#file taxes

Explore tagged Tumblr posts

Text

psa for usamericans

if you live in any of the states below: the tax filing resource you should be looking for is IRS Direct File; you can file federal taxes directly on the IRS' website, they have a free support helpline if you're stuck, they'll also redirect you to a free preparer for state taxes, and it should work with most tax situations

if you live in any other state (or aren't eligible for Direct File) and your total income for the year was $84,000 or less, you're eligible for IRS Free File; this only covers federal taxes, and works through external providers, but will guarantee that you can use their tax preparation services for free

if you are eligible for Direct File, though, you should use it! obviously very few things about the current political situation are certain right now, but it is a genuinely good and revolutionary way to handle tax paperwork and it's a lot more likely to stick around and expand into more states if more people actually know how to access it and end up using it

#maple.txt#taxes#have seen like 3 different PSAs talking about direct file and how cool it is before promptly linking exclusively to free file#so this is my attempt to correct the record

14K notes

·

View notes

Text

Phone: (734) 985-6800

Address: 1024 Ecorse Rd Suite A, Ypsilanti, MI 48197

Tax Shield Service offers expert Tax preparation and Refund advances, including Holiday and Shield Advances, Referrals, Tax planning, Christmas Advances, consultations and Audit support. Our seasoned tax consultants minimize tax liabilities and maximize savings. Specializing in business tax preparation and compliance.

1 note

·

View note

Text

How Marriage Affects Your Taxes: Filing Jointly vs. Separately

When Sarah and Michael got married, they knew they were signing up for a lifetime of partnership. They had talked about everything—finances, future kids, even where they wanted to retire someday. But as their first tax season approached as a married couple, they found themselves facing an unexpected dilemma: Should they file their taxes jointly or separately? Like many newlyweds, they had assumed that filing jointly was the obvious choice, but a few conversations with friends and some online research left them more confused than ever. What would give them the best financial outcome? They weren’t sure if filing separately might actually save them money or if they were better off sticking together in their tax filing, just as they had vowed to do in life.

Filing Jointly: The Standard Option for Married Couples

The vast majority of married couples in the United States choose to file their taxes jointly—and for good reason. Filing jointly offers several advantages, particularly for those with a significant income disparity between spouses. When filing jointly, the IRS treats both spouses as a single taxable entity, combining their incomes and applying a unified tax bracket. This often results in a lower overall tax rate compared to filing separately.

For example, in 2024, married couples filing jointly are eligible for a standard deduction of $27,700. This is double the standard deduction for single filers, which is $13,850. The larger deduction reduces the couple's taxable income, often leading to a lower tax bill.

Additionally, many tax credits and deductions are only available to couples who file jointly. These include the Earned Income Tax Credit (EITC), the Child and Dependent Care Credit, and education credits like the American Opportunity Tax Credit (AOTC). For Sarah and Michael, who were hoping to take advantage of these credits, filing jointly seemed like the clear choice.

The Benefits of Filing Separately

Despite the advantages of filing jointly, there are situations where it might make sense for a couple to file separately. While less common, filing separately can be beneficial if one spouse has significant medical expenses, high miscellaneous itemized deductions, or large unreimbursed business expenses.

The IRS allows taxpayers to deduct medical expenses that exceed 7.5% of their adjusted gross income (AGI). If Sarah had significant medical bills, filing separately could lower her AGI, making it easier to meet the threshold for deducting these expenses. For instance, if Sarah's AGI were $50,000 when filing jointly, she could only deduct medical expenses above $3,750. However, if her individual AGI was $25,000 when filing separately, she could deduct expenses above $1,875—potentially resulting in more substantial deductions.

Filing separately can also be advantageous if one spouse has a much higher income and the other has significant deductible expenses. This scenario might apply if one spouse is a business owner with considerable deductions for things like home office expenses, travel, and equipment.

The Marriage Penalty and Marriage Bonus

One of the key factors that influence the decision to file jointly or separately is the so-called "marriage penalty" or "marriage bonus." The marriage penalty occurs when a couple’s combined income pushes them into a higher tax bracket than they would have been in if they had filed as single individuals. This typically happens when both spouses have relatively high and similar incomes.

For example, in 2024, the 24% tax bracket for single filers applies to income between $95,376 and $182,100. For married couples filing jointly, the same bracket covers income from $190,751 to $364,200. If Sarah and Michael each earned $150,000, their combined income of $300,000 would be taxed at a higher rate than if they were single.

On the other hand, a marriage bonus occurs when one spouse earns significantly more than the other. The lower-earning spouse’s income essentially "fills up" the lower tax brackets, reducing the overall tax rate for the couple. This is one of the reasons why most married couples benefit from filing jointly.

