#decentralized finance platforms

Explore tagged Tumblr posts

Text

Defi lending borrowing platform development Services Discover financial empowerment with Mobiloitte's DeFi Lending and Borrowing Platform Development. Our expert team crafts decentralized solutions using smart contracts and DApps, revolutionizing lending and borrowing. Seamlessly merge blockchain and finance, creating secure, efficient, and market-leading platforms that redefine traditional financial transactions.

#defi lending and borrowing platform development company#amm defi app#decentralized finance on binance smart chain#goose defi#what is defi crowdfunding#defi lending & borrowing software#decentralized finance development#defi exchange development#defi lending and borrowing platform development#defi staking platform development#defi token development company#defi token development#decentralized finance platforms#defi development#defi wallet development solutions#defi crowdfunding platform development#benefits of defi crowdfunding#defi development company#defi lending and borrowing platform#DeFi Lending / Borrowing Platform Concept#DeFi Lending Platform Services#DeFi Lending and Borrowing Software#DeFi lending platforms

0 notes

Text

UAITrading (Unstoppable AI Trading): AI-Powered Trading for Stocks, Forex, and Crypto

https://uaitrading.ai/ UAITrading For On trading volumes offers, many free trade analysis tools and pending bonuses | Unstoppable AI Trading (Uaitrading) is a platform that integrates advanced artificial intelligence (AI) technologies to enhance trading strategies across various financial markets, including stocks, forex, and cryptocurrencies. By leveraging AI, the platform aims to provide real-time asset monitoring, automated portfolio management, and optimized trade execution, thereby simplifying the investment process for users.

One of the innovative features of Unstoppable AI Trading is its UAI token farming, which offers users opportunities to earn additional income through decentralized finance (DeFi) mechanisms. This approach allows traders to diversify their investment strategies and potentially increase returns by participating in token farming activities.

The platform's AI-driven systems are designed to analyze vast amounts of market data, identify profitable trading opportunities, and execute trades without human intervention. This automation not only enhances efficiency but also reduces the emotional biases that often affect human traders, leading to more consistent and objective trading decisions.

By harnessing the power of AI, Unstoppable AI Trading aims to empower both novice and experienced traders to navigate the complexities of financial markets more effectively, offering tools and strategies that adapt to dynamic market conditions

#Uaitrading#AI Trading#Automated Trading#Forex Trading AI#Crypto Trading Bot#UAI Token#Token Farming#Decentralized Finance (DeFi)#AI Investment Platform#Smart Trading Algorithms#AI Stock Trading#Machine Learning in Trading#AI-Powered Portfolio Management#Algorithmic Trading#Uaitrading AI Trading#Forex AI#Smart Trading#Stock Market#AI Investing#Machine Learning Trading#Trading Bot#Crypto AI#DeFi#UAI#Crypto Investing

0 notes

Text

How Are Blockchain and Smart Contracts Revolutionizing Personal Loans?

Introduction

The personal loan industry is undergoing a significant transformation, thanks to emerging technologies like blockchain and smart contracts. These innovations are making loan processing faster, more secure, and transparent. Traditional personal loan processes often involve lengthy paperwork, high-interest rates, and bureaucratic delays. However, with blockchain-powered lending, borrowers can experience streamlined approvals, reduced costs, and improved security.

As digital finance continues to evolve, understanding how blockchain and smart contracts impact the personal loan sector is crucial for both lenders and borrowers. This article explores how these technologies work and their benefits in revolutionizing the lending landscape.

What Is Blockchain and How Does It Apply to Personal Loans?

Blockchain is a decentralized, distributed ledger technology that records transactions securely and transparently. Unlike traditional banking systems, where a central authority controls loan transactions, blockchain ensures that all records are immutable and tamper-proof.

Key Features of Blockchain in Lending:

Decentralization – Eliminates the need for intermediaries like banks and credit agencies.

Transparency – Every transaction is recorded and accessible to relevant parties.

Security – Reduces fraud and unauthorized data access.

Efficiency – Speeds up loan approvals and fund disbursements.

By integrating blockchain, personal loan providers can reduce inefficiencies, making borrowing more accessible and affordable.

What Are Smart Contracts and Their Role in Personal Loans?

Smart contracts are self-executing contracts with terms directly written into code. These contracts automatically execute actions when predefined conditions are met, eliminating the need for intermediaries.

How Smart Contracts Work in Personal Lending:

Borrower Applies for a Loan – Details like loan amount, interest rate, and tenure are recorded on a blockchain.

Smart Contract Verification – The contract checks the borrower's credentials using blockchain data.

Automatic Loan Approval – If all criteria are met, the smart contract executes the loan agreement.

Instant Fund Disbursement – Upon approval, funds are transferred without manual intervention.

Automated Repayment Tracking – Payments are automatically deducted and recorded on the blockchain.

With smart contracts, borrowers benefit from a seamless lending experience, while lenders reduce risks associated with fraud and late repayments.

Benefits of Blockchain and Smart Contracts in Personal Loans

1. Faster Loan Approvals and Disbursements

Traditional personal loan applications can take days or weeks for approval due to manual verification. With blockchain and smart contracts:

Real-time verification speeds up approval processes.

Instant fund transfers ensure quick access to borrowed funds.

Automated underwriting reduces paperwork and delays.

2. Increased Security and Fraud Prevention

One of the biggest challenges in lending is fraud and identity theft. Blockchain technology mitigates these risks by:

Creating tamper-proof transaction records.

Eliminating data manipulation through decentralized verification.

Ensuring borrower identity verification using encrypted blockchain records.

3. Reduced Costs for Borrowers

Banks and traditional lenders charge high processing fees and interest rates due to administrative overheads. Blockchain-based personal loans minimize these costs by:

Removing middlemen like banks and credit agencies.

Lowering transaction fees using decentralized finance (DeFi) platforms.

Providing competitive interest rates through peer-to-peer lending.

4. Transparency and Trust in Lending

Blockchain records all transactions publicly, ensuring transparency in lending agreements. Borrowers and lenders can:

Track loan agreements in real time.

Avoid hidden fees or unfair lending terms.

Ensure compliance with agreed-upon loan conditions.

5. Improved Accessibility to Credit

Many individuals lack a formal credit history, making it difficult to obtain loans from traditional banks. Blockchain lending platforms use alternative credit assessment models, enabling:

Loans for the unbanked and underbanked populations.

Alternative credit scoring using transaction history and blockchain reputation.

Financial inclusion for freelancers, gig workers, and small business owners.

The Rise of Decentralized Finance (DeFi) in Personal Loans

Decentralized Finance (DeFi) is a blockchain-based financial ecosystem that eliminates intermediaries, allowing direct lending and borrowing between individuals.

Features of DeFi Lending:

Smart contract-based lending platforms.

Lower interest rates compared to traditional banks.

Access to global lenders without geographical restrictions.

Popular DeFi lending platforms like Aave, Compound, and MakerDAO are already revolutionizing the way personal loans are issued, making borrowing easier and more cost-effective.

Challenges and Risks of Blockchain-Based Personal Loans

Despite its advantages, blockchain lending faces some challenges:

1. Regulatory Uncertainty

Governments and financial institutions are still working on regulations for blockchain-based personal loans, which could impact widespread adoption.

2. Volatility in Crypto-Backed Loans

Some blockchain loans are backed by cryptocurrencies, which are highly volatile, posing risks for borrowers and lenders.

3. Technical Complexity

Borrowers may need basic knowledge of blockchain and digital wallets, making accessibility a challenge for non-tech-savvy individuals.

