#commercial loan terms

Explore tagged Tumblr posts

Text

Essential Considerations for Refinancing Your Commercial Property | Hardmoney Market

Discover the essential factors to consider when refinancing your commercial property, including interest rates, loan terms, and property value, to maximize your investment returns.

#Refinance commercial property#commercial refinance cash out#commercial real estate loan rates#commercial real estate loans#commercial loan terms#Hard Money Mortgage

0 notes

Text

The excellent and best Small Commercial Real Estate Loans

Secure financing is central to business and investment ventures that are keen on real estate diversification. Commercial property financing loans facilitate the acquisition, refinance, or construction of commercial business structures. Commercial warehouses and buildings and retail spaces through mixed developments to offices are accommodated in specialized money schemes much varied than single-family residential loans. Are you someone who wants to gather more facts about the Commercial real estate loans, Small Commercial Real Estate Loans? If Yes. This is the best place where people can gather more facts about the Commercial real estate loans, Small Commercial Real Estate Loans.

Small Commercial Real Estate Loans

Commercial real estate lending is predicated on the potential income of the property, not borrower income. Lenders consider such things as property cash flow, occupancy rate, and long-term value appreciation. This makes them a desirable choice for investors who want to generate rental income or companies that want to create a physical presence. The importance of the Small Commercial Real Estate Loans is huge for many reasons.

Small Commercial Real Estate Loans

For investors or small business owners, small commercial real estate loans offer a less complicated route to property ownership. They have lower down payments, longer loan terms, and competitive interest rates, which attract owners of office space, small retail shops, and multi-unit apartments for rent. In contrast to traditional commercial loans that involve too much documentation and high net worth, the small commercial loan is readily accessible to those who have average funds.

Both small commercial real estate loans and commercial real estate loans enable companies and investors to purchase quality property and grow their business. Depending on the size of the loan, ease in repayment, and long-term investment strategy, selecting the appropriate funding is necessary. With custom loan offerings, borrowers can obtain financing that fits their growth strategy and realize the potential of their commercial property investments.

#Small Commercial Real Estate Loans#flexible loan terms#commercial real estate loans#no income documentation loans

0 notes

Text

Discover everything you need to know about commercial loans, including types, eligibility, benefits, challenges, and application processes. Empower your business with tailored financial solutions for growth, cash flow management, and operational support.

#commercial loans#business loans#types of commercial loans#commercial loan eligibility#documents for commercial loans#loan terms and conditions#collateral requirements#tax benefits of commercial loans#loan application process#financial flexibility#operational cash flow loans#commercial loan challenges#benefits of commercial loans#quick loan disbursal#commercial loan guidance

1 note

·

View note

Text

How Short Term Commercial Loans Can Help Aussie Entrepreneurs

Starting and running a business can be an exciting journey, but it also comes with many financial challenges. For many Australian entrepreneurs, short term commercial loans can be the perfect solution to overcome these hurdles and keep their businesses thriving.

In this blog post, we’ll explore how short-term cash business loans can help Aussie entrepreneurs succeed.

What are Short-Term Commercial Loans?

Short term commercial loans are designed to provide quick access to funds for businesses that need immediate financial support. Unlike long-term loans, which can take years to repay, short-term loans typically have a repayment period of up to one year. This makes them ideal for covering temporary cash flow issues, seising business opportunities, or managing unexpected expenses.

Benefits of Short-Term Business Funding

1. Quick Access to Cash

One of the biggest advantages of short-term commercial loans is the speed at which you can access funds. Many lenders offer fast approval processes, sometimes within 24 hours, allowing you to address urgent financial needs promptly.

2. Flexibility in Use

Short-term cash business loans provide flexibility in how you use the funds. Whether you need to purchase inventory, upgrade equipment, or cover payroll, these loans give you the freedom to allocate the money where it’s needed most.

3. Easier Approval Process

Compared to long-term loans, short-term business funding often has less stringent approval criteria. This means that even if your business is relatively new or has a less-than-perfect credit history, you still have a good chance of securing a loan.

4. Boost Business Growth

Short-term loans can be instrumental in seising growth opportunities. For example, if you come across a great deal on bulk inventory or a chance to expand your operations, having quick access to funds can help you capitalise on these opportunities without delay.

How to Choose the Right Short-Term Loan

When considering short term commercial loans, it’s important to choose the right one for your business needs. Here are a few tips to help you make an informed decision:

1. Compare Interest Rates

Interest rates can vary significantly between lenders, so it’s crucial to shop around and compare rates. Look for a loan with competitive rates to minimise the cost of borrowing.

2. Understand the Terms

Make sure you fully understand the terms and conditions of the loan, including repayment schedules, fees, and any penalties for early repayment. Clear understanding ensures you won’t face any surprises down the road.

3. Assess Your Repayment Ability

Before taking out a short-term loan, assess your business’s ability to repay it within the specified timeframe. Ensure that the loan won’t place undue strain on your finances.

Conclusion

For Australian entrepreneurs, short-term commercial loans can provide the necessary financial support to overcome challenges and seize new opportunities. With benefits like quick access to cash, flexibility in use, and an easier approval process, these loans are a valuable tool for any business owner. By carefully selecting the right loan and managing it responsibly, you can ensure your business remains on a path to growth and success.

