#bad credit score car finance

Explore tagged Tumblr posts

Text

Secure Your Dream Car with Low Credit Car Loans in Surrey

Are you in Surrey and dreaming of owning a car, but worried about your credit score? Worry no more! Approved Auto Loans is here to make your dream a reality with our Low Credit Car Loans Surrey residents.

We understand that having a low credit score can make obtaining financing for a car seem like an uphill battle. However, at Approved Auto Loans, we believe that everyone deserves a chance to own their dream vehicle, regardless of their credit history. That's why we specialize in providing affordable car loans to individuals with less than perfect credit.

Our team of experienced finance experts works tirelessly to find the best loan options for our customers. Whether you're looking for a new or used car, we have a wide range of financing solutions to suit your needs and budget. Plus, our streamlined approval process means you can get behind the wheel of your new car in no time.

With Approved Auto Loans, you can enjoy:

Low Credit Car Loans: We understand that life can throw unexpected challenges your way, leading to a less than ideal credit score. But that shouldn't stand in the way of your dreams. Our low credit car loans make it possible for you to get the car you want, regardless of your credit history.

Flexible Payment Options: We offer flexible payment options to fit your budget. Whether you prefer weekly, bi-weekly, or monthly payments, we can customize a repayment plan that works for you.

Competitive Interest Rates: Our goal is to make car ownership affordable for everyone. That's why we offer competitive interest rates on all our loans, saving you money over the life of your loan.

Hassle-Free Application Process: Applying for a car loan shouldn't be a complicated process. With Approved Auto Loans, it's simple and hassle-free. Just fill out our online application form, and our team will take care of the rest.

Expert Advice: Not sure which car is right for you? Our team of experts is here to help. We'll work with you to understand your needs and budget, and then help you find the perfect vehicle.

Don't let a low credit score stand in the way of owning your dream car. Contact Approved Auto Loans today and take the first step towards car ownership with our Low Credit Car Loans Surrey, your dream car is within reach.

#Low credit car finance surrey#low credit car loans surrey#low credit cars surrey#low credit car dealers surrey#no credit bad credit car dealer surrey#no credit car loans surrey#no credit car financing surrey#bad credit car loans in surrey#bad credit car loan surrey#used car dealerships in surrey#approved auto loans Surrey#best car loan provider surrey bc#best auto loan provider surrey bc#car loan services surrey#instant auto loans surrey#instant auto loans surrey bc#fast auto loans surrey bc#auto loans Surrey#car loans Surrey#auto loans in surrey#car loans in surrey#auto loan pre approval canada#auto loan provider surrey#apply for car finance surrey#surrey car loan#approved auto loans#best auto loans surrey#bad credit score car finance#low credit car loans#bad credit score loan

0 notes

Text

We’ll explore the challenges faced by individuals with bad credit scores in Australia and how expert home loan mortgage brokers at VOXFIN can assist them in achieving their dream of homeownership.

#bad credit loans in australia#bad credit loans#bad credit score#australia#melbourne#bad credit car loans#bad credit#finance#mortgage broker#home loan broker#investing#personal loans

3 notes

·

View notes

Text

FIX YOUR CREDIT❗❗

CPN PACKAGE AVAILABLE ✔️

WE REMOVE👇🏾👇🏾

INQUIRIES 💻COLLECTIONS CHARGE OFFS.

JUDGMENTS MEDICAL BILLS💻LATE PAYMENTS.

REPOS STUDENT LOANS💻BANKRUPTCY

💻INCREASE YOUR CREDIT SCORE💻

#student loan#student loans#students#canada#finance#personal finance#financial#financial freedom#banking#cash#mortgage#money#bad credit#bad credit loans#credit#credit card#credit cards#credit karma#credit repair#credit score#cars

1 note

·

View note

Text

Jump Financing - Your Solution for Bad Credit Car Loans in Melbourne

Are you looking for a Bad Credit Car Loans in Melbourne? We specialize in providing solutions for individuals with less-than-perfect credit scores, helping them get behind the wheel of their dream car.

Understanding Bad Credit -

Having bad credit can feel like a roadblock when trying to obtain Financing. It often stems from missed payments, high debt levels, or past bankruptcies. However, at Jump Financing, everyone deserves a second chance. We look beyond credit scores and consider various factors to assess your eligibility for a car loan.

Benefits of Jump Financing -

With Jump Financing, you can enjoy several benefits:

Flexible Terms: We offer flexible repayment terms tailored to your financial situation.

Quick Approval: Our streamlined approval process ensures you get a decision fast, so you can start shopping for your car sooner.

Build Credit: By making timely payments on your car loan, you can gradually improve your credit score.

Wide Range of Options: We work with a network of lenders to provide you with multiple loan options, even with bad credit.

How to Qualify -

Qualifying for a bad credit car loan with Jump Financing is simple. You must:

A steady income: We must ensure you can afford the monthly payments.

Provide proof of identity: This includes a valid driver's license, passport, or other government-issued ID.

Meet the minimum age requirement: You must be 18 years old to apply.

The Application Process -

Our application process is designed to be hassle-free:

Online Application: Fill out our online application form from your home.

Documentation: Upload necessary documents such as proof of income and identification.

Approval: Once we receive your application, our team will review it promptly and notify you of the decision.

Car Selection: Upon approval, you can start shopping for your desired car within your approved budget.

Finding the Right Car -

When searching for a car, consider factors such as:

Budget: Stick to a budget that aligns with your loan approval amount.

Reliability: Look for a car with a good reputation for reliability to minimize future maintenance costs.

Fuel Efficiency: Opt for a fuel-efficient vehicle to save money on gas in the long run.

Safety Features: Prioritize safety features such as airbags, anti-lock brakes, and electronic stability control.

Tips for Successful Repayment -

To ensure a smooth repayment process, follow these tips:

Budget Wisely: Allocate a portion of your income towards your car loan payment each month.

Set up Automatic Payments: Automate your payments to avoid missing deadlines.

Communicate: Contact us immediately to discuss potential solutions if you encounter financial difficulties.

