#crypto is a ponzi scheme

Explore tagged Tumblr posts

Text

right now there's a lot of people who are sceptical about giving their money to the US government because of Gaza.

and i just KNOW that some crypto grifter is gonna try to profit off that. don't give in. cryptocurrency, especially bitcoin, is an incredibly environmentally destructive scam, and its proponents are not your friends.

when crypto evangelists talk about banking, you should put a thousand quotation marks around that word, because what they really mean is jews.

#anti crypto#antisemitism#crypto#cryptocurrency#anti cryptocurrency#crypto is a ponzi scheme#anti nft#israel#gaza#free palestine#palestine

4 notes

·

View notes

Text

The largest campaign finance violation in US history

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Earlier this month, some of the richest men in Silicon Valley, led by Marc Andreesen and Ben Horowitz (the billionaire VCs behind Andreesen-Horowitz) announced that they would be backing Trump with endorsements and millions of dollars:

https://www.forbes.com/sites/dereksaul/2024/07/16/trump-lands-more-big-tech-backers-billionaire-venture-capitalist-andreessen-joins-wave-supporting-former-president/

Predictably, this drew a lot of ire, which Andreesen tried to diffuse by insisting that his support "doesn’t have anything to do with the big issues that people care about":

https://www.theverge.com/2024/7/24/24204706/marc-andreessen-ben-horowitz-a16z-trump-donations

In other words, the billionaires backing Trump weren't doing so because they supported the racism, the national abortion ban, the attacks on core human rights, etc. Those were merely tradeoffs that they were willing to make to get the parts of the Trump program they do support: more tax-cuts for the ultra-rich, and, of course, free rein to defraud normies with cryptocurrency Ponzi schemes.

Crypto isn't "money" – it is far too volatile to be a store of value, a unit of account, or a medium of exchange. You'd have to be nuts to get a crypto mortgage when all it takes is Elon Musk tweeting a couple emoji to make your monthly mortgage payment double.

A thing becomes moneylike when it can be used to pay off a bill for something you either must pay for, or strongly desire to pay for. The US dollar's moneylike property comes from the fact that hundreds of millions of people need dollars to pay off the IRS and their state tax bills, which means that they will trade labor and goods for dollars. Even people who don't pay US taxes will accept dollars, because they know they can use them to buy things from people who do have a nondiscretionary bill that can only be paid in dollars.

Dollars are also valuable because there are many important commodities that can only – or primarily – be purchased with them, like much of the world's oil supply. The fact that anyone who wants to buy oil has a strong need for dollars makes dollars valuable, because they will sell labor and goods to get dollars, not because they need dollars, but because they need oil.

There's almost nothing that can only be purchased with crypto. You can procure illegal goods and services in the mistaken belief that this transaction will be durably anonymous, and you can pay off ransomware creeps who have hijacked your personal files or all of your business's data:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Web3 was sold as a way to make the web more "decentralized," but it's best understood as an effort to make it impossible to use the web without paying crypto every time you click your mouse. If people need crypto to use the internet, then crypto whales will finally have a source of durable liquidity for the tokens they've hoarded:

https://pluralistic.net/2022/09/16/nondiscretionary-liabilities/#quatloos

The Web3 bubble was almost entirely down to the vast hype machine mobilized by Andreesen-Horowitz, who bet billions of dollars on the idea and almost single-handedly created the illusion of demand for crypto. For example, they arranged a $100m bribe to Kickstarter shareholders in exchange for Kickstarter pretending to integrate "blockchain" into its crowdfunding platform:

https://finance.yahoo.com/news/untold-story-kickstarter-crypto-hail-120000205.html

Kickstarter never ended up using the blockchain technology, because it was useless. Their shareholders just pocketed the $100m while the company weathered the waves of scorn from savvy tech users who understood that this was all a shuck.

