#business equipment loan rates

Explore tagged Tumblr posts

Text

Learn how your industry affects equipment loan interest rates. Understand which sectors face higher rates, what lenders consider, and tips to secure favorable terms.

#equipment loan rates#equipment finance rates#heavy equipment loan rates#equipment leasing#business equipment loan rates

0 notes

Text

Exploring the Features and Benefits of SBA 7(a) Loans

The SBA 7A program is among the most widely used business financing solutions in the United States. The Small Business Administration provides these loans, which have several features and opportunities that make them a desirable option for business owners.

One of the main advantages of the 7A loans is their flexibility. These can be used for several things, such as refinancing obligations, buying working capital, inventory, or equipment, or even occasionally buying out another business. Moreover, SBA 7A loan interest rates are advantageous. It helps small businesses efficiently control borrowing costs by capping the maximum interest rate that lenders can charge on these loans. Since the interest rates are typically lower than those of traditional lenders, borrowers may end up saving a significant sum of money over time.

There are requirements that business owners must fulfill in order to be eligible for this loan. The SBA 7A loan requirements include that you must be able to repay the loan on schedule, have a strong credit score, and present enough collateral to secure the loan. Read More

#sba loans#SBA 7a loan#Small term loan#Cash Advance#interest rates#equipment financing#Term Loans#mortgage loan#business loan#same day loans online#Large capital Project

1 note

·

View note

Text

The Photo Shoot

Pretty safe for work tickling story. Ended up a bit longer than I expected, but what can you do?

------

Ryan always knew he was going to make it big. Ever since he was in high school he’d always gotten the lead parts in the school plays, and now that he was in university he was showing success in independent student productions. Of course he didn’t make any money off of any of those, and tuition for his school was expensive, which meant he had to work and had thousands in student loans to look forward to once he was done. He took this all in stride since he knew there was a pot of gold at the end of this very expensive rainbow.

One thing Ryan knew he needed if he was going to continue trying to be an actor was to get some professional pictures taken for auditions. So far he’d gotten free head shots taken by photography students. The problem is you get what you pay for, and some of the shots were clearly student work.

Luckily for Ryan, there were other photographers in town who were willing to work with students to get them some professional shots at a reduced rate. After a few days of searching, Ryan came across a photographer named Jay. He liked what he saw on Jay’s website (and liked his student discount even more) so he made an appointment to meet him. The two met for a consultation and Ryan booked a time slot to come to Jay’s studio.

On the day of the shoot, Jay brought several pairs of clothes to wear. Something formal, something casual, some streetwear, etc. When it came to the casual look, Jay instructed Ryan to take off his shoes and socks.

“Take them off? Why?”

“Shows vulnerability. Most people don’t show their feet at all, so it exposes a little bit more of you.”

Ryan wasn’t entirely convinced, but he still pulled off his shoes and socks and continued with the session.

It may have been his imagination, but Ryan felt that Jay kept glancing down at his bare feet. It wasn’t super obvious, and as far as Ryan could tell his feet were never the focus of any shots, but Jay’s eyes kept trailing down to them. Strange, yes, but Ryan didn’t want to cause a scene when he felt there was so much on the line.

Finally, with that last shot, they were done.

“Alright Ryan, that just about wraps it up. I think we got some good shots, but it will take me a few days to go through and clean them up.”

“Wow, alright, thanks. I’m looking forward to it. Can’t wait to see how they turn out.”

Ryan started to put his socks back on.

“Hey, kid, before you go any further, I have a business proposition for you. That is, if you’re looking to make a few bucks.”

Ryan stopped and looked over at the photographer. Extra money was never a bad thing.

“I mean, money is money, I guess. What are you looking for? This isn’t something dirty, is it? Because I’m not taking off my clothes.”

“Don’t worry, you’re already as undressed as you’d need to be. I just want to make a little video to post on my website.”

Ryan’s eyes narrowed.

“I’ve seen your website. You don’t have videos.”

The photographer gave a large toothy grin.

“Not that website, a different one. Here, come and take a look.”

Jay motioned for Ryan to follow him to the back of the studio where he had a large computer setup. Camera equipment and props were everywhere.

“Alright, just better not be anything too freaky.”

Ryan walked over to the far end of Jay’s studio on bare feet. When he got to the computer he was shocked by what he saw on the screen.

“Are those guys getting… tickled?”

Jay nodded and scrolled down the page a bit, showing Ryan more videos. Each one showed a young man (around Ryan’s age) being tickled. Some were tied up, some had their feet in stocks, and some just had their ankles being held down. Most were dressed like Ryan (which is to say fully dressed except for the shoes and socks), but others were in various states of undress. No one looked naked, though.

“Yup. Tickling sells well, you know. Lots of guys, and hell, women too, love seeing guys getting tickled. And it pays.”

Ryan’s ears perked up.

“People are willing to pay?”

“Oh sure. People are willing to pay for these videos if the model is cute and ticklish enough. And I have to say kid, you’re the exact type of guy they like to see.”

Ryan didn’t have much to say. His eyes stayed glued to the screen.

“I’ll make you a deal. You let me tickle you a little bit, just your feet so you don’t have to take anything else off, and not only will I not charge you for the shots, but I’ll actually give you a bit of what the video makes. What do you say?”

Ryan wanted to say no right away, but he hesitated. Not only would he get his shots for free, but he’d also get some cash for it, too? It seemed too good to be true.

“I mean… alright. I guess. As long as this is just tickling. I’m not doing anything else.”

“Alright, sounds good. And don’t worry, all I do is tickle guys, nothing else.”

Jay explained what would happen: Ryan would lay face down on a couch in the studio, so no one could see his face, and hang his bare feet over the side of the couch. Jay would sit on his legs and tickle his feet. It sounded easy enough. Ryan lay down, letting Jay move his body a little bit for the camera, and let himself relax (as much as he could). Once he was in place, Jay set up the camera and started recording.

Ryan was laying down on his stomach, bare feet on the arm of the couch, when he felt Jay straddle his ankles.

“Alright folks, this is our new tickle toy Brad. This is his first time with us, so let’s see how ticklish he is.”

Ryan (apparently going by the name Brad) tensed his whole body, waiting for whatever was supposed to come. Suddenly, he felt one finger on his right sole. It started up near his heel and trailed down towards his toes. Ryan flexed and curled his foot at the light ticklish sensation. No one had ever touched his feet (not that he could remember, anyways) so it was a strange feeling. The finger repeated the same movement on his left sole. This time Ryan wiggled a little bit under Jay, his foot waving side to side.

“Got some squirming going on it looks like. Let’s try something a little more ticklish”

One finger, one at a time, on each sole was suddenly replaced with five fingers on each sole. Those fingers dug into the insteps of his feet, scratching the soft sensitive skin there. Ryan jumped (though stayed pinned down by Jay’s weight) and started to kick his feet.

“Oh shit, what the fuck?!”

“Oh yeah, we got a ticklish one here.”

The fingers really worked their way in there, kneading the flesh of his feet. Ryan kept trying to kick those tickling fingers away, but Jay’s grip was just too strong. There was nothing that Ryan could do to make it stop. He could, of course, always say stop, but then he’d have to pay for his headshots. That was a huge motivation to stay here on the couch.

Several minutes after just assaulting the center of his feet, the hands started roaming over the real estate that was Ryan’s soft size 12 soles. The fingers came up to Ryan’s heels and attacked. Ryan jumped, and was suddenly barking out with laughter when Jay found an especially ticklish spot: the part of his sole right before his heel.

“Oh, sounds like we got a live one here!”

“NOO! PLEEEEASE!”

Fingers descended on that spot on each foot. It wasn’t just fingers working their way into the foot, but now nails were scraping and scratching too. The only thing Ryan’s over stimulated mind could think of was that this was like ringing a doorbell. It was loud, it was intense, and it was beyond annoying that Jay found this spot that reduced him to a laughing mess.