Monitor Your Credit: Regularly check your credit report to track your progress and identify any discrepancies.

Conclusion -

At Jump Financing, bad credit shouldn't stand in the way of owning a car. With our flexible financing options and personalized approach, we can help you get behind the wheel in no time. Apply today and experience the freedom of owning your vehicle, regardless of your credit history. Jump Financing - your trusted partner for bad credit car loans in Melbourne.

#Bad Credit Car Loans in Melbourne#loans#bad credit loans#bad credit score#jump financing#jumpfinancing

0 notes

Text

Short Term Cash Loans: Simple Access to Funds without a Debit Card

There may have been a time when you were burdened by immediate financial difficulties. The only option left in such a situation is to search for a short term cash loans because no family members are willing to lend a helping hand when the need is financial in nature. However, the loan application process is typically fairly uncomfortable and time-consuming because the bank or lender needs to confirm your reliability before granting you credit. However, the process has become quite simple and convenient with the introduction of short term loan. If you have a debit card in your name, you can quickly get cheap cash assistance.

It is simple to apply for short term cash loans if you need money right now. In order to help people, the finance sector is full of loan companies. There are no legal requirements for these loans, such as collateral requirements or credit check requirements. You can access funds ranging from £100 to £2500 with these financing options for your urgent financial requirements. Borrowers with arrears, defaults, insolvency, bankruptcy, and CCJs can also readily satisfy their needs, even with bad credit.

Payday loans have slightly higher interest rates than those of conventional lending programs. The application process for short term loans UK direct lender is quick, easy, and safe. You can apply with ease by completing a simple online form. There won't be any more difficult or stressful formalities in your vicinity. Applicants can apply for short term cash loans even if they are hesitant to do so because of their poor credit score and believe they won't be approved. Even people with bad credit might benefit from these loans. Lenders don't require anything in exchange for cash approval. You can get money by using your debit card.

WHO IS Eligible to Apply? You must meet some of the requirements listed below in order to be eligible for loans without debit cards: You ought to be a British citizen. You have to be at least 18 years old. Your bank account must to be open and functioning. You ought to have a steady source of money. You can apply online for short term loans UK if you've met all the requirements listed above. All you have to do is complete a short online form. After being approved, the loan money is transferred to your account within 24 hours.

Plans don't always work out in life. Some of life's inconveniencies are unavoidable and unavoidable, such as car repairs and boiler maintenance. In case you're facing financial difficulties, a short term loans online could be the solution to your problem. Applying for a same day loan is quick and simple, so you can get back on your feet quickly. An application for a short term loans direct lenders can be accepted in a matter of minutes, and you will receive the money the next day if you have an urgent bill to pay. They don't require a drawn-out application process, in contrast to bank loans that are more conventional. Payday loans and same-day loans are comparable in that they both have short terms and don't need you to repay the money you owe as quickly as payday loans UK.

https://classicquid.co.uk/

4 notes

·

View notes

Text

Short Term Loans UK: A Common Source of Funds for Borrowing

Even when your paycheck is a long way off, you still need to pay your bills on schedule. Be at ease! One common way to borrow money is through short term loans UK. All you need to do is fill out the online form and give the lender your information for verification. The lender will deposit the money directly into your bank account the same day or the following business day if all of the information is validated. Since the internet mode is a free media, it saves you both money and valuable time.

You are permitted to withdraw short term loans UK in the range of £100 and £1000. You can take care of your essential financial demands, which include paying for household expenses, credit card payments, and overdrafts in your bank account, medical bills, electricity bills, grocery store bills, and much more.

In order to easily receive a large sum of money through short term loans UK, you must meet all of the requirements given below.

• You must have a current UK resident document.

• You need to be receiving your salary into your account through direct deposit on a regular basis.

• The minimum age requirement is eighteen years old.

If you meet all the requirements listed above, you can still acquire short term loans UK direct lender without having to go through the credit check process, even if you have poor credit. Therefore, in order for fair credit holders to be eligible for financing through these loans, your bad credit factors—such as defaults, arrears, foreclosure, late or missed payments, CCJs, IVAs, or bankruptcy—must also be taken into consideration.

Can I Receive the Funds from My Short Term Loan the Same Day?

Often, the response is in the affirmative. Our short-term lending approach is designed to be as quick and entirely online as feasible. In the end, nevertheless, we are unable to ensure that you will receive your money the same day. This is due to the fact that Payday Quid, acting as short term loans direct lenders, forwards your loan request to one of our affiliated lenders. This implies that they have the last say and control over how quickly certain steps are completed.

We can assure you that we will use every effort to ensure that you receive a same-day outcome, and this frequently occurs. Yet even if it doesn't arrive that day, we promise it will arrive quickly!

Payday Quid is your short-term backup

We want you to know that whenever things get tough financially, we're always here to support you. We're here around-the-clock to assist you in obtaining the funds you require to bring stability back to your life and wallet, regardless of your credit score.

A same day loans UK could be the difference between life and death. It can help you save money by allowing you to pay off a bill before it balloons into something larger, like late fees or severe damage to your property or car.

