#Smart contracts for loans

Explore tagged Tumblr posts

Text

Can Blockchain Technology Improve Personal Loan Approvals?

The financial sector is rapidly evolving with new technologies, and blockchain is one of the most promising innovations transforming the personal loan industry. Traditionally, loan approvals have been time-consuming, requiring manual document verification, credit score analysis, and financial background checks. Blockchain technology is changing this by making the process faster, more secure, and more transparent.

With blockchain, lenders can streamline identity verification, enhance credit risk assessment, and prevent fraud, making personal loans more accessible and efficient. In this article, we explore how blockchain is improving loan approvals and why it could be the future of digital lending.

🔗 For hassle-free personal loan applications, visit FinCrif Personal Loan.

1. How Blockchain Enhances Loan Approvals

Faster and More Reliable Identity Verification

One of the biggest hurdles in personal loan approvals is verifying a borrower’s identity. Traditional Know Your Customer (KYC) processes require applicants to submit documents such as Aadhaar, PAN, and bank statements, which banks manually verify. This process can take several days, causing delays.

Blockchain eliminates redundant verification by storing identity records in a tamper-proof, decentralized ledger. Once an identity is verified and recorded on the blockchain, it can be accessed by lenders instantly, reducing processing time and ensuring authenticity.

Alternative Credit Scoring for Faster Loan Approvals

Many individuals struggle to get personal loans due to a lack of credit history or low CIBIL scores. Traditional lenders primarily rely on credit bureau scores, which do not always provide a complete picture of a borrower's financial behavior.

Blockchain allows lenders to use alternative data sources, such as utility bill payments, mobile phone transactions, and online spending patterns, to assess creditworthiness. This makes personal loans accessible to self-employed individuals, gig workers, and those without a strong credit history.

Automated Loan Processing with Smart Contracts

A smart contract is a self-executing agreement stored on a blockchain that automatically enforces the terms of a loan when certain conditions are met. These contracts eliminate the need for human intervention, making loan approvals much faster.

For example, once a borrower's identity and financial records are verified, a smart contract can instantly approve the loan and trigger fund disbursement. This removes bureaucratic delays, helping borrowers access funds within minutes instead of days.

2. Improved Security and Fraud Prevention

Prevention of Identity Theft and Fake Applications

One of the biggest challenges in personal lending is fraud. Many loan scams involve forged documents, fake identities, or manipulated financial records. Blockchain prevents fraud by ensuring that all transactions and data entries are permanent, transparent, and tamper-proof.

Lenders can verify borrower details on a shared blockchain network, making it impossible for fraudsters to manipulate loan applications. This enhances trust and reduces the risk of defaults.

Eliminating Credit Report Manipulation

In the current system, borrowers can sometimes manipulate their credit reports by temporarily improving their credit utilization before applying for a loan. Blockchain stores real-time financial data, making it impossible to alter past records. This ensures that lenders always have an accurate financial picture of borrowers, reducing lending risks.

3. Faster Loan Disbursement with Blockchain

In traditional lending, once a loan is approved, it may take several days for funds to be transferred due to interbank processes and verification checks. Blockchain speeds up disbursal by enabling direct peer-to-peer transactions without intermediary banks.

With blockchain-based digital wallets, borrowers can receive loan amounts instantly after approval, making it a game-changer for emergency loans and urgent financial needs.

🔗 Looking for a quick loan disbursal? Explore FinCrif Personal Loan.

4. Transparency and Reduced Loan Processing Costs

Lower Processing Fees for Borrowers

Loan processing involves multiple intermediaries, such as credit bureaus, third-party verifiers, and bank officers, each adding costs that are passed on to borrowers. Blockchain eliminates many of these middlemen by automating verification and reducing paperwork.

This leads to lower processing fees and better interest rates, making personal loans more affordable.

Complete Transparency in Loan Terms

Many borrowers struggle with hidden charges, fluctuating interest rates, and complex loan agreements. Blockchain ensures absolute transparency by recording all loan terms on an immutable ledger. Borrowers can access their loan history, EMI schedules, and outstanding balances without worrying about unexpected changes in loan conditions.

5. Challenges in Implementing Blockchain for Personal Loans

Despite its advantages, blockchain adoption in personal lending faces challenges, including regulatory concerns and technical barriers.

Regulatory Uncertainty: Many governments are still developing policies on blockchain-based lending, which slows adoption.

Integration with Existing Banking Systems: Most financial institutions operate on centralized databases, making integration with decentralized blockchain networks complex.

User Awareness: Many borrowers are unfamiliar with blockchain technology and may hesitate to trust a fully automated loan approval system.

However, as blockchain regulations become clearer and financial institutions invest in digital transformation, these challenges are expected to decrease.

6. The Future of Blockchain in Personal Loan Approvals

As blockchain technology continues to evolve, it will play an even bigger role in making personal loans more accessible, secure, and efficient. Some expected advancements include:

Instant Global Loan Access: Borrowers will be able to apply for and receive loans across borders without waiting for traditional bank approvals.

AI and Blockchain Integration: Combining artificial intelligence with blockchain will further enhance loan approvals by analyzing borrower behavior in real-time.

Decentralized Lending Platforms: More peer-to-peer (P2P) lending models will emerge, allowing borrowers to connect directly with lenders, bypassing traditional banks.

🔗 Be part of the future of lending! Explore AI-powered loan solutions at FinCrif Personal Loan.

Blockchain technology has the potential to redefine personal loan approvals by making them faster, more transparent, and secure. By reducing reliance on credit bureaus, enabling instant identity verification, and preventing fraud, blockchain can improve financial accessibility for millions of borrowers.

While challenges remain, the future of personal lending is increasingly digital. As blockchain adoption grows, borrowers can expect lower costs, faster approvals, and a more efficient lending experience.

For a seamless and secure personal loan application, visit FinCrif Personal Loan and explore the latest AI-driven financial solutions.

#Blockchain in personal loans#Blockchain loan approval#Blockchain technology in lending#Personal loan blockchain#Faster loan approvals with blockchain#Blockchain-based lending#Secure loan processing#Decentralized lending platforms#Smart contracts for loans#Instant loan approvals#How blockchain improves lending#Blockchain in financial services#Digital lending with blockchain#Alternative credit scoring with blockchain#AI and blockchain in loans#Fraud prevention in personal loans#Transparent loan processing#Peer-to-peer lending blockchain#Future of blockchain in banking#Secure identity verification for loans#finance#loan apps#personal loans#loan services#personal loan#fincrif#personal loan online#nbfc personal loan#bank#personal laon

0 notes

Text

BitNest

BitNest: The Leader of the Digital Finance Revolution

BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive cryptocurrency services, including saving, lending, payment, investment and many other functions, creating a rich financial experience for users.

Our story began in 2022 with the birth of the BitNest team, which has since opened a whole new chapter in digital finance. Through relentless effort and innovation, the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.

The core functions of BitNest ecosystem include:

Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed to providing users with a safe and efficient savings solution to help you achieve your financial goals. Lending Platform: BitNest lending platform provides users with convenient borrowing services, users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliable, providing users with flexible financial support. Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creating a borderless payment network that allows users to make cross-border payments and remittances anytime, anywhere. Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in various digital assets and gain lucrative returns. Our investment platform is safe and transparent, providing users with high-quality investment channels. Through continuous innovation and efforts, BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting the development of digital finance, providing users with more secure and efficient financial services, and jointly creating a better future for digital finance.