4. Limited Consumer Protection

Unlike traditional banks, blockchain-based lending platforms may lack consumer protection mechanisms in case of disputes or fraud.

The Future of Blockchain in the Personal Loan Market

As blockchain and smart contracts gain acceptance, the personal loan industry is expected to undergo further innovations:

1. Mainstream Adoption of Blockchain-Based Lending

More traditional banks may integrate blockchain technology into their lending processes for faster approvals and increased security.

2. Government-Backed Blockchain Lending Platforms

Governments may introduce blockchain-based loan programs to enhance financial inclusion and transparency.

3. AI and Blockchain Integration for Enhanced Credit Scoring

Combining AI with blockchain will enable more accurate borrower assessments, leading to fairer lending practices.

4. Smart Loans with Customizable Terms

Future personal loans may be fully customizable, allowing borrowers to set their preferred repayment structures and interest rates through AI-driven smart contracts.

Conclusion

Blockchain and smart contracts are revolutionizing the personal loan industry by making lending faster, more transparent, and secure. These technologies eliminate the need for intermediaries, reducing costs and improving accessibility for borrowers worldwide. While challenges like regulatory uncertainty and crypto volatility remain, the future of blockchain lending looks promising.

As financial institutions and fintech companies continue to innovate, borrowers can expect a seamless and efficient personal loan experience in the years to come. Understanding how blockchain-based lending works today will help individuals make informed borrowing decisions and take advantage of future advancements in digital finance.

#personal loan#loan apps#fincrif#bank#nbfc personal loan#personal loan online#personal loans#loan services#finance#personal laon#Personal loan#Blockchain in lending#Smart contracts for personal loans#Decentralized finance (DeFi) loans#Blockchain-based personal loans#Crypto-backed personal loans#Smart contract lending#Peer-to-peer lending with blockchain#Digital lending platforms#Fintech and blockchain loans#Secure loan transactions with blockchain#Instant loan approvals with smart contracts#Automated loan disbursement#Personal loan fraud prevention#AI and blockchain in lending#Digital identity verification for loans#Smart loan agreements#Alternative credit scoring with blockchain#Secure lending platforms#Financial inclusion through blockchain

0 notes

Text

Revolutionize Finance with Mobiloitte’s DeFi Lending and Borrowing Platform

Introduction

The financial world is undergoing a seismic shift, and decentralized finance (DeFi) is at the forefront of this transformation. Traditional banking systems, with their inefficiencies and centralized control, are being challenged by innovative DeFi Lending Platforms that offer transparency, speed, and accessibility. At Mobiloitte, we’re proud to lead this revolution with our cutting-edge DeFi Lending and Borrowing Platform. Designed to empower individuals and businesses alike, our platform redefines how lending and borrowing work in the digital age. Whether you’re a lender looking to earn interest or a borrower seeking quick access to funds, our platform is your gateway to a decentralized financial future.

Why DeFi Lending and Borrowing?

DeFi is more than just a buzzword—it’s a paradigm shift in how financial transactions are conducted. Unlike traditional systems, DeFi Lending eliminates intermediaries, reduces costs, and ensures transparency through blockchain technology. With Mobiloitte’s DeFi Lending and Borrowing Platform, users can:

Earn Passive Income: Lenders can deposit crypto assets into liquidity pools and earn competitive interest rates.

Access Instant Loans: Borrowers can secure loans using crypto as collateral, bypassing lengthy approval processes.

Enjoy Full Transparency: Every transaction is recorded on the blockchain, ensuring trust and immutability.

Key Features of Mobiloitte’s DeFi Platform

Our DeFi Lending and Borrowing Platform Development is built with user experience, security, and scalability in mind. Here’s what sets us apart:

Secure DeFi Wallet Integration

Our platform supports multi-currency wallets, allowing users to store, deposit, and withdraw a wide range of cryptocurrencies and stablecoins securely.

Smart Contract Automation

Smart contracts handle everything from loan approvals to repayments, ensuring a seamless, trustless, and error-free process.

Intuitive User Dashboard

A user-friendly interface makes it easy for both lenders and borrowers to manage their accounts, track transactions, and monitor earnings or repayments.

Robust Risk Management

We’ve implemented advanced risk management protocols to protect lenders from market volatility and ensure the stability of the platform.

Liquidity Pools

Our liquidity pools ensure that funds are always available for borrowing, creating a dynamic and efficient marketplace for lenders and borrowers.

Institutional-Grade Security

With state-of-the-art encryption and security measures, your assets are always safe on our platform.

Benefits of Choosing Mobiloitte for DeFi Platform Development

When you partner with Mobiloitte, you’re not just getting a platform—you’re gaining a competitive edge in the DeFi space. Here’s why businesses and individuals trust us for DeFi Lending Platform Development Services:

Expertise: Our team of 150+ blockchain and finance experts ensures your platform is built to the highest standards.

Custom Solutions: We tailor our DeFi Lending Platform to meet your specific business needs, ensuring maximum ROI.

Rapid Development: Our agile development process ensures your platform is launched quickly without compromising quality.

End-to-End Support: From DeFi Lending and Borrowing Platform Development to post-launch maintenance, we’re with you every step of the way.

The Future of Finance is Here

DeFi is not just the future—it’s the present. By leveraging blockchain technology and smart contracts, Mobiloitte’s DeFi Lending and Borrowing Platform offers a faster, cheaper, and more transparent alternative to traditional financial systems. Whether you’re a fintech startup, a financial institution, or an individual investor, our platform provides the tools you need to thrive in the decentralized economy.

Conclusion

The rise of DeFi Lending Platforms marks a new era in finance—one that prioritizes accessibility, transparency, and efficiency. Mobiloitte’s DeFi Lending and Borrowing Platform Development services are designed to help you capitalize on this transformative trend. With our expertise, cutting-edge technology, and commitment to excellence, we empower you to build a platform that not only meets but exceeds market expectations.

Don’t wait to be part of the DeFi revolution. Whether you’re looking to develop a DeFi Lending Platform or enhance your existing financial ecosystem, Mobiloitte is your trusted partner. Let’s build the future of finance together.

#Mobiloitte offers DeFi crowdfunding platform development services to help businesses create decentralized#secure#and transparent crowdfunding platforms that empower entrepreneurs and investors in the new era of finance. [Length:221]

0 notes

Text

Passive income opportunities with Sky Marvel

Ready to earn passive income effortlessly? At Sky Marvel, we provide you with exciting passive income opportunities through our staking platform. You can earn rewards simply by staking your tokens, while also helping secure our decentralized network. With our transparent and secure system, you’re in control of your assets, and the rewards keep rolling in. Sky Marvel is your gateway to stress-free earning in the world of decentralized finance. Why wait? Start staking today and let your tokens work for you!

0 notes

Text

How Many People Are Investing in Cryptocurrency?

