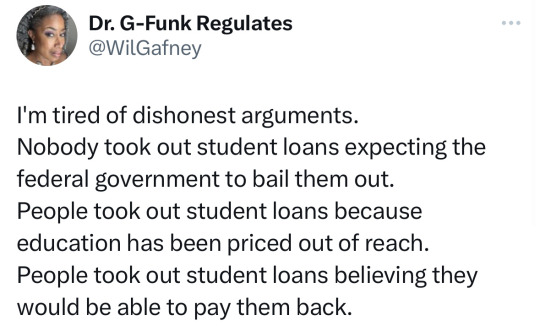

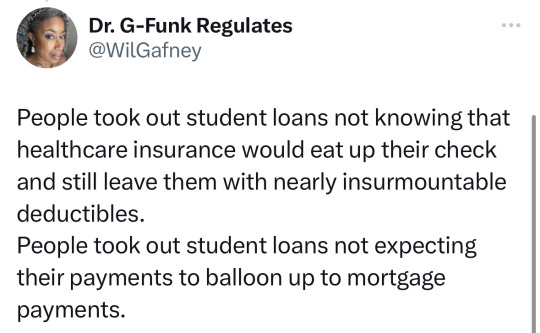

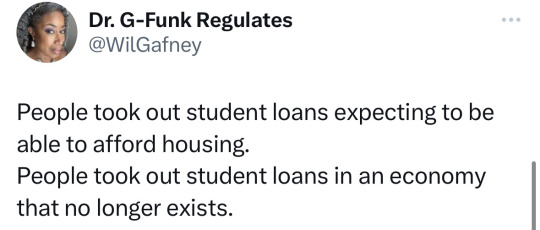

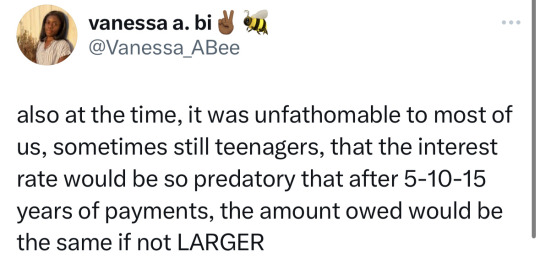

#capital loans

Text

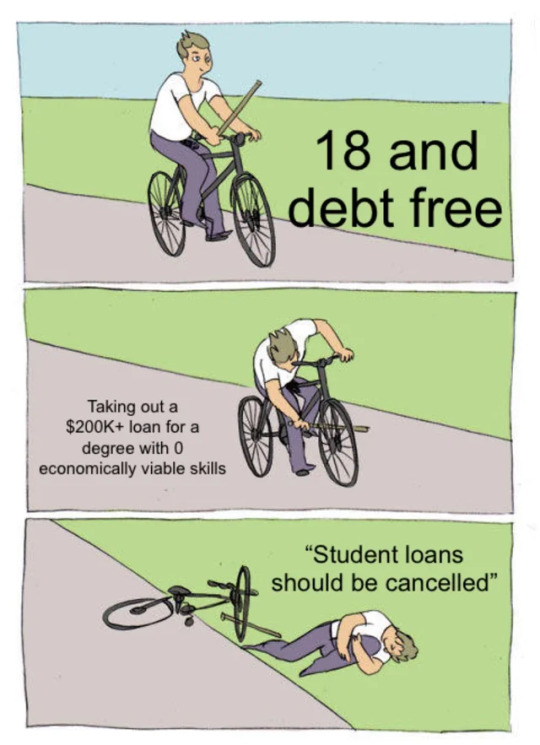

#cancel student debt#student loans#current events#government#education#college#capitalism#eat the rich

33K notes

·

View notes

Text

NYT seriously suggesting that you commit suicide to get out of student loan debt.

Someone thought this was a good idea to publish.