#BitNest: The Leader of the Digital Finance Revolution#BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive crypto#including saving#lending#payment#investment and many other functions#creating a rich financial experience for users.#Our story began in 2022 with the birth of the BitNest team#which has since opened a whole new chapter in digital finance. Through relentless effort and innovation#the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.#The core functions of BitNest ecosystem include:#Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed t#Lending Platform: BitNest lending platform provides users with convenient borrowing services#users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliab#providing users with flexible financial support.#Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creat#anywhere.#Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in#providing users with high-quality investment channels.#Through continuous innovation and efforts#BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting#providing users with more secure and efficient financial services#and jointly creating a better future for digital finance.#BitNest#BitNestCryptographically

3 notes

·

View notes

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

Flash Loan Arbitrage Bot Polygon: Types and Business Benefits

This guide delves into different aspects of flash loan arbitrage bot polygon development. Unveil market insights, bot features, types, benefits, and much more.

#blockchain#technology#crypto market#crypto#flash loan#Arbitrage flash loan bot#bsc flash loan arbitrage#crypto arbitrage flash loan#flash loan arbitrage bot bsc#Crypto flash loan arbitrage bot#flash loan arbitrage smart contract

0 notes

Note

haiii!! could I put in a request for boothill x an alcoholic engineer reader who’s personality takes a complete 180 when drunk? Like when sober they’re really quiet and a total introvert but when drunk they’re basically a party animal/super hype(the reason why they drink so much is because it helps them forget about their life problems like taxes and student loan debt, if I had to compare the reader’s personality to a character I’d say hiroi kikuri from bocchi the rock) but they’re like crazy smart when it comes to machines and stuff and even fixes up boothill from time to time

headcanons or a small fic is fine^^

HII I’M SO SORRY THIS TOOK SO LONG I’ve just been out of the groove of writing for a bit but your request is so cute and I wanted to take a shot at it. Thank you for your request and I hope you like it!

Fluff + Suggestive | Boothill x GN!Reader A Few Drinks

CONTENT Fluff, suggestive, him flirting with you, you flirting with him, getting handsy, alcohol consumption, pet name usage, no reader pronouns used, CHARACTERS ARE 18+

WORD COUNT: 1227

It was a regular Friday afternoon in your personal workshop situated in your home on a planet not far off from Penacony and easily accessible via space anchors. The planet was mostly made up of plains, your house sat near a pond and was surrounded by grass and your tiny gardens that you filled with flowers and succulents. You were an excellent engineer working both for corporations as well as taking on smaller private contracts/projects occasionally. You were currently working on a specific cyborg’s finger joint, putting the finishing touches on the cybernetics before he came to have it attached to his robotic body.

You heard a familiar clicking of boots against the sidewalk to your open workshop door before an equally familiar greeting from the cyborg cowboy.

“Heya sweetheart, how ya been? Hows my dumb fudging finger treatin ya?” he chirped, his voice slightly grainy and robotic due to a lack of organic vocal chords.

You swivel around in your chair, giving him a small smile. “Your pinky was pretty messed up but I managed,” you replied quietly, a little anxious talking to the -handsome- man you knew killed people on the daily.

“Ah, ya always fix me up fine and dandy, I knew you’d be able to help,” he said as he walked towards your workbench.

You gave him a small chuckle at the praise and turned around to grab the fixed finger. “Thanks… now just have a seat on the-” you were cut off by turning slightly and being met with his face awfully close to yours. He had leaned over your shoulder to take a closer look at your work, his hands held behind his back.

Your eyes widened as you froze for a moment, unintentionally staring at him before looking away. He was looking at your work but when you turned away he took the opportunity to scan over your flustered self, grinning slightly at how cute you were.

You always treated him so sweetly, disregarding what he did for work because you knew about his past. How could he not find you adorable?

He pulled away to walk towards the table that doubled as an operating table when he or your other clients needed bigger fixes.

“Here?” he says knowingly.

You nod quickly before grabbing a few tools and setting up to attach the part back to his synthetic nervous system.

It was a painful few minutes of him watching you intently as you worked. He was sitting up, leaning back on his right hand, legs spread as he got comfy. His left hand was propped up into a sleeve to keep it still as you worked on it. You tried hard to not look up at him despite knowing he was staring down at you the entire time, probably with that teasing grin he always wore around you.

Once you were done and he finished paying you (with a generous tip no less), he suddenly wondered what you’d be doing since the work week just ended.

“So, whadda ya doin after closin’ up shop today? Ya ever go out for Friday happy hour?”

You whipped your head around to him at the mention of drinking before looking down at the ground, hoping you didn’t seem too eager to talk about alcohol.

“Y-yeah, I go every weekend,” you replied.

He raised an eyebrow and chuckled, “really? Ya didn’t really strike me as the drinkin’ type darlin’.”

You swallowed at his use of pet name.

“Yeah… it helps me get my mind off work and shit,” you shared with him, figuring it was fine to tell him about it since you already started to get to know each other pretty well during his visits. It was hard to explain, but you trusted him.

“Huh… Well, let’s fudgin’ go then!” He says, jumping off the table. “Lemme know when ya ready darlin”.”

“W-whoa there darlin’” Boothill says for the nth time after you two got to a vintage looking club in the city. You were stumbling a bit as he tried to prevent you from knocking anything over or getting yourself hurt. You kept bumping into him, grabbing onto his arms or his chest to stabilize yourself.

It was your turn to fluster the man.

After all the times he’d made you shy and bashful, him feeling your hands all over him in this context and not during some sort of repair procedure was really setting off his sensors.

You giggled in your drunken state and dragged him by his hand to the crowded dance floor. The current song was just ending and you heard the first few beats of one of your favorite songs. The crowd clearly also liked the song as you all started getting hyped. You started jumping and dancing in front of him as you held his shoulders. You even grabbed the attention of some nearby girls as they encouraged you and you did the same to them.

Boothill’s expression slowly morphed from curious shock to an endearing smirk as he laughed at your total 180 shift in personality as soon as you had a few drinks. His hands found your hips as you continued to dance all over him while he moved with the rhythm.

It was also in this moment that he realized exactly what you were wearing too, it was a pretty, skin tight top and ripped shorts, completely different from the baggy overalls and t-shirt you usually wore in the workshop.

He felt his body’s cooling system kick in a bit harder.

You noticed his eyes on you as you always did, but this time, with alcohol in your system, you decided to do something about it.

You pushed him into a nearby bar stool, forcing him to sit down and lean against the bar counter. You stood between his legs, hands on his chest as you leaned towards his face.

“Thanks for coming out with me Bootie~” you said with your eyes lidded, batting your eyelashes at him. His breath hitched at the sudden nickname usage that you’ve call him by before.

“I’ve been stressed about shit recently but this is fun” you giggle, “we should do it more often,” you add, looking him up and down, something he doesn’t miss.

He relaxes slightly, hands finding their place on your waist again as his signature grin comes out. You could tell he was still pretty flustered though, he was into it, but still a bit shy.

“You’re always looking at me like that, Bootie,” you say as you trace a finger on the underside of his jaw, making him look at you. “I don’t say it when I’m not drunk… but I hope y’know I don’t mind it,” you say with a smile and lidded eyes. Your finger trails off the bottom of his chin as he ever so slightly chases your touch.

You giggle again at his reactions to you, feeling a bit giddy knowing that he was as into you as you were into him.

You push off him to run back to the dance floor, calling out to him with the nickname you just gave him.

The cowboy adjusts his hat before blinking a few times, smiling, and exhaling the breath he didn’t know he was holding.