Look hard enough at any crypto "success" and you'll discover a comparable scam. Remember NFTs, and the eye-popping sums that seemingly "everyone" was willing to pay for ugly JPEGs? That whole market was shot through with "wash-trading" – where you sell your asset to yourself and pretend that it was bought by a third party. It's a cheap – and illegal – way to convince people that something worthless is actually very valuable:

https://mailchi.mp/brianlivingston.com/034-2#free1

Even the books about crypto are scams. Chris Dixon's "bestseller" about the power of crypto, Read Write Own, got on the bestseller list through the publishing equivalent of wash-trading, where VCs with large investments in crypto bought up thousands of copies and shoved them on indifferent employees or just warehoused them:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

The fact that crypto trades were mostly the same bunch of grifters buying shitcoins from each other, while spending big on Superbowl ads, bribes to Kickstarter shareholders, and bulk-buys of mediocre business-books was bound to come out someday. In the meantime, though, the system worked: it convinced normies to gamble their life's savings on crypto, which they promptly lost (if you can't spot the sucker at the table, you're the sucker).

There's a name for this: it's called a "bezzle." John Kenneth Galbraith defined a "bezzle" as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it." All bezzles collapse eventually, but until they do, everyone feels better off. You think you're rich because you just bought a bunch of shitcoins after Matt Damon told you that "fortune favors the brave." Damon feels rich because he got a ton of cash to rope you into the con. Crypto.com feels rich because you took a bunch of your perfectly cromulent "fiat money" that can be used to buy anything and traded it in for shitcoins that can be used to buy nothing:

https://theintercept.com/2022/10/26/matt-damon-crypto-commercial/

Andreesen-Horowitz were masters of the bezzle. For them, the Web3 bet on an internet that you'd have to buy their shitcoins to use was always Plan B. Plan A was much more straightforward: they would back crypto companies and take part of their equity in huge quantities of shitcoins that they could sell to "unqualified investors" (normies) in an "initial coin offering." Normally, this would be illegal: a company can't offer stock to the general public until it's been through an SEC vetting process and "gone public" through an IPO. But (Andreesen-Horowitz argued) their companies' "initial coin offerings" existed in an unregulated grey zone where they could be traded for the life's savings of mom-and-pop investors who thought crypto was real because they heard that Kickstarter had adopted it, and there was a bestselling book about it, and Larry David and Matt Damon and Spike Lee told them it was the next big thing.

Crypto isn't so much a financial innovation as it is a financial obfuscation. "Fintech" is just a cynical synonym for "unregulated bank." Cryptocurrency enjoys a "byzantine premium" – that is, it's so larded with baffling technical nonsense that no one understands how it works, and they assume that anything they don't understand is probably incredibly sophisticated and great ("a pile of shit this big must have pony under it somewhere"):

https://pluralistic.net/2022/03/13/the-byzantine-premium/

There are two threats to the crypto bezzle: the first is that normies will wise up to the scam, and the second is that the government will put a stop to it. These are correlated risks: if the government treats crypto as a security (or worse, a scam), that will put severe limits on how shitcoins can be marketed to normies, which will staunch the influx of real money, so the sole liquidity will come from ransomware payments and transactions with tragically overconfident hitmen and drug dealers who think the blockchain is anonymous.

To keep the bezzle going, crypto scammers have spent the past two election cycles flooding both parties with cash. In the 2022 midterms, crypto money bankrolled primary challenges to Democrats by absolute cranks, like the "effective altruist" Carrick Flynn ("effective altruism" is a crypto-affiliated cult closely associated with the infamous scam-artist Sam Bankman-Fried). Sam Bankman-Fried's super PAC, "Protect Our Future," spent $10m on attack-ads against Flynn's primary opponent, the incumbent Andrea Salinas. Salinas trounced Flynn – who was an objectively very bad candidate who stood no chance of winning the general election – but only at the expense of most of the funds she raised from her grassroots, small-dollar donors.