Cryptocurrency has evolved from a niche interest to a mainstream financial asset. As digital currencies like Bitcoin, Ethereum, and others continue to gain traction, the question arises: how many people are investing in cryptocurrency? Statistics on Cryptocurrency Investment: As of 2023, an estimated 420 million people worldwide own cryptocurrencies. Approximately 15% of adults in the United…

View On WordPress

#Bitcoin#blockchain#blockchain technology#crypto adoption#crypto analysis#crypto demographics#crypto economy#crypto education#crypto finance#crypto growth#crypto innovation#crypto investment#crypto investors#crypto market#crypto market cap#crypto market dynamics#crypto mining#crypto news#crypto ownership#crypto platforms#crypto popularity#crypto regulations#crypto returns#crypto risks#crypto stats#crypto trading#crypto trends#cryptocurrency#decentralized finance#DeFi

1 note

·

View note

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

Defi lending borrowing platform development Company

Unlock the power of decentralized finance with Mobiloitte DeFi lending and borrowing platform development! Seamlessly connect borrowers and lenders on a secure and transparent platform. Our experts build robust smart contracts, integrate multiple cryptocurrencies, and ensure seamless user experiences. Experience the future of finance with Mobiloitte's DeFi lending and borrowing solutions. Visit us today at Mobiloitte

#defi lending and borrowing platform development company#amm defi app#decentralized finance on binance smart chain#goose defi#what is defi crowdfunding#defi lending & borrowing software#decentralized finance development#defi exchange development#defi lending and borrowing platform development#defi staking platform development#defi token development company#defi token development#decentralized finance platforms#defi development#defi wallet development solutions#defi crowdfunding platform development#benefits of defi crowdfunding#defi development company

0 notes

Text

Can Blockchain Technology Improve Personal Loan Approvals?

The financial sector is rapidly evolving with new technologies, and blockchain is one of the most promising innovations transforming the personal loan industry. Traditionally, loan approvals have been time-consuming, requiring manual document verification, credit score analysis, and financial background checks. Blockchain technology is changing this by making the process faster, more secure, and more transparent.

With blockchain, lenders can streamline identity verification, enhance credit risk assessment, and prevent fraud, making personal loans more accessible and efficient. In this article, we explore how blockchain is improving loan approvals and why it could be the future of digital lending.

��� For hassle-free personal loan applications, visit FinCrif Personal Loan.

1. How Blockchain Enhances Loan Approvals

Faster and More Reliable Identity Verification

One of the biggest hurdles in personal loan approvals is verifying a borrower’s identity. Traditional Know Your Customer (KYC) processes require applicants to submit documents such as Aadhaar, PAN, and bank statements, which banks manually verify. This process can take several days, causing delays.

Blockchain eliminates redundant verification by storing identity records in a tamper-proof, decentralized ledger. Once an identity is verified and recorded on the blockchain, it can be accessed by lenders instantly, reducing processing time and ensuring authenticity.

Alternative Credit Scoring for Faster Loan Approvals

Many individuals struggle to get personal loans due to a lack of credit history or low CIBIL scores. Traditional lenders primarily rely on credit bureau scores, which do not always provide a complete picture of a borrower's financial behavior.

Blockchain allows lenders to use alternative data sources, such as utility bill payments, mobile phone transactions, and online spending patterns, to assess creditworthiness. This makes personal loans accessible to self-employed individuals, gig workers, and those without a strong credit history.

Automated Loan Processing with Smart Contracts

A smart contract is a self-executing agreement stored on a blockchain that automatically enforces the terms of a loan when certain conditions are met. These contracts eliminate the need for human intervention, making loan approvals much faster.

For example, once a borrower's identity and financial records are verified, a smart contract can instantly approve the loan and trigger fund disbursement. This removes bureaucratic delays, helping borrowers access funds within minutes instead of days.

2. Improved Security and Fraud Prevention

Prevention of Identity Theft and Fake Applications

One of the biggest challenges in personal lending is fraud. Many loan scams involve forged documents, fake identities, or manipulated financial records. Blockchain prevents fraud by ensuring that all transactions and data entries are permanent, transparent, and tamper-proof.

Lenders can verify borrower details on a shared blockchain network, making it impossible for fraudsters to manipulate loan applications. This enhances trust and reduces the risk of defaults.

Eliminating Credit Report Manipulation

In the current system, borrowers can sometimes manipulate their credit reports by temporarily improving their credit utilization before applying for a loan. Blockchain stores real-time financial data, making it impossible to alter past records. This ensures that lenders always have an accurate financial picture of borrowers, reducing lending risks.

3. Faster Loan Disbursement with Blockchain

In traditional lending, once a loan is approved, it may take several days for funds to be transferred due to interbank processes and verification checks. Blockchain speeds up disbursal by enabling direct peer-to-peer transactions without intermediary banks.

With blockchain-based digital wallets, borrowers can receive loan amounts instantly after approval, making it a game-changer for emergency loans and urgent financial needs.

🔗 Looking for a quick loan disbursal? Explore FinCrif Personal Loan.

4. Transparency and Reduced Loan Processing Costs

Lower Processing Fees for Borrowers

Loan processing involves multiple intermediaries, such as credit bureaus, third-party verifiers, and bank officers, each adding costs that are passed on to borrowers. Blockchain eliminates many of these middlemen by automating verification and reducing paperwork.

This leads to lower processing fees and better interest rates, making personal loans more affordable.

Complete Transparency in Loan Terms

Many borrowers struggle with hidden charges, fluctuating interest rates, and complex loan agreements. Blockchain ensures absolute transparency by recording all loan terms on an immutable ledger. Borrowers can access their loan history, EMI schedules, and outstanding balances without worrying about unexpected changes in loan conditions.

5. Challenges in Implementing Blockchain for Personal Loans

Despite its advantages, blockchain adoption in personal lending faces challenges, including regulatory concerns and technical barriers.

Regulatory Uncertainty: Many governments are still developing policies on blockchain-based lending, which slows adoption.

Integration with Existing Banking Systems: Most financial institutions operate on centralized databases, making integration with decentralized blockchain networks complex.

User Awareness: Many borrowers are unfamiliar with blockchain technology and may hesitate to trust a fully automated loan approval system.

However, as blockchain regulations become clearer and financial institutions invest in digital transformation, these challenges are expected to decrease.

6. The Future of Blockchain in Personal Loan Approvals

As blockchain technology continues to evolve, it will play an even bigger role in making personal loans more accessible, secure, and efficient. Some expected advancements include:

Instant Global Loan Access: Borrowers will be able to apply for and receive loans across borders without waiting for traditional bank approvals.

AI and Blockchain Integration: Combining artificial intelligence with blockchain will further enhance loan approvals by analyzing borrower behavior in real-time.

Decentralized Lending Platforms: More peer-to-peer (P2P) lending models will emerge, allowing borrowers to connect directly with lenders, bypassing traditional banks.

🔗 Be part of the future of lending! Explore AI-powered loan solutions at FinCrif Personal Loan.

Blockchain technology has the potential to redefine personal loan approvals by making them faster, more transparent, and secure. By reducing reliance on credit bureaus, enabling instant identity verification, and preventing fraud, blockchain can improve financial accessibility for millions of borrowers.

While challenges remain, the future of personal lending is increasingly digital. As blockchain adoption grows, borrowers can expect lower costs, faster approvals, and a more efficient lending experience.

For a seamless and secure personal loan application, visit FinCrif Personal Loan and explore the latest AI-driven financial solutions.

