#banking and financial solutions

Explore tagged Tumblr posts

Text

Efficient IPO Application Processing System: A Revolution in Banking and Financial Solutions

In today’s rapidly evolving financial sector, technology plays a pivotal role in streamlining processes and enhancing customer experiences. One such innovation is the IPO Application Processing System, designed to facilitate the efficient management of Initial Public Offering (IPO) applications. As companies increasingly go public, the demand for efficient application processing has grown. Integrating these systems into broader banking and financial solutions ensures that financial institutions can handle IPO applications swiftly and accurately, improving both operational efficiency and customer satisfaction.

The Role of an IPO Application Processing System

An IPO Application Processing System is a specialized software solution that automates the handling of IPO applications. When companies launch IPOs, they attract many investors looking to buy shares. Processing these applications manually can be slow and prone to errors, especially with large volumes. An automated system eliminates these issues, offering a platform for collecting, validating and processing applications accurately.

These systems manage all stages of the IPO process, from the initial submission to the final allocation of shares. Additionally, they ensure compliance with regulatory standards, reducing the risk of errors that could result in financial or legal complications. For financial institutions, a robust IPO Application Processing System is essential for handling large volumes of applications efficiently and providing a seamless experience for their clients.

Key Benefits of an IPO Application Processing System

Efficiency: Automation accelerates the IPO process, allowing institutions to manage large numbers of applications quickly and accurately. This efficiency leads to better customer service and faster transaction times.

Accuracy: Manual processes often lead to errors, especially when processing a high volume of applications. An automated system ensures precision, reducing the likelihood of costly mistakes.

Compliance: IPO processing requires strict adherence to regulatory guidelines. An IPO Application Processing System is designed to ensure that every application meets these standards, minimizing the risk of non-compliance.

Enhanced Customer Satisfaction: Automation allows institutions to provide quicker and more transparent services, improving the overall customer experience and fostering trust with investors.

Integrating IPO Systems with Banking and Financial Solutions

The integration of IPO Application Processing Systems with existing banking and financial solutions creates a seamless workflow. Financial institutions can manage IPO applications alongside other services such as online banking and investment management. This comprehensive approach simplifies operations and enhances service delivery.

Integrated systems also provide real-time updates, enabling investors to track their application status and share allocations. This level of transparency is essential for building trust between financial institutions and their clients, leading to stronger customer relationships.

Winsoft: A Leader in Financial Technology Solutions

When it comes to delivering advanced banking and financial solutions, Winsoft stands out as a leading provider of innovative technology. Winsoft’s IPO Application Processing System helps financial institutions efficiently manage IPO applications, ensuring accuracy, compliance and customer satisfaction. By focusing on automation and seamless integration, Winsoft enables institutions to handle IPO applications alongside other financial services, streamlining operations and enhancing service quality.

Winsoft’s technology allows financial institutions to provide a smoother IPO application process, ensuring they remain competitive in the ever-evolving financial landscape.

Conclusion

In a competitive financial environment, adopting an efficient IPO Application Processing System is crucial for maintaining accuracy and speed. When integrated with banking and financial solutions, these systems enhance operational efficiency and improve the customer experience. Winsoft plays a pivotal role in offering advanced technology solutions that help financial institutions manage IPO applications seamlessly, ensuring compliance and building customer trust.

0 notes

Text

Recently I was watching Sugar and Spice (the 2001 movie about high school cheerleaders who decide to rob a bank because the head cheerleader needs money because she’s pregnant) and I teared up at the end credits when they revealed that “Diane started a scholarship program for pregnant cheerleaders so that no pregnant cheerleader would have to rob a bank again.” For a few seconds, I was fully onboard with the idea that this was a widespread problem in 2001.

#I mean teens do and did get pregnant#and that’s often a financially difficult position to be in#and some are/were cheerleaders#but I don’t think bank robbery is a common solution#anyway: fun movie except for the intermittent vicious homophobia#like even for 2001 it’s rough

7 notes

·

View notes

Text

With Innrly | Streamline Your Hospitality Operations

Manage all your hotels from anywhere | Transformation without transition

Managing a hotel or a multi-brand portfolio can be overwhelming, especially when juggling multiple systems, reports, and data sources. INNRLY, a cutting-edge hotel management software, revolutionizes the way hospitality businesses operate by delivering intelligent insights and simplifying workflows—all without the need for system changes or upgrades. Designed for seamless integration and powerful automation, INNRLY empowers hotel owners and managers to make data-driven decisions and enhance operational efficiency.

Revolutionizing Hotel Management

In the fast-paced world of hospitality, efficiency is the cornerstone of success. INNRLY’s cloud-based platform offers a brand-neutral, user-friendly interface that consolidates critical business data across all your properties. Whether you manage a single boutique hotel or a portfolio of properties spanning different regions, INNRLY provides an all-in-one solution for optimizing performance and boosting productivity.

One Dashboard for All Your Properties:

Say goodbye to fragmented data and manual processes. INNRLY enables you to monitor your entire portfolio from a single dashboard, providing instant access to key metrics like revenue, occupancy, labor costs, and guest satisfaction. With this unified view, hotel managers can make informed decisions in real time.

Customizable and Scalable Solutions:

No two hospitality businesses are alike, and INNRLY understands that. Its customizable features adapt to your unique needs, whether you're running a small chain or managing an extensive enterprise. INNRLY grows with your business, ensuring that your operations remain efficient and effective.

Seamless Integration for Effortless Operations:

One of INNRLY’s standout features is its ability to integrate seamlessly with your existing systems. Whether it's your property management system (PMS), accounting software, payroll/labor management tools, or even guest feedback platforms, INNRLY pulls data together effortlessly, eliminating the need for system overhauls.

