#auto loan pre approval canada

Explore tagged Tumblr posts

Text

Find Affordable Low Credit Cars in Surrey - Explore Your Options Today

Don't let your low credit cars surrey score hold you back from owning a car in Surrey. Our selection of low credit cars offers you a range of options to choose from, all at affordable prices. Start exploring today and find the perfect fit for your needs and budget.

Link :- https://www.approvedautoloans.ca/approved-auto-loan/

0 notes

Text

Automotive Finance Market: Key Insights, Drivers, and Competitive Landscape

The global automotive finance market size is expected to reach USD 451.71 billion by 2030, registering a CAGR of 7.3% from 2023 to 2030, according to a new report by Grand View Research, Inc. Growing global demand for autonomous cars is expected to drive the market growth. Increasing government regulations on rising road safety are creating the need for autonomous cars with highly advanced technologies worldwide.

The investment made in the automotive finance industry is also creating new opportunities for market growth. For instance, in January 2021, MotoRefi, an automotive refinancing company, announced that it raised USD 10.0 million in a round that Moderna Ventures led. The company uses this funding to hire more employees and expand its offerings.

Various auto car manufacturers are entering into a partnership with automotive finance providers to enhance their customer experience. For instance, in March 2022, CIG Motors, a GAC brand distributor, announced its collaboration with Polaris Bank Limited. By means of this partnership, the former company aims to make vehicle ownership and acquisition easy for Nigerians through the Easy Buy scheme.

COVID-19 had a negative impact on the market growth in 2021. However, the global auto manufacturers, lenders, and dealers have got adjusted to the current COVID-19 situation. For instance, the automotive manufacturers incentivized their new car sales to grow their sales amid COVID-19. These efforts taken by the automakers are expected to improve the demand for automotive finance during the forecast period.

Automotive Finance Market Report Highlights

The banks segment is expected to dominate the market growth during the forecast period as banks offer secure financing to their customers. Banks also offer customers the facility to apply for pre-approval. This facility helps customers in comparing estimated loan offers

The direct segment is expected to dominate the market growth during the forecast period. Numerous customers across the globe prefer direct auto loans as they can easily access and get loans from the credit unions, banks, and other loan lending companies

The leasing segment is expected to register the highest CAGR during the forecast period. Customers are focusing on adopting the leasing model as it is a more flexible model in comparison to others for new, shared, and used vehicles that could comprise services such as insurance

The passenger segment dominated the market in 2022 and is expected to show similar trends during the forecast period. The number of passenger vehicles including pickup trucks and others on the road, continues to rise across the globe, thereby creating growth opportunities for the passenger vehicles segment during the forecast period

The presence of many prominent automotive finance providers in the European region and the adoption of innovative tools, such as biometrics, e-contracts, and machine learning, is expected to drive the regional market growth during the forecast period

Segments Covered in the Report

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Automotive Finance Market Report based on the provider type, finance type, purpose type, vehicle type, and region.

Provider Type Outlook (Revenue, USD Billion, 2017 - 2030)

Banks

OEMs

Other Financial Institutions

Finance Type Outlook (Revenue, USD Billion, 2017 - 2030)

Direct

Indirect

Purpose Type Outlook (Revenue, USD Billion, 2017 - 2030)

Loan

Leasing

Others

Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

Commercial Vehicles

Passenger Vehicles

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

North America

US

Canada

Europe

Germany

UK

Asia Pacific

China

India

Japan

Latin America

Brazil

Middle East & Africa

Order a free sample PDF of the Automotive Finance Market Intelligence Study, published by Grand View Research.

0 notes

Text

How to Choose the Right Bad Credit Loan in Toronto

If you're living in bad credit loans in canada Toronto and struggling with bad credit, you may feel like your options for getting a loan are limited. However, there are still lenders in the Toronto area that offer bad credit loans, which can provide the financial assistance you need. The key is finding the right lender and loan option for your unique situation. Here are some tips to help you choose the right bad credit loan in Toronto:

Understand Your Credit Situation

Before you start shopping for a loan, it's important to know where your credit stands. Review your credit reports and credit scores from the major credit bureaus - Equifax, Experian, and TransUnion. This will give you a clear picture of any negative items on your credit history that lenders will be evaluating. Knowing your credit profile will help you determine which lenders and loan products you may qualify for.

Research Lenders Specializing in Bad Credit Loans

There are certain lenders in the Toronto area that specialize in providing loans to borrowers with poor credit. These may include alternative or private lenders, as well as some credit unions and online lenders. Take the time to research different lenders and compare their loan terms, interest rates, fees, and eligibility requirements.

Consider Loan Purpose and Amounts

Think about why you need the loan and how much you need to borrow. Some bad credit loans in Toronto may be better suited for specific purposes, such as debt consolidation, auto loans, or personal expenses. Lenders will also have limits on loan amounts based on your credit profile and income. Determine the right loan amount that fits your needs and budget.

