#CRM for lending

Explore tagged Tumblr posts

Text

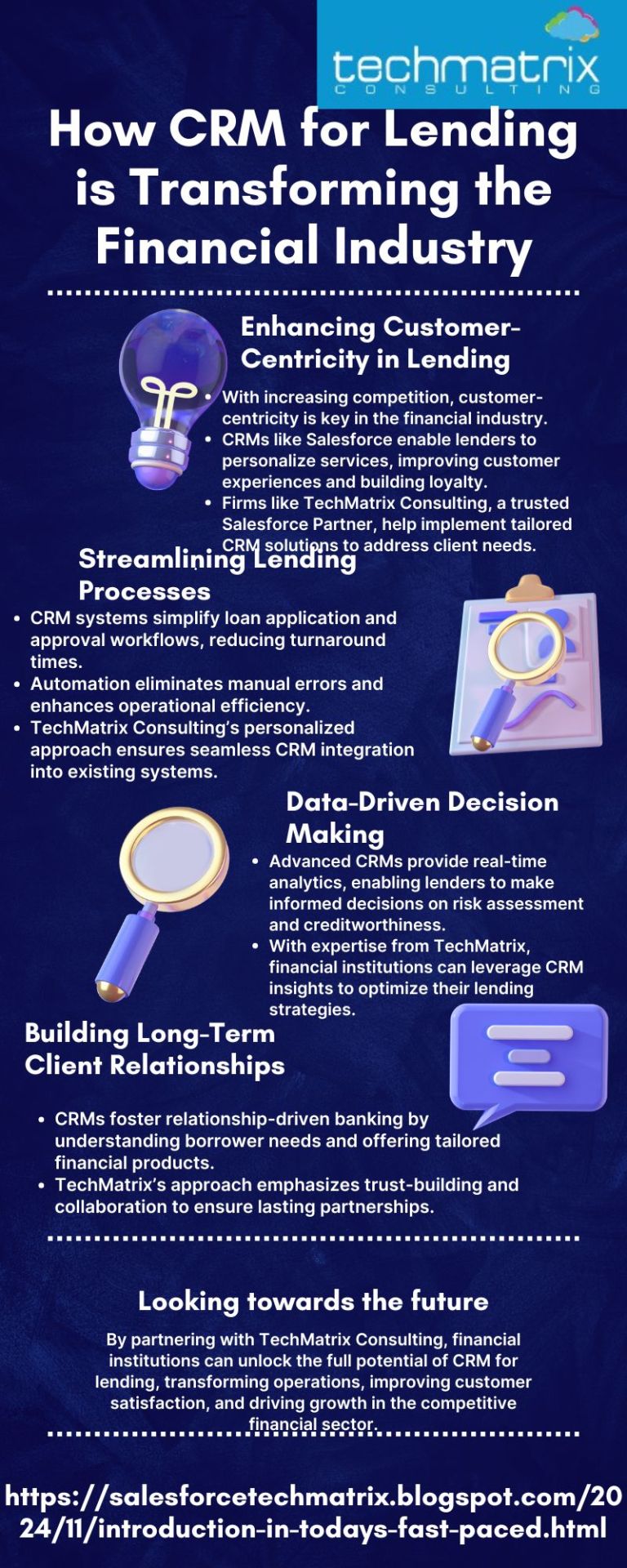

Customer Relationship Management (CRM) solutions are revolutionizing the financial industry by streamlining lending processes, enhancing customer experiences, and driving data-driven decision-making. Companies like TechMatrix Consulting, a trusted Salesforce Partner with a global presence, empower lenders with personalized CRM for lending implementations to meet evolving business needs. CRMs help automate workflows, improve communication, ensure compliance, and deliver actionable insights. With over a decade of expertise and a team of 250+ certified professionals, TechMatrix ensures long-term benefits by building trust, enabling scalability, and fostering collaboration. You can just transform your lending operations with CRM solutions tailored to your goals.

#CRM for lending#Financial industry transformation#Salesforce CRM solutions#TechMatrix Consulting#Customer-centric CRM for banks#CRM benefits in lending#Streamlining loan processes#Lending automation with CRM#Data-driven decisions in lending

0 notes

Text

Optimize your lending w/ Advanced Loan Management Software & Loan Management System

Moving from Excel to Advanced Loan Management Software

Transitioning from Excel spreadsheets to advanced loan management software can revolutionize how your business handles loan management. At Nexys, LLC, we understand the challenges you face when you manage loans manually. With our state-of-the-art loan management system, you get efficient and reliable solutions to streamline your process. Our software is designed to make loan management effortless, letting you manage everything from origination to servicing. Gone are the days of cumbersome spreadsheets that slow you down. Instead, embrace a loan management environment that's intuitive and robust. Our loan management software provides a comprehensive platform where you can manage all aspects of your lending operations efficiently. Whether you're looking to enhance your current system or need solutions for managing complex portfolios, our advanced loan management system offers the flexibility you need. Nexys's software ensures you manage your loans effectively, providing you with the tools and insights necessary for optimal performance. Say goodbye to inefficiencies and hello to a superior loan management experience.

How Loan Management System Revolutionizes Lending Solutions

At Nexys, LLC, we believe a robust loan management system can truly revolutionize lending solutions. Our advanced loan management software and loan servicing software streamline your entire loan management process, from application to closing. By leveraging innovative lending software, your team gains efficiency and accuracy, reducing manual errors and ensuring reliable credit reporting. Our loan management solutions offer unparalleled data analytics, allowing lenders to make informed decisions based on real-time data. With Nexys's advanced loan management software, manage all aspects of loan servicing effortlessly. Our loan servicing solutions are designed to adapt to your unique lending needs, offering a customizable approach to improve your daily operations. Each component of our loan management system is crafted to deliver seamless integration and real-time data insights, empowering lenders to stay ahead of the market. Experience how our loan management software can drive innovation in your business and elevate your loan servicing capabilities to new heights. Choose Nexys for cutting-edge solutions that enhance your lending efficiency and success.

