#equipment loan rates

Explore tagged Tumblr posts

Text

Learn how your industry affects equipment loan interest rates. Understand which sectors face higher rates, what lenders consider, and tips to secure favorable terms.

#equipment loan rates#equipment finance rates#heavy equipment loan rates#equipment leasing#business equipment loan rates

0 notes

Text

Empower Your Business Growth with Equipment Financing Solutions Scaling your business often requires strategic investments in new equipment to boost productivity, efficiency, and long-term growth. Equipment financing allows you to spread costs over time, improve workplace safety, and increase employee morale without straining your working capital. Modern machinery enhances output quality, automates repetitive tasks, and meets evolving customer demands, keeping your business competitive. Sandhu & Sran Leasing & Financing in Abbotsford has been empowering small and mid-sized businesses with low-rate equipment financing solutions for years. Upgrade your equipment today and unlock your business’s full potential!

#equipment financing in abbotsford#machinery loans abbotsford#low-rate equipment financing solutions

0 notes

Text

Navigating Car and Equipment Loans with LoanOptions.ai

Financing a major purchase, whether it’s a new vehicle or heavy equipment for your business, can be a daunting task. With a plethora of loan options available, finding the best deal that suits your specific needs requires careful consideration. That’s where LoanOptions.ai steps in, offering a streamlined way to compare car loans, explore equipment finance options, and make informed decisions that align with your financial goals.

Simplifying the Loan Comparison Process

When it comes to loans, one size does not fit all. The terms, interest rates, and repayment plans vary from lender to lender, and it can be challenging to navigate through all the choices on your own. LoanOptions.ai makes this process easier by providing a platform where you can compare car loans and compare equipment loans in just a few clicks.

The platform uses advanced AI technology to analyze your requirements and match you with the best available loan options. Whether you're looking to finance a new car or need heavy equipment for your business, LoanOptions.ai helps you find the perfect fit without the hassle of endless research and complicated loan jargon.

Why Comparing Car Loans Matters

For many people, purchasing a vehicle is one of the most significant financial decisions they will make. Whether it’s for personal use or business, the right car loan can save you thousands of dollars over time. By using LoanOptions.ai to compare car loans, you can easily view options from various lenders, making it easier to find a loan that offers favorable terms, low-interest rates, and manageable repayment plans.

A few key benefits of comparing car loans include:

Interest Rate Comparison: Lenders offer different interest rates based on factors such as your credit score, loan amount, and loan term. A small difference in interest rates can make a significant difference in the total cost of the loan.

Flexible Repayment Terms: Some lenders offer more flexibility in repayment schedules, allowing you to tailor the loan to your financial situation.

Extra Fees: Comparing different loan options also lets you identify any hidden fees or early repayment penalties that could increase the cost of borrowing.

LoanOptions.ai provides a clear comparison of these factors, helping you make the right choice and ensuring you get the best possible deal.

Exploring Equipment Finance Options

For business owners, access to the right equipment can be the key to unlocking growth and improving efficiency. However, purchasing heavy machinery, vehicles, or specialized tools often comes with a significant price tag. That's where equipment finance options come into play.

Equipment financing allows you to borrow money specifically for the purchase of equipment needed for your business. LoanOptions.ai enables you to compare equipment loans from a variety of lenders, ensuring that you find a solution tailored to your business’s unique needs.

Types of Equipment Finance Options

There are several types of equipment finance options available, and understanding each can help you make an informed decision.

Equipment Loan: In this scenario, you borrow a specific amount to purchase equipment, which serves as collateral for the loan. This is a straightforward way to acquire machinery or vehicles while maintaining ownership from the start.

Equipment Lease: Leasing allows you to use the equipment while making regular payments to the lender or leasing company. At the end of the lease term, you may have the option to purchase the equipment at a reduced rate. Leasing is an excellent option if you need equipment for a shorter period or want to avoid upfront costs.

Hire Purchase: This is a hybrid option where you hire the equipment with the intent of purchasing it at the end of the loan term. You’ll make payments throughout the contract period, and once all payments are made, ownership of the equipment is transferred to you.

Each of these options comes with its own set of advantages and potential drawbacks, depending on your business’s financial situation and long-term goals. With LoanOptions.ai, you can easily evaluate all these equipment finance options and choose the one that aligns with your business strategy.

The LoanOptions.ai Advantage

LoanOptions.ai stands out as a leader in the finance industry because of its user-friendly platform, which leverages AI to match you with the best loan products. Here’s why LoanOptions.ai should be your go-to solution for loan comparisons:

Comprehensive Loan Comparisons: Whether you’re looking to compare car loans or explore equipment finance options, LoanOptions.ai offers a broad selection of loans from top lenders. This ensures you can find competitive rates and terms that suit your needs.

Personalized Matches: LoanOptions.ai uses advanced algorithms to analyze your financial profile, giving you tailored loan options that increase the likelihood of approval while ensuring you get the best deal.

Transparency and Trust: The platform prides itself on transparency, providing all the essential information upfront so you can make informed decisions without hidden surprises.

Choosing the right financing for your car or business equipment is a critical decision that can impact your financial health for years to come. With so many loan options available, it’s essential to compare and evaluate each choice carefully. LoanOptions.ai makes this process simple, efficient, and tailored to your specific needs.

More Sources: Equipment Finance Options, Good Credit Score, Best Personal Loan Rates

0 notes

Text

If anyone wants to know why every tech company in the world right now is clamoring for AI like drowned rats scrabbling to board a ship, I decided to make a post to explain what's happening.

(Disclaimer to start: I'm a software engineer who's been employed full time since 2018. I am not a historian nor an overconfident Youtube essayist, so this post is my working knowledge of what I see around me and the logical bridges between pieces.)

Okay anyway. The explanation starts further back than what's going on now. I'm gonna start with the year 2000. The Dot Com Bubble just spectacularly burst. The model of "we get the users first, we learn how to profit off them later" went out in a no-money-having bang (remember this, it will be relevant later). A lot of money was lost. A lot of people ended up out of a job. A lot of startup companies went under. Investors left with a sour taste in their mouth and, in general, investment in the internet stayed pretty cooled for that decade. This was, in my opinion, very good for the internet as it was an era not suffocating under the grip of mega-corporation oligarchs and was, instead, filled with Club Penguin and I Can Haz Cheezburger websites.

Then around the 2010-2012 years, a few things happened. Interest rates got low, and then lower. Facebook got huge. The iPhone took off. And suddenly there was a huge new potential market of internet users and phone-havers, and the cheap money was available to start backing new tech startup companies trying to hop on this opportunity. Companies like Uber, Netflix, and Amazon either started in this time, or hit their ramp-up in these years by shifting focus to the internet and apps.

Now, every start-up tech company dreaming of being the next big thing has one thing in common: they need to start off by getting themselves massively in debt. Because before you can turn a profit you need to first spend money on employees and spend money on equipment and spend money on data centers and spend money on advertising and spend money on scale and and and

But also, everyone wants to be on the ship for The Next Big Thing that takes off to the moon.

So there is a mutual interest between new tech companies, and venture capitalists who are willing to invest $$$ into said new tech companies. Because if the venture capitalists can identify a prize pig and get in early, that money could come back to them 100-fold or 1,000-fold. In fact it hardly matters if they invest in 10 or 20 total bust projects along the way to find that unicorn.

