#enrico furia

Explore tagged Tumblr posts

Text

Umberto Eco: “Come va?”

Icaro: “Uno schianto”

Proserpina: “Mi sento giù”

Prometeo: “Mi rode…”

Teseo: “Finché mi danno corda…”

Edipo: “La mamma è contenta”

Damocle: “Potrebbe andar peggio”

Priapo: “Cazzi miei”

Ulisse: “Siamo a cavallo”

Omero: “Me la vedo nera”

Eraclito: “Va, va…”

Parmenide: “Non va”

Talete: “Ho l’acqua alla gola”

Epimenide: “Mentirei se glielo dicessi

Demostene: “Difficile a dirsi”

Pitagora: “Tutto quadra”

Ippocrate: “Finché c’è la salute…”

Socrate: “Non so”

Giobbe: “Non mi lamento, basta aver pazienza”

Onan: “Mi accontento”

Sheherazade: “In breve, ora le dico…”

Boezio: “Mi consolo”

Carlo Magno: “Francamente bene”

Dante: “Sono al settimo cielo”

Giovanna d’Arco: “Si suda”

San Tommaso: “Tutto sommato bene”

Erasmo: “Bene da matti”

Colombo: “Si tira avanti”

Lucrezia Borgia: “Prima beve qualcosa?”

Giordano Bruno: “Infinitamente bene”

Lorenzo de’ Medici: “Magnificamente”

Cartesio: “Bene, penso”

Berkeley: “Bene, mi sembra”

Hume: “Credo bene”

Pascal: “Sa, ho tanti pensieri…”

Enrico VIII: “Io bene, è mia moglie che…”

Galileo: “Gira bene”

Torricelli: “Tra alti e bassi”

Desdemona: “Dormo tra due guanciali…”

Newton: “Regolarmente”

Leibniz: “Non potrebbe andar meglio”

Spinoza: “In sostanza, bene”

Hobbes: “Tempo da lupi”

Papin: “Ho la pressione alta”

Montgolfier: “Ho la pressione bassa”

Franklin: “Mi sento elettrizzato”

Robespierre: “Cè da perderci la testa”

Marat: “Un bagno”

Casanova: “Vengo”

Goethe: “C’è poca luce”

Beethoven: “Non mi sento bene”

Schubert: “Non mi interrompa, per Dio”

Novalis: “Un sogno”

Leopardi: “Sfotte?”

Foscolo: “Dopo morto, meglio”

Manzoni: “Grazie a Dio, bene”

Sacher-Masoch: “Grazie a Dio, male”

Sade: “A me bene”

D’Alambert e Diderot: “Non si può dire in due parole”

Kant: “Situazione critica”

Hegel: “In sintesi, bene”

Schopenhauer: “La volontà non manca

Paganini: “L’ho già detto”

Darwin: “Ci si adatta”

Livingstone: “Mi sento un po’ perso”

Nievo: “Le dirò, da piccolo…”

Nietzsche: “Al di là del bene, grazie”

Mallarme’: “Sono andato in bianco”

Proust: “Diamo tempo al tempo”

Henry James: “Secondo i punti di vista”

Kafka: “Mi sento un verme”

Musil: “Così così”

Joyce: “Fine yes yes yes”

Nobel: “Sono in pieno boom”

Larousse: “In poche parole, male”

Curie: “Sono raggiante”

Dracula: “Sono in vena”

Picasso: “Va a periodi”

Ungaretti: “Bene (a capo) grazie”

Fermi: “O la va o la spacca”

Camus: “Di peste”

Matusalemme: “Tiro a campare”

Lazzaro: “Mi sento rivivere”

Giuda: “Al bacio”

Ponzio Pilato: “Fate voi”

San Pietro: “Mi sento un cerchio alla testa”

Nerone: “Guardi che luce”

Maometto: “Male, vado in montagna”

Savonarola: “E’ il fumo che mi fa male”

Orlando “Scusi, vado di furia”

Cyrano: “A naso, bene”

Alice: “Una meraviglia”

Verga: “Di malavoglia”

Heidegger: “Quante chiacchiere!”

Grimm: “Una favola!”

Umberto Eco - "Il Secondo Diario Minimo"

16 notes

·

View notes

Text

Dopo la caduta dell’Impero Romano, i popoli barbarici occupano l’Europa: mentre nel Nord Italia si insediano i Longobardi (di loro rimangono vestigia persino nell’Isola Comacina), in Inghilterra vi sono gli Angli, i Sassoni, gli stanziamenti dei Danesi, le incursioni dei Vichinghi e l’arrivo del popolo norreno dei Normanni. L’incontro fra questi popoli darà vita alla lingua e alla letteratura inglese.

Queste sono le principali tappe.

Angli e Sassoni ( - 1066)

Il poema Beowulf narra la saga della lotta fra questo eroe e mostri scandinavi. La sua ambientazione danese è prova delle influenze norrene in Inghilterra: la confluenza fra le lingue celtiche, germaniche e scandinave produce l’inglese antico.

Normanni (1066 - 1154)

La conquista normanna da parte di Guglielmo I introduce, attraverso i romance cavallereschi come il ciclo arturiano, elementi francesi nell’inglese antico ed è alla base dell’inglese medio di questo periodo.

Plantageneti (1154 - 1399)

Enrico II (1154 - 1189), marito di Eleonora d’Aquitania

Riccardo I (1189 - 1199)

Ambientato nel 1194, Ivanhoe di Walter Scott (1819) racconta la fusione del popolo anglosassone e del popolo normanno nel matrimonio fra la sassone Rowena e Ivanhoe, cavaliere che aveva seguito Riccardo alla crociata.

Giovanni Senzaterra (1199 - 1216)

Enrico III (1216 - 1272), in età minore soggetto alla tutela di Guglielmo il Maresciallo e Guala Bicchieri.

Edoardo I (1272 - 1307), antagonista di William Wallace

Edoardo II (1307 - 1327)

Edoardo III (1327 - 1377)

1346 - Edoardo III, grazie ai suoi arcieri, sconfigge i francesi a Crecy nella prima battaglia della Guerra dei Cent’anni.

1356 - Vittoria inglese di Poitiers

Riccardo II (1377 - 1399), nipote di Edoardo III, figlio del Principe Nero che si era distinto a Poitiers, in seguito alla crisi della Guerra dei Cento Anni, è deposto da Enrico Bolingbroke della casa di Lancaster. Sotto il suo regno ha luogo la rivolta dei contadini inglesi (1381).

1388 - I racconti di Canterbury (Chaucer) che, in “medio inglese”, mette in scena una società più ampia di quella cortese sulla scia del Decameron: del resto Chaucer era stato in Italia per attività diplomatiche.

Lancaster (1399 - 1471)

Enrico IV (1399 - 1413)

Enrico V (1413 - 1422), già principe “Hal”, nel dramma di Shakespeare amico di Falstaff. Sconfitti i francesi ad Azincourt (1415), sposa la figlia del re di Francia Caterina di Valois.

Enrico VI (1422 - 1461, 1470 - 1471) sotto il cui regno si hanno le sconfitte da parte di Giovanna d’Arco, arsa sul rogo nel 1431. In Shakespeare simbolo dell’uomo che soffre per il potere che ha ricevuto, muore nel 1471 nella Torre di Londra, imprigionato dagli York del futuro Edoardo IV al termine della Guerra delle Due Rose.

“Questa battaglia è come la guerra del mattino quando le nubi morenti contendono con la luce che cresce, e il pastore soffiandosi sulle dita intirizzite non sa se sia giorno o notte. Ora la vittoria inclina da questa parte, come un mare possente forzato dalla marea a combattere con il vento; ora inclina dall'altra parte, come quello stesso mare che la furia del vento forzi a ritirarsi; talora la vince il vento e talora la marea; ora l'uno è più forte ora l'altra fortissima: lottano entrambi per la vittoria corpo a corpo, e nessuno è vincitore o vinto: così ugualmente bilanciata è questa terribile battaglia” (Shakespeare, Enrico VI)

York (1471 - 1485)

Edoardo IV (1461 - 1470, 1471 - 1483)

Edoardo V (1483)

Riccardo III (1483 - 1485), sconfitto a Bosworth da Enrico Tudor

Tudor (1485 - 1603)

Enrico VII (1485 - 1509)

Enrico VIII (1509 - 1547)

Elisabetta I (1547 - 1603)

1516 - Utopia di Tommaso Moro

Shakespeare scrive in early modern English come il volgare di Dante: per questo si chiama Commedia.

Sonetto 75

Tu sei per la mia mente, come cibo per la vita. / Come le piogge di primavera, sono per la terra. / E per goderti in pace, combatto la stessa guerra / che conduce un avaro, per accumular ricchezza. / Prima, orgoglioso di possedere e, subito dopo, / roso dal dubbio, che il tempo gli scippi il tesoro. / Prima, voglioso di restare solo con te, / poi, orgoglioso che il mondo veda il mio piacere. / Talvolta, sazio di banchettare del tuo sguardo, / subito dopo, affamato di una tua occhiata. / Non possiedo, né perseguo alcun piacere, / se non ciò che ho da te, o da te io posso avere. / Così ogni giorno, soffro di fame e sazietà, / di tutto ghiotto, e d’ogni cosa privo.

Sonetto 116

Non sia mai ch’io ponga impedimenti all’unione di anime fedeli; / Amore non è Amore se muta quando scopre un mutamento / o tende a svanire quando l’altro s’allontana. / Oh no! Amore è un faro sempre fisso che sovrasta la tempesta e non vacilla mai; / è la stella-guida di ogni sperduta barca, / il cui valore è sconosciuto, benché nota la distanza. / Amore non è soggetto al Tempo, pur se rosee labbra e gote / dovran cadere sotto la sua curva lama; Amore non muta in poche ore / o settimane, ma impavido resiste al giorno estremo del giudizio: / se questo è errore e mi sarà provato, Io non ho mai scritto, e nessuno ha mai amato

Elisabetta I crea la Compagnia delle Indie Orientali che gestirà il commercio fino al 1874 quando nascerà il Vicerè delle Indie.