“Holy crap is he sensitive right here. How are you doing Brad? Want me to stop?”

“Y-Y-YES PL-PL-PLEEEEASE!”

“No? You’re all good? Sounds great to me!”

“NOOO!”

Jay continued to exploit the sensitive spot, attacking viciously with his fingers. Ryan was sure he was going to pass out when the tickling mercifully ended.

“Th-thank God…”

“He thought that was bad, wait till he gets a load of this…”

“Wait, what?!”

“Here comes the brush!”

Ryan’s entire body jolted when a broad hairbrush started attacking that same sensitive spot. The brush moved violently back and forth with cruel abandon. This was the worst feeling yet. Ryan was in absolute hysterics, thrashing as much as he could, trying to buck Jay off his legs. His feet kicked and squirmed to get away, one foot trying to cover the other for protection. His face and throat were starting to get sore from the laughter.

“Oh yeah, we got him right here.”

Not even able to say anything, Ryan continued to cackle. The brush alternated between feet, and each time it switched feet it was like the first time all over again. Tears were starting to stream from his tightly shut eyes. This was the first time he truly regretted his decision, and despite the promise of free shots and money, he found the urge to call out stop was right on the tip of his tongue. He bit it back though, he wasn’t going to give up.

The tickling changed, and now the brush was going up and down his soles. Again, Ryan tried curling his foot up to avoid the tickling, but Jay grabbed Ryan’s toes and flexed them back, stretching his sole out. Jay’s grip was too strong and Ryan wasn’t able to escape. He laughed and giggled, unable to stop as the brush scrubbed up and down his flexed sole. People got off on this? Ryan figured they must all be sadists.

“Let’s see how ticklish Brad’s toes are.”

The brush stopped for just a second (giving Ryan exactly one second of peace) before attacking the toes that Jay was holding back. Oh god. This was bad. This was worse than the spot hear his heels. This was like fire. Ryan didn’t just laugh, he was screaming. Tears were flowing so freely that he could taste them on his lips. He wanted to yell stop, he wanted this tickling to end, but he couldn’t form the words.

Jay continued tickling those toes, holding them tightly, even as the feet started to become slick with sweat. This of course made the brush slide and glide all the more easily. The brush scrubbed the tips of the toes all the way down to the sensitive little gap under each toe.

The tickling continued for a few minutes until finally, mercifully, it stopped.

“There we go, that was Brad. I think he did pretty well. Let me know if you want to see more of this boy.”

Jay concluded by slapping both of Ryan’s sensitive soles, making him jump and squeak.

Jay got up off of Ryan and turned off the camera.

“There we go kid, that’s it. You did good, I have to say, I think you’re going to be pretty popular.”

“Holy shit that was bad. Like… holy shit. You were torturing me.”

Jay laughed.

“That’s why they call it tickle torture. People love it.”

Ryan didn’t want to stick around much longer. He got up off the couch (his clothes were sticking to his body from all the sweat), put his shoes and socks back on (which was hard since his feet were so sensitive after the tickling), thanked Jay and left.

Several days later two things dropped in Ryan’s email. The first was a set of edited photographs. Ryan was happy to see that they looked professional and much better than any of the student work he’d had done so far. The second was much more interesting. It was an e-transfer for a couple of hundred dollars.

Ryan stared at the screen for a few minutes before he decided to call Jay.

“Hello?”

“Hey man, It’s Ryan. Thanks for the pictures, I just got them. They’re really good”

“No worries, I’m happy you’re happy.”

“So… what was the money you sent?”

“I told you that you’d get a bit of the money from the tickle video. It was pretty popular right off the bat, so that’s your share.”

“All that for just letting you tickle my feet?”

“Oh yeah. And if you’re ever interested we could do it again. You could maybe even make some more next time.”

“Like… how much more?”

“Depends on how far you’re willing to go. There’s some bondage, there’s some upper body tickling, there’s even some foot worship and tickling that drives some people wild. You interested?”

Ryan looked at the e-transfer again.

“Yeah, maybe. Tell me more.”

#malefeet#feet#gayfeet#male tickling#guy feet#male feet story#tickling#gay tickling#gay foot play#male foot story#tickle community#sfw tickling community#tickle kink#male tickling story#tickle content#m/m tickling

85 notes

·

View notes

Text

How to Get Unsecured Business Loans with No Collateral: A Guide for Small and Medium Business Owners in Australia

Running a small or medium-sized business in Australia presents many exciting opportunities, but it also comes with challenges. One of the biggest hurdles many business owners face is securing the necessary funds to sustain and grow their operations. Whether you’re looking to expand your business, purchase new equipment, or simply manage cash flow, access to financing is critical.

In Australia, securing a business loan can be difficult, particularly if you don’t have substantial assets to offer as collateral. This is where unsecured business loans can play a crucial role. In this guide, we’ll explore how you can obtain an unsecured business loan without collateral, the advantages and risks involved, and how to navigate the application process.

The Current Economic Landscape in Australia

Before diving into the specifics of unsecured business loans, it’s important to understand the broader economic context in Australia. Small and medium enterprises (SMEs) are vital to the country’s economy, contributing significantly to employment and GDP. However, economic conditions can fluctuate, and businesses often need to adapt to changes such as shifts in consumer demand, inflation, and regulatory changes.

Impact of Economic Changes on SMEs

Recent economic factors, such as global supply chain disruptions, rising inflation, and interest rate adjustments by the Reserve Bank of Australia (RBA), have put pressure on many SMEs. Access to funding has become more crucial than ever for businesses needing financial support to weather economic uncertainties or seize new opportunities.

Unsecured business loans have emerged as a popular financing option for SMEs that either lack the assets to provide as collateral or prefer to avoid tying their property or equipment to their business loan.

Read About - Quick Business Loans

What Are Unsecured Business Loans?

An unsecured business loan is a type of loan that does not require any collateral to back the loan. Unlike secured loans, where borrowers pledge assets such as property, inventory, or equipment, unsecured loans are based primarily on the borrower’s creditworthiness and the strength of the business.

Key Characteristics of Unsecured Business Loans:

No Collateral Required: The most significant feature of an unsecured loan is that you don’t need to offer your assets as security.

Higher Interest Rates: Since lenders take on more risk without collateral, unsecured loans often come with higher interest rates than secured loans.

Shorter Loan Terms: Lenders typically offer shorter repayment terms to minimize their risk exposure.

Creditworthiness is Key: Lenders will focus on your business's financial health, revenue, and credit score when evaluating your loan application.

How to Qualify for an Unsecured Business Loan with No Collateral

Securing an unsecured loan without collateral may seem challenging, but many businesses in Australia successfully obtain this type of financing. Here’s a step-by-step guide to increase your chances of approval:

1. Understand Your Business Financials

Before applying for any loan, it’s essential to have a clear understanding of your business’s financial health. Lenders will examine your financial records closely to assess your ability to repay the loan.

Review Financial Statements: Ensure that your profit and loss statements, balance sheets, and cash flow statements are up to date and accurate.

Calculate Debt-to-Income Ratio: This ratio compares your total business debts to your revenue. A lower ratio indicates better financial stability and can improve your chances of approval.

Prepare Tax Returns: Lenders often request several years of tax returns to verify your income and profitability.

2. Build and Maintain a Good Credit Score

Your credit score is one of the most important factors that lenders consider when reviewing your application. It reflects your ability to manage debt responsibly. Both your personal and business credit scores may be evaluated.

Pay Bills on Time: Ensure that you make all business payments, including suppliers and utilities, on time to avoid negative marks on your credit report.

Reduce Outstanding Debts: The lower your outstanding debts, the better your credit score will be.

Monitor Your Credit: Regularly check your business credit report to ensure there are no errors or discrepancies that could harm your score.