#Blockchain in personal loans#Blockchain loan approval#Blockchain technology in lending#Personal loan blockchain#Faster loan approvals with blockchain#Blockchain-based lending#Secure loan processing#Decentralized lending platforms#Smart contracts for loans#Instant loan approvals#How blockchain improves lending#Blockchain in financial services#Digital lending with blockchain#Alternative credit scoring with blockchain#AI and blockchain in loans#Fraud prevention in personal loans#Transparent loan processing#Peer-to-peer lending blockchain#Future of blockchain in banking#Secure identity verification for loans#finance#loan apps#personal loans#loan services#personal loan#fincrif#personal loan online#nbfc personal loan#bank#personal laon

0 notes

Text

Decentralized Finance Platforms: The Future of Finance

Decentralized finance (DeFi) platforms are becoming more popular in the world of finance. They are built on blockchain technology, which makes them more secure and transparent than traditional finance platforms. DeFi platforms are also decentralized, which means that they are not controlled by any central authority, making them more accessible to everyone. What is DeFi? DeFi is a term used to…

View On WordPress

0 notes

Text

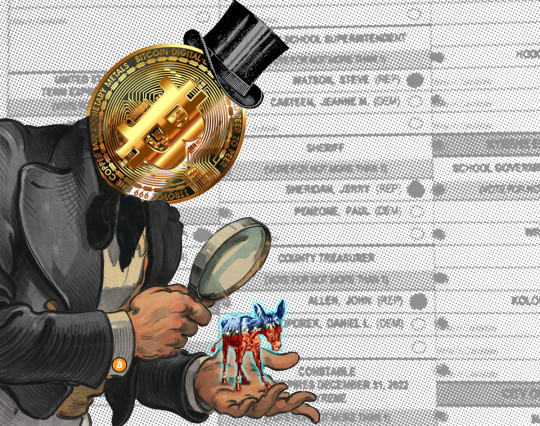

The largest campaign finance violation in US history

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Earlier this month, some of the richest men in Silicon Valley, led by Marc Andreesen and Ben Horowitz (the billionaire VCs behind Andreesen-Horowitz) announced that they would be backing Trump with endorsements and millions of dollars:

https://www.forbes.com/sites/dereksaul/2024/07/16/trump-lands-more-big-tech-backers-billionaire-venture-capitalist-andreessen-joins-wave-supporting-former-president/

Predictably, this drew a lot of ire, which Andreesen tried to diffuse by insisting that his support "doesn’t have anything to do with the big issues that people care about":

https://www.theverge.com/2024/7/24/24204706/marc-andreessen-ben-horowitz-a16z-trump-donations

In other words, the billionaires backing Trump weren't doing so because they supported the racism, the national abortion ban, the attacks on core human rights, etc. Those were merely tradeoffs that they were willing to make to get the parts of the Trump program they do support: more tax-cuts for the ultra-rich, and, of course, free rein to defraud normies with cryptocurrency Ponzi schemes.

Crypto isn't "money" – it is far too volatile to be a store of value, a unit of account, or a medium of exchange. You'd have to be nuts to get a crypto mortgage when all it takes is Elon Musk tweeting a couple emoji to make your monthly mortgage payment double.

A thing becomes moneylike when it can be used to pay off a bill for something you either must pay for, or strongly desire to pay for. The US dollar's moneylike property comes from the fact that hundreds of millions of people need dollars to pay off the IRS and their state tax bills, which means that they will trade labor and goods for dollars. Even people who don't pay US taxes will accept dollars, because they know they can use them to buy things from people who do have a nondiscretionary bill that can only be paid in dollars.

Dollars are also valuable because there are many important commodities that can only – or primarily – be purchased with them, like much of the world's oil supply. The fact that anyone who wants to buy oil has a strong need for dollars makes dollars valuable, because they will sell labor and goods to get dollars, not because they need dollars, but because they need oil.

There's almost nothing that can only be purchased with crypto. You can procure illegal goods and services in the mistaken belief that this transaction will be durably anonymous, and you can pay off ransomware creeps who have hijacked your personal files or all of your business's data:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Web3 was sold as a way to make the web more "decentralized," but it's best understood as an effort to make it impossible to use the web without paying crypto every time you click your mouse. If people need crypto to use the internet, then crypto whales will finally have a source of durable liquidity for the tokens they've hoarded:

https://pluralistic.net/2022/09/16/nondiscretionary-liabilities/#quatloos

The Web3 bubble was almost entirely down to the vast hype machine mobilized by Andreesen-Horowitz, who bet billions of dollars on the idea and almost single-handedly created the illusion of demand for crypto. For example, they arranged a $100m bribe to Kickstarter shareholders in exchange for Kickstarter pretending to integrate "blockchain" into its crowdfunding platform:

https://finance.yahoo.com/news/untold-story-kickstarter-crypto-hail-120000205.html

Kickstarter never ended up using the blockchain technology, because it was useless. Their shareholders just pocketed the $100m while the company weathered the waves of scorn from savvy tech users who understood that this was all a shuck.

Look hard enough at any crypto "success" and you'll discover a comparable scam. Remember NFTs, and the eye-popping sums that seemingly "everyone" was willing to pay for ugly JPEGs? That whole market was shot through with "wash-trading" – where you sell your asset to yourself and pretend that it was bought by a third party. It's a cheap – and illegal – way to convince people that something worthless is actually very valuable:

https://mailchi.mp/brianlivingston.com/034-2#free1

Even the books about crypto are scams. Chris Dixon's "bestseller" about the power of crypto, Read Write Own, got on the bestseller list through the publishing equivalent of wash-trading, where VCs with large investments in crypto bought up thousands of copies and shoved them on indifferent employees or just warehoused them:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

The fact that crypto trades were mostly the same bunch of grifters buying shitcoins from each other, while spending big on Superbowl ads, bribes to Kickstarter shareholders, and bulk-buys of mediocre business-books was bound to come out someday. In the meantime, though, the system worked: it convinced normies to gamble their life's savings on crypto, which they promptly lost (if you can't spot the sucker at the table, you're the sucker).

There's a name for this: it's called a "bezzle." John Kenneth Galbraith defined a "bezzle" as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it." All bezzles collapse eventually, but until they do, everyone feels better off. You think you're rich because you just bought a bunch of shitcoins after Matt Damon told you that "fortune favors the brave." Damon feels rich because he got a ton of cash to rope you into the con. Crypto.com feels rich because you took a bunch of your perfectly cromulent "fiat money" that can be used to buy anything and traded it in for shitcoins that can be used to buy nothing:

https://theintercept.com/2022/10/26/matt-damon-crypto-commercial/

Andreesen-Horowitz were masters of the bezzle. For them, the Web3 bet on an internet that you'd have to buy their shitcoins to use was always Plan B. Plan A was much more straightforward: they would back crypto companies and take part of their equity in huge quantities of shitcoins that they could sell to "unqualified investors" (normies) in an "initial coin offering." Normally, this would be illegal: a company can't offer stock to the general public until it's been through an SEC vetting process and "gone public" through an IPO. But (Andreesen-Horowitz argued) their companies' "initial coin offerings" existed in an unregulated grey zone where they could be traded for the life's savings of mom-and-pop investors who thought crypto was real because they heard that Kickstarter had adopted it, and there was a bestselling book about it, and Larry David and Matt Damon and Spike Lee told them it was the next big thing.

Crypto isn't so much a financial innovation as it is a financial obfuscation. "Fintech" is just a cynical synonym for "unregulated bank." Cryptocurrency enjoys a "byzantine premium" – that is, it's so larded with baffling technical nonsense that no one understands how it works, and they assume that anything they don't understand is probably incredibly sophisticated and great ("a pile of shit this big must have pony under it somewhere"):

https://pluralistic.net/2022/03/13/the-byzantine-premium/

There are two threats to the crypto bezzle: the first is that normies will wise up to the scam, and the second is that the government will put a stop to it. These are correlated risks: if the government treats crypto as a security (or worse, a scam), that will put severe limits on how shitcoins can be marketed to normies, which will staunch the influx of real money, so the sole liquidity will come from ransomware payments and transactions with tragically overconfident hitmen and drug dealers who think the blockchain is anonymous.