Considerations Beyond Taxes

While taxes are an important consideration, they are not the only factor to weigh when deciding whether to file jointly or separately. Filing separately can complicate the tax filing process, potentially leading to higher preparation costs and increased likelihood of errors. Additionally, when filing separately, both spouses must take the standard deduction or both must itemize their deductions—they cannot choose different options.

Moreover, some tax benefits are completely off the table if you file separately. For instance, if Sarah and Michael were hoping to deduct student loan interest or claim education credits, they would need to file jointly, as these benefits are not available to those who file separately.

The Importance of Professional Advice

As Sarah and Michael discovered, the decision to file jointly or separately is not always straightforward. Their financial situation, income disparity, and potential deductions all needed to be carefully considered. They decided to consult a tax professional to analyze their options and determine the best approach for their specific circumstances. This decision proved wise, as their advisor was able to help them navigate the complexities of the tax code and make an informed choice.

Conclusion

Deciding whether to file jointly or separately is a crucial decision for married couples that can have significant financial implications. While most couples benefit from filing jointly, there are scenarios where filing separately might be advantageous. Understanding your financial situation and the potential impact on your tax liability is essential in making the right choice. For couples who also run a business, seeking a tax service for small business can provide additional insights and ensure that all tax benefits are maximized. Whether you choose to file jointly or separately, the key is to make an informed decision that aligns with your financial goals.

0 notes

Text

i really think some of you are just lazy…like omg what do you mean I have to do the dishes again I just did them yesterday?!?

#voting is a basic adult task you have to do regularly like filing taxes and getting your oil changed and cleaning your bathroom 🤷♀️#no it won’t solve everything but my god you can show up to a church or school or whatever every couple years for 30 minutes. jesus#firebombing a Walmart tweet.jpg

12K notes

·

View notes

Text

What are the 5 Things You Will Need to File Your Taxes?

Filing taxes can be a daunting task, but being well-prepared can make the process smoother and less stressful. To ensure a successful tax-filing experience, it's crucial to gather all the necessary documents and information before you start. In this article, we'll discuss the five essential things you'll need to file your taxes efficiently while also addressing the importance of staying organized and meeting tax deadlines.

1. Personal Information

One of the first things you'll need to file your taxes is your personal information. This includes your full name, Social Security number (or Taxpayer Identification Number), and the same information for your spouse if you're married and filing jointly. It's vital to ensure that this information is accurate, as any errors can lead to delays or complications in the tax filing process.

2. Income Documents

Income documents are the heart of your tax return, as they help determine your taxable income. The key income documents you'll need include:

a. W-2 Forms: If you're an employee, your employer will provide a W-2 form that outlines your annual earnings, taxes withheld, and other essential details.

b. 1099 Forms: If you're self-employed or receive income from freelance work, investments, or other sources, you'll likely receive 1099 forms, such as 1099-MISC or 1099-INT, to report this income.

c. Statements of Additional Income: You should gather information on any additional income sources, like rental income, alimony, or any income from side gigs.

3. Deductions and Credits

To reduce your tax liability, it's crucial to gather documents related to deductions and credits. This includes:

a. Receipts and documentation for deductible expenses like mortgage interest, property taxes, medical expenses, and charitable contributions.

b. Proof of educational expenses, such as Form 1098-T for education-related tax credits.

c. Records of business-related expenses if you're self-employed.

4. Records of Investment Income

If you have investments, you'll need to gather records related to investment income. This includes statements from your brokerage accounts, records of capital gains or losses, and any dividend income. Additionally, you may need to report interest income from savings accounts or certificates of deposit.

5. Prior-Year Tax Returns

Having access to your prior-year tax returns can be incredibly helpful when filing your current taxes. It can serve as a reference point, helping you ensure that you don't miss any essential information or deductions. In case you're using tax preparation software or a tax professional, they may also request this information to expedite the process.

Conclusion

Filing your taxes can be a complex and time-consuming task, but being well-prepared with the essential documents and information can significantly simplify the process. Gathering your personal information, income documents, deductions and credits records, investment income details, and prior-year tax returns will help ensure a smooth tax-filing experience.

If you find the process overwhelming, consider using professional tax filing services to navigate the complexities of the tax code and maximize your deductions and credits.

Remember that staying organized and meeting tax deadlines are equally important to avoid penalties and ensure that you receive any refunds you're entitled to. So, don't procrastinate; start gathering your tax-related documents today to make your tax season a breeze.