3. Demonstrate Steady Cash Flow

Lenders are more likely to approve loans for businesses with a consistent and reliable cash flow. A steady stream of income demonstrates that your business has the ability to repay the loan over time.

Track Sales and Revenue: Use accounting software to maintain accurate and detailed records of your business’s sales and revenue patterns.

Seasonal Adjustments: If your business experiences seasonal fluctuations in income, provide explanations and evidence of how you manage these periods to maintain financial stability.

4. Prepare a Strong Business Plan

A well-structured business plan can help convince lenders that you’re a low-risk borrower. Your plan should outline your business goals, market strategies, and how you intend to use the loan to achieve growth or stability.

Include Revenue Projections: Show lenders how you plan to generate revenue and ensure the loan will be repaid.

Detail Your Loan Purpose: Clearly explain why you need the loan and how it will benefit your business (e.g., purchasing inventory, hiring staff, or expanding operations).

5. Explore Lenders Specializing in Unsecured Loans

Not all lenders offer unsecured loans, so it’s essential to identify financial institutions that provide this type of financing. Alternate business lenders are often more flexible than traditional banks and may be willing to lend to businesses without collateral.

Online Lenders: Many online lenders cater to small and medium businesses, offering quick approval processes and competitive terms for unsecured loans.

Peer-to-Peer Lending Platforms: These platforms connect businesses directly with investors, allowing for more flexibility in terms and conditions.

Specialized SME Lenders: Some lenders focus specifically on providing loans to SMEs, and they may offer tailored solutions for businesses without collateral.

The Application Process for Unsecured Business Loans

1. Gather Necessary Documentation

Lenders will require a variety of documents to assess your loan application. Be prepared to provide:

Financial Statements: Profit and loss, balance sheets, and cash flow statements for the past 1-2 years.

Tax Returns: Personal and business tax returns from the last few years.

Bank Statements: Business bank statements for the past 6-12 months.

Business Plan: An overview of your business, market strategies, and financial projections.

2. Complete the Loan Application

Once you’ve gathered the necessary documents, fill out the lender’s loan application. Be sure to:

Provide Accurate Information: Double-check that all details are correct, as any errors or inconsistencies could delay the approval process.

Be Honest: Be transparent about your financial situation and the purpose of the loan.

3. Wait for Approval and Review Terms

After submitting your application, the lender will review your financial information and credit history. If approved, carefully review the loan terms, including:

Interest Rate: Compare the rate offered to other lenders to ensure it’s competitive.

Repayment Schedule: Understand the repayment terms and make sure they’re manageable for your business.

Fees and Charges: Be aware of any hidden fees, such as early repayment penalties or administrative charges.

Advantages and Disadvantages of Unsecured Business Loans

Advantages:

No Collateral Required: You can obtain financing without putting your personal or business assets at risk.

Faster Approval: Since unsecured loans don’t require collateral evaluation, they often have quicker approval processes.

Flexibility: Many unsecured loans offer flexible terms that can be tailored to your business’s unique needs.

Disadvantages:

Higher Interest Rates: Lenders compensate for the increased risk by charging higher interest rates compared to secured loans.

Lower Loan Amounts: Since unsecured loans don’t involve collateral, lenders may limit the amount you can borrow.

Shorter Repayment Terms: To reduce risk, lenders may offer shorter repayment periods, leading to higher monthly payments.

Best Practices for Managing Unsecured Loans

1. Create a Repayment Plan

Once you’ve secured the loan, it’s crucial to establish a clear repayment strategy. This will help you stay on top of your loan payments and avoid financial difficulties.

Budget for Loan Payments: Include your loan payments in your monthly budget and ensure that you have enough cash flow to cover them.

Set Up Automatic Payments: Automate your loan payments to avoid missed deadlines and penalties.

2. Monitor Loan Impact on Cash Flow

Track how the loan affects your business’s cash flow. Ensure that the loan is being used efficiently and generating a return on investment.

Track Spending: Monitor where the loan funds are allocated to ensure they’re contributing to business growth.

Adjust Budgets if Necessary: If the loan payments are straining your cash flow, adjust other areas of your budget to stay financially healthy.

Conclusion

Obtaining an unsecured business loan with no collateral can be a game-changer for small and medium businesses in Australia. Whether you’re looking to expand operations, manage cash flow, or cover unexpected expenses, unsecured loans provide a flexible and accessible option for financing.

In Australia’s evolving economic landscape, understanding your business’s financial health, maintaining a strong credit score, and preparing a solid business plan are key to securing financing. With various lenders, including alternate business lenders, providing unsecured loan options, you can find the right solution for your business needs.

If your business faces a sudden financial crisis, options like same day business loans or emergency business loans can provide quick access to the capital you need. By planning carefully and understanding the terms of your loan, you can leverage unsecured business loans to help your business thrive without putting your assets at risk.

2 notes

·

View notes

Text

Which Loan is Better for Starting a Small Business

Starting a small business can be both exciting and challenging. One of the most crucial steps in launching your business is securing the right type of funding. Various loan options are available, but which one is the best for you? Here’s a breakdown of the top loan types to help you make an informed decision.

1. SBA (Small Business Administration) Loans

SBA loans are government-backed loans designed to assist small businesses. They typically offer lower interest rates and longer repayment terms than traditional loans, making them an excellent option for new business owners. However, SBA loans can be more difficult to qualify for, and the approval process may take longer.

Best For: Businesses with good credit and a solid business plan.

2. Business Line of Credit

A business line of credit gives you flexibility. Instead of receiving a lump sum, you can borrow as needed up to a pre-approved limit. You only pay interest on the amount you use, making this a great option for managing cash flow and unexpected expenses.

Best For: Businesses that need ongoing access to capital.

3. Equipment Financing

If your business requires expensive equipment to get started, equipment financing might be the right choice. This type of loan allows you to borrow money specifically for purchasing equipment, with the equipment itself often serving as collateral.

Best For: Businesses that rely heavily on equipment, such as manufacturing or construction.

4. Merchant Cash Advance (MCA)

A Merchant Cash Advance provides a lump sum in exchange for a percentage of your future credit card sales. While it’s quick to access, this option typically comes with higher fees and shorter repayment terms.

Best For: Businesses with consistent credit card sales but low credit scores.

5. Working Capital Loans

A working capital loan is designed to finance the daily operations of your business. This loan can be used for things like payroll, rent, and utilities. It’s typically short-term and is perfect for businesses that need quick cash to maintain their operations.

Best For: Covering day-to-day expenses or short-term cash flow needs.

6. Term Loans

Term loans are a straightforward option where you borrow a fixed amount and repay it over a set term, typically with a fixed interest rate. These loans can be tailored for short or long-term needs and are ideal for starting a small business that requires a specific amount of capital upfront.

Best For: Businesses needing a large, one-time capital infusion.

How to Choose the Best Loan for Your Small Business

Choosing the right loan depends on your business needs, financial situation, and long-term goals. At Biz2loan, we specialize in helping small businesses find the perfect funding solution. Whether you need a working capital loan to get started or a term loan to expand, we’re here to guide you every step of the way.

2 notes

·

View notes

Text

Eligible Uses for SBA 504 Loans!

SBA 504 loans are primarily used for purchasing or refinancing fixed assets, which makes them perfect for:

Commercial real estate purchases – Whether a business is looking to buy a new office building, warehouse, or retail space, the SBA 504 loan can help finance the purchase with favorable terms.

Large equipment purchases – Manufacturing companies, construction firms, or businesses in other capital-intensive industries can use SBA 504 loans to finance major equipment purchases.

Renovations or improvements – Business owners can also use SBA 504 loans to improve or expand their existing properties, allowing for further growth and increased operational efficiency.

Debt Refinances or cash out refinances

Borrowers can refinance high rate or maturing debt, and can also get cash out for eligible business expenses (EBE).