Stuart (1603 - 1714)

Giacomo I (1603 - 1625), amante di George Villers, il duca di Buckingham presente nei Tre Moschettieri di Dumas

Carlo I (1625 - 1649), decapitato e seguito dal periodo del Commonwealth di Oliver Cromwell

Carlo II (1660 - 1685)

Giacomo II (1685 - 1688), deposto dalla Gloriosa Rivoluzione

Maria II (1688 - 1694) seguita dal marito

Guglielmo d’Orange (1694 - 1702)

Anna (1702 - 1714)

1606 - Volpone (Ben Jonson), ambientato a Venezia

1611 - Bibbia di Re Giacomo

1633 - Poemi (John Donne, “Nessun uomo è un'isola … non mandare mai a chiedere per chi suona la Campana: essa suona per te”)

1667 - Paradiso Perduto (Milton). Il Puritanesimo, di cui Milton ha fatto parte, portò alla chiusura dei teatri e alla fine di quel periodo dorato a cui appartengono, fra gli altri, Marlowe e Shakespeare. Nel poema si assiste a quel fervore e a quello stile presenti anche nel Tasso. La lettera scarlatta (Hawthorne, 1850) racconterà il puritanesimo americano e la condanna di un'adultera.

1703 - Il Duca di Malborough ed Eugenio di Savoia sconfiggono i francesi a Bleinheim nella guerra di successione spagnola: nel 1713 il Trattato di Utrecht. La Gran Bretagna ottieni i possedimenti francesi in America ed è dominatrice incontrastata dei commerci marittimi.

Hannover (1714 - 1901)

Giorgio I (1714 - 1727)

Giorgio II (1727 - 1760)

Giorgio III (1760- 1820) di cui è famosa la “pazzia di Re Giorgio”

Giorgio IV (1820 - 1830), reggente dal 1811

Guglielmo IV (1830 - 1837)

Vittoria (1837 - 1901)

1719 - Robinson Crusoe (Defoe). Il protagonista, esponente della borghesia in ascesa, non è in viaggio per Dio, per il Re, per la Dama, ma per raggiungere la sua piantagione e la società che costruisce è orientata alla produzione, non ad un ideale. Si tratta di un novel e non di un romance cavalleresco in seguito all’evoluzione costituzionale e parlamentare della monarchia ed all’esistenza di una classe, quella borghese, che acquistava libri.

1721 - 1742 Robert Walpole primo Primo Ministro whig di Giorgio I

1722 - Moll Flanders (Defoe). La protagonista, lontana dai canoni morali tradizionali, vive le disavventure dovute al suo materialismo e alla corruzione della società.

1726 - I viaggi di Gulliver (Swift) che influenzerà il romanzo epico americano Moby Dick (Melville, 1851).

1749 - Tom Jones (Fielding) il cui protagonista orfano denota l’origine picaresca del romanzo moderno.

1757 - Edmund Burke fonda la poetica del Sublime

1759 - La vita e le opinioni di Tristram Shandy (Sterne)

1760 - Canti di Ossian (Macpherson)

1763 - Fine della Guerra dei Sette Anni: l’Inghilterra è padrona di tutte le colonie americane e del Canada.

1764 - Il castello di Otranto (Walpole), iniziatore del romanzo gotico

1773 - 1783 Sotto Giorgio III, Guerra di secessione americana iniziata con la rivolta del Boston Tea Party e decisa dalla battaglia di Yorktown (1781).

1798 - Ballate liriche (Woodsworth, Coleridge). Inizio del Romanticismo in contrapposizione con il neoclassicismo e la rivoluzione industriale (“I Wandered Lonely as a Cloud”). La ballata del vecchio marinaio (Coleridge) è il poema immaginifico di un viaggio avventuroso, di tipo gotico e medievale, e della sorte del marinaio che uccide l’albatros come il poeta romantico che, per creare, si scaglia contro le consuetudini.

1805 - Nelson sconfigge Napoleone a Trafalgar

1811 - Per via della follia di Giorgio III, inizia la reggenza del figlio Giorgio IV, periodo nel quale vi sono la vittoria su Napoleone, il neoclassicismo nelle arti, il dandismo.

Ragione e Sentimento (Austen), esempio di novel of manners, storie d’amore delle sorelle Elinor e Marianne.

1813 - Orgoglio e pregiudizio (Jane Austen), storia d’amore fra l’indipendente Lizzy Bennet, di ceto inferiore, e il Signor Darcy.

1818

Anno di maggior produzione di Keats, noto per la “negative capability” ovvero la capacità di farsi influenzare dal contesto, anche solo con espressioni evocative.

Il pellegrinaggio del giovane Aroldo (Byron) in cui diventa popolare l’eroe byroniano che combatte per la libertà dei popoli all’epoca della Restaurazione.

In Frankenstein di Mary Shelley si trattano i temi della responsabilità dello scienziato e dell’intellettuale (Vita di Galileo di Brecht, Faust di Goethe) e della società i cui pregiudizi marginalizzano la creatura e si introduce il dualismo dell’individuo.

1818 - Northanger Abbey (Austen), una satira del romanzo gotico

1836 - Ne Il Circolo Pickwick Dickens dà inizio al romanzo a puntate (“Make them laugh, make them cry, make them wait”) e racconta in modo umoristico l’Inghilterra rurale di quegli anni. Doveva essere il commento a delle vignette satiriche, divenne un romanzo illustrato di mille pagine.

Età vittoriana (1837 - 1901)

1838 - Oliver Twist (Dickens) racconta la situazione delle workhouses. Con toni ironici e drammatici, riesce a rappresentare luci e ombre della società vittoriana.

1844 - Barry Lyndon (Thackeray)

1847

Jane Eyre (Charlotte Bronte). In questo romanzo di formazione (Bildungsroman), l’orfana (come il Tom Jones di Fielding, 1749 e Oliver Twist) riesce a crearsi un’educazione è una posizione fino a trovare l’amore: la purezza salva.

Wuthering Heights (Emily Bronte). Il romanzo tratta dell’amore passionale fra Catherine e il tenebroso Heathcliff, un’opera di stampo romantico in epoca vittoriana.

1849 - David Copperfield (Dickens). Autobiografia romanzata dell’autore, storia di affrancamento di un ragazzo che si afferma fnonostante le avversità familiari e sociali del tempo.

1886 - Lo strano caso del Dr. Jeckill e di Mr. Hyde (Stevenson)

1889 - Tre uomini in barca (Jerome), originariamente pensato come guida turistica.

1894 - Il libro della giungla (Kipling)

1897 - Dracula (Stoker)

1899 - Cuore di tenebra (Conrad)

Windsor (1901 - )

Edoardo VII (1901 - 1910)

Giorgio V (1910 - 1936)

Edoardo VIII (1936)

Giorgio VI (1936 - 1952), re balbuziente

Elisabetta II (1952 - 2022)

Carlo III (2022 - )

1908 - Camera con vista (Forster)

1922 - Casa Howard (Forster)

1924 - Passaggio in India (Forster)

1928 - L’amante di Lady Chatterley (Lawrence) in cui la moglie di un nobile paralizzato descrive i piaceri di un amore con un operaio.

1951

“Non andartene docile in quella buona notte, / vecchiaia dovrebbe ardere e infierire quando cade il giorno; / infuria, infuria contro il / morire della luce” (Dylan Thomas)