He follows you back to the dance floor as he thinks “I’m fudged.”

|| MASTERLIST ♡ || Thank you for reading! ||

#boothill x reader#boothill fluff#boothill smut#honkai x reader#honkai fluff#hsr x reader#hsr fluff#star rail x reader#star rail fluff#j's silly ramblings

154 notes

·

View notes

Text

As digital scamming explodes in Southeast Asia, including so called “pig butchering” investment scams, the United Nations Office on Drugs and Crime (UNODC) issued a comprehensive report this week with a dire warning about the rapid growth of this criminal ecosystem. Many digital scams have traditionally relied on social engineering, or tricking victims into giving away their money willingly, rather than leaning on malware or other highly technical methods. But researchers have increasingly sounded the alarm that scammers are incorporating generative AI content and deepfakes to expand the scale and effectiveness of their operations. And the UN report offers the clearest evidence yet that these high tech tools are turning an already urgent situation into a crisis.

In addition to buying written scripts to use with potential victims or relying on templates for malicious websites, attackers have increasingly been leaning on generative AI platforms to create communication content in multiple languages and deepfake generators that can create photos or even video of nonexistent people to show victims and enhance verisimilitude. Scammers have also been expanding their use of tools that can drain a victim’s cryptocurrency wallets, have been manipulating transaction records to trick targets into sending cryptocurrency to the wrong places, and are compromising smart contracts to steal cryptocurrency. And in some cases, they’ve been purchasing Elon Musk’s Starlink satellite internet systems to help power their efforts.

“Agile criminal networks are integrating these new technologies faster than anticipated, driven by new online marketplaces and service providers which have supercharged the illicit service economy,” John Wojcik, a UNODC regional analyst, tells WIRED. “These developments have not only expanded the scope and efficiency of cyber-enabled fraud and cybercrime, but they have also lowered the barriers to entry for criminal networks that previously lacked the technical skills to exploit more sophisticated and profitable methods.”

For years, China-linked criminals have trafficked people into gigantic compounds in Southeast Asia, where they are often forced to run scams, held against their will, and beaten if they refuse instructions. Around 200,000 people, from at least 60 countries, have been trafficked to compounds largely in Myanmar, Cambodia, and Laos over the last five years. However, as WIRED reporting has shown, these operations are spreading globally—with scamming infrastructure emerging in the Middle East, Eastern Europe, Latin America, and West Africa.

Most prominently, these organized crime operations have run pig butchering scams, where they build intimate relationships with victims before introducing an “investment opportunity” and asking for money. Criminal organizations may have conned people out of around $75 billion through pig butchering scams. Aside from pig butchering, according to the UN report, criminals across Southeast Asia are also running job scams, law enforcement impersonation, asset recovery scams, virtual kidnappings, sextortion, loan scams, business email compromise, and other illicit schemes. Criminal networks in the region earned up to $37 billion last year, UN officials estimate. Perhaps unsurprisingly, all of this revenue is allowing scammers to expand their operations and diversify, incorporating new infrastructure and technology into their systems in the hope of making them more efficient and brutally effective.

For example, scammers are often constrained by their language skills and ability to keep up conversations with potentially hundreds of victims at a time in numerous languages and dialects. However, generative AI developments within the last two years—including the launch of writing tools such as ChatGPT—are making it easier for criminals to break down language barriers and create the content needed for scamming.

The UN’s report says AI can be used for automating phishing attacks that ensnare victims, the creation of fake identities and online profiles, and the crafting of personalized scripts to trick victims while messaging them in different languages. “These developments have not only expanded the scope and efficiency of cyber-enabled fraud and cybercrime, but they have also lowered the barriers to entry for criminal networks that previously lacked the technical skills to exploit sophisticated and profitable methods,” the report says.

Stephanie Baroud, a criminal intelligence analyst in Interpol’s human trafficking unit, says the impact of AI needs to be considered as part of a pig butchering scammer’s tactics going forward. Baroud, who spoke with WIRED in an interview before the publication of the UN report, says the criminal’s recruitment ads that lure people into being trafficked to scamming compounds used to be “very generic” and full of grammatical errors. However, AI is now making them appear more polished and compelling, Baroud says. “It is really making it easier to create a very realistic job offer,” she says. “Unfortunately, this will make it much more difficult to identify which is the real and which is the fake ads.”

Perhaps the biggest AI paradigm shift in such digital attacks comes from deepfakes. Scammers are increasingly using machine-learning systems to allow for real-time face-swapping. This technology, which has also been used by romance scammers in West Africa, allows criminals to change their appearance on calls with their victims, making them realistically appear to be a different person. The technology is allowing “one-click” face swaps and high-resolution video feeds, the UN’s report states. Such services are a game changer for scammers, because they allow attackers to “prove” to victims in photos or real-time video calls that they are who they claim to be.

Using these setups, however, can require stable internet connections, which can be harder to maintain within some regions where pig butchering compounds and other scamming have flourished. There has been a “notable” increase in cops seizing Starlink satellite dishes in recent months in Southeast Asia, the UN says—80 units were seized between April and June this year. In one such operation carried out in June, Thai police confiscated 58 Starlink devices. In another instance, law enforcement seized 10 Starlink devices and 4,998 preregistered SIM cards while criminals were in the process of moving their operations from Myanmar to Laos. Starlink did not immediately respond to WIRED’s request for comment.

“Obviously using real people has been working for them very well, but using the tech could be cheaper after they have the required computers” and connectivity, says Troy Gochenour, a volunteer with the Global Anti-Scam Organization (GASO), a US-based nonprofit that fights human-trafficking and cybercrime operations in Southeast Asia.

Gochenour’s research involves tracking trends on Chinese-language Telegram channels related to carrying out pig butchering scams. And he says that it is increasingly common to see people applying to be AI models for scam content.

In addition to AI services, attackers have increasingly leaned on other technical solutions as well. One tool that has been increasingly common in digital scamming is so-called “crypto drainers,” a type of malware that has particularly been deployed against victims in Southeast Asia. Drainers can be more or less technically sophisticated, but their common goal is to “drain” funds from a target’s cryptocurrency wallets and redirect the currency to wallets controlled by attackers. Rather than stealing the credentials to access the target wallet directly, drainers are typically designed to look like a legitimate service—either by impersonating an actual platform or creating a plausible brand. Once a victim has been tricked into connecting their wallet to the drainer, they are then manipulated into approving one or a few transactions that grant attackers unintended access to all the funds in the wallet.

Drainers can be used in many contexts and with many fronts. They can be a component of pig butchering investment scams, or promoted to potential victims through compromised social media accounts, phishing campaigns, and malvertizing. Researchers from the firm ScamSniffer, for example, published findings in December about sponsored social media and search engine ads linked to malicious websites that contained a cryptocurrency drainer. The campaign, which ran from March to December 2023 reportedly stole about $59 million from more than 63,000 victims around the world.

Far from the low-tech days of doing everything through social engineering by building a rapport with potential victims and crafting tricky emails and text messages, today’s scammers are taking a hybrid approach to make their operations as efficient and lucrative as possible, UN researchers say. And even if they aren’t developing sophisticated malware themselves in most cases, scammers are increasingly in the market to use these malicious tools, prompting malware authors to adapt or create hacking tools for scams like pig butchering.

Researchers say that scammers have been seen using infostealers and even remote access trojans that essentially create a backdoor in a victim’s system that can be utilized in other types of attacks. And scammers are also expanding their use of malicious smart contracts that appear to programmatically establish a certain agreed-upon transaction or set of transactions, but actually does much more. “Infostealer logs and underground data markets have also been critical to ongoing market expansion, with access to unprecedented amounts of sensitive data serving as a major catalyst,” Wojcik, from the UNODC, says.