But also, becoming profitable takes time. And that might mean being in debt for a long long time before that rocket ship takes off to make everyone onboard a gazzilionaire.

But luckily, for tech startup bros and venture capitalists, being in debt in the 2010's was cheap, and it only got cheaper between 2010 and 2020. If people could secure loans for ~3% or 4% annual interest, well then a $100,000 loan only really costs $3,000 of interest a year to keep afloat. And if inflation is higher than that or at least similar, you're still beating the system.

So from 2010 through early 2022, times were good for tech companies. Startups could take off with massive growth, showing massive potential for something, and venture capitalists would throw infinite money at them in the hopes of pegging just one winner who will take off. And supporting the struggling investments or the long-haulers remained pretty cheap to keep funding.

You hear constantly about "Such and such app has 10-bazillion users gained over the last 10 years and has never once been profitable", yet the thing keeps chugging along because the investors backing it aren't stressed about the immediate future, and are still banking on that "eventually" when it learns how to really monetize its users and turn that profit.

The pandemic in 2020 took a magnifying-glass-in-the-sun effect to this, as EVERYTHING was forcibly turned online which pumped a ton of money and workers into tech investment. Simultaneously, money got really REALLY cheap, bottoming out with historic lows for interest rates.

Then the tide changed with the massive inflation that struck late 2021. Because this all-gas no-brakes state of things was also contributing to off-the-rails inflation (along with your standard-fare greedflation and price gouging, given the extremely convenient excuses of pandemic hardships and supply chain issues). The federal reserve whipped out interest rate hikes to try to curb this huge inflation, which is like a fire extinguisher dousing and suffocating your really-cool, actively-on-fire party where everyone else is burning but you're in the pool. And then they did this more, and then more. And the financial climate followed suit. And suddenly money was not cheap anymore, and new loans became expensive, because loans that used to compound at 2% a year are now compounding at 7 or 8% which, in the language of compounding, is a HUGE difference. A $100,000 loan at a 2% interest rate, if not repaid a single cent in 10 years, accrues to $121,899. A $100,000 loan at an 8% interest rate, if not repaid a single cent in 10 years, more than doubles to $215,892.

Now it is scary and risky to throw money at "could eventually be profitable" tech companies. Now investors are watching companies burn through their current funding and, when the companies come back asking for more, investors are tightening their coin purses instead. The bill is coming due. The free money is drying up and companies are under compounding pressure to produce a profit for their waiting investors who are now done waiting.

You get enshittification. You get quality going down and price going up. You get "now that you're a captive audience here, we're forcing ads or we're forcing subscriptions on you." Don't get me wrong, the plan was ALWAYS to monetize the users. It's just that it's come earlier than expected, with way more feet-to-the-fire than these companies were expecting. ESPECIALLY with Wall Street as the other factor in funding (public) companies, where Wall Street exhibits roughly the same temperament as a baby screaming crying upset that it's soiled its own diaper (maybe that's too mean a comparison to babies), and now companies are being put through the wringer for anything LESS than infinite growth that Wall Street demands of them.

Internal to the tech industry, you get MASSIVE wide-spread layoffs. You get an industry that used to be easy to land multiple job offers shriveling up and leaving recent graduates in a desperately awful situation where no company is hiring and the market is flooded with laid-off workers trying to get back on their feet.

Because those coin-purse-clutching investors DO love virtue-signaling efforts from companies that say "See! We're not being frivolous with your money! We only spend on the essentials." And this is true even for MASSIVE, PROFITABLE companies, because those companies' value is based on the Rich Person Feeling Graph (their stock) rather than the literal profit money. A company making a genuine gazillion dollars a year still tears through layoffs and freezes hiring and removes the free batteries from the printer room (totally not speaking from experience, surely) because the investors LOVE when you cut costs and take away employee perks. The "beer on tap, ping pong table in the common area" era of tech is drying up. And we're still unionless.

Never mind that last part.

And then in early 2023, AI (more specifically, Chat-GPT which is OpenAI's Large Language Model creation) tears its way into the tech scene with a meteor's amount of momentum. Here's Microsoft's prize pig, which it invested heavily in and is galivanting around the pig-show with, to the desperate jealousy and rapture of every other tech company and investor wishing it had that pig. And for the first time since the interest rate hikes, investors have dollar signs in their eyes, both venture capital and Wall Street alike. They're willing to restart the hose of money (even with the new risk) because this feels big enough for them to take the risk.

Now all these companies, who were in varying stages of sweating as their bill came due, or wringing their hands as their stock prices tanked, see a single glorious gold-plated rocket up out of here, the likes of which haven't been seen since the free money days. It's their ticket to buy time, and buy investors, and say "see THIS is what will wring money forth, finally, we promise, just let us show you."

To be clear, AI is NOT profitable yet. It's a money-sink. Perhaps a money-black-hole. But everyone in the space is so wowed by it that there is a wide-spread and powerful conviction that it will become profitable and earn its keep. (Let's be real, half of that profit "potential" is the promise of automating away jobs of pesky employees who peskily cost money.) It's a tech-space industrial revolution that will automate away skilled jobs, and getting in on the ground floor is the absolute best thing you can do to get your pie slice's worth.

It's the thing that will win investors back. It's the thing that will get the investment money coming in again (or, get it second-hand if the company can be the PROVIDER of something needed for AI, which other companies with venture-back will pay handsomely for). It's the thing companies are terrified of missing out on, lest it leave them utterly irrelevant in a future where not having AI-integration is like not having a mobile phone app for your company or not having a website.

So I guess to reiterate on my earlier point:

Drowned rats. Swimming to the one ship in sight.

35K notes

·

View notes

Text

Unleashing Growth: How CapitalNeed Stands Out as Your Premier Equipment Finance Company

In today's dynamic business landscape, acquiring and upgrading equipment is pivotal for staying competitive. Whether you're a small business looking to expand or a large corporation aiming for efficiency, securing the right equipment finance company can make all the difference. At CapitalNeed, we understand the significance of having access to the latest machinery and tools, which is why we're dedicated to offering tailored solutions to suit your needs.

As an equipment finance company, CapitalNeed specializes in providing financing options for a wide range of equipment, from heavy machinery to technology assets. Our goal is to empower businesses of all sizes to invest in the equipment necessary to drive growth and success. Here's why CapitalNeed stands out as the best choice for your equipment financing needs.

Flexible Financing Options: We recognize that every business is unique, which is why we offer flexible financing solutions tailored to your specific requirements. Whether you need a loan for purchasing new equipment or leasing options to conserve capital, CapitalNeed has you covered. Our team works closely with you to understand your goals and develop a financing plan that aligns with your budget and objectives.

Competitive Rates: At CapitalNeed, we believe in providing transparent and competitive rates to our clients. Our goal is to ensure that you get the most value out of your equipment finance solution, allowing you to maximize your ROI without breaking the bank. With our competitive rates and flexible terms, you can acquire the equipment you need while maintaining financial stability.