Automated Night Audits:

Tired of labor-intensive night audits? INNRLY’s Night Audit+ automates this crucial process, providing detailed reports that are automatically synced with your accounting software. It identifies issues such as declined credit cards or high balances, ensuring no problem goes unnoticed.

A/R and A/P Optimization:

Streamline your accounts receivable (A/R) and accounts payable (A/P) processes to improve cash flow and avoid costly mistakes. INNRLY’s automation reduces manual entry, speeding up credit cycles and ensuring accurate payments.

Labor and Cost Management:

With INNRLY, you can pinpoint inefficiencies, monitor labor hours, and reduce costs. Detailed insights into overtime risks, housekeeping minutes per room (MPR), and other labor metrics help you manage staff productivity effectively.

Empowering Data-Driven Decisions:

INNRLY simplifies decision-making by surfacing actionable insights through its robust reporting and analytics tools.

Comprehensive Reporting:

Access reports on your schedule, from detailed night audit summaries to trial balances and franchise billing reconciliations. Consolidated data across multiple properties allows for easy performance comparisons and trend analysis.

Benchmarking for Success:

Compare your properties' performance against industry standards or other hotels in your portfolio. Metrics such as ADR (Average Daily Rate), RevPAR (Revenue Per Available Room), and occupancy rates are presented in an easy-to-understand format, empowering you to identify strengths and areas for improvement.

Guest Satisfaction Insights:

INNRLY compiles guest feedback and satisfaction scores, enabling you to take prompt action to enhance the guest experience. Happy guests lead to better reviews and increased bookings, driving long-term success.

Key Benefits of INNRLY

Single Login, Full Control: Manage all properties with one login, saving time and reducing complexity.

Error-Free Automation: Eliminate manual data entry, reducing errors and increasing productivity.

Cost Savings: Pinpoint problem areas to reduce labor costs and optimize spending.

Enhanced Accountability: Hold each property accountable for issues flagged by INNRLY’s tools, supported by an optional Cash Flow Protection Team at the enterprise level.

Data Security: Protect your credentials and data while maintaining your existing systems.

Transforming Hospitality Without Transition

INNRLY’s philosophy is simple: transformation without transition. You don’t need to replace or upgrade your existing systems to benefit from INNRLY. The software integrates effortlessly into your current setup, allowing you to focus on what matters most—delivering exceptional guest experiences and achieving your business goals.

Who Can Benefit from INNRLY?

Hotel Owners:

For owners managing multiple properties, INNRLY offers a centralized platform to monitor performance, identify inefficiencies, and maximize profitability.

General Managers:

Simplify day-to-day operations with automated processes and real-time insights, freeing up time to focus on strategic initiatives.

Accounting Teams:

INNRLY ensures accurate financial reporting by syncing data across systems, reducing errors, and streamlining reconciliation processes.

Multi-Brand Portfolios:

For operators managing properties across different brands, INNRLY’s brand-neutral platform consolidates data, making it easy to compare and optimize performance.

Contact INNRLY Today

Ready to revolutionize your hotel management? Join the growing number of hospitality businesses transforming their operations with INNRLY.

Website: www.innrly.com

Email: [email protected]

Phone: 833-311-0777

#Innrly#Innrly Hotel Management Software#Bank Integrations in Hospitality Software#Tracking Hotel Compliance#hotel performance software#hotel portfolio software#Hotel Performance Management Software#hotel reconciliation software#Hotel Data Entry Software#accounting software hotels#hotel banking software#hospitality automated accounting software#hotel automation software hotel bookkeeping software#back office hotel accounting software#hospitality back office software#accounting hospitality software#Hotel Management Accounting Software#Hotel Accounting Software#Hospitality Accounting Software#Accounting Software for Hotels#Hotel Budgeting Software#Automate Night Audit Software#Automate Night Audit Process#Best Hotel Accounting Software#Best Accounting Software For Hotels#Financial & Hotel Accounting Software#Hospitality Accounting Solutions

2 notes

·

View notes

Text

Haha yeah...

Nothing like being woken up to your car being repossessed because your partner, who told you they paid all their bills this time they promise, didn't pay for the car in 4 months.

Apparently, they didn't lie they claim, Because that's a car "payment" not a car "bill" they paid their "bills".

They also didn't pay their bills. ¬.¬

While we are on the subject - financial abuse is not always just physically taking money away or not having a savings account or escape stash. For a lot of people it is the other spouse sabotaging your credit score, constantly overspending, and you being unable to trust that joint household bills and loans are paid. Did you know that once you add an authorized user to your bank account it’s nearly impossible to remove them without their permission? Did you know that your spouse, who likely knows your birthday and SSN, can often gain access and reset passwords for any online accounts and create new ones?

Financial abuse will ruin your life and there’s really nothing except significant time that fixes it. If you are in a situation where you think this might happen to you you should freeze your credit with all three major agencies. You can find info on how to do this at USA.gov/credit-freeze

This is not something that only happens to tradwives. You are not exempt because you are independent or competent.

#this is past stuff#but I'm still salty#i have such a Fucking trigger about money now#and i haven't even seen them in years#i have never financially recovered#i have paid more money in bank fees covering for them#than money i have made since they left me#i just...#And the worst part is#they would also try to tell me it's my fault#because i refused to take control of both our finances#if i just prevented them from having their money they can't do this#an obvious trap. Because like so many other aspects of our marriage#the second i agree to whatever Solution they suggest#they go around telling everyone they know how terrible of a person i am for doing the thing to them they asked me to#I'm srry#i shouldn't rant about it#I'm just...#i got a lot of issues lol#ignore me#rants

11K notes

·

View notes

Text

What Should You Do If You Can't Make Your Personal Loan Payments?