2 notes

·

View notes

Text

È stato presentato venerdì 16 febbraio 2024 presso la Libreria Nuova Europa I Granai - via Mario Rigamonti 100, in zona viale Tintoretto - il libro di Valentina Notarberardino Operazione bestseller. Dietro le quinte del successo editoriale (Ponte alle Grazie). L’autrice ha dialogato con Sabina Minardi (giornalista e responsabile delle pagine culturali de «L’Espresso») e Barbara Pieralice. Testimonianze inedite di Alessandra Casella, Alessandro Della Casa, Antonio Franchini, Antonio Pascale, Barbara e Francesca Pieralice, Bruno Luverà, Caterina Marietti, Enrico Carraro, Enza Campino, Filippo Guglielmone, Gaia Manzini, Gian Marco Griffi, Gianluigi Simonetti, Giorgio Zanchini, Giuseppe Laterza, GFK, Mario Desiati, Matteo B. Bianchi, Michele Foschini, Monica Manzotti, Nicola Lagioia, Paolo Di Stefano, Romano Montroni, Simonetta Pillon, Stefano Petrocchi. «Quello che propongo è un viaggio nel mondo nascosto dell’editoria, attraverso la vita materiale dei libri e quella immateriale, che talvolta porta anche all’anonimato alle stelle. Importanti compagni di viaggio, alcuni (tanti) protagonisti d’eccezione del mondo editoriale con le loro testimonianze esclusive: scrittori, editori, direttori commerciali, editor, librai, giornalisti culturali e critici letterari, organizzatori di festival, direttore dei principali premi, conduttori televisivi, radiofonici e di podcast, e gli addetti al rilevamento delle vendite e alla compilazione delle classifiche» (Valentina Notarberardino) «Per chi fa il nostro lavoro, una vera goduria. Per gli appassionati un divertissement scritto bene, spiritoso e ricco di sorprese. Un libro pieno di risvolti. E non è una battuta. Né una fascetta» (Giuseppe Civati) «Con Notarberardino, a furia di leggere tutti i segreti dei libri, si finirà per leggerli con occhi diversi» (Giuseppe Matarazzo, «Avvenire») Un viaggio curioso, chiarificatore ed entusiasmante dietro le quinte dell'editoria italiana: la maggior industria culturale del Paese. Tutti i segreti e i misteri della vita dei libri finalmente svelati agli amanti della lettura. Cenni sparsi di anatomia editoriale: editori, scrittori, tirature e costi. Le classifiche cosa sono? Chi le fa? La sottile linea rossa: dalla tipografia al comodino. La libreria: tra romanticismo e vendite. Lo scrittore va in tournée: presentazioni, fiere e festival. I premi letterari: croce e delizia degli scrittori. I giornali e la critica: le recensioni giovano alle vendite?I social network: influencer, scrittori, editori. Lo schermo: passaggi televisivi, film e serie.La voce: trasmissioni radio e podcast sui libri. Altri elementi del successo: editor, traduttori, ghost writer. Perché certi libri hanno successo e altri no? Perché di alcuni si capisce presto che finiranno tra i «libri dell’anno» mentre altri passano in sordina? Come arrivano gli amati tomi in libreria? Come si partecipa ai premi letterari? Chi vota? E soprattutto, perché vince chi vince? E chi perde, come la prende? Si può vivere di sola scrittura? Perché ogni anno in Italia vengono pubblicati così tanti titoli? Come funzionano i festival letterari e le fiere del libro? Che cosa riesce a fare un bravo libraio per il successo di un libro? Che impatto hanno i social? I podcast? Le trasmissioni radio e tv? Come funzionano le classifiche? Come si rilevano le vendite, e chi lo fa? Insomma: che cosa fa vendere i libri? Agli appassionati/appassionate della lettura Operazione bestseller racconta tutto questo: la vita materiale del libro dalla tipografia al comodino, e la vita immateriale, dall’anonimato alle stelle. E lo fa avvalendosi del contributo di alcuni protagonisti del mondo editoriale e delle loro testimonianze esclusive. Ne risulta un viaggio curioso, chiarificatore ed entusiasmante dietro le quinte dell’editoria italiana: la maggior industria culturale del Paese. Valentina Notarberardino è nata a Fondi (LT) e vive a Roma, dove lavora nel settore editoriale da oltre quindici anni, molti fra i quali come responsabile dell’Ufficio Stampa e della Comunicazione di Contrasto.

Ha collaborato come coordinatrice didattica con il Master in Editoria, Giornalismo e Management culturale dell’Università di Roma Sapienza, dove tiene un corso dedicato al Paratesto ed alla Comunicazione dei libri. Ha uno spazio di approfondimento su RaiUno, dedicato alle copertine dei libri. È co-curatrice del volume Libero de Libero. Le poesie (Bulzoni, 2011), e autrice di Fuori di testo. Titoli, copertine, fascette e altre diavolerie (Ponte alle Grazie, 2020). Operazione bestseller. Dietro le quinte del successo editoriale di Valentina Notarberardino, pubblicato da Ponte alle Grazie (Milano) nella collana “Saggi” - testimonianze inedite di Alessandra Casella, Alessandro Della Casa, Antonio Franchini, Antonio Pascale, Barbara e Francesca Pieralice, Bruno Luverà, Caterina Marietti, Enrico Carraro, Enza Campino, Filippo Guglielmone, Gaia Manzini, Gian Marco Griffi, Gianluigi Simonetti, Giorgio Zanchini, Giuseppe Laterza, GFK, Mario Desiati, Matteo B. Bianchi, Michele Foschini, Monica Manzotti, Nicola Lagioia, Paolo Di Stefano, Romano Montroni, Simonetta Pillon, Stefano Petrocchi; copertina: Maurizio Ceccato; pp. 352 -, disponibile in libreria e online dal 2 febbraio scorso, è stato presentato presso la Libreria Nuova Europa I Granai venerdì 16 febbraio 2024.

0 notes

Text

Prime reazioni l'ultimo film del regista brasiliano-argentino #KarimAïnouz, #Firebrand con #AliciaVikander e #JudeLaw nel primo film su Enrico VIII con un punto di vista femminista.

(Inizialmente per il ruolo della regina era stata scelta Michelle Williams)

TRAMA: Nell'Inghilterra dei Tudor intrisa di sangue, Katherine Parr, la sesta e ultima moglie del re Enrico VIII, viene nominata reggente mentre il tiranno Enrico combatte all'estero. Katherine fa di tutto per spingere il Regno verso un nuovo futuro basato sulle sue convinzioni protestanti radicali. Quando il re ritorna, rivolge la sua furia contro i radicali, accusando l'amica d'infanzia di Katherine di tradimento e bruciandola sul rogo. Inorridita e addolorata, ma costretta a negarlo, Katherine si ritrova a lottare per la propria sopravvivenza.

"Alicia Vikander porta un tocco sovversivo al ritratto astorico dell'ultima moglie di Enrico VIII. Lontano da ogni favola, il film di Aïnouz inizia non con “c'era una volta” ma con "un regno marcio e intriso di sangue" dove la storia ci racconta alcune cose, soprattutto sugli uomini e sulla guerra"

(Peter Debruge, Variety)

"E' uno sguardo sorprendente del periodo Tudor in Inghilterra, sorprendente perché il suo fulcro è una donna che è riuscita a sopravvivere al terrore di vivere con Enrico VIII, un Jude Law quasi irriconoscibile, con tutta la pancia, le ulcere e la dissolutezza che ci si potrebbe aspettare"

(Pete Hammond, Deadline)

"Ci sono stati molti film su Enrico VIII, ma pochissimi preziosi si sono concentrati sull'unica regina che è riuscita a sopravvivere a lui. "Firebrand" di Karim Aïnouz mette questo donna del popolo radicalmente progressista al centro della storia in un modo mai visto prima. Alicia Vikander coltiva quella tensione femminista tra l'urgenza morale e il pericolo mortale dall'inizio alla fine, che permette al film di rimanere in qualche modo coinvolgentemente teso"

(David Elrich, IndieWire)

#CriticsReviews

#Cannes2023

0 notes

Text

Pietro ofc but I don't know if I need to check if Parker is a Jewish surname because if so I'd keep it that way. I do think about how uncle Ben (and subsequently Peter's clone) would be called Beniamino. SPEAKING OF CLONES one of those bitches really called himself Caino huh?

Antonio Stella is absolutely fucking fantastic. It fits so well too!

I've also got Stefano Ruggero (Steven Rogers. I'm missing the Grant part of it). The surnames are harder for some reason!!

I think Bruce should be Bruno (which hilariously is actually his middle name so he's Roberto Bruno in this).

Franklin Nelson is Franco (though I'd keep Frank Castle as that because it's a name he chose for himself. He's Italian American and I feel like I could still keep it that way). Or maybe Fernando now that I think about it.

Natasha and Yelena can stay as is because they're Russian. (I know I'm about to say dp can't stay the same but I think Russian still works. Either that or I make them French).

But Deadpool needs a new name AND nationality. What's the Italian equivalent to Canada? I'd say either Spain or Switzerland 🤔 and depending on the answer the name changes.

MK system needs to say as is for like 5/6 parts of them, especially if we're going w the tv show version. Marc can become Marco but his surname still needs to be Spector (for Jewish reasons). Steven is British and needs to stay such, I think I'd still fit. Jake we don't have much (the Jake is your oyster) but either we keep him that way or he becomes Jacopo/Giacomo Loretto. Layla and Jean-Paul still fit. As does Gina but barely.

Clint Barton stumps me. I can't think of any name that sounds similar! Cl-cl-claudio? I don't like it.

Scott Lang, again, stumps me.

As does Steven Strange (mostly for the surname here because a literal translation would convey the message but sound incredibly wrong)

Flash Thompson is easy because, again, nickname and the dudes real name is Eugene. Eugenio. Easy peasy.

Otto Octavius I feel like I can stay the same. It works imho. Or like instead of Octavius just Ottavio.

Thinking about Gwen Stacy and Mary Jane Watson. Because the W can't happen. But Gaia and Maria- I realized also the J makes it hard. The only J name is Jessica 🤔. Or we go MCU and Michela our way into this character.

Karen Page- I got so many- Karen is really unique because we'll K name. But maybe Chiara to keep the sound?

The Osborns are hard. Harry ok sure Enrico. But Norman? I got nothing.

The whole Morales family Can keep their names since well their ethnic background is kinda important. Maybe Milo instead of Miles since he'd be afro-italian dna Puerto Rican.

I mean T'Challa also needs to stay the same.

Same for America Chavez.

QUINTAVIUS QUIRINIUS "QUENTIN" QUIRE I don't think we can make his name any better. He's perfect.

Wanda, Pietro, and Erik also need to stay the same.

But professor x needs a change. Carlo but the X eludes me.

There's so many X-Men. Logan... I don't think there's an equivalent. But also if we make Wade non-Canadian Logan needs to be the same. Though maybe it would be funnier if he were Canadian while Wade wasn't. Wade would be mad about it. Maybe.

Gwenpool needs to have the same surname but maybe she can get the Stacy treatment and be Gaia.

All the aliens can stay the same.

Peter Quill well Pietro. That one is gonna be pretty consistent.

"Quale maestro servi?"

"Che maestro servo? Cazzo devo rispondere? Gesù?"

"... Vieni dalla Terra?"

"Non vengo dalla Terra, vengo dalla Basilicata"

"Che è sulla Terra imbecille"

I had to.

Back on track.

Nicholas Fury is easy. Nicola Furia could very well be a name.

Philip Coulson also easy. Well the first part. Filippo goes hard.

Pepper Potts already works! Her real name is Virginia and Pepper is a nickname.

Bucky. On one hand, it wouldn't make sense to keep his name as is. On the OTHER how could I get rid of a name like Buchanan??? I also don't know how to go about James.

Sam Wilson, easy, Samuele.

There's so many characters I actually got a block.