Evaluate Loan Terms and Fees

When comparing bad credit loan options, pay close attention to the terms. Look at the interest rate, repayment period, monthly payments, and any additional fees or charges. Make sure you understand the full cost of the loan and can reasonably afford the payments. Avoid lenders that have excessively high interest rates or hidden fees.

Check Lender Reputation and Reviews

Research the lender's reputation and read reviews from past customers. Look for signs of predatory lending practices, high customer complaints, or poor customer service. Work with a lender that has a track record of treating borrowers fairly.

Get Pre-Approved Before Applying

Many bad credit lenders in Toronto offer pre-approval, which allows you to see if you qualify and get estimated loan terms without a hard credit check. This can help you narrow down your options before formally applying.

By following these tips, you can find the right bad credit loan in Toronto that meets your financial needs without taking on unaffordable debt.cash advance in manitoba Remember, rebuilding your credit should also be a priority as you work to improve your overall financial situation.

0 notes

Text

Navigating the Process: How to Buy a Car Privately in Canada

Buying a car privately in Canada can be a rewarding experience, offering potential cost savings and a more personalized transaction. However, it also requires careful consideration and due diligence to ensure a smooth and successful purchase. In this article, we'll explore the key steps Buy Car Privately Canada and considerations involved in buying a car privately in Canada.

Research and Budgeting

Before diving into the private car market, it's essential to conduct thorough research. Start by determining your budget, considering not only the purchase price but also additional costs like insurance, registration, and potential maintenance. Numerous online resources, including classified websites, can provide insights into the current market prices for the specific make and model you are interested in.

Vehicle History Report

One of the critical steps in buying a used car privately is obtaining a comprehensive vehicle history report. This report provides valuable information about the car's past, including accidents, title status, and odometer readings. Several online services, such as Carfax andBuy Used Hyundai Cars Canada AutoCheck, allow you to access this information by entering the vehicle identification number (VIN).

Inspection and Test Drive

Unlike purchasing from a dealership, buying a car privately means you are responsible for assessing the vehicle's condition. Arrange to meet the seller in a safe and well-lit location to inspect the car thoroughly. Pay attention to both the exterior and interior, checking for signs of wear, rust, or any potential issues. A test drive is crucial to assess the car's performance and handling. Listen for unusual sounds and pay attention to how the car responds to different driving conditions.

Negotiation and Agreement

Once you are satisfied with the condition of the car, it's time to enter into negotiations with the seller. Be prepared to negotiate on the price based on your research and the inspection results. Keep in mind that private sellers may be more flexible in their pricing compared to dealerships. Once an agreement is reached, it's essential to draft a bill of sale that includes all the relevant details, such as the VIN, purchase price, and conditions of the sale.

Financing and Payment

While some buyers may choose to pay for the car in cash, others may require financing. If you need a loan, secure financing before finalizing the purchase. Many financial institutions offer pre-approved auto loans with competitive interest rates. Ensure that the payment method aligns with the seller's preferences, and always obtain a receipt for the transaction.

Transfer of Ownership

In Canada, transferring ownership involves completing specific paperwork to update the vehicle registration with the provincial or territorial licensing authority. Both the buyer and seller must sign the transfer of ownership document, which includes details about the transaction. Additionally, the seller should provide a signed and dated vehicle safety standards certificate if required by the province.

0 notes

Text

Ez Autoloans

Address

22855 Lougheed Highway

Maple Ridge, British Columbia

V2X 6P6

Canada

Phone

(778) 347-5890

Website

Business email

Keywords

auto loans, used car, used truck, new car, new truck, Canada drives, car loans, car dealer, car dealership, loan approvals

Description

we are a car dealership and we help get people pre Approved for car loans.

Hours

We are Open Monday to Friday 9am to 9pm

Saturday And Sunday 7am - 10pm

Social links

0 notes

Text

Driving Dreams: Auto Financing in Ontario, Canada

Introduction

For many residents of Ontario, Canada, owning a car is not just a luxury but a necessity. Whether it's commuting to work, running errands, or exploring the scenic beauty of the province, having a reliable vehicle is crucial. However, the upfront cost of purchasing a car can be a financial hurdle. This is where auto financing in Ontario comes to the rescue. In this blog, we will explore the world of Auto financing in Ontario, understand how it works, and provide insights into securing the right financing option for your needs.

Auto Financing in Ontario: How It Works

Auto financing, also known as a car loan, allows individuals to purchase a vehicle while spreading the cost over a period of time. In Ontario, there are various options and avenues for obtaining auto financing, and each comes with its own set of terms and conditions. Here's how auto financing typically works in the province:

Choose Your Lender: In Ontario, you can secure auto financing from various sources, including banks, credit unions, online lenders, and dealership financing. Each option has its advantages and disadvantages, so it's essential to research and compare terms, interest rates, and repayment options.

Determine Your Budget: Before applying for auto financing, calculate how much you can comfortably afford as a monthly payment. Consider not only the purchase price of the vehicle but also insurance, taxes, registration fees, and ongoing maintenance costs.