#Suicide tw#scotus#news#politics#capitalism#anti capitalism#democrats#republicans#collrge#student loans#federal

1K notes

·

View notes

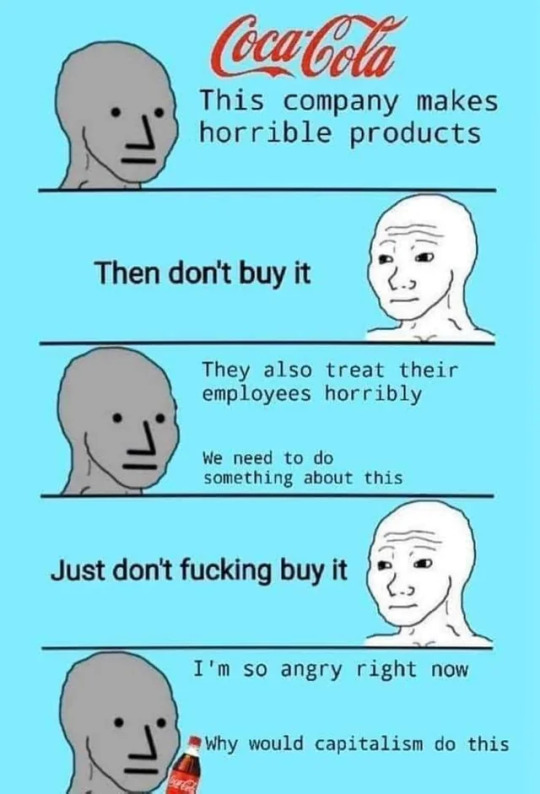

Photo

*You should recognize bad practices AND not voluntarily support companies through conducting business (i.e. purchasing luxury products).

#Capitalism#Socialism#Politics#Anticapitalism#Antisocialism#Wage#Wage Gap#Eat the Rich#Minimum Wage#Living Wage#Affordable Education#Affordable Healthcare#Free Education#Free Healthcare#Student Loans

2K notes

·

View notes

Text

>sees post complaining about student loan debt crisis

>They better not bring up capitalism

>"you see this all the time in capitalist societies--"

>mfw

186 notes

·

View notes

Text

“We are helping you actually.” -sincerely, your exploiters.

#“We are helping you actually.” -sincerely#your exploiters.#exploitation#exploitative#payday loans#fucking grifters#right wing grifters#opportunists#capitalism#poverty#homeless#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#class war#oppression#repression#anti capitalist#washington capitals#capitalist hell#capitalist dystopia

181 notes

·

View notes

Text

They used to say that the key to success was to go to college, and that anyone who didn't go to college deserves to be paid a poverty wage.

Then, they started saying that anyone who went to college deserves to be trapped in debt forever.

This is all the proof you need that if you follow the rules of a capitalist society, they'll just change the rules.

So stop following the rules. Individualism doesn't work. Making sure someone else is poor instead of you doesn't work. The only solution is for the working class to unite and fight back.

182 notes

·

View notes

Text

1K notes

·

View notes

Text

Private equity plunderers want to buy Simon & Schuster

Going to Defcon this weekend? I'm giving a keynote, "An Audacious Plan to Halt the Internet's Enshittification and Throw it Into Reverse," on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

Last November, publishing got some excellent news: the planned merger of Penguin Random House (the largest publisher in the history of human civilization) with its immediate competitor Simon & Schuster would not be permitted, thanks to the DOJ's deftly argued case against the deal:

https://pluralistic.net/2022/11/07/random-penguins/#if-you-wanted-to-get-there-i-wouldnt-start-from-here

When I was a baby writer, there were dozens of large NY publishers. Today, there are five - and it was almost four. A publishing sector with five giant companies is bad news for writers (as Stephen King said at the trial, the idea that PRH and S&S would bid against each other for books was as absurd as the idea that he and his wife would bid against each other for their next family home).

But it's also bad news for publishing workers, a historically exploited and undervalued workforce whose labor conditions have only declined as the number of employers in the sector dwindled, leading to mass resignations:

https://lithub.com/unlivable-and-untenable-molly-mcghee-on-the-punishing-life-of-junior-publishing-employees/

It should go without saying that workers in sectors with few employers get worse deals from their bosses (see, e.g., the writers' strike and actors' strike). And yup, right on time, PRH, a wildly profitable publisher, fired a bunch of its most senior (and therefore hardest to push around) workers:

https://www.nytimes.com/2023/07/18/books/penguin-random-house-layoffs-buyouts.html

