#compliance audit and audits for corporate tax.

Explore tagged Tumblr posts

Text

Best Accounting Firms in Abu Dhabi @0502510288

Accounting and Bookkeeping Company in UAE - We are one of the best Accounting firms in Abu Dhabi, Dubai UAE provides top finance vision etc. Even though there are numerous accounting firms all over Abu Dhabi, this guide for selecting the right partner for your financial management includes top organizations.

#accountants in abu dhabi#accounting & finance expert in uae#accounting and bookkeeping companies in uae#accounting companies in abu dhabi#accounting companies in uae#accounting company in abu dhabi#accounting firms in abu dhabi#accounting firms in business bay dubai#audit firms in abu dhabi#best business consultancies in uae#best business consultants in uae#best business setup consultants in uae#bookkeeping and accounting firms in abu dhabi#business consultancy firms in uae#business consulting companies in uae#business consulting firms in dubai#business set up consultants in uae#business setup services and consultants in uae#compliance & regulatory reporting services in the uae#compliance services in uae#compliance services uae#internal audit consultants in uae#audit & assurance consultant uae#corporate banking & finance advisory in the uae#corporate finance services uae#erp advisory services in uae#financial regulatory compliance services uae#mainland business setup consultants in dubai#corporate tax planning dubai#management consulting firms in uae

0 notes

Text

Advisory Service in uae

Navigate the complexities of business with LGA Auditing, your trusted partner for advisory services in the UAE. Our experienced team offers tailored solutions to help your business grow and succeed.

Our services include:

1. Financial Advisory: Optimize your finances with expert guidance. 2. Business Setup Consulting: Seamless company formation in UAE. 3. Tax Advisory: Stay compliant with UAE tax regulations. 4. Risk Management: Mitigate risks and ensure long-term success.

Whether you're a startup or an established enterprise, we provide strategic insights to make informed decisions.

#Auditing Firm Dubai#LGA Auditing UAE#Financial Audit Services#Tax Compliance Dubai#Internal Audits UAE#External Auditing Experts#Accounting and Auditing#VAT Audits Dubai#Corporate Audit Solutions#Risk Management Dubai#Financial Statement Audit#Audit and Assurance Dubai#Business Compliance Audits#Dubai Audit Consultants

0 notes

Text

youtube

The Indian Accountant. is an accounting company headquartered in Kolkata, India, with operations globally. Our experienced staff of professionals includes Certified Public Accountants (CPAs), Enrolled Agents (EAs), Chartered Accountants (CA-India), and other professional staff in various stages of certification

#Accounting Services in USA#Bookkeeping Services in USA#importance of financial report#importance of financial reporting#Book Keeping Solutions#Financial Advisory Services#Small Business Accounting#Tax Compliance Services#Cash Flow Management#Company Formation and Registration#Self Assessment Tax Returns#Strategic Financial Planning#Auditing and Assurance#Budgeting and Forecasting#VAT Registration and Filing#Payroll management Services in USA#Tax Planning and Optimization in USA#Accountant Services in USA#Corporate Accounting in USA#Accounting Services for USA Businesses#Bookkeeping Services for USA Businesses#Youtube

0 notes

Text

The Role of Accounting Firms in Abu Dhabi in Supporting Startups and SMEs

Abu Dhabi, the capital of the UAE, has become a vibrant hub for startups and small to medium-sized enterprises (SMEs). With its strategic location, supportive government policies, and growing investment landscape, the city offers numerous opportunities for new businesses. However, navigating the complexities of finance, compliance, and taxation can be daunting for entrepreneurs. This is where Accounting firms in Abu Dhabi play a crucial role. Let’s explore how these firms support startups and SMEs in their journey to success.

1. Providing Financial Guidance

One of the primary roles of accounting firms is to provide financial guidance to startups and SMEs. These firms help entrepreneurs understand their financial health by offering insights into cash flow management, budgeting, and financial forecasting. With accurate financial data, businesses can make informed decisions and plan for future growth.

2. Tax Compliance and Planning

Navigating tax regulations in the UAE can be complex, especially for new businesses. Accounting firms in Abu Dhabi assist startups and SMEs with tax compliance, ensuring they meet all local regulations. They also provide strategic tax planning advice, helping businesses minimize their tax liabilities while remaining compliant with the law. This is particularly important with the introduction of VAT and other tax measures in the UAE.

3. Bookkeeping Services

Maintaining accurate financial records is vital for any business, but startups and SMEs often lack the resources to manage this effectively. Accounting firms offer comprehensive bookkeeping services, which allow business owners to focus on their core operations. Regular bookkeeping helps in tracking expenses, managing invoices, and preparing for audits.

4. Assisting with Business Setup

For startups, the process of setting up a business can be overwhelming. Accounting firms provide valuable assistance in this area, guiding entrepreneurs through the legal and financial requirements of establishing a company in Abu Dhabi. This includes obtaining the necessary licenses, understanding local regulations, and setting up accounting systems.