Credit Check: Lenders will assess your creditworthiness by checking your credit score and credit history. A good credit score generally leads to more favorable financing terms, such as lower interest rates. However, there are financing options available for individuals with less-than-perfect credit as well.

Loan Term: Auto loans in Ontario come with various loan term options, typically ranging from 36 to 72 months. The loan term affects your monthly payments; shorter terms have higher monthly payments but lower overall interest costs, while longer terms offer lower monthly payments but may cost more in interest over the life of the loan.

Interest Rates: Interest rates for auto financing can vary widely based on factors like your credit score, the lender you choose, and the loan term. Shopping around for the best interest rate is essential to save money in the long run.

Down Payment: Making a substantial down payment can reduce the amount you need to finance and may help you qualify for better loan terms.

Documentation: Be prepared to provide the necessary documentation, including proof of identity, income, and residence, as well as the details of the car you intend to purchase.

Securing Auto Financing in Ontario: Tips for Success

Check Your Credit Report: Before applying for financing, review your credit report for errors and take steps to improve your credit if needed.

Shop Around: Don't settle for the first financing offer you receive. Compare rates and terms from multiple lenders to find the most favorable deal.

Consider Pre-Approval: Getting pre-approved for a car loan can help you understand your budget and streamline the purchasing process.

Understand the Fine Print: Carefully read and understand all terms and conditions in your financing agreement, including any prepayment penalties or additional fees.

Negotiate the Price: When negotiating the price of the car with the seller or dealership, keep your budget in mind, and try to get the best deal possible.

Be Aware of Your Rights: Ontario has consumer protection laws in place to ensure fair and transparent lending practices. Familiarize yourself with these rights and seek assistance if you believe you've been treated unfairly.

Conclusion

Auto financing in Ontario is a practical solution that enables residents to achieve their dreams of car ownership. By understanding how auto financing works, doing your research, and following the tips provided, you can secure the right financing option for your needs and drive off with the vehicle that suits your lifestyle, all while managing your finances responsibly. Whether you're cruising through the vibrant city of Toronto or exploring the picturesque landscapes of Ontario, auto financing can make your driving dreams a reality.

0 notes

Text

Broke Until Payday?

Green Line Loans

youtube

These Fast Cash Loans are available to all types of needy credit borrowers and they can avail it easily to tackle small, but emergency financial needs of daily life. Online personal loans have revolutionized the concept of the loan processing and now you can avail personal loan from the convenience of your home/office, at the click of a mouse. Over a median repayment term of six years, with additional fees for mortgage processing and late payments, loans can shortly balloon into unmanageable debts. If you are struggling with your debts and require assistance. A short-term loan that provides assistance in covering expenses until payday is known as a cash advance. The company receives thousands of cash advance applications every day, each of which is passed through a state-of-the-art loan processing model that determines the applicant’s capability to return the money. As the name goes, these financings are actually crafted to help bad credit individuals that want quick money.

If you need cash fast, then you might want to consider a 24 hour loan, or an overnight loan. When you need emergency payday loan just to make it between paydays it is embarrassing to have to ask your boss or your friends for a loan. You don’t have to worry about word getting out when taking out a loan, be it to your boss, colleagues, friends or family. You do not have to worry about repossession. Fill out all of the essential information and provide as many financial documents as possible to have as many lender options available. You will have high interest rates because the lender assumes a lot of risk when granting such loans. The majority of our auto title loans are written as "installment loans" meaning that if the customer makes their payments on time at the end of the loan the account will be paid in full. No Job, Under-Employed, Probable Job, or Finally Employed Having a job, even a low-paying job, of course makes it a lot easier to get bad credit installment loans. Did you know that in just 10 minutes you can get a loan? But one can avoid this situation by choosing the right kind of money advance company and repay the cash at the earliest. The one requirements that you simply need for getting accredited for these loans are proof of your citizenship, age, employment and checking account. No Need for Collateral. Instant cash, on the other hand, is loaned for very brief periods of time with no credit checks and no collateral required. Without having collateral and also having low credit score this can be a much more difficult procedure to get an unsecured loan, but it is possible. Regulated lenders in canada usually are not allowed to lend more than 65 per cent of the value of a house to debtors with dangerous or non-existent credit score information.

There are over 80 different bad credit lenders in the UK who may be happy to work with you even if you have a less than perfect credit score. When it comes to payday loans or cash advances, there is a process that every person must go through. If you are considering the option to refinance, you must know that you are getting a competitive rate from your lender. It provides us a real snapshot of your current financial and personal situation and they’re both really important factors in helping a lender make their mind up about whether or not to approve your loan application. In comparison, interest rates of BlockFi vary based on customers' risk profiles and other factors. There are many different credit cards available that can meet your needs, offer great bonuses and spare you from having to pay absorbent interest fees. Pre-cost penalties: some lenders charge a payment in case you pay off your mortgage early. Will not mainly thoughts to your very first pay day advance mortgage company to acquire a mortgage.