But publishing's contraction into a five-company cartel didn't occur in a vacuum. It was a normal response to monopolization elsewhere in its supply chain. First it was bookselling collapsing into two major chains. Then it was distribution going from 300 companies to three. Today, it's Amazon, a monopolist with unlimited access to the capital markets and a track record of treating publishers "the way a cheetah would pursue a sickly gazelle":

https://pluralistic.net/2023/07/31/seize-the-means-of-computation/#the-internet-con

Monopolies are like Pringles (owned by the consumer packaged goods monopolist Procter & Gamble): you can't have just one. As soon as you get a monopoly in one part of the supply chain, every other part of that chain has to monopolize in self-defense.

Think of healthcare. Consolidation in pharma lead to price-gouging, where hospitals were suddenly paying 1,000% more for routine drugs. Hospitals formed regional monopolies and boycotted pharma companies unless they lowered their prices - and then turned around and screwed insurers, jacking up the price of care. Health insurers gobbled each other up in an orgy of mergers and fought the hospitals.

Now the health care system is composed of a series of gigantic, abusive monopolists - pharma, hospitals, medical equipment, pharmacy benefit managers, insurers - and they all conspire to wreck the lives of only two parts of the system who can't fight back: patients and health care workers. Patients pay more for worse care, and medical workers get paid less for worse working conditions.

So while there was no question that a PRH takeover of Simon & Schuster would be bad for writers and readers, it was also clear that S&S - and indeed, all of the Big Five publishers - would be under pressure from the monopolies in their own supply chain. What's more, it was clear that S&S couldn't remain tethered to Paramount, its current owner.

Last week, Paramount announced that it was going to flip S&S to KKR, one of the world's most notorious private equity companies. KKR has a long, long track record of ghastly behavior, and its portfolio currently includes other publishing industry firms, including one rotten monopolist, raising similar concerns to the ones that scuttled the PRH takeover last year:

https://www.nytimes.com/2023/08/07/books/booksupdate/paramount-simon-and-schuster-kkr-sale.html

Let's review a little of KKR's track record, shall we? Most spectacularly, they are known for buying and destroying Toys R Us in a deal that saw them extract $200m from the company, leaving it bankrupt, with lifetime employees getting $0 in severance even as its executives paid themselves tens of millions in "performance bonuses":

https://memex.craphound.com/2018/06/03/private-equity-bosses-took-200m-out-of-toys-r-us-and-crashed-the-company-lifetime-employees-got-0-in-severance/

The pillaging of Toys R Us isn't the worst thing KKR did, but it was the most brazen. KKR lit a beloved national chain on fire and then walked away, hands in pockets, whistling. They didn't even bother to clear their former employees' sensitive personnel records out of the unlocked filing cabinets before they scarpered:

https://memex.craphound.com/2018/09/23/exploring-the-ruins-of-a-toys-r-us-discovering-a-trove-of-sensitive-employee-data/

But as flashy as the Toys R Us caper was, it wasn't the worst. Private equity funds specialize in buying up businesses, loading them with debts, paying themselves, and then leaving them to collapse. They're sometimes called vulture capitalists, but they're really vampire capitalists:

https://www.motherjones.com/politics/2022/05/private-equity-buyout-kkr-houdaille/

Given a choice, PE companies don't want to prey on sick businesses - they preferentially drain off value from thriving ones, preferably ones that we must use, which is why PE - and KKR in particular - loves to buy health care companies.

Heard of the "surprise billing epidemic"? That's where you go to a hospital that's covered by your insurer, only to discover - after the fact - that the emergency room is operated by a separate, PE-backed company that charges you thousands for junk fees. KKR and Blackstone invented this scam, then funneled millions into fighting the No Surprises Act, which more-or-less killed it:

https://pluralistic.net/2020/04/21/all-in-it-together/#doctor-patient-unity

KKR took one of the nation's largest healthcare providers, Envision, hostage to surprise billing, making it dependent on these fraudulent payments. When Congress finally acted to end this scam, KKR was able to take to the nation's editorial pages and damn Congress for recklessly endangering all the patients who relied on it:

https://pluralistic.net/2022/03/14/unhealthy-finances/#steins-law

Like any smart vampire, KKR doesn't drain its victim in one go. They find all kinds of ways to stretch out the blood supply. During the pandemic, KKR was front of the line to get massive bailouts for its health-care holdings, even as it fired health-care workers, increasing the workload and decreasing the pay of the survivors of its indiscriminate cuts:

https://pluralistic.net/2020/04/11/socialized-losses/#socialized-losses

It's not just emergency rooms. KKR bought and looted homes for people with disabilities, slashed wages, cut staff, and then feigned surprise at the deaths, abuse and misery that followed:

https://www.buzzfeednews.com/article/kendalltaggart/kkr-brightspring-disability-private-equity-abuse

Workers' wages went down to $8/hour, and they were given 36 hour shifts, and then KKR threatened to have any worker who walked off the job criminally charged with patient abandonment:

https://pluralistic.net/2023/06/02/plunderers/#farben

For KKR, people with disabilities and patients make great victims - disempowered and atomized, unable to fight back. No surprise, then, that so many of KKR's scams target poor people - another group that struggles to get justice when wronged. KKR took over Dollar General in 2007 and embarked on a nationwide expansion campaign, using abusive preferential distributor contracts and targeting community-owned grocers to trap poor people into buying the most heavily processed, least nutritious, most profitable food available:

https://pluralistic.net/2023/03/27/walmarts-jackals/#cheater-sizes

94.5% of the Paycheck Protection Program - designed to help small businesses keep their workers payrolled during lockdown - went to giant businesses, fraudulently siphoned off by companies like Longview Power, 40% owned by KKR:

https://pluralistic.net/2020/04/20/great-danes/#ppp

KKR also helped engineer a loophole in the Trump tax cuts, convincing Justin Muzinich to carve out taxes for C-Corporations, which let KKR save billions in taxes:

https://pluralistic.net/2020/06/02/broken-windows/#Justin-Muzinich

KKR sinks its fangs in every part of the economy, thanks to the vast fortunes it amassed from its investors, ripped off from its customers, and fraudulently obtained from the public purse. After the pandemic, KKR scooped up hundreds of companies at firesale prices:

https://pluralistic.net/2020/03/30/medtronic-stole-your-ventilator/#blackstone-kkr

Ironically, the investors in KKR funds are also its victims - especially giant public pension funds, whom KKR has systematically defrauded for years:

https://pluralistic.net/2020/07/22/stimpank/#kentucky

And now KKR has come for Simon & Schuster. The buyout was trumpeted to the press as a done deal, but it's far from a fait accompli. Before the deal can close, the FTC will have to bless it. That blessing is far from a foregone conclusion. KKR also owns Overdrive, the monopoly supplier of e-lending software to libraries.

Overdrive has a host of predatory practices, loathed by both libraries and publishers (indeed, much of the publishing sector's outrage at library e-lending is really displaced anger at Overdrive). There's a plausible case that the merger of one of the Big Five publishers with the e-lending monopoly will present competition issues every bit as deal-breaking as the PRH/S&S merger posed.

(Image: Sefa Tekin/Pexels, modified)

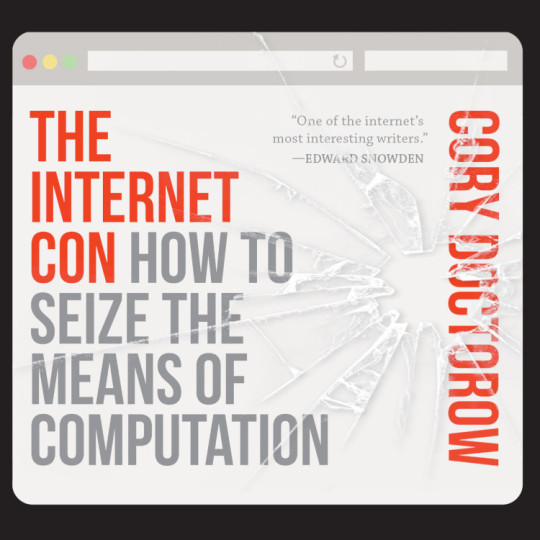

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/08/vampire-capitalism/#kkr

#kkr#simon and schuster#publishing#penguin random house#ppp loans#looters#plunderers#vampire capitalism#vulture capitalism#debt#private equity#pe#harmful dominance#monopoly#trustbusters#incentives matter#labor#writing#publishing workers#recorded books#overdrive#glam#libraries#toys r us#pluralistic