Taking out a personal loan can be a great solution when you need extra cash for an emergency, a big purchase, or debt consolidation. However, life doesn’t always go according to plan. Sometimes, unexpected financial struggles, such as job loss, medical emergencies, or sudden expenses, can make it difficult to keep up with your loan payments. If you’re unable to make your personal loan payments, it’s important to act quickly and strategically to avoid falling into a cycle of debt or default.

In this blog, we’ll explore what you should do if you find yourself in a situation where you can’t make your personal loan payments. By understanding your options and taking proactive steps, you can avoid severe consequences like damage to your credit score, high penalties, and legal action.

1. Don’t Ignore the Problem

If you’re struggling to make your personal loan payments, the worst thing you can do is ignore the issue. Many people feel embarrassed or overwhelmed, which leads them to avoid the situation altogether. However, avoiding the problem can make things worse. Missing a payment could lead to late fees, higher interest rates, and a negative impact on your credit score.

Instead, face the issue head-on and assess your current financial situation. Understand how much you owe, your payment schedule, and the consequences of missed payments. This will give you clarity on how to proceed. The sooner you address the issue, the more options you’ll have to resolve it.

2. Contact Your Lender Immediately

One of the first steps you should take if you can’t make your personal loan payments is to reach out to your lender. Lenders understand that unexpected situations happen, and they often have solutions in place for borrowers facing financial difficulties. Ignoring the problem or failing to communicate with your lender may lead to more serious consequences, so don’t wait until it’s too late.

When you contact your lender, explain your situation honestly. Whether you’ve lost your job, faced a medical emergency, or encountered another financial hardship, be transparent about what’s going on. Your lender may offer different options based on your circumstances, such as a temporary payment deferral, a loan modification, or an extended repayment period.

Lenders are often more willing to work with you if you show initiative and communicate early. The key is to be proactive and keep the lines of communication open.

3. Request a Payment Deferral

If you're struggling to make a personal loan payment due to temporary financial difficulties, a payment deferral may be an option worth considering. A payment deferral allows you to pause or reduce your loan payments for a set period, typically a few months, without facing penalties or default. This can provide you with some breathing room to recover financially.

When you request a payment deferral, it’s important to understand how it will affect your loan. While a deferral may give you short-term relief, interest may still accrue during this period, and your total loan balance could increase. However, it can prevent you from falling behind on payments and help you avoid damaging your credit score.

Be sure to ask your lender about any fees or charges associated with the deferral and whether the deferred payments will be added to the end of your loan term or spread out over the remaining payments.

4. Consider Loan Modification

If a temporary deferral isn’t enough to solve your financial troubles, a loan modification might be the right choice. A loan modification involves changing the terms of your loan to make it more manageable. This could include extending the repayment period, reducing the interest rate, or even lowering the principal balance in some cases.

Loan modifications are generally reserved for borrowers who are experiencing long-term financial difficulties, so they may not be available to everyone. However, if your lender offers this option, it could provide significant relief by lowering your monthly payments and making the loan easier to repay.

Before you agree to a loan modification, make sure you understand how the changes will affect the total cost of the loan. While a modification can lower your monthly payment, it may also result in paying more in interest over the long term.

5. Refinance Your Personal Loan

Refinancing a personal loan is another potential solution if you can’t keep up with your current payments. Refinancing involves taking out a new loan to replace your existing one, ideally with better terms, such as a lower interest rate or a longer repayment period. By refinancing, you could reduce your monthly payments and make the loan more manageable.

If you have good credit and a stable income, refinancing may be an option worth exploring. However, keep in mind that refinancing may come with fees, and it may not always result in lower payments depending on your credit profile and the terms of the new loan.

Refinancing also extends your loan term, which could mean paying more in interest over the life of the loan. Make sure to weigh the pros and cons before refinancing and determine if it’s the right option for your financial situation.

6. Explore Debt Consolidation

If you have multiple loans or debts and are struggling to make payments on all of them, debt consolidation could help simplify your finances and reduce your overall debt burden. Debt consolidation involves combining all your debts into a single loan with one monthly payment. This can lower your interest rate, reduce your monthly payments, and make it easier to manage your debt.

When consolidating debt, you can either take out a personal loan to pay off your existing debts or use a balance transfer credit card with a 0% introductory APR. Debt consolidation can help you regain control over your finances and avoid the stress of managing multiple payments.

However, it’s important to carefully evaluate whether debt consolidation is the right option for you. While it can simplify your finances, it doesn’t eliminate your debt. You’ll still need to focus on paying down the loan, and in some cases, consolidating can result in higher interest charges over time.

7. Seek Financial Counseling or Advice

If you're unsure how to proceed or feel overwhelmed by your debt, seeking financial counseling may help you regain control of your finances. Financial advisors and credit counselors can assess your financial situation and recommend strategies to manage your debt, such as creating a budget, negotiating with creditors, or setting up a debt management plan (DMP).

A DMP is a program in which a credit counselor works with your lenders to reduce your interest rates, waive fees, and create a more affordable repayment plan. While a DMP can help you get back on track, it may take several years to complete, so be sure to consider whether this approach fits your financial goals.

