#best calculator app

Explore tagged Tumblr posts

Text

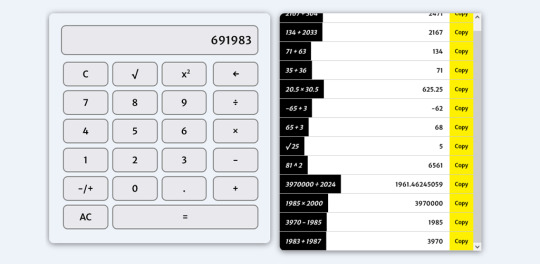

Dear Math Calculator - Best Calculator for School Students

#smart calculator#math calculator app#calculator with history#reusable calculations#advanced math calculator#scientific calculator#memory calculator#history saving calculator#student calculator#professional calculator#daily math tool#best calculator app#quick calculation app#math helper#number crunching tool#efficient calculator#calculation tracker#past calculation storage#smart math tool#productivity calculator#digital calculator#easy-to-use calculator#business calculator#engineering calculator#financial calculator#smart math assistant#all-in-one calculator#handy calculator app#math solver app#intelligent calculator

0 notes

Text

Planetary Perspectives: Guiding You Through the Stars best astrology apps for beginners

Best astrology apps for beginners is an historical exercise that has interested humanity for lots of years. Rooted inside the notion that the positions and moves of celestial bodies can have an impact on human existence and occasions on Earth, astrology has advanced thru numerous cultures and eras, taking on one of a kind paperwork and interpretations. Despite its controversial repute in the clinical community, astrology is still a popular and influential thing of many humans's lives. This essay explores the origins, development, sorts, and cutting-edge-day relevance of astrology, as well as the function of astrologers in interpreting and guiding individuals via the cosmic affects they trust form our destinies.

Origins and Historical Development of Astrology

Free daily horoscope for leo rising the origins of astrology can be traced again to ancient civilizations that observed the skies with reverence and curiosity. The earliest facts of astrological practices come from Mesopotamia, especially the Babylonians, who evolved the primary organized system of astrology across the second millennium BCE. They believed that the gods communicated their will thru celestial events, and that they meticulously recorded the positions of stars and planets to interpret omens and are expecting the destiny. This shape of astrology, known as omen-primarily based astrology, become commonly concerned with the destiny of countries and rulers in preference to people.

How to calculate my birth chart online the have an impact on of Babylonian astrology unfold to different historic civilizations, together with the Egyptians, Greeks, and Romans. The Egyptians contributed to the development of astrology with the aid of associating precise stars with deities and the usage of the heliacal growing of Sirius to predict the yearly flooding of the Nile. However, it become the Greeks who performed a pivotal function in reworking astrology right into a more state-of-the-art and systematic subject. During the Hellenistic period, astrology merged with Greek philosophy and astronomy, giving upward thrust to horoscopic astrology, which focused on the character rather than the collective.

Compatibility between virgo and libra in love the maximum sizeable contribution of the Greeks to astrology become the introduction of the zodiac, a twelve-sign system based on the plain direction of the Sun throughout the sky over the direction of a year. Each zodiac signal became associated with a particular constellation and changed into believed to steer the persona traits and destinies of people born below that signal. The Greeks also evolved the concept of the natal chart or horoscope, a map of the sky at the exact moment of an person's beginning, which astrologers use to research the positions of the planets and their impact at the individual's existence.

Astrology predictions for career in 2024 persevered to conform at some stage in the Roman Empire and the Middle Ages, with affects from Persian, Indian, and Islamic students. The spread of astrology across distinctive cultures caused the development of numerous astrological traditions, each with its unique techniques and interpretations.

Types of Astrology

Astrology isn't always a monolithic practice; it encompasses numerous branches and traditions, every with its distinct approach to deciphering celestial influences. Some of the maximum famous sorts of astrology encompass:

Western Astrology

Western astrology is the most typically practiced shape of astrology within the Western world. It is primarily based on the twelve zodiac symptoms and the department of the sky into twelve houses, each representing unique aspects of lifestyles (e.G., profession, relationships, health). Western astrologers use the positions of the Sun, Moon, and planets at the time of an man or woman's birth to create a natal chart, which serves as a blueprint for expertise their persona, strengths, challenges, and existence course. The planets are also associated with unique signs and homes, and their interactions (components) are used to predict destiny occasions and traits inside the character's life.

Vedic Astrology

Vedic astrology, also called Jyotish, is the traditional Hindu machine of astrology. It is deeply rooted in Indian spirituality and philosophy, with a focus on karma and the soul's journey via a couple of lifetimes. Vedic astrology uses a exceptional zodiac machine known as the sidereal zodiac, that's primarily based at the actual positions of the constellations in the sky. It additionally locations greater emphasis on the Moon sign in preference to the Sun sign. Vedic astrologers use a variety of charts and techniques to research an person's beyond, present, and future, in addition to to provide remedies for mitigating bad influences.

Chinese Astrology

Chinese astrology is an integral a part of Chinese culture and has been practiced for over thousand years. It is primarily based on a twelve-12 months cycle, with each yr associated with one of twelve animals (Rat, Ox, Tiger, Rabbit, Dragon, Snake, Horse, Goat, Monkey, Rooster, Dog, and Pig) and considered one of 5 factors (Wood, Fire, Earth, Metal, and Water). These animal signs are believed to steer the traits and destinies of people born in that 12 months. Chinese astrology additionally carries the principles of Yin and Yang and the Five Phases (Wu Xing) to offer a complete understanding of someone's life path.

