#finance marketing

Explore tagged Tumblr posts

Text

What services do you offer to help my finance business grow?

We provide targeted marketing strategies, including social media management, content creation, SEO optimization, and email campaigns, specifically designed to attract and retain clients in the finance sector.

#Finance marketing#Financial services marketing#Investment marketing#Wealth management marketing#SEO for finance#Finance social media#Financial content creation

0 notes

Text

Merchant Funding Advance - Live Links

https://www.reddit.com/user/merchantFundbusiness/comments/18hgjd2/the_best_funding_strategies_for_small_business/https://www.diigo.com/item/image/afp19/0o71

#merchant funding advance#funding business#Funding for Small Business Startup#Finance Marketing#Business

0 notes

Text

#girl butts#big bootie#phat butt#amazing body#beautiful#bootiecandy#bootie peach#cutie w a bootie#curvy body#curvy and cute#curvy girls#curvy chicks#curvy mature#slim and sexy#so hot and sexy#sexy chick#so hot 🔥🔥🔥#sexy pose#big juicy ass#hot as hell#accounting#stock market#sales#economy#finance#thick and juicy#big round butt

855 notes

·

View notes

Text

Thinking again about how many disabled people end up getting shunted into art/craft work because like. You can technically do it. Sometimes. Yeah you make a pittance at best and are almost certainly going to make your physical health worse by pushing yourself to get things done, but what else are you gonna do? You're too sick for anyone to hire you. You're "not sick enough" to qualify for benefits. Just devote every scrap of time and energy you have to a chronically underpaid, low-prestige, incredibly labor-intensive industry. A few people manage to make it work with luck and help and the right skills. Many people don't. Everyone gets pressured to monetize their hobbies, but it's especially insidious if you're disabled because any tiny thing you manage to accomplish to bring yourself joy gets twisted into proof that you should somehow be able to work.

#curseblogging#the thing is like#i went to bookbinding school#i saw what it was like to try to make a living as a craft worker for able-bodied people with significant starting resources#and the answer is: fucking hard!#people generally being like well if you work long hours and never allow yourself a break#and do a bunch of events and shows and teaching#and are good at not just the work but at finances and marketing and every other aspect of business management#(and ideally have a spouse with a regular job so you don't have to pay for your own healthcare. because this is America)#then maybe#MAYBE#you can make a reasonable living as a craftsperson#but this same VERY DIFFICULT PROFESSION#gets pushed on disabled people as something obvious and easy#and a lot of people do try their best to make it work because what other choice do they have?!

442 notes

·

View notes

Text

#communism#communist#socialism#socialist#social issues#economy#finance#markets#business#economics#business news#corrupt gop#democrats are corrupt#governors#alleged#billionaires#billionaire#eat the rich#tax the rich#expensive#wealth#money#luxury

3K notes

·

View notes

Text

🐙⚔️

#new method of dining & dashing: dine and doze. sleep until they give up on u and u get out of the bill. its genius#he didnt even order a drink like silver ur bill wouldnt be too high. surely. glances at azul#im actually v curious abt the finances of briar valley students beyond malleus. like im sure lilia is taken care of from military days#but like? the guy is retired. so when did he officially retire in a 'no longer getting income' way. or do they do pensions#or did he invest. or save. does twst have 401ks. what abt roth iras. what abt etfs. money market accts? high int savings?? i need to know#did he get a bond for silver as a baby that he can take out at 18. does silver get allowance. or part time job? i NEED TO KNOW#sebek seems middle class so do lilia and silver BUT I NEED DETAILS#also in the bg pretend trey is talking to jade offscreen. and the canonicity of this drawing is after book 5#so no ortho OR sebek in freshmen squad. not yet#twst#twisted wonderland#twst silver#azul ashengrotto#ace trappola#deuce spade#jack howl#epel felmier#trey clover#suntails#i would say mostro lounge was fun to draw but i dont make a habit of lying#well i mean. it wasnt NOT fun. it was satisfying? i felt accomplished? but the process was a bit rough

265 notes

·

View notes

Text

One of the funniest things about communism is that it rests on a premise that's basically like, "Hey, once everybody voluntarily gives up a specific set of strategies and advantages, everything will be wonderful. So, once we figure out how to coerce everybody into voluntarily giving those up, we'll be set."

174 notes

·

View notes

Text

I am Nadi Hamad from Gaza, I am 25 years old, and my house, my dream, my loved ones, and my life have been destroyed, and because I only have a tent without a cover and clothes, and I have a job as a men’s barber, and people do not have money to shave, and I help them with a free shave, and I want you to support me in being able to help diamonds and children get a free shave, and thank you to everyone who helps me.

I shave for the sad children of Gaza who have tasted fear, hunger and destruction, and shave for them free of charge and draw a beautiful smile on their faces and make them forget the deadly pain. I want you to support me and thank you.