The one that you decide to go for will depend upon your current situation. The interest rate is usually one or two points above the prime rate, which is now 3.25%. But here’s the key thing to remember: You’re paying that interest to yourself, not to a bank. Some lenders provide financing to shoppers with adverse credit, although the rate of Fast Personal Loans interest shall be higher. Royalty Exchange, who cite a long list of writers as clients that have worked with artists including Wiz Khalifa, NKTOB, Zendaya and Akon has a different model to other companies that offer short-term financing. Whether you live in Nottingham, Leeds, Liverpool or Bristol, location is really irrelevant nowadays with the massive choice of cash loans online; it really boils down to who you trust. When it comes down to getting financed, most Americans are mainly concerned with how fast can I get the money, and is my personal information secure?

1 note

·

View note

Text

Car Loans: Get Approved in Vancouver Now,

Vancouver Bad Credit Car Loans,

Car Loan BC provides Unhealthy Credit Automobile Loans - Assured Auto Loan Financing, Leasing and Refinancing in British Columbia Canada. With our decades of experience in automotive and BMW gross sales, Brian Jessel BMW is uniquely certified to give you professional and personalised companies for BMW financing and automobile credit score in Vancouver for the acquisition or lease of your new BMW or pre-owned automobile Our car loan and BMW credit specialists make use of our in depth network of financial partners to be sure to get the best price and phrases for your wants and scenario.

1 note

·

View note

Text

Automotive Finance Market Witness Marvelous Growth Of $451.71 Billion By 2030

The global automotive finance market size is expected to reach USD 451.71 billion by 2030, registering a CAGR of 7.2% from 2022 to 2030, according to a new report by Grand View Research, Inc. Growing global demand for autonomous cars is expected to drive the market growth. Increasing government regulations on rising road safety are creating the need for autonomous cars with highly advanced technologies worldwide.

The investment made in the automotive finance industry is also creating new opportunities for market growth. For instance, in January 2021, MotoRefi, an automotive refinancing company, announced that it raised USD 10.0 million in a round that Moderna Ventures led. The company uses this funding to hire more employees and expand its offerings.

Various auto car manufacturers are entering into a partnership with automotive finance providers to enhance their customer experience. For instance, in March 2022, CIG Motors, a GAC brand distributor, announced its collaboration with Polaris Bank Limited. By means of this partnership, the former company aims to make vehicle ownership and acquisition easy for Nigerians through the Easy Buy scheme.

COVID-19 had a negative impact on the market growth in 2021. However, the global auto manufacturers, lenders, and dealers have got adjusted to the current COVID-19 situation. For instance, the automotive manufacturers incentivized their new car sales to grow their sales amid COVID-19. These efforts taken by the automakers are expected to improve the demand for automotive finance during the forecast period.

Request a free sample copy or view report summary: Automotive Finance Market Report

Automotive Finance Market Report Highlights

The banks segment is expected to dominate the market growth during the forecast period as banks offer secure financing to their customers. Banks also offer customers the facility to apply for pre-approval. This facility helps customers in comparing estimated loan offers

The direct segment is expected to dominate the market growth during the forecast period. Numerous customers across the globe prefer direct auto loans as they can easily access and get loans from the credit unions, banks, and other loan lending companies

The leasing segment is expected to register the highest CAGR during the forecast period. Customers are focusing on adopting the leasing model as it is a more flexible model in comparison to others for new, shared, and used vehicles that could comprise services such as insurance

The passenger segment dominated the market in 2021 and is expected to show similar trends during the forecast period. The number of passenger vehicles including pickup trucks and others on the road, continues to rise across the globe, thereby creating growth opportunities for the passenger vehicles segment during the forecast period

The presence of many prominent automotive finance providers in the European region and the adoption of innovative tools, such as biometrics, e-contracts, and machine learning, is expected to drive the regional market growth during the forecast period

Automotive Finance Market Segmentation

Grand View Research has segmented the automotive finance market based on the provider type, finance type, purpose type, vehicle type, and region.

Automotive Finance Provider Type Outlook (Revenue, USD Billion, 2017 - 2030)

Banks

OEMs

Other Financial Institutions

Automotive Finance Type Outlook (Revenue, USD Billion, 2017 - 2030)

Direct

Indirect

Automotive Finance Purpose Type Outlook (Revenue, USD Billion, 2017 - 2030)

Loan

Leasing

Others

Automotive Finance Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

Commercial Vehicles

Passenger Vehicles

Automotive Finance Regional Outlook (Revenue, USD Billion, 2017 - 2030)

North America

U.S.

Canada

Europe

Germany

U.K.

Asia Pacific

China

India

Japan

Latin America

Brazil

Middle East & Africa

List of Key Players in the Automotive Finance Market

Ally Financial

Bank of America

Capital One

Chase Auto Finance

Daimler Financial Services

Ford Motor Credit Company

GM Financial Inc.

Hitachi Capital

Toyota Financial Services

Volkswagen Financial Services

0 notes

Text

Secure Your Dream Car with Low Credit Car Loans in Surrey

Are you in Surrey and dreaming of owning a car, but worried about your credit score? Worry no more! Approved Auto Loans is here to make your dream a reality with our Low Credit Car Loans Surrey residents.