I'll get back to you if I come up with more. Or some surnames.

Resisting the urge of writing a whole marvel universe where the only change is that everyone is Italian

19 notes

·

View notes

Text

RELATIONS OF ORDER AND EQUIVALENCE IN A BODY OF LAW

New Post has been published on https://www.aneddoticamagazine.com/relations-of-order-and-equivalence-in-a-body-of-law/

RELATIONS OF ORDER AND EQUIVALENCE IN A BODY OF LAW

RELATIONS OF ORDER AND EQUIVALENCE

IN A BODY OF LAW

1 – Relation

A relation is a set of ordered pairs. The first entry in the ordered pair can be called x, and the second entry can be called y.

For example, {(1, 0), (1, 1), (1, -1), (-1, 0) is an example of a relation.

A function is also an example of a relation. A function has the special property that, for each value of x, there is a unique value of y. This property does not have to hold true for a relation. The equation of a circle x²+y²=r² defines a relation between x and y, but this relation is not a function because for every value of x there are two values of y : √r²-x² and -√ r²-x².

In mathematics an order is a set on which are defined relations of order (which produce a system), or relations of equivalence (which produce an arrangement).

2 – Order

“To put in order” certainly is a work that allows to organize anyway, and in a certain sense, a set of objects, and/or concepts.

Mathematics identifies in an “order” all those properties that characterize all relations that can produce the order itself: i.e., all those properties that any relation must possess in order that the connections of the elements of the set, which is generated, constitute an order of the set itself.

The technical definition of this kind of relation is “relation of order”.

3 – Equivalence

Two logic sentences are equivalent if they will always have the same truth value. For example, the sentence “p→q” (“IF p THEN q”) is equivalent to the sentence “(NOT q)→(NOT p).”

4 – Introduction to Nomology

4.1 – Abstract

Nomology is the study of human lawmaking (theorisation) that controls and verifies the correspondence of human laws to a correct theory, i.e. to the respect of the statement of true premises, and of a valid argument. If so, then any conclusion is true, any theory is true, any law must be true.

With such a conclusion we do not want to side neither with Natural Law, nor Positive Law, nor with the polyvalent Logic of Karl Popper. We just want to assume that any human law can intervene if, and only if, it is sure to produce a benefit or an improvement to the natural order; in any contrary case no law (control brought about by enforcing rules) is needed, or can be admitted.

In this work we have tried to investigate the process of codification referred to the major aspects of society, nature, science, and other acts or facts token into consideration by a body of law.

4.2 – Definitions

Nomology can be defined as the process, which deals with the study of theories and laws. The word nomology is a neologism formed by two Greek terms: logos, which indicates ‘the study of’, and nomos, which indicates a theory, a law, the government, or the administration of something.

The etymological notion underlying theory is of ‘looking’; only secondarily did it develop via ‘contemplation’ to ‘mental conception’. It comes via late Latin theoria from Greek theörìa ‘contemplation, speculation, theory.’ This was a derivative of theöròs ‘spectator’, which was formed from the base thea- (source also of theàsthai ‘watch, look at,’ from which English gets theatre). Also derived from theoròs was theoreìn ‘look at’, which formed the basis of theorema ‘speculation, intuition, confirmed theory,’ acquired by English via late Latin theorema as theorem.

A theorem can be defined as a theory that has been proved, as the Pythagorean Theorem.

A law etymologically is that which has been ‘laid’ down. English borrowed the word from Old Norse lagu (replacing the native Old English æ ‘law’), which was the plural of lag ‘laying, good order.’ This came ultimately from the prehistoric Germanic base lag- ‘put’, from which English gets lay. It has no etymologic connection with the semantically similar legal.

English has three words lay. The common verb, ‘cause to lie’ [OE] goes back to the prehistoric Germanic base lag- ‘put,’ a variant of which produces lie. From it was derived lagjan, whose modern descendants are German legen, Dutch leggen, Swedish lägga, Danish lægge, and English lay.

Law comes from the same source, and it is possible that ledge may be an offshoot of lay (which in Middle English was legge). Ledger could well be related too. Lay ‘secular’ comes via Old French lai and Latin laicus from Greek laikòs, a derivative of laòs ‘the people’. And lay ‘ballad’ comes from Old French lai, a word of unknown origin.

The term legal, on the contrary, has a Latin source. The Latin term for ‘law’ was lex. From its stem form leg- come English legal, legislator (which goes back to a Latin compound meaning literally ‘one who proposes a law’), and legitimate. Loyal is a doublet of legal, acquired via Old French rather than directly from Latin. Another derivative of leg- was the Latin verb lēgāre ‘depute, commission, bequeath,’ which has given English collegue, college, delegate, legacy, and legation.

A ledger, etymologically, is a book that ‘lies’ in one place. The term was used in 15th and 16th century English with various specific applications, including a ‘large copy of the Breviary’ (the Roman catholic service book), and a ‘large register or record book’ – both big volumes that would not have been moved around much – but it finally settled on the ‘main book in the set of books used for keeping accounts.’ It probably comes from Dutch legger or ligger, agent nouns derived respectively from leggen ‘lay’ and liggen ‘lie’ (relatives of English lay and lie).

We said that the Latin term for ‘law’ was lex, defined by G. Devoto as an archaic Indo-European term, which defines the ‘religious law’, and that besides Latin survives only in the Indo-Iranian languages.

2.1 Commonly a theory can be:

A set of general principles drawn from any body of facts or abstract thought (as in science).

Principles governing practice (as in a profession of arts, or in an administrative regulation).

A more or less plausible or scientifically acceptable general principle offered to explain observed facts.

Any theory is an argument, i.e. a sequence of sentences (called premises) that leads to a resulting sentence (conclusion).

An argument is a valid argument if the conclusion does follow from the premises. In other words, if an argument is valid, and all its premises are true, then the conclusion must be true.

Any theory is stated through a theorem, which is the logical process by which verity is deducted from the premises of the theory itself by means of mathematical or grammatical rules of logic.

2.2 Commonly a law can be:

A rule or principle stating something that always works in the same way under the same conditions.

A rule of conduct or action established by custom or laid down and enforced by a governing authority.

The science that deals with laws and their interpretation and application.

A statement of the observed regularity of nature.

A revelation of a supreme will (as the revelation of the divine will set forth in the Old Testament).

2.3 Commonly a law tends to degenerate into:

The control brought about by enforcing rules (forces of law and order).

The imposition of a power.

Logic is the activity pertinent to the demonstration process of a statement (Theory or Law), while only the related science is pertinent to demonstrate a premise.

The doctrine of Natural Law, Positive Law, and Epistemology are the disciplines that deal with the process of legislation and codification.

In the Natural Law, any theory (or law) comes from the observation of the regularity of nature: i.e., there exists a natural order and any codification process moves to the comprehension of the truth from its observation.

Positive Law (or Positive Right) comes from the induction of experiments, i.e., reasoning from a part to the whole, or from a particular to a general conclusion.

In Epistemology theories and laws are just hypothesis. Scientific revolution in mathematics and physics in the early ‘900 demonstrated that science progresses through deep crises and rearrangements of its conceptual apparatuses. Therefore, in the contemporary Epistemology the problem of the definition of scientific criteria is continuously re-proposed.

Bertrand Russell and Rudolph Carnap consider as scientific a theory when all its items can be connected through rules of ‘correspondence’ to observable data.

Karl R. Popper, introducing the notion of ‘falsificability’, considers as scientific a theory only if it is possible to identify the events whose ascertainment can prove its falsity. In any contrary case, theory will result undemonstrated and just ‘corroborated’ (opinion supported with certain evidence).

4.3 – Theory and Law in Science

In Science, Theory and Law are terms that indicate a same object, i.e. the statement of a more or less plausible scientifically acceptable general principle offered to explain observed facts. Ohm’s law and Ohm’s theory are the same statement of a general principle of electricity. Therefore, in science law and theory have the same value.

General principles of electricity are accepted because their practical effects are visible, and easy demonstrable in the earth reference system. Nobody can state anything different than that.

General instinct to survival, reproduction, freedom, exchange, and knowledge are needs of nature, therefore they are natural laws, and nobody can state that something coming from nature is unreal, or false. Anyway, their effects are not so easy to be demonstrated as the effects of electricity are, therefore there will always exist someone somewhere who will issue human laws to regulate, by enforcing rules, those activities already regulated by the nature.

In Physics Newton’s theory and the Theory of General Relativity move to a similar gravitation theory. That is the principle of correspondence, which indicates the tendency of two physical laws to coincide when they are deducted from at least two different theories.

A few Epistemologists arrive to state that the scientific assumption of any term is nothing else than the complex of empiric operations performed when they are used. Once such a condition is satisfied, then it is possible to state that the theory under examination is scientifically valid.

Therefore, a theory results verified if observable data could be effectively related each other in the same way of the relations of ‘correspondence rules’ terms connected to data. In any contrary case we can say that the theory results counterfeited.

The inconvenient of this theory lays in the presumption that there will always exist rules of correspondence for all the terms of a theory. In the reality that never happens, because it is possible to demonstrate that almost any scientific theory contains terms with no rules of correspondence (the so called ‘theoretic terms’. Epistemologists tried to solve the problem with several modifications to strict Empiricism, looking overall for a shrewdness, which could give scientific sense also to the propositions containing some theoretic terms. Anyway, remains the fact that the verification concept itself is referred to statements with no theoretic term. These doubts are due to the circumstances that no observation, as accurate as possible, will ever allow to verify any authentic scientific law.

In fact, scientific law state the existence of a certain relationship between variable terms in infinite dominions, so that, in order to verify a law, it should be necessary to verify that the same relationship exists between an infinite number of data (corresponding to variables terms), when it is obvious that data effectively reachable by observation are always a finite number.