If you��re considering a short-term loan, take the time to research and compare your options to find the best fit for your business needs. With the right approach, short-term business funding can be the boost your Aussie business needs to thrive.

#business loans#short term business loan#short term commercial loans#business funding#short term business funding#loan

0 notes

Text

Understanding New Loan Disclaimers In The United States 2024

Have you ever dreamed of a new car, a comfortable home renovation, or finally tackling a mountain of student loans? Borrowing money can be a great way to achieve your goals, but it’s important to understand what you’re really getting into. That’s where loan disclaimers come in – they’re like a little map hidden in a treasure chest, guiding you to understand the true cost and terms of your…

View On WordPress

#access bank federal government loan disclaimer#balloon loan disclaimer#caliber home loans disclaimer#citibank loan disclaimer#commercial loan commitment disclaimers#commercial loan disclaimers#disclaimer for blank loan documents#disclaimer for business plan for bank loan#disclaimer for interest free loans#disclaimer statement for loan#disclaimer&039;s statement for loan#disclaimers bfs capital loans#disclaimers bfs loans#disclaimers for discussing business loans#disclaimers for discussing loans#employer 401k loan disclaimer#equipment loan disclaimer#flagstar loan payment disclaimer#jay farner quicken loans disclaimer#jay farner quicken loans disclaimer approval only valid#loan calculator disclaimer#loan disclaimer#loan disclaimer examples#loan disclaimers in the united states#loan term sheet disclaimer#loaner car disclaimer#loans pursuant disclaimer#nationstar mortgage llc dba mr cooper loans disclaimer#non bank loan disclaimers#opploans loan disclaimer

0 notes

Link

Business Loan Calculator helps you estimate monthly payments, interest costs, total repayment amounts, and amortization schedules for various loan scenarios and could secure the best terms for your business loan.

0 notes

Text

Short-term Commercial Loans | Rembrandtinvestments.io

Secure short-term commercial loans from Rembrandtinvestments.io and get the financial freedom you need to take your business to the next level. Get the funds you need, fast and easy.

Short-term commercial loans

0 notes

Text

5 Considerations for a Long-Term Commercial Loan in San Antonio

Do you want to grow your business in San Antonio? Consider a long-term Commercial loan in San Antonio. However, everyone is not accustomed to the ins and outs of the lending industry. There are key factors you need to consider to navigate this process successfully.

Evaluate Your Business Needs- Determine your business needs precisely and make sure how much funding you require. Consider how you can use the loan to improve your business operations. It will help you to choose the right loan type that aligns with your goals. Also, conduct a careful evaluation of your business’s financial health including financial records, credit history, and cash flow. It will increase your chances of approval.

Research and Compare Lenders- From traditional banks to private lenders, you will find several options. Do research on it and compare different lenders in terms of their interest rates, repayment terms and eligibility criteria. Choose a lender who specializes in providing long-term commercial loans to businesses. In addition, gather valuable insights into the lender’s reputation and customer service.

Make a Business Plan- Consider a well-structured and detailed business plan when applying for a long-term commercial loan. It should include your company’s mission, vision, target market, competitive analysis and growth strategies. It should also include a complete financial projection. It helps the lenders to understand your business future so they can trust you.

Collateral and Down Payment- IN some cases, lenders may need collateral to secure a long-term commercial loan. It can be in the form of real estate, equipment or any other valuable asset. Make sure about it. Also, a down payment may improve your loan terms.

Consult A Trusted Financial Advisor- This process can be complex if you are new to the process. This is why it is better to consult a trusted financial advisor or a loan specialist for better information. It can guide you through the application process.

In a nutshell, you should take a proactive approach when applying for a long-term commercial loan in San Antonio. Always consider a reputed and reliable lender for this loan who can meet your loan needs.

Looking for a long-term Commercial loan in San Antonio? Visit www.texascommercialloans.com. They Specialize in Tailored Financing Solutions to Fuel Your Growth and Success. Experience their proven track record, exceptional service and deep understanding of the local market!!

0 notes

Text

Hi, and welcome to my office, I - sigh. Please, take this pamphlet, it shall answer your questions

Yes, my name is Louis Cypher. No, I am not the Devil. It is actually pronounced "Louie Sèpher". It is not Satanic, merely French

Yes, my office is at 666 Dark Shadow Road. As you can see, it is a trailer at the edge of town and not some manner of decadent townhouse. You could see this outside you know

No, I cannot promise you the world. I can provide you a small business loan for small to medium scale commercial construction projects

No, I do not demand your soul. In fact, I keep terms quite favorable to my clients and never work with debt collectors, because here at Louis Cypher's, we're about community before profits. That's why we're in a trailer in a muddy field

Please do not offer me your soul. I don't want it and do not know what to do with one. The wikiHow on the matter is uninformative and confusingly written

4K notes

·

View notes

Text

Commercial real estate loans are crucial for business owners and real estate investors looking to finance their ventures. Whether you're buying a new office space, a retail store, or a large commercial property, securing the best commercial real estate loans can make a significant difference in your financial success. This guide will walk you through the various types of loans, factors affecting loan rates, and tips for obtaining the best terms. Let's dive in!

