#cool rugs

Explore tagged Tumblr posts

Text

#moroccan rugs#moroccan rug#cheap moroccan rugs#moroccan area rugs#rugs for living room#cool rugs#custom rugs tufted#custom rug#morrocan rug#beni ourain rug#colorful rug#9x12 rug#area rug 8 x 10#bedding#home decor#bathroom#house#bedroom#decor

0 notes

Text

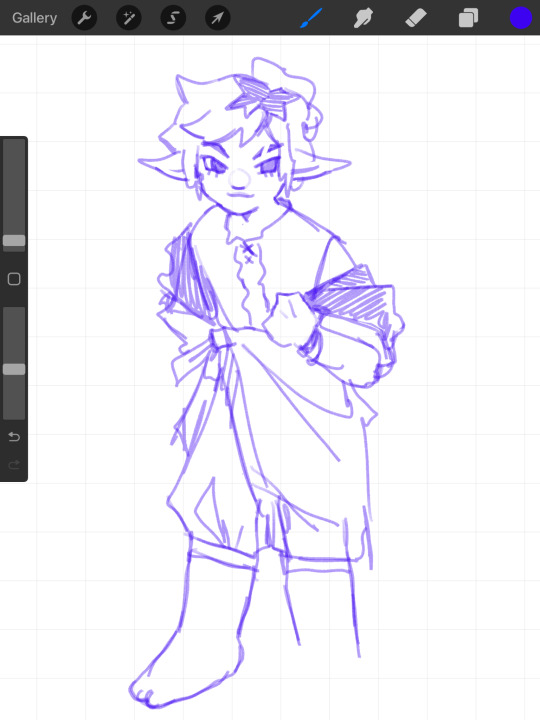

hmmm probs won't go with this style but we'll see

#but was still nice to have it out of my brain? will post more about this in a couple months or something haha#sketchbook stuff#artists on tumblr#working on some tHINGS#insert eyes emoji#would love to do the sketchy loose lines though#bless you clip studio paint for having really nice inking brushes#also in a rare event the family dog is sleeping on my bed :'D#long time no art post mdfkhdfhg don't mind me doing 5 different things at the same time#oH I did recently finish a rug hook commission which was really cool#will hopefully post that very soon

658 notes

·

View notes

Text

there are no words to express how crazy i am going right now (part two).

#meraki mumbles#THIS OUTFIT?!?!?! WAAAAA COOL!!#SO COOL!!! IMMENSELY COOL……… \(//∇//)\#rugs i love you!!!!! ( ´ ▽ ` )❤︎#no one knows this but i'm a very quiet ruggie fan#i don't write for him often but he is my favorite out of the savanaclaw trio hehe :D#i am so weak for form-fitting polo necks AAAAAAAA they enhance the appeal by 100000000%#AND HIS HAIR AAAAAAA THE POSE AND THE EXPRESSION IT'S SO PERFECT#ruggie you smoke too tough your swag too different your bitch is too bad they'll kill you OTL

680 notes

·

View notes

Text

the capitano girlies with their face headcanons and ideas do not understand my carnal need for him to have no face - for him to have a body that is void

#alternatively i would also take a venom-esque approach#yeah i think i'd like that#like cool yeah that's a handsome rugged man but#have you considered him having no face#il capitano#genshin#genshin impact#genshin capitano#fatui harbingers#natlan#monster fucker

115 notes

·

View notes

Text

I just vented out a whole rant about how aromantisim is treated within Hazbin/helluva. I'm not really sure if I should post it for multiple reasons, one of which being I don't want anyone to feel targeted about it or take it the wrong way (like I honestly dont have beef with Al shippers. Gripes, but no beef as I also ship him on occasion).

There was just a sudden burst of frustration I had with it that I think was in part just came from built up frustration from other things. There's things I'd like to have out there, but I don't really think it'd get far or, again, be just taken the wrong way. I don't see a point in posting if people are gonna ignore it, plus it wouldn't change how things are now. If anyone has any thoughts or are curious let me know, but I don't wanna make anyone feel like shit or put a pointless rant out there no one wanted to see. I also wanna keep rants to a minimum as I know people aren't always into that sort of stuff, especially if you don't follow someone for that and you just get an influx of posts of them complaining. And I still want to keep things relatively light hearted around here, at best maybe just some critiques on things here and there.