Custom Loan Configurations for Diverse Lending Software Needs

Nexys, LLC offers unparalleled lending software designed to meet your precise needs with custom loan configurations. Our advanced loan management software provides tailored solutions to manage your unique loan configuration requirements efficiently. Whether you're looking to innovate your lending practices or ensure your systems are open and functional, our loan management system delivers. With Nexys, you gain access to an expansive range of management software solutions that streamline processes and enhance productivity. Custom loan configurations are at the heart of our offerings, allowing institutions to create diverse lending software solutions that adapt to any market demand. Manage your loans with ease using our advanced tools developed to provide efficient and comprehensive loan management. We're committed to supporting your growth, making loan management not only seamless but adaptable to various financial landscapes. Trust Nexys to bring innovation and efficiency to your lending operations with our sophisticated and custom-configurable loan management software solutions, ensuring your business stays competitive and proactive.

Why Nexys's Loan Manager Software is an Industry Leader

Nexys's Loan Manager Software stands out as an industry leader due to its innovative features and efficient loan management capabilities. Our loan management software brings the power of data to your business, allowing for successful management of commercial and personal loans. At Nexys, we believe that the key to modern lending is offering customized solutions that drive business growth. Our loan software excels by providing robust data management and credit oversight, ensuring every aspect of your lending process is fine-tuned. With Nexys's Loan Manager Software, your team will enjoy a streamlined experience that simplifies complex tasks, making efficient loan management a reality. Being an industry leader isn't just about offering a product; it's about continually innovating to meet and exceed the needs of our clients. Choose Nexys's loan management software to lead your business into a future of unstoppable growth and unparalleled excellence. Discover how Nexys's software can transform your lending operation and set your business apart in the competitive loan management landscape.

Easily Manage All Your Loans from One Loan Management Platform Dashboard

With Nexys, LLC's intuitive loan management platform dashboard, you can effortlessly oversee and manage loans from a single, comprehensive interface. Our advanced loan management software is designed to simplify the way you handle business, providing efficient tools and analytics to ensure all your loan details are centralized and easily accessible. This loan management platform integrates seamlessly with your existing systems, offering a holistic view of your data and loan processes. Our loan management system supports diverse lending needs with robust customization and detailed analytics, enabling you to optimize your operations. By leveraging our advanced software, you can streamline your management processes, enhance your productivity, and focus more on growing your business. The efficient loan management platform dashboard is the cornerstone of our system, making management of loans straightforward and hassle-free. Upgrade your business operations with Nexys's innovative loan management solutions and experience a revolutionary approach to how you manage loans. Trust our software to deliver reliable data and superb management capabilities every step of the way.

The Role of Loan Servicing Suite in Modern Loan Management Software

In today's fast-paced lending environment, a versatile loan servicing suite is crucial for managing loans efficiently. Modern loan management software offers comprehensive solutions, bringing together various aspects of loan servicing into one streamlined platform. By using advanced loan software, lenders can simplify the administration process, ensuring that loan servicing is not only efficient but also accurate. The suite's versatility allows for better handling of diverse loan types, making it a must-have in any lender's toolkit. Nexys, LLC's loan servicing suite exemplifies this, offering a robust solution that integrates seamlessly with existing systems. With this modern loan management software, lenders can enhance their servicing capabilities, maintaining a high level of customer satisfaction. The all-in-one suite provides a cross-section of tools, from administration to reporting, making sure you're always on top of your loan management tasks. Embrace the future of lending with Nexys, LLC, and see how an efficient loan servicing suite can revolutionize your business.

Optimize Loan Management Solution with Full Access to Software for Loan Management of Data

At Nexys, LLC, we empower your lending operations with advanced software for loan management. Our modern system ensures you have full access to optimize loan management solutions, providing efficient management and comprehensive data analytics. With Nexys's software, it's easy to manage data, create robust reporting, and maintain a seamless loan management system. Our solutions are designed for diverse lending needs, offering not just full access but also customized configurations. You'll find that our advanced software for loan management caters to the intricacies of contemporary lending landscapes. Data analytics are integrated into the core, ensuring you can make informed decisions and enhance your lending strategies. Our focus on efficient management allows your team to optimize processes, saving time and reducing errors. With Nexys's intuitive loan management system, managing loans has never been simpler or more effective. Discover the future of lending with our cutting-edge software for loan management, tailored specifically for your success.

#loan management software#loan servicing software#commercial#LOS#nexys#nexysllc#loanoperationsystem#loan#lending#realestate#investment#mortgage#crm software

0 notes

Text

#insurance crm#sales productivity#lending crm#banking crm#sales productivity tool#lead management software#mobile crm#toolyt#crm software

0 notes

Text

How can Loan Origination Software help you?

The loan origination system is an application that allows banks or any financial institutes to produce loans efficiently in sync with internal and statutory regulations. A perfect CRM-based loan origination software can handle the entire loan management system- from loan application, and loan processes to payment tracking. The best loan origination software makes things convenient for borrowers by making loan applications easy. The primary objective of loan origination applications is to enable banks and credit institutes to achieve their strategic goals. A cloud-based loan origination platform with robust CRM features helps financial organizations automate their end-to-end loan process. A perfect loan origination tool enables you to • Reduce the risk of lending while ensuring utmost compliance with regulations • Slash the waiting time for loan approvals, thus leading to better customer satisfaction • Improve the organization's credit portfolio

How to select the best loan origination software for your organization?