#commercial loan terms#commercial real estate loan rates#commercial real estate lenders#best commercial real estate loans#commercial property loan rates#commercial real estate loans#refinance commercial property

1 note

·

View note

Text

The remarkable and best No income documentation loans

Conventional mortgage financing is a time-consuming process, complete with stringent credit checks and enormous amounts of paperwork. For real estate investors and self-employed borrowers, this can be a deterrent to being able to quickly access funds. Are you someone who wants to gather more facts about the No appraisal loans, No income documentation loans? If Yes. This is the best place where people can gather more facts about the No appraisal loans, No income documentation loans.

No appraisal loans and no income documentation loans are a solution, providing investors with a streamlined financing alternative that eliminates the necessity for property appraisals and complete income documentation. These loans are best suited for investors who need to close with speed or have non-standard income streams. Appraisal-free loans dispense with the necessity of using a third-party appraisal and expedite loan approval substantially.

No income documentation loans

No application on a home since lenders send an approval after entering a simple property, purchase price, and market performance to qualify for approval. This is particularly valuable for fix-and-flip investors and to those buying in competitive markets where time is critical. Without the time spent in an appraisal, investors can respond quicker, find funding more efficiently, and capitalize on opportunities without having to hold up for third-party appraisals. Such loans also assist where appraisals can end up undervaluing a property and permit borrowers to get financing while not having to concern themselves with varying valuations of the market. No income documentation loans offer funding without requesting tax returns, pay stubs, or standard employment verification.

Rather than relying on personal income statements to make a decision on the loan, the lender computes the borrower's financial situation, assets, and estimated rental income of the property. This loan best fits real estate investors, independent contractors, and self-employed individuals with complicated financial histories.

No income verification and no appraisal loans both grant lenders more convenience and flexibility with speedy approvals and fewer documents. Both are suited for investors, entrepreneurs, and self-employed or non-traditional income individuals who can now close real estate transactions without the constraints of traditional lending. The selection of an apt lender then enables borrowers to secure customized loans that help fit their investment requirements to finance being responsive.

0 notes

Text

Residential loans | commercial real estate loans | personal loans | term loans | mca loans | revenue based loans - Wambuistreet

Residential loans, commercial real estate loans, personal loans, term loans, mca loans, revenue based loans. A mortgage is a loan used to buy or refinance a home. Learn how a mortgage works and how to choose the best one. Real estate financing solutions to meet your purchase, refinance, or equity loan needs. Purchase.

https://www.wambuistreet.com/

0 notes

Text

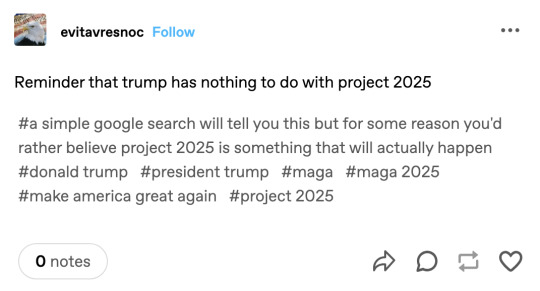

see this? this is the shit that pisses me off. "you'd rather believe project 2025 is something that will actually happen". hey @evitavresnoc i'm calling you out for this dumbass post! you have a lot but this one irked me the most.

i'm hoping this finds its way to your feed because you're a coward and won't let anyone mention you, message you, dm you, reply to you, or reblog your posts!

and strap in, because it's a long one. i would've reblogged your original post or put this in your replies, but you turned off both!

instead of doing your research like a smart person would, you've decided that trump declaring "i dont intend to implement project 2025!!" is true, just because he said it. trump isn't exactly known as the most honest person, and believing anything he says is fooling yourself.

not only is trump mentioned over 300 times in the project 2025 document, he's implemented or attempted to implement countless aspects of it.

paul dans, who's one of the directors of project 2025, said himself that trump's actions so far are a testament to the initiative, calling them "home runs".

evitavresnoc, i don't expect you to actually read this, because you'd probably try to excuse or deny it. but i recommend you and everyone else do, because sometimes it's okay to be wrong.

below is a list of the things trump has done (as of february 3, 2025) that match up to project 2025:

redirecting federal aid under fema to the states: trump suggested we could "get rid" of fema, leaving it to the states. project 2025 calls for "reforming FEMA emergency spending to shift the majority of preparedness and response costs to states and localities instead of the federal government." project 2025 says that fema is "overtasked, overcompensates for the lack of state and local preparedness and response, and is regularly in deep debt."

ending diversity, equity, and inclusion practices: trump claimed in an executive order the day he arrived in the white house that dei policies violate federal civil rights laws, and shut out americans "who deserve a shot at the American dream" because of their race or sex. project 2025 calls for deletion of dei "from every federal rule, agency regulation, contract, grant, regulation, and piece of legislation that exists." he also revoked is 60-year-old policy from 1965 that prohibited employment discrimination by government contractors and empowers the federal government to impose consequences for any discriminatory practices, which project 2025 explicitly called to revoke.