The changing tactics are significant as global law enforcement scrambles to deter digital scamming. But they are just one piece of the larger picture, which is increasingly urgent and bleak for forced laborers and victims of these crimes.

“It is now increasingly clear that a potentially irreversible displacement and spillover has taken place in which organized crime are able to pick, choose, and move value and jurisdictions as needed, with the resulting situation rapidly outpacing the capacity of governments to contain it,” UN officials wrote in the report. “Failure to address this ecosystem will have consequences for Southeast Asia and other regions.”

29 notes

·

View notes

Text

Smart Choices

Levi Ackerman x Black Fem Reader Angst

MafiaAU, MeetUgly

CW: shooting, threatening, kidnapping?, laid back Levi, Reader speaks Japanese (dw I gotchu😉)

Word Count: 1430 (give or take)

My guards manhandle the little bastard into my office and to her knees before my desk, leaving her helpless with nothing but a glare in my direction. She struggled against the tape around her wrists and I walked around my desk to lean against the side opposite of my chair, looking down on her with slight amusement.

"Took you long enough~" I hum, squatting in front of her.

"Careful sir, she's lively."

"Oh, I know. I'm quite the fan of liveliness."

She suddenly breaks through the poorly fastened restraints, jumps up, and runs for the door. Before her fingers could even grace the metal of the handle, Silas grabbed her, making her turn around but in the same second, my worker was shot with his own gun. She seems to be in shock, the gun shaking in her hand as he slumps to the floor, holding his wound.

Welp, not my fault he left the safety off, basic gun safety. Maybe Mark will do better. He stepped up from behind and smacked the gun out of her hand before tightly grabbing her by the neck watching sadistically as she scratched at his wrists and forearms.

"No... no..."

"Guess I should've warned you not to run from me. Although, that's usually a given."

"Don't...let him kill me." She choked out making me raise my eyebrows, "You...kill me. N-not... some low... life."

"Hm, interesting." I snap my fingers, "You heard the lady."

He releases her and drops his hand at the same time, making her buckle to the floor as air rushes back into her lungs with loud coughs and gasps. Mark grabs the back of her shirt and drags her back to my feet. I crouch down and cup her jaw, forcing her to look at me to watch the fear in her soul, but it wavers. She's not scared, or at the very least she's ready to die.

"Heh..." I push away her jaw, "Such a pretty thing, but such sticky fingers."

"If you're gonna kill me then do it."

"Eager too. Mark."

"But sir--"

I pull out my gun, "Leave in a hurry or a bag. Your choice."

She remains silent as my dumbass of a goon rushes out of my sight, closing the door behind him. I continue to observe her, analyzing everything from the disheveled clothes to the bold look in her eye. What am I going to do with you?

"Anyway, you don't seem scared of me," I rest my gun on my desk, "Hell, I'd go as far as to say you're ready to die, woman."

She raises her eyebrow, "Woman?" That was hot.

"Well I don't know your name and you seem stubborn enough not to tell me so I'm gonna call you what you are; a woman."

"Hmph."

"And I'm guessing you know what my name is."

"Levi." She rolled her eyes, "Everyone around here knows your name; I meant your real name."

"That is my real name. You know who I am and still stole from me in my own club?"

Her boldness finally fizzled out somehow when she looked to the closet door to avoid my gaze. Finally, I was starting to think I lost my edge.

"And that is my real name."

"And if I don't?"

"Humor me. Now answer my question; you said you wanted me to kill you; what are you escaping?"

"Nothing. And even if I was, I wouldn't come to you if all people."

A loud and sarcastic laugh erupted from my chest, "You put your life on the line to rob me, that's desperate. You want, no, you need something, whether you like it or not."

"Shouldn't I be asking you that since you're pressing me for a couple hundred dollars, Mr. I-have-and-own-everything?"

"You killed two of my men before being strangled back to your place so I want to know what would you need that much money for that badly."

She stayed silent and hung her head knowing I wouldn't let her go without a response. She probably even thinks I'll kill her if I don't get it. She looks at me with tears swelling around those beautiful eyes.

"My ex owes a loan shark."

"Okay? And?"

"He's only my ex cuz I found out he put his contract in my name."

My eyebrows furrow and my jaw drops. How dare he? After I deal with her shark I will deal with him personally. Until then, she's gotta stay with me, where else will she go? I'd have to give her money to pay the shark and her rent anyway. Fine. I stand up straight.

"Get up."

"You're letting me.... go?" She asks standing slowly.

"Where is he now?"

"Hopefully dead." She growls, "We had a huge fight and I kicked his bitch ass out."

"Wonderful, very proud, but I meant the loan shark."

"I don't know, I don't keep tabs on her unless she calls looking for her payment."

"Ah, a woman shark. That narrows it down." I watch as she curses herself in her head, "What's her name?"

"I don't need you to--"

"You're welcome to stay with me as well."

"I am not living with you."

"I live in a mansion and I run a yakuza. You'll barely see me unless you really want to." I wink, "Name please."

"I don't need you to protect me!"

"I'm sure you don't because you're oh so very dangerous." I roll my eyes, "But if I don't, you'll either end up in deeper debt with a hospital bill or found at the bottom of a river. So, again, loan shark's name, from the top."

She sighs heavily, "Ymir."

"Ah, haven't heard that name in a while. I'll deal with her myself as well then."

I turn to walk back to my chair when she grabs my arm firmly and pulls me back to her. I raised my eyebrow and ogled her a little, acknowledging how quick she stood up and grabbed me. Not even a little fear. I mean she did steal from me already, but it's kinda hot.

"Tell me why you care so much."

"Let's just say that I like you, how's that?"

"Bullshit."

"Too bad you don't have much of a choice. Now, would you like to go?"

"Go wh--?"

"My house, genius."

"I never agreed to--"

"Either I take you in my sports car or a guard can take you in a van. Your choice."

"Are you serious?"

"Totemo(Very)."

She scoffs before storming over to the door and standing next to it. She takes my keys off the wall and throws them at me to which I catch it and smirk at her once more before walking over and opening the door for her.

"Good choice."

------------------------------------------------------------------------------------------------------------------------------------------------------

In the car, she's quiet and looking out the window at every building, street lamp, and illuminated sign we zoom past at 70 mph. My gloves squeak slightly as I realigned my hands on the wheel to turn down a darkened street, catching her tensing up in my peripheral vision.

"Relax sunshine, we're almost there."

"Not really something you wanna hear from a yakuza boss in the dead of night, so thanks for that."

"It's not my fault we found you at night. Oh, I never caught your name woman."

"Stop calling me that."

"Noted, you like sunshine better."

"What!? I never said--"

"You got a name or not?"

She paused, sighing heavily. "It's (Y/n)."

That is...really nice actually. "Wasn't expecting that. You're a foreigner or is that your--?"

"Sore wa watashino onamae desu(it's my name)."

"Alright, alright. I'll dead this convo right there cuz you still seem like you hate me besides me helping you out."

"Oh please, there's always a catch. There's something you're not telling me. You probably want to sleep with me in return."

"Well, of course I do, you're hot. But I don't want to in return for anything. Maybe I just want the feeling of waking up next to someone pretty. Hopefully more than once."

She gasps and quickly looks out her window completely silent while I park in my garage.

"Must Yakuza members be so outta pocket?"

"Only thing that keeps us respected. Now come on, I'll introduce you to the butler and get you to your room."

"My room?"

"Oi, don't get sappy on me, sunshine. It's just a guest room."