Short Term Loans UK, Same Day Loans UK, Short Term Cash Loans

4 notes

·

View notes

Text

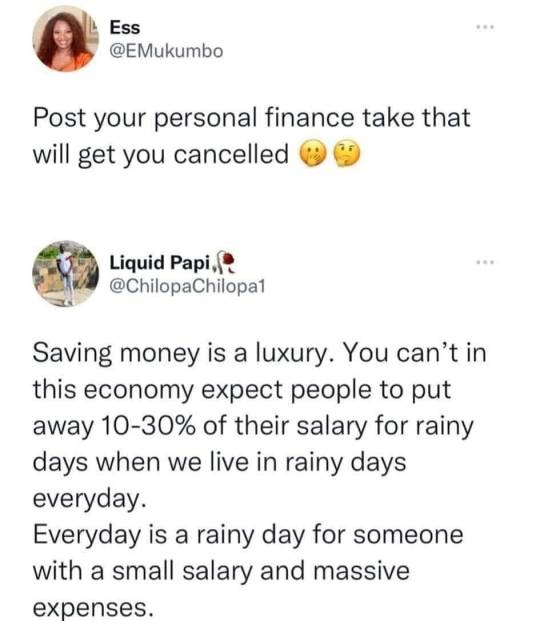

And another thing: Dave Ramsey strategies only work if you have disposable income but he gears it towards people who don't so it's like he's gaslighting poor people into thinking they're poor because of their own bad decisions when in fact they are victims of a systemic illness. On top of that, so many people are convinced to use debt (like credit cards, financing cars, keeping a high credit score) that even people who could be financially stable live paycheck to paycheck. Dave Ramsey says the only financed thing you should have is your house and everything else you should be able to buy outright, yet hardly anyone does this anyway, which again goes to guilting and gaslighting the poor into believing they're at fault for being poor.

31K notes

·

View notes

Text

How to Get a Reliable Vehicle at a Low Down Payment Dealership Near Me

Finding a dependable vehicle at an affordable price can be challenging, especially when looking for low down payment dealerships near me. Many buyers struggle with high upfront costs, making it difficult to drive off with a car that suits their needs. At EZ Auto USA, we make car ownership easier by offering flexible financing options and a wide selection of quality vehicles, ensuring that customers can find low down payment cars near me without stress.

What to Look for in a Low Down Payment Dealership

When searching for low down payment dealerships near me, it's important to choose one that prioritizes customer satisfaction and provides trustworthy vehicles. A good dealership should have a transparent buying process, offer flexible financing, and provide a variety of options to match different budgets. At EZ Auto USA, we take pride in offering a seamless car-buying experience, with financing solutions designed to fit every customer’s financial situation.

Benefits of Buying from EZ Auto USA

At EZ Auto USA, we understand that not everyone has a large sum of money saved for a car purchase. That’s why we specialize in low down payment cars near me, allowing customers to drive away in a reliable vehicle without breaking the bank. Our dealership offers:

A diverse inventory of high-quality used cars

Easy financing options tailored to different credit scores

A hassle-free buying process with honest pricing

A dedicated team ready to assist with your needs

Whether you have good credit, bad credit, or no credit history, we work with various lenders to find financing that suits your budget. Our goal is to make it possible for every customer to own a dependable vehicle, regardless of financial background.

How to Secure a Car with a Low Down Payment

Getting approved for low down payment cars near me is easier than many people think. At EZ Auto USA, we guide customers through every step of the process to ensure they can drive home in their chosen vehicle with minimal upfront costs. Here’s how to get started:

Check Your Budget: Determine how much you can afford for monthly payments and insurance costs.

Browse Our Inventory: Explore our selection of well-maintained vehicles that fit your needs.

Apply for Financing: Fill out our simple application form to see your financing options.

Visit Our Dealership: Once approved, visit EZ Auto USA to test drive and finalize your purchase.

Our team is committed to helping you find the right vehicle with flexible terms, making it easier than ever to own a car without a significant financial burden.

Drive Home in Your Next Car Today

Finding low down payment dealerships near me that offer reliable vehicles and fair financing can be overwhelming, but EZ Auto USA simplifies the process. With our extensive selection, flexible payment plans, and customer-first approach, you can secure a quality car with ease. Visit our dealership today and let us help you get behind the wheel of a car that fits your budget and lifestyle.

For more information about Lakeland Toyota Used Cars visit here EZ Auto USA

0 notes

Text

Struggling With Bad Credit? Here's How Australians Are Still Getting Car Loans

For many Australians, owning a car isn't just a convenience—it's an absolute necessity. Whether it's commuting to work, taking children to school, or simply maintaining independence, reliable transportation forms the backbone of daily life. But what happens when your credit history becomes an obstacle between you and the vehicle you desperately need?

If you're among the thousands of Australians struggling with bad credit car loans Brisbane, bad credit car loans Sydney, or other major cities, you're not alone. The good news? A less-than-perfect credit score doesn't automatically disqualify you from car ownership anymore. Today's lending landscape has evolved, creating pathways for Australians with financial challenges to still access the transportation they need.

In this comprehensive guide, we'll explore how Australians with poor credit histories are successfully securing vehicle financing through alternative lenders, specialized programs, and strategic approaches. We'll uncover the myths surrounding bad credit car finance, examine realistic options available in major metropolitan areas including bad credit car loans Melbourne and bad credit car loans Perth, and provide actionable steps to improve your approval chances.

Whether a past bankruptcy, late payments, or other financial missteps have impacted your credit score, this article will help navigate the path toward your next vehicle purchase. Let's dive into the world of bad credit car financing and discover how thousands of Australians are overcoming these challenges every day.

Understanding Bad Credit in the Australian Context

When we talk about bad credit car loans, it's important to first understand what "bad credit" actually means in Australia. Unlike some countries, Australia doesn't have a universal credit score system. Instead, several credit reporting agencies maintain records of your borrowing history, with scores typically ranging from 0 to 1,200 or 0 to 1,000 depending on the bureau.

Generally speaking, scores below 500 are considered poor or bad credit in Australia. This classification can result from various financial events:

What Causes Bad Credit in Australia?

Bad credit typically stems from a pattern of financial difficulties rather than a single missed payment. Common causes include:

Defaulted loans or credit cards

Multiple late payments on existing debts

Bankruptcy or Part 9 Debt Agreements

Court judgments related to unpaid debts

Multiple credit applications in a short timeframe

Having accounts sent to collections

Here's the thing: while traditional banks might view these factors as automatic disqualifiers, specialized lenders who offer bad credit car finance understand that past financial difficulties don't necessarily indicate future payment behavior.

How Long Do Credit Issues Affect You?

Most negative credit listings in Australia remain on your credit file for 5-7 years, with bankruptcies typically listed for 5 years. However, their impact on lending decisions diminishes over time, especially if you've demonstrated improved financial management.