8. Consider Bankruptcy as a Last Resort

If you’ve exhausted all other options and still find yourself unable to make your personal loan payments, bankruptcy may be a last resort. Filing for bankruptcy can discharge certain types of debt, including personal loans, but it comes with significant long-term consequences. Bankruptcy can severely damage your credit score and remain on your credit report for years, making it difficult to obtain future loans or credit.

Before considering bankruptcy, consult with a bankruptcy attorney to understand the process and determine if it’s the right choice for you. Bankruptcy should be viewed as a last option after you’ve explored other alternatives.

Conclusion

If you can’t make your personal loan payments, it’s essential to take action quickly and explore your available options. The most important step is to communicate openly with your lender to discuss potential solutions such as payment deferrals, loan modifications, or refinancing. Additionally, exploring options like debt consolidation, financial counseling, and, as a last resort, bankruptcy, can help you regain control over your financial situation.

Remember, there’s no need to panic. By taking proactive steps, you can avoid defaulting on your personal loan and protect your credit score. Stay informed, stay proactive, and don’t hesitate to seek professional help if you need it. With the right approach, you can navigate through your financial challenges and emerge stronger on the other side.

#finance#loan apps#nbfc personal loan#personal loans#fincrif#personal loan online#bank#loan services#personal loan#personal laon#Personal loan#Personal loan payments#Loan default#Unable to make personal loan payments#Loan payment deferral#Loan modification#Refinance personal loan#Debt consolidation#Financial counseling#Bankruptcy options for loans#Struggling with personal loan payments#Personal loan solutions#Missed loan payments#Personal loan management#Debt relief options#Loan payment help#Reduce loan payments#Financial hardship#Credit counseling for personal loans#Loan payment options

0 notes

Text

NOW EDUCATE YOUR CUSTOMERS & INVESTORS INSTANTLY

Now, drive your Bank’s revenue by displaying most knowledgeable content on the most captivating screens and empower your Customers to help themselves, while allowing your staff to handle more complex matters. Display your Bank’s core values instantly! Boost your conversions in the process alongwith Customer retention.

Our Digital Signage Solutions will benefit not only your external customers, but also your internal staff with continued updates & internal alerts meant to increase efficiency and enhance productivity.

We help you update your Bank’s content remotely with ease thus allowing you to stay ahead of your competition and technological trends.

Create trust -by displaying a financially secured future, as visuals tend to make an everlasting impression- inspiring people and customers to act alike!

Get ready to witness the positive change while we install the most attractive Digital Signage Solutions in your Bank- from Front Office to Lobbies!

Digital signage for banks

Bank digital signage solutions

Digital signage for bank branches

Interactive digital signage for banks

Digital signage displays for banks

Bank digital menu boards

Digital signage for bank promotions

Digital signage for financial institutions

Digital signage for bank marketing

Digital signage for customer engagement in banks

Visit

Add: MNG Tower, 2nd Floor, Plot no. A-2, Sector-17, Dwarka,

South West Delhi, New Delhi-110078

Call: +91-9650082579

#Digital signage for banks#Bank digital signage solutions#Digital signage for bank branches#Interactive digital signage for banks#Digital signage displays for banks#Bank digital menu boards#Digital signage for bank promotions#Digital signage for financial institutions#Digital signage for bank marketing#Digital signage for customer engagement in banks#Digital signage for banking services#Smart digital signage for banks#Digital signage for ATM displays#Custom digital signage for banks#Digital signage for bank advertising#Digital signage for bank branding#Digital signage for loan services in banks#Digital signage for bank communication

0 notes

Text

Fintech built smarter. 🤓💻

SDH integrates cutting-edge technologies with your vision. Digital banking, blockchain, personal finance apps—done right. Explore:

#financial software development#custom app solutions#fintech#SDH#digital banking#blockchain#personal finance apps

0 notes

Text

Decentralized Finance (DeFi): Reshaping Financial Systems

Decentralized Finance (DeFi) is at the forefront of fintech innovation in 2025, significantly reshaping how individuals and businesses access financial services. Built on blockchain technology, DeFi eliminates the need for traditional intermediaries like banks, allowing users to conduct transactions directly through smart contracts self-executing code on the blockchain.

DeFi platforms offer financial services such as lending, borrowing, trading, and saving to anyone with an internet connection. This is particularly transformative for underbanked populations in emerging economies, where traditional banking infrastructure is often limited.

All transactions on DeFi platforms are recorded on public ledgers, ensuring full transparency. The use of decentralized networks reduces the risk of single points of failure, enhancing security and resilience.

#fintech financial services#bank of canada digital currencies and fintech#cybersecurity fintech#fintech payment services#fintech payment solutions

0 notes

Text

ICICI Bank शेतकऱ्यांसाठी: आर्थिक उन्नतीसाठी उपयुक्त योजना आणि सेवा

शेतकऱ्यांसाठी आर्थिक विकास साधण्याच्या उद्देशाने ICICI Bank ने विविध उपयुक्त योजना आणल्या आहेत. या योजनांमुळे शेतकऱ्यांना आर्थिक सहाय्य मिळते आणि त्यांच्या शेती व्यवसायात सुधारणा होते. या लेखात ICICI बँकेच्या योजनांची माहिती देऊन, त्याचा उपयोग ग्रामीण भागातील शेतकऱ्यांसाठी कसा होतो हे समजून घेऊ.