Such a difficulty moved the ‘falsification doctrine’ of K. Popper, which states that it is not necessary that a theory results verifiable in order to define a theory as scientific. It is necessary, on the contrary, that its falsity can be proved. In fact, in the act of a theory definition one can indicate a few events whose verification could prove its falsity (potential falsifiers). In any contrary case the theory would not be scientific, but merely metaphysic.

Once the potential falsifiers have been pointed out, scientists will be charged to submit the theory to extreme tests to verify whether it resists to the falsification attempt. If positive, scientists can state that the theory has not been ‘demonstrated’, but just ‘corroborated’.

Therefore, a real science shall be constituted by theories seriously corroborated, and we must note that any corroboration, however serious, will never result as definitive, because nobody can exclude on principle that further proofs could lead to exits in antithesis with the proofs till then performed.

The existence of such a plurality of epistemologies confirms the actuality of the problem about the formulation of a criterion of science, which can give a precise sense to the objectivity of this knowledge, and to its effective superiority in comparison with pre-scientific knowledge, without any further appeal to a presumed absolute metaphysical basis of science.

4.4 – Law and Theory

How many civil or common bodies of law have currently as same casual links with social theories as law and theory scientifically have?

A civil or common law must at least demonstrate be a theory, in order to be real (proved or just corroborated), therefore to be right. If not, any civil or common law will just be a power imposition.

In nature every living being is authorized by natural programs (instinct to survival, reproduction, freedom, exchange, and knowledge) as nature needs to oppose any power imposition, even if it comes from a process of codification imposed by a Government, an Administration, and/or any presumed or self-styled positive law.

An organism that formulates a lot of codifications and laws is the State, which becomes the highest Institution when it is assumed as a ‘body of law’. ‘Law and Order’ enforce state laws, unlike scientific laws. Any State law is coercive, even when the case that has to be regulated is not by nature.

Now, if a body of law wants at least to be a theory- as any scientific statement- shall contain demonstrability criteria, or the proof that it cannot be forged. Therefore, to become eligible any law must demonstrate that: I) premises are really scientific; ii), the argument is logic; iii) conclusions come from premises, passed through a coherent (valid) argument, and support all its statements.

In order to do that, any law must demonstrate that its statements are natural (logical) and not forged. In any contrary case the law shall result undemonstrated, therefore false.

One of the most frequent objections to the aforementioned definition is that the demonstrability of a State law can take long and hard procedures, while society’s problems need urgent interventions.

That is nonsense, because a law has a sense only when it is able to classify a real order, or when it is able to really improve a natural order.

Human society, as any other living being society, has a recognized and accepted natural order that allows applying all instincts for living. Such a natural condition needs no human manipulation or forges to live on. No civil or common law is needed, but to improve technology. Therefore, if human laws want to reach a real improvement, they shall have at the most engineering skills, which shall be the definition of highest organisation levels. In any case, such a manoeuvre- as in all engineering process- must come through a theorem (that has been defined as the logical process by which verification is deducted from the premise of the theory itself by means of mathematical or grammatical rules of logic).

Now, even if we make any effort, any terrific enormous effort to try to identify the correspondence of human laws with scientific theories, we can see only a few, very few civil or common laws eligible as theory. In all other cases they are just a power imposition.

4.5 – First Conclusion

In the Abstract we have defined Nomology as the study of human lawmaking (theorisation) that controls and verifies the correspondence of human laws to a correct theory, i.e. to the respect of the statement of true premises, and of a valid argument.)

Therefore, with a law we can state a relation of equivalence (natural law) when we describe a natural process, identifying a strict equivalence, or arrangement between the statement of the theory and the condition of reality. With a positive law usually we state a relation of order, that is, we try to organize with a certain sense a set of concepts, setting up an artificial order to the elements of the set. That is, with any positive law (relation of order) we tend to innovate to the natural order of a set, because we believe we can improve its efficiency.

Definitively, consciously or unconsciously, each time we issue a positive law we innovate reality, because we believe we can be more efficient than reality itself.

5 – INNOVATION

In a state of nature human beings live through consistent patterns or “regularities” in the way ecosophic systems evolve over time. We can articulate these patterns in the form of theories, and sets, as follows:

5.1 – Theory of Completeness of Parts.

Ecosophy arises as the result of synthesis of previous separate matters (disciplines) into a single whole. In order to live and to be viable the system includes three basic sets:

Demand Set

Production Set

Non-Rational Set.

Each set is a closed set. If any of these sets is missing or inefficient, to that extent the ecosophic system is unable to survive and prevail against its competitive systems (i.e., those systems, which impose power, e.g., Political, Military, and Violence System.)

5.2 – Theory of Entropy and Energy Conductivity.

An Ecosophic System evolves in the direction of increasing efficiency in the transfer of energy from outside to inside. This transfer can take place through a condition or state that can be called entropy, as in Physics (it is the case of using the same term just because it indicates the same phenomenon.) The higher is entropy the higher is conductivity. Therefore, the higher is conductivity, the lower enthalpy.

Entropy can be argued as the thermodynamic quantity that characterizes the trend of closed systems (i.e., those systems, which do not exchange matter or energy with surrounding environment) to evolve to the maximum equilibrium. Entropy is the quantity that signifies the non-reversibility of natural phenomena, as it is the index of energy degradation. Energy and matter degrades while entropy increases, thus resulting inapplicable.

N. Georgescu-Roegen firstly used the theory of entropy in Economics, in order to emphasize as economic processes are not “circular”, and non-reversible, and that the stock of natural resources tends to exhaust itself (this theory is also used by major ecologists.)

In Information Theory, people use the term entropy as the “quantity” of information (the higher entropy, the lower information.)

In Physics any entropy increase indicates the system’s passage to a state of greater disorder.

Imagine, for example, the passage of water from solid state to liquid state: in solid state molecules are tied each other in the ice crystal lattice, (thus easier to be identified in any fixed position), whilst in liquid state molecules, subject to weaker cohesion forces, are stimulated by a less thermal motion, that is, they are more irregular. In order to transit from solid to liquid state the system has to absorb heath (energy, enthalpy) at constant temperature, therefore its entropy variation shall be positive, i.e., entropy increases in correspondence of the passage to a phase characterized by a greater disorder.

We apply to entropy as the natural chaos, the microscopic disorder of a system, which allows enthalpy (Information, Culture, etc.,) to be acknowledged by, and transferred to ecosophic system (i.e., we can argue that entropy and enthalpy are in a reverse function compared to that given by Information Theory.)

This transfer can take place through a more or less state of entropy, and the entropy level will be the standard of transfer efficiency. In a very personal and subjective scale of entropy, we consider the U.S. as the highest entropic system, and Australia as the lowest.

5.3 – Theory of Ideal Efficiency

An Ecosophic System evolves in such a direction as to increase its degree of efficiency. Efficiency is defined as the quotient of the sum of the system’s benefits, Bi, divided by the sum of its cost effects Cj.

ΣBi

Efficiency = E = ──

ΣCj.

Benefit effects include all the valuable result of the system’s functioning. Cost effects include either individual or system cost.

Taking this trend to its limit, we can assume the notion of Ideal Efficiency is obtained when the Bi are maximum and the Cj are minimum. The theory thus states that as the system evolves, the sum of the Bi trend upward and the sum of Cj trend downward.

From Mechanics we can assume, as stated by Stan Kaplan “A technical system evolves in such a direction to increase its degree of ideality”.

Chaos Theory supports the aforementioned statement through the Theory of “Strange Attractors”.

From Economics we can assume the following theories:

Cost/Benefit Analysis

Profit Maximization

Scarcity (as a prerequisite to any economic behaviour)

The ratio Cost/Benefit indicates the efficiency of any business, i.e., any human action. In effect any benefit can be material or immaterial, real or presumed. Therefore, a benefit is a very personal appreciation, which can be related to tastes, ethics, religion, ideals, and/or any further material and/or immaterial aspect. Efficiency states that in every human action benefits must ever been greater than costs. In any contrary case we have to admit that our action is useless, and it cannot be communicated to, and/or exchanged with anybody else. Therefore, benefit is equal to utility.

Profit Maximization indicates the relationship we can trace between cost and benefit of any human exchange. That is, if we want to increase the efficiency of our action we need to increase benefits (if we can); otherwise we need to reduce costs.

In any business, producer can increase selling price, which is the benefit of his business (if he can), otherwise he has to reduce his production costs. In the other hand, consumers have to increase the benefits of the product (if they can), otherwise they need to reduce the cost (selling price) of the product. Therefore, in any exchange we can see a bargaining on the selling price, which is at the same time benefit for the producer and cost for the consumer. Only consumers really know the benefit they can get from any product, just because benefit is a very personal appreciation.

Scarcity is a prerequisite to any exchange, because in case of a free product there is no cost, which ting is contrary to any efficiency (Cost/Benefit ratio) analysis.

In effect, if we admit the possibility of satisfying a need for free, we must admit than somebody else has worked for free in order to produce the product that we have consumed. In this case we have abused of another person for satisfying our need, which aspect is not ethic at all.

5.4 – Theory of Harmonization of Rhythms

Dynamics can be visualized in term of geometric shapes called attractors. (If you start a dynamical system from some initial point and watch what it does in the long run, you often find that it ends up wandering around on some well-defined shape in phase shape. A system that settles down to a steady state has an attractor that is just a point. A system that settles down to repeating the same behaviour periodically has an attractor that is a closed loop. That is, closed loops correspond to oscillators. The butterfly effect implies that the detailed motion on a strange attractor cannot be determined in advance. But this doesn’t alter the fact that it is an attractor.

