jailbreak their products and services to block their abuse.

Enshittification needs The Algorithm. When Uber wants to steal from its drivers, it can just do an old-fashioned wage theft, but eventually it will face the music for that kind of scam:

https://apnews.com/article/uber-lyft-new-york-city-wage-theft-9ae3f629cf32d3f2fb6c39b8ffcc6cc6

The best way to steal from drivers is with algorithmic wage discrimination. That's when Uber offers occassional, selective drivers higher rates than it gives to drivers who are fully locked to its platform and take every ride the app offers. The less selective a driver becomes, the lower the premium the app offers goes, but if a driver starts refusing rides, the wage offer climbs again. This isn't the mind-control of Surveillance Capitalism, it's just fraud, shaving fractional pennies off your paycheck in the hopes that you won't notice. The goal is to get drivers to abandon the other side-hustles that allow them to be so choosy about when they drive Uber, and then, once the driver is fully committed, to crank the wage-dial down to the lowest possible setting:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

This is the same game that Facebook played with publishers on the way to its enshittification: when Facebook began aggressively courting publishers, any short snippet republished from the publisher's website to a Facebook feed was likely to be recommended to large numbers of readers. Facebook offered publishers a vast traffic funnel that drove millions of readers to their sites.

But as publishers became more dependent on that traffic, Facebook's algorithm started downranking short excerpts in favor of medium-length ones, building slowly to fulltext Facebook posts that were fully substitutive for the publisher's own web offerings. Like Uber's wage algorithm, Facebook's recommendation engine played its targets like fish on a line.

When publishers responded to declining reach for short excerpts by stepping back from Facebook, Facebook goosed the traffic for their existing posts, sending fresh floods of readers to the publisher's site. When the publisher returned to Facebook, the algorithm once again set to coaxing the publishers into posting ever-larger fractions of their work to Facebook, until, finally, the publisher was totally locked into Facebook. Facebook then started charging publishers for "boosting" – not just to be included in algorithmic recommendations, but to reach their own subscribers.

Enshittification is modern, high-tech enabled, monopolistic form of rent seeking. Rent-seeking is a subtle and important idea from economics, one that is increasingly relevant to our modern economy. For economists, a "rent" is income you get from owning a "factor of production" – something that someone else needs to make or do something.

Rents are not "profits." Profit is income you get from making or doing something. Rent is income you get from owning something needed to make a profit. People who earn their income from rents are called rentiers. If you make your income from profits, you're a "capitalist."

Capitalists and rentiers are in irreconcilable combat with each other. A capitalist wants access to their factors of production at the lowest possible price, whereas rentiers want those prices to be as high as possible. A phone manufacturer wants to be able to make phones as cheaply as possible, while a patent-troll wants to own a patent that the phone manufacturer needs to license in order to make phones. The manufacturer is a capitalism, the troll is a rentier.

The troll might even decide that the best strategy for maximizing their rents is to exclusively license their patents to a single manufacturer and try to eliminate all other phones from the market. This will allow the chosen manufacturer to charge more and also allow the troll to get higher rents. Every capitalist except the chosen manufacturer loses. So do people who want to buy phones. Eventually, even the chosen manufacturer will lose, because the rentier can demand an ever-greater share of their profits in rent.

Digital technology enables all kinds of rent extraction. The more digitized an industry is, the more rent-seeking it becomes. Think of cars, which harvest your data, block third-party repair and parts, and force you to buy everything from acceleration to seat-heaters as a monthly subscription:

https://pluralistic.net/2023/07/24/rent-to-pwn/#kitt-is-a-demon

The cloud is especially prone to rent-seeking, as Yanis Varoufakis writes in his new book, Technofeudalism, where he explains how "cloudalists" have found ways to lock all kinds of productive enterprise into using cloud-based resources from which ever-increasing rents can be extracted:

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

The endless malleability of digitization makes for endless variety in rent-seeking, and cataloging all the different forms of digital rent-extraction is a major project in this Age of Enshittification. "Algorithmic Attention Rents: A theory of digital platform market power," a new UCL Institute for Innovation and Public Purpose paper by Tim O'Reilly, Ilan Strauss and Mariana Mazzucato, pins down one of these forms:

https://www.ucl.ac.uk/bartlett/public-purpose/publications/2023/nov/algorithmic-attention-rents-theory-digital-platform-market-power

The "attention rents" referenced in the paper's title are bait-and-switch scams in which a platform deliberately enshittifies its recommendations, search results or feeds to show you things that are not the thing you asked to see, expect to see, or want to see. They don't do this out of sadism! The point is to extract rent – from you (wasted time, suboptimal outcomes) and from business customers (extracting rents for "boosting," jumbling good results in among scammy or low-quality results).