1 note

·

View note

Text

Sea Cryptic! Danny AU- Pt.3

[Pt.1] [Pt.2] [Pt.4] [Pt.5] [Pt.6] [Pt.7] [Pt.8] [Pt.9] [Pt.10]

“Aquaman.” Batman swept into the room, beelining straight for the suddenly apprehensive Atlantean king.

“Batman. What can I do for you?”

“Phantom. Does he pay taxes?”

“Pardon?”

Batman makes a low noise that had Aquaman’s danger senses buzzing.

“Does Phantom have to pay taxes. Towards Atlantis.”

“No…? Why?”

“He wanted money, in exchange for… information, of a delicate sort,” Batman said, diplomatically avoiding the topic of Phantom bargaining for the identities of corpses in exchange for a measly $100 dollars per identity. Like a flea market dealer, that one was.

“You encountered Phantom again?” Aquaman perked up.

“Yes. Gotham’s bay is… polluted.” Batman paused. “With victims. Of murder.”

The entire area quieted as heads turned towards the Dark Knight.

“Yes, I am… distantly aware of Gotham’s waters.” By that, Aquaman gets green around the gills whenever he turns his awareness in that direction. There’s a reason he doesn’t enter Gotham, and the Dark Knight’s ban is only half of that reason. “Ah, but you’re correct. For what purpose would Phantom need mortal currency?”

“Hn.”

“Maybe he needs some stuff?” Flash zipped to a stop next to Batman, feet tapping as he dug into the pile of snacks cradled in his arms. “Us mortals are always coming up with new things, maybe he wants to try some games or something?”

Batman tilted his head down, seriously considering Flash’s suggestion. “It’s plausible.”

“Barry, Barry, Barry. He’s old as hell, right? He probably wants to try the new booze!”

“Hal, my man!” Flash fist bumped Green Lantern, who came up. “You’re back! What happened to John?”

“Dunno. He got called somewhere that way,” Green Lantern waved a vague hand towards the left. “Had to deal with a politician or something from that area.” He shrugged, swinging an arm over Barry’s shoulders to put him in a headlock and stealing a chip.

“Huh. Anyways, would our mortal alcohol even work on a demi-god or something?”

“We should ask!” Hal turned towards Batman. “You should ask if he wants to go for a drink, spooky!”

“He’s a child.”

“He’s been around for more than a millennia, Bats.”

“Informational gathering, right, Hal?” Flashgot out of the headlock, quickly munching on his snacks to stop Green Lantern from stealing them.

“Totally. Yup.”

“…Fine.”

“Wait, are we just gonna ignore that Gotham’s waters are full of bodies?”

“Yes.”

——

“What?” Danny asked, mind half on the bags he’s dragging out of the water and the other half on the essay he has to submit in about four hours.

“Green Lantern wanted to invite you out for a drink.”

Danny turned to the stoic Gotham knight, who had his wrist computer out to log the bodies’ info the moment Danny gave him the information. Some of them even told Danny who murdered them, so Batman could start building cases with solid leads.

Danny’s only twenty. He’s not legal yet but he doesn’t want to give any clues to who he is. How is he supposed to…

Ah!

“Can’t.” Danny shrugged. “I’m not legal. I died when I was fourteen so…” Danny trailed off, speechless at the drowned puppy face Batman was giving him. What the fuck.

“Anyways, fork over my payment.”

Batman wordlessly hands him a wad of hundreds.

“What do you need cash for?” Batman suddenly asked.

“Huh? Isn’t it obvious?” Danny tucked it in. “Material things, obviously. I need a blanket,” because holy shit, Gotham is damn cold this time of year. “Anyways, see you same time next week, litterer.”

“I don’t litter.”

“Tell that to the batarangs I found under the water,” Danny grumbled. “But I’ll stop calling you that if you get a signature from Poison Ivy. I have a friend who loves her.”

“An alive friend?”

“Wouldn’t you like to know, weatherboy?”

Danny snickered and disappeared. He’s gotta cram that essay.

——

“There’s a possibility Phantom might be homeless.”

“Batman, I mean this in the nicest way, but for the love of Atlantis, please stop giving me headaches. It’s time like these I wish I stayed a lighthouse keeper.”