What does this mean for you? Even with recent credit challenges, specialized lenders offering bad credit car loans Brisbane, bad credit car loans Sydney, and other locations may still consider your application—particularly if you can demonstrate stable income and a commitment to financial recovery.

The Traditional Lending Roadblocks

Before exploring solutions, it's worth understanding why conventional lenders often decline applicants with credit challenges. Traditional banks and mainstream financing companies typically operate with rigid lending criteria designed to minimize risk.

Why Banks Often Say "No"

Conventional lenders evaluate loan applications through standardized processes that heavily weight credit scores and history. These institutions often:

Rely heavily on automated approval systems with inflexible credit score thresholds

Require extensive documentation and perfect payment histories

Offer limited flexibility for unique circumstances or explanations

Apply stringent debt-to-income ratio requirements

Show little consideration for recent financial improvements if past issues exist

For Australians seeking bad credit car loans Melbourne or bad credit car loans Perth through traditional channels, these policies create significant barriers. Banks' one-size-fits-all approach frequently fails to account for individual circumstances or recent financial improvements.

However, as one specialized lender explained, "Traditional banks are designed for traditional borrowers. Our focus is creating pathways for those whose financial journey hasn't followed the conventional path."

Now let's dive into what options actually exist for those with credit challenges.

Specialized Lenders: The Bad Credit Solution

While mainstream banks might close their doors, specialized finance providers have created a niche specifically serving Australians with credit challenges. These lenders offer bad credit car finance solutions through more flexible assessment approaches.

How Specialized Lenders Differ

Bad credit auto finance specialists typically:

Conduct manual assessment of applications rather than relying solely on automated systems

Consider your current financial situation more heavily than past mistakes

Evaluate your overall ability to repay rather than focusing exclusively on credit score

Offer higher approval rates for bad credit car loans Brisbane and other locations

Provide specialized products designed specifically for credit-challenged borrowers

These lenders understand that life circumstances—such as medical emergencies, divorce, or temporary unemployment—can create credit issues that don't reflect a person's true financial responsibility.

What to Expect from Bad Credit Car Loans

It's important to maintain realistic expectations when seeking bad credit car loans Sydney or other locations. These specialized products typically come with:

Higher interest rates to offset the increased lending risk

Possible requirements for larger deposits

Shorter loan terms in some cases

More stringent income verification processes

Potential requirements for guarantors in severe credit situations

While these terms may be less favorable than those offered to prime borrowers, they provide viable pathways to vehicle ownership when traditional options aren't available.

Improving Your Approval Chances

While specialized lenders offer increased accessibility, there are several strategies to enhance your approval prospects for bad credit car loans Perth and other locations.

Demonstrate Stable Income

Perhaps the most critical factor in bad credit car finance approvals is demonstrating reliable, consistent income. Lenders need confidence in your ability to make regular repayments, regardless of past credit issues.

Provide at least 3-6 months of recent pay slips

Include bank statements showing regular income deposits

If self-employed, prepare tax returns and business financials

Document any additional income sources (investments, government benefits, etc.)

A stable employment history of at least six months with your current employer significantly strengthens your application for bad credit car loans Melbourne and other cities.

Prepare a Larger Deposit

One of the most effective ways to offset credit concerns is providing a substantial deposit on your vehicle purchase. This approach:

Reduces the lender's risk exposure

Demonstrates financial commitment and responsibility

Often leads to better interest rates even with credit issues

May enable approval for higher-quality vehicles

While difficult for many borrowers, saving even an additional 5-10% for your deposit can dramatically improve your approval chances for bad credit car loans Brisbane and similar products.

Address Existing Debts

Before applying, review your current debt obligations and consider:

Paying down high-interest debts where possible

Consolidating multiple small debts

Ensuring no new defaults or late payments appear

Resolving any disputes on your credit file

Many specialized lenders offering bad credit car loans Sydney view recent financial behavior more favorably than past issues, making current debt management crucial.

Consider a Guarantor

For those with particularly challenging credit histories, having a guarantor with good credit can significantly increase approval chances. A guarantor essentially provides additional security by agreeing to take responsibility for repayments if you cannot meet them.

This approach:

Substantially increases approval probability

May secure better interest rates

Could enable financing for higher-value vehicles

Provides a pathway for even severe credit situations

Vehicle Selection Strategies for Bad Credit Situations

When facing credit challenges, strategic vehicle selection can dramatically impact loan approval for bad credit car loans Perth and other locations.

Focus on Practical, High-Value Vehicles

Lenders offering bad credit car finance typically prefer:

Later model vehicles (less than 10 years old)

Cars with good fuel economy and reliability records

Mainstream models with proven resale value

Vehicles with lower mileage

Popular makes and models that retain value

These vehicles represent lower risk to lenders as they maintain value throughout the loan term and have predictable maintenance costs.

Consider Dealer-Arranged Financing

Dealerships specializing in bad credit car loans Melbourne often maintain relationships with multiple lenders, including those catering to credit-challenged customers. These relationships can sometimes facilitate approvals that might not be possible when applying directly.

Many dealerships have:

Pre-arranged financing options for credit-challenged customers

Relationships with specialized lenders across Australia

Experience structuring deals that satisfy both borrower and lender requirements

Access to inventory specifically selected for bad credit financing

Be Flexible on Vehicle Selection

Flexibility regarding your vehicle choice significantly improves approval chances for bad credit car loans Brisbane. Being open to:

Different makes and models than originally planned

Slightly older vehicles than preferred

Lower trim levels or fewer luxury features

Practical rather than prestige vehicles

This flexibility gives lenders more options to structure an approvable loan package that balances your needs with their risk management requirements.

The Car Subscription Alternative

Beyond traditional financing, innovative alternatives like car subscription services are providing Australians with credit challenges new pathways to vehicle access.

How Car Subscriptions Work

Unlike conventional bad credit car loans Sydney, car subscription services operate on a different model:

All-inclusive weekly or monthly payments

No long-term financing commitment

Often includes registration, insurance, and maintenance

Minimal credit requirements compared to traditional loans

Flexibility to change vehicles or exit the arrangement

For those unable to secure bad credit car finance through conventional means, subscription services offer a practical alternative that bypasses many traditional lending requirements.