Streamlined Application Process: We understand that time is of the essence when it comes to securing equipment financing. That's why we've streamlined our application process to make it quick and hassle-free. With CapitalNeed, you can expect a seamless experience from start to finish, with minimal paperwork and fast approval times. Our team is here to guide you through every step of the process, ensuring that you get the financing you need when you need it.

Expert Guidance: Navigating the world of equipment financing can be daunting, especially for those unfamiliar with the process. That's where CapitalNeed comes in. Our team of experts is here to provide guidance and support throughout the entire financing journey. Whether you have questions about eligibility criteria, terms and conditions, or anything else related to equipment finance, we're here to help.

Commitment to Customer Satisfaction: At CapitalNeed, customer satisfaction is our top priority. At every step, we work to surpass your expectations by offering individualized support and service to guarantee your total happiness. From the initial consultation to ongoing support after financing, we're committed to being there for you every step of the way.

In conclusion

When it comes to choosing an equipment finance company, CapitalNeed is the clear choice. With flexible financing options, competitive rates, a streamlined application process, expert guidance, and a commitment to customer satisfaction, we're here to help you take your business to the next level. Contact CapitalNeed today to learn more about our equipment finance solutions and see how we can help you achieve your goals.

0 notes

Text

Exploring the Features and Benefits of SBA 7(a) Loans

The SBA 7A program is among the most widely used business financing solutions in the United States. The Small Business Administration provides these loans, which have several features and opportunities that make them a desirable option for business owners.

One of the main advantages of the 7A loans is their flexibility. These can be used for several things, such as refinancing obligations, buying working capital, inventory, or equipment, or even occasionally buying out another business. Moreover, SBA 7A loan interest rates are advantageous. It helps small businesses efficiently control borrowing costs by capping the maximum interest rate that lenders can charge on these loans. Since the interest rates are typically lower than those of traditional lenders, borrowers may end up saving a significant sum of money over time.

There are requirements that business owners must fulfill in order to be eligible for this loan. The SBA 7A loan requirements include that you must be able to repay the loan on schedule, have a strong credit score, and present enough collateral to secure the loan. Read More

#sba loans#SBA 7a loan#Small term loan#Cash Advance#interest rates#equipment financing#Term Loans#mortgage loan#business loan#same day loans online#Large capital Project

1 note

·

View note

Text

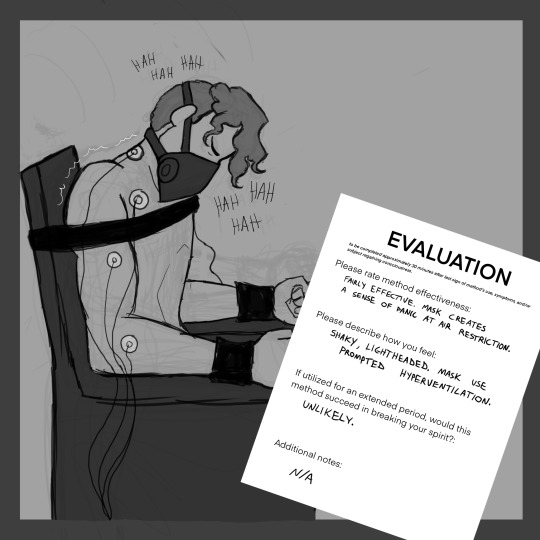

Test Track AU // Next

Vic loans Sahota out to an old friend who works as an interrogator. Armed with state-of-the-art equipment and innovative techniques, Sahota's temporary boss has him endure, rate, and review various torture methods.

#this is interactive in a meta sense so feel free to send in ideas! wild ones are very welcome lol#it may take me time to get to prompts but im gonna have fun :)#t$$ test track au#t$$ sahota#for Torture Purposes the interrogator has access to a cell resurrection unit; which drastically reduces recovery time#so uh#go crazy#electrocution#torture

153 notes

·

View notes

Text

• No. 125 Newfoundland Squadron RAF

Motto: Nunquam domandi ("Never to be tamed")

Squadron Codes: FN (Apr 1939 – Sep 1939) VA (Jun 1941 – Nov 1945)

Number 125 (Newfoundland) Squadron was a Royal Air Force squadron active during World War II and briefly in the mid-1950s. Throughout its service the squadron primarily operated night fighters. No. 125 Squadron was initially formed at Old Sarum, Wiltshire on 1 February 1918 as a light bomber squadron of the Royal Flying Corps. It was planned for the squadron to become operational and deploy to France in September however it was instead disbanded on 1 August 1918, thus never seeing active service in the First World War.

No. 125 Squadron was reformed on June 16th, 1941 at RAF Colerne equipped with Bolton-Paul Defiant night fighters. The squadron was raised as a result of a war loan raised by the Newfoundland Commission of Government in 1940. After discovering a surplus of revenue, the commission presented the British Government with $500,000 to establish a squadron with the hope that it would be manned by Newfoundlanders. This hope was realised with at least a dozen Newfoundlanders flying with No. 125 Squadron in its early days along with a contingent of English, Scottish, Welsh, Commonwealth and Polish pilots. Volunteers from Newfoundland and Labrador died at a higher rate while serving with the Royal Air Force (RAF) than with any other branch of the British Armed Forces during the war. On 24 September 1941, the squadron moved to RAF Fairwood Common, Wales and became fully operational, with the Defiant proving to be a more than effective night fighter. By February 1942, No. 125 Squadron began to convert over to the twin-engined Bristol Beaufighter, with these becoming operational by April. Defiants and Hawker Hurricanes were also used to supplement the Beaufighters in the squadron's patrols. With an increasing number of Newfoundlanders being found in No. 125 Squadron's ranks, some aircrew began to name their aircraft in recognition of their Newfoundland heritage: St, John's, Corner Brook, Deer Lake and Buchans were some of the names they used. From October to December 1942, the squadron operated a detachment at RAF Sumburgh in the Shetland Islands.

No. 125 Squadron moved north to RAF Valley in November 1943 in order to carry out patrols over the Irish Sea. While based here the squadron operated a detachment from RAF Ballyhalbert in Northern Ireland. Despite being a 'Newfoundland' squadron, by November 1943 only 5 of the 30 aircrew were from Newfoundland as well as 45 of the roughly 200 ground crew came from the Dominion. With a conversion to de Havilland Mosquito night fighters in February 1944, No. 125 Squadron moved south to RAF Hurn, Dorset at the end of March. This was in preparation to cover the Operation Overlord landings in Normandy. In April, No. 125 Squadron had their caribou squadron badge officially approved by King George VI. The squadron also participated in intercepting Operation Steinbock raids from January to May 1944. With a bridgehead secured in France and with the commencement of V-1 flying bomb attacks on London, the squadron moved to RAF Middle Wallop in July 1944 to fly night time interceptions.

On October 18th, 1944, No. 125 Squadron moved to RAF Coltishall, Norfolk. From Coltishall the squadron defended against enemy intruders and Heinkel He 111s carrying flying bombs, as well as undertaking reconnaissance to locate the remainder of German shipping. In April 1945, No. 125 Squadron transferred up to RAF Church Fenton in Yorkshire. Here it saw out the war before disbanding for the second time on 20 November 1945 when its aircraft and personnel were renumbered to No. 264 Squadron. By the end of the war No. 125 Squadron had managed to score 44 victories, 5 probables and 20 damaged. No. 125 Squadron reformed in March 1955 as a night fighter unit once more. While based at Stradishall, the squadron operated alongside fellow night fighter units No. 89 Squadron and No. 152 Squadron, as well as No. 245 Squadron. The Squadron was disbanded for the final time in May 1957.