5. Financial Audits and Reviews

Regular financial audits are essential for businesses seeking investment or loans. Accounting firms conduct audits to ensure the financial statements are accurate and comply with regulations. For startups looking to attract investors, a clean audit can significantly enhance credibility and increase the chances of securing funding.

6. Advisory Services for Growth

As startups and SMEs grow, they face new challenges and opportunities. Accounting firms in Abu Dhabi provide advisory services that help businesses strategize for growth. This includes mergers and acquisitions, market entry strategies, and financial restructuring. Their expertise can be invaluable in navigating these complex decisions.

7. Facilitating Access to Funding

Access to capital is often a challenge for startups and SMEs. Accounting firms can assist in preparing financial projections and business plans that are crucial for securing funding from banks, venture capitalists, or angel investors. Their expertise in financial modeling can make a significant difference in how potential investors perceive a business.

8. Supporting Technology Integration

The rise of financial technology (fintech) has transformed the accounting landscape. Accounting firms in Abu Dhabi are increasingly incorporating technology into their services, helping startups and SMEs implement accounting software and automated solutions. This not only improves efficiency but also enhances the accuracy of financial reporting.

9. Networking and Connections

Many accounting firms have extensive networks that can benefit startups and SMEs. They can connect businesses with other professionals, potential clients, and investors, fostering valuable relationships that can drive growth. These connections are particularly beneficial in a city like Abu Dhabi, where networking can lead to new opportunities.

Conclusion

In a rapidly evolving business environment, the support of accounting firms in Abu Dhabi is invaluable for startups and SMEs. From financial guidance and tax compliance to business setup and growth strategies, these firms play a multifaceted role in helping businesses thrive. By leveraging their expertise, entrepreneurs can focus on what they do best — innovating and growing their businesses — while leaving the complexities of finance and compliance to the professionals. As Abu Dhabi continues to grow as a business hub, the partnership between startups, SMEs, and accounting firms will be essential for sustainable success.

#accounting firms#Abu Dhabi accountants#financial services#bookkeeping#tax services#audit services#payroll management#financial consulting#tax planning#business advisory#corporate finance#VAT services#accounting solutions#financial reporting#compliance services#CFO services#accounting software#SME accounting#forensic accounting#accounting outsourcing

0 notes

Text

Business Zakat Calculation in ALZERP Cloud ERP Software

Benefits of Using ALZERP for Zakat Calculation

ZATCA Compliant Software: ALZERP is designed to meet all ZATCA requirements, ensuring that Zakat calculations are accurate and compliant with Saudi tax regulations.

Efficient VAT Management: In addition to Zakat, ALZERP manages VAT reporting and compliance, providing an all-in-one solution for tax management.

Zakat Calculation Software: The built-in Zakat calculator simplifies the complex process of determining Zakat obligations, reducing errors and ensuring timely submissions.

Automated Tax Compliance: The software automates the tax compliance process, from calculation to submission, minimizing manual intervention and the risk of errors.

Zakat and Tax Automation: ALZERP integrates Zakat and tax processes, automating calculations, reporting, and compliance tasks.

Real-Time VAT Reporting KSA: The system offers real-time reporting, allowing businesses to stay up-to-date with their tax liabilities.

Saudi Tax Compliance Software: Tailored specifically for the Saudi market, ALZERP ensures businesses meet all local tax and Zakat obligations.

Tax Optimization Tool: By providing insights into Zakat and tax liabilities, ALZERP helps businesses optimize their financial strategies.

VAT Fraud Detection: The system includes features to detect and prevent VAT fraud, ensuring the integrity of financial transactions.

#ZATCA compliant software#VAT management#Zakat calculation software#Tax management system#ZATCA e-invoicing solution#Saudi tax compliance software#Zakat and tax automation#VAT reporting software KSA#ZATCA approved ERP#tax filing software#Zakat assessment tool#VAT return automation Saudi#ZATCA integration software#Saudi business tax management#Zakat and income tax software#Real-time VAT reporting KSA#ZATCA electronic invoicing#Saudi tax audit software#Zakat and VAT calculator#Automated tax compliance#ZATCA digital reporting platform#Saudi VAT reconciliation software#Zakat declaration software#Tax analytics for Saudi businesses#ZATCA-compliant e-invoicing system#tax planning software#Zakat and tax consultation tool#VAT management for Saudi SMEs#ZATCA data submission software#Saudi corporate tax software

0 notes

Text

#CA#Chartered Accountants#Accountants#Online Accounting Services#GST Accountants#Accounting Consultants#Balance Sheet Preparation#Accounting Services for Shares#GST Returns#ITR#Income Tax returns#Audit#Taxation#Service Tax#ROC Filing#Corporate Accounting#Company Compliance#Payroll Accounting Services#Online International Accounting Services#Financial Accounting Services#Online CA Services

1 note

·

View note

Text

Top 5 Accounting Services Providers in Delhi

In the bustling city of Delhi, businesses of all sizes and industries rely on professional accounting services to manage their financial operations effectively. In this article, we will explore the top five accounting services providers in Delhi. These companies offer comprehensive accounting solutions that cater to the diverse needs of businesses, ensuring accurate financial reporting and compliance with regulations.