#batman#danny phantom#bruce wayne#dc x dp#bamf danny phantom#dpxdc#dcxdp#hal jordan#green lantern#the flash#Barry allen#mentions of Sam mason#phantom doesn’t pay taxes#but Danny Fenton absolutely pays taxes#his parents taught him how to file taxes#tax season is coming up soon tall I’m stressed#arthur curry#Aquaman#Aquaman and being interrogated on Atlantean history#Batman’s nickname is the litterer#you can’t tell me that batarangs don’t go everywhere#sea cryptic! danny au

6K notes

·

View notes

Text

Retiring the US debt would retire the US dollar

THIS WEDNESDAY (October 23) at 7PM, I'll be in DECATUR, GEORGIA, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

One of the most consequential series of investigative journalism of this decade was the Propublica series that Jesse Eisinger helmed, in which Eisinger and colleagues analyzed a trove of leaked IRS tax returns for the richest people in America:

https://www.propublica.org/series/the-secret-irs-files

The Secret IRS Files revealed the fact that many of America's oligarchs pay no tax at all. Some of them even get subsidies intended for poor families, like Jeff Bezos, whose tax affairs are so scammy that he was able to claim to be among the working poor and receive a federal Child Tax Credit, a $4,000 gift from the American public to one of the richest men who ever lived:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

As important as the numbers revealed by the Secret IRS Files were, I found the explanations even more interesting. The 99.9999% of us who never make contact with the secretive elite wealth management and tax cheating industry know, in the abstract, that there's something scammy going on in those esoteric cults of wealth accumulation, but we're pretty vague on the details. When I pondered the "tax loopholes" that the rich were exploiting, I pictured, you know, long lists of equations salted with Greek symbols, completely beyond my ken.

But when Propublica's series laid these secret tactics out, I learned that they were incredibly stupid ruses, tricks so thin that the only way they could possibly fool the IRS is if the IRS just didn't give a shit (and they truly didn't – after decades of cuts and attacks, the IRS was far more likely to audit a family earning less than $30k/year than a billionaire).

This has become a somewhat familiar experience. If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

It was this experience that fueled my interest in forensic accounting, which led to my bestselling techno-crime-thriller series starring the two-fisted, scambusting forensic accountant Martin Hench, who made his debut in 2022's Red Team Blues:

https://us.macmillan.com/books/9781250865847/red-team-blues

The double outrage of finding out how badly the powerful are ripping off the rest of us, and how stupid and transparent their accounting tricks are, is at the center of Chokepoint Capitalism, the book about how tech and entertainment companies steal from creative workers (and how to stop them) that Rebecca Giblin and I co-authored, which also came out in 2022:

https://chokepointcapitalism.com/

Now that I've written four novels and a nonfiction book about finance scams, I think I can safely call myself a oligarch ripoff hobbyist. I find this stuff endlessly fascinating, enraging, and, most importantly, energizing. So naturally, when PJ Vogt devoted two episodes of his excellent Search Engine podcast to the subject last week, I gobbled them up:

https://www.searchengine.show/listen/search-engine-1/why-is-it-so-hard-to-tax-billionaires-part-1

I love the way Vogt unpacks complex subjects. Maybe you've had the experience of following a commentator and admiring their knowledge of subjects you're unfamiliar with, only have them cover something you're an expert in and find them making a bunch of errors (this is basically the experience of using an LLM, which can give you authoritative seeming answers when the subject is one you're unfamiliar with, but which reveals itself to be a Bullshit Machine as soon as you ask it about something whose lore you know backwards and forwards).

Well, Vogt has covered many subjects that I am an expert in, and I had the opposite experience, finding that even when he covers my own specialist topics, I still learn something. I don't always agree with him, but always find those disagreements productive in that they make me clarify my own interests. (Full disclosure: I was one of Vogt's experts on his previous podcast, Reply All, talking about the inkjet printerization of everything:)

https://gimletmedia.com/shows/reply-all/brho54

Vogt's series on taxing billionaires was no exception. His interview subjects (including Eisinger) were very good, and he got into a lot of great detail on the leaker himself, Charles Littlejohn, who plead guilty and was sentenced to five years:

https://jacobin.com/2023/10/charles-littlejohn-irs-whistleblower-pro-publica-tax-evasion-prosecution

Vogt also delved into the history of the federal income tax, how it was sold to the American public, and a rather hilarious story of Republican Congressional gamesmanship that backfired spectacularly. I'd never encountered this stuff before and boy was it interesting.

But then Vogt got into the nature of taxation, and its relationship to the federal debt, another subject I've written about extensively, and that's where one of those productive disagreements emerged. Yesterday, I set out to write him a brief note unpacking this objection and ended up writing a giant essay (sorry, PJ!), and this morning I found myself still thinking about it. So I thought, why not clean up the email a little and publish it here?

As much as I enjoyed these episodes, I took serious exception to one – fairly important! – aspect of your analysis: the relationship of taxes to the national debt.

There's two ways of approaching this question, which I think of as akin to classical vs quantum physics. In the orthodox, classical telling, the government taxes us to pay for programs. This is crudely true at 10,000 feet and as a rule of thumb, it's fine in many cases. But on the ground – at the quantum level, in this analogy – the opposite is actually going on.