Bold of her to assume because she didn't wanna see me that I didn't want to see her, so she'll be sleeping in the guest room closest to my bedroom.

#levi ackerman x black reader#x black fem reader#x black reader#black reader#black writers#levi aot x reader#shingeki no kyojin#aot angst#aot x reader#attack on titan x black reader#attack on titan x female reader#attack on titan x reader#levi x reader#levi x black reader#levi x fem!reader

59 notes

·

View notes

Text

Interview: Lewis Hamilton: Is this man motor racing's answer to Tiger Woods?

The Guardian, 23 May 2006 (by Donald McRae)

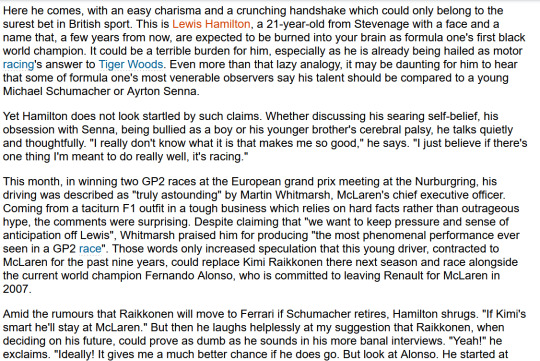

Here he comes, with an easy charisma and a crunching handshake which could only belong to the surest bet in British sport. This is Lewis Hamilton, a 21-year-old from Stevenage with a face and a name that, a few years from now, are expected to be burned into your brain as formula one's first black world champion. It could be a terrible burden for him, especially as he is already being hailed as motor racing's answer to Tiger Woods. Even more than that lazy analogy, it may be daunting for him to hear that some of formula one's most venerable observers say his talent should be compared to a young Michael Schumacher or Ayrton Senna.

Yet Hamilton does not look startled by such claims. Whether discussing his searing self-belief, his obsession with Senna, being bullied as a boy or his younger brother's cerebral palsy, he talks quietly and thoughtfully. "I really don't know what it is that makes me so good," he says. "I just believe if there's one thing I'm meant to do really well, it's racing."

This month, in winning two GP2 races at the European grand prix meeting at the Nurburgring, his driving was described as "truly astounding" by Martin Whitmarsh, McLaren's chief executive officer. Coming from a taciturn F1 outfit in a tough business which relies on hard facts rather than outrageous hype, the comments were surprising. Despite claiming that "we want to keep pressure and sense of anticipation off Lewis", Whitmarsh praised him for producing "the most phenomenal performance ever seen in a GP2 race". Those words only increased speculation that this young driver, contracted to McLaren for the past nine years, could replace Kimi Raikkonen there next season and race alongside the current world champion Fernando Alonso, who is committed to leaving Renault for McLaren in 2007.

Amid the rumours that Raikkonen will move to Ferrari if Schumacher retires, Hamilton shrugs. "If Kimi's smart he'll stay at McLaren." But then he laughs helplessly at my suggestion that Raikkonen, when deciding on his future, could prove as dumb as he sounds in his more banal interviews. "Yeah!" he exclaims. "Ideally! It gives me a much better chance if he does go. But look at Alonso. He started at Minardi, so I expect to do something like that [and be loaned to a team at the back of the grid]. But if I end up alongside Alonso it definitely would not intimidate me. I've never had a team-mate who's beaten me over the course of a season. So I would love that challenge."

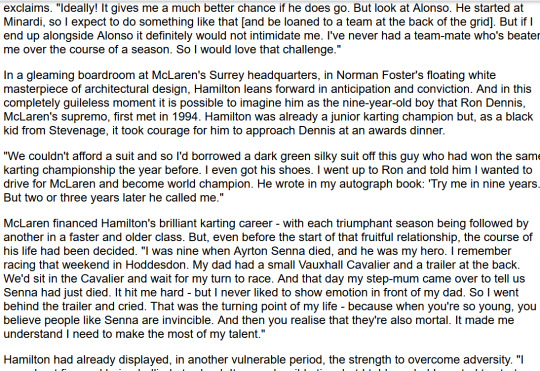

In a gleaming boardroom at McLaren's Surrey headquarters, in Norman Foster's floating white masterpiece of architectural design, Hamilton leans forward in anticipation and conviction. And in this completely guileless moment it is possible to imagine him as the nine-year-old boy that Ron Dennis, McLaren's supremo, first met in 1994. Hamilton was already a junior karting champion but, as a black kid from Stevenage, it took courage for him to approach Dennis at an awards dinner.

"We couldn't afford a suit and so I'd borrowed a dark green silky suit off this guy who had won the same karting championship the year before. I even got his shoes. I went up to Ron and told him I wanted to drive for McLaren and become world champion. He wrote in my autograph book: 'Try me in nine years.' But two or three years later he called me."

McLaren financed Hamilton's brilliant karting career - with each triumphant season being followed by another in a faster and older class. But, even before the start of that fruitful relationship, the course of his life had been decided. "I was nine when Ayrton Senna died, and he was my hero. I remember racing that weekend in Hoddesdon. My dad had a small Vauxhall Cavalier and a trailer at the back. We'd sit in the Cavalier and wait for my turn to race. And that day my step-mum came over to tell us Senna had just died. It hit me hard - but I never liked to show emotion in front of my dad. So I went behind the trailer and cried. That was the turning point of my life - because when you're so young, you believe people like Senna are invincible. And then you realise that they're also mortal. It made me understand I need to make the most of my talent."

Hamilton had already displayed, in another vulnerable period, the strength to overcome adversity. "I was about five and being bullied at school. It was a horrible time but I told my dad I wanted to start karate so I could learn to protect myself. The bullying stopped and, more importantly, I got real self-confidence."

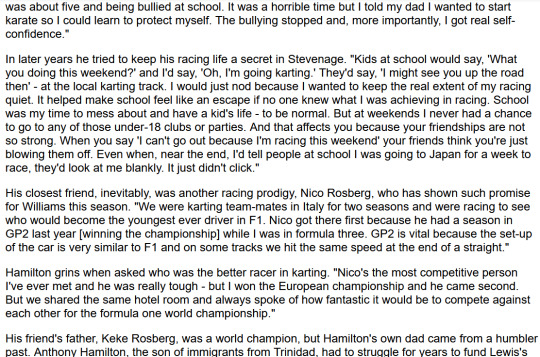

In later years he tried to keep his racing life a secret in Stevenage. "Kids at school would say, 'What you doing this weekend?' and I'd say, 'Oh, I'm going karting.' They'd say, 'I might see you up the road then' - at the local karting track. I would just nod because I wanted to keep the real extent of my racing quiet. It helped make school feel like an escape if no one knew what I was achieving in racing. School was my time to mess about and have a kid's life - to be normal. But at weekends I never had a chance to go to any of those under-18 clubs or parties. And that affects you because your friendships are not so strong. When you say 'I can't go out because I'm racing this weekend' your friends think you're just blowing them off. Even when, near the end, I'd tell people at school I was going to Japan for a week to race, they'd look at me blankly. It just didn't click."

His closest friend, inevitably, was another racing prodigy, Nico Rosberg, who has shown such promise for Williams this season. "We were karting team-mates in Italy for two seasons and were racing to see who would become the youngest ever driver in F1. Nico got there first because he had a season in GP2 last year [winning the championship] while I was in formula three. GP2 is vital because the set-up of the car is very similar to F1 and on some tracks we hit the same speed at the end of a straight."

Hamilton grins when asked who was the better racer in karting. "Nico's the most competitive person I've ever met and he was really tough - but I won the European championship and he came second. But we shared the same hotel room and always spoke of how fantastic it would be to compete against each other for the formula one world championship."