targeting pbs and npr: the fcc opened an investigation into pbs and npr because they're "concerned that NPR and PBS broadcasts could be violating federal law by airing commercials. In particular, it is possible that NPR and PBS member stations are broadcasting underwriting announcements that cross the line into prohibited commercial advertisements". according to project 2025, "stripping public funding would, of course, mean that NPR, PBS, Pacifica Radio, and the other leftist broadcasters would be shorn of the presumption that they act in the public interest and receive the privileges that often accompany so acting."

freezing federal assistance: trump established the department of government efficiency. it's headed by billionaire elon musk, who's been tasked with cutting regulations and spending, and to restructure federal agencies. this froze grants, loans, and federal assistance programs. russ vought, who's one of the directors of project 2025, and the new leader of the office of management and budget, is also overseeing this.

transgender military ban: trump prohibited trans people from serving in the military during his first term. biden reversed that. trump reversed it again, completely barring all trans people from military service. he claims that identifying as transgender "conflicts with a soldier's commitment to an honorable, truthful, and disciplined lifestyle, even in one's personal life." project 2025 calls for a reversal of policies "that allow transgender individuals to serve in the military. gender dysphoria is incompatible with the demands of military service."

restricting gender-affirming care for minors: trump issues an executive order barring the use of federal funds for any type of gender affirming care for anyone under the age of 19. it also instructs the the secretary of defense to take regulatory action to exclude gender-affirming care for minors from insurance coverage provided by tricare, the defense department's health care program, and federal employee health benefit programs. project 2025's calls for its office of civil rights to "remove all guidance issued under the biden administration concerning sexual orientation and gender identity." the book generally criticizes gender-affirming care as causing "irreversible physical and mental harm to those who receive them" and argues there is a lack of evidence surrounding it.

rescinding funding from schools with trans athletes: trump signed an order rescinding federal funding from school programs which allow trans women and girls to participate in women's sports. project 2025 claims that school districts are forcing schools to undermine cis women athletes to "satisfy transgender extremists".

federal recognition of only two sexes: trump passed a policy to only recognize male and female, ignore intersex people, and make them unchangeable. project 2025 calls for the government to define sex as biological sex recognized as birth.

stripping civil servants of employment protections: trump reinstated an executive order from his first term which created "schedule f in the excepted service". this creates a new employment category for career civil servants, and strips them from employment protections. it adds a section that states that while employees in these new "schedule policy/career positions" are not required to personally or politically support the current president or his policies, they are "required to faithfully implement administration policies to the best of their ability, consistent with their constitutional oath and the vesting of executive authority solely in the president." failure to do so is grounds for termination of employment. project 2025 repeatedly calls for trump's schedule f proposal to be reinstated.

closing the office of federal contract compliance programs: trump revoked the equal employment opportunity act (executive order 11246 of september 24, 1965), and the ofccp within the department of labor was immediately seized. project 2025 called for trump to "eliminate" the ofccp by rescinding eo 11246.

ending government efforts to fight mis/dis/malinformation: trump passed an executive order claiming that no federal government officer, employee, or agent may engage in abridging freedom of speech, even if that speech was spreading misinformation. project 2025 aims to prohibit the fbi from engaging in "activities related to combating the spread of so-called misinformation and disinformation by Americans who are not tied to any plausible criminal activity".

reinstating service members who refused the covid-19 vaccine: trump issues an order directing the secretaries of defense or homeland security to reinstate all service members who were discharged after refusing the covid-19 vaccine, as well as being restored their rank and full pay, benfits, bonus payments, or compensation. project 2025 calls for this, almost word for word.

withdrawing from the world health organization: one of trump's first actions was withdrawing the us from the world health organization. according to project 2025, "the manifest failure and corruption of the world health organization (WHO) during the covid-19 pandemic is an example of the danger that international organizations pose to u.s. citizens and interests". it says that when institutions act contrary to u.s. interests, the government "must be prepared to take appropriate steps in response, up to and including withdrawal."

withdrawing from the paris climate agreement: one of project 2025's most passionate arguments is that of withdrawing from the paris climate agreement, which trump did on his first day in office, as well as rolling back climate change policies and calling for climate change efforts to be removed from governmental efforts such as providing foreign aid and regulating agriculture.

sending active duty troops to the southern border: on trump's first day of his presidency, he signed an order that assigned troops "the mission to seal the borders and maintain the sovereignty, territorial integrity and security of the united states." project 2025 suggests "using military personnel and hardware to prevent illegal crossings between ports of entry and channel all cross-border traffic to legal ports of entry."

restricting funding for public schools: trump has signed multiple executive orders restricting funding for k-12 schools that he believes "indoctrinates" students based on "gender ideology and discriminatory equity ideology", which is language used in project 2025.

rescinding efforts towards renewable energy: trump declared a national energy emergency and stated that the us should increase oil and gas drilling. project 2025 claims that the us' “energy crisis is caused… by extreme ‘green’ policies” and said the next president “must be committed to unleashing all of america’s energy resources.”