#ICICI Bank#naruto#news#marathi#good omens#breaking news#agriculture#Banking Solutions#Financial Services#Personal Banking#Corporate Banking#ICICI Credit Card#Digital Banking#Wealth Management#ICICI Loans#Savings Account#Current Account#Banking App#ICICI Net Banking#Investment Plans#Home Loans#Education Loans#Business Banking#ICICI Bank Offers#Banking MadeEasy#Premier Banking#ICICI Bank India

0 notes

Text

Optimising Financial Operations with Banking and Financial Solutions and Brokerage Payout Reconciliation

In the ever-evolving world of finance, efficient management of resources is crucial for growth and sustainability. One of the core aspects of this is the use of Banking and Financial Solutions to streamline operations and enhance the overall client experience. From automated processes to enhanced data management, these solutions are transforming how financial institutions handle their daily activities. Another vital component is Brokerage Payout Reconciliation, a process that ensures transparency and accuracy in payments, which is essential for both brokers and financial organisations.

The Role of Banking and Financial Solutions in Today’s Market

Modern financial institutions face numerous challenges, including regulatory compliance, increasing client demands, and the need for operational efficiency. Banking and Financial Solutions offers a comprehensive suite of tools that help institutions manage everything from customer relationships to risk management. These solutions provide the infrastructure necessary for secure, scalable, and efficient banking processes.

Financial institutions are increasingly adopting these systems to improve operational efficiency, reduce manual errors, and ensure compliance with ever-changing regulatory environments. Additionally, these solutions offer real-time insights and analytics, enabling financial institutions to make informed decisions and improve their service offerings.

Why Brokerage Payout Reconciliation is Critical

In the financial sector, brokerage firms handle multiple transactions daily. To ensure that brokers are compensated accurately and promptly, Brokerage Payout Reconciliation plays a critical role. This process ensures that all transactions are tracked and matched with corresponding payouts, reducing the risk of discrepancies and disputes.

By automating Brokerage Payout Reconciliation, financial institutions can minimise errors, save time, and ensure that brokers receive their payments in a timely manner. This process not only enhances the trust between brokers and institutions but also helps to maintain the financial integrity of the organisation.

Winsoft: Leading the Charge in Financial Solutions

When it comes to providing cutting-edge solutions in the financial industry, Winsoft is at the forefront. Specialising in Banking and Financial Solutions and Brokerage Payout Reconciliation, Winsoft has helped numerous institutions streamline their processes and enhance operational efficiency. Their customizable software solutions cater to the unique needs of each financial institution, ensuring that they remain competitive in today’s fast-paced market.

In conclusion, adopting advanced Banking and Financial Solutions and automating Brokerage Payout Reconciliation are essential for financial institutions aiming to improve their operations. With Winsoft’s expertise, businesses can navigate the complexities of the financial world with confidence and precision.

0 notes

Text

Use Cases of Artificial Intelligence in the Banking Sector

Artificial Intelligence (AI) is transforming the banking sector by enhancing operational efficiency and customer experiences. AI-powered chatbots improve customer support, while fraud detection systems secure transactions in real time. Predictive analytics helps banks understand customer behavior and offer personalized services. Additionally, AI streamlines loan processing and credit scoring, ensuring faster approvals. By integrating AI, banks can drive innovation and stay competitive.

USM Business Systems stands out as the best mobile app development company, delivering AI-driven solutions tailored for the banking sector.

USM Business Systems

Services:

Mobile app development

Artificial Intelligence

Machine Learning

Android app development

RPA

Big data

HR Management

Workforce Management

IoT

IOS App Development

Cloud Migration

#AI in Banking Sector#Banking AI Use Cases#Artificial Intelligence in Banking#AI for Fraud Detection#Smart Banking Solutions#AI-Driven Banking Services#Banking Technology Innovations#AI for Financial Security#AI-Powered Banking Apps#AI in Financial Services

1 note

·

View note

Text

A financial planning advisor is a strategic partner, helping businesses analyze their financial landscape and create actionable plans. These advisors specialize in aligning financial operations with long-term goals, ensuring that every decision supports overall business growth.

#Financial planning advisor#Expert Financing Solutions#Conventional bank financing#Capital management