Benefits for Credit-Challenged Customers

Car subscription services provide several advantages:

Access to vehicles without stringent credit checks

Building positive payment history that could improve future borrowing prospects

Avoiding long-term debt commitments

Test-driving various vehicle types before committing to purchase

Maintaining mobility while rebuilding credit

For many Australians, these services provide an excellent stepping stone between credit challenges and eventual vehicle ownership.

Regional Solutions: Finding Local Assistance

The availability and terms of bad credit car loans can vary significantly between Australian cities and regions. Understanding local market conditions can improve your chances of success.

Major City Focus

Bad Credit Car Loans Brisbane

Brisbane's competitive lending market has created multiple options for credit-challenged borrowers. The city's numerous specialized dealerships and finance brokers create more opportunities for approval than in some smaller markets.

Bad Credit Car Loans Sydney

As Australia's largest city, Sydney offers the widest range of specialized lenders and bad credit car finance options. The competitive environment often results in more flexible lending criteria and specialized programs for various credit situations.

Bad Credit Car Loans Melbourne

Melbourne's diverse lending landscape includes numerous brokers specifically focusing on credit-challenged borrowers. These specialists have developed relationships with lenders willing to consider applications that mainstream banks would automatically decline.

Bad Credit Car Loans Perth

Perth's somewhat isolated market has developed unique lending solutions, with several local finance companies specifically designed to serve Western Australians with credit challenges. These lenders often have better understanding of local economic conditions affecting borrowers.

Working with Regional Specialists

Regardless of location, seeking assistance from specialists familiar with your region's lending landscape significantly improves approval chances. These professionals understand:

Which lenders are currently approving credit-challenged applications

Local economic factors affecting lending decisions

Regional variations in vehicle values and resale prospects

Location-specific programs or incentives that might assist

Rebuilding Credit Through Car Loans

Successfully managing a vehicle loan can actually help rebuild your credit profile, creating a positive cycle that improves future borrowing options.

How Car Loans Improve Credit Scores

When managed responsibly, bad credit car finance can:

Create a pattern of positive payment history

Demonstrate financial responsibility

Add a secured loan to your credit mix

Build lender relationships for future borrowing

Potentially qualify you for refinancing at better rates after 12-18 months

Many Australians have used vehicle financing as the first step in their credit recovery journey, gradually improving their options through demonstrated reliability.

"My bad credit car loan became my credit rebuilding strategy," explains Sydney resident Michael Thompson. "Eighteen months of perfect payments allowed me to refinance at half my original interest rate."

Conclusion: Moving Forward Despite Credit Challenges

While bad credit undeniably complicates vehicle financing, thousands of Australians successfully navigate these challenges every day. The key takeaway? Multiple pathways exist—from specialized lenders offering bad credit car loans Brisbane, bad credit car loans Sydney, bad credit car loans Melbourne, and bad credit car loans Perth, to innovative alternatives like car subscription services.

Success requires realistic expectations, thorough preparation, and often assistance from professionals who specialize in credit-challenged situations. By demonstrating current financial stability, selecting appropriate vehicles, and working with the right lending partners, Australians with credit challenges can access the transportation they need.

Remember that credit situations are rarely permanent. Today's bad credit car finance solution can become the foundation for rebuilding your credit profile and accessing better options in the future. The journey toward financial recovery often begins with practical steps like successfully managing a vehicle loan.

Whether you're in Brisbane, Sydney, Melbourne, Perth, or anywhere in Australia, solutions exist for your transportation needs—regardless of your credit history. The path may look different than originally expected, but the destination remains achievable.

It's time to turn insight into action—don't wait. We at Freedom Cars have helped thousands of Australians navigate bad credit car finance successfully. Contact Us Now.

#bad credit car loans brisbane#bad credit car loans sydney#bad credit car loans melbourne#bad credit car loans perth#bad credit car finance#bad credit car loans

0 notes

Text

Overcoming Bad Credit: Your Guide to Low Credit Car Finance in Surrey

In today's world, having a less-than-perfect credit score shouldn't hinder your dreams of owning a car. Whether you've faced financial challenges in the past or are just starting to build your credit, there are options available to help you secure the car you need. In this guide, we'll explore the avenues of low credit car finance in Surrey, offering insights into bad credit score loans and how you can get approved for auto loans despite your credit history.

Understanding Bad Credit Score Loans

First things first, let's address the elephant in the room: bad credit scores. A bad credit score can make traditional lenders wary of extending loans to you, but that doesn't mean you're out of options. Bad credit score loans cater specifically to individuals with less-than-perfect credit histories. These loans typically come with higher interest rates compared to conventional loans, but they provide an opportunity for those with bad credit to access the financing they need.

Low Credit Car Finance in Surrey

Living in Surrey, you're likely aware of the bustling urban life and the necessity of having a reliable mode of transportation. Fortunately, there are specialized lenders and dealerships in Surrey that offer low credit car finance options. These lenders understand the local market dynamics and are willing to work with individuals with varying credit profiles.

When exploring low credit car finance Surrey, it's essential to research different lenders and dealerships to find the one that best suits your needs. Look for lenders who specialize in bad credit auto loans and have a track record of helping individuals with similar credit situations.

Key Factors to Consider

Before diving into low credit car loans Surrey, it's crucial to assess your financial situation realistically. Determine how much you can afford to spend on a car each month, taking into account not only the loan payments but also insurance, maintenance, and other associated costs.

Additionally, consider saving up for a down payment. While some lenders may offer zero-down financing options, making a down payment can lower your monthly payments and improve your chances of approval, especially with bad credit.

The Application Process

Once you've identified potential lenders or dealerships offering low credit car finance in Surrey, it's time to start the application process. Be prepared to provide documentation that demonstrates your income, employment history, and residency. Lenders may also request information about your existing debts and expenses to assess your ability to repay the loan.