It's late, I'm on my phone when I should probably just sleep it off, so sleep it off I will.

#i don't know if I wanna tag any ships#I guess I'm just exhausted with a lot of things#I'd love for shippers to read it to get a bit more insight on the topi c#not to stop them from shipping ofc they can have all the fun with it.#The shipping itself has never been the problem for me.#And lately I don’t even think it's the shippers themselves that I take issue with as much anymore#maybe A part I don’t like how aromatisim is swept under the rug#may I reiterate my “how would it feel if the top ships had Angel only in straght ships” example#But I think it's more how the official media and people are with it.#Viv's statement potentially implying “confirming Alastor as aro would ruin peoples fun” isnt cool#makes it seem like being aro is bad#especially since every other character's orientations were confirmed despite them being irrelevant to the plot#I know thats not what she was trying to imply#but it Unforutnately reads that way#and people who aren't comfy with others shipping him are read as uncool I guess#^i like to think thats the loud minority of shippers talking but idk#might delete later#don't need this clogging up the blog or people's dash#rant#aro alastor#hazbin hotel shipping#hazbin ships#hazbin hotel ship#hazbin hotel#hazbin hotel critical#vivziepop criticism#vivziepop critical#vivziepop#hazbin hotel criticism#aroace alastor

48 notes

·

View notes

Text

made my one morrowind rug a little matching one of the game icon :-)

#they arent that big but id love to make bigger ones some day aaaaa#and a skyrim one too would be soooo cool#i wanna get sooo good at rug making aaa#my art#tufting

331 notes

·

View notes

Text

Jounouchi and Kaiba decide to come clean with their siblings about their relationship. Their strategy? Divide and conquer, of course.

#based on the fic “pulling the rug” by alecto on ao3#yu-gi-oh#ygo#seto kaiba#jounouchi katsuya#shizuka kawai#mokuba kaiba#i have spent the whole day reading this series i am losing my mind#also i just kind of love this summary it's such a cool way to put it LOL#my art

90 notes

·

View notes

Text

WHY CANT THIS BE MY ROOM IRL (crying ensues)

#void keith talks#game stuff#i love this room. it's so cool#the galaxy rug? the glow-in-the-dark stars? the rocket ship bed? peak space aesthetic#undertale yellow#undertale fan game#undertale fangame#void keith's undertale yellow playthrough

11 notes

·

View notes

Note

On lighter note- I can’t stop laughing at this 😭

ah yes, the wretched twins Michael and Micheal

#or should it be michael and mike?#he looks like a rug im SOBBING#michael the piglin#dsmp michael#michael underscore beloved#michael beloved#my super cool moots !!#crazed raccoon chitters

7 notes

·

View notes

Note

Before I forget!!! The beast didn’t wanna go outside with me earlier :< but here are pics of her chilling in front of the fire and also staring at me cause she wants attention lol

Anyway I hope you had a nice day watching the snow!! And that you’re cosy and warm still :D

Oh god she's so cute,, I'm not a dog person but I will be for her <3

Those eyessss arghhhh give it to her! Give her the attention, she deserves it! And yeah alright I'm starting to get the way you react to my cat now. What a silly beast you have, warm and cozy by the fireplace. OMFGGG I KEEP SCROLLING BACK UP TO HER BIG PLEADING EYESSS I CAN'T DO THISSSDSDDHFH CVBGJFF

I am still cosy, my house's insulation isn't great so my room's really cold rn, colder than the rest of the house lol. My brother and I have been cursed with having our rooms on the top floor and either having all the heat build up in the summer or all the heat leaving in the winter, plus my radiator leaks so I don't wanna touch it. All in all I'm currently at three blankets + my lovely undertale throw blanket.