Mundane Astrology

Mundane astrology specializes in the astrology of countries, towns, and worldwide events. It examines the positions of celestial our bodies at key moments, such as the founding of a state or the start of a conflict, to expect the consequences of political, monetary, and social developments. Mundane astrologers examine the horoscopes of global leaders and use astrological cycles, which include the Saturn-Pluto conjunction, to anticipate extensive worldwide adjustments.

Electional Astrology

Electional astrology is the practice of selecting the most auspicious time to undertake vital activities, inclusive of marriage, beginning a business, or launching a project. Astrologers use electional astrology to find the high-quality feasible alignment of planets and signs to ensure success and limit boundaries. This branch of astrology is closely related to horary astrology, which includes answering specific questions primarily based at the positions of the planets on the time the question is asked.

Medical Astrology

Medical astrology, also known as iatromathematics, is an ancient exercise that connects astrology with fitness and medicinal drug. It is primarily based on the perception that the positions of the planets and zodiac signs can influence the physical and mental well-being of individuals. Medical astrologers examine the natal chart to perceive capability fitness troubles and offer steerage on preventive measures and remedies. Each zodiac sign is associated with specific components of the body, and the planets are related to numerous physical features and organs.

The Role of Astrologers

We are practitioners who interpret the positions and actions of celestial bodies to offer insights and guidance to people looking for to recognize themselves and their existence situations. The function of an astrologer goes beyond mere fortune-telling; it entails a deep understanding of astrological symbolism, psychology, and human behavior.

One of the number one responsibilities of an astrologer is to create and examine natal charts. This involves mapping the positions of the Sun, Moon, and planets at the exact second of an character's beginning and deciphering how those positions have an impact on the individual's persona, strengths, demanding situations, and existence direction. Astrologers do not forget different factors, consisting of the zodiac signs, homes, elements (angles among planets), and transits (the movement of planets through the zodiac) to offer a complete analysis.

It is additionally offer steering on numerous elements of life, which includes relationships, career, fitness, and personal growth. By examining the planetary influences at a given time, astrologers can offer insights into the first-rate instances to make critical choices, start new ventures, or navigate tough periods. This issue of astrology is often referred to as predictive astrology.

In addition to private consultations, astrologers can also write horoscopes for e-book in newspapers, magazines, or online platforms. These horoscopes provide popular predictions and recommendation for each zodiac signal based totally at the present day positions of the planets. While now not as special as a customised natal chart studying, horoscopes offer a wide overview of the cosmic impacts affecting every sign.

It can also concentrate on particular branches of astrology, together with scientific astrology, electional astrology, or mundane astrology, depending on their hobbies and information. Some astrologers combine astrology with other non secular or mental practices, such as tarot analyzing, numerology, or Jungian psychology, to offer a greater holistic technique to steerage and self-discovery.

The Debate: Science or Pseudoscience?

Astrology has lengthy been a subject of dialogue, specially inside the scientific community. While it has a wealthy historic and cultural significance, astrology is regularly criticized for missing empirical proof and scientific rigor. Critics argue that the ideas of astrology, which include the have an effect on of celestial our bodies on human conduct, aren't supported by way of scientific facts and that the interpretations furnished by using astrologers are regularly vague and open to subjective interpretation.

Despite these criticisms, astrology remains famous and influential, with millions of people worldwide consulting astrologers, analyzing horoscopes, and using astrology as a tool for self-expertise and choice-making. Some proponents of astrology argue that it have to now not be evaluated completely by way of clinical standards, as it is a symbolic and intuitive exercise in place of a predictive technology. They view astrology as a shape of artwork, psychology, or spirituality that gives valuable insights into the human experience.

In recent years, there has been a resurgence of interest in astrology, especially amongst more youthful generations. This renewed interest is frequently attributed to the desire for meaning and connection in a swiftly converting and unsure global. Astrology presents a framework for understanding oneself and the cosmos, presenting a experience of consolation and steerage in navigating lifestyles's demanding situations.

The Modern-Day Relevance of Astrology

In the cutting-edge international, astrology continues to evolve and adapt to new cultural and technological contexts. The upward push of the internet and social media has made astrology extra available than ever before, with endless websites, apps, and social media bills committed to astrological content. Online astrology groups offer a area for individuals to connect, share reviews, and research greater about the practice.

How to read an astrology natal chart attraction within the 21st century can be attributed to numerous factors. First, it offers a customized method to self-discovery and self-development. In a time whilst people are increasingly interested in knowledge their particular identities and capability, astrology offers a framework for exploring one's persona, strengths, and demanding situations. The natal chart, in particular, is seen as a precious tool for gaining insights into one's reason and life path.

#How to read an astrology natal chart#Astrology predictions for career in 2024#Compatibility between virgo and libra in love#How to calculate my birth chart online#Free daily horoscope for leo rising#Best astrology apps for beginners

6 notes

·

View notes

Text

Can You Convert Your Fixed-Rate Loan to a Floating-Rate Loan?

A personal loan is one of the most convenient financial solutions for handling emergencies, consolidating debt, or financing major expenses. When taking out a personal loan, borrowers often choose between a fixed interest rate and a floating interest rate. However, as market conditions change, many borrowers wonder if they can convert a fixed-rate loan to a floating-rate loan to take advantage of lower interest rates.

The good news is that many lenders allow borrowers to switch from a fixed-rate personal loan to a floating-rate personal loan, but the process comes with fees, conditions, and potential risks. In this article, we will explore whether converting a fixed-rate loan to a floating-rate loan is possible, the benefits and drawbacks, and how to determine if it’s the right financial move for you.