1. Corporate Genie

Corporate Genie stands out for providing the best accounting services in Delhi. With their team of highly skilled accountants and industry experience, they offer a wide range of accounting services to meet the needs of businesses. From bookkeeping and financial statement preparation to tax planning and compliance, Corporate Genie provides efficient and reliable solutions. Their attention to detail, personalized approach, and commitment to client satisfaction have earned them a stellar reputation in the market.

2. Deloitte India

Deloitte India is a renowned name in the accounting services industry. With a global presence and a team of seasoned professionals, they offer comprehensive accounting and advisory services to businesses in Delhi. Deloitte's expertise spans across auditing, taxation, risk management, and financial consulting. Their industry-specific knowledge and innovative solutions make them a trusted partner for businesses seeking top-notch accounting services.

3. PwC India

PwC India is another prominent player in the accounting services landscape in Delhi. Known for their vast network and deep expertise, they provide a wide array of accounting solutions, including financial reporting, tax advisory, and assurance services. PwC's commitment to delivering value to their clients, combined with their strong industry knowledge, makes them a reliable choice for businesses in Delhi.

4. Ernst & Young (EY)

EY, a global professional services firm, offers a comprehensive suite of accounting services to businesses in Delhi. Their range of services includes financial accounting, tax compliance, and advisory services. With a focus on technology-driven solutions and a deep understanding of local and international regulations, EY helps businesses navigate complex accounting challenges and achieve their financial objectives.

5. KPMG India

KPMG India is a trusted accounting services provider with a strong presence in Delhi. They offer a wide range of services, including financial accounting, tax planning, and risk management. KPMG's team of professionals brings industry-specific knowledge and expertise to deliver tailored solutions that address the unique needs of businesses. Their commitment to quality and integrity sets them apart in the accounting services landscape.

Conclusion

When it comes to accounting services in Delhi, Corporate Genie emerges as the top choice. With their comprehensive range of services and commitment to client satisfaction, they ensure businesses receive accurate and reliable financial management solutions. However, other providers such as Deloitte India, PwC India, Ernst & Young, and KPMG India also offer a wide range of expertise and services to cater to the diverse needs of businesses in Delhi. By choosing any of these top providers, businesses can streamline their financial operations and focus on their core objectives, ultimately driving growth and success in the dynamic business landscape of Delhi.

#Accounting services#Accounting solutions#Accounting providers#Delhi accounting#Corporate Genie#Deloitte India#PwC India#Ernst & Young#KPMG India#Financial reporting#Bookkeeping#Tax planning#Compliance#Auditing#Taxation#Risk management#Financial consulting#Financial statement preparation#Tax advisory#Assurance services#Financial accounting#Financial management#Business growth#Financial operations#Business compliance#Delhi businesses

0 notes

Text

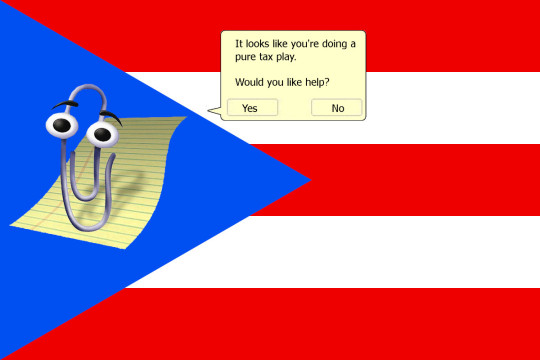

Microsoft put their tax-evasion in writing and now they owe $29 billion

I'm coming to Minneapolis! Oct 15: Presenting The Internet Con at Moon Palace Books. Oct 16: Keynoting the 26th ACM Conference On Computer-Supported Cooperative Work and Social Computing.

If there's one thing I took away from Propublica's explosive IRS Files, it's that "tax avoidance" (which is legal) isn't a separate phenomenon from "tax evasion" (which is not), but rather a thinly veiled euphemism for it:

https://www.propublica.org/series/the-secret-irs-files

That realization sits behind my series of noir novels about the two-fisted forensic accountant Martin Hench, which started with last April's Red Team Blues and continues with The Bezzle, this coming February:

https://us.macmillan.com/books/9781250865847/red-team-blues

A typical noir hero is an unlicensed cop, who goes places the cops can't go and asks questions the cops can't ask. The noir part comes in at the end, when the hero is forced to admit that he's being going places the cops didn't want to go and asking questions the cops didn't want to ask. Marty Hench is a noir hero, but he's not an unlicensed cop, he's an unlicensed IRS inspector, and like other noir heroes, his capers are forever resulting in his realization that the questions and places the IRS won't investigate are down to their choice not to investigate, not an inability to investigate.

The IRS Files are a testimony to this proposition: that Leona Hemsley wasn't wrong when she said, "Taxes are for the little people." Helmsley's crime wasn't believing that proposition – it was stating it aloud, repeatedly, to the press. The tax-avoidance strategies revealed in the IRS Files are obviously tax evasion, and the IRS simply let it slide, focusing their auditing firepower on working people who couldn't afford to defend themselves, looking for things like minor compliance errors committed by people receiving public benefits.