Who is Eligible for an SBA 504 Loan?

To be eligible for an SBA 504 loan, a business must meet certain criteria:

It must operate as a for-profit business.

It must meet SBA size requirements (the vast majority of businesses do).

The loan must be used for qualifying purposes such as commercial real estate, equipment purchases, or improvements.

Conclusion

For loan brokers and lending professionals, the SBA 504 loan program is an excellent option to recommend to your clients, especially those looking to expand their businesses with large fixed asset purchases. The program's long-term, fixed-rate financing, low down payments, and structured partnership between the SBA, CDCs, and private lenders make it a win-win for both borrowers and lenders. If you're not already offering SBA 504 loans, now is the time to consider incorporating them into your service offerings. By doing so, you can help your clients secure the financing they need to grow while positioning yourself as a valuable and knowledgeable partner in their success.

#SBALoans#SmallBusiness#BusinessFinancing#CommercialRealEstate#Entrepreneurship#EquipmentFinancing#BusinessGrowth#LoanBrokers#FinanceTips#DebtRefinance

2 notes

·

View notes

Text

Rating: 3/5

Book Blurb: From the author of Love at First Set, a new irresistible enemies-to-lovers, grumpy/sunshine queer romcom for fans of Delilah Green Doesn’t Care, about a wedding-obsessed city girl who inherits a horse farm from her estranged late aunt, and clashes with the cocky, unfairly hot farrier who thinks she’s going to run the barn into the ground.

Molly McDaniel’s life is falling apart. Between her day job as a barista, her night job at a call center, and her crushing student loans, she’s barely getting by. And that dream she has of starting a wedding event planning business? The dream that led to all those student loan in the first place? She can feel it slipping farther and farther out of reach every day. So the absolute last thing she needs is to discover she’s inherited a run-down, struggling horse barn out of the blue, courtesy of her estranged late aunt.

Molly is so ill-equipped to run the barn, it’s laughable. She certainly doesn’t have the money, time or knowledge needed to save it, no matter how much faith everyone who loved her aunt has that she will. But the more Molly gets involved, the more she starts to wonder: maybe the barn is a blessing in disguise. If she can sell the land, the profits could be the small-business seed money miracle she’s been waiting for. So what if she’s starting to love everyone in the mismatched family she’s found here?

Well, everyone except Shani, the resident farrier and family friend who took care of Molly’s aunt in her last days. Judgmental, grouchy Shani, who refuses to give up on the barn; who walks around like she so much better than Molly; who’s actually really good with the horses…and kind of thoughtful. And obnoxiously hot. And unfailingly loyal.

And suddenly, Shani has become an entirely different kind of problem, one Molly can’t possibly solve, not without risking her whole future, no matter how much her heart wishes she could.

Review:

When a city girl inherits a horse farm from her estranged late aunt. she never expects to fall head over heels for the grumpy hot farrier who dislikes her. Molly McDaniel's life is not going great, her crushing student loans haunt her, her back to back jobs to just get by take up most of her time, and her dream of starting an event planning business has been put on the backburner. When she gets news that she has inherited her late estranged aunt's run down, struggling horse barn, this could be her chance to finally get her life back in track if she can sell it.... yet when she gets there she meets Shani, the hot cocky farrier who was close to her aunt and who dislikes Molly for being the one to inherit the horse farm. Shani refuses to give up on the barn and dislikes Molly for even thinking about wanting to sell it. Molly knows she can't take care of the horse farm, she has no experience, yet the longer she spends there getting to know all the people who were working on it with her aunt and actually spending more time with Shani, she begins to fall in love with both the farm and Shani. Will Molly risk it all and keep the farm and try and convince Shani that she means to stay, or will she finally chase after her dreams and take the easy way out? This was a really easy to read cowgirl romance, but it just felt like it was missing something for me. I was hoping for some further development in the romance or some actual chemistry, but it just wasn't there for me. I really wanted to like this one but just felt like it was okay at best and that it could have been better. I would say out of all the Jennifer Dugan books I've read, this was the best one. Molly and Shani are opposites and dislike each other from the start but work to overcome their differences and stop fighting their attraction to one another. It's a easy contemporary farm girl x city girl romance and I think anyone who enjoys a sapphic romance should definitely give it a go.

*Thanks Netgalley and Avon and Harper Voyager | Avon for sending me an arc in exchange for an honest review*

3 notes

·

View notes

Text

🚀 The Best Small Business Loans in 2024

Explore top funding options tailored to help your small business thrive in 2024! From flexible terms to competitive rates, these loans cater to various business needs.

1. SBA Loans 💼 Description: Backed by the Small Business Administration, these loans offer favorable terms and lower interest rates. Best For: Established businesses looking for long-term financing. 2. Term Loans 🏦 Description: Traditional loans with fixed interest rates and repayment schedules. Best For: Businesses needing a significant amount of capital for expansion or large projects. 3. Business Line of Credit 🔄 Description: Flexible credit line that allows businesses to withdraw funds as needed. Best For: Managing cash flow and covering short-term expenses. 4. Equipment Financing ⚙️ Description: Loans specifically for purchasing business equipment. Best For: Businesses looking to acquire machinery, vehicles, or technology. 5. Invoice Financing 💳 Description: Advances based on outstanding invoices. Best For: Businesses facing cash flow issues due to slow-paying clients. 6. Microloans 📈 Description: Small, short-term loans for startups and small businesses. Best For: New businesses or those with limited credit history. 7. Merchant Cash Advances 💰 Description: Lump sum of cash in exchange for a percentage of future sales. Best For: Businesses with high credit card sales needing quick funding. 8. Peer-to-Peer (P2P) Loans 🤝 Description: Loans funded by individual investors via online platforms. Best For: Businesses seeking alternative funding sources with competitive rates. 9. Commercial Real Estate Loans 🏢 Description: Loans for purchasing or renovating commercial property. Best For: Businesses looking to buy or upgrade their physical location. 10. Franchise Financing 🌟 Description: Specialized loans for opening or expanding a franchise.

Best For: Entrepreneurs investing in a franchise opportunity. Choose the right loan to fuel your small business growth and achieve your entrepreneurial dreams in 2024! 🌟 #SmallBusiness #BusinessLoans #Entrepreneurship #2024BusinessGoals #FundingOptions

5 notes

·

View notes

Text

The Ultimate Guide to Buying Luxury Properties in Dubai

Introduction to Luxury Properties in Dubai

Dubai's real estate market is synonymous with luxury, offering a wide range of high-end properties that attract investors and homebuyers from around the world. From opulent villas and expansive penthouses to exclusive apartments in prestigious neighborhoods, Dubai's luxury real estate sector is thriving. This guide provides a comprehensive overview of the process of buying luxury properties in Dubai, offering valuable insights and practical tips to help you secure your dream home.

For more information on home loans, visit Home Loan UAE.

Why Invest in Luxury Properties in Dubai?

Dubai is a global hub that combines modernity with tradition, making it an attractive destination for luxury real estate investment. Here are several compelling reasons to invest in luxury properties in Dubai:

Strategic Location: Dubai's geographical location serves as a crucial gateway between the East and the West, making it a central hub for business and tourism.

World-Class Amenities: Luxury properties in Dubai come equipped with world-class amenities, including private beaches, state-of-the-art fitness centers, and high-end retail and dining options.

Tax Benefits: Dubai offers tax-free income on rental yields and capital gains, making it an attractive destination for investors.

High Rental Yields: The city provides some of the highest rental yields in the world, making it a lucrative investment opportunity.

Strong Economy: Dubai's robust and diversified economy supports a stable real estate market, providing a secure investment environment.

For property purchase options, explore Buy Commercial Properties in Dubai.