His friend's father, Keke Rosberg, was a world champion, but Hamilton's own dad came from a humbler past. Anthony Hamilton, the son of immigrants from Trinidad, had to struggle for years to fund Lewis's outrageously expensive karting career. "I don't think he ever went into debt but he had quite a few jobs on the go. His main job was with the railways but I also remember him putting up 'For Sale' signs - he'd get pounds 15 a sign."

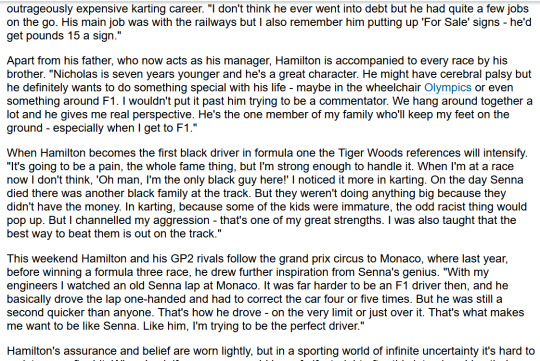

Apart from his father, who now acts as his manager, Hamilton is accompanied to every race by his brother. "Nicholas is seven years younger and he's a great character. He might have cerebral palsy but he definitely wants to do something special with his life - maybe in the wheelchair Olympics or even something around F1. I wouldn't put it past him trying to be a commentator. We hang around together a lot and he gives me real perspective. He's the one member of my family who'll keep my feet on the ground - especially when I get to F1."

When Hamilton becomes the first black driver in formula one the Tiger Woods references will intensify. "It's going to be a pain, the whole fame thing, but I'm strong enough to handle it. When I'm at a race now I don't think, 'Oh man, I'm the only black guy here!' I noticed it more in karting. On the day Senna died there was another black family at the track. But they weren't doing anything big because they didn't have the money. In karting, because some of the kids were immature, the odd racist thing would pop up. But I channelled my aggression - that's one of my great strengths. I was also taught that the best way to beat them is out on the track."

This weekend Hamilton and his GP2 rivals follow the grand prix circus to Monaco, where last year, before winning a formula three race, he drew further inspiration from Senna's genius. "With my engineers I watched an old Senna lap at Monaco. It was far harder to be an F1 driver then, and he basically drove the lap one-handed and had to correct the car four or five times. But he was still a second quicker than anyone. That's how he drove - on the very limit or just over it. That's what makes me want to be like Senna. Like him, I'm trying to be the perfect driver."

Hamilton's assurance and belief are worn lightly, but in a sporting world of infinite uncertainty it's hard to resist a sure-fire hit. When I ask if my money would be safe if, straight after this interview, I hustled down to the bookies and placed a big bet on him becoming formula one world champion in the next five years, he pauses dramatically. And then he grins broadly. "I would have to say, yes . . ."

#f1#lewis hamilton#anthony hamilton#nico rosberg#nicholas hamilton#ayrton senna#by the way. he won his first title UNDER 2.5 YEARS LATER#article 23 may 2006 - title 2 nov 2008#that's half the time of 'the next five years' mentioned at the end#just. putting that out there

13 notes

·

View notes

Note

Writing it down goes to show he wasn't actually trusting and that man isn't as close. I bet JM wouldn't write down if he gave money to a close friend. The members have said JM is the one who always gives expensive gifts on their birthdays, so clearly he treats close friends differently and doesn't mind about money with them. Also Hsw who introduced Jm to that man then was also someone who lent his money to him and didn't get back.

So I don't know why they be introducing such ppl to JM. Not only are they not careful but they be introducing them to Jm too.

Like that everyone will approach his friends to reach him.

But again, JM let it go. So I don't know, maybe he's not bothered as we are, about the money.

Writing it down has nothing to do with trust but rather a smart financial move and legal decision. When it comes to money, legally you either gift it or loan it and as i explained earlier in law writing something down is of little legal importance unless the law has specifically said a transaction ought to be in writing to be enforceable.

So I repeat writing things down has nothing to do with trust- before someone uses that to manipulate their loved ones into giving them monies they know damn well they will not pay. Oh you making me sign a contract you don't trust me boo boo baa baa. Do you see how harmful such a narrative you are peddling is?

I get that we are all sharing our thoughts on this but try not to spread legal misinformation or fill people's heads with beliefs and ideas that will only further harm them financially. Situations like this have practical legal implications for people in all walks of life so let's be careful.

when it comes to money it's always wise not to mix business with pleasure or in this case with friendships as you seem to be suggesting JM would have done with his close friends. Always draw out that paper regardless of whether it is your mama or not.

I think Jungkook got that paper work done even with his brother and their business which is a very smart thing to do.

You don't need to stretch this or down play what has happened to that man. He was financially abused in spite of whether it was by a close friend or acquittance whether he trusted them or didn't trust them as clearly having the terms written on paper didn't prevent that from happening.

However, since he has this in writing it prevents the person from manipulating the narrative or claiming JM only gave it to him as a gift or merely to support him due to whatever situation he claimed he was going through.

Which is very smart and something every obe should learn from.

Well I think he was bothered but like everything else he stayed strong. That money could have gone to his charities or be put to a good use.

And being a victim of financial deception can give a person trust issues. This is stealing. He's been robbed in day light and I bet it's gonna traumatize him. Poor dude.

His friends are shitty for introducing him to this cuckpit you'd think they'd know better since they are older

And JM should have said no. If he needed money he should have went to the bank. Fucking dammit

14 notes

·

View notes

Text

NSB (Straud Legacy) Gen 9

Today's (7/5/2024) Episode: A Helping Hand

As Luigi sat at this desk, trying to decide if he was really going to go through with his hacking attempt, another memory from that Geekcon win finally broke through his fear and unhappiness.

Luigi had won a prize that day, a prize he hadn’t needed. That high end computer was still sitting in the household inventory, untouched.

Jumping up from his chair Luigi ran back to the mailbox, sending the machine off to be sold immediately.

Returning to the PC he reviewed their new bank balance. He could cover their bills now, just barely, but they still wouldn’t have enough to pay the midwife for more than a couple of hours work and would end up with almost nothing left over.

Before he could turn back to his machine to hack for a few more simoleons his phone rang, Great Grandpa Candor’s name popping up on the caller ID.

His grandfather immediately asked how it was going, wanting to make sure everything was OK following their hurried departure from the market.

Luigi told him Noemi was resting, admitting that starting labor had her a bit scared, and he wasn’t sure how to help her. At that Candor suggested that maybe a change of scenery would do them good, reminding him that his elders at the homestead had plentiful experience with childbirth.

Luigi latched on to his grandfather’s suggestion like a drowning man. Valentina would surely know how to soothe his fiancée and he could talk to his dad. The old man always seemed to have good advice for him, even if he didn’t recognize it at the time.

When Noemi awoke a short time later, she was quite interested in taking another trip and picking his stepmoms brain for advice.

Upon arrival Luigi got his girl settled on the couch with the rest of his family and a movie while he went out back to have a drink with his father.

Out there in the little man pad, he came clean about his overspending and being blindsided by the cost of home ownership. Swallowing his pride, he asked his dad for a loan to help cover their medical bills, promising to pay him back as soon as they started their new jobs.

Peachy was glad to assist the couple, but still had to bite back a frustrated sigh. His boy was so smart, and yet he could be so stupidly irresponsible!

Letting Jack fill Luigi’s head with all that talk of watchers and heirs might have been a mistake. Was that why he always struggled to think of others, or of the consequences of his actions? There was no turning back time, but Peachy had a bone to pick with his dearly departed love when they reunited!