There is only one source of US dollars: the US Treasury (you can try and make your own dollars, but they'll put you in prison for a long-ass time if they catch you.).

If dollars can only originate with the US government, then it follows that:

a) The US government doesn't need our taxes to get US dollars (for the same reason Apple doesn't need us to redeem our iTunes cards to get more iTunes gift codes);

b) All the dollars in circulation start with spending by the US government (taxes can't be paid until dollars are first spent by their issuer, the US government); and

c) That spending must happen before anyone has been taxed, because the way dollars enter circulation is through spending.

You've probably heard people say, "Government spending isn't like household spending." That is obviously true: households are currency users while governments are currency issuers.

But the implications of this are very interesting.

First, the total dollars in circulation are:

a) All the dollars the government has ever spent into existence funding programs, transferring to the states, and paying its own employees, minus

b) All the dollars that the government has taxed away from us, and subsequently annihilated.

(Because governments spend money into existence and tax money out of existence.)

The net of dollars the government spends in a given year minus the dollars the government taxes out of existence that year is called "the national deficit." The total of all those national deficits is called "the national debt." All the dollars in circulation today are the result of this national debt. If the US government didn't have a debt, there would be no dollars in circulation.

The only way to eliminate the national debt is to tax every dollar in circulation out of existence. Because the national debt is "all the dollars the government has ever spent," minus "all the dollars the government has ever taxed." In accounting terms, "The US deficit is the public's credit."

When billionaires like Warren Buffet tell Jesse Eisinger that he doesn't pay tax because "he thinks his money is better spent on charitable works rather than contributing to an insignificant reduction of the deficit," he is, at best, technically wrong about why we tax, and at worst, he's telling a self-serving lie. The US government doesn't need to eliminate its debt. Doing so would be catastrophic. "Retiring the US debt" is the same thing as "retiring the US dollar."

So if the USG isn't taxing to retire its debts, why does it tax? Because when the USG – or any other currency issuer – creates a token, that token is, on its face, useless. If I offered to sell you some "Corycoins," you would quite rightly say that Corycoins have no value and thus you don't need any of them.

For a token to be liquid – for it to be redeemable for valuable things, like labor, goods and services – there needs to be something that someone desires that can be purchased with that token. Remember when Disney issued "Disney dollars" that you could only spend at Disney theme parks? They traded more or less at face value, even outside of Disney parks, because everyone knew someone who was planning a Disney vacation and could make use of those Disney tokens.

But if you go down to a local carny and play skeeball and win a fistful of tickets, you'll find it hard to trade those with anyone outside of the skeeball counter, especially once you leave the carny. There's two reasons for this:

1) The things you can get at the skeeball counter are pretty crappy so most people don't desire them; and ' 2) Most people aren't planning on visiting the carny, so there's no way for them to redeem the skeeball tickets even if they want the stuff behind the counter (this is also why it's hard to sell your Iranian rials if you bring them back to the US – there's not much you can buy in Iran, and even someone you wanted to buy something there, it's really hard for US citizens to get to Iran).

But when a sovereign currency issuer – one with the power of the law behind it – demands a tax denominated in its own currency, they create demand for that token. Everyone desires USD because almost everyone in the USA has to pay taxes in USD to the government every year, or they will go to prison. That fact is why there is such a liquid market for USD. Far more people want USD to pay their taxes than will ever want Disney dollars to spend on Dole Whips, and even if you are hoping to buy a Dole Whip in Fantasyland, that desire is far less important to you than your desire not to go to prison for dodging your taxes.

Even if you're not paying taxes, you know someone who is. The underlying liquidity of the USD is inextricably tied to taxation, and that's the first reason we tax. By issuing a token – the USD – and then laying on a tax that can only be paid in that token (you cannot pay federal income tax in anything except USD – not crypto, not euros, not rials – only USD), the US government creates demand for that token.

And because the US government is the only source of dollars, the US government can purchase anything that is within its sovereign territory. Anything denominated in US dollars is available to the US government: the labor of every US-residing person, the land and resources in US territory, and the goods produced within the US borders. The US doesn't need to tax us to buy these things (remember, it makes new money by typing numbers into a spreadsheet at the Federal Reserve). But it does tax us, and if the taxes it levies don't equal the spending it's making, it also sells us T-bills to make up the shortfall.

So the US government kinda acts like classical physics is true, that is, like it is a household and thus a currency user, and not a currency issuer. If it spends more than it taxes, it "borrows" (issues T-bills) to make up the difference. Why does it do this? To fight inflation.