Understanding the Luxury Property Market in Dubai

The luxury property market in Dubai is characterized by its diversity and opulence. Properties range from high-rise apartments with breathtaking views to sprawling villas with private pools and gardens. Key areas known for luxury properties include:

Palm Jumeirah: An iconic man-made island offering exclusive beachfront villas and luxury apartments.

Dubai Marina: Known for its stunning skyline and waterfront living, Dubai Marina offers high-rise luxury apartments and penthouses.

Downtown Dubai: Home to the Burj Khalifa and Dubai Mall, Downtown Dubai offers luxury apartments in a vibrant urban setting.

Emirates Hills: Often referred to as the "Beverly Hills of Dubai," this gated community offers expansive villas and mansions.

Steps to Buying Luxury Properties in Dubai

Define Your Requirements: Determine your budget, preferred location, property type, and essential amenities.

Research the Market: Conduct thorough research on the luxury property market in Dubai. Use online portals, consult real estate agents, and attend property exhibitions.

Secure Financing: If you require financing, explore mortgage options. For more details, visit Mortgage Financing in Dubai.

Hire a Real Estate Agent: Engage a reputable real estate agent specializing in luxury properties to guide you through the process.

View Properties: Schedule viewings of shortlisted properties to assess their suitability.

Make an Offer: Once you find the right property, make an offer through your agent.

Legal Checks and Documentation: Ensure all legal checks are completed, and necessary documentation is in place.

Finalize the Purchase: Complete the payment and transfer the property title to finalize the purchase.

For rental options, visit Apartments For Rent in Dubai.

Financial Considerations

Investing in luxury properties requires careful financial planning. Here are some key financial considerations to keep in mind:

Budgeting: Determine your budget, including the purchase price, closing costs, maintenance fees, and potential renovation costs.

Mortgage Options: Explore different mortgage options to find the best rates and terms. A mortgage consultant can provide valuable advice and assistance.

Down Payment: Be prepared to make a significant down payment, typically ranging from 20% to 30% of the property value.

Currency Exchange: If you are an international buyer, consider the implications of currency exchange rates on your investment.

Legal Considerations

Title Deed: Ensure the property has a clear title deed issued by the Dubai Land Department (DLD).

No Objection Certificate (NOC): Obtain an NOC from the developer if purchasing an off-plan property.

Property Registration: Register the property with the DLD to formalize ownership.

Legal Advice: Consider hiring a legal advisor to assist with the legal aspects of the purchase.

Choosing the Right Real Estate Agent

A reputable real estate agent can make the process of buying a luxury property much smoother. Here are some tips for choosing the right agent:

Experience and Reputation: Choose an agent with extensive experience and a strong reputation in the luxury property market.

Market Knowledge: Ensure the agent has in-depth knowledge of the specific areas and properties you are interested in.

Client Testimonials: Look for client testimonials and reviews to gauge the agent's performance and reliability.

Communication Skills: Select an agent who communicates effectively and is responsive to your needs and concerns.

Viewing and Selecting Properties

When viewing luxury properties, consider the following factors:

Location: The location of the property is crucial. Consider proximity to amenities, views, and the overall neighborhood.

Quality of Construction: Assess the quality of construction, materials used, and overall craftsmanship.

Amenities and Features: Ensure the property offers the amenities and features that are important to you, such as private pools, gyms, and security.

Future Development Plans: Research any future development plans in the area that could impact the value and desirability of the property.

Making an Offer and Negotiating

Once you find the perfect property, making an offer and negotiating terms is the next step. Here are some tips:

Offer Price: Work with your agent to determine a fair offer price based on market value and recent sales.

Negotiation Strategy: Have a clear negotiation strategy and be prepared to make counteroffers.

Inclusions and Exclusions: Clearly outline what is included in the sale, such as furnishings, fixtures, and appliances.

Contingencies: Include contingencies in your offer to protect your interests, such as financing and inspection contingencies.

Closing the Deal

The final step in buying a luxury property is closing the deal. This involves several key tasks:

Final Walkthrough: Conduct a final walkthrough of the property to ensure it is in the agreed-upon condition.

Finalizing Financing: Secure your mortgage and ensure all financing details are in order.

Signing the Contract: Review and sign the sales contract, ensuring all terms and conditions are clearly outlined.

Transfer of Ownership: Complete the transfer of ownership with the Dubai Land Department.

For more resources and expert advice, visit Home Loan UAE.

Real-Life Success Story

Consider the case of James, an investor from the UK, who purchased a luxury penthouse in Dubai Marina. With the help of a local real estate agent and a mortgage consultant, James secured a competitive mortgage rate and finalized the purchase within three months. His investment has since appreciated in value, providing substantial rental income.

Conclusion

Buying luxury properties in Dubai can be a rewarding investment, provided you navigate the process with due diligence and expert guidance. By following the steps outlined in this guide and leveraging professional services, you can secure a luxury property that meets your needs and investment goals. For more resources and expert advice, visit Home Loan UAE.

2 notes

·

View notes

Text

Where can I get a merchant cash advance?

If you're considering a merchant cash advance (MCA), there are various providers you can turn to, including specialized MCA companies, online lenders, and some traditional financial institutions. Below is a list of reputable MCA providers, online platforms, and key considerations for choosing a provider.

. 🎯 NEED FREE MCA LEADS? visit - https://www.fiverr.com/leads_seo_web .

1. MCA Providers and Online Platforms

Specialized MCA Companies

Rapid Finance

Features: Offers MCAs with flexible repayment terms and quick funding.

Pros: Known for transparent terms and fast approval.

National Funding

Features: Provides MCAs along with equipment financing and working capital loans.

Pros: Simplified application process and rapid funding.

Forward Financing

Features: Focuses on small business financing with quick turnaround times.

Pros: Known for customer service and flexible repayment options.

CAN Capital

Features: Offers MCAs and other small business loans.

Pros: Provides educational resources and has a straightforward application process.

Reliant Funding

Features: Offers both MCAs and short-term business loans.

Pros: Flexible funding options and quick approval process.

Online Lending Platforms

Fundera

Features: Acts as a marketplace to compare multiple MCA providers.

Pros: Allows you to compare terms from various lenders in one place.

Lendio

Features: Provides access to multiple MCA offers by submitting one application.

Pros: Offers a variety of business funding options and personalized assistance.

Biz2Credit

Features: Connects businesses with lenders offering MCAs and other financing products.

Pros: Offers tools and resources to help business owners find the best financing options.

Kabbage (part of American Express)

Features: Provides working capital loans that function similarly to MCAs.

Pros: Known for a simple application process and flexible repayment options.

Fora Financial

Features: Offers MCAs and working capital loans.

Pros: Flexible terms and quick funding decisions.

2. Key Considerations When Choosing an MCA Provider

Interest Rates and Fees: Compare the factor rates, fees, and overall cost of the advance. MCAs typically have higher rates than traditional loans, so understanding the total repayment amount is crucial.

Repayment Terms: Ensure you understand the repayment structure, which is usually a percentage of daily sales. Consider how this will impact your cash flow.

Funding Speed: Some providers offer funding within 24-48 hours, while others may take longer. Choose based on how quickly you need the funds.

Qualification Requirements: Check the eligibility criteria, such as minimum monthly revenue, credit card sales volume, and business age. Some providers are more lenient than others.

Reputation and Reviews: Research the provider’s reputation by reading customer reviews and checking for any complaints with organizations like the Better Business Bureau (BBB).

Customer Support: Good customer support can be crucial, especially if you have questions or issues during the repayment process.

3. Steps to Obtain an MCA

Evaluate Your Needs: Determine how much funding you need and what you plan to use it for.

Compare Providers: Research and compare different MCA providers to find the best fit for your business’s needs.

Gather Documentation: Prepare necessary documents, typically including recent bank statements, credit card processing statements, and identification.

Apply: Submit an application online or through a sales representative. This usually involves filling out basic information about your business and providing financial documents.