Loan origination software should perform several essential tasks to automate the end-to-end process. The cloud-based loan origination platform should come with some critical features. These features are-

Easy to adopt and use:

Organizations should be able to integrate the loan origination software easily into their existing system. The best loan origination tool allows anyone with basic knowledge to use it with a challenge. Scalable and customizable: An ideal loan origination software should allow customers to customize the solution to meet their unique requirements. The application should be able to accommodate any requirement in the future. With the growth of an organization, it becomes difficult to implement new loan origination software.

Data security:

Data security is an integral part of every system. Specifically, in the banking and financial industry, the security and privacy of customer data play vital roles. The loan origination system should have robust data security features. It's crucial to check data security features before investing in an application.

Perfect financial analysis:

The perfect loan origination system should come with an analysis feature that helps you take insights from credit decisions to make the right financial decisions.

Market Experience:

Choose a vendor with a proven track record, especially in the lending domain. The vendor should be well-familiar with the lending business, the steps of loan origination, and all the technical nuances of loan automation.

Document and contract management:

A robust document portal allows your prospects to upload all the required documents to process, Underwrite, and close the loans. The document portal comes with a contract management facility that enables you to build templates using the contract builder and update templates with loan terms and all necessary information. Seamless communication between departments: An efficient loan origination tool enables you to build a seamless communication channel between various departments like relationship managers, credit analysts, credit committees, and senior executives.

24/7 customer care:

A loan origination software vendor should offer their customers 24/7 interactive customer care support. Technical issues are unpredictable, therefore, a team of dedicated customer care support should be there 24/7. It can be an overwhelming experience for you to choose the perfect loan origination software as there are many vendors. We recommend you opt for LendCRM as it is one of the best cloud-based loan origination software with strong CRM features.

#Cloud Based Loan#Loan Origination Software Pricing#Loan Manager Pricing#Lending CRM#Mortgage Originator Software#CRM Loan

0 notes

Text

The Walking Dead: Daryl Dixon - This European Vacation Proves Refreshing

AMC's The Walking Dead has come and gone, but just like its shambling zombies, the franchise lives on. The latest spinoff is The Walking Dead: Daryl Dixon, a 6-episode series following Daryl (Norman Reedus) in France as he leads a young boy and woman to safety while also hoping to secure passage for himself back to America. As a premise, it's not too dissimilar from HBO's The Last of Us, which earlier this year brought a renewed interest into the now well-worn, post-apocalyptic genre. Daryl Dixon is looking to do the same, and inject a little freshness into television's longest running zombie story.

Thanks to a brand-new setting and largely new cast, Daryl Dixon manages to be exactly what it promises - a new tale within The Walking Dead universe that, while in many ways familiar, is different enough to feel exciting. Daryl is a stranger in a strange land, literally washing up on shore and needing to start from square one. In fact, this show itself feels like it's starting from square one, free from most of the baggage the main show collected over its 13-year run. We're familiar with Daryl, of course, the gruff loner who's actually one of Walking Dead's most kind-hearted characters, but placing him in situations where he doesn't fully grasp what's happening (and not just because of the language barrier) creates interesting challenges for him to overcome.

Daryl Dixon is a strong entry in The Walking Dead's catalogue because it's pulling in everything that's worked best before. Its story is straightforward, and thanks to a limited run of 6-episodes, moves at a good pace. Beyond the core three, characters can come and go, never at risk of overstaying their welcome, and the show doesn't linger in one place too long. It largely centers on Daryl protecting and ultimately mentoring his young charge, which has always been a good role for Daryl to play, so making it the focus here is a strong choice. The move to France also allows Daryl Dixon to be easily the best looking of The Walking Dead shows, with downright beautiful cinematography of the French countryside and Paris. There's a spooky ambiance permeating the show, too, helped along by a setting that feels more ancient and has weathered worse over the centuries. "America is an infant," one of Daryl's new allies says, "but here, we have survived many apocalypses. We will survive this one, too."

Traveling along with Daryl are Clémence Poésy as Isabelle, a nun with a checkered past, and Louis Puech Scigliuzzi as Laurent, a mysterious child who many believe is their new messiah. Because of this, Daryl Dixon is a surprisingly more spiritual show than expected, with a more positive perspective on faith than The Walking Dead has depicted before. This adds not only to Daryl's challenges, with him needing to figure out what it is he believes in, but also lends a different air of the supernatural with a kid who may or may not be destined for something greater. Both Poésy and Scigliuzzi work well alongside Reedus - who, now extremely comfortable in the role, is given the chance to peel back some layers and show new sides of the character - with Poésy's Isabelle proving an especially strong companion to Daryl as she similarly only began to understand her worth when the world ended.

Where the show suffers a bit is with its villains, who either are connected with the CRM or are just so similar they're indistinguishable. As the fascist military group is positioned to be the ultimate villains of the whole saga, it makes sense to tie them in, but it does begin to pull Daryl Dixon towards feeling a bit too much like later seasons of The Walking Dead and its spinoff World Beyond. Again, only being 6-episodes helps the show not feel too bogged down by this, but knowing a season 2 has already been ordered, it's certain they'll continue to be a problem for Daryl and his new allies. That said, the walkers this time around are given a few twists to make them scarier and more interesting than they've been of late, and it's always welcomed when the literal walking dead get to be actual threats rather than mere nuisances.

It's not controversial to say The Walking Dead became a bit stale in its later seasons, and while it did find its footing again before the end, Daryl Dixon proves a reboot may have been all that was needed. Not that this show is a true reboot, but it's enough of a return to basics to remind us why we enjoyed watching in the first place. In having Daryl struggle with new challenges in an unfamiliar setting, all while opening himself up to new people, Daryl Dixon injects The Walking Dead with a freshness the franchise has been lacking. Here's hoping a second season can continue that trend, as will the next spinoff entry centering on Rick and Michonne.