In his 1935 article “Synchronous Flashing of Fireflies” in the journal Science the America biologist Hugh Smith provides a compelling description of the phenomenon:

Imagine a tree thirty-five to forty feet high, apparently with fireflies on every leaf, and all the fireflies flashing in perfect unison at the rate of about three times in two seconds, the tree being in complete darkness between flashes. Imagine a tenth of a mile of river front with an unbroken line of mangrove trees with fireflies on every leaf flashing in synchronism, the insect on the trees at the end of the line acting in perfect unison with those between. Then, if one’s imagination is sufficiently vivid, he may form some conception of this amazing spectacle.

Why do the flashes synchronize? Asks Ian Stewart

In 1990, Renato Mirollo and Steven Strogatz showed that synchrony is the rule for mathematical models in which every firefly interacts with every other. Again, the idea is to model the insects as a population of oscillators coupled together -this time by visual signals. The chemical cycle used by each firefly to create a flash of light is represented as an oscillator. The population of fireflies is represented by a network of such oscillators with fully symmetric coupling -that is, each oscillator affects all of the others in exactly the same manner. The most unusual feature of this model, which was introduced by the American biologist Charles Peskin in 1975, is that the oscillators are pulse-coupled. That is, an oscillator affects its neighbours only at the instant when it creates a flash of light.

The mathematical difficulty is to disentangle all these interactions, so that their combined effect stands out clearly.

Mirollo and Strogatz proved that no matter what the initial conditions are, eventually all the oscillators become synchronized. The proof is based on the idea of absorption, which happens when two oscillators with different phases “lock together” and thereafter stay in phase with each other. Because the coupling is fully symmetric, once a group of oscillators has locked together, it cannot unlock. A geometric and analytic proof shows that a sequence of these absorptions must occur, which eventually lock all the oscillators together.

The big message in both locomotion and synchronization is that nature’s rhythms are often linked to symmetry, and that the patterns that occur can be classified mathematically by invoking the general principles of symmetry breaking. The principles of symmetry breaking do not answer every question about the natural world, but they do provide a unifying framework, and often suggest interesting new questions. In particular, they both pose and answer the question: Why these patterns but not others?

The lesser message is that mathematics can illuminate many aspects of nature that we do normally think of as being mathematical. This is a message that goes back to the Scottish zoologist D’Arcy Thompson, whose classic but maverick book On Growth and Form set out in 1917, an enormous variety of more or less plausible evidence for the role of mathematics in the generation of biological form and behaviour. In an age when most biologists seem to think that the only interesting thing about an animal is its DNA sequence, it is a message that needs to be repeated, loudly and often.

6. – FINAL CONCLUSION

As in Medicine it’s not responsibility of the analyst to issue the diagnosis, so in nomology is not responsibility of the analyst to come to the definition of any human law.

Our duty was to demonstrate that positive law cannot be something special than any other theory.

Theory and law (either common or civil) have the same logic. That is “Quod Erat Demonstrandum”.

Enrico Furia.

School of World Business Law

Douglas Downing, Dictionary of Mathematics Terms, 2nd ed. Barron’s Ed. Series, New York, 1995.

John Ayto, Dictionary of Word Origins, Arcade Publishing New York, 1990.

Douglas Downing, Dictionary of Mathematics Terms, Second Edition Barron’s, New York, 1990

Giacomo Devoto, Dizionario Etimologico, Le Monnier, Firenze 1968.

Ecosophy is intended as a global knowledge, which includes all aspect of life of living beings. For further description, see of the same author: “Introduction to the Ecosophic Set”; HYPERLINK “http://www.worldbusinesslaw.net/”www.worldbusinesslaw.net

Nicholas Georgescu-Roegen, (Konstanz 1906), Rumanian economist, who first applied Thermodynamics laws to Economics. See Economics and Economic Process, (1971)

Stan Kaplan, An Introduction to TRIZ, Ideation International Inc., 1996

Ian Stewart, Nature’s Numbers, Basic Books, New York, 1995

#aneddotica magazine#business#enrico furia#ethics#finance#Italia#italians#italy#magazine#news#politics

0 notes

Text

•••

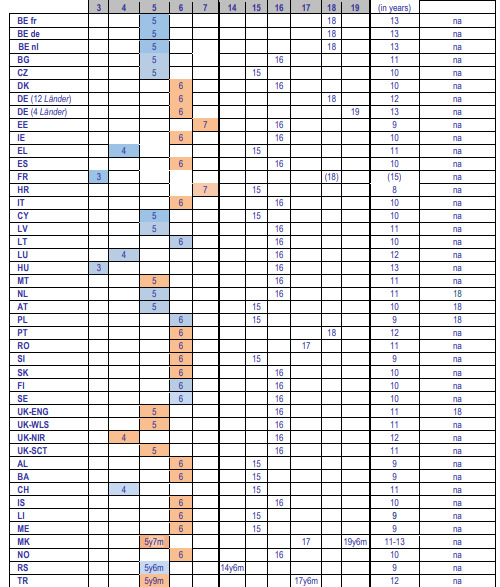

Oggi giochiamo al gioco dell'obbligo scolastico. Partiamo dalla situazione nei diversi stati che compongono l'Europa, visto come a noi Italiani piace fare gli originali in tema di obblighi. Ecco la situazione. (fonte EURIDYCE 2022)

https://eurydice.indire.it/wp-content/uploads/2020/10/Compulsory-Education-in-Europe-2020_21.pdf

Il "brillante" Enrico Letta propone l'obbligo dai 3 ai 18 anni includendo l'obbligo anche per la scuola d'infanzia. In quanti stati vige obbligo per la scuola d'infanzia in Europa? Basta consultare la tabela: pochi scendono sotto ai 6. Solo in 4 paesi UE arriva ai 18.

(https://www.nextquotidiano.it/enrico-letta-propone-scuola-infanzia-obbligatoria-fischi/)

Bonaccini si fa prendere dal furore e invoca obbligo per i nidi. Salvo poi fare retromarcia, visto che si avvicinava anche l'obbligo di concepimento secondo determinate modalità.

(https://www.orizzontescuola.it/bonaccini-asilo-nido-sia-obbligatorio-chi-lo-frequenta-poi-e-piu-bravo-alle-superiori-lo-vediamo-delle-prove-invalsi/)

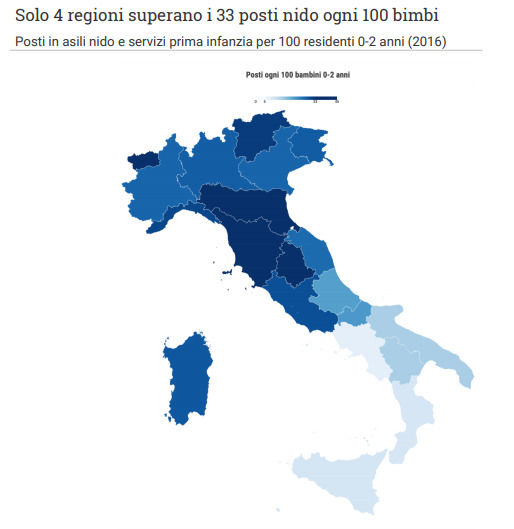

I bambini che frequentano nido+infanzia hanno standard di sviluppo cognitivo migliori di chi non li frequenta. L'obbligo è la strada da seguire? Mi si permetta di dubitarne anche a fronte di scarsa capillarità soprattutto dei nidi sul territorio.

(https://www.today.it/attualita/asili-nido-italia-divisa.html)

Si aggiunga il fatto che i nidi in particolare, ma anche le scuole d'infanzia NON sono gratuiti. Letta ha pensato a questi due semplici problemetti o siamo alle solite riforme annunciate a furia social e poi lasciate nell'ennesimo vicolo cieco? Lo ius scholae per citarne una.

Il PD si confronta con i cittadini con la modalità degli obblighi, uscendo da un consesso europeo dove scuola d'infanzia non è generalmente contemplata tra gli obblighi e mai il nido. Son gli obblighi il "nuovo" terreno di confronto politico a sinistra? Benvengano i fischi.

PS: questa foia di obbligare, sanzionare, limitare le libertà dei cittadini, facendo entrare lo stato fin in camera da letto o nella toilette ha stancato e puzza di comunismo lontano 1km. Ha stancato anche lo strombazzar riforme a caso senza realizzarle mai.

THE END

(Mr Pian Piano)

65 notes

·

View notes

Text

La miseria degli ex. Dopo vent'anni Deaglio parla ancora di "calcinaccio" - Osservatorio Repressione

Genova, 20 luglio 2001, pistola già puntata ad altezza d’uomo, estintore ancora a terra. Alle 17.27 Carlo Giuliani viene raggiunto da due colpi di pistola sparati dal Carabiniere Mario Placanica. Poi la camionetta dei carabinieri passa due volte sul corpo di Carlo, in retromarcia, schiacciandolo, per poi ripartire.

Tutto documentato negli archivi dei processi da contro inchieste, nelle immagini che i fotografi riuscirono a salvare dalla furia distruttrice dei carabinieri.

Tra questi c’era Eligio Paoni, il primo ad aver fotografato il corpo a terra di Carlo. La sua Leica fu poi distrutta mentre un poliziotto prendeva un sasso e lo scaraventava ripetutamente sulla fronte di Carlo e, insanguinato, lo lasciò lì vicino ma prima, un altro agente trascinò Paoni e gli premette la faccia su quella insanguinata di Carlo ancora vivo.

“Non so se sia stato colpito con un sasso – raccontò Bruno Abile, fotoreporter francese, collaboratore dell’agenzia Sipa Press, a Repubblica, presente in Piazza Alimonda – Di sicuro, perché l’ho visto con i miei occhi, un poliziotto o un carabiniere lo colpì con un calcio in testa quando era già morto. Ho fotografato l’ufficiale nell’istante di ‘caricare’ la gamba, come quando si sta per tirare un calcio di rigore”. Le sue due macchine fotografiche vennero distrutte dagli agenti.