To keep the bezzle going, crypto scammers have spent the past two election cycles flooding both parties with cash. In the 2022 midterms, crypto money bankrolled primary challenges to Democrats by absolute cranks, like the "effective altruist" Carrick Flynn ("effective altruism" is a crypto-affiliated cult closely associated with the infamous scam-artist Sam Bankman-Fried). Sam Bankman-Fried's super PAC, "Protect Our Future," spent $10m on attack-ads against Flynn's primary opponent, the incumbent Andrea Salinas. Salinas trounced Flynn – who was an objectively very bad candidate who stood no chance of winning the general election – but only at the expense of most of the funds she raised from her grassroots, small-dollar donors.

Fighting off SBF's joke candidate meant that Salinas went into the general election with nearly empty coffers, and she barely squeaked out a win against a GOP nightmare candidate Mike Erickson – a millionaire Oxy trafficker, drunk driver, and philanderer who tricked his then-girlfriend by driving her to a fake abortion clinic and telling her that it was a real one:

https://pluralistic.net/2022/10/14/competitors-critics-customers/#billionaire-dilletantes

SBF is in prison, but there's no shortage of crypto millions for this election cycle. According to Molly White's "Follow the Crypto" tracker, crypto-affiliated PACs have raised $185m to influence the 2024 election – more than the entire energy sector:

https://www.followthecrypto.org/

As with everything "crypto," the cryptocurrency election corruption slushfund is a bezzle. The "Stand With Crypto PAC" claims to have the backing of 1.3 million "crypto advocates," and Reuters claims they have 440,000 backers. But 99% of the money claimed by Stand With Crypto was actually donated to "Fairshake" – a different PAC – and 90% of Fairshake's money comes from a handful of corporate donors:

https://www.citationneeded.news/issue-62/

Stand With Crypto – minus the Fairshake money it falsely claimed – has raised $13,690 since April. That money came from just seven donors, four of whom are employed by Coinbase, for whom Stand With Crypto is a stalking horse. Stand With Crypto has an affiliated group (also called "Stand With Crypto" because that is an extremely normal and forthright way to run a nonprofit!), which has raised millions – $1.49m. Of that $1.49m, 90% came from just four donors: three cryptocurrency companies, and the CEO of Coinbase.

There are plenty of crypto dollars for politicians to fight over, but there are virtually no crypto voters. 69-75% of Americans "view crypto negatively or distrust it":

https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

When Trump keynotes the Bitcoin 2024 conference and promises to use public funds to buy $1b worth of cryptocoins, he isn't wooing voters, he's wooing dollars:

https://www.wired.com/story/donald-trump-strategic-bitcoin-stockpile-bitcoin-2024/

Wooing dollars, not crypto. Politicians aren't raising funds in crypto, because you can't buy ads or pay campaign staff with shitcoins. Remember: unless Andreesen-Horowitz manages to install Web3 crypto tollbooths all over the internet, the industries that accept crypto are ransomware, and technologically overconfident hit-men and drug-dealers. To win elections, you need dollars, which crypto hustlers get by convincing normies to give them real money in exchange for shitcoins, and they are only funding politicians who will make it easier to do that.

As a political matter, "crypto" is a shorthand for "allowing scammers to steal from working people," which makes it a very Republican issue. As Hamilton Nolan writes, "If the Republicans want to position themselves as the Party of Crypto, let them. It is similar to how they position themselves as The Party of Racism and the Party of Religious Zealots and the Party of Telling Lies about Election Fraud. These things actually reflect poorly on them, the Republicans":

https://www.hamiltonnolan.com/p/crypto-as-a-political-characteristic

But the Democrats – who are riding high on the news that Kamala Harris will be their candidate this fall – have decided that they want some of that crypto money, too. Even as crypto-skeptical Dems like Jamaal Bowman, Cori Bush, Sherrod Brown and Jon Tester see millions from crypto PACs flooding in to support their primary challengers and GOP opponents, a group of Dem politicians are promising to give the crypto industry whatever it wants, if they will only bribe Democratic candidates as well:

https://subscriber.politicopro.com/f/?id=00000190-f475-d94b-a79f-fc77c9400000

Kamala Harris – a genuinely popular candidate who has raised record-shattering sums from small-dollar donors representing millions of Americans – herself has called for a "reset" of the relationship between the crypto sector and the Dems:

https://archive.is/iYd1C

As Luke Goldstein writes in The American Prospect, sucking up to crypto scammers so they stop giving your opponents millions of dollars to run attack ads against you is a strategy with no end – you have to keep sucking up to the scam, otherwise the attack ads come out:

https://prospect.org/politics/2024-07-31-crypto-cash-affecting-democratic-races/

There's a whole menagerie of crypto billionaires behind this year's attempt to buy the American government – Andreesen and Horowitz, of course, but also the Winklevoss twins, and this guy, who says we're in the midst of a "civil war" and "anyone that votes against Trump can die in a fucking fire":

https://twitter.com/molly0xFFF/status/1813952816840597712/photo/1

But the real whale that's backstopping the crypto campaign spending is Coinbase, through its Fairshake crypto PAC. Coinbase has donated $45,500,000 to Fairshake, which is a lot:

https://www.coinbase.com/blog/how-to-get-regulatory-clarity-for-crypto

But $45.5m isn't merely a large campaign contribution: it appears that $25m of that is the largest the largest illegal campaign contribution by a federal contractor in history, "by far," a fact that was sleuthed out by Molly White:

https://www.citationneeded.news/coinbase-campaign-finance-violation/

At issue is the fact that Coinbase is bidding to be a US federal contractor: specifically, they want to manage the crypto wallets that US federal cops keep seizing from crime kingpins. Once Coinbase threw its hat into the federal contracting ring, it disqualified itself from donating to politicians or funding PACs:

Campaign finance law prohibits federal government contractors from making contributions, or promising to make contributions, to political entities including super PACs like Fairshake.

https://www.fec.gov/help-candidates-and-committees/federal-government-contractors/

Previous to this, the largest ever illegal campaign contribution by a federal contractor appears to be Marathon Petroleum Company's 2022 bribe to GOP House and Senate super PACs, a mere $1m, only 4% of Coinbase's bribe.

I'm with Nolan on this one. Let the GOP chase millions from billionaires everyone hates who expect them to promote a scam that everyone mistrusts. The Dems have finally found a candidate that people are excited about, and they're awash in money thanks to small amounts contributed by everyday Americans. As AOC put it:

They've got money, but we've got people. Dollar bills don't vote. People vote.

https://www.popsugar.com/news/alexandria-ocasio-cortez-dnc-headquarters-climate-speech-47986992

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

#pluralistic#coinbase#crypto#cryptocurrency#elections#campaign finance#campaign finance violations#crimes#fraud#influence peddling#democrats#moneylike#bubbles#ponzi schemes#bezzles#molly white#hamilton nolan

431 notes

·

View notes

Text

The Rise of DeFi: Revolutionizing the Financial Landscape

Decentralized Finance (DeFi) has emerged as one of the most transformative sectors within the cryptocurrency industry. By leveraging blockchain technology, DeFi aims to recreate and improve upon traditional financial systems, offering a more inclusive, transparent, and efficient financial ecosystem. This article explores the fundamental aspects of DeFi, its key components, benefits, challenges, and notable projects, including a brief mention of Sexy Meme Coin.

What is DeFi?

DeFi stands for Decentralized Finance, a movement that utilizes blockchain technology to build an open and permissionless financial system. Unlike traditional financial systems that rely on centralized intermediaries like banks and brokerages, DeFi operates on decentralized networks, allowing users to interact directly with financial services. This decentralization is achieved through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

Key Components of DeFi

Decentralized Exchanges (DEXs): DEXs allow users to trade cryptocurrencies directly with one another without the need for a central authority. Platforms like Uniswap, SushiSwap, and PancakeSwap have gained popularity for their ability to provide liquidity and facilitate peer-to-peer trading.