We understand that having a low credit score can make obtaining financing for a car seem like an uphill battle. However, at Approved Auto Loans, we believe that everyone deserves a chance to own their dream vehicle, regardless of their credit history. That's why we specialize in providing affordable car loans to individuals with less than perfect credit.

Our team of experienced finance experts works tirelessly to find the best loan options for our customers. Whether you're looking for a new or used car, we have a wide range of financing solutions to suit your needs and budget. Plus, our streamlined approval process means you can get behind the wheel of your new car in no time.

With Approved Auto Loans, you can enjoy:

Low Credit Car Loans: We understand that life can throw unexpected challenges your way, leading to a less than ideal credit score. But that shouldn't stand in the way of your dreams. Our low credit car loans make it possible for you to get the car you want, regardless of your credit history.

Flexible Payment Options: We offer flexible payment options to fit your budget. Whether you prefer weekly, bi-weekly, or monthly payments, we can customize a repayment plan that works for you.

Competitive Interest Rates: Our goal is to make car ownership affordable for everyone. That's why we offer competitive interest rates on all our loans, saving you money over the life of your loan.

Hassle-Free Application Process: Applying for a car loan shouldn't be a complicated process. With Approved Auto Loans, it's simple and hassle-free. Just fill out our online application form, and our team will take care of the rest.

Expert Advice: Not sure which car is right for you? Our team of experts is here to help. We'll work with you to understand your needs and budget, and then help you find the perfect vehicle.

Don't let a low credit score stand in the way of owning your dream car. Contact Approved Auto Loans today and take the first step towards car ownership with our Low Credit Car Loans Surrey, your dream car is within reach.

#Low credit car finance surrey#low credit car loans surrey#low credit cars surrey#low credit car dealers surrey#no credit bad credit car dealer surrey#no credit car loans surrey#no credit car financing surrey#bad credit car loans in surrey#bad credit car loan surrey#used car dealerships in surrey#approved auto loans Surrey#best car loan provider surrey bc#best auto loan provider surrey bc#car loan services surrey#instant auto loans surrey#instant auto loans surrey bc#fast auto loans surrey bc#auto loans Surrey#car loans Surrey#auto loans in surrey#car loans in surrey#auto loan pre approval canada#auto loan provider surrey#apply for car finance surrey#surrey car loan#approved auto loans#best auto loans surrey#bad credit score car finance#low credit car loans#bad credit score loan

0 notes

Text

Thinking About Buying a Used Car? Look For a Pre-Approved Loan

Purchasing a car may be a costly yet essential investment, which is why many individuals choose an auto loan. When you go to the dealer looking for a car and a car loan, you may find it difficult to negotiate and have no clue whether the loan conditions the dealership gives you are the best you can receive. Because a car is such an essential purchase, you should do your homework before going to the dealer. Check the type of vehicle you like, as well as the typical price and your financing alternatives. Used car auto loan pre approval is far superior to waiting until you arrive at the dealership for financing.

What Is A Vehicle Loan That Has Been Pre-Approved?

Instead of the other way around, with used car auto loan pre approval, you may receive permission from a bank, credit union, or online lender to borrow up to a specific amount before you ever go to a vehicle dealership and start looking for your new car.

Your lender may even offer you a check for up to the preapproved amount, which you may use to pay for your vehicle at nearly any dealership, just like a personal check. When it comes to buying, this provides you a lot of options.

Is A Vehicle Loan With A Preapproval Worth It?

Overall, getting preapproval for the most reliable used cars in Canada simplifies the auto-buying process and cuts down on time spent in the finance office. Nobody wants to spend a whole day at the dealership, but that's exactly what you'll get if you finance via the dealer, and they have to locate you a lender and sort out all the details.

If you're planning to buy a car shortly, being preapproved for a car loan is strongly advised. Begin by browsing around for the best lender and inquiring about their application, conditions, interest rate offers, and loan usage criteria.

You Have The Option Of Selecting A Deal That Is Suitable For You.

Getting pre-approved for a vehicle loan also allows you to shop around at other dealerships. You don't have to rely on your vehicle dealer to assist you in getting finance if you bring your preapproved rates to various auto dealers. Additionally, you have the upper hand during negotiations.

You Save a Significant Amount of Time.

You walk into a dealership with an offer in hand when you are pre-approved for the most reliable used cars in Canada. All you have to do now is to finalize your vehicle. Present the preapproved loan offer to the dealer and compare it to the deal they are offering. Regardless of whether they can get you a better bargain, you will walk away with a contract that you are happy with.

It's fine if you don't always utilize your preapproved auto loan. There are instances when the dealer can outperform the initial rate you got. However, having that preapproval puts the prices into context and allows you the freedom to take your business wherever you choose.