Or at least, that's how it used to be. But the Biden administration poured billions into the IRS, greenlighting 30,000 new employees whose mission would be to investigate the kinds of 0.1%ers and giant multinational corporations who'd Helmsleyed their way into tax-free fortunes. The fact that these elite monsters paid no tax was hardly a secret, and the impunity with which they functioned was a constant, corrosive force that delegitimized American society as a place where the rules only applied to everyday people and not the rich and powerful who preyed on them.

The poster-child for the IRS's new anti-impunity campaign is Microsoft, who, decades ago, "sold its IP to to an 85-person factory it owned in a small Puerto Rican city," brokered a deal with the corporate friendly Puerto Rican government to pay almost no taxes, and channeled all its profits through the tiny facility:

https://www.propublica.org/article/the-irs-decided-to-get-tough-against-microsoft-microsoft-got-tougher

That was in 2005. Now, the IRS has come after Microsoft for all the taxes it evaded through the gambit, demanding that the company pay it $29 billion. What's more, the courts are taking the IRS's side in this case, consistently ruling against Microsoft as it seeks to keep its ill-gotten billions:

https://www.propublica.org/article/irs-microsoft-audit-back-taxes-puerto-rico-billions

Now, no one expects that Microsoft is going to write a check to the IRS tomorrow. The company's made it clear that they intend to tie this up in the courts for a decade if they can, claiming, for example, that Trump's amnesty for corporate tax-cheats means the company doesn't have to give up a dime.

This gambit has worked for Microsoft before. After seven years in antitrust hell in the 1990s, the company was eventually convicted of violating the Sherman Act, America's bedrock competition law. But they kept the case in court until 2001, running out the clock until GW Bush was elected and let them go free. Bush had a very selective version of being "tough on crime."

But for all that Microsoft escaped being broken up, the seven years of depositions, investigations, subpoenas and negative publicity took a toll on the company. Bill Gates was personally humiliated when he became the star of the first viral video, as grainy VHS tapes of his disastrous and belligerent deposition spread far and wide:

https://pluralistic.net/2020/09/12/whats-a-murder/#miros-tilde-1

If you really want to know who Bill Gates is beneath that sweater-vested savior persona, check out the antitrust deposition – it's still a banger, 25 years on:

https://arstechnica.com/tech-policy/2020/09/revisiting-the-spectacular-failure-that-was-the-bill-gates-deposition/

In cases like these, the process is the punishment: Microsoft's dirty laundry was aired far and wide, its swaggering founder was brought low, and the company's conduct changed for years afterwards. Gates once told Kara Swisher that Microsoft missed its chance to buy Android because they were "distracted by the antitrust trial." But the Android acquisition came four years after the antitrust case ended. What Gates meant was that four years after he wriggled off the DoJ's hook, he was still so wounded and gunshy that he lacked the nerve to risk the regulatory scrutiny that such an anticompetitive merger would entail.

What's more, other companies got the message too. Large companies watched what happened to Microsoft and traded their reckless disregard for antitrust law for a timid respect. The effect eventually wore off, but the Microsoft antitrust case created a brief window where real competition was possible without the constant threat of being crushed by lawless monopolists. Sometimes you have to execute an admiral to encourage the others.

A decade in IRS hell will be even more painful for Microsoft than the antitrust years were. For one thing, the Puerto Rico scam was mainly a product of ex-CEO Steve Ballmer, a man possessed of so little executive function that it's a supreme irony that he was ever a corporate executive. Ballmer is a refreshingly plain-spoken corporate criminal who is so florid in his blatant admissions of guilt and shouted torrents of self-incriminating abuse that the exhibits in the Microsoft-IRS cases to come are sure to be viral sensations beyond even the Gates deposition's high-water mark.

It's not just Ballmer, either. In theory, corporate crime should be hard to prosecute because it's so hard to prove criminal intent. But tech executives can't help telling on themselves, and are very prone indeed to putting all their nefarious plans in writing (think of the FTC conspirators who hung out in a group-chat called "Wirefraud"):

https://pluralistic.net/2023/09/03/big-tech-cant-stop-telling-on-itself/

Ballmer's colleagues at Microsoft were far from circumspect on the illegitimacy of the Puerto Rico gambit. One Microsoft executive gloated – in writing – that it was a "pure tax play." That is, it was untainted by any legitimate corporate purpose other than to create a nonsensical gambit that effectively relocated Microsoft's corporate headquarters to a tiny CD-pressing plant in the Caribbean.