Lending and Borrowing Platforms: DeFi lending platforms like Aave, Compound, and MakerDAO enable users to lend their assets to earn interest or borrow assets by providing collateral. These platforms use smart contracts to automate the lending process, ensuring transparency and efficiency.

Stablecoins: Stablecoins are cryptocurrencies pegged to stable assets like fiat currencies to reduce volatility. They are crucial for DeFi as they provide a stable medium of exchange and store of value. Popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI).

Yield Farming and Liquidity Mining: Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, often in the form of additional tokens. Liquidity mining is a similar concept where users earn rewards for providing liquidity to specific pools. These practices incentivize participation and enhance liquidity within the DeFi ecosystem.

Insurance Protocols: DeFi insurance protocols like Nexus Mutual and Cover Protocol offer coverage against risks such as smart contract failures and hacks. These platforms aim to provide users with security and peace of mind when engaging with DeFi services.

Benefits of DeFi

Financial Inclusion: DeFi opens up access to financial services for individuals who are unbanked or underbanked, particularly in regions with limited access to traditional banking infrastructure. Anyone with an internet connection can participate in DeFi, democratizing access to financial services.

Transparency and Trust: DeFi operates on public blockchains, providing transparency for all transactions. This transparency reduces the need for trust in intermediaries and allows users to verify and audit transactions independently.

Efficiency and Speed: DeFi eliminates the need for intermediaries, reducing costs and increasing the speed of transactions. Smart contracts automate processes that would typically require manual intervention, enhancing efficiency.

Innovation and Flexibility: The open-source nature of DeFi allows developers to innovate and build new financial products and services. This continuous innovation leads to the creation of diverse and flexible financial instruments.

Challenges Facing DeFi

Security Risks: DeFi platforms are susceptible to hacks, bugs, and vulnerabilities in smart contracts. High-profile incidents, such as the DAO hack and the recent exploits on various DeFi platforms, highlight the need for robust security measures.

Regulatory Uncertainty: The regulatory environment for DeFi is still evolving, with governments and regulators grappling with how to address the unique challenges posed by decentralized financial systems. This uncertainty can impact the growth and adoption of DeFi.

Scalability: DeFi platforms often face scalability issues, particularly on congested blockchain networks like Ethereum. High gas fees and slow transaction times can hinder the user experience and limit the scalability of DeFi applications.

Complexity and Usability: DeFi platforms can be complex and challenging for newcomers to navigate. Improving user interfaces and providing educational resources are crucial for broader adoption.

Notable DeFi Projects

Uniswap (UNI): Uniswap is a leading decentralized exchange that allows users to trade ERC-20 tokens directly from their wallets. Its automated market maker (AMM) model has revolutionized the way liquidity is provided and traded in the DeFi space.

Aave (AAVE): Aave is a decentralized lending and borrowing platform that offers unique features such as flash loans and rate switching. It has become one of the largest and most innovative DeFi protocols.

MakerDAO (MKR): MakerDAO is the protocol behind the Dai stablecoin, a decentralized stablecoin pegged to the US dollar. MakerDAO allows users to create Dai by collateralizing their assets, providing stability and liquidity to the DeFi ecosystem.

Compound (COMP): Compound is another leading DeFi lending platform that enables users to earn interest on their cryptocurrencies or borrow assets against collateral. Its governance token, COMP, allows users to participate in protocol governance.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin has integrated DeFi features, including a decentralized marketplace for buying, selling, and trading memes as NFTs. This unique blend of humor and finance adds a distinct flavor to the DeFi landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of DeFi

The future of DeFi looks promising, with continuous innovation and growing adoption. As blockchain technology advances and scalability solutions are implemented, DeFi has the potential to disrupt traditional financial systems further. Regulatory clarity and improved security measures will be crucial for the sustainable growth of the DeFi ecosystem.

DeFi is likely to continue attracting attention from both retail and institutional investors, driving further development and integration of decentralized financial services. The flexibility and inclusivity offered by DeFi make it a compelling alternative to traditional finance, paving the way for a more open and accessible financial future.

Conclusion

Decentralized Finance (DeFi) represents a significant shift in the financial landscape, leveraging blockchain technology to create a more inclusive, transparent, and efficient financial system. Despite the challenges, the benefits of DeFi and its continuous innovation make it a transformative force in the world of finance. Notable projects like Uniswap, Aave, and MakerDAO, along with unique contributions from meme coins like Sexy Meme Coin, demonstrate the diverse and dynamic nature of the DeFi ecosystem.

For those interested in exploring the playful and innovative side of DeFi, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

253 notes

·

View notes

Text

Pluto in Aquarius: Brace for a Business Revolution (and How to Ride the Wave)

The Aquarian Revolution

Get ready, entrepreneurs and financiers, because a seismic shift is coming. Pluto, the planet of transformation and upheaval, has just entered the progressive sign of Aquarius, marking the beginning of a 20-year period that will reshape the very fabric of business and finance. Buckle up, for this is not just a ripple – it's a tsunami of change. Imagine a future where collaboration trumps competition, sustainability dictates success, and technology liberates rather than isolates. Aquarius, the sign of innovation and humanitarianism, envisions just that. Expect to see:

Rise of social impact businesses

Profits won't be the sole motive anymore. Companies driven by ethical practices, environmental consciousness, and social good will gain traction. Aquarius is intrinsically linked to collective well-being and social justice. Under its influence, individuals will value purpose-driven ventures that address crucial societal issues. Pluto urges us to connect with our deeper selves and find meaning beyond material gains. This motivates individuals to pursue ventures that resonate with their personal values and make a difference in the world.

Examples of Social Impact Businesses

Sustainable energy companies: Focused on creating renewable energy solutions while empowering local communities.

Fair-trade businesses: Ensuring ethical practices and fair wages for producers, often in developing countries.

Social impact ventures: Addressing issues like poverty, education, and healthcare through innovative, community-driven approaches.

B corporations: Certified businesses that meet rigorous social and environmental standards, balancing profit with purpose.

Navigating the Pluto in Aquarius Landscape

Align your business with social impact: Analyze your core values and find ways to integrate them into your business model.

Invest in sustainable practices: Prioritize environmental and social responsibility throughout your operations.

Empower your employees: Foster a collaborative environment where everyone feels valued and contributes to the social impact mission.

Build strong community partnerships: Collaborate with organizations and communities that share your goals for positive change.

Embrace innovation and technology: Utilize technology to scale your impact and reach a wider audience.

Pluto in Aquarius presents a thrilling opportunity to redefine the purpose of business, moving beyond shareholder value and towards societal well-being. By aligning with the Aquarian spirit of innovation and collective action, social impact businesses can thrive in this transformative era, leaving a lasting legacy of positive change in the world.

Tech-driven disruption

AI, automation, and blockchain will revolutionize industries, from finance to healthcare. Be ready to adapt or risk getting left behind. Expect a focus on developing Artificial Intelligence with ethical considerations and a humanitarian heart, tackling issues like healthcare, climate change, and poverty alleviation. Immersive technologies will blur the lines between the physical and digital realms, transforming education, communication, and entertainment. Automation will reshape the job market, but also create opportunities for new, human-centered roles focused on creativity, innovation, and social impact.

Examples of Tech-Driven Disruption:

Decentralized social media platforms: User-owned networks fueled by blockchain technology, prioritizing privacy and community over corporate profits.