The authors cite several examples of these attention rents. Much of the paper is given over to Amazon's so-called "advertising" product, a $31b/year program that charges sellers to have their products placed above the items that Amazon's own search engine predicts you will want to buy:

https://pluralistic.net/2022/11/28/enshittification/#relentless-payola

This is a form of gladiatorial combat that pits sellers against each other, forcing them to surrender an ever-larger share of their profits in rent to Amazon for pride of place. Amazon uses a variety of deceptive labels ("Highly Rated – Sponsored") to get you to click on these products, but most of all, they rely two factors. First, Amazon has a long history of surfacing good results in response to queries, which makes buying whatever's at the top of a list a good bet. Second, there's just so many possible results that it takes a lot of work to sift through the probably-adequate stuff at the top of the listings and get to the actually-good stuff down below.

Amazon spent decades subsidizing its sellers' goods – an illegal practice known as "predatory pricing" that enforcers have increasingly turned a blind eye to since the Reagan administration. This has left it with few competitors:

https://pluralistic.net/2023/05/19/fake-it-till-you-make-it/#millennial-lifestyle-subsidy

The lack of competing retail outlets lets Amazon impose other rent-seeking conditions on its sellers. For example, Amazon has a "most favored nation" requirement that forces companies that raise their prices on Amazon to raise their prices everywhere else, which makes everything you buy more expensive, whether that's a Walmart, Target, a mom-and-pop store, or direct from the manufacturer:

https://pluralistic.net/2023/04/25/greedflation/#commissar-bezos

But everyone loses in this "two-sided market." Amazon used "junk ads" to juice its ad-revenue: these are ads that are objectively bad matches for your search, like showing you a Seattle Seahawks jersey in response to a search for LA Lakers merch:

https://www.bloomberg.com/news/articles/2023-11-02/amazon-boosted-junk-ads-hid-messages-with-signal-ftc-says

The more of these junk ads Amazon showed, the more revenue it got from sellers – and the more the person selling a Lakers jersey had to pay to show up at the top of your search, and the more they had to charge you to cover those ad expenses, and the more they had to charge for it everywhere else, too.

The authors describe this process as a transformation between "attention rents" (misdirecting your attention) to "pecuniary rents" (making money). That's important: despite decades of rhetoric about the "attention economy," attention isn't money. As I wrote in my enshittification essay:

You can't use attention as a medium of exchange. You can't use it as a store of value. You can't use it as a unit of account. Attention is like cryptocurrency: a worthless token that is only valuable to the extent that you can trick or coerce someone into parting with "fiat" currency in exchange for it. You have to "monetize" it – that is, you have to exchange the fake money for real money.

The authors come up with some clever techniques for quantifying the ways that this scam harms users. For example, they count the number of places that an advertised product rises in search results, relative to where it would show up in an "organic" search. These quantifications are instructive, but they're also a kind of subtweet at the judiciary.

In 2018, SCOTUS's ruling in American Express v Ohio changed antitrust law for two-sided markets by insisting that so long as one side of a two-sided market was better off as the result of anticompetitive actions, there was no antitrust violation:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3346776

For platforms, that means that it's OK to screw over sellers, advertisers, performers and other business customers, so long as the end-users are better off: "Go ahead, cheat the Uber drivers, so long as you split the booty with Uber riders."

But in the absence of competition, regulation or self-help measures, platforms cheat everyone – that's the point of enshittification. The attention rents that Amazon's payola scheme extract from shoppers translate into higher prices, worse goods, and lower profits for platform sellers. In other words, Amazon's conduct is so sleazy that it even threads the infinitesimal needle that the Supremes created in American Express.