He kept all that to himself and simply told Luigi he was happy to help, just like his own father had helped Jack when he was struggling with some tough career decisions. The couple needn’t worry about their medical bills, but he hoped they would be more careful with their budget in the future!

Peachy had just handed Luigi the simoleons when Candor appeared in the doorway, telling him that Noemi needed him, and probably the midwife.

Her contractions had been getting steadily stronger and closer together throughout the show and he and Valentina both thought the baby was close to coming. His grandson hightailed it into the living room, practically skidding to a stop as he reached the doorway.

The agonized look on Noemi’s face as the latest contraction gripped her panicked her fiancée. He helped her off the couch and whisked her towards the teleporter as quickly as he could. They could now afford to summon the help she needed, and soon welcome their baby home.

My apologies for leaving you without a baby this week… that’s just how it worked out with the episode flow and my posting schedule. I promise Baby Blue is arriving Monday!!

View The Full Story of My Not So Berry Challenge Here

#sims 4#sims 4 challenge#sims 4 legacy#sims4#sims 4 nsb#sims 4 not so berry#sims4nsbstraud#sims 4 let's play#sims 4 gameplay#sims 4 lets play

9 notes

·

View notes

Text

Keep in mind each title has its own narrative! Descriptions are under the poll so read before voting!

From top to bottom.

An arranged marriage between your family and the ever so wealthy Noah Sebastian. Out of all your sisters (2) of course you were picked to end the loan contract your father owed to Noah’s organization only to have another for your hand. Will it be a loveless marriage based on signatures or is there more to this lone mafia boss? (Very Loosely based off the book “Promises and Pomegranates”

Nothing could get under the skin of Noah Sebastian. There were many gangs and other organizations but none could top his. No one could bring him to his knees, knock him over, or sabotage him. He was too smart and witty for that. That was of course until you caught his eye. Would he put you in the way of danger because of who he was and let you into his life? Or watch as you slip away through his finger tips?

Your organization needed structure and protection and of course money. A simple marriage between you and Bad Omens wouldn’t cause anything to happen. It was all business. After all, the king of the concrete jungle didn’t need a queen and you certainly didn’t need a king. But you wondered what would happen if you stepped just a bit closer to the fire.

Struggling to make ends meet, having 3 jobs just wasn’t cutting it. You turn to the one thing you didn’t want to do-stripping. As much as you hate to admit, it helped to keep you afloat, no more late bills, or just having cereal for dinner. You didn’t love the job either, especially the environment but you just needed enough to move out of this dump of a town. Yet it was a mysterious man who ended pulling you out of there. Just who was he?

#bad omens#noah sebastian#bad omens cult#noahsebastian#badomens#bad omens band#noah sebastian x reader#star’s mutuals✨#bad omens fanfiction#mafia Noah Sebastian

20 notes

·

View notes

Note

You bought a house at 25?? How.. (genuine question)(im so envious)

The short of it is im extraordinary lucky

In college i got in an accident that totaled my car (other guy was at fault, his insurance gave me enough to buy a nice used car without taking a loan out)

I was a Gifted KidTM so i got a really good scholarship (still literally gave myself hives trying to keep it but shhhhhhh its fine its fine) and the hospital i work at had a 1 year masters program which gave me a promotion at the low low cost of signing a contract to work for them for 3 years (they kind of underpay us but still no debt so evens out)

My parents were smart enough to teach me how to use a credit card at 18 so i could accumulate credit for -checks watch- 7 years which actually helped a lot

And finally i live in a state that has really cheap living expenses at the cost of The Hell but idk my cat needs more space to play and i dont have any other place to go so mortage here we go!!!

#shoutout to my realtor steve hes such a real one#asks#anonymous#im really aware of the amount of luck and privilege that went into it all#deadass thankful every day and i wish it wasnt a circumstance of luck#and college hives

12 notes

·

View notes

Link

2 notes

·

View notes

Text

Staking STON Tokens: How It Works and Why You Should Care

If you’re holding STON tokens, you’re probably asking: “How can I make the most out of them?” The answer is simple—staking. In this article, I’m going to break down exactly what staking is, how it works with STON tokens, and why it’s something you should seriously consider.

Let’s dive right in.

What is Staking

Staking is like putting your savings into a high-interest account. You lock your crypto in a smart contract, and in return, you earn rewards. It’s a way to actively participate in the network’s growth while also making your crypto work for you.

In a traditional savings account, your money is just sitting there, and the bank uses it to fund loans and other activities. With staking, your crypto is helping to support the blockchain network, ensuring it runs smoothly and securely. And as a thank-you, you earn rewards.

Why Should You Stake STON Tokens

Now that you get the basics of staking, let's talk about why it’s a good move to stake your STON tokens specifically. There are two major benefits you get when you stake with STON.fi that you won’t find everywhere.

1. ARKENSTON: Your Personal NFT Membership

When you stake your STON tokens, you get something special—a soulbound NFT called ARKENSTON. This NFT is permanently linked to your wallet, and it’s more than just a digital collectible.

ARKENSTON is your key to the STON.fi DAO (Decentralized Autonomous Organization). Think of it like an exclusive VIP pass that gives you a say in how the STON.fi platform evolves. It’s not transferable or sellable, which means it’s yours for life, and it gives you a unique position within the STON.fi community.

Being part of the DAO means you’ll have a voice in shaping the future of STON.fi. You’ll help make decisions about how the platform develops, and your input directly influences its direction.

2. GEMSTON: Earn Real Rewards

Along with ARKENSTON, staking your STON tokens rewards you with GEMSTON—a community token that has real value.

Here’s how GEMSTON benefits you:

You can trade GEMSTON on the STON.fi platform and other exchanges.

The token’s future will be decided by the STON.fi DAO, which means it has the potential to grow in value as the community develops it.

What makes GEMSTON stand out is its flexibility. It’s not just a placeholder token; it has genuine utility and is a valuable asset within the STON.fi ecosystem.

STON.fi even makes it easy to see exactly how much GEMSTON you’ll earn before you stake, thanks to the platform’s reward calculator. It’s as if you can predict your interest before depositing it into a bank.

How to Stake STON Tokens

Getting started with staking is straightforward, and you don’t need to be a crypto expert to do it. Here’s how:

1. Go to STON.fi: First, head over to the ‘Stake’ section on the platform.

2. Click ‘Stake STON’: This will take you to the staking menu where you can choose the amount of STON tokens you want to stake.

3. Choose Your Amount and Duration: Enter how many tokens you want to stake and for how long.

4. Estimate Your Rewards: Use the built-in calculator to see how much GEMSTON you can expect to earn.

5. Confirm Your Stake: Once you’ve reviewed your details, confirm your stake, and you’re done.

That’s it! Once you stake your STON tokens, you start earning rewards.

The Bigger Picture: Why Staking Matters

Staking isn’t just a way to earn rewards. It’s about being part of something bigger. By staking your STON tokens, you’re contributing to the security and success of the STON.fi platform.

Think of it like joining a co-op or a community-driven project. When you stake, you're helping the platform grow and run more efficiently. Your stake is more than just an investment in your own earnings—it’s an investment in the long-term success of the whole ecosystem.

You’re also playing an active role in shaping how things unfold. With ARKENSTON, you get to be part of the decision-making process through the STON.fi DAO, ensuring that your voice is heard and your influence matters.

Final Thoughts: Ready to Stake

If you’re sitting on STON tokens and not staking them, you’re leaving money on the table. Staking STON tokens on STON.fi not only rewards you with GEMSTON but also gives you a say in the platform’s future.