During the application process, be honest and transparent about your financial situation. Lying or withholding information can backfire and may result in denial or unfavorable loan terms.

Building Credit Responsibly

While low credit car finance in Surrey can help you secure a vehicle despite your bad credit score, it's essential to view it as a stepping stone toward improving your creditworthiness. Make timely payments on your auto loan to gradually rebuild your credit over time. As your credit score improves, you may qualify for better loan terms and lower interest rates in the future. Navigating the world of low credit car finance in Surrey may seem daunting, but with the right knowledge and preparation, it's entirely feasible to secure an auto loan even with a bad credit score. By understanding your options, assessing your financial situation, and working with reputable lenders, you can drive away with the car you need while taking steps toward a brighter financial future.

Read more: Get Approved Auto Loans: Overcoming Bad Credit with Low Credit Car Loans

#Low credit car finance surrey#low credit car loans surrey#low credit cars surrey#low credit car dealers surrey#no credit bad credit car dealer surrey#no credit car loans surrey#no credit car financing surrey#bad credit car loans in surrey#bad credit car loan surrey#used car dealerships in surrey#approved auto loans Surrey#best car loan provider surrey bc#best auto loan provider surrey bc#car loan services surrey#instant auto loans surrey#instant auto loans surrey bc#fast auto loans surrey bc#auto loans Surrey#car loans Surrey#auto loans in surrey#car loans in surrey#auto loan pre approval canada#auto loan provider surrey#apply for car finance surrey#surrey car loan#approved auto loans#best auto loans surrey#bad credit score car finance#low credit car loans#bad credit score loan

0 notes

Text

How to Get a Car Title Loan in Canada: A Step-by-Step Guide

If you're in need of quick cash and own a vehicle, a car title loan can be a viable solution. This guide will walk you through the process, requirements, and options available, especially in cities like Vancouver and Calgary.

What Is a Car Title Loan?

A car title loan allows you to borrow money by using your vehicle's title as collateral. Unlike traditional loans, these are often accessible to individuals with bad credit or no credit history. You retain possession of your car while repaying the loan.

Why Consider a Car Title Loan?

Quick Access to Funds: Approval and funding can occur within 24 hours.

No Credit Check: Your vehicle's value determines eligibility, not your credit score.

Continued Vehicle Use: You keep driving your car during the loan term.

Steps to Obtain a Car Title Loan

Apply Online or In-Person: Provide details about your vehicle, such as make, model, year, and mileage.

Submit Required Documents:

Lien-free vehicle title

Government-issued ID

Proof of residence

Vehicle registration and insurance

Spare set of car keys

Vehicle Evaluation: The lender assesses your car's value to determine the loan amount.

Approval and Funding: Upon approval, you receive the funds, often on the same day.

For a detailed overview, visit Fast Canada Cash.

Car Title Loans in Vancouver

Residents of Vancouver have several options for car title loans. Lenders typically allow you to borrow up to 50% of your vehicle's value. For instance, Canadian Cash Solutions offers loans to those with bad credit or no credit history.

Car Title Loans in Calgary

In Calgary, services like Snap Car Cash provide loans up to $50,000 with minimum interest rates. They offer flexible repayment terms and no penalties for early repayment.

Finding a Car Loan Near You

If you're searching for a "car loan near me," numerous lenders across Canada offer car title loans. Ensure you research and choose a reputable provider that suits your needs.

Final Thoughts

Car title loans offer a fast and flexible way to access cash when you need it most. Whether you're facing unexpected expenses or planning for a short-term financial goal, using your vehicle as collateral can be a smart solution — especially when traditional lending isn’t an option.

With easy approval, minimal paperwork, and same-day funding, car title loans are helping many Canadians in cities like Vancouver and Calgary take control of their finances without giving up their ride. As long as you understand the terms and choose a trusted lender, this can be a reliable and stress-free way to get the cash you need.

0 notes

Text

Free Car Buying Service Reviews

You ALWAYS hear us WARNING you about unethical dealership behavior, but through these real reviews written by car buyers, you’ll get to hear thoughts of customers who encountered exactly what we’ve warned you about. The good news is that dealers we feature might even start fearing the spotlight, which could actually pressure some of them to clean up their act. There’s no end in sight to these shows, because there’s no shortage of bad dealerships out there! We know that people love when we expose shady business practices, and then start naming names! The dealer we have up first is definitely worthy of Worst Dealer status. They are located in New Jersey, and are known as Freehold Mitsubishi of New Jersey. After we go through each review, we will present the potential violations involved. One review, which was so long and outrageous, it had a total of 5 law violations in it.

1. False Advertising & Bait-and-Switch Pricing Issue: The advertised price on Cargurus for the car Scot purchased was $10,700 with free shipping, but the contract listed $12,000 with a $1,300 delivery fee, and the dealer claimed they weren’t responsible for the price listed on Cargurus.

Potential Legal Violations:

Bait-and-Switch Advertising (FTC Act & State Consumer Protection Laws) – Advertising one price and switching it upon contract violates deceptive advertising laws.

False Advertising (Lanham Act & State False Advertising Laws) – If free shipping was advertised but not honored, this could be considered false advertising.

Failure to Honor Advertised Pricing (Unfair & Deceptive Acts and Practices - UDAP Laws) – Many states require dealerships to honor advertised prices or clearly disclose any changes.

2. Forced GAP Insurance & Loan Approval Misrepresentation Issue: The dealership added $2,000 in GAP insurance without consent, falsely claimed it was required by the lender, but later removed it when challenged.

Potential Legal Violations:

Tying Arrangements & Unfair Lending Practices (Truth in Lending Act - TILA & CFPB Regulations) – Forcing GAP insurance as a loan requirement is illegal unless explicitly required by the lender, which it was not.

Unfair & Deceptive Trade Practices (State Consumer Protection Laws) – Misrepresenting a product as mandatory when it is optional is illegal in many states.

Unauthorized Add-Ons & Fraudulent Business Practices (FTC & CFPB Regulations) – Adding unauthorized charges without customer approval can be considered fraud.