186 notes

·

View notes

Text

242 notes

·

View notes

Note

Hi. I saw your student debt post. A guy named Brian Manookian on Twitter is sharing the letter he sent to the company that held his debt to get out of it. I know you can do it with medical debt so you may wanna look into doing it for student debt. But basically you ask to see the papers transferring your debt between companies and if they messed up the chain of transfer somewhere you could be freed from it. Doesn't hurt to look into.

This is worth looking into if you have the time to do it. Drafting the letter only takes a half hour or so and it can be very brief.

The problem is that student loan companies *hold onto the debt.* It took 14 years for Navient to finally release my private student loan to a debt collector. They’ll hold on to federal loans for as long as they can because even if you continuously defer payment, or continuously default on payments, *they still make money.*

I’m not saying people shouldn’t dispute their debt once it goes to a collector. Like, everyone should legitimately do that because you WILL catch collectors. But here are some tips:

When a debt collector calls you, DO NOT give your name or any identifying information. Ask them repeatedly where they’re calling from and exactly what it’s regarding. They won’t tell you. Hang up. Answering the phone doesn’t count as contact, but giving your info DOES, which restarts the collection process. If a debt collector doesn’t collect or move against you legally for 7 years, the account becomes null and void.

59 notes

·

View notes

Text

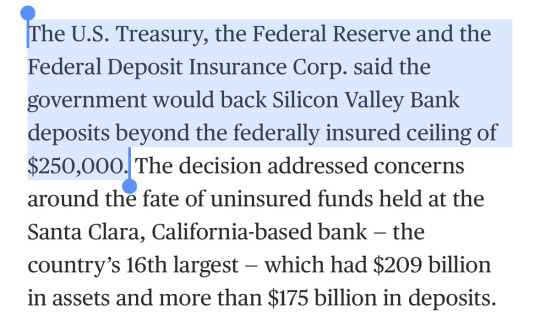

Source

Note: the FDIC (insurance paid into by banks, not taxpayers) is covering these loses. Let this be another glaring opportunity showing how deregulation is a dangerous game. If SVB’s collapse leads to broader financial turmoil, a true bailout may be needed.

#politics#us politics#government#capitalism#end capitalism#student debt#cancel student loans#the left#progressive#big banks#current events#news

6K notes

·

View notes

Text

I think this may be the spiciest NYTimes article I’ve ever read. And since it wears its data up front: That’s a compliment.

(Gifted for y’all)

75 notes

·

View notes

Text

#Student Loans#Student Debt#Student Loan Forgiveness#Communism#Antisocialism#Anticommunism#Republican#Democrat#Liberal#Libertarian#Conservative#capitalism#socialism#politics#anticapitalism

270 notes

·

View notes

Text

Cutie

#this was super quick. I'm feeling insane. I'm gonna have to start paying off my student loans in like. a month#I hate capitalism so so so so much <3#and the supreme court and biden#lots of hate for the american system <3 <3 <3#nepeta leijon#day 15#furfty days of nepurrta#hs#homestuck#my art

54 notes

·

View notes

Text

Saying the quiet part out loud

#college#university#school#education#student loans#education should be free#greedisthecreed#class war#classwar#capitalism#utas#university of tasmania#anti capitalist#capitalist hell#capitalist dystopia#capitalist bullshit#ausgov#politas#auspol#tasgov#taspol#australia#neoliberal capitalism#fuck neoliberals#anthony albanese#albanese government#poverty#fuck the gop#fuck the police#fuck the supreme court

599 notes

·

View notes

Text

"It's their own fault that they chose to take out a loan for college instead of just going to trade school."

There was a time when going to college was the key to success. Then, everyone started doing it, which caused the price to increase and caused entry level careers to require experience.

The same would happen with trade schools if everyone started doing it.

So instead of expecting people to constantly guess at how to be able to afford the cost of living and punishing them if they guess wrong, just give everyone what they need to live.

144 notes

·

View notes