1. Understanding Fixed-Rate and Floating-Rate Personal Loans

Before deciding whether to switch from a fixed to a floating-rate personal loan, it is essential to understand how both interest types work.

A. What Is a Fixed-Rate Personal Loan?

A fixed-rate personal loan comes with an unchanging interest rate throughout the tenure, ensuring consistent EMI payments.

✅ Pros of Fixed-Rate Loans:

Predictable EMIs with no fluctuations.

Better financial planning and budgeting.

Protection from interest rate hikes.

🚫 Cons of Fixed-Rate Loans:

Higher initial interest rates than floating-rate loans.

Cannot benefit from market interest rate reductions.

B. What Is a Floating-Rate Personal Loan?

A floating-rate personal loan has an interest rate that fluctuates based on the market conditions and benchmarks like the RBI’s repo rate.

✅ Pros of Floating-Rate Loans:

Interest rates may decrease, reducing EMI payments.

Generally lower initial interest rates than fixed-rate loans.

🚫 Cons of Floating-Rate Loans:

EMIs may increase if market rates rise.

Monthly repayment amounts become unpredictable.

📌 Tip: If interest rates are expected to decline, switching to a floating-rate personal loan can be a strategic move to save money.

2. Can You Convert a Fixed-Rate Personal Loan to a Floating-Rate Loan?

Yes, most banks and NBFCs allow borrowers to convert their fixed-rate personal loan into a floating-rate personal loan. However, this conversion is subject to lender policies, processing fees, and loan tenure requirements.

✅ Conditions for Conversion:

The borrower must request a loan conversion from the lender.

A conversion fee (typically 0.5%–2% of the outstanding loan amount) may be applicable.

The lender evaluates the request based on credit score and repayment history.

Some lenders only allow conversion if a certain number of EMIs have already been paid.

📌 Tip: Contact your lender to check their conversion policy, eligibility criteria, and applicable fees before making a decision.

3. Benefits of Converting a Fixed-Rate Loan to a Floating-Rate Loan

Switching to a floating-rate personal loan can be beneficial under certain conditions. Here’s why you might consider the conversion:

A. Potential Interest Rate Reduction

If market rates decline, floating rates allow borrowers to pay lower EMIs.

Example: If your fixed-rate personal loan is at 12%, but floating rates fall to 9%, switching can result in significant savings.

B. Lower Overall Interest Cost

If interest rates remain low, the total interest paid over the loan tenure decreases.

Beneficial for long-term loans with extended repayment periods.

C. Flexibility in Loan Management

Some lenders allow partial prepayments without penalties on floating-rate loans, helping you repay faster.

Floating rates can align with market trends, allowing borrowers to take advantage of falling rates.

📌 Tip: Convert to a floating-rate personal loan when rates are low and expected to remain stable.

4. Risks and Challenges of Converting a Fixed-Rate Loan to a Floating-Rate Loan

While switching can offer benefits, there are potential drawbacks to consider:

A. Market Rate Volatility

If interest rates increase, your EMIs will rise, leading to higher total loan costs.

Borrowers with tight budgets may struggle with fluctuating repayments.

B. Conversion Fees and Hidden Charges

Lenders charge conversion fees (0.5%–2% of the outstanding loan amount), increasing the switching cost.

Some lenders impose administrative or processing fees.

C. Loss of Stability

Fixed-rate loans offer predictable payments, helping in long-term financial planning.

Floating-rate loans lack certainty, making future budgeting challenging.

📌 Tip: Evaluate the total cost of conversion, including fees and potential rate fluctuations, before making a decision.

5. When Should You Convert a Fixed-Rate Loan to a Floating-Rate Loan?

Converting your fixed-rate personal loan to a floating-rate loan is beneficial under specific conditions:

✔️ If Market Interest Rates Are Consistently Declining – Beneficial if RBI repo rates are reducing and expected to stay low. ✔️ If the Difference Between Fixed and Floating Rates Is Significant – Consider conversion if the floating rate is 2%–3% lower than your fixed rate. ✔️ If You Have a Long Loan Tenure Remaining – Longer remaining tenure increases potential savings from lower rates. ✔️ If Your Lender Charges Low Conversion Fees – Some lenders waive conversion charges during special offers.

📌 Tip: Analyze your lender’s rate trends and conversion policies before switching.

6. How to Convert Your Fixed-Rate Loan to a Floating-Rate Loan?

If you decide to switch, follow these steps to convert your fixed-rate personal loan into a floating-rate loan:

Step 1: Check Current Market Interest Rates

Compare floating rates vs. your existing fixed rate to determine if switching makes financial sense.

Step 2: Contact Your Lender

Request loan conversion details, including fees, revised EMI schedule, and new loan terms.

Step 3: Submit a Loan Conversion Request

Lenders require a formal conversion application, along with updated income proofs and loan statements.

Step 4: Pay the Conversion Fee

Pay any applicable conversion charges, which may be deducted from the outstanding loan amount.

Step 5: Review the New Loan Agreement

Check for hidden charges, prepayment penalties, and revised repayment terms before signing.

📌 Tip: If your lender doesn’t offer a good deal, consider a loan balance transfer to another lender with better floating rates.

7. Conclusion

Converting a fixed-rate personal loan to a floating-rate loan can be a smart financial move if market rates are falling and expected to remain low. However, borrowers should weigh the pros and cons, account for conversion fees, and consider future rate fluctuations before making a switch.