Chi non ricorda quel video in cui il vicequestore Adriano Lauro, subito dopo lo sparo, non appena si rese conto di essere ripreso da una telecamera, si mise ad inseguire un manifestante che era lì vicino, urlando “Sei stato tu ad ucciderlo! Pezzo di merda! L’hai ucciso tu, con il tuo sasso!“, mentre dal Tg5, il giornalista Toni Capuozzo, ex Lotta Continua, ne commentava l’azione giubilante?

In questi giorni lo hanno rimandato in onda tantissime volte. Lauro, intanto, ha fatto carriera: nominato questore a Pesaro e, come sappiamo, non sarà il solo.

Ieri sera, su La7, Enrico Deaglio, già direttore del quotidiano Lotta Continua, dal 1977 al 1982, ha sposato la “tesi del proiettile deviato dal calcinaccio“, ovvero, la conclusione dei giudici di Genova con cui prosciolsero il carabiniere Mario Placanica in fase istruttoria dall’accusa di omicidio colposo: legittima difesa.

Nell’atto di archiviazione si citò la perizia che sosteneva che il proiettile, prima di colpire Giuliani, venne “deviato da un calcinaccio tirato in aria“. Un calcinaccio.

Quanto tempo è passato dai tempi de “La strage di Stato“.

Sergio Scorza

da Contropiano

6 notes

·

View notes

Text

Quella volta che si creò il silenzio e qualcuno decise di fare rumore

Abituatevi a questi titoli, perché ce ne saranno tanti altri così

Parole: 1015 (iniziamo con roba corta, dai)

Beta: Server di Discord (Giusto? Non posso fare la mia battutina sulla beta)

Fandom: Sanremo RPF (Cenone di Natale AU/Sanremo Family AU)

Ship: Nessuna (per adesso), forse ehm mentioned Anacore

Avvertimenti: piccolo discorso omofobico, roba fatta di fretta, povero Anastasio

Note autore: Ormai è da secoli che dovevo postare questa piccola cosina che sul server ha avuto conseguenze inaspettate... C’è una seconda parte (X)... Ringrazio @just-one-more-fandom dato che abbiamo stabilito che questa idea era partita da te!

L’ambiente non è per niente teso. Per una volta. Non capita quasi mai a questi incontri di famiglia che ci sia quiete. Forse è l’aria di primavera o lo spirito della Pasqua, anche se non spiega perché lo spirito del Natale non debba avere lo stesso effetto. Sembra quasi assurdo che un pranzo di Pasqua risulti più sereno di una cena di Natale… Ama per la prima volta dopo chi sa quanto, sorride serena durante una riunione di famiglia. È quasi un evento storico. Forse è per quello che Enrico sta facendo così tante foto con un sorriso soddisfatto piantato sulla faccia. Cally si guarda intorno e vede tranquillità sul volto di tutti, perfino su quei due idioti di Anastasio e Rancore, e gli viene in mente che forse può provare a spingerli un po’ nella giusta direzione giusta. In fondo, l’ambiente è certamente adatto.

Sembra un momento perfetto quando suo cugino si siede molto vicino a Tarek senza quasi accorgersene. Che adorabile idiota, pensa Cally mentre progetta un piano per farli avvicinare ancora di più. Non resiste all’idea di riuscire a farli arrossire entrambi, sarebbe una scena fantastica. Ma prima che possa avvicinarsi, prima che possa anche solo dire una delle sue battute per punzecchiarli, prima che possa anche solo pensare esattamente cosa fare, la voce del Male Assoluto parla qualche passo più avanti a lui. «Marco non ti rendi conto di che comportamento vergognoso stai avendo? Sei già un maleducato ed un delinquente, adesso devi pure appiccicarti così tanto a quell’altro delinquente? È davvero questo quello di cui ha bisogno questa famiglia? Un altro deplorevole esempio di omosessualità?». Silenzio assoluto. Tutti si voltano verso la fonte della voce. Ovviamente zia Rita, assistita dalle nonne vicine a lei che annuiscono in assenso. Cally stringe i pugni pronto a tirare un cazzotto in piena faccia ad una sua stessa parente, mentre nota una simile quantità di furia assoluta negli occhi di Tarek, che ha istintivamente stretto a sé Marco. Lui, poverino, sembra non essere riuscito nemmeno a capire esattamente cosa sia successo e continua a fissare la zia con lo sguardo perso.

Ci sono alcuni secondi di pesante attesa in cui tutti sembrano pronti ad assaltare la zia Rita, perfino la zia Ama sembra aver completamente perso il suo normale controllo. Cally inizia a fare un passo in avanti, ma viene interrotto da Antonio, l’altro Antonio, che si mette improvvisamente in mezzo tra lui e la zia Rita. «Se ne vada.» dice semplicemente Diodato con un tono stranamente calmo, ma osservandolo bene, nel suo stato di shock, Cally si accorge che sta stringendo i denti con forza. «Come prego? Antonio, caro, cosa stai dicendo?» risponde la zia confusa voltandosi improvvisamente verso il favorito della famiglia «Se ne vada. Non siamo direttamente imparentati, ma siamo una famiglia ormai da svariati anni, grazie alla meravigliosa e felice unione di Ama e Fiore. Che sono un perfetto esempio di un felice matrimonio e non so se lei in questi anni si è resa effettivamente conto che sono due persone queer sposate tra loro o se ha cercato di convincersi che fossero solo dei coinquilini molto vicini. E non sono gli unici. Questa famiglia è piena di meravigliosi individui che ognuno in modo diverso rappresenta la fantastica comunità che lei ha azzardato chiamare deplorevole. Io e lei non siamo imparentati, ma ho finto che lo fossimo in questi anni per rispetto e per educazione nei suoi confronti nonostante lei abbia continuato ad insultare in più occasioni, direttamente ed indirettamente, i membri della mia amata famiglia, sia quelli di sangue che quelli acquisiti che io considero vicini ed importanti quanto i primi. Non posso più sopportare, ad alcun livello, una mancanza di rispetto ed un odio tale nella quiete e nella tranquillità della mia famiglia e non intendo farlo. Non posso neanche più considerarla, nemmeno per rispetto ed educazione, parte della mia famiglia in alcun modo, quindi… Se ne vada immediatamente e lasci in pace i miei amati familiari, che lei, signora Pavone, non merita assolutamente. Potrà tornare, se e solo se, avrà imparato quanto meravigliosamente varia ed importante sia la sua stessa famiglia e quanto è fortunata a farne parte.» spiega Antonio con lo stesso tono calmo e posato di prima.

Altro profondo silenzio. Zia Rita rimane ammutolita, sbattendo più volte le palpebre confusa, tanto quanto sono confusi gli altri presenti. Cally abbassa il braccio che si accorge di aver tenuto alzato fino a quel momento pronto a tirare un pugno. La zia prende la sua borsa e si allontana urlando qualcosa sul fatto che se ne sta andando di sua scelta perché nessuno le aveva mai mancato di rispetto in quel modo. Enrico fermo nell’angolo appoggia la macchina fotografica e comincia ad applaudire, seguito prima soltanto da sua sorella Giordana e poi, lentamente, da tutti gli altri. Antonio si allontana e scompare da qualche parte in giardino, senza che nessuno se ne accorga. Cally rimane bloccato nello stesso posto faticando a capire cosa sia successo. Vede Marco riprendere a respirare e Tarek sciogliersi dal suo stato di tensione per poterlo consolare e si accorge che questo è merito di Antonio Diodato. Quel Antonio Diodato. Il cugino perfetto, adorato dalle zie e dalle nonne, che non ha mai detto una parola contro nessuna di loro. Quello che è sempre stato usato da Zia Rita come esempio di buona condotta. Quello che ha passato l’ultimo cenone di Natale a guardare storto Claudia perché adesso sta con Elodie? Lui è quello che ha deciso di fermare e cacciare la zia Rita? In difesa di Marco e Tarek? Questa poi. Di tutte le assurdità che sono successe alle riunioni di famiglia questa deve essere la più assurda. Che cazzo. Adesso mi tocca andargli a parlare. A ringraziarlo. A ringraziarlo per aver difeso mio cugino. Che cazzo. Appena riesce a muoversi di nuovo e si riprende abbastanza dallo shock Cally va a chiedere a zio Bugo dove sia andato Antonio. Mentre gli altri sembrano già essere tornati alla normalità, lui si dirige verso il luogo che gli viene indicato in cerca di Diodato.

#sanremo#sanremo rpf#sanremo rpf fanfiction#cenone di natale au#sanremo family au#anacore#sanremo 2020#and so it begins...

9 notes

·

View notes

Text

L'uomo che le sbagliò TUTTE

Per�� una cosa Enrico Berlinguer la disse giusta: parlò di «Eurocomunismo» anche se è rimasto un oggetto misterioso (ancor oggi) per quanto volesse essere sicuramente diverso da una politica dove, al posto del comitato centrale, c'è il comitato economico e finanziario, e al posto dei proletari ci sono milioni di correntisti.

Detto questo, il quotidiano La Repubblica è a corto di copie (come tutti i quotidiani) e sta cercando di recuperarle anche con un'operazione-nostalgia verso Enrico Berlinguer, strategia che ha una sua logica (recuperare per esempio i nostalgici e gli orfani dell'Unità, del «Partito», o comunque delle fasce generazionali ancora disposte a sbirciare i giornali) ma che alla lunga, come campagna, sta lasciando attoniti per la pervicacia della recita, interpretata da una straordinaria quantità di attori i quali, come dire, da giorni se la stanno decisamente raccontando. Forse troppo. Non vorremmo che a furia di ripetere il copione finissero per crederlo vero.

La Repubblica fa bene, lettori non olet, anche a costo di rivolgersi a un lettorato/elettorato ormai incapace di intendere e di volere. Ma gli altri?