The children of Gaza need help to make them happy and put a smile on their faces. Help me

#accounting#black art#book blog#finance#marketing#reading#book photography#poster#spilled thoughts#stock market#gaza#free gaza

131 notes

·

View notes

Note

So the stock market is crashing or at least dropping. Is there a point when I should move my 401k savings? I know youre supposed to leave them alone. But im 25 and the thought of the 24k i have in there all dissappearing and needing to start over is stressful.

DO NOTHING.

Go outside and pet a tree or something instead.

Yesterday the stock market took a temporary drop. How much of a drop? I literally don't even know because I haven't logged into my brokerage firm's dashboard to look. It doesn't matter. And I have about twelve times as much money invested as you.

Here's why we don't believe there's a point at which you should move your 401(k) out of the stock market:

Wait... Did I Just Lose All My Money Investing in the Stock Market?

And here's a more detailed lesson on how to reallocate your retirement fund as you grow older so it's less invested in stocks and more in bonds, which is as close as we get to recommending you move things out of the stock market:

Investing Deathmatch: Stocks vs. Bonds

One last thing: There's a faction of conservative finance bros who are attempting to manufacture economic anxiety in order to influence the U.S. presidential election. Ignore similar freak-outs for the next few months. Keep to your personal financial plan and you'll be just fine.

Did we just help you out? Tip us!

#stock market#investing#investing in the stock market#stock market crash#recession#economy#economics#personal finance#how to invest#401k#retirement fund#investments#money

173 notes

·

View notes

Text

Can’t stop thinking about modern!Rilla who starts a skincare brand with Una Meredith and they 100% make it to the top.

(Bonus points for Persis Ford marketing them all the way to the moon!)

#yes I will elaborate on this#listen….rilla was out here organising Red Cross meetings at age 14!!!#14 man!!#that’s impressive!!#and yea the books tell her she’s not clever or ambitious but they were also published in 1920’s sooo#she WOULD#and i always headcanoned Una as someone good with numbers i dont know why#she just seemed practical that way#and Rilla always gave off science kid vibes to me#like the way she raised Jims by consulting Morgan on everything and working very methodically?#If it was 2024 she’d be on r/ScienceBasedParenting I mean she practically ripped Irene’s throat out for kissing Jim’s#Now envision Rilla using her degree in cosmetic chemistry and Una using her finance and business degree#oh yea that’s the magic#Persis definitely gets in on it and is a marketing genius lmao#aogg#Rilla of ingleside#Rilla Blythe#Una Meredith#Persis Ford#lmm#Lucy maud Montgomery

33 notes

·

View notes

Text

#big round butt#curvy body#big bootie#amazing body#beautiful#bootiecandy#cutie w a bootie#bootie peach#phat bubble#perfect butt#girl butts#great butt#phat butt#slim and sexy#so hot and sexy#sexy chick#so hot 🔥🔥🔥#sexy pose#accounting#sales#stock market#economy#finance

360 notes

·

View notes

Text

Real me

48 notes

·

View notes

Text

Private equity ghouls have a new way to steal from their investors

Private equity is quite a racket. PE managers pile up other peoples’ money — pension funds, plutes, other pools of money — and then “invest” it (buying businesses, loading them with debt, cutting wages, lowering quality and setting traps for customers). For this, they get an annual fee — 2% — of the money they manage, and a bonus for any profits they make.

On top of this, private equity bosses get to use the carried interest tax loophole, a scam that lets them treat this ordinary income as a capital gain, so they can pay half the taxes that a working stiff would pay on a regular salary. If you don’t know much about carried interest, you might think it has to do with “interest” on a loan or a deposit, but it’s way weirder. “Carried interest” is a tax regime designed for 16th century sea captains and their “interest” in the cargo they “carried”:

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity is a cancer. Its profits come from buying productive firms, loading them with debt, abusing their suppliers, workers and customers, and driving them into ground, stiffing all of them — and the company’s creditors. The mafia have a name for this. They call it a “bust out”:

https://pluralistic.net/2023/06/02/plunderers/#farben

Private equity destroyed Toys R Us, Sears, Bed, Bath and Beyond, and many more companies beloved of Main Street, bled dry for Wall Street:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

And they’re coming for more. PE funds are “rolling up” thousands of Boomer-owned business as their owners retire. There’s a good chance that every funeral home, pet groomer and urgent care clinic within an hour’s drive of you is owned by a single PE firm. There’s 2.9m more Boomer-owned businesses going up for sale in the coming years, with 32m employees, and PE is set to buy ��em all:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE funds get their money from “institutional investors.” It shouldn’t surprise you to learn they treat their investors no better than their creditors, nor the customers, employees or suppliers of the businesses they buy.