Before proceeding, compare your lender’s terms, negotiate for lower conversion fees, and ensure that switching truly benefits your financial situation.

For expert financial insights and the best personal loan offers, visit www.fincrif.com today!

#personal loan online#nbfc personal loan#fincrif#loan apps#finance#personal loan#personal laon#personal loans#loan services#bank#fixed-rate personal loan#floating-rate personal loan#personal loan interest rates#loan conversion process#fixed vs floating interest rate personal loan#how to switch from fixed to floating rate loan#benefits of floating rate personal loan#personal loan EMI calculation#personal loan refinancing#fixed interest rate loan vs variable interest rate loan#floating interest rate benefits#how RBI repo rate affects loan interest#impact of interest rate changes on personal loans#best time to convert fixed-rate loan to floating-rate loan#fixed rate vs flexible rate loan comparison#personal loan balance transfer vs loan conversion#steps to convert fixed-rate loan into floating-rate loan#lowest floating-rate personal loan#personal loan tenure and interest rates#how to reduce EMI by switching to floating rate loan

2 notes

·

View notes

Text

Officially hit my first gw and actually came out an additional 0.7lbs under my goal today 😭😭😭 i will be sick in the head again tomorrow bc damn i still got at least 35lb more to go but today im lowkey cured. thank you Halloween gods 😩🙏🎃

#All my calculations and the lose it app had me at reaching my goal by like Nov 7th-10th so I thought this was such a long shot wtffffff#Shoot for the stars end up on the moon type shit#Gamifying this numbers and forcing myself to keep perspective and not getting so caught up in doing it the ‘right’ way + this blog i think#All made it possible#I rlly needed an outlet badddd just something personal has rlly helped me a lot#And i cant journal bc of how my brain works. The ether is easier than something private bc my internal audience picks it apart#Best holiday off to a banger start

6 notes

·

View notes

Text

List of Best Trading Apps in India 2023

The world of trading has become more accessible than ever before, thanks to the rise of trading apps. With just a few clicks on your smartphone, you can now buy and sell shares in real-time from anywhere in India. But with so many options available, which trading app should you choose? In this article, we've compiled a list of the top 10 best trading apps in India for 2023. Whether you're a seasoned trader or just starting out, this comprehensive review will help you find the perfect app for your needs. So let's dive right into it!

List of the Top 10 Trading Apps in India

Zerodha: With over 3 million users, Zerodha is one of the most popular trading apps in India. It offers a user-friendly interface and low brokerage fees, making it an excellent choice for both beginners and experienced traders.

Upstox: Another top-rated app is Upstox, which boasts a simple yet effective platform for buying and selling stocks. It has competitive pricing and advanced charting tools to help you make informed decisions.

Angel Broking: Known for its extensive research capabilities, Angel Broking provides valuable insights into market trends that can help investors maximize their profits. The app also features a range of financial products like mutual funds and insurance.

Groww: A relatively new player in the market, Groww has quickly gained popularity thanks to its zero-commission policy on stock trades and easy-to-use interface.

Kotak Securities: This app by Kotak Mahindra Bank offers seamless integration with your bank account, allowing you to transfer funds seamlessly between them while trading shares or investing in mutual funds.

Sharekhan: With more than 20 years of experience in the market, Sharekhan is known for its robust research reports that provide detailed analysis of stocks from various sectors.

Edelweiss: Offering customizable watchlists and charts along with real-time news updates, Edelweiss makes it easier for investors to stay up-to-date with current events affecting their investments.

HDFC Securities: This app by HDFC Bank provides access to global markets along with local ones at affordable prices while providing comprehensive research reports covering several industries

ICICI Direct: ICICI direct allows you not only trade through mobile but also via call-n-trade. Their simplified version makes it perfect even if you are a beginner

Axis Direct: Last but not least AxisDirect comes equipped with all essential features including personalized alerts, easy order placement and comprehensive market analysis tools.

Complete Review of All Best Trading Apps in India

When it comes to choosing the best trading app in India, there are plenty of options available. But which one is right for you? In this complete review of all the best trading apps in India, we will take a closer look at each one and help you make an informed decision.

First up is Angel Broking. With its user-friendly interface and advanced charting tools, Angel Broking makes it easy for beginners to get started with trading. It also offers low brokerage fees and instant fund transfer options.

Next on our list is Zerodha. Known for its no-brokerage policy, Zerodha has quickly become a popular choice among traders in India. The app offers various features such as market depth analysis, advance charts and technical indicators.

Groww is another great option for those looking for a seamless trading experience. Its simple design allows users to navigate through the app with ease while offering commission-free investments in mutual funds.

Kotak Securities’ mobile application provides real-time updates on the stock market along with research reports from their team of experts giving you valuable insights about specific companies' performances based on their financial history.

Edelweiss Trading App combines investment opportunities with insightful advice from analysts making sure that traders make informed decisions before investing money into stocks or mutual funds

These are just some of the top contenders when it comes to finding the best trading app in India - but ultimately, your choice will depend on what suits your needs as an investor or trader.

To sum up, in this article we have discussed the top 10 trading apps in India for the year 2023. We have reviewed each app based on its features, user interface and overall performance.

Whether you are a beginner or an experienced trader, these apps offer you a seamless experience with no brokerage charges and easy access to market data.

Angel Broking, Zerodha and Kotak Securities are some of the popular names that provide unique features to make your trading journey smooth. Edelweiss also offers reliable services with advanced charts and tools.

Groww is another great option for beginners as it has a simple user interface along with low brokerage fees. nifty bees share price can be easily tracked through Angel One while Old Mumbai Chart provides historical data essential for analysis.