Parliamo di certi giornalisti travestiti da intellettuali organici, di certi esponenti del Pd che avrebbero il problema di ridefinire eternamente un'identità. Rimpiangere Berlinguer non è certo un peccato, le icone sono icone, però ci sono anche i fatti, che sono i fatti, non opinioni.

La sinistra di Berlinguer, storicamente, è quella che perse il referendum sulla scala mobile, che scelse di non schierarsi con gli Stati Uniti e flirtò semmai con i sovietici che intanto puntavano missili nucleari contro il nostro Paese, la sinistra che non volle trattare durante il rapimento di Aldo Moro e che rifiutò ogni autonomismo e ogni riformismo che erano cavalli di battaglia di Craxi (perciò odiato) e che oggi sono divenuti patrimonio indiscusso della stessa sinistra.

E' più che ragionevole credere che Berlinguer ci avrebbe condotti a un destino greco, perché le sue posizioni su mercato e imprese e liberalismo erano da suicidio: tanto che per lustri la sua sinistra bloccò ogni opera e infrastruttura pubblica che fosse più grande di una capocchia di spillo. Non stiamo rivelando nulla, sono tutte cose che i più conoscono a menadito: anche se, a sinistra, cominciarono ufficialmente ad accorgersene solo nel tardo ottobre 2015, quando l'Unità mise in pagina un articolo dell'85enne Biagio De Giovanni secondo il quale Berlinguer, oggettivamente, aveva preso delle topiche colossali, tanto che aveva predetto il declino del capitalismo poco prima «della più grande rivoluzione capitalistica di tutti i tempi», si lesse. Un profeta, Berlinguer.

Si potrebbe continuare, anche perché non si parla di bazzecole: il partito della «questione morale» berlingueriana prendeva segretamente rubli dall'Unione Sovietica (nostra controparte politica e militare) e con la stessa e ipocrita aura di superiorità, assai probabilmente, favorì quell'antipolitica e quel qualunquismo che non si riversarono in una pulsione rivoluzionaria, ma nel giustizialismo di Mani Pulite.

Tuttavia, se ora guardate le celebrazioni di Repubblica, tra amarcord e cattiva memoria, di quanto sopra non trovate nulla. Trovate, per dire, Eugenio Scalfari che si vanta di aver intervistato Berlinguer nel 1981 sulla questione morale (complimenti) e che spiega come «Berlinguer aveva in mente di sostenere l’autonomia dei partiti nazionali comunisti occidentali dall’influenza della Russia». Ah, il famoso «strappo da Mosca», quello che non impedì al Partito di prendere rubli sino al 1989 inoltrato, quando crollò tutto l'Est e il Pci dovette umiliarsi a cambiare nome. «Berlinguer è il contrario di Renzi», scrive Scalfari. Buon per Renzi.

Anche se quest'ultimo non si è potuto sottrarre – neppure lui – al grande sciocchezzaio celebrativo: è riuscito a sostenere – e dev'essergli costato - che Berlinguer «è stato il leader che per primo ha portato la sinistra italiana dalla parte giusta della storia». Cioè il contrario della verità, come detto. Berlinguer è quello che si schierò contro gli euromissili in risposta alla minaccia dell'Urss, che cercò di salvaguardare lo zoccolo duro comunista ma che perse di vista i ceti emergenti, che rimase assolutamente comunista («l’eguaglianza è molto più importante della libertà») e non si staccò mai del tutto dall'abbraccio con Mosca, anche perché sennò i rubli non sarebbero più arrivati.

Poi c'è il famoso «eurocomunismo» berlingueriano con cui molti si riempiono la bocca in questi giorni. Sappiamo che si rivolse ai partiti comunisti di Francia e Spagna e a un certo punto anche Inghilterra. Sappiamo che doveva essere un progetto marxista intermedio al leninismo e al socialismo e che insomma voleva reinventare il comunismo.

Ma in realtà non sappiamo altro, a parte che una vera rottura con l'Unione Sovietica alla fine non ci fu, e che questo eurocomunismo non sviluppò mai una strategia politica chiara e riconoscibile. Per riconoscere invece l'eurocomunismo in salsa moderna, quello di Junker e soci, quello che ci ha reso finalmente tutti uguali nel non contare nulla, basta aprire il portafogli.

Filippo Facci

12 notes

·

View notes

Video

vimeo

Best Italian Lip Dub ISIS Enrico Fermi Bibbiena Italy Italia - Blondie Maria from ISIS Fermi on Vimeo.

Il miglior LipDub Italiano !!! facebook.com/LipDubBibbiena

Produced by Walter Pierotti Directed by Michela Franceschi & Stefano Del Furia

Filming & Videomaking: Davide Vasta dvlab.it

Filmed with Nikon D3S Photos by Bertelli Matteo

Starring (in alphabetical order) Acciai Simone - Guitarist Alexandru Georgiana - Singer Banchetti Matteo - Guitarist Bandelloni Filippo - Singer Bargellini Luca - Singer Bellini Andrea - Singer Bibtia Khalil - Singer Bussi Mattia - Guitarist Calori Giada - Singer Conti Andrea - Singer D'Amico Giovanni - Drummer David Ovidiu Emanuel - Singer Elmeruani Sukaina - Singer Ferrini Federica - Singer Fiorentini Claudio - Singer Gabrilovich Benjamin - Singer Gambineri Francesco - Singer Goretti Francesco - Singer Gori Giulio - Singer Gori Simone - Guitarist Greavu Fabian - Singer Maggio Daniele - Singer Mannelli Leonardo - Drummer Marotta Rosa - Singer Marri Beatrice - Singer Martini Davide - Singer Masetti Sara - Singer Medon Mustafaj - Singer Meini Sara - Singer Nassini Beatrice - Singer Norcini Michele - Singer Raggioli Francesco - "Sweeper" Sandroni Laura - Singer Santini Sara - Singer Squillantini Alessandro - Singer Tacconi Lorenzo - Singer Vezzosi Mirko - Singer Ziberi Ramadan - Singer

Co-Starring (in alphabetical order) Agostini Maria - Groupie Bonucci Silvia - Computer's Technician Bresciani Gabriele - Bodyguard Corsi Gianni - Fugitive David Roxana - Computer's Technician Fani Federico - Soldier Fiorini Valentina - Computer's Technician Gaietti Andrea - Soldier Martini Ilaria - Groupie Pierazzoli Lorenzo - Soldier

Teachers (in alphabetical order) Balducci Angiolo - Dancer Berti Adriana - Boss's gal Camaiani Giampiero - Card's player Fratini Rodolfo - Blind Giovani Marino - Accordionist Piccolo Francesco - Boss's bodyguard Trentini Maurizio - Biker Students 1A, 1B, 1C, 1Geo, 1Ipsia 2A, 2Geo, 2Az 3Geo, 3Inf, 3Mec, 3Tur 4Ele, 4Geo, 4Inf, 4Mec 5Ele, 5Inf, 5Ipsia, 5Mec Go-Kart Driver Nocentini Manuel

Special thanks to Giuliani Daniele Technical assistants Castelli Vasco Larghi Alberto Light & Sound TuttoMusica Service Giannini Tony Prints Baldelli Federico We thanks all ISIS "Enrico Fermi" high school's staff for their help © ISIS Enrico Fermi 2011 Bibbiena - Poppi - Italy

Songs (All copyrights belong to the artists) Blondie (1999) - "Maria" Beyond Records Ludacris (2004) - "Get Back" DTP, Def Jam The Smiths (1992) - "There Is a Light That Never Goes Out" WEA ---------------------------- Best Italian LipDub Ever !!! Il miglior Lip Dub realizzato in Italia !!! Istituto Secondario di Istruzione Superiore "Enrico Fermi" P. Matteotti 1 - 52011 . Bibbiena (AR) isisfermi.it/lipdub

0 notes

Text

Rurik e Aja. Il guerriero delle maree

Uscirà a breve in tutte le librerie il quinto e ultimo libro della serie romantico storica di Fracesca Cani, Gli eredi di Holstein, si intitola Rurik e Aja. Il guerriero delle maree .

Trama: Anno Domini 1101. Aja è l’ultima degli eredi di Holstein e ha vissuto a lungo all’ombra dei fratelli Tristan e Jonas, ma quando incontra sulla spiaggia uno straniero che indossa il kilt ed è bello come un dio pagano se ne invaghisce all’istante. Rurik è il principe di Mann, un giovane dalla chioma di fuoco che ha navigato da solo seguendo una corrente impetuosa, è spregiudicato e disposto a tutto pur di rivederla. L’amore sembra così facile, innocente e puro e ogni incontro una magia; ma il voto di matrimonio che si sono scambiati viene infranto. Due cuori separati, rotti e calpestati scelgono vie inaspettate per continuare a battere. Aja ritorna a essere invisibile, Rurik diventa re di Mann, ma l’isola viene attaccata e lui viene sottomesso. Per volere di Magnus di Norvegia, il grande monarca vichingo conquistatore delle isole, Rurik si tramuta in un Berserker, un guerriero bestia che grazie alle pozioni combatte senza coscienza. Perde la corona e la memoria gli viene cancellata, il suo volto viene sfregiato e per coprirlo indossa una maschera di rame, non è sopravvissuto nulla di umano nello spietato guerriero che chiamano il Rosso. Scarlatto come il sangue, come i peggiori istinti, come la follia, la furia assassina e la passione… Quando il Rosso attacca Holstein la sua missione è uccidere Aja, ma ben presto si accorge che può proteggerla dalla morte, non da sé stesso.

Questo è il finale di una serie di 5 libri da non perdere, ecco qui sotto i volumi precedenti:

Serie Eredi di Holstein

1. Tristan e Doralice un amore ribelle

Link: https://amzn.to/3NaCX0T