0 notes

Text

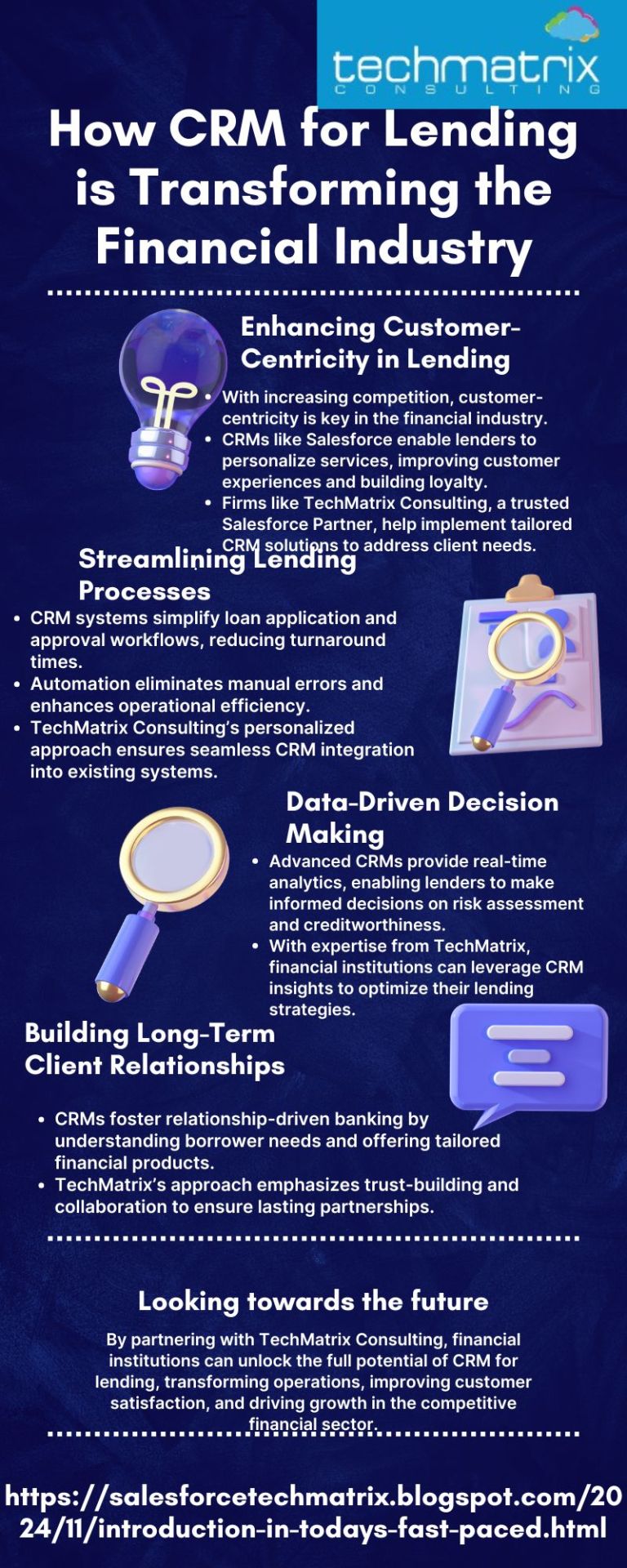

Customer Relationship Management (CRM) solutions are revolutionizing the financial industry by streamlining lending processes, enhancing customer experiences, and driving data-driven decision-making. Companies like TechMatrix Consulting, a trusted Salesforce Partner with a global presence, empower lenders with personalized CRM for lending implementations to meet evolving business needs. CRMs help automate workflows, improve communication, ensure compliance, and deliver actionable insights. With over a decade of expertise and a team of 250+ certified professionals, TechMatrix ensures long-term benefits by building trust, enabling scalability, and fostering collaboration. You can just transform your lending operations with CRM solutions tailored to your goals.

#CRM for lending#Financial industry transformation#Salesforce CRM solutions#TechMatrix Consulting#Customer-centric CRM for banks#CRM benefits in lending#Streamlining loan processes#Lending automation with CRM#Data-driven decisions in lending

0 notes

Text

What Happens to Your Credit Score After a Personal Loan Default?

A personal loan can be a useful financial tool when managed responsibly, helping borrowers cover unexpected expenses, consolidate debt, or fund significant purchases. However, failing to repay a personal loan on time can have serious consequences, particularly for your credit score. A default on a personal loan can impact your financial health for years, making it difficult to secure credit in the future. In this article, we will explore the effects of personal loan default on your credit score, the steps to take if you’ve defaulted, and strategies to rebuild your credit afterward.

Understanding Personal Loan Default

Loan default occurs when a borrower fails to make payments as agreed upon in the loan contract. Most lenders consider a personal loan to be in default after 90 to 180 days of missed payments. The exact timeline may vary depending on the lender’s policies, but the consequences remain significant.

Stages Leading to Default

Missed Payments: Lenders typically report a missed payment to credit bureaus after 30 days.

Delinquency: The account is classified as delinquent after multiple missed payments.

Default: After 90-180 days of non-payment, the lender may declare the loan in default and take legal action or send the account to collections.

Impact of Personal Loan Default on Credit Score

Defaulting on a personal loan can severely damage your credit score, making it harder to secure financial opportunities in the future. Here’s how it affects your credit profile:

1. Significant Credit Score Drop

A personal loan default can cause a major drop in your credit score. The exact impact depends on your credit history, but in general, the higher your score before default, the larger the decrease.

2. Negative Mark on Your Credit Report

A default remains on your credit report for up to seven years. Lenders reviewing your credit history will see this negative mark, making it harder to qualify for new loans or credit cards.

3. Increased Interest Rates on Future Loans

Lenders view defaulted borrowers as high-risk customers. If you manage to secure another loan, it may come with significantly higher interest rates due to the increased risk.

4. Collection Actions and Legal Consequences

Once a personal loan goes into default, lenders may hand it over to a collection agency or pursue legal action. This can lead to wage garnishment or even asset seizure, depending on local laws.

What to Do If You Default on a Personal Loan

If you find yourself in default, taking immediate action can help minimize damage to your financial future. Here are some steps to consider:

1. Contact Your Lender Immediately

Many lenders offer hardship programs that allow you to restructure your repayment terms or temporarily pause payments.

2. Negotiate a Settlement

Some lenders may agree to a settlement where you pay a reduced amount to close the loan. While this won’t erase the default from your credit report, it can prevent further damage.

3. Consider Credit Counseling

A credit counselor can help you develop a repayment plan and negotiate with creditors to improve your financial situation.

4. Avoid Taking on More Debt

If you’ve defaulted on a personal loan, taking on more debt will only worsen your situation. Focus on stabilizing your finances before applying for new credit.

How to Rebuild Your Credit After a Personal Loan Default

Although a personal loan default can have long-lasting effects, it is possible to recover financially. Here’s how:

1. Make Timely Payments Moving Forward

Your payment history is the most crucial factor in your credit score. Ensure that all future payments on other debts, such as credit cards and utilities, are made on time.

2. Pay Off Outstanding Debt

Reducing your overall debt burden will improve your credit utilization ratio and help boost your credit score over time.

3. Use a Secured Credit Card

A secured credit card requires a deposit and can help rebuild your credit by demonstrating responsible credit usage.