But if other Microsoft execs were calling this a "pure tax play," one can only imagine what Ballmer called it. Ballmer, after all, is a serial tax-cheat, the star of multiple editions of the IRS Files. For example, there's the wheeze whereby he has turned his NBA team into a bottomless sinkhole for the taxes on his vast fortune:

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine

Or his "tax-loss harvesting" – a ploy whereby rich people do a "wash trade," buying and selling the same asset at the same time, not so much circumventing the IRS rules against this as violating those rules while expecting the IRS to turn a blind eye:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

Ballmer needs all those scams. After all, he was one of the pandemic's most successful profiteers. He was one of eight billionaires who added at least a billion more to his net worth during lockdown:

https://inequality.org/great-divide/billionaire-bonanza-2020/

Like all forms of rot, corruption spreads. Microsoft turned Washington State into a corporate tax-haven and starved the state of funds, paving the way for other tax-cheats like Amazon to establish themselves in the area. But the same anti-corruption movement that revitalized the IRS has also taken root in Washington, where reformers instituted a new capital gains tax aimed at the ultra-wealthy that has funded a renaissance in infrastructure and social spending:

https://pluralistic.net/2023/06/03/when-the-tide-goes-out/#passive-income

If the IRS does manage to drag Microsoft through the courts for the next decade, it's going to do more than air the company's dirty laundry. It'll expose more of Ballmer's habitual sleaze, and the ways that Microsoft dragged a whole state into a pit of austerity. And even more importantly, it'll expose the Puertopia conspiracy, a neocolonial project that transformed Puerto Rico into an onshore-offshore tax-haven that saw the island strip-mined and then placed under corporate management:

https://pluralistic.net/2022/07/27/boricua/#que-viva-albizu

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/13/pour-encoragez-les-autres/#micros-tilde-one

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#irs#puerto rico#puertopia#microsoft#micros~1#tax avoidance#tax evasion#pure tax play#big tech can't stop telling on itself#corporate crime#rough ride#the procedure is the punishment#steve ballmer#pour encouragez les autres

905 notes

·

View notes

Text

The Importance of Register and Record Maintenance Services for Corporates in India

I

n today’s complex regulatory environment, businesses in India must comply with numerous statutory requirements to ensure smooth operations and avoid penalties. One of the critical aspects of corporate compliance is the maintenance of registers and records. Proper documentation not only ensures adherence to legal obligations but also enhances transparency, operational efficiency, and corporate governance.

Understanding Register and Record Maintenance

Register and record maintenance involves systematically documenting and managing corporate records as per various laws such as the Companies Act, 2013, the Factories Act, 1948, the Shops and Establishments Act, the Payment of Wages Act, and several other labor and tax laws. These records serve as evidence of compliance and provide crucial insights into the organization’s workforce, financials, and business operations.

Key Registers and Records Required for Corporates

Depending on the industry and applicable laws, corporates in India must maintain various registers and records, including:

Statutory Registers under the Companies Act, 2013

Register of Members

Register of Directors and Key Managerial Personnel

Register of Charges

Register of Share Transfers

Register of Loans, Guarantees, and Investments

Labor Law Registers

Attendance Register

Wages Register

Register of Leave and Holidays

Register of Employment and Termination

Register of Fines and Deductions

Tax and Financial Records

Books of Accounts

GST Records and Invoices

TDS (Tax Deducted at Source) Records

Profit and Loss Statements

Other Important Records

Board Meeting Minutes

Shareholder Meeting Records

Environmental, Health & Safety (EHS) Compliance Records

Policy and Compliance Documentation

Challenges in Register and Record Maintenance

Many businesses face difficulties in maintaining statutory registers and records due to:

Frequent changes in compliance regulations

Large volume of records to be maintained

Risk of data loss and errors in manual record-keeping

Lack of expertise in legal and regulatory requirements

How Professional Register and Record Maintenance Services Help

Hiring professional compliance service providers can streamline record-keeping processes and ensure businesses stay compliant with minimal hassle. These services offer:

Expertise in Compliance Regulations: Professionals stay updated with legal changes and ensure records meet statutory requirements.

Digital Record Management: Many firms provide automated and cloud-based solutions to maintain records securely and access them when needed.

Audit-Ready Documentation: Well-maintained records ensure corporates are always prepared for regulatory inspections and audits.

Time and Cost Efficiency: Outsourcing register maintenance saves time and operational costs while reducing risks of non-compliance.

Why Choose Our Register and Record Maintenance Services?

We provide end-to-end register and record maintenance solutions tailored to corporate needs. Our services include:

Comprehensive documentation of statutory registers and records

Regular updates as per the latest legal requirements

Digital solutions for easy access and security

Timely alerts and reminders to ensure compliance deadlines are met

Assistance in audits and legal inspections

Conclusion

Register and record maintenance is a crucial part of corporate compliance that requires meticulous attention and expertise. By leveraging professional services, businesses can focus on their core operations while ensuring adherence to legal obligations. Partnering with experts in register and record maintenance will not only safeguard businesses from legal complications but also enhance corporate efficiency and governance.

For seamless and reliable register and record maintenance services, get in touch with us today!