Each app excels in different areas making them suitable for different types of traders. So choose the one that best fits your requirements and start trading today!

After analyzing and reviewing the top 10 trading apps in India, it is evident that each app has its unique features and benefits. Whether you are a beginner or an experienced trader, there is an app on this list that will suit your needs.

From Angel Broking's seamless user interface to Zerodha's low brokerage fees, each app offers something special. Other notable mentions include Kotak Securities' advanced charting tools, Edelweiss' research reports, and Groww's zero brokerage platform for mutual funds.

Choosing the best trading app in India can be challenging. However, by assessing your needs as a trader and comparing them with the offerings of these top 10 trading apps, you can find one that perfectly suits you. So go ahead and download your favorite trading app today

Related - https://hmatrading.in/best-trading-app-in-india/

Source - https://sites.google.com/view/list-of-best-trading-apps

#best trading app in india#best trading app in india 2022#angel broking login#zerodha brokerage calculator#nifty bees share price#angel one share price#kotak securities login#edelweiss share price#old mumbai chart#angel broking share price#no brokerage#groww brokerage calculator#angelone share price#HMA Trading

2 notes

·

View notes

Text

aw hell naw thye got the half a gig and 0mp camera man. whaddee ell

#got this oldass 2015 tablet from a friend two years ago and this thing is just. wow. they could not have gutted it more#running android 4. has 9 permanent fingerprints on the screen from the numpad of a time calculator from previous owner#who was a parking lot manager? i think?#but it doesnt turn off automatically. wanna tinker with it and see what i can do with this feature#unfortunately there are very few things that can be done with old tablets like this.#best i can think of is that app that makes this work like a mouse. i wanted to install google meet to be able to see my dogs when i leave#but it doesnt even show up on the app store :/ and youtube whines about a new update that i cant install bc its so old#dextxt

1 note

·

View note

Text

How to Open a Business Bank Account in Kenya: Top Banks & Benefits of Mobile Online Banking

Opening a business bank account is an essential step for any entrepreneur. In Kenya, finding the best bank to open a business account ensures that your business needs are met. Whether you are looking for the best business bank account for startups or established businesses, there are plenty of options available. Business bank account Kenya provides access to tailored solutions for managing your company’s finances. With the rise of mobile online banking apps, managing your business finances has never been easier. Business mobile banking allows you to access your accounts, make transactions, and track financial activities at your convenience.

#Banking from Mobile App#Banking Mobile App#Personal Loan Calculator#Top Bank in Kenya#Best Bank in Kenya#Home Loan Calculator#Mortgage Calculator

0 notes

Text

A Step-by-Step Guide to Using the Craving to Quit App for Beginners

Quitting smoking is a challenging journey, but with the right tools, you can successfully overcome the cravings and lead a healthier life. One such tool is the Craving to Quit app, designed to help smokers kick the habit for good. In this guide, we’ll provide a comprehensive review of the app and show you how to get started with it.

What is the Craving to Quit App?

The Craving to Quit app is a powerful smoking cessation tool based on mindfulness training. Developed by Dr. Judson Brewer, a renowned addiction psychiatrist, the app focuses on helping users become more aware of their cravings and gradually break the habit of smoking. Unlike other apps, it takes a behavioral approach, emphasizing the mind-body connection to help you quit.

Why Use Smoking Cessation Apps?

Smoking cessation apps have become a popular choice for individuals looking to quit smoking. These apps provide users with support, tips, and resources to resist cravings. Some features include progress tracking, community support, and mindfulness techniques. The Craving to Quit app is one of the best apps to help quit smoking because it not only tracks your journey but also helps you understand and overcome cravings in real time.

How to Get Started with the Craving to Quit App

If you're a beginner looking to use the Craving to Quit app, here’s a step-by-step guide to help you navigate through the app and make the most of its features:

1. Download and Install the App

The Craving to Quit app is available on both iOS and Android platforms. To start, simply visit the App Store or Google Play and download the app.

Once installed, you can set up your profile by entering some basic information such as your smoking habits, the number of cigarettes you typically smoke, and the reasons why you want to quit.

2. Explore the App’s Features

After signing in, take a moment to explore the app’s features. Some of the key functions include:

Quit smoking day counter app: Tracks how many days you've been smoke-free.

Daily exercises: Mindfulness exercises designed to help you deal with cravings.

Community support: Connect with other users for motivation.

Progress tracker: Monitor your progress as you go through the program.

3. Begin Your 21-Day Program

The Craving to Quit app offers a structured 21-day program that guides you through the process of quitting smoking. Each day, you’ll receive new exercises, tips, and strategies to help you stay smoke-free. The daily program includes:

Mindfulness practices: Learn how to become more aware of your smoking triggers.

Educational videos: Short lessons about the psychology behind smoking and how to beat cravings.

In-app notifications: Helpful reminders to complete your daily exercises and stay on track.

4. Mindfully Address Your Cravings

One of the app’s standout features is its mindfulness-based approach. Whenever you feel a craving, the app encourages you to pause and become aware of what’s happening in your body and mind. By observing the craving without judgment, you reduce its power over you.

Here’s how to use mindfulness when a craving hits:

Pause: When you feel the urge to smoke, stop whatever you’re doing.

Breathe: Take a few deep breaths and focus on the sensation of your breath.

Observe: Notice how the craving feels. Is it in your chest? Stomach? How strong is it?

Respond: Instead of acting on the craving, allow it to pass while you remain calm.