4. Monitor Your Credit Report Regularly

Check your credit report for errors or inaccuracies. If you notice incorrect negative marks, dispute them with the credit bureau to improve your credit profile.

Preventing Future Loan Defaults

Once you’ve worked to rebuild your credit, it’s essential to avoid falling into the same situation again. Here are some strategies to prevent future personal loan defaults:

1. Borrow Only What You Can Afford

Before taking out a personal loan, assess your financial situation and ensure you can comfortably make the required payments.

2. Create a Budget

A well-structured budget helps you allocate funds for necessary expenses, loan repayments, and savings.

3. Build an Emergency Fund

Having a financial cushion can help cover unexpected expenses, reducing the risk of missing loan payments.

4. Set Up Automatic Payments

Automating your loan payments ensures that you never miss a due date, reducing the chances of delinquency and default.

Final Thoughts

Defaulting on a personal loan can have serious consequences, from a significant drop in your credit score to legal actions by lenders. However, taking proactive steps, such as negotiating with lenders, making timely payments, and adopting responsible financial habits, can help you recover and rebuild your credit. By learning from past mistakes and managing future debt wisely, you can regain financial stability and improve your creditworthiness over time.

If you’re struggling with personal loan payments or worried about default, consider seeking financial advice and exploring options that help you stay on track. With a well-planned approach, you can overcome financial setbacks and work towards a healthier credit future.

#personal loan#finance#fincrif#bank#loan services#personal loans#nbfc personal loan#personal laon#personal loan online#connectivity#loan apps#loans#loan default impact#credit score drop#personal loan repayment#missed loan payments#default consequences#bad credit score recovery#loan delinquency#credit report damage#rebuild credit after default#financial hardship solutions

0 notes

Text

Revolutionizing the BFSI Landscape with Advanced Technology Solutions by Celebal Technologies

The Banking, Financial Services, and Insurance (BFSI) industry stands at the forefront of immense digital transformation, yet also faces daunting challenges. From evolving regulatory demands and the constant threat of cyberattacks to outdated legacy systems, BFSI institutions face a complex landscape. Meanwhile, customer expectations continue to shift, spurred by agile fintech startups and the rapid digitalization of everyday services. For these organizations, the need to manage vast data reserves, ensure compliance, and maintain security is paramount.

Amidst these challenges, Celebal Technologies emerges as a trusted partner, empowering BFSI institutions to harness the potential of digital transformation. By implementing banking technology solutions such as Artificial Intelligence (AI), Machine Learning (ML), Data Analytics, and Automation, Celebal enables these organizations to enhance efficiency, boost customer engagement, and improve security. With a comprehensive approach to innovation, Celebal's offerings redefine the financial landscape, enabling financial institutions to stay competitive and agile in today’s rapidly evolving market.

Why Cloud Adoption is Essential for Banking and Financial Services

In a world where agility and scalability are non-negotiable, cloud adoption offers a solution that can evolve alongside the demands of the banking and finance industry. Cloud platforms facilitate seamless data sharing, enhanced cybersecurity, and operational flexibility, making them essential for growth in the BFSI sector. Celebal Technologies leverages cloud infrastructure to help institutions overcome the limitations of legacy systems, enabling scalability, advanced security, and rapid data access to enhance both customer and employee experiences.

The Future of Banking: Navigating Transformative Shifts

Several significant trends are transforming the BFSI sector and redefining traditional business models. These include:

Data Explosion: As data volume increases, BFSI organizations must manage and extract insights to remain competitive.

Alternative Business Models: Emerging models challenge established frameworks, requiring banks to innovate.

New Startups and Fintech Competition: Fintech companies are disrupting the industry with technology-driven solutions, pushing traditional BFSI organizations to evolve rapidly.

Shifting Customer Expectations: Today’s customers demand fast, personalized, and secure digital experiences.

To address these evolving demands, Celebal Technologies offers an array of banking IT services that empower BFSI institutions to embrace change and become leaders in the digital era.

Key BFSI Solution Areas by Celebal Technologies

Celebal Technologies specializes in providing BFSI solutions that align with the core needs of today’s banking and finance industry. By focusing on innovation, personalization, and risk management, Celebal’s solutions enhance the operational and strategic capabilities of BFSI institutions.

1. Banking Dashboards

Celebal’s Banking Dashboards are designed to improve decision-making by offering real-time reporting and tracking capabilities. By providing intelligent insights across departments, these dashboards enable financial institutions to streamline operations, identify growth opportunities, and make data-driven decisions, ensuring that organizations remain agile and competitive.

2. Enterprise BFSI Chatbots

Delivering an exceptional customer experience is critical for customer retention in the BFSI sector. Celebal’s multi-lingual AI-powered chatbots streamline customer interactions across various channels. Equipped with speech-to-text capabilities, these chatbots reduce operational costs and deliver personalized support, enhancing customer satisfaction and reinforcing brand loyalty.

3. Data Modernization

The ability to leverage data as a strategic asset is a game-changer in today’s digital age. Celebal’s data modernization services create a centralized data repository using Microsoft Azure, eliminating data silos and optimizing data management. This banking technology solution modernizes legacy systems, allowing financial institutions to harness their data for improved decision-making and service delivery.

4. Machine Learning for Enhanced Service Efficiency

Celebal offers a suite of Machine Learning applications tailored to the BFSI sector, such as automating insurance claims, reading cheques and invoices, and automating customer support. These solutions empower financial institutions to increase efficiency, reduce human error, and enhance customer interactions, thereby meeting evolving customer expectations in a cost-effective manner.