6 notes

·

View notes

Text

Certified Residential Mortgage Specialist

A Certified Residential Mortgage Specialist (CRMS) is a professional with expertise in mortgage lending, helping homebuyers secure financing with confidence. These specialists are trained to navigate loan options, interest rates, and mortgage regulations, ensuring you get the best deal possible. Whether you are a first-time buyer or refinancing your home, a CRMS can guide you through the complex mortgage process. Their knowledge of lending guidelines and market conditions makes them invaluable in securing a loan that fits your financial situation. Working with a certified specialist ensures a smooth and stress-free home-buying experience.

0 notes

Text

https://www.bloglovin.com/@krishna1056/step-by-step-guide-to-implementing-a-lending-13257714

Step-by-Step Guide to Implementing a Lending CRM System for Seamless Operations Learn how to implement a Lending CRM system step-by-step to enhance borrower management, streamline workflows, and improve efficiency.

#digitallendingplatform#bestloanmanagementsoftware#automatedloanprocessing#loantrackingsystem#loanportfoliomanagement#loanoriginationsystem#loanapplicationsoftware#digitallendingsolution

0 notes

Text

Unlocking Success with VA Loan Leads & VA Mortgage Live Transfers

What Are VA Loan Leads?

VA loan leads refer to potential borrowers who qualify for a VA-backed home loan. These leads typically include veterans, active-duty service members, and eligible spouses looking to purchase or refinance a home using VA mortgage benefits.

Types of VA Mortgage Leads:

VA Purchase Leads — First-time homebuyers or those looking to purchase a new home using VA benefits.

VA Refinance Leads — Homeowners looking to refinance their existing VA mortgage to lower interest rates or cash out equity.

VA Mortgage Live Transfers — Pre-qualified borrowers connected with lenders in real-time for immediate consultation and loan processing.

Benefits of VA Mortgage Live Transfers

1. Higher Conversion Rates

Unlike traditional lead generation, VA mortgage live transfers connect lenders directly with engaged and pre-qualified borrowers, increasing the likelihood of loan approval and faster closings.

2. Instant Engagement with Interested Borrowers

VA mortgage live transfers provide an immediate connection with veterans actively looking for loan assistance, eliminating the delays associated with cold calling or lead nurturing.

3. Reduced Lead Competition

Exclusive VA loan leads ensure that lenders aren’t competing with multiple companies for the same borrower, increasing success rates.

4. Streamlined Loan Processing

Since VA mortgage live transfers involve pre-screened borrowers, lenders can quickly assess qualifications and move forward with loan approvals.

Best Practices for Converting VA Loan Leads

1. Work with a Reputable VA Lead Provider

Choosing a trusted company ensures you receive exclusive, high-quality VA mortgage leads tailored to your business needs.

2. Train Your Loan Officers

Having a well-trained team ensures quick and efficient handling of VA mortgage live transfers, improving conversion rates.

3. Optimize Your Follow-Up Strategy

Even though VA mortgage live transfers are high-intent, some borrowers may need additional follow-ups. Using CRM automation and timely communication helps close more deals.

4. Offer Competitive VA Loan Programs

Providing attractive VA home loan and refinance options can help differentiate your services from competitors.

Why Choose The Live Lead for VA Mortgage Leads?

At The Live Lead, we specialize in delivering high-quality VA loan leads and VA mortgage live transfers that drive results. Our services include:

Exclusive, pre-screened VA mortgage leads with high intent.

Real-time live transfers connecting lenders with ready-to-convert borrowers.

Custom lead generation strategies tailored to your lending business.

Conclusion

For mortgage lenders looking to expand their VA loan business, VA mortgage leads and live transfers provide a direct and effective way to connect with veterans and active-duty service members. By leveraging these high-intent leads, lenders can increase conversion rates, streamline operations, and grow their client base.

Partner with The Live Lead today and gain access to top-tier VA loan leads and VA mortgage live transfers to enhance your business success. Contact us now to learn more about our industry-leading lead generation solutions.

0 notes

Text

Dialer Solutions for Money Lending & ACD Services in Manila

The financial industry, particularly money lending, requires efficient communication tools to manage customer interactions, loan approvals, and collections effectively. A Dialer for Money Lending streamlines these operations, ensuring better customer engagement and optimized workflow. In Manila, businesses are leveraging ACD (Automatic Call Distribution) Solutions to enhance their call center efficiency and customer service experience.

What is a Dialer for Money Lending?

A Dialer for Money Lending is an automated system designed to handle loan-related calls efficiently. It helps financial institutions and lending companies automate customer outreach, payment reminders, and collections while maintaining compliance with regulations.

Benefits of a Dialer for Money Lending

Automated Call Management:

Reduces the need for manual dialing, improving efficiency.

Increased Collections Efficiency:

Automated reminders and follow-ups help reduce overdue payments.

Enhanced Customer Experience:

Ensures timely communication with borrowers, improving trust and satisfaction.

Integration with Loan Management Systems:

Syncs with CRM and loan processing software for seamless operations.

Cost Savings:

Reduces operational costs by automating repetitive tasks.

ACD Solutions Services in Manila

ACD (Automatic Call Distribution) Solutions play a vital role in managing high call volumes and directing inquiries to the appropriate agents. These systems enhance customer service efficiency by ensuring that calls are routed to the most qualified representative.

Key Features of ACD Solutions:

Intelligent Call Routing: Ensures customers are directed to the right department.

Skill-Based Distribution: Assigns calls to agents based on expertise.

Real-Time Call Monitoring: Helps supervisors track and improve performance.

IVR (Interactive Voice Response) Integration: Enhances customer self-service options.

Top Dialer & ACD Solution Providers in Manila, Philippines

1. Lgorithm Solutions

Visit: https://lgorithmsolutions.com/ Lgorithm Solutions is a top provider of dialer and ACD solutions for money lending businesses. Their system integrates seamlessly with CRM platforms, automates call handling, and provides real-time analytics to enhance business operations.