The US government has no monetary constraints, it can make as many dollars as it cares to (by typing numbers into a spreadsheet). But the US government is fiscally constrained, because it can only buy things that are denominated in US dollars (this is why it's such a big deal that global oil is priced in USD – it means the US government can buy oil from anywhere, not only the USA, just by typing numbers into a spreadsheet).

The supply of dollars is infinite, but the supply of labor and goods denominated in US dollars is finite, and, what's more, the people inside the USA expect to use that labor and goods for their own needs. If the US government issues so many dollars that it can outbid every private construction company for the labor of electricians, bricklayers, crane drivers, etc, and puts them all to work building federal buildings, there will be no private construction.

Indeed, every time the US government bids against the private sector for anything – labor, resources, land, finished goods – the price of that thing goes up. That's one way to get inflation (and it's why inflation hawks are so horny for slashing government spending – to get government bidders out of the auction for goods, services and labor).

But while the supply of goods for sale in US dollars is finite, it's not fixed. If the US government takes away some of the private sector's productive capacity in order to build interstates, train skilled professionals, treat sick people so they can go to work (or at least not burden their working-age relations), etc, then the supply of goods and services denominated in USD goes up, and that makes more fiscal space, meaning the government and the private sector can both consume more of those goods and services and still not bid against one another, thus creating no inflationary pressure.

Thus, taxes create liquidity for US dollars, but they do something else that's really important: they reduce the spending power of the private sector. If the US only ever spent money into existence and never taxed it out of existence, that would create incredible inflation, because the supply of dollars would go up and up and up, while the supply of goods and services you could buy with dollars would grow much more slowly, because the US government wouldn't have the looming threat of taxes with which to coerce us into doing the work to build highways, care for the sick, or teach people how to be doctors, engineers, etc.

Taxes coercively reduce the purchasing power of the private sector (they're a stick). T-bills do the same thing, but voluntarily (they the carrot).

A T-bill is a bargain offered by the US government: "Voluntarily park your money instead of spending it. That will create fiscal space for us to buy things without bidding against you, because it removes your money from circulation temporarily. That means we, the US government, can buy more stuff and use it to increase the amount of goods and services you can buy with your money when the bond matures, while keeping the supply of dollars and the supply of dollar-denominated stuff in rough equilibrium."

So a bond isn't a debt – it's more like a savings account. When you move money from your checking to your savings, you reduce its liquidity, meaning the bank can treat it as a reserve without worrying quite so much about you spending it. In exchange, the bank gives you some interest, as a carrot.

I know, I know, this is a big-ass wall of text. Congrats if you made it this far! But here's the upshot. We should tax billionaires, because it will reduce their economic power and thus their political power.

But we absolutely don't need to tax billionaires to have nice things. For example: the US government could hire every single unemployed person without creating inflationary pressure on wages, because inflation only happens when the US government tries to buy something that the private sector is also trying to buy, bidding up the price. To be "unemployed" is to have labor that the private sector isn't trying to buy. They're synonyms. By definition, the feds could put every unemployed person to work (say, training one another to be teachers, construction workers, etc – and then going out and taking care of the sick, addressing the housing crisis, etc etc) without buying any labor that the private sector is also trying to buy.

What's even more true than this is that our taxes are not going to reduce the national debt. That guest you had who said, "Even if we tax billionaires, we will never pay off the national debt,"" was 100% right, because the national debt equals all the money in circulation.

Which is why that guest was also very, very wrong when she said, "We will have to tax normal people too in order to pay off the debt." We don't have to pay off the debt. We shouldn't pay off the debt. We can't pay off the debt. Paying off the debt is another way of saying "eliminating the dollar."

Taxation isn't a way for the government to pay for things. Taxation is a way to create demand for US dollars, to convince people to sell goods and services to the US government, and to constrain private sector spending, which creates fiscal space for the US government to buy goods and services without bidding up their prices.

And in a "classical physics" sense, all of the preceding is kinda a way of saying, "Taxes pay for government spending." As a rough approximation, you can think of taxes like this and generally not get into trouble.

But when you start to make policy – when you contemplate when, whether, and how much to tax billionaires – you leave behind the crude, high-level approximation and descend into the nitty-gritty world of things as they are, and you need to jettison the convenience of the easy-to-grasp approximation.