Review Offer: Carefully review the advance offer, including the terms, fees, and repayment structure.

Accept and Receive Funds: If you agree to the terms, sign the contract and receive the funds, often within a few days.

Conclusion

Merchant cash advances can be a useful financing option for businesses needing quick access to funds with flexible repayment tied to sales. It’s important to compare different providers, understand the terms, and choose a reputable company that offers transparent and fair conditions. Always consider how the repayment will affect your cash flow and whether there are alternative financing options that might better suit your needs.

#mcaleads #merchantcashadvanceleads #merchantcashadvance #cashadvance

#businessloan #unsecuredloan #loan #loanofficer #businessloansnow #funding

#businessfunding

#mca leads#mcaleads#merchant cash advance#business loan#cash advance#b2b lead generation#funding#loans#mortgage#b2bmarketing

2 notes

·

View notes

Text

The Ins and Outs of SBA Loans for Businesses

Small Business Administration (SBA) loans are an attractive option for investors, as they are typically offered at competitive rates and with flexible terms. But, before you jump in, there are some things to consider when applying for an SBA loan. Let’s take a look at the important details that you should be aware of.

Qualifying for an SBA Loan

The U.S. Small Business Administration does not provide financing directly to borrowers—rather, it partners with banks and other approved lenders to provide government-guaranteed loans to businesses. In order to qualify for an SBA loan, you must have a good credit score, a solid business plan demonstrating how you will use the funds, and a positive cash flow from your business operations. Additionally, most lenders require collateral such as real estate or equipment in order to secure the loan.

Types of SBA Loans

There are different types of SBA loans available depending on your needs. The 7(a) program is the most popular and offers up to $5 million in funding with repayment terms up to 25 years; 7(a) Express loans offer faster turnaround times but can only be used for working capital or inventory purchases; 504/CDC loans offer long-term financing with low down payments; and Microloans can provide amounts between $500-$50,000 for short-term expenses such as inventory or supplies.

Considerations when Applying for an SBA Loan

One thing that all potential borrowers should consider before applying for an SBA loan is that these loans come with certain restrictions that could impact their ability to qualify or their ability to use the funds as needed once they do qualify. For example, some restrictions include specific uses of the money (such as buying real estate), limitations on loan size based on number of employees or annual revenue, and restrictions on who can borrow (such as non-profit organizations). It is important to understand any potential restrictions before applying so that you can ensure you meet all eligibility requirements and make sure that the loan will be able to fulfill your needs if granted.

An SBA loan calculator can be a powerful business tool for business owners. It allows business owners to accurately estimate the monthly payment, total cost of the loan, and amount of their down payment. With an SBA 504 vs 7a loan calculator, business owners can confidently calculate the best business financing options for their business needs. It is essential for business owners to have a quick and valuable assessment of their business finance options before making important decisions. The SBA loan calculator is an invaluable asset to navigating business finances.

Financing a small business has many benefits but also comes with some risks—one of which is having access to sufficient capital when needed. Fortunately, there are options available such as SBA loans which offer competitive rates and more flexible terms than traditional bank loans. However, it's important to understand what qualifying criteria must be met in order for your application to be approved as well as any potential restrictions which could impact your ability to use the funds once granted. With this knowledge in mind, business owners can better assess whether getting an SBA loan is right for them and their business goals.

2 notes

·

View notes

Text

Review: News Tower - Living vicariously in a stable career

RATING: 4/5 Stars Played on: AMD 5 5600X and RTX 3060 Ti 8GB

Entering the journalism field is hard. While I was lucky to get a 2-year contract with a national broadcaster when I was in uni, getting my foot in the door became so much more difficult, especially when companies keep changing the goalposts. Not to mention, the constant amount of layoffs that occurred across the world. So, you can imagine my intrigue when there is an indie game that showcases a time when the journalism field wasn't that bad.

This is my review of News Tower, a fun journalism business sim that's somewhat reminiscent of 1930s America.

News Tower is a PC game developed by Sparrow Night and published by Twin Sails Interactive. While the developers are from Rotterdam in the Netherlands, it managed to showcase the 1930s American aesthetic that we're somewhat familiar with and what journalism was like in the past.

In this game, you play as the editor-in-chief or boss of your family's newspaper company in the USA. It is in shambles and it's up to you to restore it to a functioning state. You will be hiring employees, not just journos, and will be tasked to send them to report on topics based on what your communications team picked up. From elections to film reviews, you have it all.

Each employee you hire will be an expert in three skills/topics and you can raise their knowledge-base levels through experience or items in the office. This applies to journalists, cleaners, typewriters, lawyers, and the rest of the newspaper staff.

The game is also a business simulator, so you will have to manage the well-being of your employees, as well as other factors like rioters destroying and trashing equipment and trashing the place and paper stock. So expect to micromanage everything.

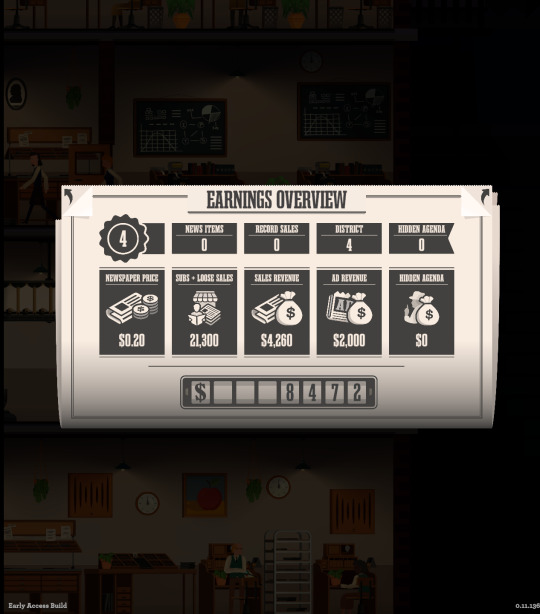

Each round lasts for a "week." After each job, you will be assessed on how well you did via the earnings overview. Did you make advertisers happy? Are the quality of your stories good or sloppy? Did you take out loans? All of that is showcased at the end.

The reason why I say "week" is because each "round" is technically a month. Once the round ends, you enter a brand new month.

If you're wondering why my screenshots are weird, that's because the graphics settings were hard to navigate. While it did offer different screen ratios so it suits many devices, finding the settings for my monitor (1440p) was seriously buried.

What I like about the game is that you also have the freedom to do whatever you want, despite the micromanagement aspects. You can tackle stories of your choosing or produce content that will attract readers. You also have the opportunity to work with three "influences," all of which could play a role in what you can and can not cover. For example, you may be required to lie to your readers or produce certain types of stories. If you can complete these tasks, you will be heavily rewarded.

Either way, it is up to you on what gets reported and how you layout your newspaper. But just like in the real world, you need to know your audience and if you want to get the funding, you need to bow down to your sponsors.

Sadly, this game only offers at least 3 hours of game time. You start the game in 1930, but it ends once you complete December 1932. Is it possible to unlock everything on the map with that limited time? Maybe. But if you're going to be a full-on completionist, good luck with that as the jobs you get to report on are randomized. Meaning that the mafia story that you needed to cover may not even happen because it didn't pop up until the very last minute. Or if you're trying to attract readers in a certain area, it may take a few attempts before you're able to make everyone happy.

These tasks and readers give you influence points, that you can use to unlock items. But like I said earlier, you only have 2 years' worth of gameplay that only lasts for 3 hours. So there is a high chance you may not be able to unlock everything during your first or second attempt.

The reason for this is because News Tower is still in early access, and the devs plan to release "Endless mode" at some point, as well as other fun features. While it is understandable, it kinda felt like the game is teasing us. For example, News Tower says you could accept jobs outside of America. But unfortunately, you can't unlock those places yet (at the time of writing).