2. CallHippo

CallHippo offers an advanced cloud-based dialer with ACD functionality. With features such as predictive dialing, call tracking, and CRM integration, it supports money lending businesses in managing high call volumes efficiently.

3. Five9

Five9 provides cloud-based ACD and dialer solutions, helping financial institutions automate their loan processing calls and improve customer engagement. It integrates with major CRM platforms like Salesforce and Zendesk.

4. RingCentral

RingCentral’s VoIP solutions include ACD and dialer capabilities, ensuring that loan inquiries and payment follow-ups are handled efficiently through automated workflows and intelligent call routing.

5. Aircall

Aircall offers an easy-to-use dialer with built-in ACD services, perfect for money lending firms looking to optimize customer communication and enhance collection efforts.

Choosing the Right Dialer & ACD Solution for Your Business

When selecting a Dialer for Money Lending or ACD Solution in Manila, consider the following:

Scalability: Can the solution grow with your business?

Compliance Features: Does it meet local financial regulations?

CRM Integration: Does it sync with your existing loan management system?

Automation Capabilities: Can it handle automated reminders and payment collections?

Cost-Effectiveness: Does it offer value for money?

Conclusion

For money lending businesses and call centers in Manila, a Dialer for Money Lending and ACD Solutions are essential for optimizing operations, enhancing customer service, and improving loan collections. Investing in a robust system can make a significant difference in efficiency and customer satisfaction.

If you are looking for a reliable solution, Lgorithm Solutions is a leading provider. Visit https://lgorithmsolutions.com/ to explore their innovative dialer and ACD services tailored to the finance industry.

0 notes

Text

Mortgage Custom Integrations: Boosting Efficiency and Enhancing the Borrower Experience

In the modern mortgage industry, efficiency, accuracy, and seamless service are essential for staying competitive. Mortgage lenders and brokers are increasingly turning to custom integrations to streamline their operations, improve data flow, and create a better borrower experience. Mortgage custom integrations allow various software systems—ranging from loan origination systems (LOS) to customer relationship management (CRM) tools and compliance platforms—to work together, reducing manual tasks, speeding up loan approvals, and minimizing errors.

By integrating mortgage software with third-party services, businesses can optimize their processes, maintain compliance, and ensure a smoother experience for both staff and customers. This article explores the importance of mortgage custom integrations, their key benefits, and how they can transform the way mortgage lenders operate.

What Are Mortgage Custom Integrations?

Mortgage custom integrations refer to the seamless connection between a mortgage company’s internal systems and third-party applications or services. These integrations allow various platforms—such as loan origination software, document management systems, customer relationship management tools, credit bureaus, and compliance services—to communicate and exchange data automatically.

Rather than relying on multiple disconnected systems, custom integrations create a unified ecosystem where data flows smoothly between platforms. This integration improves the efficiency of business processes, helps maintain data accuracy, and accelerates loan processing, all of which benefit both lenders and borrowers.

Why Are Mortgage Custom Integrations Important?

Enhanced Operational Efficiency Mortgage companies deal with a complex, multi-step process that includes loan origination, underwriting, document verification, and closing. Each of these steps typically involves separate systems, making coordination difficult and prone to errors. Custom integrations eliminate the need for manual data entry and help automate repetitive tasks. For example, when loan details are entered into the loan origination system (LOS), an integrated document management system can automatically collect and store related paperwork, saving time and reducing the chance of errors.

Improved Data Accuracy One of the biggest challenges in mortgage lending is maintaining accurate and up-to-date borrower information across various platforms. Custom integrations ensure that when data is entered into one system, it is automatically updated in all connected systems. For example, a CRM integration with a LOS ensures that borrower information is consistently reflected in both systems, helping loan officers track customer interactions while processing loans efficiently. This reduces discrepancies and ensures that the right information is always available.

Faster Loan Processing By integrating different software systems, the loan approval process becomes faster and more streamlined. For instance, integrating the LOS with credit bureaus allows lenders to automatically retrieve credit reports, speeding up the approval process. Similarly, document management integrations allow borrowers to upload necessary paperwork, which is instantly routed to the right department without delay. The faster these systems interact with each other, the quicker the loan can move through the pipeline, benefiting both the lender and the borrower.

Better Compliance Management Mortgage lenders must adhere to a variety of regulations at the federal, state, and local levels. Staying compliant is time-consuming and requires careful tracking of disclosures, deadlines, and document requirements. Custom integrations can help by automating compliance-related tasks. For example, integrating your LOS with a compliance tool can automatically generate the required disclosures and reports, ensuring they are accurate and submitted on time. This reduces the risk of non-compliance and fines.

Enhanced Customer Experience Today’s consumers expect fast, efficient, and seamless service, especially when it comes to managing complex processes like securing a mortgage. Custom integrations help create a smoother borrower experience by providing easy access to information and reducing wait times. Borrowers can track the status of their loan applications, submit documents, and receive real-time updates via customer portals. With seamless communication between systems, lenders can respond to customer needs more quickly, improving overall customer satisfaction.

Key Types of Mortgage Custom Integrations

Loan Origination System (LOS) Integrations Integrating your loan origination software with third-party services such as credit bureaus, appraisal management companies, and e-signature platforms can greatly improve the loan approval process. This allows for the automatic retrieval of credit reports, the scheduling of appraisals, and the collection of e-signatures—eliminating manual steps and speeding up processing.

CRM Integrations A custom integration between your customer relationship management (CRM) system and your loan origination software ensures that borrower information is consistently updated across platforms. This provides loan officers with a complete view of customer interactions, enabling them to follow up with potential clients, track communication history, and maintain better relationships throughout the loan process.

Document Management Integrations Mortgage lenders handle large volumes of sensitive documents, such as loan applications, financial statements, and disclosures. Integrating a document management system with your LOS allows these documents to be automatically uploaded, categorized, and routed through the system. This reduces the administrative burden and ensures that all necessary documents are in place for processing and compliance.