Embracing Generative AI in Modern Banking

Generative AI is transforming the BFSI sector, offering groundbreaking ways to enhance risk management, compliance, customer personalization, and employee productivity. Celebal Technologies has integrated Gen AI-powered banking IT services across critical areas:

Risk Management and Compliance: Celebal’s AI-driven risk management solutions help banks navigate regulatory requirements while minimizing operational risks, ensuring that they remain compliant and secure.

Core Systems Modernization: By modernizing core banking platforms, Celebal empowers institutions to process real-time transactions, enhance operational efficiency, and uncover new revenue streams.

Financial Crime Prevention: Celebal’s real-time generative AI solutions provide robust defenses against financial crime, reinforcing trust and maintaining high security standards.

Personalized Banking Experiences: By understanding customer preferences and behaviors, Celebal’s AI solutions enable banks to offer personalized services that build loyalty and trust.

Employee Empowerment: Celebal’s approach to technology integration focuses on enhancing productivity and creating a collaborative environment, enabling employees to maximize their potential in the AI-driven landscape.

Looking Forward: Unleashing BFSI Potential with Data and AI

The BFSI industry is evolving, with customer expectations, regulatory requirements, and technology innovation all playing a role in shaping its future. Celebal Technologies is committed to empowering financial institutions by delivering transformative BFSI solutions that address the industry's unique challenges. From risk management to personalized banking experiences, Celebal's expertise in banking technology solutions enables institutions to navigate the complexities of the digital era while staying competitive.

Book a 30-minute strategy session with Celebal Technologies’ experts at [email protected] to explore how our banking and financial services can elevate your enterprise’s capabilities.

#bfsi solutions#banking and finance industry#banking it services#banking technology solutions#banking and financial services

0 notes

Text

6 Easy Steps to Choose the Right Banking Recruitment Agency

Selecting the right banking recruitment agency can be a distinct advantage for both work searchers and banking foundations. The correct office can smooth out the employing system, guaranteeing that competitors with the right abilities and capabilities are coordinated with the right jobs. The following are six simple tasks to assist you with picking the best financial enlistment organization to address your issues.

1. Define Your Requirements

Before you start your advantage, it's squeezing to have a reasonable comprehension of what you really want from a banking recruitment agency. For work searchers, this recommends perceiving the sort of financial positions you're amped up for, for example, retail banking, experience banking, or cash related appraisal. For banks and monetary foundations, this integrates finishing up the particular positions you really want to fill, for example, credit specialists, consistence arranged specialists, or branch supervisors.

By framing your necessities, you can limit your rundown of expected organizations to those that have practical experience in your specific area of interest. For example, on the off chance that you're searching for significant level leaders, you could zero in on organizations with a solid history in chief hunt inside the financial area.

2. Check Their Industry Expertise

Banking is a specific field, so picking an enlistment office with profound industry knowledge is significant. Search for organizations that have a demonstrated history in banking recruitment and figure out the subtleties of different financial jobs. You can survey their aptitude by exploring their site, perusing client tributes, and requesting contextual investigations or examples of overcoming adversity.

A recruitment agency with a solid spotlight on financial will have laid out associations with industry experts and a superior handle of the abilities and capabilities expected for various jobs. This ability will be important in tracking down the right applicants or open positions.

3. Evaluate Their Recruitment Process

Understanding how an enlistment office leads its hunt and determination cycle can give you knowledge into their viability. Get some information about their way to deal with obtaining competitors, screening cycles, and how they guarantee that up-and-comers are ideal for the jobs they're filling.

For job seekers, ask about how the office coordinates your abilities and vocation objectives with accessible open doors. For bosses, it's crucial for know how the office surveys possibility to guarantee they meet your particular necessities and organizational culture.

An agency that uses a rigorous and transparent recruitment process is more likely to deliver high-quality candidates or job matches.

4. Consider Their Reputation and Reviews

Reputation speaks volumes about the effectiveness of a recruitment agency. Research online reviews, request references, and look for suggestions from associates or industry contacts. A respectable organization will have positive input from the two clients and competitors and a past filled with effective situations.

Pay attention to reviews that notice the office's correspondence, impressive skill, and capacity to comprehend client needs. These elements are significant in guaranteeing a smooth and fruitful enrollment process.

5. Assess Their Communication and Support

Effective communication is key to a successful partnership with a recruitment agency. Assess how well the organization speaks with you during the underlying phases of commitment. Is it true that they are receptive to your requests? Do they give clear and opportune updates?

For job seekers, great help from the office remembers standard updates for requests for employment and useful criticism. For businesses, it includes straightforward correspondence about the advancement of the enrollment interaction and any difficulties experienced.

An agency that focuses on correspondence and backing is bound to give a positive and useful experience.

Conclusion

Choosing the right banking recruitment agency involves careful consideration and due diligence. By characterizing your necessities, assessing industry ability, understanding the enlistment interaction, really taking a look at notoriety and surveys, evaluating correspondence and backing, and exploring expenses and terms, you can go with an educated choice. The right agency like Alliance Recruitment Agency will assist with smoothing out your pursuit of employment or enlistment process, prompting effective results for the two up-and-comers and businesses. Carve out opportunity to follow these means, and you’ll be well on your way to finding a recruitment partner that meets your needs effectively. Contact us now.

#Banking Recruitment Agencies#Banking Jobs#Recruitment Solutions#Hiring Agencies#Financial Sector Recruitment#Recruitment Tips#Job Placement Services#Banking Industry Experts#Recruitment Process#Talent Acquisition#Employment Agencies#Banking Talent#Career in Banking#Job Seekers in Banking

0 notes