5. Use the Quit Smoking Day Counter

The quit smoking day counter app is a great motivational tool that keeps track of how long you've been smoke-free. Every day, you can see your progress and celebrate small victories along the way. This feature can be particularly helpful for individuals who thrive on visual indicators of their success.

Craving to Quit App Review: Why It Stands Out

The Craving to Quit app review consistently highlights the app’s innovative mindfulness-based approach. Here are a few reasons why it’s considered one of the best apps to help quit smoking:

Behavioral approach: Rather than focusing solely on willpower, the app teaches users to become more mindful of their cravings and behaviors.

Structured program: The 21-day guided program ensures that you have daily support and encouragement.

Accessible content: Educational videos and mindfulness exercises are designed to be simple, engaging, and effective.

Community support: Users can connect with a supportive community of individuals going through the same experience.

Additional Support: The QuitSure App

While the Craving to Quit app offers a fantastic solution for those looking to quit, it’s not the only option. If you’re exploring other apps, consider the QuitSure App as well. This app also provides tailored guidance, daily exercises, and motivational tools to help you on your quit-smoking journey.

Tips for Using Smoking Cessation Apps Effectively

To maximize the benefits of the Craving to Quit app or any other smoking cessation apps, consider the following tips:

Stay consistent: Make sure to log into the app daily and complete the exercises. Consistency is key in building new habits.

Track your progress: Use the app’s tracking features to monitor how far you’ve come. Seeing your progress can be a great motivator to keep going.

Engage with the community: Connect with others in the app’s community for support and encouragement.

Stay mindful: Whenever a craving strikes, use the mindfulness techniques provided by the app to observe your feelings rather than acting on them.

Conclusion: The Best App to Help Quit Smoking

The journey to quitting smoking is a challenging one, but tools like the Craving to Quit app make it easier by providing structured guidance, mindfulness techniques, and community support. By following the steps outlined in this guide, you’ll be well on your way to a smoke-free life.

Remember, you’re not alone. Whether you choose the Craving to Quit app or other quit smoking day counter apps like QuitSure, the right support is just a download away.By using these smoking cessation apps, tracking your progress, and remaining mindful of your cravings, you'll have the tools you need to finally quit smoking and lead a healthier life.

#quitting smoking benefits#best quit smoking app android#best quit smoking app iPhone#best quit smoking tracker app#quit smoking calculator app

1 note

·

View note

Text

Mortgage Calculator and Top Customer Service from SBM Bank Kenya

Discover the best banking solutions for your business with SBM Bank Kenya. Utilize our comprehensive mortgage calculator to plan your finances effectively. Experience top-notch customer service designed to cater to all your business banking needs. SBM Bank Kenya is your reliable partner in achieving financial success and stability.