AI-powered healthcare solutions: Personalized medicine, virtual assistants for diagnostics, and AI-driven drug discovery.

VR/AR for education and training: Immersive learning experiences that transport students to different corners of the world or historical periods.

Automation with a human touch: Collaborative robots assisting in tasks while freeing up human potential for creative and leadership roles.

Navigating the Technological Tsunami:

Stay informed and adaptable: Embrace lifelong learning and upskilling to stay relevant in the evolving tech landscape.

Support ethical and sustainable tech: Choose tech products and services aligned with your values and prioritize privacy and social responsibility.

Focus on your human advantage: Cultivate creativity, critical thinking, and emotional intelligence to thrive in a world increasingly reliant on technology.

Advocate for responsible AI development: Join the conversation about ethical AI guidelines and ensure technology serves humanity's best interests.

Connect with your community: Collaborate with others to harness technology for positive change and address the potential challenges that come with rapid technological advancements.

Pluto in Aquarius represents a critical juncture in our relationship with technology. By embracing its disruptive potential and focusing on ethical development and collective benefit, we can unlock a future where technology empowers humanity and creates a more equitable and sustainable world. Remember, the choice is ours – will we be swept away by the technological tsunami or ride its wave towards a brighter future?

Decentralization and democratization

Power structures will shift, with employees demanding more autonomy and consumers seeking ownership through blockchain-based solutions. Traditional institutions, corporations, and even governments will face challenges as power shifts towards distributed networks and grassroots movements. Individuals will demand active involvement in decision-making processes, leading to increased transparency and accountability in all spheres. Property and resources will be seen as shared assets, managed sustainably and equitably within communities. This transition won't be without its bumps. We'll need to adapt existing legal frameworks, address digital divides, and foster collaboration to ensure everyone benefits from decentralization.

Examples of Decentralization and Democratization

Decentralized autonomous organizations (DAOs): Self-governing online communities managing shared resources and projects through blockchain technology.

Community-owned renewable energy initiatives: Local cooperatives generating and distributing clean energy, empowering communities and reducing reliance on centralized grids.

Participatory budgeting platforms: Citizens directly allocate local government funds, ensuring public resources are used in line with community needs.

Decentralized finance (DeFi): Peer-to-peer lending and borrowing platforms, bypassing traditional banks and offering greater financial autonomy for individuals.

Harnessing the Power of the Tide:

Embrace collaborative models: Participate in co-ops, community projects, and initiatives that empower collective ownership and decision-making.

Support ethical technology: Advocate for blockchain platforms and applications that prioritize user privacy, security, and equitable access.

Develop your tech skills: Learn about blockchain, cryptocurrencies, and other decentralized technologies to navigate the future landscape.

Engage in your community: Participate in local decision-making processes, champion sustainable solutions, and build solidarity with others.

Stay informed and adaptable: Embrace lifelong learning and critical thinking to navigate the evolving social and economic landscape.

Pluto in Aquarius presents a unique opportunity to reimagine power structures, ownership models, and how we interact with each other. By embracing decentralization and democratization, we can create a future where individuals and communities thrive, fostering a more equitable and sustainable world for all. Remember, the power lies within our collective hands – let's use it wisely to shape a brighter future built on shared ownership, collaboration, and empowered communities.

Focus on collective prosperity

Universal basic income, resource sharing, and collaborative economic models may gain momentum. Aquarius prioritizes the good of the collective, advocating for equitable distribution of resources and opportunities. Expect a rise in social safety nets, universal basic income initiatives, and policies aimed at closing the wealth gap. Environmental health is intrinsically linked to collective prosperity. We'll see a focus on sustainable practices, green economies, and resource sharing to ensure a thriving planet for generations to come. Communities will come together to address social challenges like poverty, homelessness, and healthcare disparities, recognizing that individual success is interwoven with collective well-being. Collaborative consumption, resource sharing, and community-owned assets will gain traction, challenging traditional notions of ownership and fostering a sense of shared abundance.

Examples of Collective Prosperity in Action

Community-owned renewable energy projects: Sharing the benefits of clean energy production within communities, democratizing access and fostering environmental sustainability.

Cooperatives and worker-owned businesses: Sharing profits and decision-making within companies, leading to greater employee satisfaction and productivity.

Universal basic income initiatives: Providing individuals with a basic safety net, enabling them to pursue their passions and contribute to society in meaningful ways.

Resource sharing platforms: Platforms like carsharing or tool libraries minimizing individual ownership and maximizing resource utilization, fostering a sense of interconnectedness.

Navigating the Shift

Support social impact businesses: Choose businesses that prioritize ethical practices, environmental sustainability, and positive social impact.

Contribute to your community: Volunteer your time, skills, and resources to address local challenges and empower others.

Embrace collaboration: Seek opportunities to work together with others to create solutions for shared problems.

Redefine your own path to prosperity: Focus on activities that bring you personal fulfillment and contribute to the collective good.

Advocate for systemic change: Support policies and initiatives that promote social justice, environmental protection, and equitable distribution of resources.

Pluto in Aquarius offers a unique opportunity to reshape our definition of prosperity and build a future where everyone thrives. By embracing collective well-being, collaboration, and sustainable practices, we can create a world where abundance flows freely, enriching not just individuals, but the entire fabric of society. Remember, true prosperity lies not in what we hoard, but in what we share, and by working together, we can cultivate a future where everyone has the opportunity to flourish.

#pluto in aquarius#pluto enters aquarius#astrology updates#astrology community#astrology facts#astro notes#astrology#astro girlies#astro posts#astrology observations#astropost#astronomy#astro observations#astro community#business astrology#business horoscopes

121 notes

·

View notes

Text

From Casinos to Crypto: How Las Vegas Became a Blockchain Innovation Hub

Las Vegas, long synonymous with its iconic casinos and vibrant entertainment, is now emerging as an unexpected hub for blockchain innovation. Inspired by the gaming industry’s need for security, transparency, and enhanced user experiences, the city is becoming a leader in fintech applications powered by blockchain. This transformation is driving the convergence of technology, finance, and entertainment, paving the way for the city’s tech-driven future. Fifteen years ago, in 2010, 10,000 Bitcoin was used to purchase two pizzas, a transaction that marked the first real-world use of the cryptocurrency. At the time, Bitcoin was practically worthless. Fast forward to today, and the value of Bitcoin has skyrocketed. Now, selling just 33 Bitcoin could buy you a $3 million penthouse at the prestigious Four Seasons Private Residences in Las Vegas. This dramatic shift highlights not only Bitcoin’s meteoric rise but also redefining how wealth and assets are exchanged in a tech-driven world.

1. Blockchain Integration in Las Vegas

Resorts World Las Vegas

Resorts World Las Vegas is a prime example of how casinos are embracing blockchain technology and digital currencies.

Crypto Payments: The casino allows customers to use Bitcoin and Ethereum for hotel bookings, dining, and other services, partnering with Gemini, a regulated crypto exchange.

Cashless Gaming: Patrons can use mobile wallets instead of carrying physical cash. This not only enhances convenience but also increases transaction security, reducing risks of theft or fraud.

Wynn Las Vegas

Wynn Las Vegas has partnered with fintech firms to explore blockchain-based loyalty rewards programs. Customers can earn digital tokens tied to casino activities, which can be redeemed for hotel stays, entertainment, or dining experiences.

Case Study: Blockchain for Fair Play

A notable example of blockchain in casinos is FunFair Technologies, a platform that offers decentralized casino solutions using Ethereum smart contracts. While not exclusive to Las Vegas, FunFair’s model ensures provable fairness by publishing game outcomes on the blockchain, making it impossible for casinos to manipulate results.