Compliance Integrations Maintaining compliance is one of the most critical aspects of mortgage lending. Custom integrations with compliance tools can automate the creation of required disclosures, track key dates (such as closing timelines), and generate necessary reports. By automating these processes, lenders can stay compliant with regulations and avoid costly penalties.

Credit Bureau and Underwriting Integrations Integrating credit bureaus and underwriting platforms with your LOS ensures that data is collected automatically and is accurately analyzed during the loan application process. This reduces errors and ensures faster decision-making, allowing loans to be processed more efficiently.

Benefits of Mortgage Custom Integrations

Improved Efficiency Custom integrations help automate many time-consuming tasks in the mortgage process, allowing your team to focus on more important aspects of the business. For example, rather than manually checking and re-entering borrower data, staff can rely on the integration to update information automatically. This saves time and reduces the risk of human error.

Cost Savings While implementing custom integrations requires an upfront investment, they often lead to long-term cost savings. By automating processes and reducing the need for manual interventions, mortgage companies can lower operational costs. Additionally, faster loan processing leads to higher loan volume and profitability.

Data Security Mortgage lenders deal with sensitive personal and financial information, making data security a top priority. Custom integrations can help by ensuring that borrower data is securely transmitted between systems and stored in compliance with data protection regulations. Integrated systems are also less prone to security breaches than multiple disconnected platforms.

Scalability As your mortgage business grows, so do your operational needs. Custom integrations allow your systems to scale by adding new tools or platforms as required. Whether you’re expanding into new markets or offering additional loan products, your integrations can evolve to meet the demands of your growing business.

Better Decision Making By integrating your systems, you can gain real-time insights into loan performance, customer behavior, and business trends. This data can be used to optimize workflows, improve sales strategies, and enhance customer service. Access to more comprehensive and up-to-date data allows you to make better, more informed decisions.

Considerations When Implementing Custom Integrations

Define Your Business Needs Before beginning the integration process, it’s important to identify your business requirements and the systems that need to be connected. Understand which processes can be automated and which features will provide the most value to your business.

Choose the Right Integration Partner Work with experienced integration partners who understand the mortgage industry and have a proven track record of successful integrations. The right partner will help ensure that your systems work seamlessly together and that the integration process is smooth.

Ensure Compliance and Security Mortgage companies must adhere to strict regulatory standards. Ensure that all integrations are designed with compliance and data security in mind. Choose solutions that are built with the latest security protocols to protect sensitive borrower data.

Conclusion

Mortgage custom integrations offer significant benefits, including enhanced operational efficiency, faster loan processing, improved data accuracy, and better customer experiences. By connecting your loan origination system, CRM, document management tools, compliance platforms, and other software, you can streamline your mortgage business and remain competitive in an increasingly digital marketplace. Although integrating systems may require an upfront investment, the long-term benefits of improved efficiency, reduced errors, and enhanced customer satisfaction make custom integrations a valuable strategy for any mortgage company.

#Encompass Consulting#Encompass Consultants#Mortgage Encompass Consulting#Mortgage Encompass Consultants#Mortgage Website Development#Encompass Development#Loan Origination Software Customization#Mortgage Centric Website#Mortgage Custom Applications Development#Mortgage Custom Applications#Mortgage Custom Integrations#Encompass Integrations#Encompass Software Support

0 notes

Text

Discover how Salesforce transforms the lending industry with streamlined workflows, Mortgage CRM software for lenders, and seamless customer experiences. Learn how Salesforce for lending solutions enhances efficiency, compliance, and borrower satisfaction.

#salesforce for lending Solutions#salesforce lending platform#Mortgage CRM Software for Lenders#seamless lending experiences#salesforce admin loan#salesforce in lending industry

0 notes

Text

#insurance crm#sales productivity tool#sales productivity#lending crm#banking crm#lead management software#mobile crm#toolyt#crm software

0 notes

Text

Leveraging Technology in Commercial Loan Brokering: Tools and Software!

Introduction: In the digital age, technology has become an indispensable tool for commercial loan brokers looking to streamline processes, enhance efficiency, and deliver superior service to clients. From customer relationship management (CRM) systems to loan origination platforms, there is a wide array of technology and software tools available to empower brokers in their day-to-day operations. By leveraging these tools effectively, brokers can gain a competitive edge, increase productivity, and unlock new opportunities for growth. Here's an exploration of the best technology and software tools available for commercial loan brokers.

Customer Relationship Management (CRM) Systems: CRM systems are essential for managing client relationships, tracking leads, and organizing communication. These platforms enable brokers to centralize client data, streamline workflows, and automate routine tasks such as email marketing and appointment scheduling. Popular CRM systems for commercial loan brokers include Salesforce, HubSpot, and Zoho CRM.

Loan Origination Platforms: Loan origination platforms streamline the loan application and approval process, from initial client intake to final funding. These platforms typically offer features such as online application forms, document management, credit scoring, and compliance tracking. By automating manual processes and reducing paperwork, loan origination platforms help brokers save time and improve efficiency. Examples of loan origination platforms include Blend, Lendio, and Encompass.

Financial Analysis Software: Financial analysis software enables brokers to perform in-depth analysis of clients' financial statements, cash flow projections, and creditworthiness. These tools offer features such as ratio analysis, trend analysis, and scenario modeling to help brokers assess risk and make informed lending decisions. Popular financial analysis software for commercial loan brokers includes RiskCalc, Sageworks, and Moody's Analytics.

Document Management Systems: Document management systems simplify the storage, organization, and retrieval of important documents and files related to loan transactions. These systems offer features such as cloud storage, version control, and document sharing to ensure that all parties involved in the transaction have access to the necessary information in a secure and efficient manner. Examples of document management systems include DocuWare, M-Files, and Laserfiche.