Here's another algorithmic pecuniary rent: Amazon figured out which of its major rivals used an automated price-matching algorithm, and then cataloged which products they had in common with those sellers. Then, under a program called Project Nessie, Amazon jacked up the prices of those products, knowing that as soon as they raised the prices on Amazon, the prices would go up everywhere else, so Amazon wouldn't lose customers to cheaper alternatives. That scam made Amazon at least a billion dollars:

https://gizmodo.com/ftc-alleges-amazon-used-price-gouging-algorithm-1850986303

This is a great example of how enshittification – rent-seeking on digital platforms – is different from analog rent-seeking. The speed and flexibility with which Amazon and its rivals altered their prices requires digitization. Digitization also let Amazon crank the price-gouging dial to zero whenever they worried that regulators were investigating the program.

So what do we do about it? After years of being made to look like fumblers and clowns by Big Tech, regulators and enforcers – and even lawmakers – have decided to get serious.

The neoliberal narrative of government helplessness and incompetence would have you believe that this will go nowhere. Governments aren't as powerful as giant corporations, and regulators aren't as smart as the supergeniuses of Big Tech. They don't stand a chance.

But that's a counsel of despair and a cheap trick. Weaker US governments have taken on stronger oligarchies and won – think of the defeat of JD Rockefeller and the breakup of Standard Oil in 1911. The people who pulled that off weren't wizards. They were just determined public servants, with political will behind them. There is a growing, forceful public will to end the rein of Big Tech, and there are some determined public servants surfing that will.

In this paper, the authors try to give those enforcers ammo to bring to court and to the public. For example, Amazon claims that its algorithm surfaces the products that make the public happy, without the need for competitive pressure to keep it sharp. But as the paper points out, the only successful new rival ecommerce platform – Tiktok – has found an audience for an entirely new category of goods: dupes, "lower-cost products that have the same or better features than higher cost branded products."

The authors also identify "dark patterns" that platforms use to trick users into consuming feeds that have a higher volume of things that the company profits from, and a lower volume of things that users want to see. For example, platforms routinely switch users from a "following" feed – consisting of things posted by people the user asked to hear from – with an algorithmic "For You" feed, filled with the things the company's shareholders wish the users had asked to see.

Calling this a "dark pattern" reveals just how hollow and self-aggrandizing that term is. "Dark pattern" usually means "fraud." If I ask to see posts from people I like, and you show me posts from people who'll pay you for my attention instead, that's not a sophisticated sleight of hand – it's just a scam. It's the social media equivalent of the eBay seller who sends you an iPhone box with a bunch of gravel inside it instead of an iPhone. Tech bros came up with "dark pattern" as a way of flattering themselves by draping themselves in the mantle of dopamine-hacking wizards, rather than unimaginative con-artists who use a computer to rip people off.

These For You algorithmic feeds aren't just a way to increase the load of sponsored posts in a feed – they're also part of the multi-sided ripoff of enshittified platforms. A For You feed allows platforms to trick publishers and performers into thinking that they are "good at the platform," which both convinces to optimize their production for that platform, and also turns them into Judas Goats who conspicuously brag about how great the platform is for people like them, which brings their peers in, too.

In Veena Dubal's essential paper on algorithmic wage discrimination, she describes how Uber drivers whom the algorithm has favored with (temporary) high per-ride rates brag on driver forums about their skill with the app, bringing in other drivers who blame their lower wages on their failure to "use the app right":

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4331080

As I wrote in my enshittification essay:

If you go down to the midway at your county fair, you'll spot some poor sucker walking around all day with a giant teddy bear that they won by throwing three balls in a peach basket.

The peach-basket is a rigged game. The carny can use a hidden switch to force the balls to bounce out of the basket. No one wins a giant teddy bear unless the carny wants them to win it. Why did the carny let the sucker win the giant teddy bear? So that he'd carry it around all day, convincing other suckers to put down five bucks for their chance to win one:

https://boingboing.net/2006/08/27/rigged-carny-game.html

The carny allocated a giant teddy bear to that poor sucker the way that platforms allocate surpluses to key performers – as a convincer in a "Big Store" con, a way to rope in other suckers who'll make content for the platform, anchoring themselves and their audiences to it.