0 notes

Text

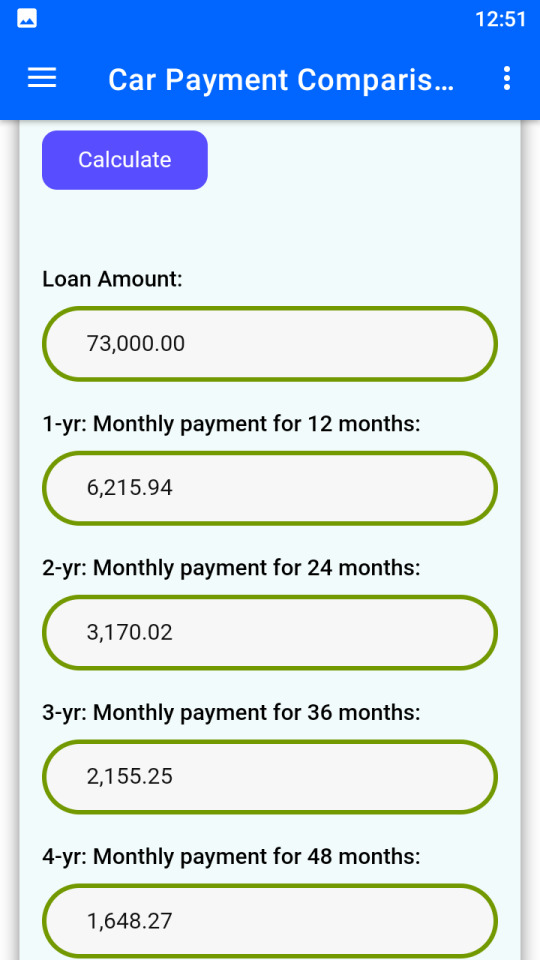

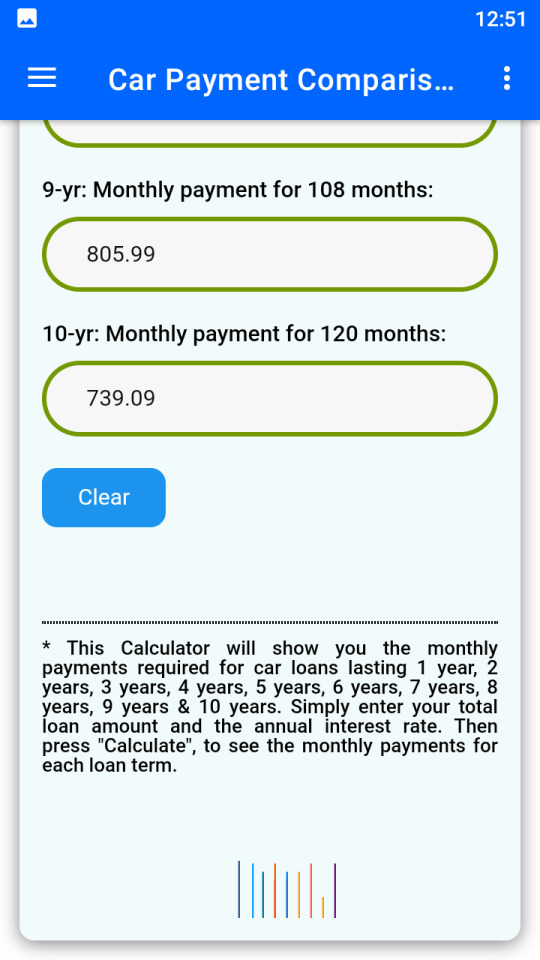

Know & compare the monthly payments from 1 year to 10 years. This App will show you the monthly payments required for car loans lasting 1 year, 2 years, 3 years, 4 years, 5 years, 6 years, 7 years, 8 years, 9 years & 10 years. Simply enter your total loan amount and the annual interest rate. Then press "Calculate", to see the monthly payments for each loan term.

#car payment calculator#auto loan calculator#vehicle loan comparison#monthly car payment estimator#car finance calculator#loan term comparison#car affordability calculator#auto financing tool#car loan repayment#interest rate calculator#car lease calculator#car loan EMI calculator#vehicle financing calculator#auto loan payment tracker#car purchase planning#car budget calculator#car loan interest calculator#auto finance planner#car loan schedule#loan amortization calculator#car cost estimator#easy car loan calculator#car financing made simple#monthly installment calculator#car loan planning tool#vehicle cost calculator#auto credit calculator#auto loan affordability#best car loan calculator#smart car finance app

0 notes

Text

Effective Strategies to Quit Smoking for Good

Effective Strategies to Quit Smoking for Good Introduction to Quitting Smoking Quitting smoking is a journey that leads to a healthier life. It’s not always easy, but with the right strategies, it’s definitely achievable. Smoking can harm nearly every organ in the body, and finding the motivation to quit is the first step towards a smoke-free life. The harmful effects of smoking on…

View On WordPress

#Benefits of quitting smoking#Best way to quit smoking#Effects of quitting smoking#Help to stop smoking#How to quit smoking#Natural ways to quit smoking#Nicotine gum for quitting smoking#Nicotine patches#Quit smoking#Quit smoking acupuncture#Quit smoking apps#Quit smoking calculator#Quit smoking cold turkey#Quit smoking hypnosis#Quit smoking motivational quotes#Quit smoking support groups#Quit smoking timeline#QuitSmoking#QuitSmokingTips#Smoking cessation programs#SmokingCessation#Stop smoking aids#Stop smoking medication#StopSmoking#Tips to quit smoking

0 notes

Text

How Digital Lending Platforms Are Competing with Traditional Banks

The personal loan landscape is undergoing a massive transformation. While traditional banks have long dominated the lending space, the rise of digital lending platforms is challenging the status quo. These tech-driven platforms are fast, efficient, user-friendly, and increasingly preferred by modern borrowers.

As the demand for personal loans continues to rise, consumers are weighing their options between conventional banking institutions and nimble digital lenders. So, how exactly are these digital lending platforms competing with traditional banks? Let’s dive into the major shifts shaping the future of the personal loan industry.

What Are Digital Lending Platforms?

Digital lending platforms are online-based financial services that provide loans—particularly personal loans—through automated systems. These platforms leverage cutting-edge technology such as artificial intelligence (AI), machine learning (ML), big data, and fintech APIs to assess creditworthiness, approve applications, and disburse loans quickly.

Unlike traditional banks, digital lenders are not bogged down by physical infrastructure or bureaucratic delays. They often specialize in specific loan types like personal loans, offering tailored experiences for today’s digital-savvy borrowers.

Speed and Simplicity: A Game-Changer for Personal Loans

One of the biggest advantages of digital lending platforms is speed. Applying for a personal loan from a bank can take days, sometimes even weeks. You’re often required to visit a branch, fill out lengthy paperwork, and wait for approvals.

Digital lending platforms, on the other hand, make it possible to apply for a personal loan online in just a few clicks. The process is streamlined, paperless, and typically takes minutes to hours—from application to disbursement.

This convenience is particularly attractive to millennials, freelancers, and gig workers who value instant financial support without the hassle of traditional systems.

Broader Credit Accessibility

Traditional banks rely heavily on credit scores, income proof, and long-standing financial histories to determine personal loan eligibility. Unfortunately, this excludes a large chunk of the population, such as new-to-credit individuals, small business owners, and self-employed professionals.

Digital lending platforms use alternative data sources—like mobile usage, social media behavior, utility bill payment history, and online transaction patterns—to assess creditworthiness. As a result, they offer personal loans to a broader audience, improving financial inclusion.

This innovation is a major competitive edge and reflects the evolving needs of today’s borrower.

Personal Loan Customization: A Modern Approach

Digital lenders understand that one size does not fit all. They offer highly customized personal loan solutions based on individual profiles. You can choose your loan tenure, amount, repayment frequency, and even get personalized interest rates.

Banks usually follow rigid criteria and standard loan structures, leaving little room for customization. This flexibility from digital lending platforms appeals to customers looking for solutions that align with their unique financial goals.

Competitive Interest Rates

Many people assume that traditional banks always offer better interest rates. But that’s changing fast. Due to lower operational costs, digital lending platforms can offer competitive or even lower interest rates on personal loans.

Moreover, fintech platforms often use AI-powered risk models that more accurately assess borrower profiles, allowing them to price loans fairly. They reward responsible borrowers with lower rates, challenging the outdated pricing structures of banks.