Pension funds, in particular, are the perennial suckers at the poker table. My parent’s pension fund, the Ontario Teachers’ Fund, are every grifter’s favorite patsy, losing $90m to Sam Bankman-Fried’s cryptocurrency scam:

https://www.otpp.com/en-ca/about-us/news-and-insights/2022/ontario-teachers--statement-on-ftx/

Pension funds are neck-deep in private equity, paying steep fees for shitty returns. Imagine knowing that the reason you can’t afford your apartment anymore is your pension fund gambled with the private equity firm that bought your building and jacked up the rent — and still lost money:

https://pluralistic.net/2020/02/25/pluralistic-your-daily-link-dose-25-feb-2020/

But there’s no depth too low for PE looters to sink to. They’ve found an exciting new way to steal from their investors, a scam called a “continuation fund.” Writing in his latest newsletter, the great Matt Levine breaks it down:

https://news.bloomberglaw.com/mergers-and-acquisitions/matt-levines-money-stuff-buyout-funds-buy-from-themselves

Here’s the deal: say you’re a PE guy who’s raised a $1b fund. That entitles you to a 2% annual “carry” on the fund: $20,000,000/year. But you’ve managed to buy and asset strip so many productive businesses that it’s now worth $5b. Your carry doesn’t go up fivefold. You could sell the company and collect your 20% commission — $800m — but you stop collecting that annual carry.

But what if you do both? Here’s how: you create a “continuation fund” — a fund that buys your old fund’s portfolio. Now you’ve got $5b under management and your carry quintuples, to $100m/year. Levine dryly notes that the FT calls this “a controversial type of transaction”:

https://www.ft.com/content/11549c33-b97d-468b-8990-e6fd64294f85

These deals “look like a pyramid scheme” — one fund flips its assets to another fund, with the same manager running both funds. It’s a way to make the pie bigger, but to decrease the share (in both real and proportional terms) going to the pension funds and other institutional investors who backed the fund.

A PE boss is supposed to be a fiduciary, with a legal requirement to do what’s best for their investors. But when the same PE manager is the buyer and the seller, and when the sale takes place without inviting any outside bidders, how can they possibly resolve their conflict of interest?

They can’t: 42% of continuation fund deals involve a sale at a value lower than the one that the PE fund told their investors the assets were worth. Now, this may sound weird — if a PE boss wants to set a high initial value for their fund in order to maximize their carry, why would they sell its assets to the new fund at a discount?

Here’s Levine’s theory: if you’re a PE guy going back to your investors for money to put in a new fund, you’re more likely to succeed if you can show that their getting a bargain. So you raise $1b, build it up to $5b, and then tell your investors they can buy the new fund for only $3b. Sure, they can get out — and lose big. Or they can take the deal, get the new fund at a 40% discount — and the PE boss gets $60m/year for the next ten years, instead of the $20m they were getting before the continuation fund deal.

PE is devouring the productive economy and making the world’s richest people even richer. The one bright light? The FTC and DoJ Antitrust Division just published new merger guidelines that would make the PE acquire/debt-load/asset-strip model illegal:

https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

The bad news is that some sneaky fuck just slipped a 20% FTC budget cut — $50m/year — into the new appropriations bill:

https://twitter.com/matthewstoller/status/1681830706488438785

They’re scared, and they’re fighting dirty.

I’m at San Diego Comic-Con!

Today (Jul 20) 16h: Signing, Tor Books booth #2802 (free advance copies of The Lost Cause — Nov 2023 — to the first 50 people!)

Tomorrow (Jul 21):

1030h: Wish They All Could be CA MCs, room 24ABC (panel)

12h: Signing, AA09

Sat, Jul 22 15h: The Worlds We Return To, room 23ABC (panel)

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

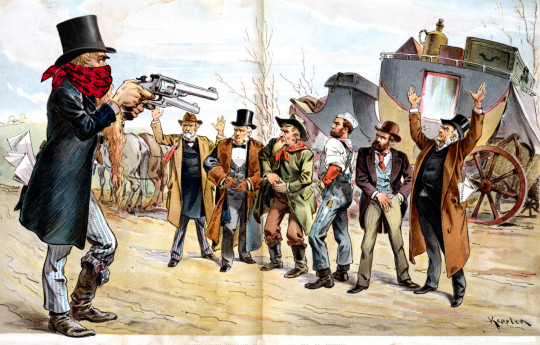

[Image ID: An old Punch editorial cartoon depicting a bank-robber sticking up a group of businesspeople and workers. He wears a bandanna emblazoned with dollar-signs and a top-hat.]

#pluralistic#buyout groups#continuation fraud#pe#pyramid schemes#the sucker at the table#pension plans#continuation funds#matt levine#fiduciaries#finance#private equity#mark to market#ripoffs

309 notes

·

View notes

Text

#forex#forex analysis#forex broker#forex education#forex expert advisor#forex indicators#forex market#forex robot#forexmastery#wealth#sexi bodi#sexy chick#united states#so hot 🔥🔥🔥#so hot and sexy#sexy pose#sexy and beautiful#so fucking sexy#rich#money#finances#invest#cash#income

27 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

68 notes

·

View notes