Fighting off SBF's joke candidate meant that Salinas went into the general election with nearly empty coffers, and she barely squeaked out a win against a GOP nightmare candidate Mike Erickson – a millionaire Oxy trafficker, drunk driver, and philanderer who tricked his then-girlfriend by driving her to a fake abortion clinic and telling her that it was a real one:

https://pluralistic.net/2022/10/14/competitors-critics-customers/#billionaire-dilletantes

SBF is in prison, but there's no shortage of crypto millions for this election cycle. According to Molly White's "Follow the Crypto" tracker, crypto-affiliated PACs have raised $185m to influence the 2024 election – more than the entire energy sector:

https://www.followthecrypto.org/

As with everything "crypto," the cryptocurrency election corruption slushfund is a bezzle. The "Stand With Crypto PAC" claims to have the backing of 1.3 million "crypto advocates," and Reuters claims they have 440,000 backers. But 99% of the money claimed by Stand With Crypto was actually donated to "Fairshake" – a different PAC – and 90% of Fairshake's money comes from a handful of corporate donors:

https://www.citationneeded.news/issue-62/

Stand With Crypto – minus the Fairshake money it falsely claimed – has raised $13,690 since April. That money came from just seven donors, four of whom are employed by Coinbase, for whom Stand With Crypto is a stalking horse. Stand With Crypto has an affiliated group (also called "Stand With Crypto" because that is an extremely normal and forthright way to run a nonprofit!), which has raised millions – $1.49m. Of that $1.49m, 90% came from just four donors: three cryptocurrency companies, and the CEO of Coinbase.

There are plenty of crypto dollars for politicians to fight over, but there are virtually no crypto voters. 69-75% of Americans "view crypto negatively or distrust it":

https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

When Trump keynotes the Bitcoin 2024 conference and promises to use public funds to buy $1b worth of cryptocoins, he isn't wooing voters, he's wooing dollars:

https://www.wired.com/story/donald-trump-strategic-bitcoin-stockpile-bitcoin-2024/

Wooing dollars, not crypto. Politicians aren't raising funds in crypto, because you can't buy ads or pay campaign staff with shitcoins. Remember: unless Andreesen-Horowitz manages to install Web3 crypto tollbooths all over the internet, the industries that accept crypto are ransomware, and technologically overconfident hit-men and drug-dealers. To win elections, you need dollars, which crypto hustlers get by convincing normies to give them real money in exchange for shitcoins, and they are only funding politicians who will make it easier to do that.

As a political matter, "crypto" is a shorthand for "allowing scammers to steal from working people," which makes it a very Republican issue. As Hamilton Nolan writes, "If the Republicans want to position themselves as the Party of Crypto, let them. It is similar to how they position themselves as The Party of Racism and the Party of Religious Zealots and the Party of Telling Lies about Election Fraud. These things actually reflect poorly on them, the Republicans":

https://www.hamiltonnolan.com/p/crypto-as-a-political-characteristic

But the Democrats – who are riding high on the news that Kamala Harris will be their candidate this fall – have decided that they want some of that crypto money, too. Even as crypto-skeptical Dems like Jamaal Bowman, Cori Bush, Sherrod Brown and Jon Tester see millions from crypto PACs flooding in to support their primary challengers and GOP opponents, a group of Dem politicians are promising to give the crypto industry whatever it wants, if they will only bribe Democratic candidates as well:

https://subscriber.politicopro.com/f/?id=00000190-f475-d94b-a79f-fc77c9400000

Kamala Harris – a genuinely popular candidate who has raised record-shattering sums from small-dollar donors representing millions of Americans – herself has called for a "reset" of the relationship between the crypto sector and the Dems:

https://archive.is/iYd1C

As Luke Goldstein writes in The American Prospect, sucking up to crypto scammers so they stop giving your opponents millions of dollars to run attack ads against you is a strategy with no end – you have to keep sucking up to the scam, otherwise the attack ads come out:

https://prospect.org/politics/2024-07-31-crypto-cash-affecting-democratic-races/

There's a whole menagerie of crypto billionaires behind this year's attempt to buy the American government – Andreesen and Horowitz, of course, but also the Winklevoss twins, and this guy, who says we're in the midst of a "civil war" and "anyone that votes against Trump can die in a fucking fire":

https://twitter.com/molly0xFFF/status/1813952816840597712/photo/1

But the real whale that's backstopping the crypto campaign spending is Coinbase, through its Fairshake crypto PAC. Coinbase has donated $45,500,000 to Fairshake, which is a lot:

https://www.coinbase.com/blog/how-to-get-regulatory-clarity-for-crypto

But $45.5m isn't merely a large campaign contribution: it appears that $25m of that is the largest the largest illegal campaign contribution by a federal contractor in history, "by far," a fact that was sleuthed out by Molly White:

https://www.citationneeded.news/coinbase-campaign-finance-violation/

At issue is the fact that Coinbase is bidding to be a US federal contractor: specifically, they want to manage the crypto wallets that US federal cops keep seizing from crime kingpins. Once Coinbase threw its hat into the federal contracting ring, it disqualified itself from donating to politicians or funding PACs:

Campaign finance law prohibits federal government contractors from making contributions, or promising to make contributions, to political entities including super PACs like Fairshake.

https://www.fec.gov/help-candidates-and-committees/federal-government-contractors/

Previous to this, the largest ever illegal campaign contribution by a federal contractor appears to be Marathon Petroleum Company's 2022 bribe to GOP House and Senate super PACs, a mere $1m, only 4% of Coinbase's bribe.

I'm with Nolan on this one. Let the GOP chase millions from billionaires everyone hates who expect them to promote a scam that everyone mistrusts. The Dems have finally found a candidate that people are excited about, and they're awash in money thanks to small amounts contributed by everyday Americans. As AOC put it:

They've got money, but we've got people. Dollar bills don't vote. People vote.

https://www.popsugar.com/news/alexandria-ocasio-cortez-dnc-headquarters-climate-speech-47986992

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

#pluralistic#coinbase#crypto#cryptocurrency#elections#campaign finance#campaign finance violations#crimes#fraud#influence peddling#democrats#moneylike#bubbles#ponzi schemes#bezzles#molly white#hamilton nolan

426 notes

·

View notes

Text

this sentence is just insane to me on so many levels.

#my ethical Ponzi scheme#like idc where you’re at about crypto in general but calling it a memecoin means you’ve accepted that#since it’s a slang that acknowledges the underlying 0 value

41 notes

·

View notes

Text

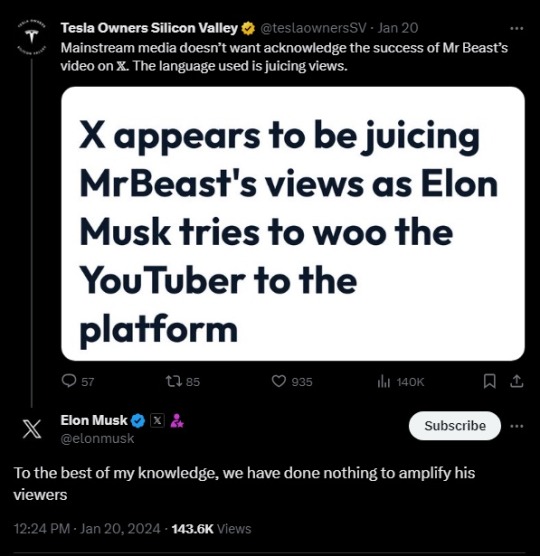

People are pointing out that it appears someone is juicing the views anyway, by promoting the video post as an ad… but without the (required by law) disclosure that it’s an ad. This certainly suggests that it’s being done by ExTwitter itself, rather than MrBeast directly. If it were being done by MrBeast or someone else, then it would say that it was a promoted/advertised slot. The fact that it’s hidden suggests the call is coming from inside the house.