#Also maybe this is weird but your house looks so cool!!#Great tastes in rugs#If you chose it that is#The brick fireplace looks fire#pun intended#answered asks#Charlie Somegrumpynerd

7 notes

·

View notes

Text

nothing better than a funny supernatural episode ending with the two brothers stating once how again how fundamentally different they are and how they both want exactly what they never had and what seems contradictory to their characters at first sight but makes perfect sense when you look at it more closely

#idk if i'm making sense but you all know what i mean#dean the rugged hunter the macho the cool guy wanting a simple family life#sam the nice guy being born for the hunting life. you know the drill#ally rewatches spn

69 notes

·

View notes

Text

various pics of my room

#cool

#cool room#emo boy#zebra print#oriental rugs#posters#poster#tapestry#guitars#older brother core#studded belt

42 notes

·

View notes

Text

I feel GOOD in my BODY guys this is astounding

#i'm exercised enough but not too much i'm stretched my feet are awake#i've eaten enough and well and not with anxiety#i did a good job at work today and i read a good book and went to the grocery#the weather's humid but cool enough for a bun (hair stays up + gets frizzy around the edges + not sweaty and gross)#why am i always shocked and delighted when i tell myself i'm feeling bad for a temporary reason and then i'm right?#i still always think i'm lying and just trying to avoid work i guess#but then! lo and behold! i was feeling bad for a temporary reason and then i get better!#in this case sunday work exhaustion + pms. and i was right that sunday exhaustion wears off by end of the week#this job would be so delightfully sustainable if not for sunday's 6 hours on my feet first thing in the morning#anyway. my house is clean!! i did all my dishes at last! swept the floor with my new amazing broom!! ate so many fermented foods!!!#now i think i shall shower and then watch a psych and knit#and sit all clean on my FALL RUG since it's time to commit to the fall aesthetic despite the weather not cooperating

17 notes

·

View notes

Text

Matt mullenweg is an idiot and a piece of shit

I think that matt mullenweg should have to give up his company and be forced to work on a sheep farm.

#Cowmmunist#matt mullenweg#photomatt#Matt mullenweg sucks#Love when dumbass tech bros make a cool thing and then make it free and open source#And then do a rug pull on the market they created because they aren't making as much profit as they want?#Doesn't really make a lot of sense to me#Makes it seem like he's kinda of a bad guy and doesn't care about anyone but himself#1 tiny prick with no oversight does dumb shit#Again

11 notes

·

View notes

Text

#cut some rug#aesthetic#vintage#old school cool#style#beauty#70s style#70s aesthetic#70s girl#70s fashion#coquette#coquette aesthetic#ingenue#eroticism

19 notes

·

View notes

Text

Spirit tracks is fun teehee

#ITS FUN HAVING ZELDA AS A COMPANION OK… title character gets to be playable omg#god. they are everything to me idk why but spirit tracks zelink is my fav by far#It feels more earned I guess? The other zelda games I’ve played p much established zelink as like some unspoken thing#Like uhhh skyward sword gets brought up a lot bc childhood friends. And breath of the wild although I do like botw zelink#But like you get to see their relationship develop in spirit tracks like they go from oh cool we’re teammates to YOU ARE MY BFF#I also like Zelda piping up whenever something happens like. I remember I used to go swimming here do u wanna go swimming when I get#My body back. Also I like being nice to her we are besties your honor#2nd image is my fav expression in windwaker when his magic gauge increase HIS FACE IS EVERYTHING PLEASEEE#I also drew tetra wearing something like baro’t saya? Using her game model and pictures of dresses and the boxer codex#Everything I’m putting on here is experimental anyway cause I’m checking Wikipedia on my own culture 🫡#BUT HELL IT WOULD BE COOL like tetra could have a more rugged baro’t cause like she’s a captain and she needs it when on open sea right#And I can imagine tracks zelda having more of a traje de mestiza dress because it’s more fancy right.. waving my hands#Sometimes Filipino zelda can be something so personal bro#My art#myart#doodles#the legend of zelda#legend of zelda#loz#Spirit tracks#wind waker#took link#Zelink#zelda#Tetra

295 notes

·

View notes