If you're interested in learning more about this, you can tune into this TED Talk by Stephanie Kelton, formerly formerly advisor to the Senate Budget Committee chair, now back teaching and researching econ at University of Missouri at Kansas City:

https://www.ted.com/talks/stephanie_kelton_the_big_myth_of_government_deficits?subtitle=en

Stephanie has written a great book about this, The Deficit Myth:

https://pluralistic.net/2020/05/14/everybody-poops/#deficit-myth

There's a really good feature length doc about it too, called "Finding the Money":

https://findingmoneyfilm.com/

If you'd like to read more of my own work on this, here's a column I wrote about the nature of currency in light of Web3, crypto, etc:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

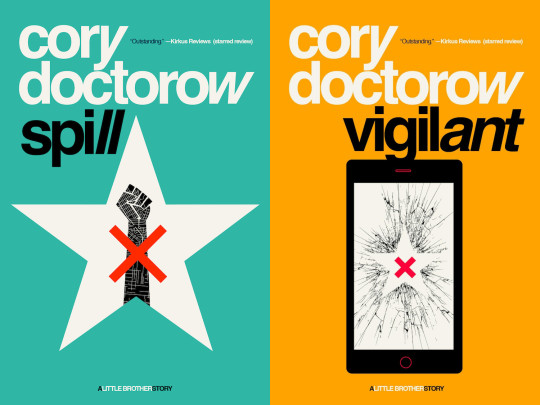

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/21/we-can-have-nice-things/#public-funds-not-taxpayer-dollars

#pluralistic#mmt#modern monetary theory#warren buffett#podcasts#pj vogt#billionaires#economics#we can have nice things#taxes#taxing billionaires#the irs files#irs files#jesse eisenger#propublica

1K notes

·

View notes

Text

i drew them

when you're 32 you will meet someone who will change your life forever

961 notes

·

View notes

Text

Putting this comment on here because I feel like I’m actually going insane…

It seems like nobody in the comments even watched the video, complaining about how paying for content is difficult in this economy, like, that's why they are doing this! They cannot continue to make the content they want for free based on ads and sponsors alone. If you have paid attention to the "Making Watcher"s of recent years, their company is not, and has not been profitable. They are so dependent on advertisers for funding that it is becoming a restriction to the content they want to make (y'a know, like Buzzfeed was), so they had to find a solution. I don't know why you all seem to think you are entitled to free content, I understand not everyone can afford it but Watcher doesn't owe you content personally. Frankly, I doubt they wanted to put their content behind a paywall, but if it's that or not make content at all, of course they are going to try to find a solution. So no, they aren't "turning into Buzzfeed” because the massive problem with Buzzfeed was its restrictions on creative freedom and exploitation of its workers. If Watcher wants to produce fulfilling content that gives their editors, designers, producers, etc full creative freedom and a livable wage, this is the best option. If you want them to pay their workers the bare minimum and tailor their content to advertiser interests just so you can watch it for free, that's fine. Just don't pretend that they are some evil media mega-corporation and you are the anti-capitalist shining hero for saying it. You don't have to like it, and you don't have to continue to support them, but don't try to shame and demonize them for making an already difficult decision.

Many of you DO have an understanding of the difficult position our current economic system puts people in because you have experienced it, but you are so unable to extend that understanding beyond your own point of view. Look past yourself for a moment and think critically, and maybe you will understand their perspective. Much love for all of the talented people within Watcher who are doing their best.

And just to add, their format going forward is almost IDENTICAL to CollegeHumor-Dropout's streaming service format (even down to the free premieres and advocating for sharing accounts with friends), which most people praise to high heaven as "the only ethical streaming service." As a huge fan of both companies the stark difference in response here is actually astounding...

#watcher#watcher entertainment#watcher tv#shane madej#ryan bergara#steven lim#ghost files#mystery files#puppet history#survival mode#too many spirits#dropout#I don’t know how to explain that 6 dollars a month is like getting cheap coffee twice a month these are not 18th century France level taxes

2K notes

·

View notes

Text

Au where they escape the circus: Pomni tries to teach the 22 year olds how to do taxes. It goes as well as expected with Jax & Zooble

(Please click for better quality!!)

#drag's art#tadc#the amazing digital circus#tadc fanart#tadc pomni#tadc jax#tadc zooble#pomni#jax#zooble#this has lived in my mind rent free. for a year.#and I’m only now drawing it LOL#is the jumper zooble is wearing one of gangle’s?? you decide ✨#the one and only time anyone has seen them cry was over taxes according to me#anyways I’m Irish idk how filing taxes works. don’t yell at me

533 notes

·

View notes

Text

music opinions

#i have no mouth and i must scream#music#still not as much as I hate david lynch#file taxes#comics#webcomic#ihnmaims

47 notes

·

View notes

Text

first came the drawing of hermione proudly holding a fat crookshanks, and then came the thought “ron would love this picture of her” like any normal, taxpaying adult would have

#i actually haven’t filed my 2023 taxes yet#romione#hermione granger#ron weasley#crookshanks#ronmione#harry potter#harry potter fanart#hp fanart#my art#artists on tumblr#character design#illustration

1K notes

·

View notes

Text

Our ex landlord owes us 3 times the security deposit we paid him lmaooooo get FUCKED💥💥💥💥💥💥💥💥💥💥💥💥💥

#this whole thing has been insane but lmao we won#we're also filing a libel case + reporting him to the irs for tax fraud#that he sent us evidence of for some reason ? so#lmao ! get fucked old man

421 notes

·

View notes

Text

What Happens if You File Late Taxes?