#second world war#world war 2#world war ii#wwii#military history#aviation history#aviation#canadian air force#canadian history#royal air force#newfoundland and labrador#newfoundland

16 notes

·

View notes

Text

The Photo Shoot

Pretty safe for work tickling story. Ended up a bit longer than I expected, but what can you do?

------

Ryan always knew he was going to make it big. Ever since he was in high school he’d always gotten the lead parts in the school plays, and now that he was in university he was showing success in independent student productions. Of course he didn’t make any money off of any of those, and tuition for his school was expensive, which meant he had to work and had thousands in student loans to look forward to once he was done. He took this all in stride since he knew there was a pot of gold at the end of this very expensive rainbow.

One thing Ryan knew he needed if he was going to continue trying to be an actor was to get some professional pictures taken for auditions. So far he’d gotten free head shots taken by photography students. The problem is you get what you pay for, and some of the shots were clearly student work.

Luckily for Ryan, there were other photographers in town who were willing to work with students to get them some professional shots at a reduced rate. After a few days of searching, Ryan came across a photographer named Jay. He liked what he saw on Jay’s website (and liked his student discount even more) so he made an appointment to meet him. The two met for a consultation and Ryan booked a time slot to come to Jay’s studio.

On the day of the shoot, Jay brought several pairs of clothes to wear. Something formal, something casual, some streetwear, etc. When it came to the casual look, Jay instructed Ryan to take off his shoes and socks.

“Take them off? Why?”

“Shows vulnerability. Most people don’t show their feet at all, so it exposes a little bit more of you.”

Ryan wasn’t entirely convinced, but he still pulled off his shoes and socks and continued with the session.

It may have been his imagination, but Ryan felt that Jay kept glancing down at his bare feet. It wasn’t super obvious, and as far as Ryan could tell his feet were never the focus of any shots, but Jay’s eyes kept trailing down to them. Strange, yes, but Ryan didn’t want to cause a scene when he felt there was so much on the line.

Finally, with that last shot, they were done.

“Alright Ryan, that just about wraps it up. I think we got some good shots, but it will take me a few days to go through and clean them up.”

“Wow, alright, thanks. I’m looking forward to it. Can’t wait to see how they turn out.”

Ryan started to put his socks back on.

“Hey, kid, before you go any further, I have a business proposition for you. That is, if you’re looking to make a few bucks.”

Ryan stopped and looked over at the photographer. Extra money was never a bad thing.

“I mean, money is money, I guess. What are you looking for? This isn’t something dirty, is it? Because I’m not taking off my clothes.”

“Don’t worry, you’re already as undressed as you’d need to be. I just want to make a little video to post on my website.”

Ryan’s eyes narrowed.

“I’ve seen your website. You don’t have videos.”

The photographer gave a large toothy grin.

“Not that website, a different one. Here, come and take a look.”

Jay motioned for Ryan to follow him to the back of the studio where he had a large computer setup. Camera equipment and props were everywhere.

“Alright, just better not be anything too freaky.”

Ryan walked over to the far end of Jay’s studio on bare feet. When he got to the computer he was shocked by what he saw on the screen.

“Are those guys getting… tickled?”

Jay nodded and scrolled down the page a bit, showing Ryan more videos. Each one showed a young man (around Ryan’s age) being tickled. Some were tied up, some had their feet in stocks, and some just had their ankles being held down. Most were dressed like Ryan (which is to say fully dressed except for the shoes and socks), but others were in various states of undress. No one looked naked, though.

“Yup. Tickling sells well, you know. Lots of guys, and hell, women too, love seeing guys getting tickled. And it pays.”

Ryan’s ears perked up.

“People are willing to pay?”

“Oh sure. People are willing to pay for these videos if the model is cute and ticklish enough. And I have to say kid, you’re the exact type of guy they like to see.”

Ryan didn’t have much to say. His eyes stayed glued to the screen.

“I’ll make you a deal. You let me tickle you a little bit, just your feet so you don’t have to take anything else off, and not only will I not charge you for the shots, but I’ll actually give you a bit of what the video makes. What do you say?”

Ryan wanted to say no right away, but he hesitated. Not only would he get his shots for free, but he’d also get some cash for it, too? It seemed too good to be true.

“I mean… alright. I guess. As long as this is just tickling. I’m not doing anything else.”

“Alright, sounds good. And don’t worry, all I do is tickle guys, nothing else.”

Jay explained what would happen: Ryan would lay face down on a couch in the studio, so no one could see his face, and hang his bare feet over the side of the couch. Jay would sit on his legs and tickle his feet. It sounded easy enough. Ryan lay down, letting Jay move his body a little bit for the camera, and let himself relax (as much as he could). Once he was in place, Jay set up the camera and started recording.

Ryan was laying down on his stomach, bare feet on the arm of the couch, when he felt Jay straddle his ankles.

“Alright folks, this is our new tickle toy Brad. This is his first time with us, so let’s see how ticklish he is.”

Ryan (apparently going by the name Brad) tensed his whole body, waiting for whatever was supposed to come. Suddenly, he felt one finger on his right sole. It started up near his heel and trailed down towards his toes. Ryan flexed and curled his foot at the light ticklish sensation. No one had ever touched his feet (not that he could remember, anyways) so it was a strange feeling. The finger repeated the same movement on his left sole. This time Ryan wiggled a little bit under Jay, his foot waving side to side.

“Got some squirming going on it looks like. Let’s try something a little more ticklish”

One finger, one at a time, on each sole was suddenly replaced with five fingers on each sole. Those fingers dug into the insteps of his feet, scratching the soft sensitive skin there. Ryan jumped (though stayed pinned down by Jay’s weight) and started to kick his feet.

“Oh shit, what the fuck?!”

“Oh yeah, we got a ticklish one here.”

The fingers really worked their way in there, kneading the flesh of his feet. Ryan kept trying to kick those tickling fingers away, but Jay’s grip was just too strong. There was nothing that Ryan could do to make it stop. He could, of course, always say stop, but then he’d have to pay for his headshots. That was a huge motivation to stay here on the couch.

Several minutes after just assaulting the center of his feet, the hands started roaming over the real estate that was Ryan’s soft size 12 soles. The fingers came up to Ryan’s heels and attacked. Ryan jumped, and was suddenly barking out with laughter when Jay found an especially ticklish spot: the part of his sole right before his heel.

“Oh, sounds like we got a live one here!”

“NOO! PLEEEEASE!”

Fingers descended on that spot on each foot. It wasn’t just fingers working their way into the foot, but now nails were scraping and scratching too. The only thing Ryan’s over stimulated mind could think of was that this was like ringing a doorbell. It was loud, it was intense, and it was beyond annoying that Jay found this spot that reduced him to a laughing mess.

“Holy crap is he sensitive right here. How are you doing Brad? Want me to stop?”

“Y-Y-YES PL-PL-PLEEEEASE!”

“No? You’re all good? Sounds great to me!”