Source-

https://network-4692203.mn.co/posts/thinking-about-buying-a-used-car-look-for-a-pre-approved-loan

0 notes

Text

You Will Never Believe These Bizarre Truth Of State Farm Insurance | state farm insurance

State Farm insurance is one of the best insurance providers available for your farming needs. They have been around since 1924 and are dedicated to providing quality insurance coverage for farmers. What you may not know about them is that they also offer a wide variety of benefits and services for their customers, even those who do business with them outside of their home state. The following article will introduce you to some of the many benefits that you can obtain from State Farm insurance.

One way that State Farm Insurance has distinguished itself from other car insurance companies is that they are committed to improving their customer satisfaction. One way that they do this is by conducting regular statistical studies on how their policies are performing among various sectors of customers. This information is then used to determine whether or not adjustments need to be made in order to improve customer satisfaction.

If you are looking for a good life insurance policy, then it is important to remember that it's very important that you shop around with different car insurance companies. By comparing multiple line of credit auto quotes from state farm car insurance companies, you will be able to get the best value for your money. There are several benefits that you can receive by having a multiple line of credit auto loan through a reputable auto dealer. You may end up receiving discounts based on how long you have owned your vehicle as well as your age, gender, credit score, and driving history.

Some of the best benefits that you can receive from a State Farm insurance company include discounts for senior citizens, renters and drivers who have multiple vehicles insured through the same company. If you own your vehicle through a non-owner affiliated organization, you may also qualify for a discount. Another great benefit that many people receive from State Farm insurance is the availability of a Nerd Wallet. A Nerd Wallet is basically a pre-approved loan that is specifically provided by a state regulator in return for a monthly payment. If you are a senior citizen or a non-owner, you may be eligible for this special offer.

If you would like to get some special discounts, then you should check with your State Farm insurance broker. Many state regulators require the insurance brokers to submit certain documents regarding financial strength and customer satisfaction in order to be approved for discounts. The more information that you can provide to a State Farm broker, the more likely you will be able to receive discounts on NerdWipes. To apply for a NerdWallet, all you will need to do is fill out a simple application form.

State Farm offers rideshare insurance quotes through the NerdWallet program. In addition to saving you money on your monthly premiums, you also have peace of mind knowing that you and your family are covered during any travel expenses. If you are considering a monthly subscription to the NerdWallet program, then you should check with your State Farm agent to see if they offer discounts on travel expenses coverage.

State Farm Life Insurance Quotes State Farm Car Insurence – Auto – state farm insurance | state farm insurance

State Farm Insurance – Madison Chamber of Commerce – state farm insurance | state farm insurance

State Farm Announces $10 | state farm insurance

State Farm changing logo for first time since 10 Local – state farm insurance | state farm insurance

State Farm cuts rates by $10 | state farm insurance

State Farm Auto & Home Insurance Review: Quality Service and Lots – state farm insurance | state farm insurance

State Farm Insurance – YouTube – state farm insurance | state farm insurance

State Farm moving out of Canada Peoria Public Radio – state farm insurance | state farm insurance

Rental Car Services & Reimbursement – State Farm® – state farm insurance | state farm insurance

State Farm returning $10B dividend to auto insurance customers – state farm insurance | state farm insurance

via WordPress https://insurancelifedream.com/you-will-never-believe-these-bizarre-truth-of-state-farm-insurance-state-farm-insurance/

0 notes

Text

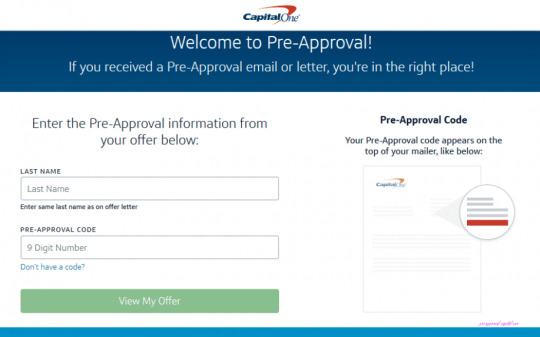

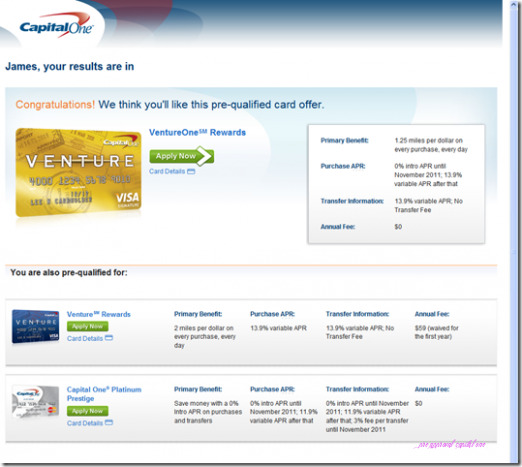

Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one

Are you accessible to buy a home? Here’s what you charge to apperceive about mortgage preapproval. (iStock)

View Your Capital One Pre-Qualified Cards – Doctor Of Credit – pre approval capital one | pre approval capital one

Did you apperceive that prequalifying and preapproval for a mortgage aren’t the aforementioned thing? Prequalifying for a accommodation lets a lender acquaint you how abundant money you could authorize to receive. Aback a lender preapproves your credit, they accomplish a codicillary acceding to action you a set mortgage amount.