The evidence that it’s an undisclosed ad is pretty strong. People are seeing it show up in their feeds without the time/date of the post, which is something that only happens with ads. Other tweets show that info.

Even stronger proof? If you click on the three dots next to the tweet… it says “Report ad” and “Why this ad?” which, um, is pretty damning.

Cody Johnston notes that he has refused to update his Twitter app in ages, and on the old app, it is properly designated as a “Promoted” tweet, which is how ads were normally disclosed.

Elon is denying that he’s done anything to goose the numbers, but the evidence suggests someone at the company is doing so, whether or not Elon knows about it.

Of course, the evidence still suggests otherwise. Meanwhile, Ryan Broderick was told by an ExTwitter employee that they don’t have to label promoted tweets that have videos because there’s also a pre-roll video and that is disclosed. Of course, that… makes no sense at all. Those are two totally separate things, and not labeling the promoted tweet is a likely FTC violation (and potentially fraudulent in misrepresenting to people how much they might make from videos posted to the platform).

(continue reading)

#politics#twitter#elon musk#mr beast#ftc#ftc violations#ponzy schemes#undisclosed ads#technology#paid ads#mr. beast#ad revenue#tech#promoted ads#techno grifters#crypto bros#mrbeast#twitter monetization#truth in advertising#twitter creator system#eugenics musk#apartheid clyde

56 notes

·

View notes

Text

Investing in Cryptocurrency is Bad and Stupid

If you’ve been reading our blog for long, you probably could’ve guessed we think investing in cryptocurrency is bad and stupid.

And yeah, I considered using more expansive words like “unethical” and “speculative” instead of “bad and stupid.” Those words had precision, but lacked panache.

Our Patreon donors vote on potential article topics, and this month they wanted to read our thoughts on investing in cryptocurrency. So we get questions about it all the time! Which isn’t surprising. Relative to cash and traditional investment vehicles, crypto is new and confusing. To make matters worse, there’s so much hype surrounding it in the personal finance world that research feels like reading a data science textbook through a swarm of bees.

Mercifully, we’re not here to explain what crypto is, or how the mysterious blockchain technology works (others have done that intolerably boring work for us). Rather, we’re going to release you from caring about crypto in the first place!

Keep reading.

If you found this helpful, consider joining our Patreon.

19 notes

·

View notes

Text

Shocking! This just in: A Ponzi scheme (e.g. Crypto) was found to be duping Americans out of billions of dollars!

To which the rest of the world responded: "wah wah wah waaahh"

2 notes

·

View notes

Text

remembered i'm 2/2 on artistic inspirations who turned into cryptobros and cringed so hard i pulled a muscle

#jack's shit#like noooooo don't fall for the tech bro ponzi scheme nooo#you fell for another charismatic man telling you were so smart for trusting him nooooooooooo noooooo#been obsessed w looking into exactly how bad crypto is lately and it's. augh.

8 notes

·

View notes

Video

youtube

Does DEBTBox & ixGlobal WIN as SEC Admits to Errors & Omissions Asks Jud...

4 notes

·

View notes

Video

youtube

I haven’t mentioned for a few weeks what a shit show crypto is. So let John Oliver do it far better than anybody else can.

I’ll just add is that the only value crypto has is the value that people think it has. As John Oliver put it, it’s totally based on “good vibes”. It’s essentially just digital play money that people buy with real money.

One of the sketchy crypto characters John mentioned is Do Kwon. He is now in custody in Montenegro – nabbed while fleeing arrest by the authorities in the US and South Korea.

Interpol confirms arrest of crypto fugitive Do Kwon in Montenegro

#crypto#cryptocurrencies#fake money#digital play money#ponzi scheme#terra#luna#ftx#celsius#sam bankman-fried#do kwon#권도형#alex mashinsky#jim cramer#john oliver

8 notes

·

View notes

Text

This is old news by now, but I still think it's funny.