Overall, the game has potential and is very well-built. The music and aesthetic really do really encapsulate that 1930s America. However, due to the limited gameplay that you're given, as well as the locked features, it feels like the game is teasing you to start a new save file over and over again. This is a shame because I want to be the next Rupert Murdoch in my game but that can't be achieved at the time being.

But maybe those locked features are what make this game addictive and how it lures you back in. It triggers that part of your brain to try and try again. I look forward to Endless Mode once it comes out. But for now, this will do.

3 notes

·

View notes

Text

Mwananchi Credit Highlights the Importance of Teaching Financial Literacy In Schools

How many times have we read numerous newspaper articles about children who squandered their inheritance money or how they trusted quick “get rich” schemes and was dubbed out of it? Again, how many times have we seen an employee who worked tirelessly for 30+ years and went on retirement, only to splurge away their pension pay-outs and suffer in their old age? Better yet, how many young people currently employed are living from paycheck to paycheck with debts overwhelming them, credit cards here, over-drafts there, revolving loans, the list is endless. The most common reason is that many heirs, pensioners or even the young workforce are simply inexperienced at handling money.

A million dollars can be put to so much good use. However, once it is spent recklessly, it can no longer produce income. Isn’t it amazing that we all completed high school knowing algebra, the scientific table, and the human anatomy, but not how to open a bank account, how to file a tax return, the importance of having funeral covers or even something as simple as budgeting and saving?

The current education system is slow to teach simple money management habits/techniques to children growing up. Most young people will graduate from universities or start new businesses with no financial foundation. As a society we lack basic financial literacy thus teaching financial literacy in schools is critical in passing on general wealth.

Financial attitudes and habits begin to mold at a very young age. It is extremely important to expose children to how to use money wisely and to smart financial decision making. School curriculum can range from budgeting and cash flows so that young people understand the concept of ‘money in, money out’ and how that will impact them in the long term.

Our young people need to know how loans work, how interests are charged on these loans and how it can impact their financial situation over the long run. Notwithstanding the above, the importance of retirement planning the power of putting a little bit of money away today and where that can land you in the future, are all critical. By teaching financial literacy in schools, we can change the narrative from poverty to debt-free lifestyle, from inheritance money being a “curse” to a gift.

Furthermore, we can pass on generational wealth by enabling our young people to make informed decisions. In this digital and social media era, we find that our young people take out a personal loans today just to finance a trip to Paris or California and only to realize that upon their return, they must start repaying this loan with a very high interest rate for four years. Just to take out another loan to offset that and find themselves in a pool of financial difficulty.

I know that many might argue that if you are a high school teenager, you most likely don’t have much money, you don’t have access to credit, you don’t have a job- so is there really any point in teaching such a youngster about savings, investing, taxes or budgeting? However, many of us were taught religious, moral education and life skills in school and that shaped us in many ways for life. We learned basic principles of respect, sharing, caring and discovering our identity. Another subject that was introduced in recent years was entrepreneurship because it uses developing real world skills that will help learners lead exceptional lives in a rapidly changing world by teaching children to think outside the box.

Many western countries have introduced Financial Literacy in their school curriculum examples of these countries are Australia, Canada, Denmark, Finland, Germany, Israel, the Netherlands, Norway and Sweden just to name a few.

Our current school curriculum equips children how to be great doctors and individuals with great business skills. Since the children of today are going to be the leaders of tomorrow, financial literacy will equip them with the skills they will need to become financially literate adults. In the end their future and that of our country Kenya is depending on it.

Mwananchi credit is the leading Microfinance company in Kenya providing log book loans and other secured emergency loans, Mwananchi Credit is at the forefront in championing for financial literacy good finance planning for individuals and SMEs.

Welcome to Mwananchi credit, Investor in people

PLEASE CALL 0709 147 000 SMS:’’LOAN’’ TO 23877 OR DIAL *684#

Article by Gitonga Muriithi, Head of Commercial, Mwananchi Credit

2 notes

·

View notes

Text

Navigating the Path to Success: Understanding Business Loans for Entrepreneurs

In the ever-evolving landscape of business, the journey from concept to successful establishment often requires a potent infusion of capital. For entrepreneurs, accessing funds through business loans can be a pivotal step towards turning their dreams into reality. Whether it's starting a new venture or expanding an existing one, the strategic use of business loans can provide the necessary financial backbone to foster growth and sustainability.

Understanding Business Loans:

Business loans are financial instruments tailored to meet the diverse needs of entrepreneurs. They come in various forms, each designed to address specific business requirements. The key types include:

1.Term Loans:

These loans involve borrowing a lump sum amount that is repaid over a predetermined period with fixed interest rates. Term loans are ideal for significant investments like equipment purchases, expansion projects, or real estate acquisitions.

2. Lines of Credit:

Providing a revolving credit facility, lines of credit enable businesses to borrow funds up to a certain limit. Entrepreneurs can withdraw as much or as little as needed, paying interest only on the amount used. This flexibility makes it suitable for managing day-to-day operations, covering seasonal fluctuations, or addressing unforeseen expenses.

3.SBA Loans:

Backed by the Small Business Administration (SBA), these loans offer favorable terms and lower interest rates. SBA loans provide financial support for various business needs, including working capital, equipment, and real estate.

4.Equipment Financing:

Specifically geared towards acquiring machinery or equipment, this type of loan allows businesses to spread the cost of these assets over time while maintaining cash flow.

5.Invoice Financing:

Also known as accounts receivable financing, this type of loan allows businesses to leverage their unpaid invoices for immediate capital. It's a useful option for businesses facing cash flow gaps due to delayed payments.

Choosing the Right Loan:

Selecting the most suitable loan requires a thorough understanding of your business needs, financial situation, and repayment capabilities. Factors to consider include:

Purpose:

Define the purpose of the loan. Is it for expansion, operational needs, equipment purchase, or something else?

Loan Amount:

* Assess the required amount considering present and future needs without overburdening the business.

- **Interest Rates and Terms:** Compare interest rates, repayment terms, and associated fees among different lenders to find the most favorable terms.

Creditworthiness:

A good credit history enhances the chances of securing loans with better terms. For startups or businesses with limited credit history, personal credit may be considered.

Collateral:

Some loans require collateral, such as business assets or personal guarantees. Understand the risks associated with offering collateral.

The Loan Application Process:

Applying for a business loan involves a systematic approach:

1. Prepare Documentation:

Lenders typically require documents such as business plans, financial statements, tax returns, and legal documents. Ensure these are up-to-date and accurately represent your business's financial health.

2. Research Lenders:

Explore various lenders, including banks, credit unions, online lenders, and alternative financing options. Each has its own set of criteria and advantages.

3. Submit Application:

Complete the loan application accurately and include all required documents. Some lenders may offer a prequalification process that gives an estimate of eligibility without impacting credit scores.

4. Review and Negotiation:

Once offers are received, carefully review terms and negotiate where possible to secure favorable terms.

5. Loan Approval and Repayment:

Upon approval, adhere to the agreed repayment schedule, managing finances responsibly to maintain a positive credit profile.

Benefits of Business Loans:

Utilizing business loans wisely can yield several advantages for entrepreneurs:

Facilitate Growth:

Loans provide the necessary capital for expansion, allowing businesses to seize growth opportunities.

Manage Cash Flow:

Access to funds during lean periods or to cover immediate expenses helps maintain stable operations.

Build Credit:

Timely repayment of loans contributes to building a positive credit history, improving future borrowing capabilities.

- **Invest in Innovation:**

Loans can fund research, development, or technology upgrades, fostering innovation within the business.

Challenges and Risks:

While business loans offer significant benefits, they also come with inherent risks:

Debt Burden:

Taking on too much debt without a solid repayment plan can strain finances and hinder growth.

Interest and Fees:

High-interest rates and additional fees can increase the overall cost of borrowing.