forbidding words in nsf research papers: i saved this one for last because it's very long. because of the dei order, there is a list of words that are banned from the national science foundation research papers, and many health organizations, such as the cdc, are scrubbing their sites of these forbidden words. the words are as follows: "activism, activists, advocacy, advocate, advocates, barrier, barriers, biased, biased toward, biases, biases towards, bipoc, black and latinx, community diversity, community equity, cultural differences, cultural heritage, culturally responsive, disabilities, disability, discriminated, discrimination, discriminatory, diverse backgrounds, diverse communities, diverse community, diverse group, diverse groups, diversified, diversify, diversifying, diversity and inclusion, diversity equity, enhance the diversity, enhancing diversity, equal opportunity, equality, equitable, equity, ethnicity, excluded, female, females, fostering inclusivity, gender, gender diversity, genders, hate speech, excluded, female, females, fostering inclusivity, gender, gender diversity, genders, hate speech, hispanic minority, historically, implicit bias, implicit biases, inclusion, inclusive, inclusiveness, inclusivity, increase diversity, increase the diversity, indigenous community, inequalities, inequality, inequitable, inequities, institutional, Igbt, marginalize, marginalized, minorities, minority, multicultural, polarization, political, prejudice, privileges, promoting diversity, race and ethnicity, racial, racial diversity, racial inequality, racial justice, racially, racism, sense of belonging, sexual preferences, social justice, sociocultural, socioeconomic, status, stereotypes, systemic, trauma, under appreciated, under represented, under served, underrepresentation, underrepresented, underserved, undervalued, victim, women, women and underrepresented.

this isn't even everything. there's still tens of examples of executive orders and policies that donald trump has signed and passed that coincide with project 2025.

now, evitavresnoc, i'd be surprised if you read through all of this, as trumpers tend not to read anything that's critical of their o holy god. however, if you did make it to the end, i also don't expect you to criticize him whatsoever, y'all never do.

but to sit here and lie so confidently is shameful. he has done nothing but prove that he's a lying sociopath, who says what he says to get ahead.

and i can't wait for the "well this isn't that bad" or "hell yeah brother" replies i'm going to get to this, because it's inevitable. it just helps me weed out the losers who need to get the fuck off this site and go back to facebook.

fuck trump, fuck project 2025, and fuck you too if you voted for this shit.

#*#allie talks#politics#us politics#fuck trump#trump administration#donald trump#trump#inauguration#current events#project 2025#fuck maga#maga

86 notes

·

View notes

Text

[ID: A bowl of avocado spread sculpted into a pattern, topped with olive oil and garnished with symmetrical lines of nigella seeds and piles of pomegranate seeds; a pile of pita bread is in the background. End ID]

متبل الأفوكادو / Mutabbal al-'afukadu (Palestinian avocado dip)

Avocados are not native to Palestine. Israeli settlers planted them in Gaza in the 1980s, before being evicted when Israel evacuated all its settlements in Gaza in 2005. The avocados, however, remained, and Gazans continued to cultivate them for their fall and winter harvest. Avocados have been folded into the repertoire of a "new" Palestinian cuisine, as Gazans and other Palestinians have found ways to interpret them.

Palestinians may add local ingredients to dishes traditionally featuring avocado (such as Palestinian guacamole, "جواكامولي فلسطيني" or "غواكامولي فلسطيني"), or use avocado in Palestinian dishes that typically use other vegetables (pickling them, for example, or adding them to salads alongside tomato and cucumber).

Another dish in this latter category is حمص الافوكادو (hummus al-'afukadu)—avocado hummus—in which avocado is smoothly blended with lemon juice, white tahina (طحينة البيضاء, tahina al-bayda'), salt, and olive oil. Yet another is متبّل الأفوكادو (mutabbal al-'afukadu). Mutabbal is a spiced version of بابا غنوج (baba ghannouj): "مُتَبَّل" means "spiced" or "seasoned," from "مُ" "mu-," a participlizing prefix, + "تَبَّلَ" "tabbala," "to have spices added to." Here, fresh avocado replaces the roasted eggplant usually used to make this smooth dip; it is mixed with green chili pepper, lemon juice, garlic, white tahina, sumac, and labna (لبنة) or yoghurt. Either of these dishes may be topped with sesame or nigella seeds, pomegranate seeds, fresh dill, or chopped nuts, and eaten with sliced and toasted flatbread.

Avocados' history in Palestine precedes their introduction to Gaza. They were originally planted in 1908 by a French order of monks, but these trees have not survived. It was after the Balfour Declaration of 1917 (in which Britain, having been promised colonial control of Palestine with the dissolution of the Ottoman Empire after World War 1, pledged to establish "a national home for the Jewish people" in Palestine) that avocado agriculture began to take root.

In the 1920s, 30s, and 40s, encouraged by Britain, Jewish Europeans began to immigrate to Palestine in greater numbers and establish agricultural settlements (leaving an estimated 29.4% of peasant farming families without land by 1929). Seeds and seedlings from several varieties of avocado were introduced from California by private companies, research stations, and governmental bodies (including Mikveh Israel, a school which provided settlers with agricultural training). In these years, prices were too high for Palestinian buyers, and quantities were too low for export.