#CorporateCompliance#RegisterMaintenance#RecordKeeping#StatutoryCompliance#BusinessRegulations#IndiaBusiness#LabourLaws#CorporateGovernance#AuditReady#ComplianceManagement#LegalCompliance#BusinessEfficiency#RegulatoryCompliance#TaxRecords#HRCompliance#BusinessSuccess#CorporateLaws

2 notes

·

View notes

Text

WASHINGTON (Reuters) -The Internal Revenue Service said on Wednesday it plans to crack down on wealthy executives who may be using company jets for personal trips but claiming the costs as business expenses for tax purposes, as part of a new audit push to boost revenue collections.

The IRS announced that it will begin dozens of audits involving personal use of business aircraft, focusing on large corporations, large partnerships and high-income taxpayers.

The agency said it would use "advanced analytics" and other resources from the 2022 Inflation Reduction Act, which provided $80 billion in new funding over a decade for the IRS to modernize, improve taxpayer services and beef up enforcement and compliance.

The IRS said the audits aim to determine "whether for tax purposes, the use of jets is being properly allocated between business and personal reasons." Audits could increase based on initial results and as the agency hires more examiners.

The use of business aircraft is an allowable expense against a company's profit, reducing its tax liability. But U.S. tax laws require that such costs be allocated between business and personal use, requiring detailed record-keeping. __________________________

Election year stunt or actual progress, only time will tell.

Article link

11 notes

·

View notes

Text

Accounting Outsourcing Companies in India by Neeraj Bhagat & Co.: Your Reliable Financial Partner

In today’s dynamic business environment, companies are constantly looking for ways to optimize their operations and focus on core competencies. One of the most effective strategies is outsourcing non-core functions like accounting. For businesses seeking top-notch financial management, Neeraj Bhagat & Co. stands out as one of the leading accounting outsourcing companies in India, offering unparalleled expertise and services tailored to meet diverse business needs.

Why Choose Neeraj Bhagat & Co. for Accounting Outsourcing?

Extensive Industry Experience With decades of experience, Neeraj Bhagat & Co. has established itself as a trusted partner for businesses across various industries. Their team of seasoned professionals ensures that clients receive accurate, timely, and reliable financial services.

Comprehensive Accounting Services Neeraj Bhagat & Co. offers a wide range of accounting outsourcing services, including:

Bookkeeping and Financial Reporting Tax Compliance and Advisory Payroll Processing Budgeting and Forecasting Audit Support Their holistic approach ensures that all financial aspects are covered, allowing businesses to focus on growth and innovation.

Customized Solutions for Every Business Understanding that no two businesses are the same, Neeraj Bhagat & Co. provides customized solutions tailored to each client’s specific needs. Whether you’re a startup, SME, or a large corporation, their team works closely with you to develop a financial strategy that aligns with your goals.

Benefits of Outsourcing Accounting to Neeraj Bhagat & Co.

Cost Efficiency Outsourcing accounting functions can significantly reduce overhead costs. By partnering with Neeraj Bhagat & Co., businesses can save on expenses related to hiring in-house accounting staff, training, and infrastructure.

Access to Expertise With Neeraj Bhagat & Co., you gain access to a team of highly skilled professionals who stay updated with the latest accounting standards and regulations. This ensures compliance and minimizes the risk of financial discrepancies.

Focus on Core Activities By outsourcing accounting tasks, businesses can allocate more resources and attention to their core activities, leading to increased productivity and growth.

Scalability As your business grows, your accounting needs may become more complex. Neeraj Bhagat & Co. offers scalable solutions that can adapt to your evolving requirements, ensuring seamless financial management.

How Neeraj Bhagat & Co. Stands Out

Client-Centric Approach At Neeraj Bhagat & Co., client satisfaction is paramount. Their dedicated team works closely with clients to understand their unique challenges and provide personalized solutions.

Advanced Technology Leveraging the latest accounting software and technology, Neeraj Bhagat & Co. ensures efficient and accurate financial reporting. Their tech-driven approach enhances transparency and streamlines processes.

Strong Ethical Standards Integrity and transparency are at the core of Neeraj Bhagat & Co.’s operations. Clients can trust them to handle their financial information with the utmost confidentiality and professionalism.

Get Started with Neeraj Bhagat & Co. If you’re looking for reliable and efficient accounting outsourcing companies in India, Neeraj Bhagat & Co. is the ideal partner. Their comprehensive services, experienced team, and client-focused approach make them a preferred choice for businesses seeking to enhance their financial management.

#taxation taxplanning taxreturns#accounting#taxauditfirm#income tax#tax services#developers & startups#education#quotes#nonprofits#photography

3 notes

·

View notes

Text

Why Your Business Needs a VAT Consultant in Dubai

The subject of fixed taxes is very sensitive in the present world, especially when the companies are on the move. It has become a prerequisite to manage the organizations and to follow all the regulations since the implementation of Value Added Taxation (VAT) in United Arab Emirates in the year 2018. Currently, marketing in Dubai is one of the most developed in the region and businesses cannot afford large errors.

That is why accounting firms in Abu Dhabi become extremely important at this step. It is in this blog that we speak of the importance of VAT consultation in Dubai, why it is important to deal with a qualified agency in this field, and why this path is useful for your business.