Platform can't run the giant teddy-bear con unless there's a For You feed. Some platforms – like Tiktok – tempt users into a For You feed by making it as useful as possible, then salting it with doses of enshittification:

https://www.forbes.com/sites/emilybaker-white/2023/01/20/tiktoks-secret-heating-button-can-make-anyone-go-viral/

Other platforms use the (ugh) "dark pattern" of simply flipping your preference from a "following" feed to a "For You" feed. Either way, the platform can't let anyone keep the giant teddy-bear. Once you've tempted, say, sports bros into piling into the platform with the promise of millions of free eyeballs, you need to withdraw the algorithm's favor for their content so you can give it to, say, astrologers. Of course, the more locked-in the users are, the more shit you can pile into that feed without worrying about them going elsewhere, and the more giant teddy-bears you can give away to more business users so you can lock them in and start extracting rent.

For regulators, the possibility of a "good" algorithmic feed presents a serious challenge: when a feed is bad, how can a regulator tell if its low quality is due to the platform's incompetence at blocking spammers or guessing what users want, or whether it's because the platform is extracting rents?

The paper includes a suite of recommendations, including one that I really liked:

Regulators, working with cooperative industry players, would define reportable metrics based on those that are actually used by the platforms themselves to manage search, social media, e-commerce, and other algorithmic relevancy and recommendation engines.

In other words: find out how the companies themselves measure their performance. Find out what KPIs executives have to hit in order to earn their annual bonuses and use those to figure out what the company's performance is – ad load, ratio of organic clicks to ad clicks, average click-through on the first organic result, etc.

They also recommend some hard rules, like reserving a portion of the top of the screen for "organic" search results, and requiring exact matches to show up as the top result.

I've proposed something similar, applicable across multiple kinds of digital businesses: an end-to-end principle for online services. The end-to-end principle is as old as the internet, and it decrees that the role of an intermediary should be to deliver data from willing senders to willing receivers as quickly and reliably as possible. When we apply this principle to your ISP, we call it Net Neutrality. For services, E2E would mean that if I subscribed to your feed, the service would have a duty to deliver it to me. If I hoisted your email out of my spam folder, none of your future emails should land there. If I search for your product and there's an exact match, that should be the top result:

https://www.eff.org/deeplinks/2023/04/platforms-decay-lets-put-users-first

One interesting wrinkle to framing platform degradation as a failure to connect willing senders and receivers is that it places a whole host of conduct within the regulatory remit of the FTC. Section 5 of the FTC Act contains a broad prohibition against "unfair and deceptive" practices:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

That means that the FTC doesn't need any further authorization from Congress to enforce an end to end rule: they can simply propose and pass that rule, on the grounds that telling someone that you'll show them the feeds that they ask for and then not doing so is "unfair and deceptive."

Some of the other proposals in the paper also fit neatly into Section 5 powers, like a "sticky" feed preference. If I tell a service to show me a feed of the people I follow and they switch it to a For You feed, that's plainly unfair and deceptive.

All of this raises the question of what a post-Big-Tech feed would look like. In "How To Break Up Amazon" for The Sling, Peter Carstensen and Darren Bush sketch out some visions for this:

https://www.thesling.org/how-to-break-up-amazon/

They imagine a "condo" model for Amazon, where the sellers collectively own the Amazon storefront, a model similar to capacity rights on natural gas pipelines, or to patent pools. They see two different ways that search-result order could be determined in such a system:

"specific premium placement could go to those vendors that value the placement the most [with revenue] shared among the owners of the condo"

or

"leave it to owners themselves to create joint ventures to promote products"

Note that both of these proposals are compatible with an end-to-end rule and the other regulatory proposals in the paper. Indeed, all these policies are easier to enforce against weaker companies that can't afford to maintain the pretense that they are headquartered in some distant regulatory haven, or pay massive salaries to ex-regulators to work the refs on their behalf:

https://www.thesling.org/in-public-discourse-and-congress-revolvers-defend-amazons-monopoly/

The re-emergence of intermediaries on the internet after its initial rush of disintermediation tells us something important about how we relate to one another. Some authors might be up for directly selling books to their audiences, and some drivers might be up for creating their own taxi service, and some merchants might want to run their own storefronts, but there's plenty of people with something they want to offer us who don't have the will or skill to do it all. Not everyone wants to be a sysadmin, a security auditor, a payment processor, a software engineer, a CFO, a tax-preparer and everything else that goes into running a business. Some people just want to sell you a book. Or find a date. Or teach an online class.