Such innovations are being tested in Las Vegas-style gaming platforms globally, showing how blockchain can build trust between casinos and players.

Casinos in Las Vegas Accepting Bitcoin for Payments

Golden Gate Hotel & Casino

Location: 1 Fremont Street, Las Vegas, NV 89101

Details: As the oldest casino in Las Vegas, Golden Gate accepts Bitcoin for hotel bookings, dining, and gift shop purchases.

Note: Bitcoin is not accepted for gambling activities but can be converted to U.S. dollars for gaming.

The D Las Vegas Hotel & Casino

Location: 301 Fremont Street, Las Vegas, NV 89101

Details: The D Las Vegas allows Bitcoin payments for hotel rooms, dining, and merchandise at its gift shop.

Note: Bitcoin cannot be used directly for gambling but works for other non-gaming services.

Resorts World Las Vegas

Location: 3000 Las Vegas Blvd S, Las Vegas, NV 89109

Details: Resorts World has partnered with Gemini, a cryptocurrency platform, to accept Bitcoin for hotel stays, dining, and select retail purchases.

Innovation: The resort also offers cashless gaming solutions, making it one of the most tech-forward destinations on the Strip.

2. Fintech Innovations Inspired by Gaming

The gaming industry’s push for seamless, secure, and engaging user experiences has inspired broader fintech applications.

Cashless Gaming Solutions

Casinos like The Venetian and MGM Grand have integrated cashless payment systems. Platforms such as Sightline Payments provide mobile wallets for gaming, dining, and retail, eliminating the need for physical cash.

These systems use fintech innovations like real-time payment settlement and biometric security for user verification, enhancing both speed and safety.

Gamification in Fintech

Gamification—using game-like elements in financial services—draws heavily from the gaming industry’s playbook.

Example: Robinhood: The stock trading app uses gamified features such as streaks, confetti animations, and rewards to engage users.

Las Vegas Influence: Gaming incentives and loyalty programs serve as inspiration for fintech apps offering rewards for saving, spending, or investing responsibly.

Case Study: The Link Between Casinos and Fintech Apps

Las Vegas casinos often deploy advanced AI-powered analytics to predict player behavior and optimize incentives. This same data-driven approach is now being used in fintech apps like Acorns and Stash, which offer personalized financial advice and savings plans based on user habits.

3. Las Vegas-Based Blockchain Gaming Companies

Infinite Games

Las Vegas-based Infinite Games is pioneering blockchain integration in mobile and online gaming:

NFT Ownership: Players can own in-game items as NFTs (non-fungible tokens), enabling trade and resale across different platforms.

Player Economy: By using blockchain, Infinite Games creates decentralized gaming economies where players can monetize their skills and assets.

PLAYSTUDIOS

PLAYSTUDIOS, famous for its loyalty-based mobile games, is exploring blockchain to make rewards more transparent and tradable:

Blockchain allows digital tokens to replace traditional rewards points. Players can transfer, sell, or redeem tokens in ways not previously possible.

Emerging Companies in the Sector

Startups like Decentral Games are pushing the boundaries by creating virtual casinos in the metaverse, powered by blockchain and cryptocurrencies.

Players can visit virtual versions of Las Vegas casinos, bet using digital assets, and enjoy provably fair gameplay.

4. Future Prospects for Blockchain in Las Vegas

Las Vegas’s integration of blockchain technology points toward a future that is both innovative and economically diverse.

Enhanced Security and Transparency

Blockchain creates an immutable ledger for transactions, making gaming and financial processes tamper-proof and transparent.

For example, blockchain is being explored to log all bets, winnings, and payouts, ensuring trust between players and casinos.

Blockchain for Tourism and Hospitality

The Las Vegas tourism industry can leverage blockchain for smart contracts in hotel bookings, event tickets, and tours.

For instance, a blockchain-based booking platform could eliminate intermediaries like OTAs (Online Travel Agencies), offering tourists lower costs and direct transparency.

Economic Diversification

By embracing blockchain technology, Las Vegas is diversifying its economy beyond casinos and entertainment:

Tech Startups: The city’s business-friendly policies are attracting fintech and blockchain startups.

Investors and Talent: Las Vegas is becoming a hub for blockchain conferences like Money 20/20, drawing global investors and tech talent.

Conclusion

Las Vegas’s journey from a global gaming capital to a blockchain innovation hub is a testament to its ability to adapt and evolve. By integrating blockchain into its casino operations, the city is setting new standards for transparency, security, and user engagement in gaming and fintech. From cashless gaming solutions to decentralized casinos, Las Vegas serves as both a case study and a blueprint for other cities looking to harness the power of blockchain.

Platforms like RealOpen are now facilitating real estate purchases using Bitcoin, Ethereum, and other cryptocurrencies. These platforms convert crypto to cash en route to escrow, allowing buyers to purchase any property, even if the seller isn’t crypto-friendly. For example, crypto enthusiasts can test these innovations by using Bitcoin to purchase luxury properties, including a Trump Las Vegas condos for sale. This seamless process allows digital asset holders to invest directly into the Las Vegas real estate market, turning crypto wealth into tangible luxury assets.

As fintech innovations inspired by the gaming industry continue to grow, Las Vegas is uniquely positioned to lead this revolution—solidifying its status not just as the Entertainment Capital of the World, but also as a Tech and Blockchain Capital for the Future.

8 notes

·

View notes

Text

Best Defi Projects to Invest in India 2023

Discover the top DeFi projects in India (2023) revolutionizing finance. Explore decentralized lending, borrowing, yield farming, DEX, and more. Unlock potential, diversify your portfolio, and shape India's financial future. Invest wisely in innovative solutions, empowered by blockchain technology.

#defi project list#new defi projects#top decentralized finance projects#defi projects to invest in#upcoming defi projects#top defi projects#best decentralized finance projects#popular defi platforms

0 notes

Text

SEJARAH SINGKAT CRYPTOCURRENCY

Tentu, berikut adalah sejarah singkat mengenai cryptocurrency:

1. Awal Mula (1980-an - 1990-an)

1982: Konsep uang digital pertama kali diperkenalkan oleh David Chaum, seorang kriptografer, dengan penerbitan "Blind Signatures for Untraceable Payments" yang menjadi dasar untuk e-cash.

1990-an: Chaum menciptakan DigiCash, salah satu bentuk uang elektronik pertama yang menggunakan kriptografi untuk menjaga privasi transaksi.

2. Bitcoin dan Era Baru (2008 - 2010)

2008: Satoshi Nakamoto, dengan nama samaran, menerbitkan whitepaper berjudul "Bitcoin: A Peer-to-Peer Electronic Cash System" yang memperkenalkan konsep Bitcoin, sebuah mata uang digital terdesentralisasi.

2009: Bitcoin secara resmi diluncurkan dan blok pertama (genesis block) ditambang. Bitcoin adalah cryptocurrency pertama yang menggunakan teknologi blockchain untuk mencatat transaksi secara aman dan transparan.

3. Pertumbuhan dan Inovasi (2011 - 2013)

2011: Cryptocurrency lain mulai muncul, seperti Litecoin, yang dibangun di atas kode Bitcoin dengan beberapa perubahan teknis untuk memperbaiki kelemahan yang ada.

2013: Ethereum diluncurkan oleh Vitalik Buterin, memperkenalkan kontrak pintar (smart contracts) yang memungkinkan pengembangan aplikasi terdesentralisasi (dApps) di blockchain.

4. Masa Depan dan Adopsi (2014 - 2017)