Communication and Collaboration Tools: Effective communication and collaboration are essential for successful brokerage. Communication and collaboration tools such as video conferencing, instant messaging, and project management platforms facilitate seamless communication and collaboration among brokers, clients, lenders, and other stakeholders. Examples of communication and collaboration tools include Zoom, Slack, Microsoft Teams, and Asana.

Conclusion: Technology has revolutionized the way commercial loan brokers operate, enabling them to streamline processes, enhance efficiency, and deliver superior service to clients. By leveraging CRM systems, loan origination platforms, financial analysis software, document management systems, and communication and collaboration tools, brokers can gain a competitive edge, increase productivity, and unlock new opportunities for growth. As technology continues to evolve, brokers must stay informed about the latest trends and innovations to remain competitive in the dynamic landscape of commercial loan brokering.

#CommercialLoans#LoanBrokering#FinTech#CRMTools#LoanOrigination#FinancialSoftware#DocumentManagement#BusinessEfficiency#TechForFinance#CollaborationTools#LoanBrokerTips#CommercialFinance#DigitalTransformation

1 note

·

View note

Text

What Can Our Innovative Solutions Do for Your Growth?

In today’s fast-paced and competitive market, businesses must adopt innovative strategies to remain relevant and ensure growth. At the heart of these strategies are tailored Solutions Services that address specific business challenges while enabling organizations to achieve their goals. By integrating the right mix of technology and expertise, such solutions have the potential to transform operations, streamline processes, and unlock new opportunities for growth.

Unlocking Efficiency Through Customized Business Software

Efficient operations are the backbone of any successful business. One of the most impactful ways to enhance efficiency is through the use of Business Software designed specifically to meet the unique needs of an organization. Unlike off-the-shelf solutions, customized business software provides:

Streamlined Processes Tailored software automates repetitive tasks and integrates disparate systems, ensuring that every part of the business works in harmony. For example, inventory management, customer relationship management (CRM), and sales tracking can all be consolidated into a single platform.

Data-Driven Insights Customized business software enables organizations to collect, analyze, and leverage data more effectively. Real-time analytics provide actionable insights, empowering businesses to make informed decisions that drive growth.

Scalability As a business grows, so do its operational needs. Custom software solutions are built to scale, accommodating increased workloads and new features without compromising performance.

Transforming Financial Operations with Fintech Software

Financial operations are a critical component of any business. The emergence of Fintech Software has revolutionized how businesses handle payments, manage accounts, and access funding. Fintech software offers several advantages:

Faster Transactions With fintech solutions like Xettle, businesses can process transactions instantly, whether they are managing payroll, receiving customer payments, or handling vendor invoices. This speed not only enhances cash flow but also improves overall efficiency.

Improved Security Fintech software often incorporates advanced encryption and fraud detection mechanisms, ensuring that financial data remains secure. For businesses handling sensitive information, this level of protection is invaluable.

Access to Financing Fintech platforms often provide innovative funding options such as peer-to-peer lending, Buy Now, Pay Later (BNPL), or automated underwriting. These features make it easier for businesses to access the capital they need for growth.

Enhanced Customer Experience With the rise of digital wallets and integrated payment systems, businesses can offer their customers a seamless and modern payment experience. Features such as one-click payments and mobile banking apps help build customer loyalty and trust.

How Solutions Services Drive Growth

Solutions Services encompass a wide range of offerings tailored to address various aspects of business operations. These services are designed not only to solve immediate challenges but also to lay a foundation for long-term success. Here’s how they contribute to growth:

Problem-Solving Expertise Solutions services bring a team of experts who analyze the specific pain points of a business. By identifying the root causes of inefficiencies, these professionals develop tailored strategies that address challenges effectively.

Technology Integration From implementing cutting-edge business software to deploying the latest fintech software, solutions services ensure that organizations leverage the right tools for their needs. This integration enhances productivity and minimizes downtime.

Cost Savings By optimizing processes and reducing manual labor, solutions services help businesses save money. Automated systems not only lower operational costs but also reduce the risk of human error, leading to significant long-term savings.

Scalability and Flexibility Solutions services are designed to adapt to a business’s changing needs. Whether it’s expanding into new markets, launching a new product line, or scaling operations, these services provide the flexibility needed to support growth.

Real-World Impact of Innovative Solutions

Consider the example of a mid-sized e-commerce business struggling with manual inventory tracking and delayed payment processing. By implementing tailored business software that integrated inventory management, payment processing, and analytics, the company experienced:

A 30% reduction in operational costs through process automation.

Faster payment cycles with the adoption of fintech software, improving cash flow and enabling the business to invest in marketing.

Enhanced customer satisfaction due to fewer stockouts and seamless checkout experiences.

The Importance of Staying Ahead

In a rapidly evolving market, staying ahead requires businesses to continuously innovate. Leveraging the latest technologies and professional expertise ensures that organizations remain competitive. Partnering with a solutions services provider offers:

Access to Industry Experts Gain insights from professionals with deep knowledge of current trends and best practices.

Cutting-Edge Technology Stay updated with the latest advancements in business software and fintech software to maintain a competitive edge.

Long-Term Strategy Develop a roadmap that aligns with your business goals and ensures sustainable growth.

Conclusion

Innovative solutions are more than just tools—they are enablers of transformation and growth. Whether it’s through Solutions Services that address complex challenges or the integration of advanced business software and fintech software, these innovations empower businesses to reach new heights. By investing in the right solutions and staying agile, companies can overcome obstacles, seize opportunities, and achieve sustained success in today’s dynamic market.

Let us help you unlock your full potential with our tailored solutions. Together, we can pave the way for your business's growth and success.