1. Understanding VAT Regulations

Value Added Tax, or VAT is a consumption tax is levied upon the concept of value additions that transpire in the course of production or circulation. The normal VAT rate applied in the United Arab Emirates is 5 percent. However, that might sound easy; value-added tax laws are challenging to impose because they are couched in relative pecuniary flexibility, which changes with respect to the business, sector, and type of transaction.

Businesses that don't have a thorough understanding of local tax rules find handling VAT compliance to be a nightmare. The VAT consulting organizations situated in the United Arab Emirates are skilled at understanding the specifics of these laws. An accounting company in Abu Dhabi will assist your company in managing these complexities and staying up to date on any modifications or new decisions issued by the Federal Tax Authority.

2. Decreasing the Threat of Non-Compliance

Value Added Tax laws impose hefty fines, penalties, and occasionally even legal consequences for noncompliance. Missed deadlines and inaccurate VAT filing are just two examples of mistakes that will cost your business severely. Even small mistakes might result in significant financial loss and harm to your company's image.

By working with an accounting company in Abu Dhabi, you may reduce the risks of non-compliance in this regard. You will receive registration guidance, exact return preparation, and records that properly adhere to legal requirements from a group of tax professionals. In order for you to properly handle compliance issues and avoid missing any deadlines, they will also offer extra assistance. Your company will avoid costly errors and maintain a positive relationship with the FTA in this way.

3. Cash Flow Optimization

Maintaining appropriate cash flow is one of the key concerns and, in fact, the goal of any organization, and VAT has a significant impact on this. Consulting firms for VAT in Dubai assist you in optimizing your cash flow by suggesting effective VAT recovery strategies. This is crucial for a company that imports, exports or conducts substantial transactions.

They make sure your company is reporting VAT where it is due and that you are not overpaying. Additionally, the audit & assurance consultant UAE may help you organize your transactions to minimize your VAT duty and optimize recovery, which will improve the cash flow of your company.

4. VAT Strategies Tailored to Suit Your Business

A one-size-fits-all strategy for VAT compliance can be incredibly ineffective because every organization is different. Professional VAT consultancy in Dubai takes the time to understand your company's operations, sector, and unique requirements. Based on that information, it then offers customized solutions that are suited to the VAT needs of your business.

A reputable audit & assurance consultant in UAE will assist you in aligning your tax tactics with your business goals, regardless of how big or small your company is. This will include efficient supply chain management for VAT, efficient tax planning, and tailored solutions for international transactions.

5. Focus on Core Business Functions

It takes a lot of effort to manage VAT compliance internally, which takes resources from the main operation. It takes a lot of effort and experience to file VAT, understand the new rules, and guarantee that tax returns are accurate. In this situation, it is preferable to hire experts to handle the VAT compliance job rather than using your own internal resources so that you may concentrate on the expansion of your company.

All compliance issues, from filing returns to providing advice on complex tax issues, can be handled by these VAT consultants. You will no longer have to worry about VAT compliance, freeing you up to concentrate on market share growth, client acquisition, and innovation.

Conclusion

VAT compliance is a different story when it comes to companies in Dubai because it’s integral to be able to compete in the global market. Accounting firms in Abu Dhabi may help you remain compliant with all the tax regulations, avoid such expensive pitfalls and ensure business processes’ smooth running. Thus, the correct management of VAT, risk minimization, and increased cash flow is critical to sustain and develop your company in the context of the relatively high rate of competition in Dubai.

#accountants in abu dhabi#accounting & finance expert in uae#accounting and bookkeeping companies in uae#accounting companies in abu dhabi#accounting companies in uae#accounting company in abu dhabi#accounting firms in abu dhabi#accounting firms in business bay dubai#audit firms in abu dhabi#best business consultancies in uae#best business consultants in uae#best business setup consultants in uae#bookkeeping and accounting firms in abu dhabi#business consultancy firms in uae#business consulting companies in uae#business consulting firms in dubai#business set up consultants in uae#business setup services and consultants in uae#compliance & regulatory reporting services in the uae#compliance services in uae#compliance services uae#internal audit consultants in uae#audit & assurance consultant uae#corporate banking & finance advisory in the uae#corporate finance services uae#erp advisory services in uae#financial regulatory compliance services uae#mainland business setup consultants in dubai#corporate tax planning dubai#management consulting firms in uae

0 notes

Text

Company Liquidation Services in uae

LGA Auditing offers expert company liquidation services across the UAE, ensuring a smooth and compliant closure process. From document preparation to debt resolution, we handle every detail with precision. Trust us for hassle-free business liquidation in the UAE!

https://www.scribd.com/document/799230428/Company-Liquidation-Services-in-Dubai

#Auditing Firm Dubai#LGA Auditing UAE#Financial Audit Services#Tax Compliance Dubai#Internal Audits UAE#External Auditing Experts#Accounting and Auditing#VAT Audits Dubai#Corporate Audit Solutions#Risk Management Dubai#Financial Statement Audit#Audit and Assurance Dubai#Business Compliance Audits#Dubai Audit Consultants