Risk of Default:

Inability to repay loans can lead to asset seizure, damaged credit, or even business closure.

Conclusion:

Business loans serve as catalysts for entrepreneurial ventures, providing crucial financial support for growth and sustainability. Understanding the various loan types, meticulous planning, and responsible financial management are vital elements in leveraging loans effectively. By evaluating needs, comparing options, and adopting a disciplined repayment approach, entrepreneurs can harness the power of business loans to steer their ventures towards success in today's dynamic business environment.

2 notes

·

View notes

Text

A Comprehensive Overview of Multiple SBA Loan Programs: What’s Best for Your Business?

Understanding the Importance of SBA Loans for Small Businesses

SBA loans are essential for fostering and advancing the expansion of small businesses. The Small Business Administration provides a range of loan programs tailored to offer financial support to entrepreneurs and small business owners. These small business loans are particularly important for startups and small businesses that may face challenges in obtaining traditional bank loans due to limited collateral or credit history. Small-term loans provide access to capital at favorable terms, including lower interest rates and longer repayment periods. An important advantage of small business loans is the inclusion of a guarantee for lenders, which mitigates their risk and encourages them to provide loans to startups. This guarantee enables lenders to offer financing alternatives that may have been otherwise inaccessible. Small business owners must comprehend the various SBA lending programs that are accessible, including but not limited to 7(a) loans, CDC/504 loans, microloans, and disaster assistance loans. Every program has unique prerequisites and qualifying requirements.

Exploring the Most Popular SBA Loan Programs and Their Eligibility Criteria

In this section, we will explore some of the most popular Small Business Administration loan programs and discuss their eligibility criteria.

1. 7(a) Loan Program:

The 7a loans stand out as the most versatile and widely used loan initiative. It provides funding of up to $5 million, catering to a myriad of business needs, from working capital to equipment purchases.

Key Features of 7a Loans:

Loan Amount: Up to $5 million.

Usage: Diverse business needs, from day-to-day operations to expansion.

Term Length: Varies based on usage.

Eligibility Criteria: Read More

#finance#business loan#loan#personal loans#same day loans online#Cash advance#line of credit#equipment financing

2 notes

·

View notes

Text

“It’s kind of a last-man-standing situation,” says Fred Thiel, CEO of US-based Marathon Digital Holdings. His crypto-mining company, among the largest in the world, has found itself—like the rest of the industry—in the path of a perfect storm.

Over the past year, the sector has been battered by a slump in the price of bitcoin, combined with a spike in the cost of energy and an increase in mining difficulty—a reflection of the amount of computing power directed at the bitcoin network, which dictates the proportion of coins miners are able to win.

At the height of the 2021 boom, profit margins in the mining business rose as high as 90 percent, says Thiel. But now, they have “totally collapsed.” If the price of bitcoin does not rally, he says, there will be “a lot more pain,” and firms that are only marginally profitable today will find themselves “very underwater.”

As they scramble to cut costs, miners are playing a high-stakes game of chicken. In spring 2024, the halving, a mechanism baked into the bitcoin system that periodically cuts the number of coins awarded in half, will slash mining profits. The goal for miners is to ensure they are in a strong enough financial position to survive the fall in profits longer than anyone else; as miners give in and drop from the network, the share of coins won by the rest will increase.

“Any miners that are struggling now will not be able to survive the halving,” says Jeff Burkey, VP of business development at Foundry, which operates its own mining facilities, a large-scale mining pool, and a marketplace for mining hardware. The dynamic will create a rush among miners to get their houses in order, he explains.

Miners will look to eke out additional profit margin wherever they can, whether by deploying superior hardware and cooling techniques, developing software to closely monitor the performance of machines, relocating to territories with cheaper power, or renegotiating the terms of their loans.

Others, like Geosyn Mining, are aiming at vertical integration—all the way down to the energy powering the facilities. The company, says CEO Caleb Ward, wants to construct its own solar farm to power its machines, thereby eliminating a major cost. “We need to be more thoughtful as an industry about how we protect against risk,” he says. “It’s not all about shooting for the moon.”

Meanwhile, the miners whose financial predicaments prevent them from fine-tuning their operations are playing a dangerous waiting game, gambling on an increase in the price of bitcoin that may never come.

“The beauty of halving cycles is that the industry [is forced] to become more efficient—a lot of weaker players will have to exit the business,” says Jeff Lucas, CFO of mining company Bitfarms, which has worked to restructure its finances in the downturn. “The devil is in the details.”

Already on the back foot, mining companies are beginning to fold. Compute North, which owned multiple large-scale mining facilities, filed for bankruptcy in September, and Core Scientific, a publicly traded miner, did the same in December. Others are having to maneuver. Argo Blockchain, also a public company, was forced to sell off mining equipment and its state-of-the-art mining center, while Stronghold Digital Mining has negotiated a debt repayment holiday. Neither company responded to interview requests.

A combination of “immaturity, poor planning, and greed” has led miners to the brink of collapse, says Phil Harvey, CEO of Sabre56, a crypto-mining consultancy firm that also operates its own facilities. While the market was hot, companies took on large amounts of debt at high interest rates (10-20 percent) to finance expansion, says Harvey, and now the value of the coins they earn is insufficient to cover the costs of repayments.

Historically, a steep rise in the price of bitcoin, triggered by a buying frenzy, has been followed by a sharp fall and then a gradual recovery. Although there is no guarantee this pattern will repeat, the process is widely described as the bitcoin cycle. The fatal mistake, says Jaime Leverton, CEO of mining company Hut 8, was to imagine that that 2021 was different—that the industry was in a “supercycle” that was going to “break prior cycles” and extend the hot streak. A lot of people bought into this idea, she explains, and so were caught off-guard when the market tanked.

In an effort to strengthen its own position, Hut 8 is in the process of merging with US Bitcoin, another mining firm. The goal, says Leverton, is to minimize risks associated with the volatility of bitcoin by diversifying both revenue streams and the regions in which the business operates.

Whereas Hut 8 only has facilities in Canada and mines exclusively for itself, US Bitcoin runs mines across the US and hosts mining hardware for third-party customers alongside other auxiliary services. “It’s important to be dynamic,” says Mike Ho, cofounder of US Bitcoin. “There is an optimal strategy, depending on the price of bitcoin. It’s about knowing how to navigate through the cycle at different stages.”

Recognizing the trajectory of the market, other companies have sought to eliminate outstanding debt as rapidly as possible. In the summer of 2021, Bitfarms had $165 million of debt on its books, at interest rates between 16 and 18 percent. Lucas says it may seem “absurd” to stomach these exorbitant rates, but it “made sense” because the cost of debt was eclipsed by the revenue generated by mining activity—at least until it wasn’t.

“As revenues came down dramatically with the price of bitcoin, there was still a high debt to pay for,” he says. “And that put a squeeze on a lot of companies.”

In June 2022, Bitfarms began to sell down the bitcoin in its treasury to eliminate its debt. Earlier this month, the firm also managed to negotiate down a $21 million debt to bankrupt crypto lender BlockFi that was instead paid off in a single $7.75 million cash payment. The company’s approach to slashing debt, coupled with a focus on maximizing the efficiency of its mining rigs, says Lucas, will put Bitfarms in good stead to weather the remainder of the crypto winter.

The scramble among miners to balance the books has attracted the attention of other market participants hoping to increase their market share at a reduced price. Investment firm Galaxy Digital has long been eager to expand its bitcoin-mining operations. Sensing an opportunity, the company swooped in to grab Argo’s flagship Helios mine in December, spending $65 million for a facility reported to have cost at least $1.5 billion to build.

Mergers, acquisitions, and collapses will continue to be a theme, says Alex Mologoko, analyst at blockchain intelligence company Elementus, until “all economically unsustainable mining operations are weeded out.”

9 notes

·

View notes