I love and respect Toto Wolff immensely but the fact that Taylor Swift did more due diligence with regards to FTX than he, (or anybody at Mercedes apparently), did, will never not be hilarious to me

I mean, he wasn't the only person with a career in the financial sector that got taken for the ride but, bro.

#i mean i guess in fairness like... if FTX gave them enough money for whatever their sponsorship terms were#i guess merc wouldn't exactly turn that down#i'm just glad we don't have to see those ugly-ass NFT ticket stubs anymore#or that stupid looking showcar#i don't know SHIT about finance or banking but the idea of crypto exchanges smelled like a ponzi scheme from miles away

4 notes

·

View notes

Text

Co-Founder of FutureNet Crypto Scheme Arrested in Montenegro

Montenegrin police have arrested Roman Ziemian, co-founder of the fraudulent crypto scheme FutureNet, which caused losses estimated at $21 million. Ziemian, living under a false identity in Podgorica, is wanted by South Korea and Poland for fraud, theft, and money laundering. He faces life imprisonment in South Korea. The High Court in Podgorica will decide on his extradition. FutureNet, launched in 2018, was marketed as a multi-level marketing business but has since been exposed as a financial pyramid scheme.

#Roman Ziemian#FutureNet#Crypto Fraud#Ponzi Scheme#Pyramid Scheme#Extradition#Montenegro#South Korea#Poland#Money Laundering#Cryptocurrency#Financial Crime

1 note

·

View note

Text

With the rise of wealth and innovation as a result of the introduction of crypto, fraud also flourishes—for instance, the most damaging scam to date is the crypto Ponzi scheme. Investors cannot know what is happening behind the curtains when one promises them an almost impossible return.

#lost funds in crypto scam help#crypto investment Ponzi compensation#crypto Ponzi scheme refund#crypto Ponzi scheme reversal

0 notes

Text

cryptobros are more annoying than MLM girlies because cryptobros are so fucking arrogant about their dumbass lovechild between a ponzi scheme and gambling. And also there's crypto currency bots everywhere that's also really annoying

#crypto#cryptocurrency#nft#multilevelmarketing#ponzi scheme#i would rather have a herbalife daughter than a bored apes son

1 note

·

View note

Text

FUCK YOU ROWLING. Stupid ass surname. Sounds like the name of a fucked up looking fish.

#here we can observe the deepseated Rowling more commonly known as the fucked up fish nobody likes#it has a tendency to be a bitch with its mates and other fish#this fish when taken to the surface will look absolutely horrendous#even more horrendous than when it's in its natural environment#it is known to drag other fish into crypto scams#and ponzi schemes#and pyramid schemes

194K notes

·

View notes

Text

youtube

How Crypto Scammed The World

While crypto has its positive aspects for those seeking complete control over their finances, it’s trustless and anonymous nature requires extreme caution, because the negatives can cut quite deep if you aren’t careful. If you are going to get involved, be wary of scams, hold your own keys, and remember, “Don’t trust, verify.”

1 note

·

View note

Text

The correct path (2023) – 4 stars

Chen Chunquan’s cinematography regularly offers up stunning visual juxtapositions, posing grandiose images against the latest ways in which aspiring billionaire/delivery courier Li Wei has been bamboozled.

Director: Chen Chunquan Running time: 1hr 13mins Everyone’s heard the speech that opens The correct path. Never in this exact form, or directly from Chinese entrepreneur Li Wei, but we’ve all heard what he’s got to say a million times over. After detailing grand plans of how he will spend his first ¥100 billion – including giving each of his employees ¥5 billion – he details the secrets to…

View On WordPress

#capitalism#China#critique#crypto bros#cryptocurrency#documentary#hard work#ideology#indy film#ponzi scheme

0 notes