Tax season can be a stressful time for many, with numerous forms and deadlines to meet. Unfortunately, some individuals find themselves unable to file their taxes by the due date. If you're one of them, it's crucial to understand the consequences of filing late taxes. In this article, we'll explore what happens if you file your taxes after the deadline, including penalties, interest, and steps to mitigate the impact on your financial situation.

1. Penalties for Filing Late

One of the immediate consequences of filing your taxes late is facing penalties. The Internal Revenue Service (IRS) imposes penalties for late filing, which can vary depending on the circumstances. Typically, the penalties consist of both a failure-to-file penalty and a failure-to-pay penalty.

The failure-to-file penalty is usually more significant, amounting to 5% of the unpaid taxes for each month your return is late, with a maximum penalty of 25% of your total tax bill. The failure-to-pay penalty is 0.5% of your unpaid taxes each month. Keep in mind that these penalties can quickly add up, making it essential to file as soon as possible to mitigate the financial impact.

2. Interest Accumulation

In addition to penalties, interest will also accrue on the unpaid taxes from the due date until the time you pay them in full. The interest rate is typically based on the federal short-term rate plus three percentage points. This means that the interest rate can fluctuate, making it challenging to predict how much interest you'll owe. The longer you delay, the more interest you'll accumulate, which can make your overall tax bill significantly higher.

3. Loss of Refunds

Filing your taxes late may also result in losing any potential tax refunds. The IRS has a statute of limitations, which generally allows you to claim a refund for the past three years. If you fail to file within that timeframe, you forfeit any refund you might be entitled to. This can be a substantial financial loss, as you'll miss out on money that could have been in your pocket.

4. Legal Consequences

Although the IRS's primary concern is collecting taxes, there can be legal consequences for continuously failing to file your taxes. The IRS may initiate collection actions, such as levies on your bank accounts, wages, or property, to recover unpaid taxes. In extreme cases, non-compliance could lead to criminal charges, including tax evasion, which can result in hefty fines and potential jail time.

5. Damage to Your Credit Score

Late tax payments can affect your credit score indirectly. While the IRS does not directly report your unpaid taxes to credit bureaus, their collection efforts, such as liens and levies, can show up on your credit report. These negative marks can significantly impact your creditworthiness, making it challenging to secure loans, mortgages, or credit cards in the future.

Strategies to Mitigate the Impact

If you're unable to meet the tax deadline, it's essential to take proactive steps to mitigate the consequences. Here are some strategies to consider:

a. File an Extension: You can file for an extension to get more time to prepare and submit your tax return. This can help you avoid the failure-to-file penalty.

b. Pay What You Can: If you can't pay your full tax bill, pay as much as you can to reduce the failure-to-pay penalty and interest.

c. Set Up a Payment Plan: The IRS offers payment plans for individuals who cannot pay their taxes in a lump sum. These plans can help you manage your tax debt over time.

d. Seek Professional Help: If you're overwhelmed by your tax situation, consider consulting a tax professional or accountant who can guide you through the process and help you navigate the IRS.

Conclusion

Filing your taxes late can have severe consequences, including penalties, interest, loss of refunds, legal actions, and damage to your credit score. It's crucial to be proactive if you find yourself unable to meet the tax deadline. By using the best online tax filing services, filing for an extension, paying what you can, setting up a payment plan, or seeking professional assistance, you can minimize the impact of filing your taxes late and avoid falling into a cycle of non-compliance. Remember that addressing the issue promptly is the best way to protect your financial well-being and peace of mind.

0 notes

Text

"Direct File" doesn't seem to be gone, (yet,) but it's really fucking scary that Musk is talking about getting rid of it

Direct Files helps you with your fucking taxes. Something that doesn't matter to Musk who doesn't pay taxes, but matters a whole lot to 99% of Americans.

#donald trump#trump#republicans#trump supporters#conservatives#conservative#republican#elon musk#direct file#irs#taxes#president elon musk

188 notes

·

View notes