“NOOO!”

Jay continued to exploit the sensitive spot, attacking viciously with his fingers. Ryan was sure he was going to pass out when the tickling mercifully ended.

“Th-thank God…”

“He thought that was bad, wait till he gets a load of this…”

“Wait, what?!”

“Here comes the brush!”

Ryan’s entire body jolted when a broad hairbrush started attacking that same sensitive spot. The brush moved violently back and forth with cruel abandon. This was the worst feeling yet. Ryan was in absolute hysterics, thrashing as much as he could, trying to buck Jay off his legs. His feet kicked and squirmed to get away, one foot trying to cover the other for protection. His face and throat were starting to get sore from the laughter.

“Oh yeah, we got him right here.”

Not even able to say anything, Ryan continued to cackle. The brush alternated between feet, and each time it switched feet it was like the first time all over again. Tears were starting to stream from his tightly shut eyes. This was the first time he truly regretted his decision, and despite the promise of free shots and money, he found the urge to call out stop was right on the tip of his tongue. He bit it back though, he wasn’t going to give up.

The tickling changed, and now the brush was going up and down his soles. Again, Ryan tried curling his foot up to avoid the tickling, but Jay grabbed Ryan’s toes and flexed them back, stretching his sole out. Jay’s grip was too strong and Ryan wasn’t able to escape. He laughed and giggled, unable to stop as the brush scrubbed up and down his flexed sole. People got off on this? Ryan figured they must all be sadists.

“Let’s see how ticklish Brad’s toes are.”

The brush stopped for just a second (giving Ryan exactly one second of peace) before attacking the toes that Jay was holding back. Oh god. This was bad. This was worse than the spot hear his heels. This was like fire. Ryan didn’t just laugh, he was screaming. Tears were flowing so freely that he could taste them on his lips. He wanted to yell stop, he wanted this tickling to end, but he couldn’t form the words.

Jay continued tickling those toes, holding them tightly, even as the feet started to become slick with sweat. This of course made the brush slide and glide all the more easily. The brush scrubbed the tips of the toes all the way down to the sensitive little gap under each toe.

The tickling continued for a few minutes until finally, mercifully, it stopped.

“There we go, that was Brad. I think he did pretty well. Let me know if you want to see more of this boy.”

Jay concluded by slapping both of Ryan’s sensitive soles, making him jump and squeak.

Jay got up off of Ryan and turned off the camera.

“There we go kid, that’s it. You did good, I have to say, I think you’re going to be pretty popular.”

“Holy shit that was bad. Like… holy shit. You were torturing me.”

Jay laughed.

“That’s why they call it tickle torture. People love it.”

Ryan didn’t want to stick around much longer. He got up off the couch (his clothes were sticking to his body from all the sweat), put his shoes and socks back on (which was hard since his feet were so sensitive after the tickling), thanked Jay and left.

Several days later two things dropped in Ryan’s email. The first was a set of edited photographs. Ryan was happy to see that they looked professional and much better than any of the student work he’d had done so far. The second was much more interesting. It was an e-transfer for a couple of hundred dollars.

Ryan stared at the screen for a few minutes before he decided to call Jay.

“Hello?”

“Hey man, It’s Ryan. Thanks for the pictures, I just got them. They’re really good”

“No worries, I’m happy you’re happy.”

“So… what was the money you sent?”

“I told you that you’d get a bit of the money from the tickle video. It was pretty popular right off the bat, so that’s your share.”

“All that for just letting you tickle my feet?”

“Oh yeah. And if you’re ever interested we could do it again. You could maybe even make some more next time.”

“Like… how much more?”

“Depends on how far you’re willing to go. There’s some bondage, there’s some upper body tickling, there’s even some foot worship and tickling that drives some people wild. You interested?”

Ryan looked at the e-transfer again.

“Yeah, maybe. Tell me more.”

#malefeet#feet#gayfeet#male tickling#guy feet#male feet story#tickling#gay tickling#gay foot play#male foot story#tickle community#sfw tickling community#tickle kink#male tickling story#tickle content#m/m tickling

85 notes

·

View notes

Note

apologies if you get asked about advice often. what advice would you have for a 19yo moving half across the country (with partner) and starting adult life?

Bearing in mind that I'm on day eight...nine? of a migraine? And so might be less coherent than is usual for me?

When I was nineteen I left the country for a summer, and then as soon as I could--which was the following year--I went back to stay as long as I could, with a guy who wasn't very good for me, but who provided an escape route from a desperately sad and abusive situation. While I returned to the US, I have not been back to my home state to stay again, and that was more than twenty years ago now. I don't recommend that way out, but it was a way out. I hope very much that you are making the decision under no duress, and not as an act of flight. I hope it is joyful and strengthening, and exciting and good.

At nineteen you are just barely on the cusp of adult life. It's such a strange time! You haven't yet been equipped with a lot of the knowledge that you'll need to navigate your solid future, but you've got all these expectations laid on your shoulders to suddenly be Grown Up. You can die for your country, but you can't rent a car. You can get a 200k university loan, but in the US you can't have a legal drink.

So a lot of what I would recommend is--don't rush. Be as sure of your footing as you can before you make decisions that you know in advance will be life-altering. You'll be making enough decisions that you don't know are going to change you forever, you want to be steady with the ones that you're pretty sure will cause big shifts.

(But when you see something that fills you with certainty, go for it.)

Power imbalances are frequent and natural when you're in a relationship at that age, because mental and emotional growth spurts can be very quick. This can leave you out of balance with a partner. Sometimes it's recoverable, and the one that is lagging a little bit will catch up! Sometimes the distance grows too great. Let what happens, happen, in that respect. Don't hold yourself back for your partner. Grow at your own rate. If your partner outstrips you, it's good to stretch for growth, but it's self-destructive to overreach. Not to be doom-and-gloom about it, but it's very rare that the person you're with at nineteen will be the person you're with at ninety; gratitude for the time you have and open hands that do not clutch are important in any relationship, but *very* important when you're young.

And then sometimes, you are still with that person decades later, so--treating them with respect, and only accepting respectful treatment from a partner, is very, very important. Love is huge! Love is incredible! But a good relationship is like a three-legged stool, and love is only one leg of it. Respect is another, and effort is the third. If you don't love someone, but you respect the hell out of them and put in a lot of effort to make life with them good, that's a working relationship, and what one should strive for as a divorced parent; if you love someone and work hard but don't respect them, that's patronizing and destructive to them and to the self, and no relationship like that can weather real storms. If you respect them and love them but don't work hard (very, very common), then you become a millstone around their neck, leaving all the effort for them to make. You need to give all three, and you should only accept a relationship where you get all three. There will be lulls, times when one person must work harder than the other, or when one person is so stressed that they get a bit distracted. Nothing is on an even keel without trials forever. But in general, there needs to be a balance.