3. Financing Manipulation & Credit Score Exploitation Issue: The dealership pushed an alternative lender under the pretense of a “better rate” and used the lower-credit-score spouse as the primary borrower, possibly to secure a higher interest rate for dealership profit.

Potential Legal Violations:

Unfair & Deceptive Lending Practices (CFPB & Equal Credit Opportunity Act - ECOA Violations) – If the dealership knowingly manipulated borrower arrangements to increase financing costs, this could violate fair lending laws.

Predatory Lending (TILA & UDAP Laws) – If the dealership intentionally targeted a borrower with a lower score for profit, this could be predatory financing.

Misrepresentation in Financing Terms (FTC Auto Financing Regulations) – If a dealership misleads customers about loan terms, rates, or better deals, it may be considered fraud.

Hiding Damage in Online Photos

Potential Violations:

Fraudulent Misrepresentation (Common Law Fraud) – If the dealership knowingly altered photos to hide damage, this could be considered fraud under state consumer protection laws.

Unfair and Deceptive Acts and Practices (UDAP) – Federal Trade Commission Act (15 U.S.C. § SECTION 45) – The FTC prohibits false advertising and misleading business practices. A dealership presenting doctored images falls under deceptive trade practices.

State Consumer Protection Laws (Deceptive Trade Practices Acts - DTPA) – Most states have DTPA laws that prohibit misrepresentation of a product’s condition.

Failure to Disclose Vehicle Defects (State-Specific Disclosure Laws) – Many states require disclosure of prior damage or significant defects.

Takeaways: Making False Claims About Vehicle Availability

Potential Violations:

False Advertising (Bait-and-Switch Laws) – A repeat pattern of telling customers a vehicle is available, then redirecting them elsewhere, is a violation of consumer protection laws.

Failure to Provide Transparent Pricing & Inventory (State Dealer Licensing Rules) – Some states require honest advertising of inventory and pricing.

Fraudulent Inducement – If a customer drives hours based on false availability claims, that could be considered intentional deception.

Takeaways: Broken Promises After the Sale

Potential Violations:

Breach of Contract – If the dealership made verbal or written guarantees about loaner vehicles or other services but failed to follow through, this could be a breach of contract.

Fraudulent Business Practices (State UDAP Laws) – Failing to honor promises could be considered deceptive conduct.

Negligent or Intentional Misrepresentation – If sales staff lied to close a deal, this may be actionable under fraud statutes.

0 notes

Text

Short-Term Cash Loans: An Excellent Aid When Things Get Tough

Short term cash loans direct lenders are an absolute must if you need money fast—say, within 24 hours—because your wallet is empty and you need to access it privately. You can obtain appropriate financing using short term cash loans without sacrificing any protection. The good news is that you can receive the money at your convenience without having to leave your house, as the financing is delivered directly to you.

Some lenders offer short term cash loans to clients with current, valid checking accounts as soon as 24 hours after the borrower submits the loan application. Online loans are preferable because all you have to do is fill out a brief application form on the lender's website and submit it. If your information is verified, the funds are transferred to your account promptly. You can skip having to fill out any onerous procedures by using this online technique.

In a matter of two or four weeks, you can receive a reimbursement in the range of £100 to £1000. When your next paycheck arrives, you will know when to make your repayment. Since the amount you borrow is secured against your paycheck, you must pay back the loan by the deadline. You don't give a damn about your poor credit history if you take out short term loans UK direct lender.

You have complete freedom to use the funds for any short term financial goal without fear of hindrance. Therefore, you don't lose out on applying for short term loans UK direct lender when you have some extra demands, including buying home appliances, paying grocery store bills, paying for your child's tuition or school, fixing your car, and many more.

Does taking out a Short Term Loans improve my credit score?

Whether short term loans direct lenders are beneficial or bad for your credit rating is a topic that is frequently debated. On the surface, obtaining a loan and properly managing it—that is, making all of the repayments on time—should improve your credit score because it shows that you can handle your money and borrow responsibly.

However, a lot of other lenders (apart from short-term loans lenders) view the usage of short-term loans as an indication that you are not good with money and that you might be too risky to lend to.

We are aware that, even if a borrower has utilized payday loan or short-term loans in the past, mortgage lenders are especially wary of them. Before applying, you should consider the dangers associated with obtaining short term loans UK. If you plan to apply for a mortgage soon, you might want to consider your options first.

Applications for short term loans UK direct lender are typically sent directly to the lender; however you can expedite the process by utilizing our price comparison.

You may go straight to the lender's website and continue doing business with them after we compare all of the top lenders in the UK and determine which one is the cheapest for the loan you're searching for.

4 notes

·

View notes

Text

Online Decision for Short Term Loans UK Direct Lenders

You can apply for short term loans UK direct lenders for free by filling out a brief application form and sending it to the financier; once the financier receives it, they will quickly approve your loan and the funds will be credited to your account on the same day of application.

Borrowers of all stripes can overcome their financial issues with short term loans UK. Even if you fall under one of the restrictions, such as being a tenant, a non-homeowner, or a poor debtor, you will still be able to acquire the financing you want because these financial instruments have no collateral tied to them. On the other hand, there is no collateral associated with the loan stated; you can obtain the loan amount solely based on your ability to repay the loan, your present financial need, and the loan's intended use. Once the financier is happy that all of same day loans UK are in order, he will provide you an amount between £100 and £2,500 with a 31-day repayment period.

Are you looking for a short term loans direct lenders that will provide you with the best financial security during a financial emergency? Need a quick loan? You've come to the proper location in this situation because payday loans for welfare recipients are primarily designed to pay off excess bills promptly. By using this to your full advantage, you may complete all of your tasks without difficulty or encountering any bank issues. You have an opportunity to start a new life and escape your financial struggles thanks to these products. Once you have the necessary amount of money, you can immediately spend it on a variety of needs, including your child's school expenditures, medical or hospital bills, household expenses, taxes, monthly rent, car maintenance costs, and any unpaid bank overdrafts.