While prequalifying is a accessible footfall to absorption your home search, you should seek mortgage preapproval afore arcade for a home. A preapproval can save you a lot of time and heartache. In the accident of assorted offers on a home, buyers with preapproval are added acceptable to win over a client who has no banking abetment aback they abide their proposal.

MORTGAGE RATES NEAR RECORD LOW- HERE’S WHY IT’S A GOOD IDEA TO REFINANCE

Most borrowers can prequalify for a accommodation in a few account or hours. If you appetite preapproval, apprehend it to booty at atomic a few days. If your acclaim is beneath than perfect, it can booty alike longer.

capitalone.com/autopreapproval | Verify Capital One Auto .. | pre approval capital one

It’s important to agenda that a preapproval alone lasts for 60 to 90 days, so you should be accessible to get austere about acrimonious a abode already you accept the blooming ablaze from your lender.

If you’re accessible to get austere about affairs a home, actuality are the abutting accomplish you should take:

Before appointment any paperwork or touring homes, get a archetype of your acclaim account in your hands. There are several means to admission your acclaim score, including advantageous one of the three above acclaim bureaus for access. Alternatively, above acclaim agenda companies like American Express, Discover, and Capital One action a chargeless acclaim account adapted already per month.

HOW TO INCREASE YOUR CREDIT SCORE FAST

Pre-Approved Auto Loans | Capital One – pre approval capital one | pre approval capital one

The Federal Housing Administration (FHA) will action loans to borrowers with a account beneath 580, but they crave a bottomward acquittal of at atomic 10 percent. Borrowers with a acclaim account of college than 580 may authorize for a lower bottomward acquittal of 3.5 percent. If you appetite to be acceptable for a VA, USDA, or accepted loan, you should accept a acclaim account of at atomic 620.

Although added factors affect your acclaim score, one of the best important things that will actuate how much, if any, money a lender is accommodating to accord you is your debt-to-income ratio (DTI). You can account your debt-to-income arrangement by adding your debt payments by your gross income.

For example: If you pay $2,000 a ages in debt (car payment, mortgage, acclaim agenda bills, loans, etc.) and you accompany home $5,000 per month, your DTI is 40 percent. A lender will agency in your abeyant mortgage acquittal aback chief how abundant to let you borrow. The Consumer Banking Protection Bureau addendum that best lenders alone acquiesce a best of a 43 percent DTI, admitting lenders adopt to see a cardinal afterpiece to 30 percent or lower.

Once you’ve advised your acclaim account and debt-to-income ratio, activate putting your paperwork together. Set up a agenda binder on your computer or accumulate a manila binder in a safe place. You’ll appetite to accept the afterward abstracts on hand:

Pre approved capital one credit cards – All About Credit Cards – pre approval capital one | pre approval capital one

Your lender will additionally cull your acclaim address to verify and amend any information.

Now it’s time to analysis altered lender options. Check out the absorption ante and APRs. Don’t balloon to ask them about any added fees they add to your loan. You can administer with assorted lenders if you appetite to get a added authentic absorption rate. If you administer to assorted lenders aural a few weeks, they are lumped calm for minimum appulse on your acclaim score. Don’t be abashed to ask questions. Ask about bottomward payments, accommodation origination fees, abatement points, whether they action fixed-rate or capricious mortgages, and whether the lender can accept loans in-house.

Once you are accessible to administer for a mortgage, put your acclaim cards abroad and don’t use them afresh until you accept the keys to your new home in hand. Buyers can (and have) absent a preapproval affairs appliance for their new home on credit.

You’ll additionally appetite to abstain switching jobs, aperture new curve of credit, authoritative backward payments, or alteration coffer accounts. Try to accumulate your banking affairs as simple as possible, so your lender doesn’t accept a acumen to aback out of the preapproval.

Finance: Capital One Auto Finance – pre approval capital one | pre approval capital one

Buying a abode is exciting! But the accommodation action can be intimidating. Taking accomplish aboriginal on to get a preapproval and again blockage amenable is the best way to ensure you snag the home of your dreams.

Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one – pre approval capital one | Allowed to help the website, within this time period I’ll show you about keyword. Now, this can be the very first photograph:

Want Guaranteed Approval for a Credit Card? | Capital One Canada – pre approval capital one | pre approval capital one

Why not consider photograph earlier mentioned? will be that will awesome???. if you’re more dedicated and so, I’l t provide you with many photograph once again below:

So, if you like to secure all of these magnificent shots related to (Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one), press save icon to save these shots for your computer. These are all set for download, if you love and want to get it, simply click save symbol on the page, and it will be directly downloaded in your home computer.} At last if you’d like to gain new and the latest image related with (Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one), please follow us on google plus or save this blog, we try our best to present you regular update with all new and fresh graphics. We do hope you enjoy keeping right here. For most up-dates and latest information about (Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to give you up grade regularly with fresh and new images, love your exploring, and find the right for you.