When you get to where you're going, naturally you will be spending a lot of time together. Whether your partner is from that place and you're joining them, or it's new for both of you, its newness to you will mean that you don't have the social safety net that you might have in the place you're moving from. So you have to work to build it! Some of that will involve meeting their friends and integrating into that group, but it is very important to make connections that don't have anything to do with them. Don't stop partaking of hobbies that are Just Yours, don't give up the things you do alone. Even if you're the kind of people who can healthily live in each other's pockets 99% of the time (and most people aren't!), it's beneficial for you to have people to talk to that aren't your partner. Not for secret-keeping, not so that you can vent about them (though sometimes that might be necessary) but simply because you have social and conversational needs that they wouldn't fill, and so do they to you. Sometimes you need to take a few hours apart so that whatever minor irritations are sensitizing you today can shrink back to their usual unimpressive size, too. You're not abandoning them, and they're not abandoning you, if there needs to be a personal day. (I adore my partner. He's absolutely steady, and we share nearly all of our interests. But not all of them. He does one martial art, I do another, and so we find commonality between them--but I don't do archery, and he isn't a baker, and so on. It's exciting to get to introduce him to something new, and it's necessary for me to have something I don't have to share. If he started being out of the house late all the time, generally ignoring me, putting the lion's share of his energy elsewhere, or if I started feeling like I wanted to be apart from him more than I want to be with him, we'd have to have a talk. But it's important to remain two people, complete unto themselves.)

A lot of the other general advice you might get, you for certain know already. If you will choose to have children, don't start reproducing yet if you can hold off for another five years or so, so that they are born into a situation of strength and protection. Don't get a big car loan or get locked into payments for physical objects that are going to devalue really quickly; don't move to the trendiest neighborhood if you can't easily and comfortably afford it, it's better to live somewhere a bit cheaper but still safe, and save what money you can; don't take up a drug habit with anything addictive, some of the brightest lights I've ever known died before they hit 30 because they got into meth or cocaine or some weird shit whose designation is a handful of mixed numbers and letters.

Try as much as you can. Weird food, musical instruments, dance class at the odd corner gym, craft you've never considered before, pickup game of volleyball, if you see the opportunity to do something you haven't before, TAKE it. Say "yes" frequently even if you're unsure if you'd enjoy whatever experience it is--trust your gut, but if it's just social uncertainty or wariness because it's new, try it! You're in the most flexible time of your life right now, your rubber-band self is at its stretchiest not just physically but mentally and emotionally, and the more stretching you do now, the less vulnerable and brittle you'll be later.

7 notes

·

View notes

Text

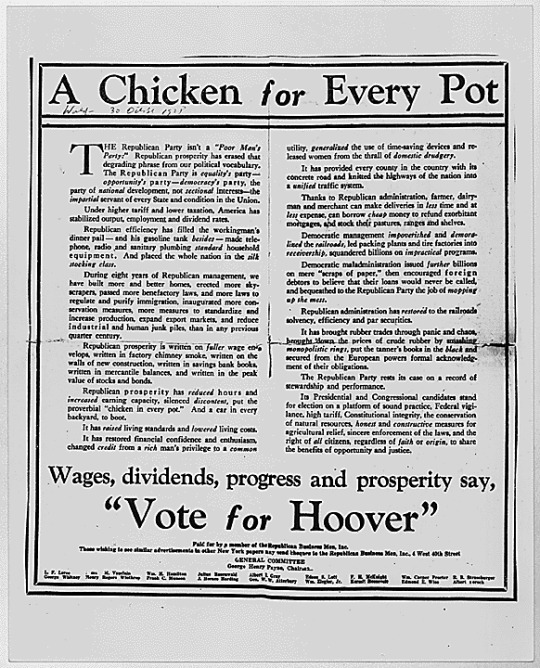

"A Chicken in Every Pot" political ad and rebuttal article in New York Times

Collection HH-HOOVH: Herbert Hoover PapersSeries: Herbert Hoover Papers: Clippings File

This is the advertisement that caused Herbert Hoover's opponents to state that he had promised voters a chicken in every pot and two cars in every garage during the campaign of 1928. During the campaign of 1932, Democrats sought to embarrass the President by recalling his alleged statement. According to an article in the New York Times (10/30/32), Hoover did not make such a statement. The report was based on this ad placed by a local committee -- which only mentions one car!

A Chicken for Every Pot [handwritten] World[?] 30 October 1928 [/handwritten] The Republican Party isn't a [italics] "Poor Man's Party:" [/italics] Republican prosperity has erased that degrading phrase from our political vocabulary. The Republican Party is [italics] equality's [/italics] party -- [italics] opportunity's [/italics] party -- [italics] democracy's [/italics] party, the party of [italics] national [/italics] development, not [italics] sectional [/italics] interests-- the [italics] impartial [/italics] servant of every State and condition in the Union. Under higher tariff and lower taxation, America has stabilized output, employment and dividend rates. Republican efficiency has filled the workingman's dinner pail -- and his gasoline tank [italics] besides [/italics] -- made telephone, radio and sanitary plumbing [italics] standard [/italics] household equipment. And placed the whole nation in the [italics] silk stocking class. [/italics] During eight years of Republican management, we have built more and better homes, erected more skyscrapers, passed more benefactory laws, and more laws to regulate and purify immigration, inaugurated more conservation measures, more measures to standardize and increase production, expand export markets, and reduce industrial and human junk piles, than in any previous quarter century. Republican prosperity is written on [italics] fuller [/italics] wage envelops, written in factory chimney smoke, written on the walls of new construction, written in savings bank books, written in mercantile balances, and written in the peak value of stocks and bonds. Republican prosperity has [italics] reduced [/italics] hours and [italics] increased [/italics] earning capacity, silenced [italics] discontent, [/italics] put the proverbial "chicken in every pot." And a car in every backyard, to boot. It has[italics] raised [/italics] living standards and [italics] lowered [/italics] living costs. It has restored financial confidence and enthusiasm, changed [italics] credit [/italics] from a [italics] rich [/italics] man's privilege to a [italics] common [/italics] utility, [italics] generalized[/italics] the use of time-saving devices and released women from the thrall of [italics] domestic drudgery. [/italics] It has provided every county in the country with its concrete road and knitted the highways of the nation into a [italics] unified [/italics] traffic system. Thanks to Republican administration, farmer, dairyman and merchant can make deliveries in [italics] less [/italics] time and at [italics] less [/italics] expense, can borrow [italics] cheap [/italics] money to refund exorbitant mortgages, and stock their pastures, ranges and shelves. Democratic management [italics] impoverished [/italics] and [italics] demoralized [/italics] the [italics] railroads,[/italics] led packing plants and tire factories into [italics] receivership, [/italics] squandered billions on [italics] impractical [/italics] programs. Democratic maladministration issued [italics] further [/italics] billions of mere "scraps of paper," then encouraged foreign debtors to believe that their loans would never be called, and bequeathed to the Republican Party the job of [italics] mopping up the mess. [/italics] Republican administration has [italics] restored [/italics] to the railroads solvency, efficiency and par securities. It has brought rubber trades through panic and chaos, brought down the prices of crude rubber by smashing [italics] monopolistic rings,[/italics] put the tanner's books in the [italics] black [/italics] and secured from the European powers formal acknowledgment of their obligations. The Republican Party rests its case on a record of stewardship and performance. [full transcription at link]

37 notes

·

View notes

Text

Negative Positive Angler

ネガポジアングラー

(Anime)

Fishing / slice of life by NUT

Era: 2020s

Rating: B

Plot: Tsunehiro Sasaki is not having a great time. He's heavily in debt after failed investments, stopped attending college, his doctor found out he has only about two years to live, and unknowing to him, his house is about to be torn down. One day, trying to escape from his creditors, he falls from a bridge, and as he accepts his fate, he's rescued out of the water by Takaaki and his group of fishing enthusiasts.