It wasn't until after the beginning of the Nakba (the ethnic cleansing of Palestinians from "Jewish" areas following the UN partition of Palestine in 1947) that avocado plantings became significant. With Palestinians having been violently expelled from most of the area's arable land, settlers were free to plant avocados en masse for export, aided (until 1960) by long-term, low-interest loans from the Israeli government. The 400 acres planted within Israel's claimed borders in 1955 ballooned to 2,000 acres in 1965, then 9,000 by 1975, and over 17,000 by 1997. By 1986, Israel was producing enough avocados to want to renegotiate trade agreements with Europe in light of the increase.

Israeli companies also attained commercial success selling avocados planted on settlements within the West Bank. As of 2014, an estimated 4.5% of Israeli avocado exports were grown in the occupied Jordan Valley alone (though data about crops grown in illegal settlements is of course difficult to obtain). These crops were often tended by Palestinian workers, including children, in inhumane conditions and at starvation wages. Despite a European Union order to specify the origin of such produce as "territories occupied by Israel since 1967," it is often simply marked "Israel." Several grocery stores across Europe, including Carrefour, Lidl, Dunnes Stores, and Aldi, even falsified provenance information on avocados and other fruits in order to circumvent consumer boycotts of goods produced in Israel altogether—claiming, for example, that they were from Morocco or Cyprus.

Meanwhile, while expanding its own production of avocados, Israel was directing, limiting, and destabilizing Palestinian agriculture in an attempt to eliminate competition. In 1982, Israel prohibited the planting of fruit trees without first obtaining permission from military authorities; in practice, this resulted in Palestinians (in Gaza and the West Bank) being entirely barred from planting new mango and avocado trees, even to replace old, unproductive ones.

Conditions worsened in the years following the second intifada. Between September of 2000 and September of 2003, Israeli military forces destroyed wells, pumps, and an estimated 85% of the agricultural land in al-Sayafa, northern Gaza, where farmers had been using irrigation systems and greenhouses to grow fruits including citrus, apricots, and avocados. They barred almost all travel into and out of al-Sayafa: blocking off all roads that lead to the area, building barricades topped with barbed wire, preventing entry within 150 meters of the barricade under threat of gunfire, and opening crossings only at limited times of day and only for specific people, if at all.

A July 2001 prohibition on Palestinian vehicles within al-Sayafa further slashed agricultural production, forcing farmers to rely on donkeys and hand carts to tend their fields and to transport produce across the crossing. If the crossing happened to be closed, or the carts could not transport all the produce in time, fruits and vegetables would sit waiting in the sun until they rotted and could not be sold. The 2007 blockade worsened Gaza's economy still further, strictly limiting imports and prohibiting exports entirely (though later on, there would be exceptions made for small quantities of specific crops).

In the following years, Israel allowed imports of food items into Gaza not exceeding the bare minimum for basic sustenance, based on an estimation of the caloric needs of its inhabitants. Permitted (apples, bananas, persimmons, flour) and banned items for import (avocados, dates, grapes) were ostensibly based on "necessary" versus "luxury" foods, but were in fact directed according to where Israeli farmers could expect the most profit.

Though most of the imports admitted into Gaza continued to come from Israel, Gazan farmers kept pursuing self-sufficiency. In 2011, farmers working on a Hamas-government-led project in the former settlements produced avocados, mangoes, and most of the grapes, onions, and melons that Gazans ate; by 2015, though still forbidden from exporting excess, they were self-sufficient in the production of crops including onions, watermelon, cantaloupe, grapes, almonds, olives, and apples.

Support Palestinian resistance by calling Elbit System’s (Israel’s primary weapons manufacturer) landlord, donating to Palestine Action’s bail fund, and donating to the Bay Area Anti-Repression Committee bail fund.

Ingredients:

2 medium avocados (300g total)

1/4 cup white tahina

2 Tbsp labna (لبنة), or yoghurt (laban, لبن رايب)

1 green chili pepper

2 cloves garlic

2 Tbsp good olive oil

Juice of 1/2 lemon (1 1/2 Tbsp)

1 tsp table salt, or to taste

Pomegranate seeds, slivered almonds, pine nuts, chopped dill, nigella seeds, sesame seeds, sumac, and/or olive oil, to serve

Khubiz al-kmaj (pita bread), to serve

Instructions:

1. In a mortar and pestle, crush garlic, pepper, and a bit of salt into a fine paste.

2. Add avocados and mash to desired texture. Stir in tahina, labna, olive oil, lemon juice, and additional salt.

You can also combine all ingredients in a blender or food processor.

3. Top with a generous drizzle of olive oil. Add toppings, as desired.

4. Cut pita into small rectangles or triangles and separate one half from the other (along where the pocket is). Toast in the oven, or in a large, dry skillet, stirring occasionally, until golden brown. Serve dip alongside toasted pita chips.

492 notes

·

View notes

Text

A Valentine's for Mr. Gold

Summary: In a cursed Storybrooke the town Grinch Mr. Gold visits the Storybrooke Library on Valentine's Day.

Rating: G

A/N:

Happy Fluffapalooza! Or Skin Deep Day! Which ever term you prefer.