1 note

·

View note

Text

Digital Transformation for Small Businesses: How Udyam Registration Catalyzes Digital Growth

For those who think that digital transformation is not an option now, but rather a do-it-now affair in this fast-moving landscape, for micro, small, and medium enterprises or MSMEs, the adoption of digital tools will make them efficient, competitive, and scalable. Udyam Registration assumes significance in making it possible for these enterprises in India. The article attempts to examine the concept of digital transformation for small-scale businesses and how Udyam Registration works as an enabler.

What is Digital Transformation for Small Businesses?

Digital transformation, in general, means the application of technology to every dimension of the business processes towards making a better process with increased experience in customers, and even the creation of new opportunities:

• Cloud Computing; makes businesses scalable.

• E-commerce Platforms; mean reaching larger audiences

• It Saves Time and Cost

Advantages of Digital Transformation for Small Businesses

• Cost-effective: Automating mundane chores eradicates extra overheads.

• The reach to the market becomes possible by digital channels alone.

• Better Decision: Data analytics offers actionable input.

• Customer Engagement: One-to-one marketing creates brand loyalty.

Why Udyam Registration Matters to Small Businesses?

Udyam registration is the plan taken by the Government of India to make udyam registration for MSMEs less complicated and provide legal recognition to them. It provides an entry point by which small businesses can avail themselves of many schemes and benefits designed by the government to support digital transformation.

Critical Benefits of Udyam Registration:

1. Fiscal Incentives:

Udyam-registered businesses can use the available software tools, low-interest loans, and easy credit facilities to invest in the digital infrastructure

2. Market Access and Growth Opportunities

The GeM registration allows for accessing the Government e-marketplace (GeM) e-procurement platforms

3. Training and Skill Development

Once registered, MSME gets access to training to implement and use digital tools effectively

4. Tax Benefits:

Most of the small business companies have various tax rebates, and that saves funds for technological upgradation.

5. Global Competitiveness:

Digital transformation makes small business enterprises globally competitive and Udyam Registration provides most of the required certifications for International business.

How Udyam Registration Enhances Digital Growth?

Availability of Funds for Digital Tools:

MSMEs get subsidies along with priority lending schemes and can invest in CRM software, ERP systems, digital marketing platforms, etc.

Digitally Integrated Ecosystem:

Udyam registered businesses have access to GeM and other digital payment gateways; it is a fully integrated digital ecosystem.

Business Credibility:

Udyam Certificate facilitates credibility in business and easier cooperation, It makes the clients feel comfortable in forging online partnerships.

Ease of operations:

Digitized processes facilitated by government initiatives help companies in automating the management of the supply chain, tracking inventories, and relating with customers for smooth-running.

Government Compliance Guide for MSMEs Going Digital:

1. Updates on Policy Change of MSME:

Go upward every time to discover each update in policy so the MSME will be rightly up to date about such laws and regulations, for it not miss or fall behind.

2. Data Privacy:

Companies now digitally advance with strong Cybersecurity in place to protect confidential details of their company.

3. Only Registered Software SHALL Be Used:

Use the legitimate software software and, from hereon, get updated and steer clear of legal issues.

4. Training Programs:

Take advantage of digital literacy programs from the government to implement for your employees to unleash the full potential of digital tools.

Conclusion:

Digital transformation proves to be a game-changer for small businesses to flourish in a competitive market by Udyam Registration acts as catalysts that make resources and financial support easily available to them along with other opportunities for digital integration on which they should look and improve their function and scale up the business to seek sustainable growth for MSMEs.

Whether you are just starting or scaling up, your starting point for an empowered digital future is Udyam registration.

0 notes

Text

Mastering the Mindset: Raising Private Money with Jay Conner & Jack Hoss

Private Money Academy Conference:

Free Report:

***Guest Appearance

Credits to: https://www.youtube.com/@reimastermind

"Jay Conner Reveals Top Secret to Raising $2M in 90 Days!"

https://www.youtube.com/watch?v=98ClNRyF20g

Welcome to another insightful episode of the Raising Private Money podcast! In today's episode, Jay joins Jack Hoss on his REI Mastermind Network podcast where Jay shared invaluable advice on cultivating the right mindset for private money, highlighting the importance of educating and serving rather than chasing funds.

Together they explore why it's crucial to secure funding before needing it, how to confidently present your private lending program, and ways to ensure your lenders' investments are secured by real estate.

Jay also sheds light on practical strategies for new investors, like finding mentors and leveraging their experience, while avoiding common pitfalls and desperation. With expert tips on creative purchasing, the importance of CRM systems for business efficiency, and the significance of a positive mindset, this episode is packed with actionable insights for both seasoned and novice investors.

Plus, Jay shares how you can get your hands on his book, "Where to Get the Money Now," and gain access to an exclusive private money conference. Tune in as we unlock the secrets to successful real estate financing and set you on the path to multiple financial paydays!

Timestamps:

00:01 Raising Private Money Without Asking For IT

03:21 Marketing requires time or money for sourcing leads.

08:35 Mindset is key to attracting private lenders.

10:12 Launched private lending program for trusted referrals.

14:18 Waiting for investments to generate returns call.

19:44 Notes backed by real estate; mentorship advised.

26:04 Borrow $50K excess for renovations and balance.

26:58 The Lease option strategy offers multiple paydays.

30:33 "University of Success" by Og Mandino recommended.

33:43 Use software for effective lead communication and organization.

Have you read Jay’s new book: Where to Get The Money Now?

It is available FREE (all you pay is the shipping and handling) at

What is Private Money? Real Estate Investing with Jay Conner

Jay Conner is a proven real estate investment leader. He maximizes creative methods to buy and sell properties with profits averaging $67,000 per deal without using his own money or credit.

What is Real Estate Investing? Live Private Money Academy Conference

youtube

YouTube Channel

Apple Podcasts:

Facebook:

#youtube#flipping houses#private money#real estate#jay conner#raising private money#real estate investing#real estate investing for beginners#foreclosures#passive income

0 notes