Length: 12 episodes

Thoughts: So, a show about fishing. Right. We're really starting to get into the “press random article on Wikipedia until a sport or hobby appears” phase of having too many shows. But here's the thing: when the end product is this solid, you could make a show even out of (tries method)... 1930s racing. Well, that's not hard, just hope you like characters dying in the most horrific ways. Anyway, This is a show I've picked out mostly out of curiosity, and it really paid off, arguably the best non remake I've followed during the Fall 2024 season after Acro Trip fizzled out a bit.

Like many of these shows, even if you don't know anything about fishing, it tries to fill you in with the basics with the main character acting as an audience surrogate, every episode has five minutes to go over some technique, equipment or basic knowledge, and you really don't need to know anything about fishing to enjoy this, you're not even forced to learn anything, more often than not those moments are used to connect characters to each other - by the final episodes, quite literally.

This is mostly a show where Sasaki gets to see his life through a different lens - he's really not in a good place at the start, but changes thanks to the kindness of those around him, starting with Takaaki who offers him a place to stay and to pay off his debt so that at least the loan sharks are no longer chasing him, and over time he also realises other people have problems too, there's an whole episode dealing with the Manager's estranged kid and his troubles connecting with him. What's more surprising about this show is how oddly upbeat it is for a show where the main character is dying. True he doesn't say anything, you just kinda forget... until reality comes knocking and things get real *fast* for the conclusion of the story, and indeed, other people have problems as well. Not really expecting a second season, but I don't think it needs one anyway - this is a fun show that tells a good story that ends in a good place in these 12 episodes, and you're probably going to want to research it again in the future.

Character design is just great and the best I've seen this season. From Hana's blobby hair and Ice’s metamorphosis between her gremlin and model looks to Fujishiro in his permanent balding, chibi mode and Takaaki who kinda looks like a male version of Harako from FLCL (although with the opposite effect in the main characters life), everyone is pretty dynamic (there's a scene where Hana ends in gremlin mode and Ice in her model looks just because) and easily distinguishable.

Recommended to: anyone looking for a mostly chill slice of life

Plus:

Great character design

A chill time, very heartwarming

Minus:

Nothing big to report, but the final episodes can be a bit of a mood swing.

3 notes

·

View notes

Text

"[T]he classical debate seems almost to attribute a secondary importance to the extraordinary historical significance of the active role of institutions in the late-joiner countries (signally in Germany) – initially in the forms of an accentuated centralization of the operations financing industrialization, and then, subsequently, with equipment intended to directly or indirectly govern the structure and composition of supply – when compared to the tendencies of the state-development relation, which is instead treated as essential. On the other hand, if a politics of fierce protections and then of imperialist expansion, which tends even to destroy the world market as simple area of exchange, corresponds to the anything but “parasitic” role of the state within second-comer industrialization, in this very phase the conditions, which had up to that point impeded the evolution of the international market from a mere moment of simple circulation to becoming the direct center of the accumulation process on a world scale, are changing radically. But concerning the whole process of internationalization, the classical debate performs a reading by all means conditioned by what has just been said.

The international movements of labor-power in this phase are events which largely remain to be studied. What is certain, however, is that they repeat on an enormous scale, though in different forms, the “originary” movements of the “slave trade” [tratta]: let it suffice to recall the massive extractions of labor-power from India and China, both towards other colonial areas (Africa) and to the metropolis, or to recall the waves of transoceanic immigration to the United States. If all this does not eliminate the existence of closed national markets of labor, still less is the relative international immobility of capital overcome by the waves of “capital export,” which the classical debate on imperialism rightly places at the center of its attention, and which constitute in fact the first massive historical phenomenon of “internationalization” of capital. In other words, this is still a hybrid form, so to speak, of transition, of the process of internationalization: this does not therefore represent a real qualitative leap of the system. As the recent literature on foreign investment has put into relief, this is dominated in this phase, quantitatively and qualitatively, by the figure of the investment “portfolio.” Although the nature of the latter cannot be made clear but in contrast to “direct” investment (a distinction that is not necessarily fully perceived in this moment), the phenomenon appears reconstructed, even then, in a substantially correct manner.

[...]

The adequate theoretical figure that encompasses [ricomprendere] the nature and dynamic of this specific mobility of capital is already totally developed in Marx: it involves capital as commodity – the loan capital market. In the 5th section of the third book Marx unfolds the general lines of his theory of this market, albeit in a rather fragmented manner:

On the money market it is only lenders and borrowers who face one another. The commodity has the same form, money. All particular forms of capital, arising from its investment in particular spheres of production or circulation, are obliterated here. It exists in the undifferentiated, self-identical form of independent value, of money. Competition between particular spheres now ceases; they are all thrown together as borrowers of money, and capital confronts them all in a form still indifferent to the specific manner and mode of its application. Here capital really does emerge, in the pressure of its demand and supply, as the common capital of the class, whereas industrial capital appears like this only in the movement and competition between particular spheres.

Whence the Marxian theory of the rate of interest and its critique of the existence of a “natural rate”:

As far as the permanently fluctuating market rate of interest is concerned, this is a fixed magnitude at any given moment, just like the market price of commodities, because on the money market all capital for loan confronts the functioning capital as an overall mass; i.e. the relationship between the supply of loan capital on the one hand, and the demand for it on the other, is what determines the market level of interest at any given time.

The rate of profit – which exists uniquely as a tendency, as a movement tending to equalize the particular rates of profit – constitutes only the external limit of the determination of the rate of interest, but the laws of formation of the one are in fact different from those of the other – their connection clearly resides only in the movement of the cycle. But the different nature of the two rates has a fundamental importance in this context, precisely for that aspect from which Marx’s analysis seems to want to abstract:

In stressing this distinction between the interest rate and the profit rate, we have so far left aside the following two factors, which favour the consolidation of the interest rate: (1) the historical pre-existence of interest-bearing capital and the existence of a general rate of interest handed down by tradition; (2) the far stronger direct influence that the world market exerts on the establishment of the interest rate, independently of the conditions of production in a country, as compared with its influence on the profit rate.

Exactly as the rate of interest historically anticipates the formation of the rate of profit, so it anticipates, at the level of the world market, the tendential movements of the rate of profit. The influence of the world market on the national rates of interest is in fact only an appearance [faccia] of the inverse process. Marx affirms this explicitly at the end of his analysis of credit:

The credit system hence accelerates the material development of the productive forces and the creation of the world market, which it is the historical task of the capitalist mode of production to bring to a certain level of development, as material foundations for the new form of production. At the same time, credit accelerates the violent outbreaks of this contradiction, crises, and with these the elements of dissolution of the old mode of production.