Why obtain a short-term loan?

There are many reasons for taking out a short term loans UK direct lender. When things don't go according to plan in life and you suddenly need money, short term loans might be useful. We advise against using short-term loans for gaming or nights out. But if you need money to pay a payment or buy something you need, they can be helpful. Just keep in mind that you will pay less interest if you pay off the loan as quickly as you can.

This specific loan amount has been granted with a variable repayment period. Those who are capable of making loan repayments on time will unquestionably see an increase in their credit score. You do not need to worry right now when it comes to credit verification. Customers can simply profit from same day loans UK in a hassle-free manner even if they are dealing with the difficulties of bad credit, such as bankruptcy, bank arrears, late payments, and missed payments.

Same day loans UK typically range from £100 to £2,000 and are repaid over a one- to three-year period. Because you are paying back same day loans direct lenders more quickly than you would a personal loan, the APR is typically high. To learn more, please go here.

4 notes

·

View notes

Text

woah man new car who this

bought a car for the very first time late last month!! learned some stuff i didn't find out in my researching. i financed a fresh new car! unfortunately, what's not often mentioned, even if a new car gets a lower APR, if you're a first time buyer your APR is a lot higher. so that was a killer 😮💨

then i learned my FICO scores are way lower than the silly vantage scores from credit karma showing me. so there was less confidence to make the apr lower

looked into why finally after hunting down a FICO score from one bureau.... and it was exactly the reason why i thought it was while in the finance office. one old card i'm still paying off is fucking up my score!!! bc it was done as a charge off!!! so even though i've been slowly paying it off, that's actually bad!!! bc the account sits there, every month, claiming i have a late/non payment..... even though i pay their internal collections every month!!! i hate credit card companies man....

with some extra help, i'm putting a big payment down to get them GONE and hopefully they'll pull off my history quickly since I paid in full.... i'll be done paying them off in July at least so it gives time

I plan to refinance my car to help with the current payments i gotta make but i won't be looking into that until my score improves and generally gonna wait until like Septemberish

At least my insurance isn't too bad! still on my mom's plan but i'm just gonna stay on it since i get a better plan for much cheaper through her 😂 and i just pay her back

in the end it's so nice i've got a fresh new car, a functioning ac, so much modern tech without it being overwhelming bc the car is still pretty mechanical, and TINTED WINDOWSSSSS

they were able to tint the windows while i was at the dealership (they said they do that but i'd probably needed to come back, sales guy was able to get them to tint them while we were talking to the insurance guys) and ever since then it's been a whole new world (old car wasn't tinted at all the whole near 12 years i had it)

the payment situation isn't as overwhelming after the fact at least! not as scary? intimidating? mainly because i can make a plan of action to make it easier. and also the fact that im building better spending habits since the start of the year its helped to build more financial confidence in myself hehehe

0 notes

Text

Discover Effective Solutions for Bad Credit Repair Services

Bad credit can seriously affect a person's cases of getting credit cards, loans, or actual a house. Although it could seem like an impossible task, those trying to raise their credit scores can find answers. Designed to help individuals restore financial stability, bad credit repair companies provide tools and techniques and help repair credit records. The value of bad credit repairs will be discussed in this post, together with how expert services might enable people to overcome bad credit.

The Importance of Credit Repair

Achieving financial freedom requires credit restoration in great part. A low credit score could make it more difficult to qualify for mortgages or auto finance and result in higher loan interest rates. Bad credit repair services seek to assist people in resolving negative marks on their credit records—that is, late payments, collections, and bankruptcies. Improving financial possibilities and getting good terms on the next loans depend on rebuilding one's credit. Analysing credit records, contesting mistakes, and developing a strategy to pay off outstanding debt usually form part of the process.

What Are Bad Credit Repairs?

Bad credit repairs deal with and correct unfavourable information on a credit report. Expert services help you find disparities, negotiate with creditors, and develop a payback plan to settle outstanding debt. These businesses also provide guidance on good credit management, therefore helping people to rebuild their credit score. Although they are not a quick remedy, bad credit repair companies provide a methodical technique to raise credit scores over time, which might finally result in better financial possibilities.

Choosing the Right Repair Service

Not all credit repair companies are made equally; hence, choosing the correct one can be rather important on the credit repair road. While some poor credit repair companies guarantee fast outcomes, it is crucial to assess the validity of their assertions. Reputable organisations work with clients over time and carefully, step-by-step, challenge credit report mistakes. Before committing to a plan, one should check consumer evaluations and confirm the validity of any service.

Common Credit Report Issues

Dealing with bad credit repairs requires knowledge of the most often occurring problems that could compromise a credit score. These can comprise late payments, debt collection records, and perhaps credit report mistakes. Bad credit repair companies assist people by spotting these problems and contesting inaccurate credit bureau information. These businesses can also help customers negotiate debt settlements with creditors so that, once debts are paid off, negative marks are eliminated.

The Benefits of Credit Repair Services

For those who find their credit scores problematic, using bad credit restoration services has several advantages. These services can assist customers in accessing more financial possibilities, including reduced loan interest rates and better credit card offers, so beyond simple credit score improvement. Through addressing the elements influencing credit, these programmes open the path for people to recover financial wellness. Effective credit restoration can lead to more financial freedom so enabling people to make significant life purchases including cars or houses.

Long-Term Financial Strategies

Although short-term credit score improvement is achieved by bad credit repairs, long-term financial plans are just as crucial for consistent success. This includes keeping debt under control, paying on time, and maintaining a low credit-use ratio. Good credit repair companies can help customers create sensible credit practices that support long-term credit health. Those who practice continuous financial discipline can keep a good credit score and avoid the mistakes that first resulted in poor credit.

Conclusion

All things considered, negative credit restoration companies provide great assistance to people trying to raise their financial situation. Those who use these services and adhere to sensible financial behaviour can help restore their credit and improve their financial prospects. See dbcreditrepairs.com, a reputable source for complete credit repair solutions and professional help in bad credit repairs.

0 notes