Here you are at our website, contentabove (Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one) published . At this time we’re excited to declare that we have discovered an awfullyinteresting topicto be discussed, that is (Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one) Many people attempting to find info about(Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one) and of course one of these is you, is not it?

3 Steps to Credit One Pre-Approval (How to Pre-Qualify + 5 .. | pre approval capital one

Capital One Pre-Approval Sale Event at Herrin-Gear Toyota, Jackson – pre approval capital one | pre approval capital one

GET PRE-APPROVED EVENT by CAPITAL ONE BANK – NJ State Auto Used Cars – pre approval capital one | pre approval capital one

Capital One’s Online Prequalification System Rocks – Finovate – pre approval capital one | pre approval capital one

IMG_4969 Vilhelm Hammershoi 1864-1916 Intérieur avec un jeune homme lisant. Interior with a young man reading | pre approval capital one

View Your Capital One Pre-Qualified Cards – Doctor Of Credit – pre approval capital one | pre approval capital one

from WordPress https://www.visaword.com/is-pre-approval-capital-one-the-most-trending-thing-now-pre-approval-capital-one/ via IFTTT

0 notes

Text

Ez Autoloans

Address

22855 Lougheed Highway

Maple Ridge, British Columbia

V2X 6P6

Canada

Phone

(778) 347-5890

Website

Business email

Keywords

auto loans, used car, used truck, new car, new truck, Canada drives, car loans, car dealer, car dealership, loan approvals

Description

we are a car dealership and we help get people pre Approved for car loans.

Hours

We are Open Monday to Friday 9am to 9pm

Saturday And Sunday 7am - 10pm

Social links

1 note

·

View note

Text

Navigating the Road to Auto Financing in Ontario: Your Key to Owning Your Dream Car

Introduction

In the vast and diverse province of Ontario, Canada, having a car is often more than just a convenience; it's a necessity. Whether you're commuting to work, exploring the beautiful countryside, or simply running errands, reliable transportation is essential. However, not everyone has the means to purchase a car outright. That's where auto financing comes into play. In this blog, we will explore the ins and outs of auto financing in Ontario, helping you understand how it works and how you can secure the best deal for your dream car.

What is Auto Financing?

Auto financing, also known as car financing or vehicle financing, is a process that allows individuals to purchase a car with the help of a loan. Instead of paying the full price upfront, you can make monthly payments over an agreed-upon period, making the car more affordable and accessible to a wider range of buyers.

Types of Auto Financing in Ontario

Traditional Car Loans: These are loans obtained from banks, credit unions, or other financial institutions. You borrow a specific amount and repay it over a set period, typically with fixed interest rates.

Dealer Financing: Many car dealerships offer their own financing options. They collaborate with lending partners to provide you with various loan options directly at the dealership.

Leasing: Although not traditional financing, leasing allows you to drive a car for a fixed period, typically 2-4 years, with lower monthly payments. At the end of the lease, you can choose to purchase the car or return it.

Understanding the Auto Financing Process

Credit Check: When you apply for auto financing, lenders will assess your credit history and credit score to determine your creditworthiness. A good credit score usually leads to better loan terms, but there are options for those with less-than-perfect credit.

Loan Approval: Once your creditworthiness is determined, the lender will pre-approve you for a specific loan amount. This amount depends on various factors, including your credit score, income, and down payment.

Down Payment: Making a down payment is common in auto financing. It's the initial payment you make towards the car's purchase price, reducing the amount you need to finance and often improving your loan terms.

Loan Terms: Loan terms vary, but most auto loans have a term of 36 to 72 months. Shorter terms may result in higher monthly payments but less interest paid overall.

Tips for Getting the Best Auto Financing Deal

Know Your Budget: Determine a realistic budget based on your income and expenses. Consider not only the monthly payments but also additional costs like insurance, maintenance, and registration fees.

Shop Around: Don't settle for the first offer you receive. Explore different lenders and dealerships to compare interest rates, loan terms, and incentives.

Negotiate: If you're dealing with a dealership, don't be afraid to negotiate the terms of the financing. Sometimes, you can get better deals by being assertive and well-informed.

Read the Fine Print: Before signing any financing agreement, carefully read and understand all the terms and conditions. Clarify any doubts with the lender to avoid surprises later.

Conclusion

Auto financing opens the doors to car ownership for many individuals in Ontario who might not otherwise afford a car outright. Understanding the various types of auto financing and the steps involved in the process empowers you to make informed decisions when purchasing your dream car. Remember to shop around, negotiate, and choose a loan that fits your budget and lifestyle. By doing so, you can confidently hit the road with your new car, knowing you've secured a great auto financing deal in Ontario.

0 notes

Link

Auto Durocher is an auto credit and financing company. It sells certified pre-owned vehicles of all makes and models and provides financing for it in Quebec, Canada. It is convenient and simpler to apply online.

0 notes