I am one of the most cynical people about Valentine's Day you'll ever meet. But apparently that didn't stop my brain from coming up with this. ¯\_(ツ)_/¯

Oh also FYI, this is set one year before the events of S1. It's not really relevant. But just FYI.

[AO3]

***

If Mr. Gold had to say why he hated Valentine’s Day, he would have said there were three main reasons: 1. The rampant commercialism made even the mercenary business owner in him cringe; 2. It was the date his ex-wife had walked out on him and their five-year-old son two decades ago; and 3. It had been the date of the car crash that had taken his son from him and left him the crippled husk of a man he was today.

So he did not acknowledge that February 14th was any different from any other day. He did not sully his shop by making a holiday display or changing his hours (not that he did that for other holidays either) and he most certainly would not give discounts or loan forgiveness to those who had overspent their means to impress the object of their desires. In fact, he added a hefty fine to those who tried to use Valentine’s Day to justify any late payments on their loans. Everyone in the town knew he was -- as he’d heard Ruby Lucas once say (along with a load of expletives) -- ‘A Grinch’ but that didn’t stop a number of them every year thinking their sob story of a romance or broken heart would stop him fining them.

Normally on Valentine’s Day he’d head straight home, drink as many glasses of whiskey as he could stomach to drown thoughts of the shoebox in the attic with handmade valentines ‘To Papa’. But this year Valentine’s Day fell on a Monday which was library day. And nothing would come between him and library day. Not even Valentine’s Day.

Monday had been library day ever since Miss French had become the town librarian what felt like forever ago -- but could only have been several years at most. Mr. Gold didn’t need to go to the small town library for his reading needs. He had a very well-stocked library at home. But�� Miss French was the only intelligent person in this town he could have a conversation with about books (or anything for that matter). She was shy, but very charming and he couldn’t resist going back week after week; letting her pick out new books for him to discover.

When he opened the library door he stopped dead. The library was covered in chains of red paper hearts draped from the ceilings. He strongly debated turning around and walking out but Miss French had already seen him and waved cheerfully at him so he moved reluctantly towards the large wooden Circulation Desk.

Miss French was dressed in a simple blue dress that brought out the color of her eyes and those eyes sparkled up at him as she grinned at him and she took his finished books from him. “Not a fan of the decorations, Mr. Gold?”

“No,” he said through gritted teeth -- although whether they were gritted so he wouldn’t comment on the decorations or her dress or her eyes he couldn’t say.

“It’s not really my thing either -- well, Valentine’s Day, that is -- it’s too superficial and too commercial for my liking,” she said as she scanned his books back, placing them on the trolley beside her. “But a holiday is a good excuse for a children’s craft project -- that’s where most of the decorations come from you know. Plus it means I can put up special quick-pick displays and I love putting those together.” She smiled as she paused for breath, after her somewhat gabbled speech (not that Mr. Gold minded that -- he was no conversational maestro either). She leaned forward towards him and said, conspiratorially, “Guess what I did this year?”

Despite himself he couldn’t help leaning forward in response. “What?”

“I took a copy of each Jane Austen novel and wrapped them in paper covered in hand-made Valentine’s wrapping paper. Then wrote descriptions such as ‘Mystery Enemies-to-Lovers Epic Romance’ on each of them to get people to check out something different.”

Mr. Gold laughed (Miss French was the only person capable of eliciting his real laugh). “So you’ve been tricking Storybrooke’s residents into improving their reading palates?”

“Well…” She blushed, Mr. Gold studiously ignored how it nicely it brought out the color of her lips, “When you put it like that I almost feel bad.”

Of course she did -- Isabelle French was goodness personified, whereas he was the opposite. That was the reason why, despite being tempted, he would never act on his attraction nor give any indication of it. There was no chance in the world his attentions would be welcome. If he said something, she’d reject him and then he’d have to stop going to the library and seeing and having these little chats with Isabelle French. He couldn’t -- wouldn’t -- do that. So instead he just quashed his feelings down and allowed these weekly interactions to be enough.

“You shouldn’t. Feel bad, I mean,” he said softly.

“That’s kind of you to say.”

He shrugged, schooling his face to give no indication of how her words affected him. “It’s just the truth.”

They stood there in silence for a few moments while Miss French bent to retrieve his new books ones from under her desk. “I hope you’ll like these,” she said. “They’re not quite your usual fare but I think you’ll like them based on what you’ve enjoyed previously.”

He looked at the books wrapped in newspaper -- at least she’d known better than to use Valentine’s wrapping paper. “Are you sure you’re not tricking me into reading Jane Austen?” She giggled. “No! Besides you’ve already read all her books and I’m pretty sure you own your own copies of them. I just thought surprise might be fun.” She blushed.

“I see.” He allowed his lips to curl up slightly. He couldn’t be annoyed at her. Not now, not ever. Besides, he trusted her taste. Her recommendations were always interesting, even when they took him outside his comfort zone. He stared at her wanting to stay there longer to open the package and see what she’d chosen for him but there was the sound of footsteps behind them and he became painfully aware they weren’t alone anymore. He didn’t want to be caught acting like a love-struck idiot with Miss French so he picked up the wrapped package with a nod and left the library.