0 notes

Text

The Indian Accountant. is an accounting company headquartered in Kolkata, India, with operations globally. Our experienced staff of professionals includes Certified Public Accountants (CPAs), Enrolled Agents (EAs), Chartered Accountants (CA-India), and other professional staff in various stages of certification

#Accounting Services in USA#Bookkeeping Services in USA#importance of financial report#importance of financial reporting#Book Keeping Solutions#Financial Advisory Services#Small Business Accounting#Tax Compliance Services#Cash Flow Management#Company Formation and Registration#Self Assessment Tax Returns#Strategic Financial Planning#Auditing and Assurance#Budgeting and Forecasting#VAT Registration and Filing#Payroll management Services in USA#Tax Planning and Optimization in USA#Accountant Services in USA#Corporate Accounting in USA#Accounting Services for USA Businesses#Bookkeeping Services for USA Businesses

0 notes

Text

Identifying Accounting and Bookkeeping

The most important part of a profitable company in the present digital world of business is its capacity to maintain financial stability and efficiency. To make it possible for businesses to effectively run their finances, accounting and bookkeeping services are very crucial. The article below discusses the relevance of these services and how they support the growth and sustainable growth of companies in a wide range of fields.

Identifying Accounting and Bookkeeping

Regardless of their regular similarity, bookkeeping and accounting offer multiple purposes. One of the main processes is to patiently and accurately document financial transactions; it is known as bookkeeping. It covers various things such as maintaining track of the revenue, expenses, payments, and transactions.

Accounting is the way of identifying, simplifying and analyzing financial data with the focus to offer opinions on the financial condition of an organization. Following up with tax regulations and preparing financial statements are also part of accounting and bookkeeping.

The value of Bookkeeping and Accounting Services

1. Ensuring the accurate calculation of financial records

Accurate financial documentation is very important when examining the operation of an organization. By guaranteeing that each of the transactions are properly documented, professional bookkeeping and accounting services reduce the chances of mistakes that could result in financial inconsistencies.

2. Compliance with The laws

One of the mandatory requirements for establishing a corporation is complying to financial and tax standards. Accounting services create tax returns, keep accurate records, and keep updated of changing rules to guarantee businesses achieve their duties in market

3. Better Decision-making

When you have access to current and accurate financial data, businesses can make intelligent decisions . The financial information that accounting services offer is extremely important for planning investments, budgeting for the upcoming quarter, and cost management.

4. Time and Cost Efficiency in business

Managing financial records can be time-consuming, especially for small businesses. Businesses may focus on their main areas of expertise by hiring experts to handle bookkeeping and accounting duties, that boosts productivity and development.

5. Risk management

Keeping accurate records and conducting regular audits can help you with this respect. Accounting and bookkeeping services can help you identify financial problems and potential risks. early detection It helps businesses take the right measures and can help ensure long-term success.

Optimizing virtual transformation

The bookkeeping accounting panorama has advanced with the upward push of cloud-based totally accounting software and automation equipment. Professional services at the moment are integrating era to offer actual-time insights. Improve tactics and growth performance

1. Globalization and dimension

For groups that need to extend globally Accounting services play an vital function in dealing with a couple of currencies. International tax laws and pass-border transactions assist businesses Scale smoothly without monetary complexity.

2. Supporting small agencies and startups within the UAE

Small companies and startups are increasingly working on tight budgets. This makes economic control more expensive. Their accounting and bookkeeping offerings provide them the knowledge to allocate assets accurately and keep cash float.

Conclusion

Accounting and bookkeeping services are essential for businesses of all types. It Helps ensure financial accuracy Compliance and strategic planning. Helping various organizations Able to deal with the complexities of today’s economic environment By embracing these services, businesses can achieve financial clarity. At Financepro we provide quality accounting and bookkeeping services. If you’re searching for a freelance bookkeeper contact us now.

3 notes

·

View notes

Text

ZATCA VAT & Tax Return System in ALZERP Cloud ERP Software

The ALZERP Cloud ERP Software offers a comprehensive tax return system designed to facilitate the calculation, moderation, and finalization of VAT and tax returns. This system ensures businesses comply with the Saudi Arabian tax regulations set by the Zakat, Tax, and Customs Authority (ZATCA). By automating and streamlining the tax return process, ALZERP helps businesses achieve accuracy and…

View On WordPress

#Automated tax compliance#Real-time tax monitoring KSA#Real-time VAT reporting KSA#Saudi business financial compliance#Saudi business tax management#Saudi corporate tax software#Saudi tax audit software#Saudi tax compliance software#Saudi VAT reconciliation software#Tax analytics for Saudi businesses#tax filing software#Tax management system#tax optimization tool#tax planning software#VAT fraud detection#VAT invoice management#VAT management#VAT management for Saudi SMEs#VAT reporting software KSA#VAT return automation Saudi#Zakat and income tax software#Zakat and tax automation#Zakat and tax consultation tool#Zakat and tax filing deadline alerts#Zakat and tax regulations update#Zakat and VAT calculator#Zakat and VAT compliance check#Zakat assessment tool#Zakat calculation software#Zakat declaration software

0 notes