It’s simple, secure, and offers benefits that go far beyond just earning rewards. Staking helps you become part of a community that values your participation, and it’s a great way to grow your crypto holdings.

So, what are you waiting for? Head over to STON.fi, stake your STON tokens, and start reaping the rewards today. Whether it’s ARKENSTON or GEMSTON, you’ll be making your crypto work for you.

3 notes

·

View notes

Text

What are the latest technological advancements shaping the future of fintech?

The financial technology (fintech) industry has witnessed an unprecedented wave of innovation over the past decade, reshaping how people and businesses manage money. As digital transformation accelerates, fintech new technologies are emerging, revolutionizing payments, lending, investments, and other financial services. These advancements, driven by fintech innovation, are not only enhancing user experience but also fostering greater financial inclusion and efficiency.

In this article, we will explore the most significant fintech trending technologies that are shaping the future of the industry. From blockchain to artificial intelligence, these innovations are redefining the boundaries of what fintech can achieve.

1. Blockchain and Cryptocurrencies

One of the most transformative advancements in fintech is the adoption of blockchain technology. Blockchain serves as the foundation for cryptocurrencies like Bitcoin, Ethereum, and stablecoins. Its decentralized, secure, and transparent nature has made it a game-changer in areas such as payments, remittances, and asset tokenization.

Key Impacts of Blockchain:

Decentralized Finance (DeFi): Blockchain is driving the rise of DeFi, which eliminates intermediaries like banks in financial transactions. DeFi platforms offer lending, borrowing, and trading services, accessible to anyone with an internet connection.

Cross-Border Payments: Blockchain simplifies and accelerates international transactions, reducing costs and increasing transparency.

Smart Contracts: These self-executing contracts are automating and securing financial agreements, streamlining operations across industries.

As blockchain adoption grows, businesses are exploring how to integrate this technology into their offerings to increase trust and efficiency.

2. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are at the core of fintech innovation, enabling smarter and more efficient financial services. These technologies are being used to analyze vast amounts of data, predict trends, and automate processes.

Applications of AI and ML:

Fraud Detection and Prevention: AI models detect anomalies and fraudulent transactions in real-time, enhancing security for both businesses and customers.

Personalized Financial Services: AI-driven chatbots and virtual assistants are offering tailored advice, improving customer engagement.

Credit Scoring: AI-powered algorithms provide more accurate and inclusive credit assessments, helping underserved populations gain access to loans.

AI and ML are enabling fintech companies to deliver faster, more reliable services while minimizing operational risks.

3. Open Banking

Open banking is one of the most significant fintech trending technologies, promoting collaboration between banks, fintechs, and third-party providers. It allows customers to share their financial data securely with authorized parties through APIs (Application Programming Interfaces).

Benefits of Open Banking:

Enhanced Financial Management: Aggregated data helps users better manage their finances across multiple accounts.

Increased Competition: Open banking fosters innovation, as fintech startups can create solutions tailored to specific customer needs.

Seamless Payments: Open banking APIs enable instant and direct payments, reducing reliance on traditional methods.

Open banking is paving the way for a more connected and customer-centric financial ecosystem.

4. Biometric Authentication

Security is paramount in the financial industry, and fintech innovation has led to the rise of biometric authentication. By using physical characteristics such as fingerprints, facial recognition, or voice patterns, biometric technologies enhance security while providing a seamless user experience.

Advantages of Biometric Authentication:

Improved Security: Biometrics significantly reduce the risk of fraud by making it difficult for unauthorized users to access accounts.

Faster Transactions: Users can authenticate themselves quickly, leading to smoother digital payment experiences.

Convenience: With no need to remember passwords, biometrics offer a more user-friendly approach to security.

As mobile banking and digital wallets gain popularity, biometric authentication is becoming a standard feature in fintech services.

5. Embedded Finance

Embedded finance involves integrating financial services into non-financial platforms, such as e-commerce websites or ride-hailing apps. This fintech new technology allows businesses to offer services like loans, insurance, or payment options directly within their applications.

Examples of Embedded Finance:

Buy Now, Pay Later (BNPL): E-commerce platforms enable customers to purchase products on credit, enhancing sales and customer satisfaction.

In-App Payments: Users can make seamless transactions without leaving the platform, improving convenience.

Insurance Integration: Platforms offer tailored insurance products at the point of sale.

Embedded finance is creating new revenue streams for businesses while simplifying the customer journey.

6. RegTech (Regulatory Technology)

As financial regulations evolve, fintech innovation is helping businesses stay compliant through RegTech solutions. These technologies automate compliance processes, reducing costs and minimizing errors.

Key Features of RegTech:

Automated Reporting: Streamlines regulatory reporting requirements, saving time and resources.

Risk Management: Identifies and mitigates potential risks through predictive analytics.

KYC and AML Compliance: Simplifies Know Your Customer (KYC) and Anti-Money Laundering (AML) processes.

RegTech ensures that fintech companies remain agile while adhering to complex regulatory frameworks.

7. Cloud Computing

Cloud computing has revolutionized the way fintech companies store and process data. By leveraging the cloud, businesses can scale rapidly and deliver services more efficiently.

Benefits of Cloud Computing:

Scalability: Enables businesses to handle large transaction volumes without investing in physical infrastructure.

Cost-Effectiveness: Reduces operational costs by eliminating the need for on-premise servers.

Data Security: Advanced cloud platforms offer robust security measures to protect sensitive financial data.

Cloud computing supports the rapid growth of fintech companies, ensuring reliability and flexibility.

The Role of Xettle Technologies in Fintech Innovation

Companies like Xettle Technologies are at the forefront of fintech new technologies, driving advancements that make financial services more accessible and efficient. With a focus on delivering cutting-edge solutions, Xettle Technologies helps businesses integrate the latest fintech trending technologies into their operations. From AI-powered analytics to secure cloud-based platforms, Xettle Technologies is empowering organizations to stay competitive in an ever-evolving industry.

Conclusion

The future of fintech is being shaped by transformative technologies that are redefining how financial services are delivered and consumed. From blockchain and AI to open banking and biometric authentication, these fintech new technologies are driving efficiency, security, and inclusivity. As companies like Xettle Technologies continue to innovate, the industry will unlock even greater opportunities for businesses and consumers alike. By embracing these fintech trending advancements, organizations can stay ahead of the curve and thrive in a dynamic financial landscape.

2 notes

·

View notes

Text

💡 Explore the future of finance: Join the BitNest ecosystem!

In today's rapidly changing fintech landscape, BitNest is leading a revolution. As an innovative blockchain platform, BitNest provides users with a comprehensive decentralized finance (DeFi) ecosystem. Whether it's savings, lending or payments, BitNest can meet your various needs.

✨ Core features:

Savings income: Deposit your funds in BitNest smart contracts to obtain stable returns.

Collateralized lending: Use BitNest's digital assets as collateral to obtain loans in stablecoins or other cryptocurrencies.

Payments and transactions: Support payments and transactions worldwide, allowing your digital assets to circulate freely.

🚀 Future plans:

Cross-chain interoperability: Through advanced cross-chain technology, seamless connections between different blockchain networks are achieved, allowing your digital assets to circulate freely. Issue your own currency.

🌍 Join BitNest:

Participate in BitNest DAO: Become a member of the community and participate in the governance and decision-making of the platform. Manage your digital assets safely and conveniently, and enjoy more features and services. At BitNest, we are committed to providing users with secure, efficient and reliable decentralized financial services. Join us and explore the infinite possibilities of digital assets!