He had meant to walk home directly from the library. But the temptation to find out what Miss French had chosen for him was too strong; so he let himself into the back of his stop and, after fumbling with the lights, tore open the package.

There were two books inside and something sticking out in between them. He didn’t even glance at the titles before pulling out a square envelope, ripping it open he stared down at the obviously handmade card with a wobbly drawing of a heart on the front. Opening the card up, he read:

Dear Mr. Gold,

Happy Valentines Day! I know you probably think it’s stupid and don’t celebrate but everyone ought to know there are people in this world who care about them.

Your friend,

Isabelle x

P.S. You don’t read much poetry but I like this collection poems about love-- it covers a lot of different eras with many different poets and many kinds of love. The novel is The Left-Hand of Darkness by Ursula K. Le Guin. You told me you’d never read much Sci-Fi/ Fantasy and this is a modern classic for a reason. Let me know what you think of these books next week.

P.P.S. The Card is an example one I made with the schoolchildren. Please excuse how poorly drawn it is.

Mr. Gold stared down at the card, and in particular the little ‘x’ after Miss French’s name. Maybe his feelings weren’t so one-sided after all. Should he go back and tell her how he felt? No. No. That was insane. He couldn’t risk that. Besides, she was probably just being kind. She’d used the words ‘care about’ not ‘love’ and she had probably meant it in a friendly way not a romantic way. He was not someone anyone -- but especially someone as perfect as Isabelle French -- could love. But perhaps it was enough to know that someone out there saw him and didn’t turn away in disgust, but rather cared.

As he locked up his shop again and headed for home he felt a lot lighter and reflected as he walked that perhaps, Valentines Day wasn’t so bad after all.

#Rumbelle Fic#Fluffapalooza#Fluffapalooza 2025#Rumbelle#Shadowedoracle's Fic#My Fic#Fic: A Valentine's for Mr. Gold

27 notes

·

View notes

Text

In its simplest and most elemental form, check kiting is the simple practice of stealing money or valuable goods by paying for them with a check that you know (or ought to know) will be rejected because there aren’t sufficient funds in the bank account to honor it. In this form it is known to the specialists as “paper hanging,” and it’s often a crime of desperation or one carried out with stolen checkbooks rather than a calculated commercial decision—there are obvious disadvantages to a method of stealing that requires you to give the victim your name and address. It is possible to make paper hanging into both a systematic fraud and a lifestyle, as Frank Abagnale did (and wrote about in his autobiography, Catch Me If You Can, later made into a movie starring Leonardo DiCaprio). Abagnale got over the main drawback by adopting a nomadic lifestyle and impersonating an airline pilot, something that also allowed him to travel for free, to date flight attendants during the high period of Pan Am recruitment sexism, and to have a plausible excuse for needing to cash checks all the time and not having a permanent local address. But as a commercial fraud carried out by businesspeople, check kiting is a little bit more sophisticated and takes advantage of a peculiarity of the American banking system. [...] The important technical detail here is that because paper checks are particularly common in America, and because the check-clearing cycle is so long, American banks have—unusually in a global context—historically been very generous when it comes to allowing their business customers to make payments out of “uncleared funds,” that is to say checks that have been deposited into their account but that have not yet been endorsed by the bank that they are drawn on. Effectively, when you deposit a check, you get access to a short-term interest-free loan, lasting for the duration of the check-clearing cycle. This raises the possibility of a form of fraud that is the equivalent of NFL football and pumpkin pie—something that Europeans would no doubt enjoy greatly if they tried it, but that is so deeply embedded into the overall American way of doing things that it doesn’t really travel.

What you do (in the simplest form) is that you open accounts in two banks. Call them Bank A (from which you get a checkbook with pictures of trees in it) and Bank B (which gives you a checkbook full of pictures of sports cars). Pretend for the time being that you put a token hundred bucks into each account. But now you write a check for $500,000 from your “trees” checkbook and deposit it in your Bank B account. That check is going to bounce, for certain. Except… it will only bounce when the check gets presented, and in the meantime, thinking that you have $500,000 in the bank, Bank B will not mind if you write a sports-car check and deposit it in Bank A. If Bank A sees the sports-car check, they will not mind honoring the trees check for the time being, while they are waiting for the sports-car check to clear. If they honor that check, then you can write another check to Bank B, and so on…

Of course, this looks like a bit of a closed system—you can make the checks going back and forth look as big as you like, but if you ever take the money out in cash or spend it on something, the checks will actually bounce and turn you into just another paper hanger. But creating the illusion of having two bank accounts with half a million dollars in each can be profitable in itself because as well as allowing customers to make payments out of uncleared funds, American banks used to be quite generous about paying interest on deposits as soon as they were made. In the heyday of check kiting in the early 1980s when interest rates were in the midteens and bank computer systems in their infancy, you could have earned quite a lot out of the simple kiting scheme described above, unless someone happened to notice. And although even a dull bank clerk might spot a kite based on two banks and checks going back and forth every few days, if you bring more banks into the scheme (“chaining”) and intermingle the kite with the ordinary back-and-forth cash flow of a large operating business, it becomes very difficult to detect.

Interest rates are back baby, guess it is time to bring back kiting

32 notes

·

View notes