Seamless Digital Experience

Today’s borrowers expect a seamless digital journey—from loan application to disbursement to repayment tracking. Digital lending platforms offer mobile apps, chat support, digital KYC, and real-time loan status updates.

Banks are trying to catch up but are often limited by legacy systems and siloed departments. A borrower applying for a personal loan via a digital lender enjoys an app-first, 24/7 service that feels modern and efficient.

This user experience is a crucial differentiator in a competitive lending environment.

Faster Approvals with AI and Automation

Traditional bank loan approvals can be slow due to manual underwriting and multiple approval layers. Digital lenders, however, use automation and artificial intelligence to speed things up.

These systems instantly analyze vast amounts of data to make smarter lending decisions. As a result, borrowers often receive approval within minutes, along with same-day or next-day disbursals—a huge leap over the traditional waiting period.

For anyone facing an emergency or looking for quick funds, a personal loan from a digital platform becomes the obvious choice.

Lower Operational Costs and Higher Efficiency

Digital lending platforms have minimal physical infrastructure and fewer staff requirements. This allows them to keep costs low and pass on the savings to customers in the form of lower fees or attractive offers.

Traditional banks, in contrast, have to maintain branches, employ large teams, and follow lengthy compliance protocols. This often increases the cost of offering personal loans and limits the bank’s ability to innovate.

The lean model of digital lenders gives them the agility and cost advantage to serve customers better.

Enhanced Risk Management with Real-Time Data

Banks often use outdated risk models that do not reflect the dynamic financial behavior of modern borrowers. Digital lenders, however, use real-time data analytics and predictive modeling to assess risk more accurately.

This enables them to not only reduce loan defaults but also offer better terms to good borrowers. It creates a win-win situation: safer lending for the platform and smarter borrowing for the customer.

This modern risk assessment approach is a strong reason why digital lenders are gaining trust and popularity in the personal loan market.

Regulatory Adaptation and Trust Building

Initially, one concern with digital lenders was the lack of regulation and transparency. However, fintech companies are increasingly collaborating with NBFCs, regulated financial institutions, or acquiring licenses themselves.

Many digital lenders now follow strict compliance protocols, RBI guidelines, and data privacy norms. As they become more transparent and secure, borrower confidence in digital personal loans is growing.

Banks still enjoy long-standing reputations, but digital lenders are quickly building their own trust-based ecosystems.

How Banks Are Responding

To stay relevant, traditional banks are stepping up their digital game. Many have launched their own mobile lending apps, partnered with fintech companies, or created digital-only loan products to match the appeal of new-age platforms.

However, changing institutional culture and legacy technology takes time. Until then, digital lending platforms will continue to attract a growing share of the personal loan market.

Conclusion: Who’s Winning the Personal Loan Battle?

Digital lending platforms have disrupted the personal loan landscape with their speed, simplicity, and smart use of technology. They are effectively competing with traditional banks by addressing gaps in accessibility, flexibility, and customer experience.

While banks still offer reliability and a wide range of financial products, they must accelerate their digital transformation to keep up. For borrowers, this competition is a win—it means more choices, better rates, and faster service.

As the personal loan industry evolves, digital lenders will play a key role in shaping the future of finance. If you’re considering your next personal loan, it might be time to explore what these platforms have to offer.

Looking for the best personal loan for your needs? Visit Fincrif.com to compare top lenders, get expert advice, and stay updated on the latest trends in digital lending.

#finance#fincrif#nbfc personal loan#bank#personal loan online#loan apps#personal loans#personal loan#loan services#personal laon#digital lending platforms#traditional banks#instant personal loan#fintech personal loan#personal loan approval process#personal loan interest rates#apply for personal loan#best personal loan app#online personal loan eligibility#paperless personal loan#AI in personal loan#personal loan for salaried individuals#personal loan for self-employed#personal loan disbursement time#loan comparison platform#secure personal loan#personal loan EMI calculator#low interest personal loan#how to get a personal loan#personal loan from digital lender

0 notes

Text

#best app for trading in india#best online trading app in india#best stock market app in india#Referral Program#Referral Calculator

0 notes

Text

#digital gold investment app in india#digital gold#digital gold disadvantages#digital gold price today#mutual fund calculator#best mutual funds next 10 years#buying digital gold online

0 notes

Text

#best trading app in india#best trading app in india 2022#angel broking login#zerodha brokerage calculator#nifty bees share price#angel one share price#kotak securities login#edelweiss share price#old mumbai chart#angel broking share price#no brokerage#groww brokerage calculator#angelone share price

0 notes

Text

Manage Your Finances with Ease: Mobile Banking, Loan Calculators, and Top Banks in Kenya

In today’s fast-paced world, managing your finances has never been easier with business mobile banking and banking from mobile app solutions. Whether you're on the go or working from home, banking mobile apps provide seamless access to your accounts, payments, and transactions. For those looking to secure financing, use a personal loan calculator, home loan calculator, or mortgage calculator to plan your financial commitments. Choosing the top bank in Kenya and the best bank in Kenya is crucial for reliable services and competitive rates. Furthermore, consider the best banking customer service when selecting a bank, ensuring that your banking experience is smooth and hassle-free. Embrace the convenience of mobile banking and financial planning tools to make smarter financial decisions.

#Business Mobile Banking#Banking from Mobile App#Banking Mobile App#Personal Loan Calculator#Top Bank in Kenya#Best Bank in Kenya#Home Loan Calculator#Mortgage Calculator

0 notes