Capital export and the process of capitalist internationalization preceding the first world war are largely the practical realization of this anticipatory function of the movement of capital that is productive of interest. As such, they reproduce on a broad scale the characteristic ambivalence of this movement. The “classical” literature is aware, even without systematizing it, of this ambivalence. Thus, the Leninist emphasis on the contrast between export of commodities and export of capitals does not change the fact that, in the last analysis, for Lenin as for almost all the contemporaneous literature, the second is still a direct function of the first, on the “strictly economic” plane, according to the unchanging schema: export of manufactured goods against import of raw materials. And it is in this light that one should also read and appreciate the twofold polemic developed by Lenin: on the one side, against anyone who unduly extends the moments of anticipation of that form of international mobility of capital (against Kautsky, but also against Bukharin); on the other, against anyone who elides them within a “normal form” of the cycle and within the schemas of enlarged reproduction."

Luciano Ferrari Bravo, "Old and new questions on the theory of imperialism." (1973)

9 notes

·

View notes

Text

Which Loan is Better for Starting a Small Business

Starting a small business can be both exciting and challenging. One of the most crucial steps in launching your business is securing the right type of funding. Various loan options are available, but which one is the best for you? Here’s a breakdown of the top loan types to help you make an informed decision.

1. SBA (Small Business Administration) Loans

SBA loans are government-backed loans designed to assist small businesses. They typically offer lower interest rates and longer repayment terms than traditional loans, making them an excellent option for new business owners. However, SBA loans can be more difficult to qualify for, and the approval process may take longer.

Best For: Businesses with good credit and a solid business plan.

2. Business Line of Credit

A business line of credit gives you flexibility. Instead of receiving a lump sum, you can borrow as needed up to a pre-approved limit. You only pay interest on the amount you use, making this a great option for managing cash flow and unexpected expenses.

Best For: Businesses that need ongoing access to capital.

3. Equipment Financing

If your business requires expensive equipment to get started, equipment financing might be the right choice. This type of loan allows you to borrow money specifically for purchasing equipment, with the equipment itself often serving as collateral.

Best For: Businesses that rely heavily on equipment, such as manufacturing or construction.

4. Merchant Cash Advance (MCA)

A Merchant Cash Advance provides a lump sum in exchange for a percentage of your future credit card sales. While it’s quick to access, this option typically comes with higher fees and shorter repayment terms.

Best For: Businesses with consistent credit card sales but low credit scores.

5. Working Capital Loans

A working capital loan is designed to finance the daily operations of your business. This loan can be used for things like payroll, rent, and utilities. It’s typically short-term and is perfect for businesses that need quick cash to maintain their operations.

Best For: Covering day-to-day expenses or short-term cash flow needs.

6. Term Loans

Term loans are a straightforward option where you borrow a fixed amount and repay it over a set term, typically with a fixed interest rate. These loans can be tailored for short or long-term needs and are ideal for starting a small business that requires a specific amount of capital upfront.

Best For: Businesses needing a large, one-time capital infusion.

How to Choose the Best Loan for Your Small Business

Choosing the right loan depends on your business needs, financial situation, and long-term goals. At Biz2loan, we specialize in helping small businesses find the perfect funding solution. Whether you need a working capital loan to get started or a term loan to expand, we’re here to guide you every step of the way.

2 notes

·

View notes

Text

Eligible Uses for SBA 504 Loans!

SBA 504 loans are primarily used for purchasing or refinancing fixed assets, which makes them perfect for:

Commercial real estate purchases – Whether a business is looking to buy a new office building, warehouse, or retail space, the SBA 504 loan can help finance the purchase with favorable terms.

Large equipment purchases – Manufacturing companies, construction firms, or businesses in other capital-intensive industries can use SBA 504 loans to finance major equipment purchases.

Renovations or improvements – Business owners can also use SBA 504 loans to improve or expand their existing properties, allowing for further growth and increased operational efficiency.

Debt Refinances or cash out refinances

Borrowers can refinance high rate or maturing debt, and can also get cash out for eligible business expenses (EBE).

Who is Eligible for an SBA 504 Loan?

To be eligible for an SBA 504 loan, a business must meet certain criteria:

It must operate as a for-profit business.

It must meet SBA size requirements (the vast majority of businesses do).

The loan must be used for qualifying purposes such as commercial real estate, equipment purchases, or improvements.

Conclusion

For loan brokers and lending professionals, the SBA 504 loan program is an excellent option to recommend to your clients, especially those looking to expand their businesses with large fixed asset purchases. The program's long-term, fixed-rate financing, low down payments, and structured partnership between the SBA, CDCs, and private lenders make it a win-win for both borrowers and lenders. If you're not already offering SBA 504 loans, now is the time to consider incorporating them into your service offerings. By doing so, you can help your clients secure the financing they need to grow while positioning yourself as a valuable and knowledgeable partner in their success.

#SBALoans#SmallBusiness#BusinessFinancing#CommercialRealEstate#Entrepreneurship#EquipmentFinancing#BusinessGrowth#LoanBrokers#FinanceTips#DebtRefinance

2 notes

·

View notes

Text

Why should I use Payday Quid as My Short Term Loans UK Direct Lender?

We are a reputable online direct lender with a focus on same-day approval. Our extensive staff of loan specialists specializes in creating short term loans UK direct lender offers that are favorable to borrowers, such as adjustable payback schedules and affordable annual percentage rates. We don't require you to set up a guarantor or submit collateral. You are free to borrow a reasonable amount and have faith in your ability.

We have introduced a variety of loan products that serve as the best remedies for different kinds of financial problems. Regardless of your credit score, our lending service guarantees that all loans are available. Do not feel guilty if your credit score is low. We've provided you a fantastic opportunity to choose from specialized short term loans direct lenders offerings where you may always receive money and raise your credit scores.

All current Payday Quid clients are eligible for short term loans UK direct lender, which allow you to access funds ranging from £100 to £2,500. They might be just what you need if you need a bigger loan amount than what was approved or if you could use a little more time to repay your loan. The website for the more than 100+ lenders understands that life can throw you curveballs, and that the scheduled 12-month payday loans are the best approach to help you get back on track because they are always designed to help you immediately. Whether your car requires an urgent repair or one of your equipment has to be replaced, you can borrow only the amount you require and pay it back over the course of a year.

Short-Term Loans UK: 99% Approval Rate, Fast Decision

They also know how critical it is that you receive the money you require as soon as possible. The online application form is quick to use, and you will receive a preliminary decision within a few minutes. You may also receive the funds in your account at the time you like, provided that you are accepted before the evening. Before a customer applies for a short term loans UK, they must read some terms and conditions. These require you to be a permanent resident of the United Kingdom and to be at least 18 years old, You should have proof of employment with a minimum monthly income of £700 and a valid checking account and debit card in your name.

How Do Customers Apply for Short Term Loan?

Applying for a one- or two-month payday loan online is easy and clear with the Payday Quid website. When you've decided how much you want to borrow, you can use its loan calculator to choose this loan option if you've already borrowed from it. When you request for a short term loans UK, the precise cost (interest rates) will be determined, and you will be able to see all of the details up front, including the monthly repayment amount. This will not alter while you have the funds.

Remember that there aren't any hidden costs or late fines, so you'll know the right interest rates for your same day loans UK right away. The lenders prefer to keep things stable. There are no additional costs if you choose to make a one-time payment or repay early.

https://paydayquid.co.uk/

4 notes

·

View notes